Management Accounting Tools for Boosting Business Performance

VerifiedAdded on 2019/12/18

|23

|4722

|275

Essay

AI Summary

Management accounting stream is crucial for an organization to amend its current working policy and facilitate its existing business. Ratio analysis, a key technique, helps analyze past performance and make informed decisions. Other management accounting tools like financial statements, quality of products, client satisfaction level, comparative financial statements, budgeting, fund flow analyses, cash flow analyses, cost variances, benchmarking, and budgetary targeting can aid in identifying loop falls, resolving financial problems, and improving operations and profit. By applying these tools, an organization can effectively manage its resources, minimize unnecessary expenditures, and achieve its objectives.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MANAGEMENT

ACCOUNTING

1

ACCOUNTING

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

INTRODUCTION

Managing finance require intellectual ability by a manager who need to applied their skills

on right track of the business. This report is based on defining the nature o management accounting

tools to be adopted by Small scale entity in improving their financial crisis. This is all about

absorption and marginal costing majorly in the whole report.

PART 1

P1 Justify Management accounting and necessary requirements of various types of management

accounting system in the given case scenario

Background

In the given case scenario, where there is highly requirement of management accounting

tools and techniques to facilitate its variety of users. The owner currently deals in offering variety of

services in order to deliver good quality products or services to attract its existing employee’s along

with their clients (Schulze and Heidenreich, 2017). Employees are the true representators of the

business who reflect the transparent conditions of the business in front of its various competitors.

The focus of this report is on explaining the needs and the objectives of small based industries deal

in hospitality organisation which is regarded service industry. This service industry is most

important firms in the overall business environment who takes cares about the tastes and

preferences of all of the customers in the external environment.

The current management structure of this organisation states that there are only fifty

employees in this corporation in order to operate several business functions in order to attain all the

objectives of the business. Management accounting plays a significant role in uplifting the existing

conditions as they helps in passing important information from one end to another in to achieve the

desired gaols and the objectives of the business (Said, 2016). The primary concern of an entity is on

reduction of cost as optimally utilisation of all the resources is important in order to minimise all

kinds of costs to gain the higher amount of profit in the business enterprise. The overall turnover of

this is not exceeding 500000 GBP which showcases the enthusiasm of the current firm who are

small scale enterprise who intends to enhance its current market share by eliminating its

deficiencies by transforming them into their strengths. These strengths can be sued against the

management in improving the skills and the capabilities in achieving its goals.. Main aim of

organization is to reduction op fist existing cost which can be done by increasing the overall sales

volume of the business as positivity will eliminate all the negativity incurred in the business. Higher

expenditure will be regulated by making expenditures budgets which eaves the role of the business

3

Managing finance require intellectual ability by a manager who need to applied their skills

on right track of the business. This report is based on defining the nature o management accounting

tools to be adopted by Small scale entity in improving their financial crisis. This is all about

absorption and marginal costing majorly in the whole report.

PART 1

P1 Justify Management accounting and necessary requirements of various types of management

accounting system in the given case scenario

Background

In the given case scenario, where there is highly requirement of management accounting

tools and techniques to facilitate its variety of users. The owner currently deals in offering variety of

services in order to deliver good quality products or services to attract its existing employee’s along

with their clients (Schulze and Heidenreich, 2017). Employees are the true representators of the

business who reflect the transparent conditions of the business in front of its various competitors.

The focus of this report is on explaining the needs and the objectives of small based industries deal

in hospitality organisation which is regarded service industry. This service industry is most

important firms in the overall business environment who takes cares about the tastes and

preferences of all of the customers in the external environment.

The current management structure of this organisation states that there are only fifty

employees in this corporation in order to operate several business functions in order to attain all the

objectives of the business. Management accounting plays a significant role in uplifting the existing

conditions as they helps in passing important information from one end to another in to achieve the

desired gaols and the objectives of the business (Said, 2016). The primary concern of an entity is on

reduction of cost as optimally utilisation of all the resources is important in order to minimise all

kinds of costs to gain the higher amount of profit in the business enterprise. The overall turnover of

this is not exceeding 500000 GBP which showcases the enthusiasm of the current firm who are

small scale enterprise who intends to enhance its current market share by eliminating its

deficiencies by transforming them into their strengths. These strengths can be sued against the

management in improving the skills and the capabilities in achieving its goals.. Main aim of

organization is to reduction op fist existing cost which can be done by increasing the overall sales

volume of the business as positivity will eliminate all the negativity incurred in the business. Higher

expenditure will be regulated by making expenditures budgets which eaves the role of the business

3

entity along its competitors who tries to pull down the status of the business by constantly amending

the overall pricing structures of several products deal by an enterprise. There are various

management accounting systems needs to be adopt by an entity in order to improve their skills and

capabilities in front of its competitors which is given as below:

According to the CIMA, the definition of management accounting states that it is that branch

of accounting which helps in reporting information related to qualitative and quantitative

information related to the business. It is that kind of communication medium under which important

information are supplied to the top management in order to maintain the current business value in

front of its various competitors who intends to suppress the market status of an entity.

Management accounting system is that terminology which used to define the data collected

by an enterprise which is of financial nature in order to regulate the business operations of the firm.

The data can be collected in order to ensure the business activities such as sales; inventory used in

the business, changes takes places in the usage of raw materials. All these activities are analysed in

order to generate final reports which will be supplied to the management in order to make final

action in the business.

Origin

The management accounting concepts came into origin in the 19th century with the

introduction of industrial revolution which gives birth to the unique concept in order to remove

weaknesses lies in the management.

Role

The role of thee management accounting is to regulate the business performance as the

resources are fully utilised in order to generate higher results. The assets are controlled in order to

retain in the business for the longer time period. The financial efficiency of the business will be

improved in order to achieve various targets.

Principle

The basic principle of the management that helps in achieving the desired aims of an

enterprise includes causality and Analogy principle. All these principles help in meeting higher

demands of the customers which in turn created image of the firm in the external market.

Difference among financial and management accounting

Objective wise these two concepts are total different as management accounting focuses on

delivering information related to the business to the management in order to make corrective

actions. On the other hand, financial accounting related to the recording of financial transactions in

the business entity in order to determine the financial performance of an enterprise.

Cost accounting system

4

the overall pricing structures of several products deal by an enterprise. There are various

management accounting systems needs to be adopt by an entity in order to improve their skills and

capabilities in front of its competitors which is given as below:

According to the CIMA, the definition of management accounting states that it is that branch

of accounting which helps in reporting information related to qualitative and quantitative

information related to the business. It is that kind of communication medium under which important

information are supplied to the top management in order to maintain the current business value in

front of its various competitors who intends to suppress the market status of an entity.

Management accounting system is that terminology which used to define the data collected

by an enterprise which is of financial nature in order to regulate the business operations of the firm.

The data can be collected in order to ensure the business activities such as sales; inventory used in

the business, changes takes places in the usage of raw materials. All these activities are analysed in

order to generate final reports which will be supplied to the management in order to make final

action in the business.

Origin

The management accounting concepts came into origin in the 19th century with the

introduction of industrial revolution which gives birth to the unique concept in order to remove

weaknesses lies in the management.

Role

The role of thee management accounting is to regulate the business performance as the

resources are fully utilised in order to generate higher results. The assets are controlled in order to

retain in the business for the longer time period. The financial efficiency of the business will be

improved in order to achieve various targets.

Principle

The basic principle of the management that helps in achieving the desired aims of an

enterprise includes causality and Analogy principle. All these principles help in meeting higher

demands of the customers which in turn created image of the firm in the external market.

Difference among financial and management accounting

Objective wise these two concepts are total different as management accounting focuses on

delivering information related to the business to the management in order to make corrective

actions. On the other hand, financial accounting related to the recording of financial transactions in

the business entity in order to determine the financial performance of an enterprise.

Cost accounting system

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

The primary concern of the management is to determine the cost incurred by an enterprise in

a particular year. The cost will be recorded in the cost sheets prepared by an entity using absorption

and marginal by considering fixed or variable costing.

Inventory management system

Inventories are kept by an entity owner in order to accomplish their sales order by meeting

higher expectations of various customers. The inventory can be managed by setting re-order

quantity point in which inventory will automatically gets filled when the certain level reaches in the

firm. Just in time will be used in order to manage inventory in which inventories are purchased just

to cater the sales order.

Job costing system

The different transactions in the business entity are classified into various batches and the

selling price o all the batches are determined separately. These separate batches units are regarded

as job orders whose costing and selling price will be ascertained separately.

Price optimising system

It is regarded as that important tool used by an enterprise in improving all the skills and the

capabilities of an enterprise owner. It uses mathematical analysis in which current costs incurred by

an entity are assessed in relation with the inventory level in order to improve the overall business

profit of the business.

Benefits of different types of system

Cost accounting system

The financial resources held in an enterprise will be properly analysed in order to remove existing

weaknesses.

Cost can be predicted by an entity

Inventory management system

Efficiency of the current inventory will be increases

Warehousing cost will be eliminated by using just in time method of using inventories

Price optimising system

Meeting higher demands of the customers in catering all the sales orders

Weaknesses lies in the existing inventory level will be reduces

Cost Volume profit analysis- The major concern of an entity is to track its current costs incurred in

their business which require proper application system in order to ensure completion of all tasks and

duties (Tucker and Parker, 2014). The costs of each and every activities of the business are

separately associated as this will help in determining the efficiency of singular activities. This

further helps in continue or discontinue the least effective market segment which is not generating

5

a particular year. The cost will be recorded in the cost sheets prepared by an entity using absorption

and marginal by considering fixed or variable costing.

Inventory management system

Inventories are kept by an entity owner in order to accomplish their sales order by meeting

higher expectations of various customers. The inventory can be managed by setting re-order

quantity point in which inventory will automatically gets filled when the certain level reaches in the

firm. Just in time will be used in order to manage inventory in which inventories are purchased just

to cater the sales order.

Job costing system

The different transactions in the business entity are classified into various batches and the

selling price o all the batches are determined separately. These separate batches units are regarded

as job orders whose costing and selling price will be ascertained separately.

Price optimising system

It is regarded as that important tool used by an enterprise in improving all the skills and the

capabilities of an enterprise owner. It uses mathematical analysis in which current costs incurred by

an entity are assessed in relation with the inventory level in order to improve the overall business

profit of the business.

Benefits of different types of system

Cost accounting system

The financial resources held in an enterprise will be properly analysed in order to remove existing

weaknesses.

Cost can be predicted by an entity

Inventory management system

Efficiency of the current inventory will be increases

Warehousing cost will be eliminated by using just in time method of using inventories

