Financial Accounting Assignment: Journal Entries and Ledgers

VerifiedAdded on 2020/10/22

|18

|3952

|92

Homework Assignment

AI Summary

This financial accounting assignment solution comprehensively addresses key accounting concepts. It begins with an introduction to financial accounting, explaining its purpose and the preparation of financial statements. The solution then delves into journal entries, providing detailed examples and explanations of how transactions are recorded. Ledger accounts are presented, classifying and summarizing financial information. A trial balance is prepared to ensure mathematical accuracy, along with a discussion of its limitations. The assignment further explores financial statements, including the income statement, balance sheet, and cash flow statement, explaining their components and purpose. The solution includes examples of trading and profit and loss accounts, illustrating the process of calculating gross profit and net profit. Finally, the solution provides a conclusion summarizing the key takeaways and references used in the assignment.

FINANCIAL ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

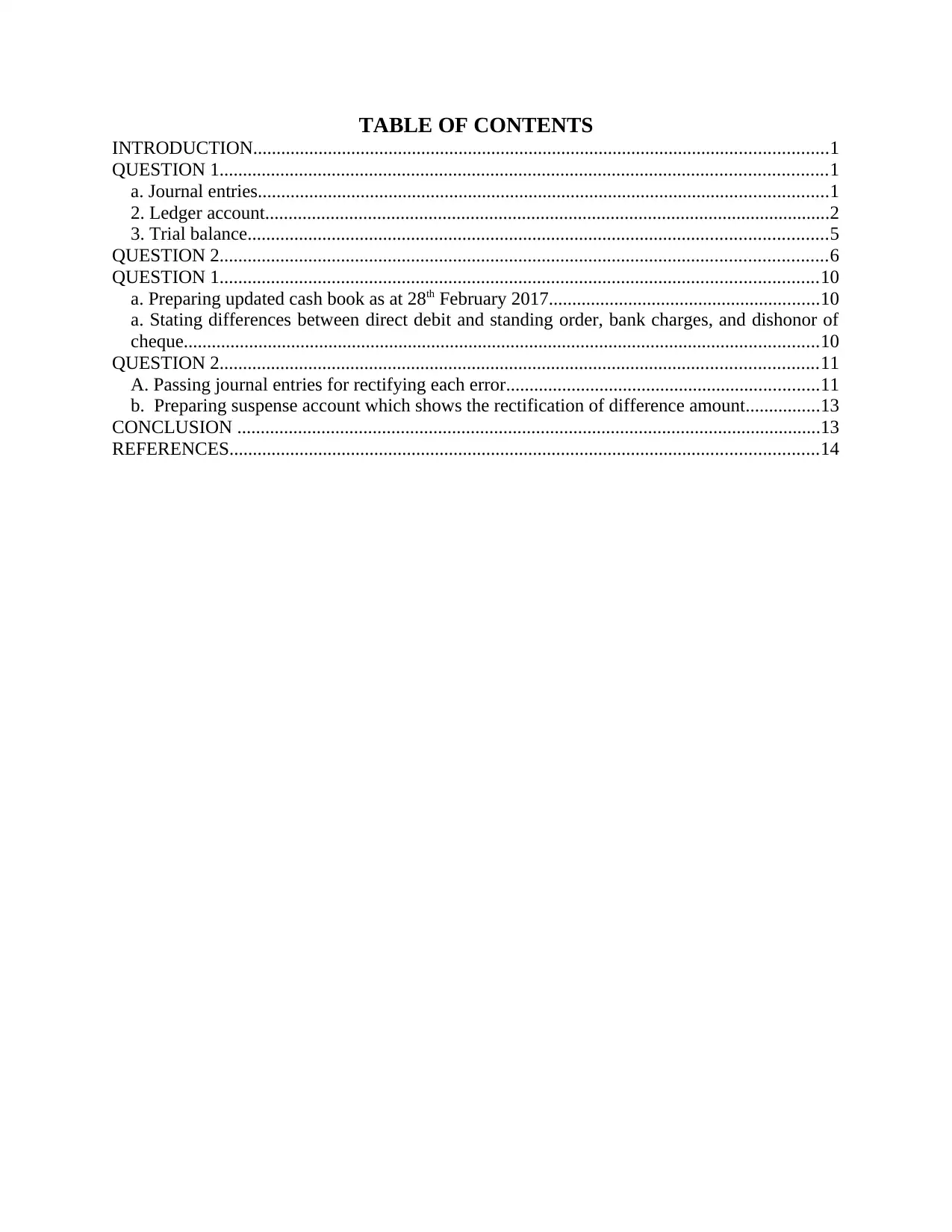

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

QUESTION 1..................................................................................................................................1

a. Journal entries..........................................................................................................................1

2. Ledger account.........................................................................................................................2

3. Trial balance............................................................................................................................5

QUESTION 2..................................................................................................................................6

QUESTION 1................................................................................................................................10

a. Preparing updated cash book as at 28th February 2017..........................................................10

a. Stating differences between direct debit and standing order, bank charges, and dishonor of

cheque........................................................................................................................................10

QUESTION 2................................................................................................................................11

A. Passing journal entries for rectifying each error...................................................................11

b. Preparing suspense account which shows the rectification of difference amount................13

CONCLUSION .............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

QUESTION 1..................................................................................................................................1

a. Journal entries..........................................................................................................................1

2. Ledger account.........................................................................................................................2

3. Trial balance............................................................................................................................5

QUESTION 2..................................................................................................................................6

QUESTION 1................................................................................................................................10

a. Preparing updated cash book as at 28th February 2017..........................................................10

a. Stating differences between direct debit and standing order, bank charges, and dishonor of

cheque........................................................................................................................................10

QUESTION 2................................................................................................................................11

A. Passing journal entries for rectifying each error...................................................................11

b. Preparing suspense account which shows the rectification of difference amount................13

CONCLUSION .............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

Financial Accounting is a process of accounting where recording, summarizing,

analyzing, reporting of financial transactions over a period of time. Financial statements which

consists of Balance Sheet, Income Statement etc. are prepared through the accounting process

through which concern understands their financial viability and helps in making sound economic

decisions. They assist in making decisions to all stakeholders which includes investors, lenders,

creditors to invest in entity. These Statements can be means of communication through which

they can disclose the information regarding its financial performance. The goal of reporting is for

enhancing ability in sound judgment about company regarding its economic strength and about

future prospects. So, Investors can have better understanding and can make investment decisions

aptly.

