Economics and Financial Analysis Report - UK and Tesco PLC

VerifiedAdded on 2021/04/21

|13

|2251

|161

Report

AI Summary

This report provides a detailed analysis of the UK's economic performance and the financial standing of Tesco PLC. It begins with an overview of key economic indicators, including Gross Domestic Product (GDP), inflation rates, and employment and unemployment levels, using data from the Office for National Statistics. The report then shifts focus to Tesco PLC, providing a market analysis based on data from the Financial Times. This includes share prices, trading volumes, and a peer analysis comparing Tesco to its competitors. The core of the report involves a comprehensive financial statement analysis, utilizing ratio analysis to assess Tesco's liquidity, profitability, efficiency, and capital structure. Specific ratios such as current ratio, quick ratio, gross profit margin, operating profit margin, debt-to-equity ratio, and interest coverage ratio are calculated and evaluated. The report concludes with a summary of findings, highlighting the UK's economic health and Tesco's financial strengths and weaknesses. References from sources such as the Office for National Statistics and the Financial Times are included to support the analysis.

RUNNING HEAD: ECONOMICS AND FINANCE

Economics and financial analysis

Economics and financial analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Economics and finance 1

Contents

Introduction...........................................................................................................................................2

Economic Data......................................................................................................................................2

Gross Domestic product....................................................................................................................2

Inflation.............................................................................................................................................3

Employment and unemployment level..............................................................................................4

Financial Data – Market analysis...........................................................................................................6

Financial Statements – Ratio Analysis..................................................................................................6

Liquidity ratios..................................................................................................................................7

Profitability ratios..............................................................................................................................7

Efficiency ratios.................................................................................................................................8

Capital structure ratio........................................................................................................................9

Conclusion...........................................................................................................................................10

References...........................................................................................................................................11

Contents

Introduction...........................................................................................................................................2

Economic Data......................................................................................................................................2

Gross Domestic product....................................................................................................................2

Inflation.............................................................................................................................................3

Employment and unemployment level..............................................................................................4

Financial Data – Market analysis...........................................................................................................6

Financial Statements – Ratio Analysis..................................................................................................6

Liquidity ratios..................................................................................................................................7

Profitability ratios..............................................................................................................................7

Efficiency ratios.................................................................................................................................8

Capital structure ratio........................................................................................................................9

Conclusion...........................................................................................................................................10

References...........................................................................................................................................11

Economics and finance 2

Introduction

This report contains the analysis of economic and financial data of the country and the

company operating in it. For this, United Kingdom’s economic data is analysed on the basis

of information provided by Office for National statistics and the financial data of Tesco Plc.

is taken from its official website and Financial Times. The report also contains a ratio

analysis followed by a conclusion including the findings.

Economic Data

United Kingdom has a highly developed and market oriented economy in the world.

According to nominal gross domestic product it is the sixth largest national economy. Also

the country is known for having the most globalised economy as it is made up of the

economies of England, Wales, Scotland and Northern Ireland. Office for National Statistics is

the largest independent producer of official statistics of United Kingdom. It is also recognized

as national statistical institute of UK. All the data related to country’s GDP, inflation prices,

unemployment and employment levels, population and many more is available on the official

website of the institute. Following economic data is been taken from the website:

Gross Domestic product

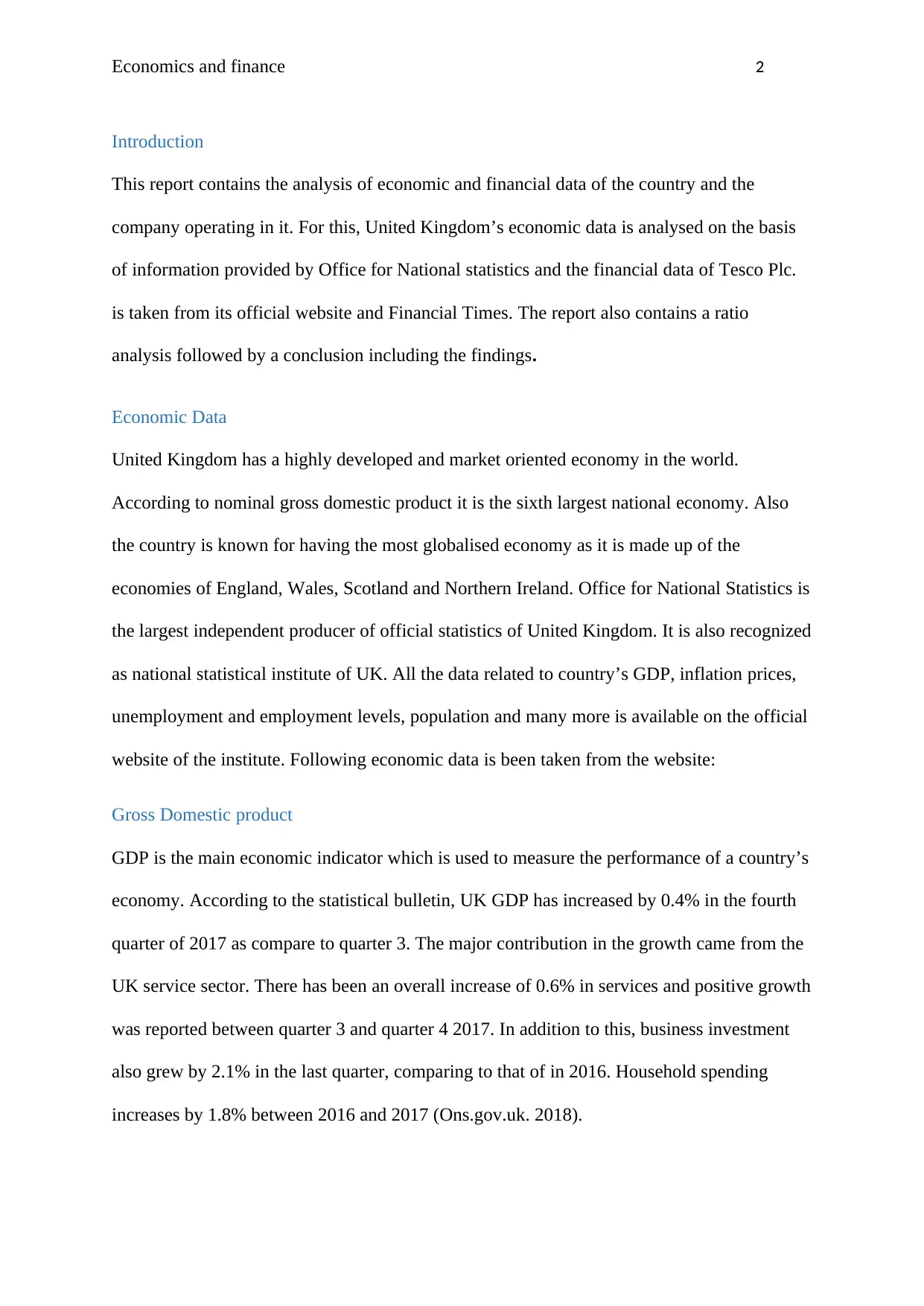

GDP is the main economic indicator which is used to measure the performance of a country’s

economy. According to the statistical bulletin, UK GDP has increased by 0.4% in the fourth

quarter of 2017 as compare to quarter 3. The major contribution in the growth came from the

UK service sector. There has been an overall increase of 0.6% in services and positive growth

was reported between quarter 3 and quarter 4 2017. In addition to this, business investment

also grew by 2.1% in the last quarter, comparing to that of in 2016. Household spending

increases by 1.8% between 2016 and 2017 (Ons.gov.uk. 2018).

