Macroeconomic Policy Analysis in the United States

VerifiedAdded on 2023/03/17

|30

|7993

|80

AI Summary

This report analyzes and discusses the major macroeconomic variables and policies in the United States. It covers topics such as the general business environment, inflation, unemployment, economic growth, and government expenditure. The report provides insights for businesses looking to invest in the United States.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

ECONOMICS1

Macroeconomic Policy

By (Name)

Course

Instructor’s Name

Institutional Affiliation

The City and State

The Date

Macroeconomic Policy

By (Name)

Course

Instructor’s Name

Institutional Affiliation

The City and State

The Date

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ECONOMICS2

Table of Contents

1. Executive summary...................................................................................................................1

2. Introduction...............................................................................................................................3

3. Analysis and Discussion of major macroeconomic variables in the United States...................4

3.1. General Business environment..............................................................................................4

3.1.1. starting a business..............................................................................................................4

3.1.2. Electricity...........................................................................................................................8

3.1.3. Property registration.........................................................................................................8

3.1.4. Paying taxes.......................................................................................................................9

3.1.5. Trade across borders.......................................................................................................10

3.1.6. Protecting minority investors..........................................................................................11

3.1.7. Construction permits.......................................................................................................12

3.2. Inflation................................................................................................................................13

3.3. Unemployment.....................................................................................................................15

3.4. Average wage rate................................................................................................................17

3.5. Economic growth.................................................................................................................18

3.6. Real Interest rate.................................................................................................................19

3.7. Government expenditure in the economy............................................................................21

3.8. Taxation policy in the United States....................................................................................22

3.9. Monetary policy...................................................................................................................24

3.10. Effects of the Global Financial Crisis (GFC) in the United States..................................25

4. Conclusion and Recommendation...........................................................................................26

References............................................................................................................................................28

Table of Contents

1. Executive summary...................................................................................................................1

2. Introduction...............................................................................................................................3

3. Analysis and Discussion of major macroeconomic variables in the United States...................4

3.1. General Business environment..............................................................................................4

3.1.1. starting a business..............................................................................................................4

3.1.2. Electricity...........................................................................................................................8

3.1.3. Property registration.........................................................................................................8

3.1.4. Paying taxes.......................................................................................................................9

3.1.5. Trade across borders.......................................................................................................10

3.1.6. Protecting minority investors..........................................................................................11

3.1.7. Construction permits.......................................................................................................12

3.2. Inflation................................................................................................................................13

3.3. Unemployment.....................................................................................................................15

3.4. Average wage rate................................................................................................................17

3.5. Economic growth.................................................................................................................18

3.6. Real Interest rate.................................................................................................................19

3.7. Government expenditure in the economy............................................................................21

3.8. Taxation policy in the United States....................................................................................22

3.9. Monetary policy...................................................................................................................24

3.10. Effects of the Global Financial Crisis (GFC) in the United States..................................25

4. Conclusion and Recommendation...........................................................................................26

References............................................................................................................................................28

ECONOMICS3

1. Executive summary

The paper discusses and analyses the macroeconomic variable and polices that can be depended

on to invest in the United States. The report indicates that Primus is a Telecommunication

company that operates in Australia with its major focus on broadband, mobile and fixed services.

Also, the report indicates that the company was the 1ts Telecom carrier to get a license at the

time it was deregulated. The research results indicate that the United States the macrocosmic

factors in the United States favor private investment. The report indicates that the United States

has a higher Gross Domestic Product per capita as compared to Australia. Also, the report

recommends investing in the United States because the business can be in the position to attain

increased economic benefits in the long run.

1. Executive summary

The paper discusses and analyses the macroeconomic variable and polices that can be depended

on to invest in the United States. The report indicates that Primus is a Telecommunication

company that operates in Australia with its major focus on broadband, mobile and fixed services.

Also, the report indicates that the company was the 1ts Telecom carrier to get a license at the

time it was deregulated. The research results indicate that the United States the macrocosmic

factors in the United States favor private investment. The report indicates that the United States

has a higher Gross Domestic Product per capita as compared to Australia. Also, the report

recommends investing in the United States because the business can be in the position to attain

increased economic benefits in the long run.

ECONOMICS4

2. Introduction

The aim of this report is to provide a detailed knowledge about the macroeconomic conditions of

one of the Australian trading and investment partner in the recent years. Also, the report aims at

illustrating how the changes in the macroeconomic variables and fiscal and monetary policies in

the target country would influence my company's long term investment decision. According to

the "United Nations’ International Standard Industrial Classification of All Economic

Activities," the chosen company is Primus Telecommunications (Eaglen et al 2009). The

company aims at making a long term investment in the United States. Primus is a

Telecommunication company that operates in Australia with its major focus on broadband,

mobile and fixed services. The company was the 1ts Telecom carrier to get a license at the time

it was deregulated. Currently, the company operates in major cities such as Melbourne, Adelaide,

Perth, Brisbane and Sydney. The company is also aiming at investing in the United States and it

needs a general analyses and justification that are favorable for its operations. Therefore, the

report will clearly indicate the macroeconomic variables and policies that the company need to

put into consideration (Phil 2012).

3. Analysis and Discussion of major macroeconomic variables in the United States

3.1. General Business environment

This section aims at analyzing the organization’s environment in the United States including the

factors that can affect the business operation and the factors that can largely influence an

organization’s investment. The environmental factors are considered to affect the general

operation of the company. As a result of the generalenvironmental influencetowards the business

2. Introduction

The aim of this report is to provide a detailed knowledge about the macroeconomic conditions of

one of the Australian trading and investment partner in the recent years. Also, the report aims at

illustrating how the changes in the macroeconomic variables and fiscal and monetary policies in

the target country would influence my company's long term investment decision. According to

the "United Nations’ International Standard Industrial Classification of All Economic

Activities," the chosen company is Primus Telecommunications (Eaglen et al 2009). The

company aims at making a long term investment in the United States. Primus is a

Telecommunication company that operates in Australia with its major focus on broadband,

mobile and fixed services. The company was the 1ts Telecom carrier to get a license at the time

it was deregulated. Currently, the company operates in major cities such as Melbourne, Adelaide,

Perth, Brisbane and Sydney. The company is also aiming at investing in the United States and it

needs a general analyses and justification that are favorable for its operations. Therefore, the

report will clearly indicate the macroeconomic variables and policies that the company need to

put into consideration (Phil 2012).

3. Analysis and Discussion of major macroeconomic variables in the United States

3.1. General Business environment

This section aims at analyzing the organization’s environment in the United States including the

factors that can affect the business operation and the factors that can largely influence an

organization’s investment. The environmental factors are considered to affect the general

operation of the company. As a result of the generalenvironmental influencetowards the business

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ECONOMICS5

operation, various trends and events need to be anticipated so as to evaluate the implications of

such events and trends (Matthew 2012).

3.1.1. starting a business

Before starting any business in the United States, various procedures have to be followed so as to

effectively carryout your business activities. The following steps are required for one to begin a

business in the United States,

1. make a decision of the right business that you wish to start

The decision of choosing the right business is considered to be very important because the nature

of the business selected influences all the day to day activities such as taxes, the number of

individual assets at risk. In addition, it is also very important in knowing the type of the business

and selects one that is best according to the business goal and situation (Andrew, et al 2012).

2. Decide the area where to your forming your company

For United States residents, they are required to locate their business or companies in their areas

of residence. For example if an individual resides in California, he or she is advisable to locate

his or her business in California. However, for people who are not residents of the United States

but have plans of stating in the United States, and then they are required to locate their

businesses in Wyoming because it is the best friendly state for business in the United States for

all Non-United states residents (Zandi, & Mark 2009).

3. Get an Agent who is Registered

In this case, all the business or companies in the United States are required to be with a

"Registered Agent" having a physical address but not "P.O.BOX" in the course of normal

operation, various trends and events need to be anticipated so as to evaluate the implications of

such events and trends (Matthew 2012).

3.1.1. starting a business

Before starting any business in the United States, various procedures have to be followed so as to

effectively carryout your business activities. The following steps are required for one to begin a

business in the United States,

1. make a decision of the right business that you wish to start

The decision of choosing the right business is considered to be very important because the nature

of the business selected influences all the day to day activities such as taxes, the number of

individual assets at risk. In addition, it is also very important in knowing the type of the business

and selects one that is best according to the business goal and situation (Andrew, et al 2012).

2. Decide the area where to your forming your company

For United States residents, they are required to locate their business or companies in their areas

of residence. For example if an individual resides in California, he or she is advisable to locate

his or her business in California. However, for people who are not residents of the United States

but have plans of stating in the United States, and then they are required to locate their

businesses in Wyoming because it is the best friendly state for business in the United States for

all Non-United states residents (Zandi, & Mark 2009).

3. Get an Agent who is Registered

In this case, all the business or companies in the United States are required to be with a

"Registered Agent" having a physical address but not "P.O.BOX" in the course of normal

ECONOMICS6

business time/hour in order to receive the documents of the company on their behalf. The

Registered Agent helps the company to receive its legal documents and official papers. A

Registered Agent acts as a service so that a company does not miss any useful document related

to the state taxes or lawsuits. This implies that the Agent must be located in the same state with

the Company (Wheatley, et al 2010).

4. Register your company

After deciding the nature of the business and after deciding the location of such a business, then

the next step should be registration of the company by filling the required fillings (Stiglitz 2010).

5. Get a United States mailing address

Most of the banks in the United States require residential address or mailing addresses in order to

open up any bank account. In the United States, you are required to provide the business address

in case you possess one. However, if you don’t possess a United States address, you can be in the

position to get one using the following companies, iPostal1.com, USAMail.com and many others

(Joseph, et al James 2011).

6. Open a United States bank account for the business

When starting a business in the United States, most non United States residents find it very

difficult to open a bank account in the different states. Opening up a bank account can be done in

case a company gets an EIN. Recently, any company can be in the position to open their business

account. In addition, the entrepreneur is required to visit the United States to open their bank

accounts (Brand 2015).

business time/hour in order to receive the documents of the company on their behalf. The

Registered Agent helps the company to receive its legal documents and official papers. A

Registered Agent acts as a service so that a company does not miss any useful document related

to the state taxes or lawsuits. This implies that the Agent must be located in the same state with

the Company (Wheatley, et al 2010).

4. Register your company

After deciding the nature of the business and after deciding the location of such a business, then

the next step should be registration of the company by filling the required fillings (Stiglitz 2010).

5. Get a United States mailing address

Most of the banks in the United States require residential address or mailing addresses in order to

open up any bank account. In the United States, you are required to provide the business address

in case you possess one. However, if you don’t possess a United States address, you can be in the

position to get one using the following companies, iPostal1.com, USAMail.com and many others

(Joseph, et al James 2011).

6. Open a United States bank account for the business

When starting a business in the United States, most non United States residents find it very

difficult to open a bank account in the different states. Opening up a bank account can be done in

case a company gets an EIN. Recently, any company can be in the position to open their business

account. In addition, the entrepreneur is required to visit the United States to open their bank

accounts (Brand 2015).

ECONOMICS7

7. Open a merchant account of the business in order to receive payments from the clients or

customers

In the United States, the "merchant service account" is free. This service allows the business to

accept debit and credit card transactions from its customers. The merchant account can be

opened after a business has got an EIN. Merchant accounts are got from Authorize.net,

payoneer.com, stripe.com, and Braintreepayments.com (Lang, et al 2012).

8. Get an insurance for the business (if necessary)

The cost of getting insurance varies according to the business operation. In the United States,

business insurance is very important because it helps in protecting a company from different

unexpected costs that may arise in a business operation. If the business is not insured, natural

disasters, lawsuits and accidents could lead to the decline of the business if it is not protected

(Hout 2012).

9. Get ITIN (if the company is a non-United States citizen without SSN)

In case an individual opening up a business in the US is not a citizen and does not have a "Social

Security Number", he or she will be required to have an "Individual Tax Identification Number

(ITIN)." An Individual Tax Identification Number is an individual tax Identity number that is

issued to an individual by the "IRS." ITIN is required for; opening a United States bank account,

apply for any rental apartment, and many others (Tausig 2013).