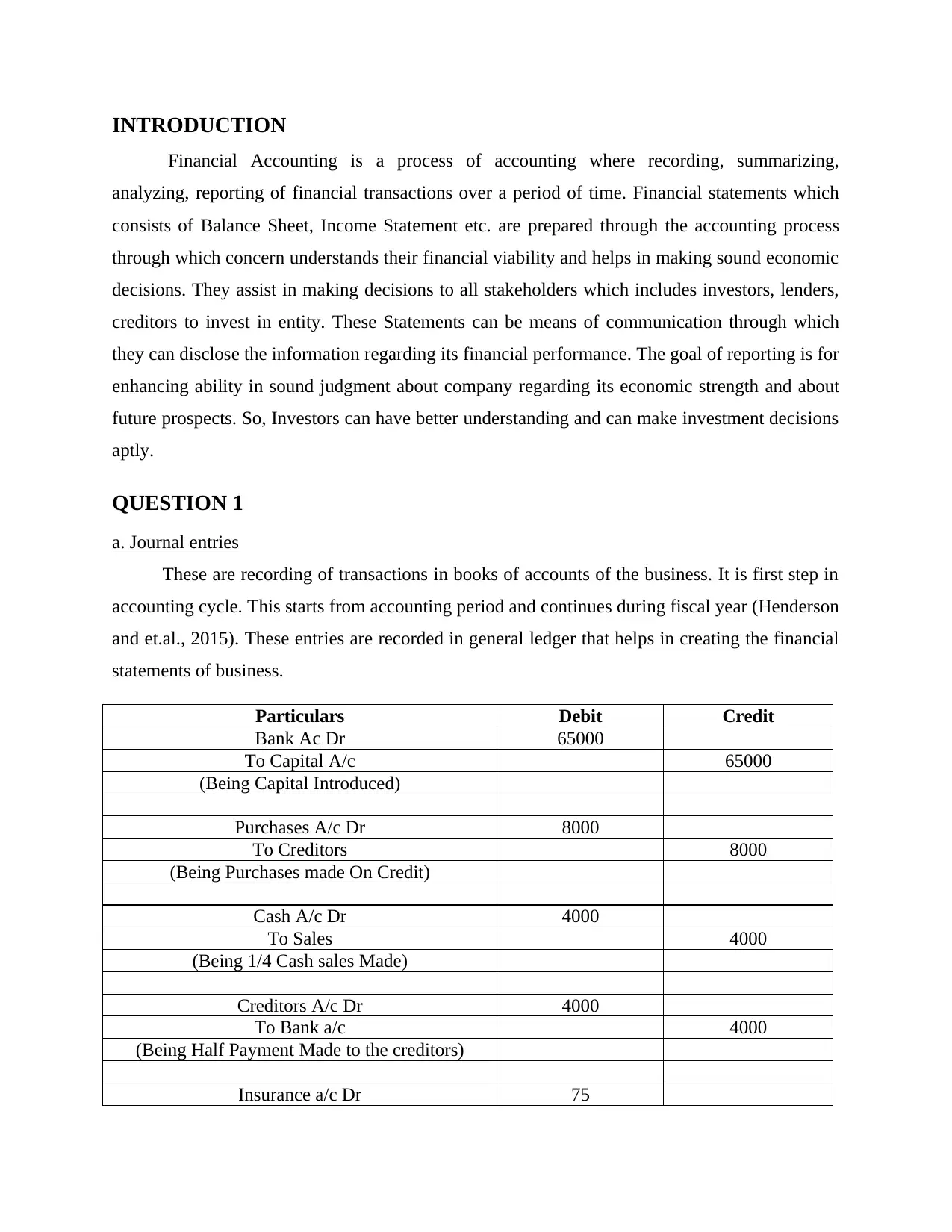

QUESTION 1

a. Journal entries

These are recording of transactions in books of accounts of the business. It is first step in

accounting cycle. This starts from accounting period and continues during fiscal year (Henderson

and et.al., 2015). These entries are recorded in general ledger that helps in creating the financial

statements of business.

Particulars Debit Credit

Bank Ac Dr 65000

To Capital A/c 65000

(Being Capital Introduced)

Purchases A/c Dr 8000

To Creditors 8000

(Being Purchases made On Credit)

Cash A/c Dr 4000

To Sales 4000

(Being 1/4 Cash sales Made)

Creditors A/c Dr 4000

To Bank a/c 4000

(Being Half Payment Made to the creditors)

Insurance a/c Dr 75

Financial Accounting is a process of accounting where recording, summarizing,

analyzing, reporting of financial transactions over a period of time. Financial statements which

consists of Balance Sheet, Income Statement etc. are prepared through the accounting process

through which concern understands their financial viability and helps in making sound economic

decisions. They assist in making decisions to all stakeholders which includes investors, lenders,

creditors to invest in entity. These Statements can be means of communication through which

they can disclose the information regarding its financial performance. The goal of reporting is for

enhancing ability in sound judgment about company regarding its economic strength and about

future prospects. So, Investors can have better understanding and can make investment decisions

aptly.

QUESTION 1

a. Journal entries

These are recording of transactions in books of accounts of the business. It is first step in

accounting cycle. This starts from accounting period and continues during fiscal year (Henderson

and et.al., 2015). These entries are recorded in general ledger that helps in creating the financial

statements of business.

Particulars Debit Credit

Bank Ac Dr 65000

To Capital A/c 65000

(Being Capital Introduced)

Purchases A/c Dr 8000

To Creditors 8000

(Being Purchases made On Credit)

Cash A/c Dr 4000

To Sales 4000

(Being 1/4 Cash sales Made)

Creditors A/c Dr 4000

To Bank a/c 4000

(Being Half Payment Made to the creditors)

Insurance a/c Dr 75

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

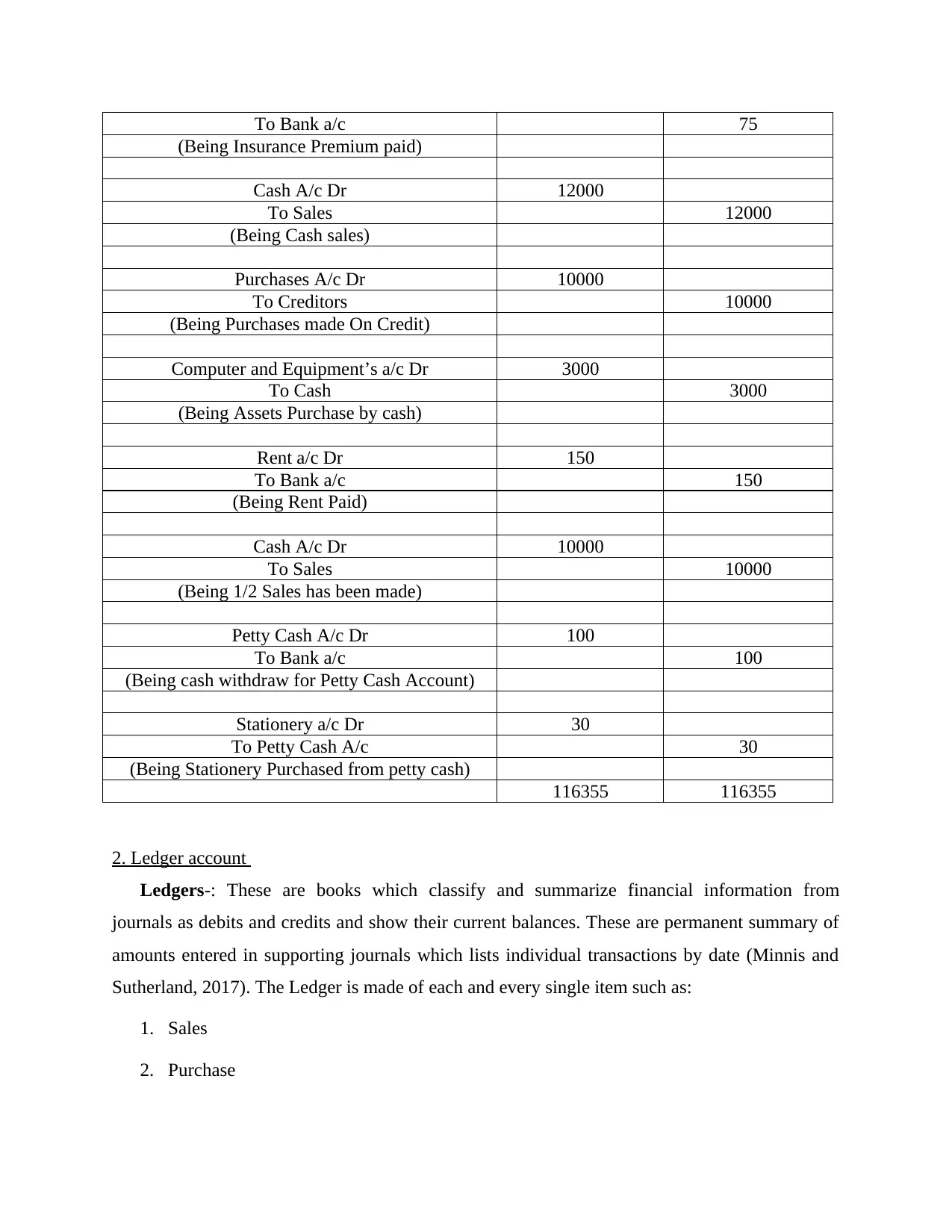

To Bank a/c 75

(Being Insurance Premium paid)

Cash A/c Dr 12000

To Sales 12000

(Being Cash sales)

