Evaluating Investment Appraisal Techniques for ABC Plc's Projects

VerifiedAdded on 2023/01/13

|7

|1262

|85

Essay

AI Summary

This essay provides an analysis of investment appraisal techniques, focusing on the Payback Period and Net Present Value (NPV) methods, within the context of ABC Plc's investment decisions. The essay begins with an introduction that highlights the importance of decision-making in organizations, setting the stage for evaluating two potential investment projects: a Motor Software project and a Hardware project. The main body includes the calculation and comparison of payback periods for both projects, revealing the time it takes to recover the initial investment. Additionally, it presents the calculation of NPV for each project, considering discounted cash flows to determine the present value of future returns. The analysis section compares the two methods, discussing their advantages and disadvantages. The practical implications section concludes that the Hardware project is more favorable for ABC Plc based on both methods. The essay also incorporates financial and non-financial factors influencing investment decisions and concludes by summarizing the insights gained from the analysis, emphasizing the importance of these techniques in strategic financial planning.

Essay

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

1. Calculation of Payback Period.................................................................................................3

2. Calculation of Net Present Value (NPV).................................................................................4

3. Analysis....................................................................................................................................4

4. Practical implications...............................................................................................................5

CONCLUSION................................................................................................................................6

REFERENCES ...............................................................................................................................7

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

1. Calculation of Payback Period.................................................................................................3

2. Calculation of Net Present Value (NPV).................................................................................4

3. Analysis....................................................................................................................................4

4. Practical implications...............................................................................................................5

CONCLUSION................................................................................................................................6

REFERENCES ...............................................................................................................................7

INTRODUCTION

In an organization, decision making process is very essential which helps the managers to

take effective actions which helps in contributing to maximise operational productivity as well as

profitability (Cheng, Hackett and Lee-Chin, 2018). Before making any strategic decision,

management should identify the need of business and perform accordingly. ABC Plc is computer

software organization where strategic managers looking to invest into new business and they

found two new opportunities to invest which are Motor software project or Hardware project.

This essay covers payback period and NPV method which helps in identifying which project is

most suitable as well as beneficial for the company.

