Econometrics Study Material

VerifiedAdded on 2023/03/17

|10

|1073

|26

AI Summary

This document provides a comprehensive study material on Econometrics, covering topics such as GDP, consumption, investment, government expenditure, and more. It includes equations, calculations, and explanations to help students understand the subject better. The document also discusses the impact of fiscal and monetary policies, as well as the potential effects of the US-China trade war on the Australian economy.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: ECONOMETRICS

Macroeconomics

Name of the Student:

Name of the University:

Author Note:

Macroeconomics

Name of the Student:

Name of the University:

Author Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1ECONOMETRICS

Table of Contents

Part a...........................................................................................................................................2

Part b..........................................................................................................................................3

Part c...........................................................................................................................................3

Part d..........................................................................................................................................4

Part e...........................................................................................................................................4

Part f...........................................................................................................................................4

Part g..........................................................................................................................................5

Part h..........................................................................................................................................5

Part i...........................................................................................................................................6

Part j...........................................................................................................................................7

Reference:..................................................................................................................................8

Table of Contents

Part a...........................................................................................................................................2

Part b..........................................................................................................................................3

Part c...........................................................................................................................................3

Part d..........................................................................................................................................4

Part e...........................................................................................................................................4

Part f...........................................................................................................................................4

Part g..........................................................................................................................................5

Part h..........................................................................................................................................5

Part i...........................................................................................................................................6

Part j...........................................................................................................................................7

Reference:..................................................................................................................................8

2ECONOMETRICS

Part a

Y =C + I+ G+( X−M )

Where, Y= Gross domestic product,

C= Consumption,

a= autonomous consumption,

b= marginal propensity to consume,

I= Investment,

G= Government expenditure,

X= export and

M= import.

The data is collected from the Australian Bureau of Statistics.

C = $260752 million

I = $109478 million & $1983 million

G =$ 84696 million

X = $100820 million

M= $99614 million

Y =260752+109478+1983+ 84696+(100820−99614)

Y =458115

The actual GDP is $458115 million.

Part a

Y =C + I+ G+( X−M )

Where, Y= Gross domestic product,

C= Consumption,

a= autonomous consumption,

b= marginal propensity to consume,

I= Investment,

G= Government expenditure,

X= export and

M= import.

The data is collected from the Australian Bureau of Statistics.

C = $260752 million

I = $109478 million & $1983 million

G =$ 84696 million

X = $100820 million

M= $99614 million

Y =260752+109478+1983+ 84696+(100820−99614)

Y =458115

The actual GDP is $458115 million.

3ECONOMETRICS

Part b

C=a+ b Y d

Where, C= Consumption,

a= autonomous consumption and

b= marginal propensity to consume.

Yd= Disposable income

Marginal propensity to consume = 1- (MPS+ marginal tax rate + nx(m))

b=1− ( 0.3+0.05+0.04 )

b=0.61

Y d = ( 1−marginlatax rate )∗Y −T

Y d = ( 1−0.05 )∗458115−70140.1

Y d =365069.2

The autonomous expenditure,

a=C−b Y d

a=260752−(0.61∗365069.2)

a=3 8059. 8

The autonomous consumption expenditure $38059.8 million.

Part c

Import= Autonomous import + (Marginal import rate * Y)

Autonomousimport=99614− ( 0.04∗458115 )

Part b

C=a+ b Y d

Where, C= Consumption,

a= autonomous consumption and

b= marginal propensity to consume.

Yd= Disposable income

Marginal propensity to consume = 1- (MPS+ marginal tax rate + nx(m))

b=1− ( 0.3+0.05+0.04 )

b=0.61

Y d = ( 1−marginlatax rate )∗Y −T

Y d = ( 1−0.05 )∗458115−70140.1

Y d =365069.2

The autonomous expenditure,

a=C−b Y d

a=260752−(0.61∗365069.2)

a=3 8059. 8

The autonomous consumption expenditure $38059.8 million.

