Financial Accounting Newsletter: Reporting and Standard Updates

VerifiedAdded on 2023/01/19

|12

|1428

|42

Report

AI Summary

This financial accounting newsletter covers the period from December 1, 2018, to March 31, 2019, and addresses key developments in financial reporting. It highlights the new accounting standard AASB 2018-8 regarding Right-of-Use assets for not-for-profit organizations, clarifying definitions and providing temporary options for measurement. The newsletter also discusses AASB 137 on onerous contracts and updates from the IASB, including decisions on IFRS for SMEs and amendments to IFRS 17 on insurance contracts. Additionally, it covers proposed amendments for standard AASB 2019-X concerning the conceptual framework. The second part of the document analyzes financial statements prepared by a trainee accountant, identifying errors and non-compliance with AASB 101, providing detailed error corrections and references to the relevant accounting standards. It also includes a list of references used for the newsletter.

Financial Accounting

News Letter

News Letter

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Name of the student

Name of the university

Student ID

Author note

Name of the university

Student ID

Author note

NEWS LETTER

New Accounting standard AASB 2018-8: Right-of-Use

assets for the Not-for-profit organisations

AASB issued AASB 2018-8 amendments with regard to

AAS – Right-of-use Assets (ROUA) of Not-for-profit

organisations to provide the temporary option for the not-

for-profit leases in context for selection of the measure.

This measurement is with regard to the classes or class of

the ROUA those are generated from the ‘concessionary

lease’ at initial recognition. This recognition is made either

at cost as per Para 23-25 of AASB 16 for leases or as per

Para Aus25.1 of AASB 16. Concessionary lease here is

considered as the lease that is significantly below as

compared to market terms. Major change made by the

standard is allowing for temporary option applicable for

ROUA based on class by class and amended AASB 1049 to

allow the government for measuring ROUA at cost rather

than at fair values.

New AAS (Australian Accounting Standard) for the

definition

Definition for the terms

material and business

have been clarified by

AASB through new

amended section as

follows –

1. AASB 2018-7 stated

that any information will

be regarded as material its

misstatement, omission or

obscuring influences the

decision of GPFS primary

users that is being taken

on the basis of the

financial statement that

include such information.

2. AASB 2018 – 6 stated

the term business as the

integrated set of the

activities and any asset

that can be conducted and

Financial reporting related news and development

Period covered: 1st December 2018 to 31st March 2019

New Accounting standard AASB 2018-8: Right-of-Use

assets for the Not-for-profit organisations

AASB issued AASB 2018-8 amendments with regard to

AAS – Right-of-use Assets (ROUA) of Not-for-profit

organisations to provide the temporary option for the not-

for-profit leases in context for selection of the measure.

This measurement is with regard to the classes or class of

the ROUA those are generated from the ‘concessionary

lease’ at initial recognition. This recognition is made either

at cost as per Para 23-25 of AASB 16 for leases or as per

Para Aus25.1 of AASB 16. Concessionary lease here is

considered as the lease that is significantly below as

compared to market terms. Major change made by the

standard is allowing for temporary option applicable for

ROUA based on class by class and amended AASB 1049 to

allow the government for measuring ROUA at cost rather

than at fair values.

New AAS (Australian Accounting Standard) for the

definition

Definition for the terms

material and business

have been clarified by

AASB through new

amended section as

follows –

1. AASB 2018-7 stated

that any information will

be regarded as material its

misstatement, omission or

obscuring influences the

decision of GPFS primary

users that is being taken

on the basis of the

financial statement that

include such information.

2. AASB 2018 – 6 stated

the term business as the

integrated set of the

activities and any asset

that can be conducted and

Financial reporting related news and development

Period covered: 1st December 2018 to 31st March 2019

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

managed for providing goods or services to the customers

to generate income.