Price optimising system

Meeting higher demands of the customers in catering all the sales orders

Weaknesses lies in the existing inventory level will be reduces

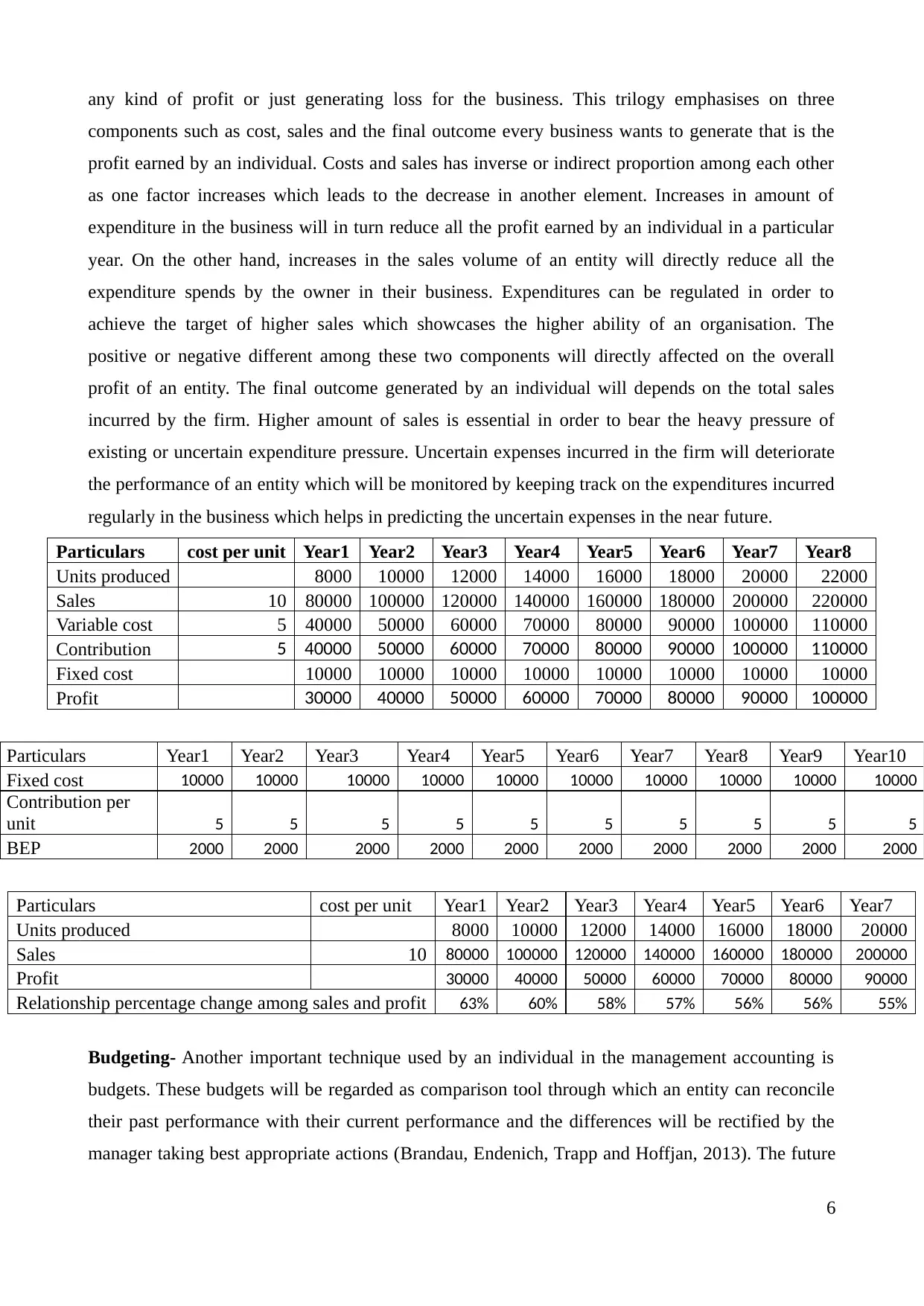

Cost Volume profit analysis- The major concern of an entity is to track its current costs incurred in

their business which require proper application system in order to ensure completion of all tasks and

duties (Tucker and Parker, 2014). The costs of each and every activities of the business are

separately associated as this will help in determining the efficiency of singular activities. This

further helps in continue or discontinue the least effective market segment which is not generating

5

any kind of profit or just generating loss for the business. This trilogy emphasises on three

components such as cost, sales and the final outcome every business wants to generate that is the

profit earned by an individual. Costs and sales has inverse or indirect proportion among each other

as one factor increases which leads to the decrease in another element. Increases in amount of

expenditure in the business will in turn reduce all the profit earned by an individual in a particular

year. On the other hand, increases in the sales volume of an entity will directly reduce all the

expenditure spends by the owner in their business. Expenditures can be regulated in order to

achieve the target of higher sales which showcases the higher ability of an organisation. The

positive or negative different among these two components will directly affected on the overall

profit of an entity. The final outcome generated by an individual will depends on the total sales

incurred by the firm. Higher amount of sales is essential in order to bear the heavy pressure of

existing or uncertain expenditure pressure. Uncertain expenses incurred in the firm will deteriorate

the performance of an entity which will be monitored by keeping track on the expenditures incurred

regularly in the business which helps in predicting the uncertain expenses in the near future.

Particulars cost per unit Year1 Year2 Year3 Year4 Year5 Year6 Year7 Year8

Units produced 8000 10000 12000 14000 16000 18000 20000 22000

Sales 10 80000 100000 120000 140000 160000 180000 200000 220000

Variable cost 5 40000 50000 60000 70000 80000 90000 100000 110000

Contribution 5 40000 50000 60000 70000 80000 90000 100000 110000

Fixed cost 10000 10000 10000 10000 10000 10000 10000 10000

Profit 30000 40000 50000 60000 70000 80000 90000 100000

Particulars Year1 Year2 Year3 Year4 Year5 Year6 Year7 Year8 Year9 Year10

Fixed cost 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000

Contribution per

unit 5 5 5 5 5 5 5 5 5 5

BEP 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000

Particulars cost per unit Year1 Year2 Year3 Year4 Year5 Year6 Year7

Units produced 8000 10000 12000 14000 16000 18000 20000

Sales 10 80000 100000 120000 140000 160000 180000 200000

Profit 30000 40000 50000 60000 70000 80000 90000

Relationship percentage change among sales and profit 63% 60% 58% 57% 56% 56% 55%

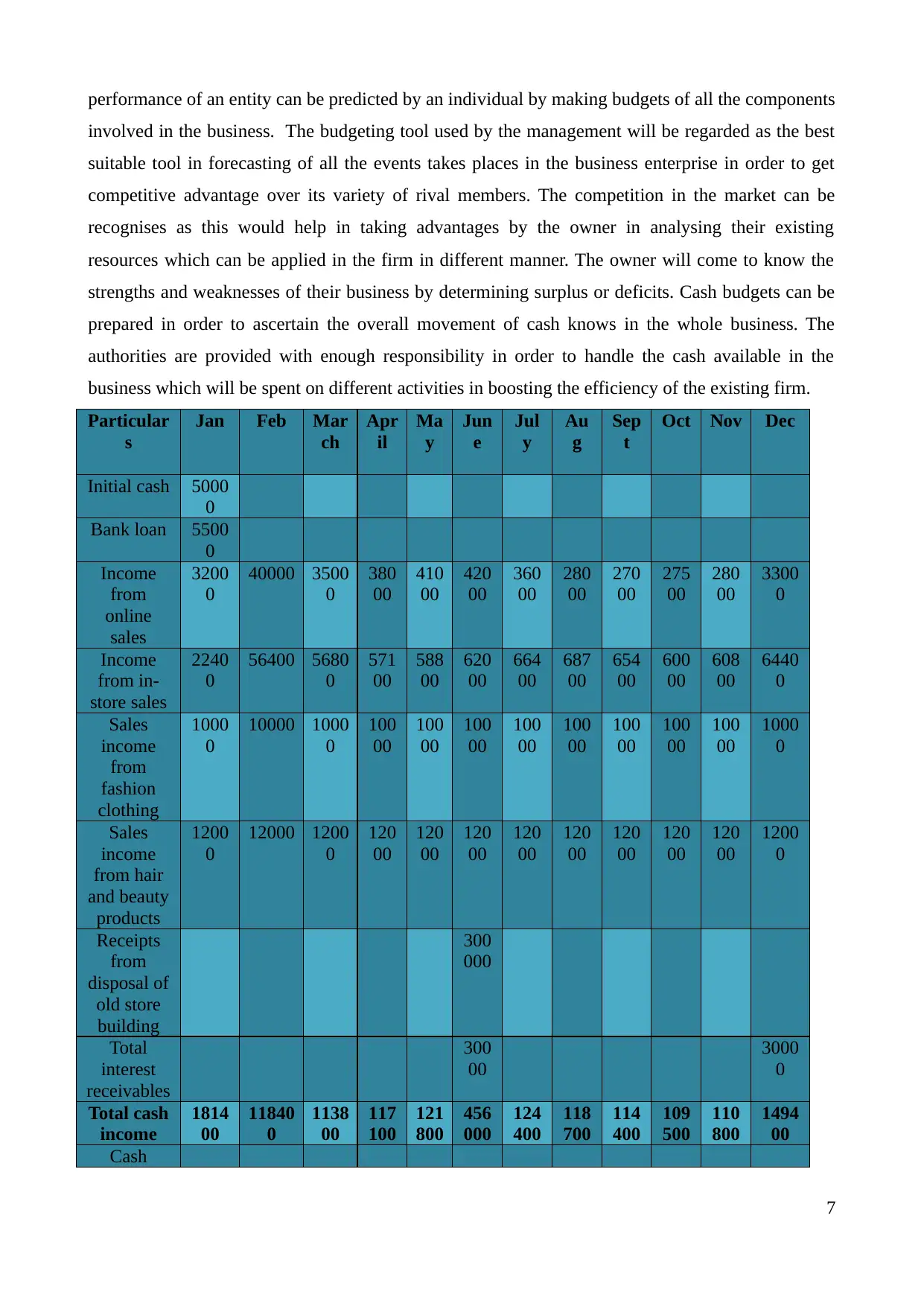

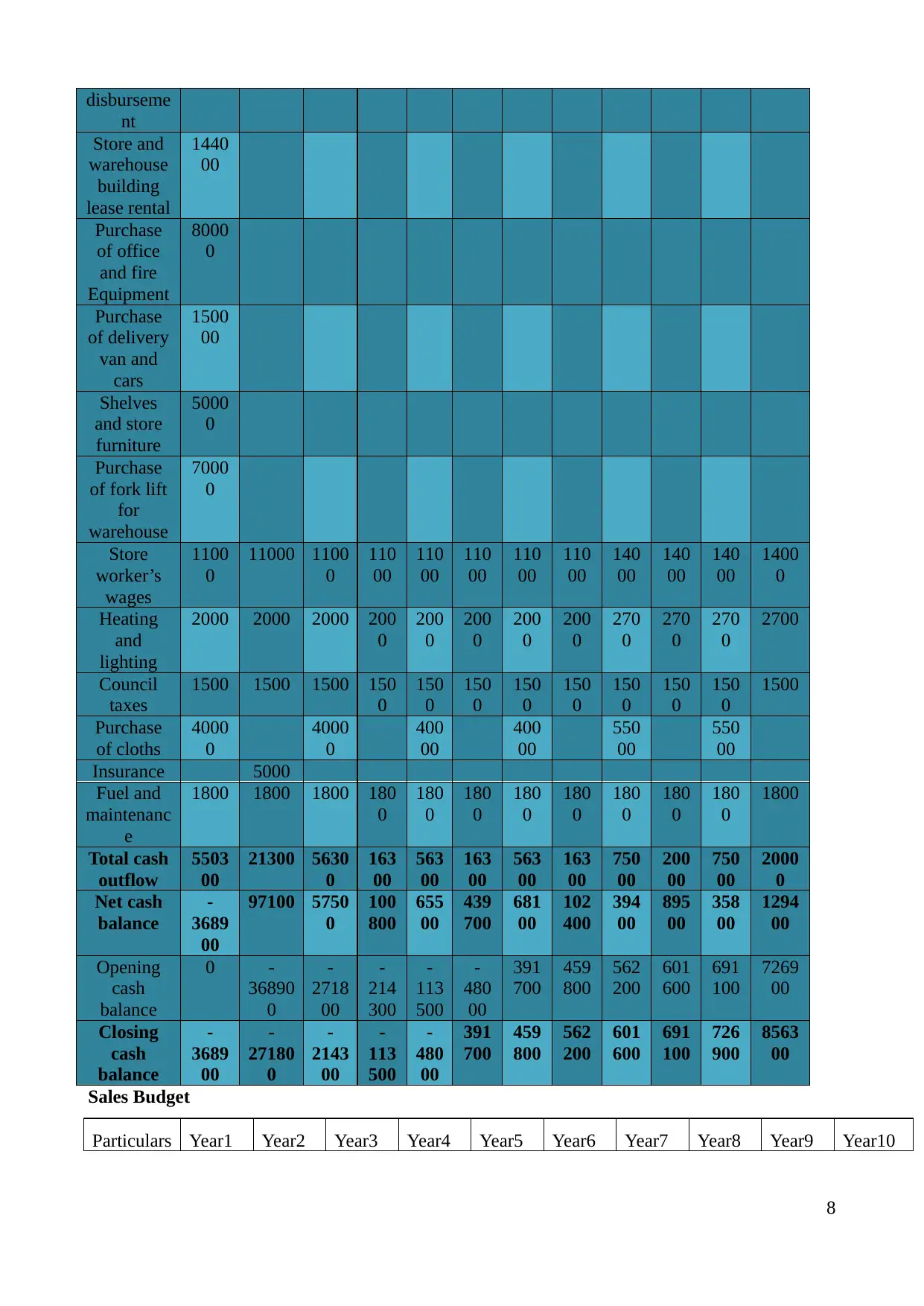

Budgeting- Another important technique used by an individual in the management accounting is

budgets. These budgets will be regarded as comparison tool through which an entity can reconcile

their past performance with their current performance and the differences will be rectified by the

manager taking best appropriate actions (Brandau, Endenich, Trapp and Hoffjan, 2013). The future

6

components such as cost, sales and the final outcome every business wants to generate that is the

profit earned by an individual. Costs and sales has inverse or indirect proportion among each other

as one factor increases which leads to the decrease in another element. Increases in amount of

expenditure in the business will in turn reduce all the profit earned by an individual in a particular

year. On the other hand, increases in the sales volume of an entity will directly reduce all the

expenditure spends by the owner in their business. Expenditures can be regulated in order to

achieve the target of higher sales which showcases the higher ability of an organisation. The

positive or negative different among these two components will directly affected on the overall

profit of an entity. The final outcome generated by an individual will depends on the total sales

incurred by the firm. Higher amount of sales is essential in order to bear the heavy pressure of

existing or uncertain expenditure pressure. Uncertain expenses incurred in the firm will deteriorate

the performance of an entity which will be monitored by keeping track on the expenditures incurred

regularly in the business which helps in predicting the uncertain expenses in the near future.

