Financial Accounting: Transactions, Bookkeeping, Journal Entries, Financial Reports, Principles

VerifiedAdded on 2022/11/25

|25

|4870

|184

AI Summary

This document provides an overview of financial accounting, including business transactions, single and double entry bookkeeping, journal entries, financial reports, and principles of accounting. It covers topics such as types of business transactions, trail balance, journal entries, ledger accounts, difference between financial reports and statements, and principles of accounting. The document is relevant for students studying financial accounting in various courses and programs.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

FINANCIAL ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

SCENARIO 1...................................................................................................................................2

Question 1....................................................................................................................................2

Question 2....................................................................................................................................3

Question 3....................................................................................................................................7

Question 4....................................................................................................................................9

Question 5..................................................................................................................................11

Question 7..................................................................................................................................12

SCENARIO 2.................................................................................................................................13

Question 2..................................................................................................................................13

Question 3..................................................................................................................................14

REFERENCES................................................................................................................................1

SCENARIO 1...................................................................................................................................2

Question 1....................................................................................................................................2

Question 2....................................................................................................................................3

Question 3....................................................................................................................................7

Question 4....................................................................................................................................9

Question 5..................................................................................................................................11

Question 7..................................................................................................................................12

SCENARIO 2.................................................................................................................................13

Question 2..................................................................................................................................13

Question 3..................................................................................................................................14

REFERENCES................................................................................................................................1

SCENARIO 1

Question 1

Business transactions:

It refers to the transactions that occur between the company and the third party and which

is recorded under organization's accounting system. These transactions are measurable in

monetary terms.

Types:

There are numerous types of accounting transactions. These are:

Purchasing goods and materials in which goods and materials are purchased by company

with respect to its business.

Sales transactions are common form under which transactions related with sales are

recorded.

Payment of wages and salaries.

Purchase of non current assets.

Accounting transactions related with payment of taxes.

Movement of cash and related transactions.

Raising of finance related transactions.

Single and double entry book keeping:

Single entry book keeping:

It is a cash oriented accounting. Under this form of book keeping single transaction for

the business transaction are recorded. Under this mode the income and expenses related with the

business are recorded in cash register. Here single entry for all the transactions are passed.

Double entry book keeping:

This concept is based on a principle that every transaction has equal and opposite effect

in at-least two different types of accounts. This is the current mode of recording transaction

(Beretta and Cencini, 2020). As per this system of book keeping the recording of transactions

starts with passing of journal entry which is followed by ledgers preparation. This will further be

carried out with the preparation of trial balance and financial statements.

Three important rules with respect to double entry bookkeeping:

Debit what comes in and credit what goes out.

Debit the receiver and credit the giver.

Question 1

Business transactions:

It refers to the transactions that occur between the company and the third party and which

is recorded under organization's accounting system. These transactions are measurable in

monetary terms.

Types:

There are numerous types of accounting transactions. These are:

Purchasing goods and materials in which goods and materials are purchased by company

with respect to its business.

Sales transactions are common form under which transactions related with sales are

recorded.

Payment of wages and salaries.

Purchase of non current assets.

Accounting transactions related with payment of taxes.

Movement of cash and related transactions.

Raising of finance related transactions.

Single and double entry book keeping:

Single entry book keeping:

It is a cash oriented accounting. Under this form of book keeping single transaction for

the business transaction are recorded. Under this mode the income and expenses related with the

business are recorded in cash register. Here single entry for all the transactions are passed.

Double entry book keeping:

This concept is based on a principle that every transaction has equal and opposite effect

in at-least two different types of accounts. This is the current mode of recording transaction

(Beretta and Cencini, 2020). As per this system of book keeping the recording of transactions

starts with passing of journal entry which is followed by ledgers preparation. This will further be

carried out with the preparation of trial balance and financial statements.

Three important rules with respect to double entry bookkeeping:

Debit what comes in and credit what goes out.

Debit the receiver and credit the giver.

Debit all expenses and credit all income.

Trail balance:

It is a book keeping worksheet under which balance of all the ledger accounts are

compiled into debit and credit account column that will be equal (Gurskaya, Kuter and

Bagdasaryan, 2019). In simple words it is a statement under which the ledger balance are shown

and its matching of debit and credit shows that the mathematical calculation regarding the

recording of financial data are accurate and correct.

Importance:

Being a starting point of the preparation of financial statements, it acts as a statement that

will lead to have an identification of errors at the starting (Gheorghe, 2017). It will also lead to

the preparation of final accounts which shows that the transactions that are recorded in books of

accounts are identical with regard to their debit and credit balances. Thus, in short it will ensure

arithmetical accuracy, assisting final account preparation, rectification of errors, assisting

adjustments along with comparative analysis are some advantage with trail balance preparation.

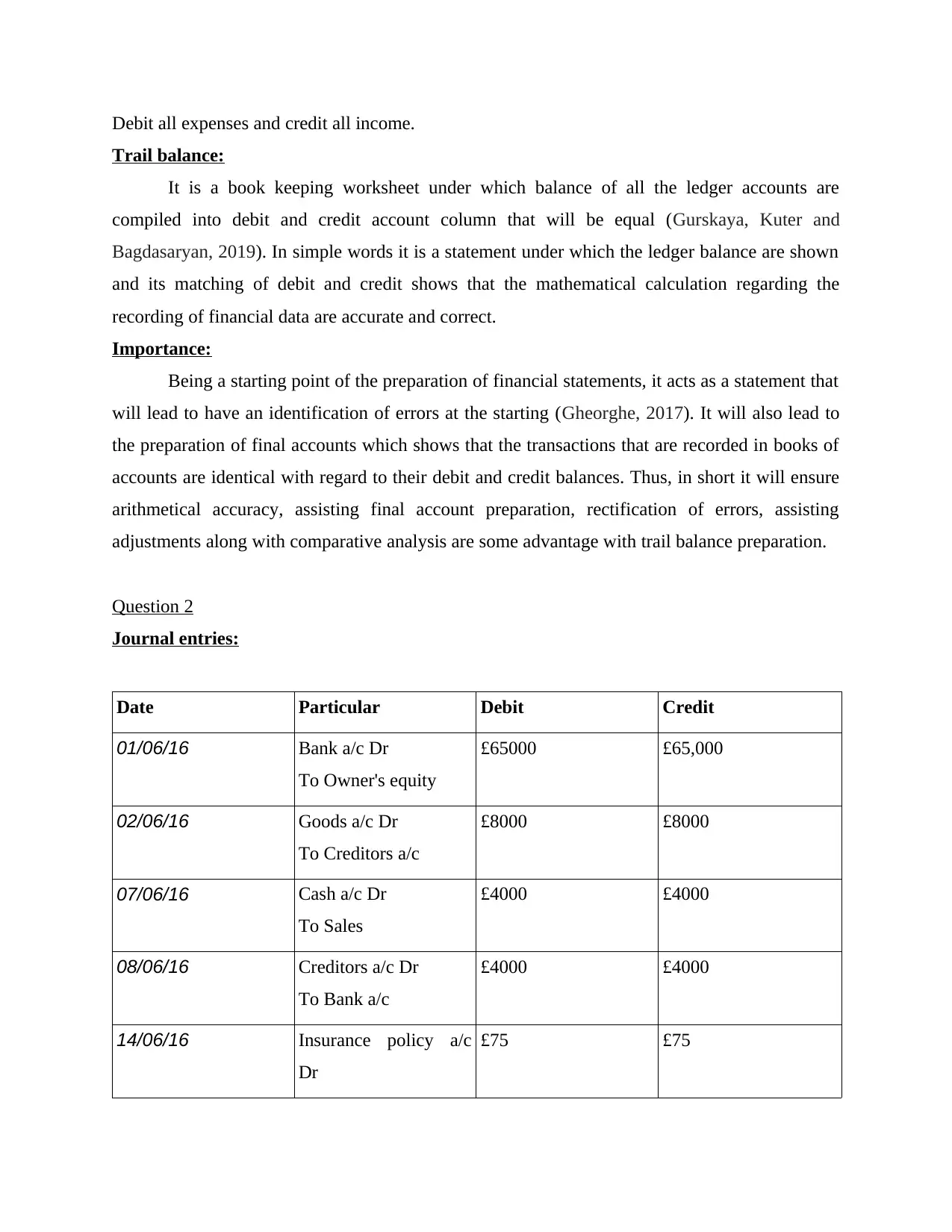

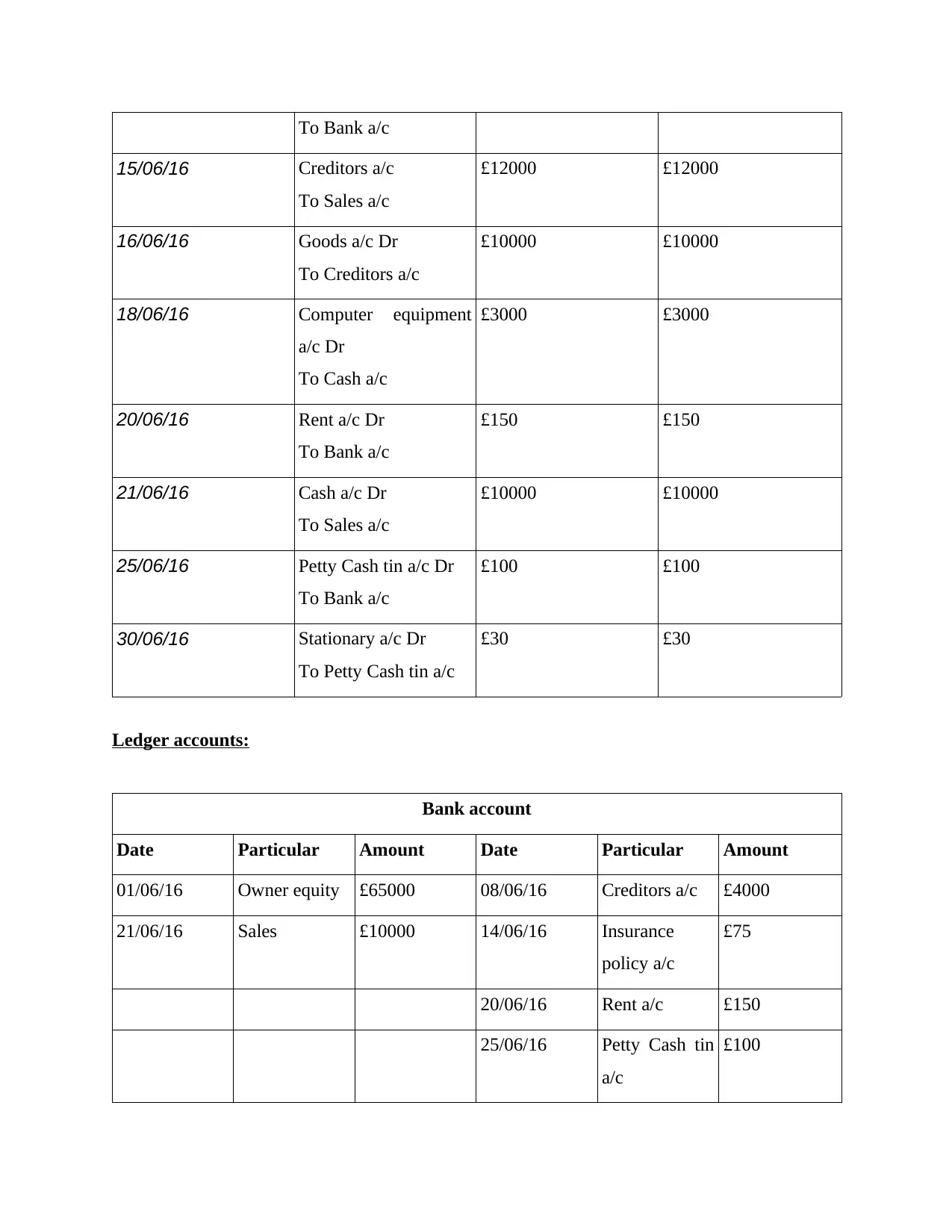

Question 2

Journal entries:

Date Particular Debit Credit

01/06/16 Bank a/c Dr

To Owner's equity

£65000 £65,000

02/06/16 Goods a/c Dr

To Creditors a/c

£8000 £8000

07/06/16 Cash a/c Dr

To Sales

£4000 £4000

08/06/16 Creditors a/c Dr

To Bank a/c

£4000 £4000

14/06/16 Insurance policy a/c

Dr

£75 £75

Trail balance:

It is a book keeping worksheet under which balance of all the ledger accounts are

compiled into debit and credit account column that will be equal (Gurskaya, Kuter and

Bagdasaryan, 2019). In simple words it is a statement under which the ledger balance are shown

and its matching of debit and credit shows that the mathematical calculation regarding the

recording of financial data are accurate and correct.

Importance:

Being a starting point of the preparation of financial statements, it acts as a statement that

will lead to have an identification of errors at the starting (Gheorghe, 2017). It will also lead to

the preparation of final accounts which shows that the transactions that are recorded in books of

accounts are identical with regard to their debit and credit balances. Thus, in short it will ensure

arithmetical accuracy, assisting final account preparation, rectification of errors, assisting

adjustments along with comparative analysis are some advantage with trail balance preparation.