Purchases A/c Dr 10000

To Creditors 10000

(Being Purchases made On Credit)

Computer and Equipment’s a/c Dr 3000

To Cash 3000

(Being Assets Purchase by cash)

Rent a/c Dr 150

To Bank a/c 150

(Being Rent Paid)

Cash A/c Dr 10000

To Sales 10000

(Being 1/2 Sales has been made)

Petty Cash A/c Dr 100

To Bank a/c 100

(Being cash withdraw for Petty Cash Account)

Stationery a/c Dr 30

To Petty Cash A/c 30

(Being Stationery Purchased from petty cash)

116355 116355

2. Ledger account

Ledgers-: These are books which classify and summarize financial information from

journals as debits and credits and show their current balances. These are permanent summary of

amounts entered in supporting journals which lists individual transactions by date (Minnis and

Sutherland, 2017). The Ledger is made of each and every single item such as:

1. Sales

2. Purchase

(Being Insurance Premium paid)

Cash A/c Dr 12000

To Sales 12000

(Being Cash sales)

Purchases A/c Dr 10000

To Creditors 10000

(Being Purchases made On Credit)

Computer and Equipment’s a/c Dr 3000

To Cash 3000

(Being Assets Purchase by cash)

Rent a/c Dr 150

To Bank a/c 150

(Being Rent Paid)

Cash A/c Dr 10000

To Sales 10000

(Being 1/2 Sales has been made)

Petty Cash A/c Dr 100

To Bank a/c 100

(Being cash withdraw for Petty Cash Account)

Stationery a/c Dr 30

To Petty Cash A/c 30

(Being Stationery Purchased from petty cash)

116355 116355

2. Ledger account

Ledgers-: These are books which classify and summarize financial information from

journals as debits and credits and show their current balances. These are permanent summary of

amounts entered in supporting journals which lists individual transactions by date (Minnis and

Sutherland, 2017). The Ledger is made of each and every single item such as:

1. Sales

2. Purchase

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

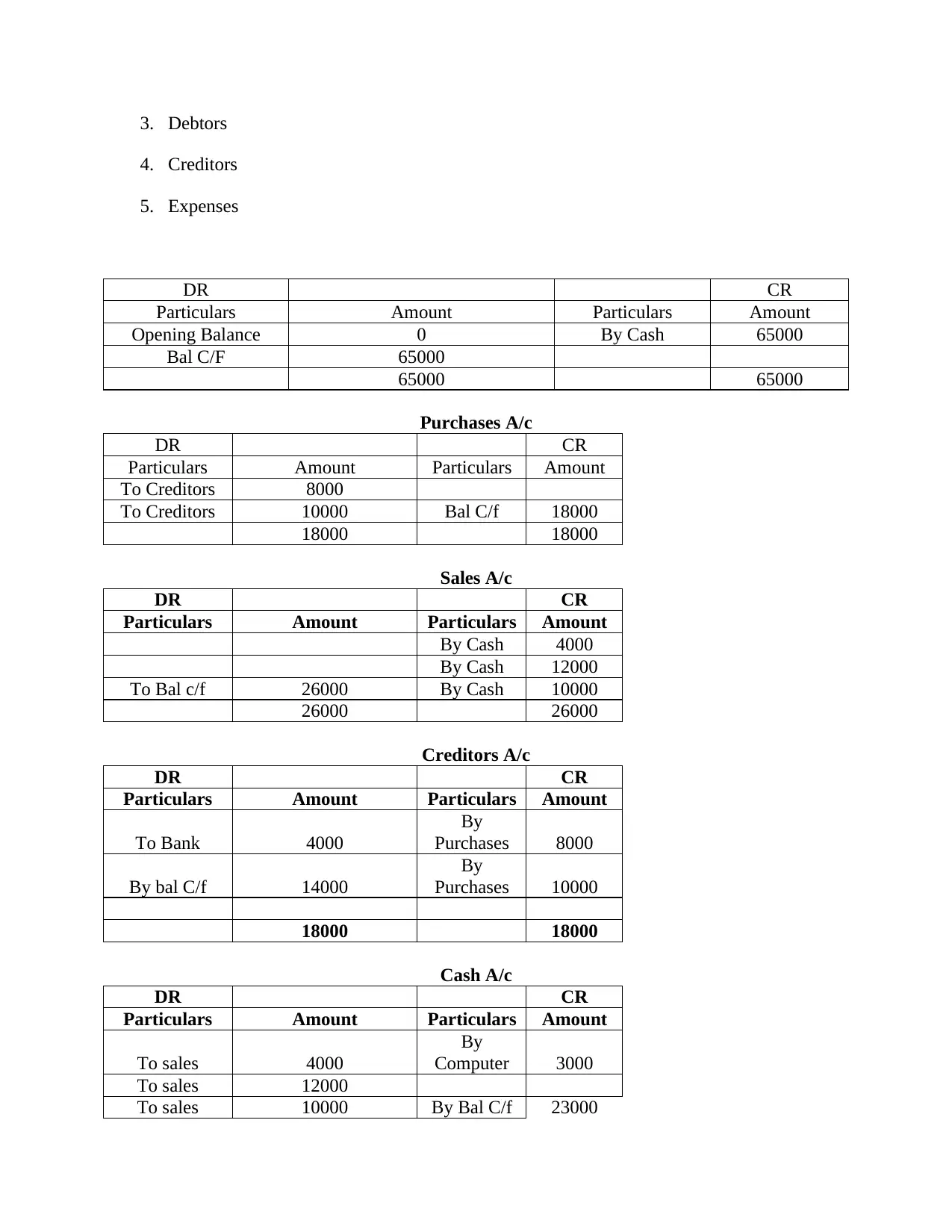

3. Debtors

4. Creditors

5. Expenses

DR CR

Particulars Amount Particulars Amount

Opening Balance 0 By Cash 65000

Bal C/F 65000

65000 65000

Purchases A/c

DR CR

Particulars Amount Particulars Amount

To Creditors 8000

To Creditors 10000 Bal C/f 18000

18000 18000

Sales A/c

DR CR

Particulars Amount Particulars Amount

By Cash 4000

By Cash 12000

To Bal c/f 26000 By Cash 10000

26000 26000

Creditors A/c

DR CR

Particulars Amount Particulars Amount

To Bank 4000

By

Purchases 8000

By bal C/f 14000

By

Purchases 10000

18000 18000

Cash A/c

DR CR

Particulars Amount Particulars Amount

To sales 4000

By

Computer 3000

To sales 12000

To sales 10000 By Bal C/f 23000

4. Creditors

5. Expenses

DR CR

Particulars Amount Particulars Amount

Opening Balance 0 By Cash 65000

Bal C/F 65000

65000 65000

Purchases A/c

DR CR

Particulars Amount Particulars Amount

To Creditors 8000

To Creditors 10000 Bal C/f 18000

18000 18000

Sales A/c

DR CR

Particulars Amount Particulars Amount

By Cash 4000

By Cash 12000

To Bal c/f 26000 By Cash 10000

26000 26000

Creditors A/c

DR CR

Particulars Amount Particulars Amount

To Bank 4000

By

Purchases 8000

By bal C/f 14000

By

Purchases 10000

18000 18000

Cash A/c

DR CR

Particulars Amount Particulars Amount

To sales 4000

By

Computer 3000

To sales 12000

To sales 10000 By Bal C/f 23000

26000 26000

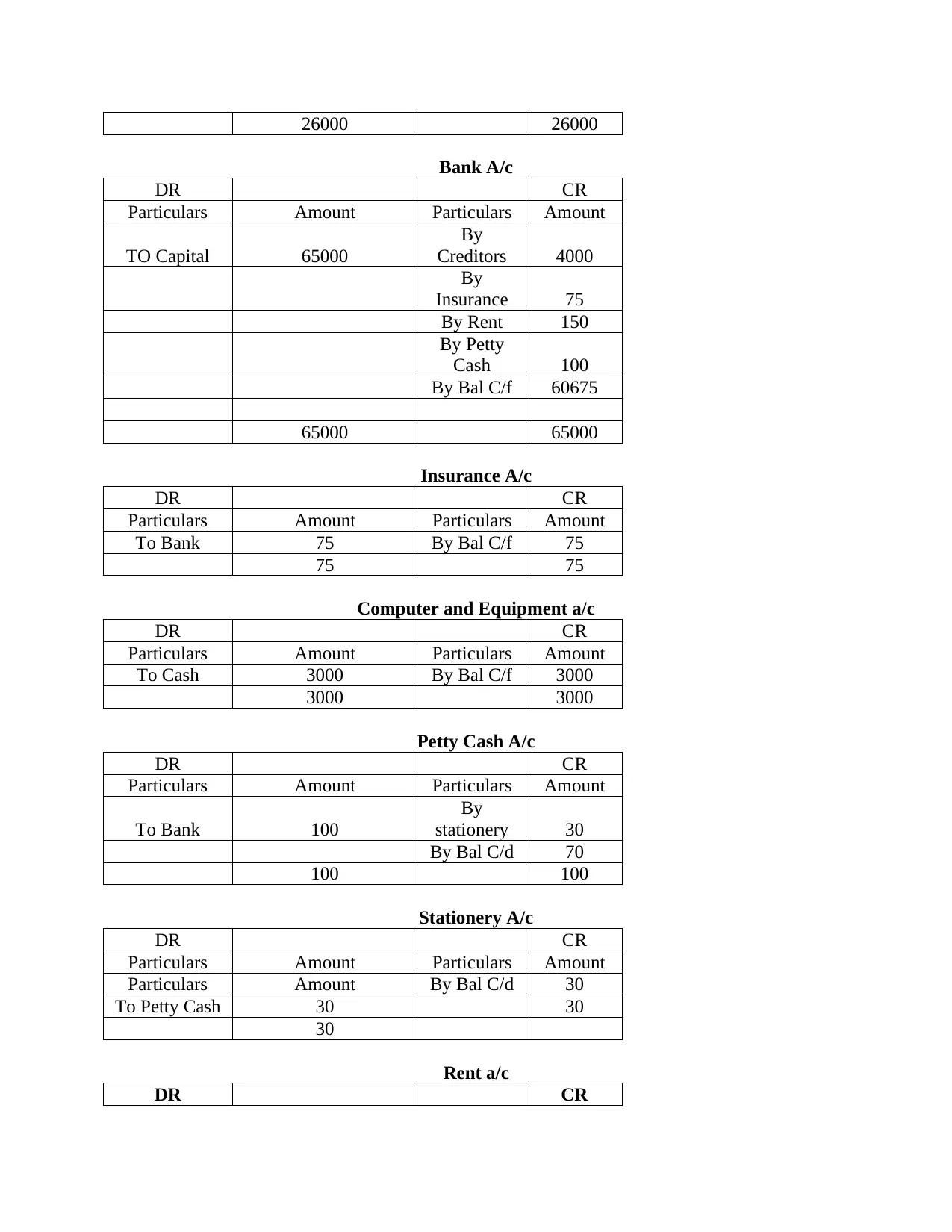

Bank A/c

DR CR

Particulars Amount Particulars Amount

TO Capital 65000

By

Creditors 4000

By

Insurance 75

By Rent 150

By Petty

Cash 100

By Bal C/f 60675

65000 65000

Insurance A/c

DR CR

Particulars Amount Particulars Amount

To Bank 75 By Bal C/f 75

75 75

Computer and Equipment a/c

DR CR

Particulars Amount Particulars Amount

To Cash 3000 By Bal C/f 3000

3000 3000

Petty Cash A/c

DR CR

Particulars Amount Particulars Amount

To Bank 100

By

stationery 30

By Bal C/d 70

100 100

Stationery A/c

DR CR

Particulars Amount Particulars Amount

Particulars Amount By Bal C/d 30

To Petty Cash 30 30

30

Rent a/c

DR CR

Bank A/c

DR CR

Particulars Amount Particulars Amount

TO Capital 65000

By

Creditors 4000

By

Insurance 75

By Rent 150

By Petty

Cash 100

By Bal C/f 60675

65000 65000

Insurance A/c

DR CR

Particulars Amount Particulars Amount

To Bank 75 By Bal C/f 75

75 75

Computer and Equipment a/c

DR CR

Particulars Amount Particulars Amount

To Cash 3000 By Bal C/f 3000

3000 3000

Petty Cash A/c

DR CR

Particulars Amount Particulars Amount

To Bank 100

By

stationery 30

By Bal C/d 70

100 100

Stationery A/c

DR CR

Particulars Amount Particulars Amount

Particulars Amount By Bal C/d 30

To Petty Cash 30 30

30

Rent a/c

DR CR

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Particulars Amount Particulars Amount

Particulars Amount By Bal C/d 150

To Bank 150 150

150

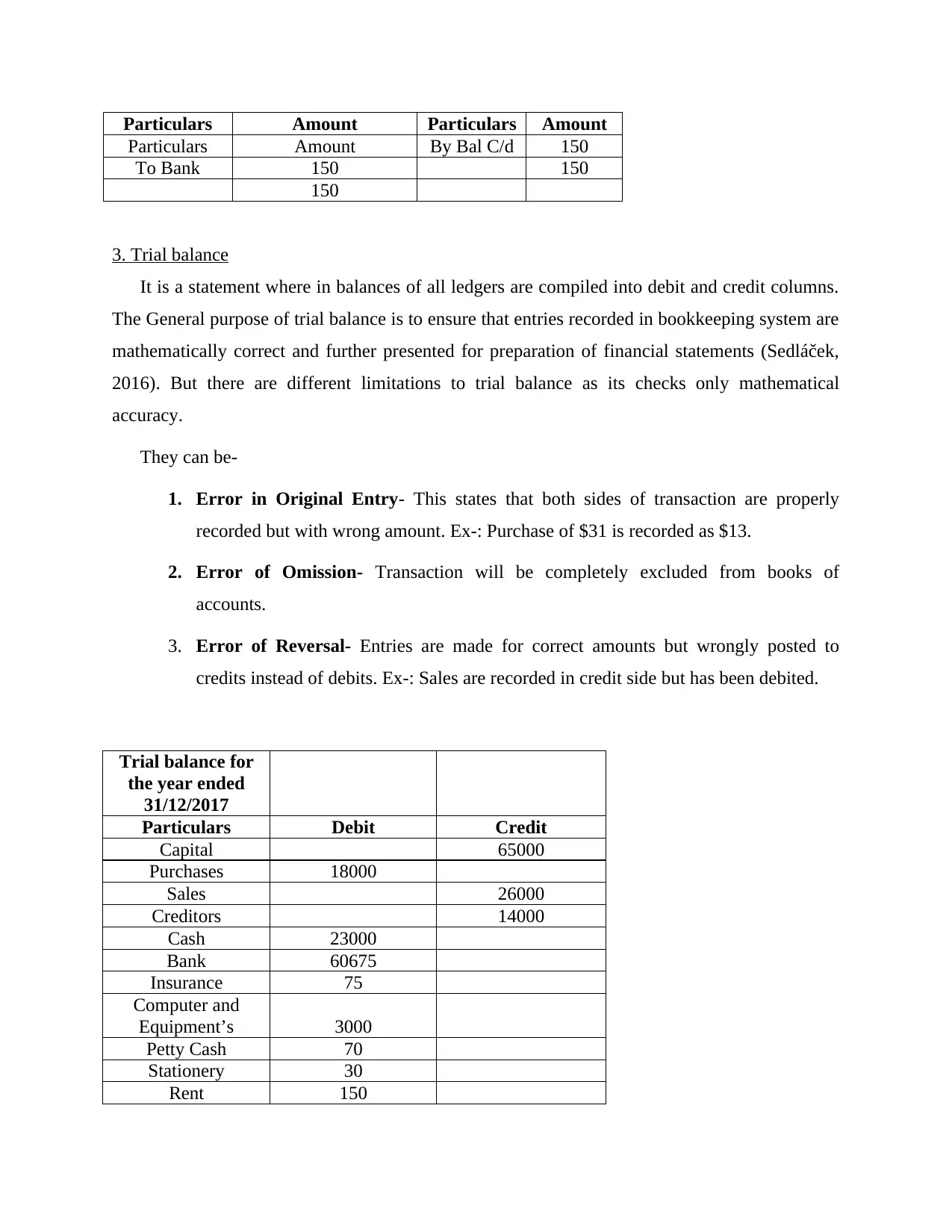

3. Trial balance

It is a statement where in balances of all ledgers are compiled into debit and credit columns.

