UGB 163 Accounting and Finance Report: Investment Appraisal Analysis

VerifiedAdded on 2023/01/18

|18

|3809

|89

Report

AI Summary

This report provides a comprehensive analysis of accounting and finance principles through three distinct parts. Part A focuses on Terry Joe Plc, constructing its income statement and statement of financial position. Part B delves into Kokolet Limited, examining contribution margins, break-even points, margin of safety, profit calculations, strategic assessments, and the assumptions underpinning break-even models. Finally, Part C evaluates Smith Howe Limited by calculating the payback period, accounting rate of return, and net present value of a machine investment, along with a discussion of the merits and limitations of investment appraisal techniques and budgeting as a strategic tool. The report integrates financial accounting and management accounting concepts to understand the role of finance at local and international levels.

Introduction to Accounting and

Finance

Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................1

Part A – Terry Joe Plc......................................................................................................................1

Statement of Income for the year ended 31st December 2018 for Terry Joe Plc........................1

Statement of Financial Position as at 31 December 2018 for Terry Joe Plc...............................3

Part B – Kokolet Limited.................................................................................................................5

a. Contribution.............................................................................................................................5

b. Break even point and margin of safety....................................................................................5

c. Calculation of profit.................................................................................................................6

d. Assessment of good strategy for Kokolet Limited..................................................................7

e. Assumptions attached to break even model.............................................................................8

Part C – Smith Howe Limited.........................................................................................................8

a. Calculating the Payback Period, the Accounting Rate of Return and the Net Present Value

of the machine, and providing recommendations........................................................................8

b. Key merits and limitations of the differing investment appraisal techniques.......................11

Key benefits and limitations of using budgets as a tool for strategic planning.........................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................1

Part A – Terry Joe Plc......................................................................................................................1

Statement of Income for the year ended 31st December 2018 for Terry Joe Plc........................1

Statement of Financial Position as at 31 December 2018 for Terry Joe Plc...............................3

Part B – Kokolet Limited.................................................................................................................5

a. Contribution.............................................................................................................................5

b. Break even point and margin of safety....................................................................................5

c. Calculation of profit.................................................................................................................6

d. Assessment of good strategy for Kokolet Limited..................................................................7

e. Assumptions attached to break even model.............................................................................8

Part C – Smith Howe Limited.........................................................................................................8

a. Calculating the Payback Period, the Accounting Rate of Return and the Net Present Value

of the machine, and providing recommendations........................................................................8

b. Key merits and limitations of the differing investment appraisal techniques.......................11

Key benefits and limitations of using budgets as a tool for strategic planning.........................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Accounting and finance is a field of study which allows a learner to deeply understanding

fundamental science behind organisational accounts and other financial activities (Ahmed and

Duellman, 2013). The main aim of this report is to build an understanding about the fundamental

models, concepts and techniques used within financial accounting and management accounting.

In this report, three individual assessment parts are covered in which knowledge and skills of

accounting are applied to understand the role of finance at a local and international level. In first

part of this report, income statement and balance sheet is developed which are based on journal

and primary books of accounting. In second part of this assessment, break even and contribution

margin is determined using costing techniques. In the last part of this report, investment appraisal

techniques are used to compute Payback Period, the Accounting Rate of Return, and the Net

Present Value along with description of merits and demerits of these techniques.

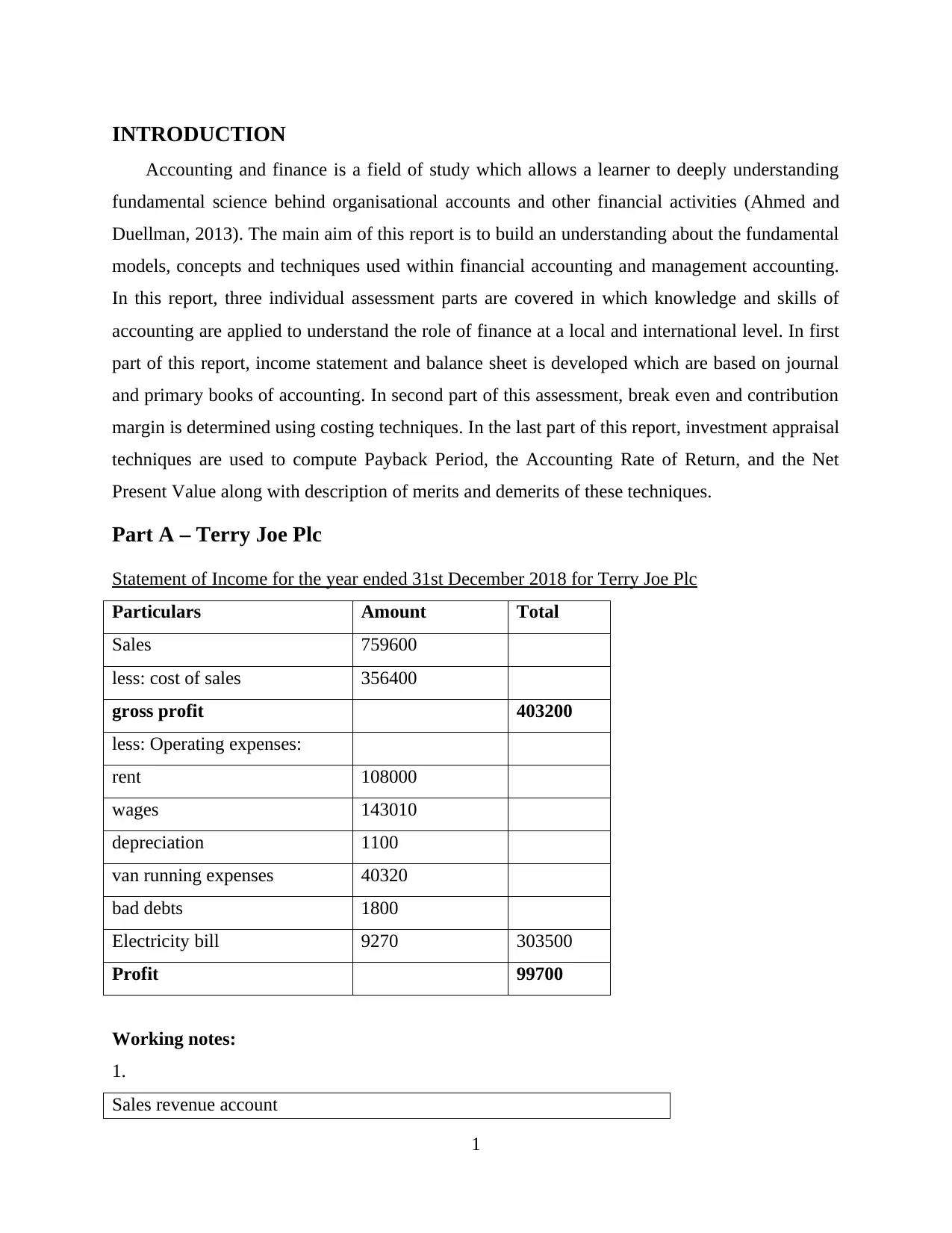

Part A – Terry Joe Plc

Statement of Income for the year ended 31st December 2018 for Terry Joe Plc

Particulars Amount Total

Sales 759600

less: cost of sales 356400

gross profit 403200

less: Operating expenses:

rent 108000

wages 143010

depreciation 1100

van running expenses 40320

bad debts 1800

Electricity bill 9270 303500

Profit 99700

Working notes:

1.