Introduction

This report contains the analysis of economic and financial data of the country and the

company operating in it. For this, United Kingdom’s economic data is analysed on the basis

of information provided by Office for National statistics and the financial data of Tesco Plc.

is taken from its official website and Financial Times. The report also contains a ratio

analysis followed by a conclusion including the findings.

Economic Data

United Kingdom has a highly developed and market oriented economy in the world.

According to nominal gross domestic product it is the sixth largest national economy. Also

the country is known for having the most globalised economy as it is made up of the

economies of England, Wales, Scotland and Northern Ireland. Office for National Statistics is

the largest independent producer of official statistics of United Kingdom. It is also recognized

as national statistical institute of UK. All the data related to country’s GDP, inflation prices,

unemployment and employment levels, population and many more is available on the official

website of the institute. Following economic data is been taken from the website:

Gross Domestic product

GDP is the main economic indicator which is used to measure the performance of a country’s

economy. According to the statistical bulletin, UK GDP has increased by 0.4% in the fourth

quarter of 2017 as compare to quarter 3. The major contribution in the growth came from the

UK service sector. There has been an overall increase of 0.6% in services and positive growth

was reported between quarter 3 and quarter 4 2017. In addition to this, business investment

also grew by 2.1% in the last quarter, comparing to that of in 2016. Household spending

increases by 1.8% between 2016 and 2017 (Ons.gov.uk. 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Economics and finance 3

(Source: Office for National Statistics).

From the above figure it is observed that GDP of UK continues to rise after facing the

downfall in year 2009. When measuring the GDP growth in volume terms, it has increased by

1.4% in quarter 4 2017 as compare to quarter 4 2016.

Inflation

Increase in prices of goods and services is generally defined by the term Inflation. The factors

which are to measure inflation are consumer price and producer price inflation and house

price index. The statistical bulletin states following points:

The CPI including owner occupiers’ housing cost (CPIH) has a 12 month inflation

rate of 2.5% in February 2018. The same was 2.7% in January 2018.

Transport and food prices brings the largest downward contribution. In addition to

this, fall in the prices of accommodation services also has a downward effect.

High prices of footwear make an upward contribution to the change (Gooding, 2018).

(Source: Office for National Statistics).

From the above figure it is observed that GDP of UK continues to rise after facing the

downfall in year 2009. When measuring the GDP growth in volume terms, it has increased by

1.4% in quarter 4 2017 as compare to quarter 4 2016.

Inflation

Increase in prices of goods and services is generally defined by the term Inflation. The factors

which are to measure inflation are consumer price and producer price inflation and house

price index. The statistical bulletin states following points:

The CPI including owner occupiers’ housing cost (CPIH) has a 12 month inflation

rate of 2.5% in February 2018. The same was 2.7% in January 2018.

Transport and food prices brings the largest downward contribution. In addition to

this, fall in the prices of accommodation services also has a downward effect.

High prices of footwear make an upward contribution to the change (Gooding, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Economics and finance 4