Proposed amendments for

standard AASB 2019-X in

context of conceptual

framework

As per the proposed AASB

2019-X, the conceptual

framework will be

applicable only to for-profit

private entities those are

publicly accountable and are

required to comply with

AAS by the legislation and

the for-profit entities those

voluntarily choose the

application of conceptual

framework. Proposed

amendments are in context

of AAS, different

pronouncement and

interpretation of the AASB

to allow other entities to

continue with the existing

framework while they will

prepare the present their

financial statements.

Further, the proposed

standards will revise the

reference and quotation

regarding which version of

AASB 137 – Onerous contract

In accordance with AASB 137 the term onerous

contract is the contract for which the expected

economic benefit to be received is lower than the

unavoidable cost of fulfilling the contractual

obligation. Here, the unavoidable cost is the cost of

fulfilling the obligation or compensation or penalty

payable for not fulfilling the contractual obligation,

whichever is lower. In accordance with the

amendment costs directly attributable to fulfilment of

contractual obligation.

Update from IASB

Updates from IASB focussed on the preliminary

decisions. It discussed the topics associated with

IFRS in context of SMEs standards – update, review,

management commentary, primary financial reports,

and amendment to IFRS 17 on insurance contracts.

All 14 members presented in the meeting were

agreed to the decision. The meeting also decided

regarding the topics to be discussed in next meeting.

to generate income.

Proposed amendments for

standard AASB 2019-X in

context of conceptual

framework

As per the proposed AASB

2019-X, the conceptual

framework will be

applicable only to for-profit

private entities those are

publicly accountable and are

required to comply with

AAS by the legislation and

the for-profit entities those

voluntarily choose the

application of conceptual

framework. Proposed

amendments are in context

of AAS, different

pronouncement and

interpretation of the AASB

to allow other entities to

continue with the existing

framework while they will

prepare the present their

financial statements.

Further, the proposed

standards will revise the

reference and quotation

regarding which version of

AASB 137 – Onerous contract

In accordance with AASB 137 the term onerous

contract is the contract for which the expected

economic benefit to be received is lower than the

unavoidable cost of fulfilling the contractual

obligation. Here, the unavoidable cost is the cost of

fulfilling the obligation or compensation or penalty

payable for not fulfilling the contractual obligation,

whichever is lower. In accordance with the

amendment costs directly attributable to fulfilment of

contractual obligation.

Update from IASB

Updates from IASB focussed on the preliminary

decisions. It discussed the topics associated with

IFRS in context of SMEs standards – update, review,

management commentary, primary financial reports,

and amendment to IFRS 17 on insurance contracts.

All 14 members presented in the meeting were

agreed to the decision. The meeting also decided

regarding the topics to be discussed in next meeting.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

conceptual framework shall be used, if it requires using conceptual framework.