Sales revenue account

1

Accounting and finance is a field of study which allows a learner to deeply understanding

fundamental science behind organisational accounts and other financial activities (Ahmed and

Duellman, 2013). The main aim of this report is to build an understanding about the fundamental

models, concepts and techniques used within financial accounting and management accounting.

In this report, three individual assessment parts are covered in which knowledge and skills of

accounting are applied to understand the role of finance at a local and international level. In first

part of this report, income statement and balance sheet is developed which are based on journal

and primary books of accounting. In second part of this assessment, break even and contribution

margin is determined using costing techniques. In the last part of this report, investment appraisal

techniques are used to compute Payback Period, the Accounting Rate of Return, and the Net

Present Value along with description of merits and demerits of these techniques.

Part A – Terry Joe Plc

Statement of Income for the year ended 31st December 2018 for Terry Joe Plc

Particulars Amount Total

Sales 759600

less: cost of sales 356400

gross profit 403200

less: Operating expenses:

rent 108000

wages 143010

depreciation 1100

van running expenses 40320

bad debts 1800

Electricity bill 9270 303500

Profit 99700

Working notes:

1.

Sales revenue account

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

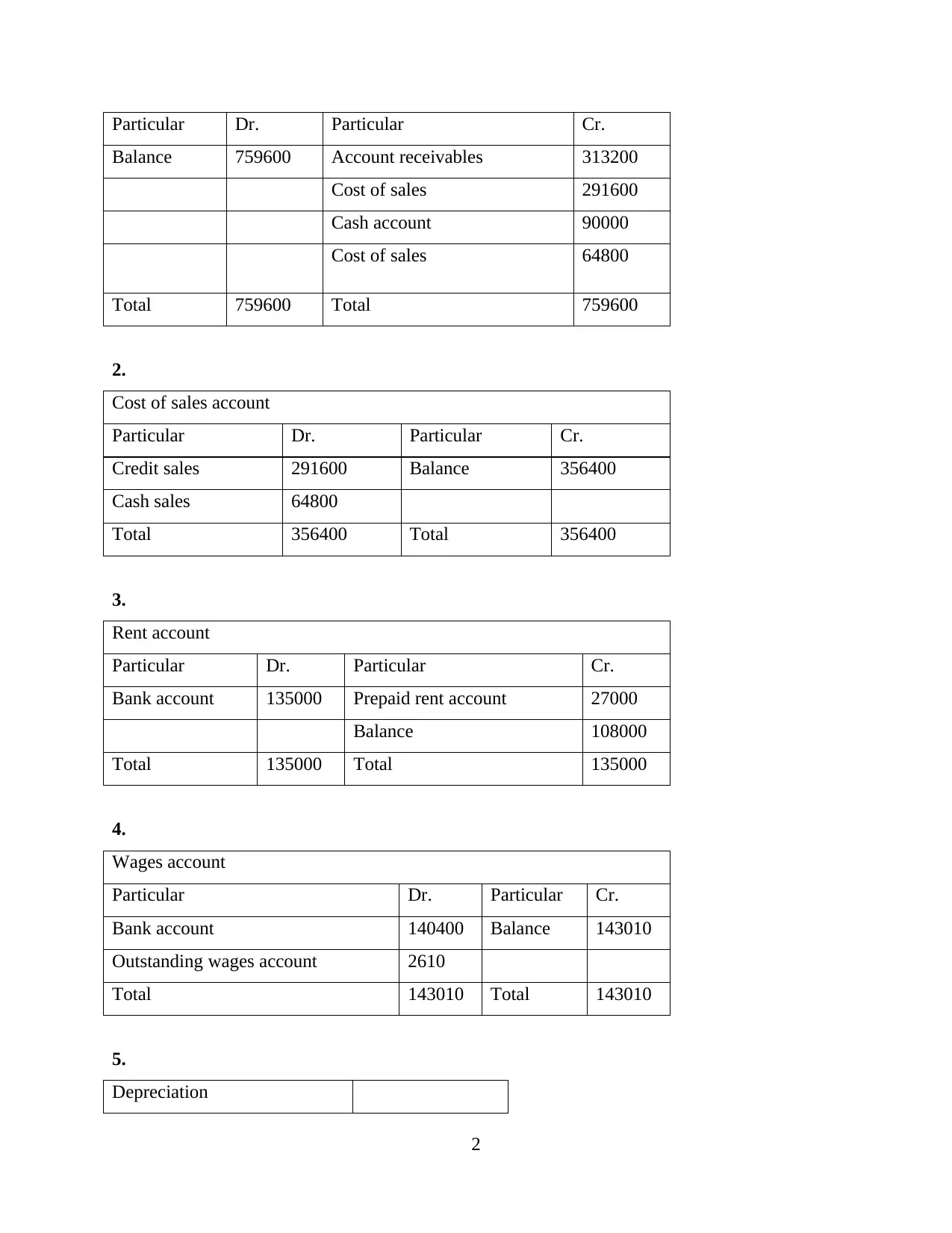

Particular Dr. Particular Cr.

Balance 759600 Account receivables 313200

Cost of sales 291600

Cash account 90000

Cost of sales 64800

Total 759600 Total 759600

2.

Cost of sales account

Particular Dr. Particular Cr.

Credit sales 291600 Balance 356400

Cash sales 64800

Total 356400 Total 356400

3.

Rent account

Particular Dr. Particular Cr.

Bank account 135000 Prepaid rent account 27000

Balance 108000

Total 135000 Total 135000

4.

Wages account

Particular Dr. Particular Cr.

Bank account 140400 Balance 143010

Outstanding wages account 2610

Total 143010 Total 143010

5.

Depreciation

2

Balance 759600 Account receivables 313200

Cost of sales 291600

Cash account 90000

Cost of sales 64800

Total 759600 Total 759600

2.

Cost of sales account

Particular Dr. Particular Cr.

Credit sales 291600 Balance 356400

Cash sales 64800

Total 356400 Total 356400

3.

Rent account

Particular Dr. Particular Cr.

Bank account 135000 Prepaid rent account 27000

Balance 108000

Total 135000 Total 135000

4.

Wages account

Particular Dr. Particular Cr.

Bank account 140400 Balance 143010

Outstanding wages account 2610

Total 143010 Total 143010

5.