10. Understand your responsibilities of paying tax and make a file for the taxes

In order to appropriately file a tax in the United States, the entrepreneur is required to consult an

accountant so as to tax his or her taxes at the right time and be in the position to set up his or her

7. Open a merchant account of the business in order to receive payments from the clients or

customers

In the United States, the "merchant service account" is free. This service allows the business to

accept debit and credit card transactions from its customers. The merchant account can be

opened after a business has got an EIN. Merchant accounts are got from Authorize.net,

payoneer.com, stripe.com, and Braintreepayments.com (Lang, et al 2012).

8. Get an insurance for the business (if necessary)

The cost of getting insurance varies according to the business operation. In the United States,

business insurance is very important because it helps in protecting a company from different

unexpected costs that may arise in a business operation. If the business is not insured, natural

disasters, lawsuits and accidents could lead to the decline of the business if it is not protected

(Hout 2012).

9. Get ITIN (if the company is a non-United States citizen without SSN)

In case an individual opening up a business in the US is not a citizen and does not have a "Social

Security Number", he or she will be required to have an "Individual Tax Identification Number

(ITIN)." An Individual Tax Identification Number is an individual tax Identity number that is

issued to an individual by the "IRS." ITIN is required for; opening a United States bank account,

apply for any rental apartment, and many others (Tausig 2013).

10. Understand your responsibilities of paying tax and make a file for the taxes

In order to appropriately file a tax in the United States, the entrepreneur is required to consult an

accountant so as to tax his or her taxes at the right time and be in the position to set up his or her

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS8

payroll. By finding an account, the entrepreneur will be able to maximize deductions and reduce

taxes (Olney 2011).

11. make sure that the business is in line with other county, federal and city requirements

This is very important because it helps the entrepreneur to understand if the business is in line

with the laws of that state where it is established. In addition, it helps in understanding if the

business requires a working permit or license. These requirements depend on the location of the

business (Boland, et al 2015).

12. Carryout consultation from the lawyer of the business

Starting a business in the United States is very challenging and complicated. Most of the

entrepreneurs in the United States make a very big mistake of failing to consult their business

lawyers while starting a business. This creates a bigger risk to the personal assets of the business

for example car, property, home, bank account and many others (David 2013).

The process of starting up a business in the United States is longer because it may take up to

three weeks. Each process performed while starting a business in the United States may take one

or two days to be completed. The process of starting up a business in the United States is quite

longer and complicated unlike that of Australia which usually requires only three procedures and

they take a very small period of time (Thomas 2013).

3.1.2. Electricity

The processes and practices of getting electricity are the United States scores 82.15 percent while

Australia scores 82.31 percent. This indicates that Australia has favored practice and procedures

of getting electricity as compared to the United States. To get electricity in the United States,

payroll. By finding an account, the entrepreneur will be able to maximize deductions and reduce

taxes (Olney 2011).

11. make sure that the business is in line with other county, federal and city requirements

This is very important because it helps the entrepreneur to understand if the business is in line

with the laws of that state where it is established. In addition, it helps in understanding if the

business requires a working permit or license. These requirements depend on the location of the

business (Boland, et al 2015).

12. Carryout consultation from the lawyer of the business

Starting a business in the United States is very challenging and complicated. Most of the

entrepreneurs in the United States make a very big mistake of failing to consult their business

lawyers while starting a business. This creates a bigger risk to the personal assets of the business

for example car, property, home, bank account and many others (David 2013).

The process of starting up a business in the United States is longer because it may take up to

three weeks. Each process performed while starting a business in the United States may take one

or two days to be completed. The process of starting up a business in the United States is quite

longer and complicated unlike that of Australia which usually requires only three procedures and

they take a very small period of time (Thomas 2013).

3.1.2. Electricity

The processes and practices of getting electricity are the United States scores 82.15 percent while

Australia scores 82.31 percent. This indicates that Australia has favored practice and procedures

of getting electricity as compared to the United States. To get electricity in the United States,

ECONOMICS9

various processes have to be followed for example, Applying for electricity, approval of the

application form, getting a utility permit, receive electricity connections, installation, and an

implementing automated machines (Lowrie 2012).

3.1.3. Property registration

In the United States, the registering a property is quite important. The procedures followed while

registering a property in UnitedStates are straightforward so long as the entrepreneur make

enough research and possess the necessary requirements. Here is a procedure followed to register

a property in the United States.

Calculating of the money paid as "stamp duty." this is in the form of a tax that a state

levies as one of the most important item required to register a property.

Preparation of a sales Deed, this document is very important during the registration

process. A valid legal sales deed of the company is supposed to appear on the business's

stamped paper.

Collect the necessary documents, while meeting the sub-registrar, there are some

documents that are required to be checked first.

Process an appointment to meet the sub-Registrar, registration is only done when a sub-

registrar is present.

Payment of property registration fees, after paying stamp duty and the sub-registrar

verifying the documents, the owner of the property will be required to pay fees for

registering his or her property

Collection of the registered documents, after approving the documents by the sub-

registrar, the original registered documents are given back to the property owner.

various processes have to be followed for example, Applying for electricity, approval of the

application form, getting a utility permit, receive electricity connections, installation, and an

implementing automated machines (Lowrie 2012).

3.1.3. Property registration

In the United States, the registering a property is quite important. The procedures followed while

registering a property in UnitedStates are straightforward so long as the entrepreneur make

enough research and possess the necessary requirements. Here is a procedure followed to register

a property in the United States.

Calculating of the money paid as "stamp duty." this is in the form of a tax that a state

levies as one of the most important item required to register a property.

Preparation of a sales Deed, this document is very important during the registration

process. A valid legal sales deed of the company is supposed to appear on the business's

stamped paper.

Collect the necessary documents, while meeting the sub-registrar, there are some

documents that are required to be checked first.

Process an appointment to meet the sub-Registrar, registration is only done when a sub-

registrar is present.

Payment of property registration fees, after paying stamp duty and the sub-registrar

verifying the documents, the owner of the property will be required to pay fees for

registering his or her property

Collection of the registered documents, after approving the documents by the sub-

registrar, the original registered documents are given back to the property owner.

ECONOMICS10

Considering the producers required registering property in Australia and United States, they all

look the same but a difference may arise on the time taken to process the registration. The

registration process depends on the terms and conditions of a given country (Stiglitz, & Joseph

2012).

3.1.4. Paying taxes

Before starting a company in any country or area, taxes are the most important things that need

to be considered. Low taxes on foreign companies play an important role in helping the business

grow faster hence increased income in the shortest run. In the United States, business are

supposed to pay a cooperate tax which is implemented most at some local, most state and federal

levels. The tax is imposed on the income that is earned by a business i9n the United States that is

received or earned within one year (Vicki, & Ramsey 2014). The tax is paid using the "employer

Identification Number." Further, all business operating in the United States are supposed to file

their tax returns. The payment of the tax can also be made in estimated payments or advance

installments for most of the states in the United States. Upon making different payments such as

wages, businesses may be in the position to withhold the obligation of a tax (Aneel 2015).

In United States, most of the localities and states impose a corporate income tax. However, the

rules of determining the tax depends on the state or locality. Also, United States imposes a value

added tax to all the commodities produced by a given company. However, Australia gains much

from its VAT because the tax is higher than that of US (Cassens 2014). In United States, the

shareholders of a given company are meant to pay an individual or corporate income tax in case

the earnings of the business are distributed. The distribution of earnings is basically regarded as

"a dividend." Notably, US taxes all foreign or non US companies differently as compared to the

Considering the producers required registering property in Australia and United States, they all

look the same but a difference may arise on the time taken to process the registration. The

registration process depends on the terms and conditions of a given country (Stiglitz, & Joseph

2012).

3.1.4. Paying taxes

Before starting a company in any country or area, taxes are the most important things that need

to be considered. Low taxes on foreign companies play an important role in helping the business

grow faster hence increased income in the shortest run. In the United States, business are

supposed to pay a cooperate tax which is implemented most at some local, most state and federal

levels. The tax is imposed on the income that is earned by a business i9n the United States that is

received or earned within one year (Vicki, & Ramsey 2014). The tax is paid using the "employer

Identification Number." Further, all business operating in the United States are supposed to file

their tax returns. The payment of the tax can also be made in estimated payments or advance

installments for most of the states in the United States. Upon making different payments such as

wages, businesses may be in the position to withhold the obligation of a tax (Aneel 2015).

In United States, most of the localities and states impose a corporate income tax. However, the

rules of determining the tax depends on the state or locality. Also, United States imposes a value

added tax to all the commodities produced by a given company. However, Australia gains much

from its VAT because the tax is higher than that of US (Cassens 2014). In United States, the

shareholders of a given company are meant to pay an individual or corporate income tax in case

the earnings of the business are distributed. The distribution of earnings is basically regarded as

"a dividend." Notably, US taxes all foreign or non US companies differently as compared to the

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ECONOMICS11

home businesses. Foreign companies operating in the United States are meant to tax on the

income of the business if the income obtained is in connection with a United States business or

trade. Also, foreign companies operating in the United States are meant to withhold a 30% tax on

interest, royalties, dividends and other forms of income (Greenstone 2012).

3.1.5. Trade across borders

Most of the countries across the world wish to take part in trade across borders so as to increase

their tax revenue and foster economic growth. In United States, trade across borders involves the

international exports and imports of the country. United States is considered to be among the

strong economic markets across the world. The United States trades with various countries

across the globe (Zeigler 2014). In 2006, the Gross United States asset that was held by

foreigners amounted to US$16.3 trillion. Just like Australia, the United States is also a member

of various international trade institutions. The United States joined this organization with an

intention of coming into close with other countries on different issues regarding trade. According

to the internal LPI index of World Bank, the United States is ranked as the 14 and Australia is

the 4th (Cowen 2011,).

Before staring up any form of business, contracts and laws need to be implemented with an

intention of enforcing and protecting the rights of the companies and entrepreneurs. In this case,

a contract is referred to as an agreement signed between different parties with an intention of

creating a "reciprocal obligation" that is enforced by a given law (Cowen 2011). The

enforcement of contracts and laws is vital to the business because it helps in measuring the cost

and time required to resolve any form of business disputes through the local court. In the United

States, the "contract law" governs the transactions that involve selling of goods (Brynjolfsson, et

home businesses. Foreign companies operating in the United States are meant to tax on the

income of the business if the income obtained is in connection with a United States business or

trade. Also, foreign companies operating in the United States are meant to withhold a 30% tax on

interest, royalties, dividends and other forms of income (Greenstone 2012).

3.1.5. Trade across borders

Most of the countries across the world wish to take part in trade across borders so as to increase

their tax revenue and foster economic growth. In United States, trade across borders involves the

international exports and imports of the country. United States is considered to be among the

strong economic markets across the world. The United States trades with various countries

across the globe (Zeigler 2014). In 2006, the Gross United States asset that was held by

foreigners amounted to US$16.3 trillion. Just like Australia, the United States is also a member

of various international trade institutions. The United States joined this organization with an

intention of coming into close with other countries on different issues regarding trade. According

to the internal LPI index of World Bank, the United States is ranked as the 14 and Australia is

the 4th (Cowen 2011,).

Before staring up any form of business, contracts and laws need to be implemented with an

intention of enforcing and protecting the rights of the companies and entrepreneurs. In this case,

a contract is referred to as an agreement signed between different parties with an intention of

creating a "reciprocal obligation" that is enforced by a given law (Cowen 2011). The

enforcement of contracts and laws is vital to the business because it helps in measuring the cost

and time required to resolve any form of business disputes through the local court. In the United

States, the "contract law" governs the transactions that involve selling of goods (Brynjolfsson, et

ECONOMICS12

al 2011). Before enforcing a given contract the country is required to first follow some indicators

such as the cost of enforcing the contract, the effect of the contract to the parties involved, the

time required to enforce a given contract though courts and the effectiveness of the judicial

process. In this case, the "quality of the judicial process" is very important because it determines

if a given county can be able to form and adapt to good practices which may influence cost and

time performance while enforcing the contracts. According to the data variables of World Bank,

Australia scored 79.00% and the United States scored 72.1 in enforcing contracts (Navarro

2011).

