Corporate Accounting Analysis of Myer Holding and Kathmandu Holdings Ltd

VerifiedAdded on 2023/06/04

|18

|4290

|486

AI Summary

Corporate accounting deals with the procedures related to preparation of balance sheet, comprehensive statement of profit and loss and cash flow statement. The present report revolves around analysis regarding the equity, cash flow statement, another comprehensive statement and tax expenses of Myer Holding and Kathmandu Holdings Ltd are done.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

CORPORATE

ACCOUNTING

2018

ACCOUNTING

2018

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Executive Summary

Corporate accounting deals with the procedures related to preparation of balance sheet,

comprehensive statement of profit and loss and cash flow statement. Further, with the

assistance of financial reporting management is able to disclose the financial position of the

company to investors, administrators as well as to government. Present report revolves

around analysis regarding the equity, cash flow statement, another comprehensive statement

and tax expenses of Myer Holding and Kathmandu Holdings Ltd are done. The study reveals

that the equity of Myer Holdings Ltd is higher than the Kathmandu Ltd. Moreover, the net

decrease in cash flow of Kathmandu Ltd is more due to the repayment of loans and

procurement of assets. Since the profit is already included in the other comprehensive income

statement, there will be no impact on the shareholder's profit appropriation in case

comprehensive income items are included in profit and loss account. Subsequently, an

effective tax rate of both the companies is calculated under which the tax rate of Kathmandu

Ltd is more in comparison to Myer Ltd.

Corporate accounting deals with the procedures related to preparation of balance sheet,

comprehensive statement of profit and loss and cash flow statement. Further, with the

assistance of financial reporting management is able to disclose the financial position of the

company to investors, administrators as well as to government. Present report revolves

around analysis regarding the equity, cash flow statement, another comprehensive statement

and tax expenses of Myer Holding and Kathmandu Holdings Ltd are done. The study reveals

that the equity of Myer Holdings Ltd is higher than the Kathmandu Ltd. Moreover, the net

decrease in cash flow of Kathmandu Ltd is more due to the repayment of loans and

procurement of assets. Since the profit is already included in the other comprehensive income

statement, there will be no impact on the shareholder's profit appropriation in case

comprehensive income items are included in profit and loss account. Subsequently, an

effective tax rate of both the companies is calculated under which the tax rate of Kathmandu

Ltd is more in comparison to Myer Ltd.

Table of Contents

Introduction................................................................................................................................5

Overview of Companies............................................................................................................5

Myer Holdings Ltd.................................................................................................................5

Kathmandu Holdings Ltd.......................................................................................................5

OWNERS EQUITY...................................................................................................................6

(I)............................................................................................................................................6

(II)..........................................................................................................................................7

CASH FLOWS STATEMENT..........................................................................................7

(III).........................................................................................................................................7

(IV).........................................................................................................................................9

(V)........................................................................................................................................10

OTHER COMPREHENSIVE INCOME STATEMENT........................................................10

(VI).......................................................................................................................................10

(VII)......................................................................................................................................11

(IX).......................................................................................................................................12

ACCOUNTING FOR CROPORATE INCOME TAX............................................................13

(X)........................................................................................................................................13

(XI).......................................................................................................................................13

(XII)......................................................................................................................................14

(XIII)....................................................................................................................................14

(XIV)....................................................................................................................................15

(XV).....................................................................................................................................15

(XVI)....................................................................................................................................16

Conclusion................................................................................................................................16

References................................................................................................................................17

Introduction................................................................................................................................5

Overview of Companies............................................................................................................5

Myer Holdings Ltd.................................................................................................................5

Kathmandu Holdings Ltd.......................................................................................................5

OWNERS EQUITY...................................................................................................................6

(I)............................................................................................................................................6

(II)..........................................................................................................................................7

CASH FLOWS STATEMENT..........................................................................................7

(III).........................................................................................................................................7

(IV).........................................................................................................................................9

(V)........................................................................................................................................10

OTHER COMPREHENSIVE INCOME STATEMENT........................................................10

(VI).......................................................................................................................................10

(VII)......................................................................................................................................11

(IX).......................................................................................................................................12

ACCOUNTING FOR CROPORATE INCOME TAX............................................................13

(X)........................................................................................................................................13

(XI).......................................................................................................................................13

(XII)......................................................................................................................................14

(XIII)....................................................................................................................................14

(XIV)....................................................................................................................................15

(XV).....................................................................................................................................15

(XVI)....................................................................................................................................16

Conclusion................................................................................................................................16

References................................................................................................................................17

List of Tables

Table 1: Equity assessment of Myer Ltd and Kathmandu Ltd...................................................6

Table 2: Statement representing debt-equity of both the companies.........................................7

Table 3: Statement representing variants of cash flow statement of Myer Holdings................8

Table 4: Statement representing variants of cash flow statement of Kathmandu Holdings......8

Table 5: Statement representing comparative analysis of cash flow statement of Myer

Holdings.....................................................................................................................................9

Table 6: Statement representing comparative analysis of cash flow statement of Kathmandu

Holdings.....................................................................................................................................9

Table 7: Comparative Analysis of Cash Flow of Myer Holding and Kathmandu Holding.....10

Table 8 Elements of Other Comprehensive Income of Myer Holding....................................11

Table 9: Elements of Other Comprehensive Income of Kathmandu Holding.........................11

Table 10: Statement presenting income tax expense of Myer Holding and Kathmandu

Holding.....................................................................................................................................13

Table 11: Statement representing deferred tax asset and deferred tax liabilities.....................14

Table 1: Equity assessment of Myer Ltd and Kathmandu Ltd...................................................6

Table 2: Statement representing debt-equity of both the companies.........................................7

Table 3: Statement representing variants of cash flow statement of Myer Holdings................8

Table 4: Statement representing variants of cash flow statement of Kathmandu Holdings......8

Table 5: Statement representing comparative analysis of cash flow statement of Myer

Holdings.....................................................................................................................................9

Table 6: Statement representing comparative analysis of cash flow statement of Kathmandu

Holdings.....................................................................................................................................9

Table 7: Comparative Analysis of Cash Flow of Myer Holding and Kathmandu Holding.....10

Table 8 Elements of Other Comprehensive Income of Myer Holding....................................11

Table 9: Elements of Other Comprehensive Income of Kathmandu Holding.........................11

Table 10: Statement presenting income tax expense of Myer Holding and Kathmandu

Holding.....................................................................................................................................13

Table 11: Statement representing deferred tax asset and deferred tax liabilities.....................14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTRODUCTION

Financial Reporting comprises disclosure of financial information to the various stakeholders

relating to financial performance and financial position of the company over a specified time.

Each part of the financial report, i.e. statement of profit and loss, statement of affairs of the

company, statement of changes in equity and cash flow statement reveal significant

information relating to the organization. The manner in which operations are being continued

in the company can be revealed from same. The present report provides an assessment of

equity, other comprehensive income, taxation and cash flow of Mayer Holding and

Kathmandu Holding. Further, all these specified parts of the financial report of both the

companies have been compared in order to provide an appropriate opinion.

OVERVIEW OF COMPANIES

Myer Holdings Ltd

Myer Holdings Limited (Myer) is a department store company situated in Australia. Its

department store network comprises a trail of about 60 retail locations in Australia. The Myer

retail deals with 11 different types of products such as Women’s wear, Menswear, Youth

shop, Intimate wears, Cosmetics, perfumes, homewares, electrical appliances, toys, handbags,

accessories along with general products. In addition to this, it also owns women wear fashion

brand sass & bide, which is an Australian designer brand. The brand of the company

comprises TOPSHOP TOPMAN, Seed, French Connection, Mimco, Veronika Mainr, Jack &

Jones as well as Industrie. Moreover, its ancillary companies are Myer Pty Ltd, NB Elizabeth

Pty, NB Russell Pty Ltd, Warehouse Solutions Pty Ltd, Myer Group Finance Ltd, Myer

Group Pty Ltd and Myer Travel Pty Ltd. Apart from this, the company also undertakes

activities outside the department store with its ancillaries sass & bide, FSS Retail Pty Ltd.

Kathmandu Holdings Ltd

Kathmandu Holdings Ltd is a public company established in New Zealand dealing with

design, marketing and retail sale of clothing as well as clothing and equipment for travel and

outdoor use. Approximately1900 employees are employed in the company. It operates in

New Zealand, Australia and UK. Further, it is administrated by its head office in

Christchurch which is located in New Zealand. Currently, the company is functioning 163

Financial Reporting comprises disclosure of financial information to the various stakeholders

relating to financial performance and financial position of the company over a specified time.

Each part of the financial report, i.e. statement of profit and loss, statement of affairs of the

company, statement of changes in equity and cash flow statement reveal significant

information relating to the organization. The manner in which operations are being continued

in the company can be revealed from same. The present report provides an assessment of

equity, other comprehensive income, taxation and cash flow of Mayer Holding and

Kathmandu Holding. Further, all these specified parts of the financial report of both the

companies have been compared in order to provide an appropriate opinion.

OVERVIEW OF COMPANIES

Myer Holdings Ltd

Myer Holdings Limited (Myer) is a department store company situated in Australia. Its

department store network comprises a trail of about 60 retail locations in Australia. The Myer

retail deals with 11 different types of products such as Women’s wear, Menswear, Youth

shop, Intimate wears, Cosmetics, perfumes, homewares, electrical appliances, toys, handbags,

accessories along with general products. In addition to this, it also owns women wear fashion

brand sass & bide, which is an Australian designer brand. The brand of the company

comprises TOPSHOP TOPMAN, Seed, French Connection, Mimco, Veronika Mainr, Jack &

Jones as well as Industrie. Moreover, its ancillary companies are Myer Pty Ltd, NB Elizabeth

Pty, NB Russell Pty Ltd, Warehouse Solutions Pty Ltd, Myer Group Finance Ltd, Myer

Group Pty Ltd and Myer Travel Pty Ltd. Apart from this, the company also undertakes

activities outside the department store with its ancillaries sass & bide, FSS Retail Pty Ltd.

