CRKC7003 Financial Management: Daniel's Rose Oil Business Analysis

VerifiedAdded on 2023/04/24

|25

|6865

|202

Project

AI Summary

This project report presents a financial analysis of a proposed rose oil business venture by Daniel, a retiree. The analysis encompasses various financial aspects, including a case overview, assumptions, and key findings. It includes a break-even analysis to determine the sales volume required for profitability, and comprehensive financial statements such as profit and loss statements, balance sheets, and monthly/annual cash flow projections. The report also addresses capital requirements and sensitivity analysis to assess the business's resilience to changes in key variables. The core objective is to evaluate the financial feasibility of the venture, determining the investment needed and the potential for profitability, offering recommendations based on the findings.

Running Head: Financial Management

1

Project Report: Financial Management

1

Project Report: Financial Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

2

Contents

Executive summary..........................................................................................................3

Introduction.......................................................................................................................4

Case overview...................................................................................................................4

Assumptions and summary of findings............................................................................6

Break even analysis..........................................................................................................9

Profit and loss statement.................................................................................................11

Balance sheet..................................................................................................................14

Monthly cash flow..........................................................................................................15

Annual cash flow............................................................................................................18

Capital required..............................................................................................................19

Sensitivity analysis.........................................................................................................19

Venture undertaken.........................................................................................................20

Conclusion and recommendation...................................................................................21

Reflection........................................................................................................................21

References.......................................................................................................................22

2

Contents

Executive summary..........................................................................................................3

Introduction.......................................................................................................................4

Case overview...................................................................................................................4

Assumptions and summary of findings............................................................................6

Break even analysis..........................................................................................................9

Profit and loss statement.................................................................................................11

Balance sheet..................................................................................................................14

Monthly cash flow..........................................................................................................15

Annual cash flow............................................................................................................18

Capital required..............................................................................................................19

Sensitivity analysis.........................................................................................................19

Venture undertaken.........................................................................................................20

Conclusion and recommendation...................................................................................21

Reflection........................................................................................................................21

References.......................................................................................................................22

Financial Management

3

Executive summary:

This paper focuses on a new business which would be run by Daniel. Case states that

the Daniel has retired from the job and looking for a new venture to start. He is planning to

start the rose oil business which will be imported from the Bulgaria and will sell the same in

France market. Daniel is planning to purchase the oil in kgs and then sell to it in small

packing in the France market. In the paper, the business feasibility of Daniel’s business has

been studied and it has been found whether the business is feasible or not. Various financial

analysis techniques have been applied over the case. The techniques have been applied on the

basis of given information by Daniel. Firstly, the summary of findings has been prepared to

summarise the case and understand all the requirement of the business. Moreover, the break

even analysis has been done on the case to measure that whether the company would be able

to sell enough quantities of rose oil that it could reach over a point where the revenue and

expenses of the company are similar.

Further, the sales of the firm have forecasted and on the basis of that financial

statement of the business has prepared. Profit and loss statement, monthly cash flow

statement, annual cash flow statement and balance sheet statement has been prepared to

measure the performance of the company after a year so that the better decision could be

made about the performance of the company. The main aim of the business paper is to

evaluate that how much investment is required to start the business and whether the business

would offer enough profits to Daniel. Is it really worth to make such heavy investment in this

business proposal? In order to answer all such questions, the paper has been prepared.

3

Executive summary:

This paper focuses on a new business which would be run by Daniel. Case states that

the Daniel has retired from the job and looking for a new venture to start. He is planning to

start the rose oil business which will be imported from the Bulgaria and will sell the same in

France market. Daniel is planning to purchase the oil in kgs and then sell to it in small

packing in the France market. In the paper, the business feasibility of Daniel’s business has

been studied and it has been found whether the business is feasible or not. Various financial

analysis techniques have been applied over the case. The techniques have been applied on the

basis of given information by Daniel. Firstly, the summary of findings has been prepared to

summarise the case and understand all the requirement of the business. Moreover, the break

even analysis has been done on the case to measure that whether the company would be able

to sell enough quantities of rose oil that it could reach over a point where the revenue and

expenses of the company are similar.

Further, the sales of the firm have forecasted and on the basis of that financial

statement of the business has prepared. Profit and loss statement, monthly cash flow

statement, annual cash flow statement and balance sheet statement has been prepared to

measure the performance of the company after a year so that the better decision could be

made about the performance of the company. The main aim of the business paper is to

evaluate that how much investment is required to start the business and whether the business

would offer enough profits to Daniel. Is it really worth to make such heavy investment in this

business proposal? In order to answer all such questions, the paper has been prepared.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Management

4

Introduction:

Financial management, it is one of the important aspect of a business. It figures out all

the activities and queries related to the funds, projects, investment, profit, financial position

etc. Financial management is a kind of approach in a business which is followed by the

business to meet the common financial objectives and goals of the business (Ward, 2012).

The financial planning in a business is basically done by the top level management to secure

and manage all the performance of the business. It takes the concern over all the financial

objectives and items to evaluate the financial position and perfo5rmance of a business.

Financial management not only limited to the financial activities and recording of financial

transaction rather it takes the concern over all the factors which could directly or indirectly

affect the financial position and financial performance of the business (Ward, 2012).

The approach of financial management is followed by the financial department and

top level management through the help of various financial techniques such as evaluation of

net profit, financial position of the business, the breakeven level of the company, sensitivity

analysis, vertical analysis, ratios etc. The main motto of the financial management to identify

and raise the funds and allocate those funds to the different project to earn more. Financial

management starts from finding the sources to raise the fund to earn more funds (Zabarankin,

Pavlikov and Uryasev, 2014). In the report, the case of Daniel has discussed where Daniel

has retired from his job and wants to start a new venture of rose oil. The rose oil will be

imported from the Bulgaria and will sell the same in France market. Daniel is planning to

purchase the oil in kgs and then sell to it in small packing in the France market. In the paper,

the business feasibility of Daniel’s business has been studied and it has been found whether

the business is feasible or not.

Case overview:

4

Introduction:

Financial management, it is one of the important aspect of a business. It figures out all

the activities and queries related to the funds, projects, investment, profit, financial position

etc. Financial management is a kind of approach in a business which is followed by the

business to meet the common financial objectives and goals of the business (Ward, 2012).

The financial planning in a business is basically done by the top level management to secure

and manage all the performance of the business. It takes the concern over all the financial

objectives and items to evaluate the financial position and perfo5rmance of a business.

Financial management not only limited to the financial activities and recording of financial

transaction rather it takes the concern over all the factors which could directly or indirectly

affect the financial position and financial performance of the business (Ward, 2012).

The approach of financial management is followed by the financial department and

top level management through the help of various financial techniques such as evaluation of

net profit, financial position of the business, the breakeven level of the company, sensitivity

analysis, vertical analysis, ratios etc. The main motto of the financial management to identify

and raise the funds and allocate those funds to the different project to earn more. Financial

management starts from finding the sources to raise the fund to earn more funds (Zabarankin,

Pavlikov and Uryasev, 2014). In the report, the case of Daniel has discussed where Daniel

has retired from his job and wants to start a new venture of rose oil. The rose oil will be

imported from the Bulgaria and will sell the same in France market. Daniel is planning to

purchase the oil in kgs and then sell to it in small packing in the France market. In the paper,

the business feasibility of Daniel’s business has been studied and it has been found whether

the business is feasible or not.

