Financial Accounting

VerifiedAdded on 2023/01/18

|12

|1333

|1

AI Summary

This document provides an analysis of acquisition and worksheet entries for Smart Ltd and Positive Ltd. It also includes an analysis of Ping Pong Ltd and worksheet entries in its books. The document covers various aspects of financial accounting and includes relevant tables and figures.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: FINANCIAL ACCOUNTING

Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1FINANCIAL ACCOUNTING

Table of Contents

Question 1:.......................................................................................................................................2

1. Acquisition analysis of Smart Ltd:..............................................................................................2

2. Worksheet entries for Positive Ltd’s group:................................................................................3

3. Worksheet for Positive Ltd:.........................................................................................................4

Question 2:.......................................................................................................................................6

1. Acquisition analysis:....................................................................................................................6

2. Worksheet entries in the books of Ping Pong Ltd:......................................................................7

Bibliography:.................................................................................................................................10

Table of Contents

Question 1:.......................................................................................................................................2

1. Acquisition analysis of Smart Ltd:..............................................................................................2

2. Worksheet entries for Positive Ltd’s group:................................................................................3

3. Worksheet for Positive Ltd:.........................................................................................................4

Question 2:.......................................................................................................................................6

1. Acquisition analysis:....................................................................................................................6

2. Worksheet entries in the books of Ping Pong Ltd:......................................................................7

Bibliography:.................................................................................................................................10

2FINANCIAL ACCOUNTING

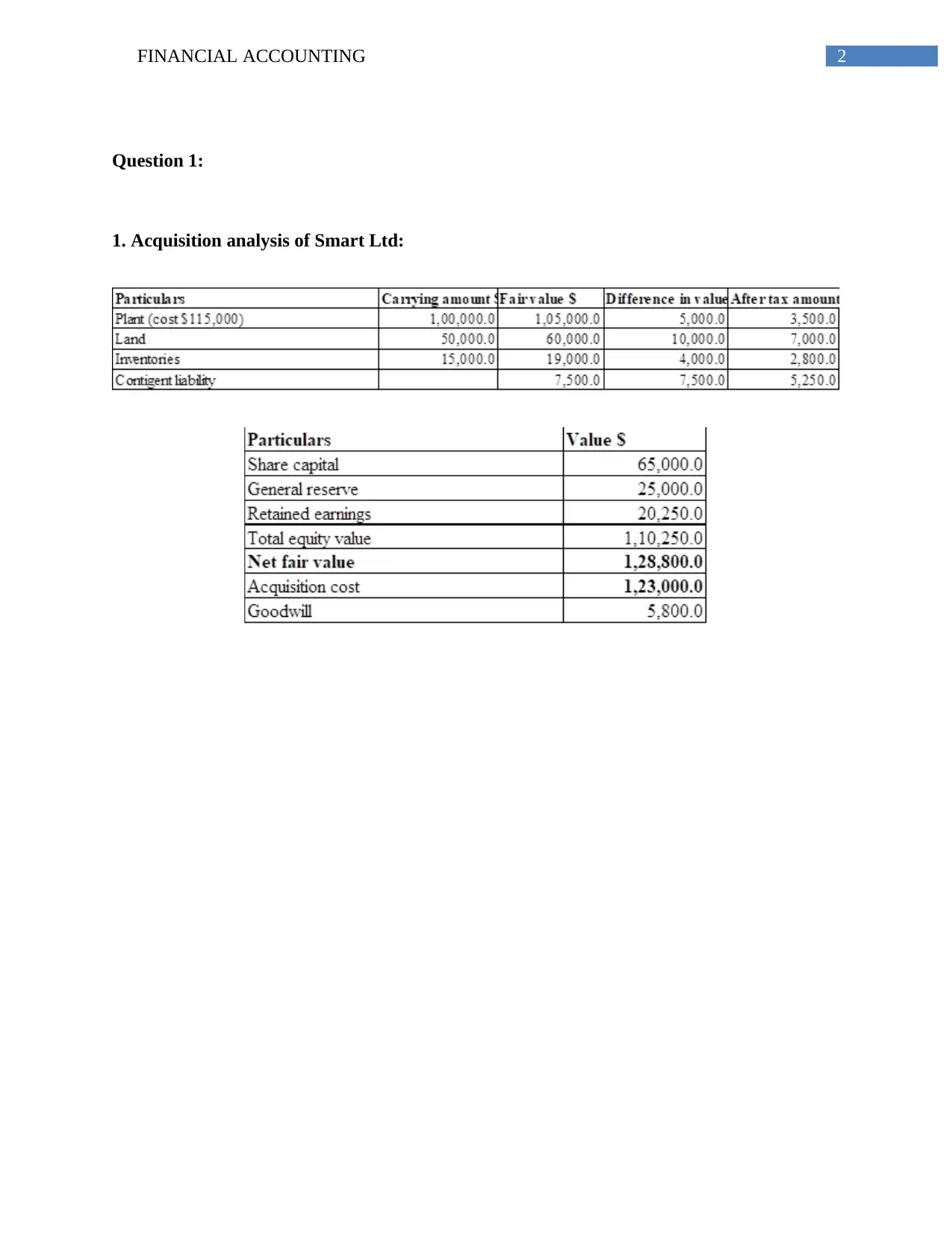

Question 1:

1. Acquisition analysis of Smart Ltd:

Question 1:

1. Acquisition analysis of Smart Ltd:

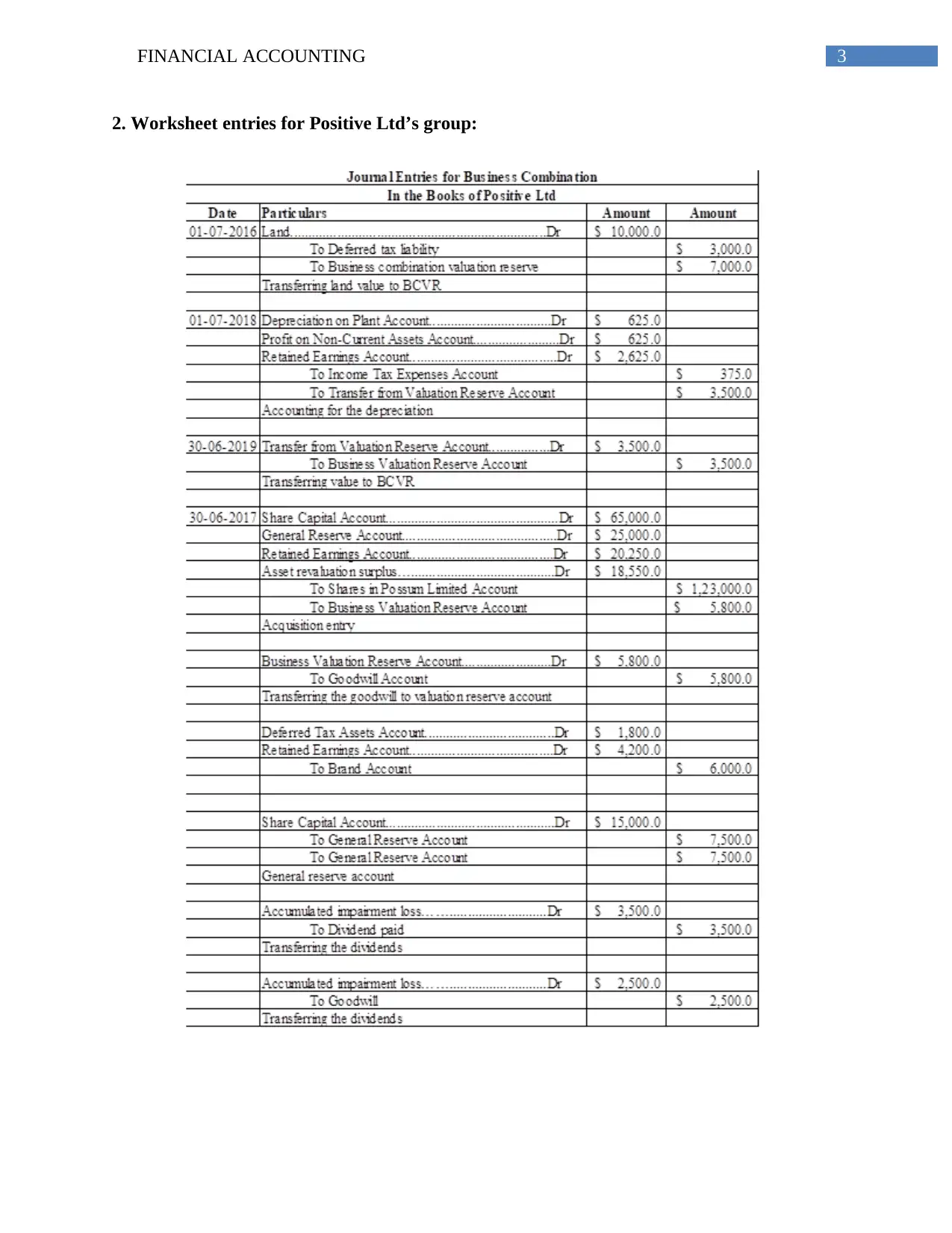

3FINANCIAL ACCOUNTING

2. Worksheet entries for Positive Ltd’s group:

2. Worksheet entries for Positive Ltd’s group:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4FINANCIAL ACCOUNTING

3. Worksheet for Positive Ltd:

Particulars

Positive

Ltd $

Smart

Ltd $

Adjustments

Debit Credit Group

Revenue

$

45,000.0

$

32,000.0

$

77,000.0

Expenses

$

17,000.0

$

21,000.0

$

625.0

$

38,625.0

Trading profit

$

28,000.0

$

11,000.0

$

38,375.0

Gains (losses) on sale of

non-current assets

$

4,000.0

$

4,000.0

$

625.0

$

7,375.0

Profit before tax

$

32,000.0

$

15,000.0

$

45,750.0

Income tax expense

$

6,000.0

$

2,500.0

$

375.0

$

8,125.0

Profit for the period

$

26,000.0

$

12,500.0

$

37,625.0

Retained earnings 1 July

2018

$

51,500.0

$

27,500.0

$

27,075.0

$

51,925.0

Transfer from general

reserve

$

15,000.0

$

7,500.0

$

5,800.0

$

16,300.0

$

33,000.0

Dividend paid

$

10,000.0

$

-

$

3,500.0

$

6,500.0

Retained earnings 30 June

2019

$

82,500.0

$

47,500.0

$

1,16,050.