Kathmandu Holdings Ltd

Kathmandu Holdings Ltd is a public company established in New Zealand dealing with

design, marketing and retail sale of clothing as well as clothing and equipment for travel and

outdoor use. Approximately1900 employees are employed in the company. It operates in

New Zealand, Australia and UK. Further, it is administrated by its head office in

Christchurch which is located in New Zealand. Currently, the company is functioning 163

stores including 47 in New Zealand, 115 in Australia and 1 in the UK. Apart from this,

Kathmandu manufactures its house-branded items, along with its product variety comprising

apparel such as waterproof jackets, down jackets, thermals, fleece jackets, shirts and pants,

merino clothing and thermals as well as footwear, socks etc.

OWNERS EQUITY

(I)

Myer Holdings Ltd

Year 2017

$’000

2016

$’000

2015

$’000

Equity 739329.00 739338.00 524755.00

Retained Earning 342146.00 379483.00 335366.00

Reserves -8607.00 -11056.00 2895.00

Total Equity 1072868.00 1107765.00 863016.00

Kathmandu Holdings Ltd

Table 1: Equity assessment of Myer Ltd and Kathmandu Ltd

Year 2017

NZ$’000

2016

NZ$’000

2015

NZ$’000

Equity 200209.00 200191.00 200191.00

Reserve -23002.00 -24541.00 -2934.00

Retained Earning 149893.00 136033.00 116057.00

Total Equity 327100.00 311683.00 313314.00

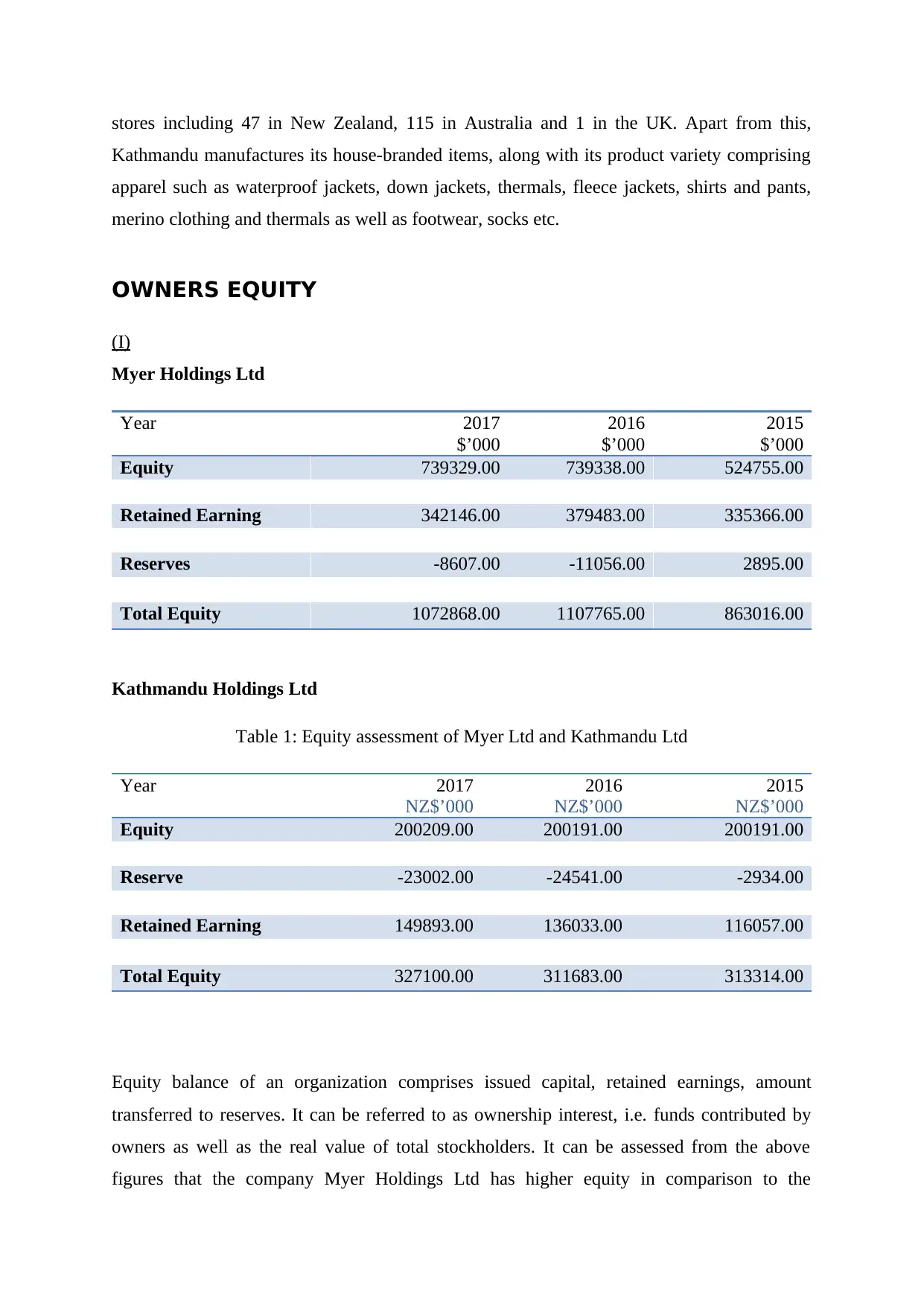

Equity balance of an organization comprises issued capital, retained earnings, amount

transferred to reserves. It can be referred to as ownership interest, i.e. funds contributed by

owners as well as the real value of total stockholders. It can be assessed from the above

figures that the company Myer Holdings Ltd has higher equity in comparison to the

Kathmandu manufactures its house-branded items, along with its product variety comprising

apparel such as waterproof jackets, down jackets, thermals, fleece jackets, shirts and pants,

merino clothing and thermals as well as footwear, socks etc.

OWNERS EQUITY

(I)

Myer Holdings Ltd

Year 2017

$’000

2016

$’000

2015

$’000

Equity 739329.00 739338.00 524755.00

Retained Earning 342146.00 379483.00 335366.00

Reserves -8607.00 -11056.00 2895.00

Total Equity 1072868.00 1107765.00 863016.00

Kathmandu Holdings Ltd

Table 1: Equity assessment of Myer Ltd and Kathmandu Ltd

Year 2017

NZ$’000

2016

NZ$’000

2015

NZ$’000

Equity 200209.00 200191.00 200191.00

Reserve -23002.00 -24541.00 -2934.00

Retained Earning 149893.00 136033.00 116057.00

Total Equity 327100.00 311683.00 313314.00

Equity balance of an organization comprises issued capital, retained earnings, amount

transferred to reserves. It can be referred to as ownership interest, i.e. funds contributed by

owners as well as the real value of total stockholders. It can be assessed from the above

figures that the company Myer Holdings Ltd has higher equity in comparison to the

Kathmandu Holdings Ltd. The dividend paid by the company was $49276 million in the year

2017and same have affected the retained earnings. From the above evaluation, it can be

noticed that the reserves of both the companies are negative. In case of Myer Holdings Ltd

the reason behind the same is that when the shareholders were entering in the contract that is

at the time of acquirement, the Group held a call opportunity over the non-controlling

shareholders. At the time of acquisition of leftover 35% of sass & bide, the cash payment of

$33.4 million was accounted against present financial accountability, and non-controlling

interest balances were accounted in other reserves. Kathmandu has issued capital of $18000

during the year 2017 (Kathmandu Annual Report, 2017). Moreover, a decreasing trend in

retained earning can be assessed in the case of Kathmandu.

(II)

Table 2: Statement representing debt-equity of both the companies

Particular Myer Ltd

$’000

Kathmandu Ltd

NZ$’000

Interest-bearing loan and liabilities 143367.00 10431.00

Total Equity 1072868.00 327100.00

Debt Equity Ratio 0.13 0.03

Debt to equity ratio refers to the financial ratio which indicates the relative proportion of

shareholder’s equity and debt utilised to finance the assets of the company (Fitri, Supriyanto

and Oemar 2016). Further, the debt to equity ratio of Kathmandu Ltd is low which shows that

the proportion of debt is less in comparison to debt. The same implies that the company relies

more on internal financing and is able to develop sufficient funds. On the other hand, Myer’s

debt to equity ratio is higher which indicates that the company is relying more on debt in

comparison to equity for financing.

CASH FLOWS STATEMENT

(III)

