Analysis of Dwelling Prices Across Three Australian Districts

VerifiedAdded on 2020/05/04

|10

|2842

|72

Report

AI Summary

This report presents a comprehensive analysis of dwelling prices across three Australian districts: Sydney, Wollongong, and Newcastle. The study utilizes a dataset of 60 observations, examining price variations based on location, dwelling type (unit or house), and the presence of an ocean view. The analysis employs various statistical techniques, including measures of central tendency, dispersion, correlation, and hypothesis testing (t-tests and ANOVA). The report begins with an overview of the data, followed by a detailed examination of prices irrespective of location, dwelling type, and ocean view. It then disaggregates the data by location, comparing average prices and dispersion using the coefficient of variation (CV). The report further investigates price differences based on dwelling type, comparing house and unit prices using t-tests. Finally, the analysis explores the impact of ocean views on prices, examining both unit and house dwellings, and provides statistical evidence to support the findings.

STUDENT ID

COURSE

COURSE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

We use the dataset of 60 observations given to us for 3 districts to answer a range of questions on

prices across places and other features like ocean view, and type of dwelling-unit or house. The 3

districts covered are Sydney, Wollongong and Newcastle. 2 other categorical variables are provided

for each data point- the type of dwelling can be unit or a house. We are also told about the

absence or presence of ocean view with the dwelling. The focus of the report is on PRICES of

dwellings and how these vary across regions, dwelling type and presence of an ocean view.

We use Microsoft Excel to answer a range of queries pertaining to this data. We use concepts like

measures of central tendency, dispersion, correlation, confidence intervals, and hypothesis testing.

We use t distribution to deal with the hypothesis testing. Visual charts are included - pie chart, bar

chart, and histogram to aid in our analysis.

ANALYSIS:

This section is divided into sub sections, where each subsection deals with a separate query. We

note that we have 4 variables in all, out of which only 1 variable is quantitative. This is prices of

dwellings. All other variables are categorical in nature.

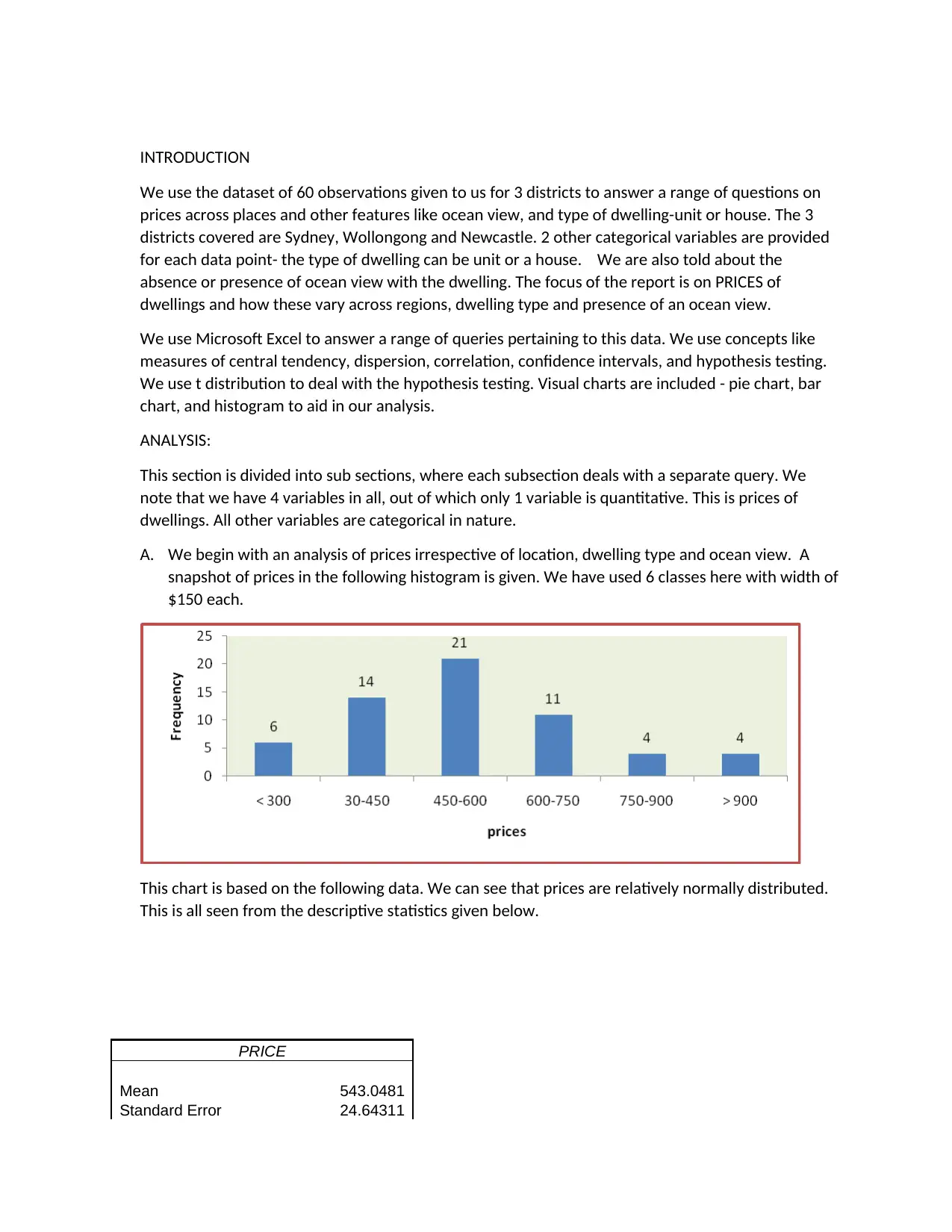

A. We begin with an analysis of prices irrespective of location, dwelling type and ocean view. A

snapshot of prices in the following histogram is given. We have used 6 classes here with width of

$150 each.

This chart is based on the following data. We can see that prices are relatively normally distributed.

This is all seen from the descriptive statistics given below.

PRICE

Mean 543.0481

Standard Error 24.64311

We use the dataset of 60 observations given to us for 3 districts to answer a range of questions on

prices across places and other features like ocean view, and type of dwelling-unit or house. The 3

districts covered are Sydney, Wollongong and Newcastle. 2 other categorical variables are provided

for each data point- the type of dwelling can be unit or a house. We are also told about the

absence or presence of ocean view with the dwelling. The focus of the report is on PRICES of

dwellings and how these vary across regions, dwelling type and presence of an ocean view.

We use Microsoft Excel to answer a range of queries pertaining to this data. We use concepts like

measures of central tendency, dispersion, correlation, confidence intervals, and hypothesis testing.

We use t distribution to deal with the hypothesis testing. Visual charts are included - pie chart, bar

chart, and histogram to aid in our analysis.

