Identify and Interpret Compliance Requirements

VerifiedAdded on 2023/01/05

|38

|7454

|49

AI Summary

This assessment task focuses on identifying and interpreting compliance requirements in the finance and mortgage broking industry. It covers topics such as responsible lending obligations, client requirements and objectives, code of ethics, credit guide requirements, and sources for staying up to date with compliance requirements.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Certificate IV in Finance and Mortgage

Broking

Assessment Task

FNS40815

Your details:

Name:

Address:

Phone:

Company name

Email:

Your assessment task

ths.

Plagiarism Statement

All assessments must be your own work and not a result of plagiarism or

collaboration with other students or workmates.

Assessment

The pass mark is 70% for each element. If you do not achieve this, you will

receive feedback via your email address and be asked to resubmit your

assessment for a second marking. Assignments will not be returned to you as

they need to be retained for by us for verification and audit purposes.

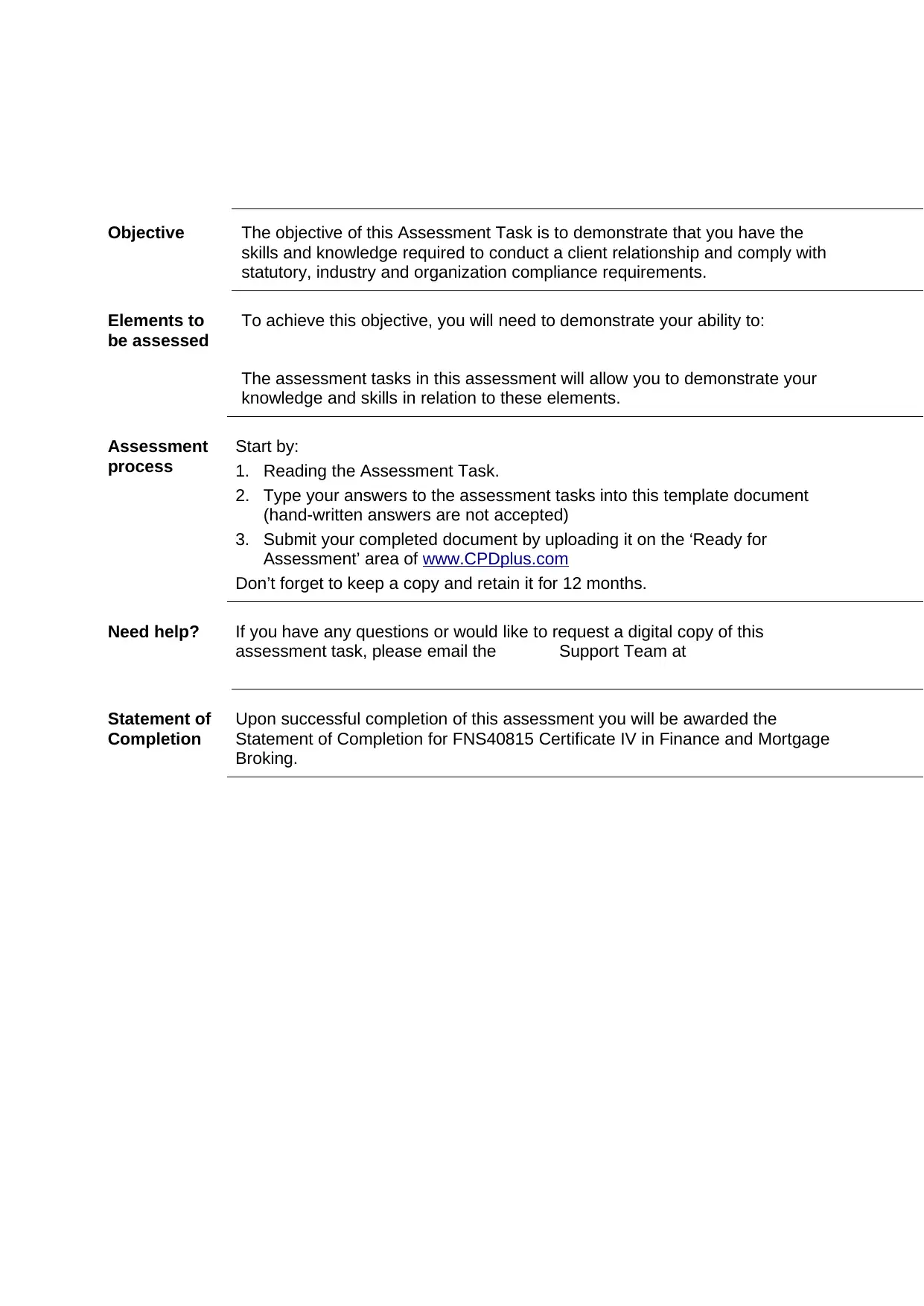

Task Assessments Total

Mark

Pass

Mark

Actual

Mark

1 Identify and Interpret Compliance Requirements 27 19

2 Deliver and Monitor a Service to Customers 39 27

3 Contribute to OHS Hazard Identification & Risk Assessment 41 29

4 Manage Personal Work Priorities and Professional Development 24 17

5 Develop and Nurture Relationships with Clients, Other

Professionals and Third Party Referrers

17 12

6 Promoting the Effective Use of Credit 15 10

7 Prepare a Loan Application on Behalf of Mortgage Broking

Clients

64 45

8 Steps Taken by the Credit Provider 23 16

Total 250 175

Broking

Assessment Task

FNS40815

Your details:

Name:

Address:

Phone:

Company name

Email:

Your assessment task

ths.

Plagiarism Statement

All assessments must be your own work and not a result of plagiarism or

collaboration with other students or workmates.

Assessment

The pass mark is 70% for each element. If you do not achieve this, you will

receive feedback via your email address and be asked to resubmit your

assessment for a second marking. Assignments will not be returned to you as

they need to be retained for by us for verification and audit purposes.

Task Assessments Total

Mark

Pass

Mark

Actual

Mark

1 Identify and Interpret Compliance Requirements 27 19

2 Deliver and Monitor a Service to Customers 39 27

3 Contribute to OHS Hazard Identification & Risk Assessment 41 29

4 Manage Personal Work Priorities and Professional Development 24 17

5 Develop and Nurture Relationships with Clients, Other

Professionals and Third Party Referrers

17 12

6 Promoting the Effective Use of Credit 15 10

7 Prepare a Loan Application on Behalf of Mortgage Broking

Clients

64 45

8 Steps Taken by the Credit Provider 23 16

Total 250 175

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Assessor’s Initials:

Assessment Date:

Assessment Date:

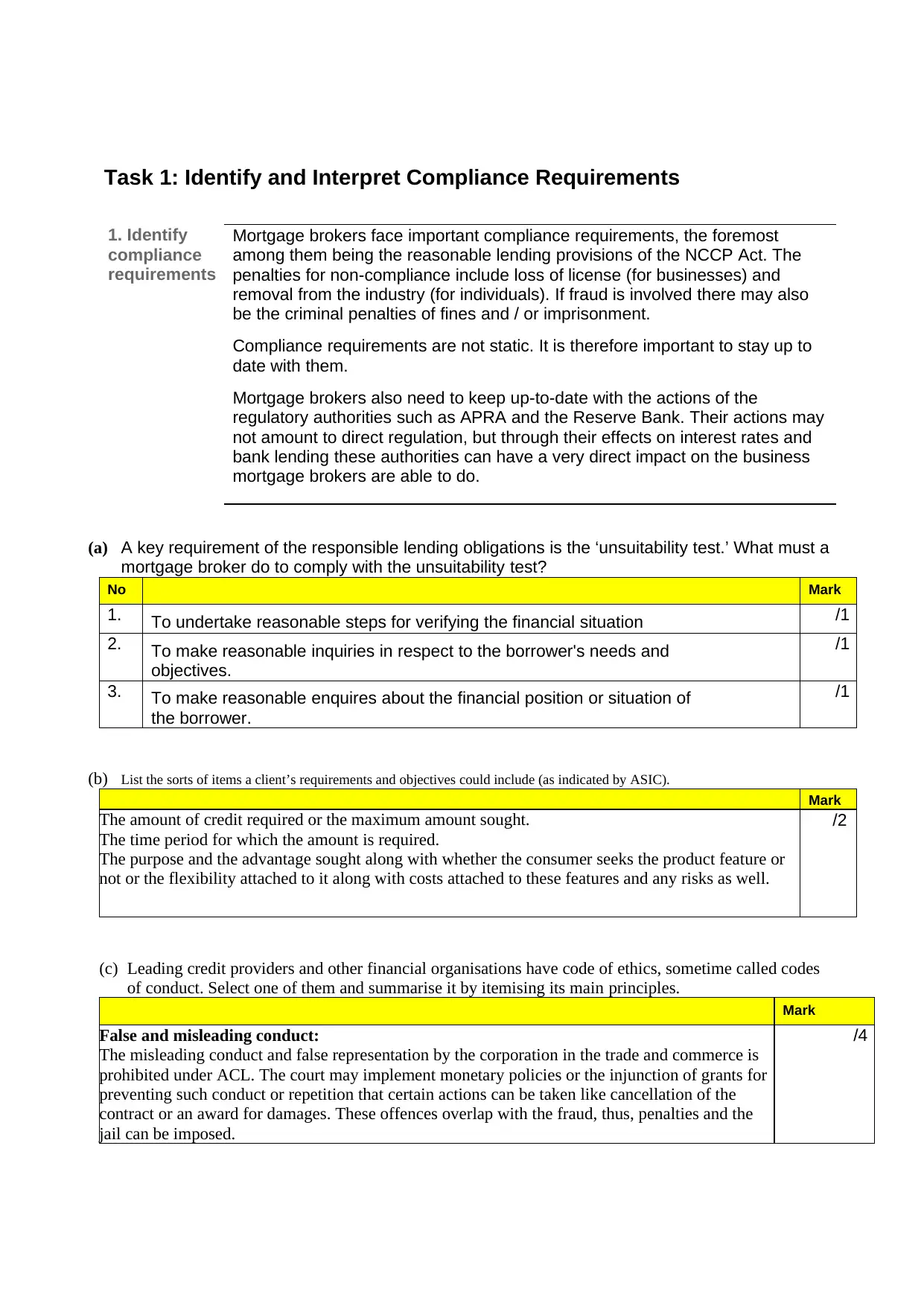

Objective The objective of this Assessment Task is to demonstrate that you have the

skills and knowledge required to conduct a client relationship and comply with

statutory, industry and organization compliance requirements.

Elements to

be assessed

To achieve this objective, you will need to demonstrate your ability to:

The assessment tasks in this assessment will allow you to demonstrate your

knowledge and skills in relation to these elements.

Assessment

process

Start by:

1. Reading the Assessment Task.

2. Type your answers to the assessment tasks into this template document

(hand-written answers are not accepted)

3. Submit your completed document by uploading it on the ‘Ready for

Assessment’ area of www.CPDplus.com

Don’t forget to keep a copy and retain it for 12 months.

Need help? If you have any questions or would like to request a digital copy of this

assessment task, please email the Support Team at

Statement of

Completion

Upon successful completion of this assessment you will be awarded the

Statement of Completion for FNS40815 Certificate IV in Finance and Mortgage

Broking.

skills and knowledge required to conduct a client relationship and comply with

statutory, industry and organization compliance requirements.

Elements to

be assessed

To achieve this objective, you will need to demonstrate your ability to:

The assessment tasks in this assessment will allow you to demonstrate your

knowledge and skills in relation to these elements.

Assessment

process

Start by:

1. Reading the Assessment Task.

2. Type your answers to the assessment tasks into this template document

(hand-written answers are not accepted)

3. Submit your completed document by uploading it on the ‘Ready for

Assessment’ area of www.CPDplus.com

Don’t forget to keep a copy and retain it for 12 months.

Need help? If you have any questions or would like to request a digital copy of this

assessment task, please email the Support Team at

Statement of

Completion

Upon successful completion of this assessment you will be awarded the

Statement of Completion for FNS40815 Certificate IV in Finance and Mortgage

Broking.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

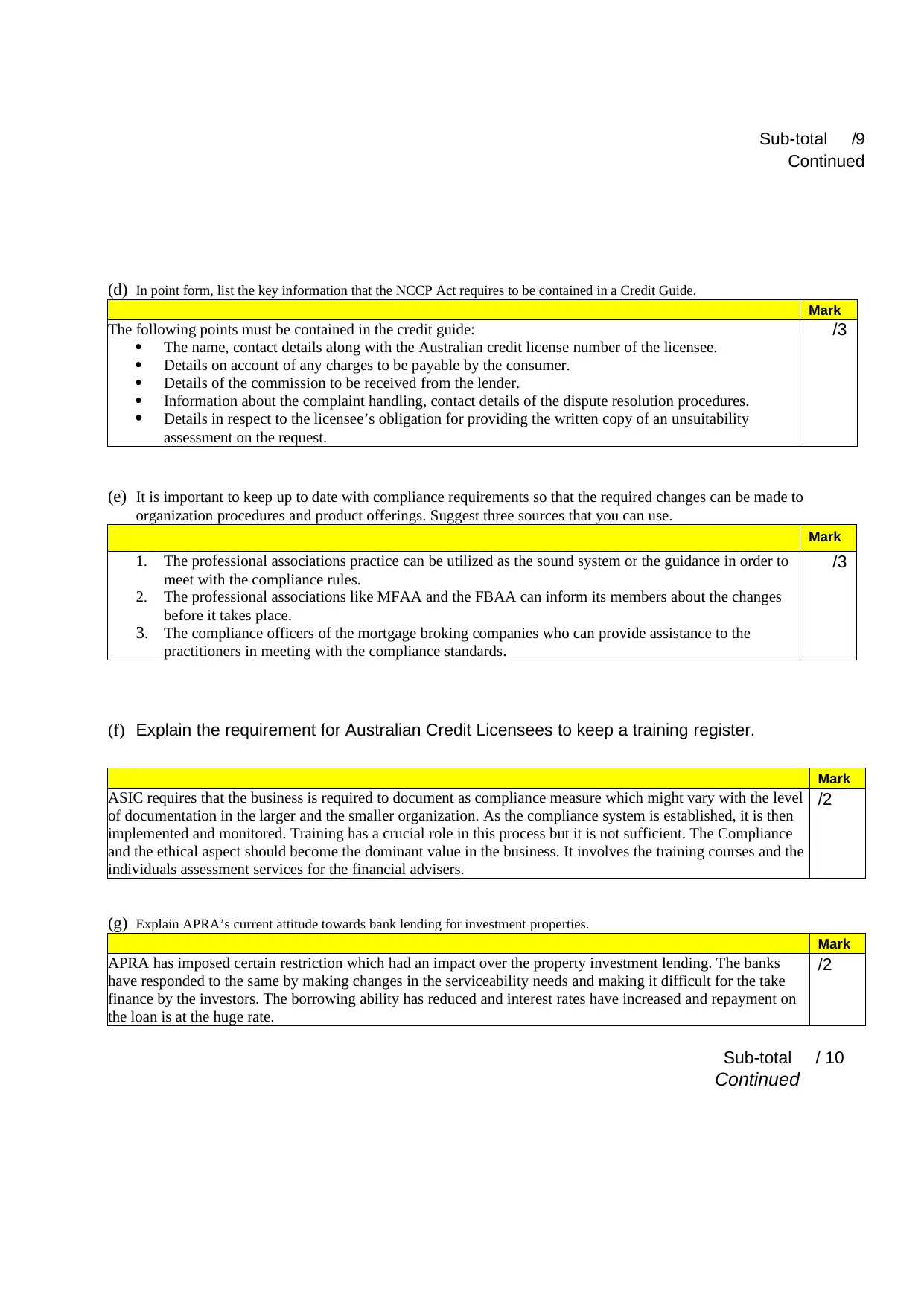

Task 1: Identify and Interpret Compliance Requirements

1. Identify

compliance

requirements

Mortgage brokers face important compliance requirements, the foremost

among them being the reasonable lending provisions of the NCCP Act. The

penalties for non-compliance include loss of license (for businesses) and

removal from the industry (for individuals). If fraud is involved there may also

be the criminal penalties of fines and / or imprisonment.