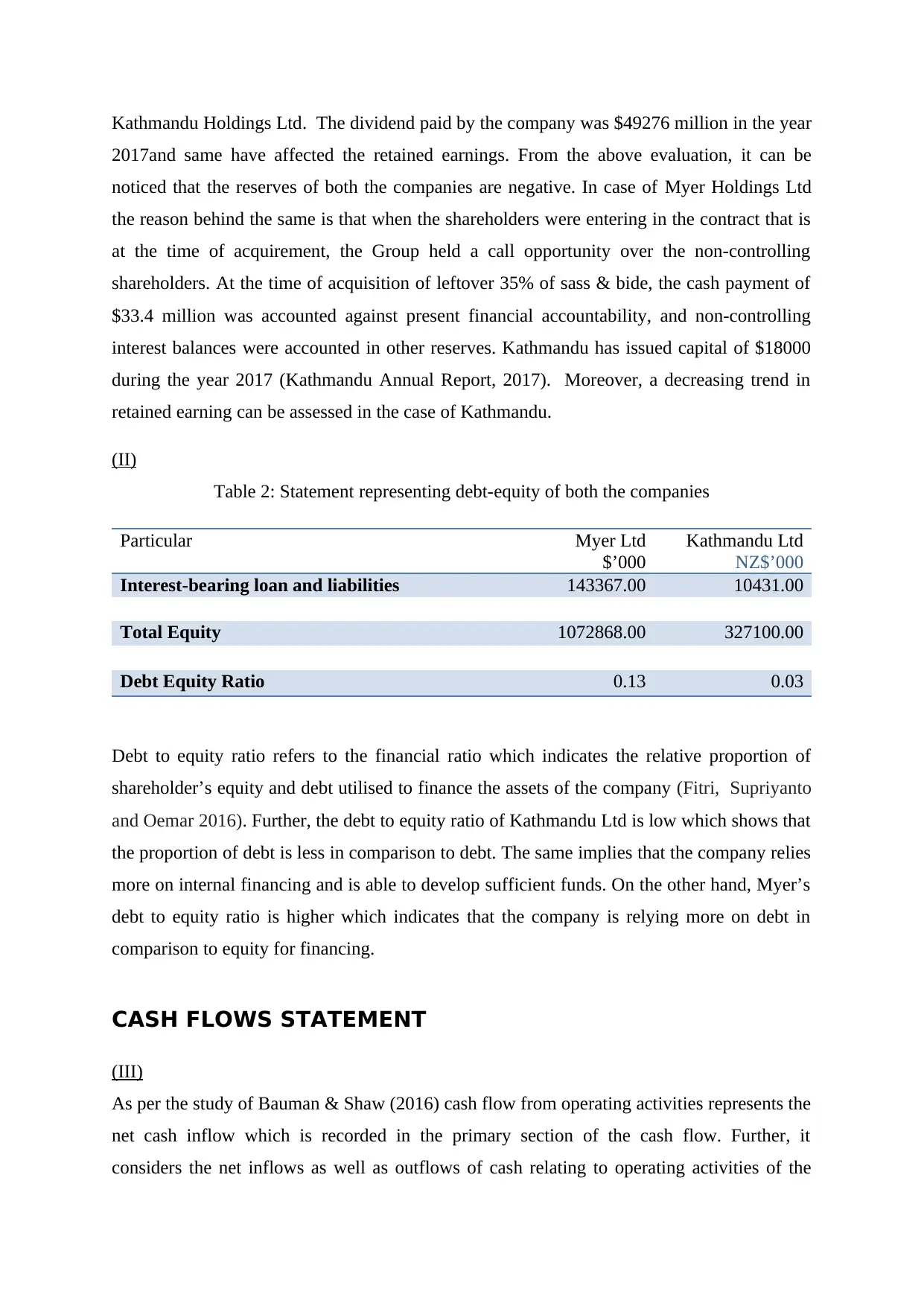

As per the study of Bauman & Shaw (2016) cash flow from operating activities represents the

net cash inflow which is recorded in the primary section of the cash flow. Further, it

considers the net inflows as well as outflows of cash relating to operating activities of the

2017and same have affected the retained earnings. From the above evaluation, it can be

noticed that the reserves of both the companies are negative. In case of Myer Holdings Ltd

the reason behind the same is that when the shareholders were entering in the contract that is

at the time of acquirement, the Group held a call opportunity over the non-controlling

shareholders. At the time of acquisition of leftover 35% of sass & bide, the cash payment of

$33.4 million was accounted against present financial accountability, and non-controlling

interest balances were accounted in other reserves. Kathmandu has issued capital of $18000

during the year 2017 (Kathmandu Annual Report, 2017). Moreover, a decreasing trend in

retained earning can be assessed in the case of Kathmandu.

(II)

Table 2: Statement representing debt-equity of both the companies

Particular Myer Ltd

$’000

Kathmandu Ltd

NZ$’000

Interest-bearing loan and liabilities 143367.00 10431.00

Total Equity 1072868.00 327100.00

Debt Equity Ratio 0.13 0.03

Debt to equity ratio refers to the financial ratio which indicates the relative proportion of

shareholder’s equity and debt utilised to finance the assets of the company (Fitri, Supriyanto

and Oemar 2016). Further, the debt to equity ratio of Kathmandu Ltd is low which shows that

the proportion of debt is less in comparison to debt. The same implies that the company relies

more on internal financing and is able to develop sufficient funds. On the other hand, Myer’s

debt to equity ratio is higher which indicates that the company is relying more on debt in

comparison to equity for financing.

CASH FLOWS STATEMENT

(III)

As per the study of Bauman & Shaw (2016) cash flow from operating activities represents the

net cash inflow which is recorded in the primary section of the cash flow. Further, it

considers the net inflows as well as outflows of cash relating to operating activities of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company (Cable, Healy, and Sun, 2018). According to Collins, Hribar and Tian (2014),

investing activities of cash flow refers to an item of a cash flow statement which reports the

aggregate change in the cash position of the company resulting from the gains and losses of

the investment. Financing activities of cash flow refer to that category of cash flow statement

which accounts external activities that enable a company to raise capital (Lee 2014).

Moreover, with accordance to Gitman, Juchau and Flanagan (2015), it also involves payment

of dividend to investors, changing in loans or issuing more inventories.

Table 3: Statement representing variants of cash flow statement of Myer Holdings

(Amount in $000)

Year 2017 2016 2015

Operating Cash Inflow 149278.00 149490.00 96915.00

Investing Cash Outflow -109456.00 -58251.00 -62350.00

Financing Cash Outflow -54438.00 -99355.00 -54806.00

Net Decrease in Cash Held -14,616 -8116 -20241

Table 4: Statement representing variants of cash flow statement of Kathmandu Holdings

Particulars 2017

NZ$’000

2016

NZ$’000

2015

NZ$’000

Operating Cash Inflow 67273.00 69080.00 29627.00

Investing Cash Outflow -13275.00 -23191.00 -19980.00

Financing Cash Outflow -57382.00 -40730.00 -14898.00

Net Decrease in Cash Held -3384 5159 -5251

investing activities of cash flow refers to an item of a cash flow statement which reports the

aggregate change in the cash position of the company resulting from the gains and losses of

the investment. Financing activities of cash flow refer to that category of cash flow statement

which accounts external activities that enable a company to raise capital (Lee 2014).

Moreover, with accordance to Gitman, Juchau and Flanagan (2015), it also involves payment

of dividend to investors, changing in loans or issuing more inventories.

Table 3: Statement representing variants of cash flow statement of Myer Holdings

(Amount in $000)

Year 2017 2016 2015

Operating Cash Inflow 149278.00 149490.00 96915.00

Investing Cash Outflow -109456.00 -58251.00 -62350.00

Financing Cash Outflow -54438.00 -99355.00 -54806.00

Net Decrease in Cash Held -14,616 -8116 -20241

Table 4: Statement representing variants of cash flow statement of Kathmandu Holdings

Particulars 2017

NZ$’000

2016

NZ$’000

2015

NZ$’000

Operating Cash Inflow 67273.00 69080.00 29627.00

Investing Cash Outflow -13275.00 -23191.00 -19980.00

Financing Cash Outflow -57382.00 -40730.00 -14898.00

Net Decrease in Cash Held -3384 5159 -5251

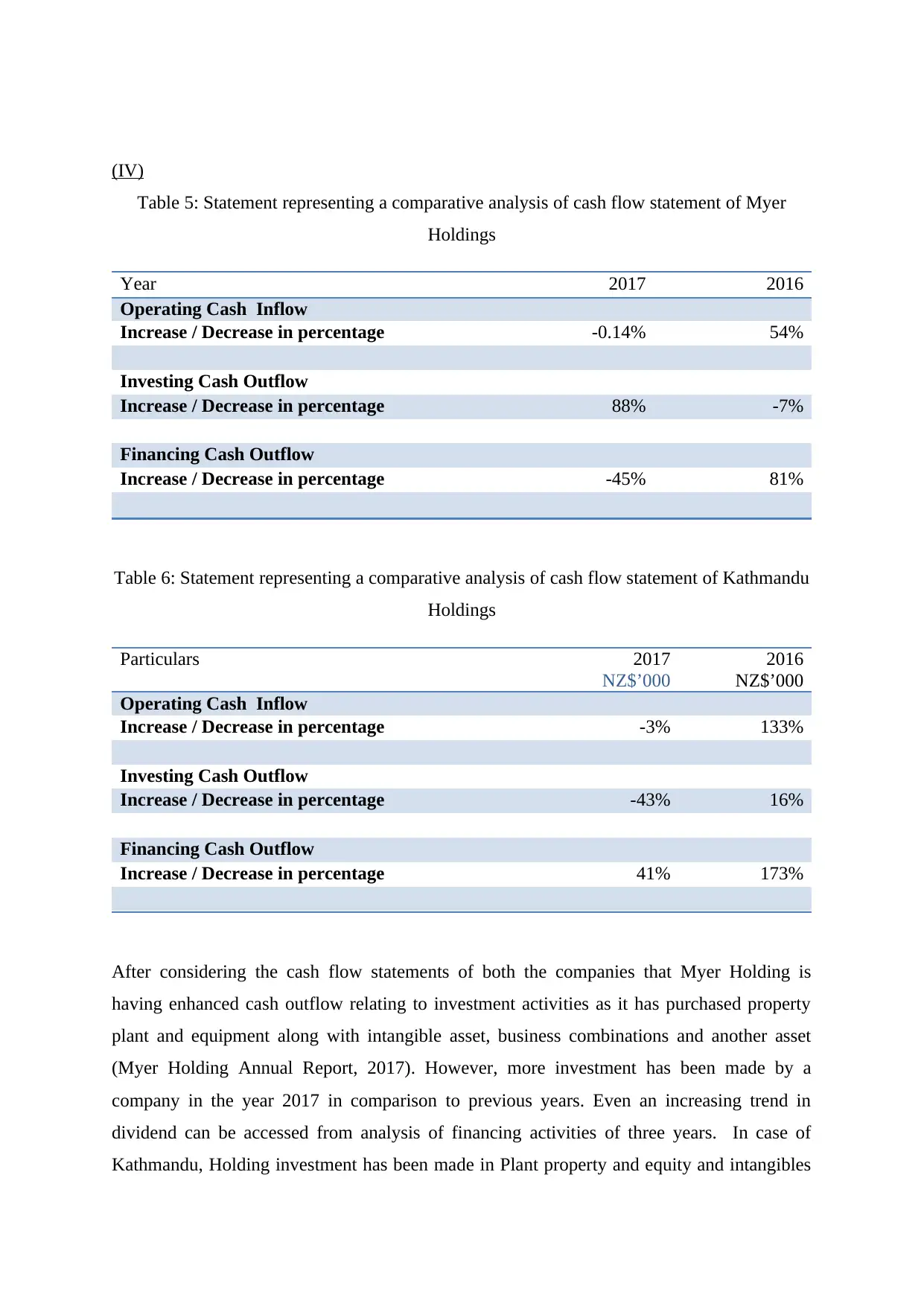

(IV)

