Financial Accounting Study Material with Solved Assignments and Essays

VerifiedAdded on 2023/06/13

|12

|3912

|399

AI Summary

This study material includes solved assignments and essays on Financial Accounting. It also provides a consolidated statement of financial position for the Pee group at 31 December 2020. The material explains the concepts of relevance, reliability, and comparability in financial information. It also discusses the financial performance of a business based on growth, profitability, and credit management. Additionally, it highlights the importance of non-financial information in predicting the future success of a business.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

221 Financial

Accounting

Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

Contents...........................................................................................................................................2

Question 1........................................................................................................................................1

A) Prepared the consolidated statement of financial position for the Pee group at 31 December

2020. Pee plc has a policy of valuing Non-Controlling interest at their share of net assets at

acquisition....................................................................................................................................1

B) Explain what is meant by relevance, reliability and comparability and how they make

financial information useful.........................................................................................................2

Question 2........................................................................................................................................6

Using the information in appendix 1 only, comment on the financial performance of the

business (briefly consider growth, profitability and credit management)...................................6

Explain why non-financial information, such as the type shown in appendix 2, is likely to give

a better indication of the likely future success of the business than the financial information

given in appendix 1......................................................................................................................6

Using the data given in appendix 2, comment on the performance of the business. Include

comments on internal business processes, customer knowledge and learning/growth, and

provide a concluding comment on the overall performance of the business...............................8

b) Briefly discuss why professional ethics are important in accounting and discuss five

fundamental principles of professional ethics for accountants....................................................9

REFERENCES..............................................................................................................................10

Contents...........................................................................................................................................2

Question 1........................................................................................................................................1

A) Prepared the consolidated statement of financial position for the Pee group at 31 December

2020. Pee plc has a policy of valuing Non-Controlling interest at their share of net assets at

acquisition....................................................................................................................................1

B) Explain what is meant by relevance, reliability and comparability and how they make

financial information useful.........................................................................................................2

Question 2........................................................................................................................................6

Using the information in appendix 1 only, comment on the financial performance of the

business (briefly consider growth, profitability and credit management)...................................6

Explain why non-financial information, such as the type shown in appendix 2, is likely to give

a better indication of the likely future success of the business than the financial information

given in appendix 1......................................................................................................................6

Using the data given in appendix 2, comment on the performance of the business. Include

comments on internal business processes, customer knowledge and learning/growth, and

provide a concluding comment on the overall performance of the business...............................8

b) Briefly discuss why professional ethics are important in accounting and discuss five

fundamental principles of professional ethics for accountants....................................................9

REFERENCES..............................................................................................................................10

