Establish and Maintain Payroll systems | Assessment

VerifiedAdded on 2022/08/16

|6

|1487

|11

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Establish and Maintain Payroll systems

Knowledge task: This assessment task requires students to research and type answers in Word to

eleven questions as listed in this document, at home in a safe environment. Students to answer in their own

words as much as possible. Include any website references used for each question.

Question 13: 13. Describe current Australian Tax Office (ATO) requirements for:

Australian Business Number (ABN)

Employee declaration

Tax file number (TFN) declaration

Satisfactory

response

Yes

☐

No ☐

Answer:

The Australian Business Number (ABN) is required only for entities carrying on or starting

an enterprise in Australia and making supplies in relation to Australia’s indirect tax zone. A

corporations Act company also needs to have the same.

The employee declaration should contain the details of the fringe benefits received by the

employees which is written by the employees themselves. These should be obtained before

the date of lodging the FBT return.

The ATO states that the Tax File Number (TFN) should be applied for all people residing in

Australia and looking to obtain the benefits of the government in the country.

References: ABN entitlement | ABR. (2020). Abr.gov.au. Retrieved 6 March 2020, from

https://www.abr.gov.au/business-super-funds-charities/applying-abn/abn-entitlement

Comment:

Question 14: Explain pay as you go (PAYG) withholding tax and when an employer must

register

Satisfactory

response

Yes

☐

No ☐

Answer:

A Pay as you Go (PAYG) is a withholding tax in which incremental amounts of the business

income are paid by the businesses to the ATO. These instalment payments accumulate and

form a part of the income tax liability of the business. An employer must register for PAYG

before they first withhold an amount of tax from a payment.

References: PAYG withholding. (2020). Ato.gov.au. Retrieved 6 March 2020, from

https://www.ato.gov.au/Business/PAYG-withholding/

Comment:

Knowledge task: This assessment task requires students to research and type answers in Word to

eleven questions as listed in this document, at home in a safe environment. Students to answer in their own

words as much as possible. Include any website references used for each question.

Question 13: 13. Describe current Australian Tax Office (ATO) requirements for:

Australian Business Number (ABN)

Employee declaration

Tax file number (TFN) declaration

Satisfactory

response

Yes

☐

No ☐

Answer:

The Australian Business Number (ABN) is required only for entities carrying on or starting

an enterprise in Australia and making supplies in relation to Australia’s indirect tax zone. A

corporations Act company also needs to have the same.

The employee declaration should contain the details of the fringe benefits received by the

employees which is written by the employees themselves. These should be obtained before

the date of lodging the FBT return.

The ATO states that the Tax File Number (TFN) should be applied for all people residing in

Australia and looking to obtain the benefits of the government in the country.

References: ABN entitlement | ABR. (2020). Abr.gov.au. Retrieved 6 March 2020, from

https://www.abr.gov.au/business-super-funds-charities/applying-abn/abn-entitlement

Comment:

Question 14: Explain pay as you go (PAYG) withholding tax and when an employer must

register

Satisfactory

response

Yes

☐

No ☐

Answer:

A Pay as you Go (PAYG) is a withholding tax in which incremental amounts of the business

income are paid by the businesses to the ATO. These instalment payments accumulate and

form a part of the income tax liability of the business. An employer must register for PAYG

before they first withhold an amount of tax from a payment.

References: PAYG withholding. (2020). Ato.gov.au. Retrieved 6 March 2020, from

https://www.ato.gov.au/Business/PAYG-withholding/

Comment:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Question 15: Describe fringe benefits tax (FBT). What does the term “grossing up” refer to?

Give 3 examples of fringe benefits

Satisfactory

response

Yes

☐

No ☐

Answer: Fringe Benefits Tax (FTB) is the tax paid by the employers for the additional

benefits paid to the employees apart from the salary. This tax is applicable even if the tax is

paid by a third party under an agreement with the employer. Grossing up refers to the adding

up of all the FBTs provided by the employer. There are two gross up rates used in the

calculation of the benefits received by the employee. Car for private purposes, gym

membership and a discounted loan are examples of fringe benefits.

References: Fringe benefits tax (FBT). (2020). Ato.gov.au. Retrieved 6 March 2020, from

https://www.ato.gov.au/General/Fringe-benefits-tax-(FBT)/

Comment:

Question 16: An organisational payroll policy and procedures establish among other

things internal checks and balances to control and protect this

expense. This can then reduce the incidence of what two things?

Satisfactory response

Yes ☐ No ☐

Answer:

The establishment of the payroll policy and procedures result in the reduction of the

incidence of errors and the possibility of occurrence of frauds. However, the checks

should be taken regularly and also involves a lot of time and resources.