Compliance requirements are not static. It is therefore important to stay up to

date with them.

Mortgage brokers also need to keep up-to-date with the actions of the

regulatory authorities such as APRA and the Reserve Bank. Their actions may

not amount to direct regulation, but through their effects on interest rates and

bank lending these authorities can have a very direct impact on the business

mortgage brokers are able to do.

(a) A key requirement of the responsible lending obligations is the ‘unsuitability test.’ What must a

mortgage broker do to comply with the unsuitability test?

No Mark

1. To undertake reasonable steps for verifying the financial situation /1

2. To make reasonable inquiries in respect to the borrower's needs and

objectives.

/1

3. To make reasonable enquires about the financial position or situation of

the borrower.

/1

(b) List the sorts of items a client’s requirements and objectives could include (as indicated by ASIC).

Mark

The amount of credit required or the maximum amount sought.

The time period for which the amount is required.

The purpose and the advantage sought along with whether the consumer seeks the product feature or

not or the flexibility attached to it along with costs attached to these features and any risks as well.

/2

(c) Leading credit providers and other financial organisations have code of ethics, sometime called codes

of conduct. Select one of them and summarise it by itemising its main principles.

Mark

False and misleading conduct:

The misleading conduct and false representation by the corporation in the trade and commerce is

prohibited under ACL. The court may implement monetary policies or the injunction of grants for

preventing such conduct or repetition that certain actions can be taken like cancellation of the

contract or an award for damages. These offences overlap with the fraud, thus, penalties and the

jail can be imposed.

/4

1. Identify

compliance

requirements

Mortgage brokers face important compliance requirements, the foremost

among them being the reasonable lending provisions of the NCCP Act. The

penalties for non-compliance include loss of license (for businesses) and

removal from the industry (for individuals). If fraud is involved there may also

be the criminal penalties of fines and / or imprisonment.

Compliance requirements are not static. It is therefore important to stay up to

date with them.

Mortgage brokers also need to keep up-to-date with the actions of the

regulatory authorities such as APRA and the Reserve Bank. Their actions may

not amount to direct regulation, but through their effects on interest rates and

bank lending these authorities can have a very direct impact on the business

mortgage brokers are able to do.

(a) A key requirement of the responsible lending obligations is the ‘unsuitability test.’ What must a

mortgage broker do to comply with the unsuitability test?

No Mark

1. To undertake reasonable steps for verifying the financial situation /1

2. To make reasonable inquiries in respect to the borrower's needs and

objectives.

/1

3. To make reasonable enquires about the financial position or situation of

the borrower.

/1

(b) List the sorts of items a client’s requirements and objectives could include (as indicated by ASIC).

Mark

The amount of credit required or the maximum amount sought.

The time period for which the amount is required.

The purpose and the advantage sought along with whether the consumer seeks the product feature or

not or the flexibility attached to it along with costs attached to these features and any risks as well.

/2

(c) Leading credit providers and other financial organisations have code of ethics, sometime called codes

of conduct. Select one of them and summarise it by itemising its main principles.

Mark

False and misleading conduct:

The misleading conduct and false representation by the corporation in the trade and commerce is

prohibited under ACL. The court may implement monetary policies or the injunction of grants for

preventing such conduct or repetition that certain actions can be taken like cancellation of the

contract or an award for damages. These offences overlap with the fraud, thus, penalties and the

jail can be imposed.

/4

Sub-total /9

Continued

(d) In point form, list the key information that the NCCP Act requires to be contained in a Credit Guide.

Mark

The following points must be contained in the credit guide:

The name, contact details along with the Australian credit license number of the licensee.

Details on account of any charges to be payable by the consumer.

Details of the commission to be received from the lender.

Information about the complaint handling, contact details of the dispute resolution procedures.

Details in respect to the licensee’s obligation for providing the written copy of an unsuitability

assessment on the request.

/3

(e) It is important to keep up to date with compliance requirements so that the required changes can be made to

organization procedures and product offerings. Suggest three sources that you can use.

Mark

1. The professional associations practice can be utilized as the sound system or the guidance in order to

meet with the compliance rules.

2. The professional associations like MFAA and the FBAA can inform its members about the changes

before it takes place.

3. The compliance officers of the mortgage broking companies who can provide assistance to the

practitioners in meeting with the compliance standards.

/3

(f) Explain the requirement for Australian Credit Licensees to keep a training register.

Mark

ASIC requires that the business is required to document as compliance measure which might vary with the level

of documentation in the larger and the smaller organization. As the compliance system is established, it is then

implemented and monitored. Training has a crucial role in this process but it is not sufficient. The Compliance

and the ethical aspect should become the dominant value in the business. It involves the training courses and the

individuals assessment services for the financial advisers.

/2

(g) Explain APRA’s current attitude towards bank lending for investment properties.

Mark

APRA has imposed certain restriction which had an impact over the property investment lending. The banks

have responded to the same by making changes in the serviceability needs and making it difficult for the take

finance by the investors. The borrowing ability has reduced and interest rates have increased and repayment on

the loan is at the huge rate.

/2

Sub-total / 10

Continued

Continued

(d) In point form, list the key information that the NCCP Act requires to be contained in a Credit Guide.

Mark

The following points must be contained in the credit guide:

The name, contact details along with the Australian credit license number of the licensee.

Details on account of any charges to be payable by the consumer.

Details of the commission to be received from the lender.

Information about the complaint handling, contact details of the dispute resolution procedures.

Details in respect to the licensee’s obligation for providing the written copy of an unsuitability

assessment on the request.

/3

(e) It is important to keep up to date with compliance requirements so that the required changes can be made to

organization procedures and product offerings. Suggest three sources that you can use.

Mark

1. The professional associations practice can be utilized as the sound system or the guidance in order to

meet with the compliance rules.

2. The professional associations like MFAA and the FBAA can inform its members about the changes

before it takes place.

3. The compliance officers of the mortgage broking companies who can provide assistance to the

practitioners in meeting with the compliance standards.

/3

(f) Explain the requirement for Australian Credit Licensees to keep a training register.

Mark

ASIC requires that the business is required to document as compliance measure which might vary with the level

of documentation in the larger and the smaller organization. As the compliance system is established, it is then

implemented and monitored. Training has a crucial role in this process but it is not sufficient. The Compliance

and the ethical aspect should become the dominant value in the business. It involves the training courses and the

individuals assessment services for the financial advisers.

/2

(g) Explain APRA’s current attitude towards bank lending for investment properties.

Mark

APRA has imposed certain restriction which had an impact over the property investment lending. The banks

have responded to the same by making changes in the serviceability needs and making it difficult for the take

finance by the investors. The borrowing ability has reduced and interest rates have increased and repayment on

the loan is at the huge rate.

/2

Sub-total / 10

Continued

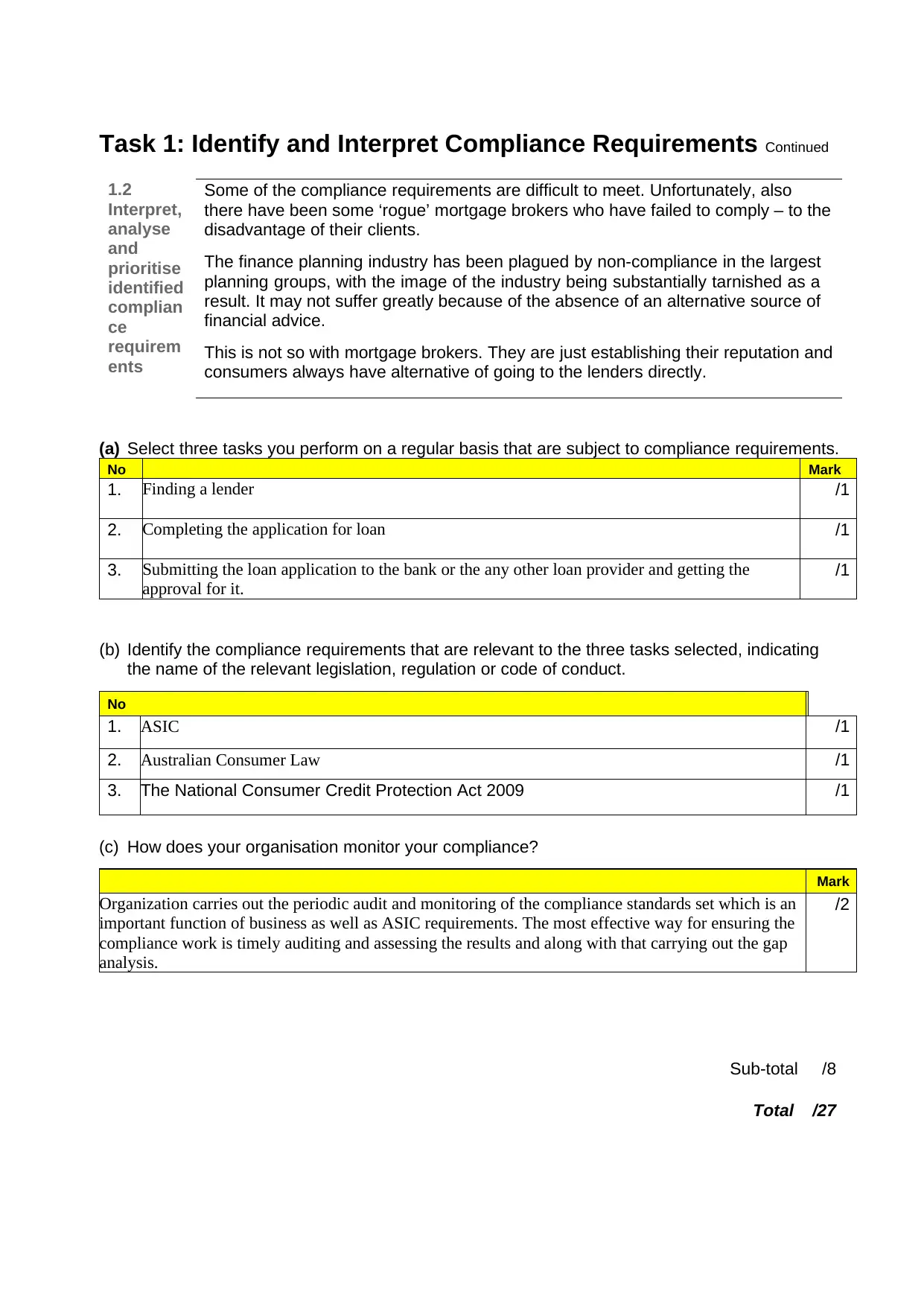

Task 1: Identify and Interpret Compliance Requirements Continued

1.2

Interpret,

analyse

and

prioritise

identified

complian

ce

requirem

ents

Some of the compliance requirements are difficult to meet. Unfortunately, also

there have been some ‘rogue’ mortgage brokers who have failed to comply – to the

disadvantage of their clients.

The finance planning industry has been plagued by non-compliance in the largest

planning groups, with the image of the industry being substantially tarnished as a

result. It may not suffer greatly because of the absence of an alternative source of

financial advice.

This is not so with mortgage brokers. They are just establishing their reputation and

consumers always have alternative of going to the lenders directly.

(a) Select three tasks you perform on a regular basis that are subject to compliance requirements.

No Mark

1. Finding a lender /1

2. Completing the application for loan /1

3. Submitting the loan application to the bank or the any other loan provider and getting the

approval for it.

/1

(b) Identify the compliance requirements that are relevant to the three tasks selected, indicating

the name of the relevant legislation, regulation or code of conduct.

No

1. ASIC /1

2. Australian Consumer Law /1

3. The National Consumer Credit Protection Act 2009 /1

(c) How does your organisation monitor your compliance?

Mark

Organization carries out the periodic audit and monitoring of the compliance standards set which is an

important function of business as well as ASIC requirements. The most effective way for ensuring the

compliance work is timely auditing and assessing the results and along with that carrying out the gap

analysis.

/2

Sub-total /8

Total /27

1.2

Interpret,

analyse

and

prioritise

identified

complian

ce

requirem

ents

Some of the compliance requirements are difficult to meet. Unfortunately, also

there have been some ‘rogue’ mortgage brokers who have failed to comply – to the

disadvantage of their clients.

The finance planning industry has been plagued by non-compliance in the largest

planning groups, with the image of the industry being substantially tarnished as a

result. It may not suffer greatly because of the absence of an alternative source of

financial advice.

This is not so with mortgage brokers. They are just establishing their reputation and

consumers always have alternative of going to the lenders directly.

(a) Select three tasks you perform on a regular basis that are subject to compliance requirements.

No Mark

1. Finding a lender /1

2. Completing the application for loan /1

3. Submitting the loan application to the bank or the any other loan provider and getting the

approval for it.

/1

(b) Identify the compliance requirements that are relevant to the three tasks selected, indicating

the name of the relevant legislation, regulation or code of conduct.

No

1. ASIC /1

2. Australian Consumer Law /1

3. The National Consumer Credit Protection Act 2009 /1

(c) How does your organisation monitor your compliance?

Mark

Organization carries out the periodic audit and monitoring of the compliance standards set which is an

important function of business as well as ASIC requirements. The most effective way for ensuring the

compliance work is timely auditing and assessing the results and along with that carrying out the gap

analysis.

