Corporate Accounting Assignment: Business Combinations and Goodwill

VerifiedAdded on 2022/12/26

|20

|2658

|64

Homework Assignment

AI Summary

This corporate accounting assignment solution covers several key areas within corporate finance. It begins with journal entries and tax worksheets, including calculations for current tax and deferred tax assets and liabilities. The solution then delves into business combinations, providing acquisition analysis and journal entries related to the acquisition of shares. Further, the assignment includes a detailed goodwill calculation, illustrating the process of determining goodwill and related journal entries. The solution also presents a consolidated worksheet, demonstrating the consolidation of financial statements. Finally, the assignment addresses a bargaining purchase scenario, including journal entries and the preparation of financial statements. The solution uses examples and calculations to illustrate each concept, making it a comprehensive resource for understanding corporate accounting principles.

Running head: CORPORATE ACCOUNTING

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1CORPORATE ACCOUNTING

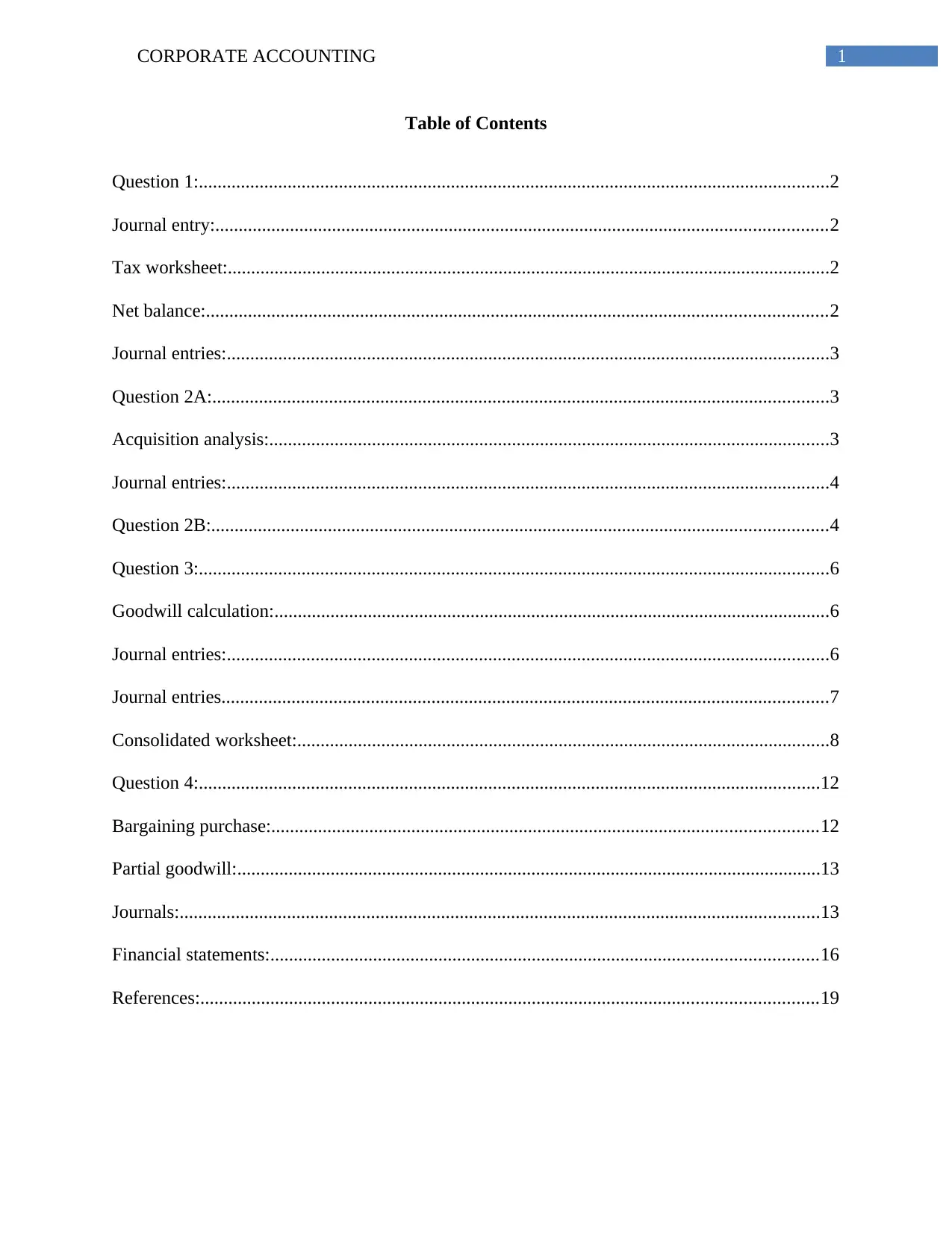

Table of Contents

Question 1:.......................................................................................................................................2

Journal entry:...................................................................................................................................2

Tax worksheet:.................................................................................................................................2

Net balance:.....................................................................................................................................2

Journal entries:.................................................................................................................................3

Question 2A:....................................................................................................................................3

Acquisition analysis:........................................................................................................................3

Journal entries:.................................................................................................................................4

Question 2B:....................................................................................................................................4

Question 3:.......................................................................................................................................6

Goodwill calculation:.......................................................................................................................6

Journal entries:.................................................................................................................................6

Journal entries..................................................................................................................................7

Consolidated worksheet:..................................................................................................................8

Question 4:.....................................................................................................................................12

Bargaining purchase:.....................................................................................................................12

Partial goodwill:.............................................................................................................................13

Journals:.........................................................................................................................................13

Financial statements:.....................................................................................................................16

References:....................................................................................................................................19

Table of Contents

Question 1:.......................................................................................................................................2

Journal entry:...................................................................................................................................2

Tax worksheet:.................................................................................................................................2

Net balance:.....................................................................................................................................2

Journal entries:.................................................................................................................................3

Question 2A:....................................................................................................................................3

Acquisition analysis:........................................................................................................................3

Journal entries:.................................................................................................................................4

Question 2B:....................................................................................................................................4

Question 3:.......................................................................................................................................6

Goodwill calculation:.......................................................................................................................6

Journal entries:.................................................................................................................................6

Journal entries..................................................................................................................................7

Consolidated worksheet:..................................................................................................................8

Question 4:.....................................................................................................................................12

Bargaining purchase:.....................................................................................................................12

Partial goodwill:.............................................................................................................................13

Journals:.........................................................................................................................................13

Financial statements:.....................................................................................................................16

References:....................................................................................................................................19

2CORPORATE ACCOUNTING

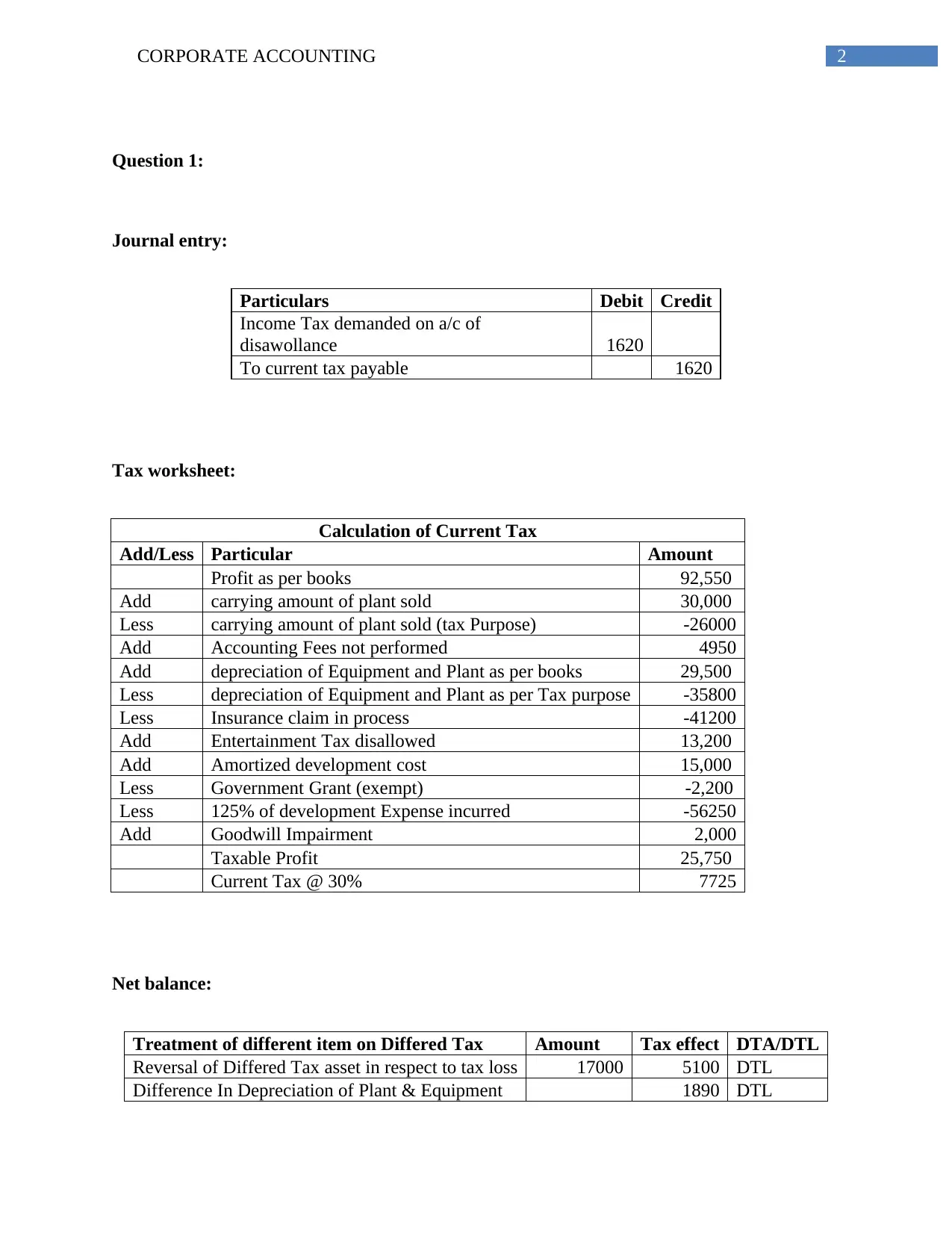

Question 1:

Journal entry:

Particulars Debit Credit

Income Tax demanded on a/c of

disawollance 1620

To current tax payable 1620

Tax worksheet:

Calculation of Current Tax

Add/Less Particular Amount

Profit as per books 92,550

Add carrying amount of plant sold 30,000

Less carrying amount of plant sold (tax Purpose) -26000

Add Accounting Fees not performed 4950

Add depreciation of Equipment and Plant as per books 29,500

Less depreciation of Equipment and Plant as per Tax purpose -35800

Less Insurance claim in process -41200

Add Entertainment Tax disallowed 13,200

Add Amortized development cost 15,000

Less Government Grant (exempt) -2,200

Less 125% of development Expense incurred -56250

Add Goodwill Impairment 2,000

Taxable Profit 25,750

Current Tax @ 30% 7725

Net balance:

Treatment of different item on Differed Tax Amount Tax effect DTA/DTL

Reversal of Differed Tax asset in respect to tax loss 17000 5100 DTL

Difference In Depreciation of Plant & Equipment 1890 DTL

Question 1:

Journal entry:

Particulars Debit Credit

Income Tax demanded on a/c of

disawollance 1620

To current tax payable 1620

Tax worksheet:

Calculation of Current Tax

Add/Less Particular Amount

Profit as per books 92,550

Add carrying amount of plant sold 30,000

Less carrying amount of plant sold (tax Purpose) -26000

Add Accounting Fees not performed 4950

Add depreciation of Equipment and Plant as per books 29,500

Less depreciation of Equipment and Plant as per Tax purpose -35800

Less Insurance claim in process -41200

Add Entertainment Tax disallowed 13,200

Add Amortized development cost 15,000

Less Government Grant (exempt) -2,200

Less 125% of development Expense incurred -56250

Add Goodwill Impairment 2,000

Taxable Profit 25,750

Current Tax @ 30% 7725

Net balance:

