MOS 3310B Finance Project Report: Costco Wholesale Corporation

VerifiedAdded on 2023/06/14

|20

|4057

|196

Report

AI Summary

This report provides a comprehensive financial analysis of Costco Wholesale Corporation, utilizing data from their 2017 annual report. It begins with an analysis of cash flows, examining operating, investing, and financing activities across 2015-2017, noting a decline in overall cash position due to investing and financing activities. The report then conducts a ratio analysis, evaluating liquidity, asset management, debt utilization, and profitability positions, suggesting areas for improvement in short-term debt payment capacity and inventory turnover. Finally, the report includes a sales forecast and calculates additional funds needed (AFN) for a projected sales increase, determining that $1230.77 million would need to be raised through external sources. The analysis concludes that Costco's financial position is generally strong, making it a potentially good investment opportunity.

Running Head: Finance

1

Project Report: Finance

1

Project Report: Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

2

Contents

Introduction.......................................................................................................................3

Analysis of cash flow........................................................................................................3

Ratio analysis....................................................................................................................5

Financial forecasting.........................................................................................................6

Conclusion......................................................................................................................10

References.......................................................................................................................11

Appendix.........................................................................................................................12

2

Contents

Introduction.......................................................................................................................3

Analysis of cash flow........................................................................................................3

Ratio analysis....................................................................................................................5

Financial forecasting.........................................................................................................6

Conclusion......................................................................................................................10

References.......................................................................................................................11

Appendix.........................................................................................................................12

Finance

3

Introduction:

The report briefs about the financial position and the prediction about the financial

position of Costco Wholesale Corporation. Financial analysis and prediction about financial

position of an organization is crucial methods which makes it easier for the management of

the company to identify the current performance of the company as well as the future changes

in the company. In the report, cash flow of the company has been analyzed firstly to identify

the performance of the company. Further, the ratio analysis study has been done to evaluate

the different levels of the company and lastly, financial forecasting has been done on the

future performance and the position of Costco Wholesale Corporation.

Analysis of cash flow:

Cash flow analysis is an examination which is done on the cash outflows and cash

inflows of a company in a particular period. The cash flow analysis starts with the initial cash

balance and generates the ending cash flow of the company. The evaluation on the statement

of cash flows of Costco Wholesale Corporation has been done.

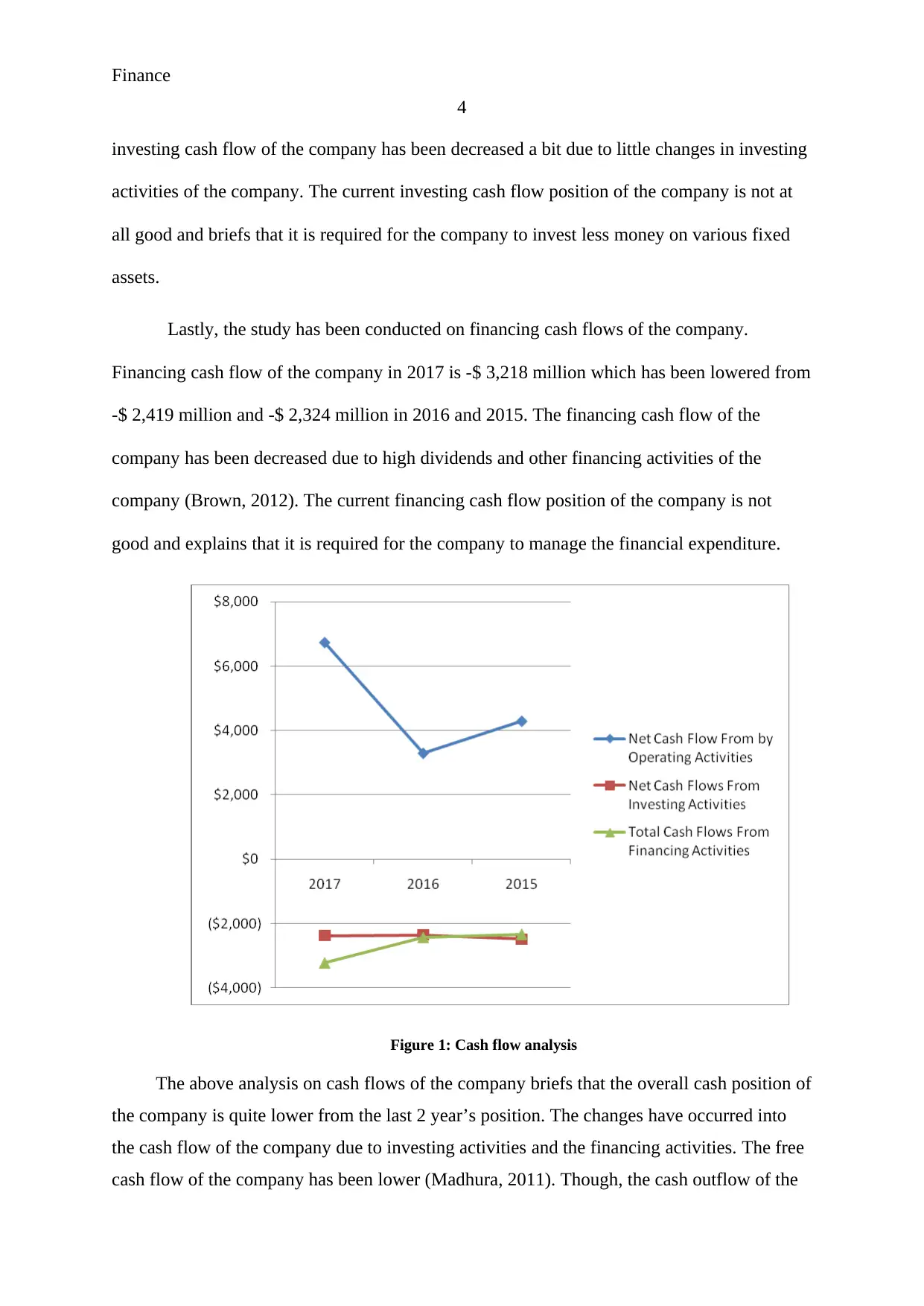

The cash flow statement of the company expresses that the operating cash flow of the

company in 2017 is $ 6,726 million which has been enhanced from $ 3,292 million and $

4,285 million in 2016 and 2015. The operating cash flow of the company has been enhanced

due to changes in operating assets and liabilities (Home, 2018). The current operating cash

flow position of the company is quite better and briefs about the better cash position of the

company.

In addition, investing cash flows of Costco Wholesale Corporation has been done.