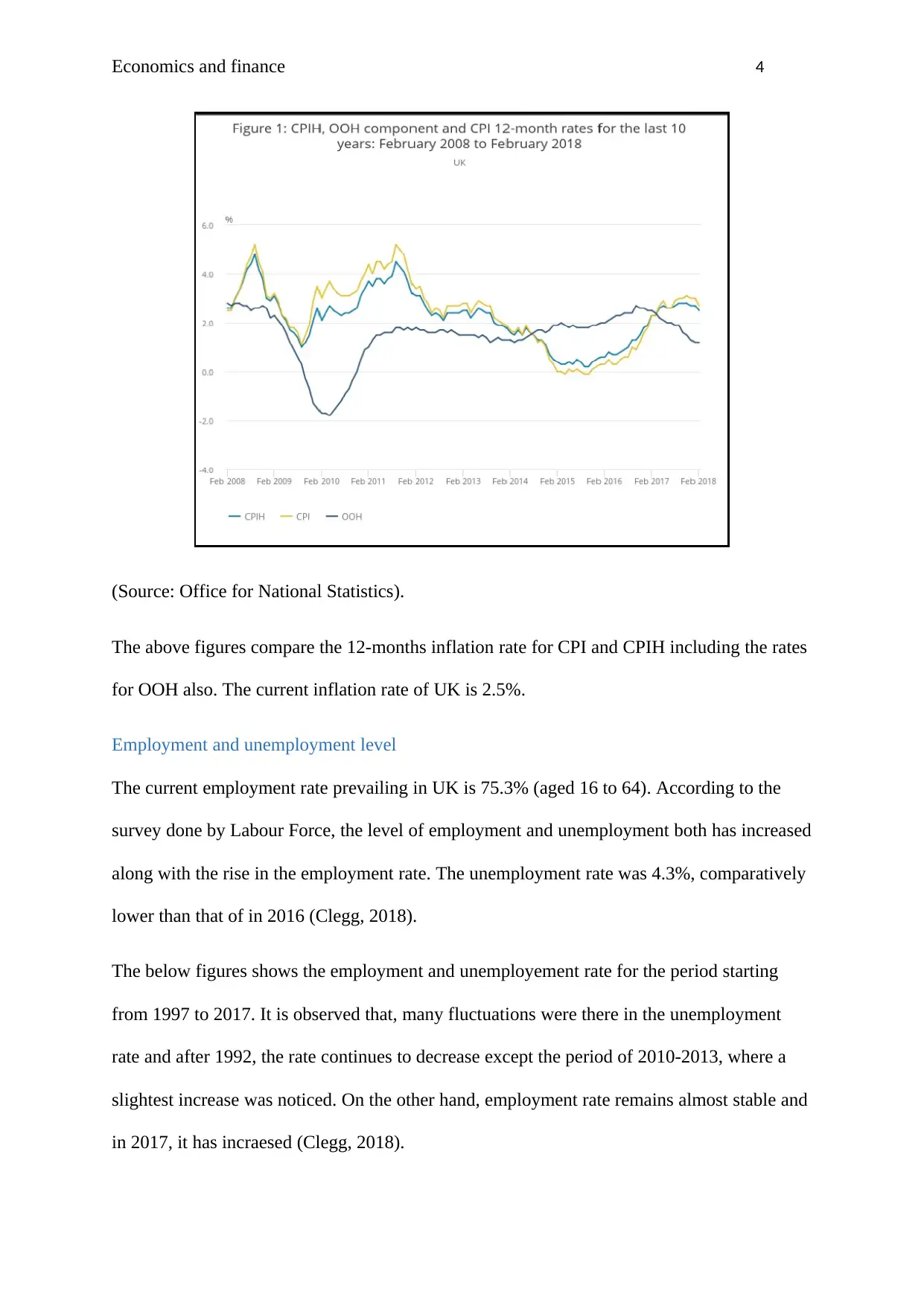

(Source: Office for National Statistics).

The above figures compare the 12-months inflation rate for CPI and CPIH including the rates

for OOH also. The current inflation rate of UK is 2.5%.

Employment and unemployment level

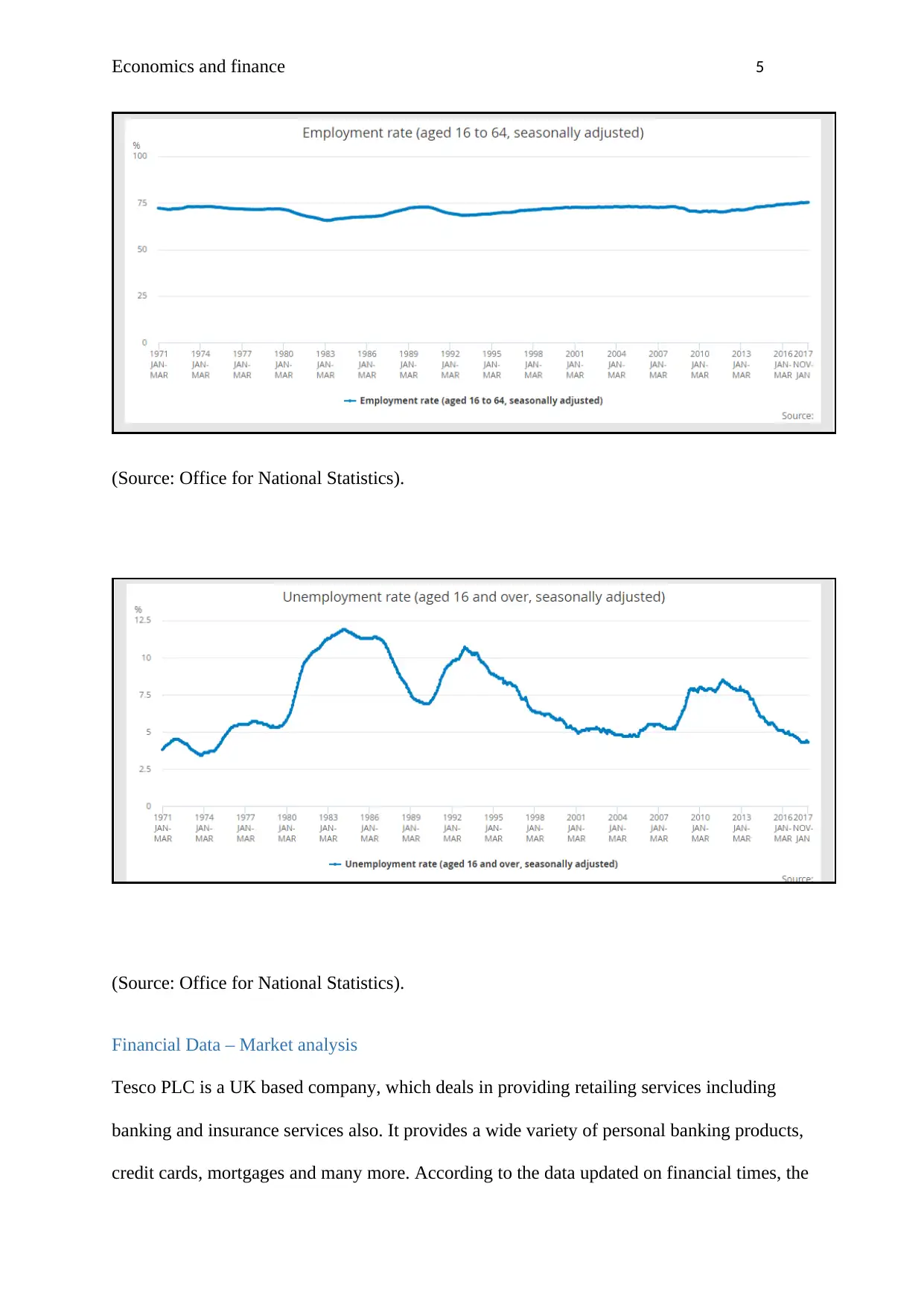

The current employment rate prevailing in UK is 75.3% (aged 16 to 64). According to the

survey done by Labour Force, the level of employment and unemployment both has increased

along with the rise in the employment rate. The unemployment rate was 4.3%, comparatively

lower than that of in 2016 (Clegg, 2018).

The below figures shows the employment and unemployement rate for the period starting

from 1997 to 2017. It is observed that, many fluctuations were there in the unemployment

rate and after 1992, the rate continues to decrease except the period of 2010-2013, where a

slightest increase was noticed. On the other hand, employment rate remains almost stable and

in 2017, it has incraesed (Clegg, 2018).

(Source: Office for National Statistics).

The above figures compare the 12-months inflation rate for CPI and CPIH including the rates

for OOH also. The current inflation rate of UK is 2.5%.

Employment and unemployment level

The current employment rate prevailing in UK is 75.3% (aged 16 to 64). According to the

survey done by Labour Force, the level of employment and unemployment both has increased

along with the rise in the employment rate. The unemployment rate was 4.3%, comparatively

lower than that of in 2016 (Clegg, 2018).

The below figures shows the employment and unemployement rate for the period starting

from 1997 to 2017. It is observed that, many fluctuations were there in the unemployment

rate and after 1992, the rate continues to decrease except the period of 2010-2013, where a

slightest increase was noticed. On the other hand, employment rate remains almost stable and

in 2017, it has incraesed (Clegg, 2018).

Economics and finance 5

(Source: Office for National Statistics).

(Source: Office for National Statistics).