MAIN BODY

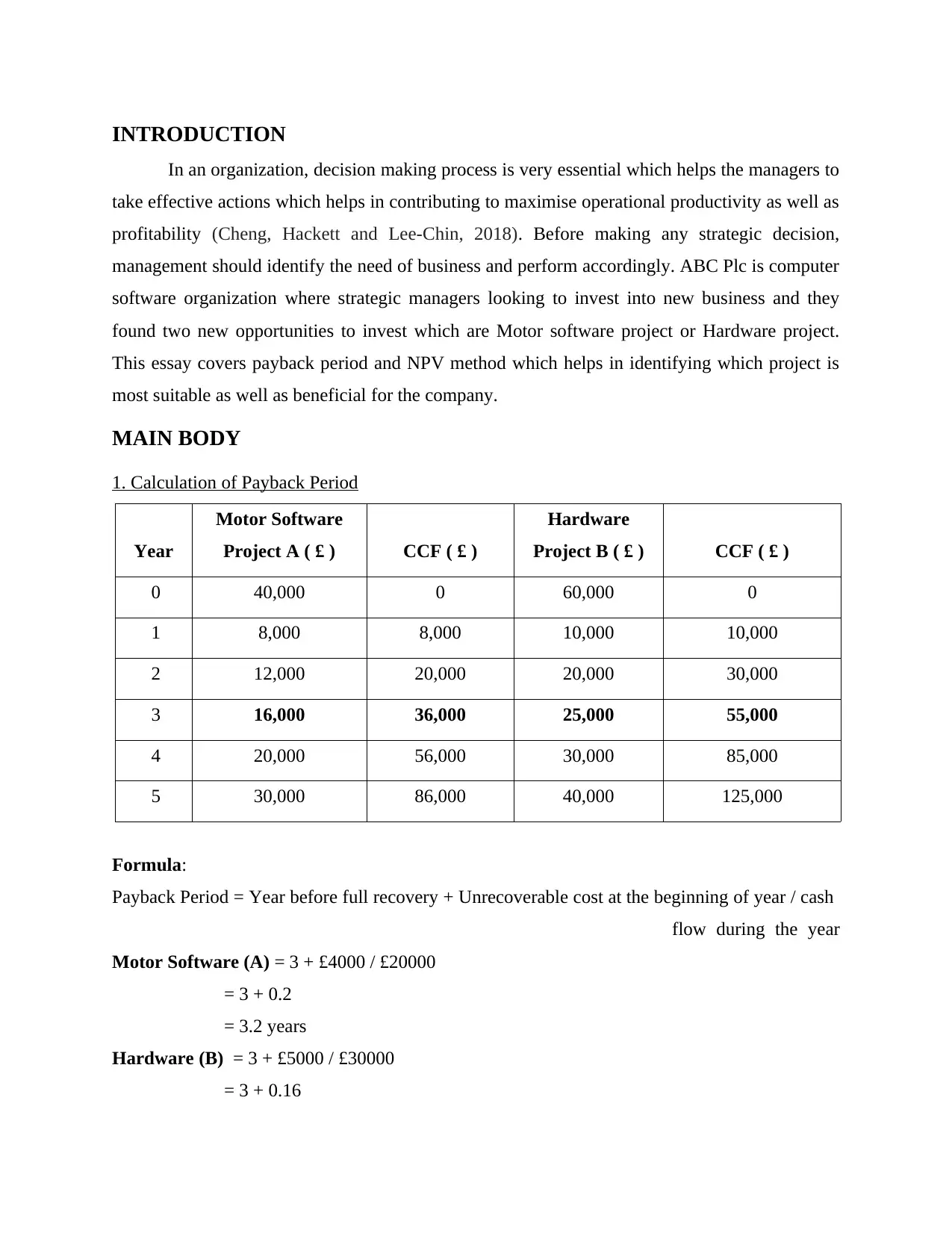

1. Calculation of Payback Period

Year

Motor Software

Project A ( £ ) CCF ( £ )

Hardware

Project B ( £ ) CCF ( £ )

0 40,000 0 60,000 0

1 8,000 8,000 10,000 10,000

2 12,000 20,000 20,000 30,000

3 16,000 36,000 25,000 55,000

4 20,000 56,000 30,000 85,000

5 30,000 86,000 40,000 125,000

Formula:

Payback Period = Year before full recovery + Unrecoverable cost at the beginning of year / cash

flow during the year

Motor Software (A) = 3 + £4000 / £20000

= 3 + 0.2

= 3.2 years

Hardware (B) = 3 + £5000 / £30000

= 3 + 0.16

In an organization, decision making process is very essential which helps the managers to

take effective actions which helps in contributing to maximise operational productivity as well as

profitability (Cheng, Hackett and Lee-Chin, 2018). Before making any strategic decision,

management should identify the need of business and perform accordingly. ABC Plc is computer

software organization where strategic managers looking to invest into new business and they

found two new opportunities to invest which are Motor software project or Hardware project.

This essay covers payback period and NPV method which helps in identifying which project is

most suitable as well as beneficial for the company.

MAIN BODY

1. Calculation of Payback Period

Year

Motor Software

Project A ( £ ) CCF ( £ )

Hardware

Project B ( £ ) CCF ( £ )

0 40,000 0 60,000 0

1 8,000 8,000 10,000 10,000

2 12,000 20,000 20,000 30,000

3 16,000 36,000 25,000 55,000

4 20,000 56,000 30,000 85,000

5 30,000 86,000 40,000 125,000

Formula:

Payback Period = Year before full recovery + Unrecoverable cost at the beginning of year / cash

flow during the year

Motor Software (A) = 3 + £4000 / £20000

= 3 + 0.2

= 3.2 years

Hardware (B) = 3 + £5000 / £30000

= 3 + 0.16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

= 3.16 years

From the above calculations it has been observed that ABC Plc has two different options

to invest but according to Payback period there is no such difference among the recovery time.

Project B that is hardware business is more favourable in respect of Project A, so company

should invest in this business which has 3.16 year recovery period.

