Detailed Analysis of Rio Tinto Mining Company in the Economics Context

VerifiedAdded on 2023/03/17

|12

|3673

|100

Report

AI Summary

This report provides an economic analysis of Rio Tinto, an Australian and United Kingdom registered exploration and mining company. The report examines the company's industry background, market structure (oligopoly), and the factors influencing the demand and supply of its products, particularly iron ore. It discusses the impact of product price and expectations on demand, as well as production costs on supply. The report also explores the concept of elasticity related to Rio Tinto's products and considers the impacts of external events, such as Cyclone Veronica, on the industry. The analysis includes key market leaders, like BHP Billiton and South 32, and illustrates the company's vision, revenue, and employment structure. The report concludes with a summary of the company's strategic position and its response to market dynamics. The report uses figures and diagrams to support its analysis.

ECONOMICS1

Economics for business

By (Name)

Course

Instructor’s Name

Institutional Affiliation

The City and State

The Date

Economics for business

By (Name)

Course

Instructor’s Name

Institutional Affiliation

The City and State

The Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS2

Executive summary

This paper presents an analysis of Rio Tinto mining company in terms of its strategy in

the next five years. The paper illustrates that Rio Tinto is an Australian and United

Kingdom registered exploration and mining company. Australia, “Rio Tinto” is

considered to be among the fast developing mining companies. The company’s main

products include salt, iron ore, gypsum, uranium copper, and coal. Also, the paper

indicates that Rio Tinto operates in an oligopoly market structure which involved very

few companies. Further, the paper illustrates that Rio Tinto has an “inelastic demand for

its iron ore.” This is as a result of less sensitivity of the products demand to price

changes. Also, the paper indicates how the company has created an impact on the

“rampage of Cyclone Veronica” across the coast of Pilbara.

Executive summary

This paper presents an analysis of Rio Tinto mining company in terms of its strategy in

the next five years. The paper illustrates that Rio Tinto is an Australian and United

Kingdom registered exploration and mining company. Australia, “Rio Tinto” is

considered to be among the fast developing mining companies. The company’s main

products include salt, iron ore, gypsum, uranium copper, and coal. Also, the paper

indicates that Rio Tinto operates in an oligopoly market structure which involved very

few companies. Further, the paper illustrates that Rio Tinto has an “inelastic demand for

its iron ore.” This is as a result of less sensitivity of the products demand to price

changes. Also, the paper indicates how the company has created an impact on the

“rampage of Cyclone Veronica” across the coast of Pilbara.

ECONOMICS3

Contents

Executive summary................................................................................................................................2

Introduction..............................................................................................................................................4

Industry background.............................................................................................................................4

Market structure......................................................................................................................................4

Factors that influence the demand for the company's product (s)............................................6

Factors that influence the supply for the company's product (s)...............................................7

Elasticity...................................................................................................................................................9

Impacts of an event on the industry/company..............................................................................10

Conclusion.............................................................................................................................................10

References.............................................................................................................................................11

Contents

Executive summary................................................................................................................................2

Introduction..............................................................................................................................................4

Industry background.............................................................................................................................4

Market structure......................................................................................................................................4

Factors that influence the demand for the company's product (s)............................................6

Factors that influence the supply for the company's product (s)...............................................7

Elasticity...................................................................................................................................................9

Impacts of an event on the industry/company..............................................................................10

Conclusion.............................................................................................................................................10

References.............................................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS4

Introduction

The purpose of this paper is to make a world market report about Rio Tinto

mining company. In this case, we shall look at a detailed background of the company

such as its major aims, objectives, products, revenue, employees and many others. In

addition, the paper will describe the market structure of the company by illustrating its

leaders, their statistics and many others. In addition, the report will also consider the

demand side of the company in terms of demand elasticity for the products. Also, a brief

description of the event that has created a substantial impact on the industry will also be

explained in the people. In brief, the report covers a detailed structure of the company

(Rio Tinto) in terms of its revenue, contribution to the GDP of the company, employment

structure, and many others (Calibre 2014).

Industry background

Rio Tinto is an Australian and United Kingdom registered exploration and mining

company. The company is among the popular “mining companies “in the region. The

main products of Rio Tinto include salt, iron ore, gypsum, uranium copper, and coal. In

addition, the company processes some materials that is to say; bauxite into aluminum

and alumina, and "ore into iron". The by-products of the company include lead, silver,

and gold. The company was formed way back in 1873 by a syndicate of Matheson,

Deutsche, and Punchard, Clark, and company (Lilleyman 2013). Rio Tinto's executive

officers are located in Melbourne. The company is also made up of partly or wholly

subsidies, associated companies, and joint ventures. The major activities performed by

the company include processing, mining and finding mineral resources across the

world. The company covers over forty countries in 6 continents. By 2018 the company

had a revenue structure of US$ 56.036 billion. In addition, the company has over thirty-

five thousand employees across the world (Walsh 2009). The vision of the company is

to become a leading metal and mining company. As a way of achieving its vision, the

company aims at maximizing the returns of shareholders by sustainably developing,

processing and finding natural resources across the world. Also, the company has a

competent financial resource made up of innovation potential that leads to the

development influence the development of the responsive design to pursue the

company's strategy. As a result of an increase in the prices of commodities, market

demands and decreasing productivity of the workforce the company needs to make a

step into innovation. As a mining company, Rio Tinto's 44% sales are obtained from

exploration and extraction of "iron ore." The company has a large "market capitalization"

of US $27 billion making it the 2nd largest mining company in Australia (Fantinel, &

Rusu 2013).

Market structure

Rio Tinto operates in an oligopoly market structure whereby the industry or

market is only dominated by very few large sellers. The mining sector of Australia is an

oligopolistic market as a result of collusion that results in reduced competition. In this

case, Rio Tinto operates in an oligopoly market structure because there are few sellers

whereby the demand for products is high and production is low. In addition, the

decisions made by the Rio Tinto company highly influenced by other firms (Lilleyman

Introduction

The purpose of this paper is to make a world market report about Rio Tinto

mining company. In this case, we shall look at a detailed background of the company

such as its major aims, objectives, products, revenue, employees and many others. In

addition, the paper will describe the market structure of the company by illustrating its

leaders, their statistics and many others. In addition, the report will also consider the

demand side of the company in terms of demand elasticity for the products. Also, a brief

description of the event that has created a substantial impact on the industry will also be

explained in the people. In brief, the report covers a detailed structure of the company

(Rio Tinto) in terms of its revenue, contribution to the GDP of the company, employment

structure, and many others (Calibre 2014).