Comment:

Question 17: An employer is required to follow industry codes of practice for payroll

operations. Name 3 forms an employer is required to give a new

employee before paying them

Satisfactory response

Yes ☐ No ☐

Answer:

The three forms which an employer needs to give to the employee before paying

them include a Tax File Number (TFN) declaration, Standard Choice form for those

eligible to choose a superannuation fund and another Standard Choice form to

nominate their preferred super fund.

Comment:

Give 3 examples of fringe benefits

Satisfactory

response

Yes

☐

No ☐

Answer: Fringe Benefits Tax (FTB) is the tax paid by the employers for the additional

benefits paid to the employees apart from the salary. This tax is applicable even if the tax is

paid by a third party under an agreement with the employer. Grossing up refers to the adding

up of all the FBTs provided by the employer. There are two gross up rates used in the

calculation of the benefits received by the employee. Car for private purposes, gym

membership and a discounted loan are examples of fringe benefits.

References: Fringe benefits tax (FBT). (2020). Ato.gov.au. Retrieved 6 March 2020, from

https://www.ato.gov.au/General/Fringe-benefits-tax-(FBT)/

Comment:

Question 16: An organisational payroll policy and procedures establish among other

things internal checks and balances to control and protect this

expense. This can then reduce the incidence of what two things?

Satisfactory response

Yes ☐ No ☐

Answer:

The establishment of the payroll policy and procedures result in the reduction of the

incidence of errors and the possibility of occurrence of frauds. However, the checks

should be taken regularly and also involves a lot of time and resources.

Comment:

Question 17: An employer is required to follow industry codes of practice for payroll

operations. Name 3 forms an employer is required to give a new

employee before paying them

Satisfactory response

Yes ☐ No ☐

Answer:

The three forms which an employer needs to give to the employee before paying

them include a Tax File Number (TFN) declaration, Standard Choice form for those

eligible to choose a superannuation fund and another Standard Choice form to

nominate their preferred super fund.

Comment:

Question 18: Describe key features of manual and computerised payroll systems Satisfactory response

Yes ☐ No ☐

Answer:

The main features of a manual payroll system include the calculation of the payroll

each day on paper. All earning heads and statutorily applicable deductions are

applied without any start-up costs. The time taken for processing the payroll is very

high in this case.

A computerised payroll system maintains a payroll software which assists the

entity in the processing of the payroll. Once the input for each employee is entered,

all the other calculations are done by the software. The relevant forms for each

employee is also processed at the year-end which saves a lot of time.

Comment:

Yes ☐ No ☐

Answer:

The main features of a manual payroll system include the calculation of the payroll

each day on paper. All earning heads and statutorily applicable deductions are

applied without any start-up costs. The time taken for processing the payroll is very

high in this case.

A computerised payroll system maintains a payroll software which assists the

entity in the processing of the payroll. Once the input for each employee is entered,

all the other calculations are done by the software. The relevant forms for each

employee is also processed at the year-end which saves a lot of time.

Comment:

Question 19: Refer to Unit 7 of your textbook. Name the 4 types of payment summary. Name

the document issued by My gov if an employer is using Single Touch Payroll.

Satisfactory

response

Yes

☐

No ☐

Answer: The four types of payment summaries are the payment summaries for workers,

electronic payment summaries, part-year payment summaries and paper payment

summaries. If an employer is using the single touch payroll, then Mygov will send a tax and

super information related document.

References: PAYG payment summaries. (2020). Ato.gov.au. Retrieved 6 March 2020, from

https://www.ato.gov.au/business/payg-withholding/payg-payment-summaries/

Comment:

Question 20: Define an employment termination payment (ETP), including 3 examples of an

ETP

Satisfactory

response

Yes

☐

No ☐

Answer:

An employment termination payment (ETP) is a payment received by the employee on the

completion of their employment tenure. Some of the examples of ETP include payments for

unused leave or unused roster days off, payments in lieu of notice and compensation for

loss of job or wrongful dismissal of the employee.

References: Employment termination payments. (2020). Ato.gov.au. Retrieved 6 March 2020,

from https://www.ato.gov.au/Individuals/Working/Working-as-an-employee/Leaving-your-job/

Employment-termination-payments/

Comment:

Question 21: Go to www.tpb.gov.au and list 5 different categories of the code of professional

conduct for BAS agents. Give one workplace example of one of the categories

Satisfactory

response

Yes

☐

No ☐

Answer:

The 5 different categories of the code of professional conduct for BAS agents includes

honesty and integrity, independence, confidentiality, competence and other

responsibilities. One of the examples is to act with honesty and integrity if one receives

money or other properties on behalf of a client or hold the money or other related

properties on trust.