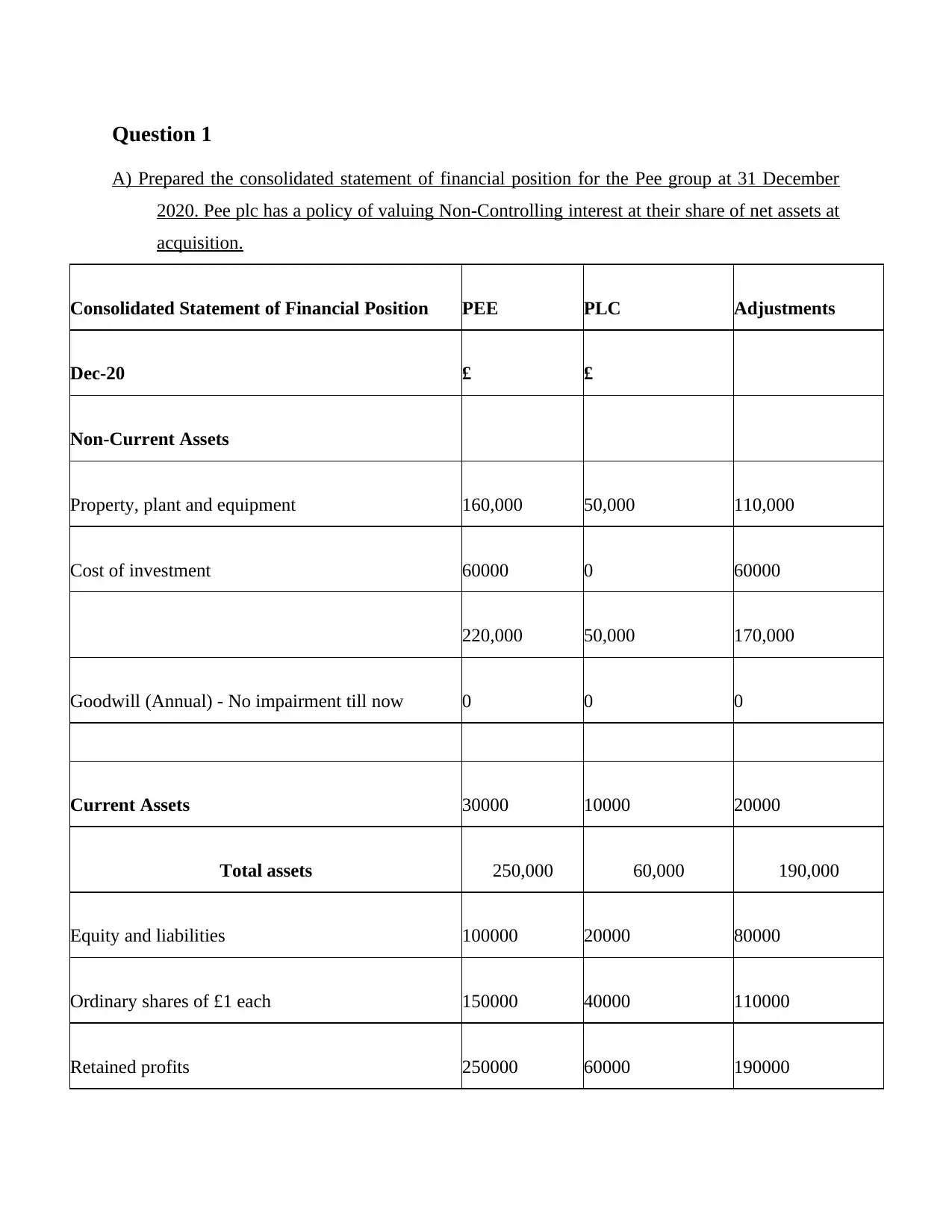

Question 1

A) Prepared the consolidated statement of financial position for the Pee group at 31 December

2020. Pee plc has a policy of valuing Non-Controlling interest at their share of net assets at

acquisition.

Consolidated Statement of Financial Position PEE PLC Adjustments

Dec-20 £ £

Non-Current Assets

Property, plant and equipment 160,000 50,000 110,000

Cost of investment 60000 0 60000

220,000 50,000 170,000

Goodwill (Annual) - No impairment till now 0 0 0

Current Assets 30000 10000 20000

Total assets 250,000 60,000 190,000

Equity and liabilities 100000 20000 80000

Ordinary shares of £1 each 150000 40000 110000

Retained profits 250000 60000 190000

A) Prepared the consolidated statement of financial position for the Pee group at 31 December

2020. Pee plc has a policy of valuing Non-Controlling interest at their share of net assets at

acquisition.

Consolidated Statement of Financial Position PEE PLC Adjustments

Dec-20 £ £

Non-Current Assets

Property, plant and equipment 160,000 50,000 110,000

Cost of investment 60000 0 60000

220,000 50,000 170,000

Goodwill (Annual) - No impairment till now 0 0 0

Current Assets 30000 10000 20000

Total assets 250,000 60,000 190,000

Equity and liabilities 100000 20000 80000

Ordinary shares of £1 each 150000 40000 110000

Retained profits 250000 60000 190000

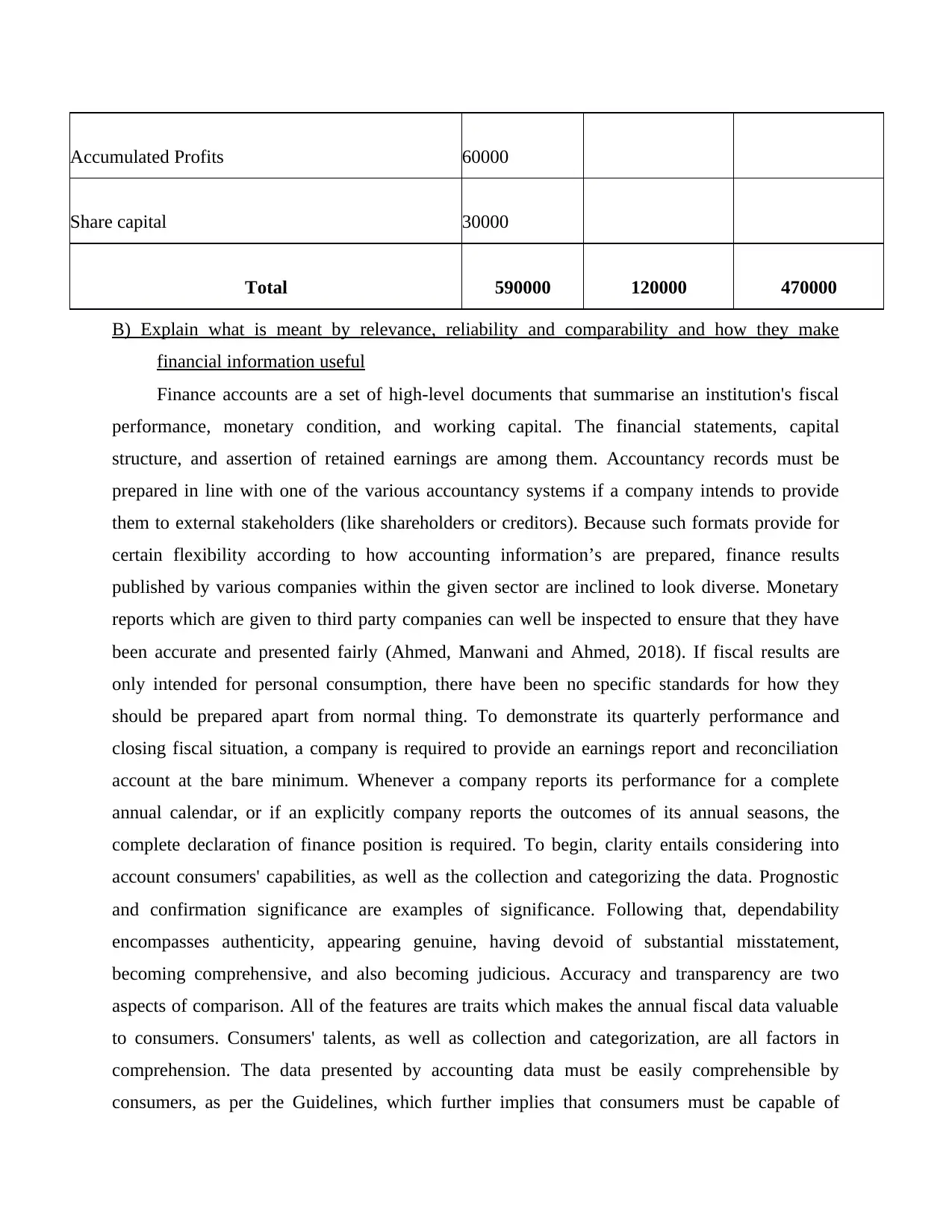

Accumulated Profits 60000

Share capital 30000

Total 590000 120000 470000

B) Explain what is meant by relevance, reliability and comparability and how they make