The investing cash flow of the company in 2017 is $ -2300 million which has been enhanced

from -$ 2,649 million and -$ 2,480 million in 2016 and 2015 (Annual Report, 2017). The

3

Introduction:

The report briefs about the financial position and the prediction about the financial

position of Costco Wholesale Corporation. Financial analysis and prediction about financial

position of an organization is crucial methods which makes it easier for the management of

the company to identify the current performance of the company as well as the future changes

in the company. In the report, cash flow of the company has been analyzed firstly to identify

the performance of the company. Further, the ratio analysis study has been done to evaluate

the different levels of the company and lastly, financial forecasting has been done on the

future performance and the position of Costco Wholesale Corporation.

Analysis of cash flow:

Cash flow analysis is an examination which is done on the cash outflows and cash

inflows of a company in a particular period. The cash flow analysis starts with the initial cash

balance and generates the ending cash flow of the company. The evaluation on the statement

of cash flows of Costco Wholesale Corporation has been done.

The cash flow statement of the company expresses that the operating cash flow of the

company in 2017 is $ 6,726 million which has been enhanced from $ 3,292 million and $

4,285 million in 2016 and 2015. The operating cash flow of the company has been enhanced

due to changes in operating assets and liabilities (Home, 2018). The current operating cash

flow position of the company is quite better and briefs about the better cash position of the

company.

In addition, investing cash flows of Costco Wholesale Corporation has been done.

The investing cash flow of the company in 2017 is $ -2300 million which has been enhanced

from -$ 2,649 million and -$ 2,480 million in 2016 and 2015 (Annual Report, 2017). The

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance

4

investing cash flow of the company has been decreased a bit due to little changes in investing

activities of the company. The current investing cash flow position of the company is not at

all good and briefs that it is required for the company to invest less money on various fixed

assets.

Lastly, the study has been conducted on financing cash flows of the company.

Financing cash flow of the company in 2017 is -$ 3,218 million which has been lowered from

-$ 2,419 million and -$ 2,324 million in 2016 and 2015. The financing cash flow of the

company has been decreased due to high dividends and other financing activities of the

company (Brown, 2012). The current financing cash flow position of the company is not

good and explains that it is required for the company to manage the financial expenditure.

Figure 1: Cash flow analysis

The above analysis on cash flows of the company briefs that the overall cash position of

the company is quite lower from the last 2 year’s position. The changes have occurred into

the cash flow of the company due to investing activities and the financing activities. The free

cash flow of the company has been lower (Madhura, 2011). Though, the cash outflow of the

4

investing cash flow of the company has been decreased a bit due to little changes in investing

activities of the company. The current investing cash flow position of the company is not at

all good and briefs that it is required for the company to invest less money on various fixed

assets.

Lastly, the study has been conducted on financing cash flows of the company.

Financing cash flow of the company in 2017 is -$ 3,218 million which has been lowered from

-$ 2,419 million and -$ 2,324 million in 2016 and 2015. The financing cash flow of the

company has been decreased due to high dividends and other financing activities of the

company (Brown, 2012). The current financing cash flow position of the company is not

good and explains that it is required for the company to manage the financial expenditure.

Figure 1: Cash flow analysis

The above analysis on cash flows of the company briefs that the overall cash position of

the company is quite lower from the last 2 year’s position. The changes have occurred into

the cash flow of the company due to investing activities and the financing activities. The free

cash flow of the company has been lower (Madhura, 2011). Though, the cash outflow of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

5

company has been higher due to dividend amount which has been given to the shareholders

of the company. The accounts payable amount has not affected the cash outflow of the

company. Though, the current cash flow of the company has been lower due to investing and

financial activities of the company which are required to be managed by the company in a

better way.

Ratio analysis:

Ratio analysis is a financial analysis study which is done on Costco Wholesale

Corporation to evaluate the financial performance, position and changes in the company.

Ratio analysis evaluates the financial position and performance of an organization on various

bases such as liquidity position, profitability position, capital position, debt position, solvency

position etc. (Brooks, 2015). The study of ratio analysis of the company is as follows:

Liquidity position:

Liquidity position of the company has been evaluated on the basis of various ratios

such as current ratio and quick ratio. Current ratio calculations and the quick ratio of the

company are 0.99 and 0.43 in current year which briefs that the short term debt payment

capacity of the company is not far better and it is required for the company to enhance the

level of the current assets.

Asset management:

Asset management position of the company has been evaluated further on the basis of

various ratios such as asset turnover ratio, inventory turnover ratio and debtor’s turnover

ratio. Asset turnover ratio, inventory turnover ratio and debtor’s turnover ratio of the

company are 3.54, 32.08 days and 4.05 days in current year which briefs that the position of

the company is quite efficient (Brigham and Houston, 2012). Though, the comapny should

reduce the level of inventory turnover days.

5

company has been higher due to dividend amount which has been given to the shareholders

of the company. The accounts payable amount has not affected the cash outflow of the

company. Though, the current cash flow of the company has been lower due to investing and

financial activities of the company which are required to be managed by the company in a

better way.

Ratio analysis:

Ratio analysis is a financial analysis study which is done on Costco Wholesale

Corporation to evaluate the financial performance, position and changes in the company.

Ratio analysis evaluates the financial position and performance of an organization on various

bases such as liquidity position, profitability position, capital position, debt position, solvency

position etc. (Brooks, 2015). The study of ratio analysis of the company is as follows:

Liquidity position:

Liquidity position of the company has been evaluated on the basis of various ratios

such as current ratio and quick ratio. Current ratio calculations and the quick ratio of the

company are 0.99 and 0.43 in current year which briefs that the short term debt payment

capacity of the company is not far better and it is required for the company to enhance the

level of the current assets.

Asset management:

Asset management position of the company has been evaluated further on the basis of

various ratios such as asset turnover ratio, inventory turnover ratio and debtor’s turnover

ratio. Asset turnover ratio, inventory turnover ratio and debtor’s turnover ratio of the

company are 3.54, 32.08 days and 4.05 days in current year which briefs that the position of

the company is quite efficient (Brigham and Houston, 2012). Though, the comapny should

reduce the level of inventory turnover days.