Comment:

the document issued by My gov if an employer is using Single Touch Payroll.

Satisfactory

response

Yes

☐

No ☐

Answer: The four types of payment summaries are the payment summaries for workers,

electronic payment summaries, part-year payment summaries and paper payment

summaries. If an employer is using the single touch payroll, then Mygov will send a tax and

super information related document.

References: PAYG payment summaries. (2020). Ato.gov.au. Retrieved 6 March 2020, from

https://www.ato.gov.au/business/payg-withholding/payg-payment-summaries/

Comment:

Question 20: Define an employment termination payment (ETP), including 3 examples of an

ETP

Satisfactory

response

Yes

☐

No ☐

Answer:

An employment termination payment (ETP) is a payment received by the employee on the

completion of their employment tenure. Some of the examples of ETP include payments for

unused leave or unused roster days off, payments in lieu of notice and compensation for

loss of job or wrongful dismissal of the employee.

References: Employment termination payments. (2020). Ato.gov.au. Retrieved 6 March 2020,

from https://www.ato.gov.au/Individuals/Working/Working-as-an-employee/Leaving-your-job/

Employment-termination-payments/

Comment:

Question 21: Go to www.tpb.gov.au and list 5 different categories of the code of professional

conduct for BAS agents. Give one workplace example of one of the categories

Satisfactory

response

Yes

☐

No ☐

Answer:

The 5 different categories of the code of professional conduct for BAS agents includes

honesty and integrity, independence, confidentiality, competence and other

responsibilities. One of the examples is to act with honesty and integrity if one receives

money or other properties on behalf of a client or hold the money or other related

properties on trust.

Comment:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

References: Code of Professional Conduct for BAS agents | TPB. (2020). Tpb.gov.au. Retrieved

