Comparative Financial Analysis: Daimler vs. Tesla (2014-2017)

VerifiedAdded on 2020/12/10

|27

|9136

|179

Report

AI Summary

This report presents a detailed financial analysis of Daimler and Tesla, evaluating their performance from 2014 to 2017. The analysis encompasses ratio analysis, including liquidity, profitability, efficiency, and leverage ratios, providing a comparative view of their financial health. Horizontal and vertical analyses of the income statement and balance sheet are conducted to identify trends and performance changes over the period. The report also assesses the cash positions of both companies. The findings reveal Daimler's stronger performance in profitability and efficiency metrics compared to Tesla, while Tesla demonstrates higher turnover on assets in earlier years. The report highlights key financial strengths and weaknesses, offering insights into the companies' financial strategies and overall performance.

FINANCIAL ANALYSIS

MANAGEMENT &

ENTERPRISE - FAME

MANAGEMENT &

ENTERPRISE - FAME

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

Ratio Analysis..............................................................................................................................1

Daimler's Horizontal analysis of statement of profit and loss.....................................................4

Daimler's Horizontal analysis of statement of financial position................................................5

Daimler's Vertical analysis of statement of profit and loss.........................................................7

Daimler's Vertical analysis of statement of financial position....................................................8

Tesla's horizontal analysis of statement of profit and loss.........................................................10

Tesla's horizontal analysis of statement of financial position....................................................11

Tesla's vertical analysis of statement of profit and loss.............................................................13

Tesla's vertical analysis of statement of financial position........................................................14

2. Analysing cash position of both organization........................................................................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

APPENDIX....................................................................................................................................19

INTRODUCTION...........................................................................................................................1

Ratio Analysis..............................................................................................................................1

Daimler's Horizontal analysis of statement of profit and loss.....................................................4

Daimler's Horizontal analysis of statement of financial position................................................5

Daimler's Vertical analysis of statement of profit and loss.........................................................7

Daimler's Vertical analysis of statement of financial position....................................................8

Tesla's horizontal analysis of statement of profit and loss.........................................................10

Tesla's horizontal analysis of statement of financial position....................................................11

Tesla's vertical analysis of statement of profit and loss.............................................................13

Tesla's vertical analysis of statement of financial position........................................................14

2. Analysing cash position of both organization........................................................................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

APPENDIX....................................................................................................................................19

INTRODUCTION

Financial analysis is considered as process for business evaluation, budgets, projects

along with other entities on basis of finance. The present report will give brief discussion about

financial performance of Daimler and Tesla with context of ratio analysis, horizontal and vertical

analysis of their financial position. It will articulate about cash position of these specified

business entities.

Ratio Analysis

Liquidity

Ratio Formula 2014 2015 2016 2017

Daimler

Current

Ratio

Current

Asset/

Current

Liability 1.152 1.192 1.208 1.225

Tesla 1.518 0.991 1.074 0.856

Daimler Quick ratio

(Current

asset-

Inventory-

prepaid

expenses)/C

urrent

Liability 0.836 0.878 0.901 0.923

Tesla 1.020 0.493 0.686 0.526

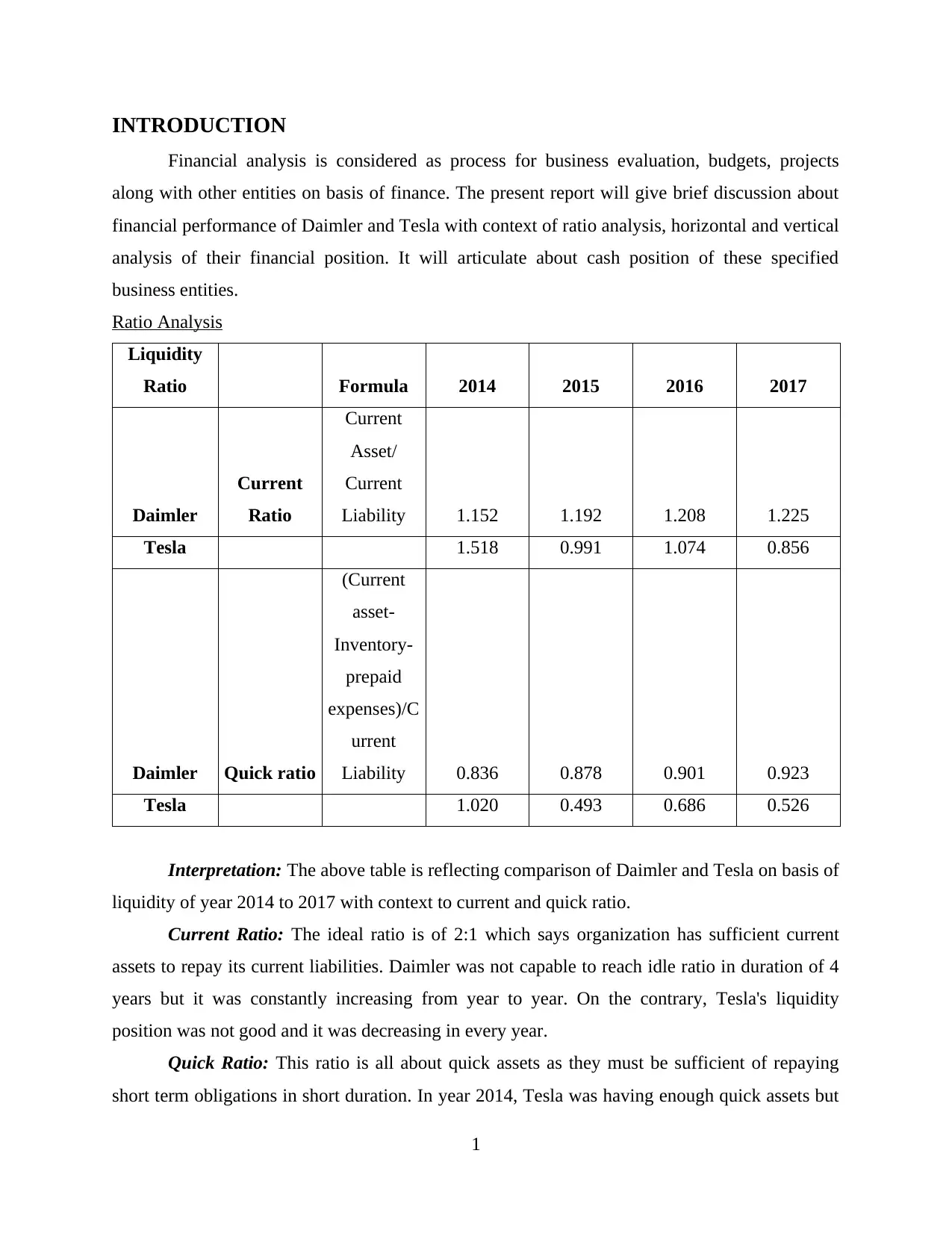

Interpretation: The above table is reflecting comparison of Daimler and Tesla on basis of

liquidity of year 2014 to 2017 with context to current and quick ratio.

Current Ratio: The ideal ratio is of 2:1 which says organization has sufficient current

assets to repay its current liabilities. Daimler was not capable to reach idle ratio in duration of 4

years but it was constantly increasing from year to year. On the contrary, Tesla's liquidity

position was not good and it was decreasing in every year.

Quick Ratio: This ratio is all about quick assets as they must be sufficient of repaying

short term obligations in short duration. In year 2014, Tesla was having enough quick assets but

1

Financial analysis is considered as process for business evaluation, budgets, projects

along with other entities on basis of finance. The present report will give brief discussion about

financial performance of Daimler and Tesla with context of ratio analysis, horizontal and vertical

analysis of their financial position. It will articulate about cash position of these specified

business entities.

Ratio Analysis

Liquidity

Ratio Formula 2014 2015 2016 2017

Daimler

Current

Ratio

Current

Asset/

Current

Liability 1.152 1.192 1.208 1.225

Tesla 1.518 0.991 1.074 0.856

Daimler Quick ratio

(Current

asset-

Inventory-

prepaid

expenses)/C

urrent

Liability 0.836 0.878 0.901 0.923

Tesla 1.020 0.493 0.686 0.526

Interpretation: The above table is reflecting comparison of Daimler and Tesla on basis of

liquidity of year 2014 to 2017 with context to current and quick ratio.

Current Ratio: The ideal ratio is of 2:1 which says organization has sufficient current

assets to repay its current liabilities. Daimler was not capable to reach idle ratio in duration of 4

years but it was constantly increasing from year to year. On the contrary, Tesla's liquidity

position was not good and it was decreasing in every year.

