Financial Reporting Analysis: Assessing GWA Group Limited's Reports

VerifiedAdded on 2021/05/31

|14

|2227

|111

Report

AI Summary

This report provides a detailed analysis of the financial statements of GWA Group Limited, evaluating their compliance with accounting standards. It examines provisions and contingencies, including guarantees and capital expenditure commitments, discussing their recognition criteria and measurement issues. The report explores arguments for and against recording contingencies in financial statements, highlighting their impact on qualitative characteristics. It also delves into the details of leased items, their classification, and presentation requirements, including reclassification scenarios. Furthermore, the report assesses the valuation methods of non-current assets, specifically focusing on intangible assets and alternative valuation approaches like the income approach, concluding with an evaluation of the overall quality of GWA Group Limited's financial reporting and the importance of adequate disclosures.

Running head: FINANCIAL REPORTING

Financial Reporting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Financial Reporting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL REPORTING

Table of Contents

Introduction:....................................................................................................................................2

1. Provisions and contingencies:......................................................................................................2

2. Recognition criteria and measurement issues related to provisions and contingencies:.............3

3. Arguments for and against the record of contingency in the financial report:............................5

4. Details of leased items:................................................................................................................6

5. Classification and presentation requirements related to leased items:........................................7

6. Reclassification of leased items:..................................................................................................9

7. Valuation method of non-current asset:.......................................................................................9

8. Alternative valuation method of non-current asset:...................................................................10

Conclusion:....................................................................................................................................10

References:....................................................................................................................................12

Table of Contents

Introduction:....................................................................................................................................2

1. Provisions and contingencies:......................................................................................................2

2. Recognition criteria and measurement issues related to provisions and contingencies:.............3

3. Arguments for and against the record of contingency in the financial report:............................5

4. Details of leased items:................................................................................................................6

5. Classification and presentation requirements related to leased items:........................................7

6. Reclassification of leased items:..................................................................................................9

7. Valuation method of non-current asset:.......................................................................................9

8. Alternative valuation method of non-current asset:...................................................................10

Conclusion:....................................................................................................................................10

References:....................................................................................................................................12

2FINANCIAL REPORTING

Introduction:

The current essay deals with the issue by evaluating the financial statements of GWA

Group Limited for ascertaining whether the accounting reports are developed in accordance with

the stated standards in order to ascertain their overall reliability. The annual report of the

organisation is evaluated for highlight the significant aspects mentioned in the paper. The essay

intends to provide an in-depth understanding and evaluation of the financial statements of the

organisation.

1. Provisions and contingencies:

The contingencies reported in the financial statements of the business organisations are

sub-divided into various financial elements. According to Amiram et al. (2018), contingencies

denote those assets and liabilities, which are not accounted, since they have taken place due to

emergency situation. The primary component that could be identified under contingency section

in the annual report of the organisation is guarantees. The contract of financial guarantee is

recognised in the form of liability, which is in the nature of finance when the guarantee is issued.

This liability is gauged at the fair value approach in compliance with the standards of “Australian

Accounting Standards Board (AASB)”. More specifically, the standard used is “AASB 137

Provisions, Contingent Assets and Contingent Liabilities”.

The financial element taken into account includes the capital expenditure commitments.

Capital expenditure commitments are those, in which the parent entity is required to enter into

contractual agreements for the wholly-owned subsidiaries in relation to acquisition of property,

Introduction:

The current essay deals with the issue by evaluating the financial statements of GWA

Group Limited for ascertaining whether the accounting reports are developed in accordance with

the stated standards in order to ascertain their overall reliability. The annual report of the

organisation is evaluated for highlight the significant aspects mentioned in the paper. The essay

intends to provide an in-depth understanding and evaluation of the financial statements of the

organisation.

1. Provisions and contingencies:

The contingencies reported in the financial statements of the business organisations are

sub-divided into various financial elements. According to Amiram et al. (2018), contingencies

denote those assets and liabilities, which are not accounted, since they have taken place due to

emergency situation. The primary component that could be identified under contingency section

in the annual report of the organisation is guarantees. The contract of financial guarantee is

recognised in the form of liability, which is in the nature of finance when the guarantee is issued.

This liability is gauged at the fair value approach in compliance with the standards of “Australian

Accounting Standards Board (AASB)”. More specifically, the standard used is “AASB 137

Provisions, Contingent Assets and Contingent Liabilities”.

The financial element taken into account includes the capital expenditure commitments.

Capital expenditure commitments are those, in which the parent entity is required to enter into

contractual agreements for the wholly-owned subsidiaries in relation to acquisition of property,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL REPORTING

plant and equipment. GWA Group Limited has disclosed no such commitments based on its

2017 annual report.