Finance

6

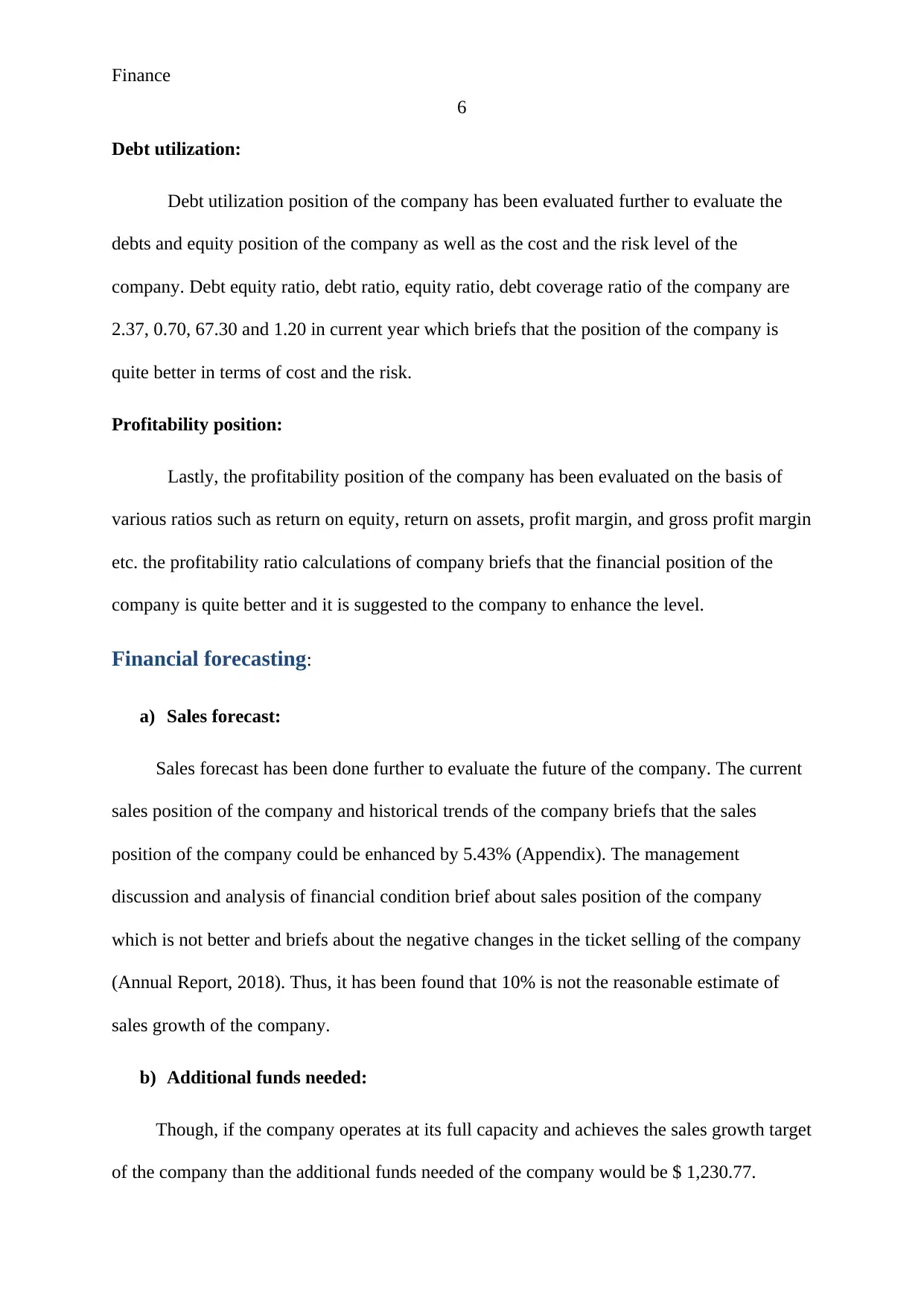

Debt utilization:

Debt utilization position of the company has been evaluated further to evaluate the

debts and equity position of the company as well as the cost and the risk level of the

company. Debt equity ratio, debt ratio, equity ratio, debt coverage ratio of the company are

2.37, 0.70, 67.30 and 1.20 in current year which briefs that the position of the company is

quite better in terms of cost and the risk.

Profitability position:

Lastly, the profitability position of the company has been evaluated on the basis of

various ratios such as return on equity, return on assets, profit margin, and gross profit margin

etc. the profitability ratio calculations of company briefs that the financial position of the

company is quite better and it is suggested to the company to enhance the level.

Financial forecasting:

a) Sales forecast:

Sales forecast has been done further to evaluate the future of the company. The current

sales position of the company and historical trends of the company briefs that the sales

position of the company could be enhanced by 5.43% (Appendix). The management

discussion and analysis of financial condition brief about sales position of the company

which is not better and briefs about the negative changes in the ticket selling of the company

(Annual Report, 2018). Thus, it has been found that 10% is not the reasonable estimate of

sales growth of the company.

b) Additional funds needed:

Though, if the company operates at its full capacity and achieves the sales growth target

of the company than the additional funds needed of the company would be $ 1,230.77.

6

Debt utilization:

Debt utilization position of the company has been evaluated further to evaluate the

debts and equity position of the company as well as the cost and the risk level of the

company. Debt equity ratio, debt ratio, equity ratio, debt coverage ratio of the company are

2.37, 0.70, 67.30 and 1.20 in current year which briefs that the position of the company is

quite better in terms of cost and the risk.

Profitability position:

Lastly, the profitability position of the company has been evaluated on the basis of

various ratios such as return on equity, return on assets, profit margin, and gross profit margin

etc. the profitability ratio calculations of company briefs that the financial position of the

company is quite better and it is suggested to the company to enhance the level.

Financial forecasting:

a) Sales forecast:

Sales forecast has been done further to evaluate the future of the company. The current

sales position of the company and historical trends of the company briefs that the sales

position of the company could be enhanced by 5.43% (Appendix). The management

discussion and analysis of financial condition brief about sales position of the company

which is not better and briefs about the negative changes in the ticket selling of the company

(Annual Report, 2018). Thus, it has been found that 10% is not the reasonable estimate of

sales growth of the company.

b) Additional funds needed:

Though, if the company operates at its full capacity and achieves the sales growth target

of the company than the additional funds needed of the company would be $ 1,230.77.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance

7

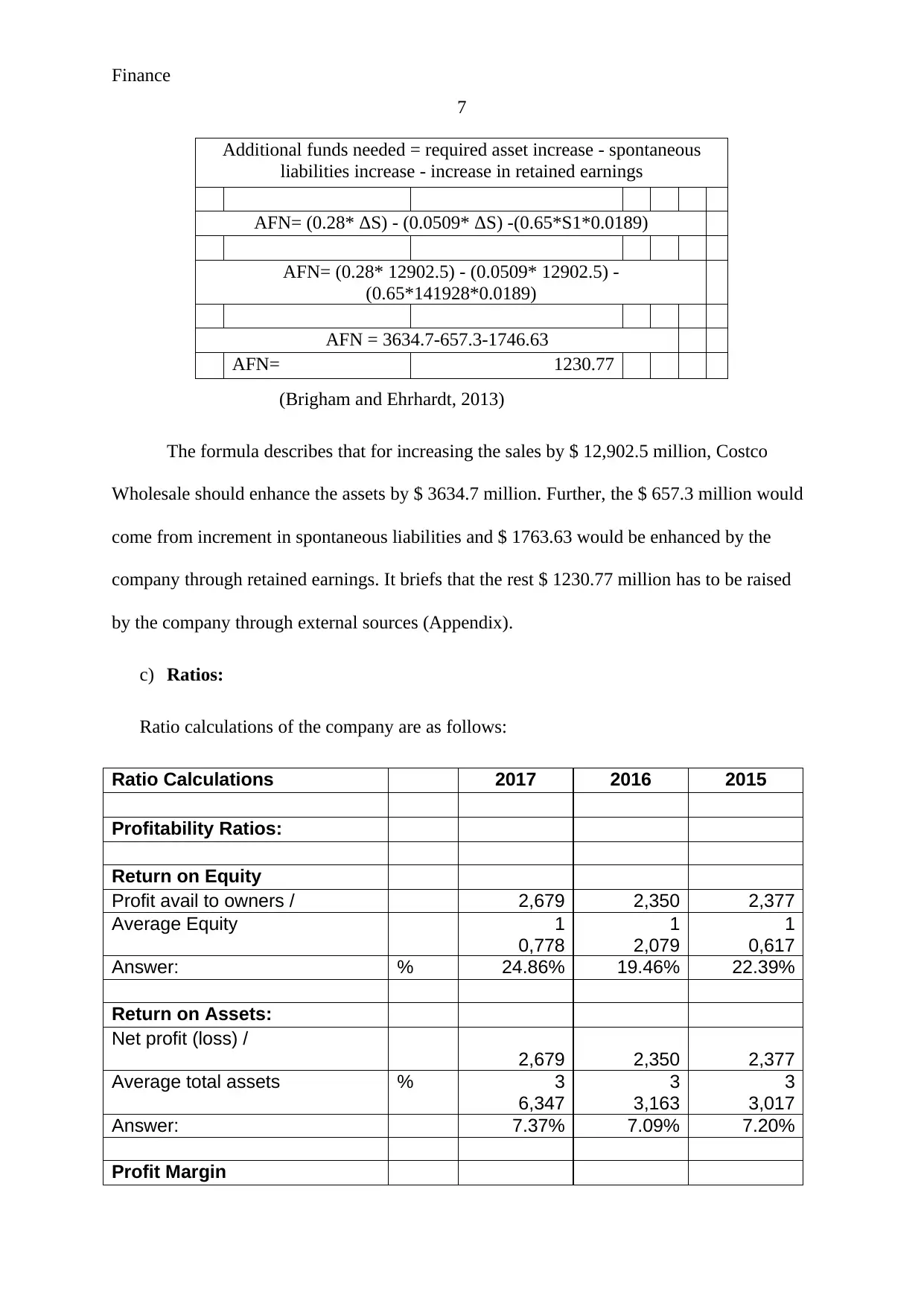

Additional funds needed = required asset increase - spontaneous

liabilities increase - increase in retained earnings

AFN= (0.28* ΔS) - (0.0509* ΔS) -(0.65*S1*0.0189)

AFN= (0.28* 12902.5) - (0.0509* 12902.5) -

(0.65*141928*0.0189)

AFN = 3634.7-657.3-1746.63

AFN= 1230.77

(Brigham and Ehrhardt, 2013)

The formula describes that for increasing the sales by $ 12,902.5 million, Costco

Wholesale should enhance the assets by $ 3634.7 million. Further, the $ 657.3 million would

come from increment in spontaneous liabilities and $ 1763.63 would be enhanced by the

company through retained earnings. It briefs that the rest $ 1230.77 million has to be raised

by the company through external sources (Appendix).

c) Ratios:

Ratio calculations of the company are as follows:

Ratio Calculations 2017 2016 2015

Profitability Ratios:

Return on Equity

Profit avail to owners / 2,679 2,350 2,377

Average Equity 1

0,778

1

2,079

1

0,617

Answer: % 24.86% 19.46% 22.39%

Return on Assets:

Net profit (loss) /

2,679 2,350 2,377

Average total assets % 3

6,347

3

3,163

3

3,017

Answer: 7.37% 7.09% 7.20%

Profit Margin

7

Additional funds needed = required asset increase - spontaneous

liabilities increase - increase in retained earnings

AFN= (0.28* ΔS) - (0.0509* ΔS) -(0.65*S1*0.0189)

AFN= (0.28* 12902.5) - (0.0509* 12902.5) -

(0.65*141928*0.0189)

AFN = 3634.7-657.3-1746.63

AFN= 1230.77

(Brigham and Ehrhardt, 2013)

The formula describes that for increasing the sales by $ 12,902.5 million, Costco

Wholesale should enhance the assets by $ 3634.7 million. Further, the $ 657.3 million would

come from increment in spontaneous liabilities and $ 1763.63 would be enhanced by the

company through retained earnings. It briefs that the rest $ 1230.77 million has to be raised

by the company through external sources (Appendix).

c) Ratios:

Ratio calculations of the company are as follows:

Ratio Calculations 2017 2016 2015

Profitability Ratios:

Return on Equity

Profit avail to owners / 2,679 2,350 2,377

Average Equity 1

0,778

1

2,079

1

0,617

Answer: % 24.86% 19.46% 22.39%

Return on Assets:

Net profit (loss) /

2,679 2,350 2,377

Average total assets % 3

6,347

3

3,163

3

3,017

Answer: 7.37% 7.09% 7.20%

Profit Margin

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

8

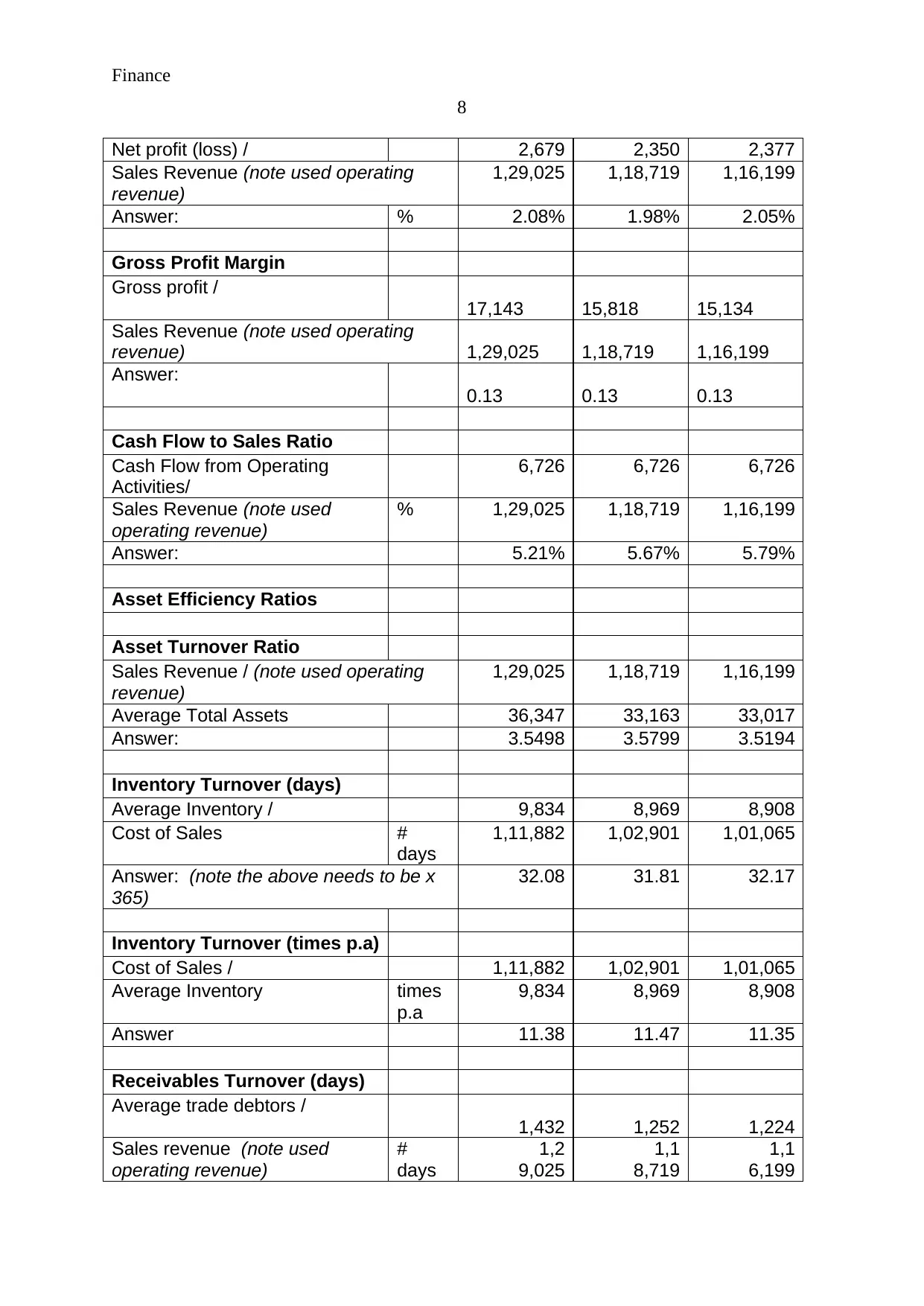

Net profit (loss) / 2,679 2,350 2,377

Sales Revenue (note used operating

revenue)

1,29,025 1,18,719 1,16,199

Answer: % 2.08% 1.98% 2.05%

Gross Profit Margin

Gross profit /

17,143 15,818 15,134

Sales Revenue (note used operating

revenue) 1,29,025 1,18,719 1,16,199

Answer:

0.13 0.13 0.13

Cash Flow to Sales Ratio

Cash Flow from Operating

Activities/

6,726 6,726 6,726

Sales Revenue (note used

operating revenue)

% 1,29,025 1,18,719 1,16,199

Answer: 5.21% 5.67% 5.79%

Asset Efficiency Ratios

Asset Turnover Ratio

Sales Revenue / (note used operating

revenue)

1,29,025 1,18,719 1,16,199

Average Total Assets 36,347 33,163 33,017

Answer: 3.5498 3.5799 3.5194

Inventory Turnover (days)

Average Inventory / 9,834 8,969 8,908

Cost of Sales #

days

1,11,882 1,02,901 1,01,065

Answer: (note the above needs to be x

365)

32.08 31.81 32.17

Inventory Turnover (times p.a)

Cost of Sales / 1,11,882 1,02,901 1,01,065

Average Inventory times

p.a

9,834 8,969 8,908

Answer 11.38 11.47 11.35

Receivables Turnover (days)

Average trade debtors /

1,432 1,252 1,224

Sales revenue (note used

operating revenue)

#

days

1,2

9,025

1,1

8,719

1,1

6,199

8

Net profit (loss) / 2,679 2,350 2,377

Sales Revenue (note used operating

revenue)

1,29,025 1,18,719 1,16,199

Answer: % 2.08% 1.98% 2.05%

Gross Profit Margin

Gross profit /

17,143 15,818 15,134

Sales Revenue (note used operating

revenue) 1,29,025 1,18,719 1,16,199

Answer:

0.13 0.13 0.13

Cash Flow to Sales Ratio

Cash Flow from Operating

Activities/

6,726 6,726 6,726

Sales Revenue (note used

operating revenue)

% 1,29,025 1,18,719 1,16,199

Answer: 5.21% 5.67% 5.79%

Asset Efficiency Ratios

Asset Turnover Ratio

Sales Revenue / (note used operating

revenue)

1,29,025 1,18,719 1,16,199

Average Total Assets 36,347 33,163 33,017

Answer: 3.5498 3.5799 3.5194

Inventory Turnover (days)

Average Inventory / 9,834 8,969 8,908

Cost of Sales #

days

1,11,882 1,02,901 1,01,065

Answer: (note the above needs to be x

365)

32.08 31.81 32.17

Inventory Turnover (times p.a)

Cost of Sales / 1,11,882 1,02,901 1,01,065

Average Inventory times

p.a

9,834 8,969 8,908

Answer 11.38 11.47 11.35

Receivables Turnover (days)

Average trade debtors /

1,432 1,252 1,224

Sales revenue (note used

operating revenue)