Quick Ratio: This ratio is all about quick assets as they must be sufficient of repaying

short term obligations in short duration. In year 2014, Tesla was having enough quick assets but

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

as time passed, it started decreasing. However, Daimler was not meet appropriate situation in any

year but it was improving from year to year.

Profitability

Ratio Formula

2014 2015 2016 2017

Daimler

Gross profit

ratio

(Gross

Profit/

Sales)*100 21.701 21.274 20.855 20.891

Tesla 27.580 22.837 22.843 18.896

Daimler

Return on

Asset (ROA)

Net profit/

Total Assets 0.037 0.039 0.035 0.041

Tesla -0.050 -0.110 -0.030 -0.068

Daimler

Return on

capital

employed

(ROCE)

Net

operating

profit/

Capital

employed) 0.077 0.090 0.076 0.077

Tesla -0.050 -0.136 -0.040 -0.078

Daimler

Return on

Equity

(ROE)

Profit after

tax/ Net

worth 0.159 0.157 0.147 0.164

Tesla -0.322 -0.816 -0.142 -0.463

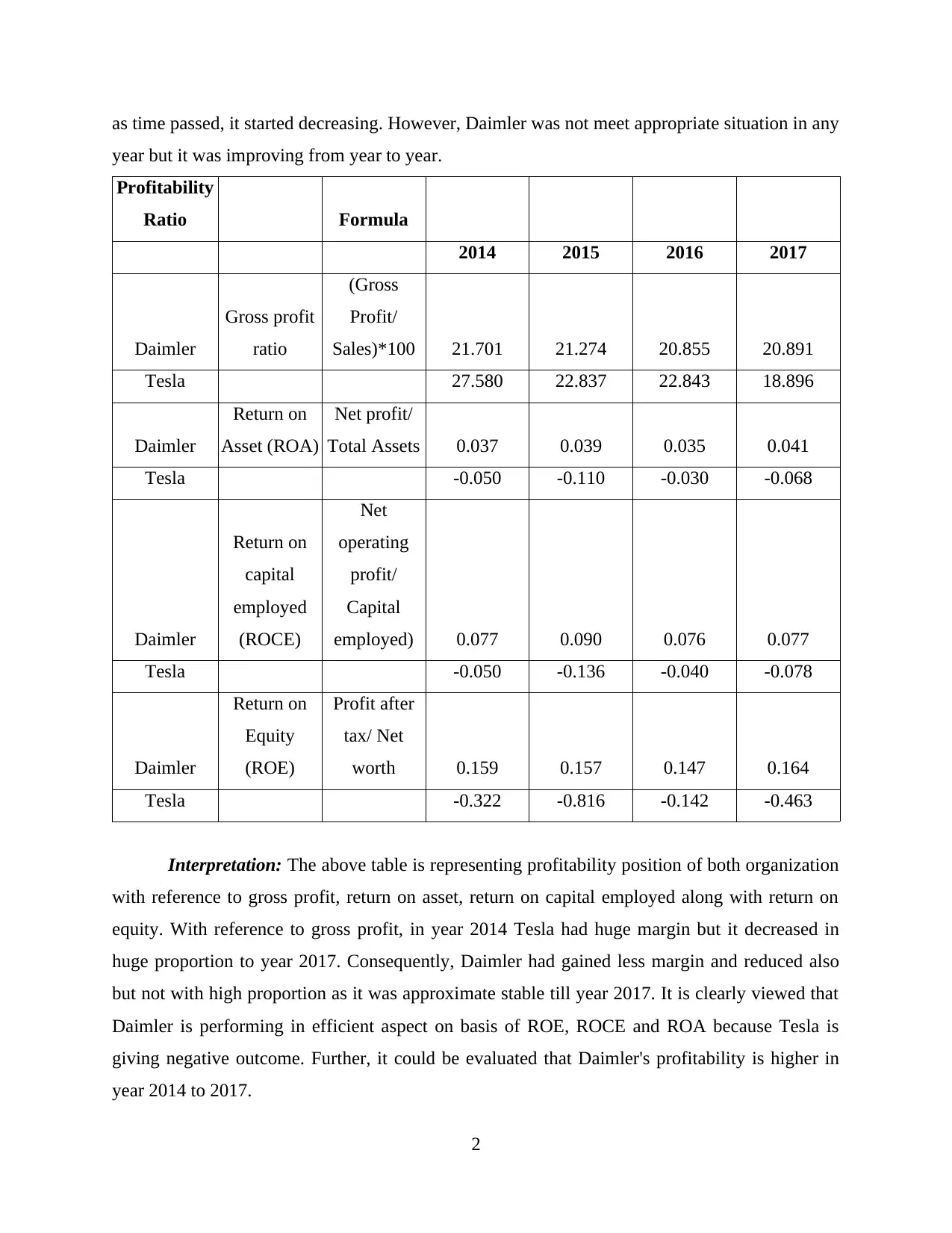

Interpretation: The above table is representing profitability position of both organization

with reference to gross profit, return on asset, return on capital employed along with return on

equity. With reference to gross profit, in year 2014 Tesla had huge margin but it decreased in

huge proportion to year 2017. Consequently, Daimler had gained less margin and reduced also

but not with high proportion as it was approximate stable till year 2017. It is clearly viewed that

Daimler is performing in efficient aspect on basis of ROE, ROCE and ROA because Tesla is

giving negative outcome. Further, it could be evaluated that Daimler's profitability is higher in

year 2014 to 2017.

2

year but it was improving from year to year.

Profitability

Ratio Formula

2014 2015 2016 2017

Daimler

Gross profit

ratio

(Gross

Profit/

Sales)*100 21.701 21.274 20.855 20.891

Tesla 27.580 22.837 22.843 18.896

Daimler

Return on

Asset (ROA)

Net profit/

Total Assets 0.037 0.039 0.035 0.041

Tesla -0.050 -0.110 -0.030 -0.068

Daimler

Return on

capital

employed

(ROCE)

Net

operating

profit/

Capital

employed) 0.077 0.090 0.076 0.077

Tesla -0.050 -0.136 -0.040 -0.078

Daimler

Return on

Equity

(ROE)

Profit after

tax/ Net

worth 0.159 0.157 0.147 0.164

Tesla -0.322 -0.816 -0.142 -0.463

Interpretation: The above table is representing profitability position of both organization

with reference to gross profit, return on asset, return on capital employed along with return on

equity. With reference to gross profit, in year 2014 Tesla had huge margin but it decreased in

huge proportion to year 2017. Consequently, Daimler had gained less margin and reduced also

but not with high proportion as it was approximate stable till year 2017. It is clearly viewed that

Daimler is performing in efficient aspect on basis of ROE, ROCE and ROA because Tesla is

giving negative outcome. Further, it could be evaluated that Daimler's profitability is higher in

year 2014 to 2017.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Efficiency