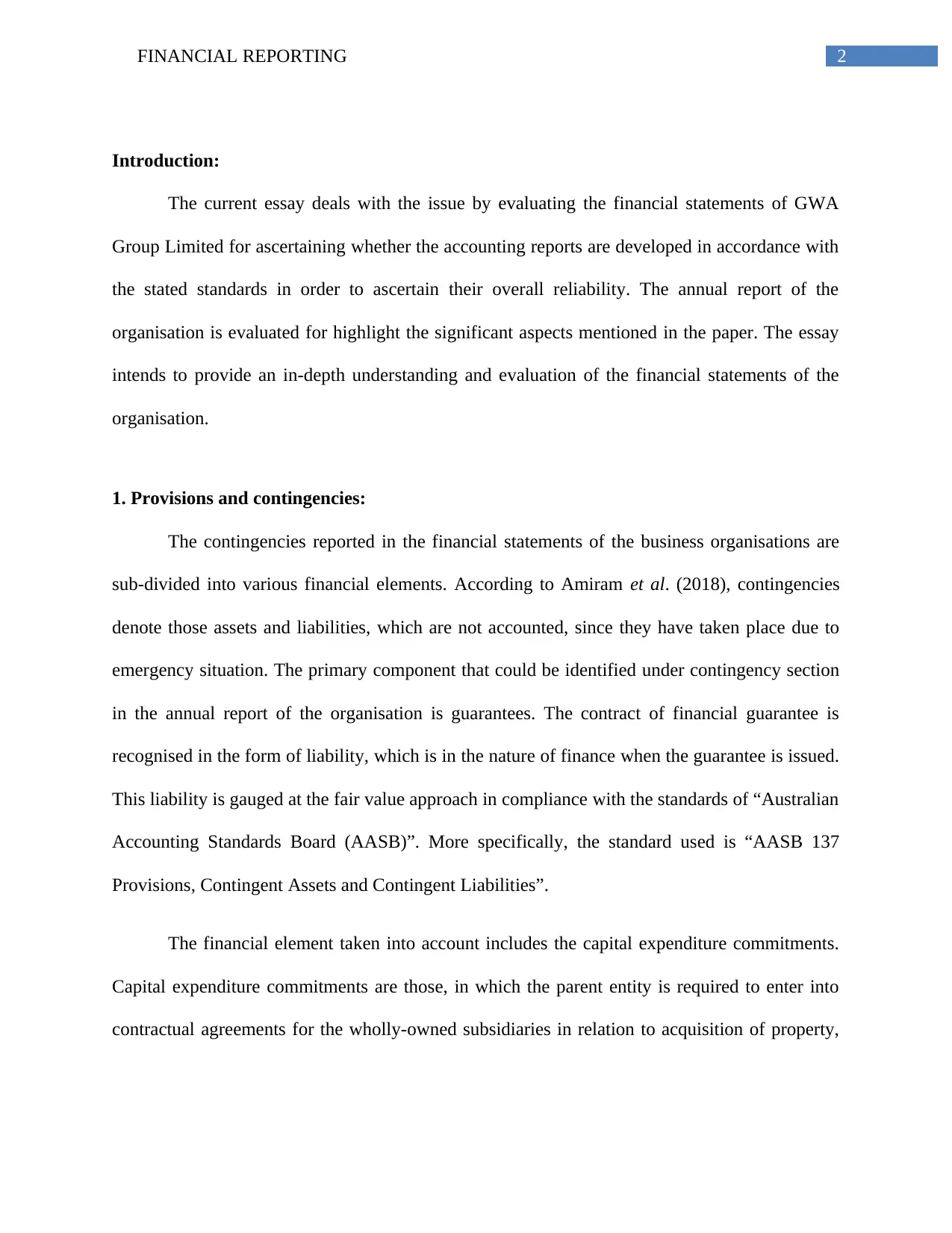

The final financial element disclosed in the annual report is contingent liability, which is

related to the terminated agreement. As of 2017, the organisation has not realised any contingent

liability.

In case of provisions, the main items that are realised include warranties, restructuring,

site restoration and other and the total amount of provisions in 2017 have been reported as

$12,861,000.

plant and equipment. GWA Group Limited has disclosed no such commitments based on its

2017 annual report.

The final financial element disclosed in the annual report is contingent liability, which is

related to the terminated agreement. As of 2017, the organisation has not realised any contingent

liability.

In case of provisions, the main items that are realised include warranties, restructuring,

site restoration and other and the total amount of provisions in 2017 have been reported as