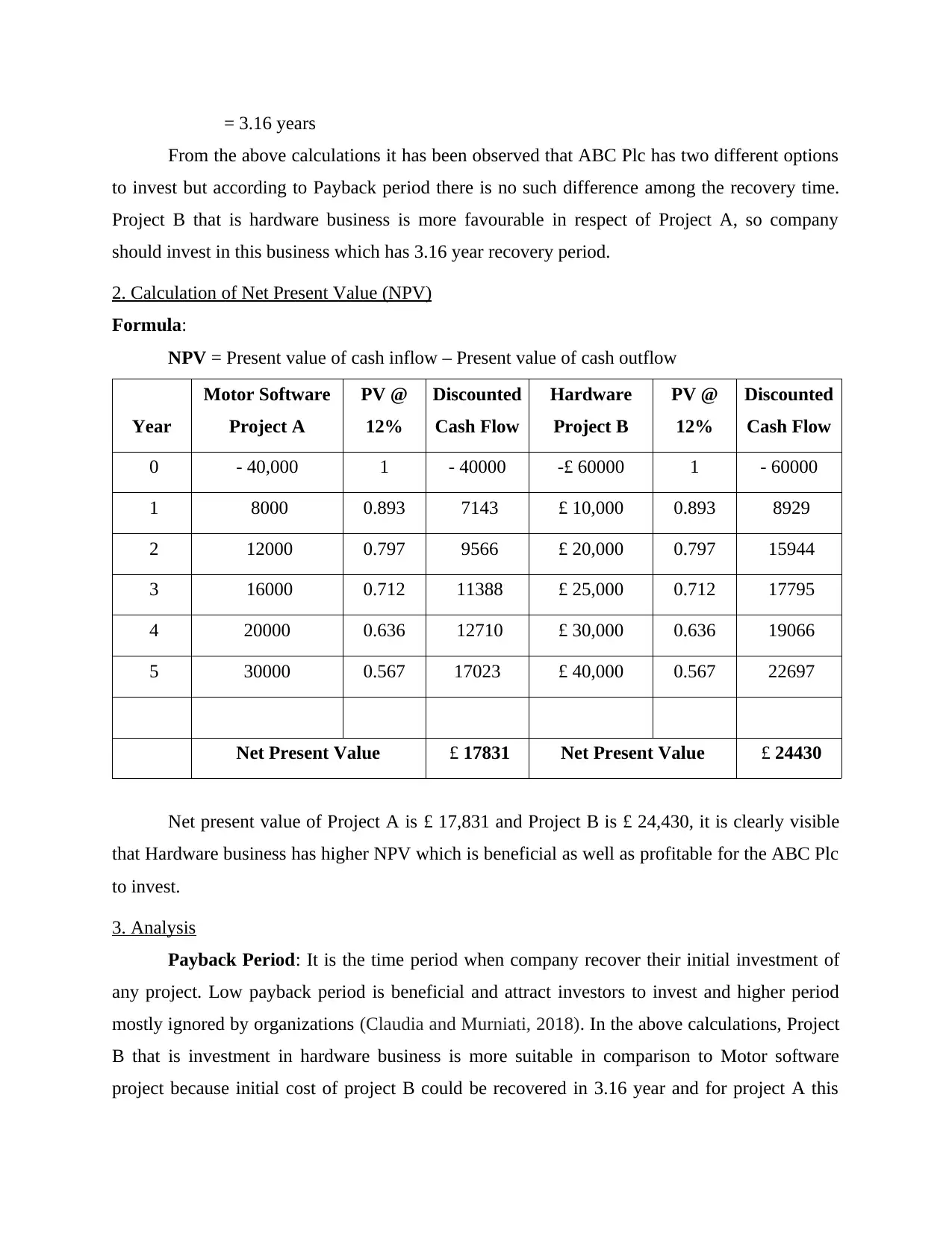

2. Calculation of Net Present Value (NPV)

Formula:

NPV = Present value of cash inflow – Present value of cash outflow

Year

Motor Software

Project A

PV @

12%

Discounted

Cash Flow

Hardware

Project B

PV @

12%

Discounted

Cash Flow

0 - 40,000 1 - 40000 -£ 60000 1 - 60000

1 8000 0.893 7143 £ 10,000 0.893 8929

2 12000 0.797 9566 £ 20,000 0.797 15944

3 16000 0.712 11388 £ 25,000 0.712 17795

4 20000 0.636 12710 £ 30,000 0.636 19066

5 30000 0.567 17023 £ 40,000 0.567 22697

Net Present Value £ 17831 Net Present Value £ 24430

Net present value of Project A is £ 17,831 and Project B is £ 24,430, it is clearly visible

that Hardware business has higher NPV which is beneficial as well as profitable for the ABC Plc

to invest.