Ratio Formula 2014 2015 2016 2017

Daimler

Asset

Turnover

Ratio

Net sales/

Average

total asset 0.725 0.735 0.666 0.659

Tesla 0.774 0.580 0.455 0.458

Daimler

Inventory

turnover

ratio

Cost of

goods sold/

Average

inventory 5.322 5.274 4.936 5.091

Tesla 3.58 2.80 3.23 4.40

Daimler

Days' Sales

in inventory

(Closing

stock/ Cost

of goods

sold)*365 74.889 73.701 76.383 72.119

Tesla 150.285 149.366 139.688 86.657

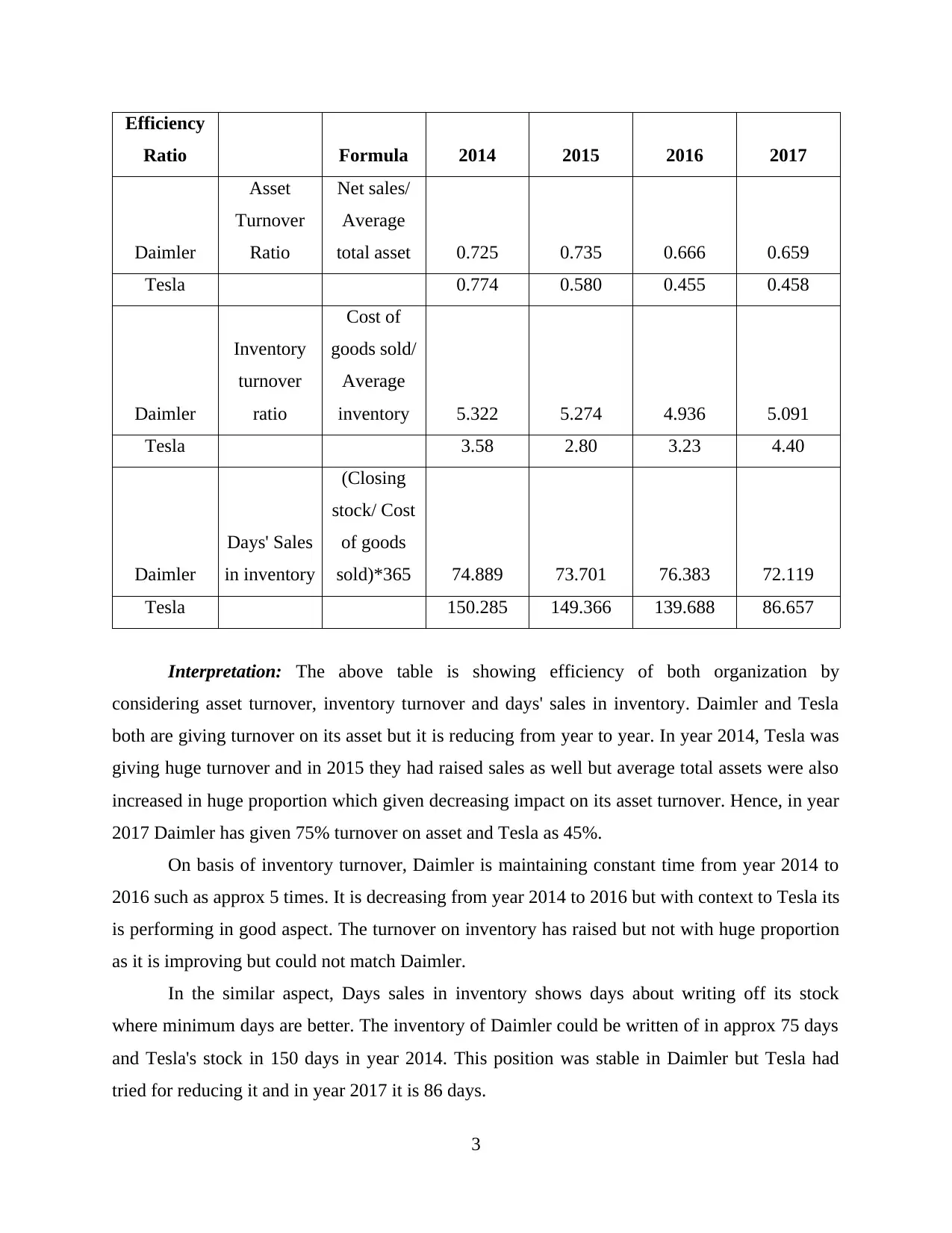

Interpretation: The above table is showing efficiency of both organization by

considering asset turnover, inventory turnover and days' sales in inventory. Daimler and Tesla

both are giving turnover on its asset but it is reducing from year to year. In year 2014, Tesla was

giving huge turnover and in 2015 they had raised sales as well but average total assets were also

increased in huge proportion which given decreasing impact on its asset turnover. Hence, in year

2017 Daimler has given 75% turnover on asset and Tesla as 45%.

On basis of inventory turnover, Daimler is maintaining constant time from year 2014 to

2016 such as approx 5 times. It is decreasing from year 2014 to 2016 but with context to Tesla its

is performing in good aspect. The turnover on inventory has raised but not with huge proportion

as it is improving but could not match Daimler.

In the similar aspect, Days sales in inventory shows days about writing off its stock

where minimum days are better. The inventory of Daimler could be written of in approx 75 days

and Tesla's stock in 150 days in year 2014. This position was stable in Daimler but Tesla had

tried for reducing it and in year 2017 it is 86 days.

3

Ratio Formula 2014 2015 2016 2017

Daimler

Asset

Turnover

Ratio

Net sales/

Average

total asset 0.725 0.735 0.666 0.659

Tesla 0.774 0.580 0.455 0.458

Daimler

Inventory

turnover

ratio

Cost of

goods sold/

Average

inventory 5.322 5.274 4.936 5.091

Tesla 3.58 2.80 3.23 4.40

Daimler

Days' Sales

in inventory

(Closing

stock/ Cost

of goods

sold)*365 74.889 73.701 76.383 72.119

Tesla 150.285 149.366 139.688 86.657

Interpretation: The above table is showing efficiency of both organization by

considering asset turnover, inventory turnover and days' sales in inventory. Daimler and Tesla

both are giving turnover on its asset but it is reducing from year to year. In year 2014, Tesla was

giving huge turnover and in 2015 they had raised sales as well but average total assets were also

increased in huge proportion which given decreasing impact on its asset turnover. Hence, in year

2017 Daimler has given 75% turnover on asset and Tesla as 45%.

On basis of inventory turnover, Daimler is maintaining constant time from year 2014 to

2016 such as approx 5 times. It is decreasing from year 2014 to 2016 but with context to Tesla its

is performing in good aspect. The turnover on inventory has raised but not with huge proportion

as it is improving but could not match Daimler.

In the similar aspect, Days sales in inventory shows days about writing off its stock

where minimum days are better. The inventory of Daimler could be written of in approx 75 days

and Tesla's stock in 150 days in year 2014. This position was stable in Daimler but Tesla had

tried for reducing it and in year 2017 it is 86 days.

3

Leverage

Ratio Formula 2014 2015 2016 2017

Daimler Debt ratio

total

liabilities/

Total asset 0.770 0.753 0.762 0.750

Tesla 0.844 0.866 0.790 0.852

Daimler Equity ratio

Total Equity/

Total Assets 0.230 0.247 0.238 0.250

Tesla 0.156 0.135 0.210 0.148

Daimler

Debt equity

ratio

Total

Liabilities/

Total Equity 3.344 3.055 3.193 2.992

Tesla 5.414 6.432 3.768 5.763

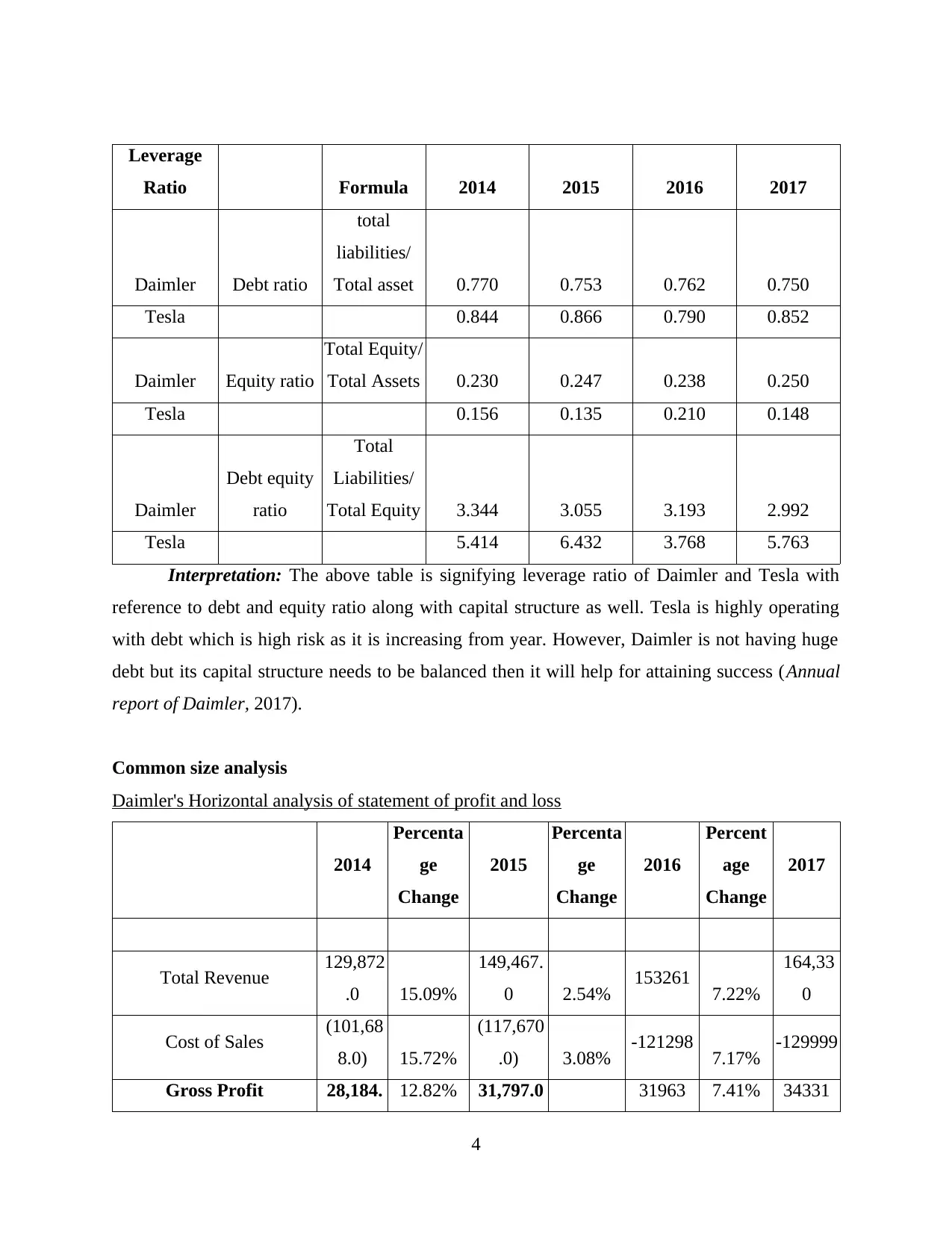

Interpretation: The above table is signifying leverage ratio of Daimler and Tesla with

