Comprehensive Report on IAS 36 Impairment of Assets and Valuation

VerifiedAdded on 2020/07/22

|8

|1874

|80

Report

AI Summary

This report provides a detailed analysis of IAS 36, focusing on the impairment of assets. It begins with an introduction to the objectives of IAS 36, emphasizing the importance of asset valuation and depreciation in maintaining a firm's financial health. The report then explores the relevance of fair value and disposal value in asset valuation, followed by a discussion on internal and external indications of asset impairment. It outlines the determination of the recoverable amount of assets and includes practical asset valuation calculations, such as the determination of value in use, impairment loss, and depreciation using the straight-line method. The report concludes by summarizing the key findings and emphasizing the significance of accurate asset valuation and adherence to IAS 36 for sound financial reporting. Various references are provided to support the analysis, including journal articles and online resources.

FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

1. Evaluating the objectives of IAS36 impairment of assets......................................................1

2. Relevance of assets fair value and disposal value...................................................................2

3. Main indications which in turn suggesting the impairment of assets.....................................2

4. Determination of recoverable amount of assets......................................................................3

5. Asset valuation........................................................................................................................3

CONCLUSIONS..............................................................................................................................5

REFERENCES................................................................................................................................6

INTRODUCTION...........................................................................................................................1

1. Evaluating the objectives of IAS36 impairment of assets......................................................1

2. Relevance of assets fair value and disposal value...................................................................2

3. Main indications which in turn suggesting the impairment of assets.....................................2

4. Determination of recoverable amount of assets......................................................................3

5. Asset valuation........................................................................................................................3

CONCLUSIONS..............................................................................................................................5

REFERENCES................................................................................................................................6

INTRODUCTION

In terms of making the adequate valuation of the assets as well as charging the

authenticated depreciation with the specific methods the firm will be able to have the fair

depreciation over its assets. In the present report there has been use of straight line method to

value the assets over the cash inflows or the value of it. The report will also evaluate various

terms, indications and benefits of making the adequate valuation of such assets. There will be

discussion over the laws and rules set my IAS in terms of impairments of the value of assets such

as IAS 36 and its objectives which are fruitful for the business operations.