Treatment of different item on Differed Tax Amount Tax effect DTA/DTL

Reversal of Differed Tax asset in respect to tax loss 17000 5100 DTL

Difference In Depreciation of Plant & Equipment 1890 DTL

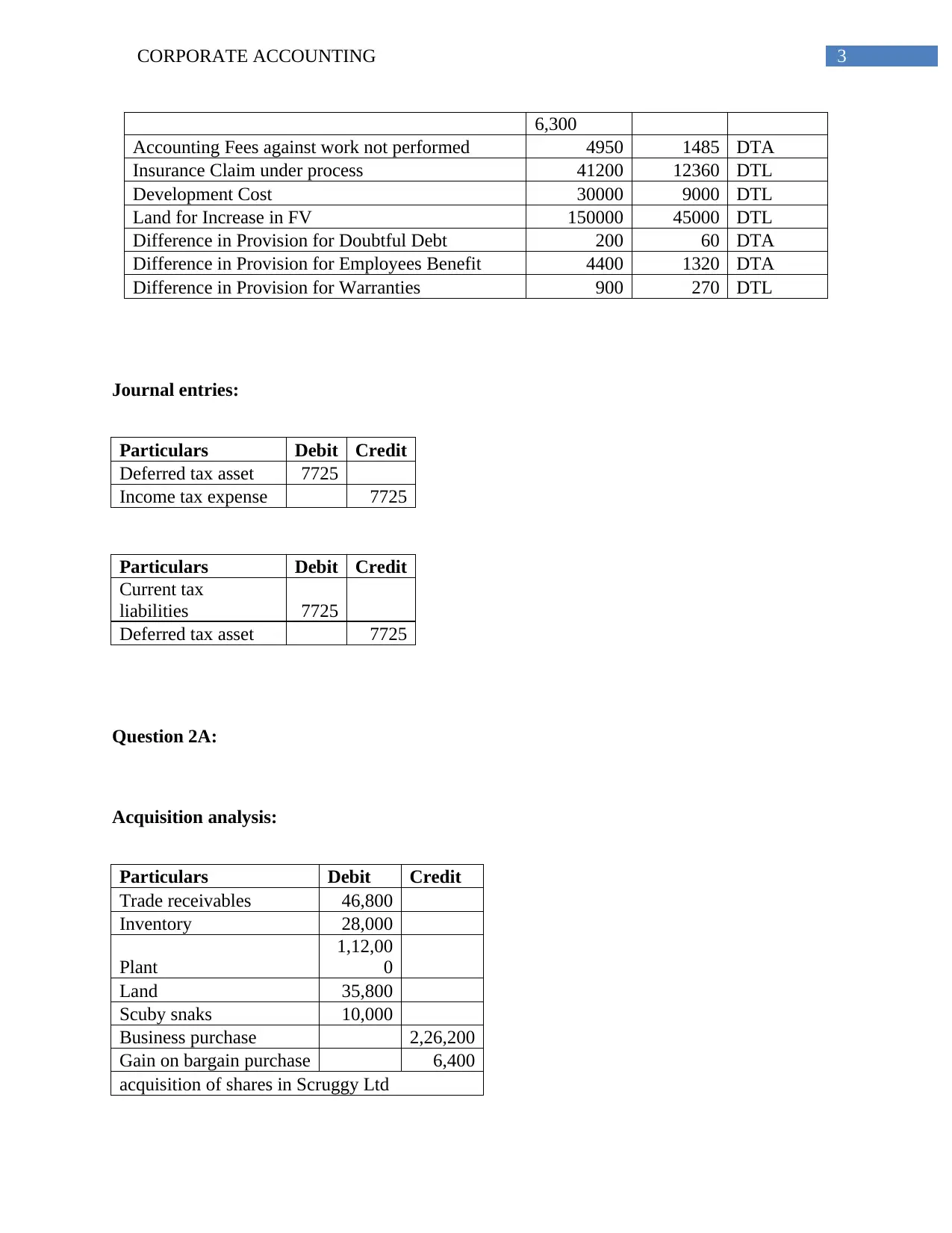

3CORPORATE ACCOUNTING

6,300

Accounting Fees against work not performed 4950 1485 DTA

Insurance Claim under process 41200 12360 DTL

Development Cost 30000 9000 DTL

Land for Increase in FV 150000 45000 DTL

Difference in Provision for Doubtful Debt 200 60 DTA

Difference in Provision for Employees Benefit 4400 1320 DTA

Difference in Provision for Warranties 900 270 DTL

Journal entries:

Particulars Debit Credit

Deferred tax asset 7725

Income tax expense 7725

Particulars Debit Credit

Current tax

liabilities 7725

Deferred tax asset 7725

Question 2A:

Acquisition analysis:

Particulars Debit Credit

Trade receivables 46,800

Inventory 28,000

Plant

1,12,00

0

Land 35,800

Scuby snaks 10,000

Business purchase 2,26,200

Gain on bargain purchase 6,400

acquisition of shares in Scruggy Ltd

6,300

Accounting Fees against work not performed 4950 1485 DTA

Insurance Claim under process 41200 12360 DTL

Development Cost 30000 9000 DTL

Land for Increase in FV 150000 45000 DTL

Difference in Provision for Doubtful Debt 200 60 DTA

Difference in Provision for Employees Benefit 4400 1320 DTA

Difference in Provision for Warranties 900 270 DTL

Journal entries:

Particulars Debit Credit

Deferred tax asset 7725

Income tax expense 7725

Particulars Debit Credit

Current tax

liabilities 7725

Deferred tax asset 7725

Question 2A:

Acquisition analysis:

Particulars Debit Credit

Trade receivables 46,800

Inventory 28,000

Plant

1,12,00

0

Land 35,800

Scuby snaks 10,000

Business purchase 2,26,200

Gain on bargain purchase 6,400

acquisition of shares in Scruggy Ltd

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4CORPORATE ACCOUNTING

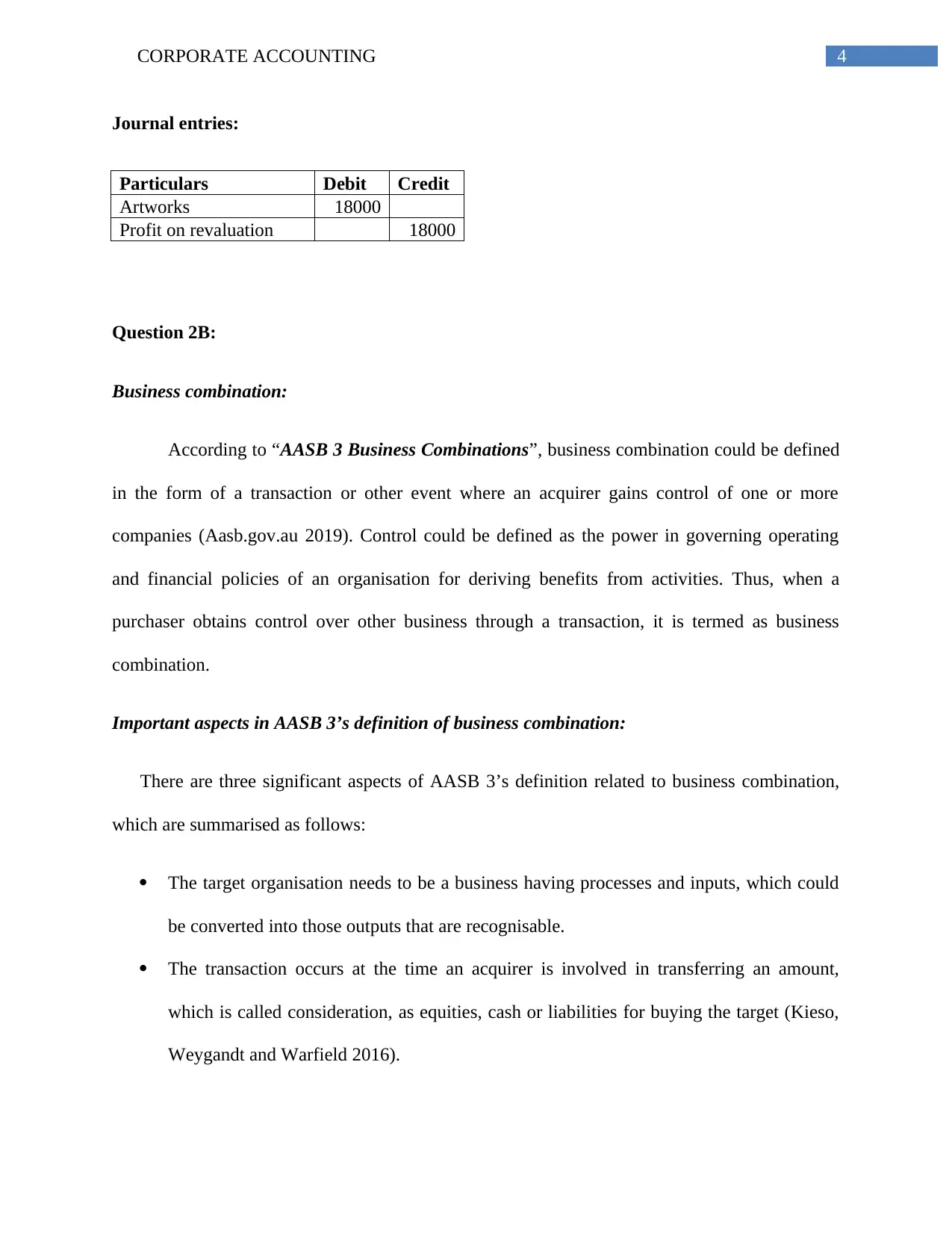

Journal entries:

Particulars Debit Credit

Artworks 18000

Profit on revaluation 18000

Question 2B:

Business combination:

According to “AASB 3 Business Combinations”, business combination could be defined

in the form of a transaction or other event where an acquirer gains control of one or more

companies (Aasb.gov.au 2019). Control could be defined as the power in governing operating

and financial policies of an organisation for deriving benefits from activities. Thus, when a

purchaser obtains control over other business through a transaction, it is termed as business

combination.

Important aspects in AASB 3’s definition of business combination:

There are three significant aspects of AASB 3’s definition related to business combination,

which are summarised as follows:

The target organisation needs to be a business having processes and inputs, which could

be converted into those outputs that are recognisable.

The transaction occurs at the time an acquirer is involved in transferring an amount,

which is called consideration, as equities, cash or liabilities for buying the target (Kieso,

Weygandt and Warfield 2016).

Journal entries:

Particulars Debit Credit

Artworks 18000

Profit on revaluation 18000

Question 2B:

Business combination:

According to “AASB 3 Business Combinations”, business combination could be defined

in the form of a transaction or other event where an acquirer gains control of one or more

companies (Aasb.gov.au 2019). Control could be defined as the power in governing operating

and financial policies of an organisation for deriving benefits from activities. Thus, when a

purchaser obtains control over other business through a transaction, it is termed as business

combination.

Important aspects in AASB 3’s definition of business combination:

There are three significant aspects of AASB 3’s definition related to business combination,

which are summarised as follows:

The target organisation needs to be a business having processes and inputs, which could

be converted into those outputs that are recognisable.

The transaction occurs at the time an acquirer is involved in transferring an amount,

which is called consideration, as equities, cash or liabilities for buying the target (Kieso,

Weygandt and Warfield 2016).

5CORPORATE ACCOUNTING

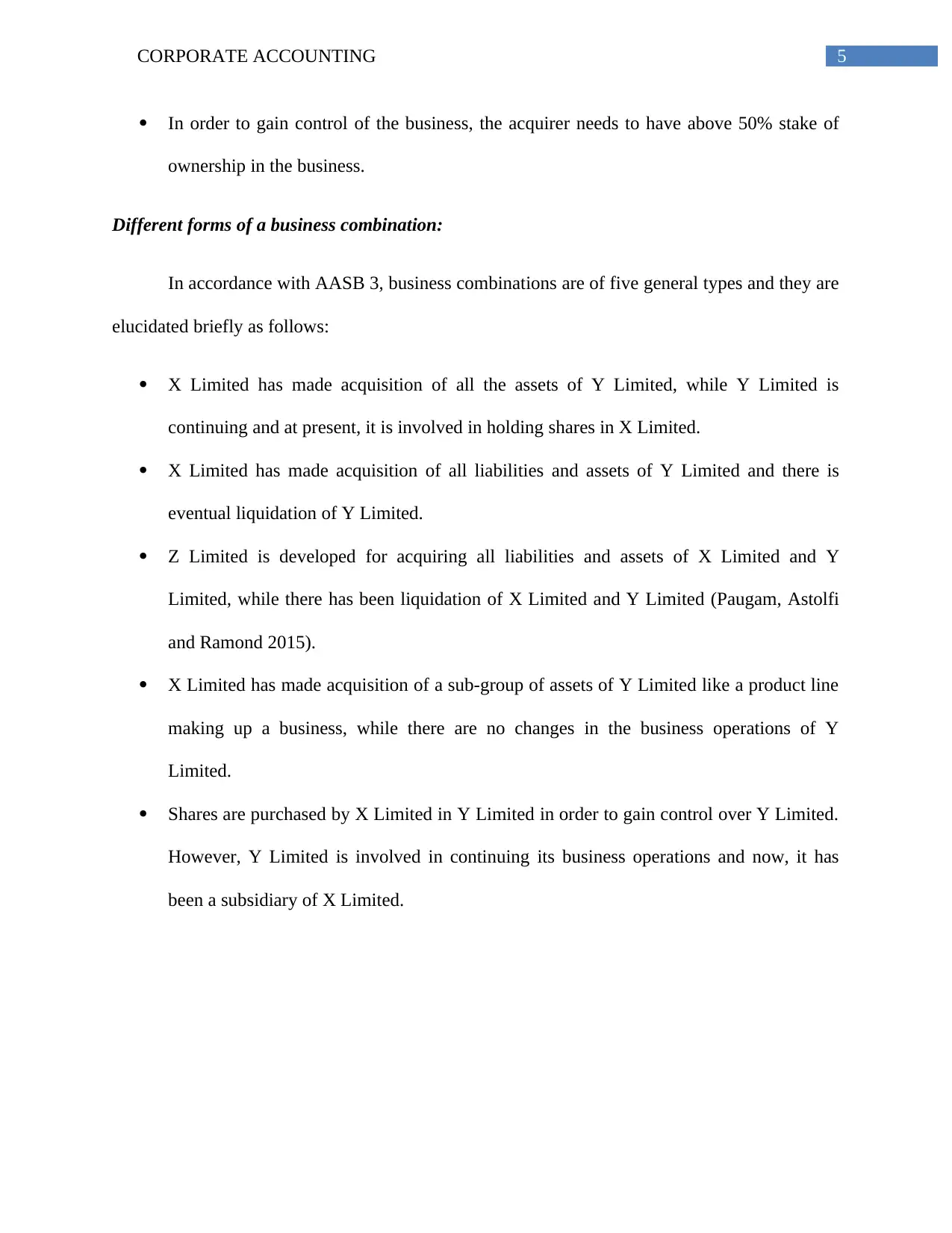

In order to gain control of the business, the acquirer needs to have above 50% stake of

ownership in the business.