reference to debt and equity ratio along with capital structure as well. Tesla is highly operating

with debt which is high risk as it is increasing from year. However, Daimler is not having huge

debt but its capital structure needs to be balanced then it will help for attaining success (Annual

report of Daimler, 2017).

Common size analysis

Daimler's Horizontal analysis of statement of profit and loss

2014

Percenta

ge

Change

2015

Percenta

ge

Change

2016

Percent

age

Change

2017

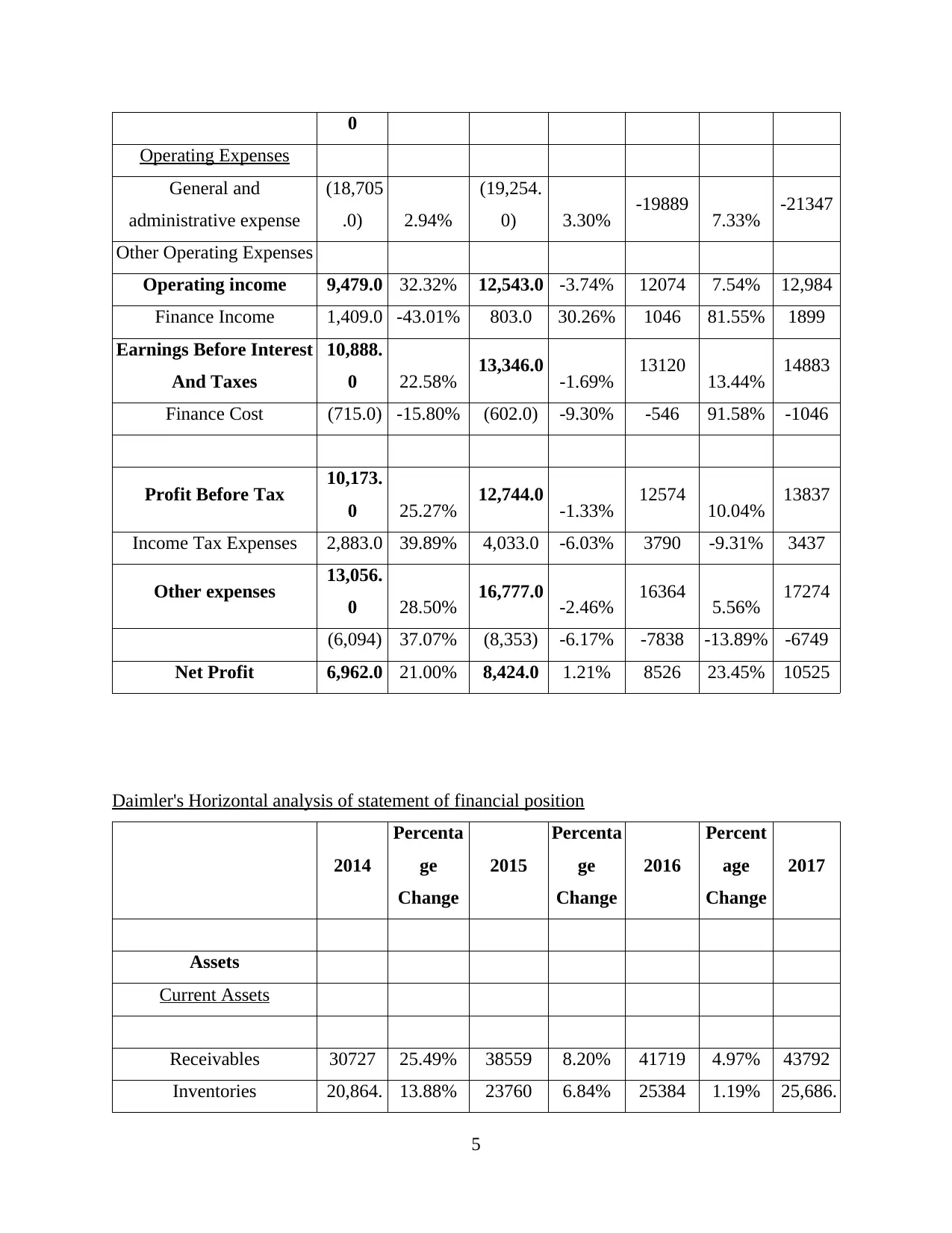

Total Revenue 129,872

.0 15.09%

149,467.

0 2.54% 153261 7.22%

164,33

0

Cost of Sales (101,68

8.0) 15.72%

(117,670

.0) 3.08% -121298 7.17% -129999

Gross Profit 28,184. 12.82% 31,797.0 31963 7.41% 34331

4

Ratio Formula 2014 2015 2016 2017

Daimler Debt ratio

total

liabilities/

Total asset 0.770 0.753 0.762 0.750

Tesla 0.844 0.866 0.790 0.852

Daimler Equity ratio

Total Equity/

Total Assets 0.230 0.247 0.238 0.250

Tesla 0.156 0.135 0.210 0.148

Daimler

Debt equity

ratio

Total

Liabilities/

Total Equity 3.344 3.055 3.193 2.992

Tesla 5.414 6.432 3.768 5.763

Interpretation: The above table is signifying leverage ratio of Daimler and Tesla with

reference to debt and equity ratio along with capital structure as well. Tesla is highly operating

with debt which is high risk as it is increasing from year. However, Daimler is not having huge

debt but its capital structure needs to be balanced then it will help for attaining success (Annual

report of Daimler, 2017).

Common size analysis

Daimler's Horizontal analysis of statement of profit and loss

2014

Percenta

ge

Change

2015

Percenta

ge

Change

2016

Percent

age

Change

2017

Total Revenue 129,872

.0 15.09%

149,467.

0 2.54% 153261 7.22%

164,33

0

Cost of Sales (101,68

8.0) 15.72%

(117,670

.0) 3.08% -121298 7.17% -129999

Gross Profit 28,184. 12.82% 31,797.0 31963 7.41% 34331

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

0

Operating Expenses

General and

administrative expense

(18,705

.0) 2.94%

(19,254.

0) 3.30% -19889 7.33% -21347

Other Operating Expenses

Operating income 9,479.0 32.32% 12,543.0 -3.74% 12074 7.54% 12,984

Finance Income 1,409.0 -43.01% 803.0 30.26% 1046 81.55% 1899

Earnings Before Interest

And Taxes

10,888.

0 22.58% 13,346.0 -1.69% 13120 13.44% 14883

Finance Cost (715.0) -15.80% (602.0) -9.30% -546 91.58% -1046

Profit Before Tax 10,173.

0 25.27% 12,744.0 -1.33% 12574 10.04% 13837

Income Tax Expenses 2,883.0 39.89% 4,033.0 -6.03% 3790 -9.31% 3437

Other expenses 13,056.