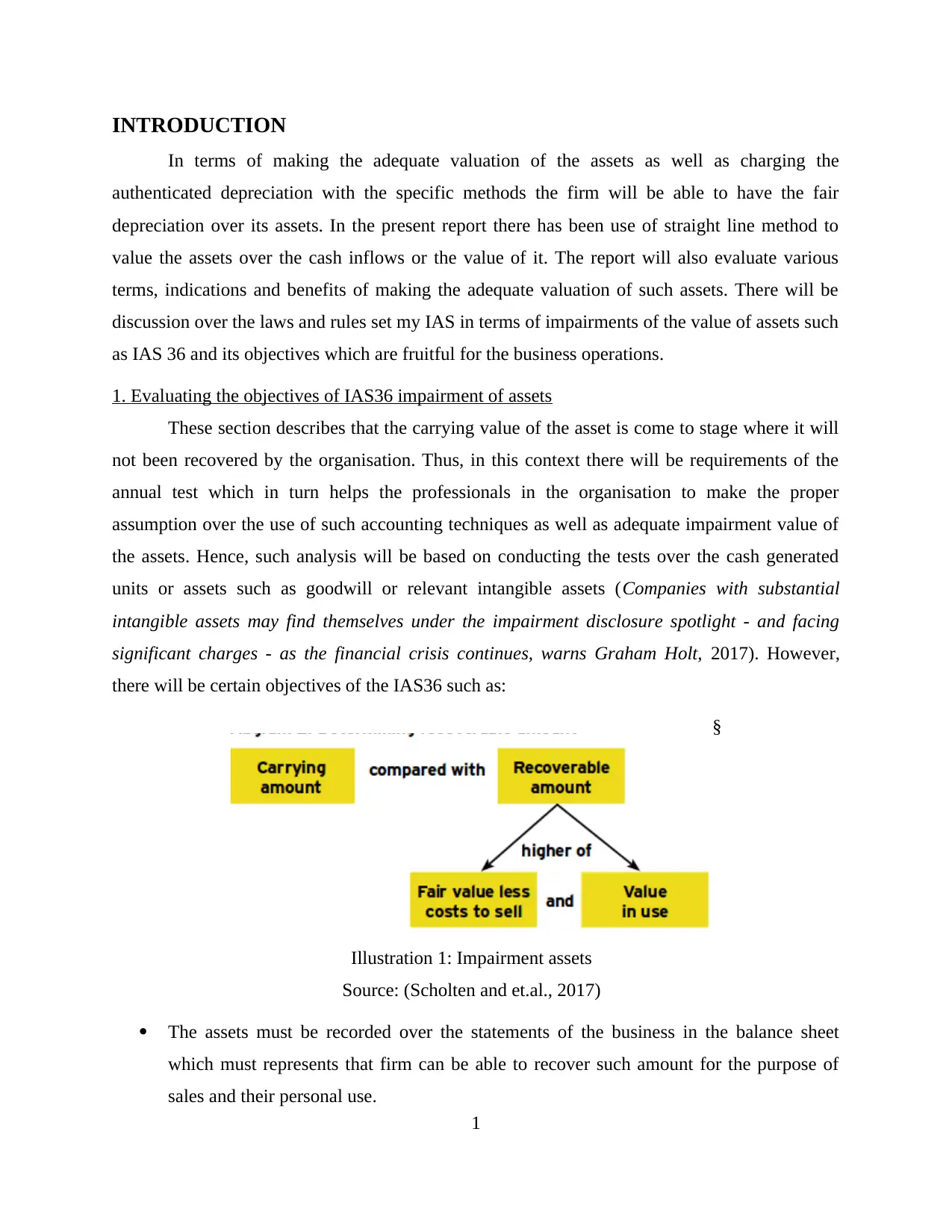

1. Evaluating the objectives of IAS36 impairment of assets

These section describes that the carrying value of the asset is come to stage where it will

not been recovered by the organisation. Thus, in this context there will be requirements of the

annual test which in turn helps the professionals in the organisation to make the proper

assumption over the use of such accounting techniques as well as adequate impairment value of

the assets. Hence, such analysis will be based on conducting the tests over the cash generated

units or assets such as goodwill or relevant intangible assets (Companies with substantial

intangible assets may find themselves under the impairment disclosure spotlight - and facing

significant charges - as the financial crisis continues, warns Graham Holt, 2017). However,

there will be certain objectives of the IAS36 such as:

Illustration 1: Impairment assets

Source: (Scholten and et.al., 2017)

§

The assets must be recorded over the statements of the business in the balance sheet

which must represents that firm can be able to recover such amount for the purpose of

sales and their personal use.

1

In terms of making the adequate valuation of the assets as well as charging the

authenticated depreciation with the specific methods the firm will be able to have the fair

depreciation over its assets. In the present report there has been use of straight line method to

value the assets over the cash inflows or the value of it. The report will also evaluate various

terms, indications and benefits of making the adequate valuation of such assets. There will be

discussion over the laws and rules set my IAS in terms of impairments of the value of assets such

as IAS 36 and its objectives which are fruitful for the business operations.

1. Evaluating the objectives of IAS36 impairment of assets

These section describes that the carrying value of the asset is come to stage where it will

not been recovered by the organisation. Thus, in this context there will be requirements of the

annual test which in turn helps the professionals in the organisation to make the proper

assumption over the use of such accounting techniques as well as adequate impairment value of

the assets. Hence, such analysis will be based on conducting the tests over the cash generated

units or assets such as goodwill or relevant intangible assets (Companies with substantial

intangible assets may find themselves under the impairment disclosure spotlight - and facing

significant charges - as the financial crisis continues, warns Graham Holt, 2017). However,

there will be certain objectives of the IAS36 such as:

Illustration 1: Impairment assets

Source: (Scholten and et.al., 2017)

§

The assets must be recorded over the statements of the business in the balance sheet

which must represents that firm can be able to recover such amount for the purpose of

sales and their personal use.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It measures the impairment loss as if the carrying amount of assets is increased or can be

more than the cash generating units such as goodwill and intangible assets which in turn

exceed the recoverable cost of the assets.

