Management Accounting: Cost Analysis, Inventory, and Valuation

VerifiedAdded on 2020/02/03

|17

|5410

|87

Homework Assignment

AI Summary

This homework assignment solution provides a detailed analysis of cost accounting principles, focusing on cost classification, inventory valuation, and cost of goods sold calculations. The solution begins by classifying costs into fixed, variable, and semi-variable categories, providing examples and definitions. It then explores different methods of cost classification, including product costs and period costs, and examines the computation of total costs at varying production levels. The assignment further delves into inventory valuation methods, including First-In, First-Out (FIFO), Last-In, First-Out (LIFO), and average cost methods, with calculations for each. Finally, the solution calculates the cost of goods sold under FIFO, LIFO, and average cost methods, providing a comprehensive overview of cost accounting practices. This assignment is valuable for students learning about financial analysis and cost management.

INTRODUCTION

Management accounting tools are necessary for the development of the firm and also assist the

business to have sustainable development. Now, every manufacturing concerns are aware about

that the leadership in market can be attained by two ways, via- product differentiation and the

other one is price differentiation(Kaplan and Atkinson, 2015). Product differentiation can be get

by the firm via making innovative or creative products in the market that will also make the

company to get the core competence in the market. The other is cost differentiation, this can be

achieved with the help of making the production process so smooth and eliminate the waste cost

along with reducing the cost in the manufacturing process. Now, each and every firm is trying to

have the competitive advantage over the competitors with the help of opting cost leadership

strategy. The cost leadership strategy in the firm is only achieved via effective doing

management accounting practices n the business. Mainly company is able to control the variable

cost of the product and fixed can be managed, this is remain fix. However, the firm is able to

produce the goods at large quantity then the fixed cost can optimum utilised. So company need

to look out all these issues for managing the production cost.

TASK 1

Q1.

a) Classify the above costs into Fixed, Variable and Semi-variable cost.

Cost:It is a act of beginning to get a benefit or any other assets. For example in manufacture

of a auto mobile. we sacrifice material, electricity the worth of machine life depreciation and

labour wages etc.

Costs are usually classified as follows:

Product costs are reimbursement allotted to the manufacture of trade goods and recognized for

financial reporting when sold. They consider direct materials, direct labour, factory wages,

factory depreciation, etc.

Period costs are on the hired hand are all costs other than product price. They include marketing

costs and administrative costs.

The product costs are further classified into:

Management accounting tools are necessary for the development of the firm and also assist the

business to have sustainable development. Now, every manufacturing concerns are aware about

that the leadership in market can be attained by two ways, via- product differentiation and the

other one is price differentiation(Kaplan and Atkinson, 2015). Product differentiation can be get

by the firm via making innovative or creative products in the market that will also make the

company to get the core competence in the market. The other is cost differentiation, this can be

achieved with the help of making the production process so smooth and eliminate the waste cost

along with reducing the cost in the manufacturing process. Now, each and every firm is trying to

have the competitive advantage over the competitors with the help of opting cost leadership

strategy. The cost leadership strategy in the firm is only achieved via effective doing

management accounting practices n the business. Mainly company is able to control the variable

cost of the product and fixed can be managed, this is remain fix. However, the firm is able to

produce the goods at large quantity then the fixed cost can optimum utilised. So company need

to look out all these issues for managing the production cost.

TASK 1

Q1.

a) Classify the above costs into Fixed, Variable and Semi-variable cost.

Cost:It is a act of beginning to get a benefit or any other assets. For example in manufacture

of a auto mobile. we sacrifice material, electricity the worth of machine life depreciation and

labour wages etc.

Costs are usually classified as follows:

Product costs are reimbursement allotted to the manufacture of trade goods and recognized for

financial reporting when sold. They consider direct materials, direct labour, factory wages,

factory depreciation, etc.

Period costs are on the hired hand are all costs other than product price. They include marketing

costs and administrative costs.

The product costs are further classified into:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1. Direct materials: The cost of the materials that can be known straight with the good at

reasonable cost. For example, cost of iron in a car.

2. Direct labour: It shows the cost of the labour time spent on that production.

3. Manufacturing overhead: Represents all manufacture costs exclude those for direct labour

and direct materials, for example the cost of business associates time in a company,

depreciation on instruments, electrical energy, fuel, etc.

The costs that can be generally known with each unit of a product are called direct product costs.

Whereas those which cannot be derived to a specific unit are indirect product costs.

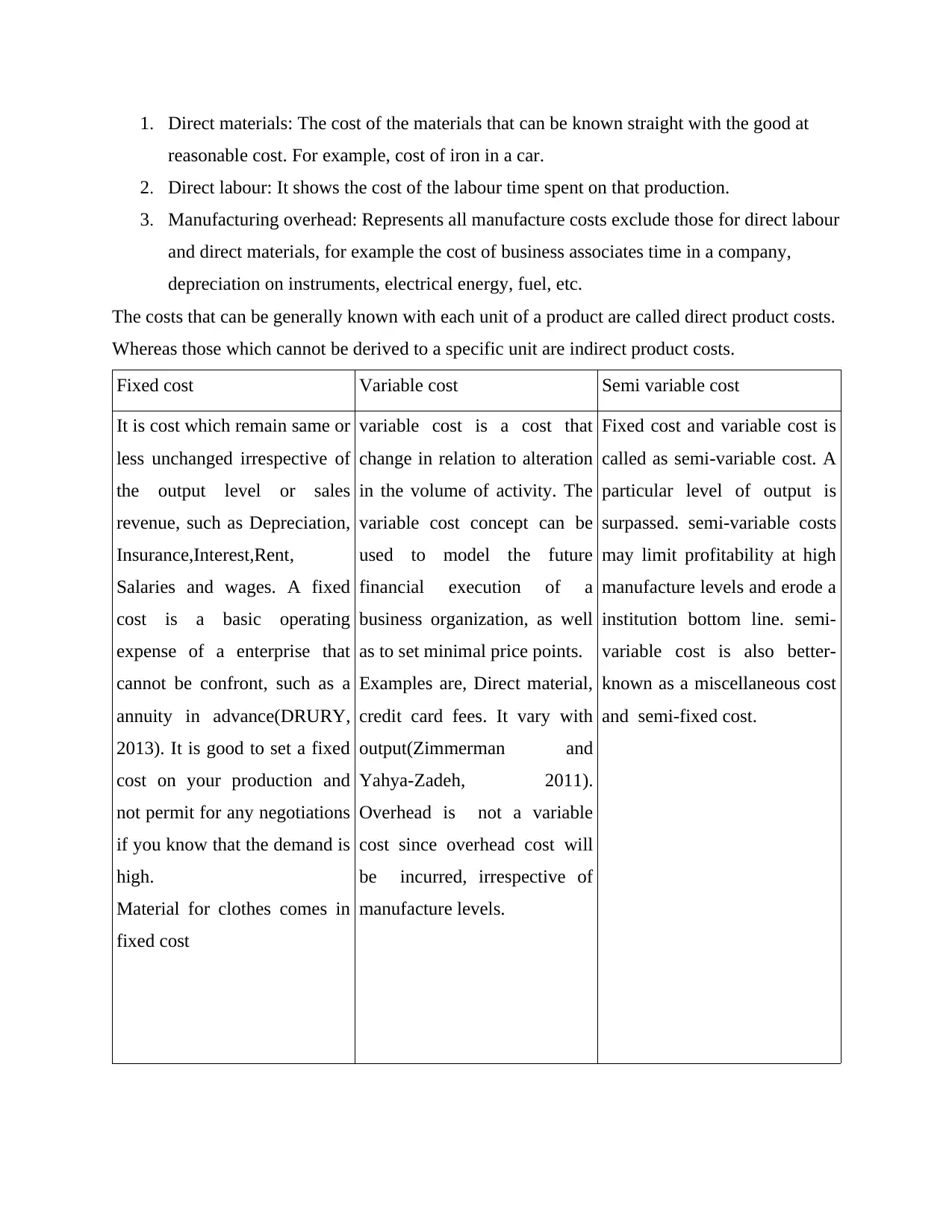

Fixed cost Variable cost Semi variable cost

It is cost which remain same or

less unchanged irrespective of

the output level or sales

revenue, such as Depreciation,

Insurance,Interest,Rent,

Salaries and wages. A fixed

cost is a basic operating

expense of a enterprise that

cannot be confront, such as a

annuity in advance(DRURY,

2013). It is good to set a fixed

cost on your production and

not permit for any negotiations

if you know that the demand is

high.