Industry background

Rio Tinto is an Australian and United Kingdom registered exploration and mining

company. The company is among the popular “mining companies “in the region. The

main products of Rio Tinto include salt, iron ore, gypsum, uranium copper, and coal. In

addition, the company processes some materials that is to say; bauxite into aluminum

and alumina, and "ore into iron". The by-products of the company include lead, silver,

and gold. The company was formed way back in 1873 by a syndicate of Matheson,

Deutsche, and Punchard, Clark, and company (Lilleyman 2013). Rio Tinto's executive

officers are located in Melbourne. The company is also made up of partly or wholly

subsidies, associated companies, and joint ventures. The major activities performed by

the company include processing, mining and finding mineral resources across the

world. The company covers over forty countries in 6 continents. By 2018 the company

had a revenue structure of US$ 56.036 billion. In addition, the company has over thirty-

five thousand employees across the world (Walsh 2009). The vision of the company is

to become a leading metal and mining company. As a way of achieving its vision, the

company aims at maximizing the returns of shareholders by sustainably developing,

processing and finding natural resources across the world. Also, the company has a

competent financial resource made up of innovation potential that leads to the

development influence the development of the responsive design to pursue the

company's strategy. As a result of an increase in the prices of commodities, market

demands and decreasing productivity of the workforce the company needs to make a

step into innovation. As a mining company, Rio Tinto's 44% sales are obtained from

exploration and extraction of "iron ore." The company has a large "market capitalization"

of US $27 billion making it the 2nd largest mining company in Australia (Fantinel, &

Rusu 2013).

Market structure

Rio Tinto operates in an oligopoly market structure whereby the industry or

market is only dominated by very few large sellers. The mining sector of Australia is an

oligopolistic market as a result of collusion that results in reduced competition. In this

case, Rio Tinto operates in an oligopoly market structure because there are few sellers

whereby the demand for products is high and production is low. In addition, the

decisions made by the Rio Tinto company highly influenced by other firms (Lilleyman

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS5

2012). Also, the company majorly deals in mining of iron ore which is very hard for any

company to take part in as a result of various entry barriers such as government

regulation. Also, Rio Tinto's strategic plans depend on the influence of market factors.

Also, the firm operates in an oligopoly market because it has very few major competitors

that is to say Bhp Billion and Vale. In addition, the commodities that the company deals

in are homogeneous meaning they have very close substitutes with the neighbors.

Compared to other “mining companies” like Bhp Billiton, the company deals in major

products such as Iron ore making it be in an oligopoly market structure. In addition, Rio

Tinto deals in limited natural resources which need only large firms. Also, the resources

dealt in by Rio Tinto are very hard for small companies to invest in making the market

oligopoly (Farrell 2013).

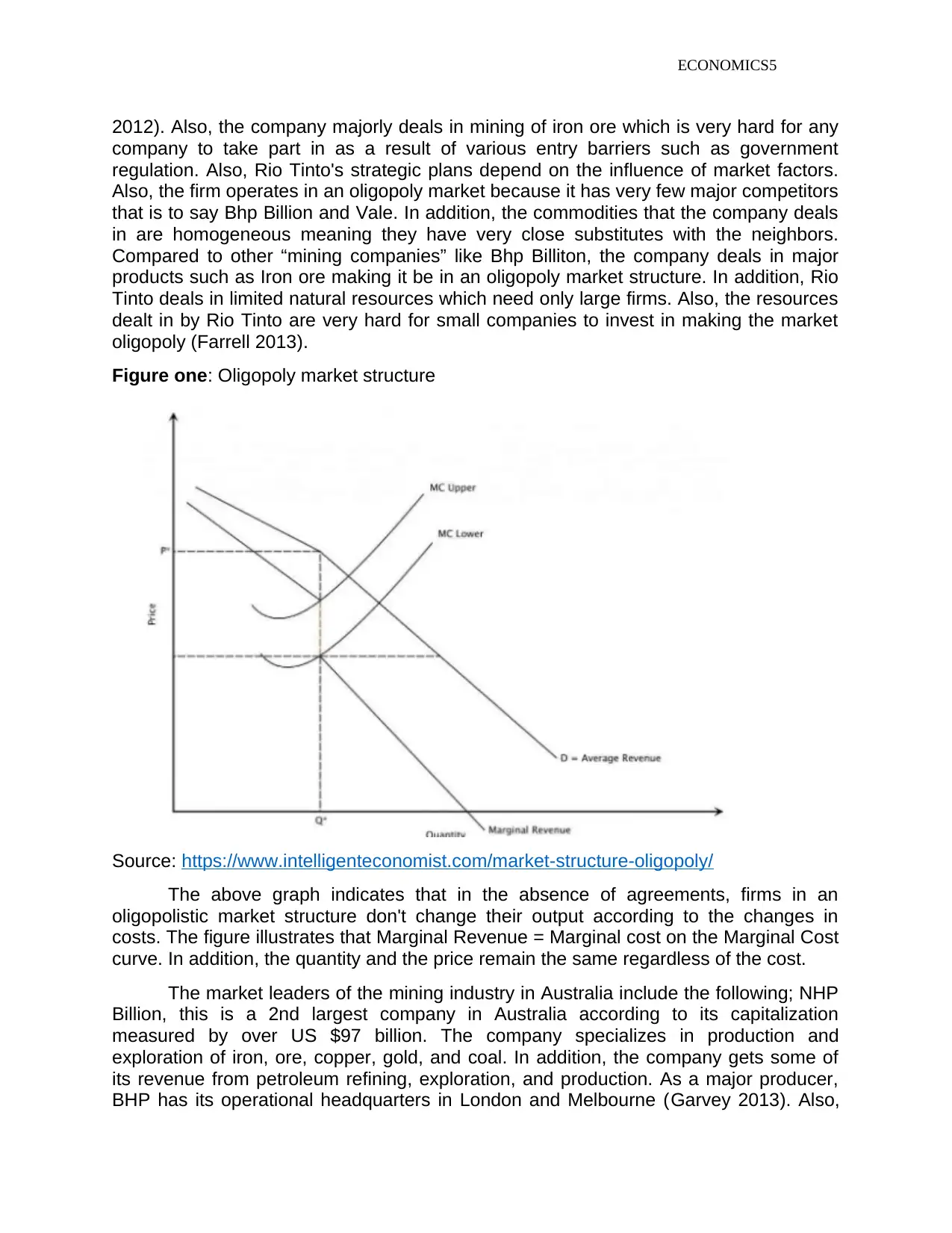

Figure one: Oligopoly market structure

Source: https://www.intelligenteconomist.com/market-structure-oligopoly/

The above graph indicates that in the absence of agreements, firms in an

oligopolistic market structure don't change their output according to the changes in

costs. The figure illustrates that Marginal Revenue = Marginal cost on the Marginal Cost

curve. In addition, the quantity and the price remain the same regardless of the cost.