/2

Sub-total /8

Total /27

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

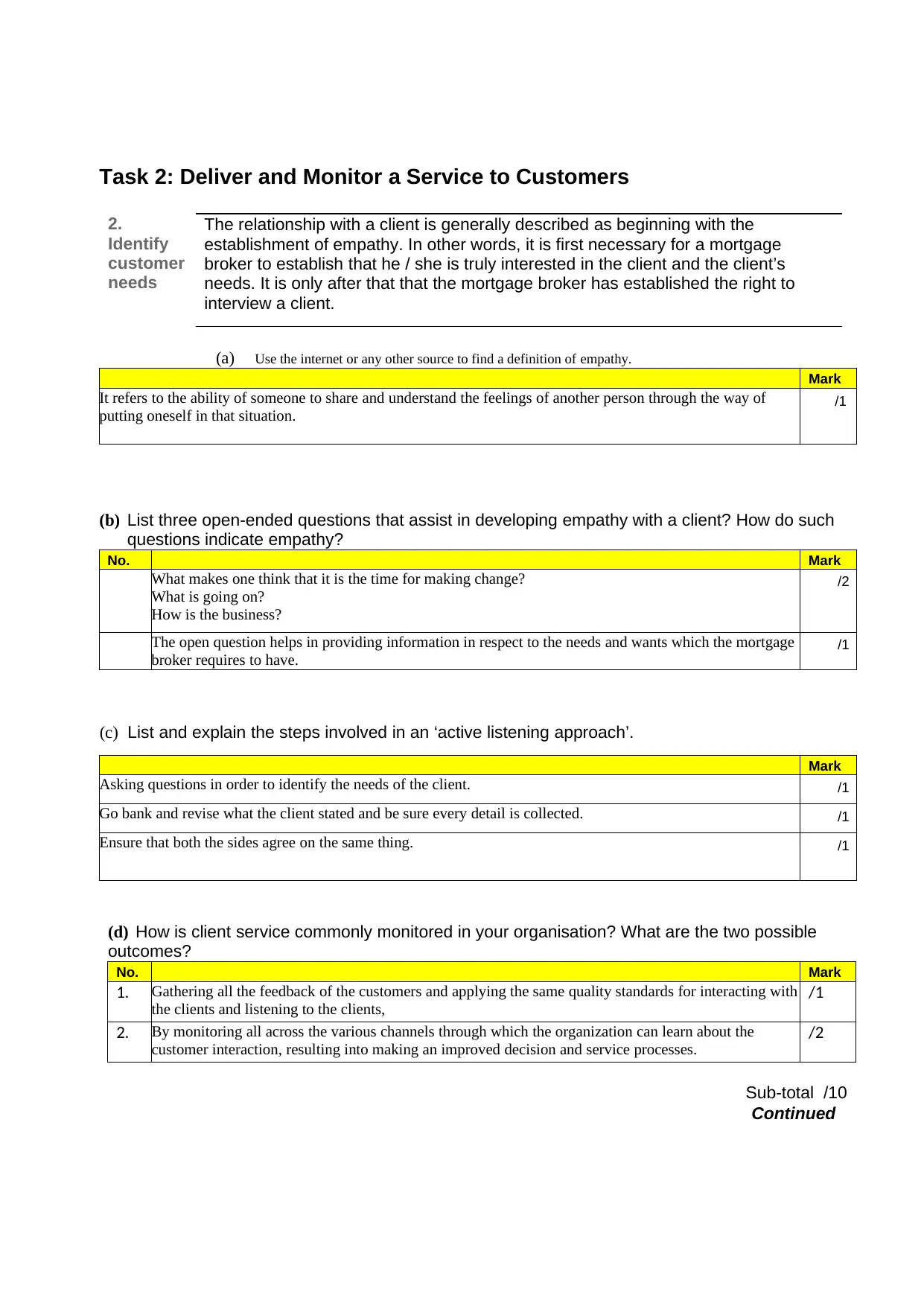

Task 2: Deliver and Monitor a Service to Customers

2.

Identify

customer

needs

The relationship with a client is generally described as beginning with the

establishment of empathy. In other words, it is first necessary for a mortgage

broker to establish that he / she is truly interested in the client and the client’s

needs. It is only after that that the mortgage broker has established the right to

interview a client.

(a) Use the internet or any other source to find a definition of empathy.

Mark

It refers to the ability of someone to share and understand the feelings of another person through the way of

putting oneself in that situation. /1

(b) List three open-ended questions that assist in developing empathy with a client? How do such

questions indicate empathy?

No. Mark

What makes one think that it is the time for making change?

What is going on?

How is the business?

/2

The open question helps in providing information in respect to the needs and wants which the mortgage

broker requires to have.

/1

(c) List and explain the steps involved in an ‘active listening approach’.

Mark

Asking questions in order to identify the needs of the client. /1

Go bank and revise what the client stated and be sure every detail is collected. /1

Ensure that both the sides agree on the same thing. /1

(d) How is client service commonly monitored in your organisation? What are the two possible

outcomes?

No. Mark

1. Gathering all the feedback of the customers and applying the same quality standards for interacting with

the clients and listening to the clients,

/1

2. By monitoring all across the various channels through which the organization can learn about the

customer interaction, resulting into making an improved decision and service processes.

/2

Sub-total /10

Continued

2.

Identify

customer

needs

The relationship with a client is generally described as beginning with the

establishment of empathy. In other words, it is first necessary for a mortgage

broker to establish that he / she is truly interested in the client and the client’s

needs. It is only after that that the mortgage broker has established the right to

interview a client.

(a) Use the internet or any other source to find a definition of empathy.

Mark

It refers to the ability of someone to share and understand the feelings of another person through the way of

putting oneself in that situation. /1

(b) List three open-ended questions that assist in developing empathy with a client? How do such

questions indicate empathy?

No. Mark

What makes one think that it is the time for making change?

What is going on?

How is the business?

/2

The open question helps in providing information in respect to the needs and wants which the mortgage

broker requires to have.

/1

(c) List and explain the steps involved in an ‘active listening approach’.

Mark

Asking questions in order to identify the needs of the client. /1

Go bank and revise what the client stated and be sure every detail is collected. /1

Ensure that both the sides agree on the same thing. /1

(d) How is client service commonly monitored in your organisation? What are the two possible

outcomes?

No. Mark

1. Gathering all the feedback of the customers and applying the same quality standards for interacting with

the clients and listening to the clients,

/1

2. By monitoring all across the various channels through which the organization can learn about the

customer interaction, resulting into making an improved decision and service processes.

/2

Sub-total /10

Continued

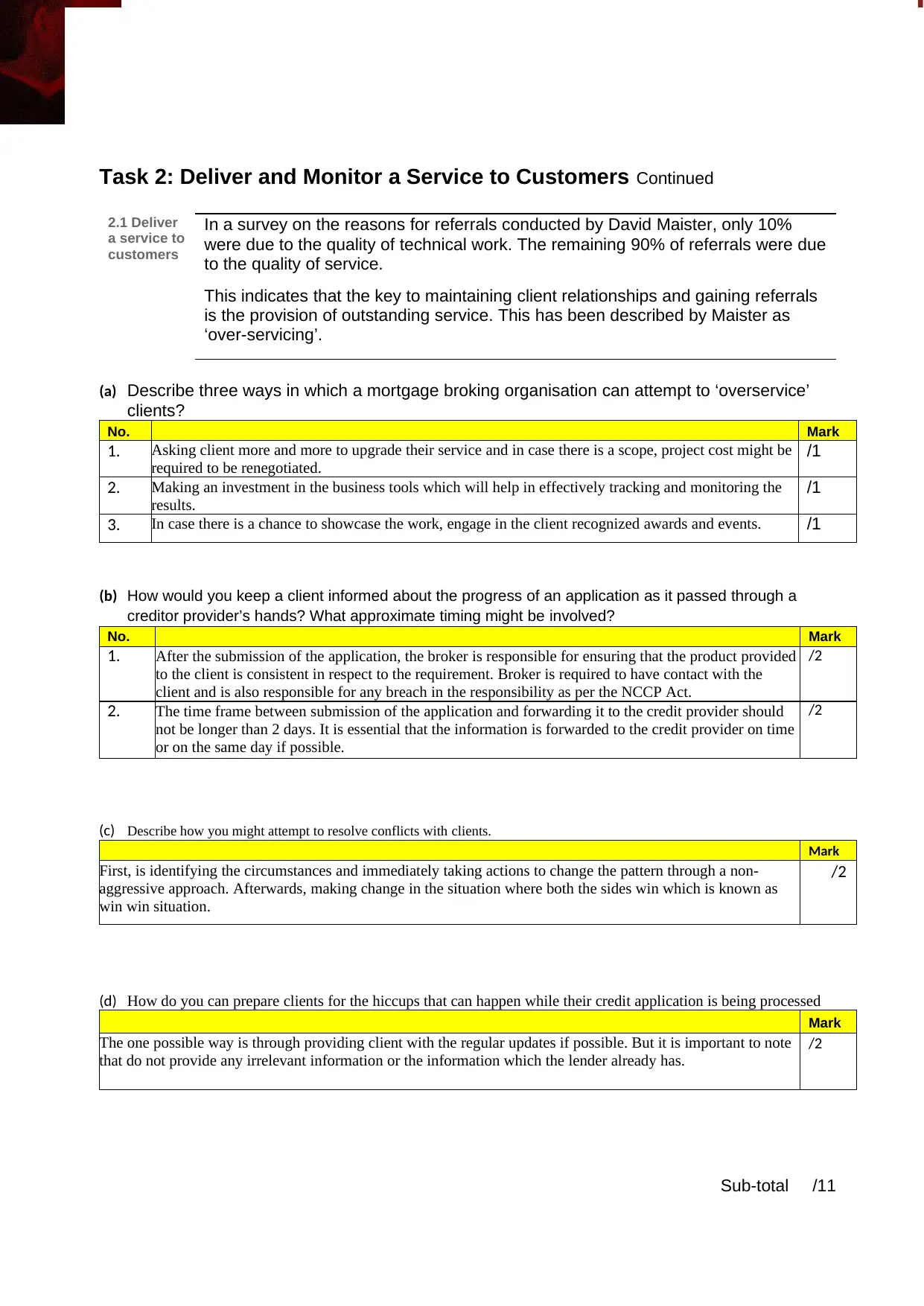

Task 2: Deliver and Monitor a Service to Customers Continued

2.1 Deliver

a service to

customers

In a survey on the reasons for referrals conducted by David Maister, only 10%

were due to the quality of technical work. The remaining 90% of referrals were due

to the quality of service.

This indicates that the key to maintaining client relationships and gaining referrals

is the provision of outstanding service. This has been described by Maister as

‘over-servicing’.

(a) Describe three ways in which a mortgage broking organisation can attempt to ‘overservice’

clients?

No. Mark

1. Asking client more and more to upgrade their service and in case there is a scope, project cost might be

required to be renegotiated.

/1

2. Making an investment in the business tools which will help in effectively tracking and monitoring the

results.

/1

3. In case there is a chance to showcase the work, engage in the client recognized awards and events. /1

(b) How would you keep a client informed about the progress of an application as it passed through a

creditor provider’s hands? What approximate timing might be involved?

No. Mark

1. After the submission of the application, the broker is responsible for ensuring that the product provided

to the client is consistent in respect to the requirement. Broker is required to have contact with the

client and is also responsible for any breach in the responsibility as per the NCCP Act.

/2

2. The time frame between submission of the application and forwarding it to the credit provider should

not be longer than 2 days. It is essential that the information is forwarded to the credit provider on time

or on the same day if possible.

/2

(c) Describe how you might attempt to resolve conflicts with clients.

Mark

First, is identifying the circumstances and immediately taking actions to change the pattern through a non-

aggressive approach. Afterwards, making change in the situation where both the sides win which is known as

win win situation.

/2

(d) How do you can prepare clients for the hiccups that can happen while their credit application is being processed

Mark

The one possible way is through providing client with the regular updates if possible. But it is important to note

that do not provide any irrelevant information or the information which the lender already has.

/2

Sub-total /11

2.1 Deliver

a service to

customers

In a survey on the reasons for referrals conducted by David Maister, only 10%

were due to the quality of technical work. The remaining 90% of referrals were due

to the quality of service.

This indicates that the key to maintaining client relationships and gaining referrals

is the provision of outstanding service. This has been described by Maister as

‘over-servicing’.

(a) Describe three ways in which a mortgage broking organisation can attempt to ‘overservice’

clients?

No. Mark

1. Asking client more and more to upgrade their service and in case there is a scope, project cost might be

required to be renegotiated.

/1

2. Making an investment in the business tools which will help in effectively tracking and monitoring the

results.

/1

3. In case there is a chance to showcase the work, engage in the client recognized awards and events. /1

(b) How would you keep a client informed about the progress of an application as it passed through a

creditor provider’s hands? What approximate timing might be involved?

No. Mark

1. After the submission of the application, the broker is responsible for ensuring that the product provided

to the client is consistent in respect to the requirement. Broker is required to have contact with the

client and is also responsible for any breach in the responsibility as per the NCCP Act.

/2

2. The time frame between submission of the application and forwarding it to the credit provider should

not be longer than 2 days. It is essential that the information is forwarded to the credit provider on time

or on the same day if possible.

/2

(c) Describe how you might attempt to resolve conflicts with clients.

Mark

First, is identifying the circumstances and immediately taking actions to change the pattern through a non-

aggressive approach. Afterwards, making change in the situation where both the sides win which is known as

win win situation.

/2

(d) How do you can prepare clients for the hiccups that can happen while their credit application is being processed

Mark

The one possible way is through providing client with the regular updates if possible. But it is important to note

that do not provide any irrelevant information or the information which the lender already has.