0

Share capital

$

75,000.0

$

65,000.0

$

80,000.0

$

60,000.0

General reserve

$

5,000.0

$

10,000.0

$

16,300.0

$

9,300.0

$

8,000.0

Other components of equity

$

12,500.0

$

9,000.0

$

18,550.0

$

2,950.0

Total equity

$

1,75,000.0

$

1,31,500.

0

$

1,87,000.

0

Accounts payable

$

20,000.0

$

5,000.0

$

25,000.0

Deferred tax liability

$

9,000.0

$

5,000.0

$

14,000.0

Other non-current liabilities

$

1,25,000.0

$

1,15,000.

0

$

2,40,000.

0

Total liabilities $

1,54,000.0

$

1,25,000.

$

2,79,000.

3. Worksheet for Positive Ltd:

Particulars

Positive

Ltd $

Smart

Ltd $

Adjustments

Debit Credit Group

Revenue

$

45,000.0

$

32,000.0

$

77,000.0

Expenses

$

17,000.0

$

21,000.0

$

625.0

$

38,625.0

Trading profit

$

28,000.0

$

11,000.0

$

38,375.0

Gains (losses) on sale of

non-current assets

$

4,000.0

$

4,000.0

$

625.0

$

7,375.0

Profit before tax

$

32,000.0

$

15,000.0

$

45,750.0

Income tax expense

$

6,000.0

$

2,500.0

$

375.0

$

8,125.0

Profit for the period

$

26,000.0

$

12,500.0

$

37,625.0

Retained earnings 1 July

2018

$

51,500.0

$

27,500.0

$

27,075.0

$

51,925.0

Transfer from general

reserve

$

15,000.0

$

7,500.0

$

5,800.0

$

16,300.0

$

33,000.0

Dividend paid

$

10,000.0

$

-

$

3,500.0

$

6,500.0

Retained earnings 30 June

2019

$

82,500.0

$

47,500.0

$

1,16,050.

0

Share capital

$

75,000.0

$

65,000.0

$

80,000.0

$

60,000.0

General reserve

$

5,000.0

$

10,000.0

$

16,300.0

$

9,300.0

$

8,000.0

Other components of equity

$

12,500.0

$

9,000.0

$

18,550.0

$

2,950.0

Total equity

$

1,75,000.0

$

1,31,500.

0

$

1,87,000.

0

Accounts payable

$

20,000.0

$

5,000.0

$

25,000.0

Deferred tax liability

$

9,000.0

$

5,000.0

$

14,000.0

Other non-current liabilities

$

1,25,000.0

$

1,15,000.

0

$

2,40,000.

0

Total liabilities $

1,54,000.0

$

1,25,000.

$

2,79,000.

5FINANCIAL ACCOUNTING

0 0

Total equity and liabilities

$

3,29,000.0

$

2,56,500.

0

$

4,66,000.

0

Plant

$

1,57,000.0

$

2,33,000.

0

$

3,90,000.

0

Accumulated depreciation –

plant

$ -

91,000.0

$ -

1,10,000.

0

$ -

2,01,000.

0

Land

$

10,000.0

$

10,000.0

$

10,000.0

$

30,000.0

Brands

$

40,000.0

$

-

$

6,000.0

$

34,000.0

Shares in Smart Ltd

$

1,23,000.0

$

-

$

1,23,000.0

$

-

Financial assets

$

55,000.0

$

1,03,500.

0

$

1,58,500.

0

Cash

$

5,000.0

$

2,500.0

$

7,500.0

Inventories

$

20,000.0

$

15,000.0

$

35,000.0

Goodwill

$

10,000.0

$

9,000.0

$

8,300.0

$

10,700.0

Deferred tax asset

$

1,800.0

$

1,800.0

Accumulated impairment

losses

$

-

$ -

6,500.0

$

6,000.0

$ -

500.0

Total assets

$

3,29,000.0

$

2,56,500.

0

$

4,66,000.

0

0 0

Total equity and liabilities

$

3,29,000.0

$

2,56,500.

0

$

4,66,000.

0

Plant

$

1,57,000.0

$

2,33,000.

0

$

3,90,000.

0

Accumulated depreciation –

plant

$ -

91,000.0

$ -

1,10,000.

0

$ -

2,01,000.

0

Land

$

10,000.0

$

10,000.0

$

10,000.0

$

30,000.0

Brands

$

40,000.0

$

-

$

6,000.0

$

34,000.0

Shares in Smart Ltd

$

1,23,000.0

$

-

$

1,23,000.0

$

-

Financial assets

$

55,000.0

$

1,03,500.

0

$

1,58,500.

0

Cash

$

5,000.0

$

2,500.0

$

7,500.0

Inventories

$

20,000.0

$

15,000.0

$

35,000.0

Goodwill

$

10,000.0

$

9,000.0

$

8,300.0

$

10,700.0

Deferred tax asset

$

1,800.0

$

1,800.0

Accumulated impairment

losses

$

-

$ -

6,500.0

$

6,000.0

$ -

500.0

Total assets

$

3,29,000.0

$

2,56,500.

0

$

4,66,000.