6 March 2020, from https://www.tpb.gov.au/code-professional-conduct-bas-agents

6 March 2020, from https://www.tpb.gov.au/code-professional-conduct-bas-agents

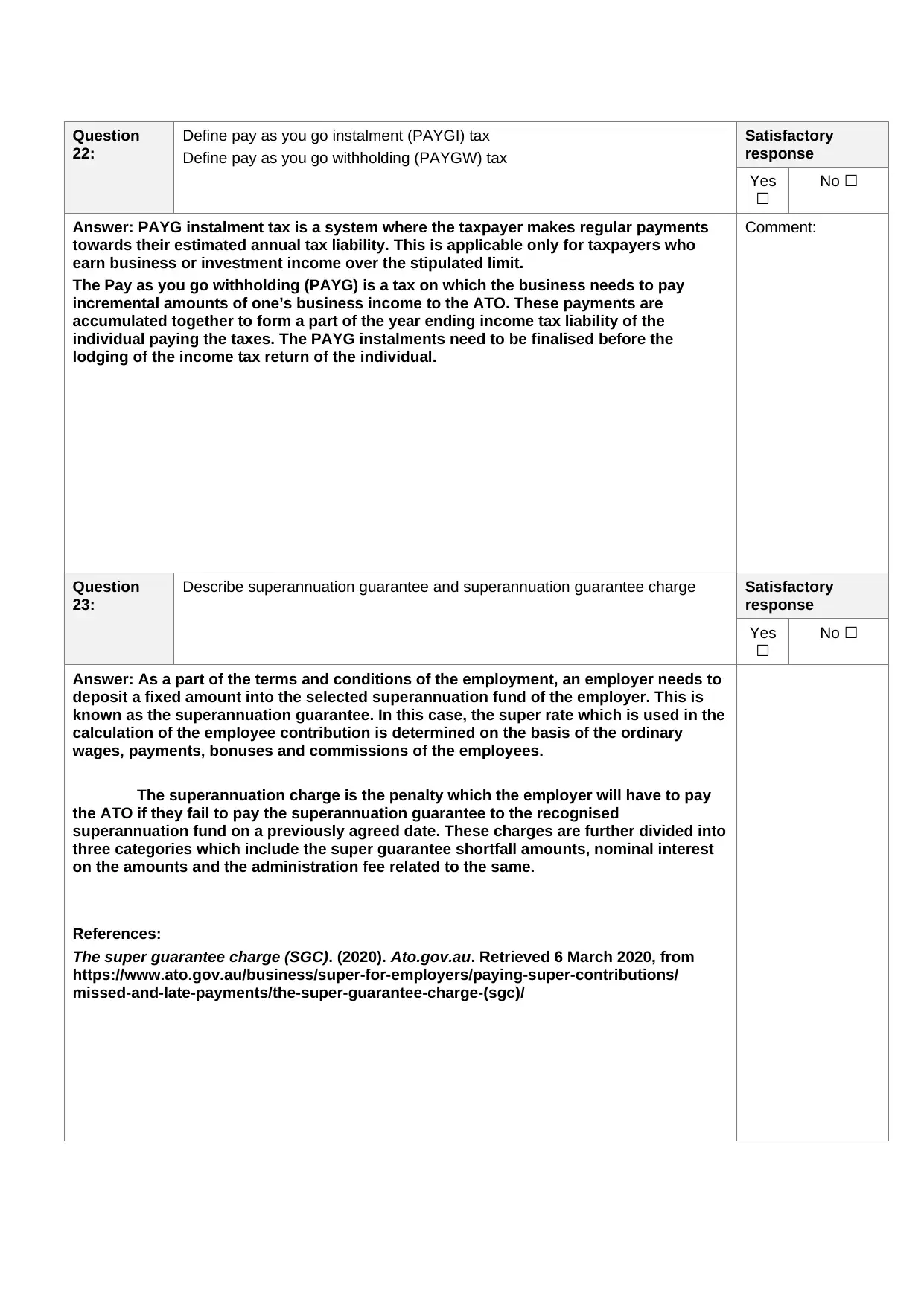

Question

22:

Define pay as you go instalment (PAYGI) tax

Define pay as you go withholding (PAYGW) tax

Satisfactory

response

Yes

☐

No ☐

Answer: PAYG instalment tax is a system where the taxpayer makes regular payments

towards their estimated annual tax liability. This is applicable only for taxpayers who

earn business or investment income over the stipulated limit.

The Pay as you go withholding (PAYG) is a tax on which the business needs to pay

incremental amounts of one’s business income to the ATO. These payments are

accumulated together to form a part of the year ending income tax liability of the

individual paying the taxes. The PAYG instalments need to be finalised before the

lodging of the income tax return of the individual.

Comment:

Question

23:

Describe superannuation guarantee and superannuation guarantee charge Satisfactory

response

Yes

☐

No ☐

Answer: As a part of the terms and conditions of the employment, an employer needs to

deposit a fixed amount into the selected superannuation fund of the employer. This is

known as the superannuation guarantee. In this case, the super rate which is used in the

calculation of the employee contribution is determined on the basis of the ordinary

wages, payments, bonuses and commissions of the employees.

The superannuation charge is the penalty which the employer will have to pay

the ATO if they fail to pay the superannuation guarantee to the recognised

superannuation fund on a previously agreed date. These charges are further divided into

three categories which include the super guarantee shortfall amounts, nominal interest

on the amounts and the administration fee related to the same.

References:

The super guarantee charge (SGC). (2020). Ato.gov.au. Retrieved 6 March 2020, from

https://www.ato.gov.au/business/super-for-employers/paying-super-contributions/

missed-and-late-payments/the-super-guarantee-charge-(sgc)/

22:

Define pay as you go instalment (PAYGI) tax

Define pay as you go withholding (PAYGW) tax

Satisfactory

response

Yes

☐

No ☐

Answer: PAYG instalment tax is a system where the taxpayer makes regular payments

towards their estimated annual tax liability. This is applicable only for taxpayers who

earn business or investment income over the stipulated limit.

The Pay as you go withholding (PAYG) is a tax on which the business needs to pay

incremental amounts of one’s business income to the ATO. These payments are

accumulated together to form a part of the year ending income tax liability of the

individual paying the taxes. The PAYG instalments need to be finalised before the

lodging of the income tax return of the individual.

Comment:

Question

23:

Describe superannuation guarantee and superannuation guarantee charge Satisfactory

response

Yes

☐

No ☐

Answer: As a part of the terms and conditions of the employment, an employer needs to

deposit a fixed amount into the selected superannuation fund of the employer. This is

known as the superannuation guarantee. In this case, the super rate which is used in the

calculation of the employee contribution is determined on the basis of the ordinary

wages, payments, bonuses and commissions of the employees.

The superannuation charge is the penalty which the employer will have to pay

the ATO if they fail to pay the superannuation guarantee to the recognised

superannuation fund on a previously agreed date. These charges are further divided into

three categories which include the super guarantee shortfall amounts, nominal interest

on the amounts and the administration fee related to the same.

References:

The super guarantee charge (SGC). (2020). Ato.gov.au. Retrieved 6 March 2020, from

https://www.ato.gov.au/business/super-for-employers/paying-super-contributions/

missed-and-late-payments/the-super-guarantee-charge-(sgc)/

1 out of 6

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.