Different forms of a business combination:

In accordance with AASB 3, business combinations are of five general types and they are

elucidated briefly as follows:

X Limited has made acquisition of all the assets of Y Limited, while Y Limited is

continuing and at present, it is involved in holding shares in X Limited.

X Limited has made acquisition of all liabilities and assets of Y Limited and there is

eventual liquidation of Y Limited.

Z Limited is developed for acquiring all liabilities and assets of X Limited and Y

Limited, while there has been liquidation of X Limited and Y Limited (Paugam, Astolfi

and Ramond 2015).

X Limited has made acquisition of a sub-group of assets of Y Limited like a product line

making up a business, while there are no changes in the business operations of Y

Limited.

Shares are purchased by X Limited in Y Limited in order to gain control over Y Limited.

However, Y Limited is involved in continuing its business operations and now, it has

been a subsidiary of X Limited.

In order to gain control of the business, the acquirer needs to have above 50% stake of

ownership in the business.

Different forms of a business combination:

In accordance with AASB 3, business combinations are of five general types and they are

elucidated briefly as follows:

X Limited has made acquisition of all the assets of Y Limited, while Y Limited is

continuing and at present, it is involved in holding shares in X Limited.

X Limited has made acquisition of all liabilities and assets of Y Limited and there is

eventual liquidation of Y Limited.

Z Limited is developed for acquiring all liabilities and assets of X Limited and Y

Limited, while there has been liquidation of X Limited and Y Limited (Paugam, Astolfi

and Ramond 2015).

X Limited has made acquisition of a sub-group of assets of Y Limited like a product line

making up a business, while there are no changes in the business operations of Y

Limited.

Shares are purchased by X Limited in Y Limited in order to gain control over Y Limited.

However, Y Limited is involved in continuing its business operations and now, it has

been a subsidiary of X Limited.

6CORPORATE ACCOUNTING

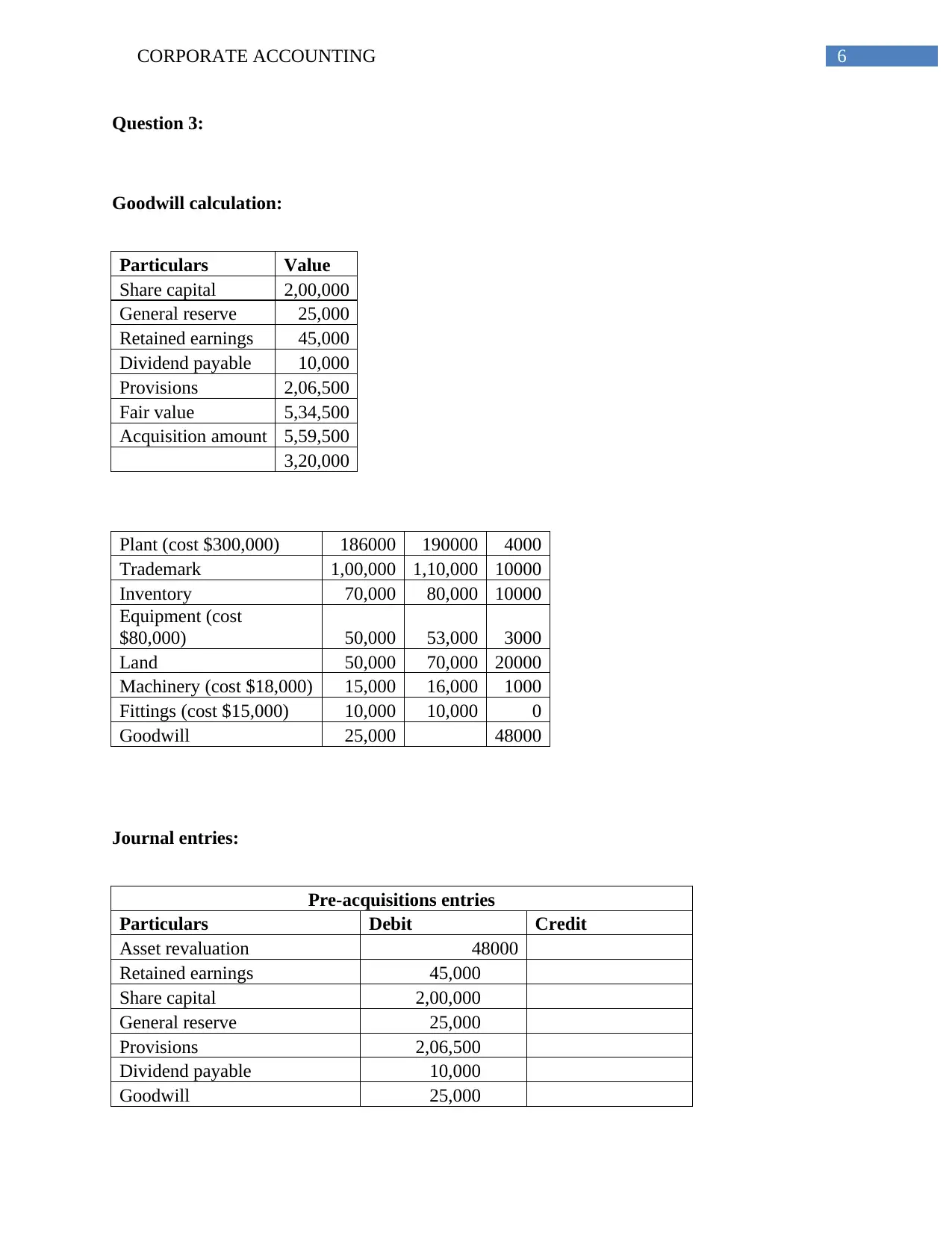

Question 3:

Goodwill calculation:

Particulars Value

Share capital 2,00,000

General reserve 25,000

Retained earnings 45,000

Dividend payable 10,000

Provisions 2,06,500

Fair value 5,34,500

Acquisition amount 5,59,500

3,20,000

Plant (cost $300,000) 186000 190000 4000

Trademark 1,00,000 1,10,000 10000

Inventory 70,000 80,000 10000

Equipment (cost

$80,000) 50,000 53,000 3000

Land 50,000 70,000 20000

Machinery (cost $18,000) 15,000 16,000 1000

Fittings (cost $15,000) 10,000 10,000 0

Goodwill 25,000 48000

Journal entries:

Pre-acquisitions entries

Particulars Debit Credit

Asset revaluation 48000

Retained earnings 45,000

Share capital 2,00,000

General reserve 25,000

Provisions 2,06,500

Dividend payable 10,000

Goodwill 25,000

Question 3:

Goodwill calculation:

Particulars Value

Share capital 2,00,000

General reserve 25,000

Retained earnings 45,000

Dividend payable 10,000

Provisions 2,06,500

Fair value 5,34,500

Acquisition amount 5,59,500

3,20,000

Plant (cost $300,000) 186000 190000 4000

Trademark 1,00,000 1,10,000 10000

Inventory 70,000 80,000 10000

Equipment (cost

$80,000) 50,000 53,000 3000

Land 50,000 70,000 20000

Machinery (cost $18,000) 15,000 16,000 1000

Fittings (cost $15,000) 10,000 10,000 0

Goodwill 25,000 48000

Journal entries:

Pre-acquisitions entries

Particulars Debit Credit

Asset revaluation 48000

Retained earnings 45,000

Share capital 2,00,000

General reserve 25,000

Provisions 2,06,500

Dividend payable 10,000

Goodwill 25,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE ACCOUNTING

Shares in Fish Ltd 5,59,500

Particulars Debit Credit

Brands 17,000

BCV reserve 11,900

Deferred tax liability 5,100

Particulars Debit Credit

Impairment valuation 5,000

Goodwill 5,000

Particulars Debit Credit

Goodwill 25,000

BCV reserve 25,000

Journal entries

BCV entries BCV entries

Particulars Debit Credit Particulars Debit Credit

Inventory 4,000 Inventory 6,000

Income tax expense 1,200 Income tax expense 1,800

Retained earnings 2,800 Retained earnings 4,200

Transfer from BCV

reserve 5,600

Transfer from BCV

reserve 8,400

BCV entries BCV entries

Particulars Debit Credit Particulars Debit Credit

Depreciation expense 1,000 Depreciation expense 200

Sale of Plant (Gain) 5,000 Sale of furniture (Gain) 1,000

Income tax expense 1,800 Income tax expense 360

Shares in Fish Ltd 5,59,500

Particulars Debit Credit

Brands 17,000

BCV reserve 11,900

Deferred tax liability 5,100

Particulars Debit Credit

Impairment valuation 5,000

Goodwill 5,000

Particulars Debit Credit

Goodwill 25,000

BCV reserve 25,000

Journal entries

BCV entries BCV entries

Particulars Debit Credit Particulars Debit Credit

Inventory 4,000 Inventory 6,000

Income tax expense 1,200 Income tax expense 1,800

Retained earnings 2,800 Retained earnings 4,200

Transfer from BCV

reserve 5,600

Transfer from BCV

reserve 8,400

BCV entries BCV entries

Particulars Debit Credit Particulars Debit Credit

Depreciation expense 1,000 Depreciation expense 200

Sale of Plant (Gain) 5,000 Sale of furniture (Gain) 1,000

Income tax expense 1,800 Income tax expense 360

8CORPORATE ACCOUNTING

Retained earnings 2,800 Retained earnings 560

Transfer from BCV

reserve 7,000

Transfer from BCV

reserve 1,400

BCV entries

BCV entries Particulars Debit Credit

Particulars Debit Credit Inventory 9,000

Interim dividend 5,000 Income tax expense 2,700

Transfer from BCV

reserve 5,000 Retained earnings 6,300

Transfer from BCV

reserve 12,600

BCV entries

Particulars Debit Credit BCV entries

Inventory 1,800 Particulars Debit Credit

Income tax expense 540 Depreciation expense 2,000

Retained earnings 1,260 Sale of furniture (Gain) 10,000

Transfer from BCV

reserve 2,520 Income tax expense 3,600

Retained earnings 5,600

Transfer from BCV

reserve 14,000

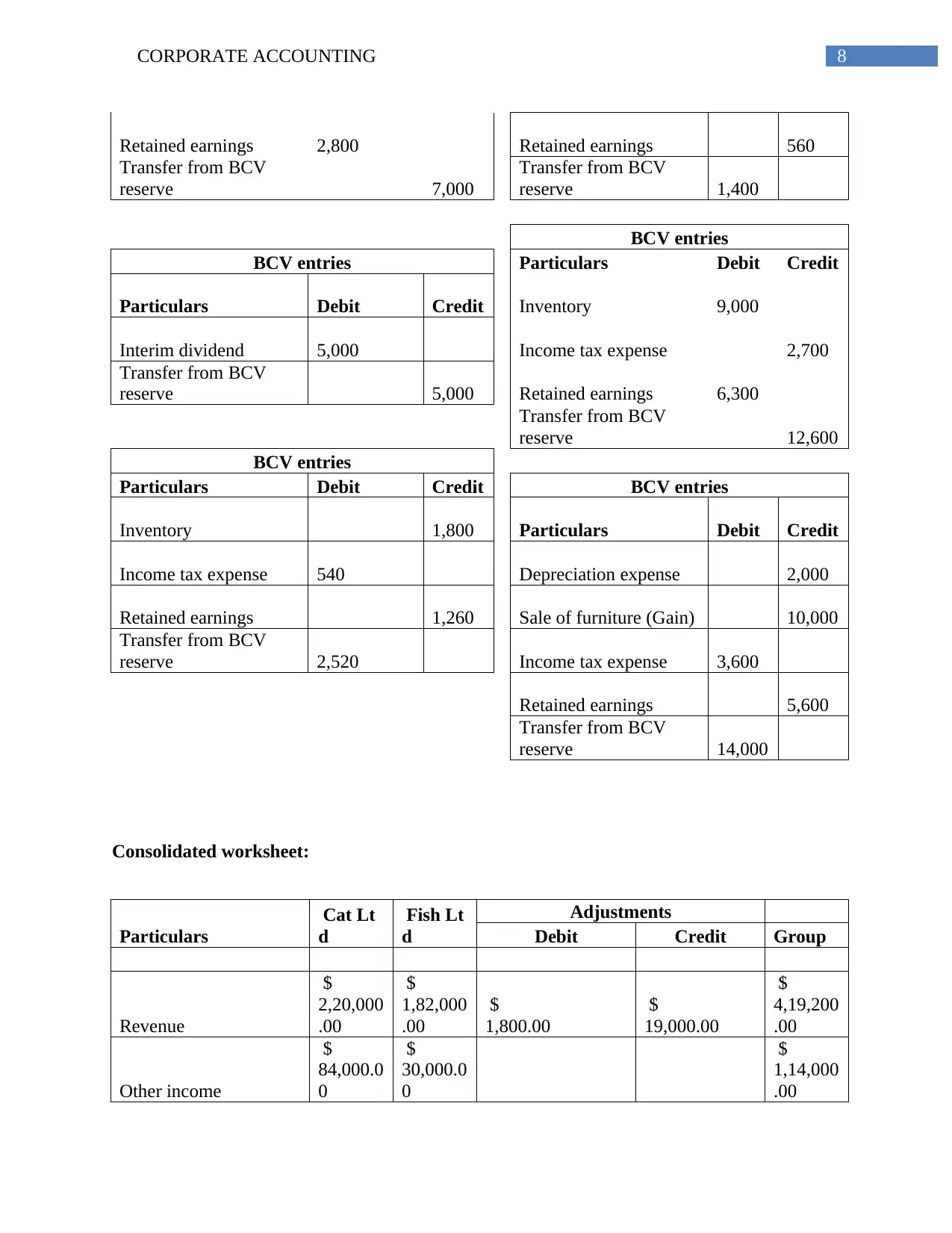

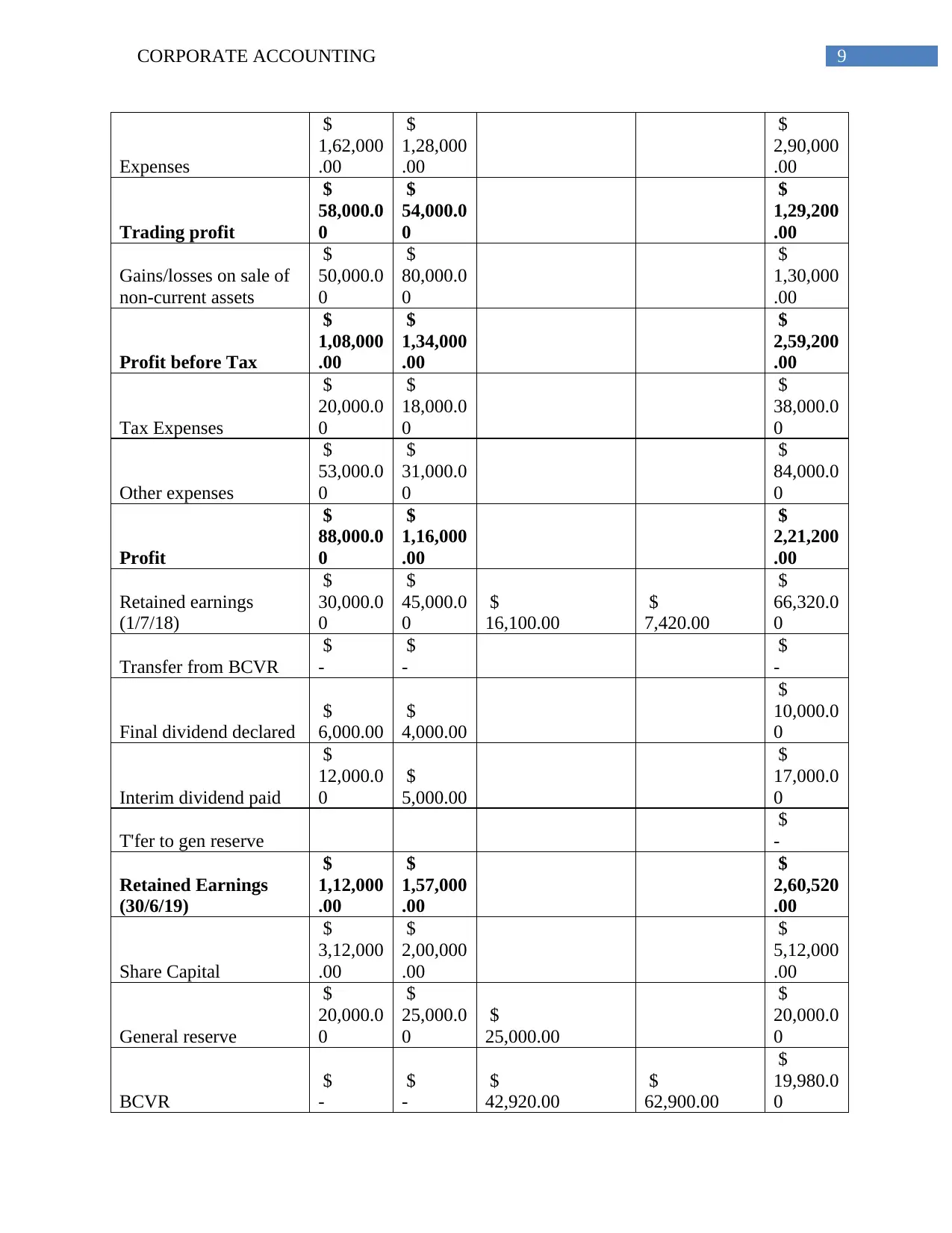

Consolidated worksheet:

Particulars

Cat Lt

d

Fish Lt

d

Adjustments

Debit Credit Group

Revenue

$

2,20,000

.00

$

1,82,000

.00

$

1,800.00

$

19,000.00

$

4,19,200

.00

Other income

$

84,000.0

0

$

30,000.0

0

$

1,14,000

.00

Retained earnings 2,800 Retained earnings 560

Transfer from BCV

reserve 7,000

Transfer from BCV

reserve 1,400

BCV entries

BCV entries Particulars Debit Credit

Particulars Debit Credit Inventory 9,000

Interim dividend 5,000 Income tax expense 2,700

Transfer from BCV

reserve 5,000 Retained earnings 6,300

Transfer from BCV

reserve 12,600

BCV entries

Particulars Debit Credit BCV entries

Inventory 1,800 Particulars Debit Credit

Income tax expense 540 Depreciation expense 2,000

Retained earnings 1,260 Sale of furniture (Gain) 10,000

Transfer from BCV

reserve 2,520 Income tax expense 3,600

Retained earnings 5,600

Transfer from BCV

reserve 14,000

Consolidated worksheet:

Particulars

Cat Lt

d

Fish Lt

d

Adjustments

Debit Credit Group

Revenue

$

2,20,000

.00

$

1,82,000

.00

$

1,800.00

$

19,000.00

$

4,19,200

.00

Other income

$

84,000.0

0

$

30,000.0

0

$

1,14,000

.00

9CORPORATE ACCOUNTING

Expenses

$

1,62,000

.00

$

1,28,000

.00

$

2,90,000

.00

Trading profit

$

58,000.0

0

$

54,000.0

0

$

1,29,200

.00

Gains/losses on sale of

non-current assets

$

50,000.0

0

$

80,000.0

0

$

1,30,000

.00

Profit before Tax

$

1,08,000

.00

$

1,34,000

.00

$

2,59,200

.00

Tax Expenses

$

20,000.0

0

$

18,000.0

0

$

38,000.0

0

Other expenses

$

53,000.0

0

$

31,000.0

0

$

84,000.0

0

Profit

$

88,000.0

0

$

1,16,000

.00

$

2,21,200

.00

Retained earnings

(1/7/18)

$

30,000.0

0

$

45,000.0

0

$

16,100.00

$

7,420.00

$

66,320.0

0

Transfer from BCVR

$

-

$

-

$

-

Final dividend declared

$

6,000.00

$

4,000.00

$

10,000.0

0

Interim dividend paid

$

12,000.0

0

$

5,000.00

$

17,000.0

0

T'fer to gen reserve

$

-

Retained Earnings

(30/6/19)

$

1,12,000

.00

$

1,57,000

.00

$

2,60,520

.00

Share Capital

$

3,12,000

.00

$

2,00,000

.00

$

5,12,000

.00

General reserve

$

20,000.0

0

$

25,000.0

0

$

25,000.00

$

20,000.0

0

BCVR

$

-

$

-

$

42,920.00

$

62,900.00

$

19,980.0

0

Expenses

$

1,62,000

.00

$

1,28,000

.00

$

2,90,000

.00

Trading profit

$

58,000.0

0

$

54,000.0

0

$

1,29,200

.00

Gains/losses on sale of

non-current assets

$

50,000.0

0

$

80,000.0

0

$

1,30,000

.00

Profit before Tax

$

1,08,000

.00

$

1,34,000

.00

$

2,59,200

.00

Tax Expenses

$

20,000.0

0

$

18,000.0

0

$

38,000.0

0

Other expenses

$

53,000.0

0

$

31,000.0

0

$

84,000.0

0

Profit

$

88,000.0

0

$

1,16,000

.00

$

2,21,200

.00

Retained earnings

(1/7/18)

$

30,000.0

0

$

45,000.0

0

$

16,100.00

$

7,420.00

$

66,320.0

0

Transfer from BCVR

$

-

$

-

$

-

Final dividend declared

$

6,000.00

$

4,000.00

$

10,000.0

0

Interim dividend paid

$

12,000.0

0

$

5,000.00

$

17,000.0

0

T'fer to gen reserve

$

-

Retained Earnings

(30/6/19)

$

1,12,000

.00

$

1,57,000

.00

$

2,60,520

.00

Share Capital

$

3,12,000

.00

$

2,00,000

.00

$

5,12,000

.00

General reserve

$

20,000.0

0

$

25,000.0

0

$

25,000.00

$

20,000.0

0

BCVR

$

-

$

-

$

42,920.00

$

62,900.00

$

19,980.0

0

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

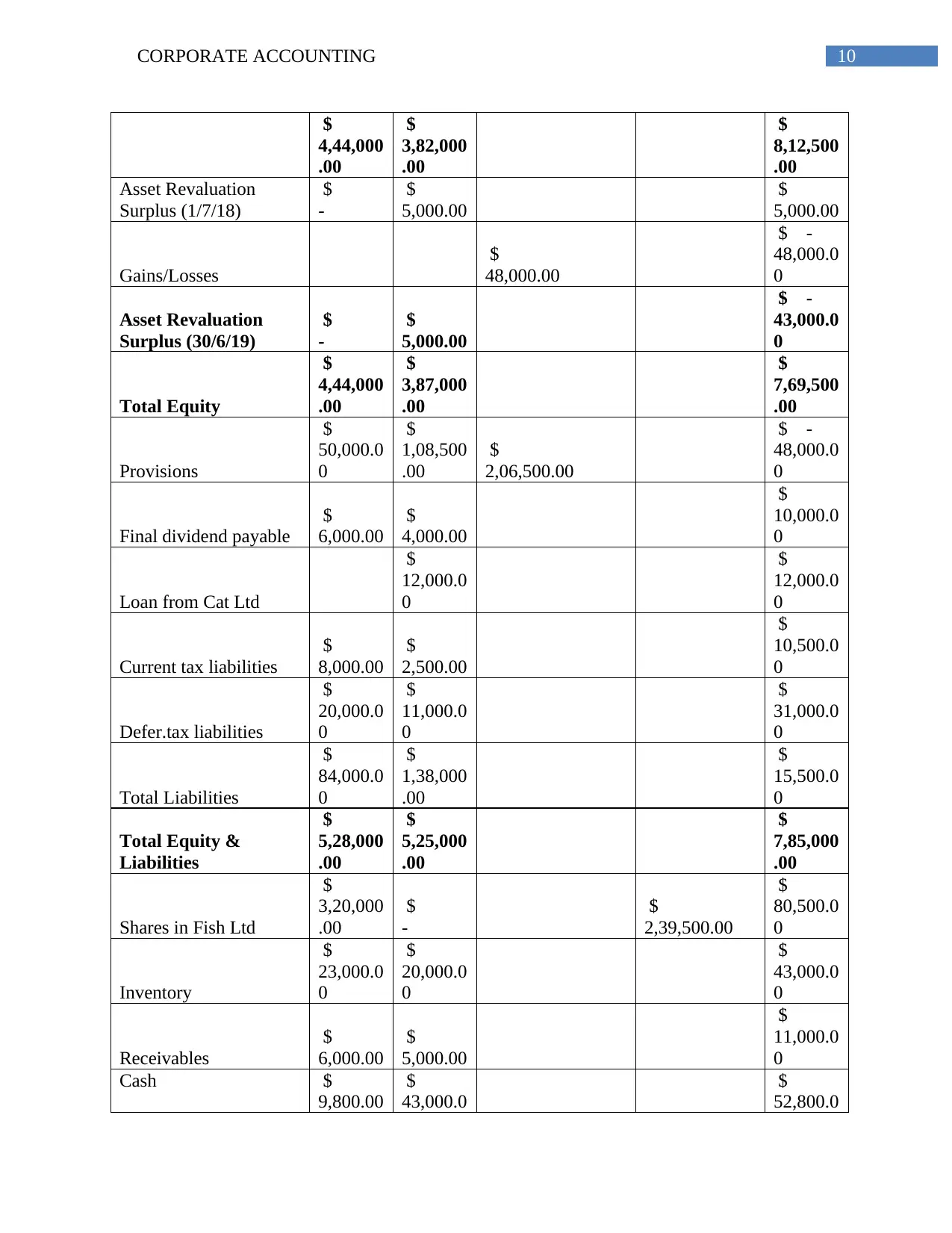

10CORPORATE ACCOUNTING

$

4,44,000

.00

$

3,82,000

.00

$

8,12,500

.00

Asset Revaluation

Surplus (1/7/18)