financial information useful

Finance accounts are a set of high-level documents that summarise an institution's fiscal

performance, monetary condition, and working capital. The financial statements, capital

structure, and assertion of retained earnings are among them. Accountancy records must be

prepared in line with one of the various accountancy systems if a company intends to provide

them to external stakeholders (like shareholders or creditors). Because such formats provide for

certain flexibility according to how accounting information’s are prepared, finance results

published by various companies within the given sector are inclined to look diverse. Monetary

reports which are given to third party companies can well be inspected to ensure that they have

been accurate and presented fairly (Ahmed, Manwani and Ahmed, 2018). If fiscal results are

only intended for personal consumption, there have been no specific standards for how they

should be prepared apart from normal thing. To demonstrate its quarterly performance and

closing fiscal situation, a company is required to provide an earnings report and reconciliation

account at the bare minimum. Whenever a company reports its performance for a complete

annual calendar, or if an explicitly company reports the outcomes of its annual seasons, the

complete declaration of finance position is required. To begin, clarity entails considering into

account consumers' capabilities, as well as the collection and categorizing the data. Prognostic

and confirmation significance are examples of significance. Following that, dependability

encompasses authenticity, appearing genuine, having devoid of substantial misstatement,

becoming comprehensive, and also becoming judicious. Accuracy and transparency are two

aspects of comparison. All of the features are traits which makes the annual fiscal data valuable

to consumers. Consumers' talents, as well as collection and categorization, are all factors in

comprehension. The data presented by accounting data must be easily comprehensible by

consumers, as per the Guidelines, which further implies that consumers must be capable of

Share capital 30000

Total 590000 120000 470000

B) Explain what is meant by relevance, reliability and comparability and how they make

financial information useful

Finance accounts are a set of high-level documents that summarise an institution's fiscal

performance, monetary condition, and working capital. The financial statements, capital

structure, and assertion of retained earnings are among them. Accountancy records must be

prepared in line with one of the various accountancy systems if a company intends to provide

them to external stakeholders (like shareholders or creditors). Because such formats provide for

certain flexibility according to how accounting information’s are prepared, finance results

published by various companies within the given sector are inclined to look diverse. Monetary

reports which are given to third party companies can well be inspected to ensure that they have

been accurate and presented fairly (Ahmed, Manwani and Ahmed, 2018). If fiscal results are

only intended for personal consumption, there have been no specific standards for how they

should be prepared apart from normal thing. To demonstrate its quarterly performance and

closing fiscal situation, a company is required to provide an earnings report and reconciliation

account at the bare minimum. Whenever a company reports its performance for a complete

annual calendar, or if an explicitly company reports the outcomes of its annual seasons, the

complete declaration of finance position is required. To begin, clarity entails considering into

account consumers' capabilities, as well as the collection and categorizing the data. Prognostic

and confirmation significance are examples of significance. Following that, dependability

encompasses authenticity, appearing genuine, having devoid of substantial misstatement,

becoming comprehensive, and also becoming judicious. Accuracy and transparency are two

aspects of comparison. All of the features are traits which makes the annual fiscal data valuable

to consumers. Consumers' talents, as well as collection and categorization, are all factors in

comprehension. The data presented by accounting data must be easily comprehensible by

consumers, as per the Guidelines, which further implies that consumers must be capable of

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

grasping its importance. Aside from that, individuals compiling income reports have had the

right to presume that consumers have such a basic understanding of economics, related to

international trade, and accountancy, as well as a desire to investigate the data supplied with

basic thoroughness. Monetary data is combined and grouped as per conventional disclosures,

such as the monetary statements and cash flow account, to make it easier to interpret. It will be

useless to publish a summary of all the values to customers. The value of presenting a summary

of all outstanding client amounts at December 31, for instance, is minimal, although an overall

amount for all accounts receipts would offer insights which could help to consumers. They might

contrast the present year's accounts receipts to the previous years. This would offer a sense of

how financial planning has evolved throughout decades (Bastani and Bayati, 2020).

Fiscal accounts' quantitative qualities- The following are the 3 most important

quantitative qualities of fiscal declarations:

Relevance- Consumers' wants must be relevant to the data that would be the situation

whenever the data affects their financial decision. This can involve revealing data that is

particularly important or material whose lack or mistake might have had an effect on

participants' spending activities. It is referred by the Contextual knowledge as the

potential of the details to affect consumers' investment choices by assisting people in

evaluating previous, current, or prospective occurrences, or by verifying or rectifying

their previous view. As a result, data must have prognostic or confirming significance. If

data aids consumers in evaluating or assessing previous, current, or upcoming

projections, it has prognostic validity. Knowledge does not seem to be in the shape of an

unambiguous prognosis to have predictive ability. The idea of creating forecasts from

fiscal accounts, on the other hand, is aided by the presentation of historical data.