Depreciation

2

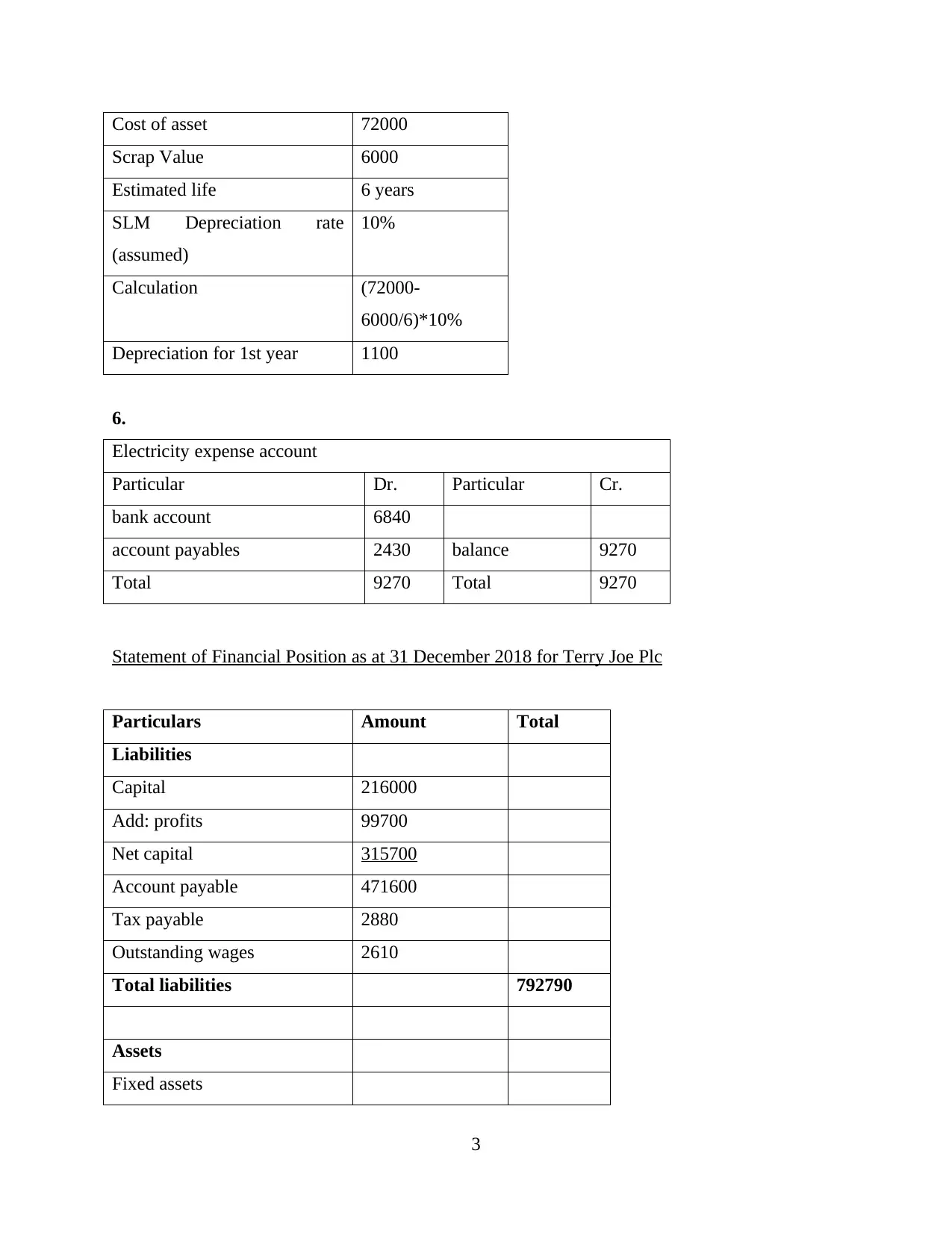

Cost of asset 72000

Scrap Value 6000

Estimated life 6 years

SLM Depreciation rate

(assumed)

10%

Calculation (72000-

6000/6)*10%

Depreciation for 1st year 1100

6.

Electricity expense account

Particular Dr. Particular Cr.

bank account 6840

account payables 2430 balance 9270

Total 9270 Total 9270

Statement of Financial Position as at 31 December 2018 for Terry Joe Plc

Particulars Amount Total

Liabilities

Capital 216000

Add: profits 99700

Net capital 315700

Account payable 471600

Tax payable 2880

Outstanding wages 2610

Total liabilities 792790

Assets

Fixed assets

3

Scrap Value 6000

Estimated life 6 years

SLM Depreciation rate

(assumed)

10%

Calculation (72000-

6000/6)*10%

Depreciation for 1st year 1100

6.

Electricity expense account

Particular Dr. Particular Cr.