Question 2

Journal entries:

Date Particular Debit Credit

01/06/16 Bank a/c Dr

To Owner's equity

£65000 £65,000

02/06/16 Goods a/c Dr

To Creditors a/c

£8000 £8000

07/06/16 Cash a/c Dr

To Sales

£4000 £4000

08/06/16 Creditors a/c Dr

To Bank a/c

£4000 £4000

14/06/16 Insurance policy a/c

Dr

£75 £75

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

To Bank a/c

15/06/16 Creditors a/c

To Sales a/c

£12000 £12000

16/06/16 Goods a/c Dr

To Creditors a/c

£10000 £10000

18/06/16 Computer equipment

a/c Dr

To Cash a/c

£3000 £3000

20/06/16 Rent a/c Dr

To Bank a/c

£150 £150

21/06/16 Cash a/c Dr

To Sales a/c

£10000 £10000

25/06/16 Petty Cash tin a/c Dr

To Bank a/c

£100 £100

30/06/16 Stationary a/c Dr

To Petty Cash tin a/c

£30 £30

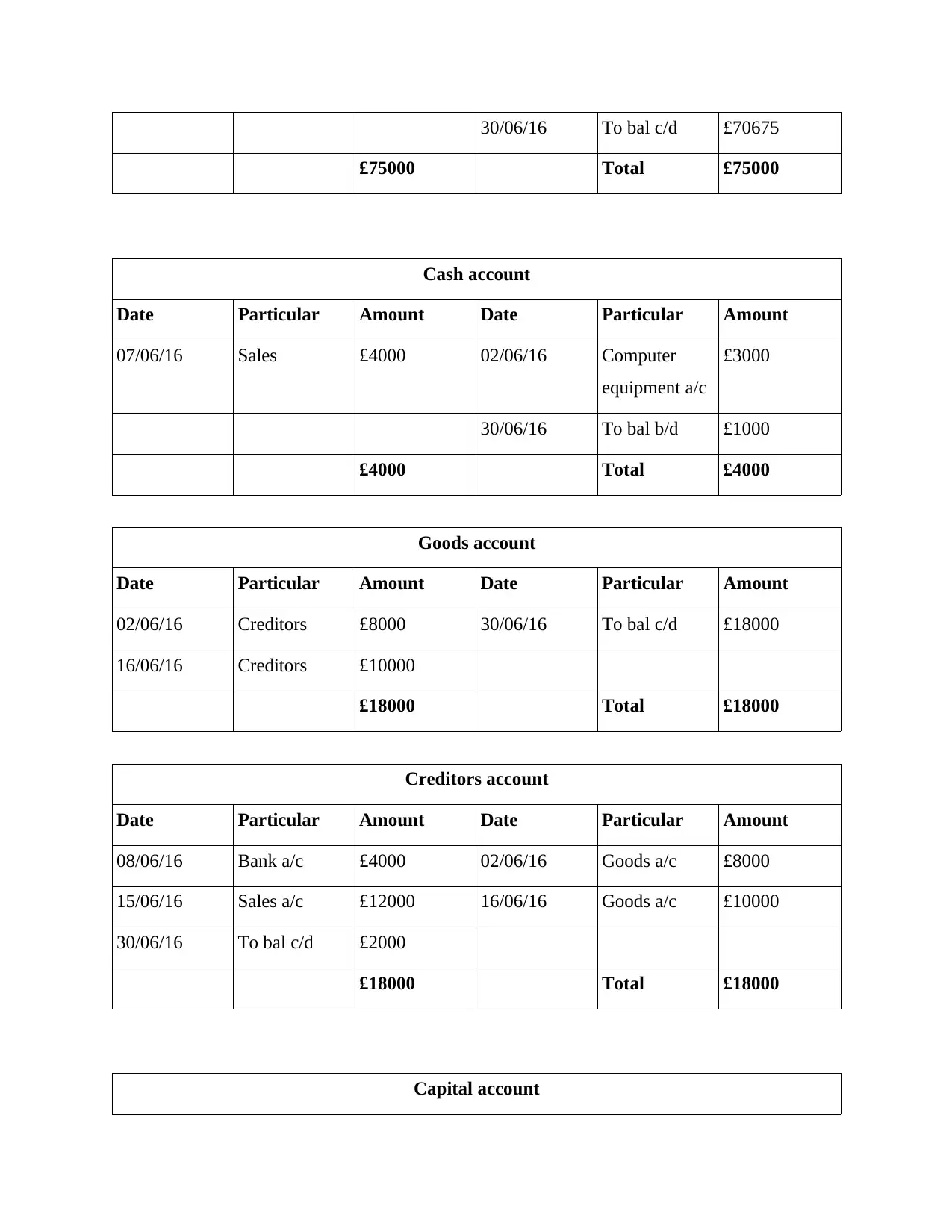

Ledger accounts:

Bank account

Date Particular Amount Date Particular Amount

01/06/16 Owner equity £65000 08/06/16 Creditors a/c £4000

21/06/16 Sales £10000 14/06/16 Insurance

policy a/c

£75

20/06/16 Rent a/c £150

25/06/16 Petty Cash tin

a/c

£100

15/06/16 Creditors a/c

To Sales a/c

£12000 £12000

16/06/16 Goods a/c Dr

To Creditors a/c

£10000 £10000

18/06/16 Computer equipment

a/c Dr

To Cash a/c

£3000 £3000

20/06/16 Rent a/c Dr

To Bank a/c

£150 £150

21/06/16 Cash a/c Dr

To Sales a/c

£10000 £10000

25/06/16 Petty Cash tin a/c Dr

To Bank a/c

£100 £100

30/06/16 Stationary a/c Dr

To Petty Cash tin a/c

£30 £30

Ledger accounts:

Bank account

Date Particular Amount Date Particular Amount

01/06/16 Owner equity £65000 08/06/16 Creditors a/c £4000

21/06/16 Sales £10000 14/06/16 Insurance

policy a/c

£75

20/06/16 Rent a/c £150

25/06/16 Petty Cash tin

a/c

£100

30/06/16 To bal c/d £70675

£75000 Total £75000

Cash account

Date Particular Amount Date Particular Amount

07/06/16 Sales £4000 02/06/16 Computer

equipment a/c

£3000

30/06/16 To bal b/d £1000

£4000 Total £4000

Goods account

Date Particular Amount Date Particular Amount

02/06/16 Creditors £8000 30/06/16 To bal c/d £18000

16/06/16 Creditors £10000

£18000 Total £18000

Creditors account

Date Particular Amount Date Particular Amount

08/06/16 Bank a/c £4000 02/06/16 Goods a/c £8000

15/06/16 Sales a/c £12000 16/06/16 Goods a/c £10000

30/06/16 To bal c/d £2000

£18000 Total £18000

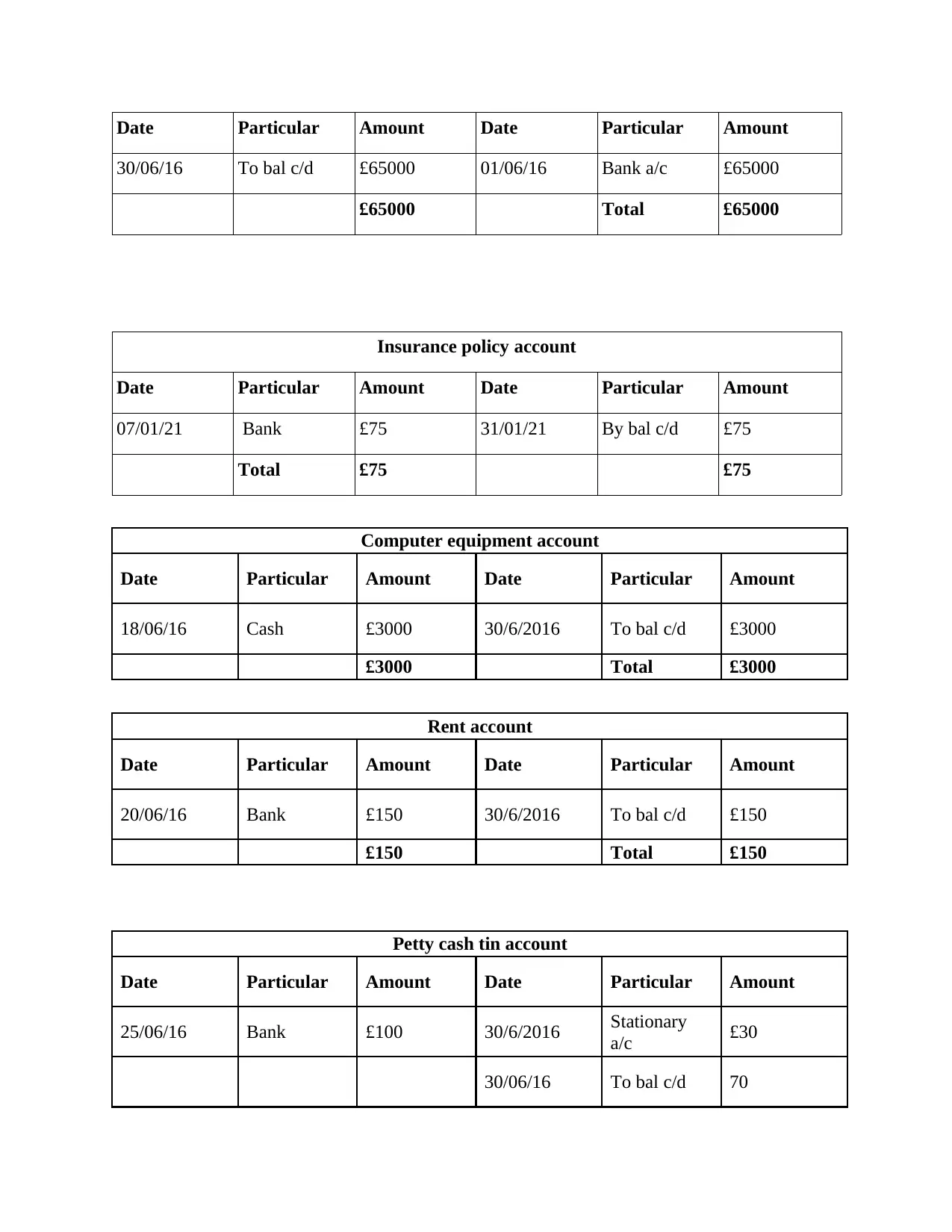

Capital account

£75000 Total £75000

Cash account

Date Particular Amount Date Particular Amount

07/06/16 Sales £4000 02/06/16 Computer

equipment a/c

£3000

30/06/16 To bal b/d £1000

£4000 Total £4000

Goods account

Date Particular Amount Date Particular Amount

02/06/16 Creditors £8000 30/06/16 To bal c/d £18000

16/06/16 Creditors £10000

£18000 Total £18000

Creditors account

Date Particular Amount Date Particular Amount

08/06/16 Bank a/c £4000 02/06/16 Goods a/c £8000

15/06/16 Sales a/c £12000 16/06/16 Goods a/c £10000

30/06/16 To bal c/d £2000

£18000 Total £18000

Capital account

Date Particular Amount Date Particular Amount

30/06/16 To bal c/d £65000 01/06/16 Bank a/c £65000

£65000 Total £65000

Insurance policy account

Date Particular Amount Date Particular Amount

07/01/21 Bank £75 31/01/21 By bal c/d £75

Total £75 £75

Computer equipment account

Date Particular Amount Date Particular Amount

18/06/16 Cash £3000 30/6/2016 To bal c/d £3000

£3000 Total £3000

Rent account

Date Particular Amount Date Particular Amount

20/06/16 Bank £150 30/6/2016 To bal c/d £150

£150 Total £150

Petty cash tin account

Date Particular Amount Date Particular Amount

25/06/16 Bank £100 30/6/2016 Stationary

a/c £30

30/06/16 To bal c/d 70

30/06/16 To bal c/d £65000 01/06/16 Bank a/c £65000

£65000 Total £65000

Insurance policy account

Date Particular Amount Date Particular Amount

07/01/21 Bank £75 31/01/21 By bal c/d £75

Total £75 £75

Computer equipment account

Date Particular Amount Date Particular Amount

18/06/16 Cash £3000 30/6/2016 To bal c/d £3000

£3000 Total £3000

Rent account

Date Particular Amount Date Particular Amount

20/06/16 Bank £150 30/6/2016 To bal c/d £150

£150 Total £150

Petty cash tin account

Date Particular Amount Date Particular Amount

25/06/16 Bank £100 30/6/2016 Stationary

a/c £30

30/06/16 To bal c/d 70

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

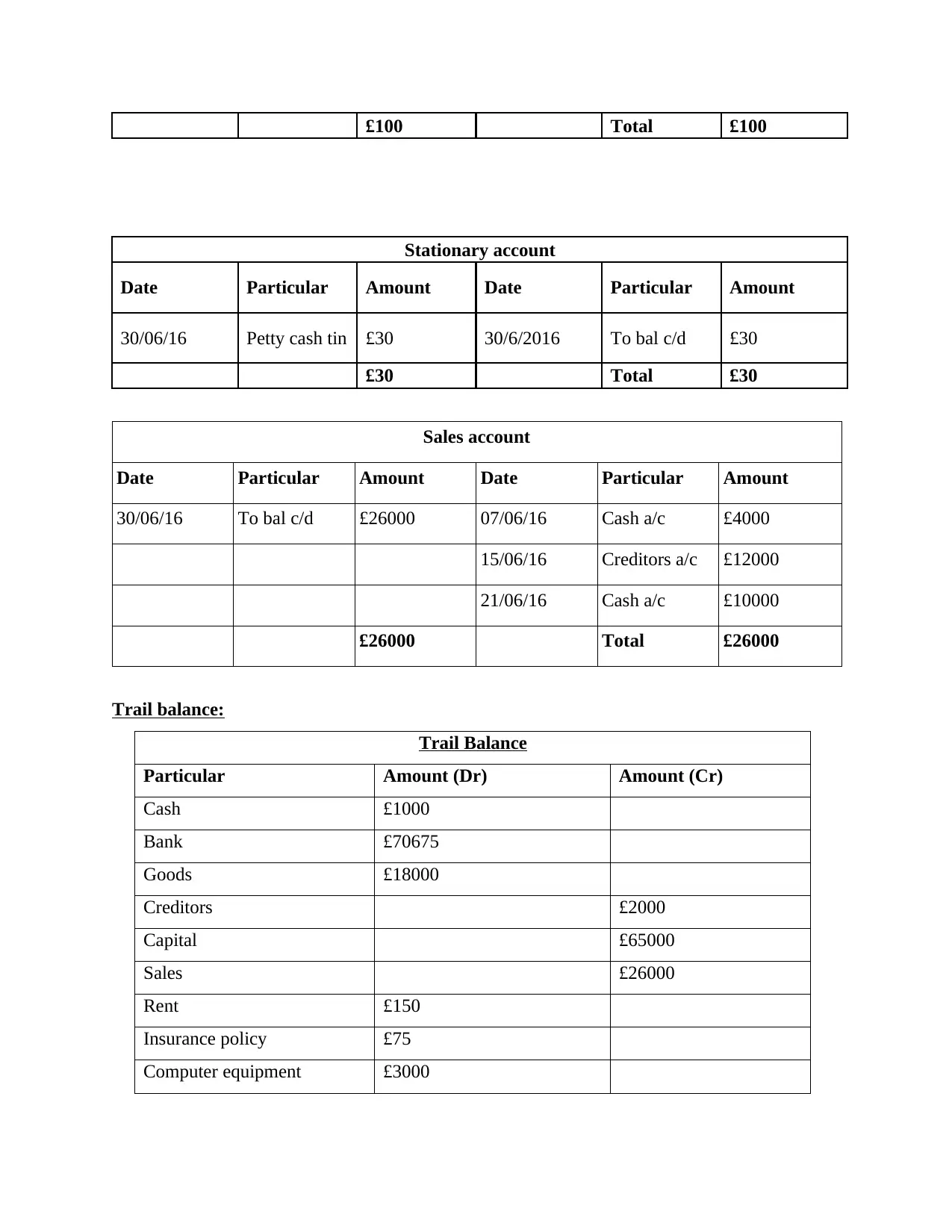

£100 Total £100

Stationary account

Date Particular Amount Date Particular Amount

30/06/16 Petty cash tin £30 30/6/2016 To bal c/d £30

£30 Total £30

Sales account

Date Particular Amount Date Particular Amount

30/06/16 To bal c/d £26000 07/06/16 Cash a/c £4000

15/06/16 Creditors a/c £12000

21/06/16 Cash a/c £10000

£26000 Total £26000

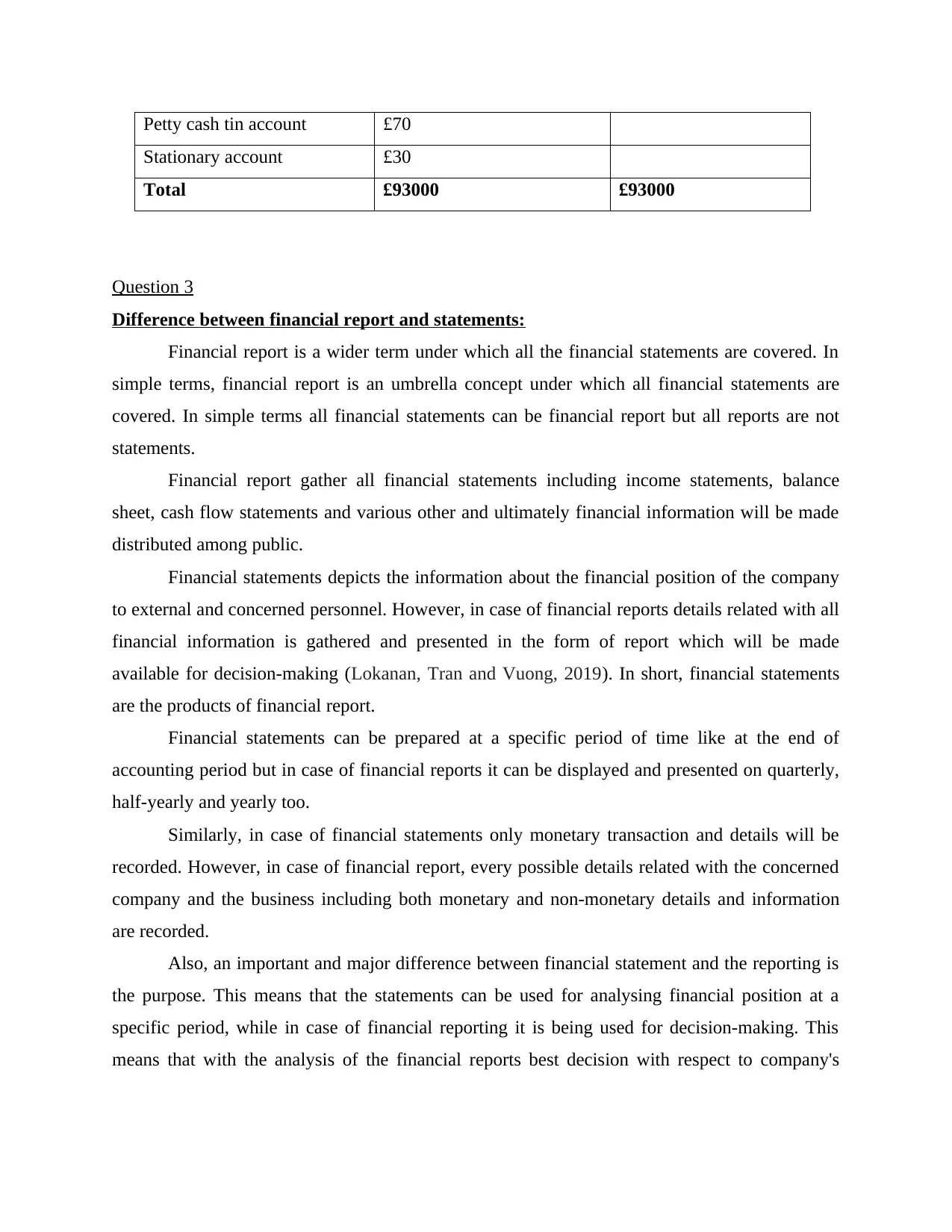

Trail balance:

Trail Balance

Particular Amount (Dr) Amount (Cr)

Cash £1000

Bank £70675

Goods £18000

Creditors £2000

Capital £65000

Sales £26000

Rent £150

Insurance policy £75

Computer equipment £3000

Stationary account

Date Particular Amount Date Particular Amount

30/06/16 Petty cash tin £30 30/6/2016 To bal c/d £30

£30 Total £30

Sales account

Date Particular Amount Date Particular Amount

30/06/16 To bal c/d £26000 07/06/16 Cash a/c £4000

15/06/16 Creditors a/c £12000

21/06/16 Cash a/c £10000

£26000 Total £26000

Trail balance:

Trail Balance

Particular Amount (Dr) Amount (Cr)

Cash £1000

Bank £70675

Goods £18000

Creditors £2000

Capital £65000

Sales £26000

Rent £150

Insurance policy £75

Computer equipment £3000

Petty cash tin account £70

Stationary account £30

Total £93000 £93000

Question 3

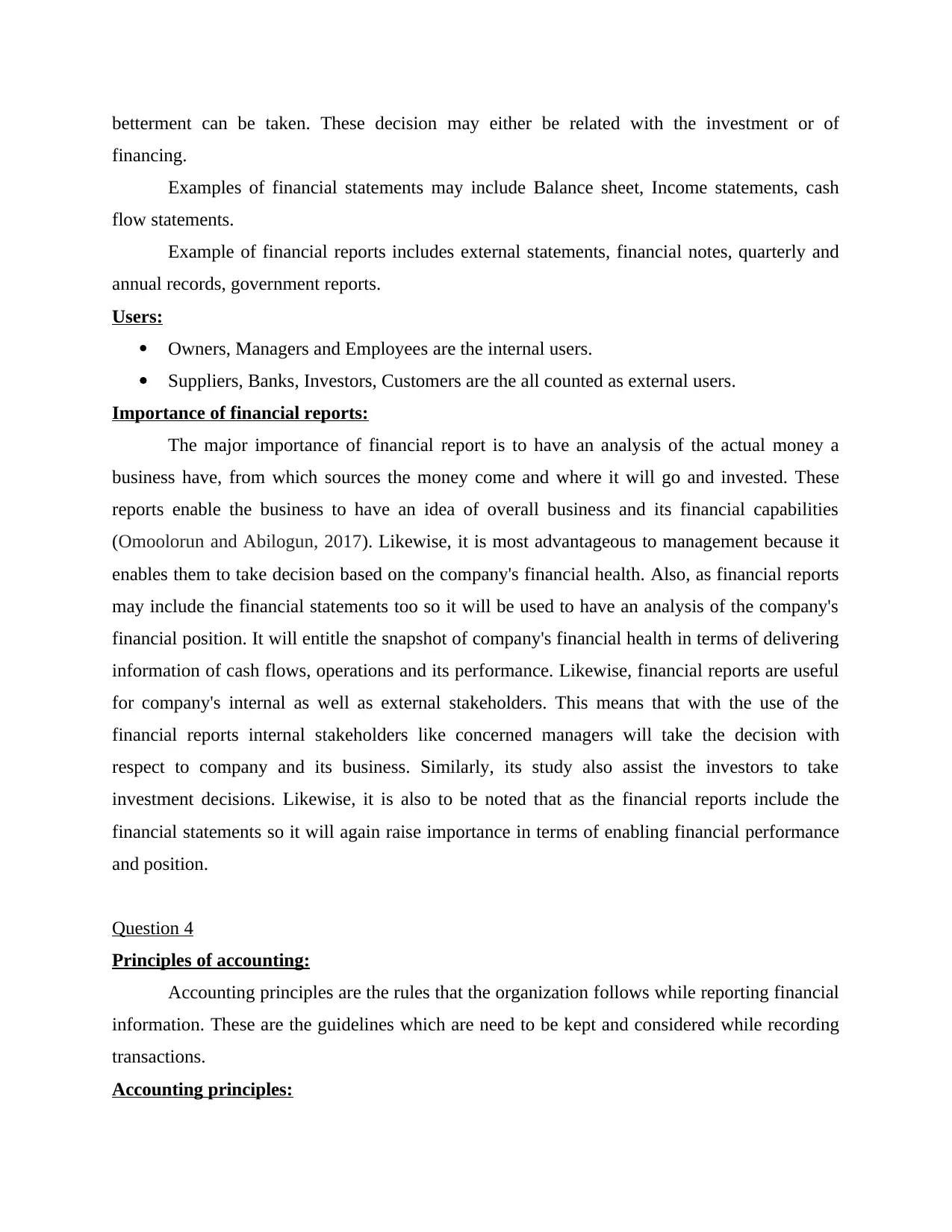

Difference between financial report and statements:

Financial report is a wider term under which all the financial statements are covered. In

simple terms, financial report is an umbrella concept under which all financial statements are

covered. In simple terms all financial statements can be financial report but all reports are not

statements.

Financial report gather all financial statements including income statements, balance

sheet, cash flow statements and various other and ultimately financial information will be made

distributed among public.

Financial statements depicts the information about the financial position of the company

to external and concerned personnel. However, in case of financial reports details related with all

financial information is gathered and presented in the form of report which will be made

available for decision-making (Lokanan, Tran and Vuong, 2019). In short, financial statements

are the products of financial report.

Financial statements can be prepared at a specific period of time like at the end of

accounting period but in case of financial reports it can be displayed and presented on quarterly,

half-yearly and yearly too.

Similarly, in case of financial statements only monetary transaction and details will be

recorded. However, in case of financial report, every possible details related with the concerned

company and the business including both monetary and non-monetary details and information

are recorded.

Also, an important and major difference between financial statement and the reporting is

the purpose. This means that the statements can be used for analysing financial position at a

specific period, while in case of financial reporting it is being used for decision-making. This

means that with the analysis of the financial reports best decision with respect to company's

Stationary account £30

Total £93000 £93000

Question 3

Difference between financial report and statements:

Financial report is a wider term under which all the financial statements are covered. In

simple terms, financial report is an umbrella concept under which all financial statements are

covered. In simple terms all financial statements can be financial report but all reports are not

statements.

Financial report gather all financial statements including income statements, balance

sheet, cash flow statements and various other and ultimately financial information will be made

distributed among public.

Financial statements depicts the information about the financial position of the company

to external and concerned personnel. However, in case of financial reports details related with all

financial information is gathered and presented in the form of report which will be made

available for decision-making (Lokanan, Tran and Vuong, 2019). In short, financial statements

are the products of financial report.

Financial statements can be prepared at a specific period of time like at the end of

accounting period but in case of financial reports it can be displayed and presented on quarterly,

half-yearly and yearly too.

Similarly, in case of financial statements only monetary transaction and details will be

recorded. However, in case of financial report, every possible details related with the concerned

company and the business including both monetary and non-monetary details and information

are recorded.

Also, an important and major difference between financial statement and the reporting is

the purpose. This means that the statements can be used for analysing financial position at a

specific period, while in case of financial reporting it is being used for decision-making. This

means that with the analysis of the financial reports best decision with respect to company's

betterment can be taken. These decision may either be related with the investment or of

financing.

Examples of financial statements may include Balance sheet, Income statements, cash

flow statements.

Example of financial reports includes external statements, financial notes, quarterly and

annual records, government reports.

Users:

Owners, Managers and Employees are the internal users.

Suppliers, Banks, Investors, Customers are the all counted as external users.

Importance of financial reports:

The major importance of financial report is to have an analysis of the actual money a

business have, from which sources the money come and where it will go and invested. These

reports enable the business to have an idea of overall business and its financial capabilities

(Omoolorun and Abilogun, 2017). Likewise, it is most advantageous to management because it

enables them to take decision based on the company's financial health. Also, as financial reports

may include the financial statements too so it will be used to have an analysis of the company's

financial position. It will entitle the snapshot of company's financial health in terms of delivering

information of cash flows, operations and its performance. Likewise, financial reports are useful

for company's internal as well as external stakeholders. This means that with the use of the

financial reports internal stakeholders like concerned managers will take the decision with

respect to company and its business. Similarly, its study also assist the investors to take

investment decisions. Likewise, it is also to be noted that as the financial reports include the

financial statements so it will again raise importance in terms of enabling financial performance

and position.

Question 4

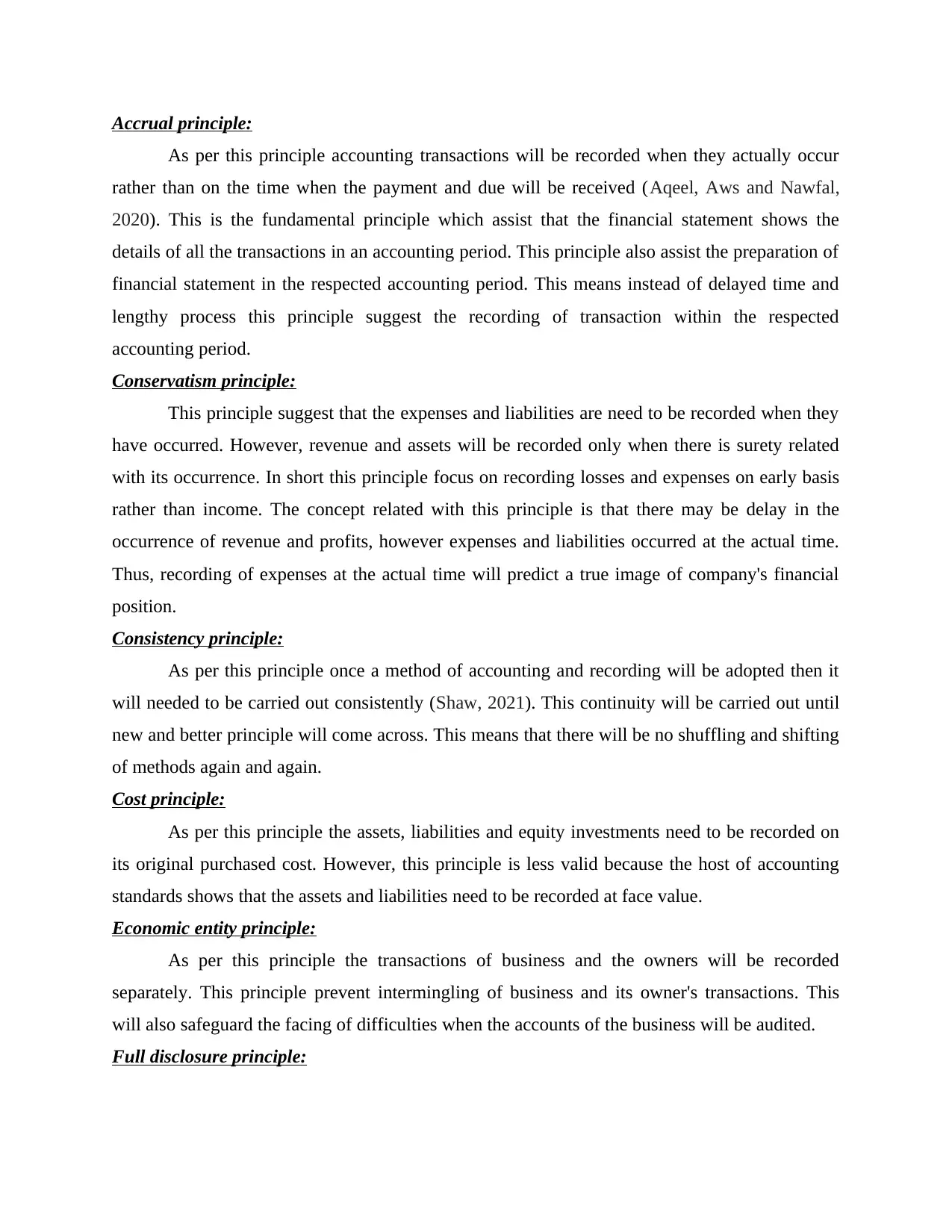

Principles of accounting:

Accounting principles are the rules that the organization follows while reporting financial

information. These are the guidelines which are need to be kept and considered while recording

transactions.