ANALYSIS:

This section is divided into sub sections, where each subsection deals with a separate query. We

note that we have 4 variables in all, out of which only 1 variable is quantitative. This is prices of

dwellings. All other variables are categorical in nature.

A. We begin with an analysis of prices irrespective of location, dwelling type and ocean view. A

snapshot of prices in the following histogram is given. We have used 6 classes here with width of

$150 each.

This chart is based on the following data. We can see that prices are relatively normally distributed.

This is all seen from the descriptive statistics given below.

PRICE

Mean 543.0481

Standard Error 24.64311

Median 528.7699

Standard Deviation 190.8847

Sample Variance 36436.97

Kurtosis 0.844758

Skewness 0.770584

< 300 6

30-450 14

450-600 21

600-750 11

750-900 4

> 900 4

The mean price is $543, whereas the median is $528. So we have 50% dwellings with a price that

exceeds $528. As mean exceeds median we know that the distribution is positively skewed, but not

by a large degree. The skewness value is only 0.77.

B. Next we disaggregate the data by location. Each location has 20 data points, which are analysed

in table below. As can see that mean price is highest for Sydney.

Variance in prices is also highest in Sydney, showing the highest dispersion in prices.

The lowest average price is for Newcastle, which also has lowest dispersion value.

To compare average against dispersion we use the CV- coefficient of variation value. It is given

as the ratio of standard deviation to mean value. It is a relative measure of the dispersion. As

shown the CV is highest for Newcastle, whereas it is lowest for Wollongong. This data is not in

line with variance / standard deviation. The latter is a an absolute measure of dispersion,

whereas CV is an absolute measure devoid of units. CV is therefore better measure to compare

dispersion of different series.

SYDNEY WOLLONGONG NEWCASTLE

Mean 717.2859 532.6064044 379.252

Standard Error 38.79888 24.32388522 23.33847

Median 668.4485 515.1707706 364.8505

Standard

Deviation 173.5139 108.7797217 104.3728

Sample Variance 30107.06 11833.02784 10893.69

Kurtosis 0.500424 -0.4987024 -0.52924

Skewness 0.930083 0.208633606 0.507136

CV 0.241903 0.204240356 0.275207

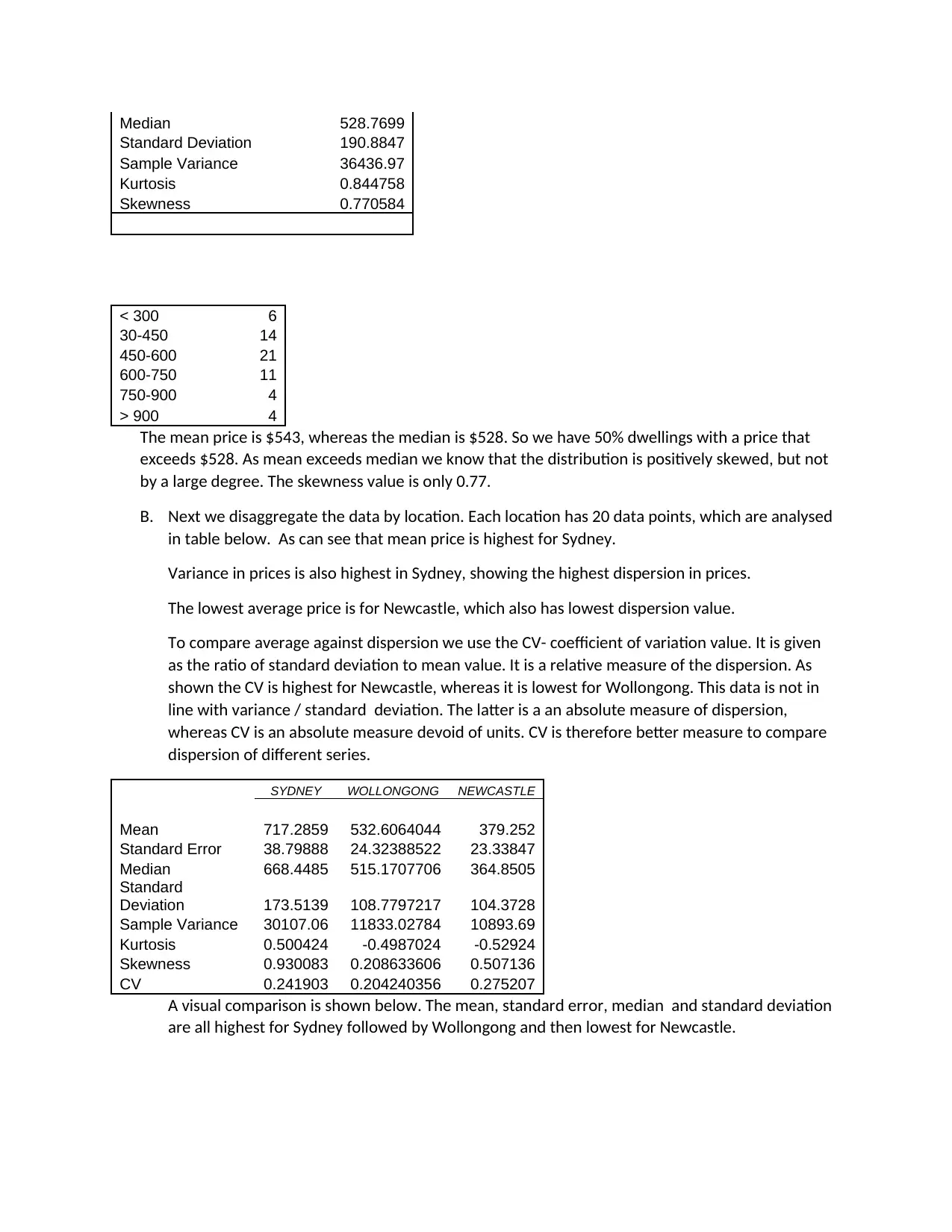

A visual comparison is shown below. The mean, standard error, median and standard deviation

are all highest for Sydney followed by Wollongong and then lowest for Newcastle.

Standard Deviation 190.8847

Sample Variance 36436.97

Kurtosis 0.844758

Skewness 0.770584

< 300 6

30-450 14

450-600 21

600-750 11

750-900 4

> 900 4

The mean price is $543, whereas the median is $528. So we have 50% dwellings with a price that

exceeds $528. As mean exceeds median we know that the distribution is positively skewed, but not

by a large degree. The skewness value is only 0.77.

B. Next we disaggregate the data by location. Each location has 20 data points, which are analysed

in table below. As can see that mean price is highest for Sydney.

Variance in prices is also highest in Sydney, showing the highest dispersion in prices.

The lowest average price is for Newcastle, which also has lowest dispersion value.