The market leaders of the mining industry in Australia include the following; NHP

Billion, this is a 2nd largest company in Australia according to its capitalization

measured by over US $97 billion. The company specializes in production and

exploration of iron, ore, copper, gold, and coal. In addition, the company gets some of

its revenue from petroleum refining, exploration, and production. As a major producer,

BHP has its operational headquarters in London and Melbourne (Garvey 2013). Also,

2012). Also, the company majorly deals in mining of iron ore which is very hard for any

company to take part in as a result of various entry barriers such as government

regulation. Also, Rio Tinto's strategic plans depend on the influence of market factors.

Also, the firm operates in an oligopoly market because it has very few major competitors

that is to say Bhp Billion and Vale. In addition, the commodities that the company deals

in are homogeneous meaning they have very close substitutes with the neighbors.

Compared to other “mining companies” like Bhp Billiton, the company deals in major

products such as Iron ore making it be in an oligopoly market structure. In addition, Rio

Tinto deals in limited natural resources which need only large firms. Also, the resources

dealt in by Rio Tinto are very hard for small companies to invest in making the market

oligopoly (Farrell 2013).

Figure one: Oligopoly market structure

Source: https://www.intelligenteconomist.com/market-structure-oligopoly/

The above graph indicates that in the absence of agreements, firms in an

oligopolistic market structure don't change their output according to the changes in

costs. The figure illustrates that Marginal Revenue = Marginal cost on the Marginal Cost

curve. In addition, the quantity and the price remain the same regardless of the cost.

The market leaders of the mining industry in Australia include the following; NHP

Billion, this is a 2nd largest company in Australia according to its capitalization

measured by over US $97 billion. The company specializes in production and

exploration of iron, ore, copper, gold, and coal. In addition, the company gets some of

its revenue from petroleum refining, exploration, and production. As a major producer,

BHP has its operational headquarters in London and Melbourne (Garvey 2013). Also,

ECONOMICS6

another market leader of the mining industry is South 32, the company is the 3rd largest

miner after BHP and Rio Tinto. The company is relatively new in the market and it

emerged from BHP in 2015 with an intention of streamlining the business. Basically, the

company focuses on producing alumina, nickel, lead, nickel, and silver. The company

operates in Australia, South Africa, and South America with less strategy in China which

is not the case with other mines. However, the company has put much of its focus in

European and African countries. As an international company, Rio Tinto is among the

most dominant Australian mining companies (Grad 2010).

Factors that influence the demand for the company's product (s)

This section illustrates the factors that influence the demand for “Rio Tinto's Iron

ore” in the market. In this case, it is iron ore is considered as the most influential

company's product. The major two determinants of demand for the company’s product

are; First, product price. In this case, increased“Iron ore” pricesresults into reduced

demand for such a product as buyers are not favored by the market prices. For Rio

Tinto, increased“Iron ore” prices results into increased revenue to the company.

Currently, a rise in “Rio Tinto's iron ore” prices has resulted into a 14% increase in

revenue. Despite reducing the demand for the commodity, the higher prices generate

high income for the company. On the other hand, a decrease in the price of the

commodity leads to increased demand for “Iron Ore”(IBM 2009). In this case, if the

prices of iron ore reduce, buyers will be motivated to buy more and stock for the future.

However, a decrease in the price of the commodities will affects the company's revenue

as it receives reduced income for iron ore. Currently, the product’s price hasdeclined

resulting to trading of around "$US 87 tonne" in the market. Also, a decline in “iron

ore’s” price is considered as a major factor resulting to a decrease of 5.0 percent of the

commodity leading to a loss of $US 65.4 billion. Therefore, the product’s price is

considered as a major “determinant of demand” as it influences the customers in the

market to buy more of the commodity (Harding 2014a).

Second, expectation, if buyers of “iron ore” expect the commodity to gain value in

the future, demand increases. In this case, if buyers of the product expect future

increase in demand, they will be prompted to buy more of iron ore so as to continue

supplying their customers. Also, any sort of price increase expectations will prompt

buyers to purchase more of the product so as to stock for the future use (Lynch, &

Hamilton 2012). The buyers of iron ore aim at avoiding the burden of higher prices in

the future. For example, the recent decline of iron ore prices in Australia has led to

increased demand because buyers are willing to stock more of the commodity so as to

avoid being over exploited by the higher prices in the future. However, the expectation

of price decreases may not increase demand as buyers may expect a continuous fall in

the prices. On the other hand, if there are no expectations of price fall or increase,

buyers may not be in the position to demand more of the commodity leading to normal

demand (Harding 2014b).

another market leader of the mining industry is South 32, the company is the 3rd largest

miner after BHP and Rio Tinto. The company is relatively new in the market and it

emerged from BHP in 2015 with an intention of streamlining the business. Basically, the

company focuses on producing alumina, nickel, lead, nickel, and silver. The company

operates in Australia, South Africa, and South America with less strategy in China which

is not the case with other mines. However, the company has put much of its focus in

European and African countries. As an international company, Rio Tinto is among the

most dominant Australian mining companies (Grad 2010).

Factors that influence the demand for the company's product (s)

This section illustrates the factors that influence the demand for “Rio Tinto's Iron

ore” in the market. In this case, it is iron ore is considered as the most influential

company's product. The major two determinants of demand for the company’s product

are; First, product price. In this case, increased“Iron ore” pricesresults into reduced

demand for such a product as buyers are not favored by the market prices. For Rio

Tinto, increased“Iron ore” prices results into increased revenue to the company.

Currently, a rise in “Rio Tinto's iron ore” prices has resulted into a 14% increase in

revenue. Despite reducing the demand for the commodity, the higher prices generate

high income for the company. On the other hand, a decrease in the price of the

commodity leads to increased demand for “Iron Ore”(IBM 2009). In this case, if the

prices of iron ore reduce, buyers will be motivated to buy more and stock for the future.