/2

Sub-total /11

Continued

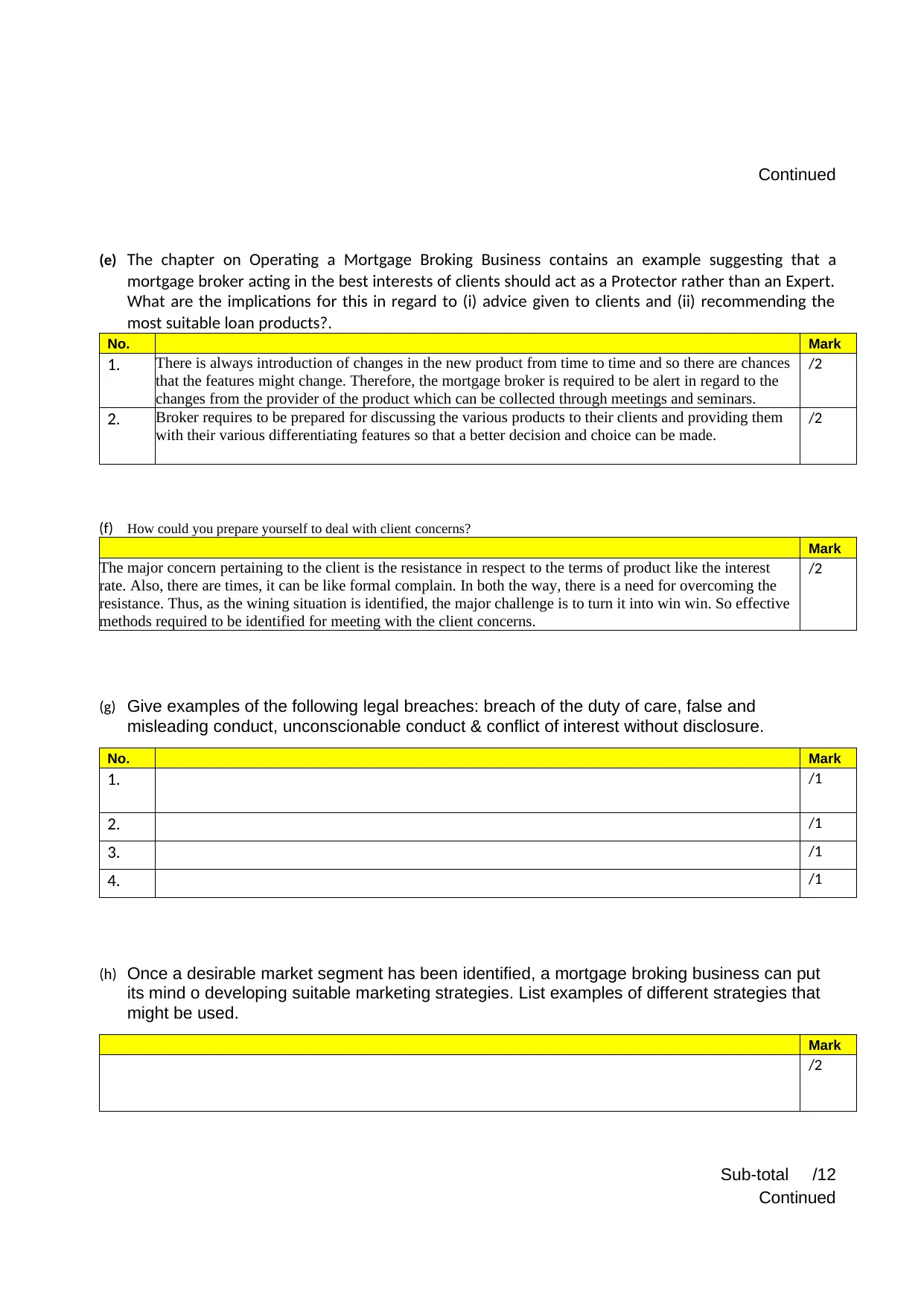

(e) The chapter on Operating a Mortgage Broking Business contains an example suggesting that a

mortgage broker acting in the best interests of clients should act as a Protector rather than an Expert.

What are the implications for this in regard to (i) advice given to clients and (ii) recommending the

most suitable loan products?.

No. Mark

1. There is always introduction of changes in the new product from time to time and so there are chances

that the features might change. Therefore, the mortgage broker is required to be alert in regard to the

changes from the provider of the product which can be collected through meetings and seminars.

/2

2. Broker requires to be prepared for discussing the various products to their clients and providing them

with their various differentiating features so that a better decision and choice can be made.

/2

(f) How could you prepare yourself to deal with client concerns?

Mark

The major concern pertaining to the client is the resistance in respect to the terms of product like the interest

rate. Also, there are times, it can be like formal complain. In both the way, there is a need for overcoming the

resistance. Thus, as the wining situation is identified, the major challenge is to turn it into win win. So effective

methods required to be identified for meeting with the client concerns.

/2

(g) Give examples of the following legal breaches: breach of the duty of care, false and

misleading conduct, unconscionable conduct & conflict of interest without disclosure.

No. Mark

1. /1

2. /1

3. /1

4. /1

(h) Once a desirable market segment has been identified, a mortgage broking business can put

its mind o developing suitable marketing strategies. List examples of different strategies that

might be used.

Mark

/2

Sub-total /12

Continued

(e) The chapter on Operating a Mortgage Broking Business contains an example suggesting that a

mortgage broker acting in the best interests of clients should act as a Protector rather than an Expert.

What are the implications for this in regard to (i) advice given to clients and (ii) recommending the

most suitable loan products?.

No. Mark

1. There is always introduction of changes in the new product from time to time and so there are chances

that the features might change. Therefore, the mortgage broker is required to be alert in regard to the

changes from the provider of the product which can be collected through meetings and seminars.

/2

2. Broker requires to be prepared for discussing the various products to their clients and providing them

with their various differentiating features so that a better decision and choice can be made.

/2

(f) How could you prepare yourself to deal with client concerns?

Mark

The major concern pertaining to the client is the resistance in respect to the terms of product like the interest

rate. Also, there are times, it can be like formal complain. In both the way, there is a need for overcoming the

resistance. Thus, as the wining situation is identified, the major challenge is to turn it into win win. So effective

methods required to be identified for meeting with the client concerns.

/2

(g) Give examples of the following legal breaches: breach of the duty of care, false and

misleading conduct, unconscionable conduct & conflict of interest without disclosure.

No. Mark

1. /1

2. /1

3. /1

4. /1

(h) Once a desirable market segment has been identified, a mortgage broking business can put

its mind o developing suitable marketing strategies. List examples of different strategies that

might be used.

Mark

/2

Sub-total /12

Continued

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

(i) What steps can be taken to keep up to date with product changes and ensure that this

knowledge is properly disseminated?

Mark

/2

(j) What are the procedures for dealing with client complaints in your organisation?

Mark

/2

(k) What normal protocols should for protecting the confidentiality of client files?

Mark

/2

Sub-total /6

Total /39

knowledge is properly disseminated?

Mark

/2

(j) What are the procedures for dealing with client complaints in your organisation?

Mark

/2

(k) What normal protocols should for protecting the confidentiality of client files?

Mark

/2

Sub-total /6

Total /39

Task 3: Contribute to OHS Hazard Identification & Risk Assessment

3.

Contribute

to workplace

hazard

identificatio

n

Occupational health and safety hazards are often considered only in terms of

physical injury, perhaps the result of working with heavy machinery, working in an

excessively noisy environment, or slipping or falling. Just as relevant, however, is

work-related stress. This describes the physical, mental and emotional reactions

of workers who perceive that their work demands exceed their abilities and/or

their resources (such as time, help/support) to do the work.

For the questions that follow, please read ‘Overview of Work-related Stress’ from

the NSW Government. It may be found at:

http://www.safework.nsw.gov.au/ data/assets/pdf_file/0008/99233/SW0836

7-1117-395314.pdf

Other ‘Tip Sheets’ from the same website may also be useful.

(a) How would you define workplace stress?

Mark

/4

(b) Suggest at least two ways in which work-related stress may affect client relationships.

Mark

/2

(c) Suggest at least four approaches you can take to reduce workplace stress? (Hint: you may

find suggested ways if you key ‘handling workplace stress’ into a search engine).

Mark

/4

Sub-total /10

Continued

3.

Contribute

to workplace

hazard

identificatio

n

Occupational health and safety hazards are often considered only in terms of

physical injury, perhaps the result of working with heavy machinery, working in an

excessively noisy environment, or slipping or falling. Just as relevant, however, is

work-related stress. This describes the physical, mental and emotional reactions

of workers who perceive that their work demands exceed their abilities and/or

their resources (such as time, help/support) to do the work.

For the questions that follow, please read ‘Overview of Work-related Stress’ from

the NSW Government. It may be found at:

http://www.safework.nsw.gov.au/ data/assets/pdf_file/0008/99233/SW0836

7-1117-395314.pdf

Other ‘Tip Sheets’ from the same website may also be useful.

(a) How would you define workplace stress?

Mark

/4

(b) Suggest at least two ways in which work-related stress may affect client relationships.

Mark

/2

(c) Suggest at least four approaches you can take to reduce workplace stress? (Hint: you may

find suggested ways if you key ‘handling workplace stress’ into a search engine).

Mark

/4

Sub-total /10

Continued

Task 3: Contribute to OHS Hazard Identification & Risk

Assessment Continued

3.1 Gather

information

about

workplace

hazards

In assisting in the control of work-related hazards, you will need to be access

suitable information.

Please read ‘Glossary of Job Demands and Job Resources’ from the QUT/ANU

People at Work project. It may be found here:

http://web.archive.org/web/20150227212940/http://www.peopleatworkproject.

com.au/LiteratureRetrieve.aspx?ID=174670

(a) Explain the distinction between ‘job demands’ and ‘job resources’ risk factors.

Mark

/4

(b) Identify two ‘job demands’ risk factors that are relevant to your workplace and describe what

detrimental effect they might have.

No. Mark

1. / 2

2. / 2

Sub-total /8

Continued

Assessment Continued

3.1 Gather

information

about

workplace

hazards

In assisting in the control of work-related hazards, you will need to be access

suitable information.

Please read ‘Glossary of Job Demands and Job Resources’ from the QUT/ANU

People at Work project. It may be found here:

http://web.archive.org/web/20150227212940/http://www.peopleatworkproject.

com.au/LiteratureRetrieve.aspx?ID=174670

(a) Explain the distinction between ‘job demands’ and ‘job resources’ risk factors.

Mark

/4

(b) Identify two ‘job demands’ risk factors that are relevant to your workplace and describe what

detrimental effect they might have.

No. Mark

1. / 2

2. / 2

Sub-total /8

Continued

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3.2

Contribute to

OHS risk

assessment

Once risks have been identified, they should be controlled. A way of doing this is to

use “job resources” available in the organization.

Once again, please refer to the ‘Glossary of Job Demands and Job Resources’ that

was referred to earlier.

Apart from OHS issues, there are other significant risks that have to be dealt with at

all levels in an organisation.

(a) List the job demand factors you have identified previously and for each one select one or

more job resources that might be used to mitigate these risks.

No. Mark

1. / 1

2. / 1

(b) Select one of the job resources listed and suggest how you could apply it in your work situation.

Mark

/ 1

(c) Select a significant risk issue, other than OHS issues, that has an impact on the way you perform your duties and explain how

it is managed.

Mark

/3

Sub-total /5

Continued

Contribute to

OHS risk

assessment

Once risks have been identified, they should be controlled. A way of doing this is to

use “job resources” available in the organization.

Once again, please refer to the ‘Glossary of Job Demands and Job Resources’ that

was referred to earlier.

Apart from OHS issues, there are other significant risks that have to be dealt with at

all levels in an organisation.

(a) List the job demand factors you have identified previously and for each one select one or

more job resources that might be used to mitigate these risks.

No. Mark

1. / 1

2. / 1

(b) Select one of the job resources listed and suggest how you could apply it in your work situation.

Mark

/ 1

(c) Select a significant risk issue, other than OHS issues, that has an impact on the way you perform your duties and explain how

it is managed.

Mark

/3

Sub-total /5

Continued

3.3

Environment

al risks

The risks that should be considered in management decision-making include

environmental risks.

This is giving rise to a new way for businesses to report to stakeholders that goes

beyond traditional financial reporting. It is called “triple bottom line” reporting.

(a) List the three criteria of triple bottom line reporting. What is the likely effect of this form of

reporting on management decision-making at all levels.

No. Mark

1. → / 2

2. / 2

(b) Select the annual report of a leading financial organization such as a major bank and, after identifying the

organization, summarise what it says about its environmental impact (suggested maximum length of 50 words).

Mark

/ 2

(c) Briefly indicate the environmental protection assistance that your business organization is able to receive from your State or

Territory environment protection agency.

Mark

/ 2

Sub-total /8

Continued

Environment

al risks

The risks that should be considered in management decision-making include

environmental risks.

This is giving rise to a new way for businesses to report to stakeholders that goes

beyond traditional financial reporting. It is called “triple bottom line” reporting.

(a) List the three criteria of triple bottom line reporting. What is the likely effect of this form of

reporting on management decision-making at all levels.

No. Mark

1. → / 2

2. / 2

(b) Select the annual report of a leading financial organization such as a major bank and, after identifying the

organization, summarise what it says about its environmental impact (suggested maximum length of 50 words).

Mark

/ 2

(c) Briefly indicate the environmental protection assistance that your business organization is able to receive from your State or

Territory environment protection agency.

Mark

/ 2

Sub-total /8

Continued

3.4 Effective

team

management

Risk assessment also requires effective team management and participation and

the right sorts of questions being asked.

(a) Describe the benefits of team meetings.

Mark

/ 2

(b) Consider your own role in team meetings and describe the approach you and other members

should take to information sharing.

Mark

/ 2

(c) Give examples of the types of risks that should be considered in all team meetings.

Mark

/ 2

(d) Explain why leadership is important in risk management.

No. Mark

1. /1

2. /1

3. /1

4. /1

Sub-total /10

Total /41

team

management

Risk assessment also requires effective team management and participation and

the right sorts of questions being asked.

(a) Describe the benefits of team meetings.

Mark

/ 2

(b) Consider your own role in team meetings and describe the approach you and other members

should take to information sharing.

Mark

/ 2

(c) Give examples of the types of risks that should be considered in all team meetings.

Mark

/ 2

(d) Explain why leadership is important in risk management.

No. Mark

1. /1

2. /1

3. /1

4. /1

Sub-total /10

Total /41

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Task 4: Manage Personal Work Priorities and Professional

Development

4. Set and

meet own

work

priorities

One of the challenges we face in a workplace situation is time management.

Management theory on the subject began with the Pareto Principle, suggested

that only about 20% of the things we do produce 80% of the results we achieve.

The challenge than becomes to set time aside for the 20% that matters.

The theory was taken further with Stephen Covey’s Time management matrix.

(a) Describe Covey’s Quadrant 2.

Mark

/2

(b) List three of your work activities that should belong in Covey’s Quadrant 2.

Mark

/3

(c) Suggest ways that you might utilize to ensure that proper time is spent on Quadrant 2 activities so that stress is avoided.

Mark

/2

(d) Digital diaries are now available as both computer and mobile phone apps. Describe the

place of digital diaries in managing personal work priorities.

Mark

/2

(e) Describe the importance of setting goals in terms of personal well-being.

Mark

/2

Sub-total /11

Development

4. Set and

meet own

work

priorities

One of the challenges we face in a workplace situation is time management.

Management theory on the subject began with the Pareto Principle, suggested

that only about 20% of the things we do produce 80% of the results we achieve.

The challenge than becomes to set time aside for the 20% that matters.

The theory was taken further with Stephen Covey’s Time management matrix.

(a) Describe Covey’s Quadrant 2.

Mark

/2

(b) List three of your work activities that should belong in Covey’s Quadrant 2.