Part c

Import= Autonomous import + (Marginal import rate * Y)

Autonomousimport=99614− ( 0.04∗458115 )

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4ECONOMETRICS

Autonomousimport=81289. 4

Part d

Net export= Autonomous net export + (marginal rate of net export* Y)

Autonomous net export=1206− ( 0.04∗458115 )

Autonomous net export=−17118. 6

The autonomous net export is -$17118.6 million dollar.

Part e

Expenditure multiplier= 1

1−MPC

Expenditure multiplier= 1

1−0.61

Expenditure multiplier=2.56

Tax multipliers,

Lumpsum multiplier= −MPC

1−MPC = −0.61

1−0.61 =−1.56

Again,

Proportional multiplier= −1

1−MPC∗(1−t) = −1

1− ( 0.61∗( 1−0.05 ) ) =−2.38

Part f

Equilibrium GDP = C + Ig+ G + NX

Equilibrium GDP=260752+109478+ 84696+(100820−99614)

Equilibrium GDP=456132

Autonomousimport=81289. 4

Part d

Net export= Autonomous net export + (marginal rate of net export* Y)

Autonomous net export=1206− ( 0.04∗458115 )

Autonomous net export=−17118. 6

The autonomous net export is -$17118.6 million dollar.

Part e

Expenditure multiplier= 1

1−MPC

Expenditure multiplier= 1

1−0.61

Expenditure multiplier=2.56

Tax multipliers,

Lumpsum multiplier= −MPC

1−MPC = −0.61

1−0.61 =−1.56

Again,

Proportional multiplier= −1

1−MPC∗(1−t) = −1

1− ( 0.61∗( 1−0.05 ) ) =−2.38

Part f

Equilibrium GDP = C + Ig+ G + NX

Equilibrium GDP=260752+109478+ 84696+(100820−99614)

Equilibrium GDP=456132

5ECONOMETRICS

Part g

The change in government spending is dG.

The government expenditure multiplier,

dY

dG = 1

1−MPC

dg=dY ∗(1−MPC)

dg=(458115−456132)∗(1−0.61)