$

-

$

5,000.00

$

5,000.00

Gains/Losses

$

48,000.00

$ -

48,000.0

0

Asset Revaluation

Surplus (30/6/19)

$

-

$

5,000.00

$ -

43,000.0

0

Total Equity

$

4,44,000

.00

$

3,87,000

.00

$

7,69,500

.00

Provisions

$

50,000.0

0

$

1,08,500

.00

$

2,06,500.00

$ -

48,000.0

0

Final dividend payable

$

6,000.00

$

4,000.00

$

10,000.0

0

Loan from Cat Ltd

$

12,000.0

0

$

12,000.0

0

Current tax liabilities

$

8,000.00

$

2,500.00

$

10,500.0

0

Defer.tax liabilities

$

20,000.0

0

$

11,000.0

0

$

31,000.0

0

Total Liabilities

$

84,000.0

0

$

1,38,000

.00

$

15,500.0

0

Total Equity &

Liabilities

$

5,28,000

.00

$

5,25,000

.00

$

7,85,000

.00

Shares in Fish Ltd

$

3,20,000

.00

$

-

$

2,39,500.00

$

80,500.0

0

Inventory

$

23,000.0

0

$

20,000.0

0

$

43,000.0

0

Receivables

$

6,000.00

$

5,000.00

$

11,000.0

0

Cash $

9,800.00

$

43,000.0

$

52,800.0

$

4,44,000

.00

$

3,82,000

.00

$

8,12,500

.00

Asset Revaluation

Surplus (1/7/18)

$

-

$

5,000.00

$

5,000.00

Gains/Losses

$

48,000.00

$ -

48,000.0

0

Asset Revaluation

Surplus (30/6/19)

$

-

$

5,000.00

$ -

43,000.0

0

Total Equity

$

4,44,000

.00

$

3,87,000

.00

$

7,69,500

.00

Provisions

$

50,000.0

0

$

1,08,500

.00

$

2,06,500.00

$ -

48,000.0

0

Final dividend payable

$

6,000.00

$

4,000.00

$

10,000.0

0

Loan from Cat Ltd

$

12,000.0

0

$

12,000.0

0

Current tax liabilities

$

8,000.00

$

2,500.00

$

10,500.0

0

Defer.tax liabilities

$

20,000.0

0

$

11,000.0

0

$

31,000.0

0

Total Liabilities

$

84,000.0

0

$

1,38,000

.00

$

15,500.0

0

Total Equity &

Liabilities

$

5,28,000

.00

$

5,25,000

.00

$

7,85,000

.00

Shares in Fish Ltd

$

3,20,000

.00

$

-

$

2,39,500.00

$

80,500.0

0

Inventory

$

23,000.0

0

$

20,000.0

0

$

43,000.0

0

Receivables

$

6,000.00

$

5,000.00

$

11,000.0

0

Cash $

9,800.00

$

43,000.0

$

52,800.0

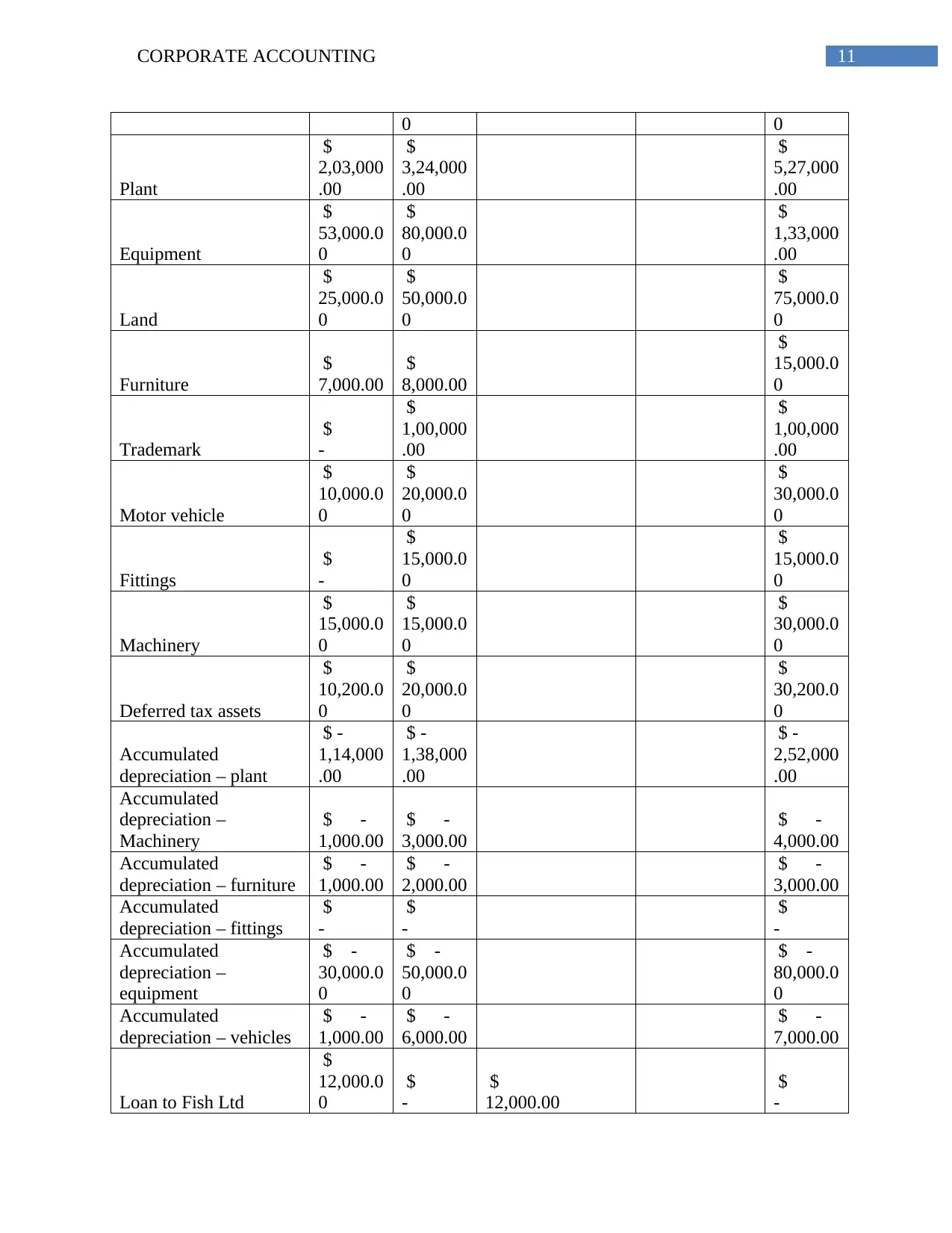

11CORPORATE ACCOUNTING

0 0

Plant

$

2,03,000

.00

$

3,24,000

.00

$

5,27,000

.00

Equipment

$

53,000.0

0

$

80,000.0

0

$

1,33,000

.00

Land

$

25,000.0

0

$

50,000.0

0

$

75,000.0

0

Furniture

$

7,000.00

$

8,000.00

$

15,000.0

0

Trademark

$

-

$

1,00,000

.00

$

1,00,000

.00

Motor vehicle

$

10,000.0

0

$

20,000.0

0

$

30,000.0

0

Fittings

$

-

$

15,000.0

0

$

15,000.0

0

Machinery

$

15,000.0

0

$

15,000.0

0

$

30,000.0

0

Deferred tax assets

$

10,200.0

0

$

20,000.0

0

$

30,200.0

0

Accumulated

depreciation – plant

$ -

1,14,000

.00

$ -

1,38,000

.00

$ -

2,52,000

.00

Accumulated

depreciation –

Machinery

$ -

1,000.00

$ -

3,000.00

$ -

4,000.00

Accumulated

depreciation – furniture

$ -

1,000.00

$ -

2,000.00

$ -

3,000.00

Accumulated

depreciation – fittings

$

-

$

-

$

-

Accumulated

depreciation –

equipment

$ -

30,000.0

0

$ -

50,000.0

0

$ -

80,000.0

0

Accumulated

depreciation – vehicles

$ -

1,000.00

$ -

6,000.00

$ -

7,000.00

Loan to Fish Ltd

$

12,000.0

0

$

-

$

12,000.00

$

-

0 0

Plant

$

2,03,000

.00

$

3,24,000

.00

$

5,27,000

.00

Equipment

$

53,000.0

0

$

80,000.0

0

$

1,33,000

.00

Land

$

25,000.0

0

$

50,000.0

0

$

75,000.0

0

Furniture

$

7,000.00

$

8,000.00

$

15,000.0

0

Trademark

$

-

$

1,00,000

.00

$

1,00,000

.00

Motor vehicle

$

10,000.0

0

$

20,000.0

0

$

30,000.0

0

Fittings

$

-

$

15,000.0

0

$

15,000.0

0

Machinery

$

15,000.0

0

$

15,000.0

0

$

30,000.0

0

Deferred tax assets

$

10,200.0

0

$

20,000.0

0

$

30,200.0

0

Accumulated

depreciation – plant

$ -

1,14,000

.00

$ -

1,38,000

.00

$ -

2,52,000

.00

Accumulated

depreciation –

Machinery

$ -

1,000.00

$ -

3,000.00

$ -

4,000.00

Accumulated

depreciation – furniture

$ -

1,000.00

$ -

2,000.00

$ -

3,000.00

Accumulated

depreciation – fittings

$

-

$

-

$

-

Accumulated

depreciation –

equipment

$ -

30,000.0

0

$ -

50,000.0

0

$ -

80,000.0

0

Accumulated

depreciation – vehicles

$ -

1,000.00

$ -

6,000.00

$ -

7,000.00

Loan to Fish Ltd

$

12,000.0

0

$

-

$

12,000.00

$

-

12CORPORATE ACCOUNTING

Brand

$

-

$

-

$

11,500.00

$ -

11,500.0

0

Goodwill

$

-

$

25,000.0

0

$

25,000.00

$

-

Total Assets

$

5,47,000

.00

$

5,26,000

.00

$

7,85,000

.00

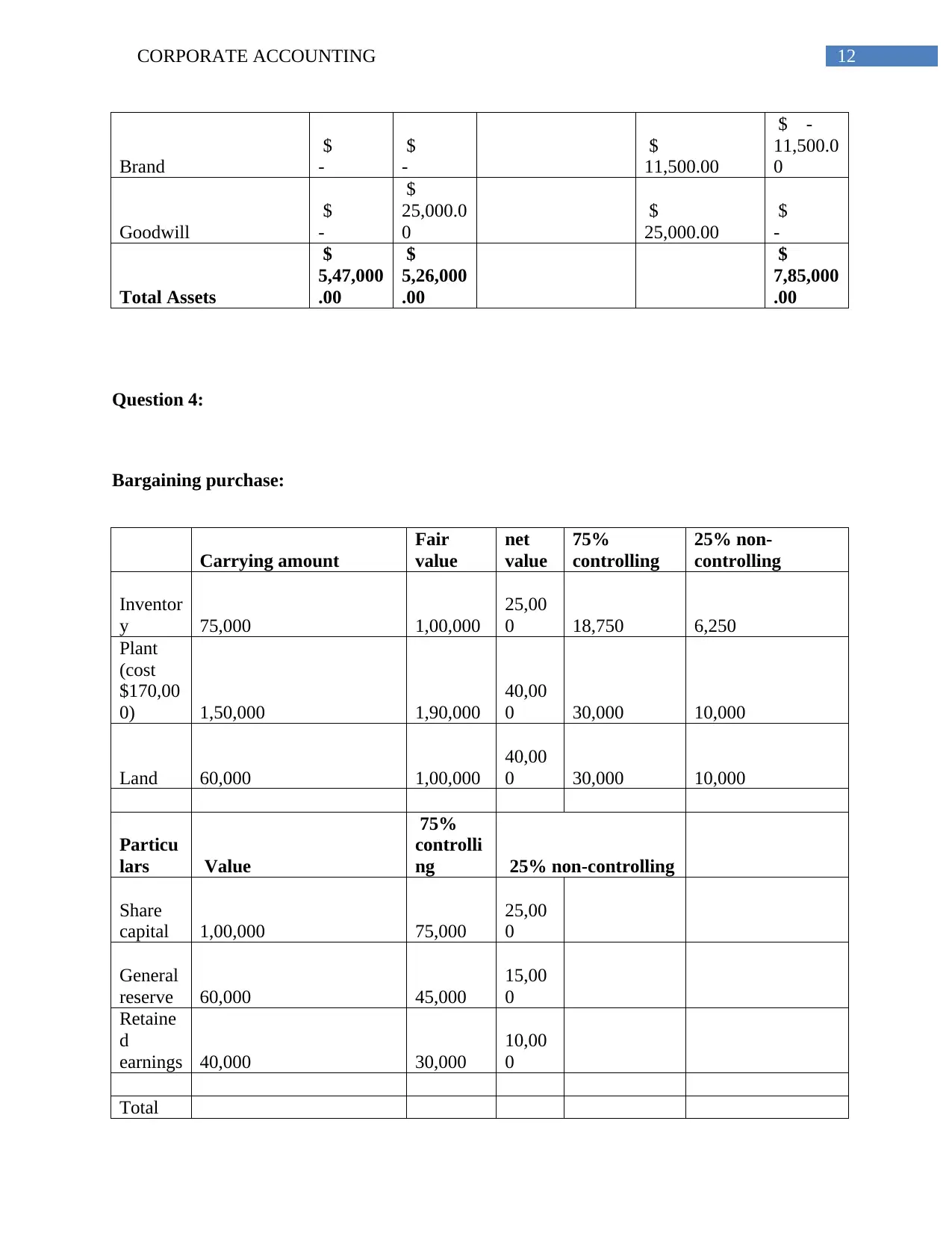

Question 4:

Bargaining purchase:

Carrying amount

Fair

value

net

value

75%

controlling

25% non-

controlling

Inventor

y 75,000 1,00,000

25,00

0 18,750 6,250

Plant

(cost

$170,00

0) 1,50,000 1,90,000

40,00

0 30,000 10,000

Land 60,000 1,00,000

40,00

0 30,000 10,000

Particu

lars Value

75%

controlli

ng 25% non-controlling

Share

capital 1,00,000 75,000

25,00

0

General

reserve 60,000 45,000

15,00

0

Retaine

d

earnings 40,000 30,000

10,00

0

Total

Brand

$

-

$

-

$

11,500.00

$ -

11,500.0

0

Goodwill

$

-

$

25,000.0

0

$

25,000.00

$

-

Total Assets

$

5,47,000

.00

$

5,26,000

.00

$

7,85,000

.00

Question 4:

Bargaining purchase:

Carrying amount

Fair

value

net

value

75%

controlling

25% non-

controlling

Inventor

y 75,000 1,00,000

25,00

0 18,750 6,250

Plant

(cost

$170,00

0) 1,50,000 1,90,000

40,00

0 30,000 10,000

Land 60,000 1,00,000

40,00

0 30,000 10,000

Particu

lars Value

75%

controlli

ng 25% non-controlling

Share

capital 1,00,000 75,000

25,00

0

General

reserve 60,000 45,000

15,00

0

Retaine

d

earnings 40,000 30,000

10,00

0

Total

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

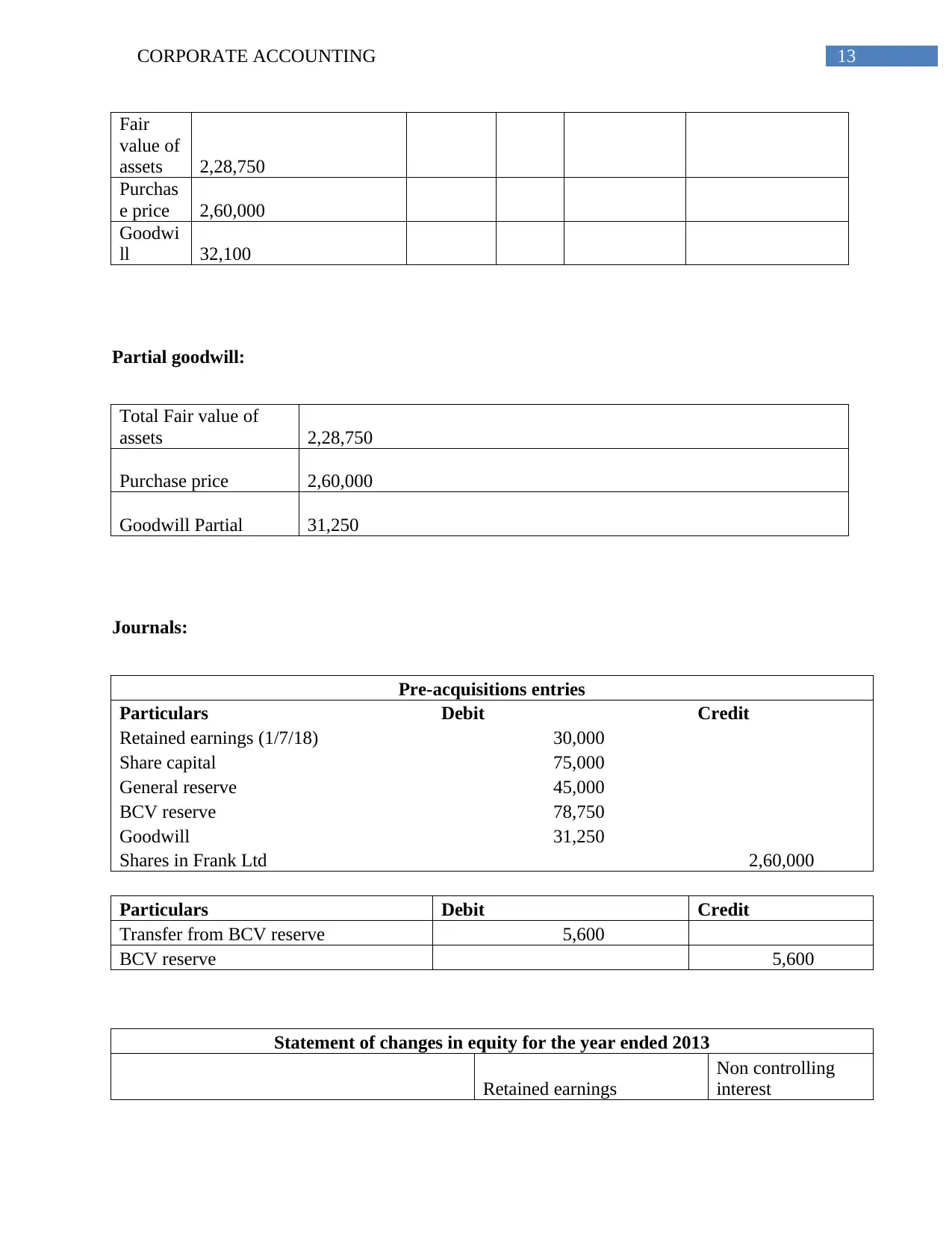

13CORPORATE ACCOUNTING

Fair

value of

assets 2,28,750

Purchas

e price 2,60,000

Goodwi

ll 32,100

Partial goodwill:

Total Fair value of

assets 2,28,750

Purchase price 2,60,000

Goodwill Partial 31,250

Journals:

Pre-acquisitions entries

Particulars Debit Credit

Retained earnings (1/7/18) 30,000

Share capital 75,000

General reserve 45,000

BCV reserve 78,750

Goodwill 31,250

Shares in Frank Ltd 2,60,000

Particulars Debit Credit

Transfer from BCV reserve 5,600

BCV reserve 5,600

Statement of changes in equity for the year ended 2013

Retained earnings

Non controlling

interest

Fair

value of

assets 2,28,750

Purchas

e price 2,60,000

Goodwi

ll 32,100

Partial goodwill:

Total Fair value of

assets 2,28,750

Purchase price 2,60,000

Goodwill Partial 31,250

Journals:

Pre-acquisitions entries

Particulars Debit Credit

Retained earnings (1/7/18) 30,000

Share capital 75,000

General reserve 45,000

BCV reserve 78,750

Goodwill 31,250

Shares in Frank Ltd 2,60,000

Particulars Debit Credit

Transfer from BCV reserve 5,600

BCV reserve 5,600

Statement of changes in equity for the year ended 2013

Retained earnings

Non controlling

interest

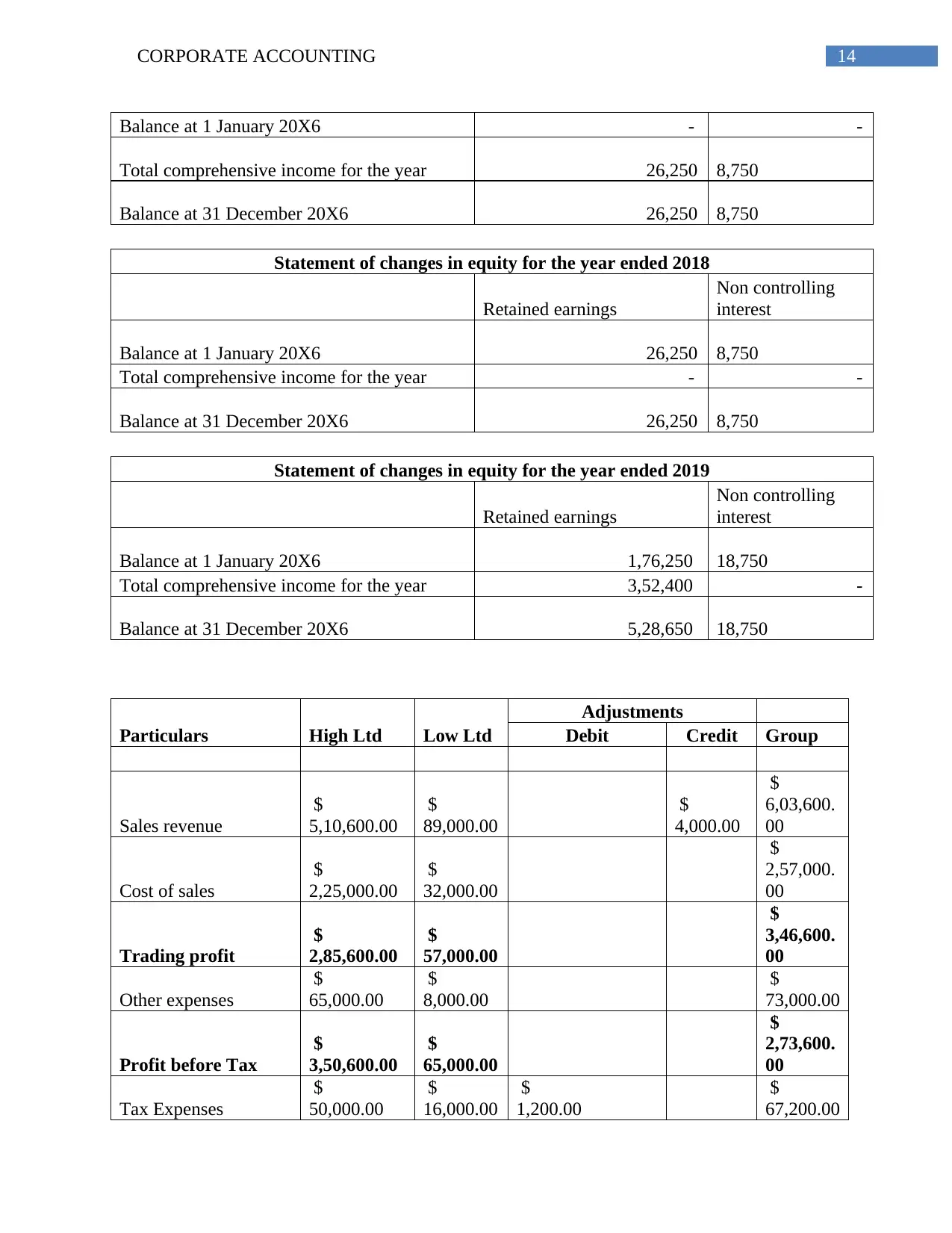

14CORPORATE ACCOUNTING

Balance at 1 January 20X6 - -

Total comprehensive income for the year 26,250 8,750

Balance at 31 December 20X6 26,250 8,750

Statement of changes in equity for the year ended 2018

Retained earnings

Non controlling

interest

Balance at 1 January 20X6 26,250 8,750

Total comprehensive income for the year - -

Balance at 31 December 20X6 26,250 8,750

Statement of changes in equity for the year ended 2019

Retained earnings

Non controlling

interest

Balance at 1 January 20X6 1,76,250 18,750

Total comprehensive income for the year 3,52,400 -

Balance at 31 December 20X6 5,28,650 18,750

Particulars High Ltd Low Ltd

Adjustments

Debit Credit Group

Sales revenue

$

5,10,600.00

$

89,000.00

$

4,000.00

$

6,03,600.

00

Cost of sales

$

2,25,000.00

$

32,000.00

$

2,57,000.