0

6FINANCIAL ACCOUNTING

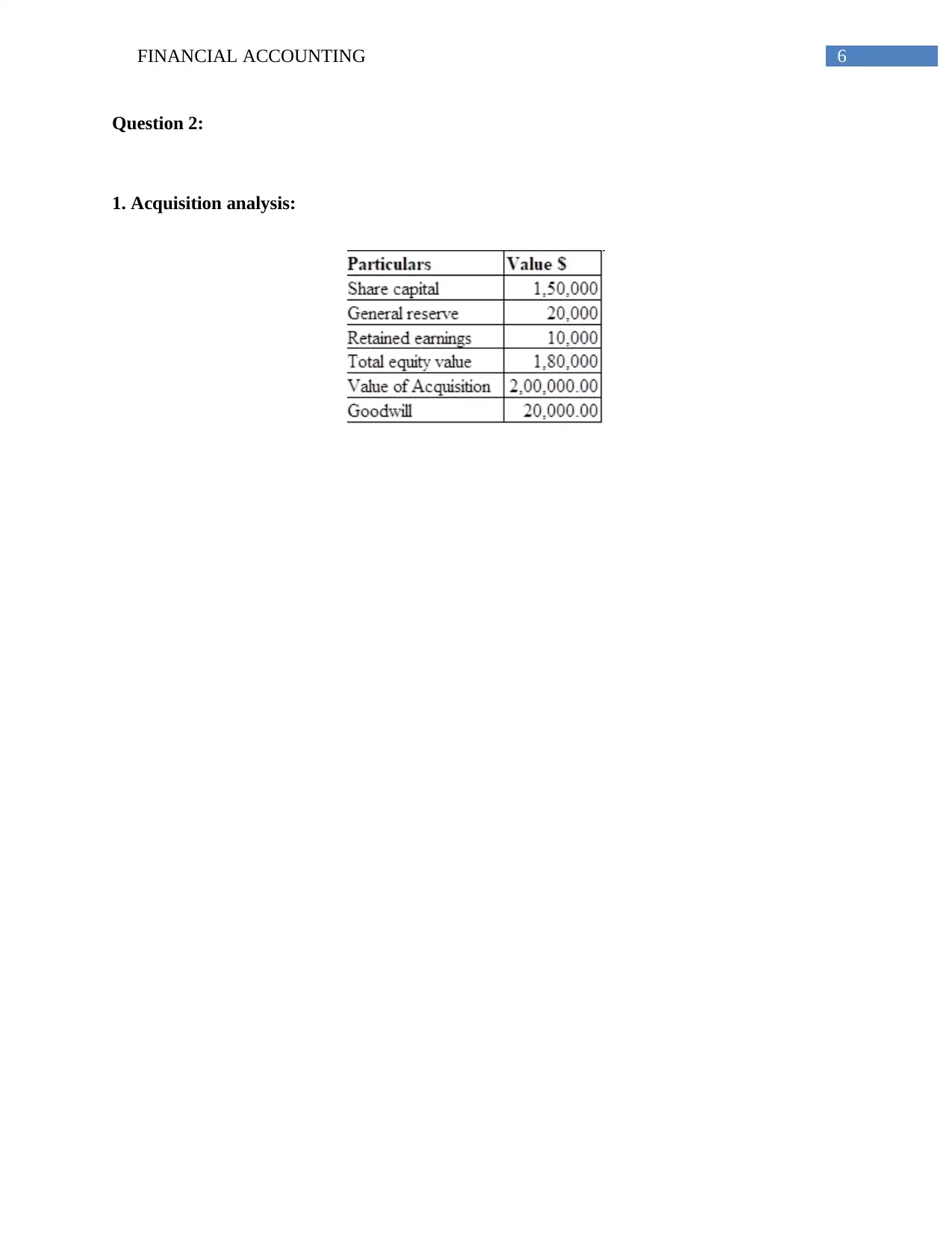

Question 2:

1. Acquisition analysis:

Question 2:

1. Acquisition analysis:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL ACCOUNTING

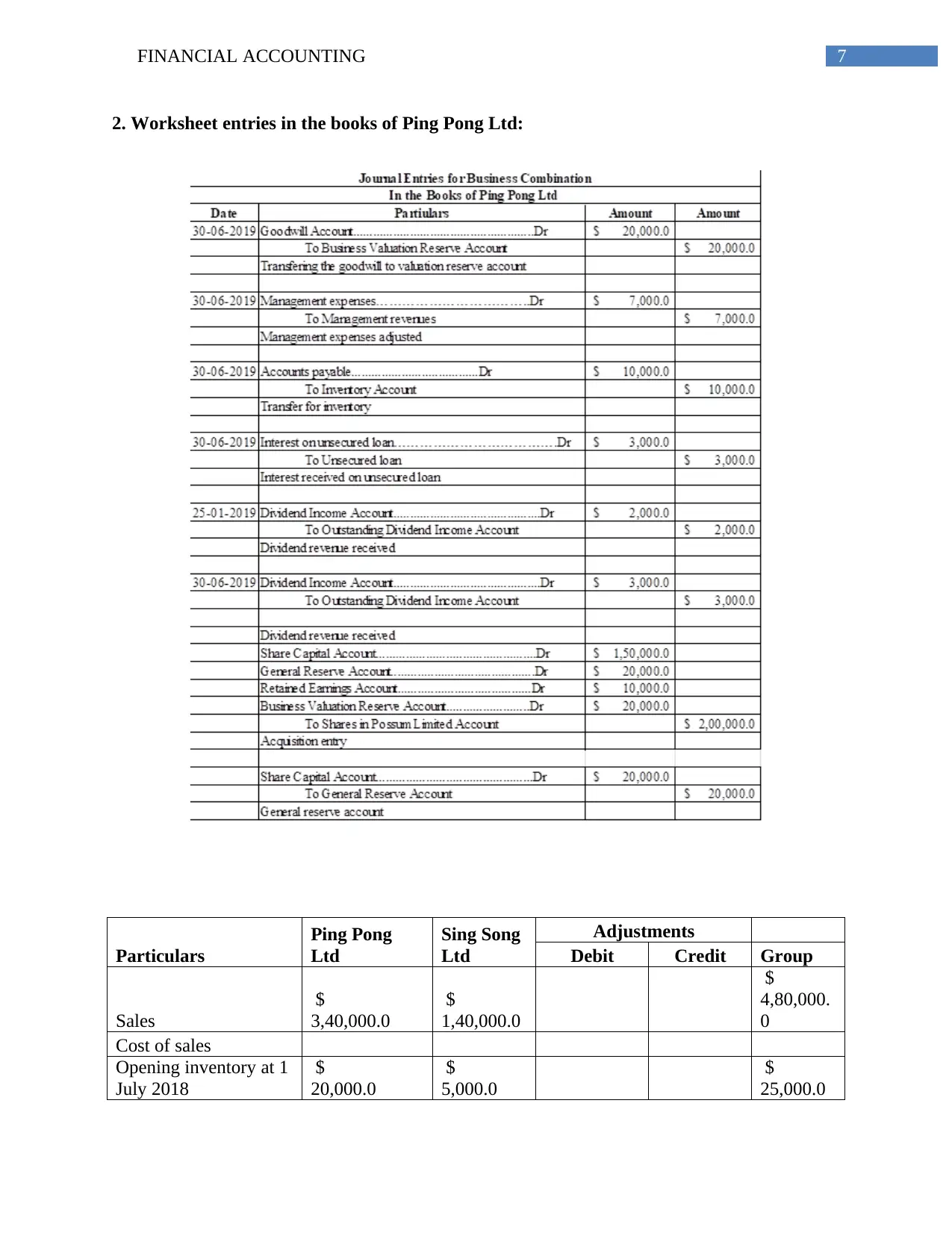

2. Worksheet entries in the books of Ping Pong Ltd:

Particulars

Ping Pong

Ltd

Sing Song

Ltd

Adjustments

Debit Credit Group

Sales

$

3,40,000.0

$

1,40,000.0

$

4,80,000.

0

Cost of sales

Opening inventory at 1

July 2018

$

20,000.0

$

5,000.0

$

25,000.0

2. Worksheet entries in the books of Ping Pong Ltd:

Particulars

Ping Pong

Ltd

Sing Song

Ltd

Adjustments

Debit Credit Group

Sales

$

3,40,000.0

$

1,40,000.0

$

4,80,000.