Material for clothes comes in

fixed cost

variable cost is a cost that

change in relation to alteration

in the volume of activity. The

variable cost concept can be

used to model the future

financial execution of a

business organization, as well

as to set minimal price points.

Examples are, Direct material,

credit card fees. It vary with

output(Zimmerman and

Yahya-Zadeh, 2011).

Overhead is not a variable

cost since overhead cost will

be incurred, irrespective of

manufacture levels.

Fixed cost and variable cost is

called as semi-variable cost. A

particular level of output is

surpassed. semi-variable costs

may limit profitability at high

manufacture levels and erode a

institution bottom line. semi-

variable cost is also better-

known as a miscellaneous cost

and semi-fixed cost.

reasonable cost. For example, cost of iron in a car.

2. Direct labour: It shows the cost of the labour time spent on that production.

3. Manufacturing overhead: Represents all manufacture costs exclude those for direct labour

and direct materials, for example the cost of business associates time in a company,

depreciation on instruments, electrical energy, fuel, etc.

The costs that can be generally known with each unit of a product are called direct product costs.

Whereas those which cannot be derived to a specific unit are indirect product costs.

Fixed cost Variable cost Semi variable cost

It is cost which remain same or

less unchanged irrespective of

the output level or sales

revenue, such as Depreciation,

Insurance,Interest,Rent,

Salaries and wages. A fixed

cost is a basic operating

expense of a enterprise that

cannot be confront, such as a

annuity in advance(DRURY,

2013). It is good to set a fixed

cost on your production and

not permit for any negotiations

if you know that the demand is

high.

Material for clothes comes in

fixed cost

variable cost is a cost that

change in relation to alteration

in the volume of activity. The

variable cost concept can be

used to model the future

financial execution of a

business organization, as well

as to set minimal price points.

Examples are, Direct material,

credit card fees. It vary with

output(Zimmerman and

Yahya-Zadeh, 2011).

Overhead is not a variable

cost since overhead cost will

be incurred, irrespective of

manufacture levels.

Fixed cost and variable cost is

called as semi-variable cost. A

particular level of output is

surpassed. semi-variable costs

may limit profitability at high

manufacture levels and erode a

institution bottom line. semi-

variable cost is also better-

known as a miscellaneous cost

and semi-fixed cost.

b) Other ways of classifying costs.

Quality of Expense: costs are categorized into raw material, labour and expenditure.

Relation to Cost Object: This categorization is supported on the relation of cost component with

the cost object. The categorization is through into direct and indirect costs. The basis is cause and

consequence relationship between cost element and cost object or ability of costs to its cost

object.

Purpose: Costs can besides be categorized into different purpose. Common functional

classification of costs are done into following:

Product

Management

Finance

Selling

Distribution

Research and Development

Quality Check etc.

Q.2

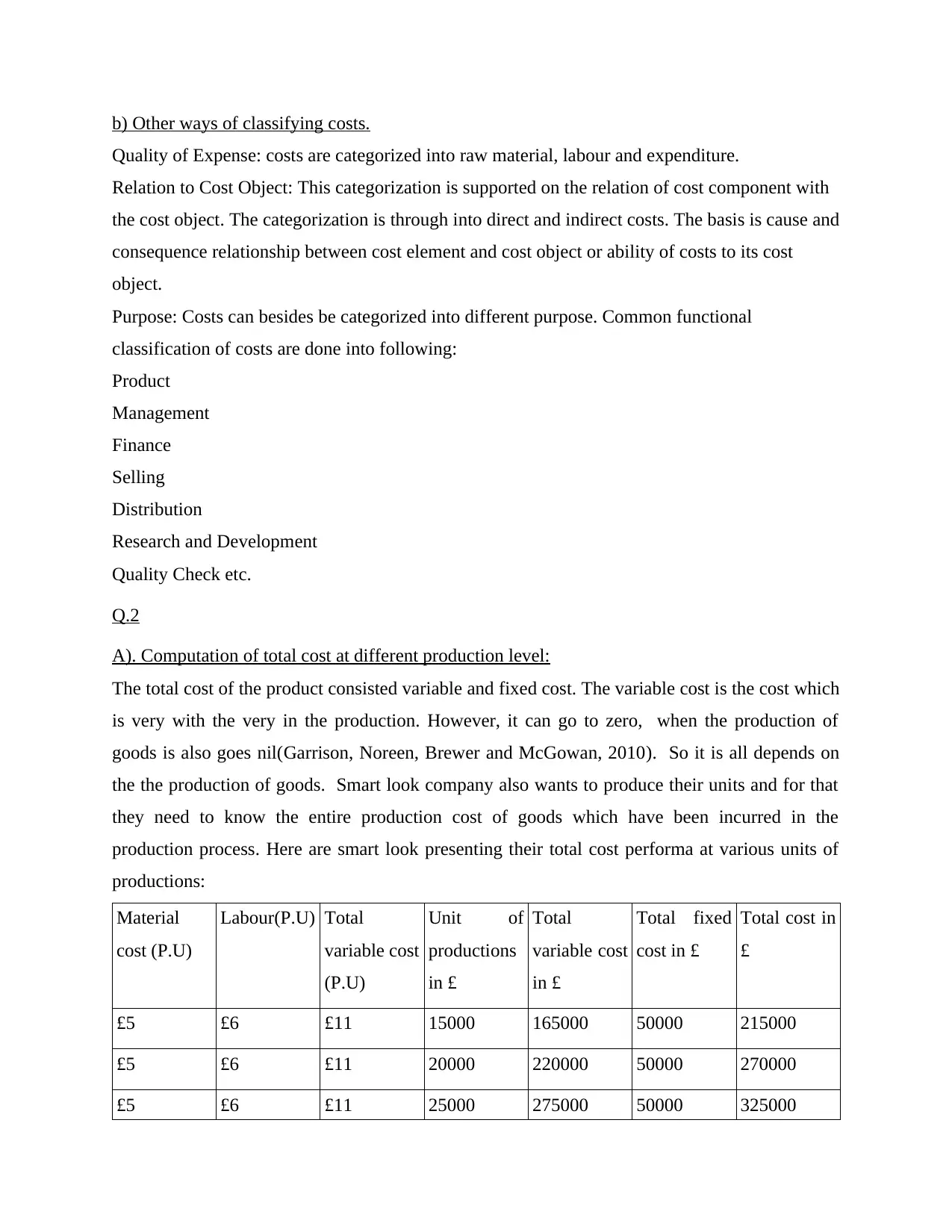

A). Computation of total cost at different production level:

The total cost of the product consisted variable and fixed cost. The variable cost is the cost which

is very with the very in the production. However, it can go to zero, when the production of

goods is also goes nil(Garrison, Noreen, Brewer and McGowan, 2010). So it is all depends on

the the production of goods. Smart look company also wants to produce their units and for that

they need to know the entire production cost of goods which have been incurred in the

production process. Here are smart look presenting their total cost performa at various units of

productions:

Material

cost (P.U)

Labour(P.U) Total

variable cost

(P.U)

Unit of

productions

in £

Total

variable cost

in £

Total fixed

cost in £

Total cost in

£

£5 £6 £11 15000 165000 50000 215000

£5 £6 £11 20000 220000 50000 270000

£5 £6 £11 25000 275000 50000 325000

Quality of Expense: costs are categorized into raw material, labour and expenditure.