To compare average against dispersion we use the CV- coefficient of variation value. It is given

as the ratio of standard deviation to mean value. It is a relative measure of the dispersion. As

shown the CV is highest for Newcastle, whereas it is lowest for Wollongong. This data is not in

line with variance / standard deviation. The latter is a an absolute measure of dispersion,

whereas CV is an absolute measure devoid of units. CV is therefore better measure to compare

dispersion of different series.

SYDNEY WOLLONGONG NEWCASTLE

Mean 717.2859 532.6064044 379.252

Standard Error 38.79888 24.32388522 23.33847

Median 668.4485 515.1707706 364.8505

Standard

Deviation 173.5139 108.7797217 104.3728

Sample Variance 30107.06 11833.02784 10893.69

Kurtosis 0.500424 -0.4987024 -0.52924

Skewness 0.930083 0.208633606 0.507136

CV 0.241903 0.204240356 0.275207

A visual comparison is shown below. The mean, standard error, median and standard deviation

are all highest for Sydney followed by Wollongong and then lowest for Newcastle.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

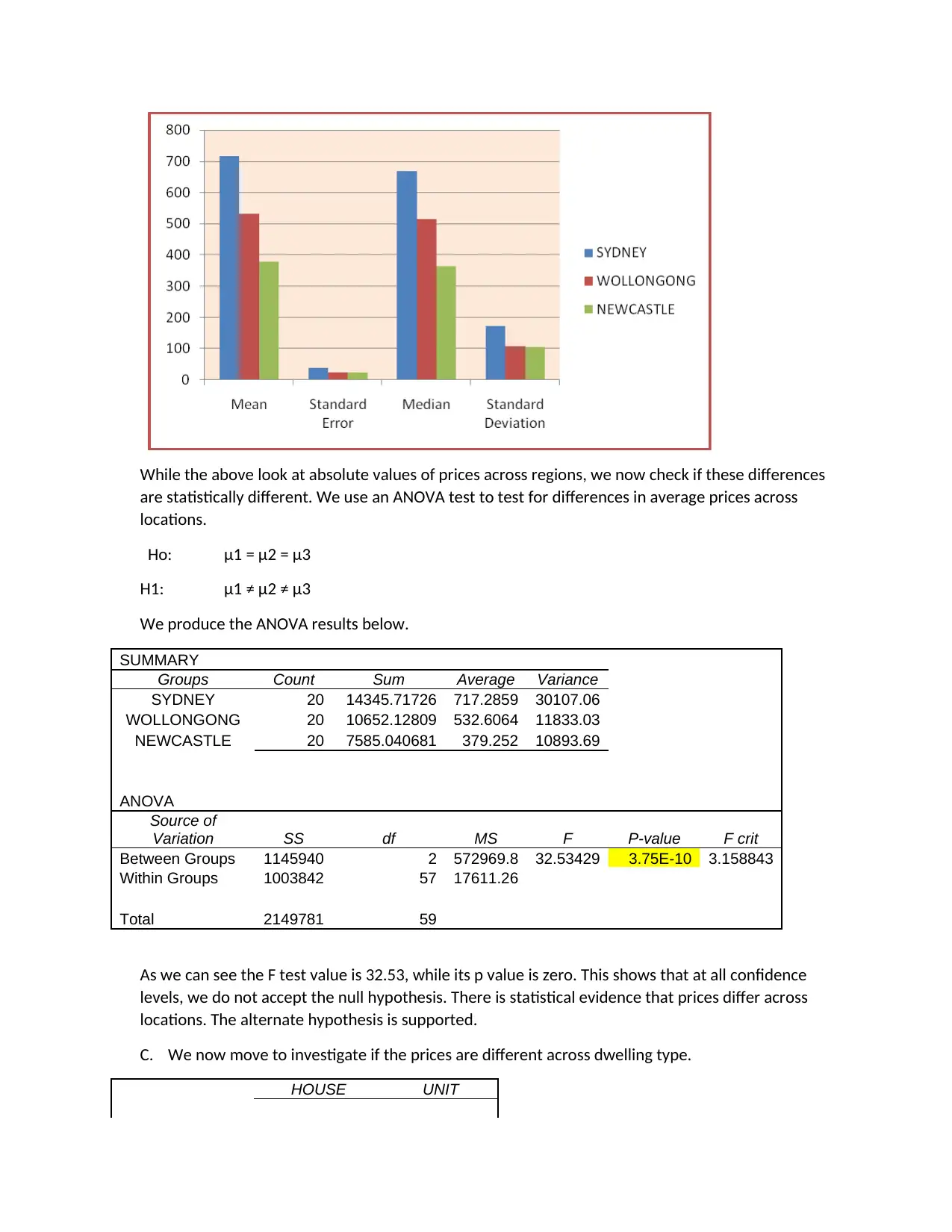

While the above look at absolute values of prices across regions, we now check if these differences

are statistically different. We use an ANOVA test to test for differences in average prices across

locations.

Ho: μ1 = μ2 = μ3

H1: μ1 ≠ μ2 ≠ μ3

We produce the ANOVA results below.

SUMMARY

Groups Count Sum Average Variance

SYDNEY 20 14345.71726 717.2859 30107.06

WOLLONGONG 20 10652.12809 532.6064 11833.03

NEWCASTLE 20 7585.040681 379.252 10893.69

ANOVA

Source of

Variation SS df MS F P-value F crit

Between Groups 1145940 2 572969.8 32.53429 3.75E-10 3.158843

Within Groups 1003842 57 17611.26

Total 2149781 59

As we can see the F test value is 32.53, while its p value is zero. This shows that at all confidence

levels, we do not accept the null hypothesis. There is statistical evidence that prices differ across

locations. The alternate hypothesis is supported.