0

Cost of sales

Opening inventory at 1

July 2018

$

20,000.0

$

5,000.0

$

25,000.0

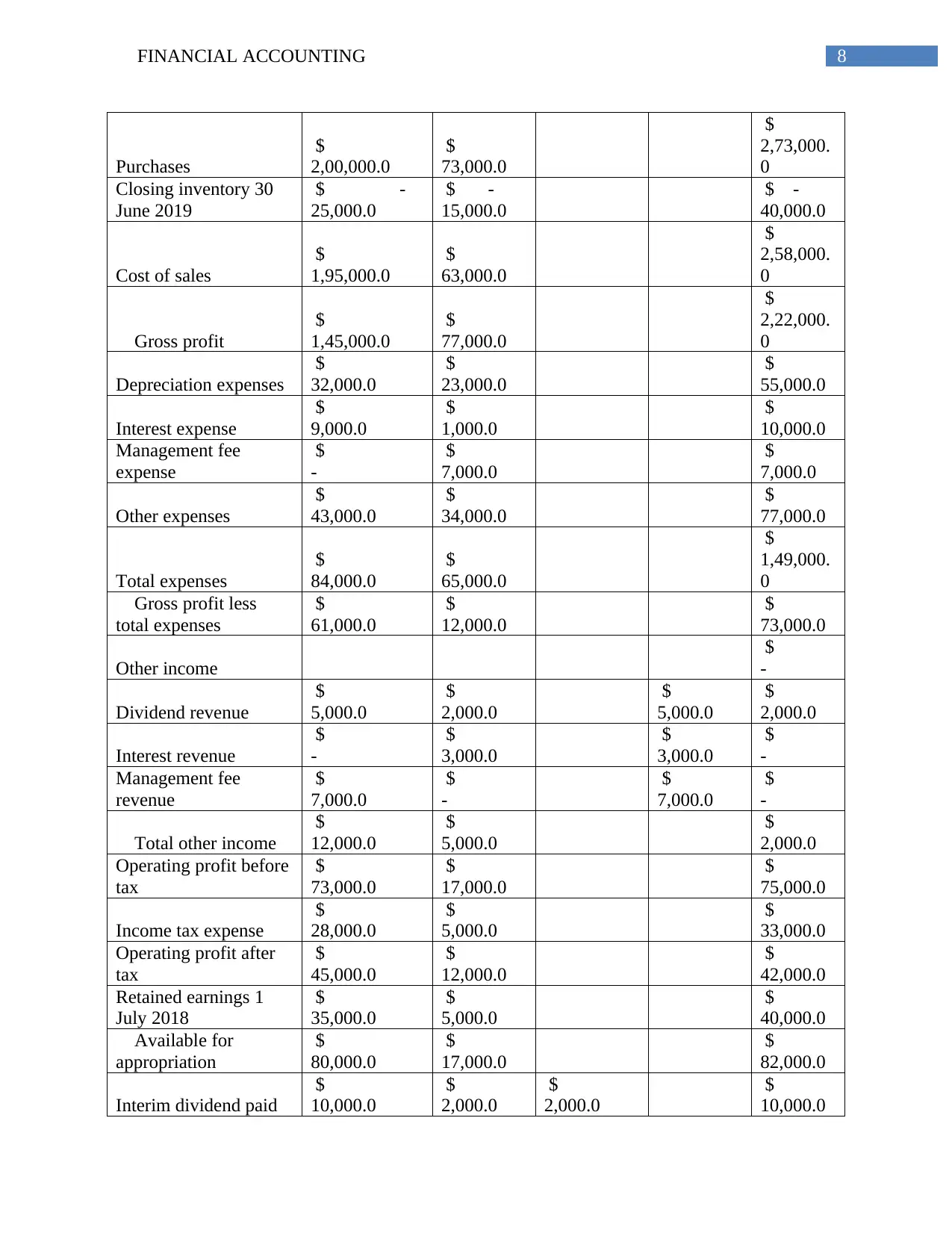

8FINANCIAL ACCOUNTING

Purchases

$

2,00,000.0

$

73,000.0

$

2,73,000.

0

Closing inventory 30

June 2019

$ -

25,000.0

$ -

15,000.0

$ -

40,000.0

Cost of sales

$

1,95,000.0

$

63,000.0

$

2,58,000.

0

Gross profit

$

1,45,000.0

$

77,000.0

$

2,22,000.

0

Depreciation expenses

$

32,000.0

$

23,000.0

$

55,000.0

Interest expense

$

9,000.0

$

1,000.0

$

10,000.0

Management fee

expense

$

-

$

7,000.0

$

7,000.0

Other expenses

$

43,000.0

$

34,000.0

$

77,000.0

Total expenses

$

84,000.0

$

65,000.0

$

1,49,000.

0

Gross profit less

total expenses

$

61,000.0

$

12,000.0

$

73,000.0

Other income

$

-

Dividend revenue

$

5,000.0

$

2,000.0

$

5,000.0

$

2,000.0

Interest revenue

$

-

$

3,000.0

$

3,000.0

$

-

Management fee

revenue

$

7,000.0

$

-

$

7,000.0

$

-

Total other income

$

12,000.0

$

5,000.0

$

2,000.0

Operating profit before

tax

$

73,000.0

$

17,000.0

$

75,000.0

Income tax expense

$

28,000.0

$

5,000.0

$

33,000.0

Operating profit after

tax

$

45,000.0

$

12,000.0

$

42,000.0

Retained earnings 1

July 2018

$

35,000.0

$

5,000.0

$

40,000.0

Available for

appropriation

$

80,000.0

$

17,000.0

$

82,000.0

Interim dividend paid

$

10,000.0

$

2,000.0

$

2,000.0

$

10,000.0

Purchases

$

2,00,000.0

$

73,000.0

$

2,73,000.

0

Closing inventory 30

June 2019

$ -

25,000.0

$ -

15,000.0

$ -

40,000.0

Cost of sales

$

1,95,000.0

$

63,000.0

$

2,58,000.

0

Gross profit

$

1,45,000.0

$

77,000.0

$

2,22,000.

0

Depreciation expenses

$

32,000.0

$

23,000.0

$

55,000.0

Interest expense

$

9,000.0

$

1,000.0

$

10,000.0

Management fee

expense

$

-

$

7,000.0

$

7,000.0

Other expenses

$

43,000.0

$

34,000.0

$

77,000.0

Total expenses

$

84,000.0

$

65,000.0

$

1,49,000.