Table 5: Statement representing a comparative analysis of cash flow statement of Myer

Holdings

Year 2017 2016

Operating Cash Inflow

Increase / Decrease in percentage -0.14% 54%

Investing Cash Outflow

Increase / Decrease in percentage 88% -7%

Financing Cash Outflow

Increase / Decrease in percentage -45% 81%

Table 6: Statement representing a comparative analysis of cash flow statement of Kathmandu

Holdings

Particulars 2017

NZ$’000

2016

NZ$’000

Operating Cash Inflow

Increase / Decrease in percentage -3% 133%

Investing Cash Outflow

Increase / Decrease in percentage -43% 16%

Financing Cash Outflow

Increase / Decrease in percentage 41% 173%

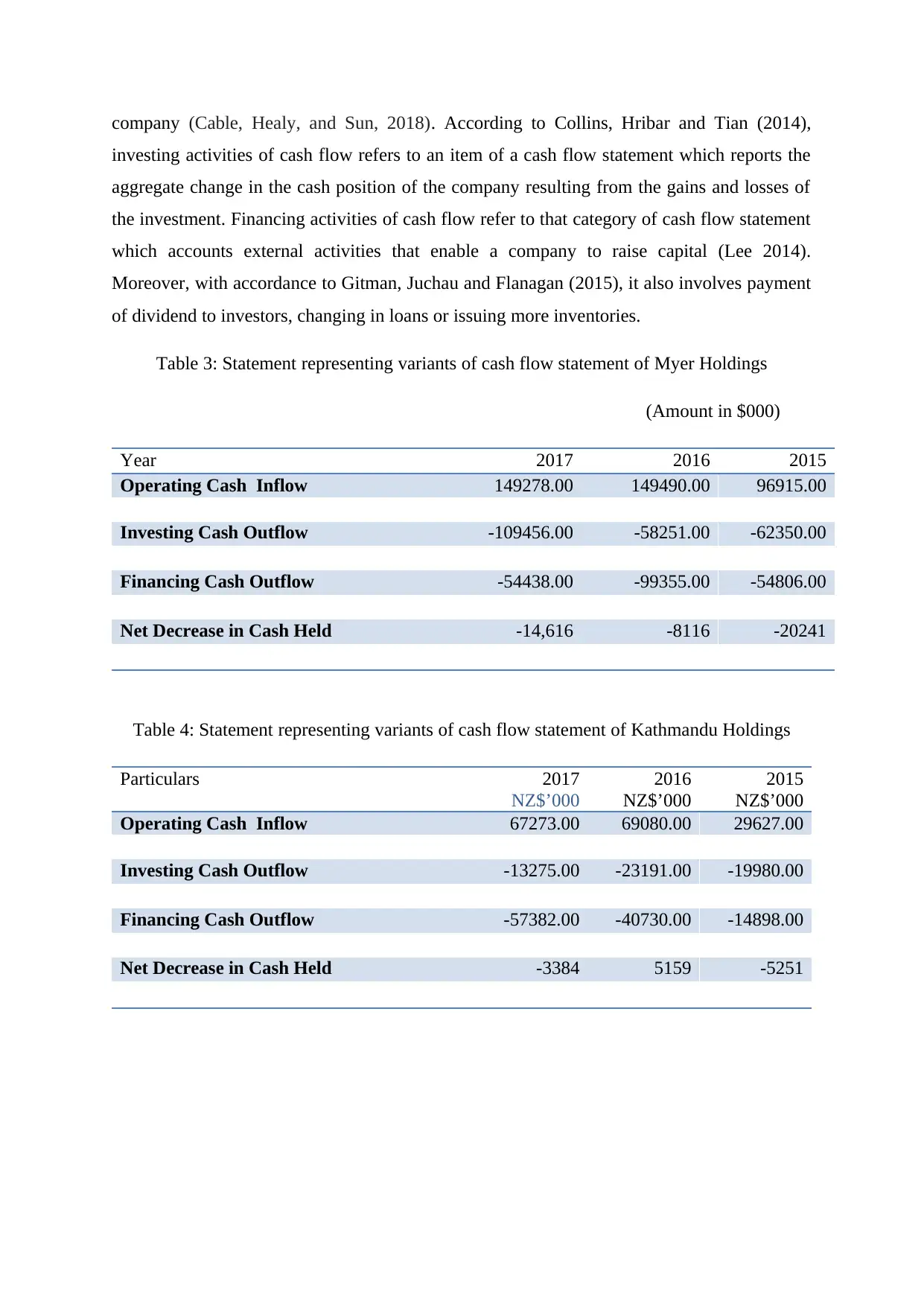

After considering the cash flow statements of both the companies that Myer Holding is

having enhanced cash outflow relating to investment activities as it has purchased property

plant and equipment along with intangible asset, business combinations and another asset

(Myer Holding Annual Report, 2017). However, more investment has been made by a

company in the year 2017 in comparison to previous years. Even an increasing trend in

dividend can be accessed from analysis of financing activities of three years. In case of

Kathmandu, Holding investment has been made in Plant property and equity and intangibles

Table 5: Statement representing a comparative analysis of cash flow statement of Myer

Holdings

Year 2017 2016

Operating Cash Inflow

Increase / Decrease in percentage -0.14% 54%

Investing Cash Outflow

Increase / Decrease in percentage 88% -7%

Financing Cash Outflow

Increase / Decrease in percentage -45% 81%

Table 6: Statement representing a comparative analysis of cash flow statement of Kathmandu

Holdings

Particulars 2017

NZ$’000

2016

NZ$’000

Operating Cash Inflow

Increase / Decrease in percentage -3% 133%

Investing Cash Outflow

Increase / Decrease in percentage -43% 16%

Financing Cash Outflow

Increase / Decrease in percentage 41% 173%

After considering the cash flow statements of both the companies that Myer Holding is

having enhanced cash outflow relating to investment activities as it has purchased property

plant and equipment along with intangible asset, business combinations and another asset

(Myer Holding Annual Report, 2017). However, more investment has been made by a

company in the year 2017 in comparison to previous years. Even an increasing trend in

dividend can be accessed from analysis of financing activities of three years. In case of

Kathmandu, Holding investment has been made in Plant property and equity and intangibles

only. After analyzing three years, it can be concluded that major of the investment has been

made in the year 2016 (Kathmandu Holdings Ltd Annual Report 2017).

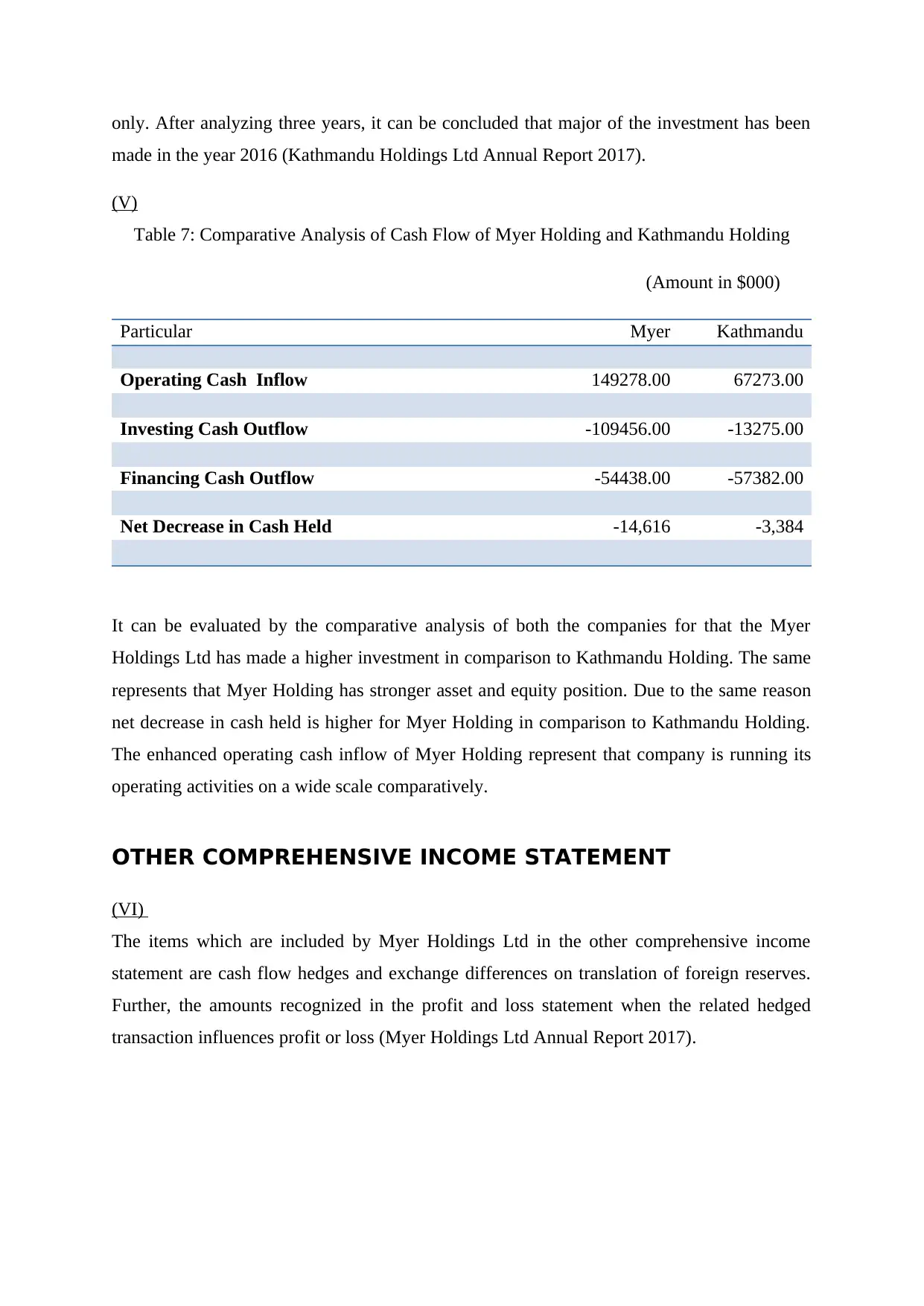

(V)

Table 7: Comparative Analysis of Cash Flow of Myer Holding and Kathmandu Holding

(Amount in $000)

Particular Myer Kathmandu

Operating Cash Inflow 149278.00 67273.00

Investing Cash Outflow -109456.00 -13275.00

Financing Cash Outflow -54438.00 -57382.00

Net Decrease in Cash Held -14,616 -3,384

It can be evaluated by the comparative analysis of both the companies for that the Myer

Holdings Ltd has made a higher investment in comparison to Kathmandu Holding. The same

represents that Myer Holding has stronger asset and equity position. Due to the same reason

net decrease in cash held is higher for Myer Holding in comparison to Kathmandu Holding.