Financial Data – Market analysis

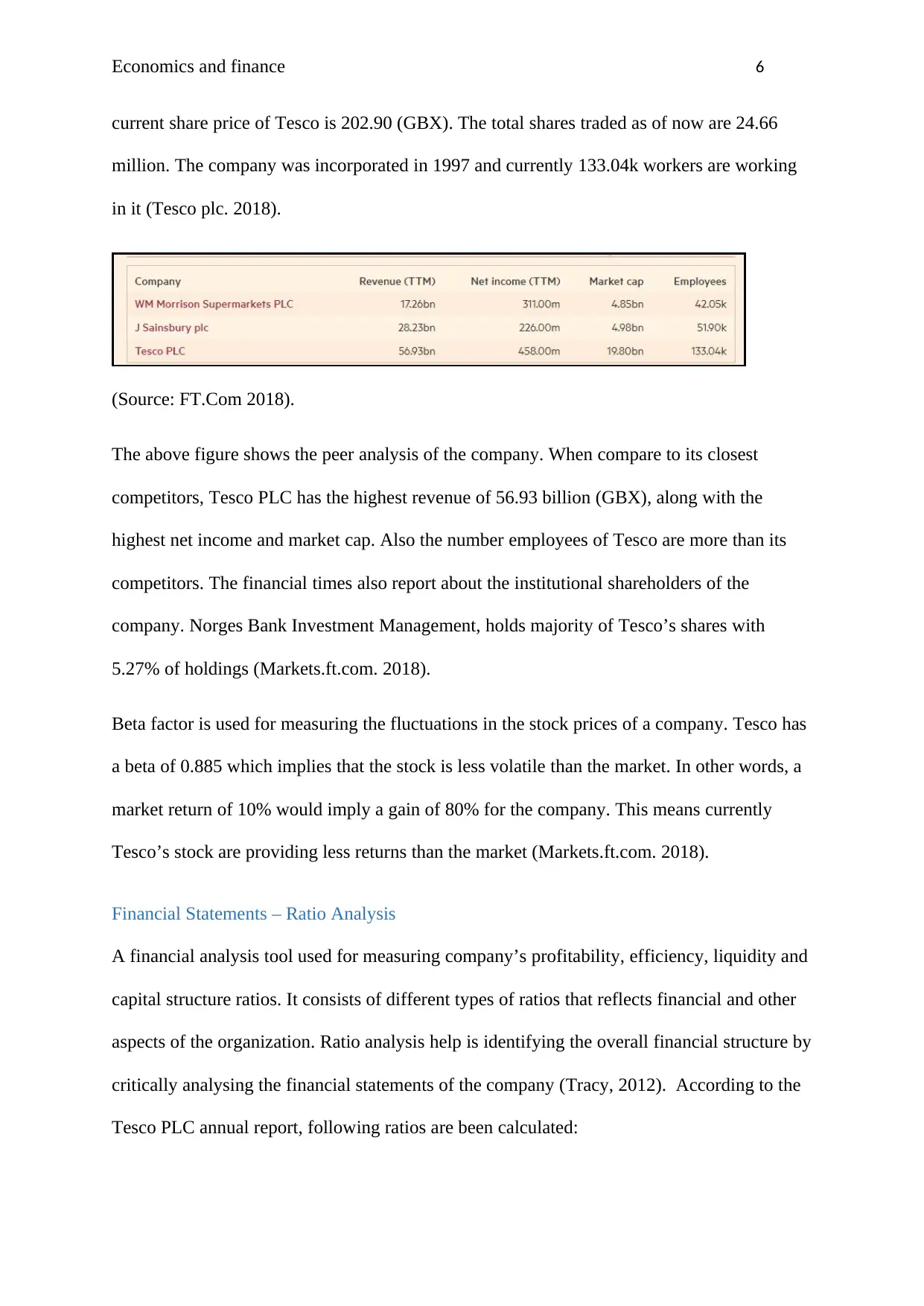

Tesco PLC is a UK based company, which deals in providing retailing services including

banking and insurance services also. It provides a wide variety of personal banking products,

credit cards, mortgages and many more. According to the data updated on financial times, the

(Source: Office for National Statistics).

(Source: Office for National Statistics).

Financial Data – Market analysis

Tesco PLC is a UK based company, which deals in providing retailing services including

banking and insurance services also. It provides a wide variety of personal banking products,

credit cards, mortgages and many more. According to the data updated on financial times, the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Economics and finance 6

current share price of Tesco is 202.90 (GBX). The total shares traded as of now are 24.66

million. The company was incorporated in 1997 and currently 133.04k workers are working

in it (Tesco plc. 2018).

(Source: FT.Com 2018).

The above figure shows the peer analysis of the company. When compare to its closest

competitors, Tesco PLC has the highest revenue of 56.93 billion (GBX), along with the

highest net income and market cap. Also the number employees of Tesco are more than its

competitors. The financial times also report about the institutional shareholders of the

company. Norges Bank Investment Management, holds majority of Tesco’s shares with

5.27% of holdings (Markets.ft.com. 2018).

Beta factor is used for measuring the fluctuations in the stock prices of a company. Tesco has

a beta of 0.885 which implies that the stock is less volatile than the market. In other words, a

market return of 10% would imply a gain of 80% for the company. This means currently

Tesco’s stock are providing less returns than the market (Markets.ft.com. 2018).

Financial Statements – Ratio Analysis

A financial analysis tool used for measuring company’s profitability, efficiency, liquidity and

capital structure ratios. It consists of different types of ratios that reflects financial and other

aspects of the organization. Ratio analysis help is identifying the overall financial structure by

critically analysing the financial statements of the company (Tracy, 2012). According to the

Tesco PLC annual report, following ratios are been calculated:

current share price of Tesco is 202.90 (GBX). The total shares traded as of now are 24.66

million. The company was incorporated in 1997 and currently 133.04k workers are working

in it (Tesco plc. 2018).

(Source: FT.Com 2018).

The above figure shows the peer analysis of the company. When compare to its closest

competitors, Tesco PLC has the highest revenue of 56.93 billion (GBX), along with the

highest net income and market cap. Also the number employees of Tesco are more than its

competitors. The financial times also report about the institutional shareholders of the

company. Norges Bank Investment Management, holds majority of Tesco’s shares with

5.27% of holdings (Markets.ft.com. 2018).

Beta factor is used for measuring the fluctuations in the stock prices of a company. Tesco has

a beta of 0.885 which implies that the stock is less volatile than the market. In other words, a

market return of 10% would imply a gain of 80% for the company. This means currently

Tesco’s stock are providing less returns than the market (Markets.ft.com. 2018).