Relation to Cost Object: This categorization is supported on the relation of cost component with

the cost object. The categorization is through into direct and indirect costs. The basis is cause and

consequence relationship between cost element and cost object or ability of costs to its cost

object.

Purpose: Costs can besides be categorized into different purpose. Common functional

classification of costs are done into following:

Product

Management

Finance

Selling

Distribution

Research and Development

Quality Check etc.

Q.2

A). Computation of total cost at different production level:

The total cost of the product consisted variable and fixed cost. The variable cost is the cost which

is very with the very in the production. However, it can go to zero, when the production of

goods is also goes nil(Garrison, Noreen, Brewer and McGowan, 2010). So it is all depends on

the the production of goods. Smart look company also wants to produce their units and for that

they need to know the entire production cost of goods which have been incurred in the

production process. Here are smart look presenting their total cost performa at various units of

productions:

Material

cost (P.U)

Labour(P.U) Total

variable cost

(P.U)

Unit of

productions

in £

Total

variable cost

in £

Total fixed

cost in £

Total cost in

£

£5 £6 £11 15000 165000 50000 215000

£5 £6 £11 20000 220000 50000 270000

£5 £6 £11 25000 275000 50000 325000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Form the above table, smart look total cost of production is different at various

production level. At the initial level, company produce the 15000 units and in that case, company

total cost of production is computed £215000. which includes the total variable cost and the total

fixed cost in the production process. But when company produce 20000 units then in that case,

smart look total variable cost increase but the fixed cost is remained same. Ultimately, due the

change in the variable cost, total cost is also changed.

B). Analyse the data:

It has been seen that the total cost of production is changed due to the change of variable

cost. Company's fixed cost is fixed and does not change with the change in the

production of goods(Davies and Crawford, 2011). Fixed cost of the company can not be

zero. But the variable cost of the company can become zero if the company did not

produce the single units. However, it has been analysed that when the production of the

firm rise the total cost per unit decreases. This is due to the constant of fixed cost. Smart

look company could make the efficiency at the point where the marginal cost= marginal

revenue. This is the point where the firm can attain the profits at an optimum level . Here,

it has been researched that the company need to produce the 25000 units so that the firm

could utilised fixed cost at maximum level. At this point, firm's per unit cost of

production is the total cost is £13 (325000/25000). but when the company producing

20000 units then the total cost per unit was £13.5 and it went up at the time when the firm

produces the 15000 units in that case, the organisation per unit total cost of production

was £14.33 (215000/15000).

Q3

1. First out (FIFO) for stock valuation is a cost movement hypothesis which tells that the

first product come in the manufacturing firm is to be sold out first(Angelakis, Theriou and

Floropoulos, 2010). FIFO method idea is a consistent one for a firm to follow,as discharging of

old goods remove the risk of obsolescence. Before going to calculate the first in first out method,

production level. At the initial level, company produce the 15000 units and in that case, company

total cost of production is computed £215000. which includes the total variable cost and the total

fixed cost in the production process. But when company produce 20000 units then in that case,

smart look total variable cost increase but the fixed cost is remained same. Ultimately, due the

change in the variable cost, total cost is also changed.

B). Analyse the data:

It has been seen that the total cost of production is changed due to the change of variable

cost. Company's fixed cost is fixed and does not change with the change in the

production of goods(Davies and Crawford, 2011). Fixed cost of the company can not be

zero. But the variable cost of the company can become zero if the company did not

produce the single units. However, it has been analysed that when the production of the

firm rise the total cost per unit decreases. This is due to the constant of fixed cost. Smart

look company could make the efficiency at the point where the marginal cost= marginal

revenue. This is the point where the firm can attain the profits at an optimum level . Here,

it has been researched that the company need to produce the 25000 units so that the firm

could utilised fixed cost at maximum level. At this point, firm's per unit cost of

production is the total cost is £13 (325000/25000). but when the company producing

20000 units then the total cost per unit was £13.5 and it went up at the time when the firm

produces the 15000 units in that case, the organisation per unit total cost of production

was £14.33 (215000/15000).

Q3

1. First out (FIFO) for stock valuation is a cost movement hypothesis which tells that the

first product come in the manufacturing firm is to be sold out first(Angelakis, Theriou and

Floropoulos, 2010). FIFO method idea is a consistent one for a firm to follow,as discharging of

old goods remove the risk of obsolescence. Before going to calculate the first in first out method,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

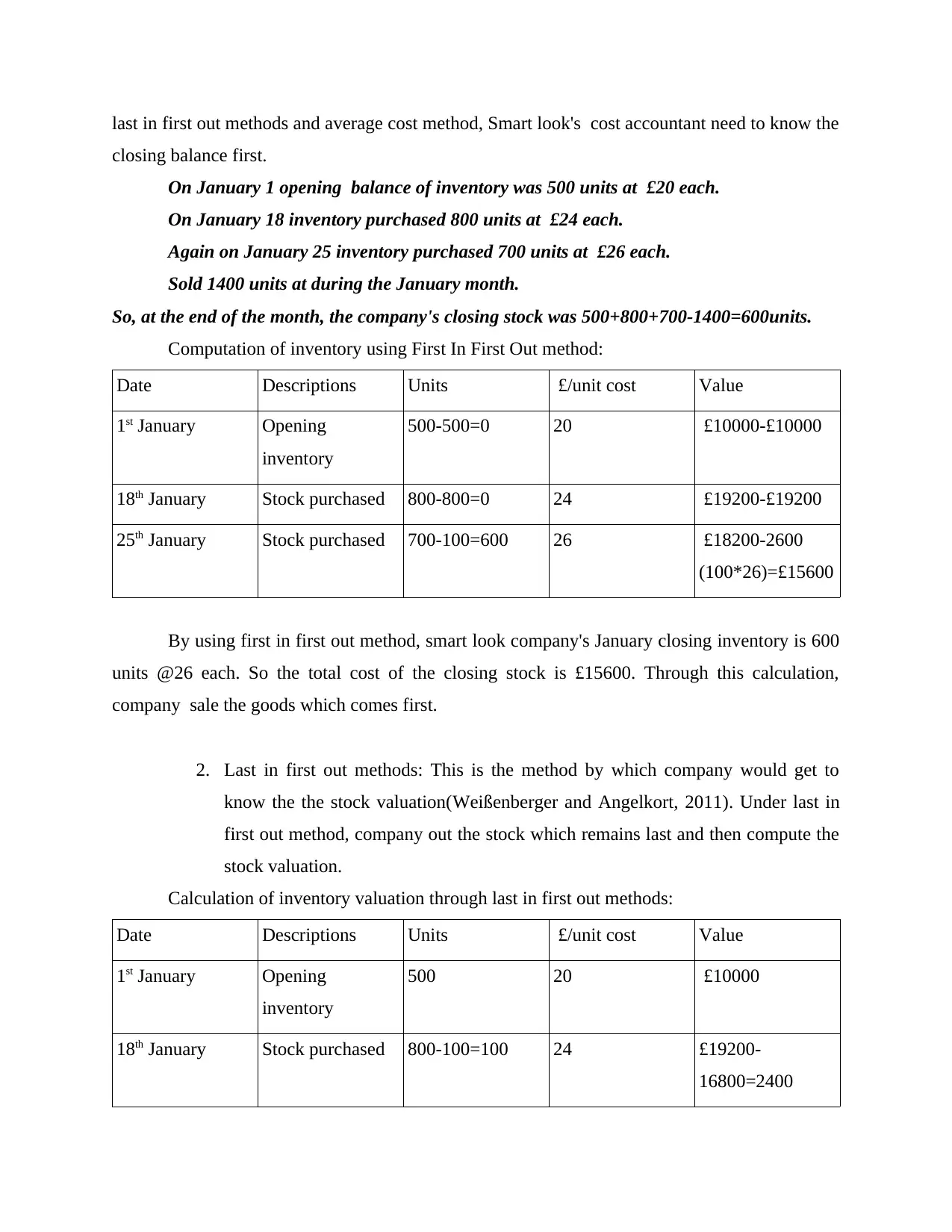

last in first out methods and average cost method, Smart look's cost accountant need to know the

closing balance first.