The enhanced operating cash inflow of Myer Holding represent that company is running its

operating activities on a wide scale comparatively.

OTHER COMPREHENSIVE INCOME STATEMENT

(VI)

The items which are included by Myer Holdings Ltd in the other comprehensive income

statement are cash flow hedges and exchange differences on translation of foreign reserves.

Further, the amounts recognized in the profit and loss statement when the related hedged

transaction influences profit or loss (Myer Holdings Ltd Annual Report 2017).

made in the year 2016 (Kathmandu Holdings Ltd Annual Report 2017).

(V)

Table 7: Comparative Analysis of Cash Flow of Myer Holding and Kathmandu Holding

(Amount in $000)

Particular Myer Kathmandu

Operating Cash Inflow 149278.00 67273.00

Investing Cash Outflow -109456.00 -13275.00

Financing Cash Outflow -54438.00 -57382.00

Net Decrease in Cash Held -14,616 -3,384

It can be evaluated by the comparative analysis of both the companies for that the Myer

Holdings Ltd has made a higher investment in comparison to Kathmandu Holding. The same

represents that Myer Holding has stronger asset and equity position. Due to the same reason

net decrease in cash held is higher for Myer Holding in comparison to Kathmandu Holding.

The enhanced operating cash inflow of Myer Holding represent that company is running its

operating activities on a wide scale comparatively.

OTHER COMPREHENSIVE INCOME STATEMENT

(VI)

The items which are included by Myer Holdings Ltd in the other comprehensive income

statement are cash flow hedges and exchange differences on translation of foreign reserves.

Further, the amounts recognized in the profit and loss statement when the related hedged

transaction influences profit or loss (Myer Holdings Ltd Annual Report 2017).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

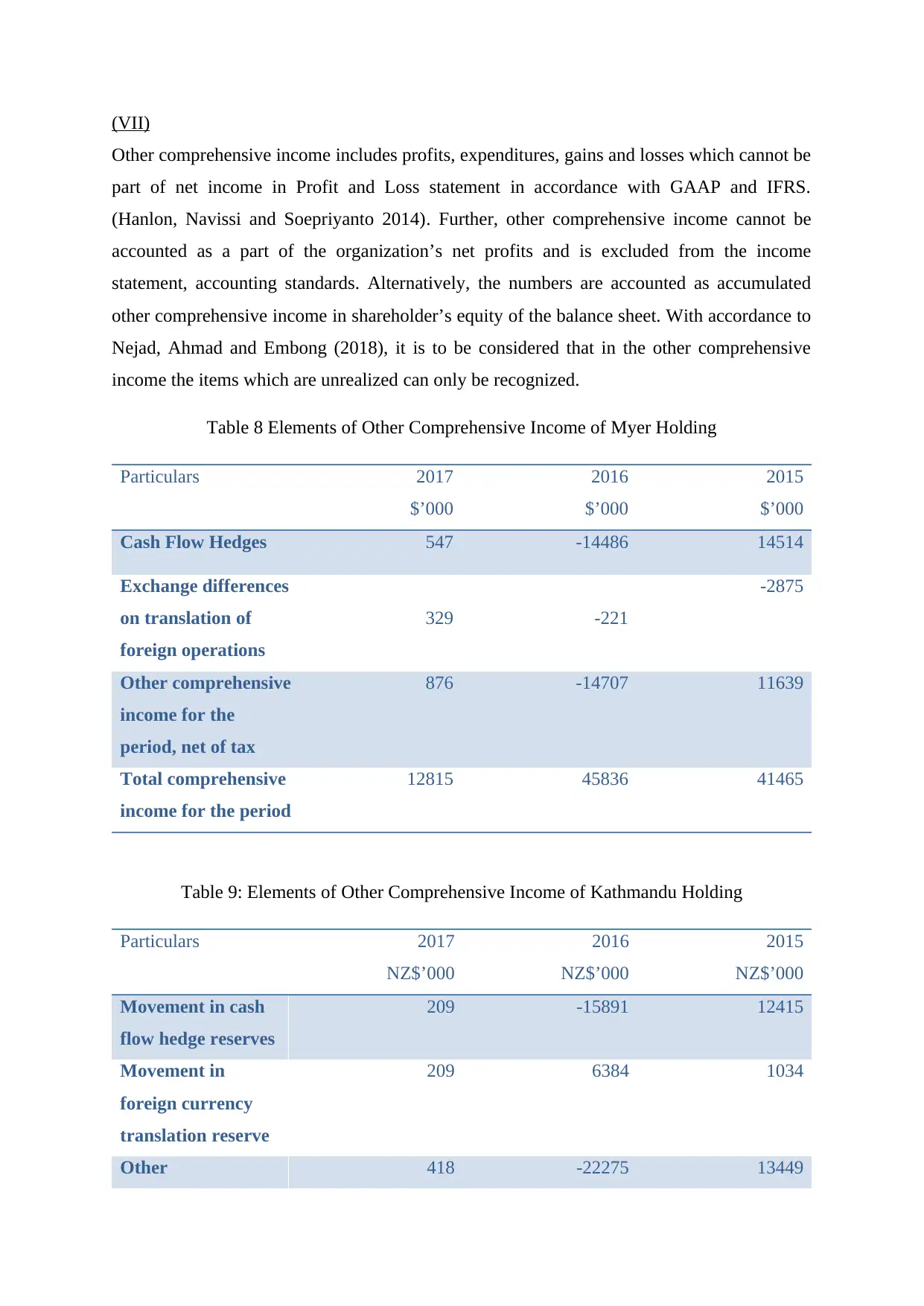

(VII)

Other comprehensive income includes profits, expenditures, gains and losses which cannot be

part of net income in Profit and Loss statement in accordance with GAAP and IFRS.

(Hanlon, Navissi and Soepriyanto 2014). Further, other comprehensive income cannot be

accounted as a part of the organization’s net profits and is excluded from the income

statement, accounting standards. Alternatively, the numbers are accounted as accumulated

other comprehensive income in shareholder’s equity of the balance sheet. With accordance to

Nejad, Ahmad and Embong (2018), it is to be considered that in the other comprehensive

income the items which are unrealized can only be recognized.

Table 8 Elements of Other Comprehensive Income of Myer Holding

Particulars 2017

$’000

2016

$’000

2015

$’000

Cash Flow Hedges 547 -14486 14514

Exchange differences

on translation of

foreign operations

329 -221

-2875

Other comprehensive

income for the

period, net of tax

876 -14707 11639

Total comprehensive

income for the period

12815 45836 41465

Table 9: Elements of Other Comprehensive Income of Kathmandu Holding

Particulars 2017

NZ$’000

2016

NZ$’000

2015

NZ$’000

Movement in cash

flow hedge reserves

209 -15891 12415

Movement in

foreign currency

translation reserve

209 6384 1034

Other 418 -22275 13449

Other comprehensive income includes profits, expenditures, gains and losses which cannot be

part of net income in Profit and Loss statement in accordance with GAAP and IFRS.

(Hanlon, Navissi and Soepriyanto 2014). Further, other comprehensive income cannot be

accounted as a part of the organization’s net profits and is excluded from the income

statement, accounting standards. Alternatively, the numbers are accounted as accumulated

other comprehensive income in shareholder’s equity of the balance sheet. With accordance to

Nejad, Ahmad and Embong (2018), it is to be considered that in the other comprehensive

income the items which are unrealized can only be recognized.