Particulars cost per unit Year1 Year2 Year3 Year4 Year5 Year6 Year7 Year8

Units produced 8000 10000 12000 14000 16000 18000 20000 22000

Sales 10 80000 100000 120000 140000 160000 180000 200000 220000

Variable cost 5 40000 50000 60000 70000 80000 90000 100000 110000

Contribution 5 40000 50000 60000 70000 80000 90000 100000 110000

Fixed cost 10000 10000 10000 10000 10000 10000 10000 10000

Profit 30000 40000 50000 60000 70000 80000 90000 100000

Particulars Year1 Year2 Year3 Year4 Year5 Year6 Year7 Year8 Year9 Year10

Fixed cost 10000 10000 10000 10000 10000 10000 10000 10000 10000 10000

Contribution per

unit 5 5 5 5 5 5 5 5 5 5

BEP 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000

Particulars cost per unit Year1 Year2 Year3 Year4 Year5 Year6 Year7

Units produced 8000 10000 12000 14000 16000 18000 20000

Sales 10 80000 100000 120000 140000 160000 180000 200000

Profit 30000 40000 50000 60000 70000 80000 90000

Relationship percentage change among sales and profit 63% 60% 58% 57% 56% 56% 55%

Budgeting- Another important technique used by an individual in the management accounting is

budgets. These budgets will be regarded as comparison tool through which an entity can reconcile

their past performance with their current performance and the differences will be rectified by the

manager taking best appropriate actions (Brandau, Endenich, Trapp and Hoffjan, 2013). The future

6

performance of an entity can be predicted by an individual by making budgets of all the components

involved in the business. The budgeting tool used by the management will be regarded as the best

suitable tool in forecasting of all the events takes places in the business enterprise in order to get

competitive advantage over its variety of rival members. The competition in the market can be

recognises as this would help in taking advantages by the owner in analysing their existing

resources which can be applied in the firm in different manner. The owner will come to know the

strengths and weaknesses of their business by determining surplus or deficits. Cash budgets can be

prepared in order to ascertain the overall movement of cash knows in the whole business. The

authorities are provided with enough responsibility in order to handle the cash available in the

business which will be spent on different activities in boosting the efficiency of the existing firm.

Particular

s

Jan Feb Mar

ch

Apr

il

Ma

y

Jun

e

Jul

y

Au

g

Sep

t

Oct Nov Dec

Initial cash 5000

0

Bank loan 5500

0

Income

from

online

sales

3200

0

40000 3500

0

380

00

410

00

420

00

360

00

280

00

270

00

275

00

280

00

3300

0

Income

from in-

store sales

2240

0

56400 5680

0

571

00

588

00

620

00

664

00

687

00

654

00

600

00

608

00

6440

0

Sales

income

from

fashion

clothing

1000

0

10000 1000

0

100

00

100

00

100

00

100

00

100

00

100

00

100

00

100

00

1000

0

Sales

income

from hair

and beauty

products

1200

0

12000 1200

0

120

00

120

00

120

00

120

00

120

00

120

00

120

00

120

00

1200

0

Receipts

from

disposal of

old store

building

300

000

Total

interest

receivables

300

00

3000

0

Total cash

income

1814

00

11840

0

1138

00

117

100

121

800

456

000

124

400

118

700

114

400

109

500

110

800

1494

00

Cash

7

involved in the business. The budgeting tool used by the management will be regarded as the best

suitable tool in forecasting of all the events takes places in the business enterprise in order to get

competitive advantage over its variety of rival members. The competition in the market can be

recognises as this would help in taking advantages by the owner in analysing their existing

resources which can be applied in the firm in different manner. The owner will come to know the

strengths and weaknesses of their business by determining surplus or deficits. Cash budgets can be

prepared in order to ascertain the overall movement of cash knows in the whole business. The

authorities are provided with enough responsibility in order to handle the cash available in the

business which will be spent on different activities in boosting the efficiency of the existing firm.

Particular

s

Jan Feb Mar

ch

Apr

il

Ma

y

Jun

e

Jul

y

Au

g

Sep

t

Oct Nov Dec

Initial cash 5000

0

Bank loan 5500

0

Income

from

online

sales

3200

0

40000 3500

0

380

00

410

00

420

00

360

00

280

00

270

00

275

00

280

00

3300

0

Income

from in-

store sales

2240

0

56400 5680

0

571

00

588

00

620

00

664

00

687

00

654

00

600

00

608

00

6440

0

Sales

income

from

fashion

clothing

1000

0

10000 1000

0

100

00

100

00

100

00

100

00

100

00

100

00

100

00

100

00

1000

0

Sales

income

from hair

and beauty

products

1200

0

12000 1200

0

120

00

120

00

120

00

120

00

120

00

120

00

120

00

120

00

1200

0

Receipts

from

disposal of

old store

building

300

000

Total

interest

receivables

300

00

3000

0

Total cash

income

1814

00

11840

0

1138

00

117

100

121

800

456

000

124

400

118

700

114

400

109

500

110

800

1494

00

Cash

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

disburseme

nt

Store and

warehouse

building

lease rental

1440

00

Purchase

of office

and fire

Equipment

8000

0

Purchase

of delivery

van and

cars

1500

00

Shelves

and store

furniture

5000

0

Purchase

of fork lift

for

warehouse

7000

0

Store

worker’s

wages

1100

0

11000 1100

0

110

00

110

00

110

00

110

00

110

00

140

00

140

00

140

00

1400

0

Heating

and

lighting

2000 2000 2000 200

0

200

0

200

0

200

0

200

0

270

0

270

0

270

0

2700

Council

taxes

1500 1500 1500 150

0

150

0

150

0

150

0

150

0

150

0

150

0

150

0

1500

Purchase

of cloths

4000

0

4000

0

400

00

400

00

550

00

550

00

Insurance 5000

Fuel and

maintenanc

e

1800 1800 1800 180

0

180

0

180

0

180

0

180

0

180

0

180

0

180

0

1800

Total cash

outflow

5503

00

21300 5630

0

163

00

563

00

163

00

563

00

163

00

750

00

200

00

750

00

2000

0

Net cash

balance

-

3689

00

97100 5750

0

100

800

655

00

439

700

681

00

102

400

394

00

895

00

358

00

1294

00

Opening

cash

balance

0 -

36890

0

-

2718

00

-

214

300

-

113

500

-

480

00

391

700

459

800

562

200

601

600

691

100

7269

00

Closing

cash

balance

-

3689

00

-

27180

0

-

2143

00

-

113

500

-

480

00

391

700

459

800

562

200

601

600

691

100

726

900

8563

00

Sales Budget

Particulars Year1 Year2 Year3 Year4 Year5 Year6 Year7 Year8 Year9 Year10

8

nt

Store and

warehouse

building

lease rental

1440

00

Purchase

of office

and fire

Equipment

8000

0

Purchase

of delivery

van and

cars

1500

00

Shelves

and store

furniture

5000

0

Purchase

of fork lift

for

warehouse

7000

0

Store

worker’s

wages

1100

0

11000 1100

0

110

00

110

00

110

00

110

00

110

00

140

00

140

00

140

00

1400

0

Heating

and

lighting

2000 2000 2000 200

0

200

0

200

0

200

0

200

0

270

0

270

0

270

0

2700

Council

taxes

1500 1500 1500 150

0

150

0

150

0

150

0

150

0

150

0

150

0

150

0

1500

Purchase

of cloths

4000

0

4000

0

400

00

400

00

550

00

550

00

Insurance 5000

Fuel and

maintenanc

e

1800 1800 1800 180

0

180

0

180

0

180

0

180

0

180

0

180

0

180

0

1800

Total cash

outflow

5503

00

21300 5630

0

163

00

563

00

163

00

563

00

163

00

750

00

200

00

750

00

2000

0

Net cash

balance

-

3689

00

97100 5750

0

100

800

655

00

439

700

681

00

102

400

394

00

895

00

358

00

1294

00

Opening

cash

balance

0 -

36890

0

-

2718

00

-

214

300

-

113

500

-

480

00

391

700

459

800

562

200

601

600

691

100

7269

00

Closing

cash

balance

-

3689

00

-

27180

0

-

2143

00

-

113

500

-

480

00

391

700

459

800

562

200

601

600

691

100

726

900

8563

00

Sales Budget

Particulars Year1 Year2 Year3 Year4 Year5 Year6 Year7 Year8 Year9 Year10

8

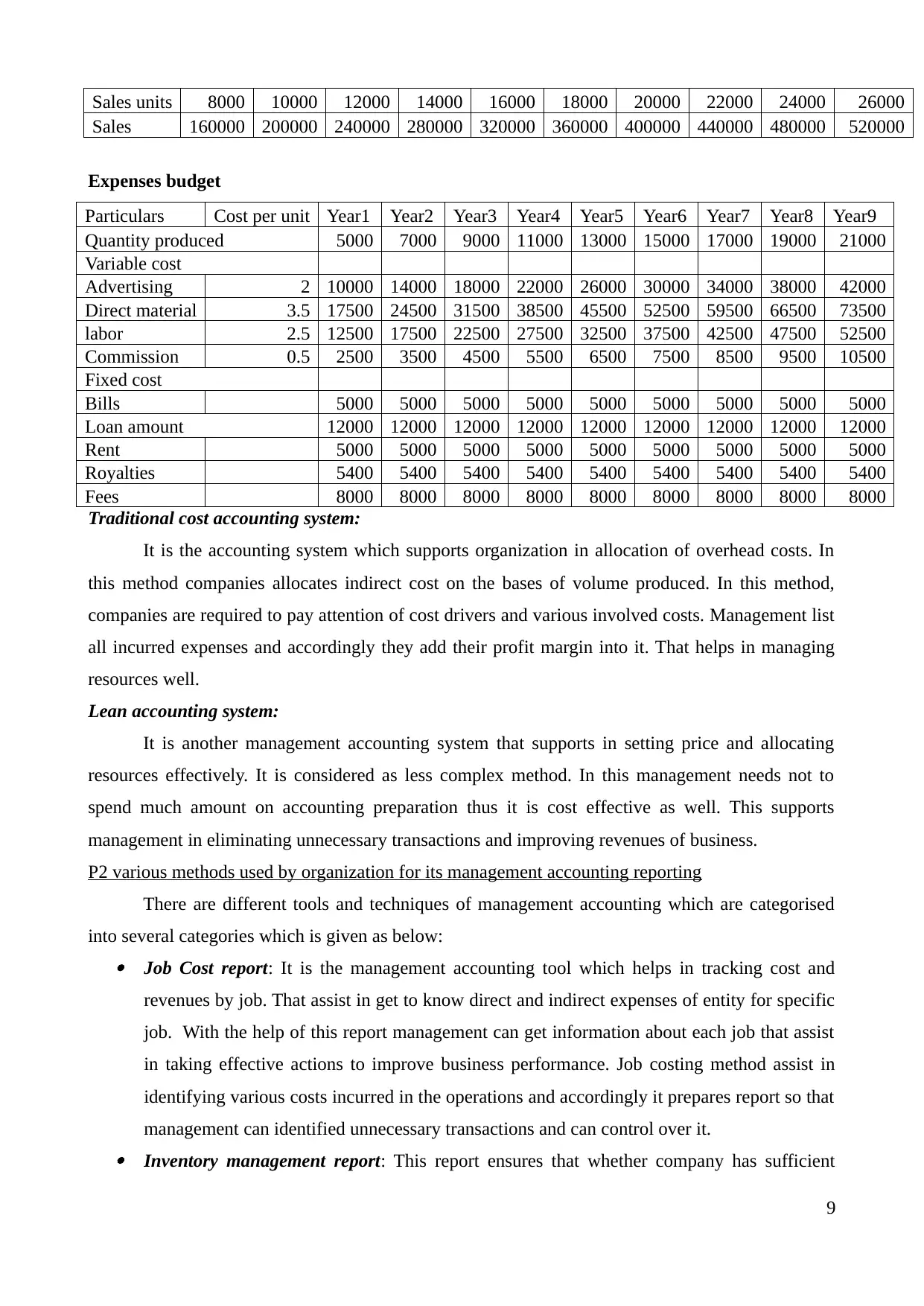

Sales units 8000 10000 12000 14000 16000 18000 20000 22000 24000 26000

Sales 160000 200000 240000 280000 320000 360000 400000 440000 480000 520000

Expenses budget

Particulars Cost per unit Year1 Year2 Year3 Year4 Year5 Year6 Year7 Year8 Year9

Quantity produced 5000 7000 9000 11000 13000 15000 17000 19000 21000

Variable cost

Advertising 2 10000 14000 18000 22000 26000 30000 34000 38000 42000

Direct material 3.5 17500 24500 31500 38500 45500 52500 59500 66500 73500

labor 2.5 12500 17500 22500 27500 32500 37500 42500 47500 52500

Commission 0.5 2500 3500 4500 5500 6500 7500 8500 9500 10500

Fixed cost

Bills 5000 5000 5000 5000 5000 5000 5000 5000 5000

Loan amount 12000 12000 12000 12000 12000 12000 12000 12000 12000

Rent 5000 5000 5000 5000 5000 5000 5000 5000 5000

Royalties 5400 5400 5400 5400 5400 5400 5400 5400 5400

Fees 8000 8000 8000 8000 8000 8000 8000 8000 8000

Traditional cost accounting system:

It is the accounting system which supports organization in allocation of overhead costs. In

this method companies allocates indirect cost on the bases of volume produced. In this method,

companies are required to pay attention of cost drivers and various involved costs. Management list

all incurred expenses and accordingly they add their profit margin into it. That helps in managing

resources well.

Lean accounting system:

It is another management accounting system that supports in setting price and allocating

resources effectively. It is considered as less complex method. In this management needs not to

spend much amount on accounting preparation thus it is cost effective as well. This supports

management in eliminating unnecessary transactions and improving revenues of business.

P2 various methods used by organization for its management accounting reporting

There are different tools and techniques of management accounting which are categorised

into several categories which is given as below: Job Cost report: It is the management accounting tool which helps in tracking cost and

revenues by job. That assist in get to know direct and indirect expenses of entity for specific

job. With the help of this report management can get information about each job that assist

in taking effective actions to improve business performance. Job costing method assist in

identifying various costs incurred in the operations and accordingly it prepares report so that

management can identified unnecessary transactions and can control over it. Inventory management report: This report ensures that whether company has sufficient

9

Sales 160000 200000 240000 280000 320000 360000 400000 440000 480000 520000

Expenses budget

Particulars Cost per unit Year1 Year2 Year3 Year4 Year5 Year6 Year7 Year8 Year9

Quantity produced 5000 7000 9000 11000 13000 15000 17000 19000 21000

Variable cost

Advertising 2 10000 14000 18000 22000 26000 30000 34000 38000 42000

Direct material 3.5 17500 24500 31500 38500 45500 52500 59500 66500 73500

labor 2.5 12500 17500 22500 27500 32500 37500 42500 47500 52500

Commission 0.5 2500 3500 4500 5500 6500 7500 8500 9500 10500

Fixed cost

Bills 5000 5000 5000 5000 5000 5000 5000 5000 5000

Loan amount 12000 12000 12000 12000 12000 12000 12000 12000 12000

Rent 5000 5000 5000 5000 5000 5000 5000 5000 5000

Royalties 5400 5400 5400 5400 5400 5400 5400 5400 5400

Fees 8000 8000 8000 8000 8000 8000 8000 8000 8000

Traditional cost accounting system:

It is the accounting system which supports organization in allocation of overhead costs. In

this method companies allocates indirect cost on the bases of volume produced. In this method,

companies are required to pay attention of cost drivers and various involved costs. Management list

all incurred expenses and accordingly they add their profit margin into it. That helps in managing

resources well.

Lean accounting system:

It is another management accounting system that supports in setting price and allocating

resources effectively. It is considered as less complex method. In this management needs not to

spend much amount on accounting preparation thus it is cost effective as well. This supports

management in eliminating unnecessary transactions and improving revenues of business.

P2 various methods used by organization for its management accounting reporting

There are different tools and techniques of management accounting which are categorised

into several categories which is given as below: Job Cost report: It is the management accounting tool which helps in tracking cost and

revenues by job. That assist in get to know direct and indirect expenses of entity for specific

job. With the help of this report management can get information about each job that assist

in taking effective actions to improve business performance. Job costing method assist in

identifying various costs incurred in the operations and accordingly it prepares report so that

management can identified unnecessary transactions and can control over it. Inventory management report: This report ensures that whether company has sufficient

9

availability of products or not as per the demand. With the help of this statement

management of cited firm can make effective control over the internal controls over its

inventory and can minimize errors. Inventory management is one of the most important part

of business. That helps in effective utilization of resources and minimizing operational costs

of business. Performance report: This report is prepared by including budget and cost report both. It is

considered as most important statement that supports the organization in meeting with its

objective. The main reason of preparing this report is that management can identifies their

operational cost, expenses, income and can prepare budget accordingly. That would support

in minimizing expenditures and improving performance of business.

Budget Report: It is another management accounting tool that assists in analysing financial

performance of the company. This tool supports in identifying availability of economic

resources and allocating resources effectively. By preparing budget report management can

identify which activity will require much cost thus, they can make strategy to reduce

unnecessary expenses and completing task within specific estimated budget. Shortage of

funds type of issues can be minimized with the help of budget report.

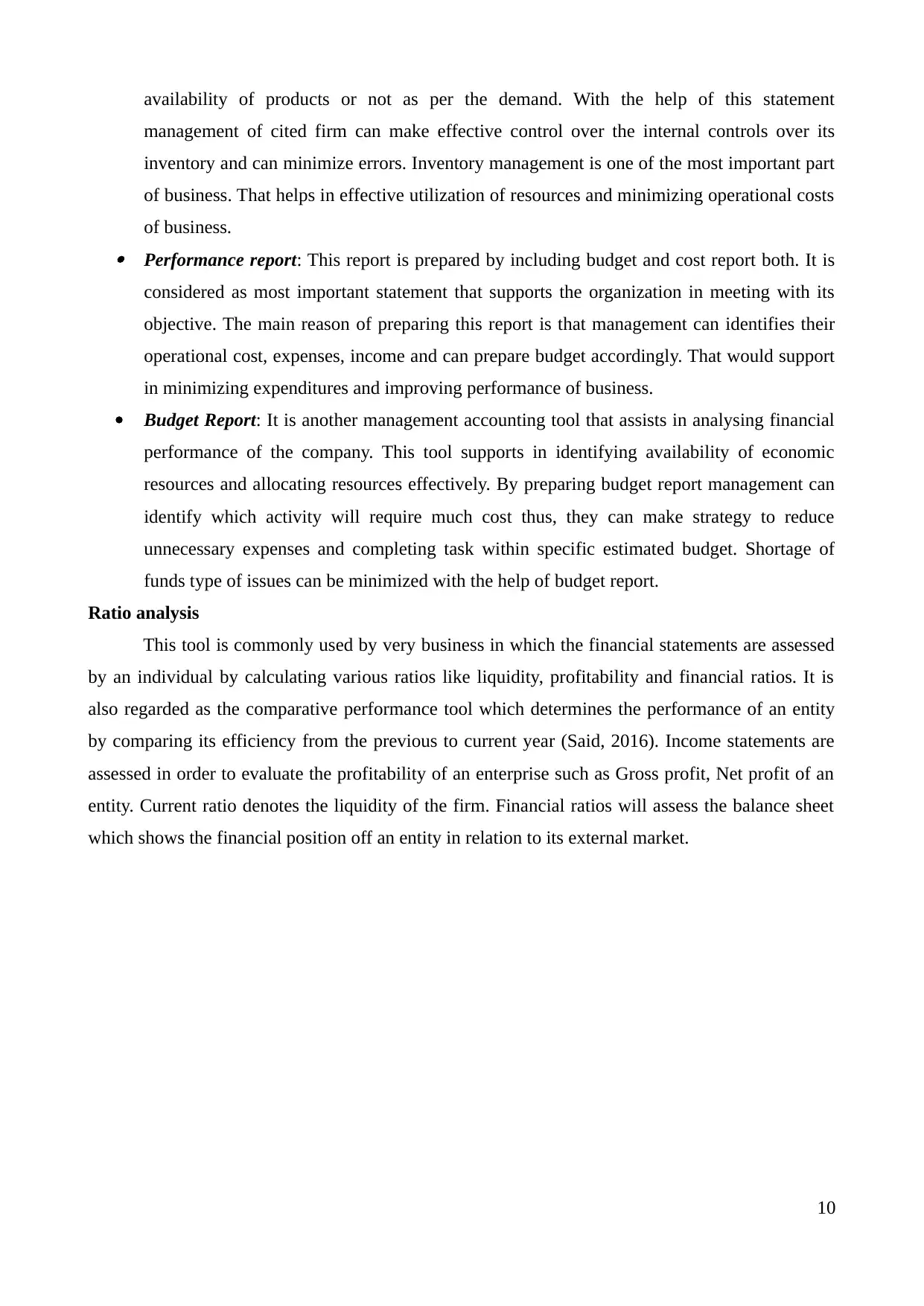

Ratio analysis

This tool is commonly used by very business in which the financial statements are assessed

by an individual by calculating various ratios like liquidity, profitability and financial ratios. It is

also regarded as the comparative performance tool which determines the performance of an entity

by comparing its efficiency from the previous to current year (Said, 2016). Income statements are

assessed in order to evaluate the profitability of an enterprise such as Gross profit, Net profit of an

entity. Current ratio denotes the liquidity of the firm. Financial ratios will assess the balance sheet

which shows the financial position off an entity in relation to its external market.

10

management of cited firm can make effective control over the internal controls over its

inventory and can minimize errors. Inventory management is one of the most important part

of business. That helps in effective utilization of resources and minimizing operational costs

of business. Performance report: This report is prepared by including budget and cost report both. It is

considered as most important statement that supports the organization in meeting with its

objective. The main reason of preparing this report is that management can identifies their

operational cost, expenses, income and can prepare budget accordingly. That would support

in minimizing expenditures and improving performance of business.

Budget Report: It is another management accounting tool that assists in analysing financial

performance of the company. This tool supports in identifying availability of economic

resources and allocating resources effectively. By preparing budget report management can

identify which activity will require much cost thus, they can make strategy to reduce

unnecessary expenses and completing task within specific estimated budget. Shortage of

funds type of issues can be minimized with the help of budget report.

Ratio analysis

This tool is commonly used by very business in which the financial statements are assessed

by an individual by calculating various ratios like liquidity, profitability and financial ratios. It is

also regarded as the comparative performance tool which determines the performance of an entity

by comparing its efficiency from the previous to current year (Said, 2016). Income statements are

assessed in order to evaluate the profitability of an enterprise such as Gross profit, Net profit of an

entity. Current ratio denotes the liquidity of the firm. Financial ratios will assess the balance sheet

which shows the financial position off an entity in relation to its external market.

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Cash flow analysis

Cash flow statement is third most important financial statement prepared by an entity in

order to determine the amount of current cash movement in the business (Renz, 2016). The cash

inflow will be ascertained in order to reduce all the cash outflows generated by an entity in a

particular year. The cash flow are divided into three activities such as operating activities, investing

and financing activities that represents all the activities and operations included in the business of

an individual. Good cash position of an entity is essential in order to maintain appropriate level of

cash in order to repay their market obligations. The cash can be stored when the profit is sufficiently

generated by the firm in paying off all the liabilities currently incurred by the business enterprise.