$12,861,000.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL REPORTING

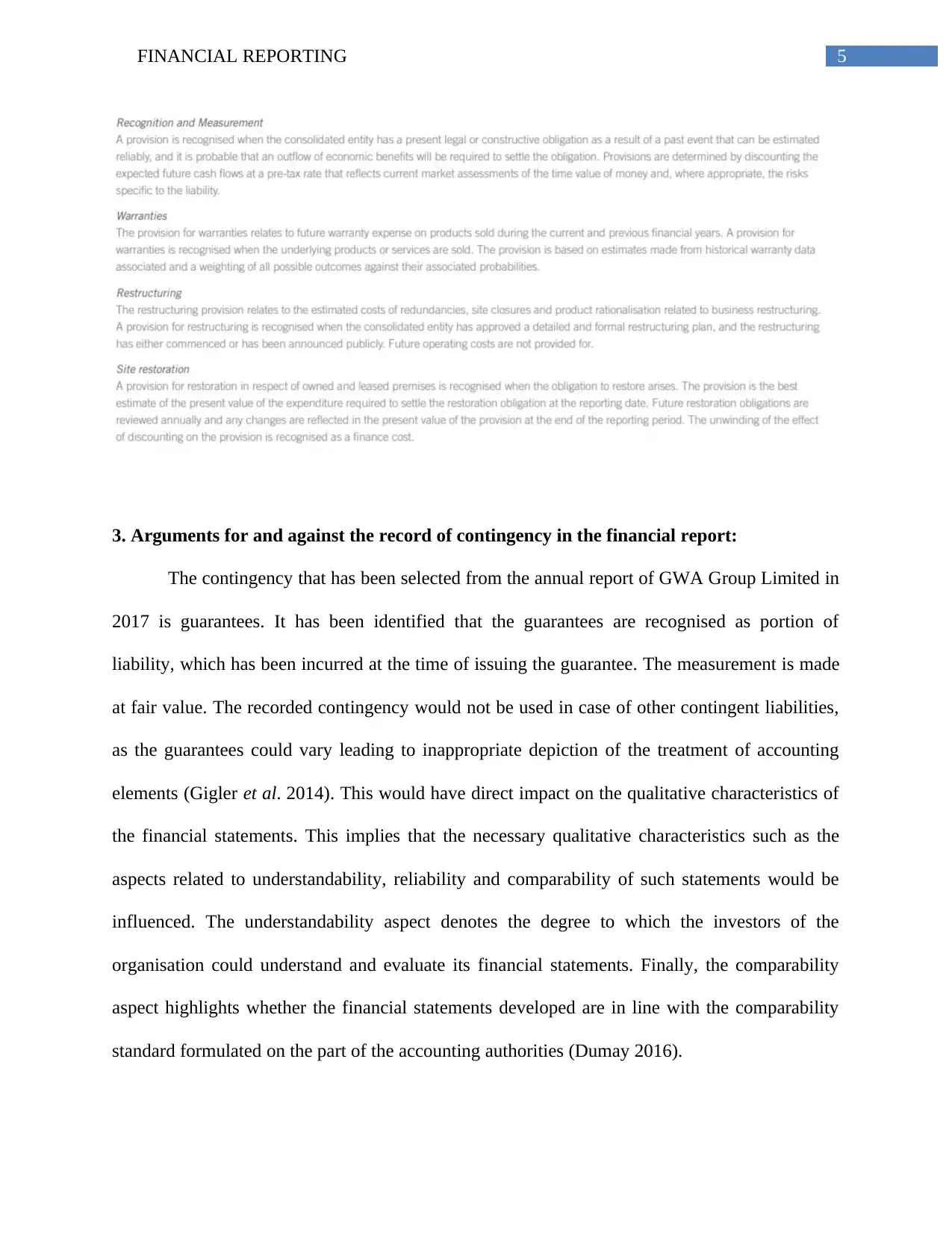

2. Recognition criteria and measurement issues related to provisions and contingencies:

The criteria of recognition and issues of measurement for provisions and contingencies

are described as follows:

Guarantees:

The criterion of recognition included in the annual report in relation to the specific

liability of guarantees is that the measurement is conducted by using the technique of fair value

mentioned in AASB 137.