Table 8 Elements of Other Comprehensive Income of Myer Holding

Particulars 2017

$’000

2016

$’000

2015

$’000

Cash Flow Hedges 547 -14486 14514

Exchange differences

on translation of

foreign operations

329 -221

-2875

Other comprehensive

income for the

period, net of tax

876 -14707 11639

Total comprehensive

income for the period

12815 45836 41465

Table 9: Elements of Other Comprehensive Income of Kathmandu Holding

Particulars 2017

NZ$’000

2016

NZ$’000

2015

NZ$’000

Movement in cash

flow hedge reserves

209 -15891 12415

Movement in

foreign currency

translation reserve

209 6384 1034

Other 418 -22275 13449

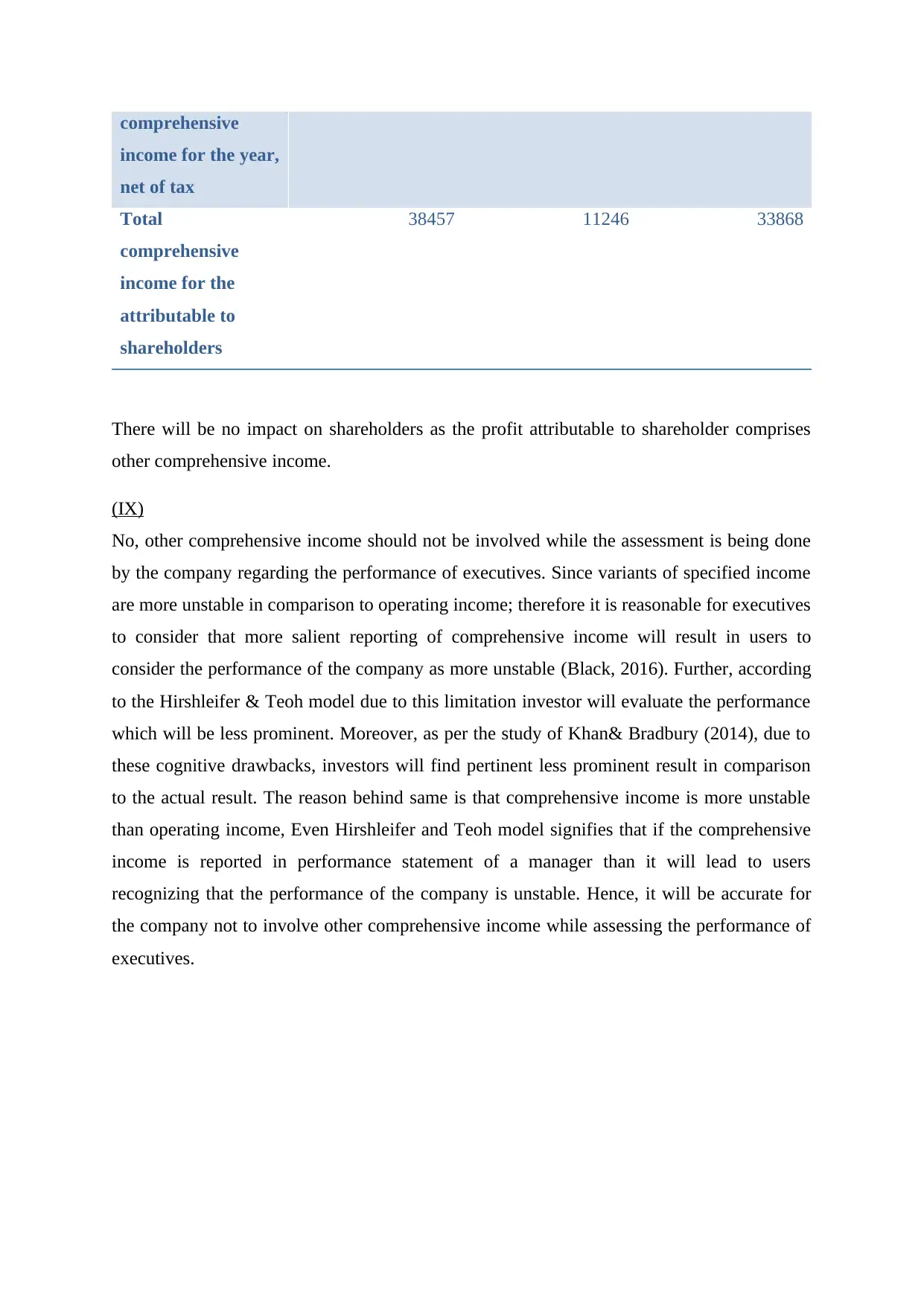

comprehensive

income for the year,

net of tax

Total

comprehensive

income for the

attributable to

shareholders

38457 11246 33868

There will be no impact on shareholders as the profit attributable to shareholder comprises

other comprehensive income.

(IX)

No, other comprehensive income should not be involved while the assessment is being done

by the company regarding the performance of executives. Since variants of specified income

are more unstable in comparison to operating income; therefore it is reasonable for executives

to consider that more salient reporting of comprehensive income will result in users to

consider the performance of the company as more unstable (Black, 2016). Further, according

to the Hirshleifer & Teoh model due to this limitation investor will evaluate the performance

which will be less prominent. Moreover, as per the study of Khan& Bradbury (2014), due to

these cognitive drawbacks, investors will find pertinent less prominent result in comparison

to the actual result. The reason behind same is that comprehensive income is more unstable

than operating income, Even Hirshleifer and Teoh model signifies that if the comprehensive

income is reported in performance statement of a manager than it will lead to users

recognizing that the performance of the company is unstable. Hence, it will be accurate for

the company not to involve other comprehensive income while assessing the performance of

executives.

income for the year,

net of tax

Total

comprehensive

income for the

attributable to

shareholders

38457 11246 33868

There will be no impact on shareholders as the profit attributable to shareholder comprises

other comprehensive income.

(IX)

No, other comprehensive income should not be involved while the assessment is being done

by the company regarding the performance of executives. Since variants of specified income

are more unstable in comparison to operating income; therefore it is reasonable for executives

to consider that more salient reporting of comprehensive income will result in users to

consider the performance of the company as more unstable (Black, 2016). Further, according

to the Hirshleifer & Teoh model due to this limitation investor will evaluate the performance

which will be less prominent. Moreover, as per the study of Khan& Bradbury (2014), due to

these cognitive drawbacks, investors will find pertinent less prominent result in comparison

to the actual result. The reason behind same is that comprehensive income is more unstable

than operating income, Even Hirshleifer and Teoh model signifies that if the comprehensive

income is reported in performance statement of a manager than it will lead to users

recognizing that the performance of the company is unstable. Hence, it will be accurate for

the company not to involve other comprehensive income while assessing the performance of

executives.

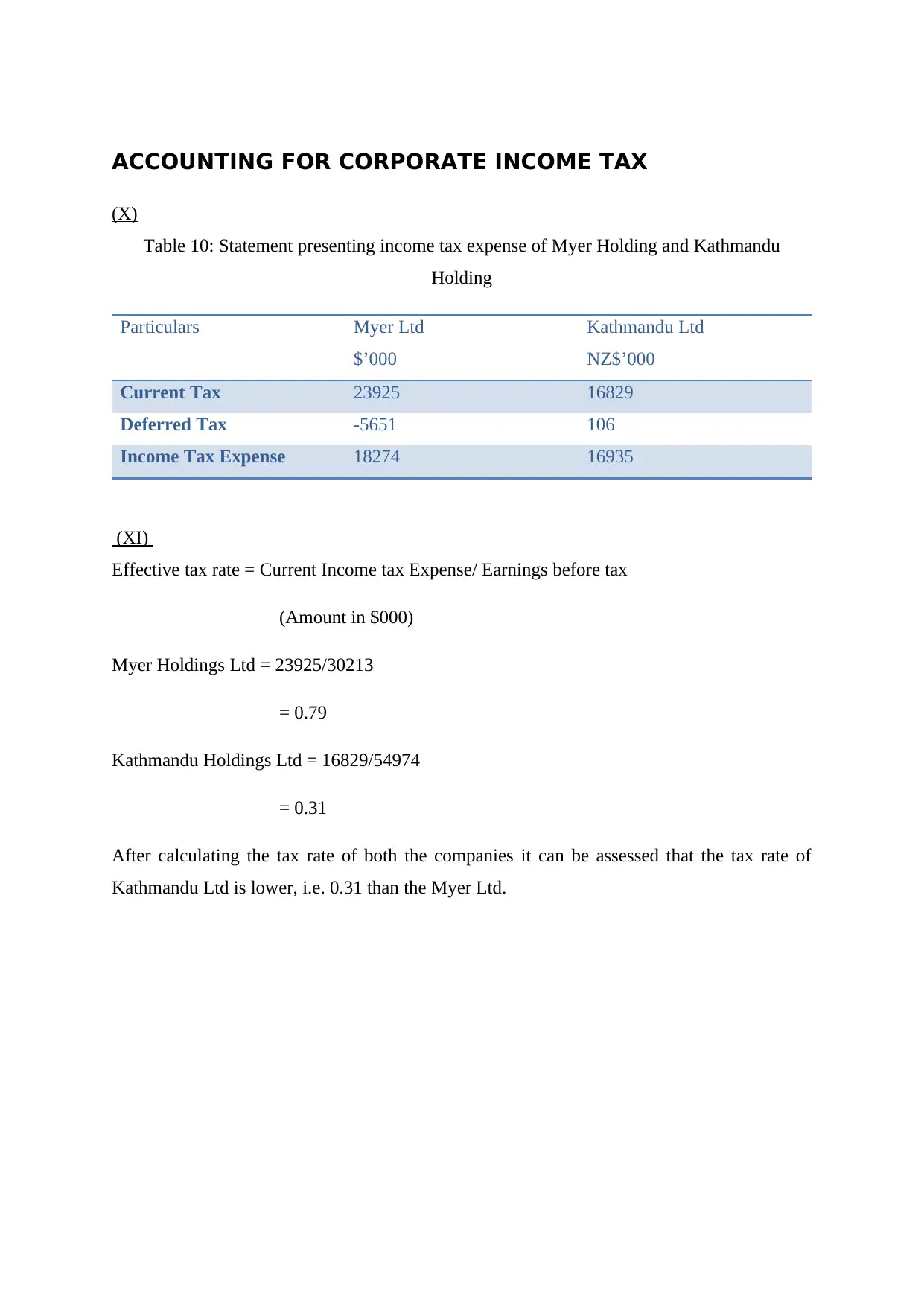

ACCOUNTING FOR CORPORATE INCOME TAX

(X)

Table 10: Statement presenting income tax expense of Myer Holding and Kathmandu

Holding

Particulars Myer Ltd

$’000

Kathmandu Ltd

NZ$’000

Current Tax 23925 16829

Deferred Tax -5651 106

Income Tax Expense 18274 16935

(XI)

Effective tax rate = Current Income tax Expense/ Earnings before tax

(Amount in $000)

Myer Holdings Ltd = 23925/30213

= 0.79

Kathmandu Holdings Ltd = 16829/54974

= 0.31

After calculating the tax rate of both the companies it can be assessed that the tax rate of

Kathmandu Ltd is lower, i.e. 0.31 than the Myer Ltd.

