Econometrics Assignment: Analyzing Distributions and Regression Models

VerifiedAdded on 2023/01/16

|9

|1116

|32

Homework Assignment

AI Summary

This econometrics assignment explores key concepts in statistical analysis and econometrics, including the calculation of joint and marginal probability distributions, expected values, variance, and covariance. It delves into conditional distributions, population regression lines, and the relationship between population slopes, variance, and covariance. The assignment also examines the relationship between dependent and independent variables, the estimation and comparison of regression equations, and the determination of error terms and residuals. The solution includes detailed calculations, interpretations, and a regression analysis output, providing a comprehensive understanding of the statistical methods applied in the field of econometrics. The assignment covers a range of topics, from basic probability to regression modeling.

Running head: Econometrics

Econometrics

Name of the student

Name of the university

Course name

Course ID:

Econometrics

Name of the student

Name of the university

Course name

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

Econometrics

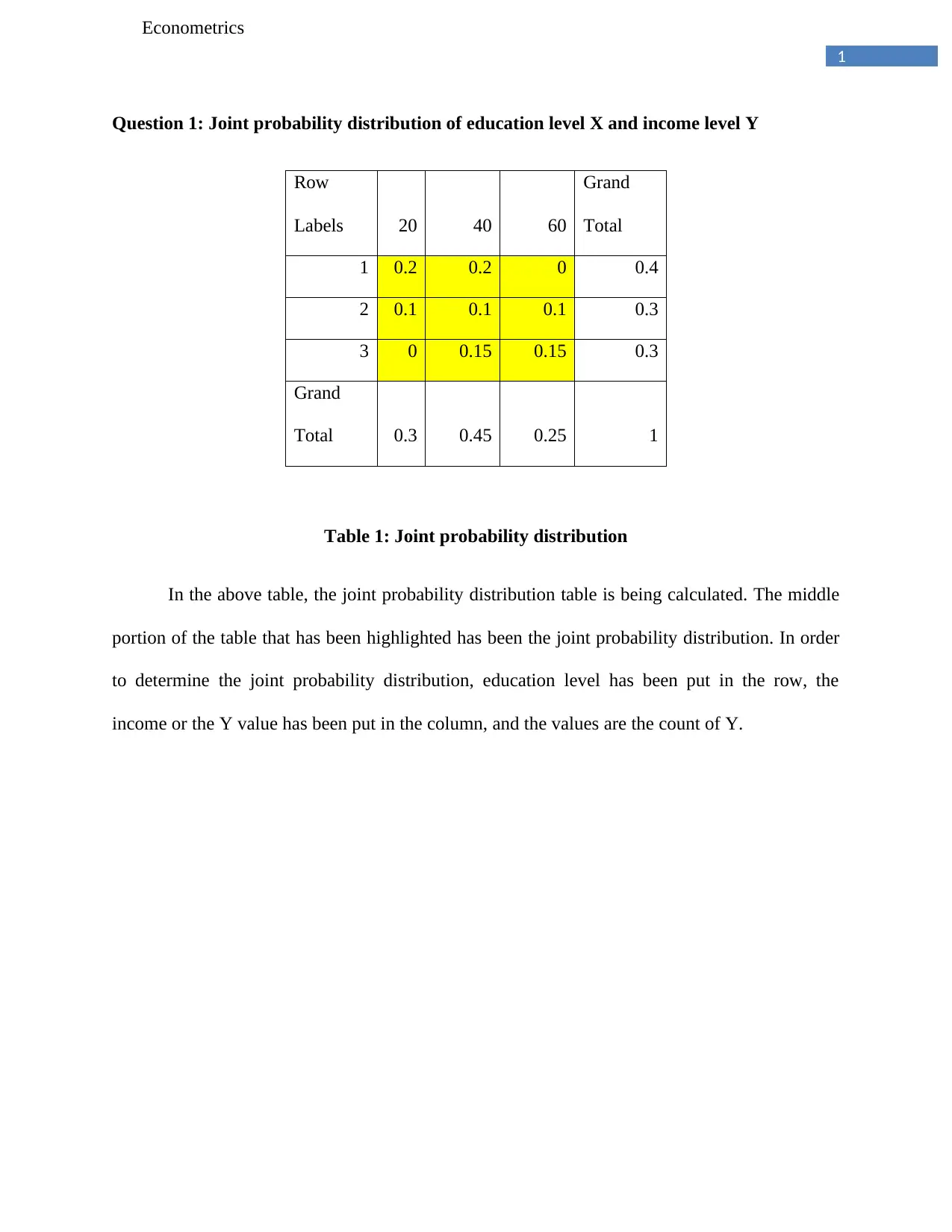

Question 1: Joint probability distribution of education level X and income level Y