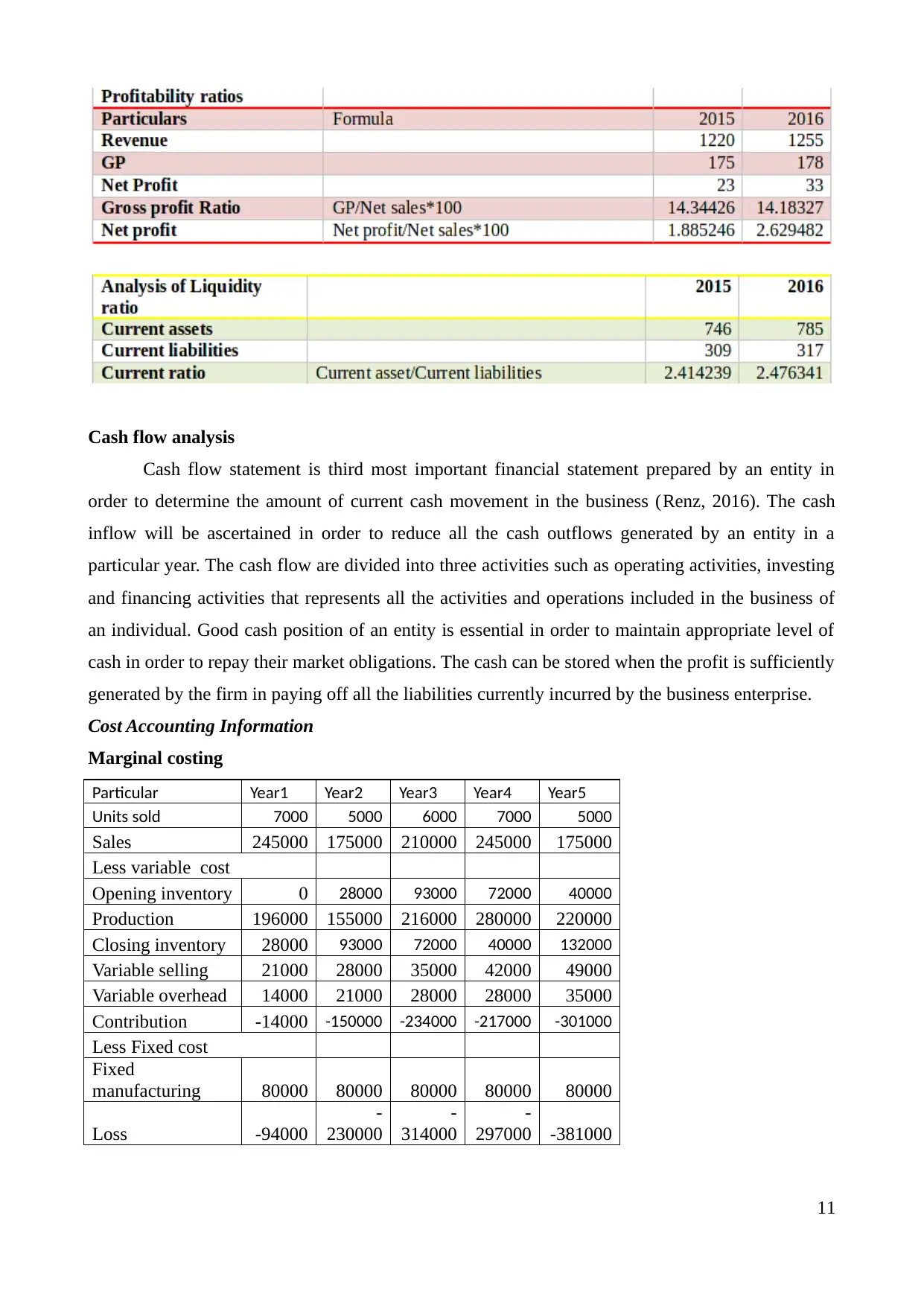

Cost Accounting Information

Marginal costing

Particular Year1 Year2 Year3 Year4 Year5

Units sold 7000 5000 6000 7000 5000

Sales 245000 175000 210000 245000 175000

Less variable cost

Opening inventory 0 28000 93000 72000 40000

Production 196000 155000 216000 280000 220000

Closing inventory 28000 93000 72000 40000 132000

Variable selling 21000 28000 35000 42000 49000

Variable overhead 14000 21000 28000 28000 35000

Contribution -14000 -150000 -234000 -217000 -301000

Less Fixed cost

Fixed

manufacturing 80000 80000 80000 80000 80000

Loss -94000

-

230000

-

314000

-

297000 -381000

11

Cash flow statement is third most important financial statement prepared by an entity in

order to determine the amount of current cash movement in the business (Renz, 2016). The cash

inflow will be ascertained in order to reduce all the cash outflows generated by an entity in a

particular year. The cash flow are divided into three activities such as operating activities, investing

and financing activities that represents all the activities and operations included in the business of

an individual. Good cash position of an entity is essential in order to maintain appropriate level of

cash in order to repay their market obligations. The cash can be stored when the profit is sufficiently

generated by the firm in paying off all the liabilities currently incurred by the business enterprise.

Cost Accounting Information

Marginal costing

Particular Year1 Year2 Year3 Year4 Year5

Units sold 7000 5000 6000 7000 5000

Sales 245000 175000 210000 245000 175000

Less variable cost

Opening inventory 0 28000 93000 72000 40000

Production 196000 155000 216000 280000 220000

Closing inventory 28000 93000 72000 40000 132000

Variable selling 21000 28000 35000 42000 49000

Variable overhead 14000 21000 28000 28000 35000

Contribution -14000 -150000 -234000 -217000 -301000

Less Fixed cost

Fixed

manufacturing 80000 80000 80000 80000 80000

Loss -94000

-

230000

-

314000

-

297000 -381000

11

SP 35

Units produced 8000

Particular Year1 Year2 Year3 Year4 Year5

Direct Material 8 9 11 13 15

Direct labor 5 5 6 7 7

Variable Overhead 2 3 4 4 5

variable selling 3 4 5 6 7

Fixed

manufacturing 10 10 10 10 10

Total production

cost 28 31 36 40 44

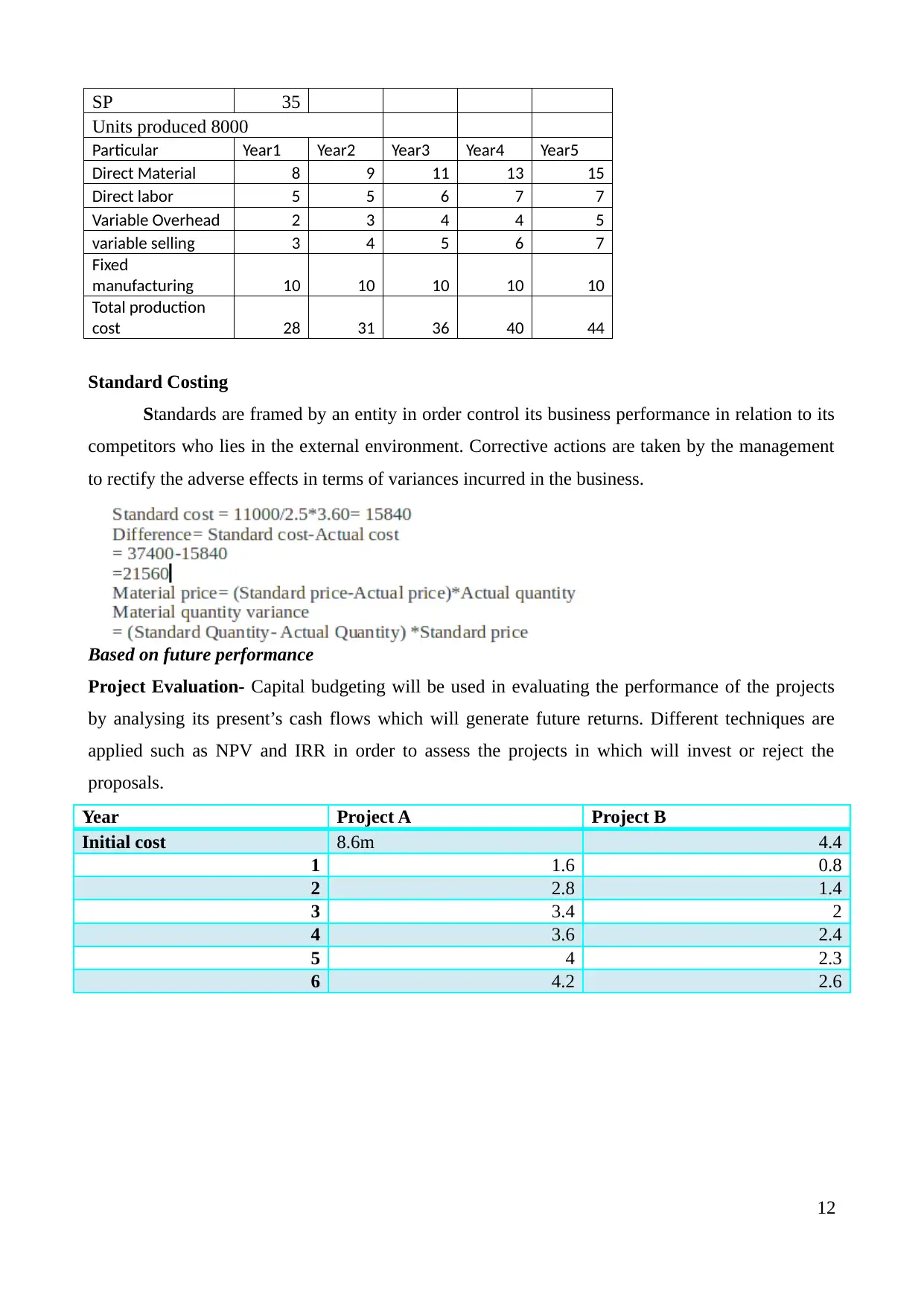

Standard Costing

Standards are framed by an entity in order control its business performance in relation to its

competitors who lies in the external environment. Corrective actions are taken by the management

to rectify the adverse effects in terms of variances incurred in the business.

Based on future performance

Project Evaluation- Capital budgeting will be used in evaluating the performance of the projects

by analysing its present’s cash flows which will generate future returns. Different techniques are

applied such as NPV and IRR in order to assess the projects in which will invest or reject the

proposals.

Year Project A Project B

Initial cost 8.6m 4.4

1 1.6 0.8

2 2.8 1.4

3 3.4 2

4 3.6 2.4

5 4 2.3

6 4.2 2.6

12

Units produced 8000

Particular Year1 Year2 Year3 Year4 Year5

Direct Material 8 9 11 13 15

Direct labor 5 5 6 7 7

Variable Overhead 2 3 4 4 5

variable selling 3 4 5 6 7

Fixed

manufacturing 10 10 10 10 10

Total production

cost 28 31 36 40 44

Standard Costing

Standards are framed by an entity in order control its business performance in relation to its

competitors who lies in the external environment. Corrective actions are taken by the management

to rectify the adverse effects in terms of variances incurred in the business.

Based on future performance

Project Evaluation- Capital budgeting will be used in evaluating the performance of the projects

by analysing its present’s cash flows which will generate future returns. Different techniques are

applied such as NPV and IRR in order to assess the projects in which will invest or reject the

proposals.