However, these are the main objectives of the IAS 36 which in turn facilitate the

organisation in having the adequate recovery amount of assets as well as make the changes in the

profitable gains of the firm. Hence, it can be fruitful in reflecting the adequate value of such

assets in the financial statements of the firm. Thus, such laws are applicable over various assets

of the organisation such as land, building, intangible assets, goodwill, machineries, tools and

equipment, investment property, subsidiaries, joint ventures etc. (IAS 36 — Impairment of Assets,

2017).

2. Relevance of assets fair value and disposal value

In accordance with the value of the assets in the books of accounts which will be

recorded as well as presented in the financial statement after making deductions of all the

relevant accumulated depreciation, impairment losses are known as the carrying value of such

assets. Hence, there will be deduction of the impairment losses which incurred due to the value

of such assets exceed than the recoverable amount.

However, in terms of analysing the recoverable value of the assets which acne be denoted

as the fair value of the assets after making deduction of the selling price or the costs of disposal

then it presents the value in use (Visvanathan, 2017). Hence, it describes the value will be easily

recoverable or not. Hence, such value in use will be present in the future cash flows as the

expected amount over assets while the fair value less cost to sell will be known as the price that

would be received from making the sales and costs of disposal.

3. Main indications which in turn suggesting the impairment of assets

There will be various sources which in turn facilitates the adequate indications of the

assets to be impaired such as:

Internal indications:

There will be various internal indications which are presenting the condition of the assets

such as tools, equipment’s and the infrastructural property of the business which are need to be

managed by the organisational professionals. Hence, there will be indications like:

2

more than the cash generating units such as goodwill and intangible assets which in turn

exceed the recoverable cost of the assets.

However, these are the main objectives of the IAS 36 which in turn facilitate the

organisation in having the adequate recovery amount of assets as well as make the changes in the

profitable gains of the firm. Hence, it can be fruitful in reflecting the adequate value of such

assets in the financial statements of the firm. Thus, such laws are applicable over various assets

of the organisation such as land, building, intangible assets, goodwill, machineries, tools and

equipment, investment property, subsidiaries, joint ventures etc. (IAS 36 — Impairment of Assets,

2017).

2. Relevance of assets fair value and disposal value

In accordance with the value of the assets in the books of accounts which will be

recorded as well as presented in the financial statement after making deductions of all the

relevant accumulated depreciation, impairment losses are known as the carrying value of such

assets. Hence, there will be deduction of the impairment losses which incurred due to the value

of such assets exceed than the recoverable amount.

However, in terms of analysing the recoverable value of the assets which acne be denoted

as the fair value of the assets after making deduction of the selling price or the costs of disposal

then it presents the value in use (Visvanathan, 2017). Hence, it describes the value will be easily

recoverable or not. Hence, such value in use will be present in the future cash flows as the

expected amount over assets while the fair value less cost to sell will be known as the price that

would be received from making the sales and costs of disposal.

3. Main indications which in turn suggesting the impairment of assets

There will be various sources which in turn facilitates the adequate indications of the

assets to be impaired such as:

Internal indications:

There will be various internal indications which are presenting the condition of the assets

such as tools, equipment’s and the infrastructural property of the business which are need to be

managed by the organisational professionals. Hence, there will be indications like:

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

If the visible damage to the asset such as physically it breaks any part or not be in use

again as well as it may become idle (Gonçalves, Lopes and Craig, 2017).

The asset exceeds the useful life or not being profitable for the business in gaining the

adequate resale value as if they make any sale of it. It could not have the adequate recoverable value of assets as it gives the poor

performance as well as affecting the performance of the organisation.

External indication:

If the market value of the assets declines such as changes in the technology and

innovative machineries are highly required for performing the operational tasks.

Reduction in the economic condition of the market which in turn affect the reduction in

the value of fixed assets.