Furthermore, deals involving recently bought businesses or businesses which have been

sold are reviewed and analysed and reported independently from deals involving ongoing

work (Commerford, Hatfield and Houston, 2018). As a consequence, a conscientious

customer could find variations in the institution's profitability and fiscal condition as a

consequence of routine operations which are likely to develop in the coming. If research

provides consumers verify or improve their previous judgments and determinations, it has

predictive quality. Whenever important data is communicated in a reasonable timeframe,

it has a greater chance of influencing judgement call. Materiality that is also known as

right to presume that consumers have such a basic understanding of economics, related to

international trade, and accountancy, as well as a desire to investigate the data supplied with

basic thoroughness. Monetary data is combined and grouped as per conventional disclosures,

such as the monetary statements and cash flow account, to make it easier to interpret. It will be

useless to publish a summary of all the values to customers. The value of presenting a summary

of all outstanding client amounts at December 31, for instance, is minimal, although an overall

amount for all accounts receipts would offer insights which could help to consumers. They might

contrast the present year's accounts receipts to the previous years. This would offer a sense of

how financial planning has evolved throughout decades (Bastani and Bayati, 2020).

Fiscal accounts' quantitative qualities- The following are the 3 most important

quantitative qualities of fiscal declarations:

Relevance- Consumers' wants must be relevant to the data that would be the situation

whenever the data affects their financial decision. This can involve revealing data that is

particularly important or material whose lack or mistake might have had an effect on

participants' spending activities. It is referred by the Contextual knowledge as the

potential of the details to affect consumers' investment choices by assisting people in

evaluating previous, current, or prospective occurrences, or by verifying or rectifying

their previous view. As a result, data must have prognostic or confirming significance. If

data aids consumers in evaluating or assessing previous, current, or upcoming

projections, it has prognostic validity. Knowledge does not seem to be in the shape of an

unambiguous prognosis to have predictive ability. The idea of creating forecasts from

fiscal accounts, on the other hand, is aided by the presentation of historical data.

Furthermore, deals involving recently bought businesses or businesses which have been

sold are reviewed and analysed and reported independently from deals involving ongoing

work (Commerford, Hatfield and Houston, 2018). As a consequence, a conscientious

customer could find variations in the institution's profitability and fiscal condition as a

consequence of routine operations which are likely to develop in the coming. If research

provides consumers verify or improve their previous judgments and determinations, it has

predictive quality. Whenever important data is communicated in a reasonable timeframe,

it has a greater chance of influencing judgement call. Materiality that is also known as

applicability is a fundamental accountancy term. The structure and substance of data have

an impact on its usefulness. Materiality indicates how well an activity or piece of data

must be categorised in a fiscal report and/or whether this must be reported independently

instead of as part of a larger group of related stuff. Materiality is sometimes used to

determine whether a certain investment should be classified as a non-current resource or

a cost. Independent reporting of some elements in finance administration is yet

an additional prominent usage of it. High quantities of specific data are difficult for

consumers to absorb. This demands a significant amount of information processing. By

stating that elements must be reported individually, it gives guidelines on what activities

must be combined (Eichelberger, Mattioli and Foxhoven, 2017).

Reliability- The information should be devoid of glaring inaccuracies and bias, nor

deceitful. As a result, the data must accurately describe trades and some other operations,

portray the fundamental structure of operations, and responsibly convey estimations and

concerns via correct reporting. If data is to be helpful, it should also be accurate. If data is

independent of substantial inaccuracy, purposeful or systemic bias, and may be relied

trusted by consumers to accurately reflect what it essentially means or might possibly be

anticipated to reflect, it possesses the property of dependability. Facts must accurately

depict the actual business or occurrence, portray the content of the actual trade or

occasion, be impartial, judicious, and comprehensive in order to be trustworthy.

Monetary reports must contain unbiased data in order to be trustworthy. To put it another

way, bias-free. Caution that is contained in the term "faithful," has long been regarded as

among the most basic financial ideas. The essence of caution would be that accountants

must use caution while setting policy regarding unknown elements like reserves for

dubious creditors, equipment lifetimes, or the amount of consumer complaints which may

arise. It was also mentioned as being one of the accountancy data's subjective qualities.

Caution is ingrained in accountancy, and it may well be ingrained in the personalities of

several auditors. Another of the chief causes why auditors are frequently regarded as

conventional, careful, apprehensive, gloomy, etc is because of this. The significant issue

is that such statements to not overestimating revenue or holdings, and just not

misunderstanding expenditures or obligations, fundamentally apply to not overestimating

an impact on its usefulness. Materiality indicates how well an activity or piece of data

must be categorised in a fiscal report and/or whether this must be reported independently

instead of as part of a larger group of related stuff. Materiality is sometimes used to

determine whether a certain investment should be classified as a non-current resource or

a cost. Independent reporting of some elements in finance administration is yet

an additional prominent usage of it. High quantities of specific data are difficult for

consumers to absorb. This demands a significant amount of information processing. By

stating that elements must be reported individually, it gives guidelines on what activities

must be combined (Eichelberger, Mattioli and Foxhoven, 2017).

Reliability- The information should be devoid of glaring inaccuracies and bias, nor

deceitful. As a result, the data must accurately describe trades and some other operations,

portray the fundamental structure of operations, and responsibly convey estimations and

concerns via correct reporting. If data is to be helpful, it should also be accurate. If data is

independent of substantial inaccuracy, purposeful or systemic bias, and may be relied

trusted by consumers to accurately reflect what it essentially means or might possibly be

anticipated to reflect, it possesses the property of dependability. Facts must accurately

depict the actual business or occurrence, portray the content of the actual trade or

occasion, be impartial, judicious, and comprehensive in order to be trustworthy.