0 28.50% 16,777.0 -2.46% 16364 5.56% 17274

(6,094) 37.07% (8,353) -6.17% -7838 -13.89% -6749

Net Profit 6,962.0 21.00% 8,424.0 1.21% 8526 23.45% 10525

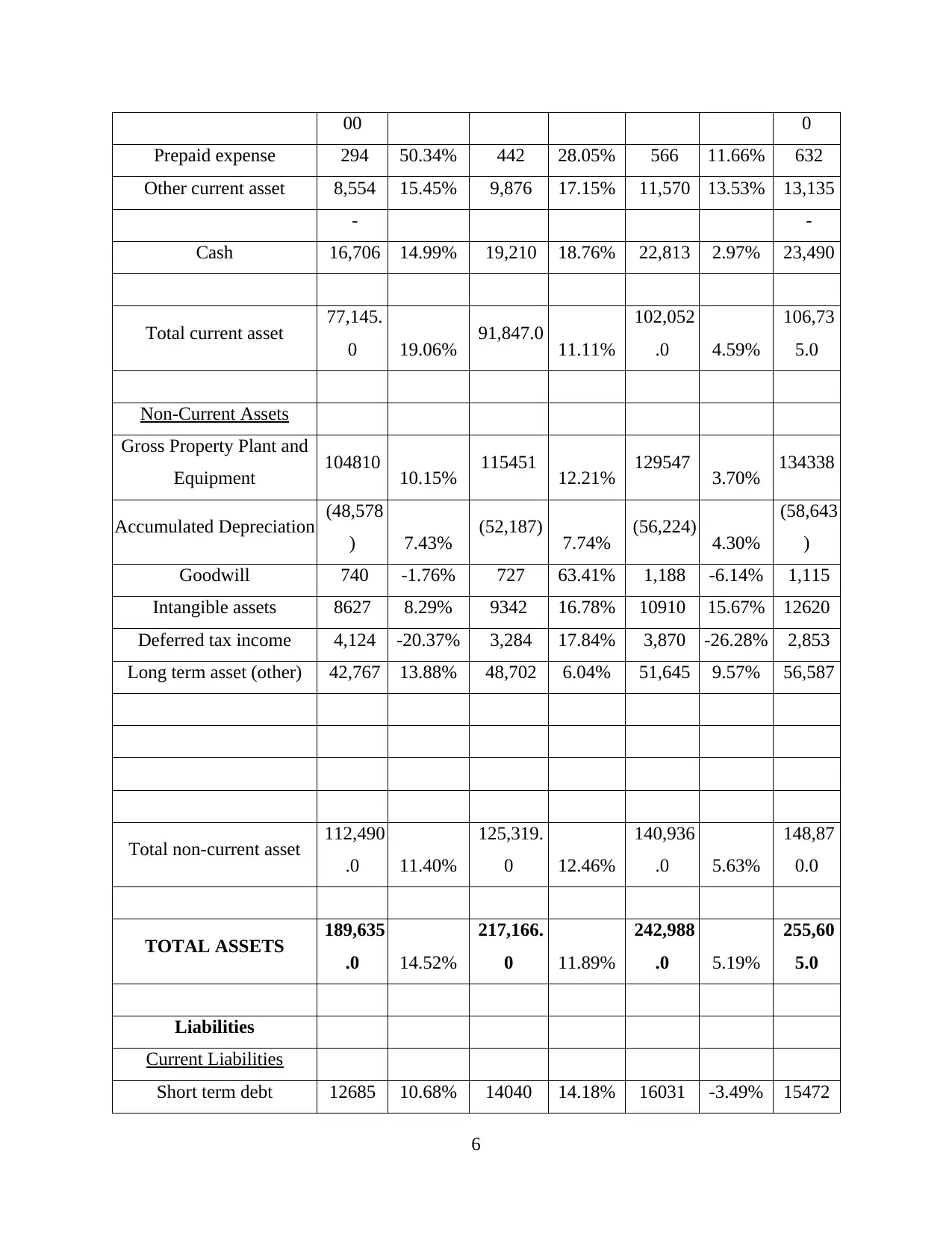

Daimler's Horizontal analysis of statement of financial position

2014

Percenta

ge

Change

2015

Percenta

ge

Change

2016

Percent

age

Change

2017

Assets

Current Assets

Receivables 30727 25.49% 38559 8.20% 41719 4.97% 43792

Inventories 20,864. 13.88% 23760 6.84% 25384 1.19% 25,686.

5

Operating Expenses

General and

administrative expense

(18,705

.0) 2.94%

(19,254.

0) 3.30% -19889 7.33% -21347

Other Operating Expenses

Operating income 9,479.0 32.32% 12,543.0 -3.74% 12074 7.54% 12,984

Finance Income 1,409.0 -43.01% 803.0 30.26% 1046 81.55% 1899

Earnings Before Interest

And Taxes

10,888.

0 22.58% 13,346.0 -1.69% 13120 13.44% 14883

Finance Cost (715.0) -15.80% (602.0) -9.30% -546 91.58% -1046

Profit Before Tax 10,173.

0 25.27% 12,744.0 -1.33% 12574 10.04% 13837

Income Tax Expenses 2,883.0 39.89% 4,033.0 -6.03% 3790 -9.31% 3437

Other expenses 13,056.

0 28.50% 16,777.0 -2.46% 16364 5.56% 17274

(6,094) 37.07% (8,353) -6.17% -7838 -13.89% -6749

Net Profit 6,962.0 21.00% 8,424.0 1.21% 8526 23.45% 10525

Daimler's Horizontal analysis of statement of financial position

2014

Percenta

ge

Change

2015

Percenta

ge

Change

2016

Percent

age

Change

2017

Assets

Current Assets

Receivables 30727 25.49% 38559 8.20% 41719 4.97% 43792

Inventories 20,864. 13.88% 23760 6.84% 25384 1.19% 25,686.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

00 0

Prepaid expense 294 50.34% 442 28.05% 566 11.66% 632

Other current asset 8,554 15.45% 9,876 17.15% 11,570 13.53% 13,135

- -

Cash 16,706 14.99% 19,210 18.76% 22,813 2.97% 23,490

Total current asset 77,145.

0 19.06% 91,847.0 11.11%

102,052

.0 4.59%

106,73

5.0

Non-Current Assets

Gross Property Plant and

Equipment 104810 10.15% 115451 12.21% 129547 3.70% 134338

Accumulated Depreciation (48,578

) 7.43% (52,187) 7.74% (56,224) 4.30%

(58,643

)

Goodwill 740 -1.76% 727 63.41% 1,188 -6.14% 1,115

Intangible assets 8627 8.29% 9342 16.78% 10910 15.67% 12620

Deferred tax income 4,124 -20.37% 3,284 17.84% 3,870 -26.28% 2,853

Long term asset (other) 42,767 13.88% 48,702 6.04% 51,645 9.57% 56,587

Total non-current asset 112,490

.0 11.40%

125,319.

0 12.46%

140,936

.0 5.63%

148,87

0.0

TOTAL ASSETS 189,635

.0 14.52%

217,166.

0 11.89%

242,988

.0 5.19%

255,60

5.0

Liabilities

Current Liabilities

Short term debt 12685 10.68% 14040 14.18% 16031 -3.49% 15472

6

Prepaid expense 294 50.34% 442 28.05% 566 11.66% 632

Other current asset 8,554 15.45% 9,876 17.15% 11,570 13.53% 13,135

- -

Cash 16,706 14.99% 19,210 18.76% 22,813 2.97% 23,490

Total current asset 77,145.

0 19.06% 91,847.0 11.11%

102,052

.0 4.59%

106,73

5.0

Non-Current Assets

Gross Property Plant and

Equipment 104810 10.15% 115451 12.21% 129547 3.70% 134338

Accumulated Depreciation (48,578

) 7.43% (52,187) 7.74% (56,224) 4.30%

(58,643

)

Goodwill 740 -1.76% 727 63.41% 1,188 -6.14% 1,115

Intangible assets 8627 8.29% 9342 16.78% 10910 15.67% 12620

Deferred tax income 4,124 -20.37% 3,284 17.84% 3,870 -26.28% 2,853

Long term asset (other) 42,767 13.88% 48,702 6.04% 51,645 9.57% 56,587

Total non-current asset 112,490

.0 11.40%

125,319.

0 12.46%

140,936

.0 5.63%

148,87

0.0

TOTAL ASSETS 189,635

.0 14.52%

217,166.