bank account 6840

account payables 2430 balance 9270

Total 9270 Total 9270

Statement of Financial Position as at 31 December 2018 for Terry Joe Plc

Particulars Amount Total

Liabilities

Capital 216000

Add: profits 99700

Net capital 315700

Account payable 471600

Tax payable 2880

Outstanding wages 2610

Total liabilities 792790

Assets

Fixed assets

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

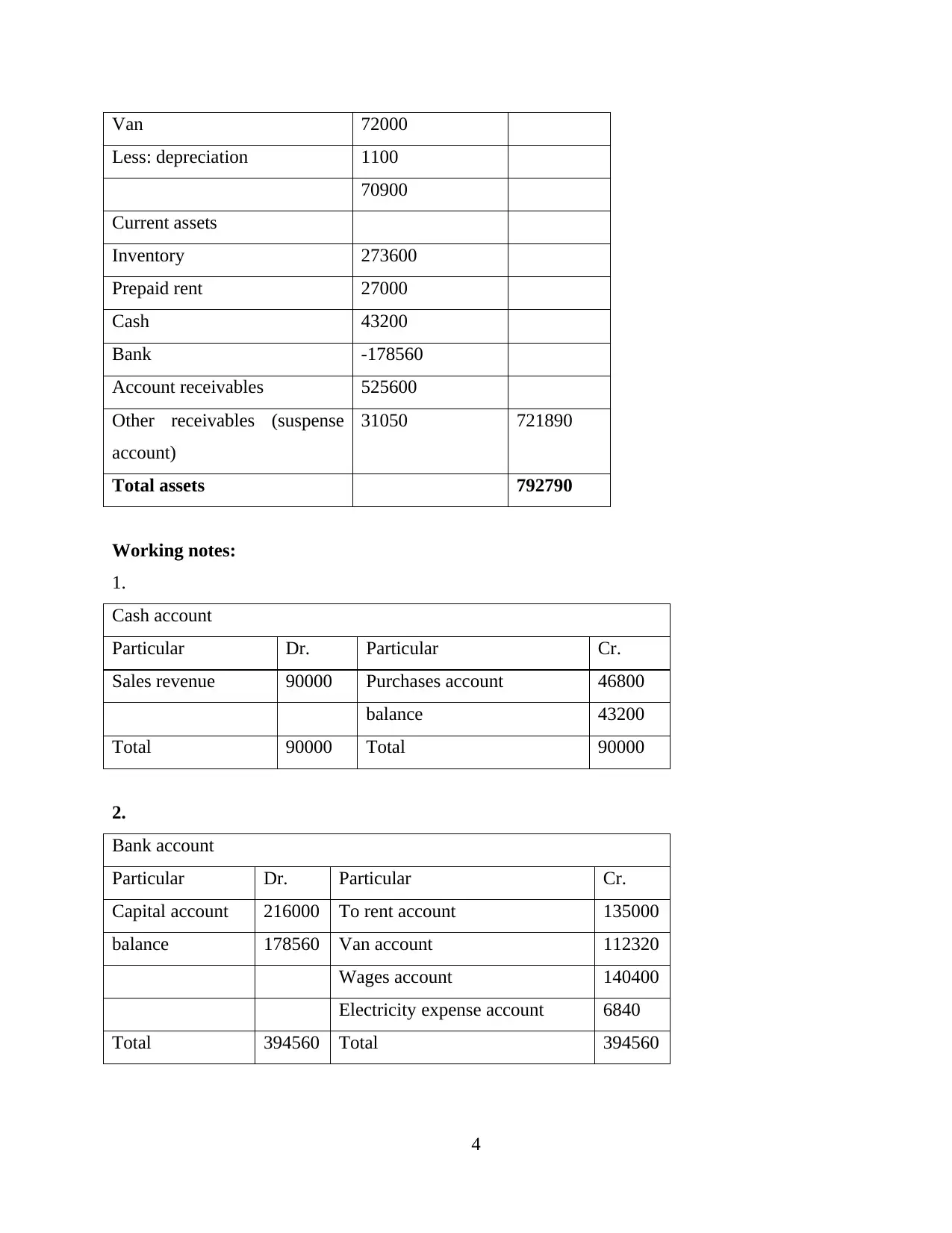

Van 72000

Less: depreciation 1100

70900

Current assets

Inventory 273600

Prepaid rent 27000

Cash 43200

Bank -178560

Account receivables 525600

Other receivables (suspense

account)

31050 721890

Total assets 792790

Working notes:

1.

Cash account

Particular Dr. Particular Cr.

Sales revenue 90000 Purchases account 46800

balance 43200

Total 90000 Total 90000

2.

Bank account

Particular Dr. Particular Cr.

Capital account 216000 To rent account 135000

balance 178560 Van account 112320

Wages account 140400

Electricity expense account 6840

Total 394560 Total 394560

4

Less: depreciation 1100

70900

Current assets

Inventory 273600

Prepaid rent 27000

Cash 43200

Bank -178560

Account receivables 525600

Other receivables (suspense

account)

31050 721890

Total assets 792790

Working notes:

1.

Cash account

Particular Dr. Particular Cr.

Sales revenue 90000 Purchases account 46800

balance 43200

Total 90000 Total 90000

2.

Bank account

Particular Dr. Particular Cr.

Capital account 216000 To rent account 135000

balance 178560 Van account 112320

Wages account 140400

Electricity expense account 6840

Total 394560 Total 394560

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial statements are the analytical records which are developed by the end of a year

in order to ascertain how much company owes by the way of calculating liabilities and how

much company owns by computing assets (Anandarajan, Anandarajan and Srinivasan, 2012).

Terry Joe Plc is a new establishment of which income statement and statement of financial

position is developed above from which it has been interpreted that this organisation has a high

potential of attaining growth in future. After various expenses of being a new business, this

organisation has managed to earn a profit of 99700. Along with this, other there is a considerable

balance in entity’s assets and liabilities.

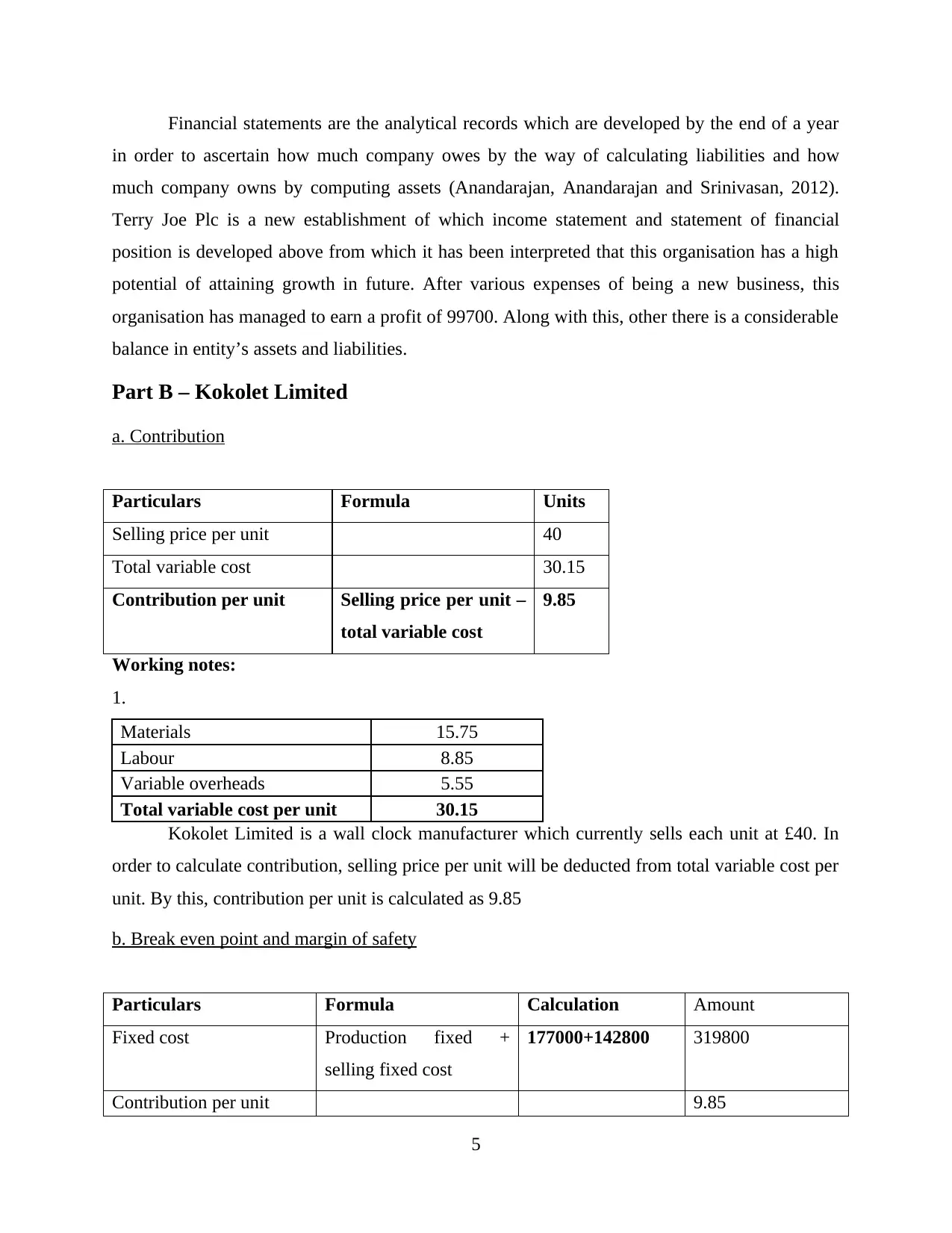

Part B – Kokolet Limited

a. Contribution

Particulars Formula Units

Selling price per unit 40

Total variable cost 30.15

Contribution per unit Selling price per unit –

total variable cost

9.85

Working notes:

1.