Monetary reports must contain unbiased data in order to be trustworthy. To put it another

way, bias-free. Caution that is contained in the term "faithful," has long been regarded as

among the most basic financial ideas. The essence of caution would be that accountants

must use caution while setting policy regarding unknown elements like reserves for

dubious creditors, equipment lifetimes, or the amount of consumer complaints which may

arise. It was also mentioned as being one of the accountancy data's subjective qualities.

Caution is ingrained in accountancy, and it may well be ingrained in the personalities of

several auditors. Another of the chief causes why auditors are frequently regarded as

conventional, careful, apprehensive, gloomy, etc is because of this. The significant issue

is that such statements to not overestimating revenue or holdings, and just not

misunderstanding expenditures or obligations, fundamentally apply to not overestimating

profits and fiscal situation in the cash flow summary and disclosure of revenue condition,

respectively (Ghesquiere, McAfee and Burnett, 2019).

Comparability- Users will be able to discern trends in the reported institution's

performance and fiscal condition if the data is comparable to finance statements supplied

for specific accountancy seasons. In addition to correctly evaluate an institution's

comparative fiscal circumstances, productivity, and effect on monetary stance, customers

should be able to compare the fiscal report of a company across period and compared to

other businesses. As a result, finance reports must comprise existing annual reports,

substantial revenue accounts, and declarations of condition financially, which must be

provided alongside previous annual declarations and are referred to as comparisons.

Customer can create judgements regarding patterns in productivity and effect on fiscal

situation by looking at similarly produced income reports across time and using this

knowledge to forecast the upcoming. For obtaining equivalent data, uniformity in the

execution of bookkeeping principles is essential. Any modifications in accountancy

standards, as well as their effect, must be reported. The accountancy rules involve

transparency. It aids in the attainment of comparison.

Such Attributes Makes Content Beneficial- Some of the 4 basic quantitative criteria of

information in accrual analysis are relevancy and dependability. Compatibility and ease of

understanding are the other two. Relevancy permits fiscal accountancy data to be tailored to the

needs of clients, influencing its choices. Knowledge must be trustworthy, honest, and fair to be

considered dependable. Significance and dependability are both crucial for the monetary

information to be consistent, but they are intertwined to the point where relying on one impacts

another and conversely. And we'll have to switch back and forth amongst these. Accountancy

knowledge is crucial once it is provided in a reasonable timeframe, but it is inaccurate and

consequently inaccurate earlier onwards. However, if people delay for advantage whereas the

knowledge is still valid, this should lose its significance (Khemakhem and Boujelbene, 2018).

respectively (Ghesquiere, McAfee and Burnett, 2019).

Comparability- Users will be able to discern trends in the reported institution's

performance and fiscal condition if the data is comparable to finance statements supplied

for specific accountancy seasons. In addition to correctly evaluate an institution's

comparative fiscal circumstances, productivity, and effect on monetary stance, customers

should be able to compare the fiscal report of a company across period and compared to

other businesses. As a result, finance reports must comprise existing annual reports,

substantial revenue accounts, and declarations of condition financially, which must be

provided alongside previous annual declarations and are referred to as comparisons.

Customer can create judgements regarding patterns in productivity and effect on fiscal

situation by looking at similarly produced income reports across time and using this

knowledge to forecast the upcoming. For obtaining equivalent data, uniformity in the

execution of bookkeeping principles is essential. Any modifications in accountancy

standards, as well as their effect, must be reported. The accountancy rules involve

transparency. It aids in the attainment of comparison.

Such Attributes Makes Content Beneficial- Some of the 4 basic quantitative criteria of

information in accrual analysis are relevancy and dependability. Compatibility and ease of

understanding are the other two. Relevancy permits fiscal accountancy data to be tailored to the

needs of clients, influencing its choices. Knowledge must be trustworthy, honest, and fair to be

considered dependable. Significance and dependability are both crucial for the monetary

information to be consistent, but they are intertwined to the point where relying on one impacts

another and conversely. And we'll have to switch back and forth amongst these. Accountancy

knowledge is crucial once it is provided in a reasonable timeframe, but it is inaccurate and

consequently inaccurate earlier onwards. However, if people delay for advantage whereas the

knowledge is still valid, this should lose its significance (Khemakhem and Boujelbene, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 2

Using the information in appendix 1 only, comment on the financial performance of the business

(briefly consider growth, profitability and credit management)

Monetary evaluation- The information could be used to make a variety of fiscal

conclusions, including:

Revenue has increased by 5%. It is not particularly significant, but it is greater than the

pace of prices, implying actual development. This is reassuring and indicative of a

successful industry (Kovalenko, 2019).

The biggest flaw in the revenue numbers would be that the overall income margins have

decreased from 20% to 19.8 percent, implying that budgetary management is

deteriorating or even that charge rates are indeed being eroded.

Revenue rose by 3.9 percent. Especially when the individual is the lone member and

owns 100% of the company, the earnings are outstanding in real numbers.

The median monetary amount has increased by 5%, showing enhanced flexibility. In a

firm, having a healthy money reserve is often a good thing.

The mean borrowers' days has decreased by three days, suggesting increased

effectiveness in collecting remaining borrowing. These days are noticeably fewer than the

accepted standard, demonstrating excellent operating cash flow. It's sole potential cause

for worry is that he is very active in pursuing remaining borrowing.

With the exception of potential profitability concerns and limited development, the company

appears to be in excellent form and has a great potential (Nurcholisah, 2016).