Accounting principles:

financing.

Examples of financial statements may include Balance sheet, Income statements, cash

flow statements.

Example of financial reports includes external statements, financial notes, quarterly and

annual records, government reports.

Users:

Owners, Managers and Employees are the internal users.

Suppliers, Banks, Investors, Customers are the all counted as external users.

Importance of financial reports:

The major importance of financial report is to have an analysis of the actual money a

business have, from which sources the money come and where it will go and invested. These

reports enable the business to have an idea of overall business and its financial capabilities

(Omoolorun and Abilogun, 2017). Likewise, it is most advantageous to management because it

enables them to take decision based on the company's financial health. Also, as financial reports

may include the financial statements too so it will be used to have an analysis of the company's

financial position. It will entitle the snapshot of company's financial health in terms of delivering

information of cash flows, operations and its performance. Likewise, financial reports are useful

for company's internal as well as external stakeholders. This means that with the use of the

financial reports internal stakeholders like concerned managers will take the decision with

respect to company and its business. Similarly, its study also assist the investors to take

investment decisions. Likewise, it is also to be noted that as the financial reports include the

financial statements so it will again raise importance in terms of enabling financial performance

and position.

Question 4

Principles of accounting:

Accounting principles are the rules that the organization follows while reporting financial

information. These are the guidelines which are need to be kept and considered while recording

transactions.

Accounting principles:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accrual principle:

As per this principle accounting transactions will be recorded when they actually occur

rather than on the time when the payment and due will be received (Aqeel, Aws and Nawfal,

2020). This is the fundamental principle which assist that the financial statement shows the

details of all the transactions in an accounting period. This principle also assist the preparation of

financial statement in the respected accounting period. This means instead of delayed time and

lengthy process this principle suggest the recording of transaction within the respected

accounting period.

Conservatism principle:

This principle suggest that the expenses and liabilities are need to be recorded when they

have occurred. However, revenue and assets will be recorded only when there is surety related

with its occurrence. In short this principle focus on recording losses and expenses on early basis

rather than income. The concept related with this principle is that there may be delay in the

occurrence of revenue and profits, however expenses and liabilities occurred at the actual time.

Thus, recording of expenses at the actual time will predict a true image of company's financial

position.

Consistency principle:

As per this principle once a method of accounting and recording will be adopted then it

will needed to be carried out consistently (Shaw, 2021). This continuity will be carried out until

new and better principle will come across. This means that there will be no shuffling and shifting

of methods again and again.

Cost principle:

As per this principle the assets, liabilities and equity investments need to be recorded on

its original purchased cost. However, this principle is less valid because the host of accounting

standards shows that the assets and liabilities need to be recorded at face value.

Economic entity principle:

As per this principle the transactions of business and the owners will be recorded

separately. This principle prevent intermingling of business and its owner's transactions. This

will also safeguard the facing of difficulties when the accounts of the business will be audited.

Full disclosure principle:

As per this principle accounting transactions will be recorded when they actually occur

rather than on the time when the payment and due will be received (Aqeel, Aws and Nawfal,

2020). This is the fundamental principle which assist that the financial statement shows the

details of all the transactions in an accounting period. This principle also assist the preparation of

financial statement in the respected accounting period. This means instead of delayed time and

lengthy process this principle suggest the recording of transaction within the respected

accounting period.

Conservatism principle:

This principle suggest that the expenses and liabilities are need to be recorded when they

have occurred. However, revenue and assets will be recorded only when there is surety related

with its occurrence. In short this principle focus on recording losses and expenses on early basis

rather than income. The concept related with this principle is that there may be delay in the

occurrence of revenue and profits, however expenses and liabilities occurred at the actual time.

Thus, recording of expenses at the actual time will predict a true image of company's financial

position.

Consistency principle:

As per this principle once a method of accounting and recording will be adopted then it

will needed to be carried out consistently (Shaw, 2021). This continuity will be carried out until

new and better principle will come across. This means that there will be no shuffling and shifting

of methods again and again.

Cost principle:

As per this principle the assets, liabilities and equity investments need to be recorded on

its original purchased cost. However, this principle is less valid because the host of accounting

standards shows that the assets and liabilities need to be recorded at face value.

Economic entity principle:

As per this principle the transactions of business and the owners will be recorded

separately. This principle prevent intermingling of business and its owner's transactions. This

will also safeguard the facing of difficulties when the accounts of the business will be audited.

Full disclosure principle:

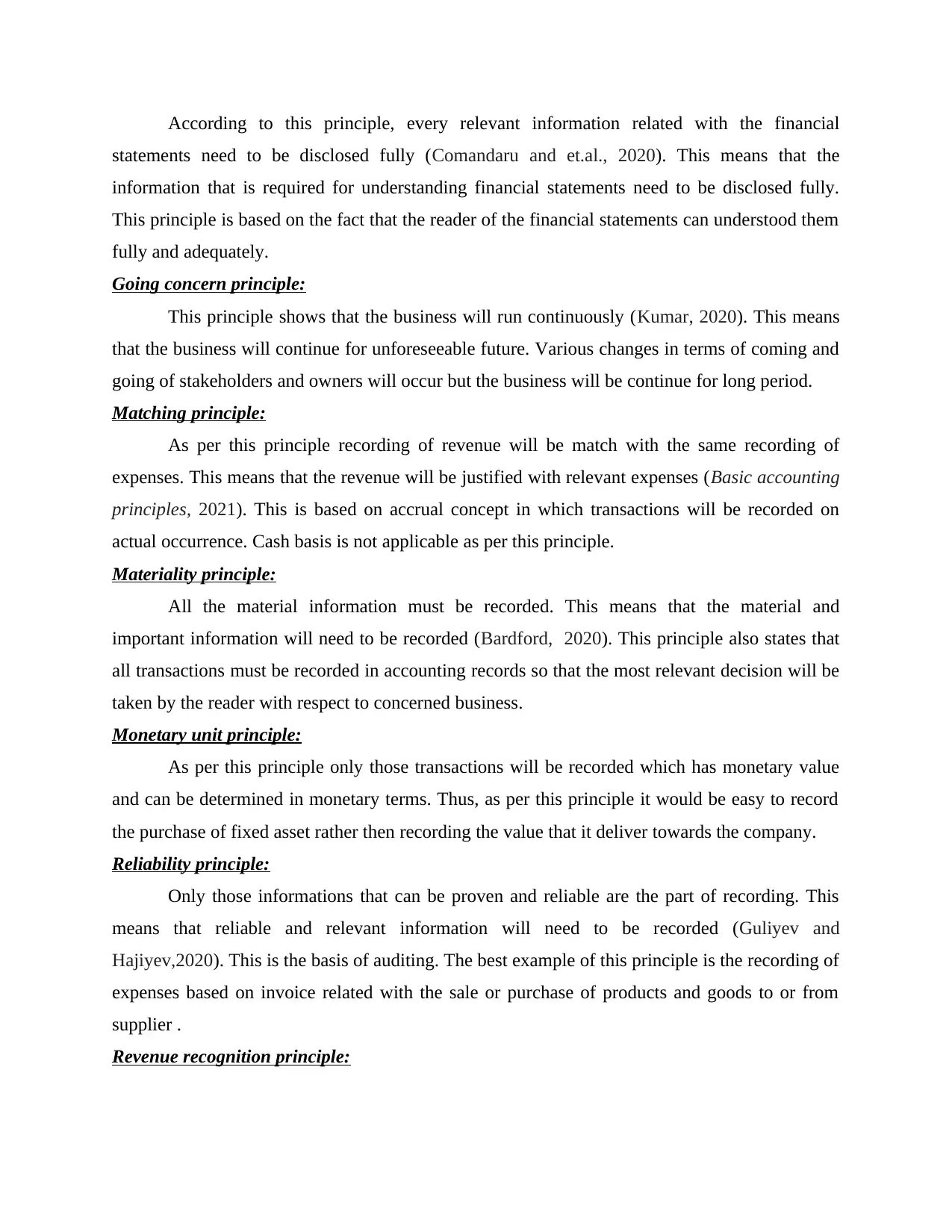

According to this principle, every relevant information related with the financial

statements need to be disclosed fully (Comandaru and et.al., 2020). This means that the

information that is required for understanding financial statements need to be disclosed fully.

This principle is based on the fact that the reader of the financial statements can understood them

fully and adequately.

Going concern principle:

This principle shows that the business will run continuously (Kumar, 2020). This means

that the business will continue for unforeseeable future. Various changes in terms of coming and

going of stakeholders and owners will occur but the business will be continue for long period.

Matching principle:

As per this principle recording of revenue will be match with the same recording of

expenses. This means that the revenue will be justified with relevant expenses (Basic accounting

principles, 2021). This is based on accrual concept in which transactions will be recorded on

actual occurrence. Cash basis is not applicable as per this principle.

Materiality principle:

All the material information must be recorded. This means that the material and

important information will need to be recorded (Bardford, 2020). This principle also states that

all transactions must be recorded in accounting records so that the most relevant decision will be

taken by the reader with respect to concerned business.

Monetary unit principle:

As per this principle only those transactions will be recorded which has monetary value

and can be determined in monetary terms. Thus, as per this principle it would be easy to record

the purchase of fixed asset rather then recording the value that it deliver towards the company.

Reliability principle:

Only those informations that can be proven and reliable are the part of recording. This

means that reliable and relevant information will need to be recorded (Guliyev and

Hajiyev,2020). This is the basis of auditing. The best example of this principle is the recording of

expenses based on invoice related with the sale or purchase of products and goods to or from

supplier .

Revenue recognition principle:

statements need to be disclosed fully (Comandaru and et.al., 2020). This means that the

information that is required for understanding financial statements need to be disclosed fully.

This principle is based on the fact that the reader of the financial statements can understood them

fully and adequately.

Going concern principle:

This principle shows that the business will run continuously (Kumar, 2020). This means

that the business will continue for unforeseeable future. Various changes in terms of coming and

going of stakeholders and owners will occur but the business will be continue for long period.

Matching principle:

As per this principle recording of revenue will be match with the same recording of

expenses. This means that the revenue will be justified with relevant expenses (Basic accounting

principles, 2021). This is based on accrual concept in which transactions will be recorded on

actual occurrence. Cash basis is not applicable as per this principle.

Materiality principle:

All the material information must be recorded. This means that the material and

important information will need to be recorded (Bardford, 2020). This principle also states that

all transactions must be recorded in accounting records so that the most relevant decision will be

taken by the reader with respect to concerned business.

Monetary unit principle:

As per this principle only those transactions will be recorded which has monetary value

and can be determined in monetary terms. Thus, as per this principle it would be easy to record

the purchase of fixed asset rather then recording the value that it deliver towards the company.

Reliability principle:

Only those informations that can be proven and reliable are the part of recording. This

means that reliable and relevant information will need to be recorded (Guliyev and

Hajiyev,2020). This is the basis of auditing. The best example of this principle is the recording of

expenses based on invoice related with the sale or purchase of products and goods to or from

supplier .

Revenue recognition principle:

As per this principle revenue will be recognized only when business has completed

earning process.

Time period principle:

According to this principle business to report its result over a standard period of time.

This means that there should be standard time with relation to reporting.