However, a decrease in the price of the commodities will affects the company's revenue

as it receives reduced income for iron ore. Currently, the product’s price hasdeclined

resulting to trading of around "$US 87 tonne" in the market. Also, a decline in “iron

ore’s” price is considered as a major factor resulting to a decrease of 5.0 percent of the

commodity leading to a loss of $US 65.4 billion. Therefore, the product’s price is

considered as a major “determinant of demand” as it influences the customers in the

market to buy more of the commodity (Harding 2014a).

Second, expectation, if buyers of “iron ore” expect the commodity to gain value in

the future, demand increases. In this case, if buyers of the product expect future

increase in demand, they will be prompted to buy more of iron ore so as to continue

supplying their customers. Also, any sort of price increase expectations will prompt

buyers to purchase more of the product so as to stock for the future use (Lynch, &

Hamilton 2012). The buyers of iron ore aim at avoiding the burden of higher prices in

the future. For example, the recent decline of iron ore prices in Australia has led to

increased demand because buyers are willing to stock more of the commodity so as to

avoid being over exploited by the higher prices in the future. However, the expectation

of price decreases may not increase demand as buyers may expect a continuous fall in

the prices. On the other hand, if there are no expectations of price fall or increase,

buyers may not be in the position to demand more of the commodity leading to normal

demand (Harding 2014b).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS7

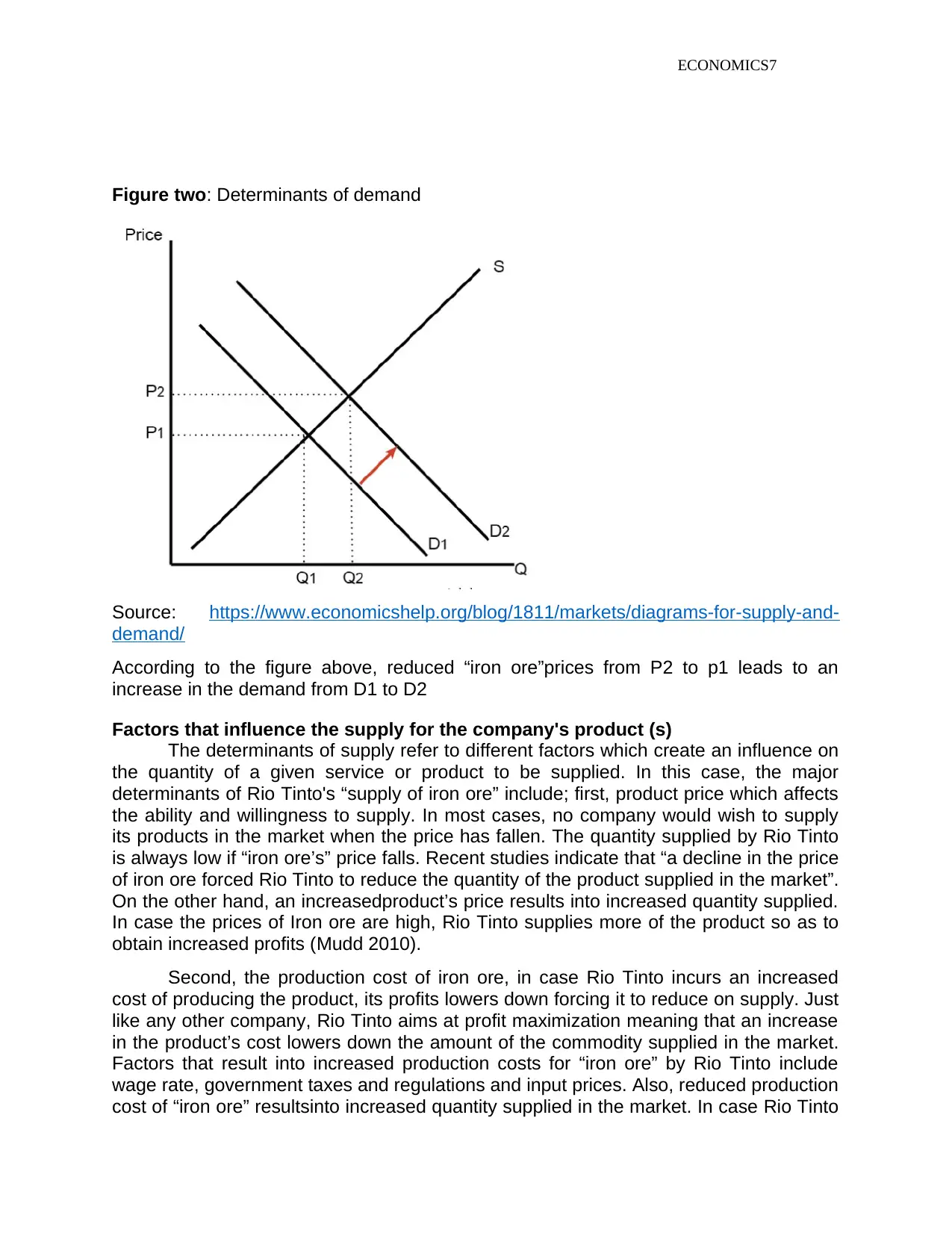

Figure two: Determinants of demand

Source: https://www.economicshelp.org/blog/1811/markets/diagrams-for-supply-and-

demand/

According to the figure above, reduced “iron ore”prices from P2 to p1 leads to an

increase in the demand from D1 to D2

Factors that influence the supply for the company's product (s)

The determinants of supply refer to different factors which create an influence on

the quantity of a given service or product to be supplied. In this case, the major

determinants of Rio Tinto's “supply of iron ore” include; first, product price which affects

the ability and willingness to supply. In most cases, no company would wish to supply

its products in the market when the price has fallen. The quantity supplied by Rio Tinto

is always low if “iron ore’s” price falls. Recent studies indicate that “a decline in the price

of iron ore forced Rio Tinto to reduce the quantity of the product supplied in the market”.

On the other hand, an increasedproduct’s price results into increased quantity supplied.

In case the prices of Iron ore are high, Rio Tinto supplies more of the product so as to

obtain increased profits (Mudd 2010).

Second, the production cost of iron ore, in case Rio Tinto incurs an increased

cost of producing the product, its profits lowers down forcing it to reduce on supply. Just

like any other company, Rio Tinto aims at profit maximization meaning that an increase

in the product’s cost lowers down the amount of the commodity supplied in the market.