Financial Statements – Ratio Analysis

A financial analysis tool used for measuring company’s profitability, efficiency, liquidity and

capital structure ratios. It consists of different types of ratios that reflects financial and other

aspects of the organization. Ratio analysis help is identifying the overall financial structure by

critically analysing the financial statements of the company (Tracy, 2012). According to the

Tesco PLC annual report, following ratios are been calculated:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Economics and finance 7

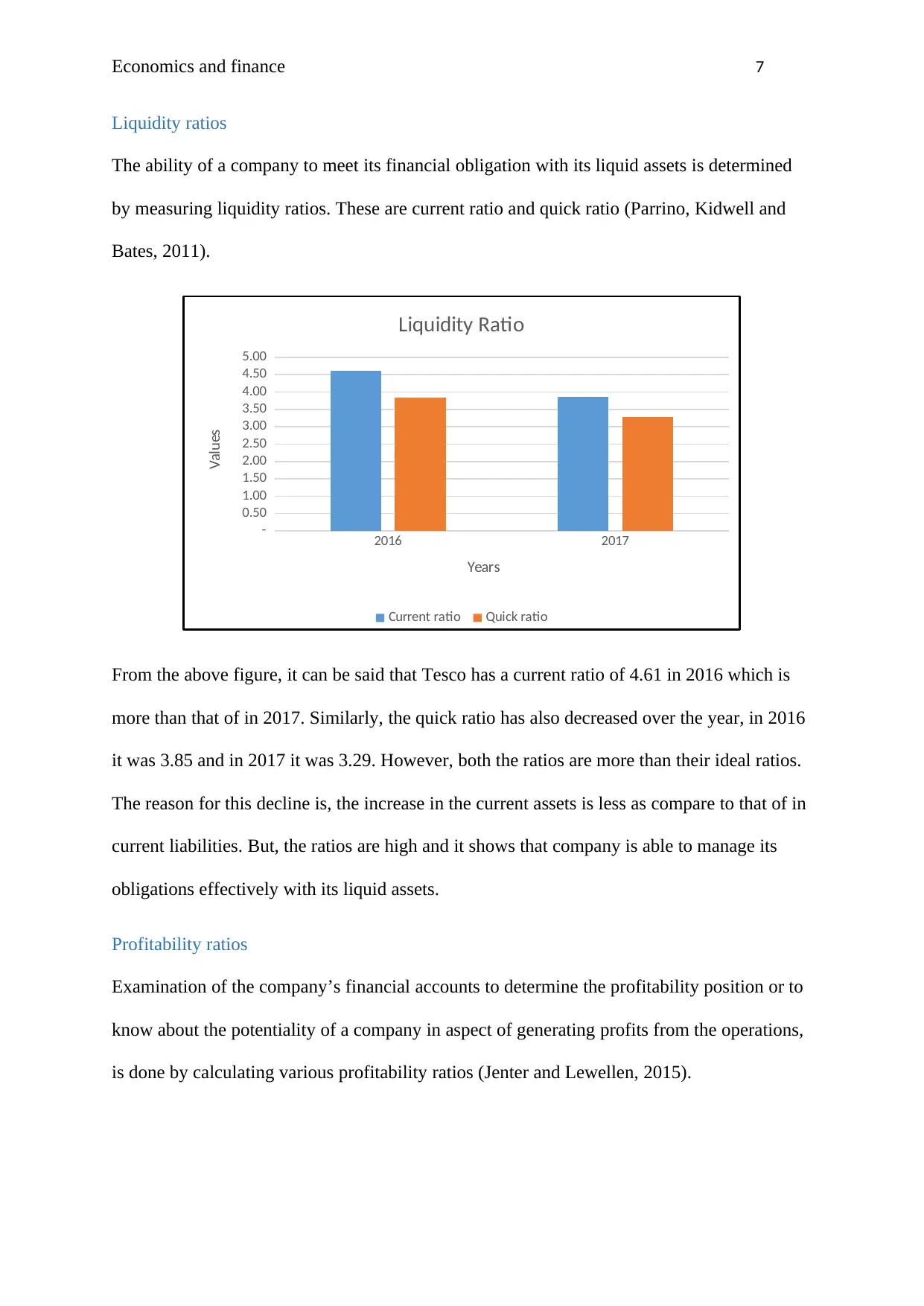

Liquidity ratios

The ability of a company to meet its financial obligation with its liquid assets is determined

by measuring liquidity ratios. These are current ratio and quick ratio (Parrino, Kidwell and

Bates, 2011).

2016 2017

-

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

Liquidity Ratio

Current ratio Quick ratio

Years

Values

From the above figure, it can be said that Tesco has a current ratio of 4.61 in 2016 which is

more than that of in 2017. Similarly, the quick ratio has also decreased over the year, in 2016

it was 3.85 and in 2017 it was 3.29. However, both the ratios are more than their ideal ratios.

The reason for this decline is, the increase in the current assets is less as compare to that of in

current liabilities. But, the ratios are high and it shows that company is able to manage its

obligations effectively with its liquid assets.

Profitability ratios

Examination of the company’s financial accounts to determine the profitability position or to

know about the potentiality of a company in aspect of generating profits from the operations,

is done by calculating various profitability ratios (Jenter and Lewellen, 2015).

Liquidity ratios

The ability of a company to meet its financial obligation with its liquid assets is determined

by measuring liquidity ratios. These are current ratio and quick ratio (Parrino, Kidwell and

Bates, 2011).

2016 2017

-

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

Liquidity Ratio

Current ratio Quick ratio

Years

Values

From the above figure, it can be said that Tesco has a current ratio of 4.61 in 2016 which is

more than that of in 2017. Similarly, the quick ratio has also decreased over the year, in 2016

it was 3.85 and in 2017 it was 3.29. However, both the ratios are more than their ideal ratios.

The reason for this decline is, the increase in the current assets is less as compare to that of in

current liabilities. But, the ratios are high and it shows that company is able to manage its

obligations effectively with its liquid assets.

Profitability ratios

Examination of the company’s financial accounts to determine the profitability position or to

know about the potentiality of a company in aspect of generating profits from the operations,

is done by calculating various profitability ratios (Jenter and Lewellen, 2015).