Case overview:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

5

Daniel is a France citizen who has retired from his job and got some amount. Now,

rather than being at home, he is planning to open a new venture of rose oil. One of his friends

lives in Bulgaria market and he has decided to import the rose oil from him. The rose oil will

be bought by him in Kgs and he planned to sell it in small packets of 2.5 grams in the France

market. The market feasibility shows that the demand of the product would be high and from

the 50 units in the first month, the sell would be improved to 800 small packets by the end of

the year. The sales of the company would be variable and Daniel has decided to order the

rose oil on the basis of the demand only. The market feasibility of the company states that the

total revenue of the company would be improved by the end of the year because of the

increment in the demand. With the increment in the sales, profitability level of the business

would also be improved. There are various fixed and variable expenses associated with the

business which would affect over the profits of the business. However the study over the

market and business depicts that the main fixed expenses of the business are rent, labour and

machineries of the business.

Daniel has also explained in the business brief that if required, Daniel could take the

loan from the bank. The maximum limit of the bank loan is € 75,000 which would be lent on

the rate of 8%. The total savings of Daniel are € 7,30,000 which will be invested in the

business to run the business smoothly and earn more money from the business. Daniel would

sell the rose oil from online portal as well as one of his friend has also approach to sell 20

bottles on monthly basis. In order to sell 20 bottles to friend, Daniel would require purchasing

new machinery and hiring assistant. The business would help the Daniel to meet his goals.

The main vision behind this business plan is to ensure that the financial performance of the

business become well as well as the business could serve better to its stakeholders. Below is

the list of the case facts and figures:

5

Daniel is a France citizen who has retired from his job and got some amount. Now,

rather than being at home, he is planning to open a new venture of rose oil. One of his friends

lives in Bulgaria market and he has decided to import the rose oil from him. The rose oil will

be bought by him in Kgs and he planned to sell it in small packets of 2.5 grams in the France

market. The market feasibility shows that the demand of the product would be high and from

the 50 units in the first month, the sell would be improved to 800 small packets by the end of

the year. The sales of the company would be variable and Daniel has decided to order the

rose oil on the basis of the demand only. The market feasibility of the company states that the

total revenue of the company would be improved by the end of the year because of the

increment in the demand. With the increment in the sales, profitability level of the business

would also be improved. There are various fixed and variable expenses associated with the

business which would affect over the profits of the business. However the study over the

market and business depicts that the main fixed expenses of the business are rent, labour and

machineries of the business.

Daniel has also explained in the business brief that if required, Daniel could take the

loan from the bank. The maximum limit of the bank loan is € 75,000 which would be lent on

the rate of 8%. The total savings of Daniel are € 7,30,000 which will be invested in the

business to run the business smoothly and earn more money from the business. Daniel would

sell the rose oil from online portal as well as one of his friend has also approach to sell 20

bottles on monthly basis. In order to sell 20 bottles to friend, Daniel would require purchasing

new machinery and hiring assistant. The business would help the Daniel to meet his goals.

The main vision behind this business plan is to ensure that the financial performance of the

business become well as well as the business could serve better to its stakeholders. Below is

the list of the case facts and figures:

Financial Management

6

Lump sum payment € 730,000.00

Life time (years) 6

Material price per kg BGN 19000

Discount 33%

Shipment cost BGN 450

Inventory time 3 Weeks

Order would be placed

monthly

Minimum inventory level 4 Weeks

Refrigerator € 8,500.00

filtering and dosing

equipment

€ 5,200.00

Industrial room € 850.00 Per month

Payable advance with 3 month

deposit

Website € 7,500.00

Market study € 6,500.00

Demand per month Kg 2

Starting month demand Bottles 50

Average selling price KG 800

Packaging and shipping € 5.50 Per bottle

Credit card 1.30%

Salary each employee NOK 15500 per year

Number of employees 2

Loan amount € 75,000

Interest rate 8%

Tax rate 40% payable in

arrears

Sales unit 800 Bottle

Sales measurement 800

bottles

2.5 gms

Price 45 per bottle

Shipping 8.2 Per bottle

Assumptions and summary of findings:

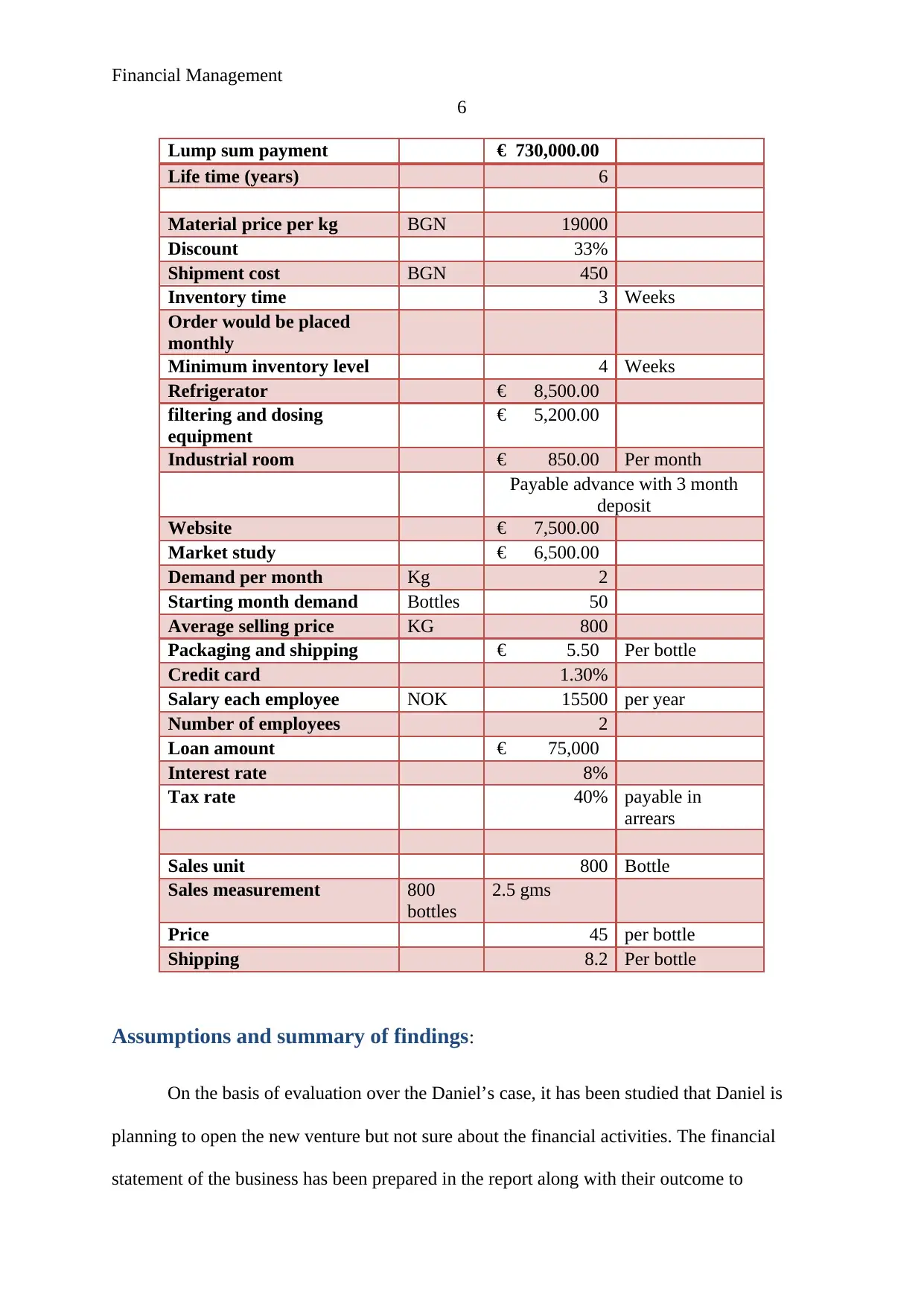

On the basis of evaluation over the Daniel’s case, it has been studied that Daniel is

planning to open the new venture but not sure about the financial activities. The financial

statement of the business has been prepared in the report along with their outcome to