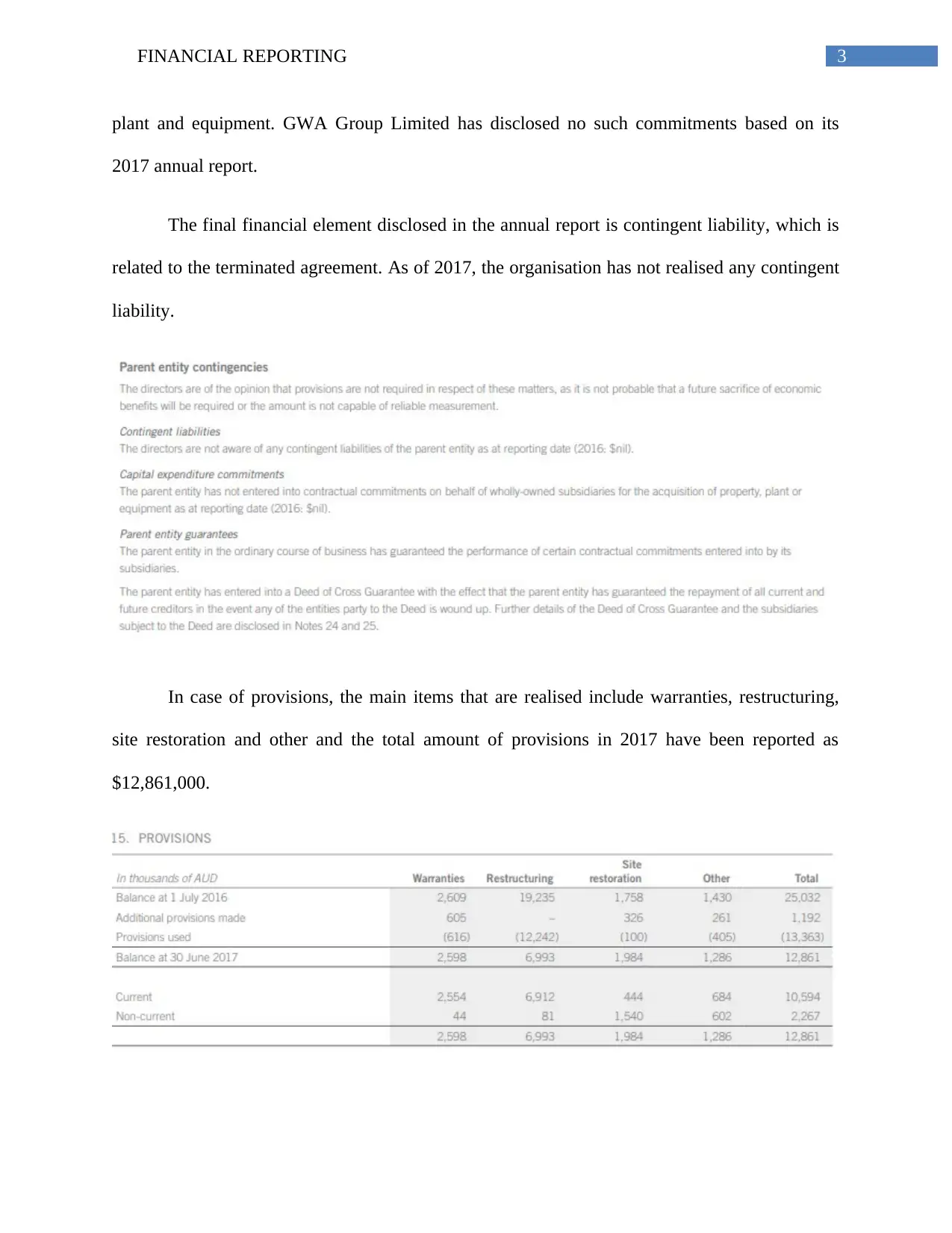

Capital expenditure commitments:

GWA Group Limited realises its capital expenditure commitments in accordance with

‘AASB 101 Presentation of Financial Statements”, in which specific timeframes are mentioned.

Contingent liabilities:

The organisation has not disclosed any information regarding contingent liabilities in its

annual report of 2017.

Provisions:

Provisions are realised at the time the organisation has current legal or constructive

obligations due to previous events that could be projected reliably and it is likely that the

economic benefit outflow would be needed in settling the obligation.

2. Recognition criteria and measurement issues related to provisions and contingencies:

The criteria of recognition and issues of measurement for provisions and contingencies

are described as follows:

Guarantees:

The criterion of recognition included in the annual report in relation to the specific

liability of guarantees is that the measurement is conducted by using the technique of fair value

mentioned in AASB 137.

Capital expenditure commitments:

GWA Group Limited realises its capital expenditure commitments in accordance with

‘AASB 101 Presentation of Financial Statements”, in which specific timeframes are mentioned.

Contingent liabilities:

The organisation has not disclosed any information regarding contingent liabilities in its

annual report of 2017.

Provisions:

Provisions are realised at the time the organisation has current legal or constructive

obligations due to previous events that could be projected reliably and it is likely that the

economic benefit outflow would be needed in settling the obligation.