Row

Labels 20 40 60

Grand

Total

1 0.2 0.2 0 0.4

2 0.1 0.1 0.1 0.3

3 0 0.15 0.15 0.3

Grand

Total 0.3 0.45 0.25 1

Table 1: Joint probability distribution

In the above table, the joint probability distribution table is being calculated. The middle

portion of the table that has been highlighted has been the joint probability distribution. In order

to determine the joint probability distribution, education level has been put in the row, the

income or the Y value has been put in the column, and the values are the count of Y.

Econometrics

Question 1: Joint probability distribution of education level X and income level Y

Row

Labels 20 40 60

Grand

Total

1 0.2 0.2 0 0.4

2 0.1 0.1 0.1 0.3

3 0 0.15 0.15 0.3

Grand

Total 0.3 0.45 0.25 1

Table 1: Joint probability distribution

In the above table, the joint probability distribution table is being calculated. The middle

portion of the table that has been highlighted has been the joint probability distribution. In order

to determine the joint probability distribution, education level has been put in the row, the

income or the Y value has been put in the column, and the values are the count of Y.

2

Econometrics

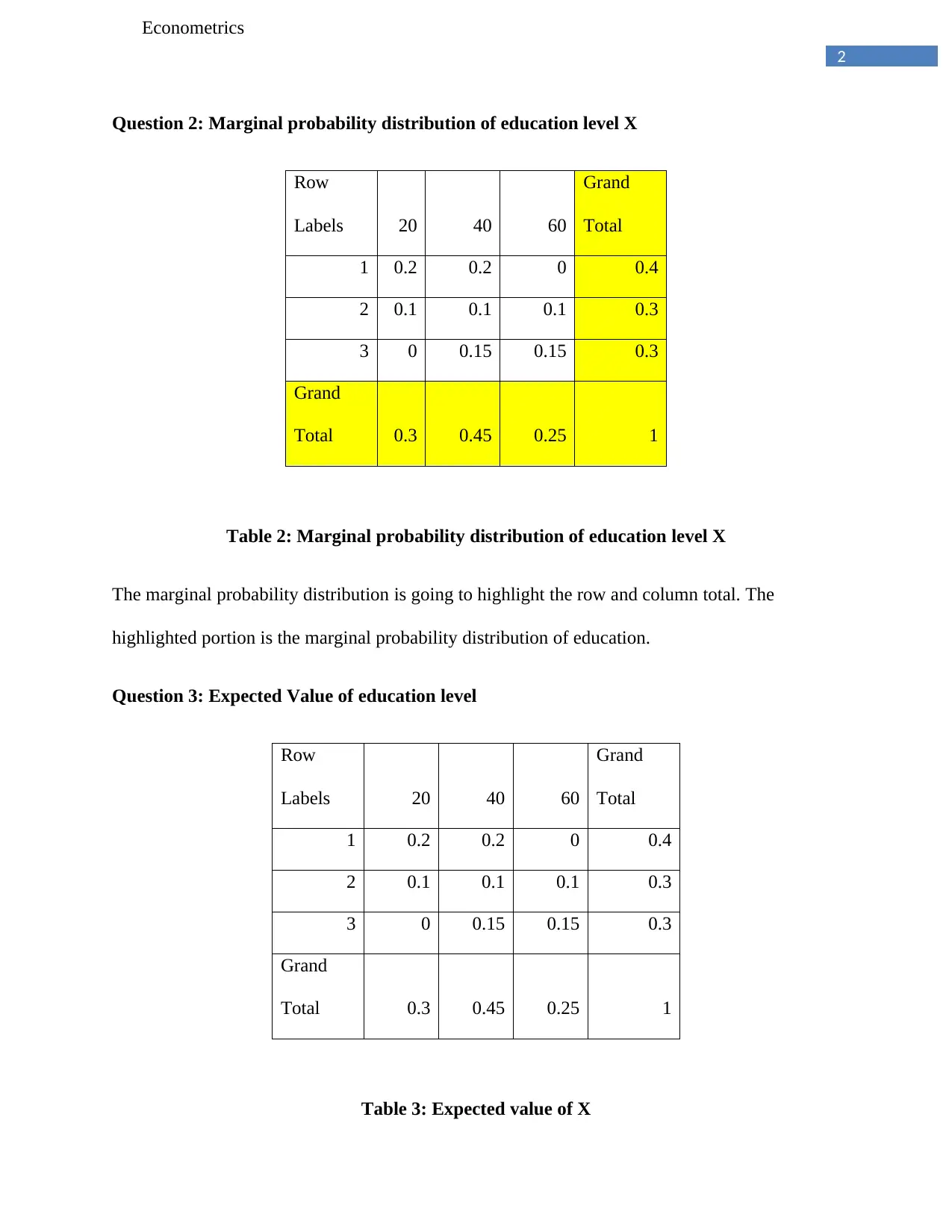

Question 2: Marginal probability distribution of education level X

Row

Labels 20 40 60

Grand

Total

1 0.2 0.2 0 0.4

2 0.1 0.1 0.1 0.3

3 0 0.15 0.15 0.3

Grand

Total 0.3 0.45 0.25 1

Table 2: Marginal probability distribution of education level X

The marginal probability distribution is going to highlight the row and column total. The

highlighted portion is the marginal probability distribution of education.

Question 3: Expected Value of education level

Row

Labels 20 40 60

Grand

Total

1 0.2 0.2 0 0.4

2 0.1 0.1 0.1 0.3

3 0 0.15 0.15 0.3

Grand

Total 0.3 0.45 0.25 1

Table 3: Expected value of X

Econometrics

Question 2: Marginal probability distribution of education level X

Row

Labels 20 40 60

Grand

Total

1 0.2 0.2 0 0.4

2 0.1 0.1 0.1 0.3

3 0 0.15 0.15 0.3

Grand

Total 0.3 0.45 0.25 1

Table 2: Marginal probability distribution of education level X

The marginal probability distribution is going to highlight the row and column total. The

highlighted portion is the marginal probability distribution of education.