6

Lump sum payment € 730,000.00

Life time (years) 6

Material price per kg BGN 19000

Discount 33%

Shipment cost BGN 450

Inventory time 3 Weeks

Order would be placed

monthly

Minimum inventory level 4 Weeks

Refrigerator € 8,500.00

filtering and dosing

equipment

€ 5,200.00

Industrial room € 850.00 Per month

Payable advance with 3 month

deposit

Website € 7,500.00

Market study € 6,500.00

Demand per month Kg 2

Starting month demand Bottles 50

Average selling price KG 800

Packaging and shipping € 5.50 Per bottle

Credit card 1.30%

Salary each employee NOK 15500 per year

Number of employees 2

Loan amount € 75,000

Interest rate 8%

Tax rate 40% payable in

arrears

Sales unit 800 Bottle

Sales measurement 800

bottles

2.5 gms

Price 45 per bottle

Shipping 8.2 Per bottle

Assumptions and summary of findings:

On the basis of evaluation over the Daniel’s case, it has been studied that Daniel is

planning to open the new venture but not sure about the financial activities. The financial

statement of the business has been prepared in the report along with their outcome to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Management

7

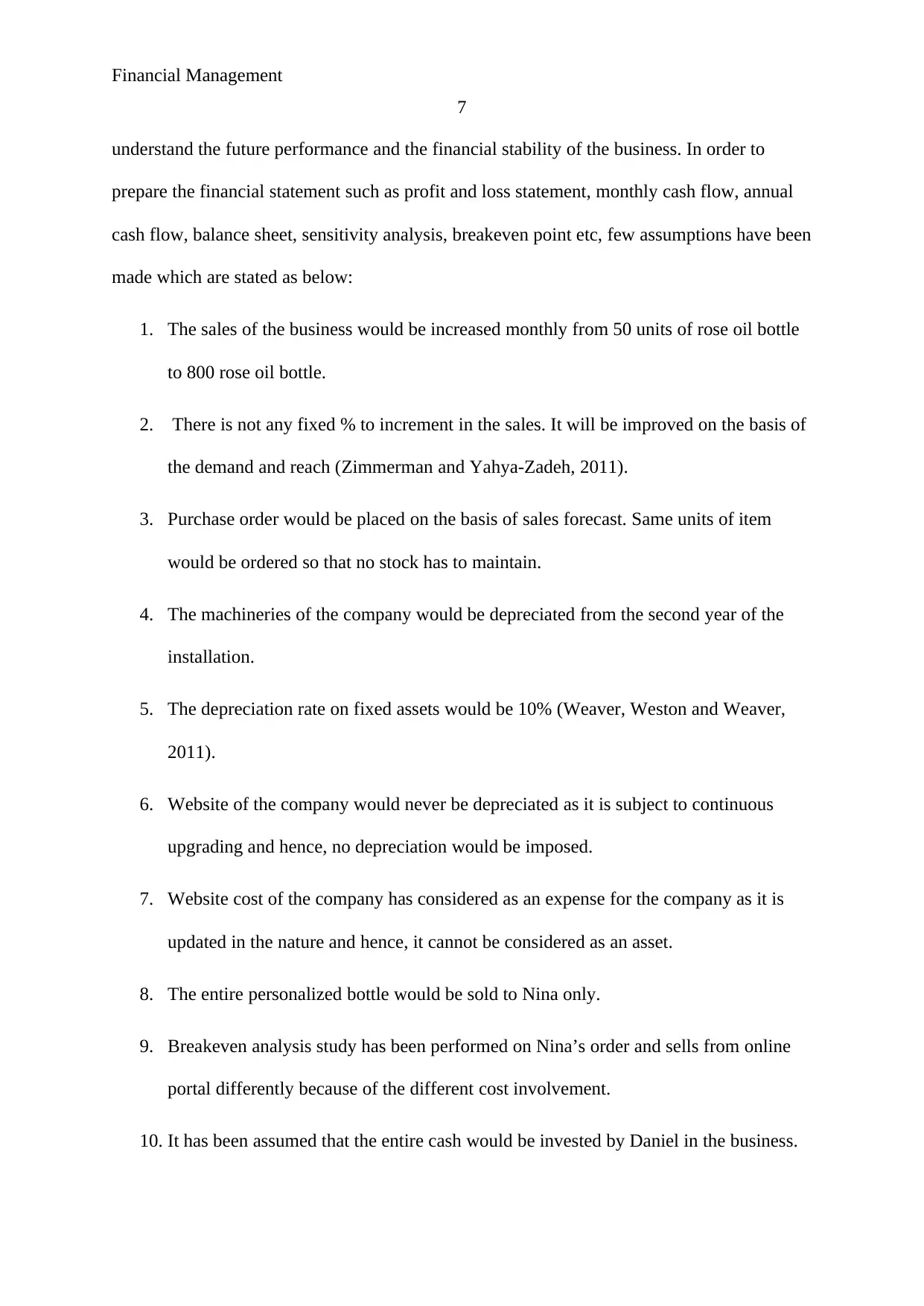

understand the future performance and the financial stability of the business. In order to

prepare the financial statement such as profit and loss statement, monthly cash flow, annual

cash flow, balance sheet, sensitivity analysis, breakeven point etc, few assumptions have been

made which are stated as below:

1. The sales of the business would be increased monthly from 50 units of rose oil bottle

to 800 rose oil bottle.

2. There is not any fixed % to increment in the sales. It will be improved on the basis of

the demand and reach (Zimmerman and Yahya-Zadeh, 2011).

3. Purchase order would be placed on the basis of sales forecast. Same units of item

would be ordered so that no stock has to maintain.

4. The machineries of the company would be depreciated from the second year of the

installation.

5. The depreciation rate on fixed assets would be 10% (Weaver, Weston and Weaver,

2011).

6. Website of the company would never be depreciated as it is subject to continuous

upgrading and hence, no depreciation would be imposed.

7. Website cost of the company has considered as an expense for the company as it is

updated in the nature and hence, it cannot be considered as an asset.

8. The entire personalized bottle would be sold to Nina only.

9. Breakeven analysis study has been performed on Nina’s order and sells from online

portal differently because of the different cost involvement.