#

days

1,2

9,025

1,1

8,719

1,1

6,199

Finance

9

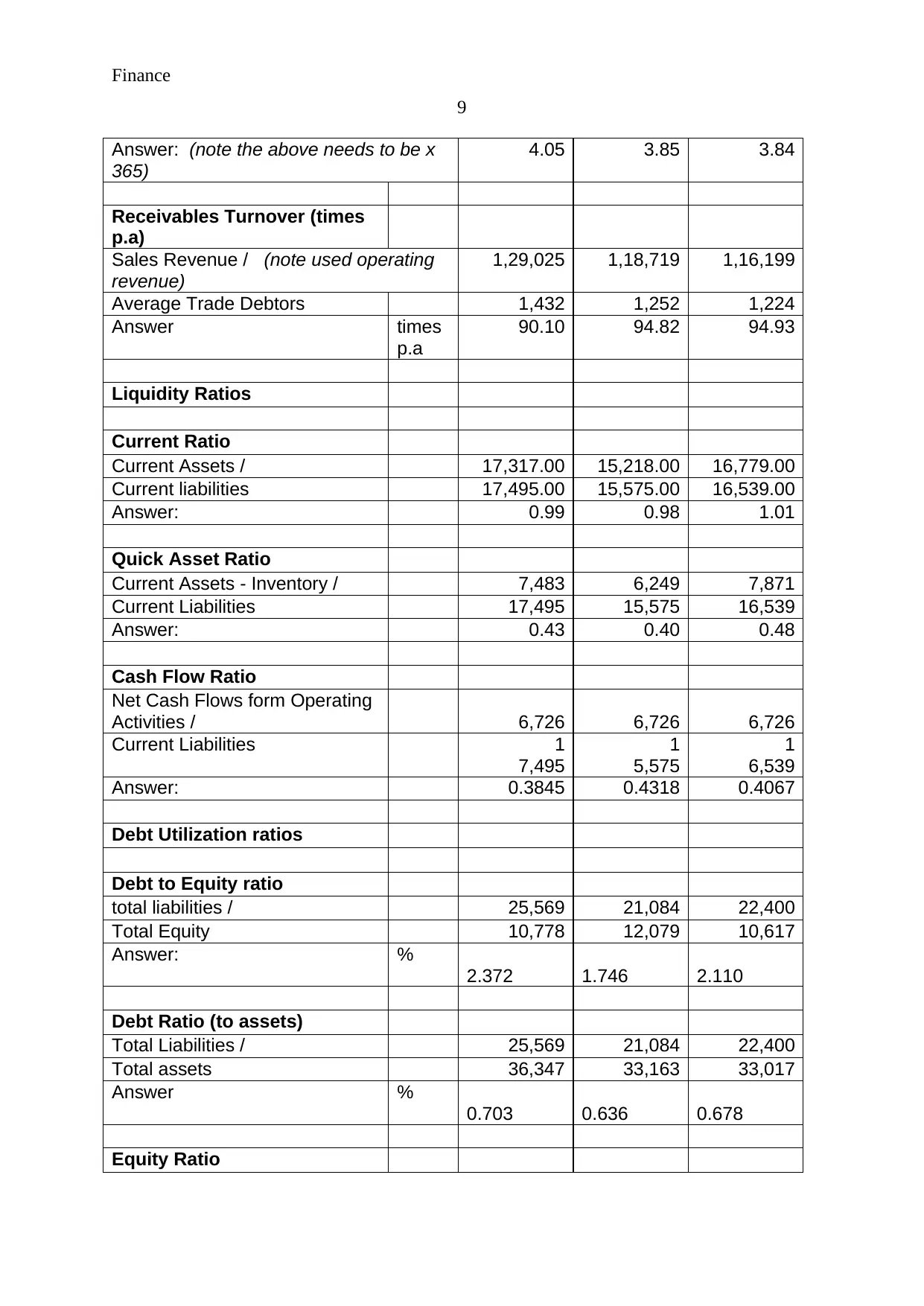

Answer: (note the above needs to be x

365)

4.05 3.85 3.84

Receivables Turnover (times

p.a)

Sales Revenue / (note used operating

revenue)

1,29,025 1,18,719 1,16,199

Average Trade Debtors 1,432 1,252 1,224

Answer times

p.a

90.10 94.82 94.93

Liquidity Ratios

Current Ratio

Current Assets / 17,317.00 15,218.00 16,779.00

Current liabilities 17,495.00 15,575.00 16,539.00

Answer: 0.99 0.98 1.01

Quick Asset Ratio

Current Assets - Inventory / 7,483 6,249 7,871

Current Liabilities 17,495 15,575 16,539

Answer: 0.43 0.40 0.48

Cash Flow Ratio

Net Cash Flows form Operating

Activities / 6,726 6,726 6,726

Current Liabilities 1

7,495

1

5,575

1

6,539

Answer: 0.3845 0.4318 0.4067

Debt Utilization ratios

Debt to Equity ratio

total liabilities / 25,569 21,084 22,400

Total Equity 10,778 12,079 10,617

Answer: %

2.372 1.746 2.110

Debt Ratio (to assets)

Total Liabilities / 25,569 21,084 22,400

Total assets 36,347 33,163 33,017

Answer %

0.703 0.636 0.678

Equity Ratio

9

Answer: (note the above needs to be x

365)

4.05 3.85 3.84

Receivables Turnover (times

p.a)

Sales Revenue / (note used operating

revenue)

1,29,025 1,18,719 1,16,199

Average Trade Debtors 1,432 1,252 1,224

Answer times

p.a

90.10 94.82 94.93

Liquidity Ratios

Current Ratio

Current Assets / 17,317.00 15,218.00 16,779.00

Current liabilities 17,495.00 15,575.00 16,539.00

Answer: 0.99 0.98 1.01

Quick Asset Ratio

Current Assets - Inventory / 7,483 6,249 7,871

Current Liabilities 17,495 15,575 16,539

Answer: 0.43 0.40 0.48

Cash Flow Ratio

Net Cash Flows form Operating

Activities / 6,726 6,726 6,726

Current Liabilities 1

7,495

1

5,575

1

6,539

Answer: 0.3845 0.4318 0.4067

Debt Utilization ratios

Debt to Equity ratio

total liabilities / 25,569 21,084 22,400

Total Equity 10,778 12,079 10,617

Answer: %

2.372 1.746 2.110

Debt Ratio (to assets)