Question 3: Expected Value of education level

Row

Labels 20 40 60

Grand

Total

1 0.2 0.2 0 0.4

2 0.1 0.1 0.1 0.3

3 0 0.15 0.15 0.3

Grand

Total 0.3 0.45 0.25 1

Table 3: Expected value of X

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Econometrics

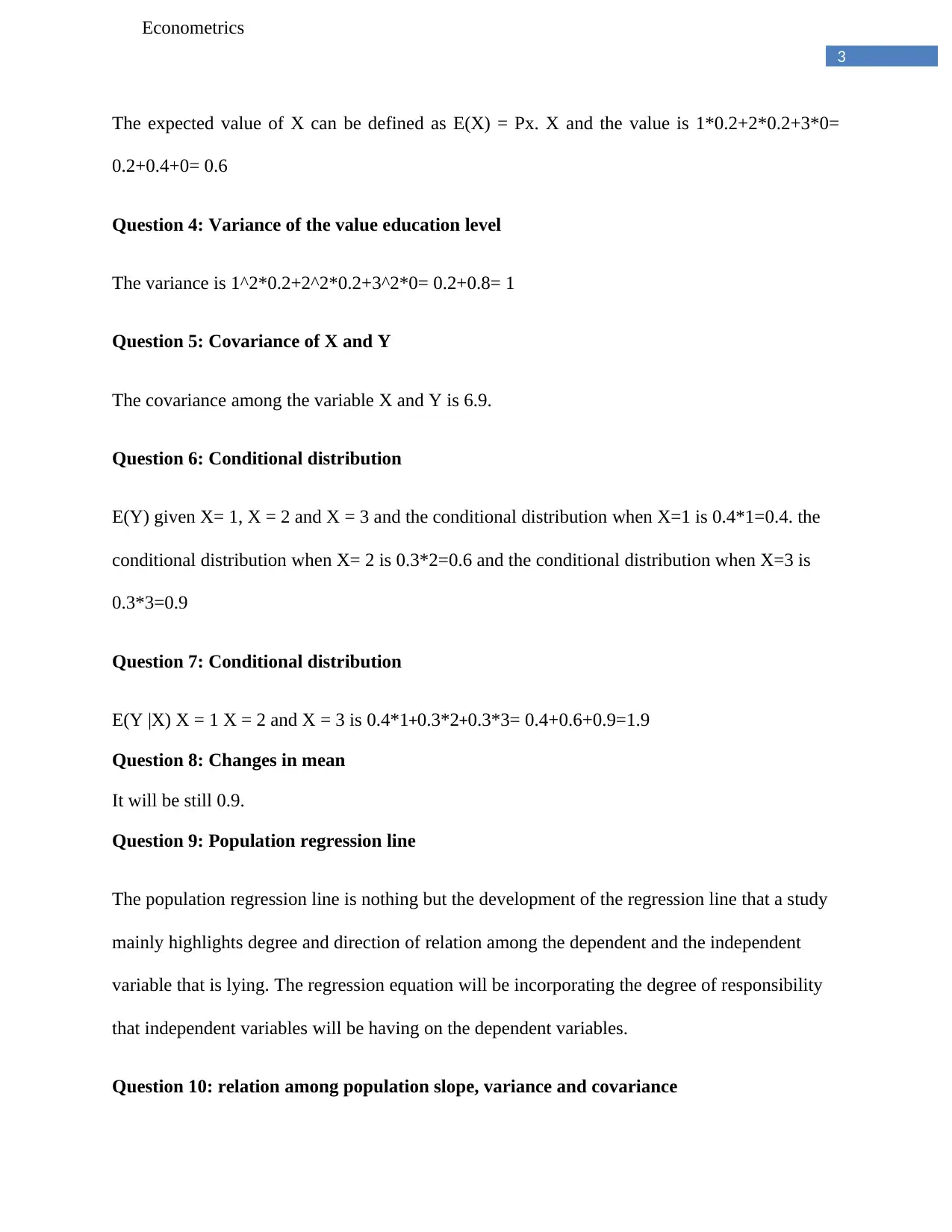

The expected value of X can be defined as E(X) = Px. X and the value is 1*0.2+2*0.2+3*0=

0.2+0.4+0= 0.6

Question 4: Variance of the value education level

The variance is 1^2*0.2+2^2*0.2+3^2*0= 0.2+0.8= 1

Question 5: Covariance of X and Y

The covariance among the variable X and Y is 6.9.

Question 6: Conditional distribution

E(Y) given X= 1, X = 2 and X = 3 and the conditional distribution when X=1 is 0.4*1=0.4. the

conditional distribution when X= 2 is 0.3*2=0.6 and the conditional distribution when X=3 is

0.3*3=0.9

Question 7: Conditional distribution

E(Y |X) X = 1 X = 2 and X = 3 is 0.4*1+0.3*2+0.3*3= 0.4+0.6+0.9=1.9

Question 8: Changes in mean

It will be still 0.9.

Question 9: Population regression line

The population regression line is nothing but the development of the regression line that a study

mainly highlights degree and direction of relation among the dependent and the independent

variable that is lying. The regression equation will be incorporating the degree of responsibility

that independent variables will be having on the dependent variables.

Question 10: relation among population slope, variance and covariance

Econometrics

The expected value of X can be defined as E(X) = Px. X and the value is 1*0.2+2*0.2+3*0=

0.2+0.4+0= 0.6

Question 4: Variance of the value education level

The variance is 1^2*0.2+2^2*0.2+3^2*0= 0.2+0.8= 1

Question 5: Covariance of X and Y