Increase in the rate of interest in the environment as well as the stock value of the

company is below the book value (André, Dionysiou and Tsalavoutas, 2017).

4. Determination of recoverable amount of assets

The recoverable value of the assets will be determined over the fair value of assets to be

reduced with the cost of making the disposal of such assets as well as the value in use will be

exceeding the cost of carrying. Hence, on the other side if the assets to be sold out of\r disposed

of than it must be the fair value of such assets less the costs of sell (Wang, Butterfield and

Campbell, 2016).

5. Asset valuation

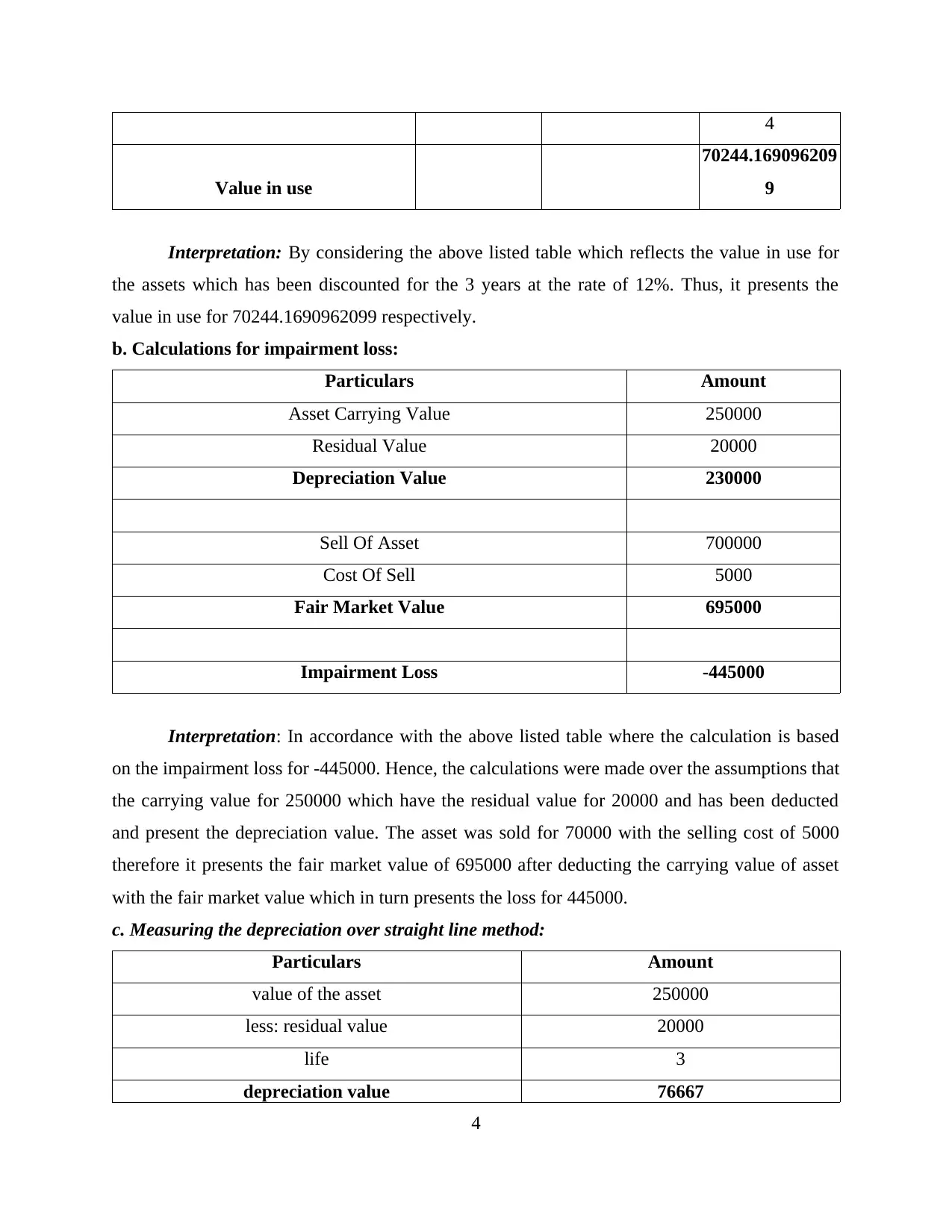

a. Determination of asset value:

year value

discount factor

@12% Present value

1 20000 0.893

17857.142857142

9

2 30000 0.797

23915.816326530

6

3 40000 0.712 28471.209912536

3

again as well as it may become idle (Gonçalves, Lopes and Craig, 2017).