Mark

/3

(c) Suggest ways that you might utilize to ensure that proper time is spent on Quadrant 2 activities so that stress is avoided.

Mark

/2

(d) Digital diaries are now available as both computer and mobile phone apps. Describe the

place of digital diaries in managing personal work priorities.

Mark

/2

(e) Describe the importance of setting goals in terms of personal well-being.

Mark

/2

Sub-total /11

Continued

(f) What does Stephen Corvey recommend for “re-creation” (a Quadrant 2 activitiy),

Mark

/2

(g) What are the common characteristics of work goals?

Mark

/2

Sub-total /4

Continued

(f) What does Stephen Corvey recommend for “re-creation” (a Quadrant 2 activitiy),

Mark

/2

(g) What are the common characteristics of work goals?

Mark

/2

Sub-total /4

Continued

Task 4: Manage Personal Work Priorities and Professional

Development Continued

4.1. Develop

and

maintain

professional

competence

One of the outcomes of spending more time on Covey’s Quadrant 2 is that we

have more time for professional development. Desirable professional

development includes a range of activities begin with reading the morning press

to undertaking a degree course at university. Increasingly these days, it may also

involve doing a course through the internet.

Setting professional development goals is part of the goal setting we should

undertake in are working life. If we have personal goals we are more likely to

make things happen. Also, research suggests that goal setting relieves stress and

increases physical wellbeing.

Goal setting of this type is a Covey Quadrant 2 activity. As such it is something

we have to deliberately set time aside for. This may be easier over time because

that way it becomes more of a habit.

Ideas for professional development do not come out of a vacuum. You should be

prepared to seek advice from colleagues and other mortgage brokers.

(a) List three activities you might consider undertaking to increase your competency (in addition

to formal professional development training) to comply with ethical, legal and procedural

requirements.

No. Mark

1. /1

2. /1

3. /1

(b) Describe how you can obtain ideas for professional development from (i) feedback and (ii)

competency standards.

No. Mark

1. /1

2. /1

(c) Where do you see yourself in three years time? List three skills or competencies you will need

to arrive there. Against each skill or competency nominated, suggest how you will attain it.

No.

Mark

1. /1

2. /1

Development Continued

4.1. Develop

and

maintain

professional

competence

One of the outcomes of spending more time on Covey’s Quadrant 2 is that we

have more time for professional development. Desirable professional

development includes a range of activities begin with reading the morning press

to undertaking a degree course at university. Increasingly these days, it may also

involve doing a course through the internet.

Setting professional development goals is part of the goal setting we should

undertake in are working life. If we have personal goals we are more likely to

make things happen. Also, research suggests that goal setting relieves stress and

increases physical wellbeing.

Goal setting of this type is a Covey Quadrant 2 activity. As such it is something

we have to deliberately set time aside for. This may be easier over time because

that way it becomes more of a habit.

Ideas for professional development do not come out of a vacuum. You should be

prepared to seek advice from colleagues and other mortgage brokers.

(a) List three activities you might consider undertaking to increase your competency (in addition

to formal professional development training) to comply with ethical, legal and procedural

requirements.

No. Mark

1. /1

2. /1

3. /1

(b) Describe how you can obtain ideas for professional development from (i) feedback and (ii)

competency standards.

No. Mark

1. /1

2. /1

(c) Where do you see yourself in three years time? List three skills or competencies you will need

to arrive there. Against each skill or competency nominated, suggest how you will attain it.

No.

Mark

1. /1

2. /1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(d) Suggest ways in which mortgage brokers may network to assist other mortgage brokers.

Mark

/2

Sub-total / 9

Total /24

Mark

/2

Sub-total / 9

Total /24

Task 5: Develop and Nurture Relationships with Clients, Other

Professionals and Third Party Referrers

5 Develop

professional

business

relationships

David Maistre has defined professionalism as an ‘‘… an unqualified dedication to

excellence in serving clients and their needs.’ This has important implications for

how client relationships are established and maintained.

Mortgage brokers are also able to develop and benefit from relationships with

other brokers because their main competition is not with each other. Rather, it is

the banks and other financial institutions.

Networking within the industry is therefore important.

Meeting other mortgage brokers requires much the same techniques as meeting

clients, other professionals and third party referrers. The relationship depends on

the development of rapport and the ability to contribute to the relationship in key

knowledge areas.

(a) What needs to be demonstrated at the outset in a client relationship? When is appropriate to

demonstrate competence?

No. Mark

1. /1

2. /1

(b) Imagine that you are explaining the function of mortgage broking to a client. What words would you use?

Mark

/2

(c) Explain the importance of a code of ethics in the relationship between a professional and clients.

Mark

/2

Sub-total /6

Continued

Professionals and Third Party Referrers

5 Develop

professional

business

relationships

David Maistre has defined professionalism as an ‘‘… an unqualified dedication to

excellence in serving clients and their needs.’ This has important implications for

how client relationships are established and maintained.

Mortgage brokers are also able to develop and benefit from relationships with

other brokers because their main competition is not with each other. Rather, it is

the banks and other financial institutions.

Networking within the industry is therefore important.

Meeting other mortgage brokers requires much the same techniques as meeting

clients, other professionals and third party referrers. The relationship depends on

the development of rapport and the ability to contribute to the relationship in key

knowledge areas.

(a) What needs to be demonstrated at the outset in a client relationship? When is appropriate to

demonstrate competence?

No. Mark

1. /1

2. /1

(b) Imagine that you are explaining the function of mortgage broking to a client. What words would you use?

Mark

/2

(c) Explain the importance of a code of ethics in the relationship between a professional and clients.

Mark

/2

Sub-total /6

Continued

(d) Drawing on your own experience or the experience of a more experienced colleague or

manager, describe a situation where a need was identified to use language and concepts

appropriate to cultural differences. How was the need met?

No.

1. /1

2. /1

Sub-total /2

Continued

manager, describe a situation where a need was identified to use language and concepts

appropriate to cultural differences. How was the need met?

No.

1. /1

2. /1

Sub-total /2

Continued

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

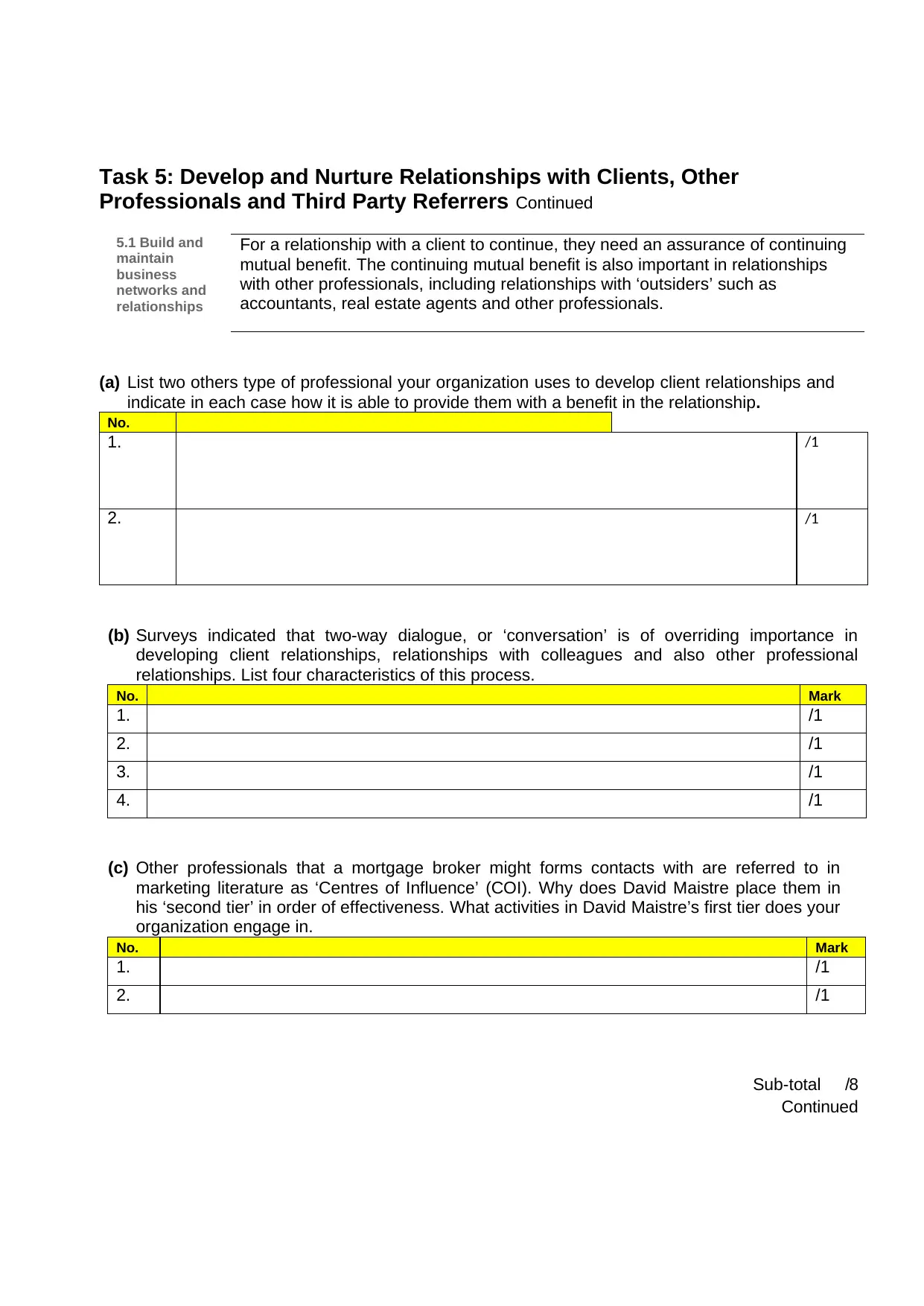

Task 5: Develop and Nurture Relationships with Clients, Other

Professionals and Third Party Referrers Continued

5.1 Build and

maintain

business

networks and

relationships

For a relationship with a client to continue, they need an assurance of continuing

mutual benefit. The continuing mutual benefit is also important in relationships

with other professionals, including relationships with ‘outsiders’ such as

accountants, real estate agents and other professionals.

(a) List two others type of professional your organization uses to develop client relationships and

indicate in each case how it is able to provide them with a benefit in the relationship.

No.

1. /1

2. /1

(b) Surveys indicated that two-way dialogue, or ‘conversation’ is of overriding importance in

developing client relationships, relationships with colleagues and also other professional

relationships. List four characteristics of this process.

No. Mark

1. /1

2. /1

3. /1

4. /1

(c) Other professionals that a mortgage broker might forms contacts with are referred to in

marketing literature as ‘Centres of Influence’ (COI). Why does David Maistre place them in

his ‘second tier’ in order of effectiveness. What activities in David Maistre’s first tier does your

organization engage in.

No. Mark

1. /1

2. /1

Sub-total /8

Continued

Professionals and Third Party Referrers Continued

5.1 Build and

maintain

business

networks and

relationships

For a relationship with a client to continue, they need an assurance of continuing

mutual benefit. The continuing mutual benefit is also important in relationships

with other professionals, including relationships with ‘outsiders’ such as

accountants, real estate agents and other professionals.

(a) List two others type of professional your organization uses to develop client relationships and

indicate in each case how it is able to provide them with a benefit in the relationship.

No.

1. /1

2. /1

(b) Surveys indicated that two-way dialogue, or ‘conversation’ is of overriding importance in

developing client relationships, relationships with colleagues and also other professional

relationships. List four characteristics of this process.

No. Mark

1. /1

2. /1

3. /1

4. /1

(c) Other professionals that a mortgage broker might forms contacts with are referred to in

marketing literature as ‘Centres of Influence’ (COI). Why does David Maistre place them in

his ‘second tier’ in order of effectiveness. What activities in David Maistre’s first tier does your

organization engage in.

No. Mark

1. /1

2. /1

Sub-total /8

Continued

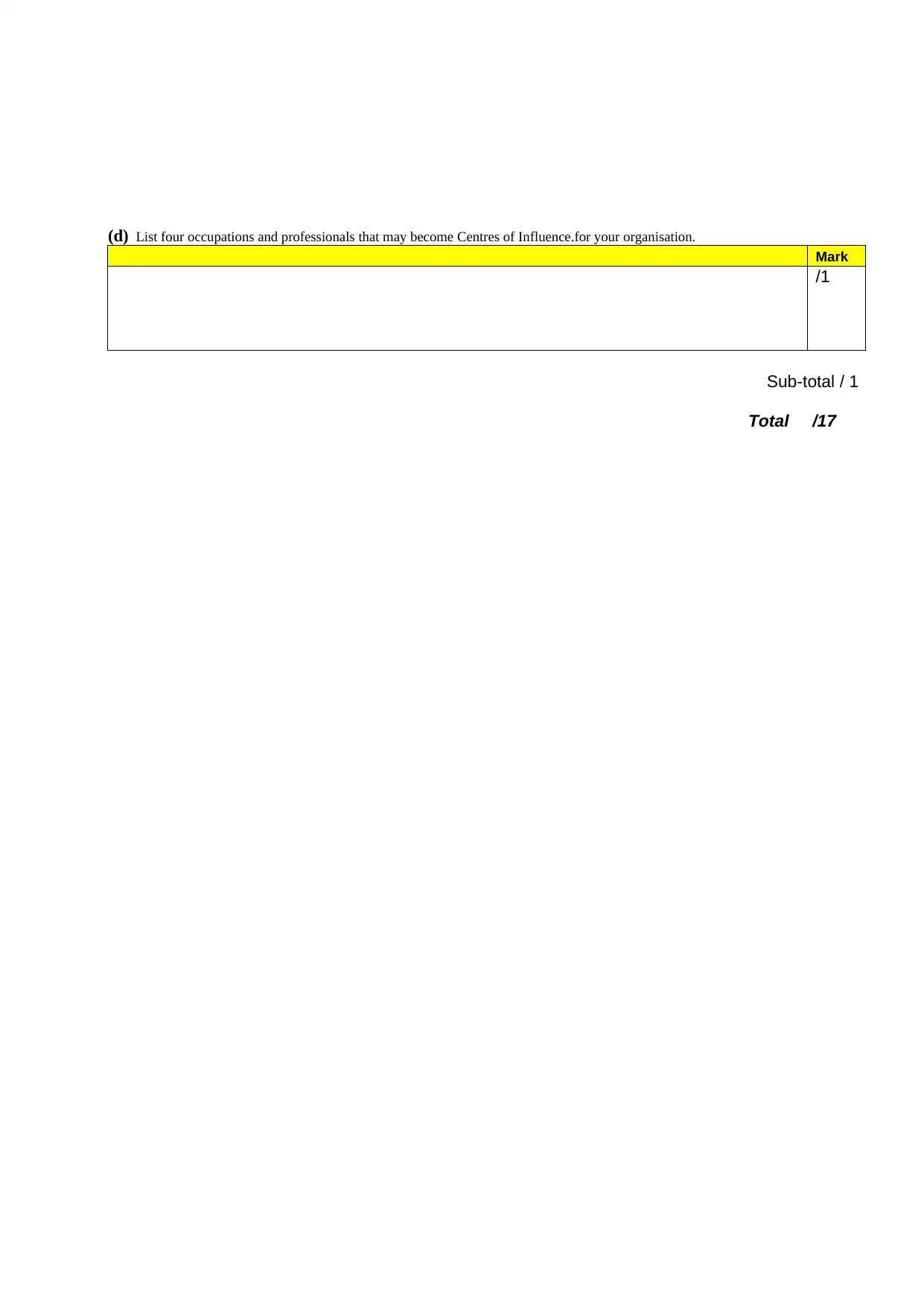

(d) List four occupations and professionals that may become Centres of Influence.for your organisation.