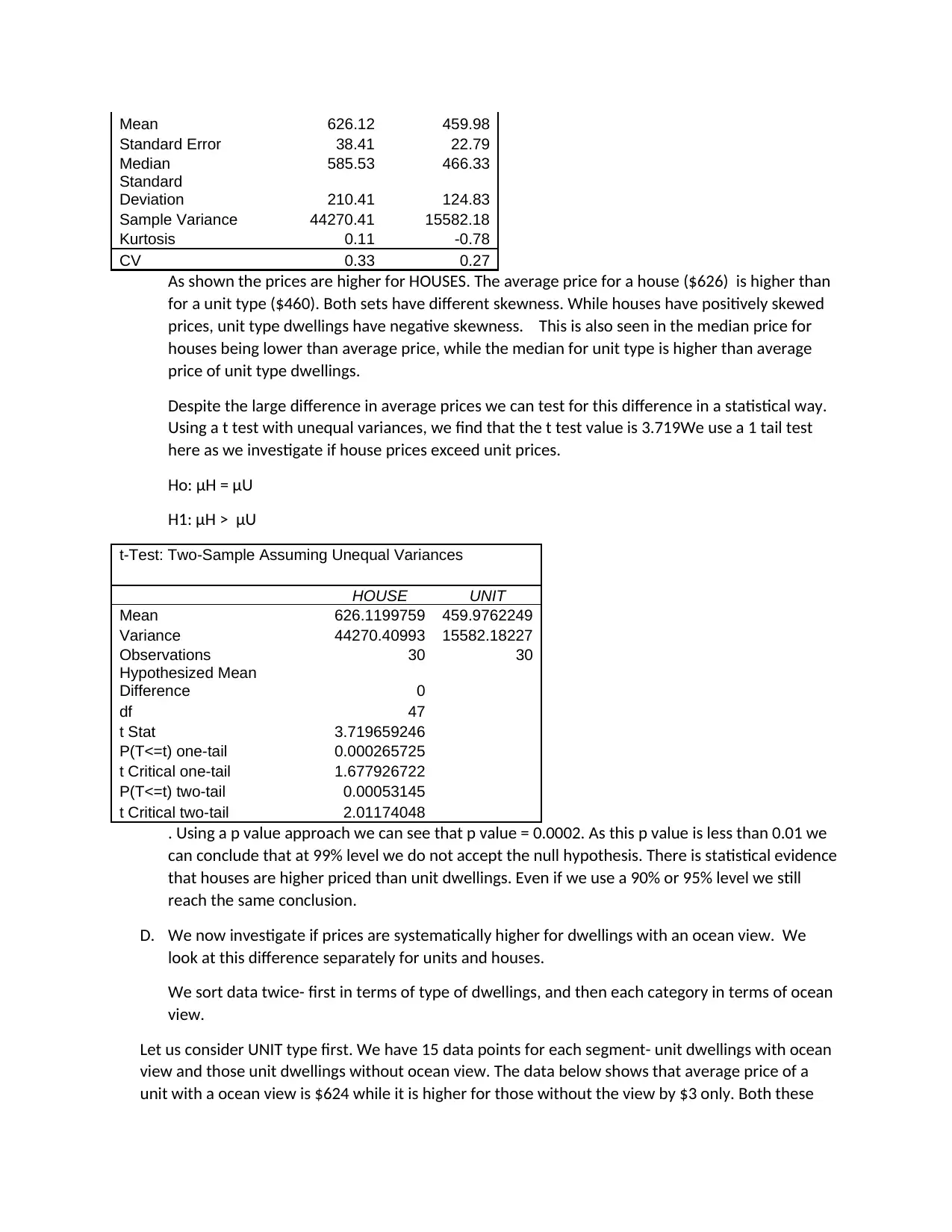

C. We now move to investigate if the prices are different across dwelling type.

HOUSE UNIT

are statistically different. We use an ANOVA test to test for differences in average prices across

locations.

Ho: μ1 = μ2 = μ3

H1: μ1 ≠ μ2 ≠ μ3

We produce the ANOVA results below.

SUMMARY

Groups Count Sum Average Variance

SYDNEY 20 14345.71726 717.2859 30107.06

WOLLONGONG 20 10652.12809 532.6064 11833.03

NEWCASTLE 20 7585.040681 379.252 10893.69

ANOVA

Source of

Variation SS df MS F P-value F crit

Between Groups 1145940 2 572969.8 32.53429 3.75E-10 3.158843

Within Groups 1003842 57 17611.26

Total 2149781 59

As we can see the F test value is 32.53, while its p value is zero. This shows that at all confidence

levels, we do not accept the null hypothesis. There is statistical evidence that prices differ across

locations. The alternate hypothesis is supported.

C. We now move to investigate if the prices are different across dwelling type.

HOUSE UNIT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Mean 626.12 459.98

Standard Error 38.41 22.79

Median 585.53 466.33

Standard

Deviation 210.41 124.83

Sample Variance 44270.41 15582.18

Kurtosis 0.11 -0.78

CV 0.33 0.27

As shown the prices are higher for HOUSES. The average price for a house ($626) is higher than

for a unit type ($460). Both sets have different skewness. While houses have positively skewed

prices, unit type dwellings have negative skewness. This is also seen in the median price for

houses being lower than average price, while the median for unit type is higher than average

price of unit type dwellings.

Despite the large difference in average prices we can test for this difference in a statistical way.

Using a t test with unequal variances, we find that the t test value is 3.719We use a 1 tail test

here as we investigate if house prices exceed unit prices.

Ho: μH = μU

H1: μH > μU

t-Test: Two-Sample Assuming Unequal Variances

HOUSE UNIT

Mean 626.1199759 459.9762249

Variance 44270.40993 15582.18227

Observations 30 30

Hypothesized Mean

Difference 0

df 47

t Stat 3.719659246

P(T<=t) one-tail 0.000265725

t Critical one-tail 1.677926722

P(T<=t) two-tail 0.00053145

t Critical two-tail 2.01174048

. Using a p value approach we can see that p value = 0.0002. As this p value is less than 0.01 we

can conclude that at 99% level we do not accept the null hypothesis. There is statistical evidence

that houses are higher priced than unit dwellings. Even if we use a 90% or 95% level we still

reach the same conclusion.

D. We now investigate if prices are systematically higher for dwellings with an ocean view. We

look at this difference separately for units and houses.

We sort data twice- first in terms of type of dwellings, and then each category in terms of ocean

view.

Let us consider UNIT type first. We have 15 data points for each segment- unit dwellings with ocean

view and those unit dwellings without ocean view. The data below shows that average price of a

unit with a ocean view is $624 while it is higher for those without the view by $3 only. Both these

Standard Error 38.41 22.79

Median 585.53 466.33

Standard

Deviation 210.41 124.83

Sample Variance 44270.41 15582.18

Kurtosis 0.11 -0.78

CV 0.33 0.27

As shown the prices are higher for HOUSES. The average price for a house ($626) is higher than

for a unit type ($460). Both sets have different skewness. While houses have positively skewed

prices, unit type dwellings have negative skewness. This is also seen in the median price for

houses being lower than average price, while the median for unit type is higher than average

price of unit type dwellings.

Despite the large difference in average prices we can test for this difference in a statistical way.

Using a t test with unequal variances, we find that the t test value is 3.719We use a 1 tail test

here as we investigate if house prices exceed unit prices.

Ho: μH = μU

H1: μH > μU

t-Test: Two-Sample Assuming Unequal Variances

HOUSE UNIT

Mean 626.1199759 459.9762249

Variance 44270.40993 15582.18227

Observations 30 30

Hypothesized Mean

Difference 0

df 47

t Stat 3.719659246

P(T<=t) one-tail 0.000265725

t Critical one-tail 1.677926722

P(T<=t) two-tail 0.00053145

t Critical two-tail 2.01174048

. Using a p value approach we can see that p value = 0.0002. As this p value is less than 0.01 we

can conclude that at 99% level we do not accept the null hypothesis. There is statistical evidence

that houses are higher priced than unit dwellings. Even if we use a 90% or 95% level we still

reach the same conclusion.