3.1.6. Protecting minority investors

For the business to improve its performance, new investors are required because they provide

new investments to the company. In addition, all companies or businesses which are aim at

expanding and developing, they require getting access to different external financing. The

protection of the minority investors plays a bigger role in increasing the invertors' confidence in

the market (Matthew 2013).According to the recent World Bank statistics, they indicate that

Australia scores 60.00 percent and the United States scores 64.67 in the protection of minority

investors. This indicates that both Australia and the United States almost have the same

performance though US is ranked highly as compared to Australia (Rampell 2012).

In United States, most new comers find a very big challenge in getting credit. Most of the new

migrants in the United States quickly understand that they cannot be in the position to acquire a

credit card, an apartment or even buying a car as a result of lack of credit history. In order to get

credit in the United States, one is required to have at least a credit history. In the United States

where an individual is a temporary or permanent resident is required to begin establishing his or

al 2011). Before enforcing a given contract the country is required to first follow some indicators

such as the cost of enforcing the contract, the effect of the contract to the parties involved, the

time required to enforce a given contract though courts and the effectiveness of the judicial

process. In this case, the "quality of the judicial process" is very important because it determines

if a given county can be able to form and adapt to good practices which may influence cost and

time performance while enforcing the contracts. According to the data variables of World Bank,

Australia scored 79.00% and the United States scored 72.1 in enforcing contracts (Navarro

2011).

3.1.6. Protecting minority investors

For the business to improve its performance, new investors are required because they provide

new investments to the company. In addition, all companies or businesses which are aim at

expanding and developing, they require getting access to different external financing. The

protection of the minority investors plays a bigger role in increasing the invertors' confidence in

the market (Matthew 2013).According to the recent World Bank statistics, they indicate that

Australia scores 60.00 percent and the United States scores 64.67 in the protection of minority

investors. This indicates that both Australia and the United States almost have the same

performance though US is ranked highly as compared to Australia (Rampell 2012).

In United States, most new comers find a very big challenge in getting credit. Most of the new

migrants in the United States quickly understand that they cannot be in the position to acquire a

credit card, an apartment or even buying a car as a result of lack of credit history. In order to get

credit in the United States, one is required to have at least a credit history. In the United States

where an individual is a temporary or permanent resident is required to begin establishing his or

ECONOMICS13

her credit history (Victoria 2014). In this case, healthy credit can be made i9f an individual

wishes to get a loan for purchasing a house or car, pay for different items using credit card or

even do other basic activities like opening a utility account or cell phone (Peter, et al 2017). In

some cases, employers may check the credit of an individual before offering him or her a job.

While coming to the United States, everyone is required to prepare to begin building his or her

credit from scratch because it is what everyone goes through. Getting credit in the United States

may take an individual some got time but is very possible to establish it. In order to get a credit

in the United States, one has to follow the following steps (Latham 2018).

start by applying for an Individual Taxpayer Identification Number (ITIN) or Social

Security Number (SSN)

Open an account from any bank in your state

make sure that you possess income

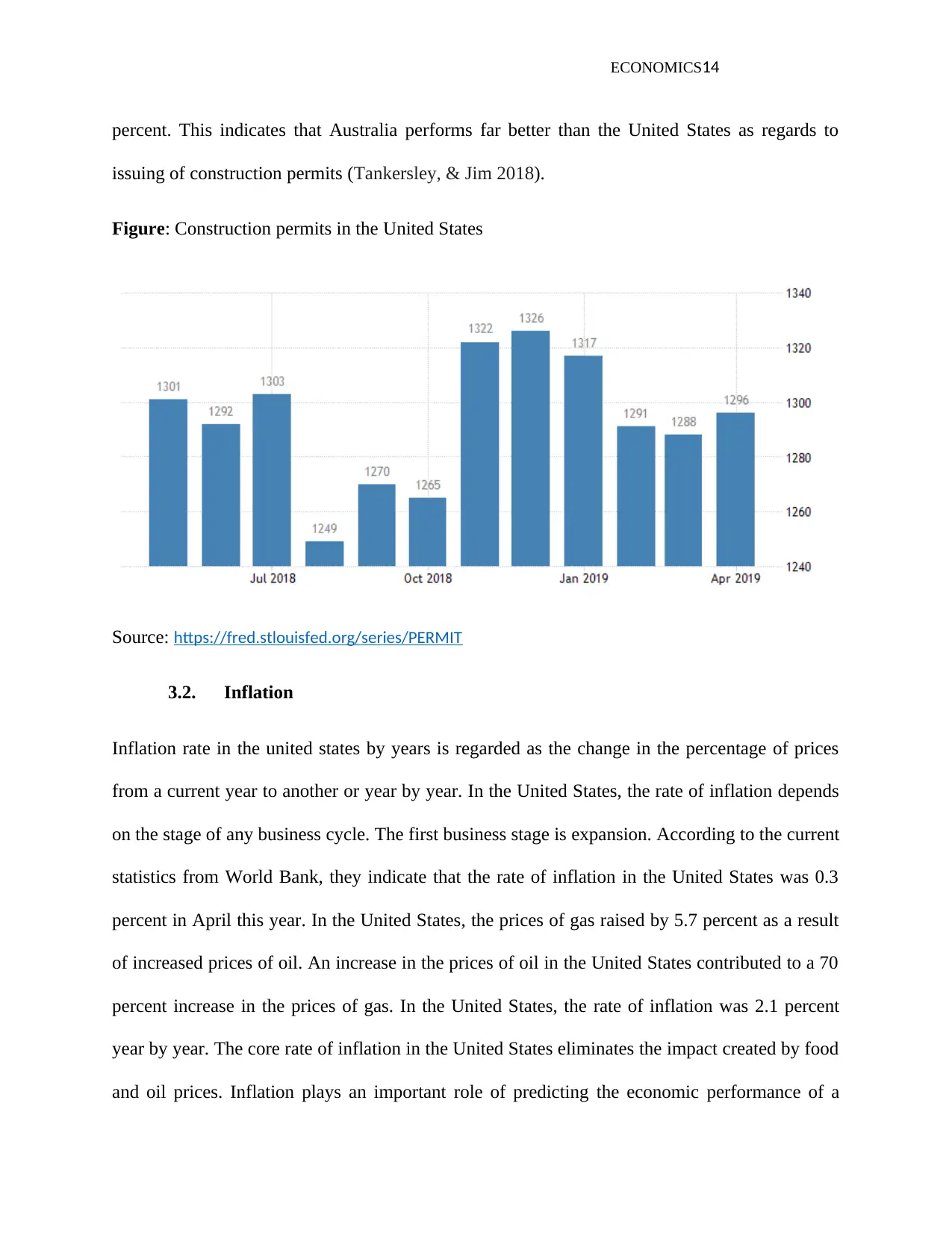

3.1.7. Construction permits

Construction permits help in ensuring that the region has experienced development with an

intention of protecting the interest of the community and the people at large. In this case, a

construction permit helps in regulating building with an intention of ensuring that structural, fire,

and health standards are attained. In the United States, it is always a very big offense to start

building any house minus getting a permit. Also, any individual in the United States who starts

building any house without being permitted does it on his own by violating the "Building By-law

and the Building Code Act." An individual who Violates the "Building By-law and the Building

Code Act" is subjected to legal and financial consequences. In the United States, construction

permits rose to 0.6% in January 2019 as compared to the previous year. As compared to

Australia with 84.59 percentage score of construction permit, the United States has 77.88

her credit history (Victoria 2014). In this case, healthy credit can be made i9f an individual

wishes to get a loan for purchasing a house or car, pay for different items using credit card or

even do other basic activities like opening a utility account or cell phone (Peter, et al 2017). In

some cases, employers may check the credit of an individual before offering him or her a job.

While coming to the United States, everyone is required to prepare to begin building his or her

credit from scratch because it is what everyone goes through. Getting credit in the United States

may take an individual some got time but is very possible to establish it. In order to get a credit

in the United States, one has to follow the following steps (Latham 2018).

start by applying for an Individual Taxpayer Identification Number (ITIN) or Social

Security Number (SSN)

Open an account from any bank in your state

make sure that you possess income

3.1.7. Construction permits

Construction permits help in ensuring that the region has experienced development with an

intention of protecting the interest of the community and the people at large. In this case, a

construction permit helps in regulating building with an intention of ensuring that structural, fire,

and health standards are attained. In the United States, it is always a very big offense to start

building any house minus getting a permit. Also, any individual in the United States who starts

building any house without being permitted does it on his own by violating the "Building By-law

and the Building Code Act." An individual who Violates the "Building By-law and the Building

Code Act" is subjected to legal and financial consequences. In the United States, construction

permits rose to 0.6% in January 2019 as compared to the previous year. As compared to

Australia with 84.59 percentage score of construction permit, the United States has 77.88

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS14

percent. This indicates that Australia performs far better than the United States as regards to

issuing of construction permits (Tankersley, & Jim 2018).

Figure: Construction permits in the United States

Source: https://fred.stlouisfed.org/series/PERMIT

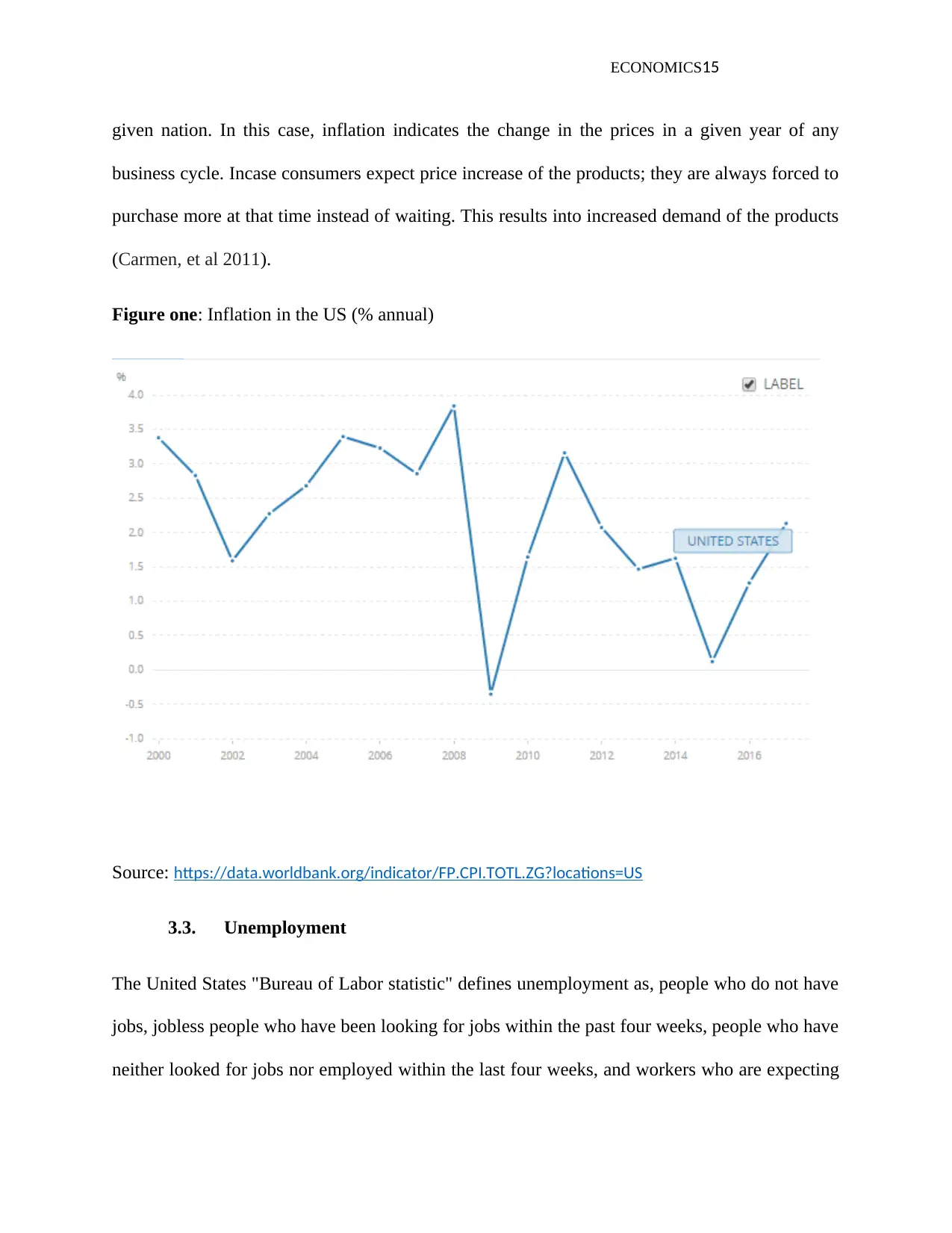

3.2. Inflation

Inflation rate in the united states by years is regarded as the change in the percentage of prices

from a current year to another or year by year. In the United States, the rate of inflation depends

on the stage of any business cycle. The first business stage is expansion. According to the current

statistics from World Bank, they indicate that the rate of inflation in the United States was 0.3

percent in April this year. In the United States, the prices of gas raised by 5.7 percent as a result

of increased prices of oil. An increase in the prices of oil in the United States contributed to a 70

percent increase in the prices of gas. In the United States, the rate of inflation was 2.1 percent

year by year. The core rate of inflation in the United States eliminates the impact created by food

and oil prices. Inflation plays an important role of predicting the economic performance of a

percent. This indicates that Australia performs far better than the United States as regards to

issuing of construction permits (Tankersley, & Jim 2018).