Mark

/1

Sub-total / 1

Total /17

Mark

/1

Sub-total / 1

Total /17

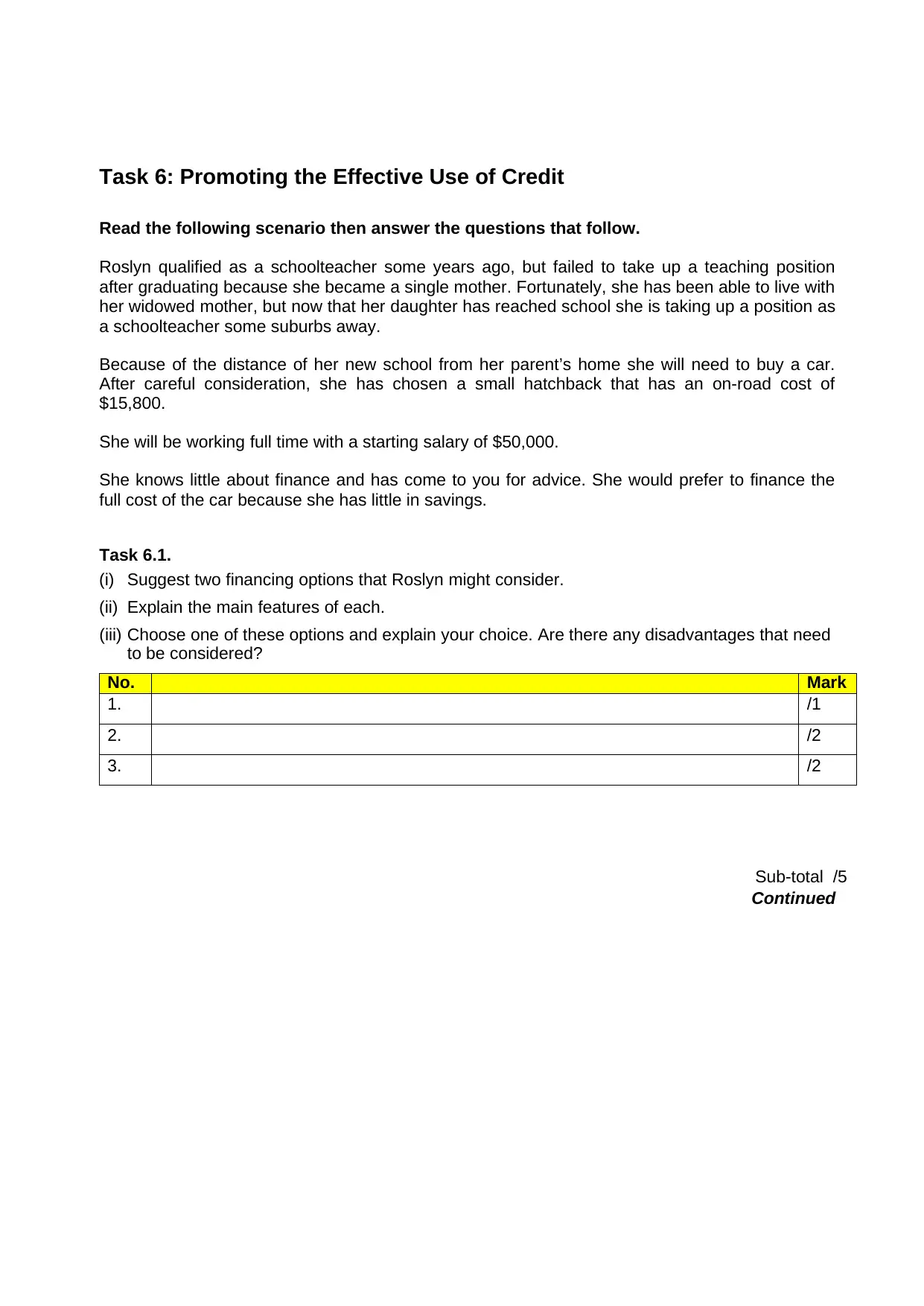

Task 6: Promoting the Effective Use of Credit

Read the following scenario then answer the questions that follow.

Roslyn qualified as a schoolteacher some years ago, but failed to take up a teaching position

after graduating because she became a single mother. Fortunately, she has been able to live with

her widowed mother, but now that her daughter has reached school she is taking up a position as

a schoolteacher some suburbs away.

Because of the distance of her new school from her parent’s home she will need to buy a car.

After careful consideration, she has chosen a small hatchback that has an on-road cost of

$15,800.

She will be working full time with a starting salary of $50,000.

She knows little about finance and has come to you for advice. She would prefer to finance the

full cost of the car because she has little in savings.

Task 6.1.

(i) Suggest two financing options that Roslyn might consider.

(ii) Explain the main features of each.

(iii) Choose one of these options and explain your choice. Are there any disadvantages that need

to be considered?

No. Mark

1. /1

2. /2

3. /2

Sub-total /5

Continued

Read the following scenario then answer the questions that follow.

Roslyn qualified as a schoolteacher some years ago, but failed to take up a teaching position

after graduating because she became a single mother. Fortunately, she has been able to live with

her widowed mother, but now that her daughter has reached school she is taking up a position as

a schoolteacher some suburbs away.

Because of the distance of her new school from her parent’s home she will need to buy a car.

After careful consideration, she has chosen a small hatchback that has an on-road cost of

$15,800.

She will be working full time with a starting salary of $50,000.

She knows little about finance and has come to you for advice. She would prefer to finance the

full cost of the car because she has little in savings.

Task 6.1.

(i) Suggest two financing options that Roslyn might consider.

(ii) Explain the main features of each.

(iii) Choose one of these options and explain your choice. Are there any disadvantages that need

to be considered?

No. Mark

1. /1

2. /2

3. /2

Sub-total /5

Continued

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

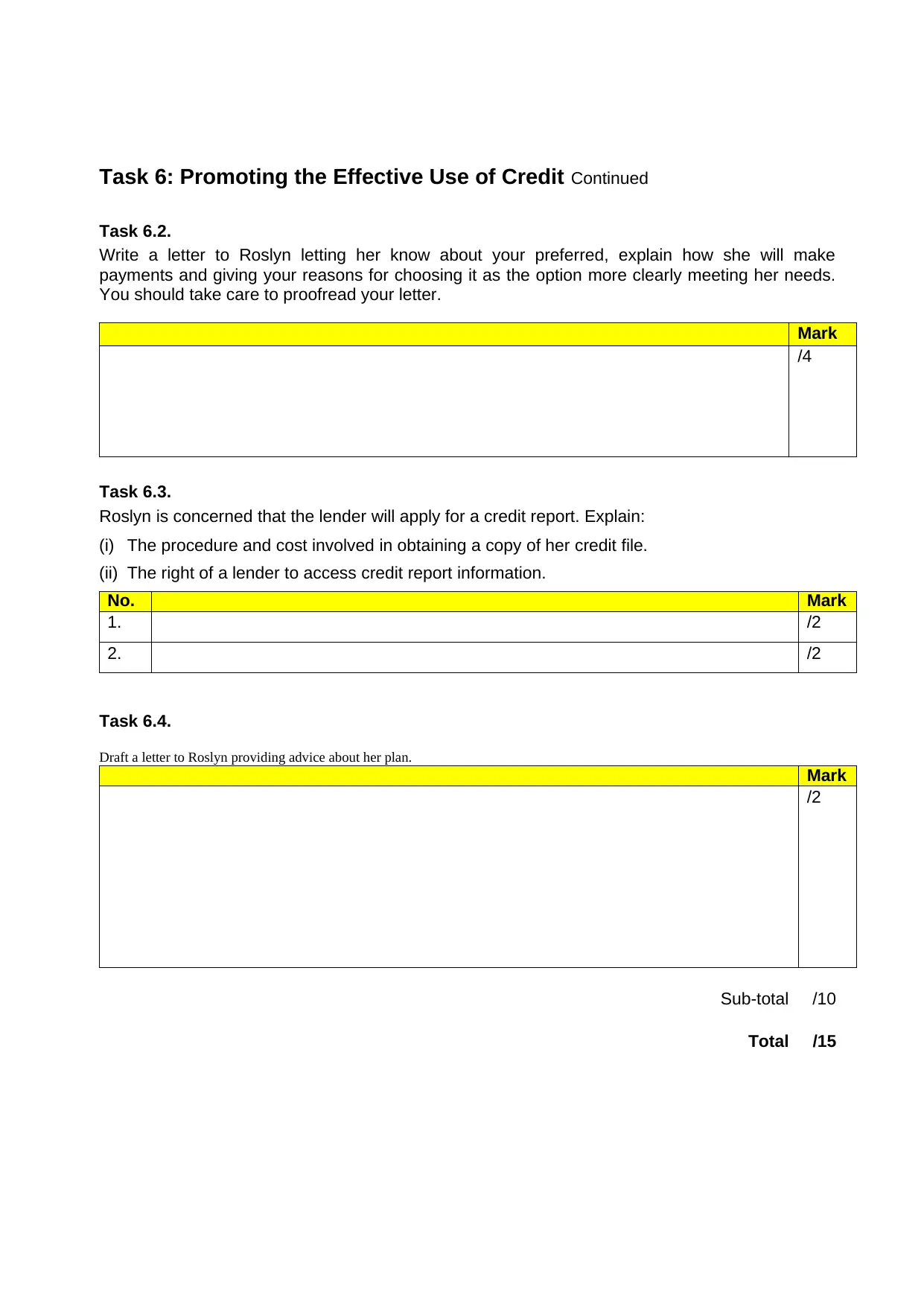

Task 6: Promoting the Effective Use of Credit Continued

Task 6.2.

Write a letter to Roslyn letting her know about your preferred, explain how she will make

payments and giving your reasons for choosing it as the option more clearly meeting her needs.

You should take care to proofread your letter.

Mark

/4

Task 6.3.

Roslyn is concerned that the lender will apply for a credit report. Explain:

(i) The procedure and cost involved in obtaining a copy of her credit file.

(ii) The right of a lender to access credit report information.

No. Mark

1. /2

2. /2

Task 6.4.

Draft a letter to Roslyn providing advice about her plan.

Mark

/2

Sub-total /10

Total /15

Task 6.2.

Write a letter to Roslyn letting her know about your preferred, explain how she will make

payments and giving your reasons for choosing it as the option more clearly meeting her needs.

You should take care to proofread your letter.

Mark

/4

Task 6.3.

Roslyn is concerned that the lender will apply for a credit report. Explain:

(i) The procedure and cost involved in obtaining a copy of her credit file.

(ii) The right of a lender to access credit report information.

No. Mark

1. /2

2. /2

Task 6.4.

Draft a letter to Roslyn providing advice about her plan.