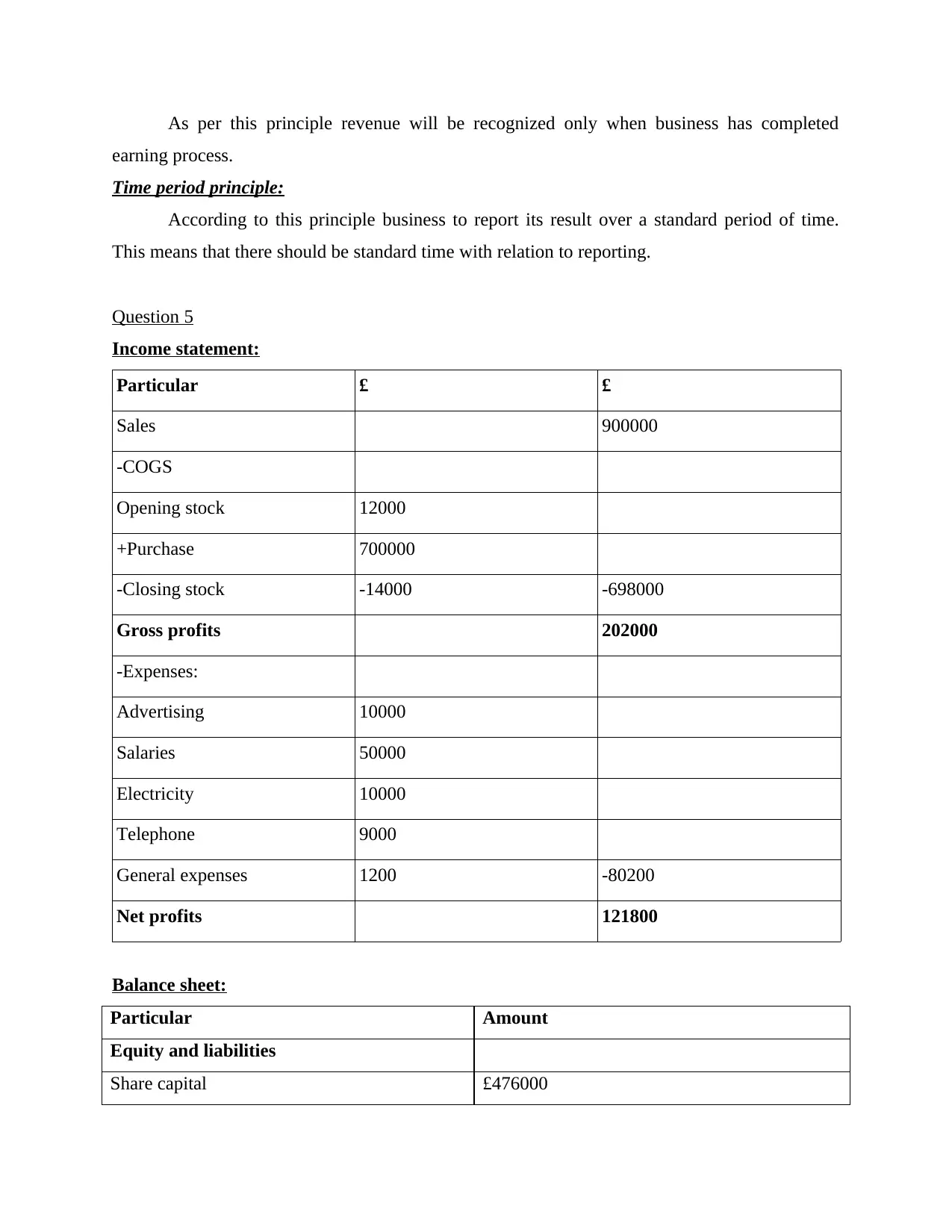

Question 5

Income statement:

Particular £ £

Sales 900000

-COGS

Opening stock 12000

+Purchase 700000

-Closing stock -14000 -698000

Gross profits 202000

-Expenses:

Advertising 10000

Salaries 50000

Electricity 10000

Telephone 9000

General expenses 1200 -80200

Net profits 121800

Balance sheet:

Particular Amount

Equity and liabilities

Share capital £476000

earning process.

Time period principle:

According to this principle business to report its result over a standard period of time.

This means that there should be standard time with relation to reporting.

Question 5

Income statement:

Particular £ £

Sales 900000

-COGS

Opening stock 12000

+Purchase 700000

-Closing stock -14000 -698000

Gross profits 202000

-Expenses:

Advertising 10000

Salaries 50000

Electricity 10000

Telephone 9000

General expenses 1200 -80200

Net profits 121800

Balance sheet:

Particular Amount

Equity and liabilities

Share capital £476000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

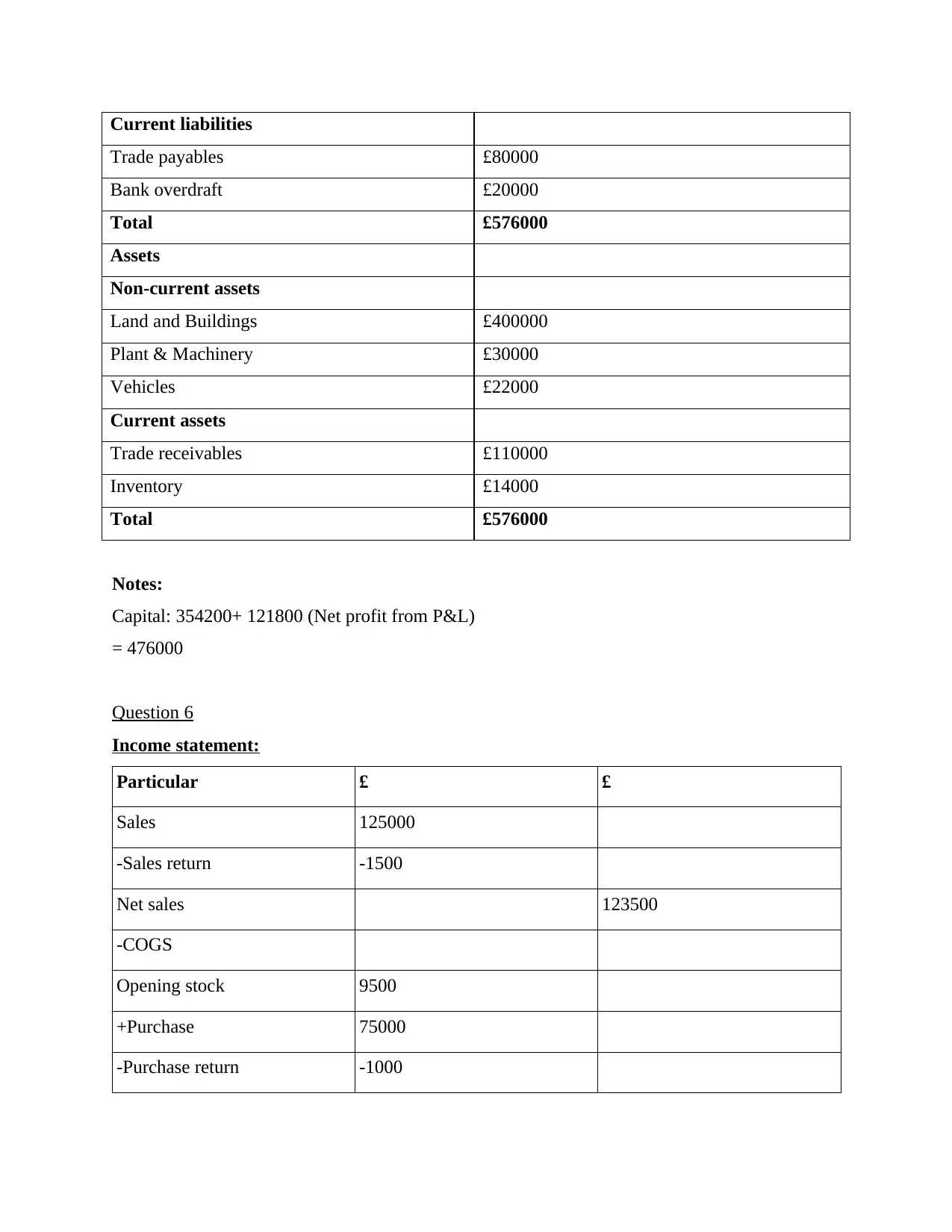

Current liabilities

Trade payables £80000

Bank overdraft £20000

Total £576000

Assets

Non-current assets

Land and Buildings £400000

Plant & Machinery £30000

Vehicles £22000

Current assets

Trade receivables £110000

Inventory £14000

Total £576000

Notes:

Capital: 354200+ 121800 (Net profit from P&L)

= 476000

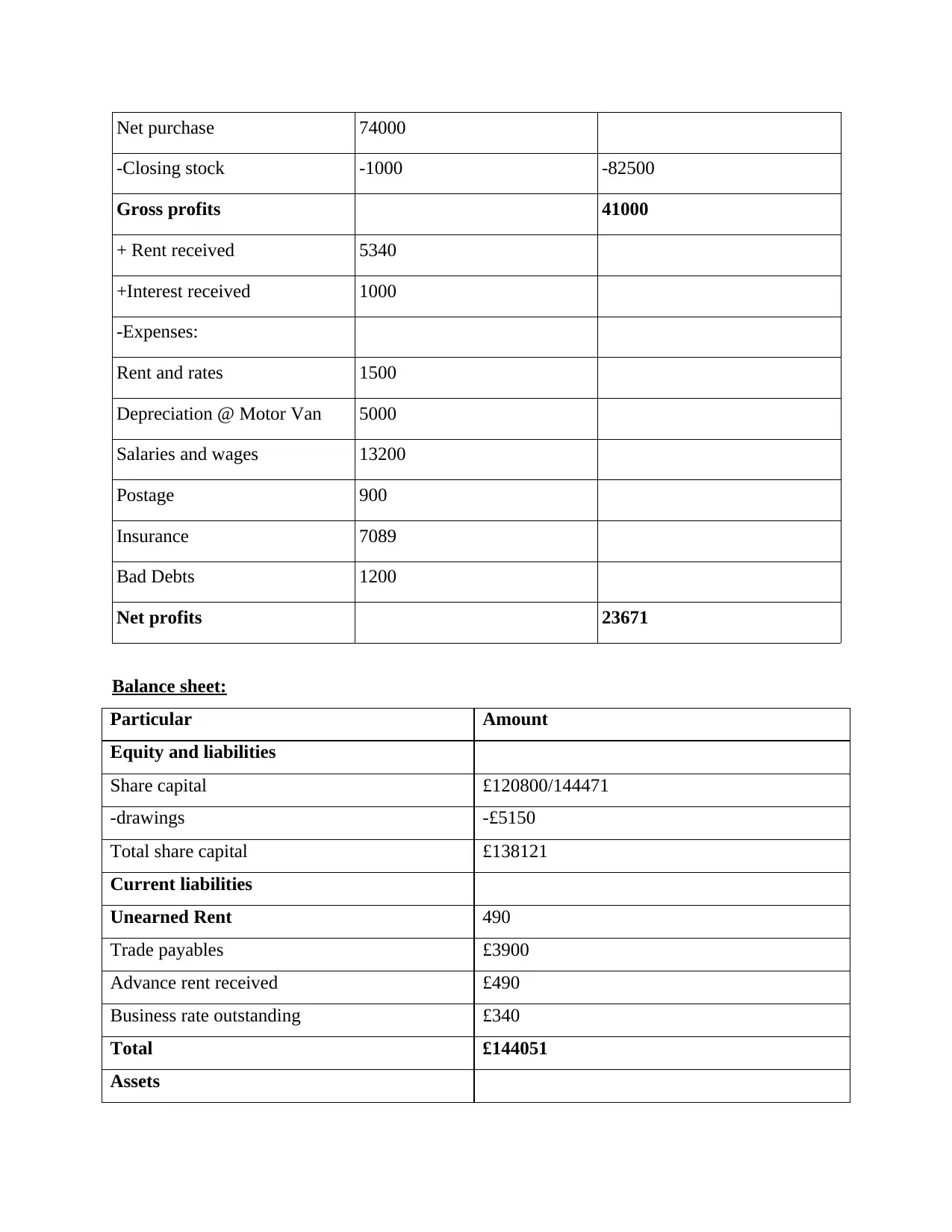

Question 6

Income statement:

Particular £ £

Sales 125000

-Sales return -1500

Net sales 123500

-COGS

Opening stock 9500

+Purchase 75000

-Purchase return -1000

Trade payables £80000

Bank overdraft £20000

Total £576000

Assets

Non-current assets

Land and Buildings £400000

Plant & Machinery £30000

Vehicles £22000

Current assets

Trade receivables £110000

Inventory £14000

Total £576000

Notes:

Capital: 354200+ 121800 (Net profit from P&L)

= 476000

Question 6

Income statement:

Particular £ £

Sales 125000

-Sales return -1500

Net sales 123500

-COGS

Opening stock 9500

+Purchase 75000

-Purchase return -1000

Net purchase 74000

-Closing stock -1000 -82500

Gross profits 41000

+ Rent received 5340

+Interest received 1000

-Expenses:

Rent and rates 1500

Depreciation @ Motor Van 5000

Salaries and wages 13200

Postage 900

Insurance 7089

Bad Debts 1200

Net profits 23671

Balance sheet:

Particular Amount

Equity and liabilities

Share capital £120800/144471

-drawings -£5150

Total share capital £138121

Current liabilities

Unearned Rent 490

Trade payables £3900

Advance rent received £490

Business rate outstanding £340

Total £144051

Assets

-Closing stock -1000 -82500

Gross profits 41000

+ Rent received 5340

+Interest received 1000

-Expenses:

Rent and rates 1500

Depreciation @ Motor Van 5000

Salaries and wages 13200

Postage 900

Insurance 7089

Bad Debts 1200

Net profits 23671

Balance sheet:

Particular Amount

Equity and liabilities

Share capital £120800/144471

-drawings -£5150

Total share capital £138121

Current liabilities

Unearned Rent 490

Trade payables £3900

Advance rent received £490

Business rate outstanding £340

Total £144051

Assets

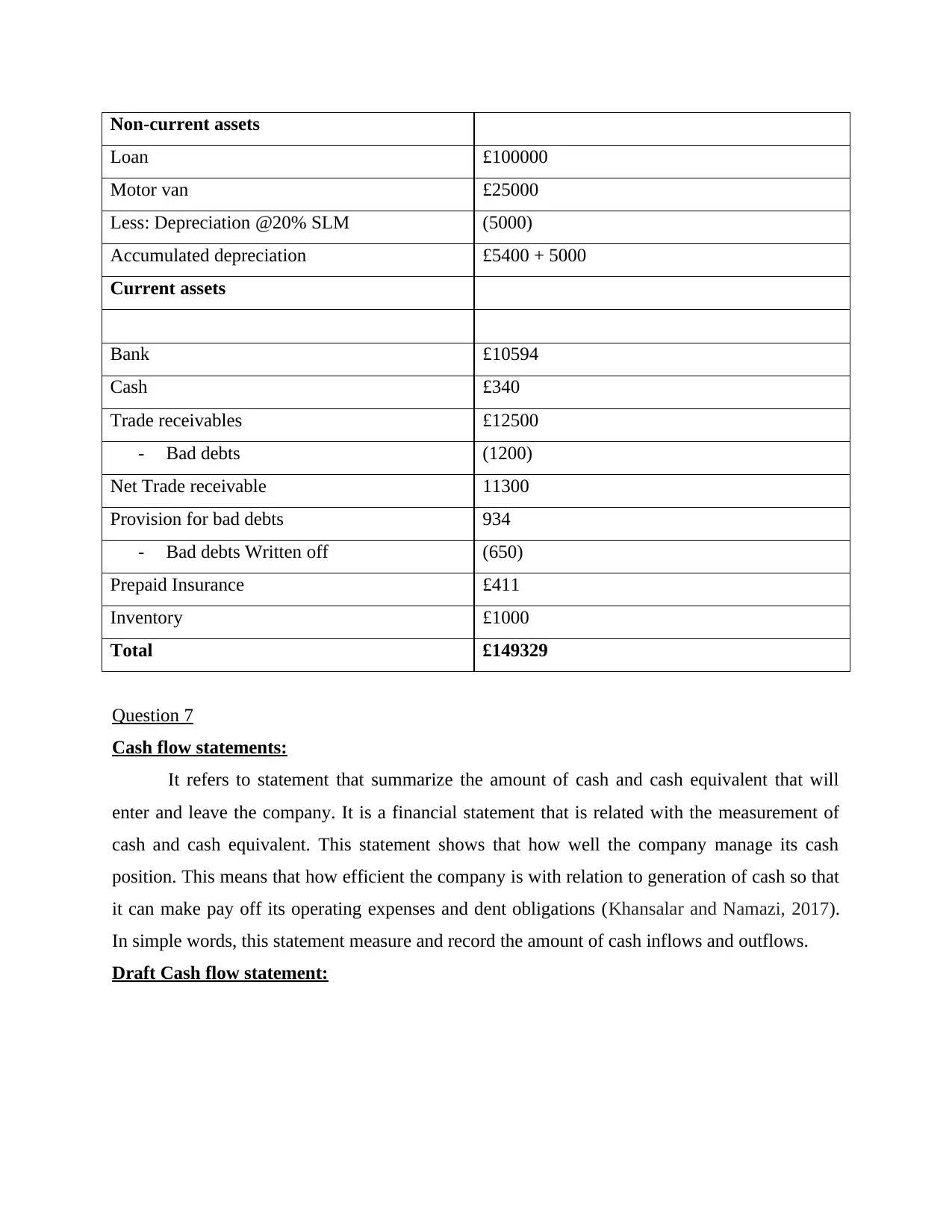

Non-current assets

Loan £100000

Motor van £25000

Less: Depreciation @20% SLM (5000)

Accumulated depreciation £5400 + 5000

Current assets

Bank £10594

Cash £340

Trade receivables £12500

- Bad debts (1200)

Net Trade receivable 11300

Provision for bad debts 934

- Bad debts Written off (650)

Prepaid Insurance £411

Inventory £1000

Total £149329

Question 7

Cash flow statements:

It refers to statement that summarize the amount of cash and cash equivalent that will

enter and leave the company. It is a financial statement that is related with the measurement of

cash and cash equivalent. This statement shows that how well the company manage its cash

position. This means that how efficient the company is with relation to generation of cash so that

it can make pay off its operating expenses and dent obligations (Khansalar and Namazi, 2017).