0 11.89%

242,988

.0 5.19%

255,60

5.0

Liabilities

Current Liabilities

Short term debt 12685 10.68% 14040 14.18% 16031 -3.49% 15472

6

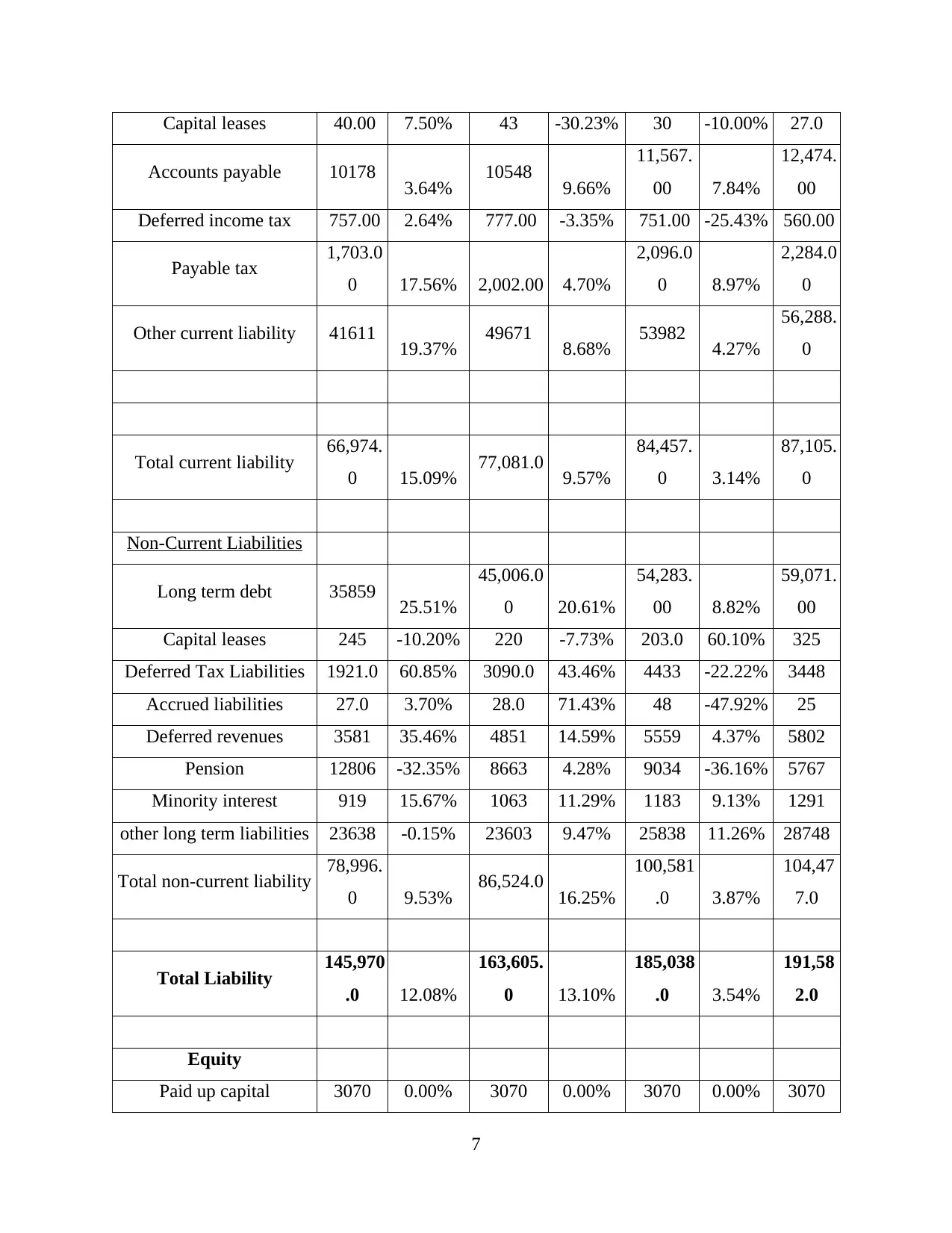

Capital leases 40.00 7.50% 43 -30.23% 30 -10.00% 27.0

Accounts payable 10178 3.64% 10548 9.66%

11,567.

00 7.84%

12,474.

00

Deferred income tax 757.00 2.64% 777.00 -3.35% 751.00 -25.43% 560.00

Payable tax 1,703.0

0 17.56% 2,002.00 4.70%

2,096.0

0 8.97%

2,284.0

0

Other current liability 41611 19.37% 49671 8.68% 53982 4.27%

56,288.

0

Total current liability 66,974.

0 15.09% 77,081.0 9.57%

84,457.

0 3.14%

87,105.

0

Non-Current Liabilities

Long term debt 35859 25.51%

45,006.0

0 20.61%

54,283.

00 8.82%

59,071.

00

Capital leases 245 -10.20% 220 -7.73% 203.0 60.10% 325

Deferred Tax Liabilities 1921.0 60.85% 3090.0 43.46% 4433 -22.22% 3448

Accrued liabilities 27.0 3.70% 28.0 71.43% 48 -47.92% 25

Deferred revenues 3581 35.46% 4851 14.59% 5559 4.37% 5802

Pension 12806 -32.35% 8663 4.28% 9034 -36.16% 5767

Minority interest 919 15.67% 1063 11.29% 1183 9.13% 1291

other long term liabilities 23638 -0.15% 23603 9.47% 25838 11.26% 28748

Total non-current liability 78,996.

0 9.53% 86,524.0 16.25%

100,581

.0 3.87%

104,47

7.0

Total Liability 145,970

.0 12.08%

163,605.

0 13.10%

185,038

.0 3.54%

191,58

2.0

Equity

Paid up capital 3070 0.00% 3070 0.00% 3070 0.00% 3070

7

Accounts payable 10178 3.64% 10548 9.66%

11,567.

00 7.84%

12,474.

00

Deferred income tax 757.00 2.64% 777.00 -3.35% 751.00 -25.43% 560.00

Payable tax 1,703.0

0 17.56% 2,002.00 4.70%

2,096.0

0 8.97%

2,284.0

0

Other current liability 41611 19.37% 49671 8.68% 53982 4.27%

56,288.

0

Total current liability 66,974.

0 15.09% 77,081.0 9.57%

84,457.

0 3.14%

87,105.

0

Non-Current Liabilities

Long term debt 35859 25.51%

45,006.0

0 20.61%

54,283.

00 8.82%

59,071.

00

Capital leases 245 -10.20% 220 -7.73% 203.0 60.10% 325

Deferred Tax Liabilities 1921.0 60.85% 3090.0 43.46% 4433 -22.22% 3448

Accrued liabilities 27.0 3.70% 28.0 71.43% 48 -47.92% 25

Deferred revenues 3581 35.46% 4851 14.59% 5559 4.37% 5802

Pension 12806 -32.35% 8663 4.28% 9034 -36.16% 5767

Minority interest 919 15.67% 1063 11.29% 1183 9.13% 1291

other long term liabilities 23638 -0.15% 23603 9.47% 25838 11.26% 28748

Total non-current liability 78,996.

0 9.53% 86,524.0 16.25%

100,581

.0 3.87%

104,47

7.0

Total Liability 145,970

.0 12.08%

163,605.