Figure: Construction permits in the United States

Source: https://fred.stlouisfed.org/series/PERMIT

3.2. Inflation

Inflation rate in the united states by years is regarded as the change in the percentage of prices

from a current year to another or year by year. In the United States, the rate of inflation depends

on the stage of any business cycle. The first business stage is expansion. According to the current

statistics from World Bank, they indicate that the rate of inflation in the United States was 0.3

percent in April this year. In the United States, the prices of gas raised by 5.7 percent as a result

of increased prices of oil. An increase in the prices of oil in the United States contributed to a 70

percent increase in the prices of gas. In the United States, the rate of inflation was 2.1 percent

year by year. The core rate of inflation in the United States eliminates the impact created by food

and oil prices. Inflation plays an important role of predicting the economic performance of a

ECONOMICS15

given nation. In this case, inflation indicates the change in the prices in a given year of any

business cycle. Incase consumers expect price increase of the products; they are always forced to

purchase more at that time instead of waiting. This results into increased demand of the products

(Carmen, et al 2011).

Figure one: Inflation in the US (% annual)

Source: https://data.worldbank.org/indicator/FP.CPI.TOTL.ZG?locations=US

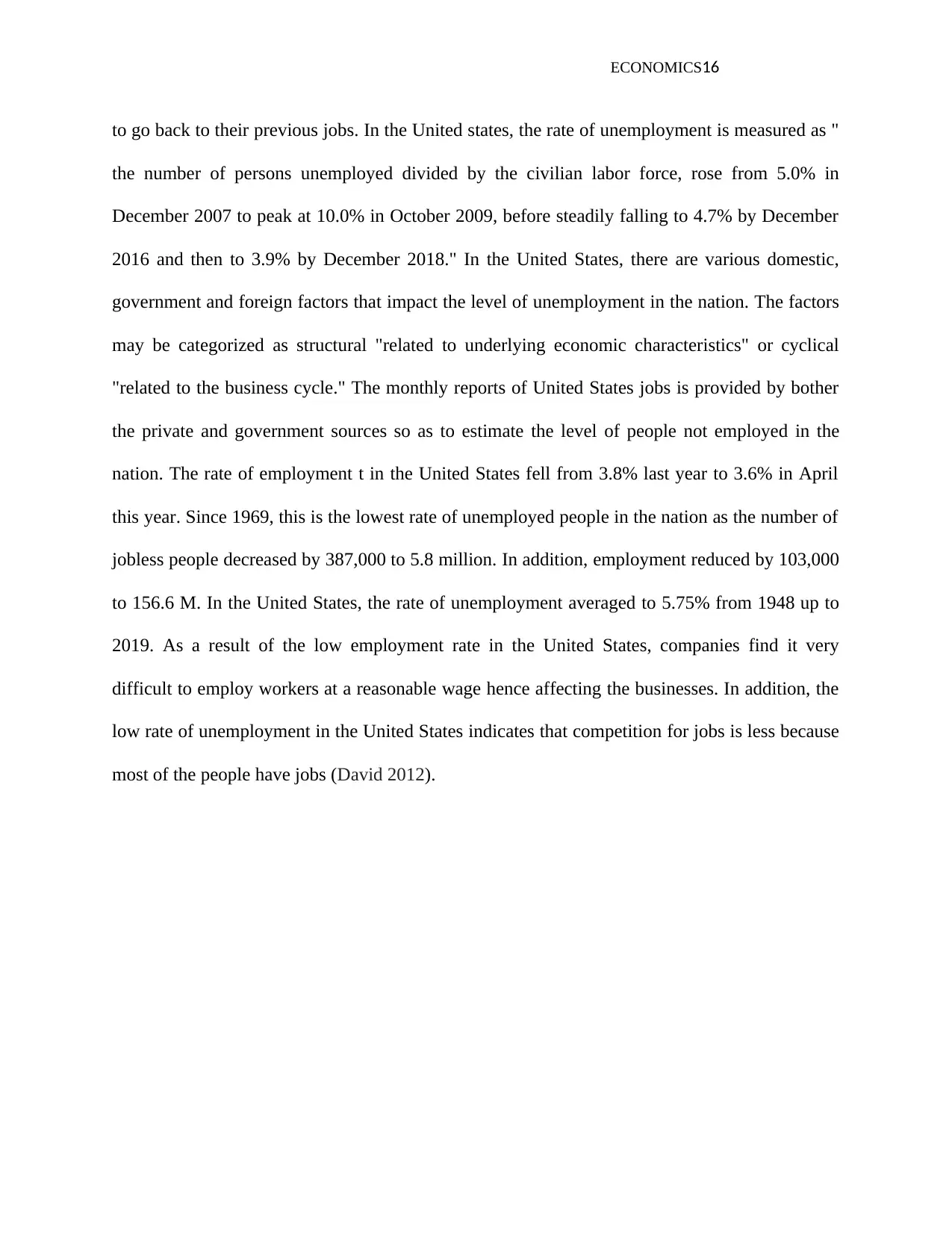

3.3. Unemployment

The United States "Bureau of Labor statistic" defines unemployment as, people who do not have

jobs, jobless people who have been looking for jobs within the past four weeks, people who have

neither looked for jobs nor employed within the last four weeks, and workers who are expecting

given nation. In this case, inflation indicates the change in the prices in a given year of any

business cycle. Incase consumers expect price increase of the products; they are always forced to

purchase more at that time instead of waiting. This results into increased demand of the products

(Carmen, et al 2011).

Figure one: Inflation in the US (% annual)

Source: https://data.worldbank.org/indicator/FP.CPI.TOTL.ZG?locations=US

3.3. Unemployment

The United States "Bureau of Labor statistic" defines unemployment as, people who do not have

jobs, jobless people who have been looking for jobs within the past four weeks, people who have

neither looked for jobs nor employed within the last four weeks, and workers who are expecting

ECONOMICS16

to go back to their previous jobs. In the United states, the rate of unemployment is measured as "

the number of persons unemployed divided by the civilian labor force, rose from 5.0% in

December 2007 to peak at 10.0% in October 2009, before steadily falling to 4.7% by December

2016 and then to 3.9% by December 2018." In the United States, there are various domestic,

government and foreign factors that impact the level of unemployment in the nation. The factors

may be categorized as structural "related to underlying economic characteristics" or cyclical

"related to the business cycle." The monthly reports of United States jobs is provided by bother

the private and government sources so as to estimate the level of people not employed in the

nation. The rate of employment t in the United States fell from 3.8% last year to 3.6% in April

this year. Since 1969, this is the lowest rate of unemployed people in the nation as the number of

jobless people decreased by 387,000 to 5.8 million. In addition, employment reduced by 103,000

to 156.6 M. In the United States, the rate of unemployment averaged to 5.75% from 1948 up to

2019. As a result of the low employment rate in the United States, companies find it very

difficult to employ workers at a reasonable wage hence affecting the businesses. In addition, the

low rate of unemployment in the United States indicates that competition for jobs is less because

most of the people have jobs (David 2012).

to go back to their previous jobs. In the United states, the rate of unemployment is measured as "

the number of persons unemployed divided by the civilian labor force, rose from 5.0% in

December 2007 to peak at 10.0% in October 2009, before steadily falling to 4.7% by December

2016 and then to 3.9% by December 2018." In the United States, there are various domestic,

government and foreign factors that impact the level of unemployment in the nation. The factors

may be categorized as structural "related to underlying economic characteristics" or cyclical

"related to the business cycle." The monthly reports of United States jobs is provided by bother

the private and government sources so as to estimate the level of people not employed in the

nation. The rate of employment t in the United States fell from 3.8% last year to 3.6% in April

this year. Since 1969, this is the lowest rate of unemployed people in the nation as the number of

jobless people decreased by 387,000 to 5.8 million. In addition, employment reduced by 103,000

to 156.6 M. In the United States, the rate of unemployment averaged to 5.75% from 1948 up to

2019. As a result of the low employment rate in the United States, companies find it very

difficult to employ workers at a reasonable wage hence affecting the businesses. In addition, the

low rate of unemployment in the United States indicates that competition for jobs is less because

most of the people have jobs (David 2012).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ECONOMICS17