The covariance among the variable X and Y is 6.9.

Question 6: Conditional distribution

E(Y) given X= 1, X = 2 and X = 3 and the conditional distribution when X=1 is 0.4*1=0.4. the

conditional distribution when X= 2 is 0.3*2=0.6 and the conditional distribution when X=3 is

0.3*3=0.9

Question 7: Conditional distribution

E(Y |X) X = 1 X = 2 and X = 3 is 0.4*1+0.3*2+0.3*3= 0.4+0.6+0.9=1.9

Question 8: Changes in mean

It will be still 0.9.

Question 9: Population regression line

The population regression line is nothing but the development of the regression line that a study

mainly highlights degree and direction of relation among the dependent and the independent

variable that is lying. The regression equation will be incorporating the degree of responsibility

that independent variables will be having on the dependent variables.

Question 10: relation among population slope, variance and covariance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

Econometrics

Population slope is highlighting the fact that the tangent of the slope intercepts that will

definitely allow the curve to identify the direction of the regression. The population slope β will

determine the development of the prediction and that will definitely increase the prediction

regarding the development of the future trends and the estimated OLS regression that will allow

the prediction of the model in an effective and innovative manner. The variance will be looking

for the mean and they will be allowing the model to increase the improvement in the allocation

of the data. The covariance will be looking for the correlation and the inter dependence among

the dependent and independent variable and the model will be able to predict the goodness of fit

of the model.