Economics and finance 8

2016 2017

-2.00%

-1.00%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

Profitability ratio

Operating Profit Margin Net Profit Margin Return on Equity

Return on Total assets Gross Profit Ratio

Years

%

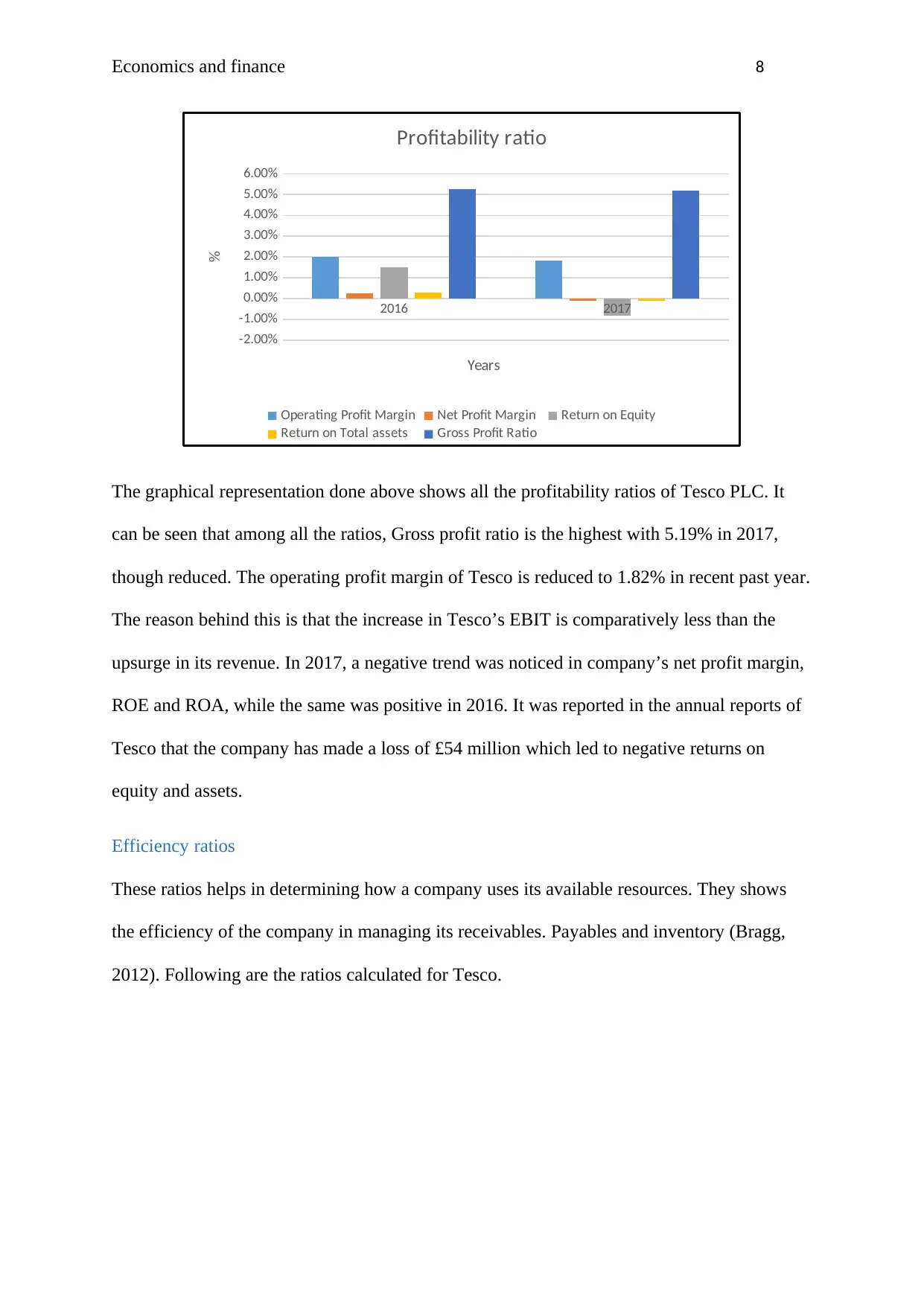

The graphical representation done above shows all the profitability ratios of Tesco PLC. It

can be seen that among all the ratios, Gross profit ratio is the highest with 5.19% in 2017,

though reduced. The operating profit margin of Tesco is reduced to 1.82% in recent past year.

The reason behind this is that the increase in Tesco’s EBIT is comparatively less than the

upsurge in its revenue. In 2017, a negative trend was noticed in company’s net profit margin,

ROE and ROA, while the same was positive in 2016. It was reported in the annual reports of

Tesco that the company has made a loss of £54 million which led to negative returns on

equity and assets.

Efficiency ratios

These ratios helps in determining how a company uses its available resources. They shows

the efficiency of the company in managing its receivables. Payables and inventory (Bragg,

2012). Following are the ratios calculated for Tesco.

2016 2017

-2.00%

-1.00%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

Profitability ratio

Operating Profit Margin Net Profit Margin Return on Equity

Return on Total assets Gross Profit Ratio

Years

%

The graphical representation done above shows all the profitability ratios of Tesco PLC. It

can be seen that among all the ratios, Gross profit ratio is the highest with 5.19% in 2017,

though reduced. The operating profit margin of Tesco is reduced to 1.82% in recent past year.

The reason behind this is that the increase in Tesco’s EBIT is comparatively less than the

upsurge in its revenue. In 2017, a negative trend was noticed in company’s net profit margin,

ROE and ROA, while the same was positive in 2016. It was reported in the annual reports of

Tesco that the company has made a loss of £54 million which led to negative returns on

equity and assets.

Efficiency ratios

These ratios helps in determining how a company uses its available resources. They shows

the efficiency of the company in managing its receivables. Payables and inventory (Bragg,

2012). Following are the ratios calculated for Tesco.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Economics and finance 9