5FINANCIAL REPORTING

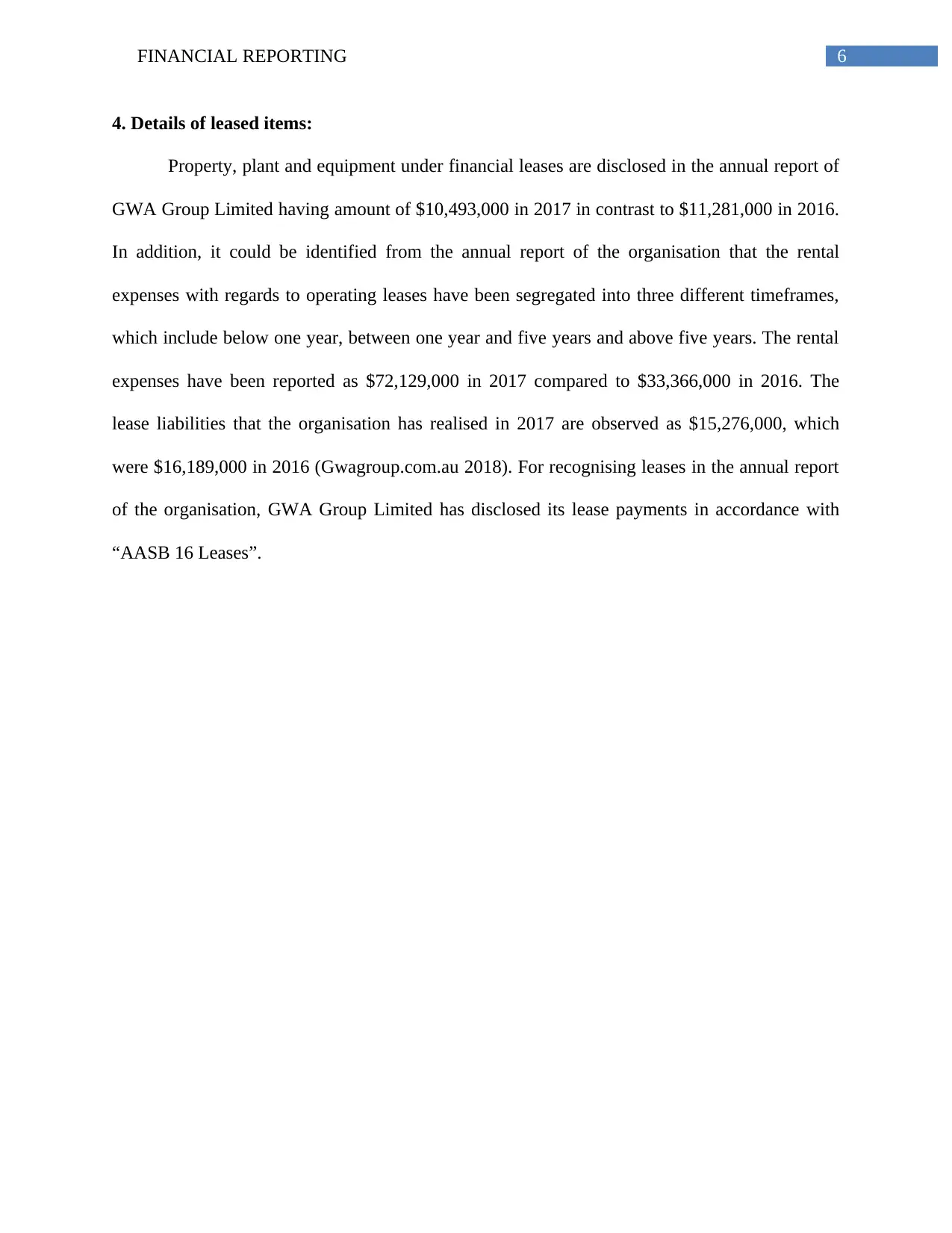

3. Arguments for and against the record of contingency in the financial report:

The contingency that has been selected from the annual report of GWA Group Limited in

2017 is guarantees. It has been identified that the guarantees are recognised as portion of

liability, which has been incurred at the time of issuing the guarantee. The measurement is made

at fair value. The recorded contingency would not be used in case of other contingent liabilities,

as the guarantees could vary leading to inappropriate depiction of the treatment of accounting

elements (Gigler et al. 2014). This would have direct impact on the qualitative characteristics of

the financial statements. This implies that the necessary qualitative characteristics such as the

aspects related to understandability, reliability and comparability of such statements would be

influenced. The understandability aspect denotes the degree to which the investors of the

organisation could understand and evaluate its financial statements. Finally, the comparability

aspect highlights whether the financial statements developed are in line with the comparability

standard formulated on the part of the accounting authorities (Dumay 2016).

3. Arguments for and against the record of contingency in the financial report:

The contingency that has been selected from the annual report of GWA Group Limited in

2017 is guarantees. It has been identified that the guarantees are recognised as portion of

liability, which has been incurred at the time of issuing the guarantee. The measurement is made

at fair value. The recorded contingency would not be used in case of other contingent liabilities,

as the guarantees could vary leading to inappropriate depiction of the treatment of accounting

elements (Gigler et al. 2014). This would have direct impact on the qualitative characteristics of

the financial statements. This implies that the necessary qualitative characteristics such as the

aspects related to understandability, reliability and comparability of such statements would be

influenced. The understandability aspect denotes the degree to which the investors of the

organisation could understand and evaluate its financial statements. Finally, the comparability

aspect highlights whether the financial statements developed are in line with the comparability

standard formulated on the part of the accounting authorities (Dumay 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL REPORTING