Question 11: Dependent or independent of the variables

Both the variables X that is denoting the level of education and the variable Y is denoting the

level of the income. Both of these two variables are dependent to each other in the sense that

level of the education level will determine the income that the employees will be earning. The

two variables are having high chance of getting highly significant correlation variable.

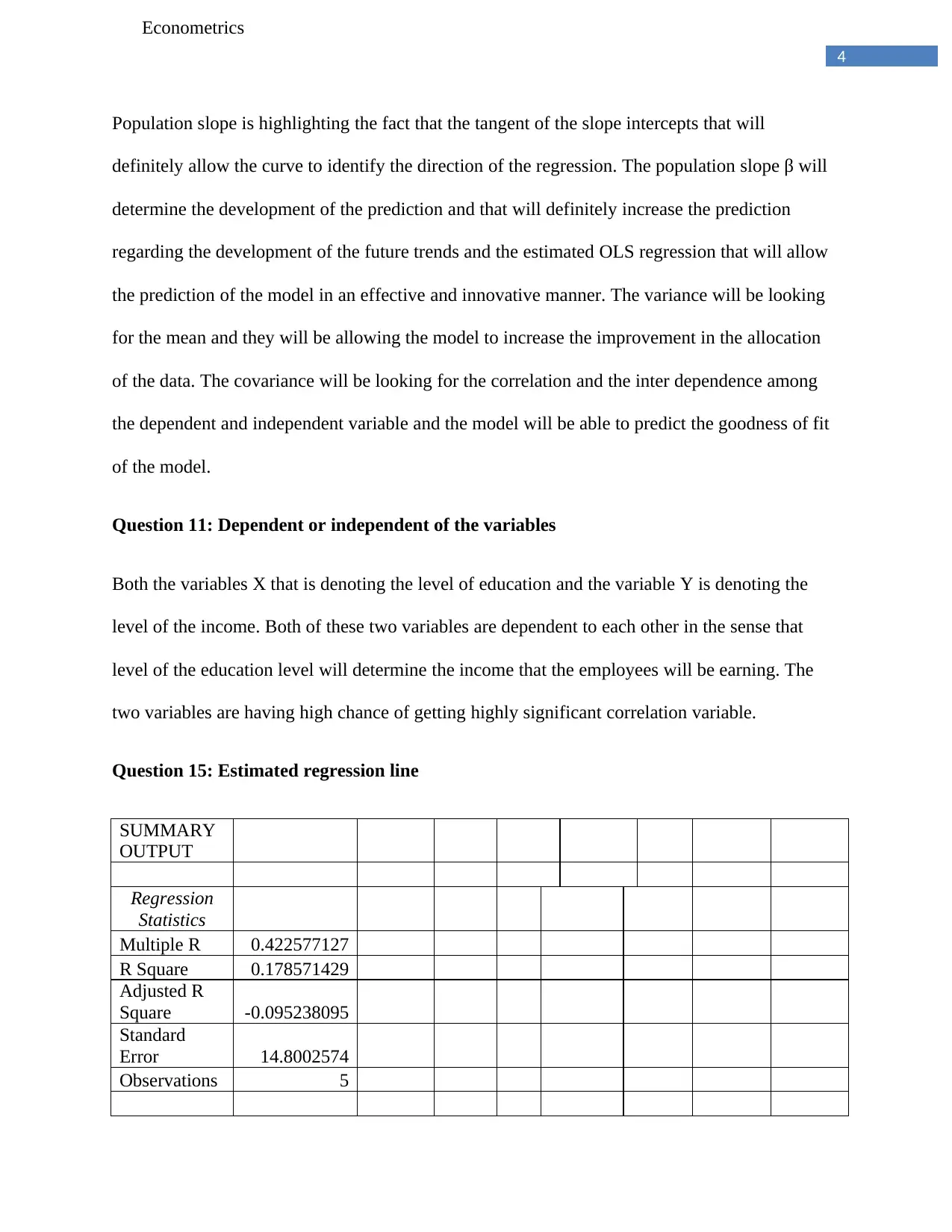

Question 15: Estimated regression line

SUMMARY

OUTPUT

Regression

Statistics

Multiple R 0.422577127

R Square 0.178571429

Adjusted R

Square -0.095238095

Standard

Error 14.8002574

Observations 5

Econometrics

Population slope is highlighting the fact that the tangent of the slope intercepts that will

definitely allow the curve to identify the direction of the regression. The population slope β will

determine the development of the prediction and that will definitely increase the prediction

regarding the development of the future trends and the estimated OLS regression that will allow

the prediction of the model in an effective and innovative manner. The variance will be looking

for the mean and they will be allowing the model to increase the improvement in the allocation

of the data. The covariance will be looking for the correlation and the inter dependence among

the dependent and independent variable and the model will be able to predict the goodness of fit

of the model.