The asset exceeds the useful life or not being profitable for the business in gaining the

adequate resale value as if they make any sale of it. It could not have the adequate recoverable value of assets as it gives the poor

performance as well as affecting the performance of the organisation.

External indication:

If the market value of the assets declines such as changes in the technology and

innovative machineries are highly required for performing the operational tasks.

Reduction in the economic condition of the market which in turn affect the reduction in

the value of fixed assets.

Increase in the rate of interest in the environment as well as the stock value of the

company is below the book value (André, Dionysiou and Tsalavoutas, 2017).

4. Determination of recoverable amount of assets

The recoverable value of the assets will be determined over the fair value of assets to be

reduced with the cost of making the disposal of such assets as well as the value in use will be

exceeding the cost of carrying. Hence, on the other side if the assets to be sold out of\r disposed

of than it must be the fair value of such assets less the costs of sell (Wang, Butterfield and

Campbell, 2016).

5. Asset valuation

a. Determination of asset value:

year value

discount factor

@12% Present value

1 20000 0.893

17857.142857142

9

2 30000 0.797

23915.816326530

6

3 40000 0.712 28471.209912536

3

4

Value in use

70244.169096209

9

Interpretation: By considering the above listed table which reflects the value in use for

the assets which has been discounted for the 3 years at the rate of 12%. Thus, it presents the

value in use for 70244.1690962099 respectively.