In simple words, this statement measure and record the amount of cash inflows and outflows.

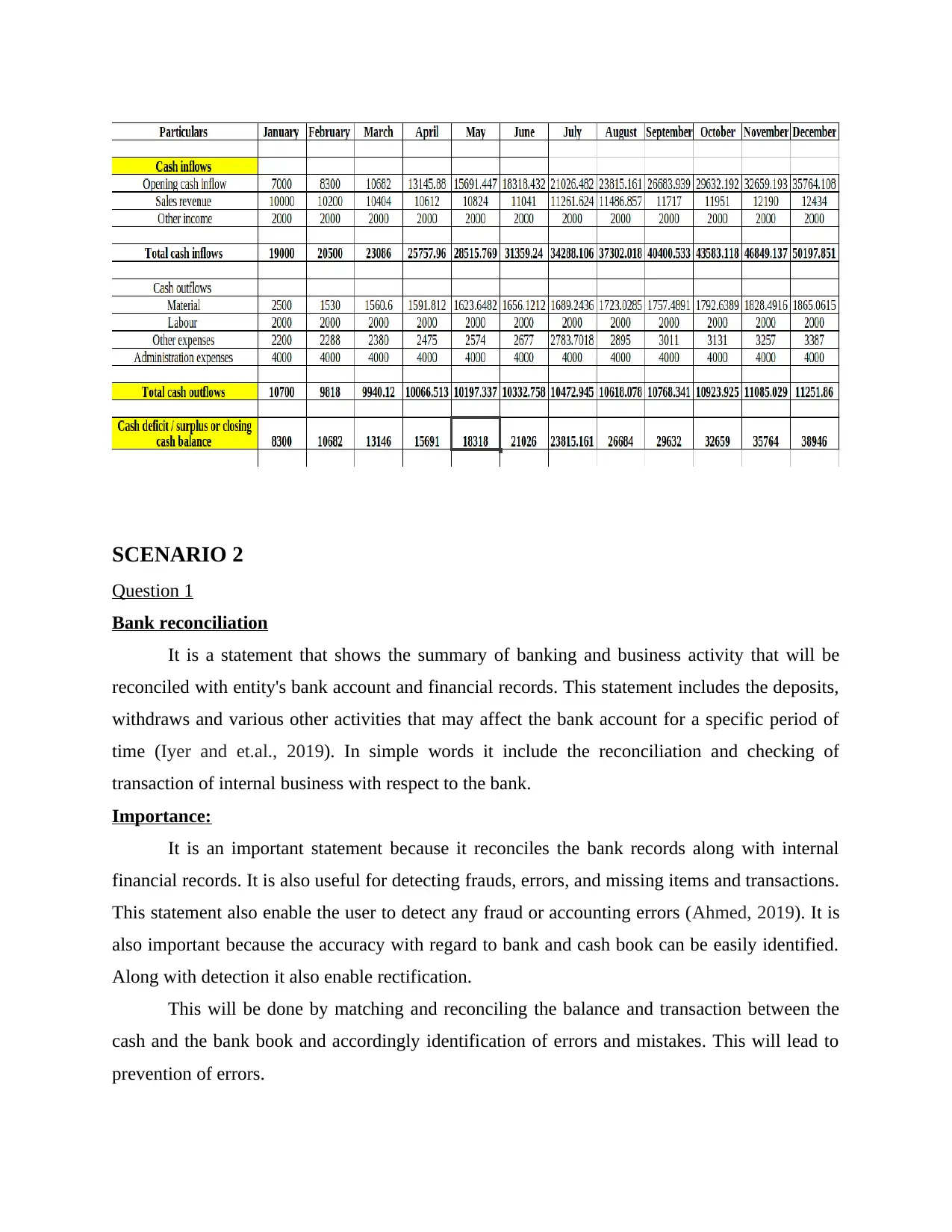

Draft Cash flow statement:

Loan £100000

Motor van £25000

Less: Depreciation @20% SLM (5000)

Accumulated depreciation £5400 + 5000

Current assets

Bank £10594

Cash £340

Trade receivables £12500

- Bad debts (1200)

Net Trade receivable 11300

Provision for bad debts 934

- Bad debts Written off (650)

Prepaid Insurance £411

Inventory £1000

Total £149329

Question 7

Cash flow statements:

It refers to statement that summarize the amount of cash and cash equivalent that will

enter and leave the company. It is a financial statement that is related with the measurement of

cash and cash equivalent. This statement shows that how well the company manage its cash

position. This means that how efficient the company is with relation to generation of cash so that

it can make pay off its operating expenses and dent obligations (Khansalar and Namazi, 2017).

In simple words, this statement measure and record the amount of cash inflows and outflows.

Draft Cash flow statement:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

SCENARIO 2

Question 1

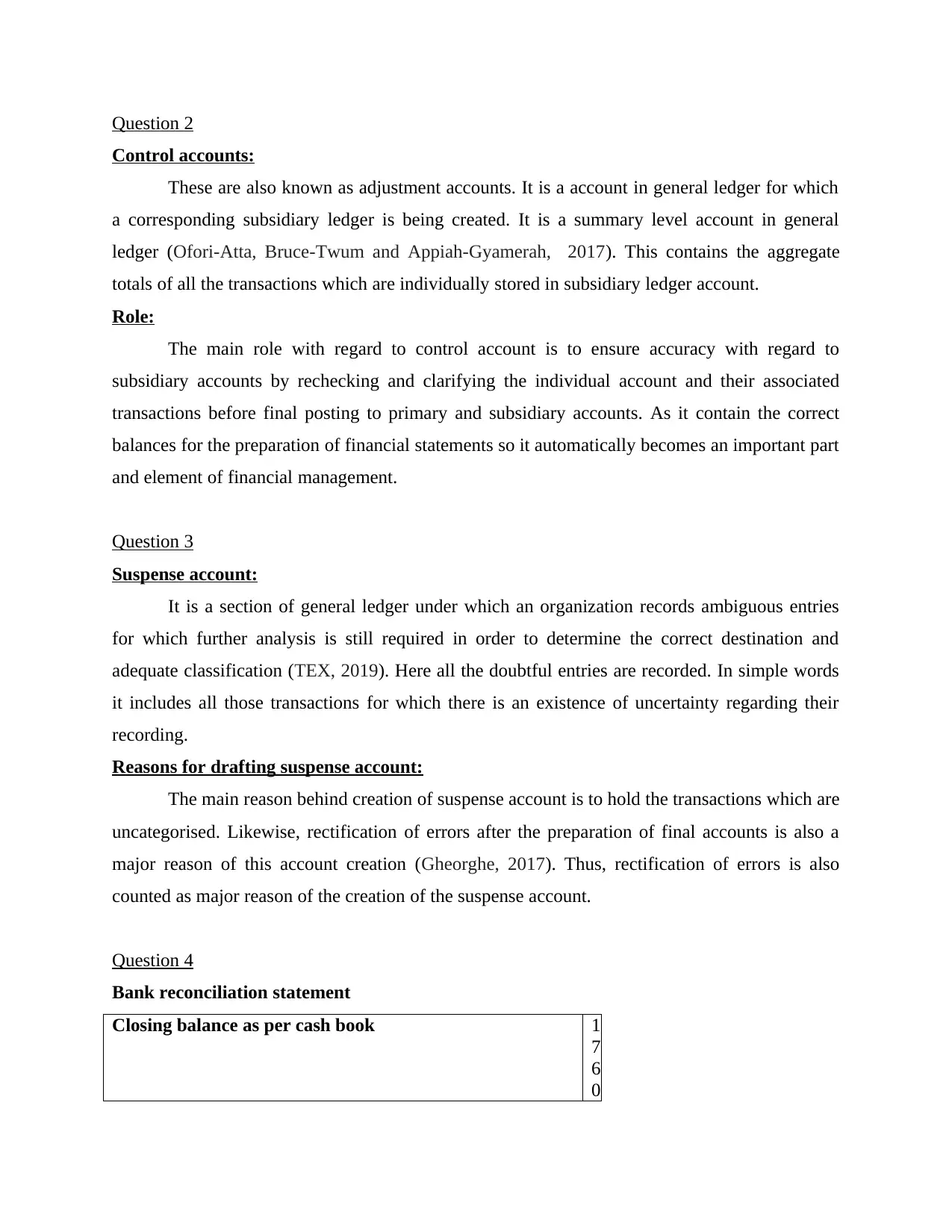

Bank reconciliation

It is a statement that shows the summary of banking and business activity that will be

reconciled with entity's bank account and financial records. This statement includes the deposits,

withdraws and various other activities that may affect the bank account for a specific period of

time (Iyer and et.al., 2019). In simple words it include the reconciliation and checking of

transaction of internal business with respect to the bank.

Importance:

It is an important statement because it reconciles the bank records along with internal

financial records. It is also useful for detecting frauds, errors, and missing items and transactions.

This statement also enable the user to detect any fraud or accounting errors (Ahmed, 2019). It is

also important because the accuracy with regard to bank and cash book can be easily identified.

Along with detection it also enable rectification.

This will be done by matching and reconciling the balance and transaction between the

cash and the bank book and accordingly identification of errors and mistakes. This will lead to

prevention of errors.

Question 1

Bank reconciliation

It is a statement that shows the summary of banking and business activity that will be

reconciled with entity's bank account and financial records. This statement includes the deposits,

withdraws and various other activities that may affect the bank account for a specific period of

time (Iyer and et.al., 2019). In simple words it include the reconciliation and checking of

transaction of internal business with respect to the bank.

Importance:

It is an important statement because it reconciles the bank records along with internal

financial records. It is also useful for detecting frauds, errors, and missing items and transactions.

This statement also enable the user to detect any fraud or accounting errors (Ahmed, 2019). It is

also important because the accuracy with regard to bank and cash book can be easily identified.

Along with detection it also enable rectification.

This will be done by matching and reconciling the balance and transaction between the

cash and the bank book and accordingly identification of errors and mistakes. This will lead to

prevention of errors.

Question 2

Control accounts:

These are also known as adjustment accounts. It is a account in general ledger for which

a corresponding subsidiary ledger is being created. It is a summary level account in general

ledger (Ofori-Atta, Bruce-Twum and Appiah-Gyamerah, 2017). This contains the aggregate

totals of all the transactions which are individually stored in subsidiary ledger account.

Role:

The main role with regard to control account is to ensure accuracy with regard to

subsidiary accounts by rechecking and clarifying the individual account and their associated

transactions before final posting to primary and subsidiary accounts. As it contain the correct

balances for the preparation of financial statements so it automatically becomes an important part

and element of financial management.

Question 3

Suspense account:

It is a section of general ledger under which an organization records ambiguous entries

for which further analysis is still required in order to determine the correct destination and

adequate classification (TEX, 2019). Here all the doubtful entries are recorded. In simple words

it includes all those transactions for which there is an existence of uncertainty regarding their

recording.

Reasons for drafting suspense account:

The main reason behind creation of suspense account is to hold the transactions which are

uncategorised. Likewise, rectification of errors after the preparation of final accounts is also a

major reason of this account creation (Gheorghe, 2017). Thus, rectification of errors is also

counted as major reason of the creation of the suspense account.