(X)

Table 10: Statement presenting income tax expense of Myer Holding and Kathmandu

Holding

Particulars Myer Ltd

$’000

Kathmandu Ltd

NZ$’000

Current Tax 23925 16829

Deferred Tax -5651 106

Income Tax Expense 18274 16935

(XI)

Effective tax rate = Current Income tax Expense/ Earnings before tax

(Amount in $000)

Myer Holdings Ltd = 23925/30213

= 0.79

Kathmandu Holdings Ltd = 16829/54974

= 0.31

After calculating the tax rate of both the companies it can be assessed that the tax rate of

Kathmandu Ltd is lower, i.e. 0.31 than the Myer Ltd.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

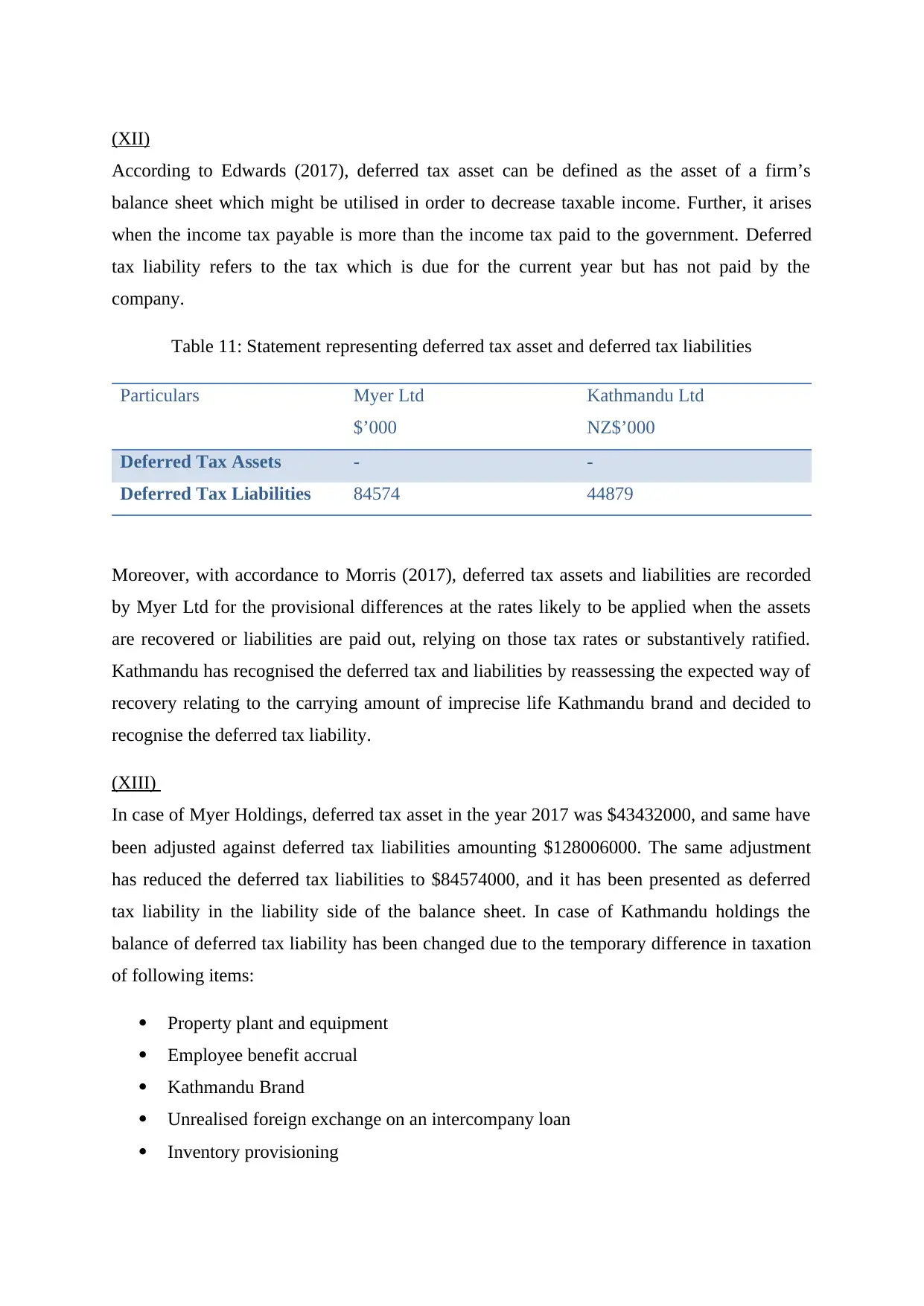

(XII)

According to Edwards (2017), deferred tax asset can be defined as the asset of a firm’s

balance sheet which might be utilised in order to decrease taxable income. Further, it arises

when the income tax payable is more than the income tax paid to the government. Deferred

tax liability refers to the tax which is due for the current year but has not paid by the

company.

Table 11: Statement representing deferred tax asset and deferred tax liabilities

Particulars Myer Ltd

$’000

Kathmandu Ltd

NZ$’000

Deferred Tax Assets - -

Deferred Tax Liabilities 84574 44879

Moreover, with accordance to Morris (2017), deferred tax assets and liabilities are recorded

by Myer Ltd for the provisional differences at the rates likely to be applied when the assets

are recovered or liabilities are paid out, relying on those tax rates or substantively ratified.

Kathmandu has recognised the deferred tax and liabilities by reassessing the expected way of

recovery relating to the carrying amount of imprecise life Kathmandu brand and decided to

recognise the deferred tax liability.

(XIII)

In case of Myer Holdings, deferred tax asset in the year 2017 was $43432000, and same have

been adjusted against deferred tax liabilities amounting $128006000. The same adjustment

has reduced the deferred tax liabilities to $84574000, and it has been presented as deferred

tax liability in the liability side of the balance sheet. In case of Kathmandu holdings the

balance of deferred tax liability has been changed due to the temporary difference in taxation

of following items:

Property plant and equipment

Employee benefit accrual

Kathmandu Brand

Unrealised foreign exchange on an intercompany loan

Inventory provisioning

According to Edwards (2017), deferred tax asset can be defined as the asset of a firm’s

balance sheet which might be utilised in order to decrease taxable income. Further, it arises

when the income tax payable is more than the income tax paid to the government. Deferred

tax liability refers to the tax which is due for the current year but has not paid by the

company.

Table 11: Statement representing deferred tax asset and deferred tax liabilities

Particulars Myer Ltd

$’000

Kathmandu Ltd

NZ$’000

Deferred Tax Assets - -

Deferred Tax Liabilities 84574 44879

Moreover, with accordance to Morris (2017), deferred tax assets and liabilities are recorded

by Myer Ltd for the provisional differences at the rates likely to be applied when the assets

are recovered or liabilities are paid out, relying on those tax rates or substantively ratified.

Kathmandu has recognised the deferred tax and liabilities by reassessing the expected way of

recovery relating to the carrying amount of imprecise life Kathmandu brand and decided to

recognise the deferred tax liability.

(XIII)

In case of Myer Holdings, deferred tax asset in the year 2017 was $43432000, and same have

been adjusted against deferred tax liabilities amounting $128006000. The same adjustment

has reduced the deferred tax liabilities to $84574000, and it has been presented as deferred

tax liability in the liability side of the balance sheet. In case of Kathmandu holdings the

balance of deferred tax liability has been changed due to the temporary difference in taxation

of following items:

Property plant and equipment

Employee benefit accrual

Kathmandu Brand

Unrealised foreign exchange on an intercompany loan

Inventory provisioning

Realized gain or loss on foreign exchange contract not yet provided in comprehensive

income.

The main change has been due to change in accounting treatment of Brand as it was

previously recognised as indefinite life brand when acquired in the year 2006. But now the

company follows IFRS interpretation relating to recovery of the intangible asset with

indefinite life for the purpose of evaluating deferred tax as per IAS 12 Income Taxes. As a

result, company has recognized additional goodwill, deferred tax liability and retained

earnings by giving the effect of same.

(XIV)

Cash tax expense for

Kathmandu holding for the year 2017:

Book-Tax $15393000

Deferred Tax Adjustment $80000

Cash Tax $16935000

Myer Holdings for the year 2017:

Book-Tax $23925000

Deferred Tax Adjustment ($5651000)

Cash Tax $18274000.

(XV)

The cash tax amount evaluated as per tax laws reflects the amount the company must pay to

satisfy its obligation relating to the government. The formula for cash tax rate is Cash tax

paid for the year/ earnings before taxes.

Myer Holdings for the year 2017:

Profit before income tax $30213000

Cash Tax $18274000

Rate 60.05%

income.

The main change has been due to change in accounting treatment of Brand as it was

previously recognised as indefinite life brand when acquired in the year 2006. But now the

company follows IFRS interpretation relating to recovery of the intangible asset with

indefinite life for the purpose of evaluating deferred tax as per IAS 12 Income Taxes. As a

result, company has recognized additional goodwill, deferred tax liability and retained

earnings by giving the effect of same.

(XIV)

Cash tax expense for

Kathmandu holding for the year 2017:

Book-Tax $15393000

Deferred Tax Adjustment $80000

Cash Tax $16935000

Myer Holdings for the year 2017:

Book-Tax $23925000

Deferred Tax Adjustment ($5651000)

Cash Tax $18274000.

(XV)

The cash tax amount evaluated as per tax laws reflects the amount the company must pay to

satisfy its obligation relating to the government. The formula for cash tax rate is Cash tax

paid for the year/ earnings before taxes.

Myer Holdings for the year 2017:

Profit before income tax $30213000

Cash Tax $18274000

Rate 60.05%

Kathmandu holding for the year 2017:

Profit before income tax $54974000

Cash Tax $16935000

Rate 30.80%

Kathmandu holding Ltd has lower cash tax rate as a higher adjustment from deferred tax

asset are available and on the contrary same are not available in case of Myer holding Ltd.

The same has enhanced the cash tax effective rate.