Year Project A Project B

Initial cost 8.6m 4.4

1 1.6 0.8

2 2.8 1.4

3 3.4 2

4 3.6 2.4

5 4 2.3

6 4.2 2.6

12

Year Project

A

Project

B

Initial

cost

-8.6 -4.4

1 1.6 0.8

2 2.8 1.4

3 3.4 2

4 3.6 2.4

5 4 2.3

6 4.2 2.6

IRR 25% 30%

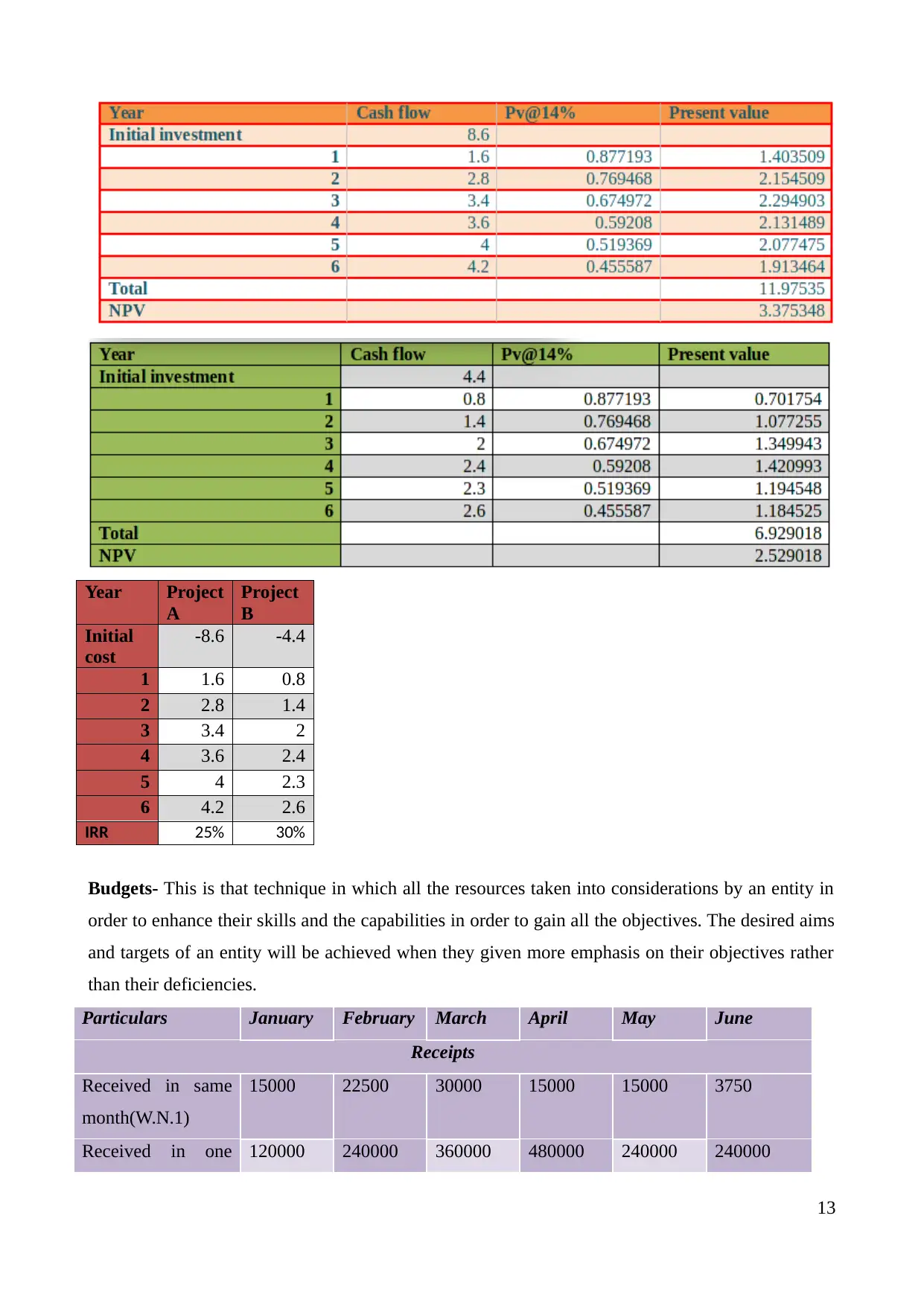

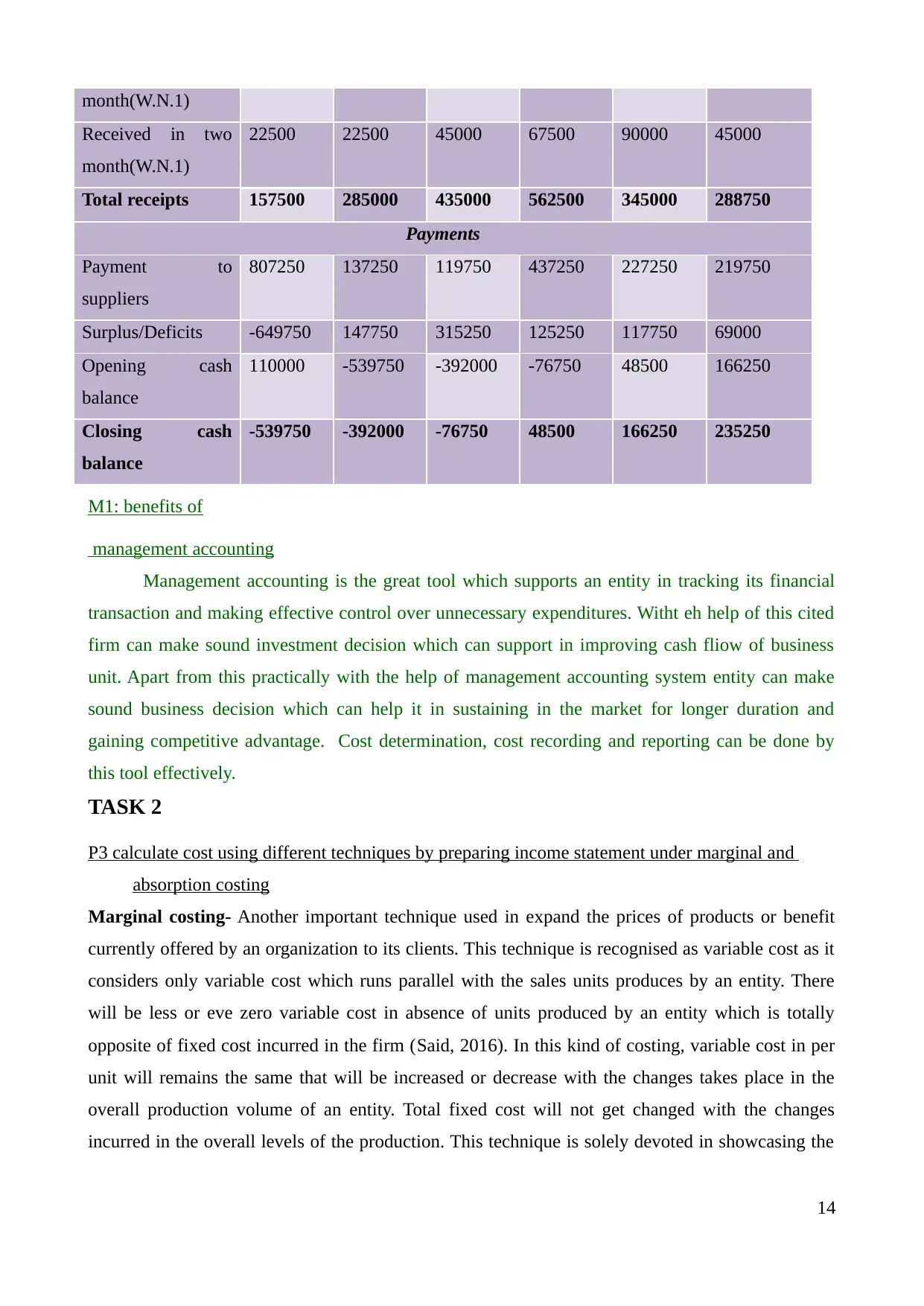

Budgets- This is that technique in which all the resources taken into considerations by an entity in

order to enhance their skills and the capabilities in order to gain all the objectives. The desired aims

and targets of an entity will be achieved when they given more emphasis on their objectives rather

than their deficiencies.

Particulars January February March April May June

Receipts

Received in same

month(W.N.1)

15000 22500 30000 15000 15000 3750

Received in one 120000 240000 360000 480000 240000 240000

13

A

Project

B

Initial

cost

-8.6 -4.4

1 1.6 0.8

2 2.8 1.4

3 3.4 2

4 3.6 2.4

5 4 2.3

6 4.2 2.6

IRR 25% 30%

Budgets- This is that technique in which all the resources taken into considerations by an entity in

order to enhance their skills and the capabilities in order to gain all the objectives. The desired aims

and targets of an entity will be achieved when they given more emphasis on their objectives rather

than their deficiencies.

Particulars January February March April May June

Receipts

Received in same

month(W.N.1)

15000 22500 30000 15000 15000 3750

Received in one 120000 240000 360000 480000 240000 240000

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

month(W.N.1)

Received in two

month(W.N.1)

22500 22500 45000 67500 90000 45000

Total receipts 157500 285000 435000 562500 345000 288750

Payments

Payment to

suppliers

807250 137250 119750 437250 227250 219750

Surplus/Deficits -649750 147750 315250 125250 117750 69000

Opening cash

balance

110000 -539750 -392000 -76750 48500 166250

Closing cash

balance

-539750 -392000 -76750 48500 166250 235250

M1: benefits of

management accounting

Management accounting is the great tool which supports an entity in tracking its financial

transaction and making effective control over unnecessary expenditures. Witht eh help of this cited

firm can make sound investment decision which can support in improving cash fliow of business

unit. Apart from this practically with the help of management accounting system entity can make

sound business decision which can help it in sustaining in the market for longer duration and

gaining competitive advantage. Cost determination, cost recording and reporting can be done by

this tool effectively.

TASK 2

P3 calculate cost using different techniques by preparing income statement under marginal and

absorption costing

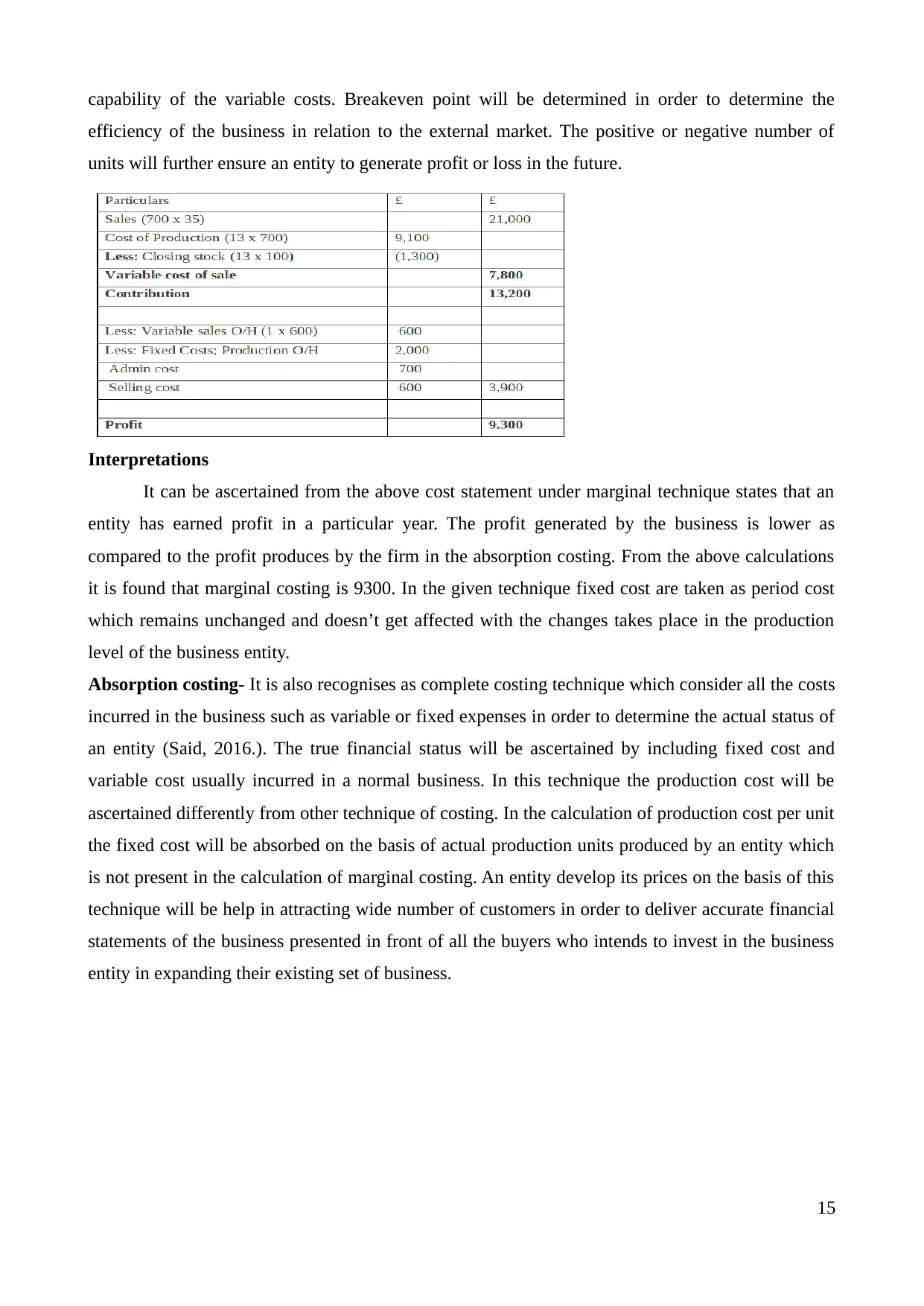

Marginal costing- Another important technique used in expand the prices of products or benefit

currently offered by an organization to its clients. This technique is recognised as variable cost as it

considers only variable cost which runs parallel with the sales units produces by an entity. There

will be less or eve zero variable cost in absence of units produced by an entity which is totally

opposite of fixed cost incurred in the firm (Said, 2016). In this kind of costing, variable cost in per

unit will remains the same that will be increased or decrease with the changes takes place in the

overall production volume of an entity. Total fixed cost will not get changed with the changes

incurred in the overall levels of the production. This technique is solely devoted in showcasing the

14

Received in two

month(W.N.1)

22500 22500 45000 67500 90000 45000

Total receipts 157500 285000 435000 562500 345000 288750

Payments

Payment to

suppliers

807250 137250 119750 437250 227250 219750

Surplus/Deficits -649750 147750 315250 125250 117750 69000

Opening cash

balance

110000 -539750 -392000 -76750 48500 166250

Closing cash

balance

-539750 -392000 -76750 48500 166250 235250

M1: benefits of

management accounting

Management accounting is the great tool which supports an entity in tracking its financial

transaction and making effective control over unnecessary expenditures. Witht eh help of this cited

firm can make sound investment decision which can support in improving cash fliow of business

unit. Apart from this practically with the help of management accounting system entity can make

sound business decision which can help it in sustaining in the market for longer duration and

gaining competitive advantage. Cost determination, cost recording and reporting can be done by

this tool effectively.