Question 11: Dependent or independent of the variables

Both the variables X that is denoting the level of education and the variable Y is denoting the

level of the income. Both of these two variables are dependent to each other in the sense that

level of the education level will determine the income that the employees will be earning. The

two variables are having high chance of getting highly significant correlation variable.

Question 15: Estimated regression line

SUMMARY

OUTPUT

Regression

Statistics

Multiple R 0.422577127

R Square 0.178571429

Adjusted R

Square -0.095238095

Standard

Error 14.8002574

Observations 5

5

Econometrics

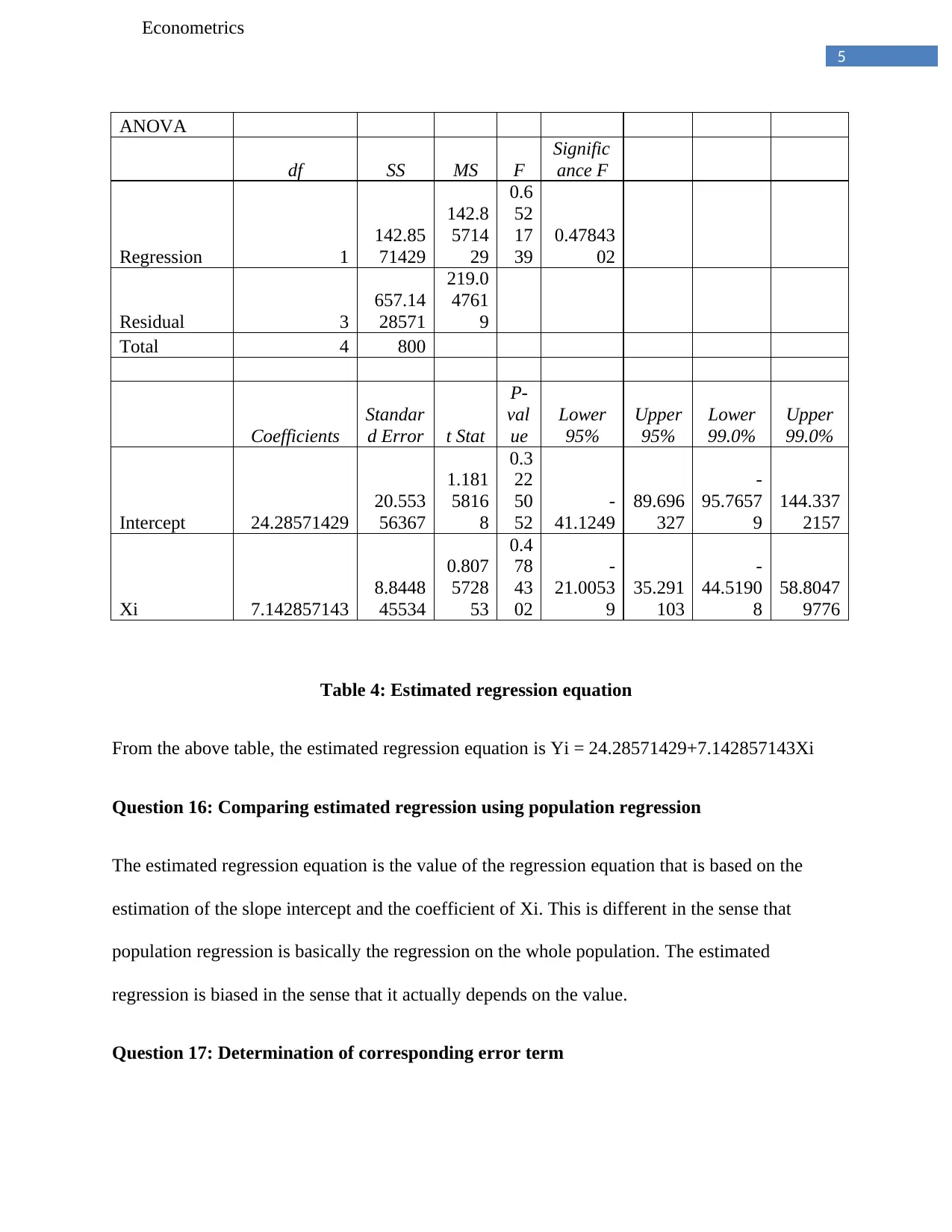

ANOVA

df SS MS F

Signific

ance F

Regression 1

142.85

71429

142.8

5714

29

0.6

52

17

39

0.47843

02

Residual 3

657.14

28571

219.0

4761

9

Total 4 800

Coefficients

Standar

d Error t Stat

P-

val

ue

Lower

95%

Upper

95%

Lower

99.0%

Upper

99.0%

Intercept 24.28571429

20.553

56367

1.181

5816

8

0.3

22

50

52

-

41.1249

89.696

327

-

95.7657

9

144.337

2157

Xi 7.142857143

8.8448

45534

0.807

5728

53

0.4

78

43

02

-

21.0053

9

35.291

103

-

44.5190

8

58.8047

9776

Table 4: Estimated regression equation

From the above table, the estimated regression equation is Yi = 24.28571429+7.142857143Xi

Question 16: Comparing estimated regression using population regression