The General purpose of trial balance is to ensure that entries recorded in bookkeeping system are

mathematically correct and further presented for preparation of financial statements (Sedláček,

2016). But there are different limitations to trial balance as its checks only mathematical

accuracy.

They can be-

1. Error in Original Entry- This states that both sides of transaction are properly

recorded but with wrong amount. Ex-: Purchase of $31 is recorded as $13.

2. Error of Omission- Transaction will be completely excluded from books of

accounts.

3. Error of Reversal- Entries are made for correct amounts but wrongly posted to

credits instead of debits. Ex-: Sales are recorded in credit side but has been debited.

Trial balance for

the year ended

31/12/2017

Particulars Debit Credit

Capital 65000

Purchases 18000

Sales 26000

Creditors 14000

Cash 23000

Bank 60675

Insurance 75

Computer and

Equipment’s 3000

Petty Cash 70

Stationery 30

Rent 150

Particulars Amount By Bal C/d 150

To Bank 150 150

150

3. Trial balance

It is a statement where in balances of all ledgers are compiled into debit and credit columns.

The General purpose of trial balance is to ensure that entries recorded in bookkeeping system are

mathematically correct and further presented for preparation of financial statements (Sedláček,

2016). But there are different limitations to trial balance as its checks only mathematical

accuracy.

They can be-

1. Error in Original Entry- This states that both sides of transaction are properly

recorded but with wrong amount. Ex-: Purchase of $31 is recorded as $13.

2. Error of Omission- Transaction will be completely excluded from books of

accounts.

3. Error of Reversal- Entries are made for correct amounts but wrongly posted to

credits instead of debits. Ex-: Sales are recorded in credit side but has been debited.

Trial balance for

the year ended

31/12/2017

Particulars Debit Credit

Capital 65000

Purchases 18000

Sales 26000

Creditors 14000

Cash 23000

Bank 60675

Insurance 75

Computer and

Equipment’s 3000

Petty Cash 70

Stationery 30

Rent 150

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Total 105000 105000

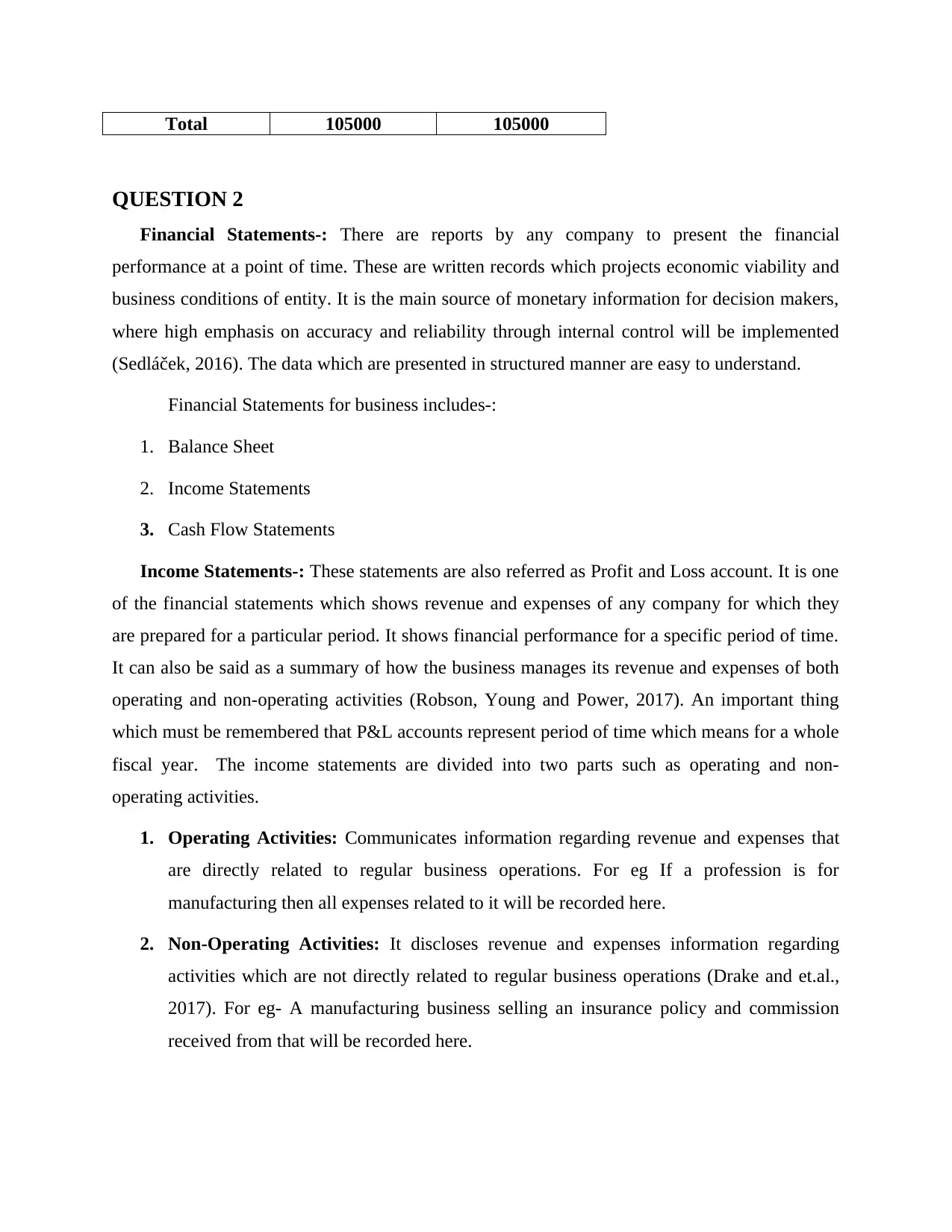

QUESTION 2

Financial Statements-: There are reports by any company to present the financial

performance at a point of time. These are written records which projects economic viability and

business conditions of entity. It is the main source of monetary information for decision makers,

where high emphasis on accuracy and reliability through internal control will be implemented

(Sedláček, 2016). The data which are presented in structured manner are easy to understand.

Financial Statements for business includes-:

1. Balance Sheet

2. Income Statements

3. Cash Flow Statements

Income Statements-: These statements are also referred as Profit and Loss account. It is one

of the financial statements which shows revenue and expenses of any company for which they

are prepared for a particular period. It shows financial performance for a specific period of time.

It can also be said as a summary of how the business manages its revenue and expenses of both

operating and non-operating activities (Robson, Young and Power, 2017). An important thing

which must be remembered that P&L accounts represent period of time which means for a whole

fiscal year. The income statements are divided into two parts such as operating and non-

operating activities.

1. Operating Activities: Communicates information regarding revenue and expenses that

are directly related to regular business operations. For eg If a profession is for

manufacturing then all expenses related to it will be recorded here.

2. Non-Operating Activities: It discloses revenue and expenses information regarding

activities which are not directly related to regular business operations (Drake and et.al.,

2017). For eg- A manufacturing business selling an insurance policy and commission

received from that will be recorded here.

QUESTION 2

Financial Statements-: There are reports by any company to present the financial

performance at a point of time. These are written records which projects economic viability and

business conditions of entity. It is the main source of monetary information for decision makers,

where high emphasis on accuracy and reliability through internal control will be implemented

(Sedláček, 2016). The data which are presented in structured manner are easy to understand.