D. We now investigate if prices are systematically higher for dwellings with an ocean view. We

look at this difference separately for units and houses.

We sort data twice- first in terms of type of dwellings, and then each category in terms of ocean

view.

Let us consider UNIT type first. We have 15 data points for each segment- unit dwellings with ocean

view and those unit dwellings without ocean view. The data below shows that average price of a

unit with a ocean view is $624 while it is higher for those without the view by $3 only. Both these

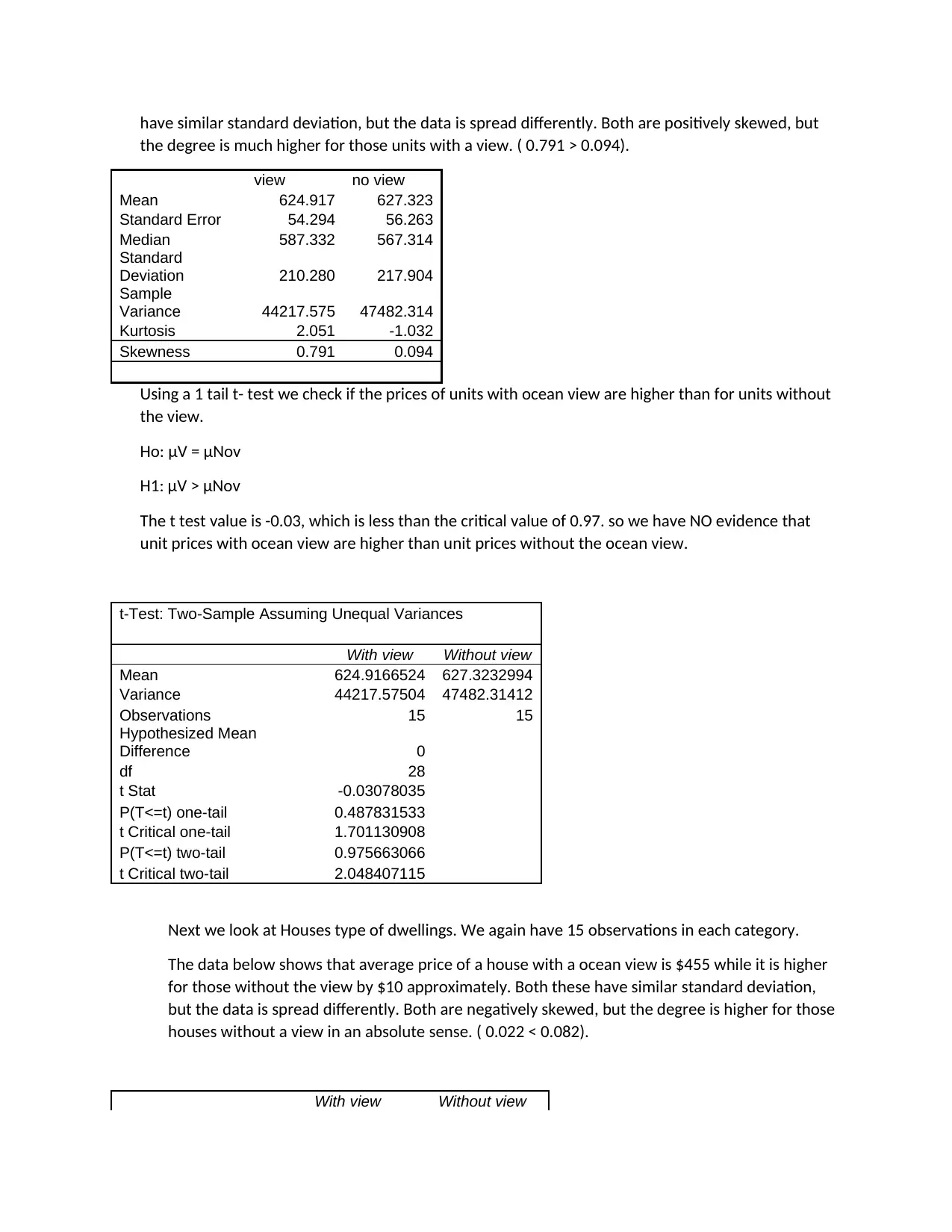

have similar standard deviation, but the data is spread differently. Both are positively skewed, but

the degree is much higher for those units with a view. ( 0.791 > 0.094).

view no view

Mean 624.917 627.323

Standard Error 54.294 56.263

Median 587.332 567.314

Standard

Deviation 210.280 217.904

Sample

Variance 44217.575 47482.314

Kurtosis 2.051 -1.032

Skewness 0.791 0.094

Using a 1 tail t- test we check if the prices of units with ocean view are higher than for units without

the view.

Ho: μV = μNov

H1: μV > μNov

The t test value is -0.03, which is less than the critical value of 0.97. so we have NO evidence that

unit prices with ocean view are higher than unit prices without the ocean view.