Figure: The rate of unemployment in the US

Source: https://tradingeconomics.com/united-states/unemployment-rate

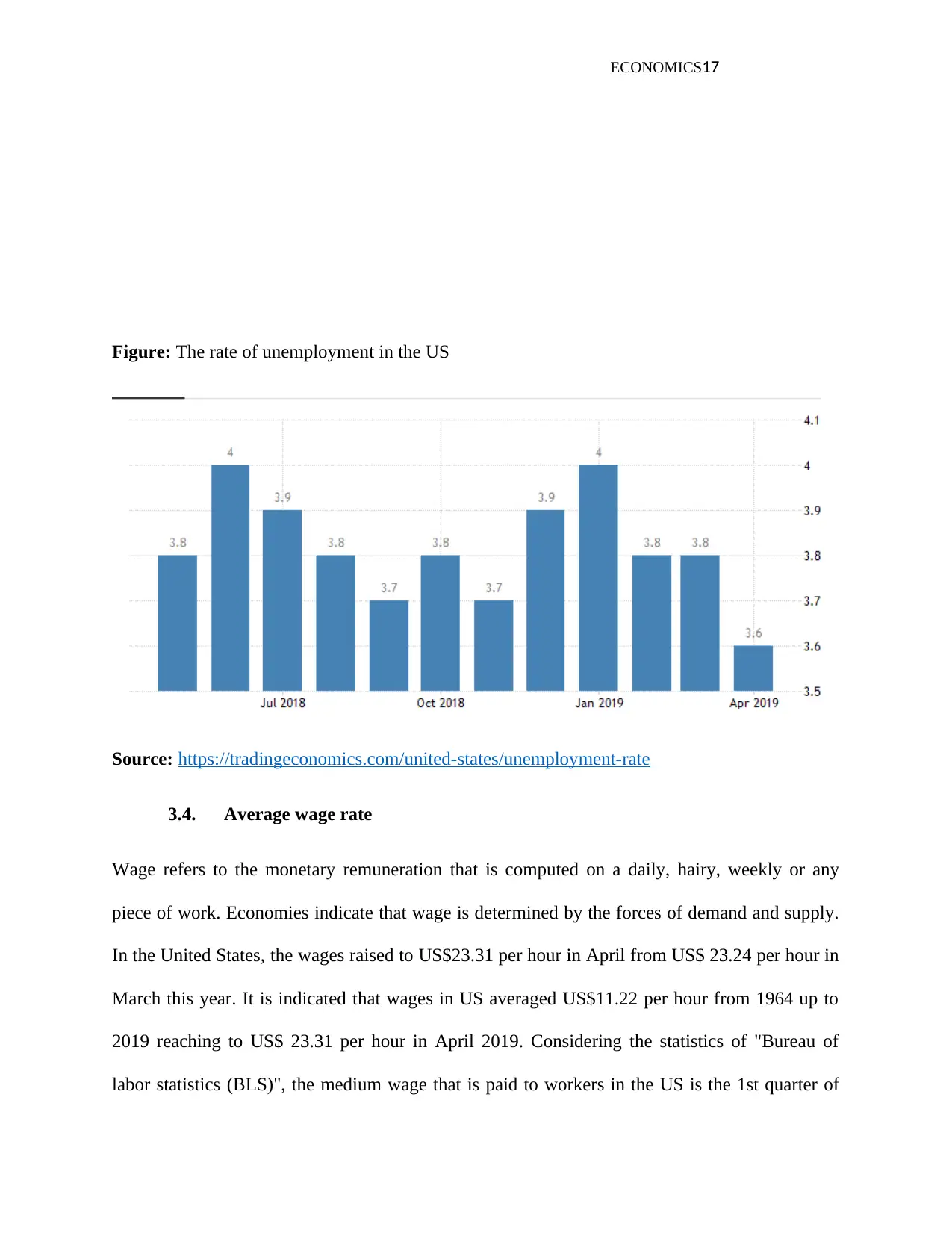

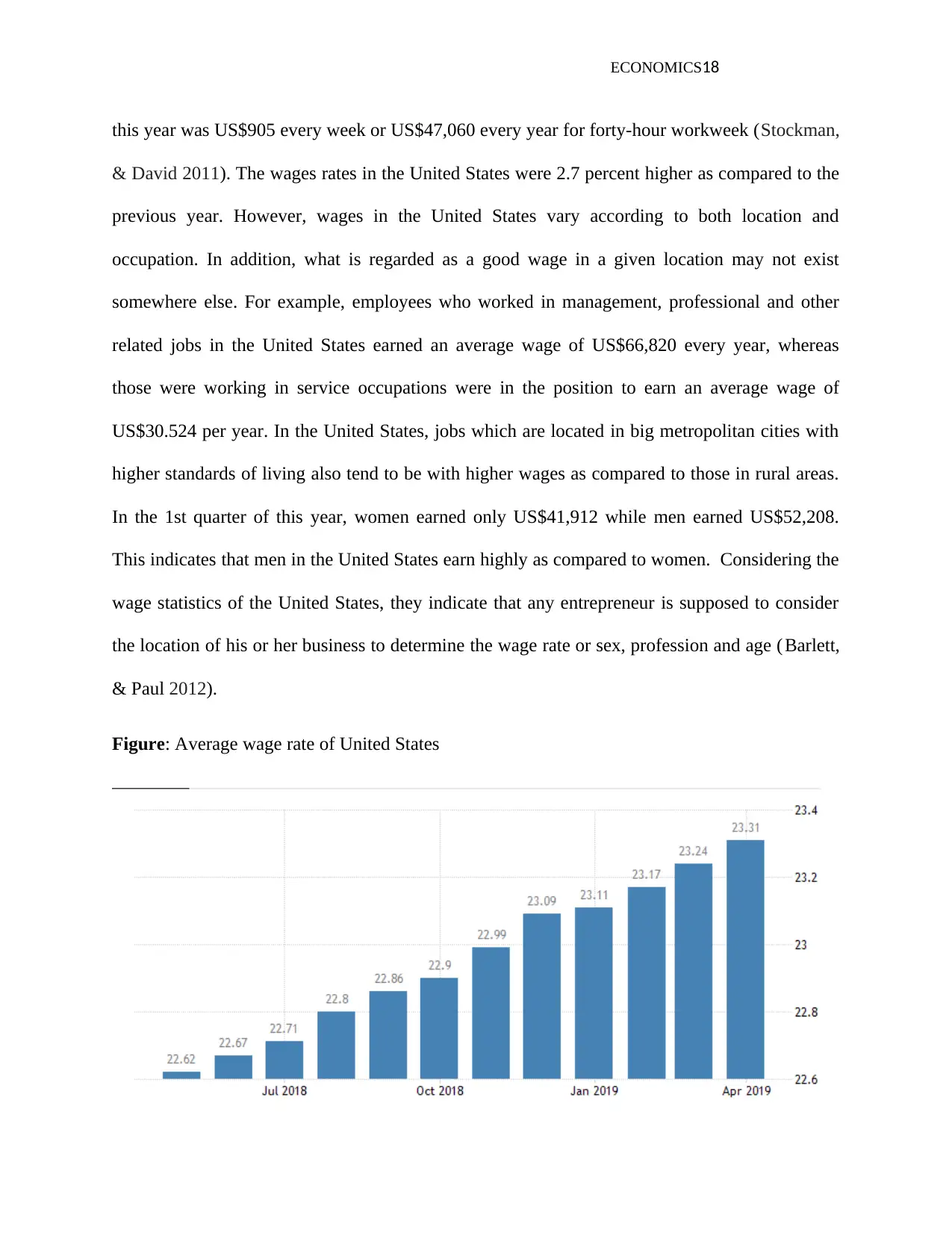

3.4. Average wage rate

Wage refers to the monetary remuneration that is computed on a daily, hairy, weekly or any

piece of work. Economies indicate that wage is determined by the forces of demand and supply.

In the United States, the wages raised to US$23.31 per hour in April from US$ 23.24 per hour in

March this year. It is indicated that wages in US averaged US$11.22 per hour from 1964 up to

2019 reaching to US$ 23.31 per hour in April 2019. Considering the statistics of "Bureau of

labor statistics (BLS)", the medium wage that is paid to workers in the US is the 1st quarter of

Figure: The rate of unemployment in the US

Source: https://tradingeconomics.com/united-states/unemployment-rate

3.4. Average wage rate

Wage refers to the monetary remuneration that is computed on a daily, hairy, weekly or any

piece of work. Economies indicate that wage is determined by the forces of demand and supply.

In the United States, the wages raised to US$23.31 per hour in April from US$ 23.24 per hour in

March this year. It is indicated that wages in US averaged US$11.22 per hour from 1964 up to

2019 reaching to US$ 23.31 per hour in April 2019. Considering the statistics of "Bureau of

labor statistics (BLS)", the medium wage that is paid to workers in the US is the 1st quarter of

ECONOMICS18

this year was US$905 every week or US$47,060 every year for forty-hour workweek (Stockman,

& David 2011). The wages rates in the United States were 2.7 percent higher as compared to the

previous year. However, wages in the United States vary according to both location and

occupation. In addition, what is regarded as a good wage in a given location may not exist

somewhere else. For example, employees who worked in management, professional and other

related jobs in the United States earned an average wage of US$66,820 every year, whereas

those were working in service occupations were in the position to earn an average wage of

US$30.524 per year. In the United States, jobs which are located in big metropolitan cities with

higher standards of living also tend to be with higher wages as compared to those in rural areas.

In the 1st quarter of this year, women earned only US$41,912 while men earned US$52,208.

This indicates that men in the United States earn highly as compared to women. Considering the

wage statistics of the United States, they indicate that any entrepreneur is supposed to consider

the location of his or her business to determine the wage rate or sex, profession and age ( Barlett,

& Paul 2012).

Figure: Average wage rate of United States

this year was US$905 every week or US$47,060 every year for forty-hour workweek (Stockman,

& David 2011). The wages rates in the United States were 2.7 percent higher as compared to the

previous year. However, wages in the United States vary according to both location and

occupation. In addition, what is regarded as a good wage in a given location may not exist

somewhere else. For example, employees who worked in management, professional and other

related jobs in the United States earned an average wage of US$66,820 every year, whereas

those were working in service occupations were in the position to earn an average wage of

US$30.524 per year. In the United States, jobs which are located in big metropolitan cities with

higher standards of living also tend to be with higher wages as compared to those in rural areas.

In the 1st quarter of this year, women earned only US$41,912 while men earned US$52,208.

This indicates that men in the United States earn highly as compared to women. Considering the

wage statistics of the United States, they indicate that any entrepreneur is supposed to consider

the location of his or her business to determine the wage rate or sex, profession and age ( Barlett,

& Paul 2012).

Figure: Average wage rate of United States

ECONOMICS19

Source: https://fred.stlouisfed.org/tags/series?

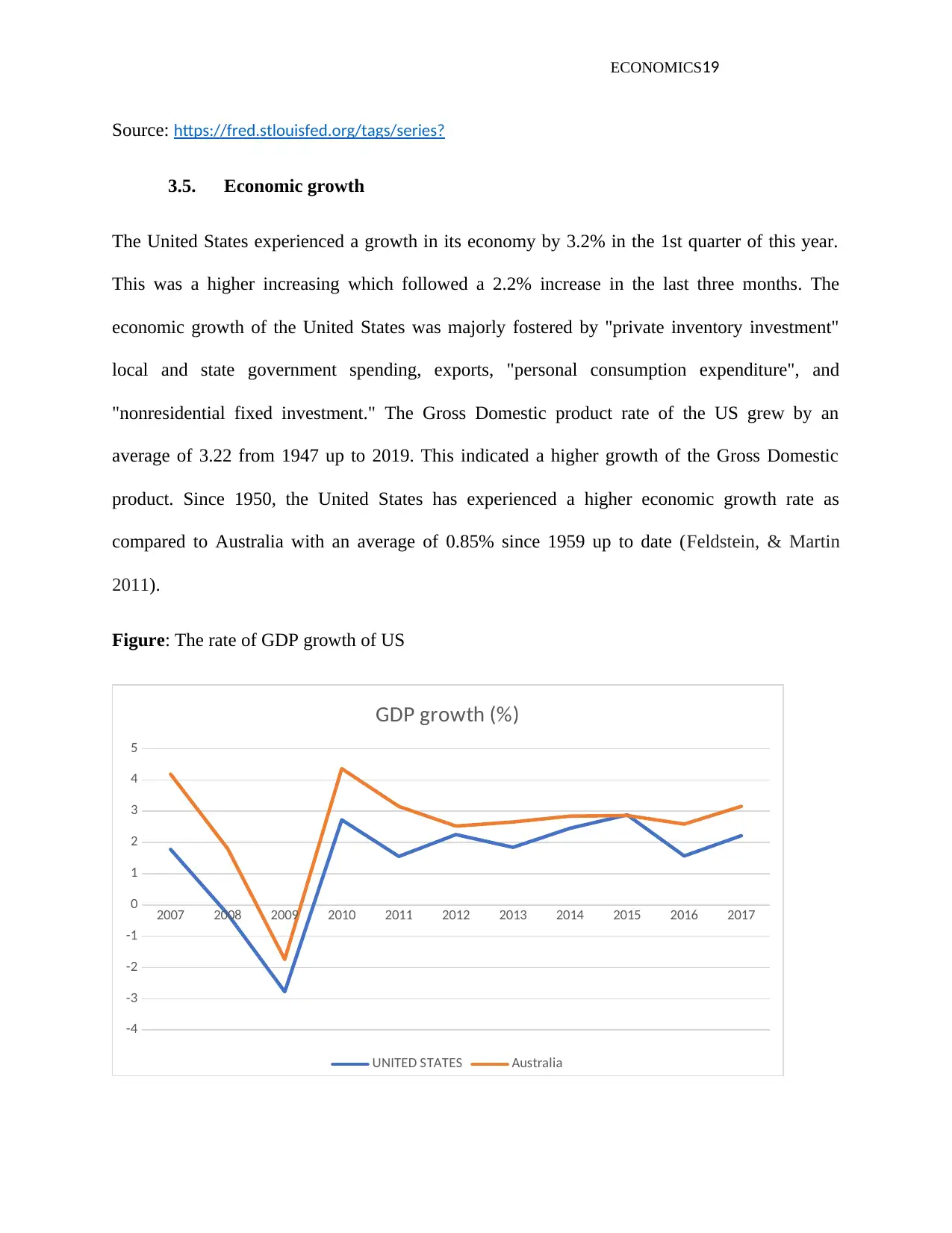

3.5. Economic growth

The United States experienced a growth in its economy by 3.2% in the 1st quarter of this year.

This was a higher increasing which followed a 2.2% increase in the last three months. The

economic growth of the United States was majorly fostered by "private inventory investment"

local and state government spending, exports, "personal consumption expenditure", and

"nonresidential fixed investment." The Gross Domestic product rate of the US grew by an

average of 3.22 from 1947 up to 2019. This indicated a higher growth of the Gross Domestic

product. Since 1950, the United States has experienced a higher economic growth rate as

compared to Australia with an average of 0.85% since 1959 up to date (Feldstein, & Martin

2011).