Factors that result into increased production costs for “iron ore” by Rio Tinto include

wage rate, government taxes and regulations and input prices. Also, reduced production

cost of “iron ore” resultsinto increased quantity supplied in the market. In case Rio Tinto

Figure two: Determinants of demand

Source: https://www.economicshelp.org/blog/1811/markets/diagrams-for-supply-and-

demand/

According to the figure above, reduced “iron ore”prices from P2 to p1 leads to an

increase in the demand from D1 to D2

Factors that influence the supply for the company's product (s)

The determinants of supply refer to different factors which create an influence on

the quantity of a given service or product to be supplied. In this case, the major

determinants of Rio Tinto's “supply of iron ore” include; first, product price which affects

the ability and willingness to supply. In most cases, no company would wish to supply

its products in the market when the price has fallen. The quantity supplied by Rio Tinto

is always low if “iron ore’s” price falls. Recent studies indicate that “a decline in the price

of iron ore forced Rio Tinto to reduce the quantity of the product supplied in the market”.

On the other hand, an increasedproduct’s price results into increased quantity supplied.

In case the prices of Iron ore are high, Rio Tinto supplies more of the product so as to

obtain increased profits (Mudd 2010).

Second, the production cost of iron ore, in case Rio Tinto incurs an increased

cost of producing the product, its profits lowers down forcing it to reduce on supply. Just

like any other company, Rio Tinto aims at profit maximization meaning that an increase

in the product’s cost lowers down the amount of the commodity supplied in the market.

Factors that result into increased production costs for “iron ore” by Rio Tinto include

wage rate, government taxes and regulations and input prices. Also, reduced production

cost of “iron ore” resultsinto increased quantity supplied in the market. In case Rio Tinto

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS8

incurs a reduced cost of producing Iron ore, it will be in the position to produce more of

the product hence increased quantity supplied. Therefore, the production cost of iron

ore strongly influences the quantity supplied in the market (Wade 2009.).

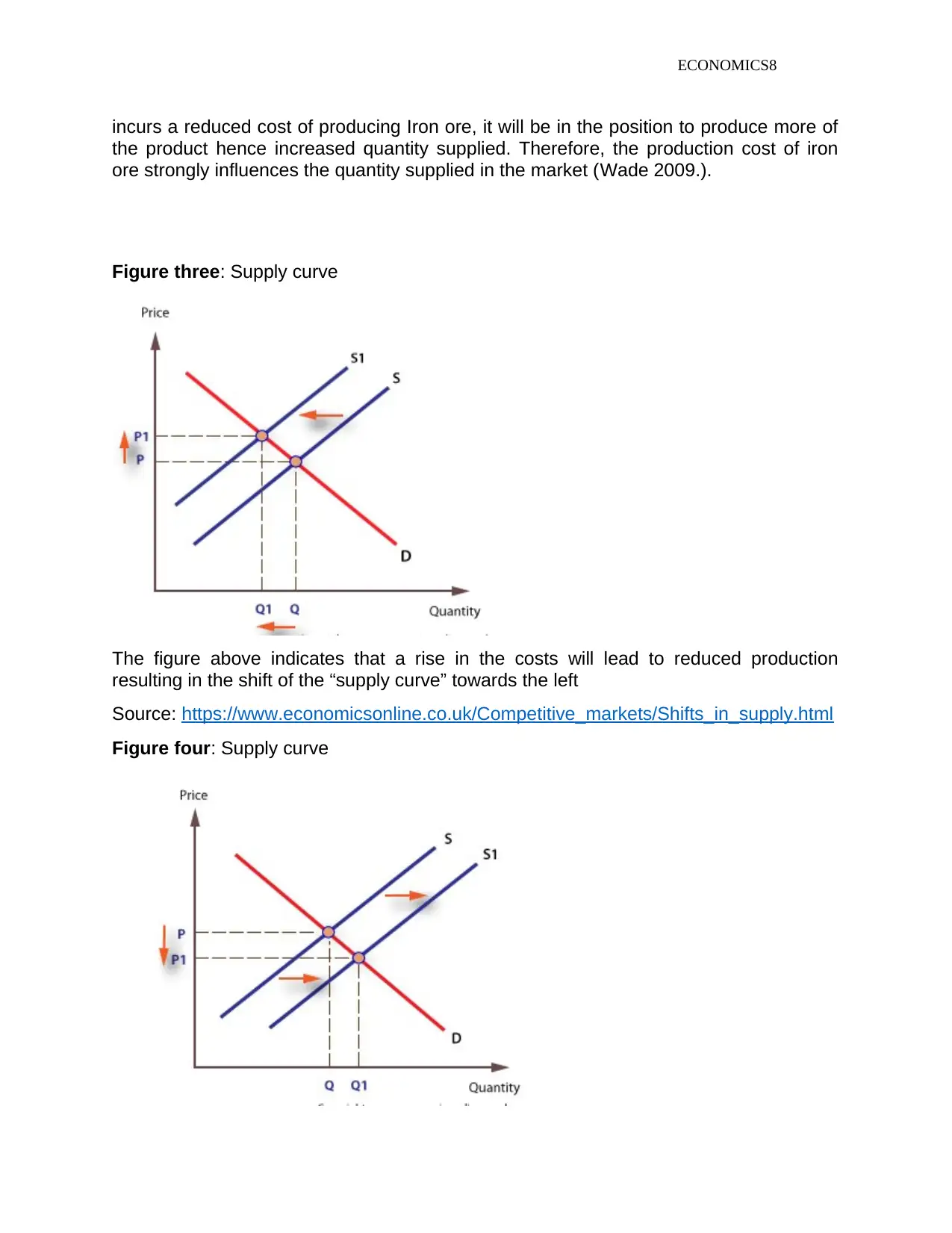

Figure three: Supply curve

The figure above indicates that a rise in the costs will lead to reduced production

resulting in the shift of the “supply curve” towards the left

Source: https://www.economicsonline.co.uk/Competitive_markets/Shifts_in_supply.html