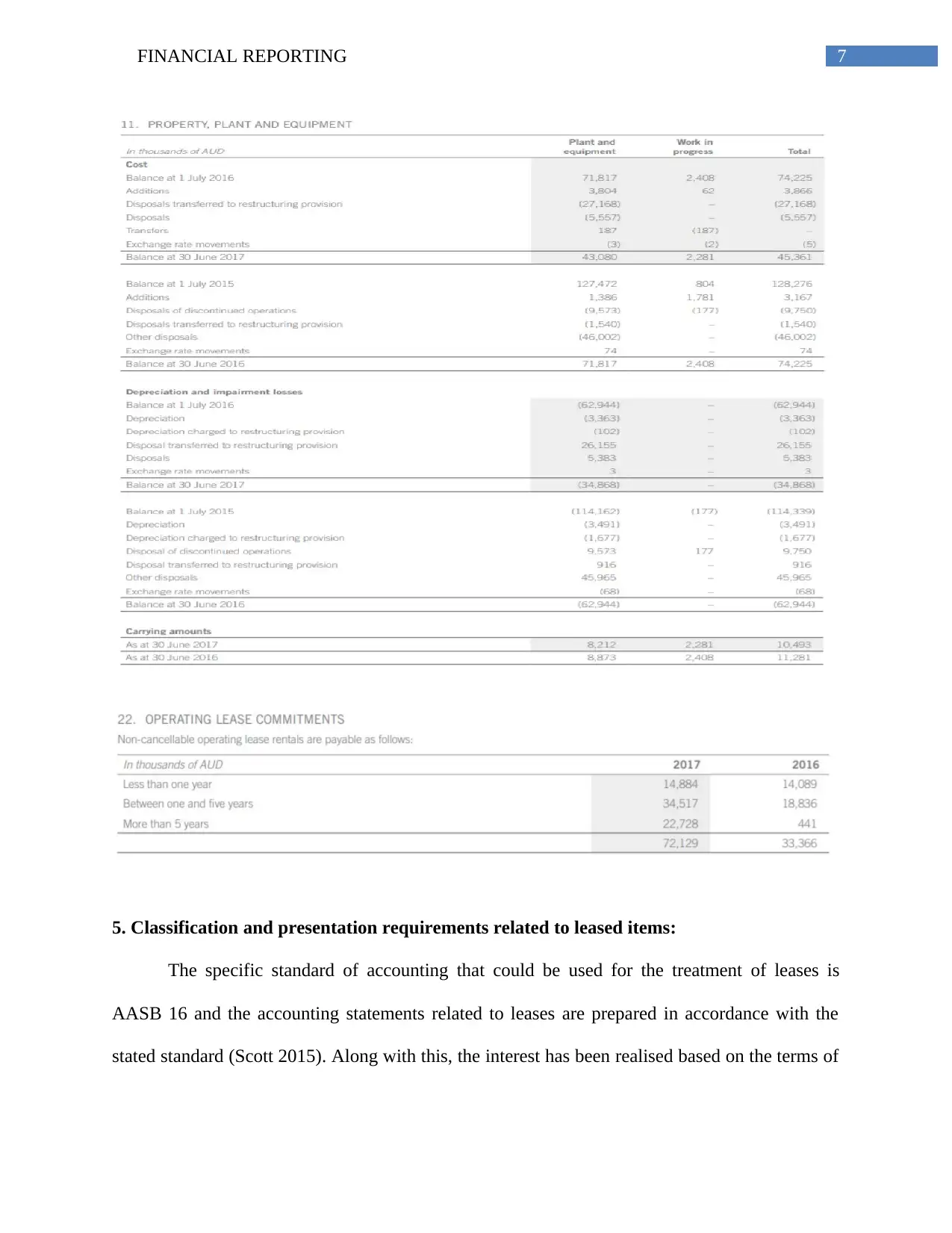

4. Details of leased items:

Property, plant and equipment under financial leases are disclosed in the annual report of

GWA Group Limited having amount of $10,493,000 in 2017 in contrast to $11,281,000 in 2016.

In addition, it could be identified from the annual report of the organisation that the rental

expenses with regards to operating leases have been segregated into three different timeframes,

which include below one year, between one year and five years and above five years. The rental

expenses have been reported as $72,129,000 in 2017 compared to $33,366,000 in 2016. The

lease liabilities that the organisation has realised in 2017 are observed as $15,276,000, which

were $16,189,000 in 2016 (Gwagroup.com.au 2018). For recognising leases in the annual report

of the organisation, GWA Group Limited has disclosed its lease payments in accordance with

“AASB 16 Leases”.

4. Details of leased items:

Property, plant and equipment under financial leases are disclosed in the annual report of

GWA Group Limited having amount of $10,493,000 in 2017 in contrast to $11,281,000 in 2016.

In addition, it could be identified from the annual report of the organisation that the rental

expenses with regards to operating leases have been segregated into three different timeframes,

which include below one year, between one year and five years and above five years. The rental

expenses have been reported as $72,129,000 in 2017 compared to $33,366,000 in 2016. The

lease liabilities that the organisation has realised in 2017 are observed as $15,276,000, which

were $16,189,000 in 2016 (Gwagroup.com.au 2018). For recognising leases in the annual report

of the organisation, GWA Group Limited has disclosed its lease payments in accordance with

“AASB 16 Leases”.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL REPORTING

5. Classification and presentation requirements related to leased items:

The specific standard of accounting that could be used for the treatment of leases is

AASB 16 and the accounting statements related to leases are prepared in accordance with the

stated standard (Scott 2015). Along with this, the interest has been realised based on the terms of

5. Classification and presentation requirements related to leased items:

The specific standard of accounting that could be used for the treatment of leases is

AASB 16 and the accounting statements related to leases are prepared in accordance with the

stated standard (Scott 2015). Along with this, the interest has been realised based on the terms of

8FINANCIAL REPORTING

the lease. The exceptions that are incorporated in the annual report constitute of lower value and

short-term leases (Higgins, Milne and Van Gramberg 2015).

Property, plant and equipment recorded under financial leases in the annual report of

GWA Group Limited are valued at $10,493,000 in 2017, which were $11,281,000 in 2016. The

lease liabilities that have been incurred in 2017 are $15,276,000, which were $16,189,000 in

2016.

the lease. The exceptions that are incorporated in the annual report constitute of lower value and

short-term leases (Higgins, Milne and Van Gramberg 2015).