0

Gross profit less

total expenses

$

61,000.0

$

12,000.0

$

73,000.0

Other income

$

-

Dividend revenue

$

5,000.0

$

2,000.0

$

5,000.0

$

2,000.0

Interest revenue

$

-

$

3,000.0

$

3,000.0

$

-

Management fee

revenue

$

7,000.0

$

-

$

7,000.0

$

-

Total other income

$

12,000.0

$

5,000.0

$

2,000.0

Operating profit before

tax

$

73,000.0

$

17,000.0

$

75,000.0

Income tax expense

$

28,000.0

$

5,000.0

$

33,000.0

Operating profit after

tax

$

45,000.0

$

12,000.0

$

42,000.0

Retained earnings 1

July 2018

$

35,000.0

$

5,000.0

$

40,000.0

Available for

appropriation

$

80,000.0

$

17,000.0

$

82,000.0

Interim dividend paid

$

10,000.0

$

2,000.0

$

2,000.0

$

10,000.0

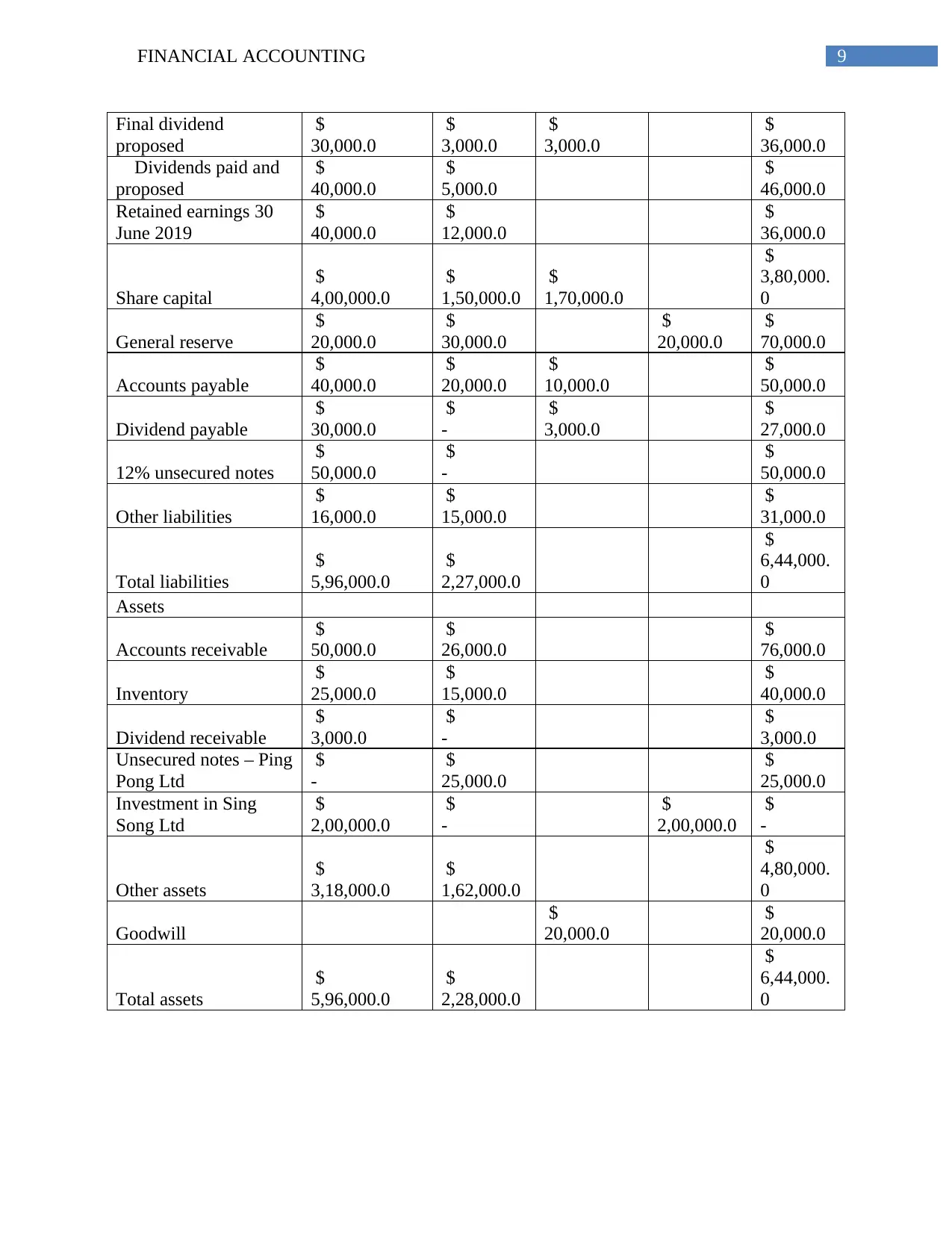

9FINANCIAL ACCOUNTING

Final dividend

proposed

$

30,000.0

$

3,000.0

$

3,000.0

$

36,000.0

Dividends paid and

proposed

$

40,000.0

$

5,000.0

$

46,000.0

Retained earnings 30

June 2019

$

40,000.0

$

12,000.0

$

36,000.0

Share capital

$

4,00,000.0

$

1,50,000.0

$

1,70,000.0

$

3,80,000.

0

General reserve

$

20,000.0

$

30,000.0

$

20,000.0

$

70,000.0

Accounts payable

$

40,000.0

$

20,000.0

$

10,000.0

$

50,000.0

Dividend payable

$

30,000.0

$

-

$

3,000.0

$

27,000.0

12% unsecured notes

$

50,000.0

$

-

$

50,000.0

Other liabilities

$

16,000.0

$

15,000.0

$

31,000.0

Total liabilities

$

5,96,000.0

$

2,27,000.0

$

6,44,000.

0

Assets

Accounts receivable

$

50,000.0

$

26,000.0

$

76,000.0

Inventory

$

25,000.0

$

15,000.0

$

40,000.0

Dividend receivable

$

3,000.0

$

-

$

3,000.0

Unsecured notes – Ping

Pong Ltd

$

-

$

25,000.0

$

25,000.0

Investment in Sing

Song Ltd

$

2,00,000.0

$

-

$

2,00,000.0

$

-

Other assets

$

3,18,000.0

$

1,62,000.0

$

4,80,000.

0

Goodwill

$

20,000.0

$

20,000.0

Total assets

$

5,96,000.0

$

2,28,000.0

$

6,44,000.