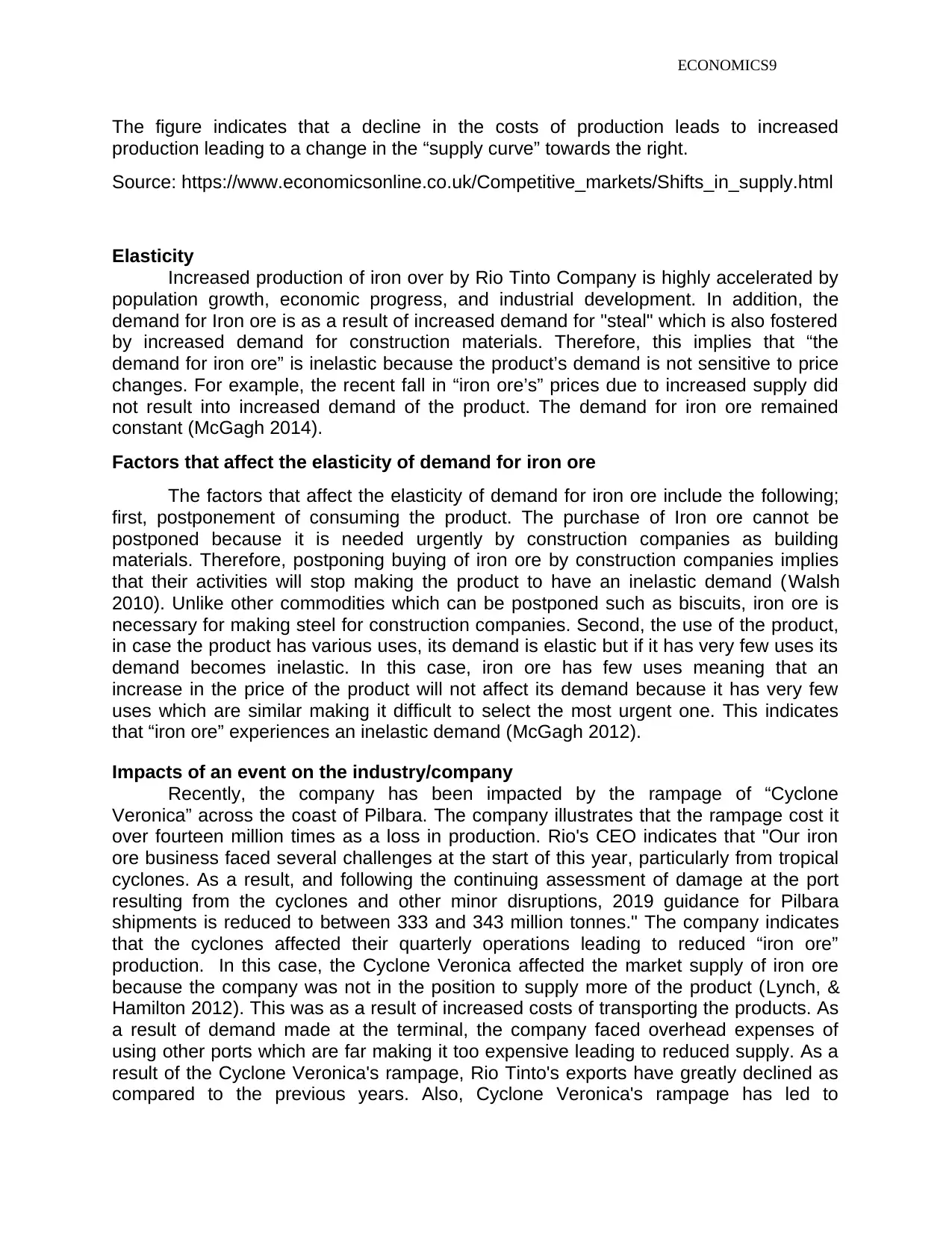

Figure four: Supply curve

incurs a reduced cost of producing Iron ore, it will be in the position to produce more of

the product hence increased quantity supplied. Therefore, the production cost of iron

ore strongly influences the quantity supplied in the market (Wade 2009.).

Figure three: Supply curve

The figure above indicates that a rise in the costs will lead to reduced production

resulting in the shift of the “supply curve” towards the left

Source: https://www.economicsonline.co.uk/Competitive_markets/Shifts_in_supply.html

Figure four: Supply curve

ECONOMICS9

The figure indicates that a decline in the costs of production leads to increased

production leading to a change in the “supply curve” towards the right.

Source: https://www.economicsonline.co.uk/Competitive_markets/Shifts_in_supply.html

Elasticity

Increased production of iron over by Rio Tinto Company is highly accelerated by

population growth, economic progress, and industrial development. In addition, the

demand for Iron ore is as a result of increased demand for "steal" which is also fostered

by increased demand for construction materials. Therefore, this implies that “the

demand for iron ore” is inelastic because the product’s demand is not sensitive to price

changes. For example, the recent fall in “iron ore’s” prices due to increased supply did

not result into increased demand of the product. The demand for iron ore remained

constant (McGagh 2014).

Factors that affect the elasticity of demand for iron ore

The factors that affect the elasticity of demand for iron ore include the following;

first, postponement of consuming the product. The purchase of Iron ore cannot be

postponed because it is needed urgently by construction companies as building

materials. Therefore, postponing buying of iron ore by construction companies implies

that their activities will stop making the product to have an inelastic demand (Walsh

2010). Unlike other commodities which can be postponed such as biscuits, iron ore is

necessary for making steel for construction companies. Second, the use of the product,

in case the product has various uses, its demand is elastic but if it has very few uses its

demand becomes inelastic. In this case, iron ore has few uses meaning that an

increase in the price of the product will not affect its demand because it has very few

uses which are similar making it difficult to select the most urgent one. This indicates

that “iron ore” experiences an inelastic demand (McGagh 2012).

Impacts of an event on the industry/company

Recently, the company has been impacted by the rampage of “Cyclone

Veronica” across the coast of Pilbara. The company illustrates that the rampage cost it

over fourteen million times as a loss in production. Rio's CEO indicates that "Our iron

ore business faced several challenges at the start of this year, particularly from tropical

cyclones. As a result, and following the continuing assessment of damage at the port

resulting from the cyclones and other minor disruptions, 2019 guidance for Pilbara

shipments is reduced to between 333 and 343 million tonnes." The company indicates

that the cyclones affected their quarterly operations leading to reduced “iron ore”

production. In this case, the Cyclone Veronica affected the market supply of iron ore

because the company was not in the position to supply more of the product (Lynch, &

Hamilton 2012). This was as a result of increased costs of transporting the products. As

a result of demand made at the terminal, the company faced overhead expenses of

using other ports which are far making it too expensive leading to reduced supply. As a

result of the Cyclone Veronica's rampage, Rio Tinto's exports have greatly declined as

compared to the previous years. Also, Cyclone Veronica's rampage has led to

The figure indicates that a decline in the costs of production leads to increased

production leading to a change in the “supply curve” towards the right.

Source: https://www.economicsonline.co.uk/Competitive_markets/Shifts_in_supply.html

Elasticity

Increased production of iron over by Rio Tinto Company is highly accelerated by

population growth, economic progress, and industrial development. In addition, the

demand for Iron ore is as a result of increased demand for "steal" which is also fostered

by increased demand for construction materials. Therefore, this implies that “the

demand for iron ore” is inelastic because the product’s demand is not sensitive to price

changes. For example, the recent fall in “iron ore’s” prices due to increased supply did

not result into increased demand of the product. The demand for iron ore remained

constant (McGagh 2014).