Property, plant and equipment recorded under financial leases in the annual report of

GWA Group Limited are valued at $10,493,000 in 2017, which were $11,281,000 in 2016. The

lease liabilities that have been incurred in 2017 are $15,276,000, which were $16,189,000 in

2016.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL REPORTING

6. Reclassification of leased items:

In this case, a hypothetical situation has been developed where a particular lease item is

required to be reclassified. This could be described with a list of certain examples that are

represented as follows:

The ownership of the asset is transferred to the lessee after the end of the lease term.

An option is provided to the lessee, in which the leased asset could be bought at a price

below its fair value (Jin, Shan and Taylor 2015).

With the help of the features of the leased asset, the lessee could use it, as there is no

need to make any further modifications.

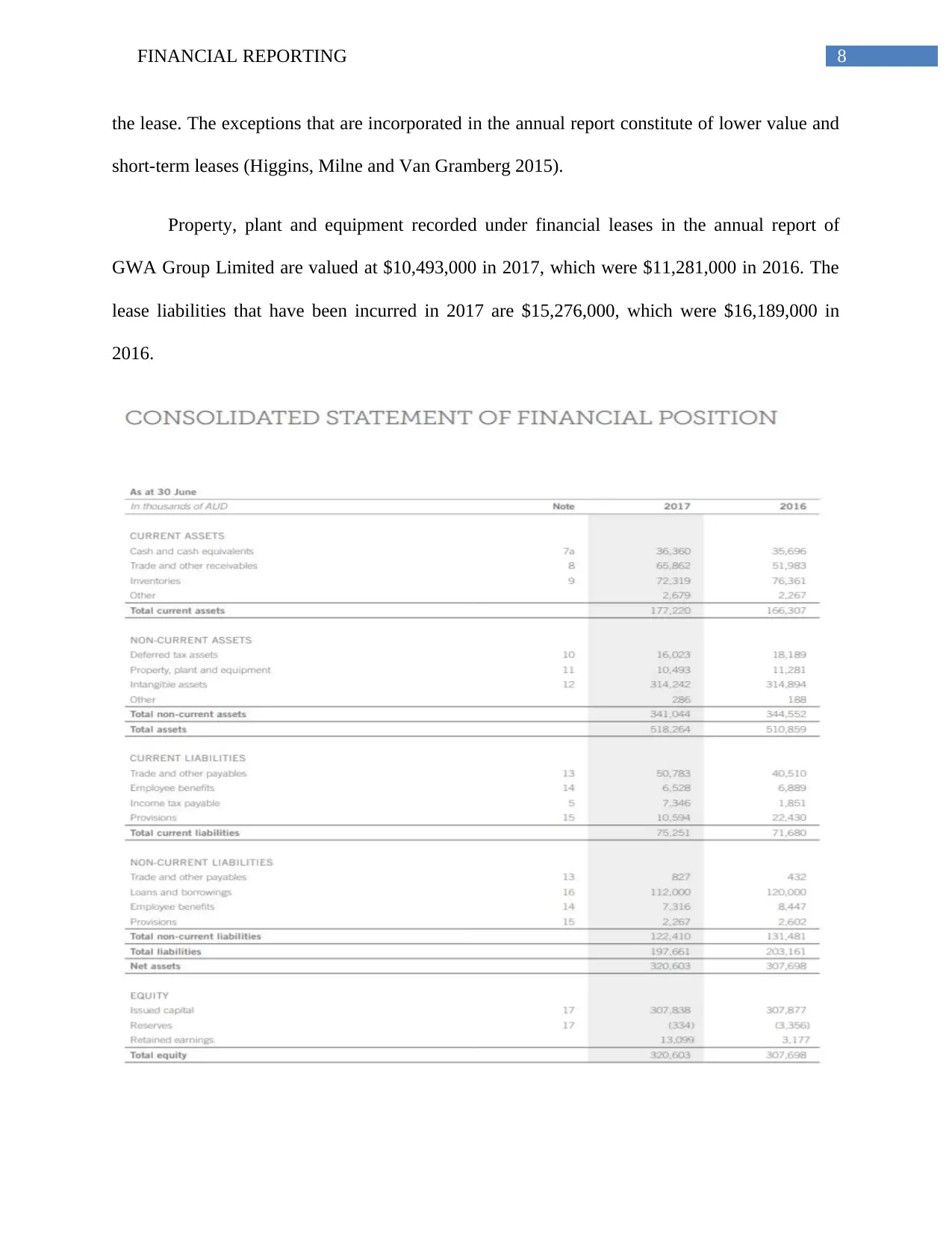

7. Valuation method of non-current asset:

In this case, a particular item listed in the non-current asset section of the balance sheet

statement of GWA Group Limited is selected and accordingly, necessary details are provided

about that item. Therefore, the item that is selected is intangible assets, which are included in the

financial statements of the organisation and notes are provided regarding their treatment or

valuation. From the balance sheet statement of the organisation, it has been found that the total

value of intangible assets has been $314,242,000 in 2017 against $314,894,000 in 2016. In this

context, Lang and Stice-Lawrence (2015) stated that intangible assets do not have physical value

like equipment or machinery; however, they are extremely valuable for an organisation in terms

of its long-term success or failure. For instance, a business organisation could develop a mailing

list of the clients or it might develop a patent.