On January 1 opening balance of inventory was 500 units at £20 each.

On January 18 inventory purchased 800 units at £24 each.

Again on January 25 inventory purchased 700 units at £26 each.

Sold 1400 units at during the January month.

So, at the end of the month, the company's closing stock was 500+800+700-1400=600units.

Computation of inventory using First In First Out method:

Date Descriptions Units £/unit cost Value

1st January Opening

inventory

500-500=0 20 £10000-£10000

18th January Stock purchased 800-800=0 24 £19200-£19200

25th January Stock purchased 700-100=600 26 £18200-2600

(100*26)=£15600

By using first in first out method, smart look company's January closing inventory is 600

units @26 each. So the total cost of the closing stock is £15600. Through this calculation,

company sale the goods which comes first.

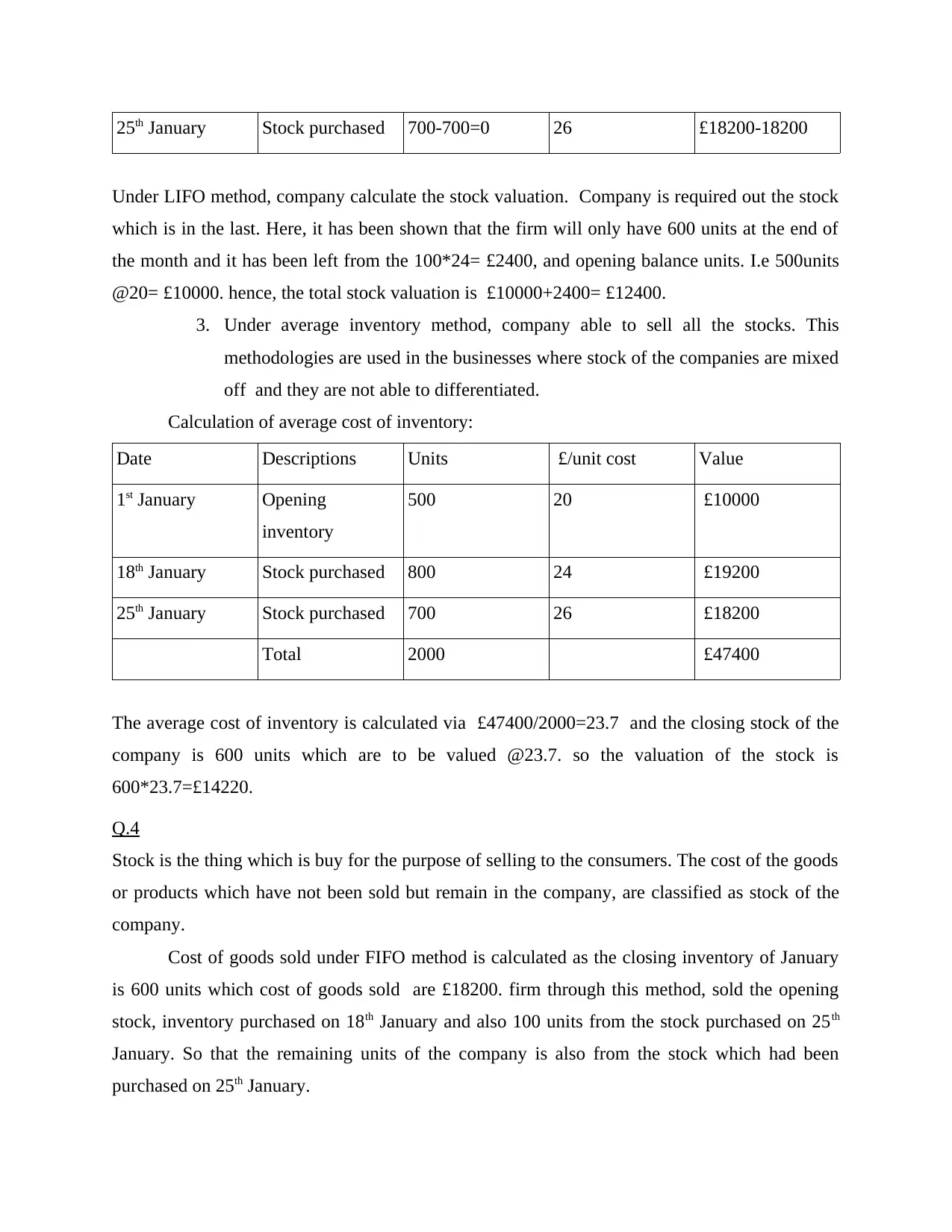

2. Last in first out methods: This is the method by which company would get to

know the the stock valuation(Weißenberger and Angelkort, 2011). Under last in

first out method, company out the stock which remains last and then compute the

stock valuation.

Calculation of inventory valuation through last in first out methods:

Date Descriptions Units £/unit cost Value

1st January Opening

inventory

500 20 £10000

18th January Stock purchased 800-100=100 24 £19200-

16800=2400

closing balance first.

On January 1 opening balance of inventory was 500 units at £20 each.

On January 18 inventory purchased 800 units at £24 each.

Again on January 25 inventory purchased 700 units at £26 each.

Sold 1400 units at during the January month.

So, at the end of the month, the company's closing stock was 500+800+700-1400=600units.

Computation of inventory using First In First Out method:

Date Descriptions Units £/unit cost Value

1st January Opening

inventory

500-500=0 20 £10000-£10000

18th January Stock purchased 800-800=0 24 £19200-£19200

25th January Stock purchased 700-100=600 26 £18200-2600

(100*26)=£15600

By using first in first out method, smart look company's January closing inventory is 600

units @26 each. So the total cost of the closing stock is £15600. Through this calculation,

company sale the goods which comes first.

2. Last in first out methods: This is the method by which company would get to

know the the stock valuation(Weißenberger and Angelkort, 2011). Under last in

first out method, company out the stock which remains last and then compute the

stock valuation.

Calculation of inventory valuation through last in first out methods:

Date Descriptions Units £/unit cost Value

1st January Opening

inventory

500 20 £10000

18th January Stock purchased 800-100=100 24 £19200-

16800=2400

25th January Stock purchased 700-700=0 26 £18200-18200

Under LIFO method, company calculate the stock valuation. Company is required out the stock

which is in the last. Here, it has been shown that the firm will only have 600 units at the end of

the month and it has been left from the 100*24= £2400, and opening balance units. I.e 500units

@20= £10000. hence, the total stock valuation is £10000+2400= £12400.

3. Under average inventory method, company able to sell all the stocks. This

methodologies are used in the businesses where stock of the companies are mixed

off and they are not able to differentiated.

Calculation of average cost of inventory:

Date Descriptions Units £/unit cost Value

1st January Opening

inventory

500 20 £10000

18th January Stock purchased 800 24 £19200

25th January Stock purchased 700 26 £18200

Total 2000 £47400

The average cost of inventory is calculated via £47400/2000=23.7 and the closing stock of the

company is 600 units which are to be valued @23.7. so the valuation of the stock is

600*23.7=£14220.