t-Test: Two-Sample Assuming Unequal Variances

With view Without view

Mean 624.9166524 627.3232994

Variance 44217.57504 47482.31412

Observations 15 15

Hypothesized Mean

Difference 0

df 28

t Stat -0.03078035

P(T<=t) one-tail 0.487831533

t Critical one-tail 1.701130908

P(T<=t) two-tail 0.975663066

t Critical two-tail 2.048407115

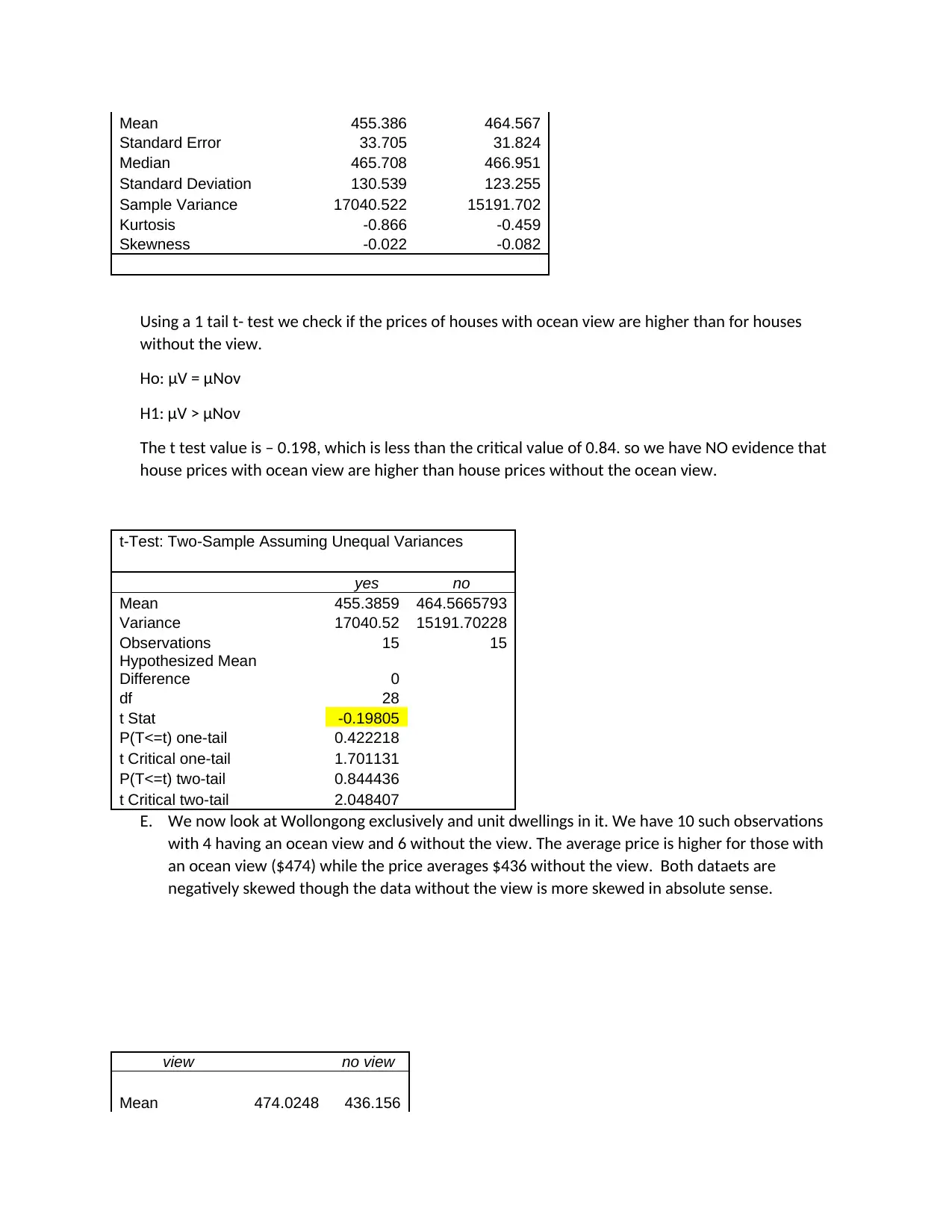

Next we look at Houses type of dwellings. We again have 15 observations in each category.

The data below shows that average price of a house with a ocean view is $455 while it is higher

for those without the view by $10 approximately. Both these have similar standard deviation,

but the data is spread differently. Both are negatively skewed, but the degree is higher for those

houses without a view in an absolute sense. ( 0.022 < 0.082).

With view Without view

the degree is much higher for those units with a view. ( 0.791 > 0.094).

view no view

Mean 624.917 627.323

Standard Error 54.294 56.263

Median 587.332 567.314

Standard

Deviation 210.280 217.904

Sample

Variance 44217.575 47482.314

Kurtosis 2.051 -1.032

Skewness 0.791 0.094

Using a 1 tail t- test we check if the prices of units with ocean view are higher than for units without

the view.

Ho: μV = μNov

H1: μV > μNov

The t test value is -0.03, which is less than the critical value of 0.97. so we have NO evidence that

unit prices with ocean view are higher than unit prices without the ocean view.

t-Test: Two-Sample Assuming Unequal Variances

With view Without view

Mean 624.9166524 627.3232994

Variance 44217.57504 47482.31412

Observations 15 15

Hypothesized Mean

Difference 0

df 28

t Stat -0.03078035

P(T<=t) one-tail 0.487831533

t Critical one-tail 1.701130908

P(T<=t) two-tail 0.975663066

t Critical two-tail 2.048407115

Next we look at Houses type of dwellings. We again have 15 observations in each category.

The data below shows that average price of a house with a ocean view is $455 while it is higher

for those without the view by $10 approximately. Both these have similar standard deviation,

but the data is spread differently. Both are negatively skewed, but the degree is higher for those

houses without a view in an absolute sense. ( 0.022 < 0.082).

With view Without view

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Mean 455.386 464.567

Standard Error 33.705 31.824

Median 465.708 466.951

Standard Deviation 130.539 123.255

Sample Variance 17040.522 15191.702

Kurtosis -0.866 -0.459

Skewness -0.022 -0.082

Using a 1 tail t- test we check if the prices of houses with ocean view are higher than for houses

without the view.

Ho: μV = μNov

H1: μV > μNov

The t test value is – 0.198, which is less than the critical value of 0.84. so we have NO evidence that

house prices with ocean view are higher than house prices without the ocean view.