3. Analysis

Payback Period: It is the time period when company recover their initial investment of

any project. Low payback period is beneficial and attract investors to invest and higher period

mostly ignored by organizations (Claudia and Murniati, 2018). In the above calculations, Project

B that is investment in hardware business is more suitable in comparison to Motor software

project because initial cost of project B could be recovered in 3.16 year and for project A this

From the above calculations it has been observed that ABC Plc has two different options

to invest but according to Payback period there is no such difference among the recovery time.

Project B that is hardware business is more favourable in respect of Project A, so company

should invest in this business which has 3.16 year recovery period.

2. Calculation of Net Present Value (NPV)

Formula:

NPV = Present value of cash inflow – Present value of cash outflow

Year

Motor Software

Project A

PV @

12%

Discounted

Cash Flow

Hardware

Project B

PV @

12%

Discounted

Cash Flow

0 - 40,000 1 - 40000 -£ 60000 1 - 60000

1 8000 0.893 7143 £ 10,000 0.893 8929

2 12000 0.797 9566 £ 20,000 0.797 15944

3 16000 0.712 11388 £ 25,000 0.712 17795

4 20000 0.636 12710 £ 30,000 0.636 19066

5 30000 0.567 17023 £ 40,000 0.567 22697

Net Present Value £ 17831 Net Present Value £ 24430

Net present value of Project A is £ 17,831 and Project B is £ 24,430, it is clearly visible

that Hardware business has higher NPV which is beneficial as well as profitable for the ABC Plc

to invest.

3. Analysis

Payback Period: It is the time period when company recover their initial investment of

any project. Low payback period is beneficial and attract investors to invest and higher period

mostly ignored by organizations (Claudia and Murniati, 2018). In the above calculations, Project

B that is investment in hardware business is more suitable in comparison to Motor software

project because initial cost of project B could be recovered in 3.16 year and for project A this

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

period is 3.20 years. It is one of the effective method of capital budgeting and its advantages or

disadvantage are as follow:

Advantage: It is very simple to calculate method which help the managers to evaluate

results of projects. With the help of its analysis, businesses will be able to reduce risk and

make decisions accordingly.

Disadvantage: This method does not consider the time value of money which may vary

the results and further impact managers decisions. In addition, this method does not

consider the cash inflows after calculating payback period.

Net Present Value (NPV): It is most useable method of capital budgeting that is used to

evaluate the present value of cash flow (Fan and Xia, 2018). NPV is calculated through

identifying difference between present value of cash inflow and present value of cash outflow.

From the above calculations it has been determined that NPV of Project A is £ 17,831 and

Project B is £ 24,430. Managers of ABC Plc decided to invest in Project B because its NPV is

high in comparison to other project. In addition, there are some advantages or disadvantage of

this method which are mentioned below:

Advantage: This method helps the organization to identify that whether project is

beneficial as well as profitable for the company or not, to invest.

Disadvantage: NPV method can't be compared with other project or portfolio if they are

if different size. In addition, entire calculation based on discounting rate of rerun which

can vary the final results.

Financial factors are various financial factors which influence the decision making

process of business. These are interest rate on borrowings, economic growth rate etc. because

high interest rate will demotivate people to invest more but if interest rate is low than it will

encourage them to invest to generate more revenue for them.

Non financial factors evaluated by the managers of ABC Plc, at the time of making

business decisions managers should evaluate non financial factors and it can be identified with

the help of SWOT or PESTEL analysis. By using SWOT, managers able to identify future

opportunities, threats or weakness. In addition, also helps in evaluating external factors such as

political, economic, social etc.

disadvantage are as follow:

Advantage: It is very simple to calculate method which help the managers to evaluate

results of projects. With the help of its analysis, businesses will be able to reduce risk and

make decisions accordingly.