Figure: The rate of GDP growth of US

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

-4

-3

-2

-1

0

1

2

3

4

5

GDP growth (%)

UNITED STATES Australia

Source: https://fred.stlouisfed.org/tags/series?

3.5. Economic growth

The United States experienced a growth in its economy by 3.2% in the 1st quarter of this year.

This was a higher increasing which followed a 2.2% increase in the last three months. The

economic growth of the United States was majorly fostered by "private inventory investment"

local and state government spending, exports, "personal consumption expenditure", and

"nonresidential fixed investment." The Gross Domestic product rate of the US grew by an

average of 3.22 from 1947 up to 2019. This indicated a higher growth of the Gross Domestic

product. Since 1950, the United States has experienced a higher economic growth rate as

compared to Australia with an average of 0.85% since 1959 up to date (Feldstein, & Martin

2011).

Figure: The rate of GDP growth of US

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

-4

-3

-2

-1

0

1

2

3

4

5

GDP growth (%)

UNITED STATES Australia

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ECONOMICS20

Source: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?locations=IL-OE-DE-US

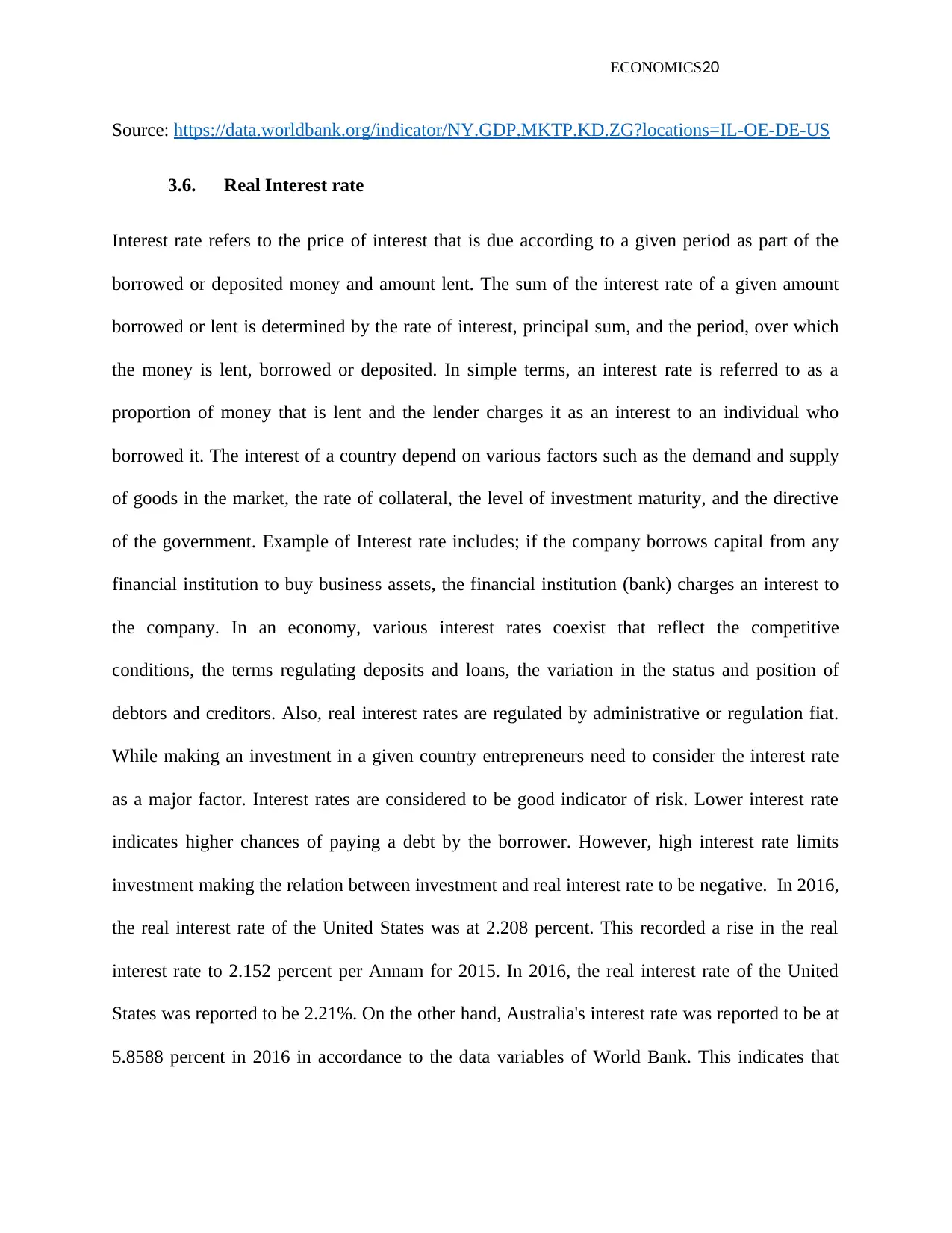

3.6. Real Interest rate

Interest rate refers to the price of interest that is due according to a given period as part of the

borrowed or deposited money and amount lent. The sum of the interest rate of a given amount

borrowed or lent is determined by the rate of interest, principal sum, and the period, over which

the money is lent, borrowed or deposited. In simple terms, an interest rate is referred to as a

proportion of money that is lent and the lender charges it as an interest to an individual who

borrowed it. The interest of a country depend on various factors such as the demand and supply

of goods in the market, the rate of collateral, the level of investment maturity, and the directive

of the government. Example of Interest rate includes; if the company borrows capital from any

financial institution to buy business assets, the financial institution (bank) charges an interest to

the company. In an economy, various interest rates coexist that reflect the competitive

conditions, the terms regulating deposits and loans, the variation in the status and position of

debtors and creditors. Also, real interest rates are regulated by administrative or regulation fiat.

While making an investment in a given country entrepreneurs need to consider the interest rate

as a major factor. Interest rates are considered to be good indicator of risk. Lower interest rate

indicates higher chances of paying a debt by the borrower. However, high interest rate limits

investment making the relation between investment and real interest rate to be negative. In 2016,

the real interest rate of the United States was at 2.208 percent. This recorded a rise in the real

interest rate to 2.152 percent per Annam for 2015. In 2016, the real interest rate of the United

States was reported to be 2.21%. On the other hand, Australia's interest rate was reported to be at

5.8588 percent in 2016 in accordance to the data variables of World Bank. This indicates that

Source: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?locations=IL-OE-DE-US

3.6. Real Interest rate

Interest rate refers to the price of interest that is due according to a given period as part of the

borrowed or deposited money and amount lent. The sum of the interest rate of a given amount

borrowed or lent is determined by the rate of interest, principal sum, and the period, over which

the money is lent, borrowed or deposited. In simple terms, an interest rate is referred to as a

proportion of money that is lent and the lender charges it as an interest to an individual who

borrowed it. The interest of a country depend on various factors such as the demand and supply

of goods in the market, the rate of collateral, the level of investment maturity, and the directive

of the government. Example of Interest rate includes; if the company borrows capital from any

financial institution to buy business assets, the financial institution (bank) charges an interest to

the company. In an economy, various interest rates coexist that reflect the competitive

conditions, the terms regulating deposits and loans, the variation in the status and position of

debtors and creditors. Also, real interest rates are regulated by administrative or regulation fiat.

While making an investment in a given country entrepreneurs need to consider the interest rate

as a major factor. Interest rates are considered to be good indicator of risk. Lower interest rate

indicates higher chances of paying a debt by the borrower. However, high interest rate limits

investment making the relation between investment and real interest rate to be negative. In 2016,

the real interest rate of the United States was at 2.208 percent. This recorded a rise in the real

interest rate to 2.152 percent per Annam for 2015. In 2016, the real interest rate of the United

States was reported to be 2.21%. On the other hand, Australia's interest rate was reported to be at

5.8588 percent in 2016 in accordance to the data variables of World Bank. This indicates that

ECONOMICS21

Australia had a higher interest rate in 2016 as compared to the United States (Krugman, & Paul

2011).

Figure: Interest rates

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

0 100 200 300 400 500 600

Interest rate payments

Australia UNITED STATES

Source: https://data.worldbank.org/indicator/GC.XPN.INTP.CN?