Financial Statements for business includes-:

1. Balance Sheet

2. Income Statements

3. Cash Flow Statements

Income Statements-: These statements are also referred as Profit and Loss account. It is one

of the financial statements which shows revenue and expenses of any company for which they

are prepared for a particular period. It shows financial performance for a specific period of time.

It can also be said as a summary of how the business manages its revenue and expenses of both

operating and non-operating activities (Robson, Young and Power, 2017). An important thing

which must be remembered that P&L accounts represent period of time which means for a whole

fiscal year. The income statements are divided into two parts such as operating and non-

operating activities.

1. Operating Activities: Communicates information regarding revenue and expenses that

are directly related to regular business operations. For eg If a profession is for

manufacturing then all expenses related to it will be recorded here.

2. Non-Operating Activities: It discloses revenue and expenses information regarding

activities which are not directly related to regular business operations (Drake and et.al.,

2017). For eg- A manufacturing business selling an insurance policy and commission

received from that will be recorded here.

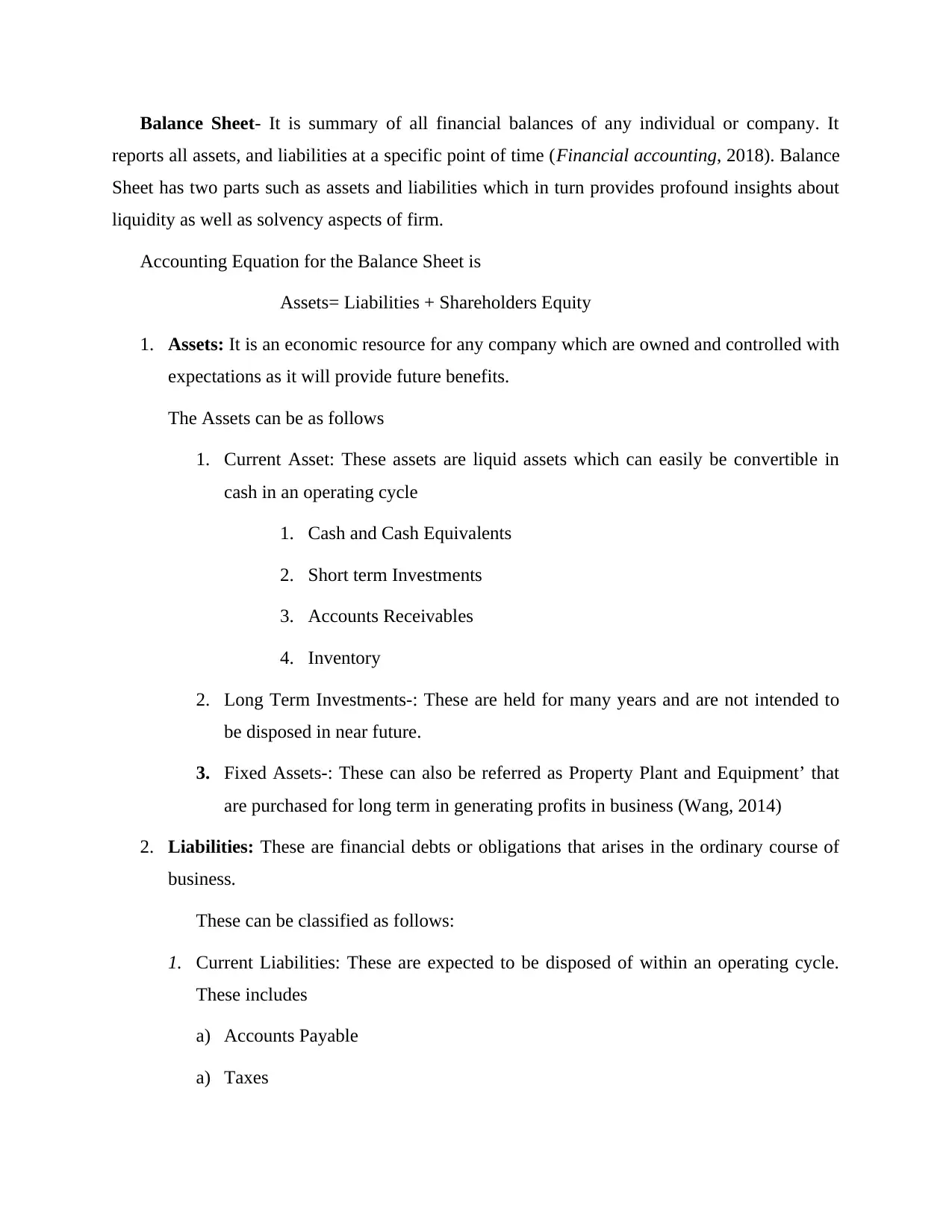

Balance Sheet- It is summary of all financial balances of any individual or company. It

reports all assets, and liabilities at a specific point of time (Financial accounting, 2018). Balance

Sheet has two parts such as assets and liabilities which in turn provides profound insights about

liquidity as well as solvency aspects of firm.

Accounting Equation for the Balance Sheet is

Assets= Liabilities + Shareholders Equity

1. Assets: It is an economic resource for any company which are owned and controlled with

expectations as it will provide future benefits.

The Assets can be as follows

1. Current Asset: These assets are liquid assets which can easily be convertible in

cash in an operating cycle

1. Cash and Cash Equivalents

2. Short term Investments

3. Accounts Receivables

4. Inventory

2. Long Term Investments-: These are held for many years and are not intended to

be disposed in near future.

3. Fixed Assets-: These can also be referred as Property Plant and Equipment’ that

are purchased for long term in generating profits in business (Wang, 2014)

2. Liabilities: These are financial debts or obligations that arises in the ordinary course of

business.

These can be classified as follows:

1. Current Liabilities: These are expected to be disposed of within an operating cycle.

These includes

a) Accounts Payable

a) Taxes

reports all assets, and liabilities at a specific point of time (Financial accounting, 2018). Balance

Sheet has two parts such as assets and liabilities which in turn provides profound insights about

liquidity as well as solvency aspects of firm.

Accounting Equation for the Balance Sheet is

Assets= Liabilities + Shareholders Equity

1. Assets: It is an economic resource for any company which are owned and controlled with

expectations as it will provide future benefits.

The Assets can be as follows

1. Current Asset: These assets are liquid assets which can easily be convertible in

cash in an operating cycle

1. Cash and Cash Equivalents

2. Short term Investments

3. Accounts Receivables

4. Inventory

2. Long Term Investments-: These are held for many years and are not intended to

be disposed in near future.

3. Fixed Assets-: These can also be referred as Property Plant and Equipment’ that

are purchased for long term in generating profits in business (Wang, 2014)

2. Liabilities: These are financial debts or obligations that arises in the ordinary course of

business.

These can be classified as follows:

1. Current Liabilities: These are expected to be disposed of within an operating cycle.

These includes

a) Accounts Payable

a) Taxes

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2. Long Term Liabilities: These are not to be liquidated within an operating cycle. These

includes

a) Long Term Bonds

a) Leases

3. Shareholders’ Equity: These are owners fund, which are left after all the payments of

debts. It is also known as capital of the company. It consists of-:

a) Issued Authorized Capital

b) Reserves and Surplus

c) Non-Controlling Interest

4. Cash Flow Statements-: These are statements which summarizes cash and cash

equivalents of company. These measures how well they manage their liquidity position

and generates cash to pay its obligations (Vanauken and et.al., 2016). The following is

structure of cash flow statement.