10. It has been assumed that the entire cash would be invested by Daniel in the business.

7

understand the future performance and the financial stability of the business. In order to

prepare the financial statement such as profit and loss statement, monthly cash flow, annual

cash flow, balance sheet, sensitivity analysis, breakeven point etc, few assumptions have been

made which are stated as below:

1. The sales of the business would be increased monthly from 50 units of rose oil bottle

to 800 rose oil bottle.

2. There is not any fixed % to increment in the sales. It will be improved on the basis of

the demand and reach (Zimmerman and Yahya-Zadeh, 2011).

3. Purchase order would be placed on the basis of sales forecast. Same units of item

would be ordered so that no stock has to maintain.

4. The machineries of the company would be depreciated from the second year of the

installation.

5. The depreciation rate on fixed assets would be 10% (Weaver, Weston and Weaver,

2011).

6. Website of the company would never be depreciated as it is subject to continuous

upgrading and hence, no depreciation would be imposed.

7. Website cost of the company has considered as an expense for the company as it is

updated in the nature and hence, it cannot be considered as an asset.

8. The entire personalized bottle would be sold to Nina only.

9. Breakeven analysis study has been performed on Nina’s order and sells from online

portal differently because of the different cost involvement.

10. It has been assumed that the entire cash would be invested by Daniel in the business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

8

11. Business does not have any liability.

12. Currency exchange rate is 0.51 (Fx rate, 2019).

13. Capital of the company would differ on the basis of the total assets of the venture

(Voelkl and Fritz, 2017).

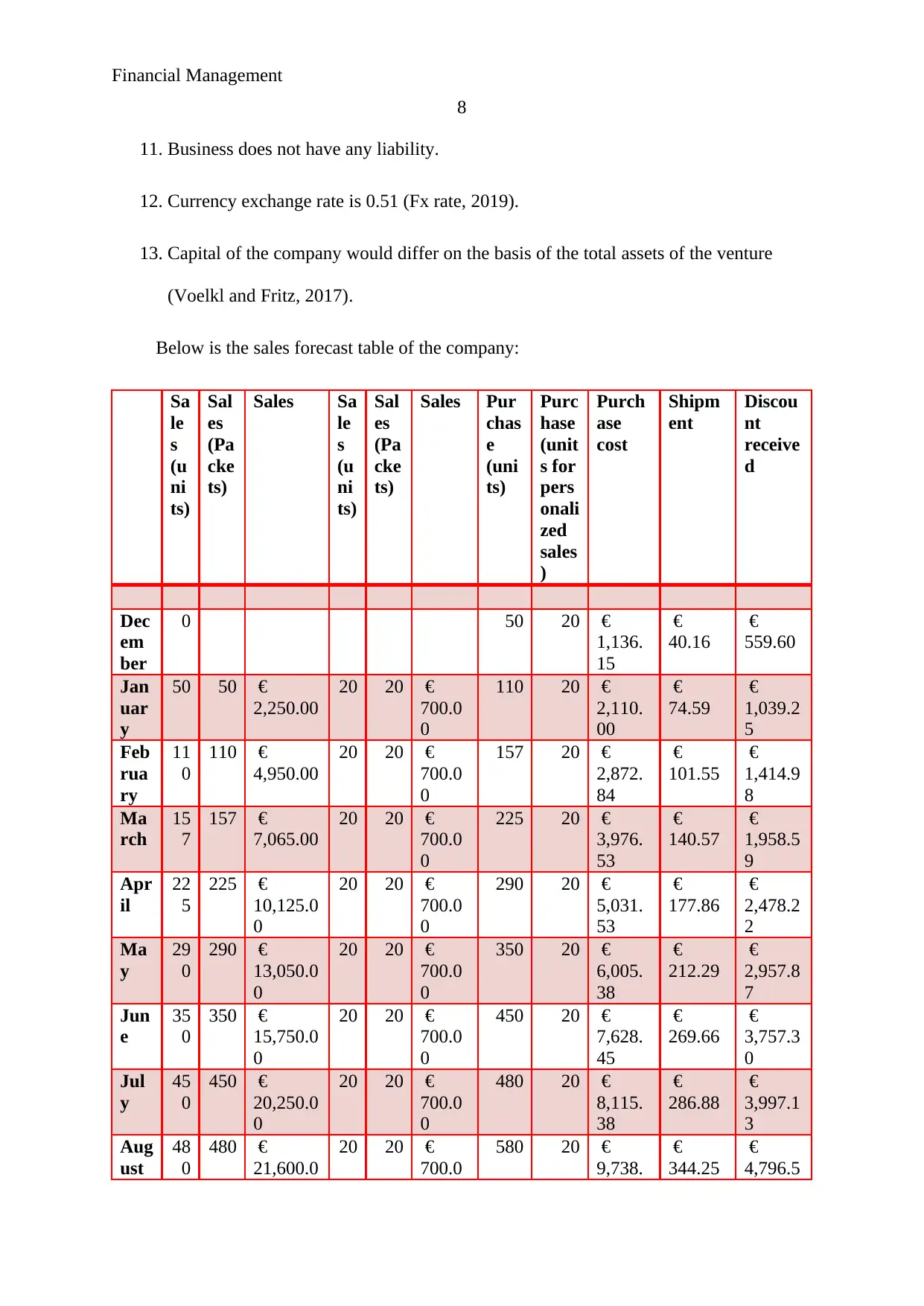

Below is the sales forecast table of the company:

Sa

le

s

(u

ni

ts)

Sal

es

(Pa

cke

ts)

Sales Sa

le

s

(u

ni

ts)

Sal

es

(Pa

cke

ts)

Sales Pur

chas

e

(uni

ts)

Purc

hase

(unit

s for

pers

onali

zed

sales

)

Purch

ase

cost

Shipm

ent

Discou

nt

receive

d

Dec

em

ber

0 50 20 €

1,136.

15

€

40.16

€

559.60

Jan

uar

y

50 50 €

2,250.00

20 20 €

700.0

0

110 20 €

2,110.

00

€

74.59

€

1,039.2

5

Feb

rua

ry

11

0

110 €

4,950.00

20 20 €

700.0

0

157 20 €

2,872.

84

€

101.55

€

1,414.9

8

Ma

rch

15

7

157 €

7,065.00

20 20 €

700.0

0

225 20 €

3,976.

53

€

140.57

€

1,958.5

9

Apr

il

22

5

225 €

10,125.0

0

20 20 €

700.0

0

290 20 €

5,031.

53

€

177.86

€

2,478.2

2

Ma

y

29

0

290 €

13,050.0

0

20 20 €

700.0

0

350 20 €

6,005.

38

€

212.29

€

2,957.8

7

Jun

e

35

0

350 €

15,750.0

0

20 20 €

700.0

0

450 20 €

7,628.

45

€

269.66

€

3,757.3

0

Jul

y

45

0

450 €

20,250.0

0

20 20 €

700.0

0

480 20 €

8,115.

38

€

286.88

€

3,997.1

3

Aug

ust

48

0

480 €

21,600.0

20 20 €

700.0

580 20 €

9,738.

€

344.25

€

4,796.5

8

11. Business does not have any liability.

12. Currency exchange rate is 0.51 (Fx rate, 2019).

13. Capital of the company would differ on the basis of the total assets of the venture

(Voelkl and Fritz, 2017).