Explain why non-financial information, such as the type shown in appendix 2, is likely to give a

better indication of the likely future success of the business than the financial information

given in appendix 1

The additional non-financial data provides far more transparency into the company's core

administrative challenges and presents a grimmer vision of the foreseeable.

Interior administrative procedures

Error levels - Mistake statistics for completed tasks have increased from 10% to 16%,

owing to shorter response periods and higher delivering on schedule rates. This is crucial

because consumers want accurate reports.

Using the information in appendix 1 only, comment on the financial performance of the business

(briefly consider growth, profitability and credit management)

Monetary evaluation- The information could be used to make a variety of fiscal

conclusions, including:

Revenue has increased by 5%. It is not particularly significant, but it is greater than the

pace of prices, implying actual development. This is reassuring and indicative of a

successful industry (Kovalenko, 2019).

The biggest flaw in the revenue numbers would be that the overall income margins have

decreased from 20% to 19.8 percent, implying that budgetary management is

deteriorating or even that charge rates are indeed being eroded.

Revenue rose by 3.9 percent. Especially when the individual is the lone member and

owns 100% of the company, the earnings are outstanding in real numbers.

The median monetary amount has increased by 5%, showing enhanced flexibility. In a

firm, having a healthy money reserve is often a good thing.

The mean borrowers' days has decreased by three days, suggesting increased

effectiveness in collecting remaining borrowing. These days are noticeably fewer than the

accepted standard, demonstrating excellent operating cash flow. It's sole potential cause

for worry is that he is very active in pursuing remaining borrowing.

With the exception of potential profitability concerns and limited development, the company

appears to be in excellent form and has a great potential (Nurcholisah, 2016).

Explain why non-financial information, such as the type shown in appendix 2, is likely to give a

better indication of the likely future success of the business than the financial information

given in appendix 1

The additional non-financial data provides far more transparency into the company's core

administrative challenges and presents a grimmer vision of the foreseeable.

Interior administrative procedures

Error levels - Mistake statistics for completed tasks have increased from 10% to 16%,

owing to shorter response periods and higher delivering on schedule rates. This is crucial

because consumers want accurate reports.

Mistakes can cause difficulties for customers with the Internal Taxation, banks, and other

financial institutions. Furthermore, if people incur money as a result of these mistakes,

the owner may be prosecuted. It's possible that faults will not be exposed to clients.

Businesses almost never admit to making errors. Authorities must, in fact, correct any

errors as soon as possible (Paluri and Mehra, 2016).

The usual duration it takes to complete a work has decreased by 30%, from a mean of 10

weeks to a mean of 7 weeks. On the surface, this appears to be a beneficial improvement,

because customers would enjoy the speed with which their bookkeeping tasks are

completed. The short response period, on the other hand, might be connected to a rise in

mistakes, which must be studied deeper.

Consumer awareness

Consumer maintenance- User loyalty has dropped drastically, which is concerning and

shows a higher degree of customer’s discontent. A greater standard of recurring labour is

expected in an accounting practise, as taxes calculations, for instance, must be completed

annually. Current customers are obviously dissatisfied with the assistance given.

Usual charges- It appears that perhaps the rise in income is attributable to a big rise in

overall prices instead of more customers, since the typical charge has increased by 29%

from $600 to $775. This might account for the decline of customers on its own, but there

may be additional factors at play.

Industry participation- As a consequence of the foregoing 2 variables, customer base

has decreased from 20% to 14%. According to sales estimates, the sector has increased

from $4.5 million to $6.75 million, representing a 50% rise. It's numbers are especially

troubling in comparison. The company must be performing considerably higher and is on

the verge of someone being overtaken by rivals (Suykens, De Rynck and Verschuere,

2019).

Development and knowledge

Non-core operations- The company's biggest shortcoming appears to be its absence of

non-core activities. The industrial median income from non-core activity has climbed

from 25 percent to 30 percent yet it's stats actually declined from 5 percent to 4 percent.

Some customers seem to be wanting for their auditors to offer a greater variety of

services, but the owner appears to be neglecting this pattern.

financial institutions. Furthermore, if people incur money as a result of these mistakes,

the owner may be prosecuted. It's possible that faults will not be exposed to clients.

Businesses almost never admit to making errors. Authorities must, in fact, correct any

errors as soon as possible (Paluri and Mehra, 2016).

The usual duration it takes to complete a work has decreased by 30%, from a mean of 10

weeks to a mean of 7 weeks. On the surface, this appears to be a beneficial improvement,

because customers would enjoy the speed with which their bookkeeping tasks are

completed. The short response period, on the other hand, might be connected to a rise in

mistakes, which must be studied deeper.

Consumer awareness

Consumer maintenance- User loyalty has dropped drastically, which is concerning and

shows a higher degree of customer’s discontent. A greater standard of recurring labour is

expected in an accounting practise, as taxes calculations, for instance, must be completed

annually. Current customers are obviously dissatisfied with the assistance given.

Usual charges- It appears that perhaps the rise in income is attributable to a big rise in

overall prices instead of more customers, since the typical charge has increased by 29%

from $600 to $775. This might account for the decline of customers on its own, but there

may be additional factors at play.

Industry participation- As a consequence of the foregoing 2 variables, customer base

has decreased from 20% to 14%. According to sales estimates, the sector has increased

from $4.5 million to $6.75 million, representing a 50% rise. It's numbers are especially

troubling in comparison. The company must be performing considerably higher and is on

the verge of someone being overtaken by rivals (Suykens, De Rynck and Verschuere,

2019).