Q.4

Stock is the thing which is buy for the purpose of selling to the consumers. The cost of the goods

or products which have not been sold but remain in the company, are classified as stock of the

company.

Cost of goods sold under FIFO method is calculated as the closing inventory of January

is 600 units which cost of goods sold are £18200. firm through this method, sold the opening

stock, inventory purchased on 18th January and also 100 units from the stock purchased on 25th

January. So that the remaining units of the company is also from the stock which had been

purchased on 25th January.

Under LIFO method, company calculate the stock valuation. Company is required out the stock

which is in the last. Here, it has been shown that the firm will only have 600 units at the end of

the month and it has been left from the 100*24= £2400, and opening balance units. I.e 500units

@20= £10000. hence, the total stock valuation is £10000+2400= £12400.

3. Under average inventory method, company able to sell all the stocks. This

methodologies are used in the businesses where stock of the companies are mixed

off and they are not able to differentiated.

Calculation of average cost of inventory:

Date Descriptions Units £/unit cost Value

1st January Opening

inventory

500 20 £10000

18th January Stock purchased 800 24 £19200

25th January Stock purchased 700 26 £18200

Total 2000 £47400

The average cost of inventory is calculated via £47400/2000=23.7 and the closing stock of the

company is 600 units which are to be valued @23.7. so the valuation of the stock is

600*23.7=£14220.

Q.4

Stock is the thing which is buy for the purpose of selling to the consumers. The cost of the goods

or products which have not been sold but remain in the company, are classified as stock of the

company.

Cost of goods sold under FIFO method is calculated as the closing inventory of January

is 600 units which cost of goods sold are £18200. firm through this method, sold the opening

stock, inventory purchased on 18th January and also 100 units from the stock purchased on 25th

January. So that the remaining units of the company is also from the stock which had been

purchased on 25th January.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Under LIFO method, company always consider the last stock for selling purpose. The

sale first to be set off from the last inventory and then come to the another one if remains(Hope

and Fraser, 2013). As per company's calculation, the inventory purchased on the 25th January is

firstly utilized for the selling purposes. After that the accountant takes the 18th march inventory.

From 15th January inventory, company consider 700 units from 800 units for the selling purpose.

The opening inventory and 100 units from the inventory purchased is totally left for the

company's valuation purposes(King, Clarkson and Wallace, 2010). Hence the cost of goods sold

is £12400. this is calculated via (500*20+100*24)

Through average cost methods company's cost of goods sold is calculated by dividing the

whole units of the firm with the entire cost of such units so that firm is able to make per unit cost

of production and then multiply the such per unit cost of production with the closing balance of

stock. Here, there are 600 units are the closing inventory and the average cost of the company is

computed by multiplying 600 units to per unit average cost of production 23.7. So, the average

cost of the company is 600*23.7=14220.

Q5.a) TWO critical success factors and related key

Performance Indicators.

client experience: By the help of the quality of production we can analyse the experience

of client by taking the feed back of the product which we have render to them by the sampling of

the product(Baldvinsdottir, Mitchell and Nørreklit, 2010). According to the feed back of the

client we can change strategy of making the product if the product is better then we have to gave

some varieties if the product.

Supplier and product quality: If supplier send the product on time than the client which is

going to purchase the product will be use our product frequently and it may rays the sale of the

product. If the quality of product is better than the client highly appreciate your product and will

raise demand is the market. Through the advertisement on the television or on social sites it will

increases the sales of the product. The provider occurrence of working with the buying Smart

Looks Limited must be reasoned in the judgement, as it might be the case that they are facing

unneeded obstruction or handling with difficult grouping.

Operations Efficiency: The upper administration of the company do their work better it

will maximise the profit of the production material. It may help to generate more and more

sale first to be set off from the last inventory and then come to the another one if remains(Hope

and Fraser, 2013). As per company's calculation, the inventory purchased on the 25th January is

firstly utilized for the selling purposes. After that the accountant takes the 18th march inventory.

From 15th January inventory, company consider 700 units from 800 units for the selling purpose.

The opening inventory and 100 units from the inventory purchased is totally left for the

company's valuation purposes(King, Clarkson and Wallace, 2010). Hence the cost of goods sold

is £12400. this is calculated via (500*20+100*24)

Through average cost methods company's cost of goods sold is calculated by dividing the

whole units of the firm with the entire cost of such units so that firm is able to make per unit cost

of production and then multiply the such per unit cost of production with the closing balance of

stock. Here, there are 600 units are the closing inventory and the average cost of the company is

computed by multiplying 600 units to per unit average cost of production 23.7. So, the average

cost of the company is 600*23.7=14220.

Q5.a) TWO critical success factors and related key

Performance Indicators.

client experience: By the help of the quality of production we can analyse the experience

of client by taking the feed back of the product which we have render to them by the sampling of

the product(Baldvinsdottir, Mitchell and Nørreklit, 2010). According to the feed back of the

client we can change strategy of making the product if the product is better then we have to gave

some varieties if the product.

Supplier and product quality: If supplier send the product on time than the client which is

going to purchase the product will be use our product frequently and it may rays the sale of the

product. If the quality of product is better than the client highly appreciate your product and will

raise demand is the market. Through the advertisement on the television or on social sites it will

increases the sales of the product. The provider occurrence of working with the buying Smart

Looks Limited must be reasoned in the judgement, as it might be the case that they are facing

unneeded obstruction or handling with difficult grouping.

Operations Efficiency: The upper administration of the company do their work better it

will maximise the profit of the production material. It may help to generate more and more

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

clients in the market through it company get better goodwill in the market(Frezatti, Aguiar,

Guerreiro and Gouvea, 2011). Determination a balance between reduction the reimbursement of

running your business Smart Looks Limited and generating income is the key to entrepreneurial

prosperity. While many undeveloped business man focusing the number of their physical

phenomenon on bringing in sales, do not bury that making your business Smart Looks Limited as

efficient as possible is just as or even more crucial in the long-run as it makes your project

sustainable.

Reducing Maintenance Spending: Facility administration program survive in all public

works social group. In easy terms it is null more than the decision-making procedure. However,

the decision-making method selected in large part, determine prosperity or non achievement.

Effective installation repair social control requires the use and power of large amounts of info.

This consider trailing incoming requests for facilities repair work, programming preventative

maintenance, preparing budget approximation, projected facilities repair necessitate and

determining assets apportion(Parker, 2012). Predictive testing can cut down facilities repair costs

and improve accessibility by facultative just-in-time upkeep of facilities systems and related

equipment. Predictive testing monitors the stipulation or operating parameters of facilities system

components to observe trends or conditions that betoken excessive wear or impending failure.

This permits initiation of timely repair activity. It is for safely working in the firm or in an

organisation.

Cost reduction and profitability increase: If you uses high techniques in the Smart Looks Limited

you will produce large amount of goods. Addition productiveness of your staff value and reward

staff effort with staff execution reviews, and teach them sales skills and how to up sell products

so clients make multiple purchases at one time Create new product lines survey your custom-

made about products and clients can help grow up your business Smart Looks Limited use

market research to find out if you could spread out your enterprise into new areas. client service

amend your client work and develop a staff training program in an organisation(Østergren and

Stensaker, 2011). Addition your cost check if you have priced your products and work correctly

and if you could maximise prices without reduction gross sales. price discounts and promotions

to addition your client base.

Alteration inventory stock control is a good way to contour your enterprise. Lessening direct cost

sort certain you have the right provider for your business concern and discuss for finer prices or

Guerreiro and Gouvea, 2011). Determination a balance between reduction the reimbursement of

running your business Smart Looks Limited and generating income is the key to entrepreneurial

prosperity. While many undeveloped business man focusing the number of their physical

phenomenon on bringing in sales, do not bury that making your business Smart Looks Limited as

efficient as possible is just as or even more crucial in the long-run as it makes your project

sustainable.