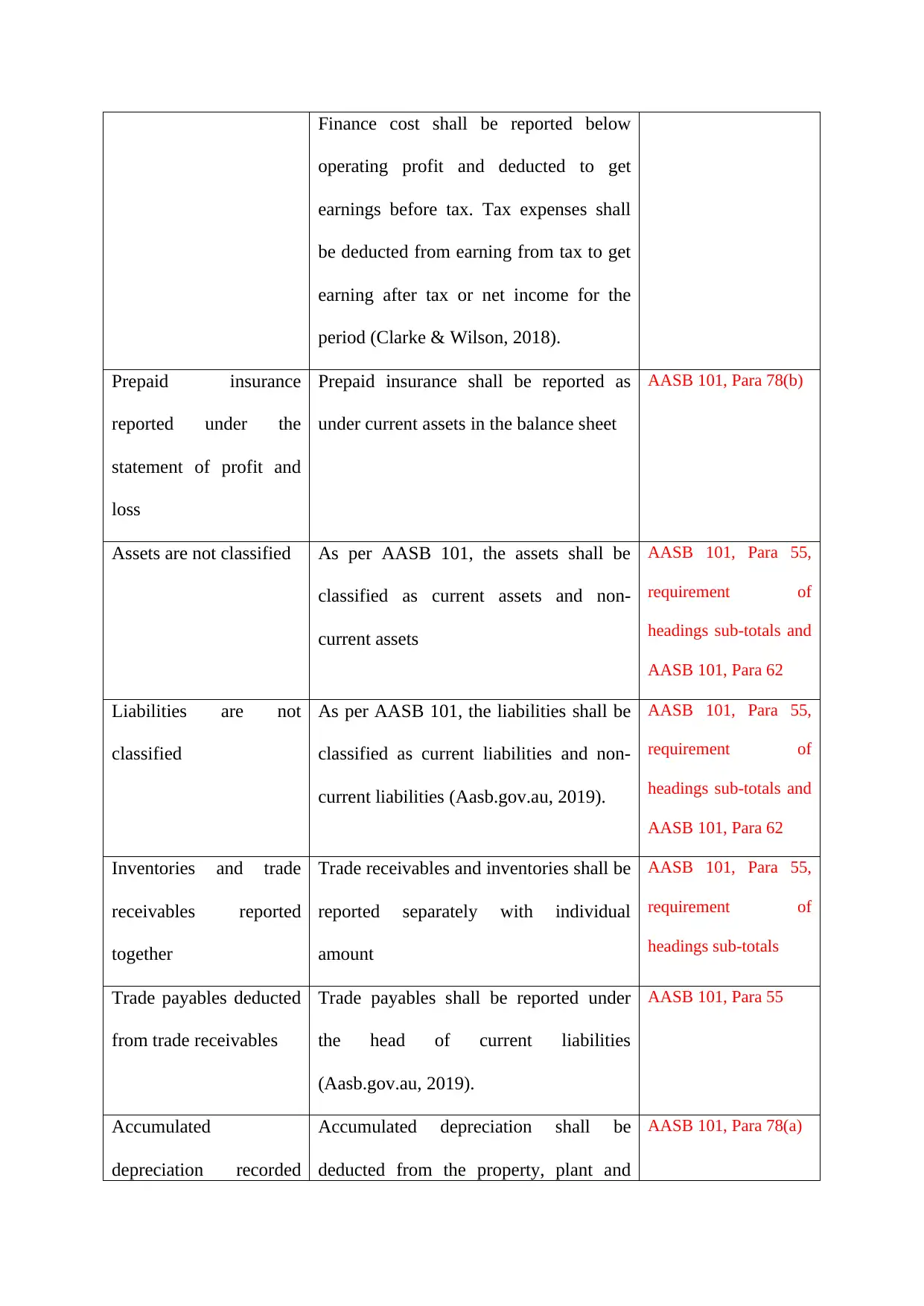

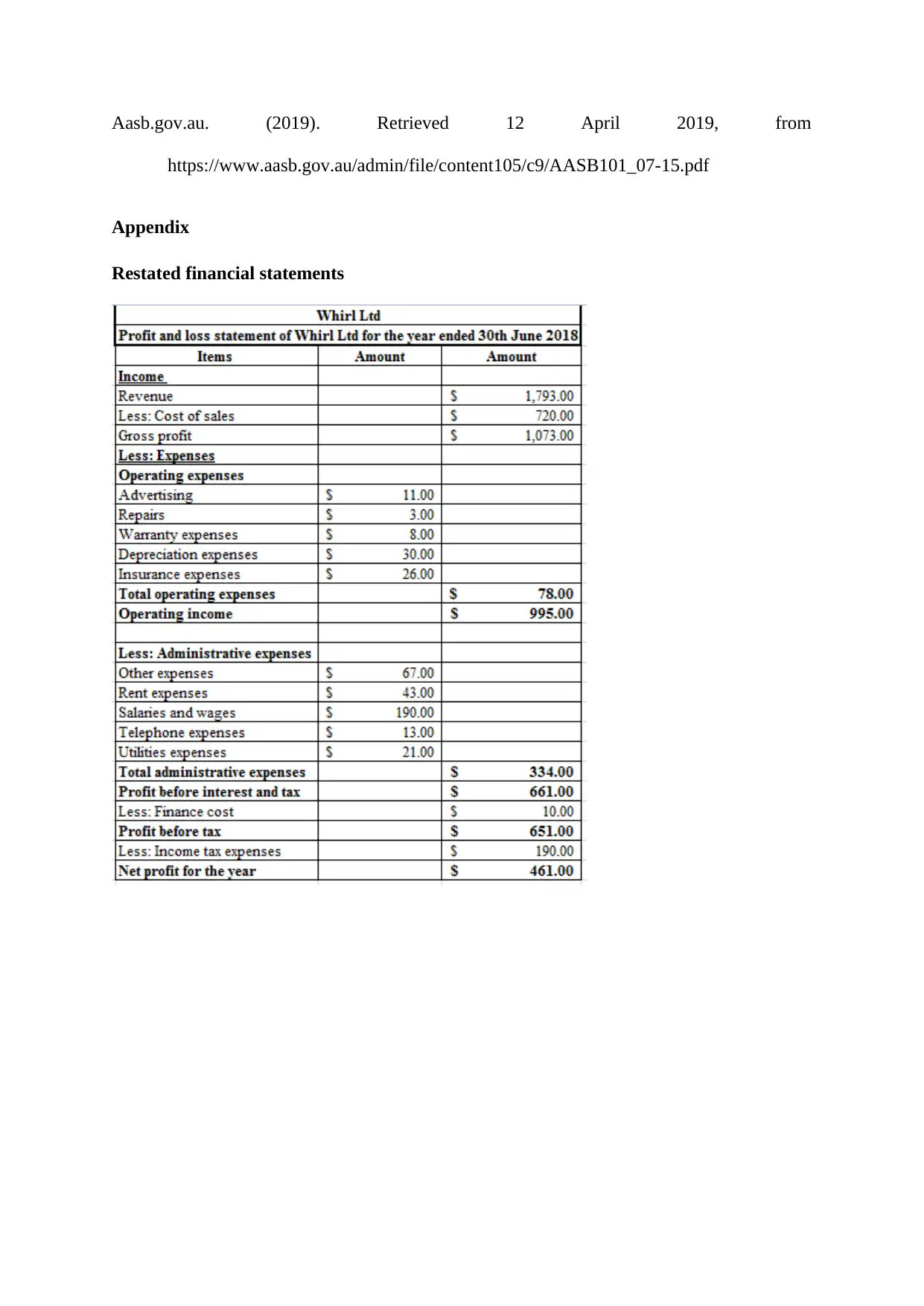

Answer 2

Financial statements are the written records that represent the business activities and

the financial performance of any organisation. It includes the balance sheet, income

statements, changes in the equity statement and cash flow statement. AASB 101 requires the

ASX listed entities to present the financial statement in faithful manner through reporting and

disclosing the impact of each transaction taken place during the concerned period

(Aasb.gov.au, 2019). Financial statements shall be prepared as per the requirement of AASB

101 and it must provide information regarding accounting in such manner that it shall be

relevant, reliable, understandable and comparable. Main purpose of financial statement is

providing information with regard to the company’s financial performance and position that

will influence the decision of a user of financial statement while making any economic

decisions (Aasb.gov.au, 2019).

Financial statement prepared by trainee accountant of Whirl Limited involves various

mistakes those were not in compliance with AASB 101 as follows –

Error Correction Reference

In statement of profit or

loss cost of sales has

been reported after

reporting advertising and

annual leave expenses

Cost of sales shall be reported under

revenue and deducted from revenues to

get the gross profit amount (Hodgson &

Russell, 2014).

AASB 101, Para 103

All the expenses are

reported randomly

Operating and selling and administrative

expenses shall be reported below the line

of gross profit and shall be deducted from

gross profit to get operating profit.