Mark

/2

Sub-total /10

Total /15

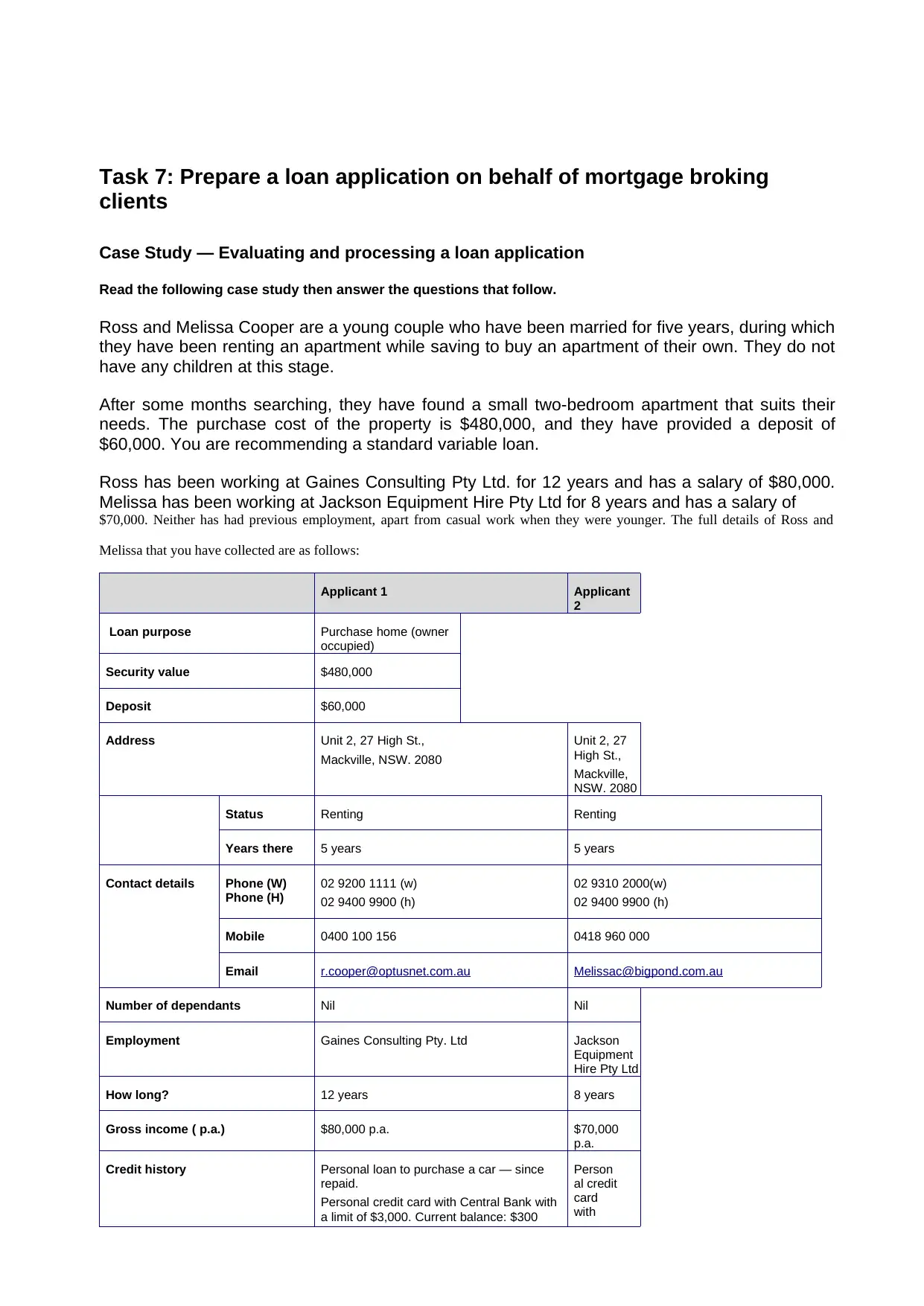

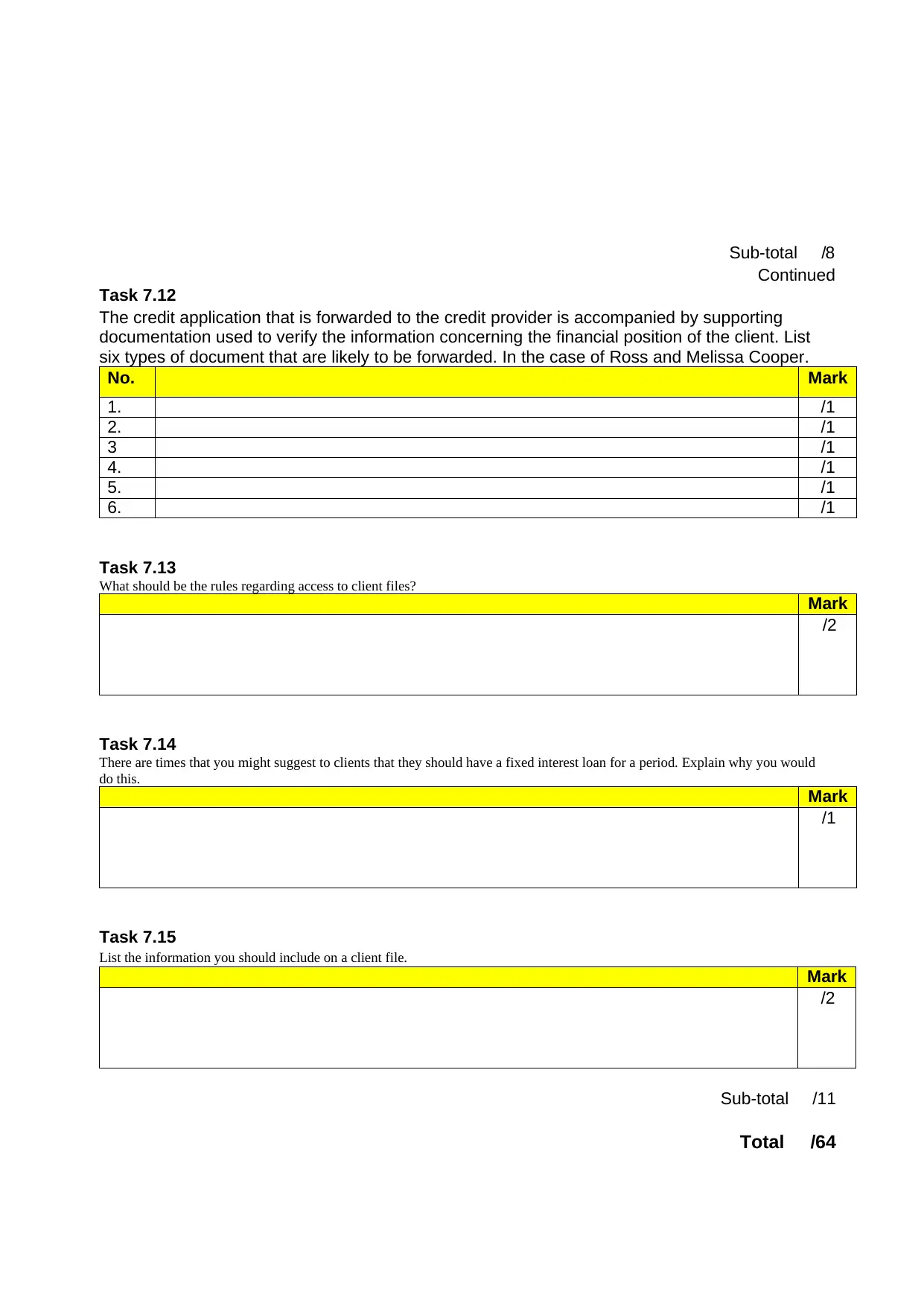

Task 7: Prepare a loan application on behalf of mortgage broking

clients

Case Study — Evaluating and processing a loan application

Read the following case study then answer the questions that follow.

Ross and Melissa Cooper are a young couple who have been married for five years, during which

they have been renting an apartment while saving to buy an apartment of their own. They do not

have any children at this stage.

After some months searching, they have found a small two-bedroom apartment that suits their

needs. The purchase cost of the property is $480,000, and they have provided a deposit of

$60,000. You are recommending a standard variable loan.

Ross has been working at Gaines Consulting Pty Ltd. for 12 years and has a salary of $80,000.

Melissa has been working at Jackson Equipment Hire Pty Ltd for 8 years and has a salary of

$70,000. Neither has had previous employment, apart from casual work when they were younger. The full details of Ross and

Melissa that you have collected are as follows:

Applicant 1 Applicant

2

Loan purpose Purchase home (owner

occupied)

Security value $480,000

Deposit $60,000

Address Unit 2, 27 High St.,

Mackville, NSW. 2080

Unit 2, 27

High St.,

Mackville,

NSW. 2080

Status Renting Renting

Years there 5 years 5 years

Contact details Phone (W)

Phone (H)

02 9200 1111 (w)

02 9400 9900 (h)

02 9310 2000(w)

02 9400 9900 (h)

Mobile 0400 100 156 0418 960 000

Email r.cooper@optusnet.com.au Melissac@bigpond.com.au

Number of dependants Nil Nil

Employment Gaines Consulting Pty. Ltd Jackson

Equipment

Hire Pty Ltd

How long? 12 years 8 years

Gross income ( p.a.) $80,000 p.a. $70,000

p.a.

Credit history Personal loan to purchase a car — since

repaid.

Personal credit card with Central Bank with

a limit of $3,000. Current balance: $300

Person

al credit

card

with

clients

Case Study — Evaluating and processing a loan application

Read the following case study then answer the questions that follow.

Ross and Melissa Cooper are a young couple who have been married for five years, during which

they have been renting an apartment while saving to buy an apartment of their own. They do not

have any children at this stage.

After some months searching, they have found a small two-bedroom apartment that suits their

needs. The purchase cost of the property is $480,000, and they have provided a deposit of

$60,000. You are recommending a standard variable loan.

Ross has been working at Gaines Consulting Pty Ltd. for 12 years and has a salary of $80,000.

Melissa has been working at Jackson Equipment Hire Pty Ltd for 8 years and has a salary of

$70,000. Neither has had previous employment, apart from casual work when they were younger. The full details of Ross and

Melissa that you have collected are as follows:

Applicant 1 Applicant

2

Loan purpose Purchase home (owner

occupied)

Security value $480,000

Deposit $60,000

Address Unit 2, 27 High St.,

Mackville, NSW. 2080

Unit 2, 27

High St.,

Mackville,

NSW. 2080

Status Renting Renting

Years there 5 years 5 years

Contact details Phone (W)

Phone (H)

02 9200 1111 (w)

02 9400 9900 (h)

02 9310 2000(w)

02 9400 9900 (h)

Mobile 0400 100 156 0418 960 000

Email r.cooper@optusnet.com.au Melissac@bigpond.com.au

Number of dependants Nil Nil

Employment Gaines Consulting Pty. Ltd Jackson

Equipment

Hire Pty Ltd

How long? 12 years 8 years

Gross income ( p.a.) $80,000 p.a. $70,000

p.a.

Credit history Personal loan to purchase a car — since

repaid.

Personal credit card with Central Bank with

a limit of $3,000. Current balance: $300

Person

al credit

card

with

Norther

n with a

limit of

$2,000.

Current

balance

: $300

Store card

with

Wilson’s

Departme

nt Store.

Current

balance:

S250

n with a

limit of

$2,000.

Current

balance

: $300

Store card

with

Wilson’s

Departme

nt Store.

Current

balance:

S250

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Note: All credit cards are repaid in full when

due.

Note: All credit cards are repaid in full when

due.

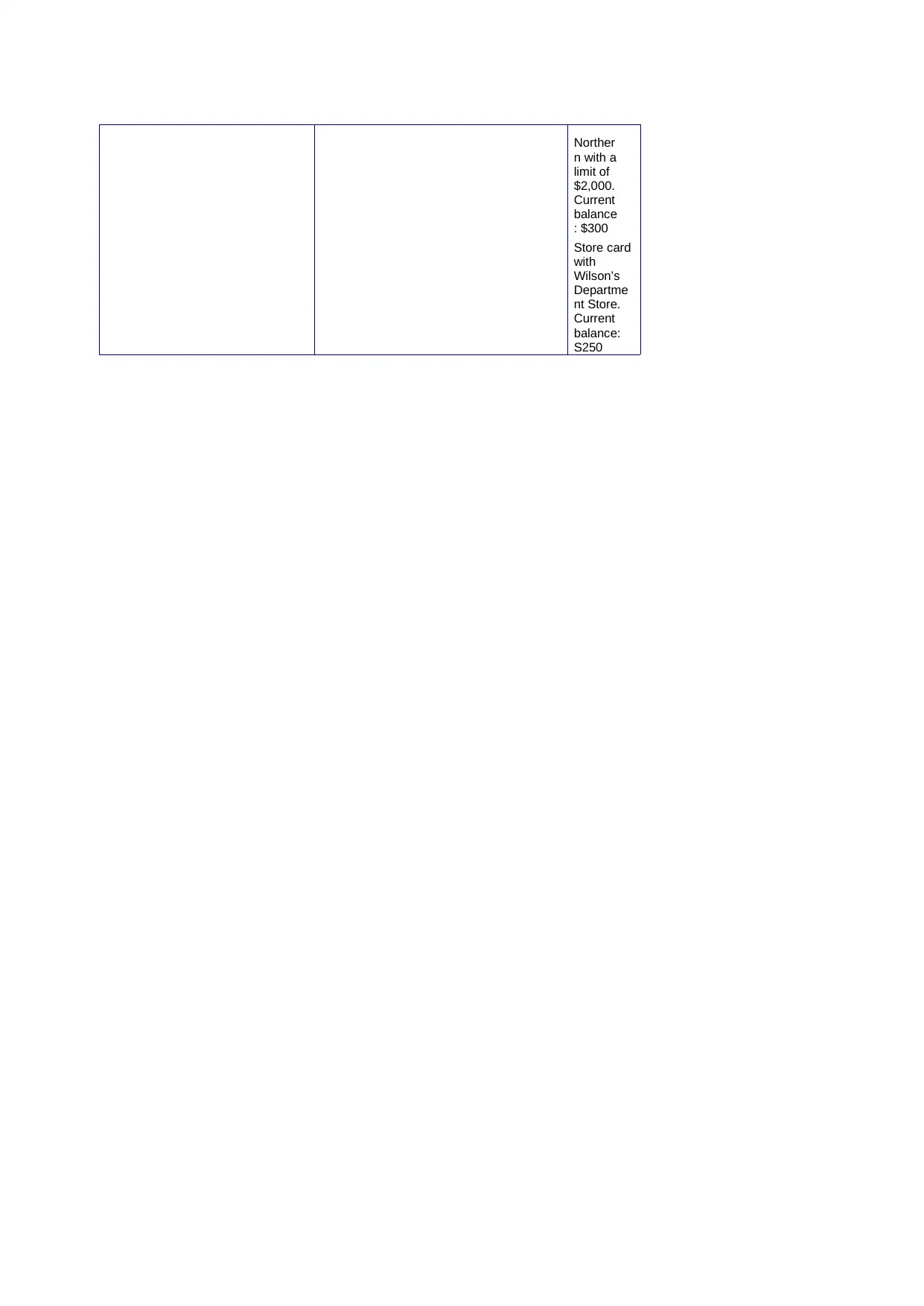

ASSETS AND LIABILITIES

Assets

Details Market value Details Monthly

payments

Amount owing

Cash at bank $15,000 Credit card limit:

$2,000

$2,000 $300

Deposit paid on

property

$60,000 Credit card limit:

$3,000

$3,000 $300

Motor vehicles:

1.

2.

$15,000

$7,000

Other:

Personal effects $30,000

Business value Nil

Total assets $127,000 Total liabilities $600

Surplus/deficiency: $126,400

OTHER DETAILS:

They are seeking a loan term of 25 years. Other requirements are:

proposed settlement date — 6 weeks time

ability to make additional payments from time to time without penalty

monthly repayments

redraw facility.

The applicants will have no other financial commitments other than their monthly mortgage

commitments, rates and utility costs and strata fees.

The current variable home loan rate is 6% pa.

Note: For the purposes of this assignment, any first home purchase assistance should be ignored.

OTHER INFORMATION

APRA is concerned that interest rates may rise and because of this it is requiring all lenders to

“stress test” all housing loans at a borrowing rate of 7% p.a.

due.

Note: All credit cards are repaid in full when

due.

ASSETS AND LIABILITIES

Assets

Details Market value Details Monthly

payments

Amount owing

Cash at bank $15,000 Credit card limit:

$2,000

$2,000 $300

Deposit paid on

property

$60,000 Credit card limit:

$3,000

$3,000 $300

Motor vehicles:

1.

2.

$15,000

$7,000

Other:

Personal effects $30,000

Business value Nil

Total assets $127,000 Total liabilities $600

Surplus/deficiency: $126,400

OTHER DETAILS:

They are seeking a loan term of 25 years. Other requirements are:

proposed settlement date — 6 weeks time

ability to make additional payments from time to time without penalty

monthly repayments

redraw facility.

The applicants will have no other financial commitments other than their monthly mortgage

commitments, rates and utility costs and strata fees.

The current variable home loan rate is 6% pa.

Note: For the purposes of this assignment, any first home purchase assistance should be ignored.

OTHER INFORMATION

APRA is concerned that interest rates may rise and because of this it is requiring all lenders to

“stress test” all housing loans at a borrowing rate of 7% p.a.