TASK 2

P3 calculate cost using different techniques by preparing income statement under marginal and

absorption costing

Marginal costing- Another important technique used in expand the prices of products or benefit

currently offered by an organization to its clients. This technique is recognised as variable cost as it

considers only variable cost which runs parallel with the sales units produces by an entity. There

will be less or eve zero variable cost in absence of units produced by an entity which is totally

opposite of fixed cost incurred in the firm (Said, 2016). In this kind of costing, variable cost in per

unit will remains the same that will be increased or decrease with the changes takes place in the

overall production volume of an entity. Total fixed cost will not get changed with the changes

incurred in the overall levels of the production. This technique is solely devoted in showcasing the

14

capability of the variable costs. Breakeven point will be determined in order to determine the

efficiency of the business in relation to the external market. The positive or negative number of

units will further ensure an entity to generate profit or loss in the future.

Interpretations

It can be ascertained from the above cost statement under marginal technique states that an

entity has earned profit in a particular year. The profit generated by the business is lower as

compared to the profit produces by the firm in the absorption costing. From the above calculations

it is found that marginal costing is 9300. In the given technique fixed cost are taken as period cost

which remains unchanged and doesn’t get affected with the changes takes place in the production

level of the business entity.

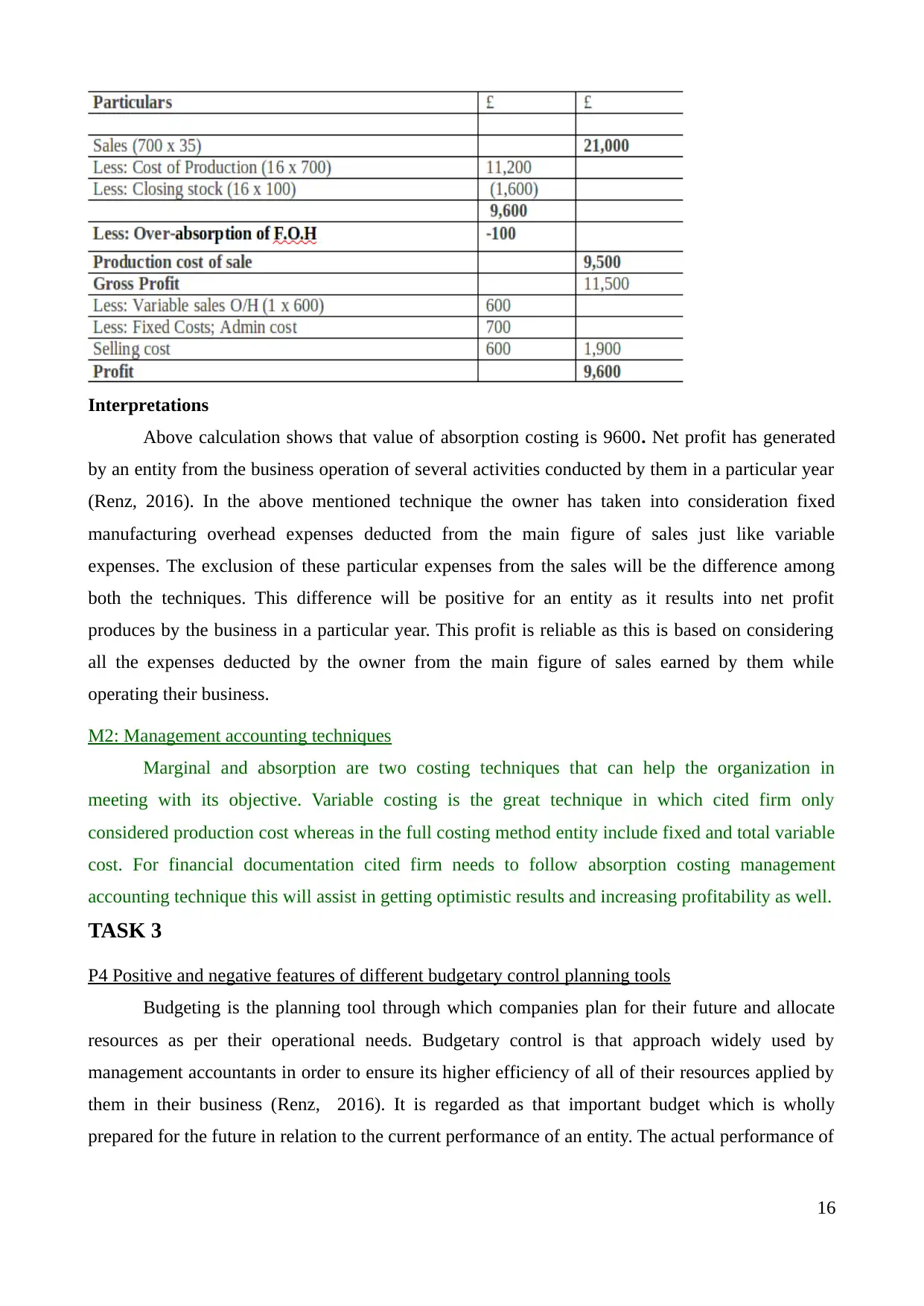

Absorption costing- It is also recognises as complete costing technique which consider all the costs

incurred in the business such as variable or fixed expenses in order to determine the actual status of

an entity (Said, 2016.). The true financial status will be ascertained by including fixed cost and

variable cost usually incurred in a normal business. In this technique the production cost will be

ascertained differently from other technique of costing. In the calculation of production cost per unit

the fixed cost will be absorbed on the basis of actual production units produced by an entity which

is not present in the calculation of marginal costing. An entity develop its prices on the basis of this

technique will be help in attracting wide number of customers in order to deliver accurate financial

statements of the business presented in front of all the buyers who intends to invest in the business

entity in expanding their existing set of business.

15

efficiency of the business in relation to the external market. The positive or negative number of

units will further ensure an entity to generate profit or loss in the future.

Interpretations

It can be ascertained from the above cost statement under marginal technique states that an

entity has earned profit in a particular year. The profit generated by the business is lower as

compared to the profit produces by the firm in the absorption costing. From the above calculations

it is found that marginal costing is 9300. In the given technique fixed cost are taken as period cost

which remains unchanged and doesn’t get affected with the changes takes place in the production

level of the business entity.

Absorption costing- It is also recognises as complete costing technique which consider all the costs

incurred in the business such as variable or fixed expenses in order to determine the actual status of

an entity (Said, 2016.). The true financial status will be ascertained by including fixed cost and

variable cost usually incurred in a normal business. In this technique the production cost will be

ascertained differently from other technique of costing. In the calculation of production cost per unit

the fixed cost will be absorbed on the basis of actual production units produced by an entity which

is not present in the calculation of marginal costing. An entity develop its prices on the basis of this

technique will be help in attracting wide number of customers in order to deliver accurate financial

statements of the business presented in front of all the buyers who intends to invest in the business

entity in expanding their existing set of business.

15

Interpretations

Above calculation shows that value of absorption costing is 9600. Net profit has generated

by an entity from the business operation of several activities conducted by them in a particular year

(Renz, 2016). In the above mentioned technique the owner has taken into consideration fixed

manufacturing overhead expenses deducted from the main figure of sales just like variable

expenses. The exclusion of these particular expenses from the sales will be the difference among

both the techniques. This difference will be positive for an entity as it results into net profit

produces by the business in a particular year. This profit is reliable as this is based on considering

all the expenses deducted by the owner from the main figure of sales earned by them while

operating their business.

M2: Management accounting techniques

Marginal and absorption are two costing techniques that can help the organization in

meeting with its objective. Variable costing is the great technique in which cited firm only

considered production cost whereas in the full costing method entity include fixed and total variable

cost. For financial documentation cited firm needs to follow absorption costing management

accounting technique this will assist in getting optimistic results and increasing profitability as well.

TASK 3

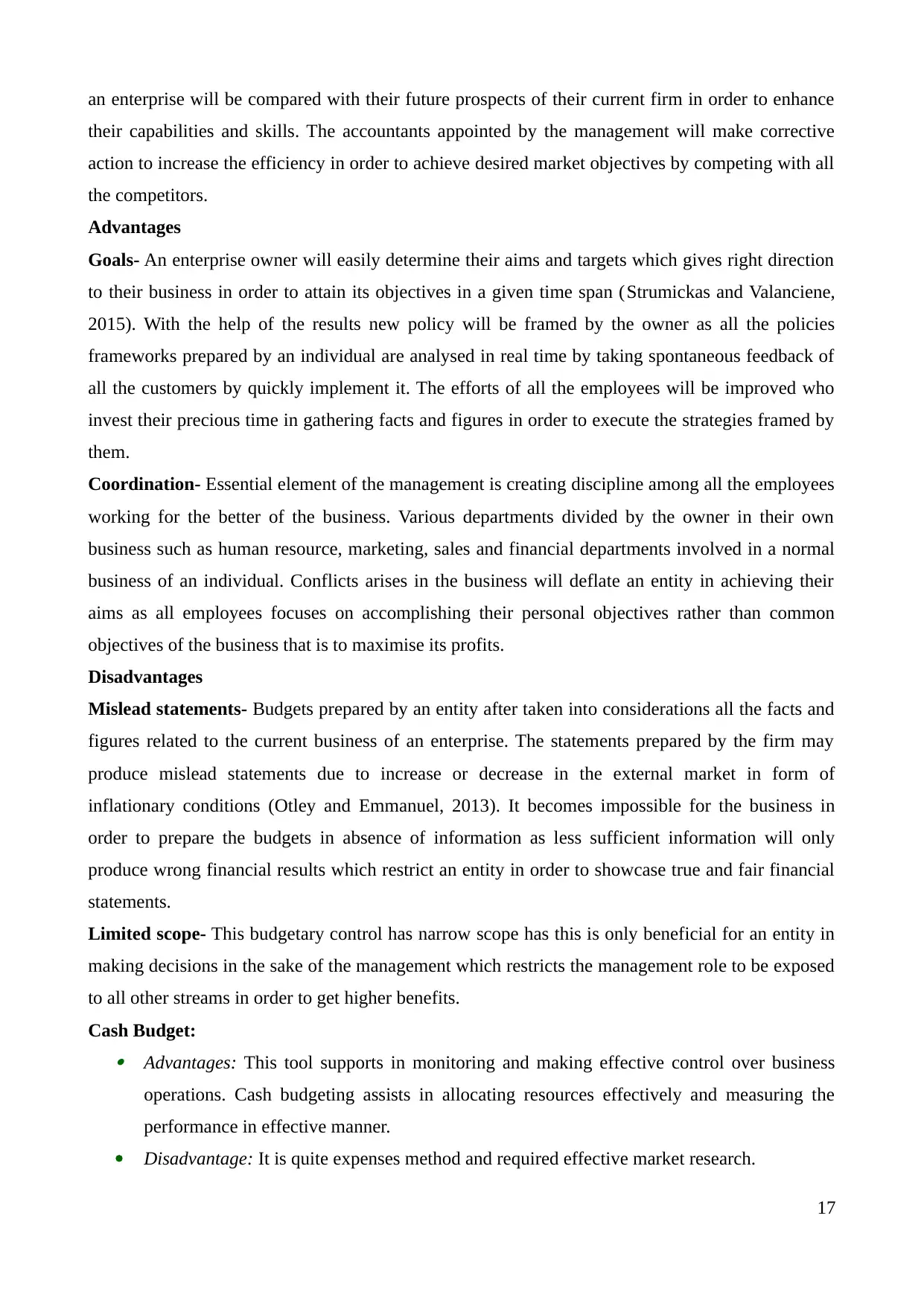

P4 Positive and negative features of different budgetary control planning tools

Budgeting is the planning tool through which companies plan for their future and allocate

resources as per their operational needs. Budgetary control is that approach widely used by

management accountants in order to ensure its higher efficiency of all of their resources applied by

them in their business (Renz, 2016). It is regarded as that important budget which is wholly

prepared for the future in relation to the current performance of an entity. The actual performance of

16

Above calculation shows that value of absorption costing is 9600. Net profit has generated

by an entity from the business operation of several activities conducted by them in a particular year

(Renz, 2016). In the above mentioned technique the owner has taken into consideration fixed

manufacturing overhead expenses deducted from the main figure of sales just like variable

expenses. The exclusion of these particular expenses from the sales will be the difference among

both the techniques. This difference will be positive for an entity as it results into net profit

produces by the business in a particular year. This profit is reliable as this is based on considering

all the expenses deducted by the owner from the main figure of sales earned by them while

operating their business.