Below is the sales forecast table of the company:

Sa

le

s

(u

ni

ts)

Sal

es

(Pa

cke

ts)

Sales Sa

le

s

(u

ni

ts)

Sal

es

(Pa

cke

ts)

Sales Pur

chas

e

(uni

ts)

Purc

hase

(unit

s for

pers

onali

zed

sales

)

Purch

ase

cost

Shipm

ent

Discou

nt

receive

d

Dec

em

ber

0 50 20 €

1,136.

15

€

40.16

€

559.60

Jan

uar

y

50 50 €

2,250.00

20 20 €

700.0

0

110 20 €

2,110.

00

€

74.59

€

1,039.2

5

Feb

rua

ry

11

0

110 €

4,950.00

20 20 €

700.0

0

157 20 €

2,872.

84

€

101.55

€

1,414.9

8

Ma

rch

15

7

157 €

7,065.00

20 20 €

700.0

0

225 20 €

3,976.

53

€

140.57

€

1,958.5

9

Apr

il

22

5

225 €

10,125.0

0

20 20 €

700.0

0

290 20 €

5,031.

53

€

177.86

€

2,478.2

2

Ma

y

29

0

290 €

13,050.0

0

20 20 €

700.0

0

350 20 €

6,005.

38

€

212.29

€

2,957.8

7

Jun

e

35

0

350 €

15,750.0

0

20 20 €

700.0

0

450 20 €

7,628.

45

€

269.66

€

3,757.3

0

Jul

y

45

0

450 €

20,250.0

0

20 20 €

700.0

0

480 20 €

8,115.

38

€

286.88

€

3,997.1

3

Aug

ust

48

0

480 €

21,600.0

20 20 €

700.0

580 20 €

9,738.

€

344.25

€

4,796.5

Financial Management

9

0 0 45 5

Sep

tem

ber

58

0

580 €

26,100.0

0

20 20 €

700.0

0

650 20 €

10,874

.60

€

384.41

€

5,356.1

5

Oct

obe

r

65

0

650 €

29,250.0

0

20 20 €

700.0

0

700 20 €

11,686

.14

€

413.10

€

5,755.8

6

Nov

em

ber

70

0

700 €

31,500.0

0

20 20 €

700.0

0

800 20 €

13,309

.22

€

470.48

€

6,555.2

9

Dec

em

ber

80

0

800 €

36,000.0

0

20 20 €

700.0

0

Tot

al

48

42

484

2

€

217,890.

00

24

0

240 €

8,400.

00

€

4,84

2.00

€

82,484

.67

€

2,915.8

0

€

40,626.

78

On the basis of the above analysis, assumptions, findings, the financial statement such

as profit and loss statement, monthly cash flow, annual cash flow, balance sheet, sensitivity

analysis, breakeven point etc have been prepared.

Break even analysis:

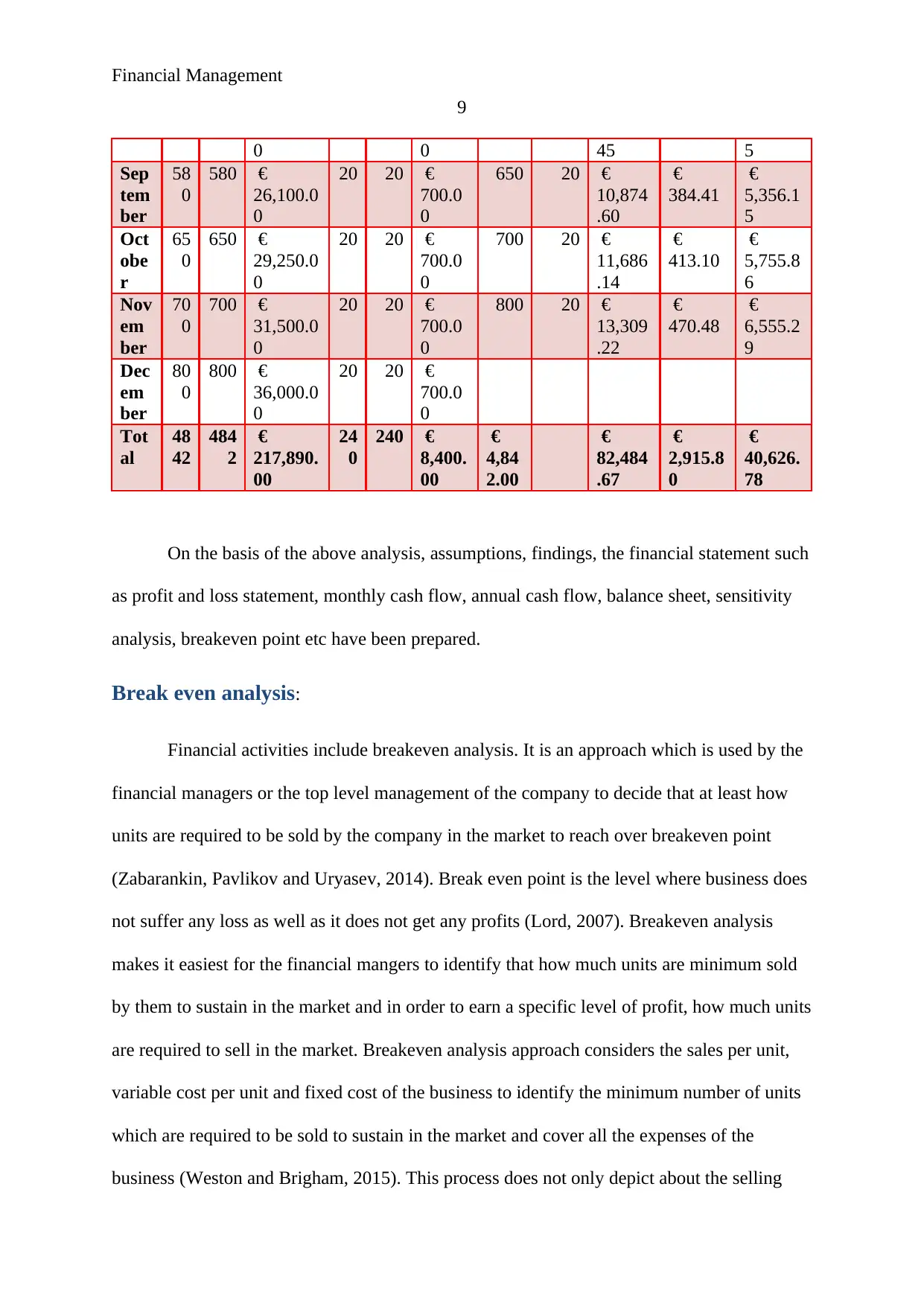

Financial activities include breakeven analysis. It is an approach which is used by the

financial managers or the top level management of the company to decide that at least how

units are required to be sold by the company in the market to reach over breakeven point

(Zabarankin, Pavlikov and Uryasev, 2014). Break even point is the level where business does

not suffer any loss as well as it does not get any profits (Lord, 2007). Breakeven analysis

makes it easiest for the financial mangers to identify that how much units are minimum sold

by them to sustain in the market and in order to earn a specific level of profit, how much units

are required to sell in the market. Breakeven analysis approach considers the sales per unit,

variable cost per unit and fixed cost of the business to identify the minimum number of units

which are required to be sold to sustain in the market and cover all the expenses of the

business (Weston and Brigham, 2015). This process does not only depict about the selling

9

0 0 45 5

Sep

tem

ber

58

0

580 €

26,100.0

0

20 20 €

700.0

0

650 20 €

10,874

.60

€

384.41

€

5,356.1

5

Oct

obe

r

65

0

650 €

29,250.0

0

20 20 €

700.0

0

700 20 €

11,686

.14

€

413.10

€

5,755.8

6

Nov

em

ber

70

0

700 €

31,500.0

0

20 20 €

700.0

0

800 20 €

13,309

.22

€

470.48

€

6,555.2

9

Dec

em

ber

80

0

800 €

36,000.0

0

20 20 €

700.0

0

Tot

al

48

42

484

2

€

217,890.