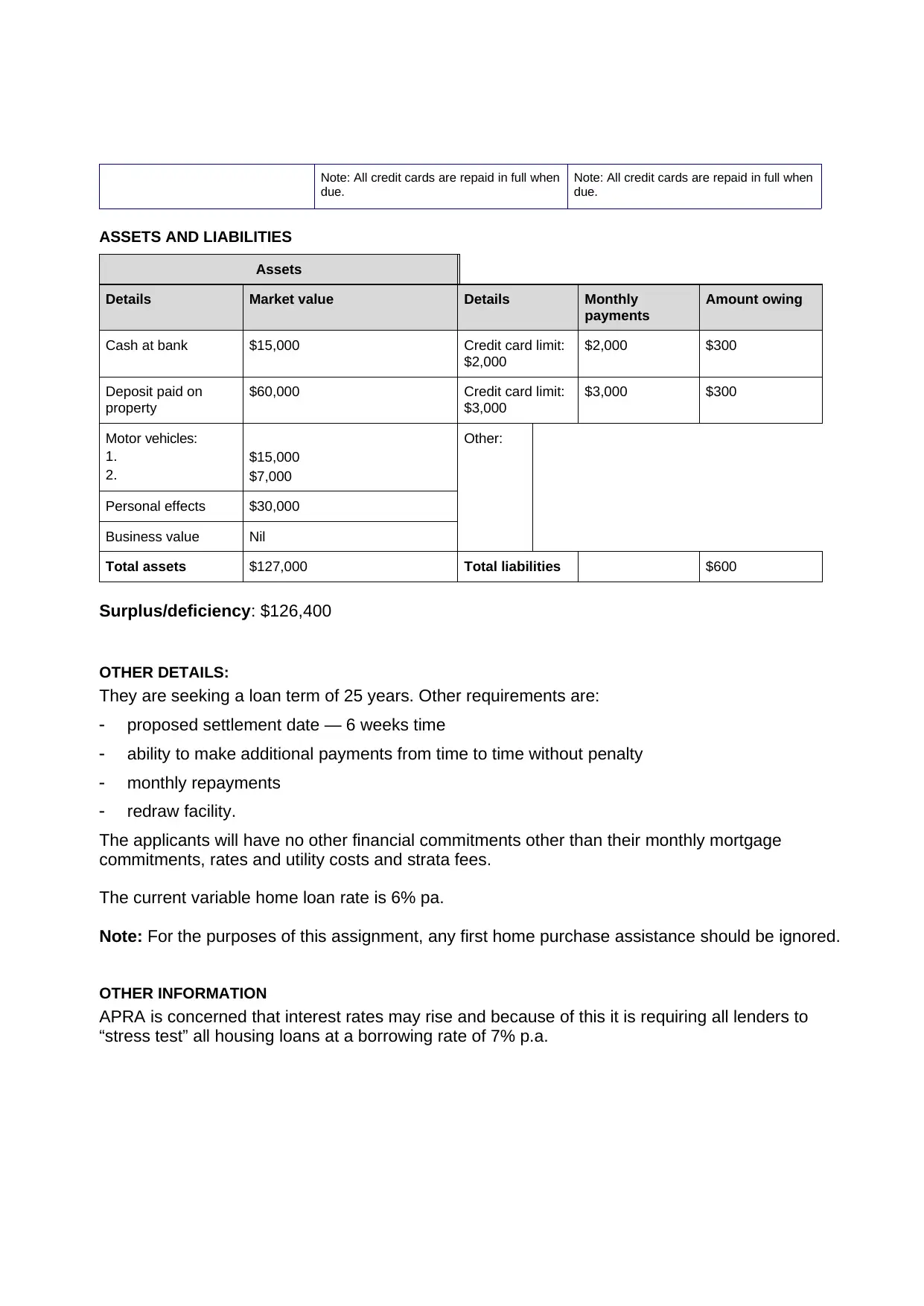

Apart from requiring the presentation of a Credit Guide, the NCCP Act says nothing about what a

mortgage broker should say about him/herself at the beginning of a client interview. In the space

below, make a few brief points about what you would say about yourself and your firm at this

stage. Remember that at the outside the client is primarily looking for assurance that the broker is

concerned about them and their interests.

Mark

/2

Task 7.2.

List in point form the important information a Credit Guide conveys to the credit applicant.

Mark

/3

Task 7.3.

Under the Anti-money Laundering and Counter-terrorism Financing Act 2006 (AML/CTF Act),

mortgage brokers are required to establish the identity of their clients. To do this they must cite

original copies of at least three primary documents and one secondary document. List three

primary documents and one secondary document below.

Mark

/3

Sub-total /8

Continued

mortgage broker should say about him/herself at the beginning of a client interview. In the space

below, make a few brief points about what you would say about yourself and your firm at this

stage. Remember that at the outside the client is primarily looking for assurance that the broker is

concerned about them and their interests.

Mark

/2

Task 7.2.

List in point form the important information a Credit Guide conveys to the credit applicant.

Mark

/3

Task 7.3.

Under the Anti-money Laundering and Counter-terrorism Financing Act 2006 (AML/CTF Act),

mortgage brokers are required to establish the identity of their clients. To do this they must cite

original copies of at least three primary documents and one secondary document. List three

primary documents and one secondary document below.

Mark

/3

Sub-total /8

Continued

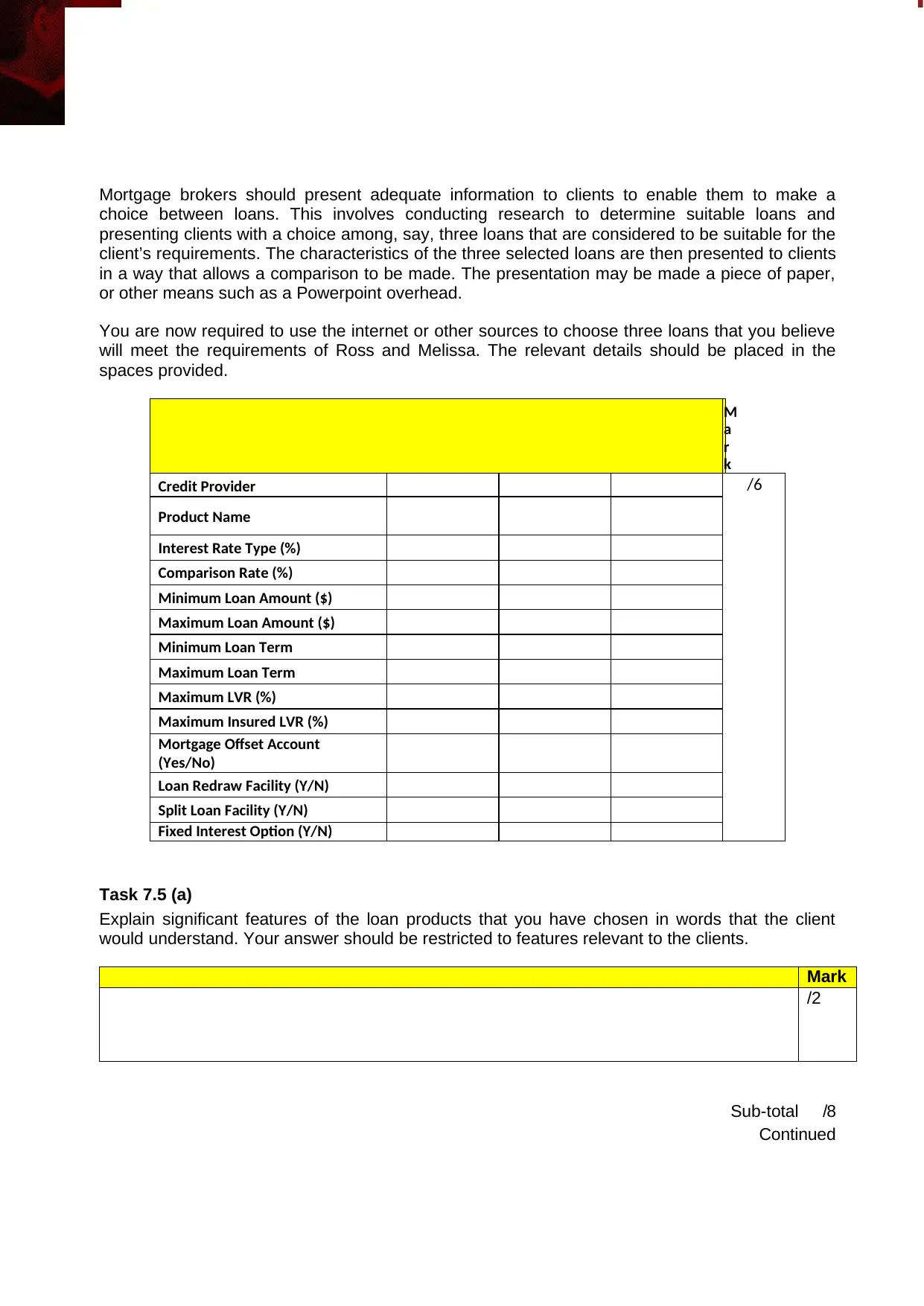

Mortgage brokers should present adequate information to clients to enable them to make a

choice between loans. This involves conducting research to determine suitable loans and

presenting clients with a choice among, say, three loans that are considered to be suitable for the

client’s requirements. The characteristics of the three selected loans are then presented to clients

in a way that allows a comparison to be made. The presentation may be made a piece of paper,

or other means such as a Powerpoint overhead.

You are now required to use the internet or other sources to choose three loans that you believe

will meet the requirements of Ross and Melissa. The relevant details should be placed in the

spaces provided.

M

a

r

k

Credit Provider /6

Product Name

Interest Rate Type (%)

Comparison Rate (%)

Minimum Loan Amount ($)

Maximum Loan Amount ($)

Minimum Loan Term

Maximum Loan Term

Maximum LVR (%)

Maximum Insured LVR (%)

Mortgage Offset Account

(Yes/No)

Loan Redraw Facility (Y/N)

Split Loan Facility (Y/N)

Fixed Interest Option (Y/N)

Task 7.5 (a)

Explain significant features of the loan products that you have chosen in words that the client

would understand. Your answer should be restricted to features relevant to the clients.

Mark

/2

Sub-total /8

Continued

choice between loans. This involves conducting research to determine suitable loans and

presenting clients with a choice among, say, three loans that are considered to be suitable for the

client’s requirements. The characteristics of the three selected loans are then presented to clients

in a way that allows a comparison to be made. The presentation may be made a piece of paper,

or other means such as a Powerpoint overhead.

You are now required to use the internet or other sources to choose three loans that you believe

will meet the requirements of Ross and Melissa. The relevant details should be placed in the

spaces provided.

M

a

r

k

Credit Provider /6

Product Name

Interest Rate Type (%)

Comparison Rate (%)

Minimum Loan Amount ($)

Maximum Loan Amount ($)

Minimum Loan Term

Maximum Loan Term

Maximum LVR (%)

Maximum Insured LVR (%)

Mortgage Offset Account

(Yes/No)

Loan Redraw Facility (Y/N)

Split Loan Facility (Y/N)

Fixed Interest Option (Y/N)

Task 7.5 (a)

Explain significant features of the loan products that you have chosen in words that the client

would understand. Your answer should be restricted to features relevant to the clients.

Mark

/2

Sub-total /8

Continued

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Task 7.5 (b)

Credit providers always have other fees and charges beyond their stated interest rates. Select one of the loans you have set out in

Task 7.4 as the one preferred by Ross and Melinda, and explain any additional fees and charges in a manner that your clients can

understand.

Mark

/2

Task 7.6

It is important to verify the information that you obtain from clients, particularly information that relates to income. List the

documents that you should ask for and then examine to verify the incomes of Ross and Melissa.

Mark

/3

Task 7.7

In dealing with clients, it is important to explain technical concepts in ‘plain English’ so that they

understand them. In the first two spaces below, explain the terms ‘LVR’ and ‘insured’ LVR’ in

terms that that your clients will understand. Then, in the third space, explain how Lender’s

Mortgage Insurance is normally paid, once again expressing yourself in a way that the clients are

likely to understand.

No. Mark

1. /1

2. /1

3. /1

Task 7.8

Mortgage brokers assist their clients to complete their preferred lender’s credit application form,

as well as applications for the First Home Buyer’s Grant and (where applicable) stamp duty

exemption. Examples of these forms are set out over the following pages and you are required to

complete them on behalf of Ross and Melissa. In this case, please fill in our sample of ANZ

application form. Treat these buyers as first home buyers and treat this property as a new

property, for the purpose to get use to filling FHOG and Exemption forms. Remember that each

form must be signed by the client, so facsimile signatures must be attached

Mark

The forms for the following pages can be found at:

https://www.homeloanexperts.com.au/wp-content/uploads/2016/05/ANZ-Loan-application-

cover-sheet.pdf

https://www.revenue.nsw.gov.au/help-centre/resources-library/072017-ofh001.pdf

(application form only)

/15

Credit providers always have other fees and charges beyond their stated interest rates. Select one of the loans you have set out in

Task 7.4 as the one preferred by Ross and Melinda, and explain any additional fees and charges in a manner that your clients can

understand.

Mark

/2

Task 7.6

It is important to verify the information that you obtain from clients, particularly information that relates to income. List the

documents that you should ask for and then examine to verify the incomes of Ross and Melissa.

Mark

/3

Task 7.7

In dealing with clients, it is important to explain technical concepts in ‘plain English’ so that they

understand them. In the first two spaces below, explain the terms ‘LVR’ and ‘insured’ LVR’ in

terms that that your clients will understand. Then, in the third space, explain how Lender’s

Mortgage Insurance is normally paid, once again expressing yourself in a way that the clients are

likely to understand.

No. Mark

1. /1

2. /1

3. /1

Task 7.8

Mortgage brokers assist their clients to complete their preferred lender’s credit application form,

as well as applications for the First Home Buyer’s Grant and (where applicable) stamp duty

exemption. Examples of these forms are set out over the following pages and you are required to

complete them on behalf of Ross and Melissa. In this case, please fill in our sample of ANZ

application form. Treat these buyers as first home buyers and treat this property as a new

property, for the purpose to get use to filling FHOG and Exemption forms. Remember that each

form must be signed by the client, so facsimile signatures must be attached

Mark

The forms for the following pages can be found at:

https://www.homeloanexperts.com.au/wp-content/uploads/2016/05/ANZ-Loan-application-

cover-sheet.pdf

https://www.revenue.nsw.gov.au/help-centre/resources-library/072017-ofh001.pdf

(application form only)

/15

https://www.revenue.nsw.gov.au/help-centre/resources-library/oda066.pdf ((application

form only)

Sub-total /23

Continued

Task 7: Prepare a Loan Application on Behalf of Mortgage Broking

Clients Continued

Task 7.9.

It is important to keep clients informed about the steps involved in the credit approval process.

Indicate how your organization keeps your client informed as the loan application proceeds. What

are the likely normal time intervals for each step that you explain to your clients.

No. Mark

1. /2

Task 7.10

Assess the loan application of Ross and Melissa Cooper against the five C’s.

Character

How would you assess the applicants’ character?

Mark

/2

Capacity