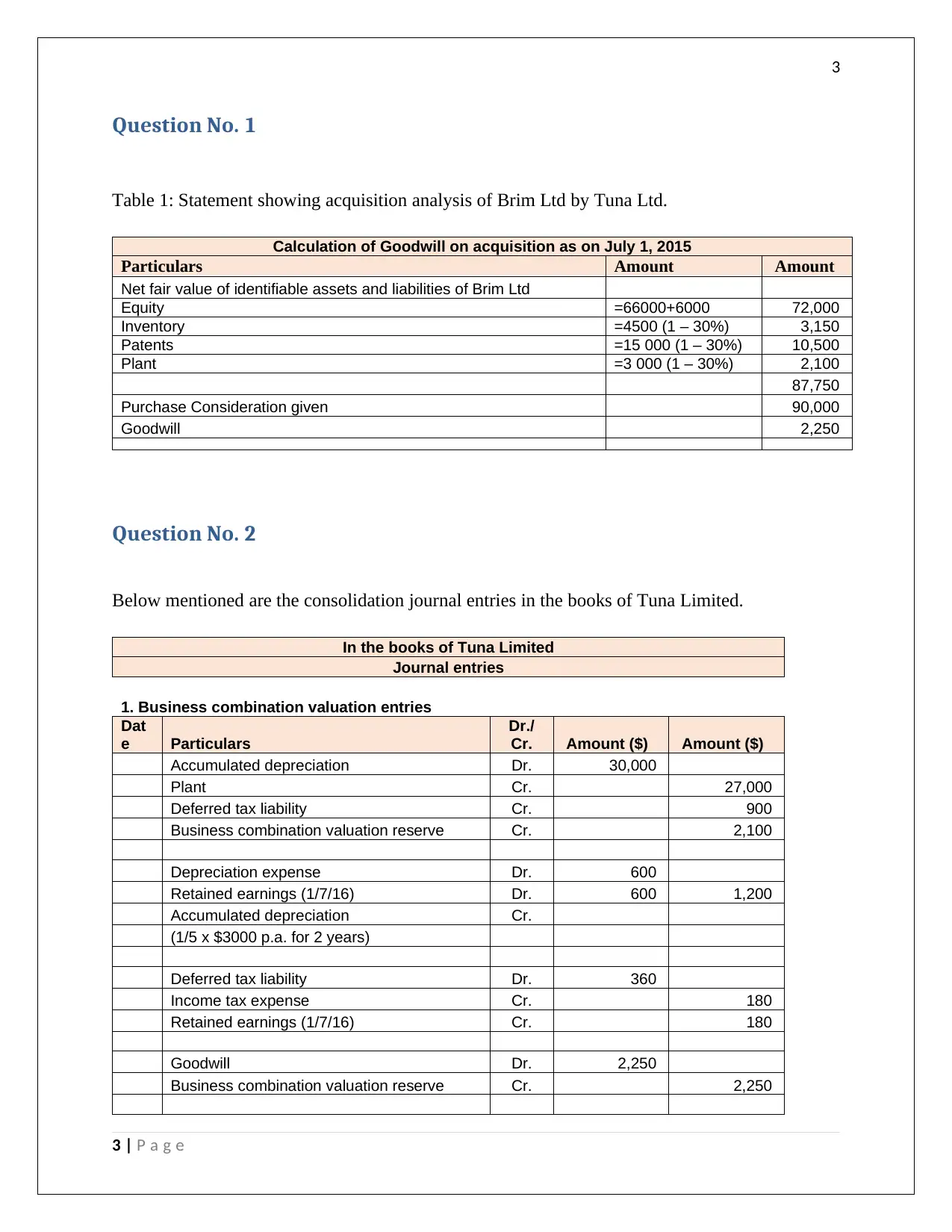

Consolidated Set of Financial Statements for Tuna Ltd and Brim Ltd

VerifiedAdded on 2023/06/11

|10

|1166

|150