M2: Management accounting techniques

Marginal and absorption are two costing techniques that can help the organization in

meeting with its objective. Variable costing is the great technique in which cited firm only

considered production cost whereas in the full costing method entity include fixed and total variable

cost. For financial documentation cited firm needs to follow absorption costing management

accounting technique this will assist in getting optimistic results and increasing profitability as well.

TASK 3

P4 Positive and negative features of different budgetary control planning tools

Budgeting is the planning tool through which companies plan for their future and allocate

resources as per their operational needs. Budgetary control is that approach widely used by

management accountants in order to ensure its higher efficiency of all of their resources applied by

them in their business (Renz, 2016). It is regarded as that important budget which is wholly

prepared for the future in relation to the current performance of an entity. The actual performance of

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

an enterprise will be compared with their future prospects of their current firm in order to enhance

their capabilities and skills. The accountants appointed by the management will make corrective

action to increase the efficiency in order to achieve desired market objectives by competing with all

the competitors.

Advantages

Goals- An enterprise owner will easily determine their aims and targets which gives right direction

to their business in order to attain its objectives in a given time span (Strumickas and Valanciene,

2015). With the help of the results new policy will be framed by the owner as all the policies

frameworks prepared by an individual are analysed in real time by taking spontaneous feedback of

all the customers by quickly implement it. The efforts of all the employees will be improved who

invest their precious time in gathering facts and figures in order to execute the strategies framed by

them.

Coordination- Essential element of the management is creating discipline among all the employees

working for the better of the business. Various departments divided by the owner in their own

business such as human resource, marketing, sales and financial departments involved in a normal

business of an individual. Conflicts arises in the business will deflate an entity in achieving their

aims as all employees focuses on accomplishing their personal objectives rather than common

objectives of the business that is to maximise its profits.

Disadvantages

Mislead statements- Budgets prepared by an entity after taken into considerations all the facts and

figures related to the current business of an enterprise. The statements prepared by the firm may

produce mislead statements due to increase or decrease in the external market in form of

inflationary conditions (Otley and Emmanuel, 2013). It becomes impossible for the business in

order to prepare the budgets in absence of information as less sufficient information will only

produce wrong financial results which restrict an entity in order to showcase true and fair financial

statements.

Limited scope- This budgetary control has narrow scope has this is only beneficial for an entity in

making decisions in the sake of the management which restricts the management role to be exposed

to all other streams in order to get higher benefits.

Cash Budget: Advantages: This tool supports in monitoring and making effective control over business

operations. Cash budgeting assists in allocating resources effectively and measuring the

performance in effective manner.

Disadvantage: It is quite expenses method and required effective market research.

17

their capabilities and skills. The accountants appointed by the management will make corrective

action to increase the efficiency in order to achieve desired market objectives by competing with all

the competitors.

Advantages

Goals- An enterprise owner will easily determine their aims and targets which gives right direction

to their business in order to attain its objectives in a given time span (Strumickas and Valanciene,

2015). With the help of the results new policy will be framed by the owner as all the policies

frameworks prepared by an individual are analysed in real time by taking spontaneous feedback of

all the customers by quickly implement it. The efforts of all the employees will be improved who

invest their precious time in gathering facts and figures in order to execute the strategies framed by

them.

Coordination- Essential element of the management is creating discipline among all the employees

working for the better of the business. Various departments divided by the owner in their own

business such as human resource, marketing, sales and financial departments involved in a normal

business of an individual. Conflicts arises in the business will deflate an entity in achieving their

aims as all employees focuses on accomplishing their personal objectives rather than common

objectives of the business that is to maximise its profits.

Disadvantages

Mislead statements- Budgets prepared by an entity after taken into considerations all the facts and

figures related to the current business of an enterprise. The statements prepared by the firm may

produce mislead statements due to increase or decrease in the external market in form of

inflationary conditions (Otley and Emmanuel, 2013). It becomes impossible for the business in

order to prepare the budgets in absence of information as less sufficient information will only

produce wrong financial results which restrict an entity in order to showcase true and fair financial

statements.

Limited scope- This budgetary control has narrow scope has this is only beneficial for an entity in

making decisions in the sake of the management which restricts the management role to be exposed

to all other streams in order to get higher benefits.

Cash Budget: Advantages: This tool supports in monitoring and making effective control over business

operations. Cash budgeting assists in allocating resources effectively and measuring the

performance in effective manner.

Disadvantage: It is quite expenses method and required effective market research.

17

Capital expenditure: Advantage: It is considered as one of the effective tool that supports organization in

selecting most appropriate project. With the help of this point company can take effective

investment decisions. It is time and cost saving approach that helps in improving profit of

the entity.

Disadvantage: It is essential to keep records of all transactions for capital budgeting

otherwise it can give huge loss to entity. Wrong forecasting can create huge pressure of the

organization because it will fail the entire prepared budget.

M3: Use of planning tools and their application

Zero based budgeting techniques is considered as more suitable method because by this way

realistic projection can be done by the management and it can assist in getting high revenues in

future. With the help of this planning tool managers can easily compare effectiveness of operations.

With the help of this technique higher authorities can find out variance and can make strategy to

minimize the gap between estimated and actual budget. By this way chances of getting failure can

be reduced and cited firm can get success.

P5 Compare how an entity adopt management accounting systems in order to deal with the financial

problems

The management accounting tools and techniques emphasises on determining the cost

element incurred in an entity in the near future in advance that helps in enhancing the overall skills

and the capabilities of the business (Renz, 2016). The cost is eliminated in order to achieve the

desired goal and the objectives by an entity which in turn improves the current ability of the

business entity in relation to its outer industry. There are different types of accounting management

stream that is used by an organization will be helpful in amending their current working policy in

facilitating its existing business which is given as below:

Ratio analysis is that technique analyses the past performance of an entity comparing current

with past in order to take important decisions in their business

Business can be boosted in order to provide higher market advantage in order to explore variety

opportunities lies in the external environment. Coordination is another important goal which creates proper alignment among all the activities

of the business in order to get higher market advantage. (Return on investment issue) Key performance indicators: Financial statements, quality of

products, Client satisfaction level are various key performance indicators that supports

organization in identifying loop fall in the system and help in taking appropriate action ion

18

selecting most appropriate project. With the help of this point company can take effective

investment decisions. It is time and cost saving approach that helps in improving profit of

the entity.

Disadvantage: It is essential to keep records of all transactions for capital budgeting

otherwise it can give huge loss to entity. Wrong forecasting can create huge pressure of the

organization because it will fail the entire prepared budget.

M3: Use of planning tools and their application

Zero based budgeting techniques is considered as more suitable method because by this way

realistic projection can be done by the management and it can assist in getting high revenues in

future. With the help of this planning tool managers can easily compare effectiveness of operations.

With the help of this technique higher authorities can find out variance and can make strategy to

minimize the gap between estimated and actual budget. By this way chances of getting failure can

be reduced and cited firm can get success.

P5 Compare how an entity adopt management accounting systems in order to deal with the financial

problems

The management accounting tools and techniques emphasises on determining the cost

element incurred in an entity in the near future in advance that helps in enhancing the overall skills

and the capabilities of the business (Renz, 2016). The cost is eliminated in order to achieve the

desired goal and the objectives by an entity which in turn improves the current ability of the

business entity in relation to its outer industry. There are different types of accounting management

stream that is used by an organization will be helpful in amending their current working policy in

facilitating its existing business which is given as below:

Ratio analysis is that technique analyses the past performance of an entity comparing current

with past in order to take important decisions in their business

Business can be boosted in order to provide higher market advantage in order to explore variety

opportunities lies in the external environment. Coordination is another important goal which creates proper alignment among all the activities

of the business in order to get higher market advantage. (Return on investment issue) Key performance indicators: Financial statements, quality of

products, Client satisfaction level are various key performance indicators that supports

organization in identifying loop fall in the system and help in taking appropriate action ion

18

respect to resolve such problems.

Profit level issue: Comparative financial statements is one of the effective tool through

which company can compare its performance with its competitors. With the help of this tool

it can address its financial problems and can manage its work accordingly. Sometimes due to

ineffective management cited firm fails to identify its expenditures that creates economic

burden on the entity. Through budgeting it can identify which task is required how much

cost then accordingly it can reduce chances of over budget issues.

Growth level issues: It is considered as one of the effective tool which is used by companies

to manage their accounting transactions. Fund flow analyses will support cited firm in

improving its business revenues and improve profitability as well. Whereas cash flow

analyses will help in minimizing cash shortage issues that will assist in accomplish short

term objective of entity.

Cost variances: The cost variance are related with the efficiency. The person is responsible

to find the problem for such kind of unfavorable variances. Variance is like when the cost is

varied between actual and standard. Cost variance is affect the overall organization

performance and structure.

Budgetary control: in this factor the budget must be fixed to achieve the objective of the

organization. It fixs the target for the firm and it also provides better coordination and

communication between the departments of the entity. It facilitates integrated system with

separate activity in the firm.

Benchmarking: It is considered as one of the effective method which support the

organization ion responding to financial problems and resolving them. By looking at

benchmarks and standards cited firm can conduct operation in effective manner by this way

issues related to cash flow can be minimized.

Budgetary targeting: It is another management accounting tool which supports organization

in identifying loop fall in the operation. This tool supports in utilizing resources well and

minimizing unnecessary expenditures.

M4: Responding financial problems

Ratio analysis is the great tool which support organization in comparing the performance of

business and by this way it can identify loop fall. This strategy can support in improving operations

and profit of the organization. Difference in expected budget and actual budget is major financial

problem faced by cited firm. In order to resolve this problem company can apply variance analysis

tool. By this way it will be able to minimize gap between both these budgets. This management

19

Profit level issue: Comparative financial statements is one of the effective tool through

which company can compare its performance with its competitors. With the help of this tool

it can address its financial problems and can manage its work accordingly. Sometimes due to

ineffective management cited firm fails to identify its expenditures that creates economic

burden on the entity. Through budgeting it can identify which task is required how much

cost then accordingly it can reduce chances of over budget issues.

Growth level issues: It is considered as one of the effective tool which is used by companies

to manage their accounting transactions. Fund flow analyses will support cited firm in

improving its business revenues and improve profitability as well. Whereas cash flow

analyses will help in minimizing cash shortage issues that will assist in accomplish short

term objective of entity.

Cost variances: The cost variance are related with the efficiency. The person is responsible

to find the problem for such kind of unfavorable variances. Variance is like when the cost is

varied between actual and standard. Cost variance is affect the overall organization

performance and structure.

Budgetary control: in this factor the budget must be fixed to achieve the objective of the

organization. It fixs the target for the firm and it also provides better coordination and

communication between the departments of the entity. It facilitates integrated system with

separate activity in the firm.

Benchmarking: It is considered as one of the effective method which support the

organization ion responding to financial problems and resolving them. By looking at