dg=773.37

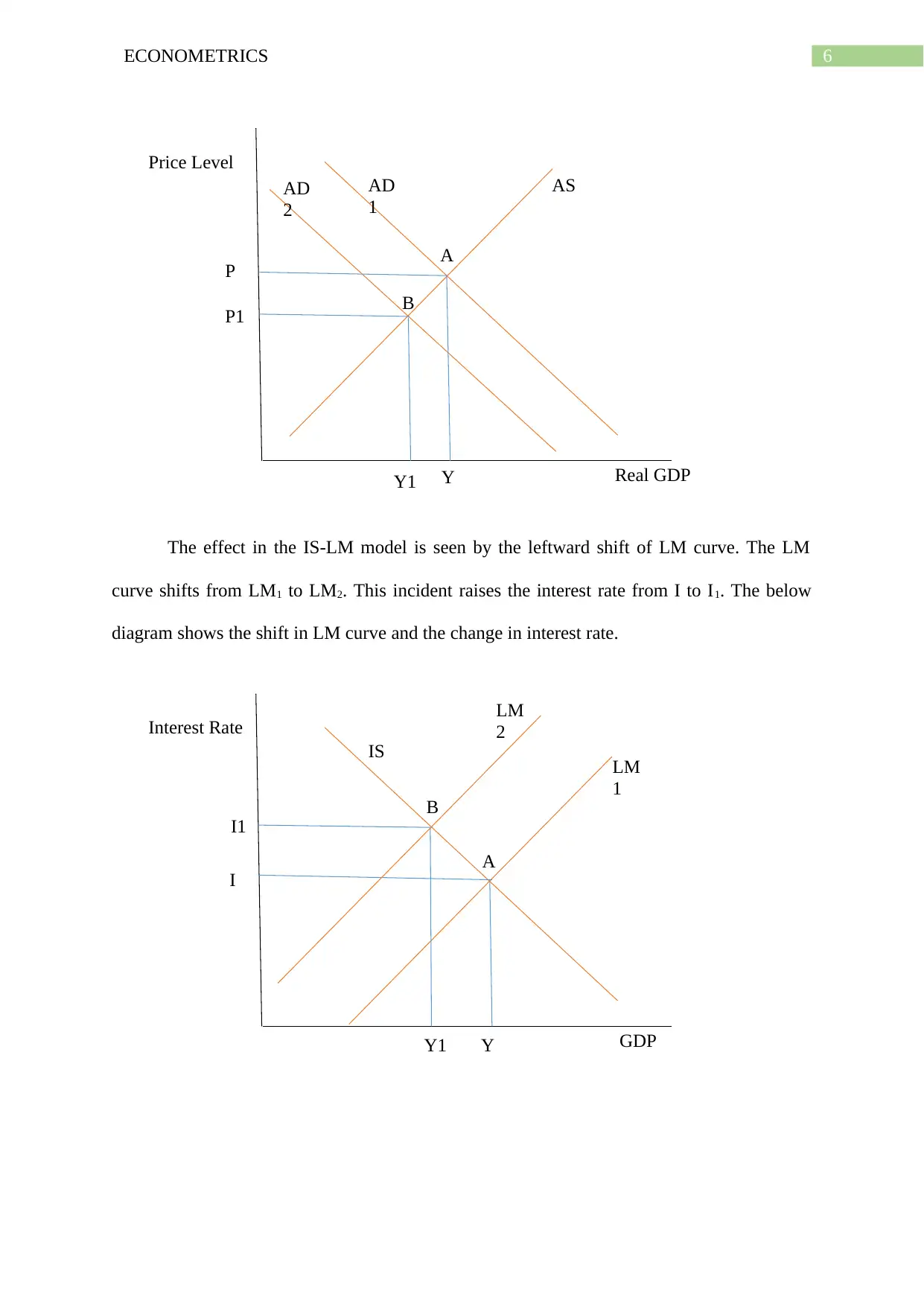

Part h

The bank takes action to reduce the GDP gap through the monetary policies. The gap

is defined by the difference between actual GDP and equilibrium GDP. In order to do so, the

government reduces the money supply that raises the interest rate. This reduces the aggregate

demand and thus the AD falls from AD1 to AD2. Thus, equilibrium shifts from point A to B.

This reduces the price level from the P to P1 and the real GDP falls from Y to Y1. This is

presented in the below diagram.

Part g

The change in government spending is dG.

The government expenditure multiplier,

dY

dG = 1

1−MPC

dg=dY ∗(1−MPC)

dg=(458115−456132)∗(1−0.61)

dg=773.37

Part h

The bank takes action to reduce the GDP gap through the monetary policies. The gap

is defined by the difference between actual GDP and equilibrium GDP. In order to do so, the

government reduces the money supply that raises the interest rate. This reduces the aggregate

demand and thus the AD falls from AD1 to AD2. Thus, equilibrium shifts from point A to B.

This reduces the price level from the P to P1 and the real GDP falls from Y to Y1. This is

presented in the below diagram.