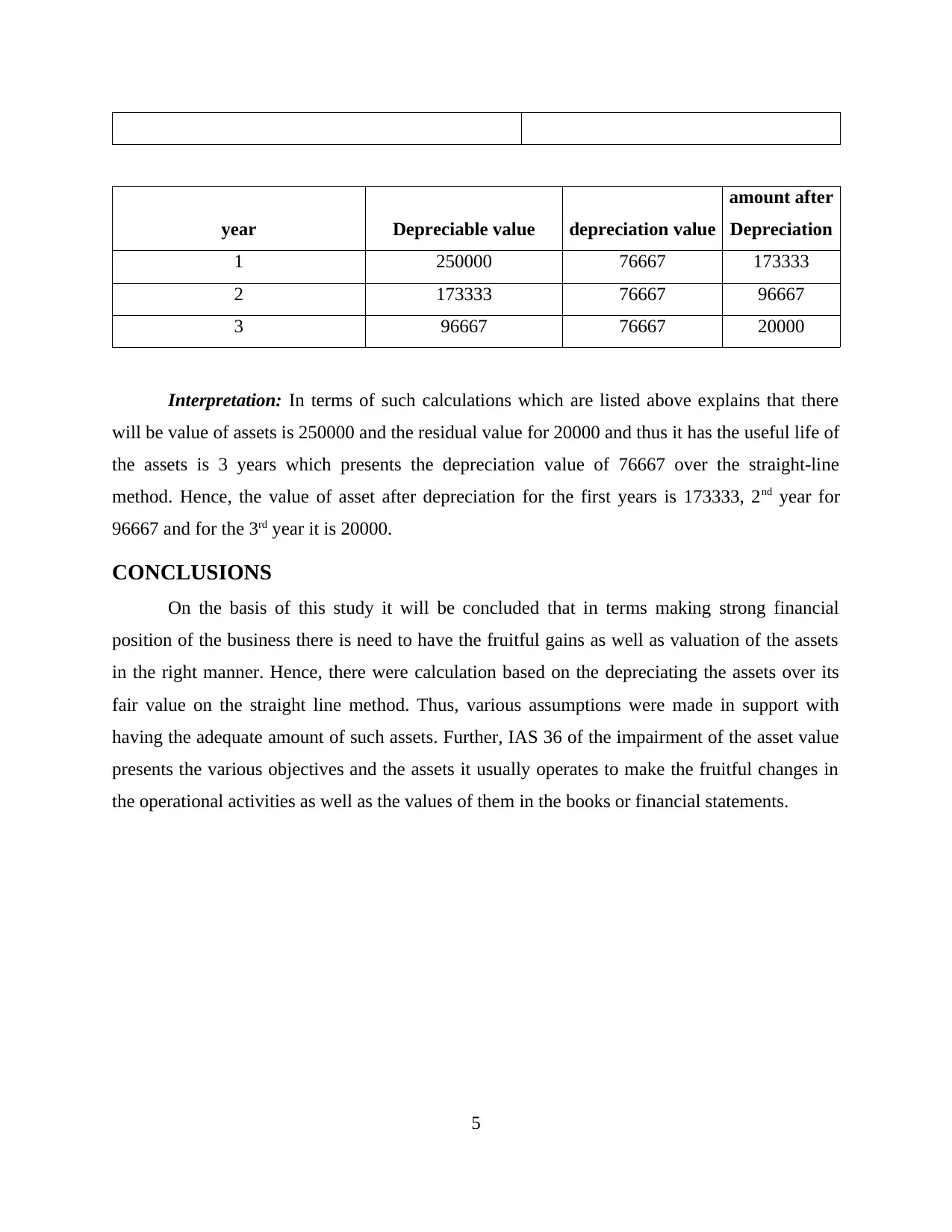

b. Calculations for impairment loss:

Particulars Amount

Asset Carrying Value 250000

Residual Value 20000

Depreciation Value 230000

Sell Of Asset 700000

Cost Of Sell 5000

Fair Market Value 695000

Impairment Loss -445000

Interpretation: In accordance with the above listed table where the calculation is based

on the impairment loss for -445000. Hence, the calculations were made over the assumptions that

the carrying value for 250000 which have the residual value for 20000 and has been deducted

and present the depreciation value. The asset was sold for 70000 with the selling cost of 5000

therefore it presents the fair market value of 695000 after deducting the carrying value of asset

with the fair market value which in turn presents the loss for 445000.

c. Measuring the depreciation over straight line method:

Particulars Amount

value of the asset 250000

less: residual value 20000

life 3

depreciation value 76667

4

Value in use

70244.169096209

9

Interpretation: By considering the above listed table which reflects the value in use for

the assets which has been discounted for the 3 years at the rate of 12%. Thus, it presents the

value in use for 70244.1690962099 respectively.

b. Calculations for impairment loss:

Particulars Amount

Asset Carrying Value 250000

Residual Value 20000

Depreciation Value 230000

Sell Of Asset 700000

Cost Of Sell 5000

Fair Market Value 695000

Impairment Loss -445000

Interpretation: In accordance with the above listed table where the calculation is based

on the impairment loss for -445000. Hence, the calculations were made over the assumptions that

the carrying value for 250000 which have the residual value for 20000 and has been deducted

and present the depreciation value. The asset was sold for 70000 with the selling cost of 5000

therefore it presents the fair market value of 695000 after deducting the carrying value of asset

with the fair market value which in turn presents the loss for 445000.

c. Measuring the depreciation over straight line method:

Particulars Amount

value of the asset 250000

less: residual value 20000

life 3

depreciation value 76667

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

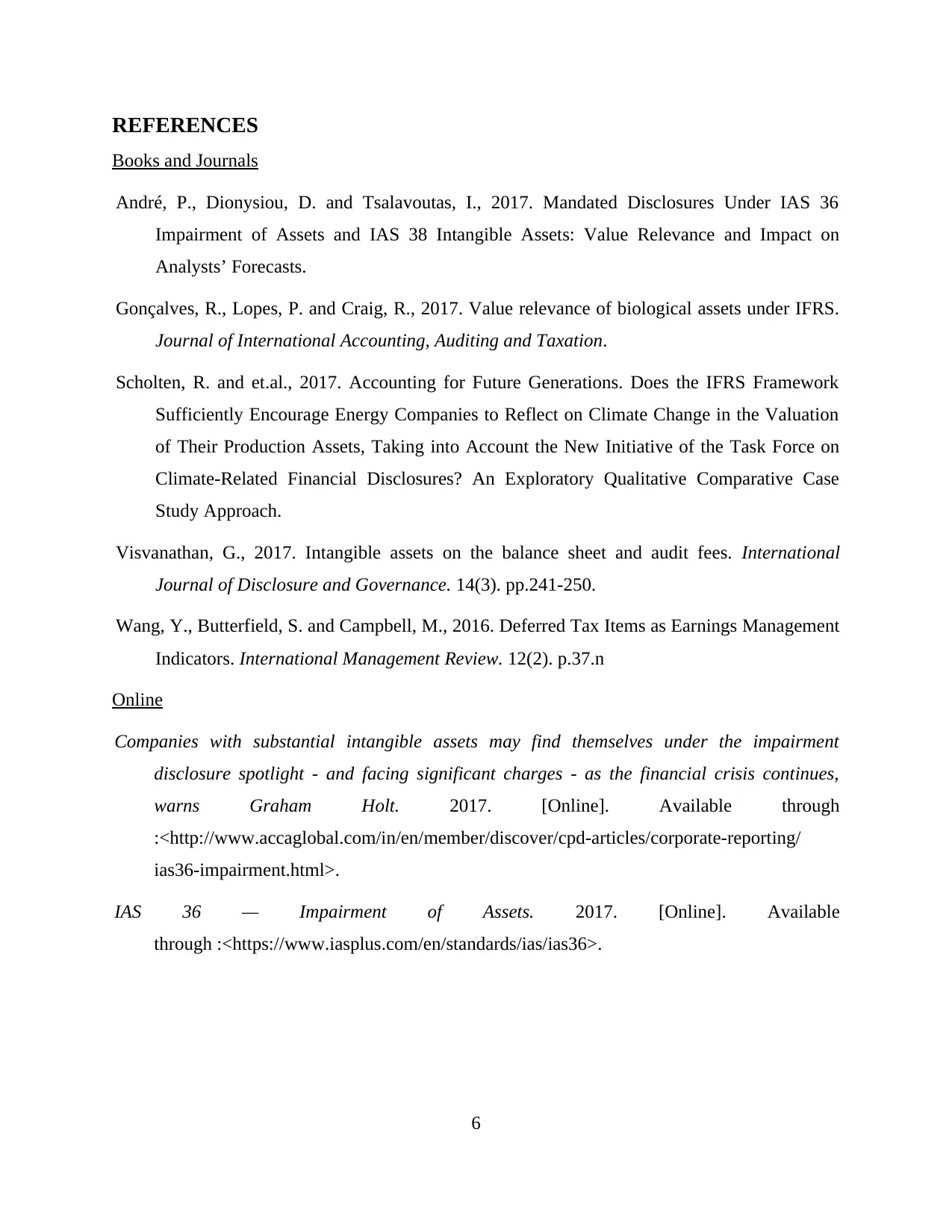

year Depreciable value depreciation value

amount after

Depreciation

1 250000 76667 173333

2 173333 76667 96667

3 96667 76667 20000

Interpretation: In terms of such calculations which are listed above explains that there

will be value of assets is 250000 and the residual value for 20000 and thus it has the useful life of

the assets is 3 years which presents the depreciation value of 76667 over the straight-line

method. Hence, the value of asset after depreciation for the first years is 173333, 2nd year for

96667 and for the 3rd year it is 20000.

CONCLUSIONS

On the basis of this study it will be concluded that in terms making strong financial

position of the business there is need to have the fruitful gains as well as valuation of the assets

in the right manner. Hence, there were calculation based on the depreciating the assets over its

fair value on the straight line method. Thus, various assumptions were made in support with

having the adequate amount of such assets. Further, IAS 36 of the impairment of the asset value

presents the various objectives and the assets it usually operates to make the fruitful changes in

the operational activities as well as the values of them in the books or financial statements.