AASB 101, Para 99

and Para 103

Answer 2

Financial statements are the written records that represent the business activities and

the financial performance of any organisation. It includes the balance sheet, income

statements, changes in the equity statement and cash flow statement. AASB 101 requires the

ASX listed entities to present the financial statement in faithful manner through reporting and

disclosing the impact of each transaction taken place during the concerned period

(Aasb.gov.au, 2019). Financial statements shall be prepared as per the requirement of AASB

101 and it must provide information regarding accounting in such manner that it shall be

relevant, reliable, understandable and comparable. Main purpose of financial statement is

providing information with regard to the company’s financial performance and position that

will influence the decision of a user of financial statement while making any economic

decisions (Aasb.gov.au, 2019).

Financial statement prepared by trainee accountant of Whirl Limited involves various

mistakes those were not in compliance with AASB 101 as follows –

Error Correction Reference

In statement of profit or

loss cost of sales has

been reported after

reporting advertising and

annual leave expenses

Cost of sales shall be reported under

revenue and deducted from revenues to

get the gross profit amount (Hodgson &

Russell, 2014).

AASB 101, Para 103

All the expenses are

reported randomly

Operating and selling and administrative

expenses shall be reported below the line

of gross profit and shall be deducted from

gross profit to get operating profit.

AASB 101, Para 99

and Para 103

Finance cost shall be reported below

operating profit and deducted to get

earnings before tax. Tax expenses shall

be deducted from earning from tax to get

earning after tax or net income for the

period (Clarke & Wilson, 2018).