AI Summary

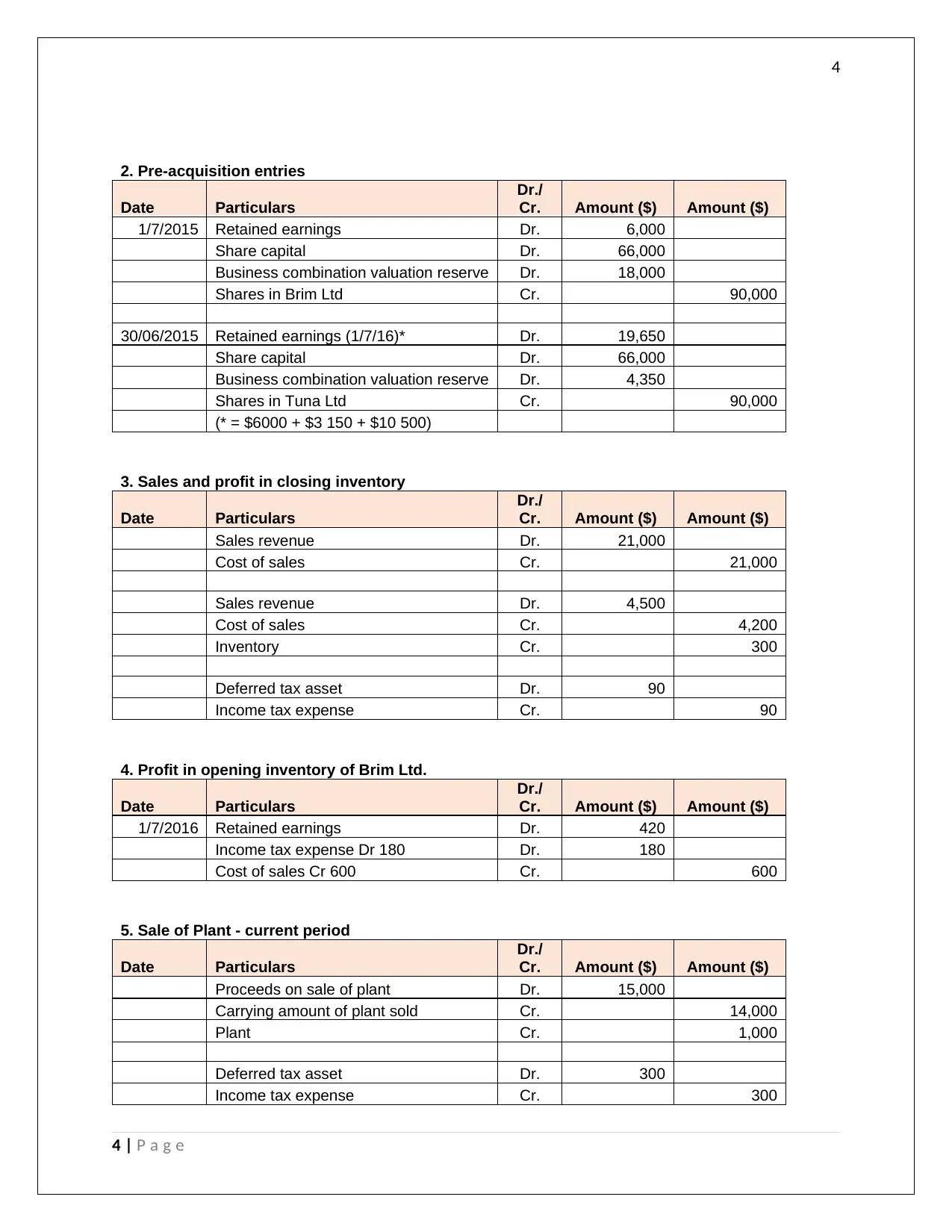

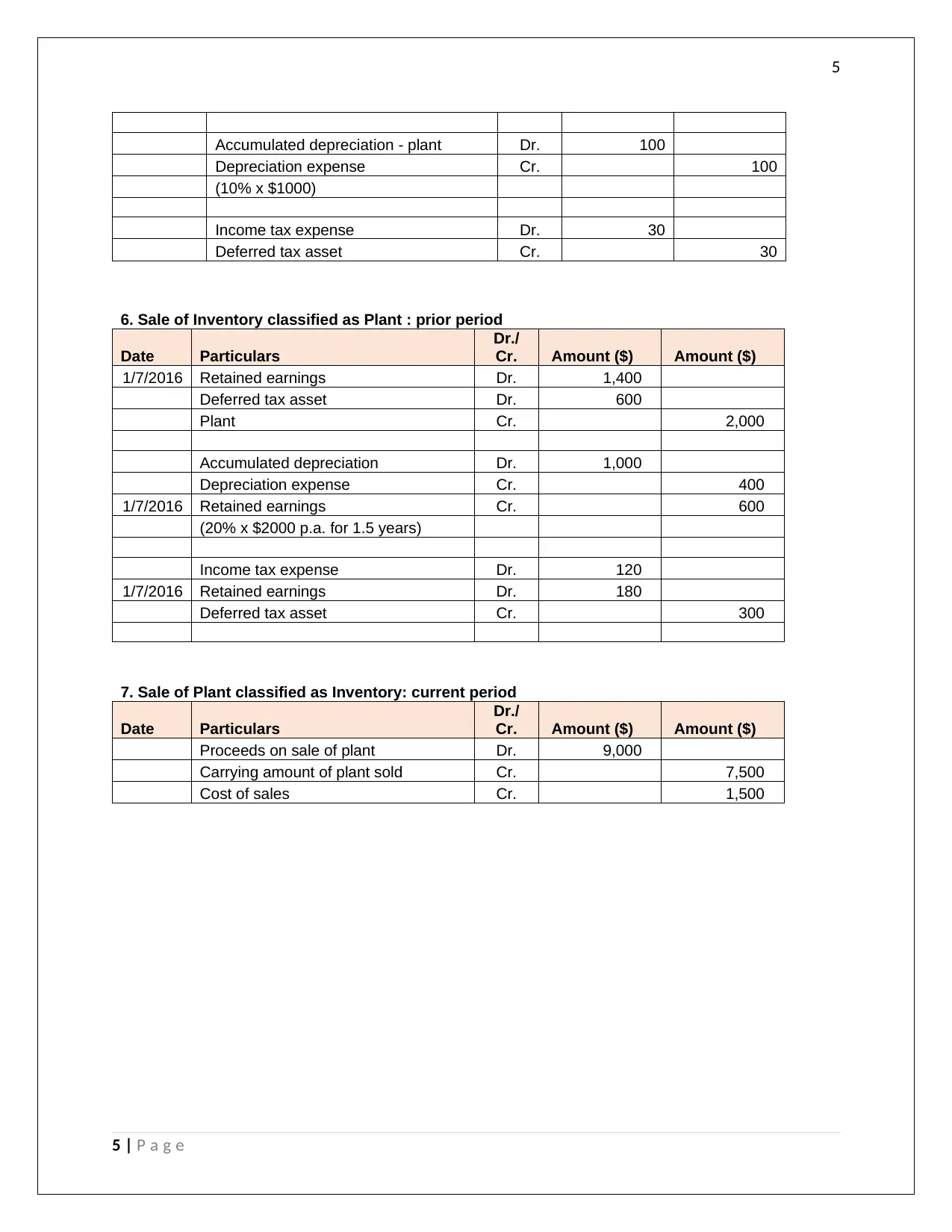

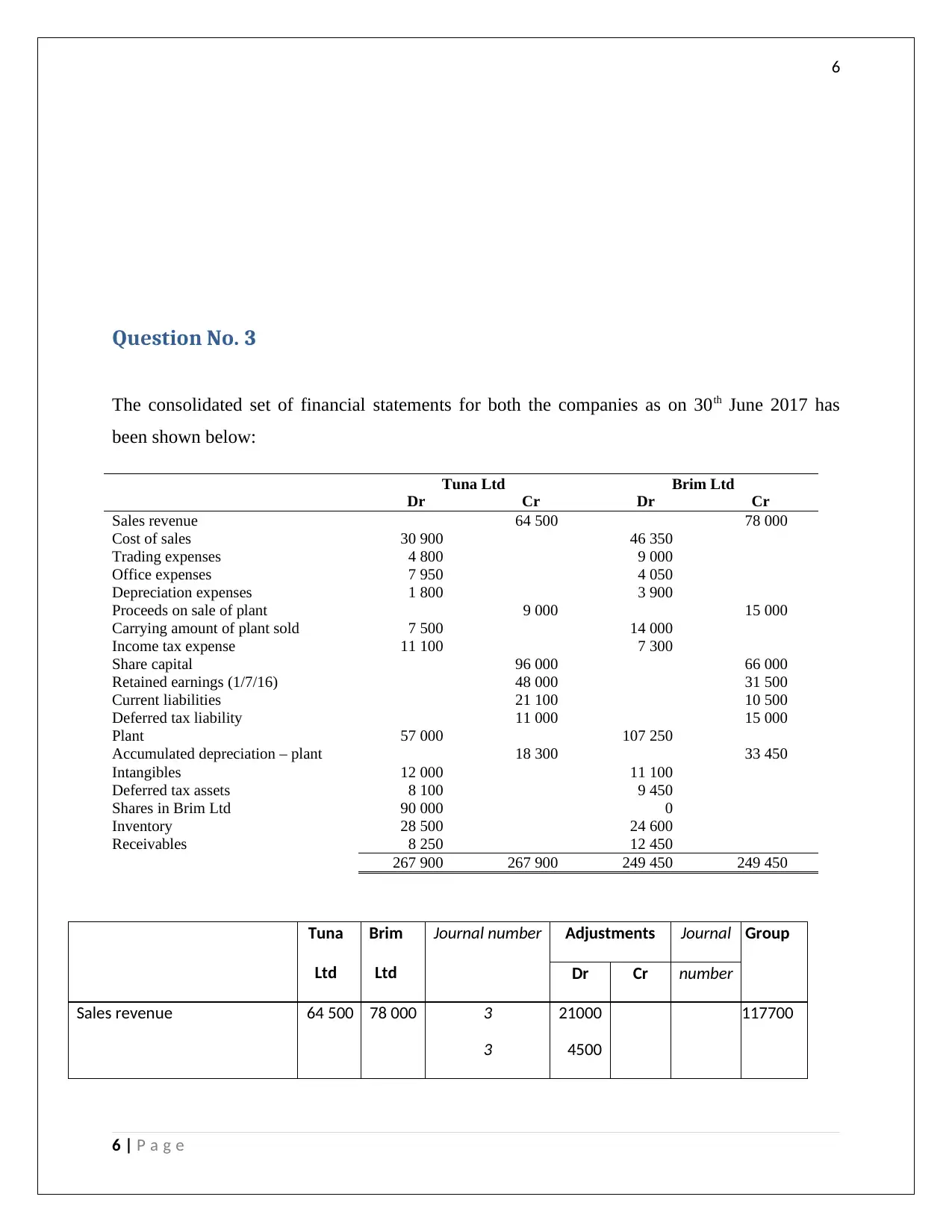