1. Cash from Operating Activities

2. Cash from Investing Activities

3. Cash from Financing Activities

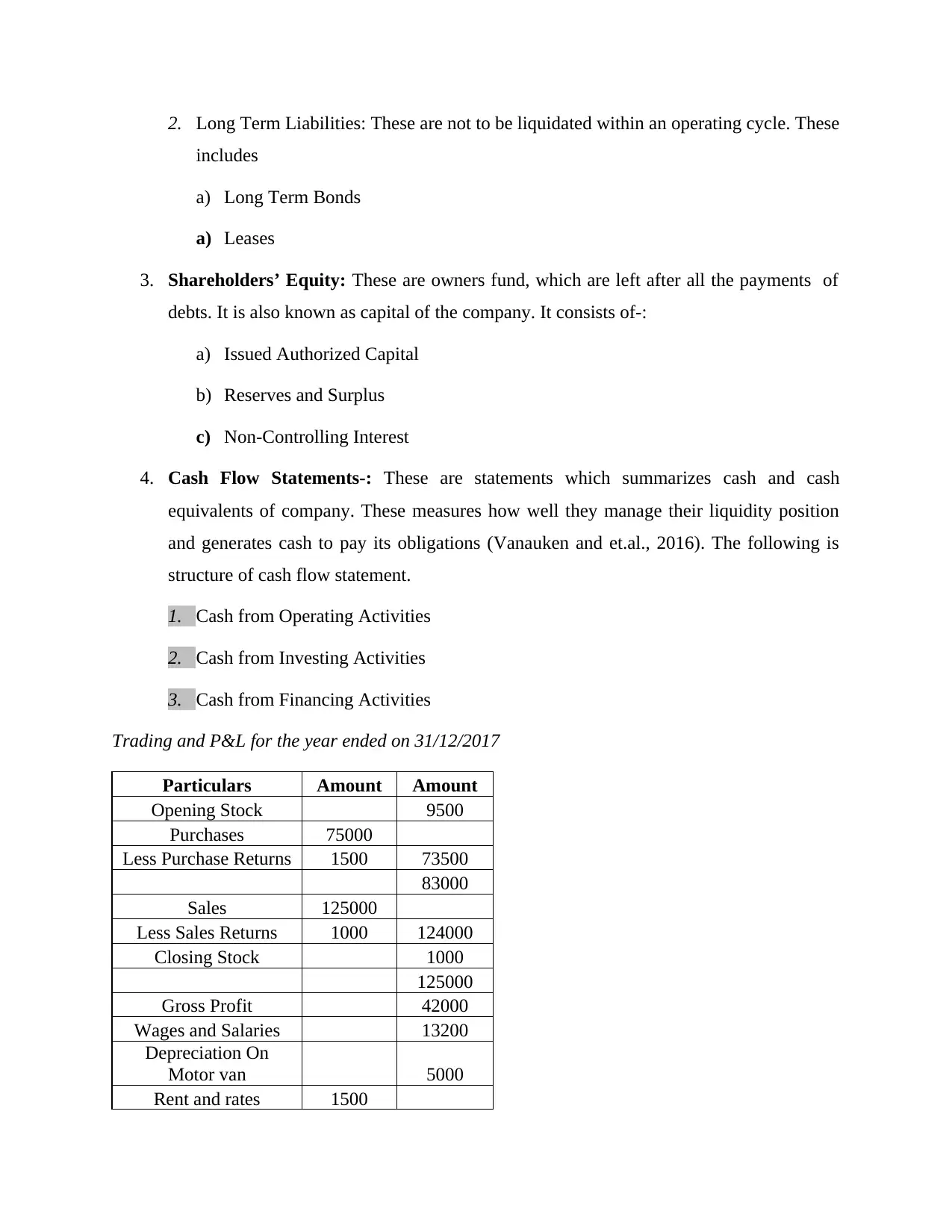

Trading and P&L for the year ended on 31/12/2017

Particulars Amount Amount

Opening Stock 9500

Purchases 75000

Less Purchase Returns 1500 73500

83000

Sales 125000

Less Sales Returns 1000 124000

Closing Stock 1000

125000

Gross Profit 42000

Wages and Salaries 13200

Depreciation On

Motor van 5000

Rent and rates 1500

includes

a) Long Term Bonds

a) Leases

3. Shareholders’ Equity: These are owners fund, which are left after all the payments of

debts. It is also known as capital of the company. It consists of-:

a) Issued Authorized Capital

b) Reserves and Surplus

c) Non-Controlling Interest

4. Cash Flow Statements-: These are statements which summarizes cash and cash

equivalents of company. These measures how well they manage their liquidity position

and generates cash to pay its obligations (Vanauken and et.al., 2016). The following is

structure of cash flow statement.

1. Cash from Operating Activities

2. Cash from Investing Activities

3. Cash from Financing Activities

Trading and P&L for the year ended on 31/12/2017

Particulars Amount Amount

Opening Stock 9500

Purchases 75000

Less Purchase Returns 1500 73500

83000

Sales 125000

Less Sales Returns 1000 124000

Closing Stock 1000

125000

Gross Profit 42000

Wages and Salaries 13200

Depreciation On

Motor van 5000

Rent and rates 1500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Add outstanding Rates 340 1840