00

24

0

240 €

8,400.

00

€

4,84

2.00

€

82,484

.67

€

2,915.8

0

€

40,626.

78

On the basis of the above analysis, assumptions, findings, the financial statement such

as profit and loss statement, monthly cash flow, annual cash flow, balance sheet, sensitivity

analysis, breakeven point etc have been prepared.

Break even analysis:

Financial activities include breakeven analysis. It is an approach which is used by the

financial managers or the top level management of the company to decide that at least how

units are required to be sold by the company in the market to reach over breakeven point

(Zabarankin, Pavlikov and Uryasev, 2014). Break even point is the level where business does

not suffer any loss as well as it does not get any profits (Lord, 2007). Breakeven analysis

makes it easiest for the financial mangers to identify that how much units are minimum sold

by them to sustain in the market and in order to earn a specific level of profit, how much units

are required to sell in the market. Breakeven analysis approach considers the sales per unit,

variable cost per unit and fixed cost of the business to identify the minimum number of units

which are required to be sold to sustain in the market and cover all the expenses of the

business (Weston and Brigham, 2015). This process does not only depict about the selling

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Management

10

units rather it also tells the financial manager about the total sales amount which must be earn

by the company.

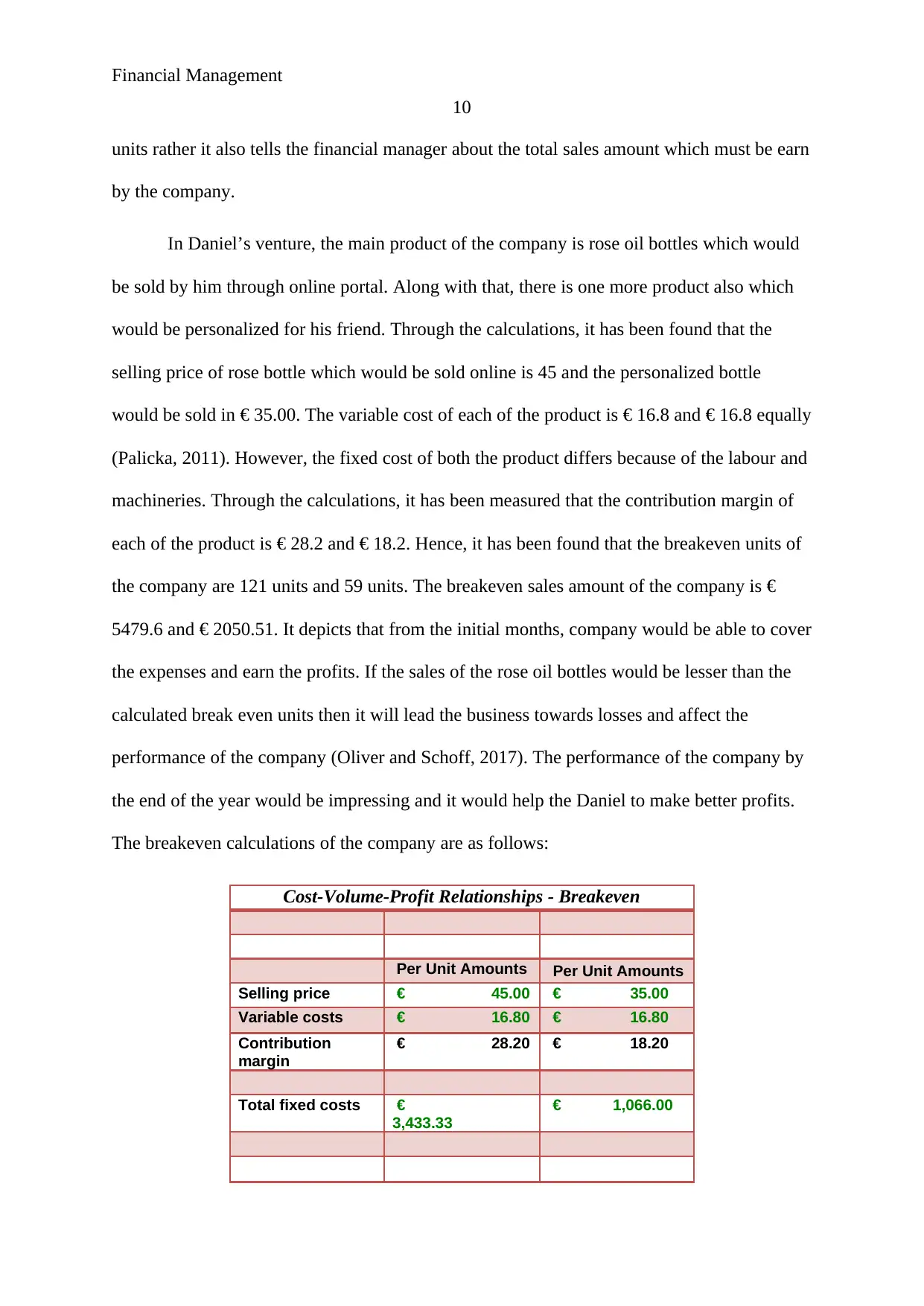

In Daniel’s venture, the main product of the company is rose oil bottles which would

be sold by him through online portal. Along with that, there is one more product also which

would be personalized for his friend. Through the calculations, it has been found that the

selling price of rose bottle which would be sold online is 45 and the personalized bottle

would be sold in € 35.00. The variable cost of each of the product is € 16.8 and € 16.8 equally

(Palicka, 2011). However, the fixed cost of both the product differs because of the labour and

machineries. Through the calculations, it has been measured that the contribution margin of

each of the product is € 28.2 and € 18.2. Hence, it has been found that the breakeven units of

the company are 121 units and 59 units. The breakeven sales amount of the company is €

5479.6 and € 2050.51. It depicts that from the initial months, company would be able to cover

the expenses and earn the profits. If the sales of the rose oil bottles would be lesser than the

calculated break even units then it will lead the business towards losses and affect the

performance of the company (Oliver and Schoff, 2017). The performance of the company by

the end of the year would be impressing and it would help the Daniel to make better profits.

The breakeven calculations of the company are as follows:

Cost-Volume-Profit Relationships - Breakeven

Per Unit Amounts Per Unit Amounts

Selling price € 45.00 € 35.00

Variable costs € 16.80 € 16.80

Contribution

margin

€ 28.20 € 18.20

Total fixed costs €

3,433.33

€ 1,066.00

10

units rather it also tells the financial manager about the total sales amount which must be earn

by the company.