t-Test: Two-Sample Assuming Unequal Variances

yes no

Mean 455.3859 464.5665793

Variance 17040.52 15191.70228

Observations 15 15

Hypothesized Mean

Difference 0

df 28

t Stat -0.19805

P(T<=t) one-tail 0.422218

t Critical one-tail 1.701131

P(T<=t) two-tail 0.844436

t Critical two-tail 2.048407

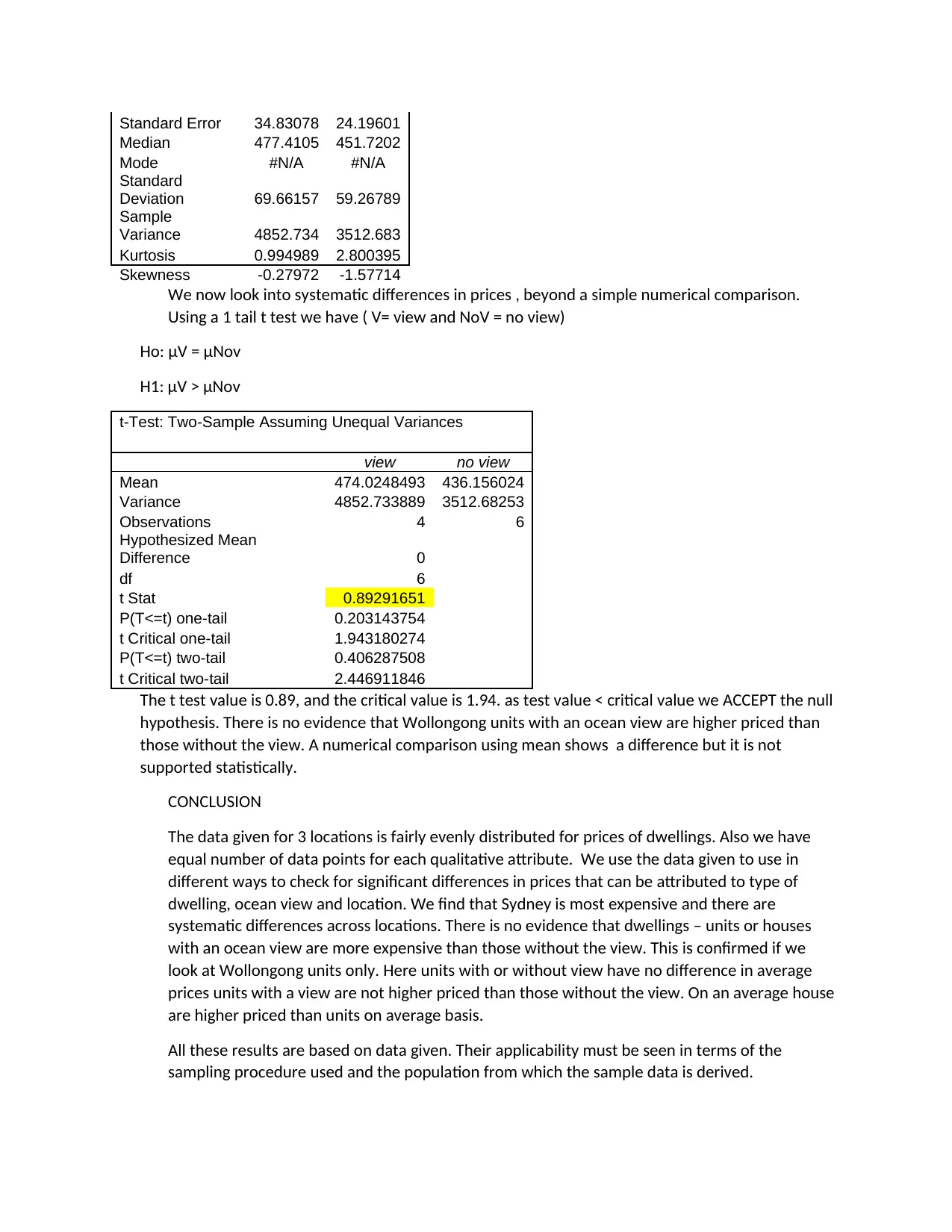

E. We now look at Wollongong exclusively and unit dwellings in it. We have 10 such observations

with 4 having an ocean view and 6 without the view. The average price is higher for those with

an ocean view ($474) while the price averages $436 without the view. Both dataets are

negatively skewed though the data without the view is more skewed in absolute sense.

view no view

Mean 474.0248 436.156

Standard Error 33.705 31.824

Median 465.708 466.951

Standard Deviation 130.539 123.255

Sample Variance 17040.522 15191.702

Kurtosis -0.866 -0.459

Skewness -0.022 -0.082

Using a 1 tail t- test we check if the prices of houses with ocean view are higher than for houses

without the view.

Ho: μV = μNov

H1: μV > μNov

The t test value is – 0.198, which is less than the critical value of 0.84. so we have NO evidence that

house prices with ocean view are higher than house prices without the ocean view.

t-Test: Two-Sample Assuming Unequal Variances

yes no

Mean 455.3859 464.5665793

Variance 17040.52 15191.70228

Observations 15 15

Hypothesized Mean

Difference 0

df 28

t Stat -0.19805

P(T<=t) one-tail 0.422218

t Critical one-tail 1.701131

P(T<=t) two-tail 0.844436

t Critical two-tail 2.048407

E. We now look at Wollongong exclusively and unit dwellings in it. We have 10 such observations

with 4 having an ocean view and 6 without the view. The average price is higher for those with

an ocean view ($474) while the price averages $436 without the view. Both dataets are

negatively skewed though the data without the view is more skewed in absolute sense.

view no view

Mean 474.0248 436.156

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Standard Error 34.83078 24.19601

Median 477.4105 451.7202

Mode #N/A #N/A

Standard

Deviation 69.66157 59.26789

Sample

Variance 4852.734 3512.683

Kurtosis 0.994989 2.800395

Skewness -0.27972 -1.57714

We now look into systematic differences in prices , beyond a simple numerical comparison.

Using a 1 tail t test we have ( V= view and NoV = no view)

Ho: μV = μNov

H1: μV > μNov

t-Test: Two-Sample Assuming Unequal Variances

view no view

Mean 474.0248493 436.156024

Variance 4852.733889 3512.68253

Observations 4 6

Hypothesized Mean

Difference 0

df 6

t Stat 0.89291651

P(T<=t) one-tail 0.203143754

t Critical one-tail 1.943180274

P(T<=t) two-tail 0.406287508

t Critical two-tail 2.446911846

The t test value is 0.89, and the critical value is 1.94. as test value < critical value we ACCEPT the null

hypothesis. There is no evidence that Wollongong units with an ocean view are higher priced than

those without the view. A numerical comparison using mean shows a difference but it is not

supported statistically.

CONCLUSION

The data given for 3 locations is fairly evenly distributed for prices of dwellings. Also we have

equal number of data points for each qualitative attribute. We use the data given to use in

different ways to check for significant differences in prices that can be attributed to type of

dwelling, ocean view and location. We find that Sydney is most expensive and there are

systematic differences across locations. There is no evidence that dwellings – units or houses

with an ocean view are more expensive than those without the view. This is confirmed if we

look at Wollongong units only. Here units with or without view have no difference in average

prices units with a view are not higher priced than those without the view. On an average house

are higher priced than units on average basis.

All these results are based on data given. Their applicability must be seen in terms of the

sampling procedure used and the population from which the sample data is derived.

Median 477.4105 451.7202

Mode #N/A #N/A

Standard

Deviation 69.66157 59.26789

Sample

Variance 4852.734 3512.683

Kurtosis 0.994989 2.800395

Skewness -0.27972 -1.57714

We now look into systematic differences in prices , beyond a simple numerical comparison.

Using a 1 tail t test we have ( V= view and NoV = no view)

Ho: μV = μNov

H1: μV > μNov

t-Test: Two-Sample Assuming Unequal Variances

view no view

Mean 474.0248493 436.156024

Variance 4852.733889 3512.68253

Observations 4 6

Hypothesized Mean

Difference 0

df 6

t Stat 0.89291651

P(T<=t) one-tail 0.203143754

t Critical one-tail 1.943180274

P(T<=t) two-tail 0.406287508

t Critical two-tail 2.446911846

The t test value is 0.89, and the critical value is 1.94. as test value < critical value we ACCEPT the null

hypothesis. There is no evidence that Wollongong units with an ocean view are higher priced than

those without the view. A numerical comparison using mean shows a difference but it is not

supported statistically.

CONCLUSION

The data given for 3 locations is fairly evenly distributed for prices of dwellings. Also we have

equal number of data points for each qualitative attribute. We use the data given to use in

different ways to check for significant differences in prices that can be attributed to type of

dwelling, ocean view and location. We find that Sydney is most expensive and there are

systematic differences across locations. There is no evidence that dwellings – units or houses

with an ocean view are more expensive than those without the view. This is confirmed if we

look at Wollongong units only. Here units with or without view have no difference in average

prices units with a view are not higher priced than those without the view. On an average house

are higher priced than units on average basis.