Factors that affect the elasticity of demand for iron ore

The factors that affect the elasticity of demand for iron ore include the following;

first, postponement of consuming the product. The purchase of Iron ore cannot be

postponed because it is needed urgently by construction companies as building

materials. Therefore, postponing buying of iron ore by construction companies implies

that their activities will stop making the product to have an inelastic demand (Walsh

2010). Unlike other commodities which can be postponed such as biscuits, iron ore is

necessary for making steel for construction companies. Second, the use of the product,

in case the product has various uses, its demand is elastic but if it has very few uses its

demand becomes inelastic. In this case, iron ore has few uses meaning that an

increase in the price of the product will not affect its demand because it has very few

uses which are similar making it difficult to select the most urgent one. This indicates

that “iron ore” experiences an inelastic demand (McGagh 2012).

Impacts of an event on the industry/company

Recently, the company has been impacted by the rampage of “Cyclone

Veronica” across the coast of Pilbara. The company illustrates that the rampage cost it

over fourteen million times as a loss in production. Rio's CEO indicates that "Our iron

ore business faced several challenges at the start of this year, particularly from tropical

cyclones. As a result, and following the continuing assessment of damage at the port

resulting from the cyclones and other minor disruptions, 2019 guidance for Pilbara

shipments is reduced to between 333 and 343 million tonnes." The company indicates

that the cyclones affected their quarterly operations leading to reduced “iron ore”

production. In this case, the Cyclone Veronica affected the market supply of iron ore

because the company was not in the position to supply more of the product (Lynch, &

Hamilton 2012). This was as a result of increased costs of transporting the products. As

a result of demand made at the terminal, the company faced overhead expenses of

using other ports which are far making it too expensive leading to reduced supply. As a

result of the Cyclone Veronica's rampage, Rio Tinto's exports have greatly declined as

compared to the previous years. Also, Cyclone Veronica's rampage has led to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ECONOMICS10

increased prices in the market as a result of reduced quantity supplied. In order to

recover the overhead production cost incurred by the Company, it decided to increase

the prices of commodities. As a result of reduced “supply of iron ore” from Brazil, the

prices of “iron ore” in the market have increased as compared to when the rampage had

to take place (Australian Mining Review 2014).

Conclusion

As a major Australian mining company, Rio Tinto has created an increased

revenue to the country. Increased gains from mining iron ore have been accelerated by

China that has increased the demand for the products. This has increased the prices of

iron ore across Australian and the world at large. As a result of being an oligopoly

market structure, Rio Tinto and other related companies have continuously enjoyed

increased profits from mining iron ore. Also, Rio Tinto has been in the position to grow

in over forty countries as a result of its strong innovation capability and financial

resource that helps it to responsively develop so as to obtain its business objectives. In

brief, the development of the company was as a result of its desire to become a

worldwide metal and mining company (The Australian Manufacturing 2014).

increased prices in the market as a result of reduced quantity supplied. In order to

recover the overhead production cost incurred by the Company, it decided to increase

the prices of commodities. As a result of reduced “supply of iron ore” from Brazil, the

prices of “iron ore” in the market have increased as compared to when the rampage had

to take place (Australian Mining Review 2014).

Conclusion

As a major Australian mining company, Rio Tinto has created an increased

revenue to the country. Increased gains from mining iron ore have been accelerated by

China that has increased the demand for the products. This has increased the prices of

iron ore across Australian and the world at large. As a result of being an oligopoly

market structure, Rio Tinto and other related companies have continuously enjoyed

increased profits from mining iron ore. Also, Rio Tinto has been in the position to grow

in over forty countries as a result of its strong innovation capability and financial

resource that helps it to responsively develop so as to obtain its business objectives. In

brief, the development of the company was as a result of its desire to become a

worldwide metal and mining company (The Australian Manufacturing 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS11

References

Australian Manufacturing. 2014. Robotic trains for Rio Tinto's Pilbara site. Australian

Manufacturing. Retrieved from http://www.australianmanufacturing.com.au/2246/roboti-

trains-for-rio-tintos-pilbarasite

Australian Mining Review. 2014. With Andrew Harding – Iron clad future. Retrieved from

http://www.miningreview.com.au/news/andrew-harding-iron-clad-future/

Caliber. 2014. Industrial Technology: AutoHaul® Project. Retrieved from

http://www.calibreglobal.com.au/our-projects/our-project/autohaul-project

Fantinel, K., & Rusu, M. 2013. Innovation: Ghost in the machine. South Australian

Mines & Energy Journal. Retrieved from

http://www.urb.net.au/attachments/File/SACOME_AugustSept_2013_Ghost_in_the_ma

chine.pdf

Farrell, J. 2013. History, challenges, and innovation: an Australian mining industry

perspective. Paper presented in the meeting of XXXII Triennial Congress of the

International Association of Lyceums Club, Perth, Australia. Retrieved from

http://www.riotinto.com/investors/presentations-91.aspx?tx=253

Garvey, P. 2013. Rio’s autonomous haul trucks quietly improving productivity in Pilbara.

The Australian Business Review. Retrieved from

http://www.theaustralian.com.au/business/in-depth/rios-autonomous-haul-trucksquietly-

improving-productivity-in-pilbara/story-fni4k1kl-1226627375954

Grad, P, S. 2010. Running with robotics. WOMP:The Mining E-Journal, 10. Retrieved

from http://www.womp-int.com/story/2010vol01/story026.htm

Harding, A. 2014a. Ironclad future. Australian Mining Review. Retrieved from

http://www.miningreview.com.au/news/andrew-harding-iron-clad-future/

Harding, A. 2014b. From mine to market: driving business value from sustainable

logistics. Paper presented in the meeting of Australia-Japan Business Co-operation

Committee. Retrieved from http://www.riotinto.com/investors/presentations91.aspx?

tx=253

IBM. 2009. Envisioning the future of mining. Retrieved from

http://www07.ibm.com/innovation/au/shapingourfuture/downloads/wp_envisioning_minin

g.pdf

Lilleyman, G. 2012. Building the business. Paper presented in the meeting of AMEC