Reducing Maintenance Spending: Facility administration program survive in all public

works social group. In easy terms it is null more than the decision-making procedure. However,

the decision-making method selected in large part, determine prosperity or non achievement.

Effective installation repair social control requires the use and power of large amounts of info.

This consider trailing incoming requests for facilities repair work, programming preventative

maintenance, preparing budget approximation, projected facilities repair necessitate and

determining assets apportion(Parker, 2012). Predictive testing can cut down facilities repair costs

and improve accessibility by facultative just-in-time upkeep of facilities systems and related

equipment. Predictive testing monitors the stipulation or operating parameters of facilities system

components to observe trends or conditions that betoken excessive wear or impending failure.

This permits initiation of timely repair activity. It is for safely working in the firm or in an

organisation.

Cost reduction and profitability increase: If you uses high techniques in the Smart Looks Limited

you will produce large amount of goods. Addition productiveness of your staff value and reward

staff effort with staff execution reviews, and teach them sales skills and how to up sell products

so clients make multiple purchases at one time Create new product lines survey your custom-

made about products and clients can help grow up your business Smart Looks Limited use

market research to find out if you could spread out your enterprise into new areas. client service

amend your client work and develop a staff training program in an organisation(Østergren and

Stensaker, 2011). Addition your cost check if you have priced your products and work correctly

and if you could maximise prices without reduction gross sales. price discounts and promotions

to addition your client base.

Alteration inventory stock control is a good way to contour your enterprise. Lessening direct cost

sort certain you have the right provider for your business concern and discuss for finer prices or

discounts for buying in volume. Change indirect costs try to minimise waste material and

mistake in your enterprise by training staff, or reduce selling costs by using low-priced selling

method.

Costs can be decreased.

Reducing costs is not merely effort to cut any and all expenditure disorganized. The owner-

manager must realize the quality of expenditure and how expenditure inter-relate with gross

sales, cost of goods oversubscribed, gross profits, and net profits. To Cut down reimbursement

does not mean only the decrease of specific expenditure(Christ and Burritt, 2013). You can

accomplish greater income through more economic use of the disbursal dollar. Many of the

structure you do this are by acceleration the average sale per client, by in effect using display

space and thereby accelerative sales volume per square foot, by getting a bigger return for your

publicity and sales promotion by rising your interior methods and process.

Value and quality can be increased

Managing director can display worker how to work hard. They should be prepared and capable

to do the activity being which is done by staff. Be expert in these jobs so that if the worker has a

inquiry or uncertainty something, the managing director is able to put those concern to rest. If the

managing director is doubtful about anything that is occurrence, this will bilobate the disarray for

the worker. Confused force are generally disgruntled and will not do their work right. By

respondent queries and inform trouble, managing director gain the honer of the group working

for them.

Q6.

a)Define Budget:

Budget is a set of interconnect plans that quantifiable report an entity's proposed future

operations. Budget is utilized as a yard measure against which to measuring actualized

operational output, for the allotment of financial support, and as a plan for coming business

activity. The budget is done by the senior management they have right to make the rules and

regulation. In this budget all budget are included such as: sales budget, direct budget,

manufacturing budget etc. All of these program roll up into the master budget, which comprise a

budgeted financial statement, balance sheet, and cash forecasting. There may also be a funding

mistake in your enterprise by training staff, or reduce selling costs by using low-priced selling

method.

Costs can be decreased.

Reducing costs is not merely effort to cut any and all expenditure disorganized. The owner-

manager must realize the quality of expenditure and how expenditure inter-relate with gross

sales, cost of goods oversubscribed, gross profits, and net profits. To Cut down reimbursement

does not mean only the decrease of specific expenditure(Christ and Burritt, 2013). You can

accomplish greater income through more economic use of the disbursal dollar. Many of the

structure you do this are by acceleration the average sale per client, by in effect using display

space and thereby accelerative sales volume per square foot, by getting a bigger return for your

publicity and sales promotion by rising your interior methods and process.

Value and quality can be increased

Managing director can display worker how to work hard. They should be prepared and capable

to do the activity being which is done by staff. Be expert in these jobs so that if the worker has a

inquiry or uncertainty something, the managing director is able to put those concern to rest. If the

managing director is doubtful about anything that is occurrence, this will bilobate the disarray for

the worker. Confused force are generally disgruntled and will not do their work right. By

respondent queries and inform trouble, managing director gain the honer of the group working

for them.

Q6.

a)Define Budget:

Budget is a set of interconnect plans that quantifiable report an entity's proposed future

operations. Budget is utilized as a yard measure against which to measuring actualized

operational output, for the allotment of financial support, and as a plan for coming business

activity. The budget is done by the senior management they have right to make the rules and

regulation. In this budget all budget are included such as: sales budget, direct budget,

manufacturing budget etc. All of these program roll up into the master budget, which comprise a

budgeted financial statement, balance sheet, and cash forecasting. There may also be a funding

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

budget in which is component the debt and equity make-up required to check that the cash

necessitate of the budget.

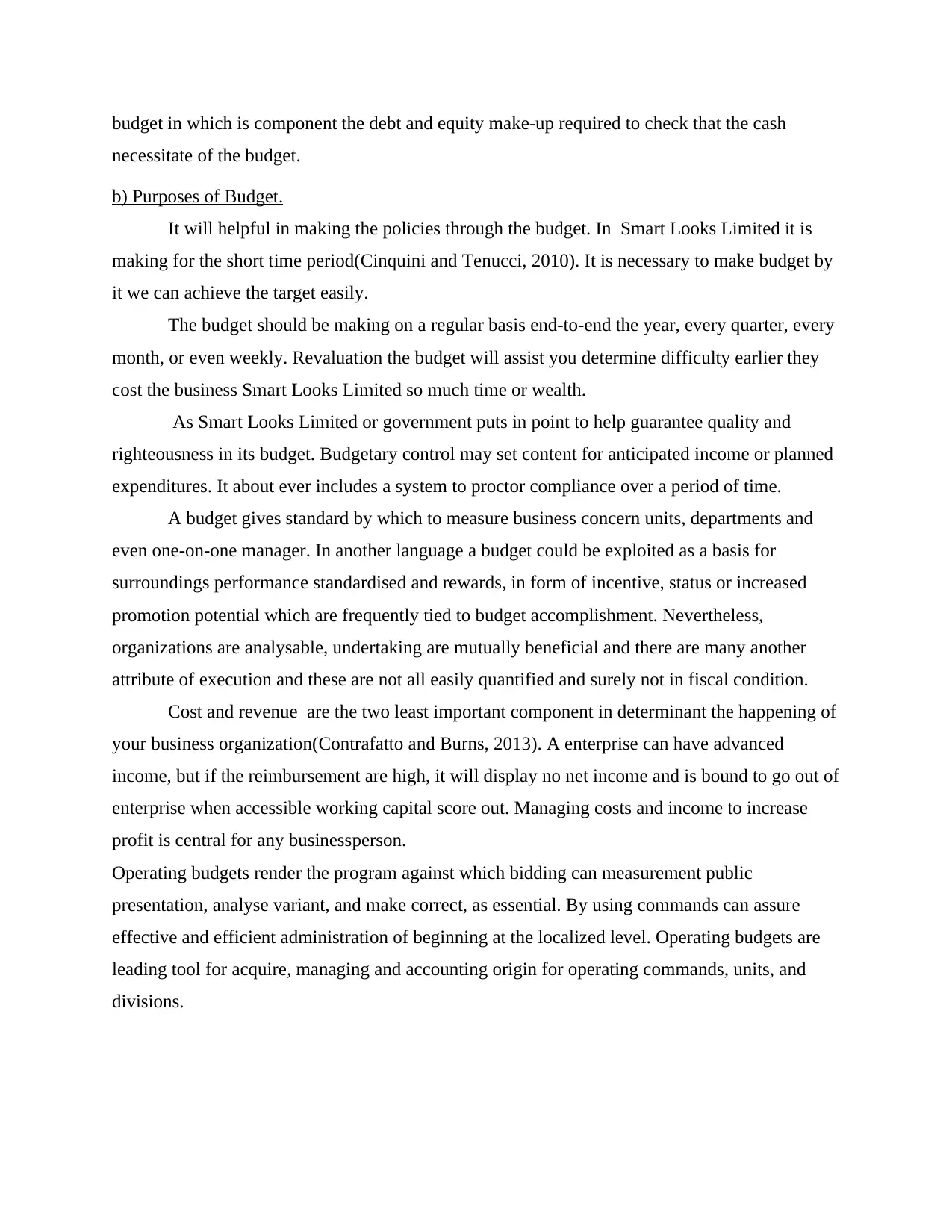

b) Purposes of Budget.