0 13.10%

185,038

.0 3.54%

191,58

2.0

Equity

Paid up capital 3070 0.00% 3070 0.00% 3070 0.00% 3070

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

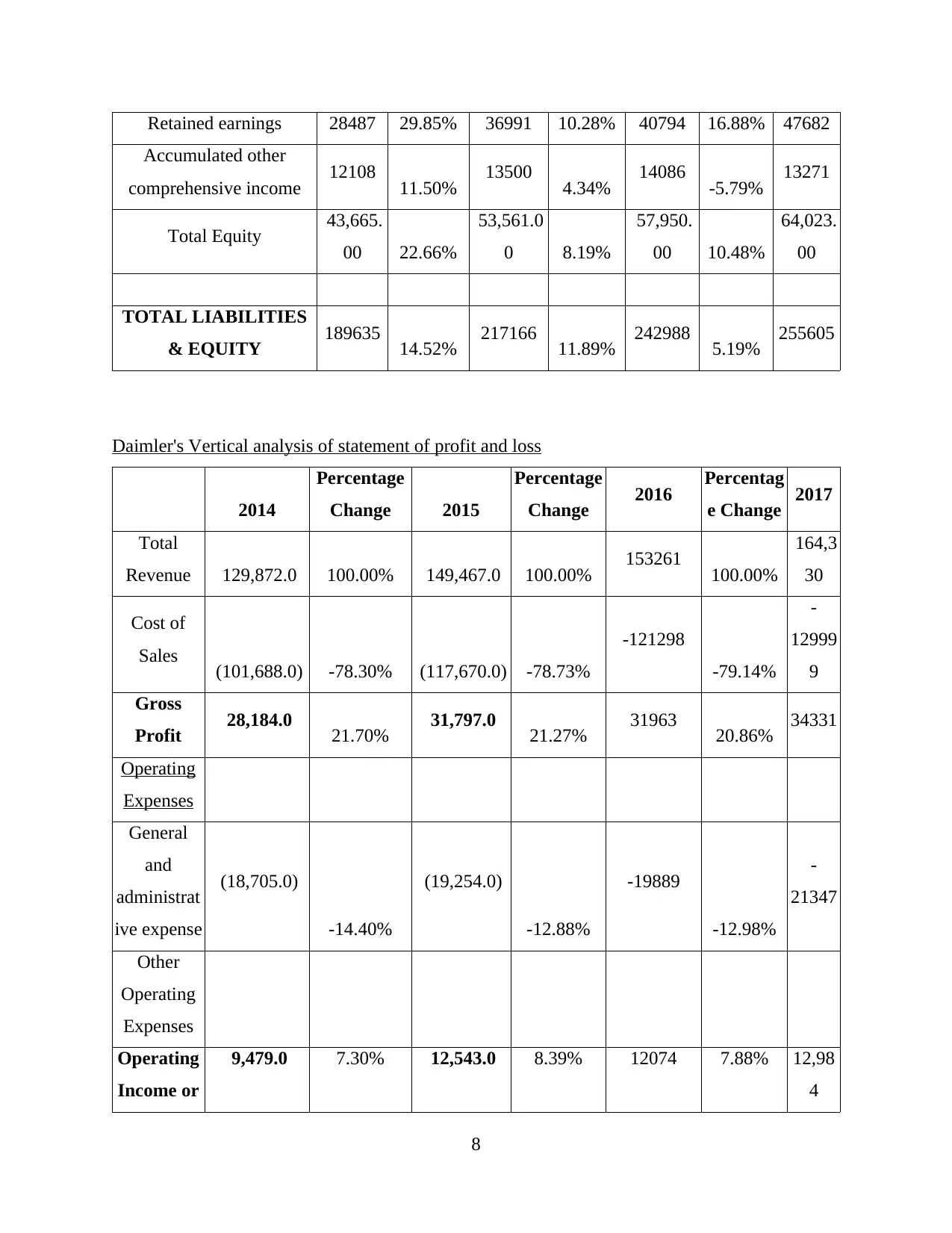

Retained earnings 28487 29.85% 36991 10.28% 40794 16.88% 47682

Accumulated other

comprehensive income 12108 11.50% 13500 4.34% 14086 -5.79% 13271

Total Equity 43,665.

00 22.66%

53,561.0

0 8.19%

57,950.

00 10.48%

64,023.

00

TOTAL LIABILITIES

& EQUITY 189635 14.52% 217166 11.89% 242988 5.19% 255605

Daimler's Vertical analysis of statement of profit and loss

2014

Percentage

Change 2015

Percentage

Change 2016 Percentag

e Change 2017

Total

Revenue 129,872.0 100.00% 149,467.0 100.00% 153261 100.00%

164,3

30

Cost of

Sales (101,688.0) -78.30% (117,670.0) -78.73%

-121298

-79.14%

-

12999

9

Gross

Profit 28,184.0 21.70% 31,797.0 21.27% 31963 20.86% 34331

Operating

Expenses

General

and

administrat

ive expense

(18,705.0)

-14.40%

(19,254.0)

-12.88%

-19889

-12.98%

-

21347

Other

Operating

Expenses

Operating

Income or

9,479.0 7.30% 12,543.0 8.39% 12074 7.88% 12,98

4

8

Accumulated other

comprehensive income 12108 11.50% 13500 4.34% 14086 -5.79% 13271

Total Equity 43,665.

00 22.66%

53,561.0

0 8.19%

57,950.

00 10.48%

64,023.

00

TOTAL LIABILITIES

& EQUITY 189635 14.52% 217166 11.89% 242988 5.19% 255605

Daimler's Vertical analysis of statement of profit and loss

2014

Percentage

Change 2015

Percentage

Change 2016 Percentag

e Change 2017

Total

Revenue 129,872.0 100.00% 149,467.0 100.00% 153261 100.00%

164,3

30

Cost of

Sales (101,688.0) -78.30% (117,670.0) -78.73%

-121298

-79.14%

-

12999

9

Gross

Profit 28,184.0 21.70% 31,797.0 21.27% 31963 20.86% 34331

Operating

Expenses

General

and

administrat

ive expense

(18,705.0)

-14.40%

(19,254.0)