00

Trading profit

$

2,85,600.00

$

57,000.00

$

3,46,600.

00

Other expenses

$

65,000.00

$

8,000.00

$

73,000.00

Profit before Tax

$

3,50,600.00

$

65,000.00

$

2,73,600.

00

Tax Expenses

$

50,000.00

$

16,000.00

$

1,200.00

$

67,200.00

Balance at 1 January 20X6 - -

Total comprehensive income for the year 26,250 8,750

Balance at 31 December 20X6 26,250 8,750

Statement of changes in equity for the year ended 2018

Retained earnings

Non controlling

interest

Balance at 1 January 20X6 26,250 8,750

Total comprehensive income for the year - -

Balance at 31 December 20X6 26,250 8,750

Statement of changes in equity for the year ended 2019

Retained earnings

Non controlling

interest

Balance at 1 January 20X6 1,76,250 18,750

Total comprehensive income for the year 3,52,400 -

Balance at 31 December 20X6 5,28,650 18,750

Particulars High Ltd Low Ltd

Adjustments

Debit Credit Group

Sales revenue

$

5,10,600.00

$

89,000.00

$

4,000.00

$

6,03,600.

00

Cost of sales

$

2,25,000.00

$

32,000.00

$

2,57,000.

00

Trading profit

$

2,85,600.00

$

57,000.00

$

3,46,600.

00

Other expenses

$

65,000.00

$

8,000.00

$

73,000.00

Profit before Tax

$

3,50,600.00

$

65,000.00

$

2,73,600.

00

Tax Expenses

$

50,000.00

$

16,000.00

$

1,200.00

$

67,200.00

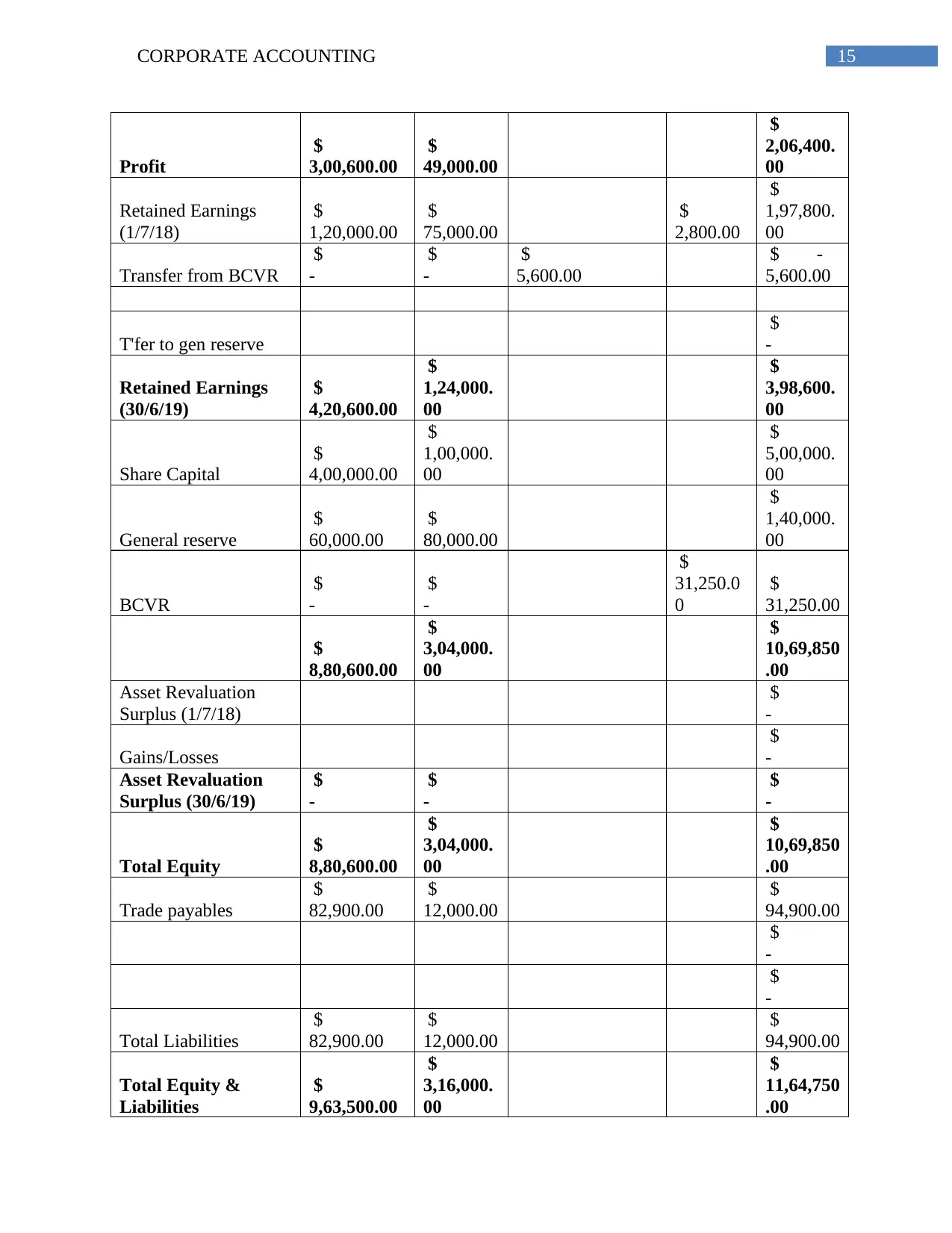

15CORPORATE ACCOUNTING

Profit

$

3,00,600.00

$

49,000.00

$

2,06,400.

00

Retained Earnings

(1/7/18)

$

1,20,000.00

$

75,000.00

$

2,800.00

$

1,97,800.

00

Transfer from BCVR

$

-

$

-

$

5,600.00

$ -

5,600.00

T'fer to gen reserve

$

-

Retained Earnings

(30/6/19)

$

4,20,600.00

$

1,24,000.

00

$

3,98,600.

00

Share Capital

$

4,00,000.00

$

1,00,000.

00

$

5,00,000.

00

General reserve

$

60,000.00

$

80,000.00

$

1,40,000.

00

BCVR

$

-

$

-

$

31,250.0

0

$

31,250.00

$

8,80,600.00

$

3,04,000.

00

$

10,69,850

.00

Asset Revaluation

Surplus (1/7/18)

$

-

Gains/Losses

$

-

Asset Revaluation

Surplus (30/6/19)

$

-

$

-

$

-

Total Equity

$

8,80,600.00

$

3,04,000.

00

$

10,69,850

.00

Trade payables

$

82,900.00

$

12,000.00

$

94,900.00

$

-

$

-

Total Liabilities

$

82,900.00

$

12,000.00

$

94,900.00

Total Equity &

Liabilities

$

9,63,500.00

$

3,16,000.

00

$

11,64,750

.00

Profit

$

3,00,600.00

$

49,000.00

$

2,06,400.

00

Retained Earnings

(1/7/18)

$

1,20,000.00

$

75,000.00

$

2,800.00

$

1,97,800.

00

Transfer from BCVR

$

-

$

-

$

5,600.00

$ -

5,600.00

T'fer to gen reserve

$

-

Retained Earnings

(30/6/19)

$

4,20,600.00

$

1,24,000.

00

$

3,98,600.

00

Share Capital

$

4,00,000.00

$

1,00,000.

00

$

5,00,000.

00

General reserve

$

60,000.00

$

80,000.00

$

1,40,000.

00

BCVR

$

-

$

-

$

31,250.0

0

$

31,250.00

$

8,80,600.00

$

3,04,000.

00

$

10,69,850

.00

Asset Revaluation

Surplus (1/7/18)

$

-

Gains/Losses

$

-

Asset Revaluation

Surplus (30/6/19)

$

-

$

-

$

-

Total Equity

$

8,80,600.00

$

3,04,000.

00

$

10,69,850

.00

Trade payables

$

82,900.00

$

12,000.00

$

94,900.00

$

-

$

-

Total Liabilities

$

82,900.00

$

12,000.00

$

94,900.00

Total Equity &

Liabilities

$

9,63,500.00

$

3,16,000.

00

$

11,64,750

.00

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

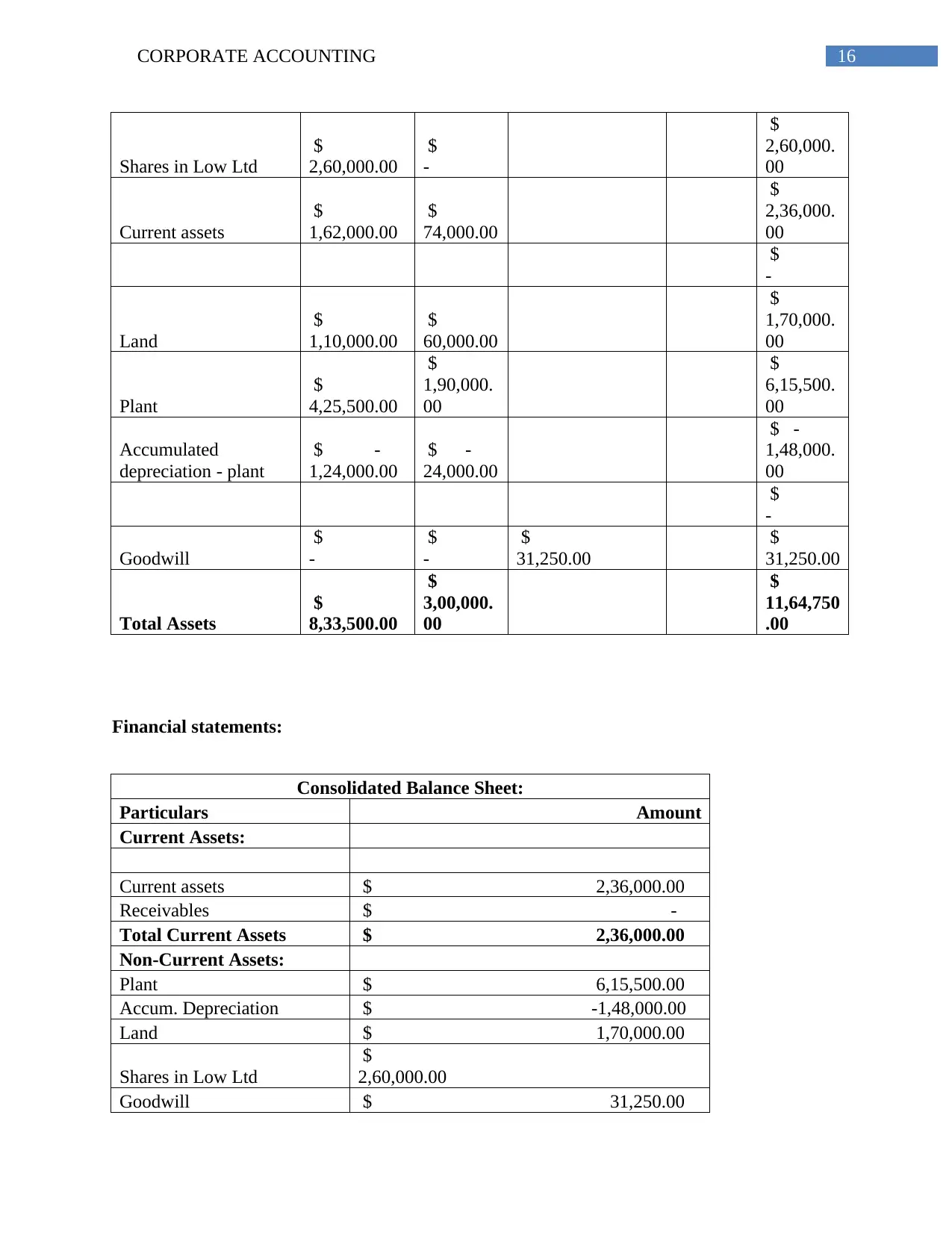

16CORPORATE ACCOUNTING

Shares in Low Ltd

$

2,60,000.00

$

-

$

2,60,000.

00

Current assets

$

1,62,000.00

$

74,000.00

$

2,36,000.

00

$

-

Land

$

1,10,000.00

$

60,000.00

$

1,70,000.

00

Plant

$

4,25,500.00

$

1,90,000.

00

$

6,15,500.

00

Accumulated

depreciation - plant

$ -

1,24,000.00

$ -

24,000.00

$ -

1,48,000.

00

$

-

Goodwill

$

-

$

-

$

31,250.00

$

31,250.00

Total Assets

$

8,33,500.00

$

3,00,000.

00

$

11,64,750

.00

Financial statements:

Consolidated Balance Sheet:

Particulars Amount

Current Assets:

Current assets $ 2,36,000.00

Receivables $ -

Total Current Assets $ 2,36,000.00

Non-Current Assets:

Plant $ 6,15,500.00

Accum. Depreciation $ -1,48,000.00

Land $ 1,70,000.00

Shares in Low Ltd

$

2,60,000.00

Goodwill $ 31,250.00

Shares in Low Ltd

$

2,60,000.00

$

-

$

2,60,000.