In Daniel’s venture, the main product of the company is rose oil bottles which would

be sold by him through online portal. Along with that, there is one more product also which

would be personalized for his friend. Through the calculations, it has been found that the

selling price of rose bottle which would be sold online is 45 and the personalized bottle

would be sold in € 35.00. The variable cost of each of the product is € 16.8 and € 16.8 equally

(Palicka, 2011). However, the fixed cost of both the product differs because of the labour and

machineries. Through the calculations, it has been measured that the contribution margin of

each of the product is € 28.2 and € 18.2. Hence, it has been found that the breakeven units of

the company are 121 units and 59 units. The breakeven sales amount of the company is €

5479.6 and € 2050.51. It depicts that from the initial months, company would be able to cover

the expenses and earn the profits. If the sales of the rose oil bottles would be lesser than the

calculated break even units then it will lead the business towards losses and affect the

performance of the company (Oliver and Schoff, 2017). The performance of the company by

the end of the year would be impressing and it would help the Daniel to make better profits.

The breakeven calculations of the company are as follows:

Cost-Volume-Profit Relationships - Breakeven

Per Unit Amounts Per Unit Amounts

Selling price € 45.00 € 35.00

Variable costs € 16.80 € 16.80

Contribution

margin

€ 28.20 € 18.20

Total fixed costs €

3,433.33

€ 1,066.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Management

11

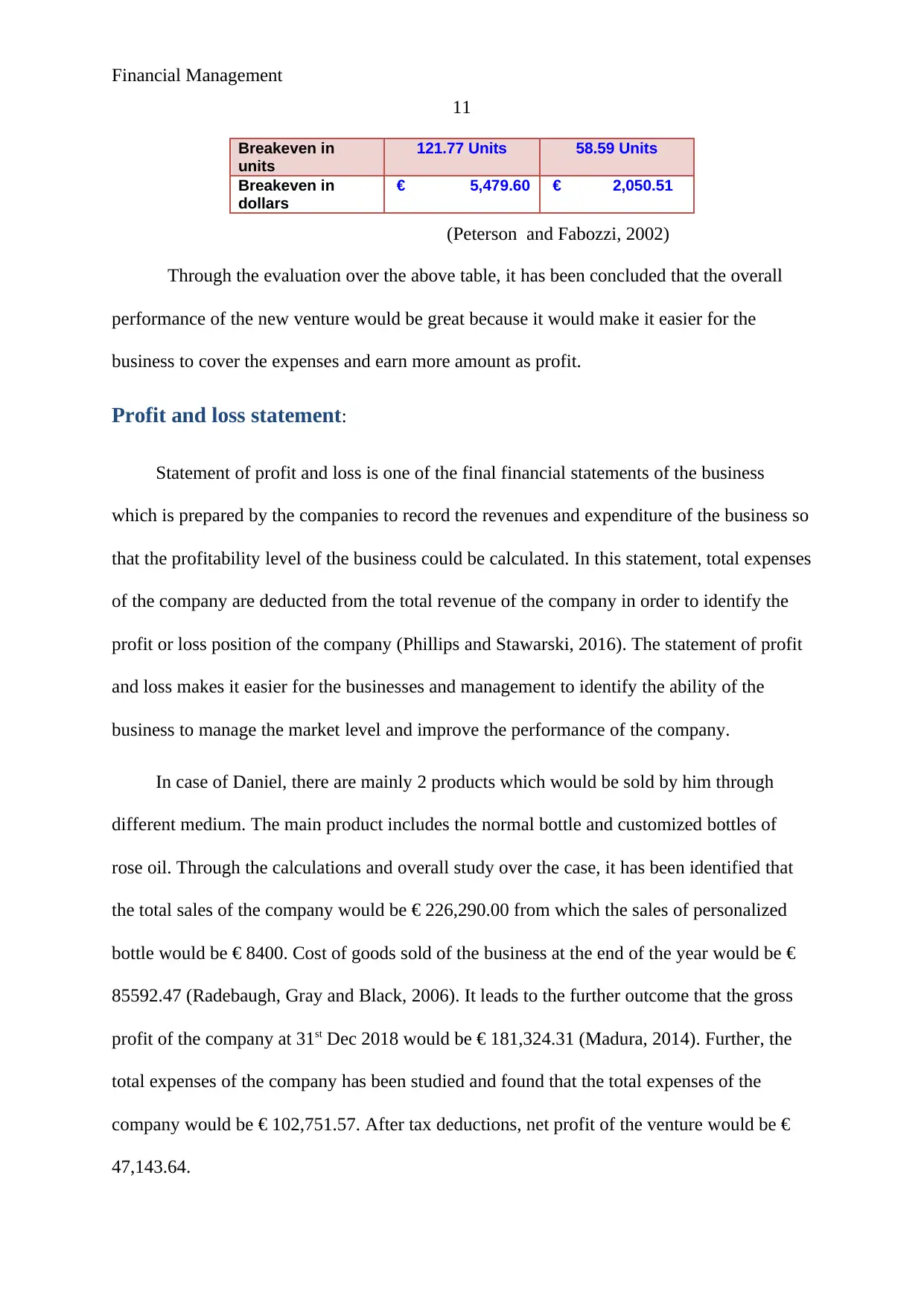

Breakeven in

units

121.77 Units 58.59 Units

Breakeven in

dollars

€ 5,479.60 € 2,050.51

(Peterson and Fabozzi, 2002)

Through the evaluation over the above table, it has been concluded that the overall

performance of the new venture would be great because it would make it easier for the

business to cover the expenses and earn more amount as profit.

Profit and loss statement:

Statement of profit and loss is one of the final financial statements of the business

which is prepared by the companies to record the revenues and expenditure of the business so

that the profitability level of the business could be calculated. In this statement, total expenses

of the company are deducted from the total revenue of the company in order to identify the

profit or loss position of the company (Phillips and Stawarski, 2016). The statement of profit

and loss makes it easier for the businesses and management to identify the ability of the

business to manage the market level and improve the performance of the company.