(XVI)

The cash tax rate is estimated as per the tax laws and replicates the total amount that

company have to pay in order to complete its tax duty towards the government. On the other

hand, the book tax rate is estimated pursuant to financial accounting rules which are directed

by GAAP that is Generally Accepted Accounting Principles, and it is reported on financial

reports of the company. Further, the major difference among the tax laws and GAAP is that

whilst cash taxes owed under the tax laws are estimated on the basis of the current year, the

tax liabilities which are recorded in the financial reports of a company entails current as well

as future year tax liabilities. Thus cash tax rate is different from book tax rate because book

tax rate is calculated on tax in accordance with profit earned during the year and cash tax rate

is evaluated on the basis of cash tax paid during the year.

CONCLUSION

The core elements of an annual report are a statement of affairs, profit and loss statement,

statement of changes in equity and cash flow statement. All these statements reveals detail

information relating to financial efficiency and other areas such as investment done by the

organization, financing and other information. The performance of both the companies has

been done with the assistance of their annual reports. It can be concluded from the above

study that the equity of Myer Ltd is higher than that of Kathmandu Ltd. Further, the debt to

equity ratio of Myer is higher which implies that the company is relying more on internal

financing. Moreover, the net decrease in cash flow of Kathmandu Ltd is higher in comparison

to Myer Ltd. The reason behind same has enhanced investment in plant, property and

equipment, associates, intangibles and another asset. In addition to this above study

concludes that the other income should not be included while evaluating the executive’s

Profit before income tax $54974000

Cash Tax $16935000

Rate 30.80%

Kathmandu holding Ltd has lower cash tax rate as a higher adjustment from deferred tax

asset are available and on the contrary same are not available in case of Myer holding Ltd.

The same has enhanced the cash tax effective rate.

(XVI)

The cash tax rate is estimated as per the tax laws and replicates the total amount that

company have to pay in order to complete its tax duty towards the government. On the other

hand, the book tax rate is estimated pursuant to financial accounting rules which are directed

by GAAP that is Generally Accepted Accounting Principles, and it is reported on financial

reports of the company. Further, the major difference among the tax laws and GAAP is that

whilst cash taxes owed under the tax laws are estimated on the basis of the current year, the

tax liabilities which are recorded in the financial reports of a company entails current as well

as future year tax liabilities. Thus cash tax rate is different from book tax rate because book

tax rate is calculated on tax in accordance with profit earned during the year and cash tax rate

is evaluated on the basis of cash tax paid during the year.

CONCLUSION

The core elements of an annual report are a statement of affairs, profit and loss statement,

statement of changes in equity and cash flow statement. All these statements reveals detail

information relating to financial efficiency and other areas such as investment done by the

organization, financing and other information. The performance of both the companies has

been done with the assistance of their annual reports. It can be concluded from the above

study that the equity of Myer Ltd is higher than that of Kathmandu Ltd. Further, the debt to

equity ratio of Myer is higher which implies that the company is relying more on internal

financing. Moreover, the net decrease in cash flow of Kathmandu Ltd is higher in comparison

to Myer Ltd. The reason behind same has enhanced investment in plant, property and

equipment, associates, intangibles and another asset. In addition to this above study

concludes that the other income should not be included while evaluating the executive’s

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

performance since they are volatile. Subsequently, in case, they are included than same will

provide inappropriate information to the user of manager performance report as it will

provide the result of the basis of volatile information.

REFERENCES

Bauman, M. P., & Shaw, K. W. (2016). Balance sheet classification and the valuation of

deferred taxes. Research in Accounting Regulation, 28(2), 77-85.

Black, D. E. (2016). Other comprehensive income: a review and directions for future

research. Accounting & Finance, 56(1), 9-45.

Cable, R.J., Healy, P.& Sun, N., (2018). The Changes in Cash Flows from Operating

Activities and Related Debt and Interest Coverage Ratios of Fortune 200 Companies–An

Analysis of FASB's Proposed Accounting Standards Update. International Research

Journal of Applied Finance, 9(5), pp.232-240.

Collins, D.W., Hribar, P. & Tian, X.S., (2014). Cash flow asymmetry: Causes and

implications for conditional conservatism research. Journal of Accounting and

Economics, 58(2-3), pp.173-200.

Edwards, A. (2017). The deferred tax asset valuation allowance and firm

creditworthiness. The Journal of the American Taxation Association, 40(1), 57-80.

Fitri, M.C., Supriyanto, A. & Oemar, A., (2016). Analysis of debt to equity ratio, firm size,

inventory turnover, cash turnover, working capital turnover and current ratio to

profitability company (study on mining companies listed in bei period 2010-

2013). Journal Of Accounting, 2(2).

Gitman, L.J., Juchau, R. & Flanagan, J., (2015). Principles of managerial finance. Pearson

Higher Education AU.

Hanlon, D., Navissi, F., & Soepriyanto, G. (2014). The value relevance of deferred tax

attributed to asset revaluations. Journal of Contemporary Accounting & Economics, 10(2),

87-99.

Kathmandu Holdings Ltd Annual Report 2015. (2015). [PDF]. Available through <

http://www.annualreports.com/HostedData/AnnualReportArchive/K/ASX_KMD_2015.pd

f>.[Accessed on 22 September 2018]

Kathmandu Holdings Ltd Annual Report 2017. 2017. [PDF]. Available through <

https://www.kathmanduholdings.com/wp-content/uploads/2012/08/Kathmandu-Annual-

Report-2017_online.pdf>.[Accessed on 22 September 2018]

Khan, S., & Bradbury, M. E. (2014). Volatility and risk relevance of comprehensive

income. Journal of Contemporary Accounting & Economics, 10(1), 76-85.

Lee, T. A. (2014). Cash Flow Reporting (RLE Accounting): A Recent History of an

Accounting Practice. Routledge.

provide inappropriate information to the user of manager performance report as it will

provide the result of the basis of volatile information.

REFERENCES

Bauman, M. P., & Shaw, K. W. (2016). Balance sheet classification and the valuation of

deferred taxes. Research in Accounting Regulation, 28(2), 77-85.

Black, D. E. (2016). Other comprehensive income: a review and directions for future

research. Accounting & Finance, 56(1), 9-45.

Cable, R.J., Healy, P.& Sun, N., (2018). The Changes in Cash Flows from Operating

Activities and Related Debt and Interest Coverage Ratios of Fortune 200 Companies–An

Analysis of FASB's Proposed Accounting Standards Update. International Research

Journal of Applied Finance, 9(5), pp.232-240.

Collins, D.W., Hribar, P. & Tian, X.S., (2014). Cash flow asymmetry: Causes and

implications for conditional conservatism research. Journal of Accounting and

Economics, 58(2-3), pp.173-200.

Edwards, A. (2017). The deferred tax asset valuation allowance and firm

creditworthiness. The Journal of the American Taxation Association, 40(1), 57-80.

Fitri, M.C., Supriyanto, A. & Oemar, A., (2016). Analysis of debt to equity ratio, firm size,

inventory turnover, cash turnover, working capital turnover and current ratio to

profitability company (study on mining companies listed in bei period 2010-

2013). Journal Of Accounting, 2(2).

Gitman, L.J., Juchau, R. & Flanagan, J., (2015). Principles of managerial finance. Pearson

Higher Education AU.

Hanlon, D., Navissi, F., & Soepriyanto, G. (2014). The value relevance of deferred tax

attributed to asset revaluations. Journal of Contemporary Accounting & Economics, 10(2),

87-99.

Kathmandu Holdings Ltd Annual Report 2015. (2015). [PDF]. Available through <

http://www.annualreports.com/HostedData/AnnualReportArchive/K/ASX_KMD_2015.pd

f>.[Accessed on 22 September 2018]

Kathmandu Holdings Ltd Annual Report 2017. 2017. [PDF]. Available through <

https://www.kathmanduholdings.com/wp-content/uploads/2012/08/Kathmandu-Annual-

Report-2017_online.pdf>.[Accessed on 22 September 2018]

Khan, S., & Bradbury, M. E. (2014). Volatility and risk relevance of comprehensive

income. Journal of Contemporary Accounting & Economics, 10(1), 76-85.

Lee, T. A. (2014). Cash Flow Reporting (RLE Accounting): A Recent History of an

Accounting Practice. Routledge.

Morris, J. L. (2017). Classification of Deferred Tax Assets and Deferred Tax Liabilities: An

Evaluation of FASB's Attempt at Standards Simplification. Journal of Accounting &

Finance (2158-3625), 17(8).

Myer Holdings Ltd Annual Report 2016. (2016). [PDF]. Available through <

nvestor.myer.com.au/FormBuilder/_Resource/_module/dGngnzELxUikQxL5gb1cgA/

file/Myer_Annual_Report_2016.pdf>. [Accessed on 22 September 2018]

Myer Holdings Ltd Annual Report 2017. (2017). [PDF]. Available through <

http://investor.myer.com.au/FormBuilder/_Resource/_module/dGngnzELxUikQxL5gb1cg

A/file/Myer_Annual_Report_2017.pdf>. [Accessed on 22 September 2018]

Nejad, M. Y., Ahmad, A., & Embong, Z. (2018). Value Relevance Of Other Comprehensive

Income. Asian Journal of Accounting and Governance, 8, 133-144.

Evaluation of FASB's Attempt at Standards Simplification. Journal of Accounting &

Finance (2158-3625), 17(8).

Myer Holdings Ltd Annual Report 2016. (2016). [PDF]. Available through <

nvestor.myer.com.au/FormBuilder/_Resource/_module/dGngnzELxUikQxL5gb1cgA/

file/Myer_Annual_Report_2016.pdf>. [Accessed on 22 September 2018]

Myer Holdings Ltd Annual Report 2017. (2017). [PDF]. Available through <

http://investor.myer.com.au/FormBuilder/_Resource/_module/dGngnzELxUikQxL5gb1cg

A/file/Myer_Annual_Report_2017.pdf>. [Accessed on 22 September 2018]

Nejad, M. Y., Ahmad, A., & Embong, Z. (2018). Value Relevance Of Other Comprehensive

Income. Asian Journal of Accounting and Governance, 8, 133-144.

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.