2017

-

5.00

10.00

15.00

20.00

25.00

30.00

35.00

40.00

45.00

Efficiency ratios

Receivable tunover ratio Creditor turnover ratio

Inventory turnover ratio Assets turnover ratio

Years

Values

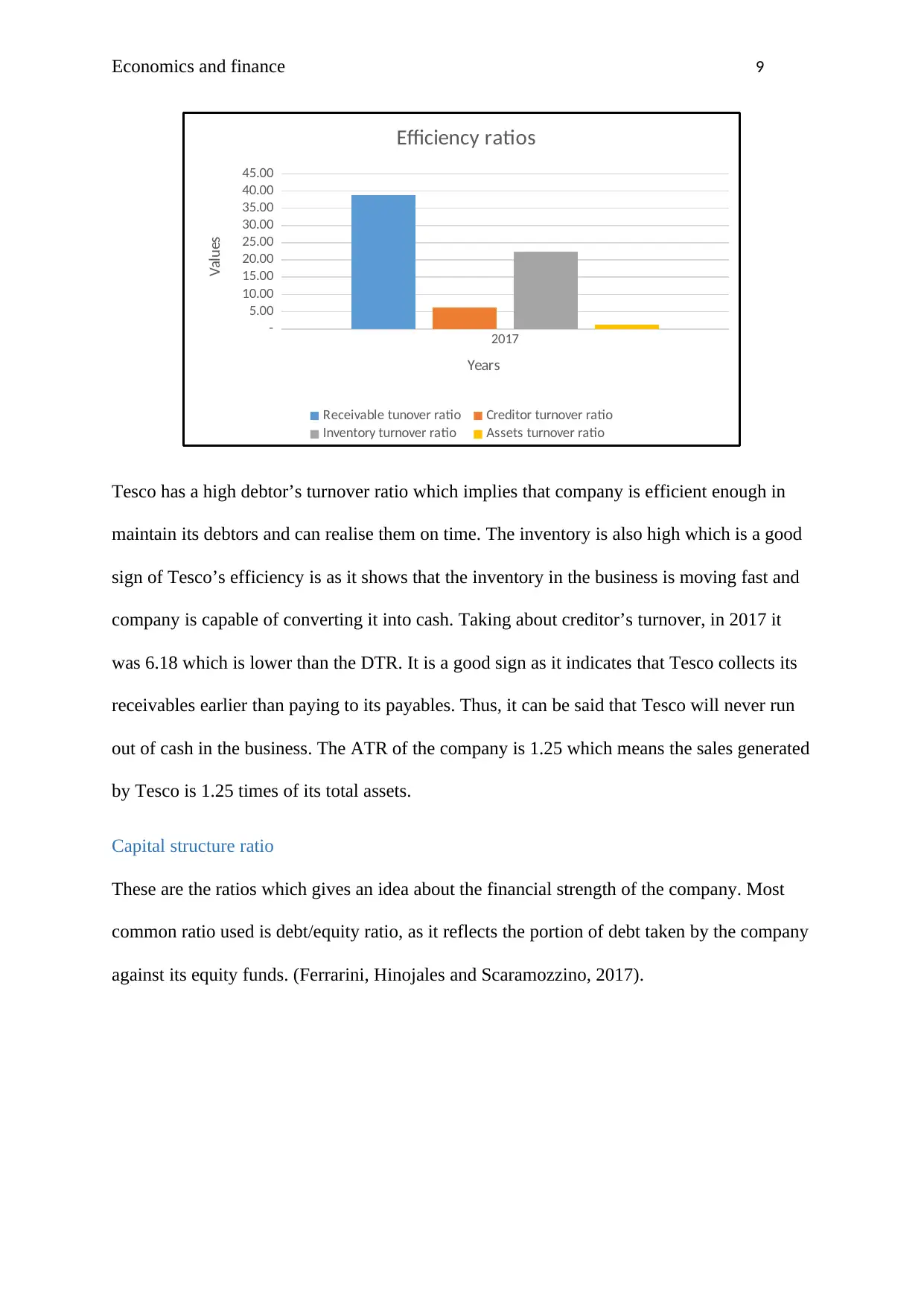

Tesco has a high debtor’s turnover ratio which implies that company is efficient enough in

maintain its debtors and can realise them on time. The inventory is also high which is a good

sign of Tesco’s efficiency is as it shows that the inventory in the business is moving fast and

company is capable of converting it into cash. Taking about creditor’s turnover, in 2017 it

was 6.18 which is lower than the DTR. It is a good sign as it indicates that Tesco collects its

receivables earlier than paying to its payables. Thus, it can be said that Tesco will never run

out of cash in the business. The ATR of the company is 1.25 which means the sales generated

by Tesco is 1.25 times of its total assets.

Capital structure ratio

These are the ratios which gives an idea about the financial strength of the company. Most

common ratio used is debt/equity ratio, as it reflects the portion of debt taken by the company

against its equity funds. (Ferrarini, Hinojales and Scaramozzino, 2017).

2017

-

5.00

10.00

15.00

20.00

25.00

30.00

35.00

40.00

45.00

Efficiency ratios

Receivable tunover ratio Creditor turnover ratio

Inventory turnover ratio Assets turnover ratio

Years

Values

Tesco has a high debtor’s turnover ratio which implies that company is efficient enough in

maintain its debtors and can realise them on time. The inventory is also high which is a good

sign of Tesco’s efficiency is as it shows that the inventory in the business is moving fast and

company is capable of converting it into cash. Taking about creditor’s turnover, in 2017 it

was 6.18 which is lower than the DTR. It is a good sign as it indicates that Tesco collects its

receivables earlier than paying to its payables. Thus, it can be said that Tesco will never run

out of cash in the business. The ATR of the company is 1.25 which means the sales generated

by Tesco is 1.25 times of its total assets.

Capital structure ratio

These are the ratios which gives an idea about the financial strength of the company. Most

common ratio used is debt/equity ratio, as it reflects the portion of debt taken by the company

against its equity funds. (Ferrarini, Hinojales and Scaramozzino, 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Economics and finance 10