Total Liabilities / 25,569 21,084 22,400

Total assets 36,347 33,163 33,017

Answer %

0.703 0.636 0.678

Equity Ratio

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

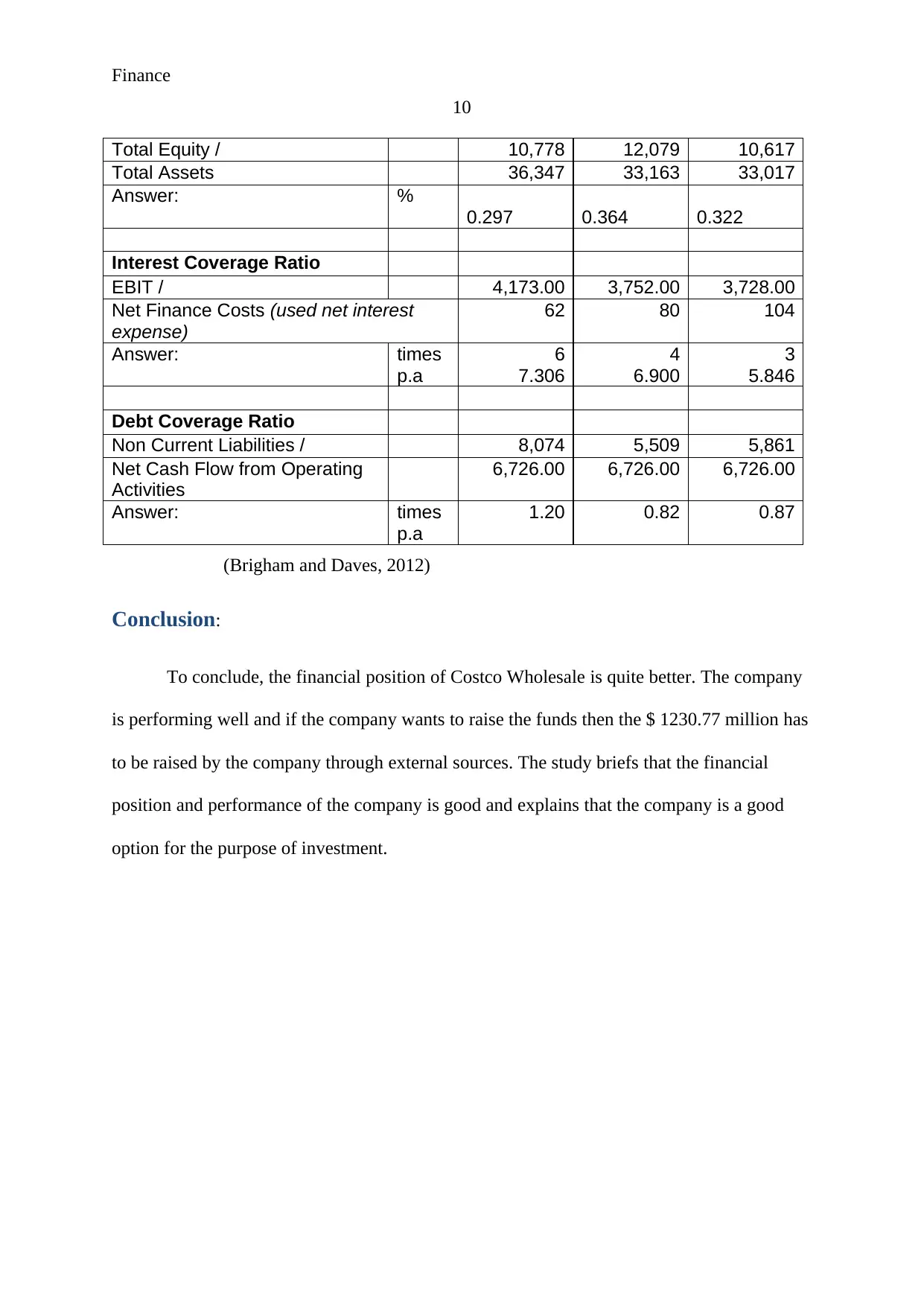

Finance

10

Total Equity / 10,778 12,079 10,617

Total Assets 36,347 33,163 33,017

Answer: %

0.297 0.364 0.322

Interest Coverage Ratio

EBIT / 4,173.00 3,752.00 3,728.00

Net Finance Costs (used net interest

expense)

62 80 104

Answer: times

p.a

6

7.306

4

6.900

3

5.846

Debt Coverage Ratio

Non Current Liabilities / 8,074 5,509 5,861

Net Cash Flow from Operating

Activities

6,726.00 6,726.00 6,726.00

Answer: times

p.a

1.20 0.82 0.87

(Brigham and Daves, 2012)

Conclusion:

To conclude, the financial position of Costco Wholesale is quite better. The company

is performing well and if the company wants to raise the funds then the $ 1230.77 million has

to be raised by the company through external sources. The study briefs that the financial

position and performance of the company is good and explains that the company is a good

option for the purpose of investment.

10

Total Equity / 10,778 12,079 10,617

Total Assets 36,347 33,163 33,017

Answer: %

0.297 0.364 0.322

Interest Coverage Ratio

EBIT / 4,173.00 3,752.00 3,728.00

Net Finance Costs (used net interest

expense)

62 80 104

Answer: times

p.a

6

7.306

4

6.900

3

5.846

Debt Coverage Ratio

Non Current Liabilities / 8,074 5,509 5,861

Net Cash Flow from Operating

Activities

6,726.00 6,726.00 6,726.00

Answer: times

p.a

1.20 0.82 0.87

(Brigham and Daves, 2012)

Conclusion:

To conclude, the financial position of Costco Wholesale is quite better. The company

is performing well and if the company wants to raise the funds then the $ 1230.77 million has

to be raised by the company through external sources. The study briefs that the financial

position and performance of the company is good and explains that the company is a good

option for the purpose of investment.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

11

References:

Annual Report. 2017. Costco Wholesale Corporation. [Online]. Available at:

http://phx.corporate-ir.net/phoenix.zhtml?c=83830&p=irol-sec [Accessed as on 10th April

2018].

Brigham, E. and Daves, P., 2012. Intermediate financial management. Nelson Education.

Brigham, E.F. and Ehrhardt, M.C., 2013. Financial management: Theory & practice.

Cengage Learning.

Brigham, E.F. and Houston, J.F., 2012. Fundamentals of financial management. Cengage

Learning.

Brooks, R., 2015. Financial management: core concepts. Pearson.

Brown, R., 2012. Analysis of investments & management of portfolios. Pearson Higher Ed.

Home. 2017. Costco Wholesale Corporation. [Online]. Available at: https://www.costco.com/

[Accessed as on 10th April 2018].

Madura, J., 2011. International financial management. Cengage Learning.

11

References:

Annual Report. 2017. Costco Wholesale Corporation. [Online]. Available at:

http://phx.corporate-ir.net/phoenix.zhtml?c=83830&p=irol-sec [Accessed as on 10th April

2018].

Brigham, E. and Daves, P., 2012. Intermediate financial management. Nelson Education.

Brigham, E.F. and Ehrhardt, M.C., 2013. Financial management: Theory & practice.

Cengage Learning.

Brigham, E.F. and Houston, J.F., 2012. Fundamentals of financial management. Cengage

Learning.

Brooks, R., 2015. Financial management: core concepts. Pearson.

Brown, R., 2012. Analysis of investments & management of portfolios. Pearson Higher Ed.

Home. 2017. Costco Wholesale Corporation. [Online]. Available at: https://www.costco.com/

[Accessed as on 10th April 2018].

Madura, J., 2011. International financial management. Cengage Learning.