6ECONOMETRICS

Price Level

Real GDP

AS

Y1 Y

P1

P

AD

2

AD

1

A

B

Interest Rate

GDP

LM

1

Y1 Y

I1

I

LM

2

IS

B

A

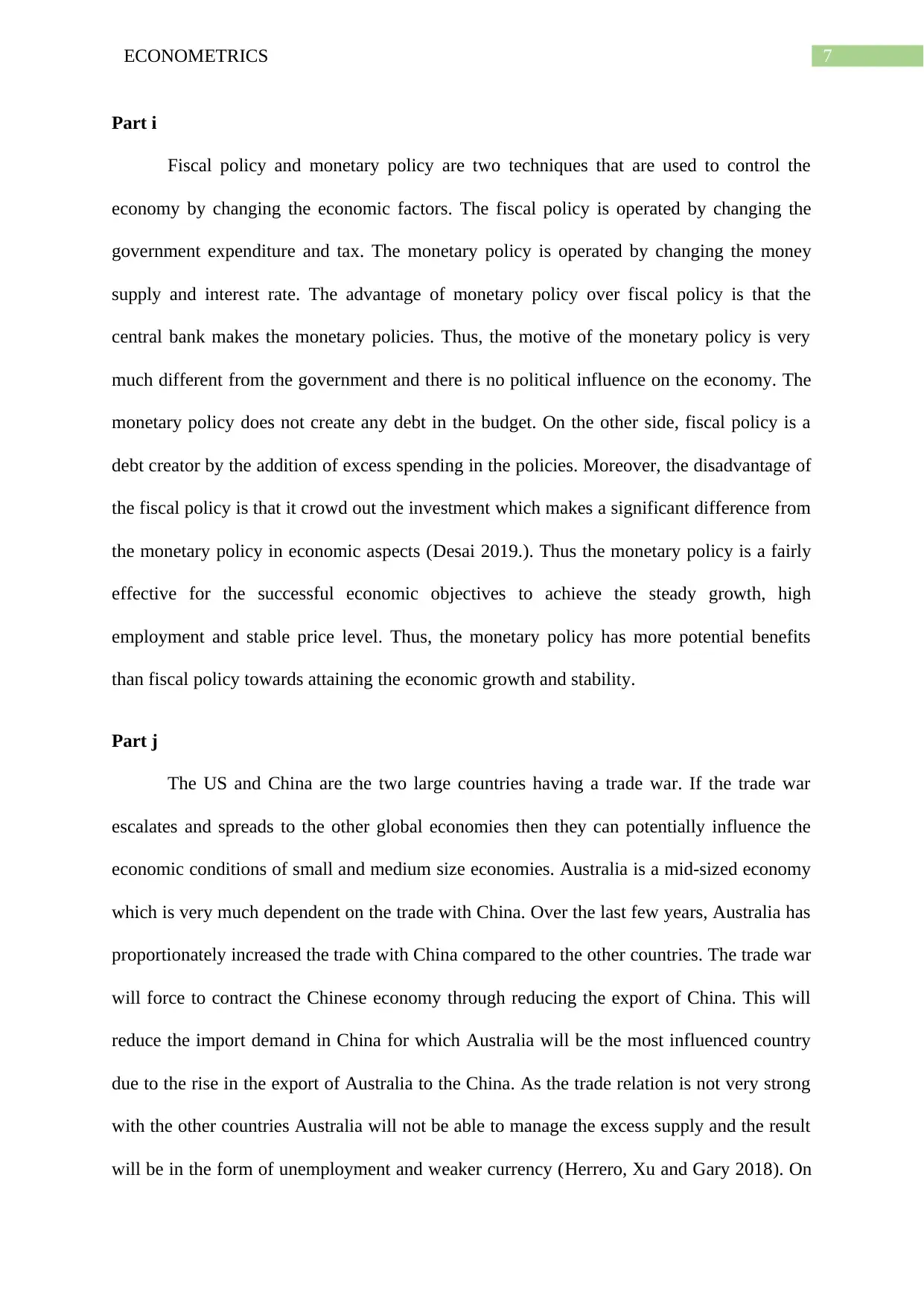

The effect in the IS-LM model is seen by the leftward shift of LM curve. The LM

curve shifts from LM1 to LM2. This incident raises the interest rate from I to I1. The below

diagram shows the shift in LM curve and the change in interest rate.

Price Level

Real GDP

AS

Y1 Y

P1

P

AD

2

AD

1

A

B

Interest Rate

GDP

LM

1

Y1 Y

I1

I

LM

2

IS

B

A

The effect in the IS-LM model is seen by the leftward shift of LM curve. The LM

curve shifts from LM1 to LM2. This incident raises the interest rate from I to I1. The below

diagram shows the shift in LM curve and the change in interest rate.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMETRICS

Part i

Fiscal policy and monetary policy are two techniques that are used to control the

economy by changing the economic factors. The fiscal policy is operated by changing the

government expenditure and tax. The monetary policy is operated by changing the money

supply and interest rate. The advantage of monetary policy over fiscal policy is that the

central bank makes the monetary policies. Thus, the motive of the monetary policy is very

much different from the government and there is no political influence on the economy. The

monetary policy does not create any debt in the budget. On the other side, fiscal policy is a

debt creator by the addition of excess spending in the policies. Moreover, the disadvantage of

the fiscal policy is that it crowd out the investment which makes a significant difference from

the monetary policy in economic aspects (Desai 2019.). Thus the monetary policy is a fairly

effective for the successful economic objectives to achieve the steady growth, high

employment and stable price level. Thus, the monetary policy has more potential benefits

than fiscal policy towards attaining the economic growth and stability.

Part j

The US and China are the two large countries having a trade war. If the trade war

escalates and spreads to the other global economies then they can potentially influence the

economic conditions of small and medium size economies. Australia is a mid-sized economy

which is very much dependent on the trade with China. Over the last few years, Australia has

proportionately increased the trade with China compared to the other countries. The trade war

will force to contract the Chinese economy through reducing the export of China. This will

reduce the import demand in China for which Australia will be the most influenced country

due to the rise in the export of Australia to the China. As the trade relation is not very strong

with the other countries Australia will not be able to manage the excess supply and the result

will be in the form of unemployment and weaker currency (Herrero, Xu and Gary 2018). On

Part i

Fiscal policy and monetary policy are two techniques that are used to control the

economy by changing the economic factors. The fiscal policy is operated by changing the

government expenditure and tax. The monetary policy is operated by changing the money

supply and interest rate. The advantage of monetary policy over fiscal policy is that the

central bank makes the monetary policies. Thus, the motive of the monetary policy is very

much different from the government and there is no political influence on the economy. The

monetary policy does not create any debt in the budget. On the other side, fiscal policy is a

debt creator by the addition of excess spending in the policies. Moreover, the disadvantage of

the fiscal policy is that it crowd out the investment which makes a significant difference from

the monetary policy in economic aspects (Desai 2019.). Thus the monetary policy is a fairly

effective for the successful economic objectives to achieve the steady growth, high

employment and stable price level. Thus, the monetary policy has more potential benefits

than fiscal policy towards attaining the economic growth and stability.

Part j

The US and China are the two large countries having a trade war. If the trade war

escalates and spreads to the other global economies then they can potentially influence the

economic conditions of small and medium size economies. Australia is a mid-sized economy

which is very much dependent on the trade with China. Over the last few years, Australia has

proportionately increased the trade with China compared to the other countries. The trade war

will force to contract the Chinese economy through reducing the export of China. This will

reduce the import demand in China for which Australia will be the most influenced country

due to the rise in the export of Australia to the China. As the trade relation is not very strong

with the other countries Australia will not be able to manage the excess supply and the result

will be in the form of unemployment and weaker currency (Herrero, Xu and Gary 2018). On

8ECONOMETRICS

the contrary, the Australian economy will be benefited in few sectors like in the agribusiness

and the demand of wine and grains may rise.

the contrary, the Australian economy will be benefited in few sectors like in the agribusiness

and the demand of wine and grains may rise.

9ECONOMETRICS

Reference:

Desai, C., 2019. Economics, Monetary Theory and Fiscal Policy. In Management for

Scientists (pp. 1-15). Emerald Publishing Limited.

Herrero, A.G., Xu, J. and Gary, N.G., 2018. IS THE MARKET OVERREACTING TO THE

US-CHINA TRADE WAR? YES IF ONLY FOCUSING ON TRADE MEASURES.

Reference:

Desai, C., 2019. Economics, Monetary Theory and Fiscal Policy. In Management for

Scientists (pp. 1-15). Emerald Publishing Limited.

Herrero, A.G., Xu, J. and Gary, N.G., 2018. IS THE MARKET OVERREACTING TO THE

US-CHINA TRADE WAR? YES IF ONLY FOCUSING ON TRADE MEASURES.

1 out of 10

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.