0

Final dividend

proposed

$

30,000.0

$

3,000.0

$

3,000.0

$

36,000.0

Dividends paid and

proposed

$

40,000.0

$

5,000.0

$

46,000.0

Retained earnings 30

June 2019

$

40,000.0

$

12,000.0

$

36,000.0

Share capital

$

4,00,000.0

$

1,50,000.0

$

1,70,000.0

$

3,80,000.

0

General reserve

$

20,000.0

$

30,000.0

$

20,000.0

$

70,000.0

Accounts payable

$

40,000.0

$

20,000.0

$

10,000.0

$

50,000.0

Dividend payable

$

30,000.0

$

-

$

3,000.0

$

27,000.0

12% unsecured notes

$

50,000.0

$

-

$

50,000.0

Other liabilities

$

16,000.0

$

15,000.0

$

31,000.0

Total liabilities

$

5,96,000.0

$

2,27,000.0

$

6,44,000.

0

Assets

Accounts receivable

$

50,000.0

$

26,000.0

$

76,000.0

Inventory

$

25,000.0

$

15,000.0

$

40,000.0

Dividend receivable

$

3,000.0

$

-

$

3,000.0

Unsecured notes – Ping

Pong Ltd

$

-

$

25,000.0

$

25,000.0

Investment in Sing

Song Ltd

$

2,00,000.0

$

-

$

2,00,000.0

$

-

Other assets

$

3,18,000.0

$

1,62,000.0

$

4,80,000.

0

Goodwill

$

20,000.0

$

20,000.0

Total assets

$

5,96,000.0

$

2,28,000.0

$

6,44,000.

0

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10FINANCIAL ACCOUNTING

Bibliography:

Beatty, A., & Liao, S. (2014). Financial accounting in the banking industry: A review of the

empirical literature. Journal of Accounting and Economics, 58(2-3), 339-383.

Beaumont, S. J. (2015). An investigation of the short‐and long‐run relations between executive

cash bonus payments and firm financial performance: a pitch. Accounting &

Finance, 55(2), 337-343.

Henderson, S., Peirson, G., Herbohn, K., & Howieson, B. (2015). Issues in financial accounting.

Pearson Higher Education AU.

Hodder, L., Hopkins, P., & Schipper, K. (2014). Fair value measurement in financial

reporting. Foundations and Trends® in Accounting, 8(3-4), 143-270.

Hoyle, J. B., Schaefer, T., & Doupnik, T. (2015). Advanced accounting. McGraw Hill.

Kieso, D. E., Weygandt, J. J., & Warfield, T. D. (2016). Intermediate Accounting, Binder Ready

Version. John Wiley & Sons.

Lovell, H. (2014). Climate change, markets and standards: the case of financial

accounting. Economy and Society, 43(2), 260-284.

Mullinova, S. (2016). Use of the principles of IFRS (IAS) 39" Financial instruments: recognition

and assessment" for bank financial accounting. Modern European Researches, (1), 60-64.

Nobes, C. (2014). International classification of financial reporting. Routledge.

Bibliography:

Beatty, A., & Liao, S. (2014). Financial accounting in the banking industry: A review of the

empirical literature. Journal of Accounting and Economics, 58(2-3), 339-383.

Beaumont, S. J. (2015). An investigation of the short‐and long‐run relations between executive

cash bonus payments and firm financial performance: a pitch. Accounting &

Finance, 55(2), 337-343.

Henderson, S., Peirson, G., Herbohn, K., & Howieson, B. (2015). Issues in financial accounting.

Pearson Higher Education AU.

Hodder, L., Hopkins, P., & Schipper, K. (2014). Fair value measurement in financial

reporting. Foundations and Trends® in Accounting, 8(3-4), 143-270.

Hoyle, J. B., Schaefer, T., & Doupnik, T. (2015). Advanced accounting. McGraw Hill.

Kieso, D. E., Weygandt, J. J., & Warfield, T. D. (2016). Intermediate Accounting, Binder Ready

Version. John Wiley & Sons.

Lovell, H. (2014). Climate change, markets and standards: the case of financial

accounting. Economy and Society, 43(2), 260-284.

Mullinova, S. (2016). Use of the principles of IFRS (IAS) 39" Financial instruments: recognition

and assessment" for bank financial accounting. Modern European Researches, (1), 60-64.

Nobes, C. (2014). International classification of financial reporting. Routledge.

11FINANCIAL ACCOUNTING

Oseghale, G. E., & Wahab, A. B. (2014). Analysis of relationship between preliminary estimate,

tender sum and final accounts (a case study of selected building projects in Edo State,

Nigeria). Journal of Civil and Environmental Research, 6(6), 76.

Schaltegger, S., & Burritt, R. (2017). Contemporary environmental accounting: issues, concepts

and practice. Routledge.

Warren Jr, J. D., Moffitt, K. C., & Byrnes, P. (2015). How Big Data will change

accounting. Accounting Horizons, 29(2), 397-407.

Oseghale, G. E., & Wahab, A. B. (2014). Analysis of relationship between preliminary estimate,

tender sum and final accounts (a case study of selected building projects in Edo State,

Nigeria). Journal of Civil and Environmental Research, 6(6), 76.

Schaltegger, S., & Burritt, R. (2017). Contemporary environmental accounting: issues, concepts

and practice. Routledge.

Warren Jr, J. D., Moffitt, K. C., & Byrnes, P. (2015). How Big Data will change

accounting. Accounting Horizons, 29(2), 397-407.

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.