The estimated regression equation is the value of the regression equation that is based on the

estimation of the slope intercept and the coefficient of Xi. This is different in the sense that

population regression is basically the regression on the whole population. The estimated

regression is biased in the sense that it actually depends on the value.

Question 17: Determination of corresponding error term

Econometrics

ANOVA

df SS MS F

Signific

ance F

Regression 1

142.85

71429

142.8

5714

29

0.6

52

17

39

0.47843

02

Residual 3

657.14

28571

219.0

4761

9

Total 4 800

Coefficients

Standar

d Error t Stat

P-

val

ue

Lower

95%

Upper

95%

Lower

99.0%

Upper

99.0%

Intercept 24.28571429

20.553

56367

1.181

5816

8

0.3

22

50

52

-

41.1249

89.696

327

-

95.7657

9

144.337

2157

Xi 7.142857143

8.8448

45534

0.807

5728

53

0.4

78

43

02

-

21.0053

9

35.291

103

-

44.5190

8

58.8047

9776

Table 4: Estimated regression equation

From the above table, the estimated regression equation is Yi = 24.28571429+7.142857143Xi

Question 16: Comparing estimated regression using population regression

The estimated regression equation is the value of the regression equation that is based on the

estimation of the slope intercept and the coefficient of Xi. This is different in the sense that

population regression is basically the regression on the whole population. The estimated

regression is biased in the sense that it actually depends on the value.