-12.88%

-19889

-12.98%

-

21347

Other

Operating

Expenses

Operating

Income or

9,479.0 7.30% 12,543.0 8.39% 12074 7.88% 12,98

4

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

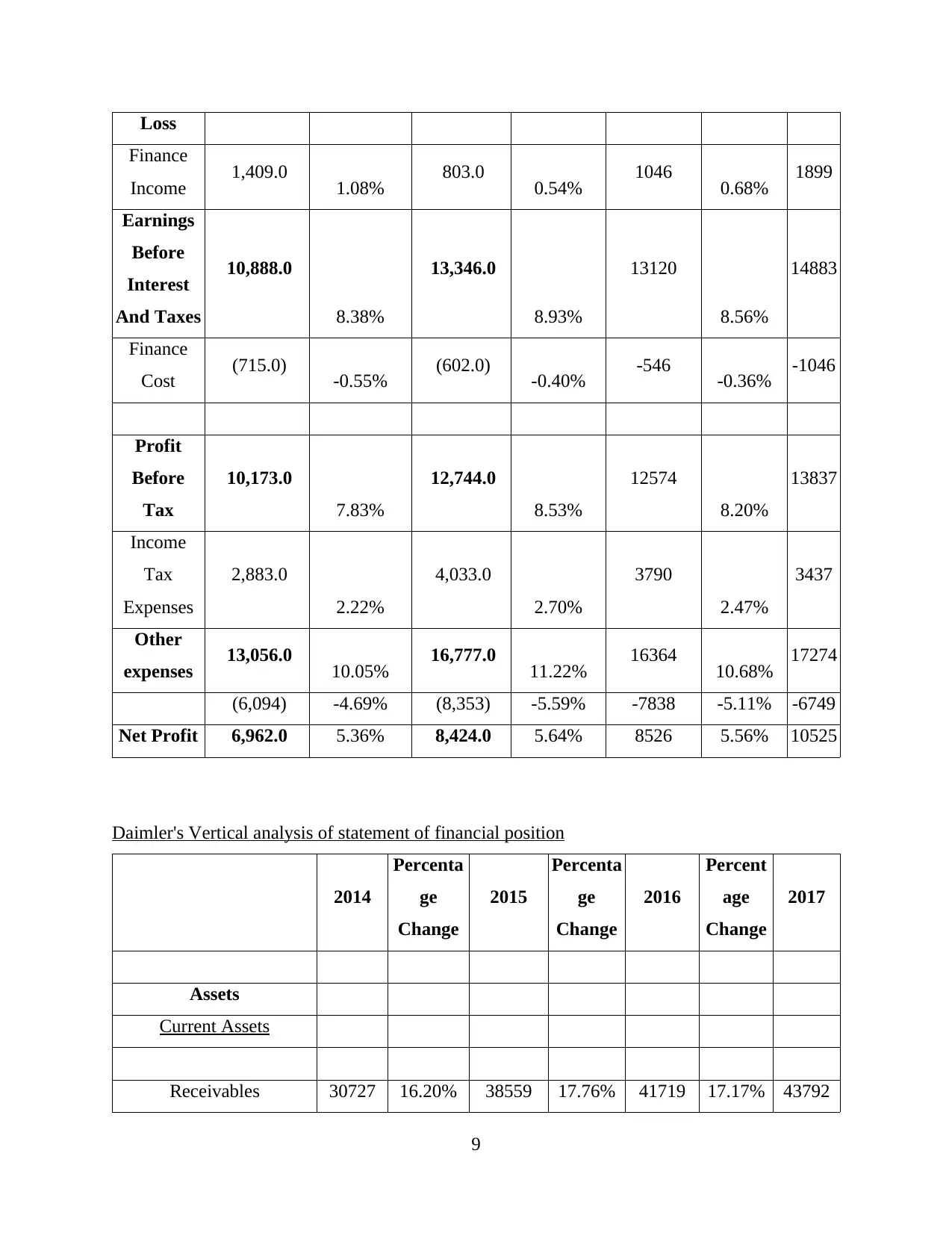

Loss

Finance

Income 1,409.0 1.08% 803.0 0.54% 1046 0.68% 1899

Earnings

Before

Interest

And Taxes

10,888.0

8.38%

13,346.0

8.93%

13120

8.56%

14883

Finance

Cost (715.0) -0.55% (602.0) -0.40% -546 -0.36% -1046

Profit

Before

Tax

10,173.0

7.83%

12,744.0

8.53%

12574

8.20%

13837

Income

Tax

Expenses

2,883.0

2.22%

4,033.0

2.70%

3790

2.47%

3437

Other

expenses 13,056.0 10.05% 16,777.0 11.22% 16364 10.68% 17274

(6,094) -4.69% (8,353) -5.59% -7838 -5.11% -6749

Net Profit 6,962.0 5.36% 8,424.0 5.64% 8526 5.56% 10525

Daimler's Vertical analysis of statement of financial position

2014

Percenta

ge

Change

2015

Percenta

ge

Change

2016

Percent

age

Change

2017

Assets

Current Assets

Receivables 30727 16.20% 38559 17.76% 41719 17.17% 43792

9

Finance

Income 1,409.0 1.08% 803.0 0.54% 1046 0.68% 1899

Earnings

Before

Interest

And Taxes

10,888.0

8.38%

13,346.0

8.93%

13120

8.56%

14883

Finance

Cost (715.0) -0.55% (602.0) -0.40% -546 -0.36% -1046

Profit

Before

Tax

10,173.0

7.83%

12,744.0

8.53%

12574

8.20%

13837

Income

Tax

Expenses

2,883.0

2.22%

4,033.0

2.70%

3790

2.47%

3437

Other

expenses 13,056.0 10.05% 16,777.0 11.22% 16364 10.68% 17274

(6,094) -4.69% (8,353) -5.59% -7838 -5.11% -6749

Net Profit 6,962.0 5.36% 8,424.0 5.64% 8526 5.56% 10525

Daimler's Vertical analysis of statement of financial position

2014

Percenta

ge

Change

2015

Percenta

ge

Change

2016

Percent

age

Change

2017

Assets

Current Assets

Receivables 30727 16.20% 38559 17.76% 41719 17.17% 43792

9

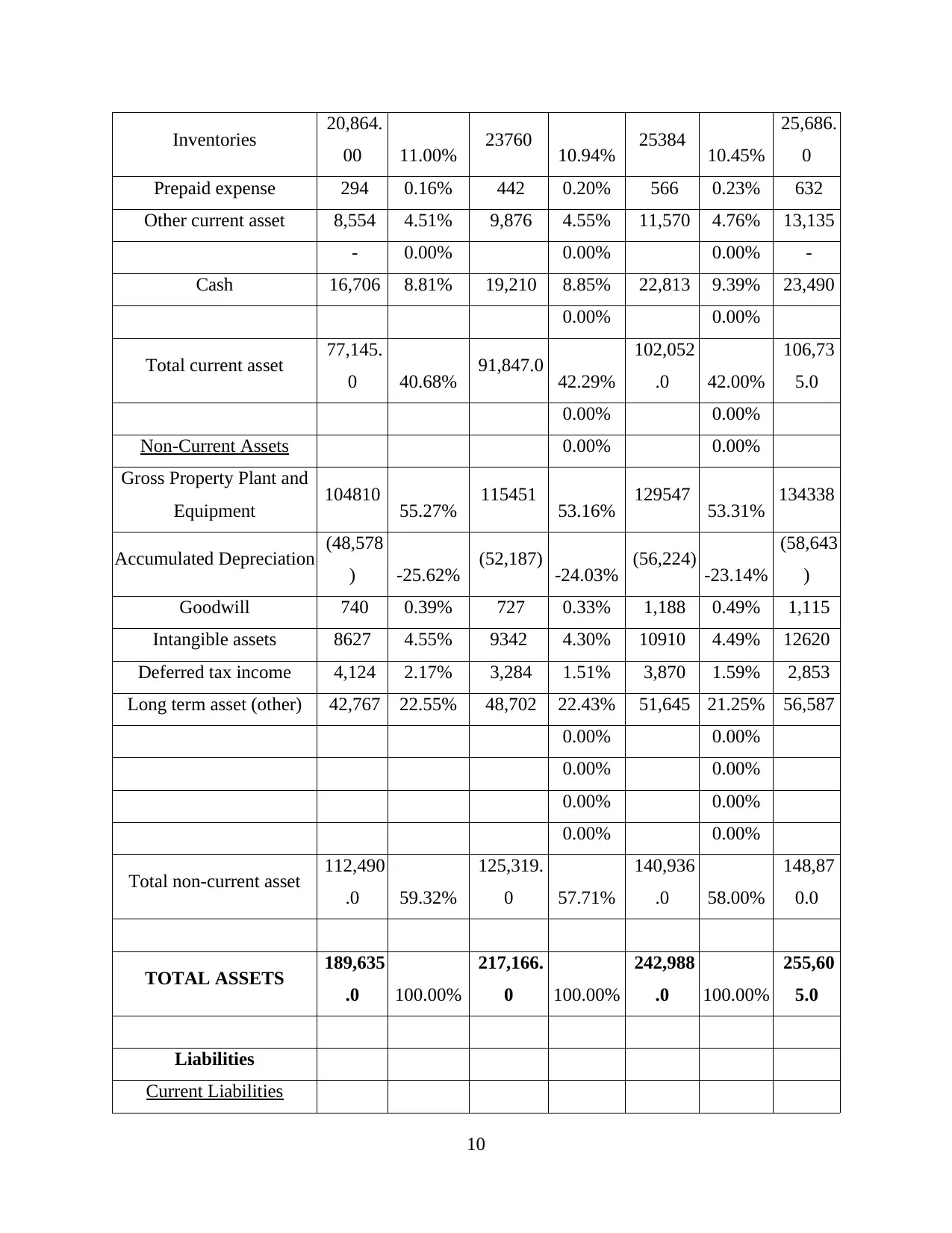

Inventories 20,864.

00 11.00% 23760 10.94% 25384 10.45%

25,686.

0

Prepaid expense 294 0.16% 442 0.20% 566 0.23% 632

Other current asset 8,554 4.51% 9,876 4.55% 11,570 4.76% 13,135

- 0.00% 0.00% 0.00% -

Cash 16,706 8.81% 19,210 8.85% 22,813 9.39% 23,490

0.00% 0.00%

Total current asset 77,145.

0 40.68% 91,847.0 42.29%

102,052

.0 42.00%

106,73

5.0

0.00% 0.00%

Non-Current Assets 0.00% 0.00%

Gross Property Plant and

Equipment 104810 55.27% 115451 53.16% 129547 53.31% 134338

Accumulated Depreciation (48,578

) -25.62% (52,187) -24.03% (56,224) -23.14%

(58,643

)

Goodwill 740 0.39% 727 0.33% 1,188 0.49% 1,115

Intangible assets 8627 4.55% 9342 4.30% 10910 4.49% 12620

Deferred tax income 4,124 2.17% 3,284 1.51% 3,870 1.59% 2,853

Long term asset (other) 42,767 22.55% 48,702 22.43% 51,645 21.25% 56,587

0.00% 0.00%

0.00% 0.00%

0.00% 0.00%

0.00% 0.00%

Total non-current asset 112,490

.0 59.32%

125,319.

0 57.71%

140,936

.0 58.00%

148,87

0.0

TOTAL ASSETS 189,635

.0 100.00%

217,166.

0 100.00%

242,988

.0 100.00%

255,60

5.0

Liabilities

Current Liabilities

10

00 11.00% 23760 10.94% 25384 10.45%

25,686.

0

Prepaid expense 294 0.16% 442 0.20% 566 0.23% 632

Other current asset 8,554 4.51% 9,876 4.55% 11,570 4.76% 13,135

- 0.00% 0.00% 0.00% -

Cash 16,706 8.81% 19,210 8.85% 22,813 9.39% 23,490

0.00% 0.00%

Total current asset 77,145.

0 40.68% 91,847.0 42.29%

102,052

.0 42.00%

106,73

5.0

0.00% 0.00%

Non-Current Assets 0.00% 0.00%

Gross Property Plant and

Equipment 104810 55.27% 115451 53.16% 129547 53.31% 134338

Accumulated Depreciation (48,578

) -25.62% (52,187) -24.03% (56,224) -23.14%

(58,643

)

Goodwill 740 0.39% 727 0.33% 1,188 0.49% 1,115

Intangible assets 8627 4.55% 9342 4.30% 10910 4.49% 12620

Deferred tax income 4,124 2.17% 3,284 1.51% 3,870 1.59% 2,853

Long term asset (other) 42,767 22.55% 48,702 22.43% 51,645 21.25% 56,587

0.00% 0.00%

0.00% 0.00%

0.00% 0.00%

0.00% 0.00%

Total non-current asset 112,490

.0 59.32%

125,319.

0 57.71%

140,936

.0 58.00%

148,87

0.0

TOTAL ASSETS 189,635

.0 100.00%

217,166.

0 100.00%

242,988

.0 100.00%

255,60

5.0

Liabilities

Current Liabilities

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 27

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.