Materials 15.75

Labour 8.85

Variable overheads 5.55

Total variable cost per unit 30.15

Kokolet Limited is a wall clock manufacturer which currently sells each unit at £40. In

order to calculate contribution, selling price per unit will be deducted from total variable cost per

unit. By this, contribution per unit is calculated as 9.85

b. Break even point and margin of safety

Particulars Formula Calculation Amount

Fixed cost Production fixed +

selling fixed cost

177000+142800 319800

Contribution per unit 9.85

5

in order to ascertain how much company owes by the way of calculating liabilities and how

much company owns by computing assets (Anandarajan, Anandarajan and Srinivasan, 2012).

Terry Joe Plc is a new establishment of which income statement and statement of financial

position is developed above from which it has been interpreted that this organisation has a high

potential of attaining growth in future. After various expenses of being a new business, this

organisation has managed to earn a profit of 99700. Along with this, other there is a considerable

balance in entity’s assets and liabilities.

Part B – Kokolet Limited

a. Contribution

Particulars Formula Units

Selling price per unit 40

Total variable cost 30.15

Contribution per unit Selling price per unit –

total variable cost

9.85

Working notes:

1.

Materials 15.75

Labour 8.85

Variable overheads 5.55

Total variable cost per unit 30.15

Kokolet Limited is a wall clock manufacturer which currently sells each unit at £40. In

order to calculate contribution, selling price per unit will be deducted from total variable cost per

unit. By this, contribution per unit is calculated as 9.85

b. Break even point and margin of safety

Particulars Formula Calculation Amount

Fixed cost Production fixed +

selling fixed cost

177000+142800 319800

Contribution per unit 9.85

5

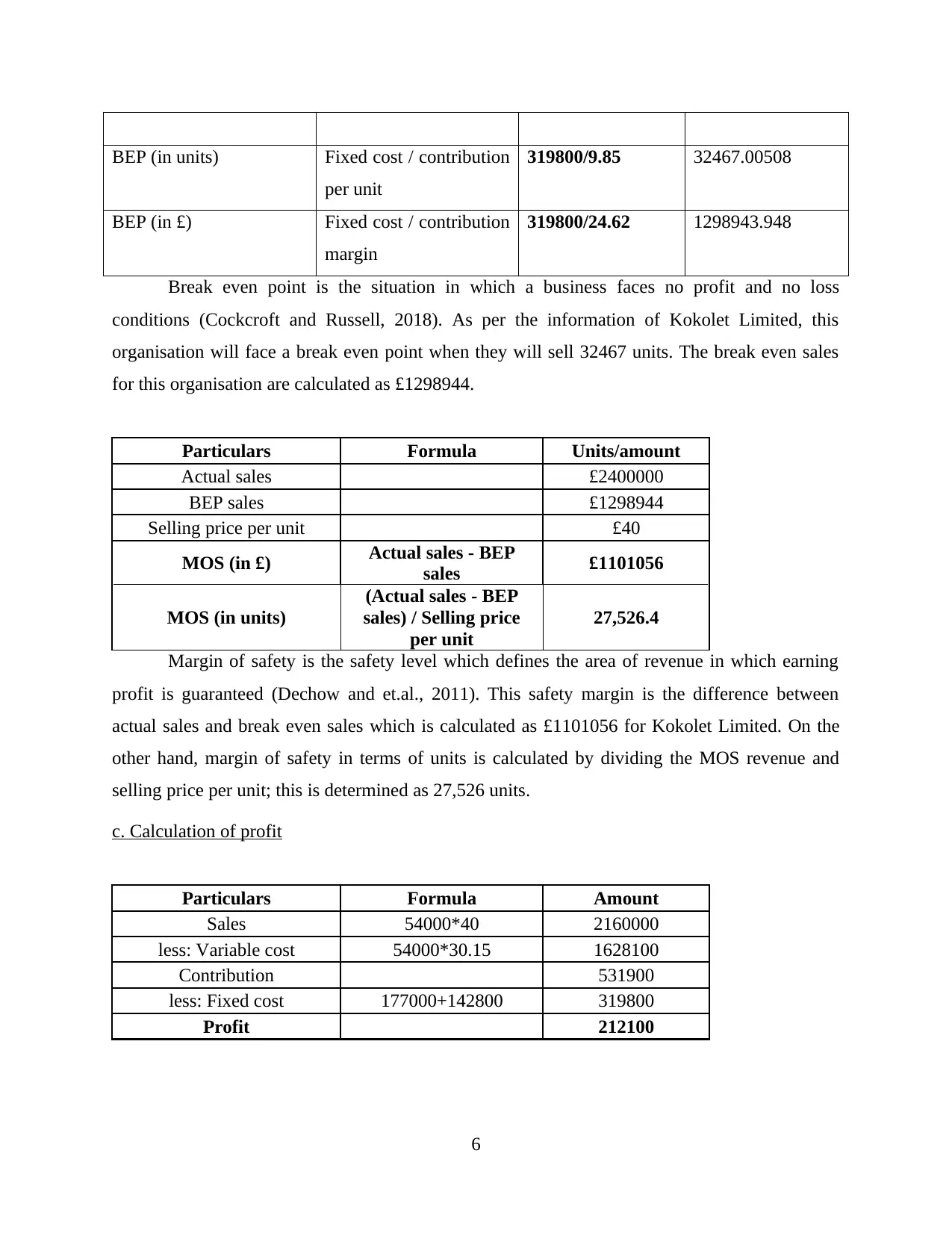

BEP (in units) Fixed cost / contribution

per unit

319800/9.85 32467.00508

BEP (in £) Fixed cost / contribution

margin

319800/24.62 1298943.948

Break even point is the situation in which a business faces no profit and no loss

conditions (Cockcroft and Russell, 2018). As per the information of Kokolet Limited, this

organisation will face a break even point when they will sell 32467 units. The break even sales

for this organisation are calculated as £1298944.