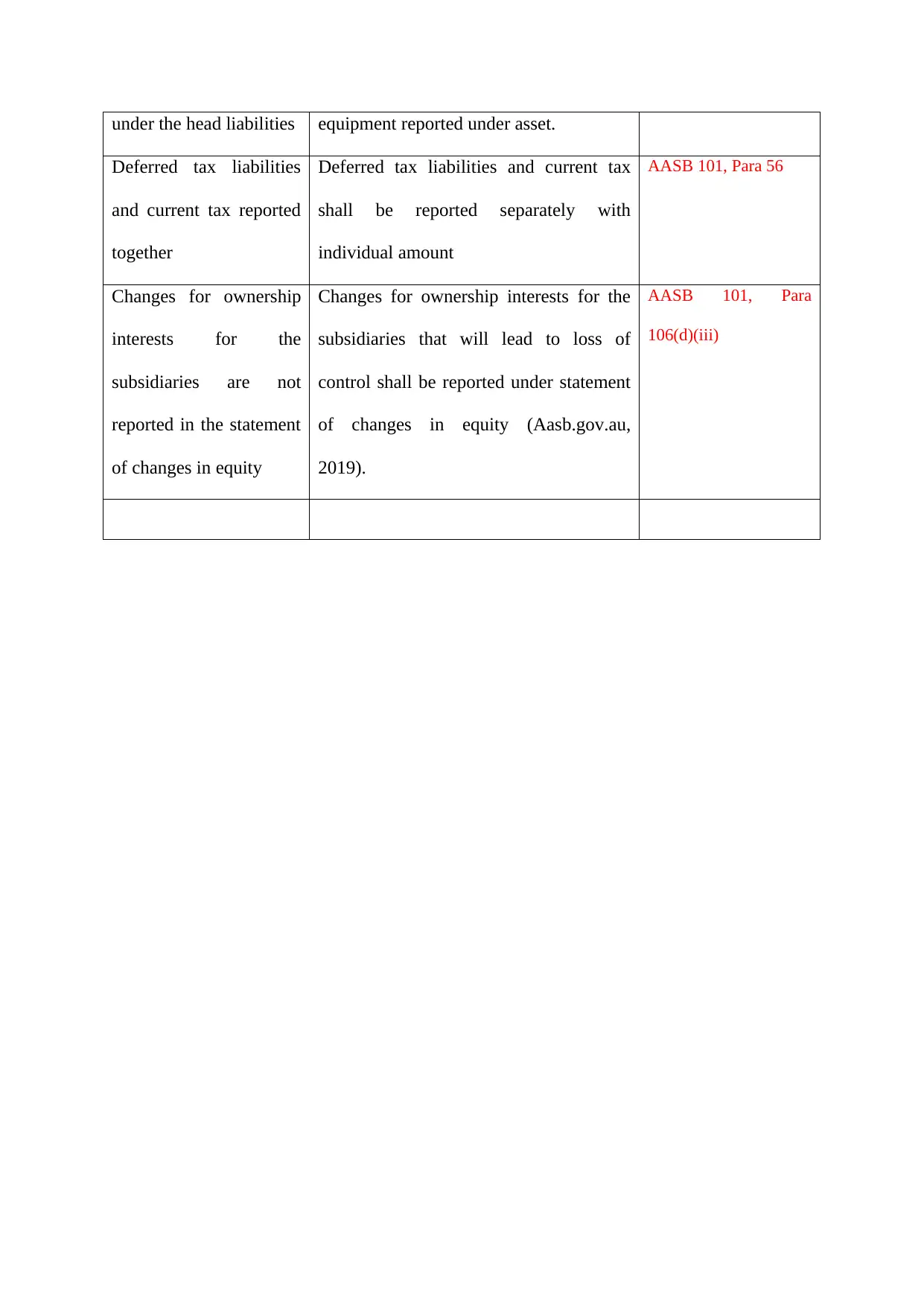

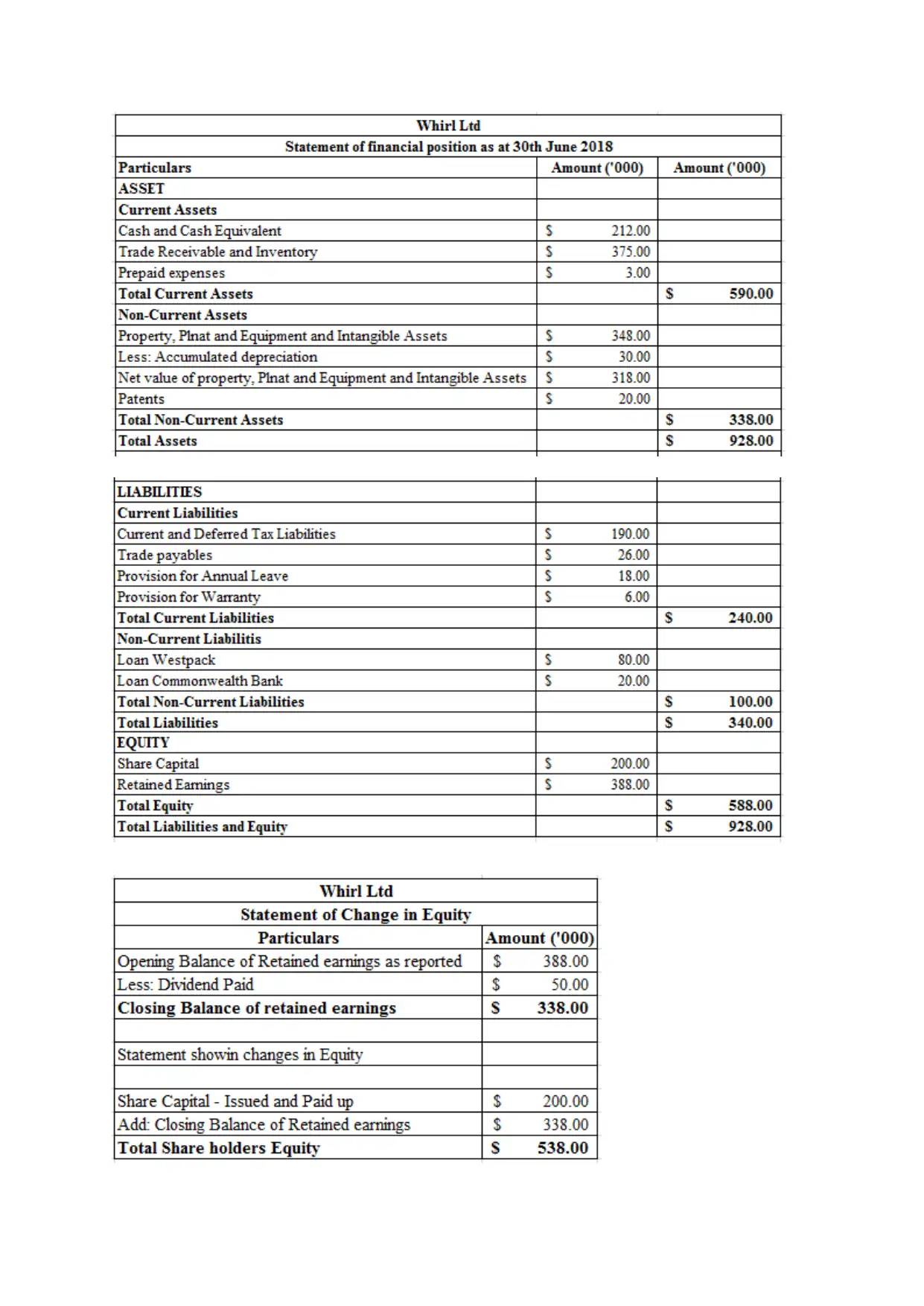

Prepaid insurance

reported under the

statement of profit and

loss

Prepaid insurance shall be reported as

under current assets in the balance sheet

AASB 101, Para 78(b)

Assets are not classified As per AASB 101, the assets shall be

classified as current assets and non-

current assets

AASB 101, Para 55,

requirement of

headings sub-totals and

AASB 101, Para 62

Liabilities are not

classified

As per AASB 101, the liabilities shall be

classified as current liabilities and non-

current liabilities (Aasb.gov.au, 2019).

AASB 101, Para 55,

requirement of

headings sub-totals and

AASB 101, Para 62

Inventories and trade

receivables reported

together

Trade receivables and inventories shall be

reported separately with individual

amount

AASB 101, Para 55,

requirement of

headings sub-totals

Trade payables deducted

from trade receivables

Trade payables shall be reported under

the head of current liabilities

(Aasb.gov.au, 2019).

AASB 101, Para 55

Accumulated

depreciation recorded

Accumulated depreciation shall be

deducted from the property, plant and

AASB 101, Para 78(a)

operating profit and deducted to get

earnings before tax. Tax expenses shall

be deducted from earning from tax to get

earning after tax or net income for the

period (Clarke & Wilson, 2018).

Prepaid insurance

reported under the

statement of profit and

loss

Prepaid insurance shall be reported as

under current assets in the balance sheet

AASB 101, Para 78(b)

Assets are not classified As per AASB 101, the assets shall be

classified as current assets and non-

current assets

AASB 101, Para 55,

requirement of

headings sub-totals and

AASB 101, Para 62

Liabilities are not

classified

As per AASB 101, the liabilities shall be

classified as current liabilities and non-

current liabilities (Aasb.gov.au, 2019).

AASB 101, Para 55,

requirement of

headings sub-totals and

AASB 101, Para 62

Inventories and trade

receivables reported

together

Trade receivables and inventories shall be

reported separately with individual

amount

AASB 101, Para 55,

requirement of

headings sub-totals

Trade payables deducted

from trade receivables

Trade payables shall be reported under

the head of current liabilities

(Aasb.gov.au, 2019).

AASB 101, Para 55

Accumulated

depreciation recorded

Accumulated depreciation shall be

deducted from the property, plant and

AASB 101, Para 78(a)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

under the head liabilities equipment reported under asset.