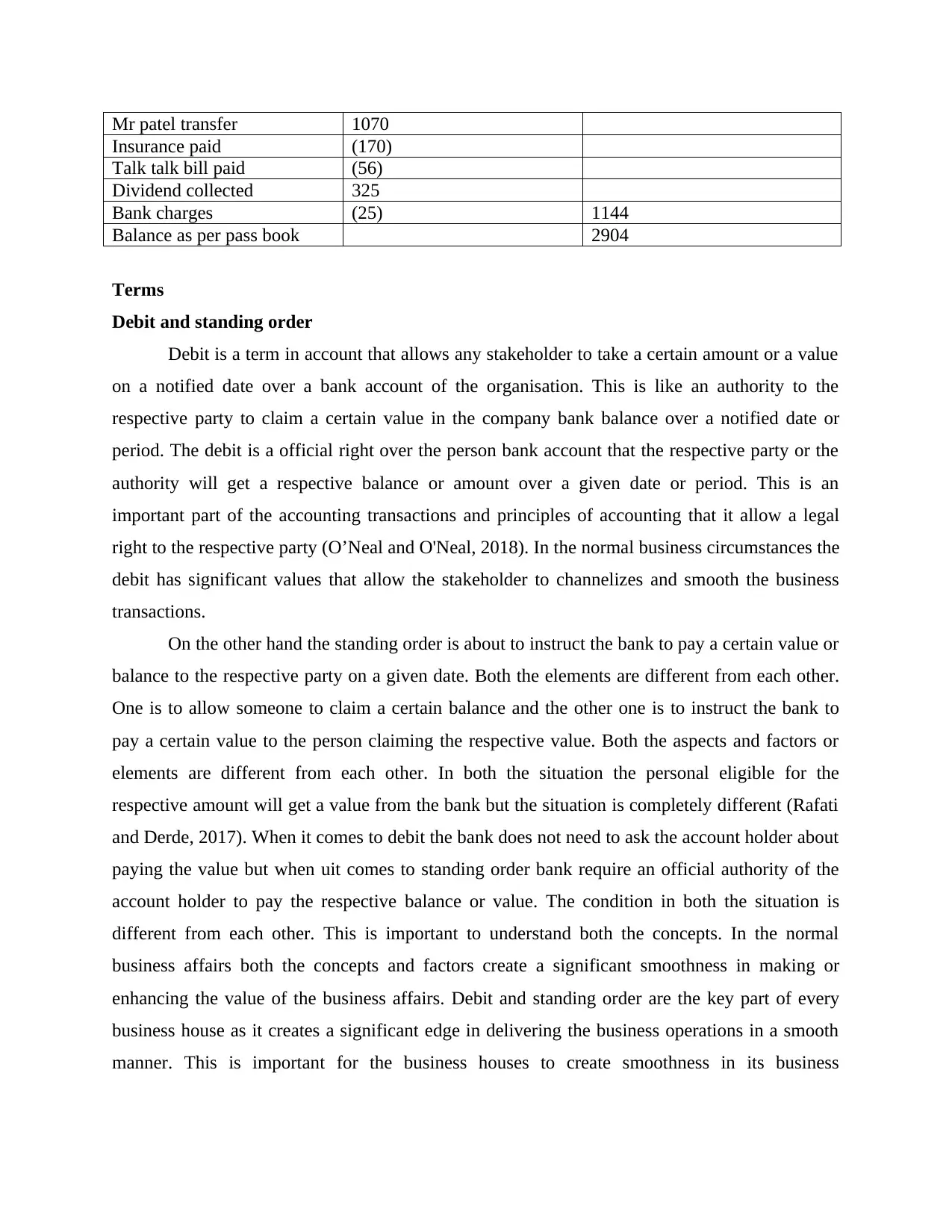

Question 4

Bank reconciliation statement

Closing balance as per cash book 1

7

6

0

Control accounts:

These are also known as adjustment accounts. It is a account in general ledger for which

a corresponding subsidiary ledger is being created. It is a summary level account in general

ledger (Ofori-Atta, Bruce-Twum and Appiah-Gyamerah, 2017). This contains the aggregate

totals of all the transactions which are individually stored in subsidiary ledger account.

Role:

The main role with regard to control account is to ensure accuracy with regard to

subsidiary accounts by rechecking and clarifying the individual account and their associated

transactions before final posting to primary and subsidiary accounts. As it contain the correct

balances for the preparation of financial statements so it automatically becomes an important part

and element of financial management.

Question 3

Suspense account:

It is a section of general ledger under which an organization records ambiguous entries

for which further analysis is still required in order to determine the correct destination and

adequate classification (TEX, 2019). Here all the doubtful entries are recorded. In simple words

it includes all those transactions for which there is an existence of uncertainty regarding their

recording.

Reasons for drafting suspense account:

The main reason behind creation of suspense account is to hold the transactions which are

uncategorised. Likewise, rectification of errors after the preparation of final accounts is also a

major reason of this account creation (Gheorghe, 2017). Thus, rectification of errors is also

counted as major reason of the creation of the suspense account.

Question 4

Bank reconciliation statement

Closing balance as per cash book 1

7

6

0

Mr patel transfer 1070

Insurance paid (170)

Talk talk bill paid (56)

Dividend collected 325

Bank charges (25) 1144

Balance as per pass book 2904

Terms

Debit and standing order

Debit is a term in account that allows any stakeholder to take a certain amount or a value

on a notified date over a bank account of the organisation. This is like an authority to the

respective party to claim a certain value in the company bank balance over a notified date or

period. The debit is a official right over the person bank account that the respective party or the

authority will get a respective balance or amount over a given date or period. This is an

important part of the accounting transactions and principles of accounting that it allow a legal

right to the respective party (O’Neal and O'Neal, 2018). In the normal business circumstances the

debit has significant values that allow the stakeholder to channelizes and smooth the business

transactions.

On the other hand the standing order is about to instruct the bank to pay a certain value or

balance to the respective party on a given date. Both the elements are different from each other.

One is to allow someone to claim a certain balance and the other one is to instruct the bank to

pay a certain value to the person claiming the respective value. Both the aspects and factors or

elements are different from each other. In both the situation the personal eligible for the

respective amount will get a value from the bank but the situation is completely different (Rafati

and Derde, 2017). When it comes to debit the bank does not need to ask the account holder about

paying the value but when uit comes to standing order bank require an official authority of the

account holder to pay the respective balance or value. The condition in both the situation is

different from each other. This is important to understand both the concepts. In the normal

business affairs both the concepts and factors create a significant smoothness in making or

enhancing the value of the business affairs. Debit and standing order are the key part of every

business house as it creates a significant edge in delivering the business operations in a smooth

manner. This is important for the business houses to create smoothness in its business

Insurance paid (170)

Talk talk bill paid (56)

Dividend collected 325

Bank charges (25) 1144

Balance as per pass book 2904

Terms

Debit and standing order

Debit is a term in account that allows any stakeholder to take a certain amount or a value

on a notified date over a bank account of the organisation. This is like an authority to the

respective party to claim a certain value in the company bank balance over a notified date or

period. The debit is a official right over the person bank account that the respective party or the

authority will get a respective balance or amount over a given date or period. This is an

important part of the accounting transactions and principles of accounting that it allow a legal

right to the respective party (O’Neal and O'Neal, 2018). In the normal business circumstances the

debit has significant values that allow the stakeholder to channelizes and smooth the business

transactions.

On the other hand the standing order is about to instruct the bank to pay a certain value or

balance to the respective party on a given date. Both the elements are different from each other.

One is to allow someone to claim a certain balance and the other one is to instruct the bank to

pay a certain value to the person claiming the respective value. Both the aspects and factors or

elements are different from each other. In both the situation the personal eligible for the

respective amount will get a value from the bank but the situation is completely different (Rafati

and Derde, 2017). When it comes to debit the bank does not need to ask the account holder about

paying the value but when uit comes to standing order bank require an official authority of the

account holder to pay the respective balance or value. The condition in both the situation is

different from each other. This is important to understand both the concepts. In the normal

business affairs both the concepts and factors create a significant smoothness in making or

enhancing the value of the business affairs. Debit and standing order are the key part of every

business house as it creates a significant edge in delivering the business operations in a smooth

manner. This is important for the business houses to create smoothness in its business

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

transactions and operations and the concept like standing order and debit make a competitive

edge for the businesses to sustain the smoothness of the business transactions and operations.

Bank charges

Bank charges are the one that charges by the bank where the holder kept its account.

These are a charges that collected by the bank against delivering some kind of services. In

against to offer a facility of opening up bank account the bank provide the services like

maintaining the balance, depositing the value and pay the value every time the account holder

desire to do the same. The bank also provide a massage alert to the account holder every time

any transaction occurred with the bank account of the account holder (Ogada and et.al., 2018).

Al these services bank offer to the account holder. Along with this bank also offer loan and other

such borrowing schemes that can meet up the financial needs and requirements of the account

holder. In against to all the services deliver to the account holder bank charges fees or the

charges from the bank account of the account holder. This is important for the bank and

customer to establish a connection between both the parties. This makes it more significant for

the account holder to maintain a proper connection with support of services and delivery of

different features. In against to all the services bank allocate to the holder it charges a significant

value in form of bank charges.

Dis houner cheque

This is a cheque that could not get the proper honour. Every cheque that could not offer

the respective value that was mentioned in the cheque is claimed as a dis honour cheque. The

cheque got bounce in context to the dis honour cheque. The bank strictly condemn any

transaction based on the dis honour cheque (Bose and et.al., 2020). It also claims the respective

charges and strict action against the account holder. This is strictly prohibited to deal or involved

under any truncation based on the dis honour cheque situation. This is very unprofessional as the

stakeholders get involved under the dis honour cheque transactions.

The above stated terms are the basic and general terms associated with the banking affairs

offer by the business venture. This is important for the business unit to grab the complete

advantage of all the affairs mentioned above. This is important for the business entity to take a

completely position against all the different factors mentioned above.

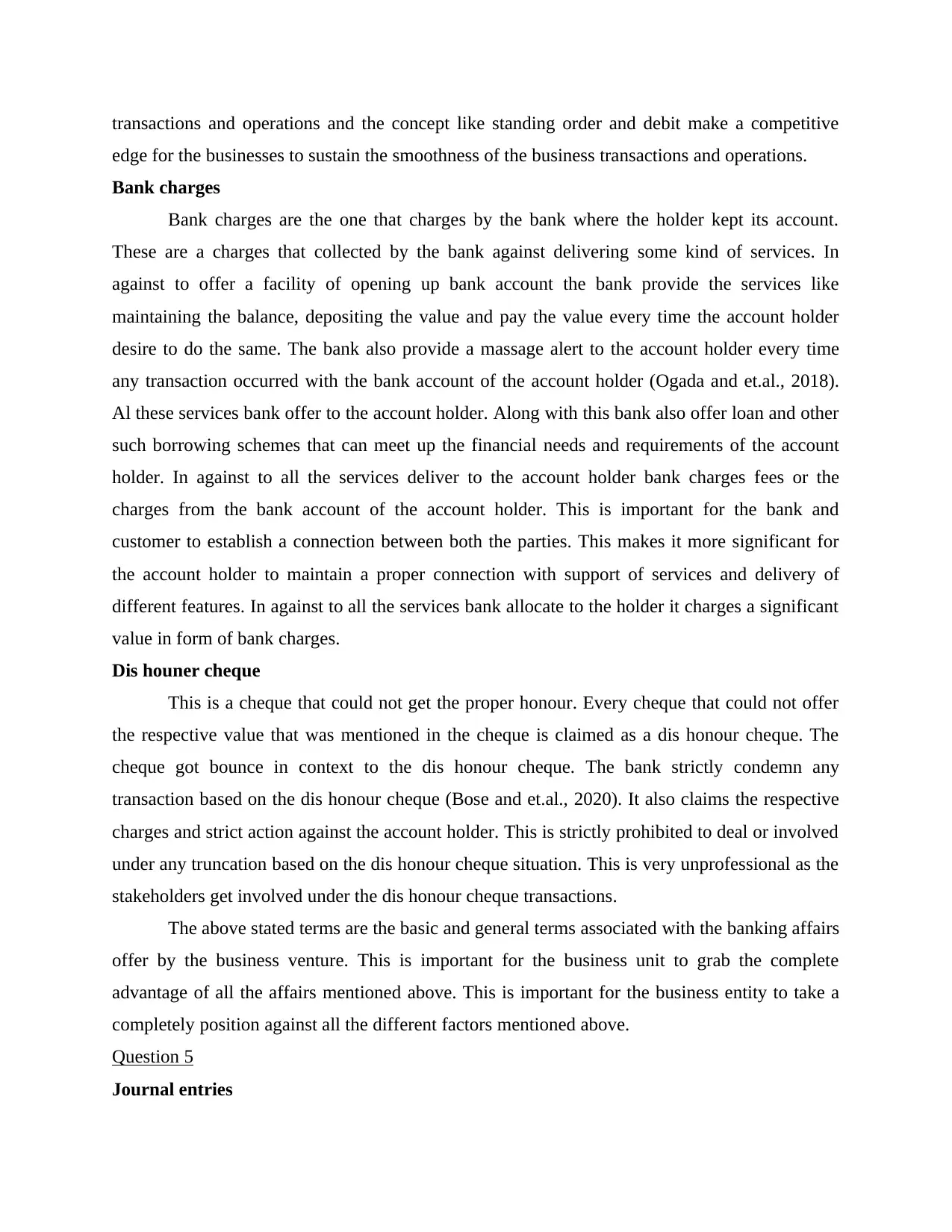

Question 5

Journal entries

edge for the businesses to sustain the smoothness of the business transactions and operations.

Bank charges

Bank charges are the one that charges by the bank where the holder kept its account.

These are a charges that collected by the bank against delivering some kind of services. In

against to offer a facility of opening up bank account the bank provide the services like

maintaining the balance, depositing the value and pay the value every time the account holder

desire to do the same. The bank also provide a massage alert to the account holder every time

any transaction occurred with the bank account of the account holder (Ogada and et.al., 2018).

Al these services bank offer to the account holder. Along with this bank also offer loan and other

such borrowing schemes that can meet up the financial needs and requirements of the account

holder. In against to all the services deliver to the account holder bank charges fees or the

charges from the bank account of the account holder. This is important for the bank and

customer to establish a connection between both the parties. This makes it more significant for

the account holder to maintain a proper connection with support of services and delivery of

different features. In against to all the services bank allocate to the holder it charges a significant

value in form of bank charges.

Dis houner cheque

This is a cheque that could not get the proper honour. Every cheque that could not offer

the respective value that was mentioned in the cheque is claimed as a dis honour cheque. The

cheque got bounce in context to the dis honour cheque. The bank strictly condemn any

transaction based on the dis honour cheque (Bose and et.al., 2020). It also claims the respective

charges and strict action against the account holder. This is strictly prohibited to deal or involved

under any truncation based on the dis honour cheque situation. This is very unprofessional as the

stakeholders get involved under the dis honour cheque transactions.

The above stated terms are the basic and general terms associated with the banking affairs

offer by the business venture. This is important for the business unit to grab the complete

advantage of all the affairs mentioned above. This is important for the business entity to take a

completely position against all the different factors mentioned above.