Particulars Formula Units/amount

Actual sales £2400000

BEP sales £1298944

Selling price per unit £40

MOS (in £) Actual sales - BEP

sales £1101056

MOS (in units)

(Actual sales - BEP

sales) / Selling price

per unit

27,526.4

Margin of safety is the safety level which defines the area of revenue in which earning

profit is guaranteed (Dechow and et.al., 2011). This safety margin is the difference between

actual sales and break even sales which is calculated as £1101056 for Kokolet Limited. On the

other hand, margin of safety in terms of units is calculated by dividing the MOS revenue and

selling price per unit; this is determined as 27,526 units.

c. Calculation of profit

Particulars Formula Amount

Sales 54000*40 2160000

less: Variable cost 54000*30.15 1628100

Contribution 531900

less: Fixed cost 177000+142800 319800

Profit 212100

6

per unit

319800/9.85 32467.00508

BEP (in £) Fixed cost / contribution

margin

319800/24.62 1298943.948

Break even point is the situation in which a business faces no profit and no loss

conditions (Cockcroft and Russell, 2018). As per the information of Kokolet Limited, this

organisation will face a break even point when they will sell 32467 units. The break even sales

for this organisation are calculated as £1298944.

Particulars Formula Units/amount

Actual sales £2400000

BEP sales £1298944

Selling price per unit £40

MOS (in £) Actual sales - BEP

sales £1101056

MOS (in units)

(Actual sales - BEP

sales) / Selling price

per unit

27,526.4

Margin of safety is the safety level which defines the area of revenue in which earning

profit is guaranteed (Dechow and et.al., 2011). This safety margin is the difference between

actual sales and break even sales which is calculated as £1101056 for Kokolet Limited. On the

other hand, margin of safety in terms of units is calculated by dividing the MOS revenue and

selling price per unit; this is determined as 27,526 units.

c. Calculation of profit

Particulars Formula Amount

Sales 54000*40 2160000

less: Variable cost 54000*30.15 1628100

Contribution 531900

less: Fixed cost 177000+142800 319800

Profit 212100

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The situation in which kokolet Limited will produce and sell 54000 units of wall clock,

the net profit earned by this organisation will vary. This variation is the result of selling units and

also the manufactured units. The net profit in this case is calculated as £212100.

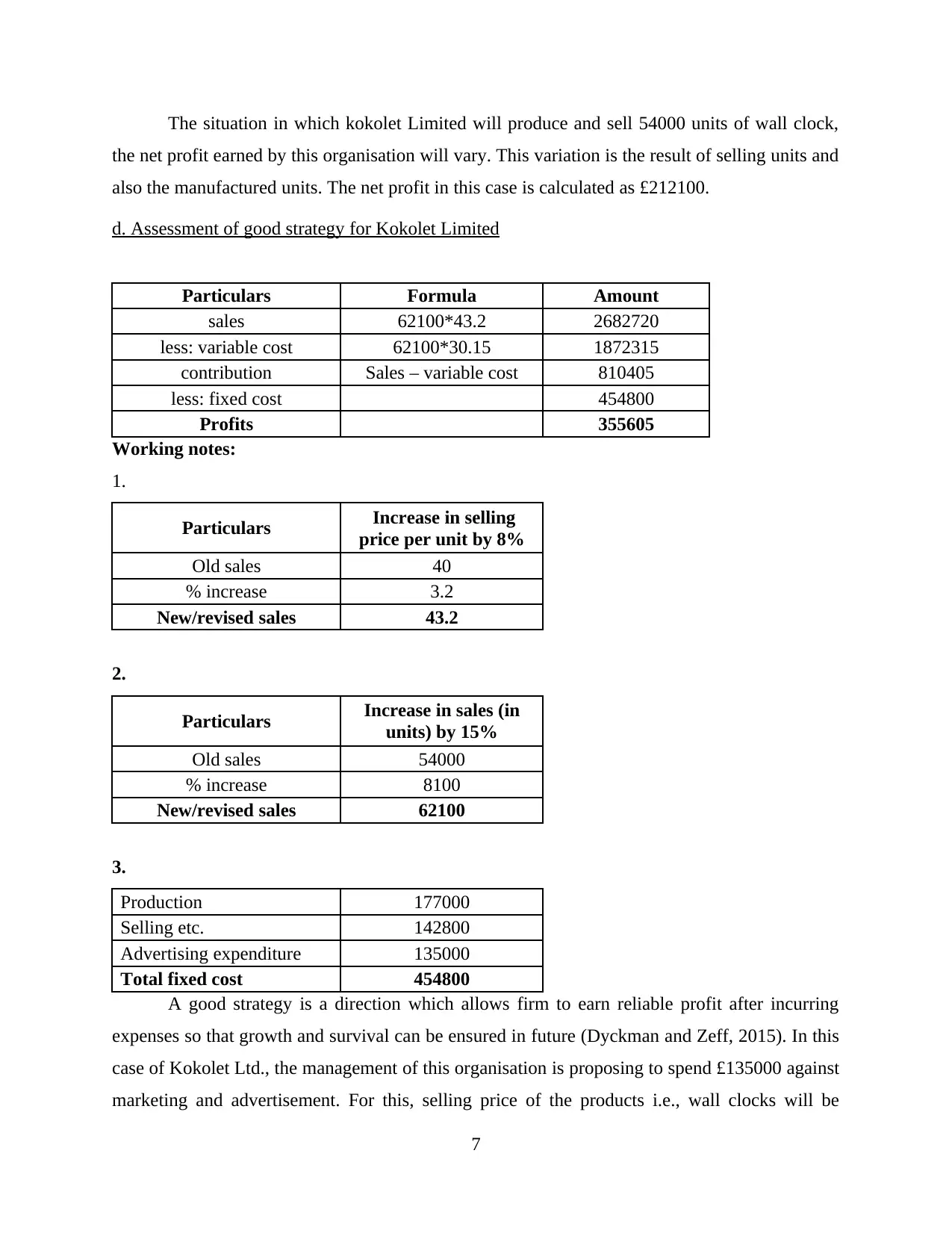

d. Assessment of good strategy for Kokolet Limited

Particulars Formula Amount

sales 62100*43.2 2682720

less: variable cost 62100*30.15 1872315

contribution Sales – variable cost 810405

less: fixed cost 454800

Profits 355605

Working notes:

1.

Particulars Increase in selling

price per unit by 8%

Old sales 40

% increase 3.2

New/revised sales 43.2

2.

Particulars Increase in sales (in

units) by 15%

Old sales 54000

% increase 8100

New/revised sales 62100

3.