end=2017&locations=AU&start=2007

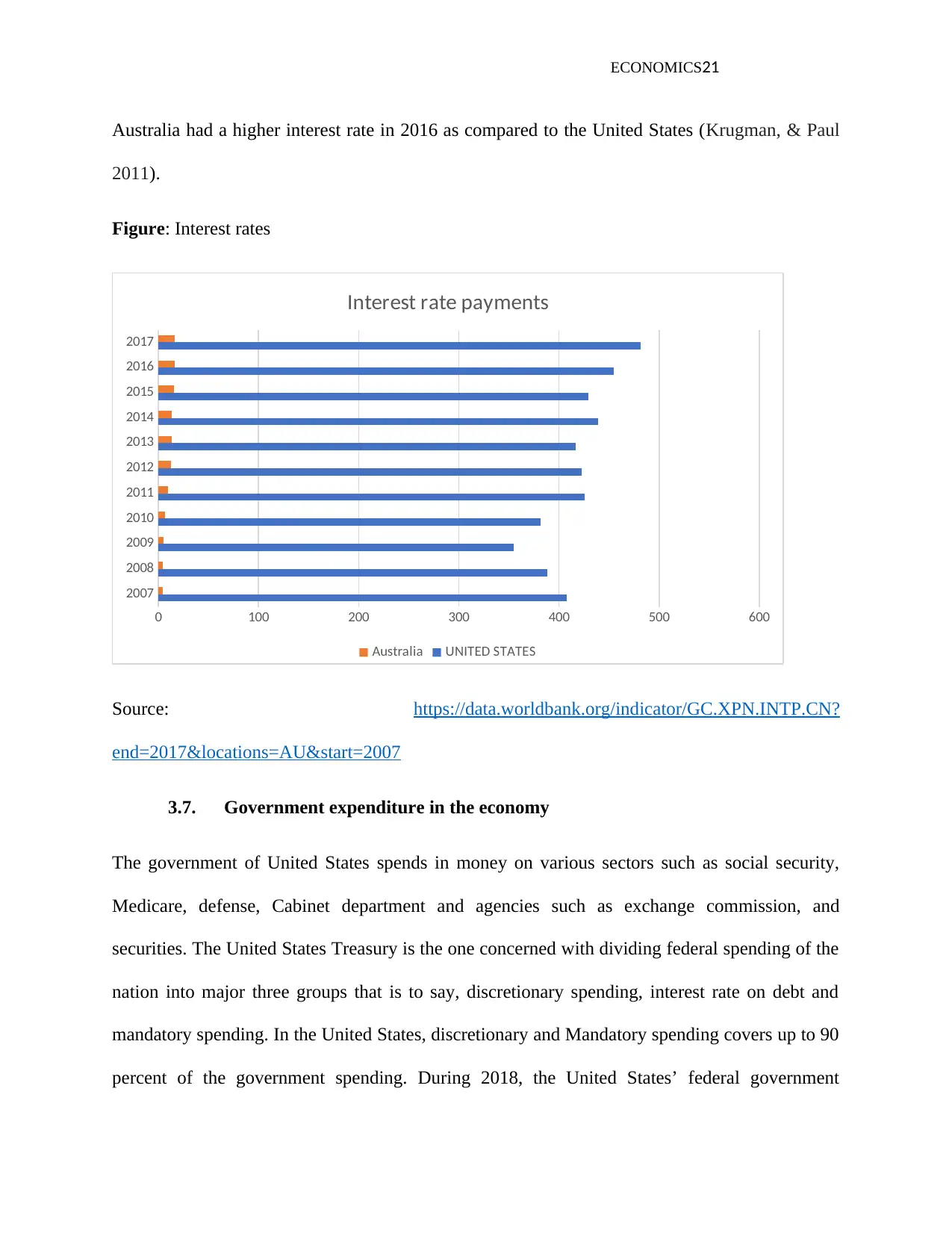

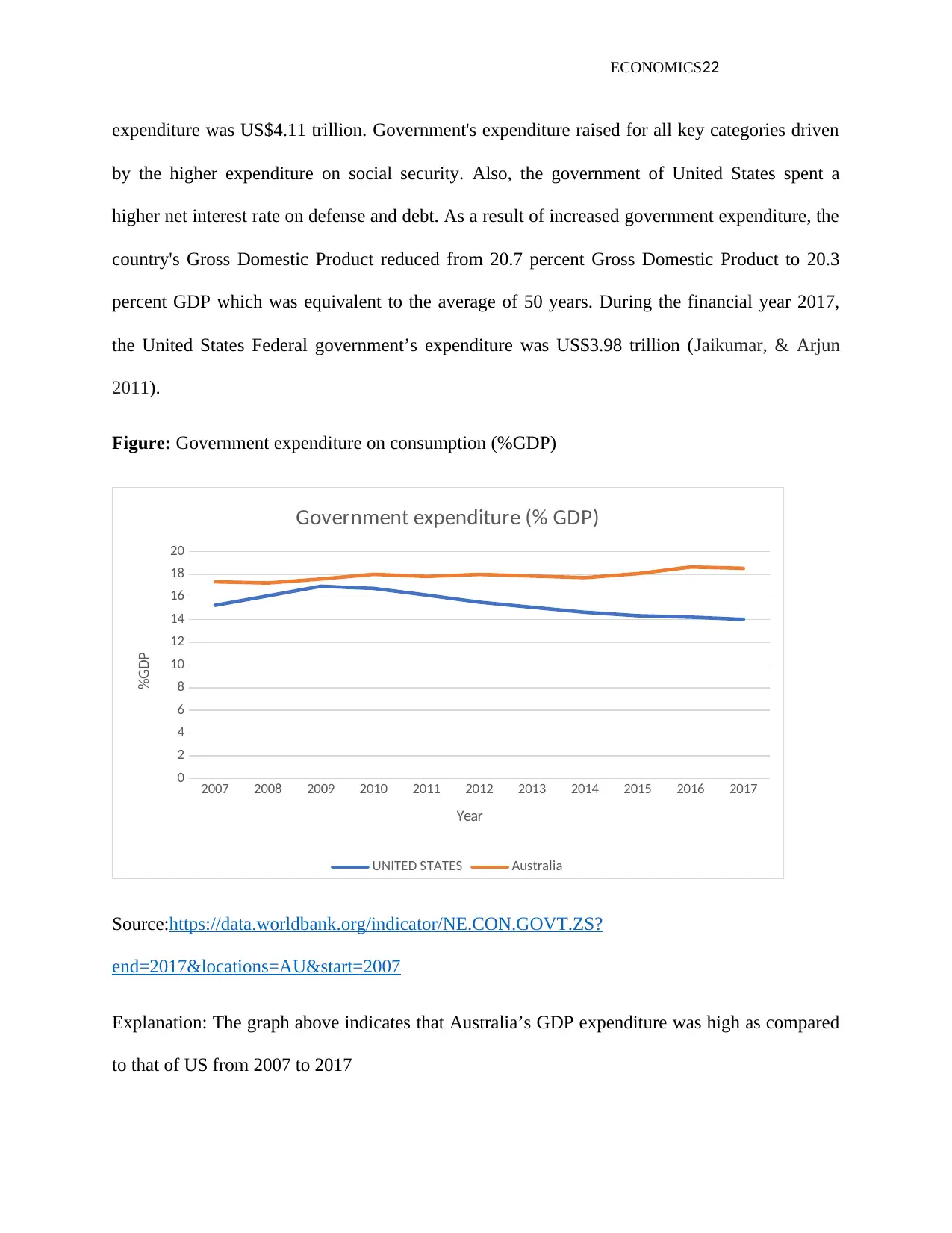

3.7. Government expenditure in the economy

The government of United States spends in money on various sectors such as social security,

Medicare, defense, Cabinet department and agencies such as exchange commission, and

securities. The United States Treasury is the one concerned with dividing federal spending of the

nation into major three groups that is to say, discretionary spending, interest rate on debt and

mandatory spending. In the United States, discretionary and Mandatory spending covers up to 90

percent of the government spending. During 2018, the United States’ federal government

Australia had a higher interest rate in 2016 as compared to the United States (Krugman, & Paul

2011).

Figure: Interest rates

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

0 100 200 300 400 500 600

Interest rate payments

Australia UNITED STATES

Source: https://data.worldbank.org/indicator/GC.XPN.INTP.CN?

end=2017&locations=AU&start=2007

3.7. Government expenditure in the economy

The government of United States spends in money on various sectors such as social security,

Medicare, defense, Cabinet department and agencies such as exchange commission, and

securities. The United States Treasury is the one concerned with dividing federal spending of the

nation into major three groups that is to say, discretionary spending, interest rate on debt and

mandatory spending. In the United States, discretionary and Mandatory spending covers up to 90

percent of the government spending. During 2018, the United States’ federal government

ECONOMICS22

expenditure was US$4.11 trillion. Government's expenditure raised for all key categories driven

by the higher expenditure on social security. Also, the government of United States spent a

higher net interest rate on defense and debt. As a result of increased government expenditure, the

country's Gross Domestic Product reduced from 20.7 percent Gross Domestic Product to 20.3

percent GDP which was equivalent to the average of 50 years. During the financial year 2017,

the United States Federal government’s expenditure was US$3.98 trillion (Jaikumar, & Arjun

2011).

Figure: Government expenditure on consumption (%GDP)

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

2

4

6

8

10

12

14

16

18

20

Government expenditure (% GDP)

UNITED STATES Australia

Year

%GDP

Source:https://data.worldbank.org/indicator/NE.CON.GOVT.ZS?

end=2017&locations=AU&start=2007

Explanation: The graph above indicates that Australia’s GDP expenditure was high as compared

to that of US from 2007 to 2017

expenditure was US$4.11 trillion. Government's expenditure raised for all key categories driven

by the higher expenditure on social security. Also, the government of United States spent a

higher net interest rate on defense and debt. As a result of increased government expenditure, the

country's Gross Domestic Product reduced from 20.7 percent Gross Domestic Product to 20.3

percent GDP which was equivalent to the average of 50 years. During the financial year 2017,

the United States Federal government’s expenditure was US$3.98 trillion (Jaikumar, & Arjun

2011).

Figure: Government expenditure on consumption (%GDP)

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

0

2

4

6

8

10

12

14

16

18

20

Government expenditure (% GDP)

UNITED STATES Australia

Year

%GDP

Source:https://data.worldbank.org/indicator/NE.CON.GOVT.ZS?

end=2017&locations=AU&start=2007

Explanation: The graph above indicates that Australia’s GDP expenditure was high as compared

to that of US from 2007 to 2017

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ECONOMICS23

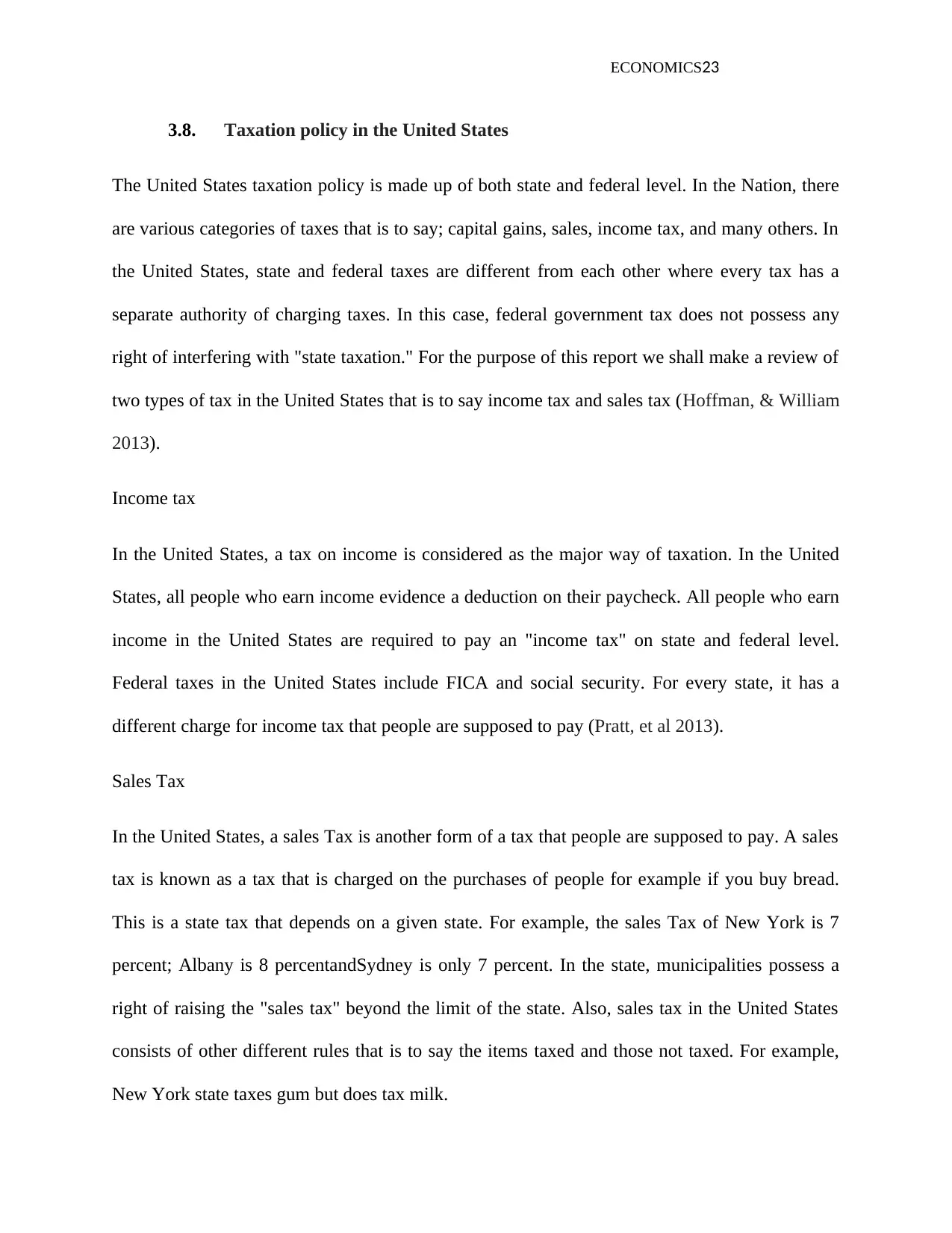

3.8. Taxation policy in the United States

The United States taxation policy is made up of both state and federal level. In the Nation, there

are various categories of taxes that is to say; capital gains, sales, income tax, and many others. In

the United States, state and federal taxes are different from each other where every tax has a

separate authority of charging taxes. In this case, federal government tax does not possess any

right of interfering with "state taxation." For the purpose of this report we shall make a review of

two types of tax in the United States that is to say income tax and sales tax (Hoffman, & William

2013).

Income tax

In the United States, a tax on income is considered as the major way of taxation. In the United

States, all people who earn income evidence a deduction on their paycheck. All people who earn

income in the United States are required to pay an "income tax" on state and federal level.

Federal taxes in the United States include FICA and social security. For every state, it has a

different charge for income tax that people are supposed to pay (Pratt, et al 2013).

Sales Tax

In the United States, a sales Tax is another form of a tax that people are supposed to pay. A sales

tax is known as a tax that is charged on the purchases of people for example if you buy bread.

This is a state tax that depends on a given state. For example, the sales Tax of New York is 7

percent; Albany is 8 percentandSydney is only 7 percent. In the state, municipalities possess a

right of raising the "sales tax" beyond the limit of the state. Also, sales tax in the United States

consists of other different rules that is to say the items taxed and those not taxed. For example,

New York state taxes gum but does tax milk.

3.8. Taxation policy in the United States

The United States taxation policy is made up of both state and federal level. In the Nation, there

are various categories of taxes that is to say; capital gains, sales, income tax, and many others. In

the United States, state and federal taxes are different from each other where every tax has a

separate authority of charging taxes. In this case, federal government tax does not possess any

right of interfering with "state taxation." For the purpose of this report we shall make a review of

two types of tax in the United States that is to say income tax and sales tax (Hoffman, & William

2013).

Income tax

In the United States, a tax on income is considered as the major way of taxation. In the United

States, all people who earn income evidence a deduction on their paycheck. All people who earn

income in the United States are required to pay an "income tax" on state and federal level.

Federal taxes in the United States include FICA and social security. For every state, it has a

different charge for income tax that people are supposed to pay (Pratt, et al 2013).