Finance

12

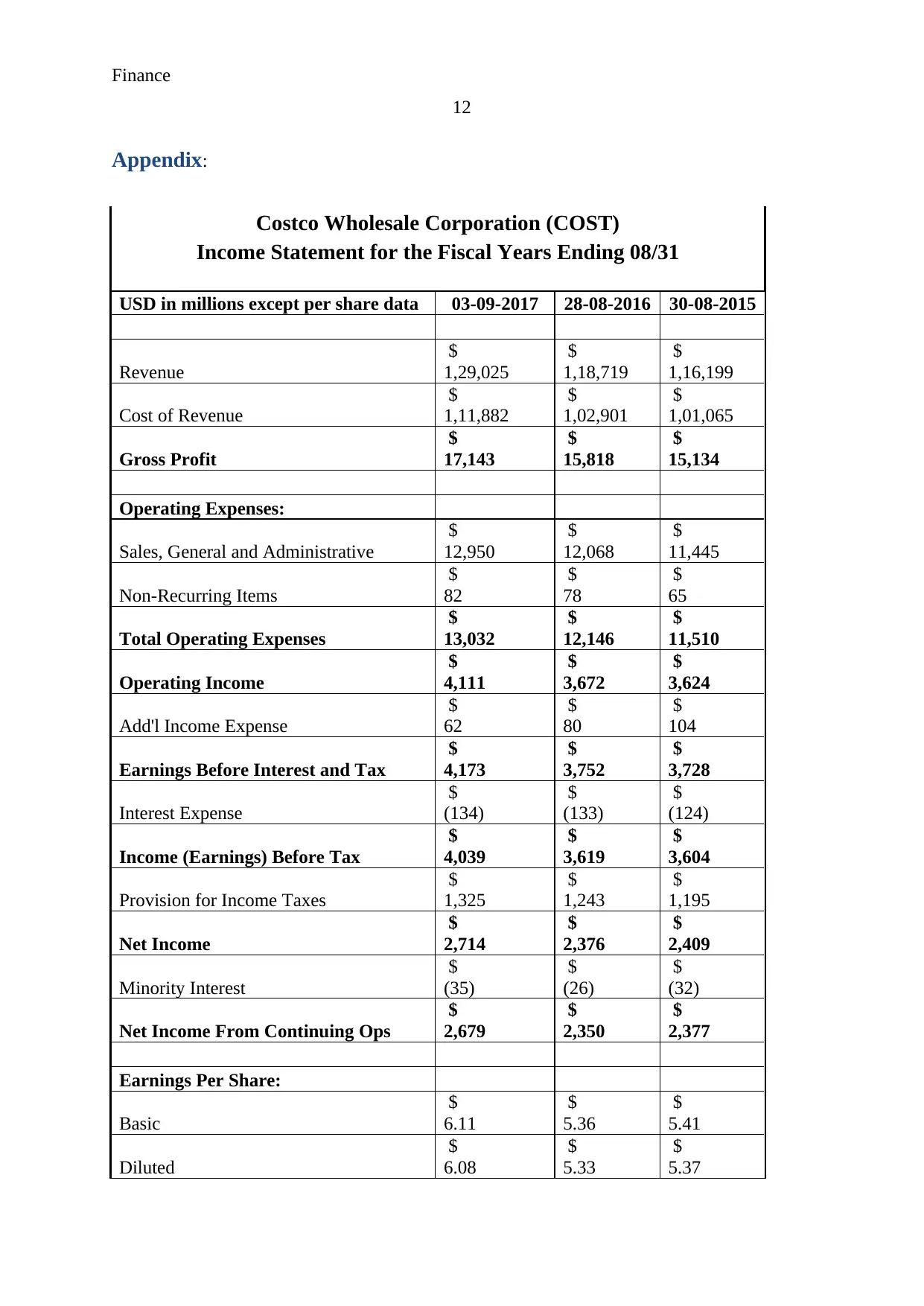

Appendix:

Costco Wholesale Corporation (COST)

Income Statement for the Fiscal Years Ending 08/31

USD in millions except per share data 03-09-2017 28-08-2016 30-08-2015

Revenue

$

1,29,025

$

1,18,719

$

1,16,199

Cost of Revenue

$

1,11,882

$

1,02,901

$

1,01,065

Gross Profit

$

17,143

$

15,818

$

15,134

Operating Expenses:

Sales, General and Administrative

$

12,950

$

12,068

$

11,445

Non-Recurring Items

$

82

$

78

$

65

Total Operating Expenses

$

13,032

$

12,146

$

11,510

Operating Income

$

4,111

$

3,672

$

3,624

Add'l Income Expense

$

62

$

80

$

104

Earnings Before Interest and Tax

$

4,173

$

3,752

$

3,728

Interest Expense

$

(134)

$

(133)

$

(124)

Income (Earnings) Before Tax

$

4,039

$

3,619

$

3,604

Provision for Income Taxes

$

1,325

$

1,243

$

1,195

Net Income

$

2,714

$

2,376

$

2,409

Minority Interest

$

(35)

$

(26)

$

(32)

Net Income From Continuing Ops

$

2,679

$

2,350

$

2,377

Earnings Per Share:

Basic

$

6.11

$

5.36

$

5.41

Diluted

$

6.08

$

5.33

$

5.37

12

Appendix:

Costco Wholesale Corporation (COST)

Income Statement for the Fiscal Years Ending 08/31

USD in millions except per share data 03-09-2017 28-08-2016 30-08-2015

Revenue

$

1,29,025

$

1,18,719

$

1,16,199

Cost of Revenue

$

1,11,882

$

1,02,901

$

1,01,065

Gross Profit

$

17,143

$

15,818

$

15,134

Operating Expenses:

Sales, General and Administrative

$

12,950

$

12,068

$

11,445

Non-Recurring Items

$

82

$

78

$

65

Total Operating Expenses

$

13,032

$

12,146

$

11,510

Operating Income

$

4,111

$

3,672

$

3,624

Add'l Income Expense

$

62

$

80

$

104

Earnings Before Interest and Tax

$

4,173

$

3,752

$

3,728

Interest Expense

$

(134)

$

(133)

$

(124)

Income (Earnings) Before Tax

$

4,039

$

3,619

$

3,604

Provision for Income Taxes

$

1,325

$

1,243

$

1,195

Net Income

$

2,714

$

2,376

$

2,409

Minority Interest

$

(35)

$

(26)

$

(32)

Net Income From Continuing Ops

$

2,679

$

2,350

$

2,377

Earnings Per Share:

Basic

$

6.11

$

5.36

$

5.41

Diluted

$

6.08

$

5.33

$

5.37

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.