Production 177000

Selling etc. 142800

Advertising expenditure 135000

Total fixed cost 454800

A good strategy is a direction which allows firm to earn reliable profit after incurring

expenses so that growth and survival can be ensured in future (Dyckman and Zeff, 2015). In this

case of Kokolet Ltd., the management of this organisation is proposing to spend £135000 against

marketing and advertisement. For this, selling price of the products i.e., wall clocks will be

7

the net profit earned by this organisation will vary. This variation is the result of selling units and

also the manufactured units. The net profit in this case is calculated as £212100.

d. Assessment of good strategy for Kokolet Limited

Particulars Formula Amount

sales 62100*43.2 2682720

less: variable cost 62100*30.15 1872315

contribution Sales – variable cost 810405

less: fixed cost 454800

Profits 355605

Working notes:

1.

Particulars Increase in selling

price per unit by 8%

Old sales 40

% increase 3.2

New/revised sales 43.2

2.

Particulars Increase in sales (in

units) by 15%

Old sales 54000

% increase 8100

New/revised sales 62100

3.

Production 177000

Selling etc. 142800

Advertising expenditure 135000

Total fixed cost 454800

A good strategy is a direction which allows firm to earn reliable profit after incurring

expenses so that growth and survival can be ensured in future (Dyckman and Zeff, 2015). In this

case of Kokolet Ltd., the management of this organisation is proposing to spend £135000 against

marketing and advertisement. For this, selling price of the products i.e., wall clocks will be

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

increased by 8% and sales level will be enhanced at 15%. This proposal will result into profit of

£355605 as calculated above. This profit margin is more than the profit of last proposal that is

£212100. So, it is evidently analysed that this proposal must be accepted by the company.

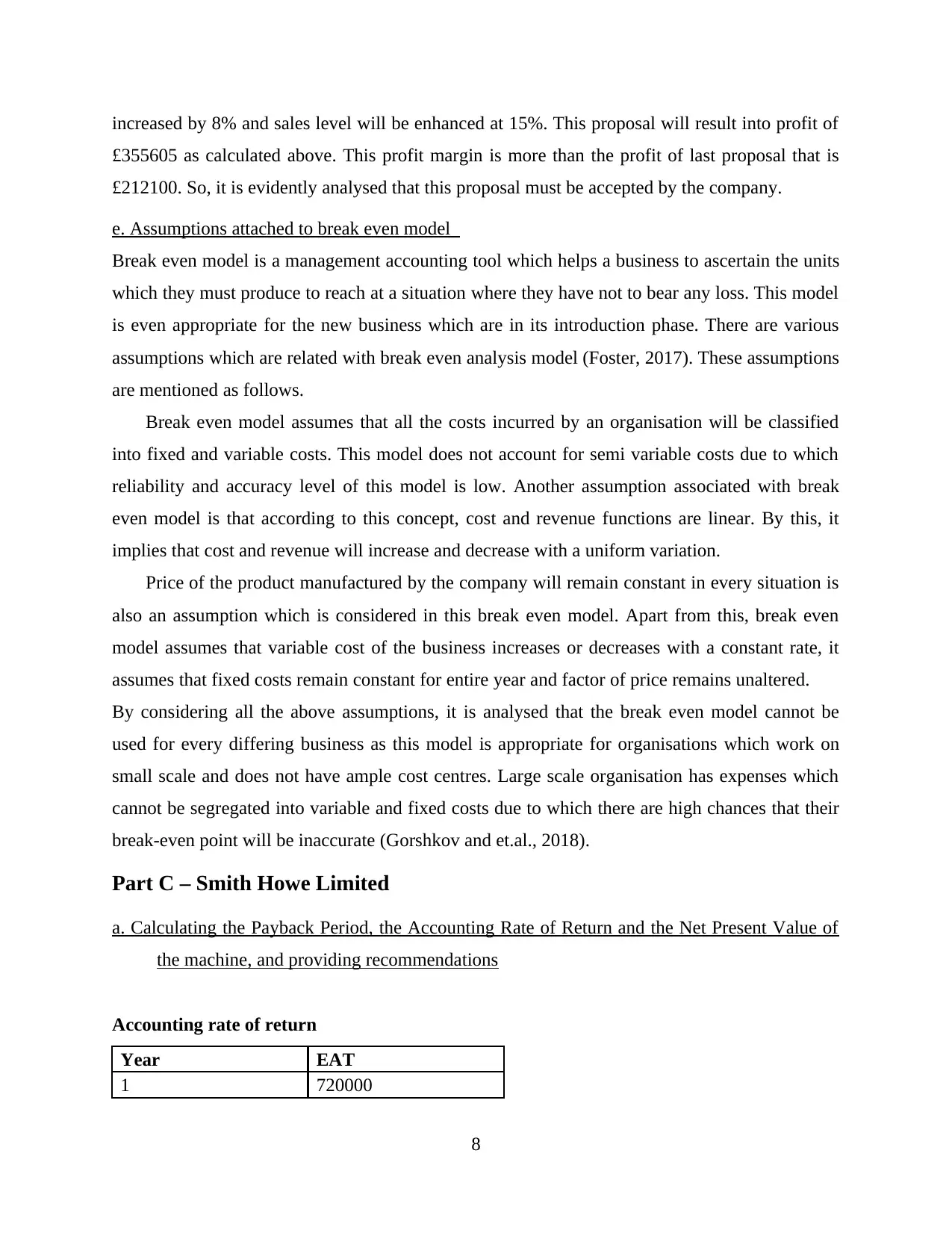

e. Assumptions attached to break even model

Break even model is a management accounting tool which helps a business to ascertain the units

which they must produce to reach at a situation where they have not to bear any loss. This model

is even appropriate for the new business which are in its introduction phase. There are various

assumptions which are related with break even analysis model (Foster, 2017). These assumptions

are mentioned as follows.

Break even model assumes that all the costs incurred by an organisation will be classified

into fixed and variable costs. This model does not account for semi variable costs due to which

reliability and accuracy level of this model is low. Another assumption associated with break

even model is that according to this concept, cost and revenue functions are linear. By this, it

implies that cost and revenue will increase and decrease with a uniform variation.

Price of the product manufactured by the company will remain constant in every situation is

also an assumption which is considered in this break even model. Apart from this, break even

model assumes that variable cost of the business increases or decreases with a constant rate, it

assumes that fixed costs remain constant for entire year and factor of price remains unaltered.

By considering all the above assumptions, it is analysed that the break even model cannot be

used for every differing business as this model is appropriate for organisations which work on

small scale and does not have ample cost centres. Large scale organisation has expenses which

cannot be segregated into variable and fixed costs due to which there are high chances that their

break-even point will be inaccurate (Gorshkov and et.al., 2018).

Part C – Smith Howe Limited

a. Calculating the Payback Period, the Accounting Rate of Return and the Net Present Value of

the machine, and providing recommendations

Accounting rate of return

Year EAT

1 720000

8

£355605 as calculated above. This profit margin is more than the profit of last proposal that is

£212100. So, it is evidently analysed that this proposal must be accepted by the company.

e. Assumptions attached to break even model

Break even model is a management accounting tool which helps a business to ascertain the units

which they must produce to reach at a situation where they have not to bear any loss. This model

is even appropriate for the new business which are in its introduction phase. There are various

assumptions which are related with break even analysis model (Foster, 2017). These assumptions

are mentioned as follows.