2016 2017

-

0.20

0.40

0.60

0.80

1.00

1.20

1.40

Capital structure ratio

Debt- equity Intrest coverage ratio

Years

Values

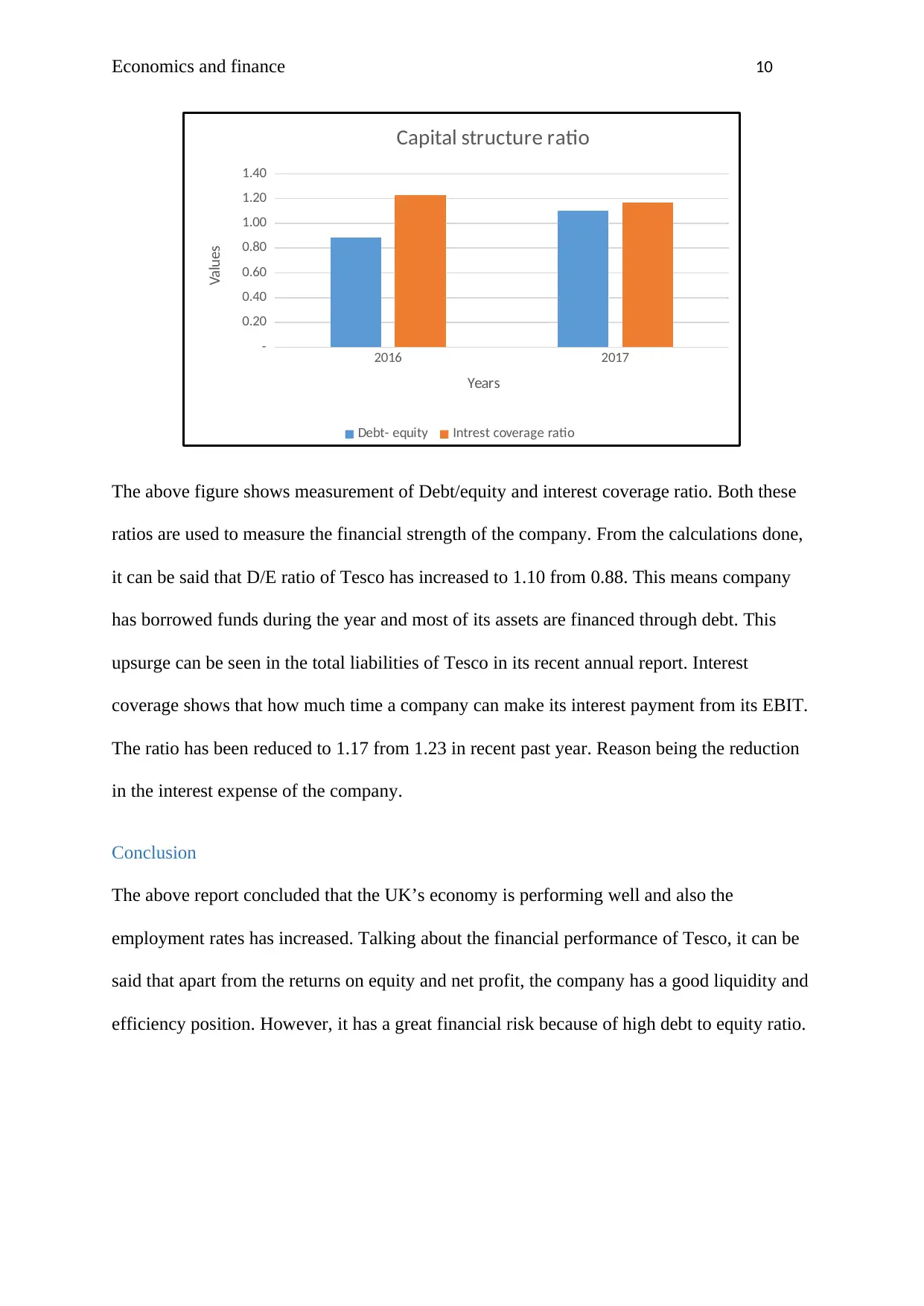

The above figure shows measurement of Debt/equity and interest coverage ratio. Both these

ratios are used to measure the financial strength of the company. From the calculations done,

it can be said that D/E ratio of Tesco has increased to 1.10 from 0.88. This means company

has borrowed funds during the year and most of its assets are financed through debt. This

upsurge can be seen in the total liabilities of Tesco in its recent annual report. Interest

coverage shows that how much time a company can make its interest payment from its EBIT.

The ratio has been reduced to 1.17 from 1.23 in recent past year. Reason being the reduction

in the interest expense of the company.

Conclusion

The above report concluded that the UK’s economy is performing well and also the

employment rates has increased. Talking about the financial performance of Tesco, it can be

said that apart from the returns on equity and net profit, the company has a good liquidity and

efficiency position. However, it has a great financial risk because of high debt to equity ratio.

2016 2017

-

0.20

0.40

0.60

0.80

1.00

1.20

1.40

Capital structure ratio

Debt- equity Intrest coverage ratio

Years

Values

The above figure shows measurement of Debt/equity and interest coverage ratio. Both these

ratios are used to measure the financial strength of the company. From the calculations done,

it can be said that D/E ratio of Tesco has increased to 1.10 from 0.88. This means company

has borrowed funds during the year and most of its assets are financed through debt. This

upsurge can be seen in the total liabilities of Tesco in its recent annual report. Interest

coverage shows that how much time a company can make its interest payment from its EBIT.

The ratio has been reduced to 1.17 from 1.23 in recent past year. Reason being the reduction

in the interest expense of the company.

Conclusion

The above report concluded that the UK’s economy is performing well and also the

employment rates has increased. Talking about the financial performance of Tesco, it can be

said that apart from the returns on equity and net profit, the company has a good liquidity and

efficiency position. However, it has a great financial risk because of high debt to equity ratio.

Economics and finance 11

References

Bragg, S. M. (2012). Business ratios and formulas: a comprehensive guide (Vol. 577). 3rd ed.

New Jersey: John Wiley & Sons.

Clegg, R. (2018). UK labour market - Office for National Statistics. [Online] Ons.gov.uk.

Available at:

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemploye

etypes/bulletins/uklabourmarket/march2018 [Accessed 25 March 2018].

Clegg, R. (2018). UK labour market - Office for National Statistics. [Online] Ons.gov.uk.

Available at:

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemploye

etypes/bulletins/uklabourmarket/march2018 [Accessed 25 March 2018].

Ferrarini, B., Hinojales, M. and Scaramozzino, P. (2017). Leverage and Capital Structure

Determinants of Chinese Listed Companies.

Gooding, P. (2018). Consumer price inflation, UK - Office for National Statistics. [Online]

Ons.gov.uk. Available at:

https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/

february2018 [Accessed 25 March 2018].

Higgins, R. C. (2012). Analysis for financial management. McGraw-Hill/Irwin.

Jenter, D., and Lewellen, K. (2015). CEO preferences and acquisitions. The Journal of

Finance, 70(6), 2813-2852.

Markets.ft.com. (2018). Tesco PLC, TSCO: LSE profile. [Online] Available at:

https://markets.ft.com/data/equities/tearsheet/profile?s=TSCO:LSE [Accessed 25 Mar. 2018].

References

Bragg, S. M. (2012). Business ratios and formulas: a comprehensive guide (Vol. 577). 3rd ed.

New Jersey: John Wiley & Sons.

Clegg, R. (2018). UK labour market - Office for National Statistics. [Online] Ons.gov.uk.

Available at:

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemploye

etypes/bulletins/uklabourmarket/march2018 [Accessed 25 March 2018].

Clegg, R. (2018). UK labour market - Office for National Statistics. [Online] Ons.gov.uk.

Available at:

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemploye

etypes/bulletins/uklabourmarket/march2018 [Accessed 25 March 2018].

Ferrarini, B., Hinojales, M. and Scaramozzino, P. (2017). Leverage and Capital Structure

Determinants of Chinese Listed Companies.

Gooding, P. (2018). Consumer price inflation, UK - Office for National Statistics. [Online]

Ons.gov.uk. Available at:

https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/

february2018 [Accessed 25 March 2018].

Higgins, R. C. (2012). Analysis for financial management. McGraw-Hill/Irwin.

Jenter, D., and Lewellen, K. (2015). CEO preferences and acquisitions. The Journal of

Finance, 70(6), 2813-2852.

Markets.ft.com. (2018). Tesco PLC, TSCO: LSE profile. [Online] Available at:

https://markets.ft.com/data/equities/tearsheet/profile?s=TSCO:LSE [Accessed 25 Mar. 2018].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.