Question 5

Journal entries

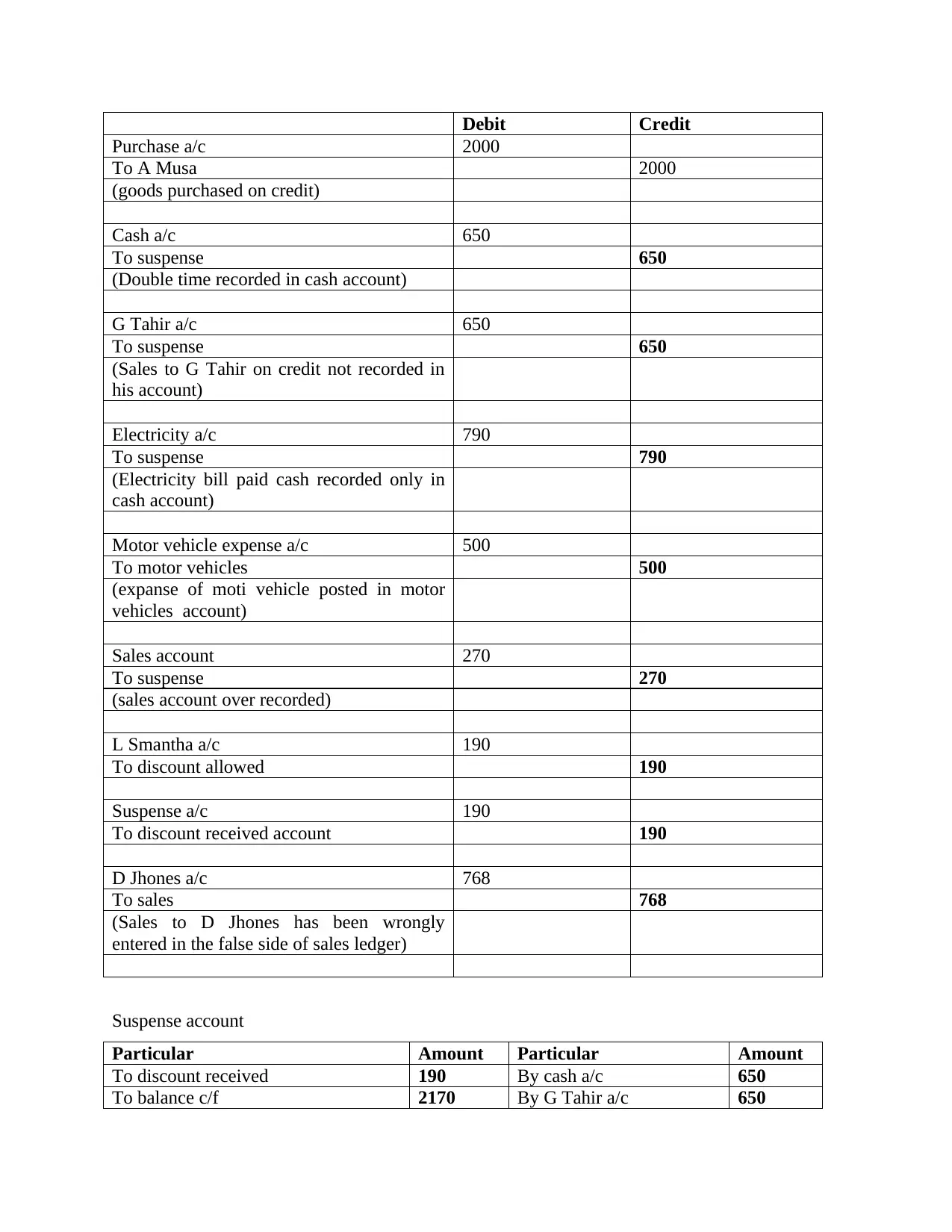

Debit Credit

Purchase a/c 2000

To A Musa 2000

(goods purchased on credit)

Cash a/c 650

To suspense 650

(Double time recorded in cash account)

G Tahir a/c 650

To suspense 650

(Sales to G Tahir on credit not recorded in

his account)

Electricity a/c 790

To suspense 790

(Electricity bill paid cash recorded only in

cash account)

Motor vehicle expense a/c 500

To motor vehicles 500

(expanse of moti vehicle posted in motor

vehicles account)

Sales account 270

To suspense 270

(sales account over recorded)

L Smantha a/c 190

To discount allowed 190

Suspense a/c 190

To discount received account 190

D Jhones a/c 768

To sales 768

(Sales to D Jhones has been wrongly

entered in the false side of sales ledger)

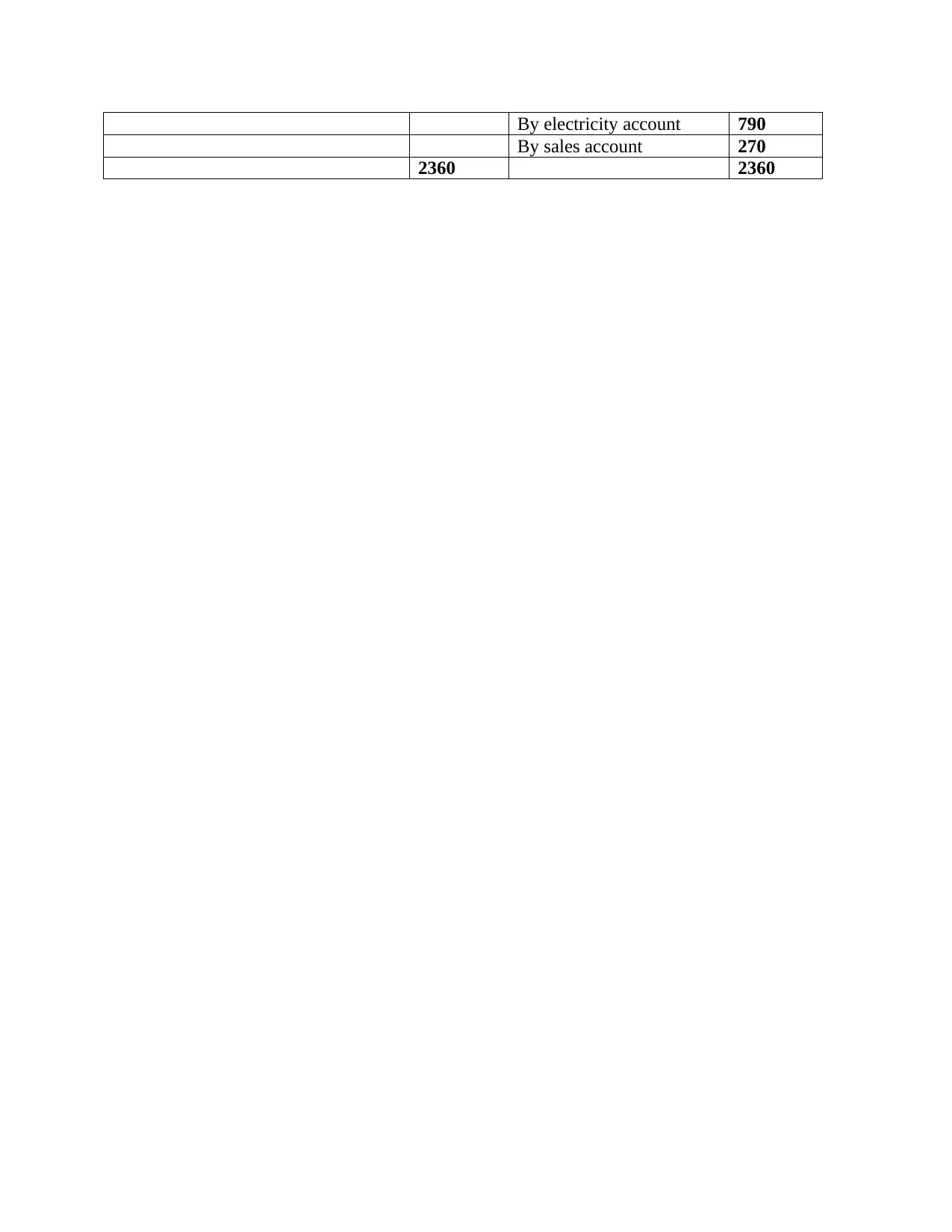

Suspense account

Particular Amount Particular Amount

To discount received 190 By cash a/c 650

To balance c/f 2170 By G Tahir a/c 650

Purchase a/c 2000

To A Musa 2000

(goods purchased on credit)

Cash a/c 650

To suspense 650

(Double time recorded in cash account)

G Tahir a/c 650

To suspense 650

(Sales to G Tahir on credit not recorded in

his account)

Electricity a/c 790

To suspense 790

(Electricity bill paid cash recorded only in

cash account)

Motor vehicle expense a/c 500

To motor vehicles 500

(expanse of moti vehicle posted in motor

vehicles account)

Sales account 270

To suspense 270

(sales account over recorded)

L Smantha a/c 190

To discount allowed 190

Suspense a/c 190

To discount received account 190

D Jhones a/c 768

To sales 768

(Sales to D Jhones has been wrongly

entered in the false side of sales ledger)

Suspense account

Particular Amount Particular Amount

To discount received 190 By cash a/c 650

To balance c/f 2170 By G Tahir a/c 650

By electricity account 790

By sales account 270

2360 2360

By sales account 270

2360 2360

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and journals

Ahmed, I., 2019. Bridging the gap between governmental accounting education and

practice. Accounting. 5(1). pp.21-30.

Aqeel, S.M., Aws, S.M. and Nawfal, H.A., 2020. The role of real time reporting to limiting the

creative accounting practice. Вопросы инновационной экономики. 10(4). pp.2347-

2358.

Beretta, E. and Cencini, A., 2020. Double-entry bookkeeping and balance of payments: the need

for developing a new approach. Insights into Regional Development. 2(3). pp.610-629.

Bradford, B., 2020. Fundamental Principles of Accounting: A Case Analysis.

Comandaru, and et.al., 2020. ACCOUNTING INFORMATION-NOTICE OF AN EFFICIENT

DECISION SYSTEM. Hyperion Economic Journal, p.3.

Gheorghe, H., 2017. Preliminary Accounting Works For The Establishment Of Financial

Statements. Annals-Economy Series. 1. pp.158-165.

Gheorghe, H., 2017. Preliminary Accounting Works For The Establishment Of Financial

Statements. Annals-Economy Series. 1. pp.158-165.

Guliyev, V. and Hajiyev, N., 2020. POSTULATES AND PRINCIPLES IN

ACCOUNTING. Economic and Social Development: Book of Proceedings. 2. pp.674-

683.

Gurskaya, M., Kuter, M. and Bagdasaryan, R., 2019, May. The structure of the trial balance.

In International Conference on Integrated Science (pp. 103-116). Springer, Cham.

Iyer, and et.al., 2019, April. Bank Reconciliation Bot. In 2nd International Conference on

Advances in Science & Technology (ICAST).

Khansalar, E. and Namazi, M., 2017. Cash flow disaggregation and prediction of cash

flow. Journal of Applied Accounting Research.

Kumar, V., 2020. Accounting Principles.

Lokanan, M., Tran, V. and Vuong, N.H., 2019. Detecting anomalies in financial statements using

machine learning algorithm. Asian Journal of Accounting Research.

Ofori-Atta, K., Bruce-Twum, E. and Appiah-Gyamerah, I., 2017. Fundamentals of financial

Accounting 11.

Omoolorun, A.J. and Abilogun, T.O., 2017. Fraud free financial report: A conceptual

review. International Journal of Academic Research in Accounting, Finance and

Management Sciences. 7(4). pp.83-94.

Shaw, J.J.W.K.W., 2021. Fundamental Accounting Principles.

TEX, S., 2019. Financial Express.

O’Neal, M. and O'Neal, M., 2018. ENGLISH-GERMAN TERMINOLOGY. In Banking and

financial English (pp. 163-170). Oldenbourg Wissenschaftsverlag.

Rafati, L. and Derde, P., 2017. BOEM: Business Object oriented Enterprise Modeling. In PoEM

Doctoral Consortium (pp. 41-49).

Ogada, M. J. and et.al., 2018. The burden of produce cess and other market charges in Kenya’s

agriculture. African Journal of Economic Review. 6(2). pp.232-245.

Books and journals

Ahmed, I., 2019. Bridging the gap between governmental accounting education and

practice. Accounting. 5(1). pp.21-30.

Aqeel, S.M., Aws, S.M. and Nawfal, H.A., 2020. The role of real time reporting to limiting the

creative accounting practice. Вопросы инновационной экономики. 10(4). pp.2347-

2358.

Beretta, E. and Cencini, A., 2020. Double-entry bookkeeping and balance of payments: the need

for developing a new approach. Insights into Regional Development. 2(3). pp.610-629.

Bradford, B., 2020. Fundamental Principles of Accounting: A Case Analysis.

Comandaru, and et.al., 2020. ACCOUNTING INFORMATION-NOTICE OF AN EFFICIENT

DECISION SYSTEM. Hyperion Economic Journal, p.3.

Gheorghe, H., 2017. Preliminary Accounting Works For The Establishment Of Financial

Statements. Annals-Economy Series. 1. pp.158-165.

Gheorghe, H., 2017. Preliminary Accounting Works For The Establishment Of Financial

Statements. Annals-Economy Series. 1. pp.158-165.

Guliyev, V. and Hajiyev, N., 2020. POSTULATES AND PRINCIPLES IN

ACCOUNTING. Economic and Social Development: Book of Proceedings. 2. pp.674-

683.

Gurskaya, M., Kuter, M. and Bagdasaryan, R., 2019, May. The structure of the trial balance.

In International Conference on Integrated Science (pp. 103-116). Springer, Cham.

Iyer, and et.al., 2019, April. Bank Reconciliation Bot. In 2nd International Conference on

Advances in Science & Technology (ICAST).

Khansalar, E. and Namazi, M., 2017. Cash flow disaggregation and prediction of cash

flow. Journal of Applied Accounting Research.

Kumar, V., 2020. Accounting Principles.

Lokanan, M., Tran, V. and Vuong, N.H., 2019. Detecting anomalies in financial statements using

machine learning algorithm. Asian Journal of Accounting Research.

Ofori-Atta, K., Bruce-Twum, E. and Appiah-Gyamerah, I., 2017. Fundamentals of financial

Accounting 11.

Omoolorun, A.J. and Abilogun, T.O., 2017. Fraud free financial report: A conceptual

review. International Journal of Academic Research in Accounting, Finance and

Management Sciences. 7(4). pp.83-94.

Shaw, J.J.W.K.W., 2021. Fundamental Accounting Principles.

TEX, S., 2019. Financial Express.

O’Neal, M. and O'Neal, M., 2018. ENGLISH-GERMAN TERMINOLOGY. In Banking and

financial English (pp. 163-170). Oldenbourg Wissenschaftsverlag.

Rafati, L. and Derde, P., 2017. BOEM: Business Object oriented Enterprise Modeling. In PoEM

Doctoral Consortium (pp. 41-49).

Ogada, M. J. and et.al., 2018. The burden of produce cess and other market charges in Kenya’s

agriculture. African Journal of Economic Review. 6(2). pp.232-245.

Bose, A. and et.al., 2020. Law of Contract-II-Fall 2020.

Online references

Basic accounting principles., 2021. [Online]. Available through

<https://www.accountingtools.com/articles/2017/5/15/basic-accounting-principles>

2

Online references

Basic accounting principles., 2021. [Online]. Available through

<https://www.accountingtools.com/articles/2017/5/15/basic-accounting-principles>

2

3

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.