Disadvantage: This method does not consider the time value of money which may vary

the results and further impact managers decisions. In addition, this method does not

consider the cash inflows after calculating payback period.

Net Present Value (NPV): It is most useable method of capital budgeting that is used to

evaluate the present value of cash flow (Fan and Xia, 2018). NPV is calculated through

identifying difference between present value of cash inflow and present value of cash outflow.

From the above calculations it has been determined that NPV of Project A is £ 17,831 and

Project B is £ 24,430. Managers of ABC Plc decided to invest in Project B because its NPV is

high in comparison to other project. In addition, there are some advantages or disadvantage of

this method which are mentioned below:

Advantage: This method helps the organization to identify that whether project is

beneficial as well as profitable for the company or not, to invest.

Disadvantage: NPV method can't be compared with other project or portfolio if they are

if different size. In addition, entire calculation based on discounting rate of rerun which

can vary the final results.

Financial factors are various financial factors which influence the decision making

process of business. These are interest rate on borrowings, economic growth rate etc. because

high interest rate will demotivate people to invest more but if interest rate is low than it will

encourage them to invest to generate more revenue for them.

Non financial factors evaluated by the managers of ABC Plc, at the time of making

business decisions managers should evaluate non financial factors and it can be identified with

the help of SWOT or PESTEL analysis. By using SWOT, managers able to identify future

opportunities, threats or weakness. In addition, also helps in evaluating external factors such as

political, economic, social etc.

4. Practical implications

From the above analysis it has been observed that Project B is more favourable for ABC

Plc to invest into new business (Galli, 2018). For strategic managers, it is quite difficult to make

their decision on the basis of Payback Period because it is almost similar but they can make

business decisions as per NPV of the projects. Company should make decisions to invest in

hardware business which will help to generate more return and recover their initial cost in

comparison to Project A.

CONCLUSION

Above discussion helps the managers of organizations to understand the various

advantages or disadvantages of Investment appraisal techniques such as NPV or payback period.

Along with this, identify financial or non financial factors which influence decision making

process of managers.

From the above analysis it has been observed that Project B is more favourable for ABC

Plc to invest into new business (Galli, 2018). For strategic managers, it is quite difficult to make

their decision on the basis of Payback Period because it is almost similar but they can make

business decisions as per NPV of the projects. Company should make decisions to invest in

hardware business which will help to generate more return and recover their initial cost in

comparison to Project A.

CONCLUSION

Above discussion helps the managers of organizations to understand the various

advantages or disadvantages of Investment appraisal techniques such as NPV or payback period.

Along with this, identify financial or non financial factors which influence decision making

process of managers.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books & Journals

Cheng, M. M. and et.al., 2018. Simulation and big data: in search of causality in big data-related

managial decision making.

Claudia, G. and Murniati, M. P., 2018. SELF EFFICACY AS THE MODERATING

VARIABLE IN FRAMING EFFECT ON INVESTMENT DECISION MAKING. South

East Asia Journal of Contemporary Business, Economics and Law. 16(1). pp.22-27.

Fan, Y. and Xia, X., 2018. Energy-efficiency building retrofit planning for green building

compliance. Building and Environment. 136. pp.312-321.

Galli, B. J., 2018. Effective Decision-Making in Project Based Environments: A Reflection of

Best Practices. International Journal of Applied Industrial Engineering (IJAIE). 5(1).

pp.50-62.

Books & Journals

Cheng, M. M. and et.al., 2018. Simulation and big data: in search of causality in big data-related

managial decision making.

Claudia, G. and Murniati, M. P., 2018. SELF EFFICACY AS THE MODERATING

VARIABLE IN FRAMING EFFECT ON INVESTMENT DECISION MAKING. South

East Asia Journal of Contemporary Business, Economics and Law. 16(1). pp.22-27.

Fan, Y. and Xia, X., 2018. Energy-efficiency building retrofit planning for green building

compliance. Building and Environment. 136. pp.312-321.

Galli, B. J., 2018. Effective Decision-Making in Project Based Environments: A Reflection of

Best Practices. International Journal of Applied Industrial Engineering (IJAIE). 5(1).

pp.50-62.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.