It will helpful in making the policies through the budget. In Smart Looks Limited it is

making for the short time period(Cinquini and Tenucci, 2010). It is necessary to make budget by

it we can achieve the target easily.

The budget should be making on a regular basis end-to-end the year, every quarter, every

month, or even weekly. Revaluation the budget will assist you determine difficulty earlier they

cost the business Smart Looks Limited so much time or wealth.

As Smart Looks Limited or government puts in point to help guarantee quality and

righteousness in its budget. Budgetary control may set content for anticipated income or planned

expenditures. It about ever includes a system to proctor compliance over a period of time.

A budget gives standard by which to measure business concern units, departments and

even one-on-one manager. In another language a budget could be exploited as a basis for

surroundings performance standardised and rewards, in form of incentive, status or increased

promotion potential which are frequently tied to budget accomplishment. Nevertheless,

organizations are analysable, undertaking are mutually beneficial and there are many another

attribute of execution and these are not all easily quantified and surely not in fiscal condition.

Cost and revenue are the two least important component in determinant the happening of

your business organization(Contrafatto and Burns, 2013). A enterprise can have advanced

income, but if the reimbursement are high, it will display no net income and is bound to go out of

enterprise when accessible working capital score out. Managing costs and income to increase

profit is central for any businessperson.

Operating budgets render the program against which bidding can measurement public

presentation, analyse variant, and make correct, as essential. By using commands can assure

effective and efficient administration of beginning at the localized level. Operating budgets are

leading tool for acquire, managing and accounting origin for operating commands, units, and

divisions.

necessitate of the budget.

b) Purposes of Budget.

It will helpful in making the policies through the budget. In Smart Looks Limited it is

making for the short time period(Cinquini and Tenucci, 2010). It is necessary to make budget by

it we can achieve the target easily.

The budget should be making on a regular basis end-to-end the year, every quarter, every

month, or even weekly. Revaluation the budget will assist you determine difficulty earlier they

cost the business Smart Looks Limited so much time or wealth.

As Smart Looks Limited or government puts in point to help guarantee quality and

righteousness in its budget. Budgetary control may set content for anticipated income or planned

expenditures. It about ever includes a system to proctor compliance over a period of time.

A budget gives standard by which to measure business concern units, departments and

even one-on-one manager. In another language a budget could be exploited as a basis for

surroundings performance standardised and rewards, in form of incentive, status or increased

promotion potential which are frequently tied to budget accomplishment. Nevertheless,

organizations are analysable, undertaking are mutually beneficial and there are many another

attribute of execution and these are not all easily quantified and surely not in fiscal condition.

Cost and revenue are the two least important component in determinant the happening of

your business organization(Contrafatto and Burns, 2013). A enterprise can have advanced

income, but if the reimbursement are high, it will display no net income and is bound to go out of

enterprise when accessible working capital score out. Managing costs and income to increase

profit is central for any businessperson.

Operating budgets render the program against which bidding can measurement public

presentation, analyse variant, and make correct, as essential. By using commands can assure

effective and efficient administration of beginning at the localized level. Operating budgets are

leading tool for acquire, managing and accounting origin for operating commands, units, and

divisions.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

c)Methods of preparing budgets (zero-based, fixed and variable)

2. Zero-based budget is a performing of budgeting in which all disbursement must be even

for each new time period. Zero-based budgeting starts from a zero base and all role inside

an administration is analysed for its necessarily and reimbursement.

3. The budget planned to stay changeless, careless of the act level reached is Fixed Budget.

4. The monetary fund premeditated to alteration with the occurrence in the action levels is

Flexible Budget.

TASK.2

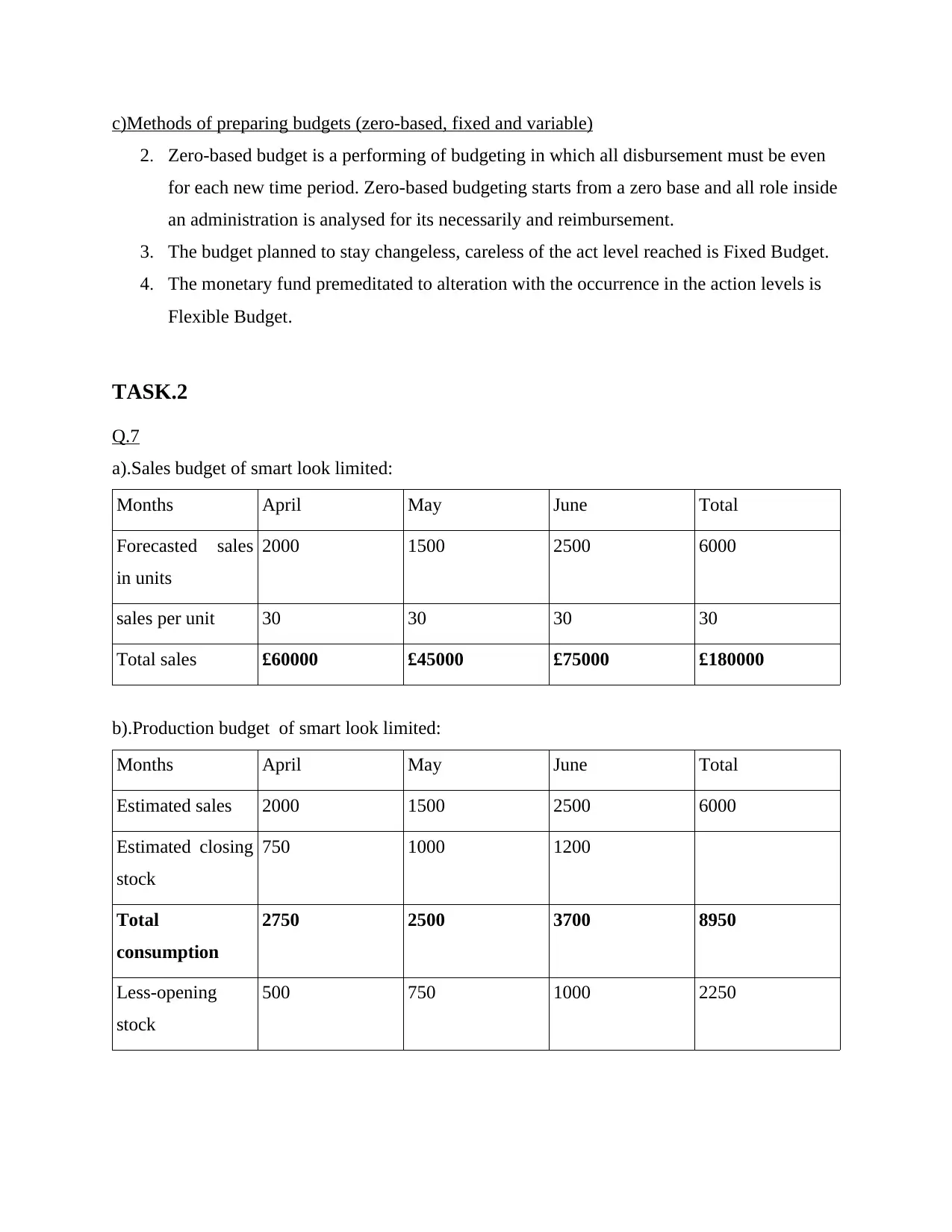

Q.7

a).Sales budget of smart look limited:

Months April May June Total

Forecasted sales

in units

2000 1500 2500 6000

sales per unit 30 30 30 30

Total sales £60000 £45000 £75000 £180000

b).Production budget of smart look limited:

Months April May June Total

Estimated sales 2000 1500 2500 6000

Estimated closing

stock

750 1000 1200

Total

consumption

2750 2500 3700 8950

Less-opening

stock

500 750 1000 2250

2. Zero-based budget is a performing of budgeting in which all disbursement must be even

for each new time period. Zero-based budgeting starts from a zero base and all role inside

an administration is analysed for its necessarily and reimbursement.

3. The budget planned to stay changeless, careless of the act level reached is Fixed Budget.

4. The monetary fund premeditated to alteration with the occurrence in the action levels is

Flexible Budget.

TASK.2

Q.7

a).Sales budget of smart look limited:

Months April May June Total

Forecasted sales

in units

2000 1500 2500 6000

sales per unit 30 30 30 30

Total sales £60000 £45000 £75000 £180000

b).Production budget of smart look limited:

Months April May June Total

Estimated sales 2000 1500 2500 6000

Estimated closing

stock

750 1000 1200

Total

consumption

2750 2500 3700 8950

Less-opening

stock

500 750 1000 2250

Units to be

manufactured

2250 1750 2700 6700

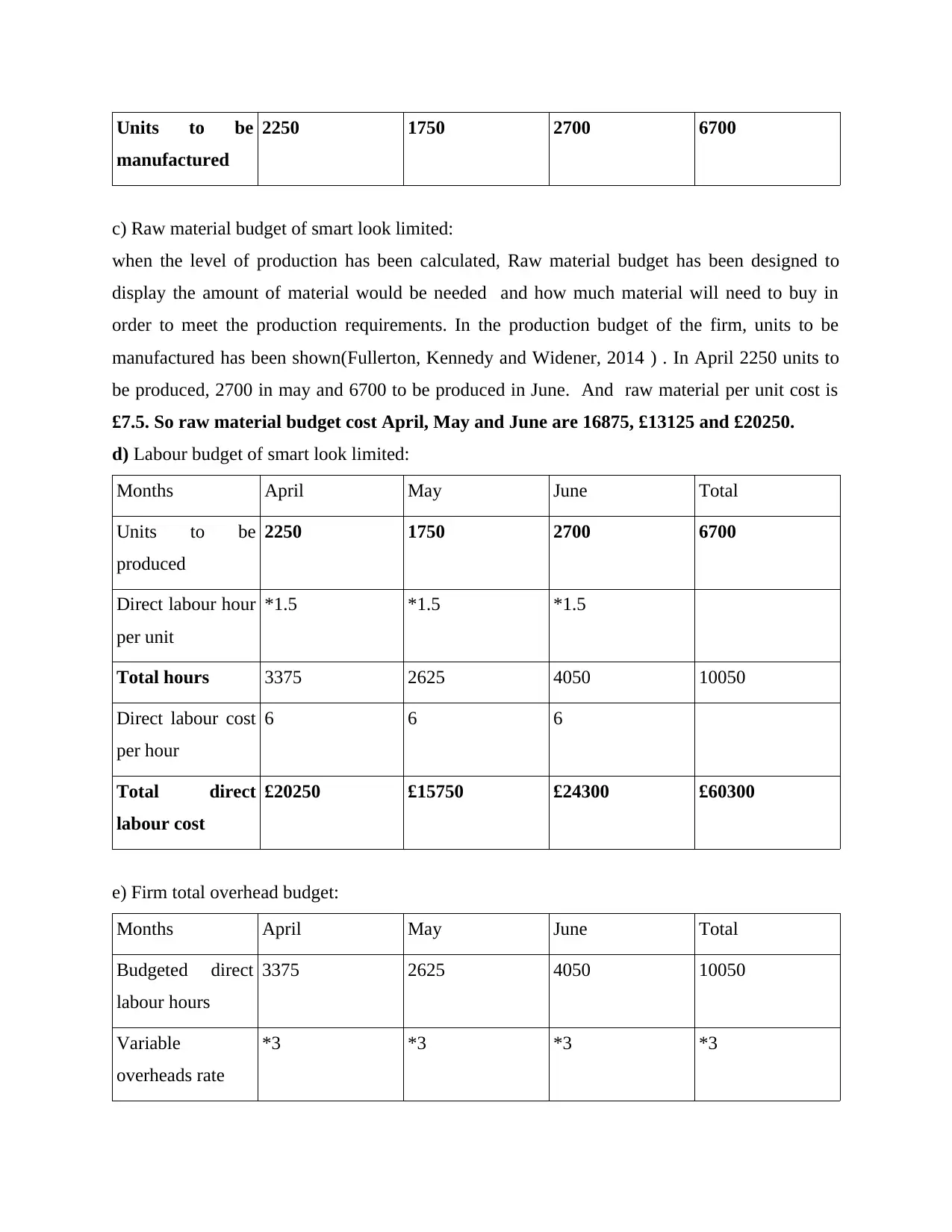

c) Raw material budget of smart look limited:

when the level of production has been calculated, Raw material budget has been designed to

display the amount of material would be needed and how much material will need to buy in

order to meet the production requirements. In the production budget of the firm, units to be

manufactured has been shown(Fullerton, Kennedy and Widener, 2014 ) . In April 2250 units to

be produced, 2700 in may and 6700 to be produced in June. And raw material per unit cost is

£7.5. So raw material budget cost April, May and June are 16875, £13125 and £20250.

d) Labour budget of smart look limited:

Months April May June Total

Units to be

produced

2250 1750 2700 6700

Direct labour hour

per unit

*1.5 *1.5 *1.5

Total hours 3375 2625 4050 10050

Direct labour cost

per hour

6 6 6

Total direct

labour cost

£20250 £15750 £24300 £60300

e) Firm total overhead budget:

Months April May June Total

Budgeted direct

labour hours

3375 2625 4050 10050

Variable

overheads rate

*3 *3 *3 *3

manufactured

2250 1750 2700 6700

c) Raw material budget of smart look limited:

when the level of production has been calculated, Raw material budget has been designed to

display the amount of material would be needed and how much material will need to buy in

order to meet the production requirements. In the production budget of the firm, units to be

manufactured has been shown(Fullerton, Kennedy and Widener, 2014 ) . In April 2250 units to

be produced, 2700 in may and 6700 to be produced in June. And raw material per unit cost is

£7.5. So raw material budget cost April, May and June are 16875, £13125 and £20250.

d) Labour budget of smart look limited:

Months April May June Total

Units to be

produced

2250 1750 2700 6700

Direct labour hour

per unit

*1.5 *1.5 *1.5

Total hours 3375 2625 4050 10050

Direct labour cost

per hour

6 6 6

Total direct

labour cost

£20250 £15750 £24300 £60300

e) Firm total overhead budget:

Months April May June Total

Budgeted direct

labour hours

3375 2625 4050 10050

Variable

overheads rate

*3 *3 *3 *3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.