Development and knowledge

Non-core operations- The company's biggest shortcoming appears to be its absence of

non-core activities. The industrial median income from non-core activity has climbed

from 25 percent to 30 percent yet it's stats actually declined from 5 percent to 4 percent.

Some customers seem to be wanting for their auditors to offer a greater variety of

services, but the owner appears to be neglecting this pattern.

Worker engagement- An increase in worker attrition indicates that employees are

unsatisfied. It is critical to maintain employee consistency at a customer to provide high-

quality items. Conservatives customers might hate disclosing individual economic

information to a wide range of persons on a yearly basis. Employee attrition may be a

sign of excessive desire to finish work more rapidly while sacrificing the enjoyment of a

well-done work. Employees could also understand that the company's limited variety of

offerings would restrict their personal expertise and professional opportunities.

Using the data given in appendix 2, comment on the performance of the business. Include

comments on internal business processes, customer knowledge and learning/growth, and

provide a concluding comment on the overall performance of the business.

In most cases, fiscal productivity metrics would only provide a measurement of a

company's historical achievement. A successful monetary result in the previous does not

ensure a better fiscal success in the foreseeable. Customers might depart, and prices

would rise, converting earnings into deficits in a brief amount of span (Tumataroa and

O'Hare, 2019).

Non-financial variables are frequently referred to as "forecasts of potential effectiveness."

Sound monetary success could be attributed to solid performances in several areas. For

instance, if a company provides high-quality service to its clients, it may attract more

revenue at greater costs in the prospective. Appendix 2 contains details on the non-

financial metrics used in the balanced scorecard.

Interior corporate procedures are a gauge of how efficient a company is on the inside.

Surprisingly, such metrics could predict present price effectiveness as well as potential

results.

Client orientation is a metric that measures how successfully a company interacts with its

exterior clients. A strong showing here will almost certainly result in increased business

in the foreseeable.

The manner the company evolves is measured by training and creativity. New goods, as

well as indications of retaining employees, would've been represented here. This is, once

again, far more concerned with the coming than with the current.

Non-financial measures of achievement are considerably more probable to predict a

company's prospective prosperity than monetary measures.

unsatisfied. It is critical to maintain employee consistency at a customer to provide high-

quality items. Conservatives customers might hate disclosing individual economic

information to a wide range of persons on a yearly basis. Employee attrition may be a

sign of excessive desire to finish work more rapidly while sacrificing the enjoyment of a

well-done work. Employees could also understand that the company's limited variety of

offerings would restrict their personal expertise and professional opportunities.

Using the data given in appendix 2, comment on the performance of the business. Include

comments on internal business processes, customer knowledge and learning/growth, and

provide a concluding comment on the overall performance of the business.

In most cases, fiscal productivity metrics would only provide a measurement of a

company's historical achievement. A successful monetary result in the previous does not

ensure a better fiscal success in the foreseeable. Customers might depart, and prices

would rise, converting earnings into deficits in a brief amount of span (Tumataroa and

O'Hare, 2019).

Non-financial variables are frequently referred to as "forecasts of potential effectiveness."

Sound monetary success could be attributed to solid performances in several areas. For

instance, if a company provides high-quality service to its clients, it may attract more

revenue at greater costs in the prospective. Appendix 2 contains details on the non-

financial metrics used in the balanced scorecard.

Interior corporate procedures are a gauge of how efficient a company is on the inside.

Surprisingly, such metrics could predict present price effectiveness as well as potential

results.

Client orientation is a metric that measures how successfully a company interacts with its

exterior clients. A strong showing here will almost certainly result in increased business

in the foreseeable.

The manner the company evolves is measured by training and creativity. New goods, as

well as indications of retaining employees, would've been represented here. This is, once

again, far more concerned with the coming than with the current.

Non-financial measures of achievement are considerably more probable to predict a

company's prospective prosperity than monetary measures.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

b) Briefly discuss why professional ethics are important in accounting and discuss five

fundamental principles of professional ethics for accountants

Professional ethics is a very important as well as crucial factor as it is the base under which

accountants work and thus it is very essential for an account to work with utmost sincerity and

work ethics so that it can add value to the firm in the long run and can help the company to attain

its goals and objectives and also to stand well ahead in the market in the longer term. 5

fundamental principles of professional ethics for accountants are discussed below-

Integrity- In all personal and commercial interactions, to be forthright and genuine.

Objectivity- Not allowing prejudice, conflicts of advantage, or excessive pressure from

everyone to affect expert or commercial judgments is not acceptable.

Appropriate Attention and Technical Competency- Keep good skills and ability at the

benchmark expected to provide qualified skilled solutions to a customer or company

given the contemporary advancements in practise, law, and methodologies, and operate

conscientiously and in compliance with relevant technological and ethical norms (Zimon

and Zimon, 2019).

Confidentiality- Appreciate the privacy of data obtained through expert and commercial

enterprise connections and, as a consequence, not publicly reveal any of that kind data to

advertisers sans appropriate and particular jurisdiction, except if there is a lawful or

specialist entitlement or obligation to reveal, and don't use the data for the

commercial investor's or foreign companies' for self benefit.

Professional Etiquette- To follow all applicable rules and standards, as well as to refrain

from doing any actions that would bring the industry into disrepute.

fundamental principles of professional ethics for accountants

Professional ethics is a very important as well as crucial factor as it is the base under which

accountants work and thus it is very essential for an account to work with utmost sincerity and

work ethics so that it can add value to the firm in the long run and can help the company to attain

its goals and objectives and also to stand well ahead in the market in the longer term. 5

fundamental principles of professional ethics for accountants are discussed below-

Integrity- In all personal and commercial interactions, to be forthright and genuine.