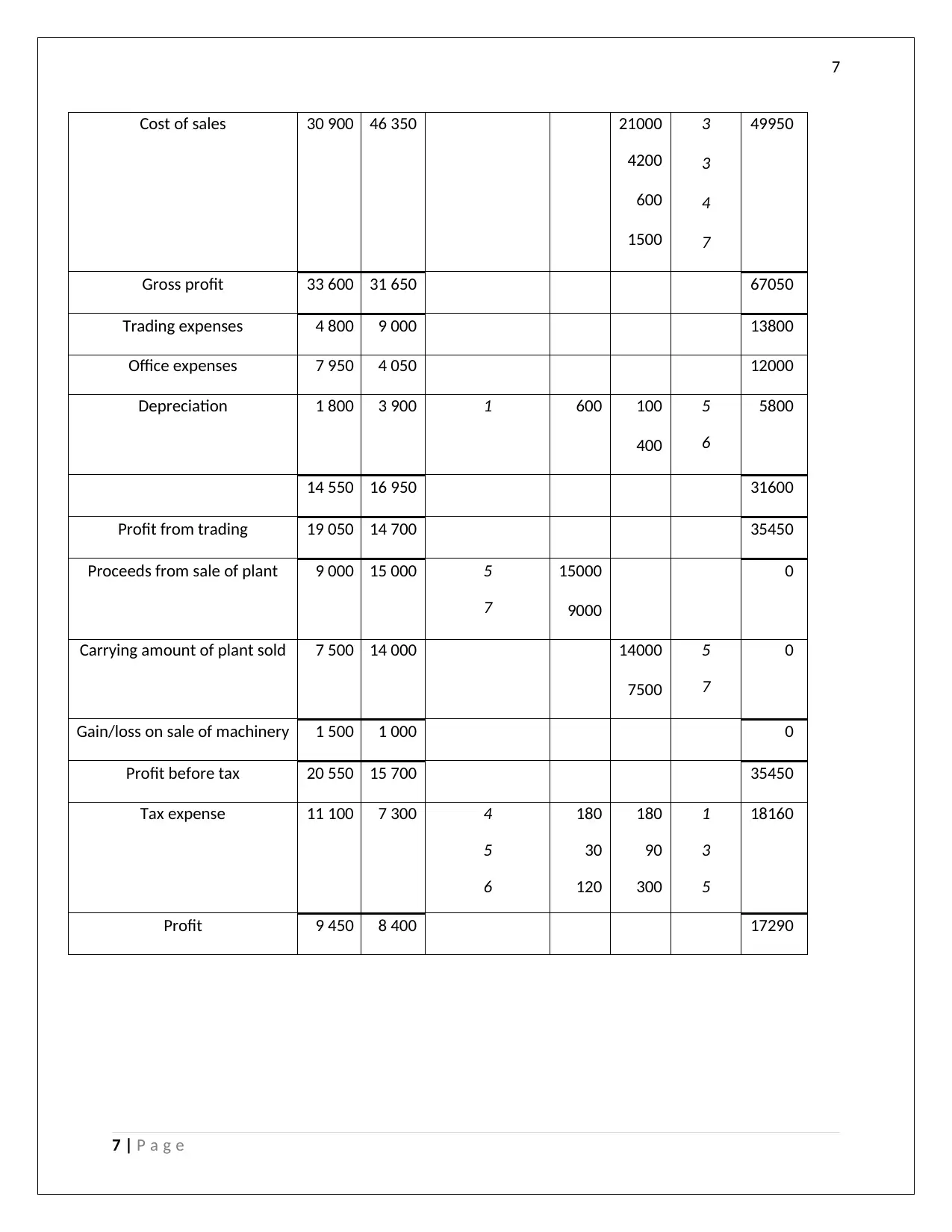

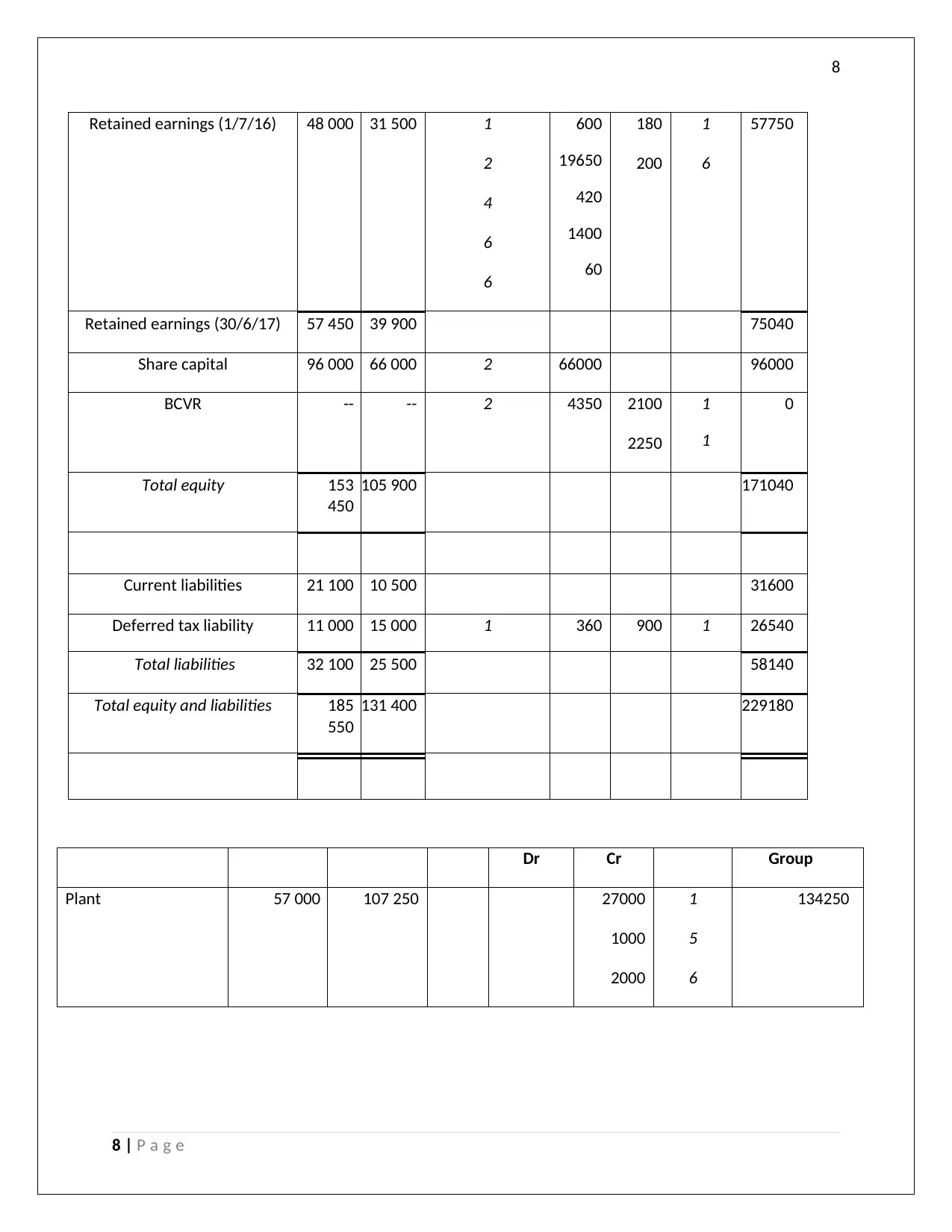

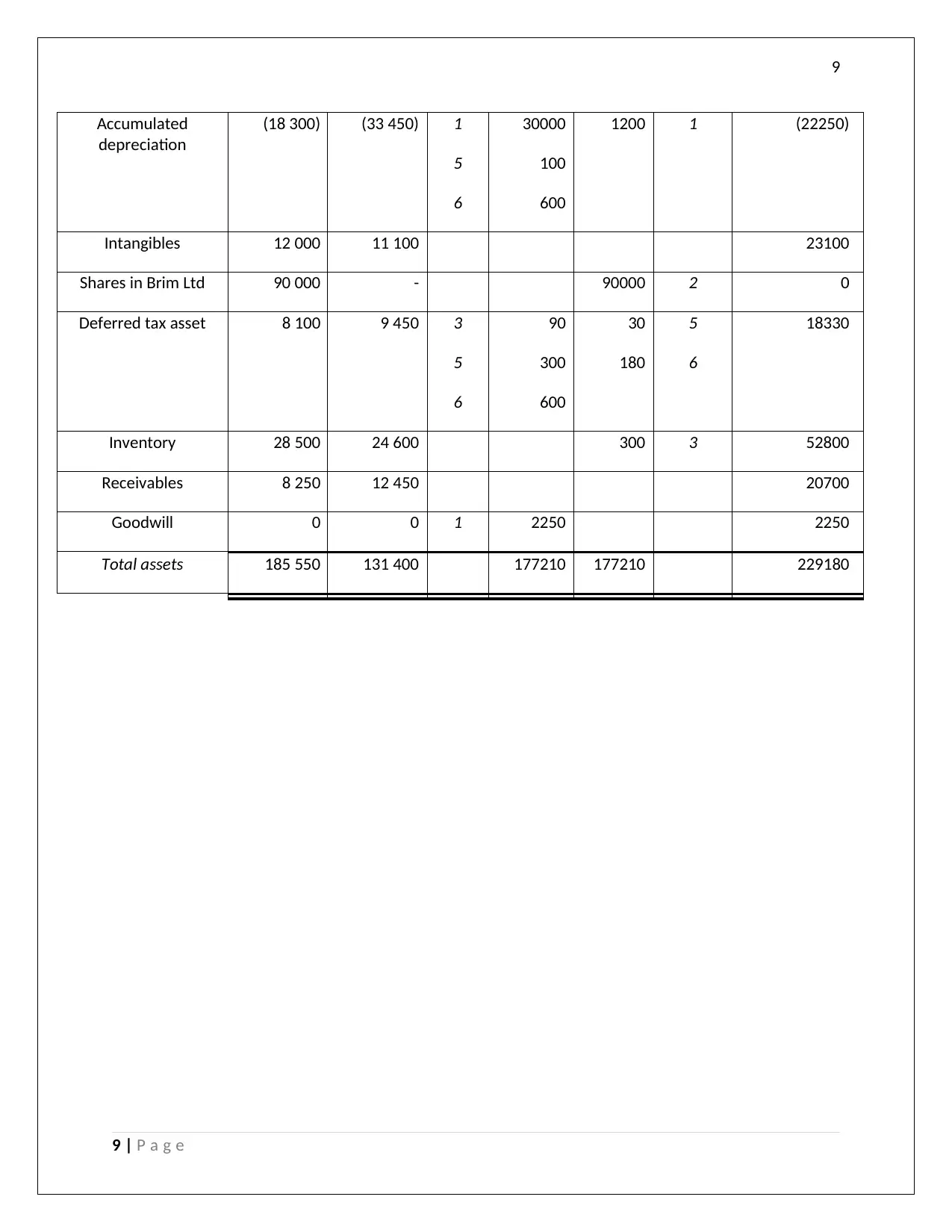

This report provides an acquisition analysis, consolidation journal entries, and a consolidated set of financial statements for Tuna Ltd and Brim Ltd. It includes calculations of goodwill, sales revenue, cost of sales, trading expenses, office expenses, depreciation expenses, proceeds on sale of plant, carrying amount of plant sold, income tax expense, share capital, retained earnings, current liabilities, deferred tax liability, plant, accumulated depreciation, intangibles, deferred tax assets, shares in Brim Ltd, inventory, and receivables.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1 out of 10

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)