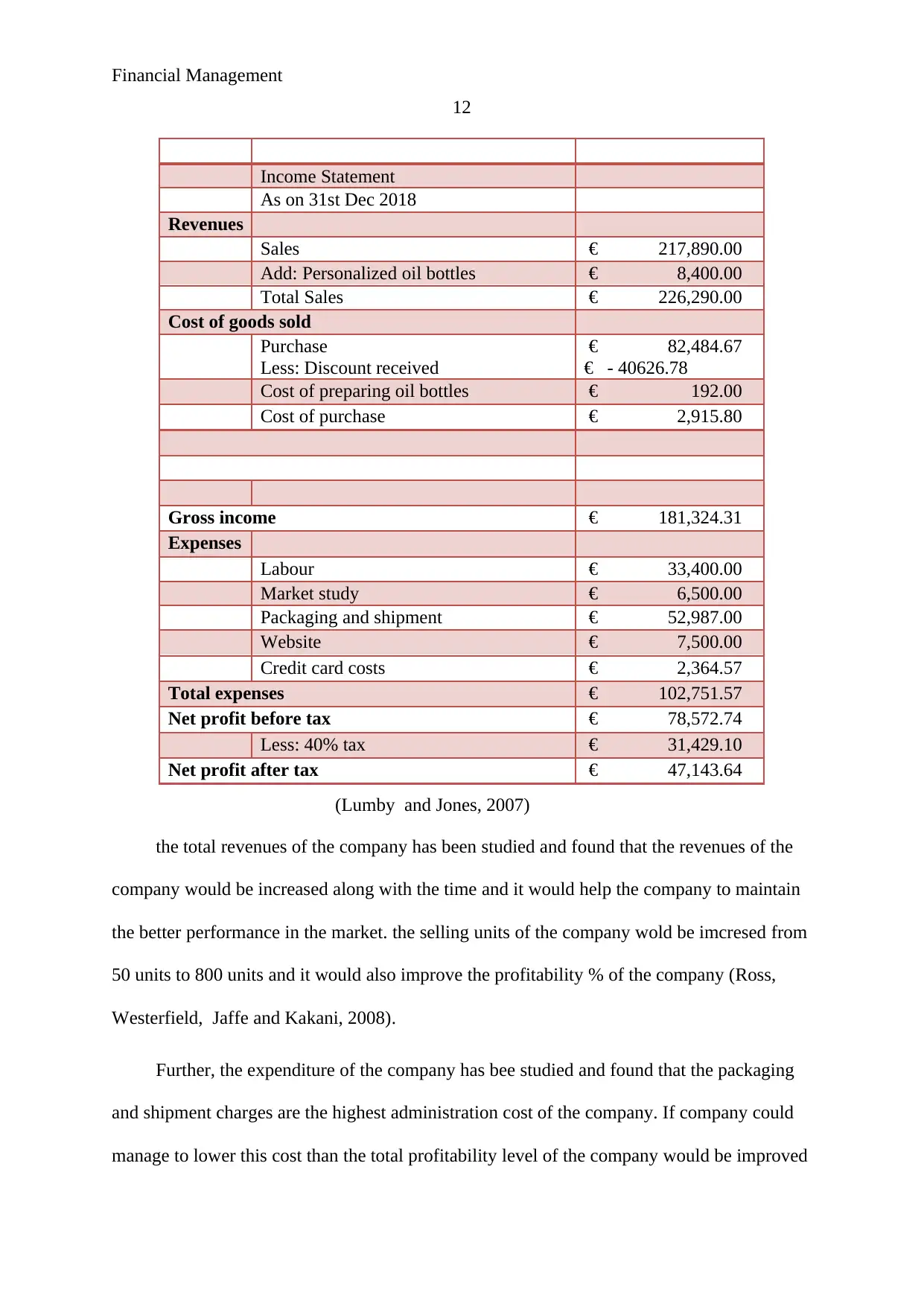

In case of Daniel, there are mainly 2 products which would be sold by him through

different medium. The main product includes the normal bottle and customized bottles of

rose oil. Through the calculations and overall study over the case, it has been identified that

the total sales of the company would be € 226,290.00 from which the sales of personalized

bottle would be € 8400. Cost of goods sold of the business at the end of the year would be €

85592.47 (Radebaugh, Gray and Black, 2006). It leads to the further outcome that the gross

profit of the company at 31st Dec 2018 would be € 181,324.31 (Madura, 2014). Further, the

total expenses of the company has been studied and found that the total expenses of the

company would be € 102,751.57. After tax deductions, net profit of the venture would be €

47,143.64.

11

Breakeven in

units

121.77 Units 58.59 Units

Breakeven in

dollars

€ 5,479.60 € 2,050.51

(Peterson and Fabozzi, 2002)

Through the evaluation over the above table, it has been concluded that the overall

performance of the new venture would be great because it would make it easier for the

business to cover the expenses and earn more amount as profit.

Profit and loss statement:

Statement of profit and loss is one of the final financial statements of the business

which is prepared by the companies to record the revenues and expenditure of the business so

that the profitability level of the business could be calculated. In this statement, total expenses

of the company are deducted from the total revenue of the company in order to identify the

profit or loss position of the company (Phillips and Stawarski, 2016). The statement of profit

and loss makes it easier for the businesses and management to identify the ability of the

business to manage the market level and improve the performance of the company.

In case of Daniel, there are mainly 2 products which would be sold by him through

different medium. The main product includes the normal bottle and customized bottles of

rose oil. Through the calculations and overall study over the case, it has been identified that

the total sales of the company would be € 226,290.00 from which the sales of personalized

bottle would be € 8400. Cost of goods sold of the business at the end of the year would be €

85592.47 (Radebaugh, Gray and Black, 2006). It leads to the further outcome that the gross

profit of the company at 31st Dec 2018 would be € 181,324.31 (Madura, 2014). Further, the

total expenses of the company has been studied and found that the total expenses of the

company would be € 102,751.57. After tax deductions, net profit of the venture would be €

47,143.64.

Financial Management

12

Income Statement

As on 31st Dec 2018

Revenues

Sales € 217,890.00

Add: Personalized oil bottles € 8,400.00

Total Sales € 226,290.00

Cost of goods sold

Purchase

Less: Discount received

€ 82,484.67

€ - 40626.78

Cost of preparing oil bottles € 192.00

Cost of purchase € 2,915.80

Gross income € 181,324.31

Expenses

Labour € 33,400.00

Market study € 6,500.00

Packaging and shipment € 52,987.00

Website € 7,500.00

Credit card costs € 2,364.57

Total expenses € 102,751.57

Net profit before tax € 78,572.74

Less: 40% tax € 31,429.10

Net profit after tax € 47,143.64

(Lumby and Jones, 2007)

the total revenues of the company has been studied and found that the revenues of the

company would be increased along with the time and it would help the company to maintain

the better performance in the market. the selling units of the company wold be imcresed from

50 units to 800 units and it would also improve the profitability % of the company (Ross,

Westerfield, Jaffe and Kakani, 2008).

Further, the expenditure of the company has bee studied and found that the packaging

and shipment charges are the highest administration cost of the company. If company could

manage to lower this cost than the total profitability level of the company would be improved

12

Income Statement

As on 31st Dec 2018

Revenues

Sales € 217,890.00

Add: Personalized oil bottles € 8,400.00

Total Sales € 226,290.00

Cost of goods sold

Purchase

Less: Discount received

€ 82,484.67

€ - 40626.78

Cost of preparing oil bottles € 192.00

Cost of purchase € 2,915.80

Gross income € 181,324.31

Expenses

Labour € 33,400.00

Market study € 6,500.00

Packaging and shipment € 52,987.00

Website € 7,500.00

Credit card costs € 2,364.57

Total expenses € 102,751.57

Net profit before tax € 78,572.74

Less: 40% tax € 31,429.10

Net profit after tax € 47,143.64

(Lumby and Jones, 2007)

the total revenues of the company has been studied and found that the revenues of the

company would be increased along with the time and it would help the company to maintain

the better performance in the market. the selling units of the company wold be imcresed from

50 units to 800 units and it would also improve the profitability % of the company (Ross,

Westerfield, Jaffe and Kakani, 2008).

Further, the expenditure of the company has bee studied and found that the packaging

and shipment charges are the highest administration cost of the company. If company could

manage to lower this cost than the total profitability level of the company would be improved

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.