Convention, Perth, Australia. Retrieved from

http://www.riotinto.com/investors/presentations-91.aspx?tx=253

Lilleyman, G. 2013. Building on success: growing the Pilbara. Paper presented in the

meeting of Global Iron Ore and Steel Forecast Conference, Perth, Australia. Retrieved

from http://www.riotinto.com/investors/presentations-91.aspx?tx=253

References

Australian Manufacturing. 2014. Robotic trains for Rio Tinto's Pilbara site. Australian

Manufacturing. Retrieved from http://www.australianmanufacturing.com.au/2246/roboti-

trains-for-rio-tintos-pilbarasite

Australian Mining Review. 2014. With Andrew Harding – Iron clad future. Retrieved from

http://www.miningreview.com.au/news/andrew-harding-iron-clad-future/

Caliber. 2014. Industrial Technology: AutoHaul® Project. Retrieved from

http://www.calibreglobal.com.au/our-projects/our-project/autohaul-project

Fantinel, K., & Rusu, M. 2013. Innovation: Ghost in the machine. South Australian

Mines & Energy Journal. Retrieved from

http://www.urb.net.au/attachments/File/SACOME_AugustSept_2013_Ghost_in_the_ma

chine.pdf

Farrell, J. 2013. History, challenges, and innovation: an Australian mining industry

perspective. Paper presented in the meeting of XXXII Triennial Congress of the

International Association of Lyceums Club, Perth, Australia. Retrieved from

http://www.riotinto.com/investors/presentations-91.aspx?tx=253

Garvey, P. 2013. Rio’s autonomous haul trucks quietly improving productivity in Pilbara.

The Australian Business Review. Retrieved from

http://www.theaustralian.com.au/business/in-depth/rios-autonomous-haul-trucksquietly-

improving-productivity-in-pilbara/story-fni4k1kl-1226627375954

Grad, P, S. 2010. Running with robotics. WOMP:The Mining E-Journal, 10. Retrieved

from http://www.womp-int.com/story/2010vol01/story026.htm

Harding, A. 2014a. Ironclad future. Australian Mining Review. Retrieved from

http://www.miningreview.com.au/news/andrew-harding-iron-clad-future/

Harding, A. 2014b. From mine to market: driving business value from sustainable

logistics. Paper presented in the meeting of Australia-Japan Business Co-operation

Committee. Retrieved from http://www.riotinto.com/investors/presentations91.aspx?

tx=253

IBM. 2009. Envisioning the future of mining. Retrieved from

http://www07.ibm.com/innovation/au/shapingourfuture/downloads/wp_envisioning_minin

g.pdf

Lilleyman, G. 2012. Building the business. Paper presented in the meeting of AMEC

Convention, Perth, Australia. Retrieved from

http://www.riotinto.com/investors/presentations-91.aspx?tx=253

Lilleyman, G. 2013. Building on success: growing the Pilbara. Paper presented in the

meeting of Global Iron Ore and Steel Forecast Conference, Perth, Australia. Retrieved

from http://www.riotinto.com/investors/presentations-91.aspx?tx=253

ECONOMICS12

Lynch, P., & Hamilton, J. 2012. Looking forward, looking back: requisite organization

and Rio Tinto Australia. Retrieved from http://researchonline.jcu.edu.au/23270/1/23270-

lynch-hamilton-2012.pdf

Lynch, P., & Hamilton, J. 2012. Looking forward, looking back: requisite organization

and Rio Tinto Australia 2012. Retrieved from

http://researchonline.jcu.edu.au/23270/1/23270-lynch-hamilton-2012.pdf

McGagh, J. 2012. Mine of the future: Rio Tinto’s innovation pathway. Retrieved from

http://www.riotinto.com/documents/120925_JMG_MineExpo.pdf

McGagh, J. 2014. Mine of the future:Autonomous Haulage. Retrieved from

http://www.riotinto.com/documents/140923_IMARC_Presentation_John_McGagh.pdf

Mudd, G, M. 2010. The Environmental Sustainability of Mining in Australia: Key Mega-

Trends and Looming Constraints. Resources Policy, pp 98-115

Wade, J. 2009. A vision of the future is here.Australian Mining. Retrieved from

http://www.miningaustralia.com.au/news/a-vision-of-the-future-is-here

Walsh, S. 2009. Delivering long-term shareholder value. Paper presented in the

meeting of AJM 12th Annual Global Iron Ore & Steel Forecast Conference, Perth,

Australia. Retrieved from http://www.riotinto.com/investors/presentations91.aspx?

tx=253

Walsh, S. 2010. The Australian mining industry in the early 21st century. Paper

presented at the meeting of Melbourne Mining Club, Melbourne, Australia. Retrieved

from

http://www.riotinto.com/documents/Presentationsironore/101202_Sam_Walsh_Melbour

ne_Mining_Club_presentation_The_Australian_

Mining_Industry_in_the_early_21st_Century.pdf

Lynch, P., & Hamilton, J. 2012. Looking forward, looking back: requisite organization

and Rio Tinto Australia. Retrieved from http://researchonline.jcu.edu.au/23270/1/23270-

lynch-hamilton-2012.pdf

Lynch, P., & Hamilton, J. 2012. Looking forward, looking back: requisite organization

and Rio Tinto Australia 2012. Retrieved from

http://researchonline.jcu.edu.au/23270/1/23270-lynch-hamilton-2012.pdf

McGagh, J. 2012. Mine of the future: Rio Tinto’s innovation pathway. Retrieved from

http://www.riotinto.com/documents/120925_JMG_MineExpo.pdf

McGagh, J. 2014. Mine of the future:Autonomous Haulage. Retrieved from

http://www.riotinto.com/documents/140923_IMARC_Presentation_John_McGagh.pdf

Mudd, G, M. 2010. The Environmental Sustainability of Mining in Australia: Key Mega-

Trends and Looming Constraints. Resources Policy, pp 98-115

Wade, J. 2009. A vision of the future is here.Australian Mining. Retrieved from

http://www.miningaustralia.com.au/news/a-vision-of-the-future-is-here

Walsh, S. 2009. Delivering long-term shareholder value. Paper presented in the

meeting of AJM 12th Annual Global Iron Ore & Steel Forecast Conference, Perth,

Australia. Retrieved from http://www.riotinto.com/investors/presentations91.aspx?

tx=253

Walsh, S. 2010. The Australian mining industry in the early 21st century. Paper

presented at the meeting of Melbourne Mining Club, Melbourne, Australia. Retrieved

from

http://www.riotinto.com/documents/Presentationsironore/101202_Sam_Walsh_Melbour

ne_Mining_Club_presentation_The_Australian_

Mining_Industry_in_the_early_21st_Century.pdf

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.