For GWA Group Limited, the intangible assets that are acquired separately are gauged on

initial recognition at cost. In fact, they are valued at cost minus accumulated amortisation and

6. Reclassification of leased items:

In this case, a hypothetical situation has been developed where a particular lease item is

required to be reclassified. This could be described with a list of certain examples that are

represented as follows:

The ownership of the asset is transferred to the lessee after the end of the lease term.

An option is provided to the lessee, in which the leased asset could be bought at a price

below its fair value (Jin, Shan and Taylor 2015).

With the help of the features of the leased asset, the lessee could use it, as there is no

need to make any further modifications.

7. Valuation method of non-current asset:

In this case, a particular item listed in the non-current asset section of the balance sheet

statement of GWA Group Limited is selected and accordingly, necessary details are provided

about that item. Therefore, the item that is selected is intangible assets, which are included in the

financial statements of the organisation and notes are provided regarding their treatment or

valuation. From the balance sheet statement of the organisation, it has been found that the total

value of intangible assets has been $314,242,000 in 2017 against $314,894,000 in 2016. In this

context, Lang and Stice-Lawrence (2015) stated that intangible assets do not have physical value

like equipment or machinery; however, they are extremely valuable for an organisation in terms

of its long-term success or failure. For instance, a business organisation could develop a mailing

list of the clients or it might develop a patent.

For GWA Group Limited, the intangible assets that are acquired separately are gauged on

initial recognition at cost. In fact, they are valued at cost minus accumulated amortisation and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL REPORTING

accumulated impairment losses (Barth 2018). On the other hand, the intangible assets that are

acquired during business combination are gauged at fair values as in the acquired date. Goodwill

acquired during business combination is gauged initially at cost. The consequent expenditure

related to capitalised intangible assets is capitalised at the time the future economic benefits are

increased embodied in the specific assets related to each other (Naranjo, Saavedra and Verdi

2017). The other expenditures are expensed as incurred.

8. Alternative valuation method of non-current asset:

An alternative method of valuing intangible assets might be the income approach. This

approach is best fitted at the time the intangible assets produce income or when it enables the

asset in generating cash flows (Nobes 2014). With the help of this particular technique, the future

benefits could be converted to one discounted amount, which is the outcome of increased

turnover or cost savings. Hence, there are two choices available, if GWA Group Limited plans to

adopt this approach for valuing its intangible assets. The first option is to capitalise a single

group of benefits or discounting future flow of benefits. This approach investigates a rate of

discount from either “weighted average cost of capital”, “weighted average return on assets” or

“internal rate of return”. However, since this technique is not considered superior over the

historical cost approach or fair value technique, since AASB does not prescribe the business

organisations to follow this approach (Robb, Rohde and Green 2016).

Conclusion:

The essay provides an in-depth overview of the various items stated in the annual report

of GWA Group Limited in 2017. It has been assessed that the organisation has conformed

effectively to the standards laid down in AASB for recognising various items in its financial

accumulated impairment losses (Barth 2018). On the other hand, the intangible assets that are

acquired during business combination are gauged at fair values as in the acquired date. Goodwill

acquired during business combination is gauged initially at cost. The consequent expenditure

related to capitalised intangible assets is capitalised at the time the future economic benefits are

increased embodied in the specific assets related to each other (Naranjo, Saavedra and Verdi

2017). The other expenditures are expensed as incurred.

8. Alternative valuation method of non-current asset:

An alternative method of valuing intangible assets might be the income approach. This

approach is best fitted at the time the intangible assets produce income or when it enables the

asset in generating cash flows (Nobes 2014). With the help of this particular technique, the future

benefits could be converted to one discounted amount, which is the outcome of increased

turnover or cost savings. Hence, there are two choices available, if GWA Group Limited plans to

adopt this approach for valuing its intangible assets. The first option is to capitalise a single

group of benefits or discounting future flow of benefits. This approach investigates a rate of

discount from either “weighted average cost of capital”, “weighted average return on assets” or

“internal rate of return”. However, since this technique is not considered superior over the

historical cost approach or fair value technique, since AASB does not prescribe the business

organisations to follow this approach (Robb, Rohde and Green 2016).

Conclusion:

The essay provides an in-depth overview of the various items stated in the annual report

of GWA Group Limited in 2017. It has been assessed that the organisation has conformed

effectively to the standards laid down in AASB for recognising various items in its financial

11FINANCIAL REPORTING

report. This implies that the financial statements are developed with due care and diligence.

Along with this, the accounting statements of the organisation highlight the fact that adequate

disclosures might be required for improving the overall quality of financial reporting of GWA

Group Limited.

report. This implies that the financial statements are developed with due care and diligence.

Along with this, the accounting statements of the organisation highlight the fact that adequate

disclosures might be required for improving the overall quality of financial reporting of GWA

Group Limited.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.