Break even model assumes that all the costs incurred by an organisation will be classified

into fixed and variable costs. This model does not account for semi variable costs due to which

reliability and accuracy level of this model is low. Another assumption associated with break

even model is that according to this concept, cost and revenue functions are linear. By this, it

implies that cost and revenue will increase and decrease with a uniform variation.

Price of the product manufactured by the company will remain constant in every situation is

also an assumption which is considered in this break even model. Apart from this, break even

model assumes that variable cost of the business increases or decreases with a constant rate, it

assumes that fixed costs remain constant for entire year and factor of price remains unaltered.

By considering all the above assumptions, it is analysed that the break even model cannot be

used for every differing business as this model is appropriate for organisations which work on

small scale and does not have ample cost centres. Large scale organisation has expenses which

cannot be segregated into variable and fixed costs due to which there are high chances that their

break-even point will be inaccurate (Gorshkov and et.al., 2018).

Part C – Smith Howe Limited

a. Calculating the Payback Period, the Accounting Rate of Return and the Net Present Value of

the machine, and providing recommendations

Accounting rate of return

Year EAT

1 720000

8

2 720000

3 720000

4 720000

5 1720000

Average annual profit 920000

Cost 8000000

Scrap value 1000000

Average investment 8500000

ARR 10.82%

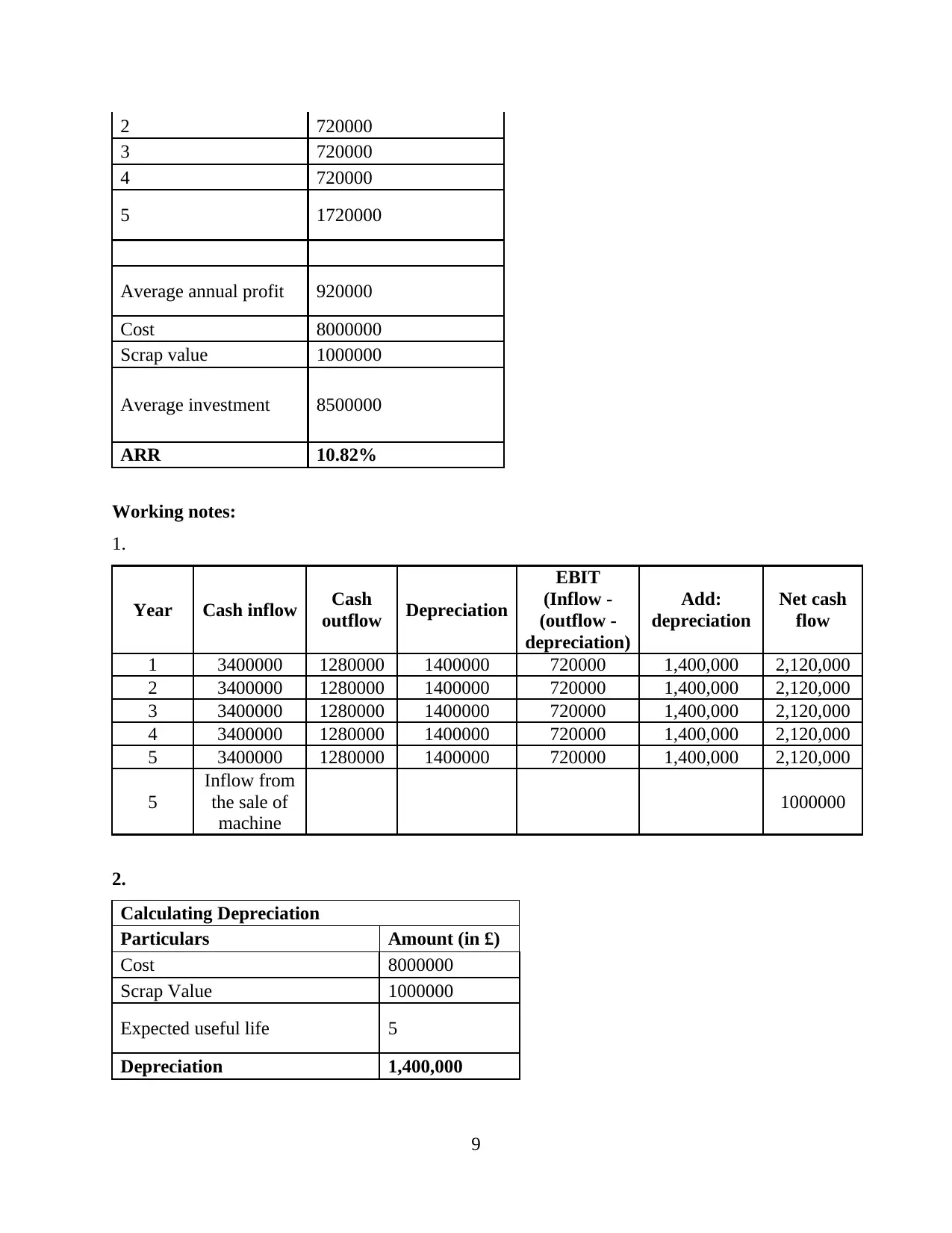

Working notes:

1.

Year Cash inflow Cash

outflow Depreciation

EBIT

(Inflow -

(outflow -

depreciation)

Add:

depreciation

Net cash

flow

1 3400000 1280000 1400000 720000 1,400,000 2,120,000

2 3400000 1280000 1400000 720000 1,400,000 2,120,000

3 3400000 1280000 1400000 720000 1,400,000 2,120,000

4 3400000 1280000 1400000 720000 1,400,000 2,120,000

5 3400000 1280000 1400000 720000 1,400,000 2,120,000

5

Inflow from

the sale of

machine

1000000

2.

Calculating Depreciation

Particulars Amount (in £)

Cost 8000000

Scrap Value 1000000

Expected useful life 5

Depreciation 1,400,000

9

3 720000

4 720000

5 1720000

Average annual profit 920000

Cost 8000000

Scrap value 1000000

Average investment 8500000

ARR 10.82%

Working notes:

1.

Year Cash inflow Cash

outflow Depreciation

EBIT

(Inflow -

(outflow -

depreciation)

Add:

depreciation

Net cash

flow

1 3400000 1280000 1400000 720000 1,400,000 2,120,000

2 3400000 1280000 1400000 720000 1,400,000 2,120,000

3 3400000 1280000 1400000 720000 1,400,000 2,120,000

4 3400000 1280000 1400000 720000 1,400,000 2,120,000

5 3400000 1280000 1400000 720000 1,400,000 2,120,000

5

Inflow from

the sale of

machine

1000000

2.

Calculating Depreciation

Particulars Amount (in £)

Cost 8000000

Scrap Value 1000000

Expected useful life 5

Depreciation 1,400,000

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.