Deferred tax liabilities

and current tax reported

together

Deferred tax liabilities and current tax

shall be reported separately with

individual amount

AASB 101, Para 56

Changes for ownership

interests for the

subsidiaries are not

reported in the statement

of changes in equity

Changes for ownership interests for the

subsidiaries that will lead to loss of

control shall be reported under statement

of changes in equity (Aasb.gov.au,

2019).

AASB 101, Para

106(d)(iii)

Deferred tax liabilities

and current tax reported

together

Deferred tax liabilities and current tax

shall be reported separately with

individual amount

AASB 101, Para 56

Changes for ownership

interests for the

subsidiaries are not

reported in the statement

of changes in equity

Changes for ownership interests for the

subsidiaries that will lead to loss of

control shall be reported under statement

of changes in equity (Aasb.gov.au,

2019).

AASB 101, Para

106(d)(iii)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Reference

Aasb.gov.au. (2019). Australian Accounting Standards Board (AASB) - Home . Retrieved 12

April 2019, from https://www.aasb.gov.au/

Iasplus.com. (2019). International Accounting Standards Board (IASB). Retrieved 12 April

2019, from https://www.iasplus.com/en/resources/ifrsf/iasb-ifrs-ic/iasb

Hodgson, A., & Russell, M. (2014). Comprehending comprehensive income. Australian

Accounting Review, 24(2), 100-110.

Mission, A. C. P. N. S. (2014). Defining and Accounting for Fundraising Income and

Expenses Executive Summary.

Coulton, J., Ribeiro, A., Shan, Y., & Taylor, S. (2016). The rise and rise of non-GAAP

disclosure.

Handley, K., Wright, S., & Evans, E. (2018). SME Reporting in Australia: Where to Now for

Decision‐usefulness?. Australian Accounting Review, 28(2), 251-265.

Wee, M., Tarca, A., & Chang, M. (2014). Disclosure incentives, mandatory standards and

firm communication in the IFRS adoption setting. Australian Journal of Management,

39(2), 265-291.

Clarke, E. A., & Wilson, M. (2018). Accounting: An Introduction to Principles and Practice

9ed. Cengage AU.

Aasb.gov.au. (2019). Retrieved 12 April 2019, from

https://www.aasb.gov.au/admin/file/content105/c9/Framework_07-

04_COMPjun14_07-14.pdf

Aasb.gov.au. (2019). Australian Accounting Standards Board (AASB) - Home . Retrieved 12

April 2019, from https://www.aasb.gov.au/

Iasplus.com. (2019). International Accounting Standards Board (IASB). Retrieved 12 April

2019, from https://www.iasplus.com/en/resources/ifrsf/iasb-ifrs-ic/iasb

Hodgson, A., & Russell, M. (2014). Comprehending comprehensive income. Australian

Accounting Review, 24(2), 100-110.

Mission, A. C. P. N. S. (2014). Defining and Accounting for Fundraising Income and

Expenses Executive Summary.

Coulton, J., Ribeiro, A., Shan, Y., & Taylor, S. (2016). The rise and rise of non-GAAP

disclosure.

Handley, K., Wright, S., & Evans, E. (2018). SME Reporting in Australia: Where to Now for

Decision‐usefulness?. Australian Accounting Review, 28(2), 251-265.

Wee, M., Tarca, A., & Chang, M. (2014). Disclosure incentives, mandatory standards and

firm communication in the IFRS adoption setting. Australian Journal of Management,

39(2), 265-291.

Clarke, E. A., & Wilson, M. (2018). Accounting: An Introduction to Principles and Practice

9ed. Cengage AU.

Aasb.gov.au. (2019). Retrieved 12 April 2019, from

https://www.aasb.gov.au/admin/file/content105/c9/Framework_07-

04_COMPjun14_07-14.pdf

Aasb.gov.au. (2019). Retrieved 12 April 2019, from

https://www.aasb.gov.au/admin/file/content105/c9/AASB101_07-15.pdf

Appendix

Restated financial statements

https://www.aasb.gov.au/admin/file/content105/c9/AASB101_07-15.pdf

Appendix

Restated financial statements

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.