Objectivity- Not allowing prejudice, conflicts of advantage, or excessive pressure from

everyone to affect expert or commercial judgments is not acceptable.

Appropriate Attention and Technical Competency- Keep good skills and ability at the

benchmark expected to provide qualified skilled solutions to a customer or company

given the contemporary advancements in practise, law, and methodologies, and operate

conscientiously and in compliance with relevant technological and ethical norms (Zimon

and Zimon, 2019).

Confidentiality- Appreciate the privacy of data obtained through expert and commercial

enterprise connections and, as a consequence, not publicly reveal any of that kind data to

advertisers sans appropriate and particular jurisdiction, except if there is a lawful or

specialist entitlement or obligation to reveal, and don't use the data for the

commercial investor's or foreign companies' for self benefit.

Professional Etiquette- To follow all applicable rules and standards, as well as to refrain

from doing any actions that would bring the industry into disrepute.

REFERENCES

Books and journals

Ahmed, F., Manwani, A. and Ahmed, S., 2018. Merger & acquisition strategy for growth,

improved performance and survival in the financial sector. Jurnal Perspektif

Pembiayaan Dan Pembangunan Daerah, 5(4), pp.196-214.

Bastani, H. and Bayati, M., 2020. Online decision making with high-dimensional covariates.

Operations Research, 68(1), pp.276-294.

Commerford, B.P., Hatfield, R.C. and Houston, R.W., 2018. The effect of real earnings

management on auditor scrutiny of management's other financial reporting decisions.

The accounting review, 93(5), pp.145-163.

Eichelberger, B., Mattioli, H. and Foxhoven, R., 2017. Uncovering barriers to financial

capability: Underrepresented students’ access to financial resources. Journal of Student

Financial Aid, 47(3), p.5.

Ghesquiere, A.R., McAfee, C. and Burnett, J., 2019. Measures of financial capacity: A review.

The Gerontologist, 59(2), pp.e109-e129.

Khemakhem, S. and Boujelbene, Y., 2018. Predicting credit risk on the basis of financial and

non-financial variables and data mining. Review of Accounting and Finance.

Kovalenko, A., 2019. Determinants of personnel policy in the process of management of

financial and economic security of business entities. Вісник Черкаського

національного університету імені Богдана Хмельницького. Серія Економічні

науки, (3), pp.70-77.

Nurcholisah, K., 2016. The effects of financial reporting quality on information asymmetry and

its impacts on investment efficiency.

Paluri, R.A. and Mehra, S., 2016. Financial attitude based segmentation of women in India: an

exploratory study. International Journal of Bank Marketing.

Suykens, B., De Rynck, F. and Verschuere, B., 2019. Nonprofit organizations in between the

nonprofit and market spheres: Shifting goals, governance and management?. Nonprofit

Management and Leadership, 29(4), pp.623-636.

Tumataroa, S. and O'Hare, D., 2019. Improving self-control through financial counseling: A

randomized controlled trial. Journal of Financial Counseling and Planning, 30(2),

pp.304-312.

Zimon, D. and Zimon, G., 2019. The impact of implementation of standardized quality

management systems on management of liabilities in group purchasing

organizations. Quality Innovation Prosperity, 23(1), pp.60-73.

Books and journals

Ahmed, F., Manwani, A. and Ahmed, S., 2018. Merger & acquisition strategy for growth,

improved performance and survival in the financial sector. Jurnal Perspektif

Pembiayaan Dan Pembangunan Daerah, 5(4), pp.196-214.

Bastani, H. and Bayati, M., 2020. Online decision making with high-dimensional covariates.

Operations Research, 68(1), pp.276-294.

Commerford, B.P., Hatfield, R.C. and Houston, R.W., 2018. The effect of real earnings

management on auditor scrutiny of management's other financial reporting decisions.

The accounting review, 93(5), pp.145-163.

Eichelberger, B., Mattioli, H. and Foxhoven, R., 2017. Uncovering barriers to financial

capability: Underrepresented students’ access to financial resources. Journal of Student

Financial Aid, 47(3), p.5.

Ghesquiere, A.R., McAfee, C. and Burnett, J., 2019. Measures of financial capacity: A review.

The Gerontologist, 59(2), pp.e109-e129.

Khemakhem, S. and Boujelbene, Y., 2018. Predicting credit risk on the basis of financial and

non-financial variables and data mining. Review of Accounting and Finance.

Kovalenko, A., 2019. Determinants of personnel policy in the process of management of

financial and economic security of business entities. Вісник Черкаського

національного університету імені Богдана Хмельницького. Серія Економічні

науки, (3), pp.70-77.

Nurcholisah, K., 2016. The effects of financial reporting quality on information asymmetry and

its impacts on investment efficiency.

Paluri, R.A. and Mehra, S., 2016. Financial attitude based segmentation of women in India: an

exploratory study. International Journal of Bank Marketing.

Suykens, B., De Rynck, F. and Verschuere, B., 2019. Nonprofit organizations in between the

nonprofit and market spheres: Shifting goals, governance and management?. Nonprofit

Management and Leadership, 29(4), pp.623-636.

Tumataroa, S. and O'Hare, D., 2019. Improving self-control through financial counseling: A

randomized controlled trial. Journal of Financial Counseling and Planning, 30(2),

pp.304-312.

Zimon, D. and Zimon, G., 2019. The impact of implementation of standardized quality

management systems on management of liabilities in group purchasing

organizations. Quality Innovation Prosperity, 23(1), pp.60-73.

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.