Question 17: Determination of corresponding error term

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

Econometrics

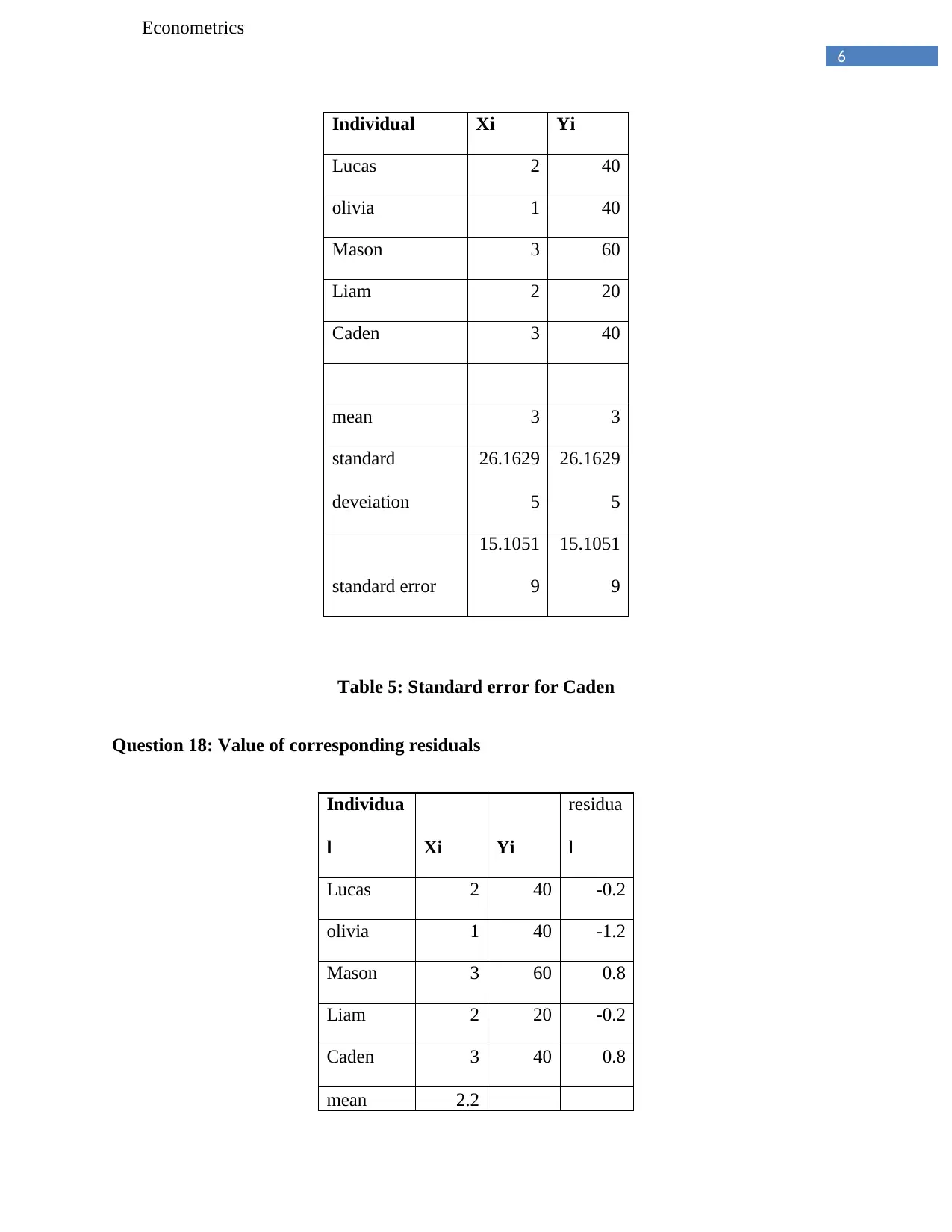

Individual Xi Yi

Lucas 2 40

olivia 1 40

Mason 3 60

Liam 2 20

Caden 3 40

mean 3 3

standard

deveiation

26.1629

5

26.1629

5

standard error

15.1051

9

15.1051

9

Table 5: Standard error for Caden

Question 18: Value of corresponding residuals

Individua

l Xi Yi

residua

l

Lucas 2 40 -0.2

olivia 1 40 -1.2

Mason 3 60 0.8

Liam 2 20 -0.2

Caden 3 40 0.8

mean 2.2

Econometrics

Individual Xi Yi

Lucas 2 40

olivia 1 40

Mason 3 60

Liam 2 20

Caden 3 40

mean 3 3

standard

deveiation

26.1629

5

26.1629

5

standard error

15.1051

9

15.1051

9

Table 5: Standard error for Caden

Question 18: Value of corresponding residuals

Individua

l Xi Yi

residua

l

Lucas 2 40 -0.2

olivia 1 40 -1.2

Mason 3 60 0.8

Liam 2 20 -0.2

Caden 3 40 0.8

mean 2.2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

Econometrics

Econometrics

8

Econometrics

Bibliography

Bell, A. and Jones, K., 2015. Explaining fixed effects: Random effects modeling of time-series

cross-sectional and panel data. Political Science Research and Methods, 3(1), pp.133-153.

Bun, M.J. and Sarafidis, V., 2015. Dynamic panel data models. The oxford handbook of panel

data, pp.76-110.

Frühwirth-Schnatter, S., 2018. Bayesian Econometrics in the Big Data Era.

Lopez, L. and Weber, S., 2018. Testing for Granger causality in panel data. The Stata

Journal, 17(4), pp.972-984.

Stock, J.H. and Watson, M.W., 2015. Introduction to econometrics.

Econometrics

Bibliography

Bell, A. and Jones, K., 2015. Explaining fixed effects: Random effects modeling of time-series

cross-sectional and panel data. Political Science Research and Methods, 3(1), pp.133-153.

Bun, M.J. and Sarafidis, V., 2015. Dynamic panel data models. The oxford handbook of panel

data, pp.76-110.

Frühwirth-Schnatter, S., 2018. Bayesian Econometrics in the Big Data Era.

Lopez, L. and Weber, S., 2018. Testing for Granger causality in panel data. The Stata

Journal, 17(4), pp.972-984.

Stock, J.H. and Watson, M.W., 2015. Introduction to econometrics.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.