Postage 900

Insurance 7500

Less Prepaid

Insurance 411 7089

Bad Debts 1200

12771

Interest On Loan 10000

Add Rent Received 4850

Less Advance Rent 490 4360

Net Profit 27131

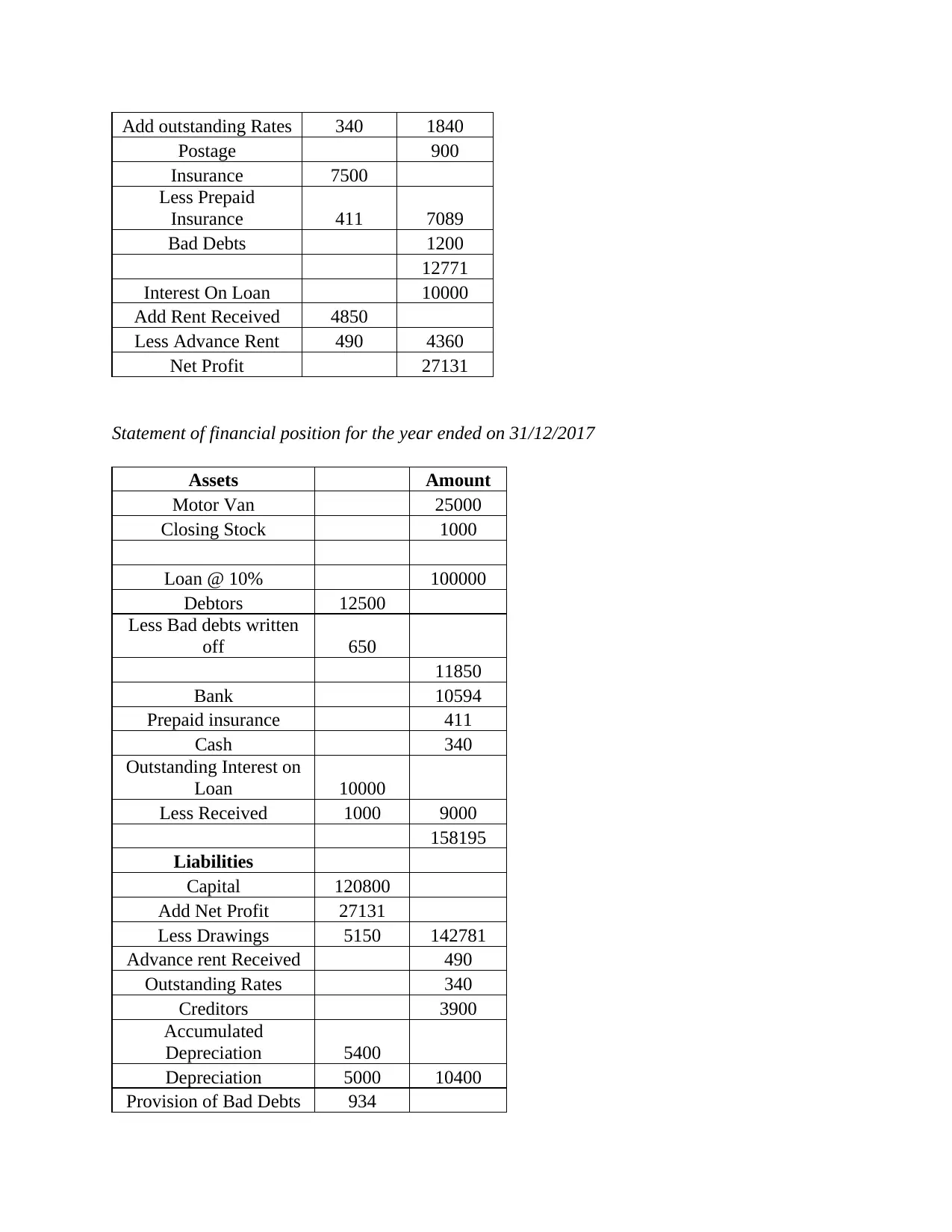

Statement of financial position for the year ended on 31/12/2017

Assets Amount

Motor Van 25000

Closing Stock 1000

Loan @ 10% 100000

Debtors 12500

Less Bad debts written

off 650

11850

Bank 10594

Prepaid insurance 411

Cash 340

Outstanding Interest on

Loan 10000

Less Received 1000 9000

158195

Liabilities

Capital 120800

Add Net Profit 27131

Less Drawings 5150 142781

Advance rent Received 490

Outstanding Rates 340

Creditors 3900

Accumulated

Depreciation 5400

Depreciation 5000 10400

Provision of Bad Debts 934

Postage 900

Insurance 7500

Less Prepaid

Insurance 411 7089

Bad Debts 1200

12771

Interest On Loan 10000

Add Rent Received 4850

Less Advance Rent 490 4360

Net Profit 27131

Statement of financial position for the year ended on 31/12/2017

Assets Amount

Motor Van 25000

Closing Stock 1000

Loan @ 10% 100000

Debtors 12500

Less Bad debts written

off 650

11850

Bank 10594

Prepaid insurance 411

Cash 340

Outstanding Interest on

Loan 10000

Less Received 1000 9000

158195

Liabilities

Capital 120800

Add Net Profit 27131

Less Drawings 5150 142781

Advance rent Received 490

Outstanding Rates 340

Creditors 3900

Accumulated

Depreciation 5400

Depreciation 5000 10400

Provision of Bad Debts 934

Written Off 650 284

158195

QUESTION 1

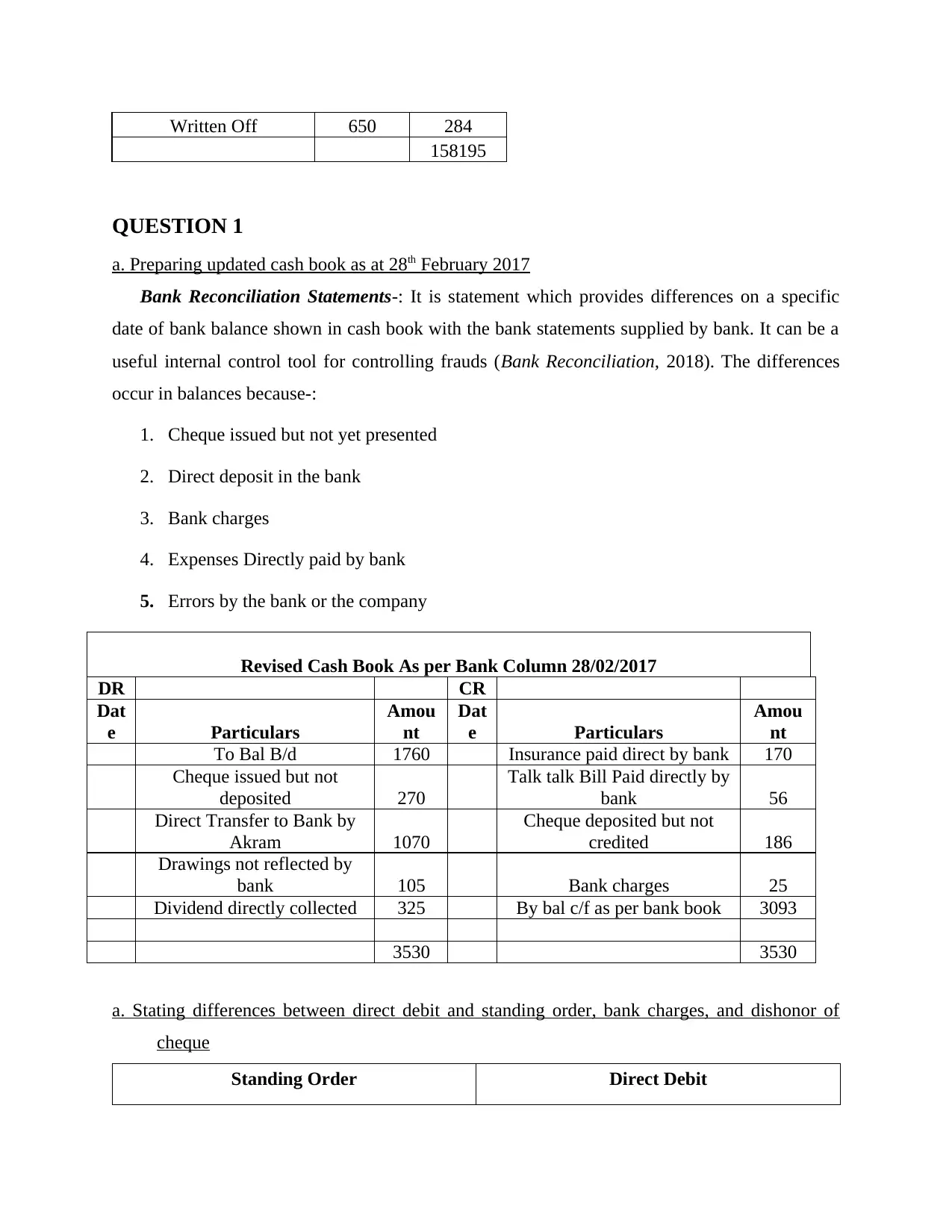

a. Preparing updated cash book as at 28th February 2017

Bank Reconciliation Statements-: It is statement which provides differences on a specific

date of bank balance shown in cash book with the bank statements supplied by bank. It can be a

useful internal control tool for controlling frauds (Bank Reconciliation, 2018). The differences

occur in balances because-:

1. Cheque issued but not yet presented

2. Direct deposit in the bank

3. Bank charges

4. Expenses Directly paid by bank

5. Errors by the bank or the company

Revised Cash Book As per Bank Column 28/02/2017

DR CR

Dat

e Particulars

Amou

nt

Dat

e Particulars

Amou

nt

To Bal B/d 1760 Insurance paid direct by bank 170

Cheque issued but not

deposited 270

Talk talk Bill Paid directly by

bank 56

Direct Transfer to Bank by

Akram 1070

Cheque deposited but not

credited 186

Drawings not reflected by

bank 105 Bank charges 25

Dividend directly collected 325 By bal c/f as per bank book 3093

3530 3530

a. Stating differences between direct debit and standing order, bank charges, and dishonor of

cheque

Standing Order Direct Debit

158195

QUESTION 1

a. Preparing updated cash book as at 28th February 2017

Bank Reconciliation Statements-: It is statement which provides differences on a specific

date of bank balance shown in cash book with the bank statements supplied by bank. It can be a

useful internal control tool for controlling frauds (Bank Reconciliation, 2018). The differences

occur in balances because-:

1. Cheque issued but not yet presented

2. Direct deposit in the bank

3. Bank charges

4. Expenses Directly paid by bank

5. Errors by the bank or the company

Revised Cash Book As per Bank Column 28/02/2017

DR CR

Dat

e Particulars

Amou

nt

Dat

e Particulars

Amou

nt

To Bal B/d 1760 Insurance paid direct by bank 170

Cheque issued but not

deposited 270

Talk talk Bill Paid directly by

bank 56

Direct Transfer to Bank by

Akram 1070

Cheque deposited but not

credited 186

Drawings not reflected by

bank 105 Bank charges 25

Dividend directly collected 325 By bal c/f as per bank book 3093

3530 3530

a. Stating differences between direct debit and standing order, bank charges, and dishonor of

cheque

Standing Order Direct Debit

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.