00

Current assets

$

1,62,000.00

$

74,000.00

$

2,36,000.

00

$

-

Land

$

1,10,000.00

$

60,000.00

$

1,70,000.

00

Plant

$

4,25,500.00

$

1,90,000.

00

$

6,15,500.

00

Accumulated

depreciation - plant

$ -

1,24,000.00

$ -

24,000.00

$ -

1,48,000.

00

$

-

Goodwill

$

-

$

-

$

31,250.00

$

31,250.00

Total Assets

$

8,33,500.00

$

3,00,000.

00

$

11,64,750

.00

Financial statements:

Consolidated Balance Sheet:

Particulars Amount

Current Assets:

Current assets $ 2,36,000.00

Receivables $ -

Total Current Assets $ 2,36,000.00

Non-Current Assets:

Plant $ 6,15,500.00

Accum. Depreciation $ -1,48,000.00

Land $ 1,70,000.00

Shares in Low Ltd

$

2,60,000.00

Goodwill $ 31,250.00

17CORPORATE ACCOUNTING

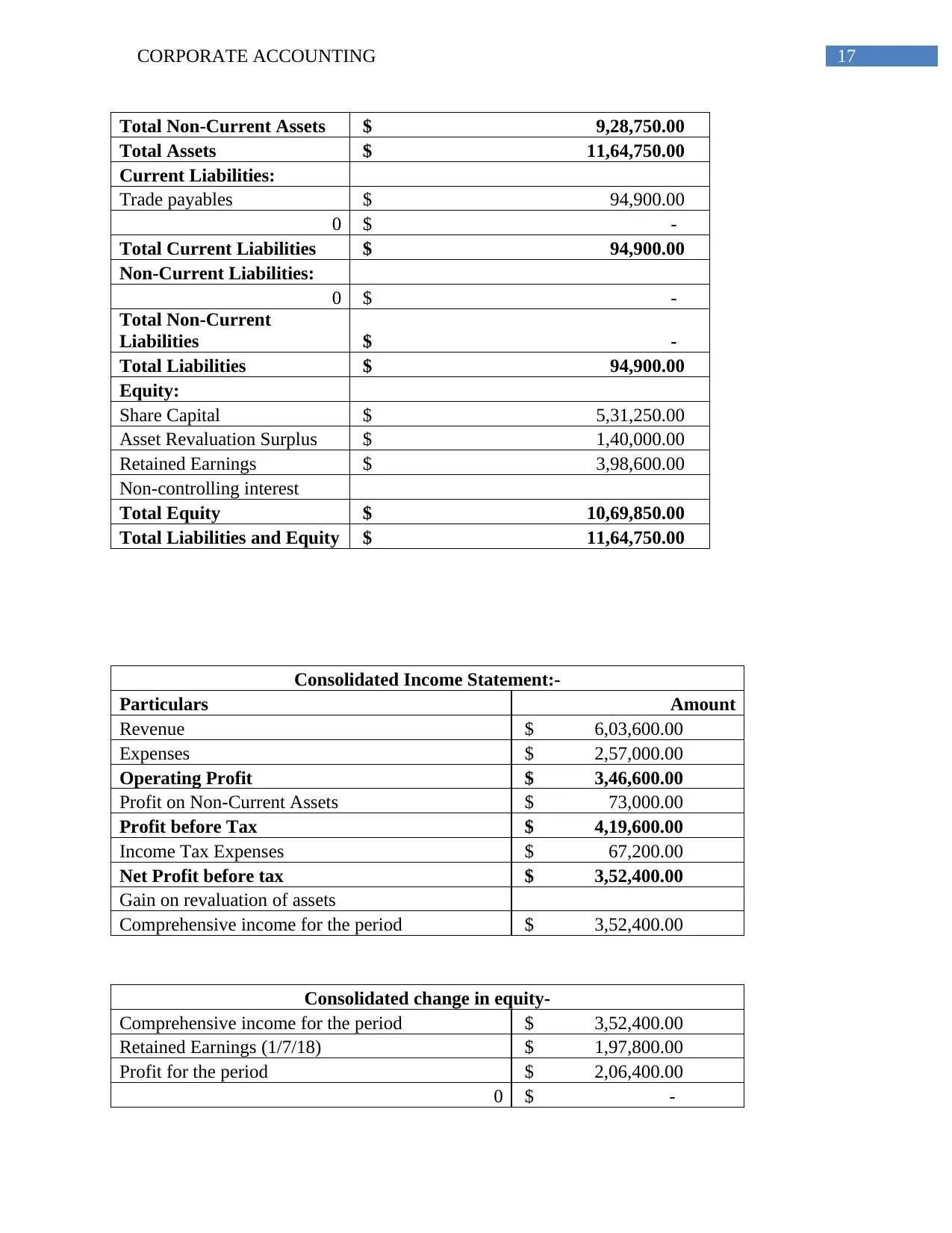

Total Non-Current Assets $ 9,28,750.00

Total Assets $ 11,64,750.00

Current Liabilities:

Trade payables $ 94,900.00

0 $ -

Total Current Liabilities $ 94,900.00

Non-Current Liabilities:

0 $ -

Total Non-Current

Liabilities $ -

Total Liabilities $ 94,900.00

Equity:

Share Capital $ 5,31,250.00

Asset Revaluation Surplus $ 1,40,000.00

Retained Earnings $ 3,98,600.00

Non-controlling interest

Total Equity $ 10,69,850.00

Total Liabilities and Equity $ 11,64,750.00

Consolidated Income Statement:-

Particulars Amount

Revenue $ 6,03,600.00

Expenses $ 2,57,000.00

Operating Profit $ 3,46,600.00

Profit on Non-Current Assets $ 73,000.00

Profit before Tax $ 4,19,600.00

Income Tax Expenses $ 67,200.00

Net Profit before tax $ 3,52,400.00

Gain on revaluation of assets

Comprehensive income for the period $ 3,52,400.00

Consolidated change in equity-

Comprehensive income for the period $ 3,52,400.00

Retained Earnings (1/7/18) $ 1,97,800.00

Profit for the period $ 2,06,400.00

0 $ -

Total Non-Current Assets $ 9,28,750.00

Total Assets $ 11,64,750.00

Current Liabilities:

Trade payables $ 94,900.00

0 $ -

Total Current Liabilities $ 94,900.00

Non-Current Liabilities:

0 $ -

Total Non-Current

Liabilities $ -

Total Liabilities $ 94,900.00

Equity:

Share Capital $ 5,31,250.00

Asset Revaluation Surplus $ 1,40,000.00

Retained Earnings $ 3,98,600.00

Non-controlling interest

Total Equity $ 10,69,850.00

Total Liabilities and Equity $ 11,64,750.00

Consolidated Income Statement:-

Particulars Amount

Revenue $ 6,03,600.00

Expenses $ 2,57,000.00

Operating Profit $ 3,46,600.00

Profit on Non-Current Assets $ 73,000.00

Profit before Tax $ 4,19,600.00

Income Tax Expenses $ 67,200.00

Net Profit before tax $ 3,52,400.00

Gain on revaluation of assets

Comprehensive income for the period $ 3,52,400.00

Consolidated change in equity-

Comprehensive income for the period $ 3,52,400.00

Retained Earnings (1/7/18) $ 1,97,800.00

Profit for the period $ 2,06,400.00

0 $ -

18CORPORATE ACCOUNTING

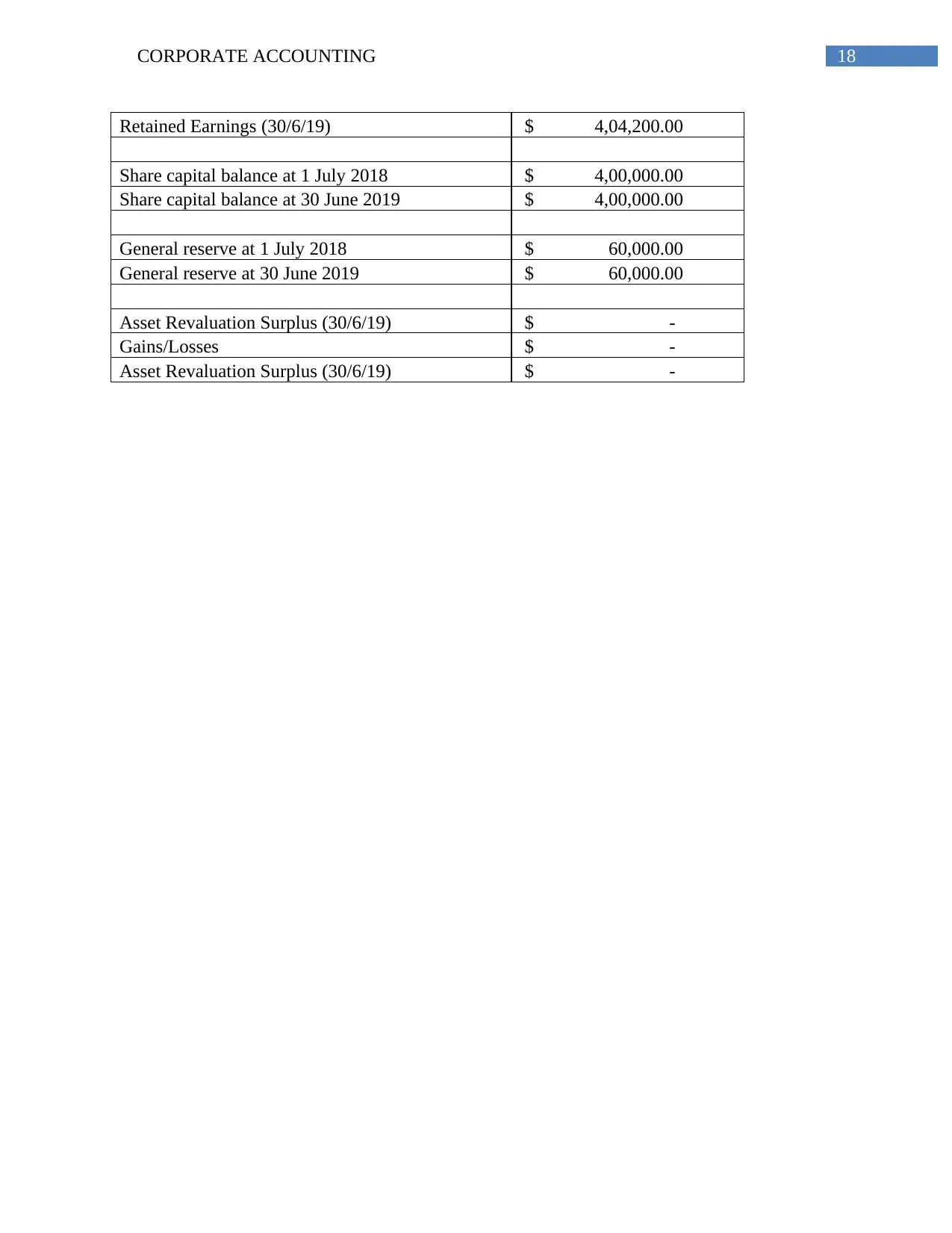

Retained Earnings (30/6/19) $ 4,04,200.00

Share capital balance at 1 July 2018 $ 4,00,000.00

Share capital balance at 30 June 2019 $ 4,00,000.00

General reserve at 1 July 2018 $ 60,000.00

General reserve at 30 June 2019 $ 60,000.00

Asset Revaluation Surplus (30/6/19) $ -

Gains/Losses $ -

Asset Revaluation Surplus (30/6/19) $ -

Retained Earnings (30/6/19) $ 4,04,200.00

Share capital balance at 1 July 2018 $ 4,00,000.00

Share capital balance at 30 June 2019 $ 4,00,000.00

General reserve at 1 July 2018 $ 60,000.00

General reserve at 30 June 2019 $ 60,000.00

Asset Revaluation Surplus (30/6/19) $ -

Gains/Losses $ -

Asset Revaluation Surplus (30/6/19) $ -

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

19CORPORATE ACCOUNTING

References:

Aasb.gov.au., 2019. [online] Available at:

https://www.aasb.gov.au/admin/file/content105/c9/AASB3_08-15.pdf [Accessed 9 May 2019].

Kieso, D.E., Weygandt, J.J. and Warfield, T.D., 2016. Intermediate Accounting, Binder Ready

Version. John Wiley & Sons.

Paugam, L., Astolfi, P. and Ramond, O., 2015. Accounting for business combinations: Do

purchase price allocations matter?. Journal of Accounting and Public Policy, 34(4), pp.362-391.

References:

Aasb.gov.au., 2019. [online] Available at:

https://www.aasb.gov.au/admin/file/content105/c9/AASB3_08-15.pdf [Accessed 9 May 2019].

Kieso, D.E., Weygandt, J.J. and Warfield, T.D., 2016. Intermediate Accounting, Binder Ready

Version. John Wiley & Sons.

Paugam, L., Astolfi, P. and Ramond, O., 2015. Accounting for business combinations: Do

purchase price allocations matter?. Journal of Accounting and Public Policy, 34(4), pp.362-391.

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.