Sales Tax

In the United States, a sales Tax is another form of a tax that people are supposed to pay. A sales

tax is known as a tax that is charged on the purchases of people for example if you buy bread.

This is a state tax that depends on a given state. For example, the sales Tax of New York is 7

percent; Albany is 8 percentandSydney is only 7 percent. In the state, municipalities possess a

right of raising the "sales tax" beyond the limit of the state. Also, sales tax in the United States

consists of other different rules that is to say the items taxed and those not taxed. For example,

New York state taxes gum but does tax milk.

ECONOMICS24

Figure: Taxation policy in United States

Source: https://data.worldbank.org/indicator/

Explanation: The graph above indicates the tax policy of United States in percent from 2002 to

2016. The graph indicates that United States the taxation policy of the US contributes highly

towards the GDP of the nation

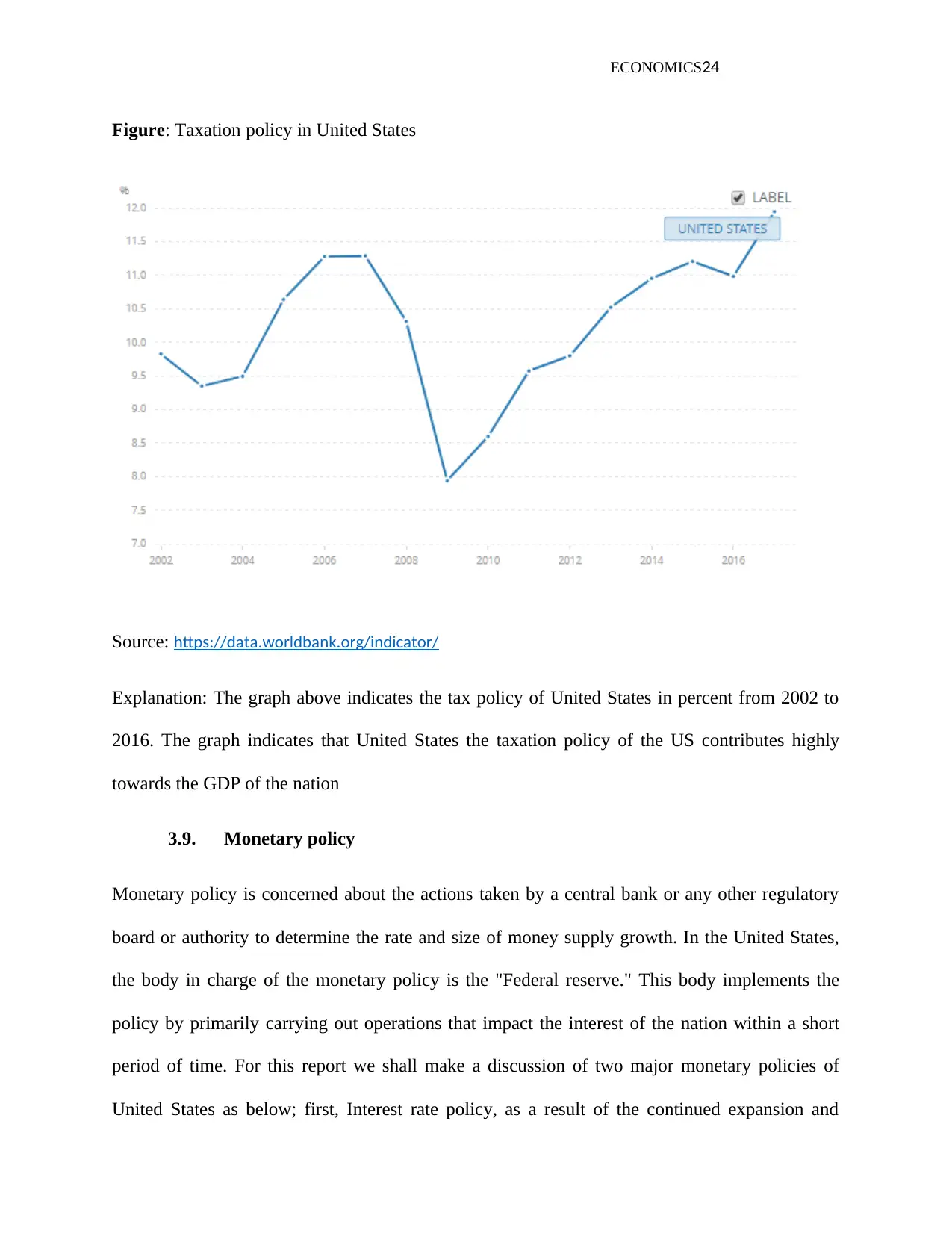

3.9. Monetary policy

Monetary policy is concerned about the actions taken by a central bank or any other regulatory

board or authority to determine the rate and size of money supply growth. In the United States,

the body in charge of the monetary policy is the "Federal reserve." This body implements the

policy by primarily carrying out operations that impact the interest of the nation within a short

period of time. For this report we shall make a discussion of two major monetary policies of

United States as below; first, Interest rate policy, as a result of the continued expansion and

Figure: Taxation policy in United States

Source: https://data.worldbank.org/indicator/

Explanation: The graph above indicates the tax policy of United States in percent from 2002 to

2016. The graph indicates that United States the taxation policy of the US contributes highly

towards the GDP of the nation

3.9. Monetary policy

Monetary policy is concerned about the actions taken by a central bank or any other regulatory

board or authority to determine the rate and size of money supply growth. In the United States,

the body in charge of the monetary policy is the "Federal reserve." This body implements the

policy by primarily carrying out operations that impact the interest of the nation within a short

period of time. For this report we shall make a discussion of two major monetary policies of

United States as below; first, Interest rate policy, as a result of the continued expansion and

ECONOMICS25

strengthening of the economic activities in the United States at a high rate, the Federal Reserve

increased the variation of the proposed range for "federal funds rate" by mid-2018. In addition,

the Federal Reserve increased United States "federal fund rate" to 2-1/2 from 2-1/4 percent in

September and December 2018. As a result of increased concerns in the United States about

trade tensions, and global growth, the Committee of Federal Reserve illustrated that it would be

in the position to monitor finical and global economic developments and also assess their

meaning for such as economic outlook (Whittenberg et al 2013).

Second, balance sheet policy, in the United states, the federal Reserve Committee went on

implementing the normalization program of the "balance sheet" that was proposed in October

2017. In this case, the Federal Reserve was in the position to cut down its agency securities and

Treasury holdings the predictable and gradual manner by only reinvesting principle payments

received from the securities that were above slowly by slowly hence rising caps. The total assets

of the FR reduced by US$260 billion leading to an average of US$ 4 trillion by mid-2018

(Stieglitz 2010).

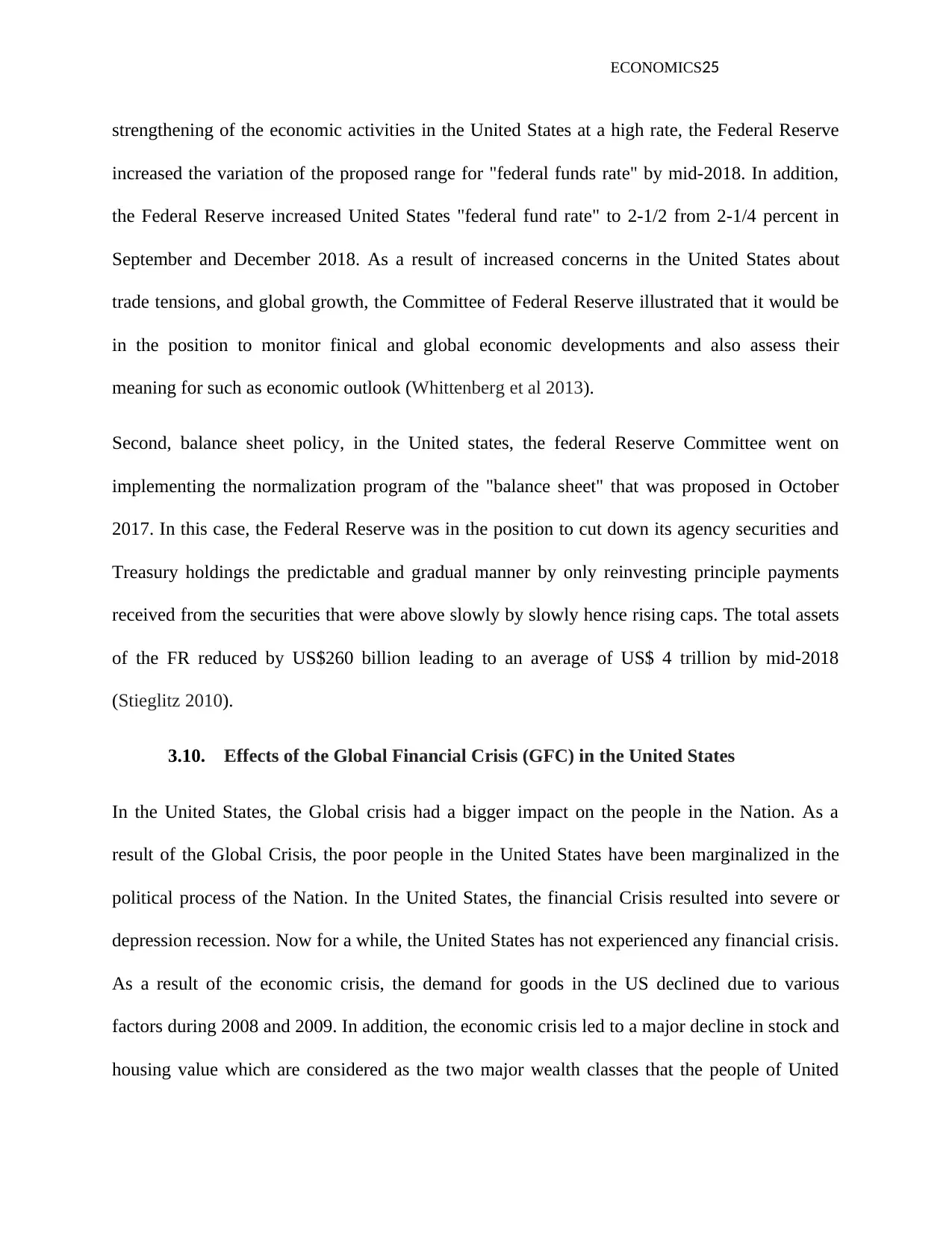

3.10. Effects of the Global Financial Crisis (GFC) in the United States

In the United States, the Global crisis had a bigger impact on the people in the Nation. As a

result of the Global Crisis, the poor people in the United States have been marginalized in the

political process of the Nation. In the United States, the financial Crisis resulted into severe or

depression recession. Now for a while, the United States has not experienced any financial crisis.

As a result of the economic crisis, the demand for goods in the US declined due to various

factors during 2008 and 2009. In addition, the economic crisis led to a major decline in stock and

housing value which are considered as the two major wealth classes that the people of United

strengthening of the economic activities in the United States at a high rate, the Federal Reserve

increased the variation of the proposed range for "federal funds rate" by mid-2018. In addition,

the Federal Reserve increased United States "federal fund rate" to 2-1/2 from 2-1/4 percent in

September and December 2018. As a result of increased concerns in the United States about

trade tensions, and global growth, the Committee of Federal Reserve illustrated that it would be

in the position to monitor finical and global economic developments and also assess their

meaning for such as economic outlook (Whittenberg et al 2013).

Second, balance sheet policy, in the United states, the federal Reserve Committee went on

implementing the normalization program of the "balance sheet" that was proposed in October

2017. In this case, the Federal Reserve was in the position to cut down its agency securities and

Treasury holdings the predictable and gradual manner by only reinvesting principle payments

received from the securities that were above slowly by slowly hence rising caps. The total assets

of the FR reduced by US$260 billion leading to an average of US$ 4 trillion by mid-2018

(Stieglitz 2010).

3.10. Effects of the Global Financial Crisis (GFC) in the United States

In the United States, the Global crisis had a bigger impact on the people in the Nation. As a

result of the Global Crisis, the poor people in the United States have been marginalized in the

political process of the Nation. In the United States, the financial Crisis resulted into severe or