All these results are based on data given. Their applicability must be seen in terms of the

sampling procedure used and the population from which the sample data is derived.

Anon., n.d. choosing the number of bins. [Online] Available

athttp://statweb.stanford.edu/~susan/courses/s60/split/node43.html [Accessed 9 Oct 2017].

Anon., n.d. How to choose no of bins. [Online] [Accessed 11 Oct 2017].

Anon., n.d. Hypothesis Testing. [Online] Available at:

https://onlinecourses.science.psu.edu/statprogram/node/138 [Accessed 14 Oct 2017].

Anon., n.d. Hypothess testing. [Online] Available athttp://www.statisticshowto.com/probability-and-

statistics/hypothesis-testing/ [Accessed 21 Oct 2017].

Anon., n.d. Mean, median, mode. [Online] Available at:

http://www.bbc.co.uk/schools/gcsebitesize/maths/statistics/measuresofaveragerev6.shtml

[Accessed 12 Oct 2017].

Cfcc.edu, n.d. Tests of hypothesis. [Online] Available at: http://cfcc.edu/faculty/cmoore/0801-

HypothesisTests.pdf [Accessed 15 Oct 2017].

Cyclismo.org, n.d. calculating confidence intervals. [Online] Available

athttp://www.cyclismo.org/tutorial/R/confidence.html [Accessed 15 Oct 2017].

Insee.fr, 2016. Coefficeient of Varaiation/CV. [Online] Available

athttps://www.insee.fr/en/metadonnees/definition/c1366 [Accessed 11 Oct 2017].

Kean.edu, n.d. Confidence Inteval for Mean. [Online] Available

athttp://www.kean.edu/~fosborne/bstat/06amean.html [Accessed 16 Oct 2017].

Learn,bu.edu, n.d. The 5 steps in Hypothesis testing. [Online] Available

athttps://learn.bu.edu/bbcswebdav/pid-826908-dt-content-rid-2073693_1/courses/

13sprgmetcj702_ol/week04/metcj702_W04S01T05_fivesteps.html [Accessed 14 Oct 2017].

LEarn.bu.edu, n.d. The fice steps for hypothesis testing. [Online] Available at:

https://learn.bu.edu/bbcswebdav/pid-826908-dt-content-rid-2073693_1/courses/

13sprgmetcj702_ol/week04/metcj702_W04S01T05_fivesteps.html [Accessed 13 Oct 2017].

Online courses.science.psu.edu, n.d. Interval estimate of population mean. [Online] Available at:

https://onlinecourses.science.psu.edu/stat505/node/61 [Accessed 17 Oct 2017].

Rgs.org, n.d. Sampling techniques. [Online] Available at:

http://www.rgs.org/OurWork/Schools/Fieldwork+and+local+learning/Fieldwork+techniques/

Sampling+techniques.htm [Accessed 18 Oct 2017].

Simon.cs.vt.edu, n.d. Measuresof dispersion. [Online] Available

athttps://simon.cs.vt.edu/SoSci/converted/Dispersion_I/ [Accessed 17 Oct 2017].

stat.yale.edu, n.d. Sampliing in Statistical Inference. [Online] Available at:

http://www.stat.yale.edu/Courses/1997-98/101/sampinf.htm [Accessed 17 Oct 2017].

athttp://statweb.stanford.edu/~susan/courses/s60/split/node43.html [Accessed 9 Oct 2017].

Anon., n.d. How to choose no of bins. [Online] [Accessed 11 Oct 2017].

Anon., n.d. Hypothesis Testing. [Online] Available at:

https://onlinecourses.science.psu.edu/statprogram/node/138 [Accessed 14 Oct 2017].

Anon., n.d. Hypothess testing. [Online] Available athttp://www.statisticshowto.com/probability-and-

statistics/hypothesis-testing/ [Accessed 21 Oct 2017].

Anon., n.d. Mean, median, mode. [Online] Available at:

http://www.bbc.co.uk/schools/gcsebitesize/maths/statistics/measuresofaveragerev6.shtml

[Accessed 12 Oct 2017].

Cfcc.edu, n.d. Tests of hypothesis. [Online] Available at: http://cfcc.edu/faculty/cmoore/0801-

HypothesisTests.pdf [Accessed 15 Oct 2017].

Cyclismo.org, n.d. calculating confidence intervals. [Online] Available

athttp://www.cyclismo.org/tutorial/R/confidence.html [Accessed 15 Oct 2017].

Insee.fr, 2016. Coefficeient of Varaiation/CV. [Online] Available

athttps://www.insee.fr/en/metadonnees/definition/c1366 [Accessed 11 Oct 2017].

Kean.edu, n.d. Confidence Inteval for Mean. [Online] Available

athttp://www.kean.edu/~fosborne/bstat/06amean.html [Accessed 16 Oct 2017].

Learn,bu.edu, n.d. The 5 steps in Hypothesis testing. [Online] Available

athttps://learn.bu.edu/bbcswebdav/pid-826908-dt-content-rid-2073693_1/courses/

13sprgmetcj702_ol/week04/metcj702_W04S01T05_fivesteps.html [Accessed 14 Oct 2017].

LEarn.bu.edu, n.d. The fice steps for hypothesis testing. [Online] Available at:

https://learn.bu.edu/bbcswebdav/pid-826908-dt-content-rid-2073693_1/courses/

13sprgmetcj702_ol/week04/metcj702_W04S01T05_fivesteps.html [Accessed 13 Oct 2017].

Online courses.science.psu.edu, n.d. Interval estimate of population mean. [Online] Available at:

https://onlinecourses.science.psu.edu/stat505/node/61 [Accessed 17 Oct 2017].

Rgs.org, n.d. Sampling techniques. [Online] Available at:

http://www.rgs.org/OurWork/Schools/Fieldwork+and+local+learning/Fieldwork+techniques/

Sampling+techniques.htm [Accessed 18 Oct 2017].

Simon.cs.vt.edu, n.d. Measuresof dispersion. [Online] Available

athttps://simon.cs.vt.edu/SoSci/converted/Dispersion_I/ [Accessed 17 Oct 2017].

stat.yale.edu, n.d. Sampliing in Statistical Inference. [Online] Available at:

http://www.stat.yale.edu/Courses/1997-98/101/sampinf.htm [Accessed 17 Oct 2017].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Statistics. laerd.com, n.d. Measures of Spread. [Online] Available at:

https://statistics.laerd.com/statistical-guides/measures-of-spread-range-quartiles.php [Accessed 17

Oct 2017].

https://statistics.laerd.com/statistical-guides/measures-of-spread-range-quartiles.php [Accessed 17

Oct 2017].

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.