5

amount after

Depreciation

1 250000 76667 173333

2 173333 76667 96667

3 96667 76667 20000

Interpretation: In terms of such calculations which are listed above explains that there

will be value of assets is 250000 and the residual value for 20000 and thus it has the useful life of

the assets is 3 years which presents the depreciation value of 76667 over the straight-line

method. Hence, the value of asset after depreciation for the first years is 173333, 2nd year for

96667 and for the 3rd year it is 20000.

CONCLUSIONS

On the basis of this study it will be concluded that in terms making strong financial

position of the business there is need to have the fruitful gains as well as valuation of the assets

in the right manner. Hence, there were calculation based on the depreciating the assets over its

fair value on the straight line method. Thus, various assumptions were made in support with

having the adequate amount of such assets. Further, IAS 36 of the impairment of the asset value

presents the various objectives and the assets it usually operates to make the fruitful changes in

the operational activities as well as the values of them in the books or financial statements.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

André, P., Dionysiou, D. and Tsalavoutas, I., 2017. Mandated Disclosures Under IAS 36

Impairment of Assets and IAS 38 Intangible Assets: Value Relevance and Impact on

Analysts’ Forecasts.

Gonçalves, R., Lopes, P. and Craig, R., 2017. Value relevance of biological assets under IFRS.

Journal of International Accounting, Auditing and Taxation.

Scholten, R. and et.al., 2017. Accounting for Future Generations. Does the IFRS Framework

Sufficiently Encourage Energy Companies to Reflect on Climate Change in the Valuation

of Their Production Assets, Taking into Account the New Initiative of the Task Force on

Climate-Related Financial Disclosures? An Exploratory Qualitative Comparative Case

Study Approach.

Visvanathan, G., 2017. Intangible assets on the balance sheet and audit fees. International

Journal of Disclosure and Governance. 14(3). pp.241-250.

Wang, Y., Butterfield, S. and Campbell, M., 2016. Deferred Tax Items as Earnings Management

Indicators. International Management Review. 12(2). p.37.n

Online

Companies with substantial intangible assets may find themselves under the impairment

disclosure spotlight - and facing significant charges - as the financial crisis continues,

warns Graham Holt. 2017. [Online]. Available through

:<http://www.accaglobal.com/in/en/member/discover/cpd-articles/corporate-reporting/

ias36-impairment.html>.

IAS 36 — Impairment of Assets. 2017. [Online]. Available

through :<https://www.iasplus.com/en/standards/ias/ias36>.

6

Books and Journals

André, P., Dionysiou, D. and Tsalavoutas, I., 2017. Mandated Disclosures Under IAS 36

Impairment of Assets and IAS 38 Intangible Assets: Value Relevance and Impact on

Analysts’ Forecasts.

Gonçalves, R., Lopes, P. and Craig, R., 2017. Value relevance of biological assets under IFRS.

Journal of International Accounting, Auditing and Taxation.

Scholten, R. and et.al., 2017. Accounting for Future Generations. Does the IFRS Framework

Sufficiently Encourage Energy Companies to Reflect on Climate Change in the Valuation

of Their Production Assets, Taking into Account the New Initiative of the Task Force on

Climate-Related Financial Disclosures? An Exploratory Qualitative Comparative Case

Study Approach.

Visvanathan, G., 2017. Intangible assets on the balance sheet and audit fees. International

Journal of Disclosure and Governance. 14(3). pp.241-250.

Wang, Y., Butterfield, S. and Campbell, M., 2016. Deferred Tax Items as Earnings Management

Indicators. International Management Review. 12(2). p.37.n

Online

Companies with substantial intangible assets may find themselves under the impairment

disclosure spotlight - and facing significant charges - as the financial crisis continues,

warns Graham Holt. 2017. [Online]. Available through

:<http://www.accaglobal.com/in/en/member/discover/cpd-articles/corporate-reporting/

ias36-impairment.html>.

IAS 36 — Impairment of Assets. 2017. [Online]. Available

through :<https://www.iasplus.com/en/standards/ias/ias36>.

6

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.