FINANCIAL ANALYSIS MANAGEMENT & ENTERPRISE - FAME INTRODUCTION

VerifiedAdded on 2021/01/02

|31

|7792

|433

AI Summary

Financial analysis is-one of the measure which is used by every firm to determine its exact performance and position in terms of profitability, liquidity and othertraits ofbusiness execution.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

FINANCIAL ANALYSIS

MANAGEMENT & ENTERPRISE -

FAME

MANAGEMENT & ENTERPRISE -

FAME

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

Ratio Analysis ............................................................................................................................1

Horizontal analysis...........................................................................................................................6

Vertical analysis ..............................................................................................................................8

Cash position of both the organisation........................................................................................9

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

APPENDIX....................................................................................................................................11

INTRODUCTION...........................................................................................................................1

Ratio Analysis ............................................................................................................................1

Horizontal analysis...........................................................................................................................6

Vertical analysis ..............................................................................................................................8

Cash position of both the organisation........................................................................................9

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

APPENDIX....................................................................................................................................11

INTRODUCTION

For every organisation the financial performance is evaluated through various fiscal

tools. Financial analysis is-one of the measure which is used by every firm to determine its exact

performance and position in terms of profitability, liquidity and other traits of business

execution. With this a comparison can be carries out with own past performances and also with

other competitors in the industry. In the present horizontal and vertical of financial position is

carries out for ratios of Daimler and Tesla. The fact related with cash position of both firms is

also determined.

Ratio Analysis

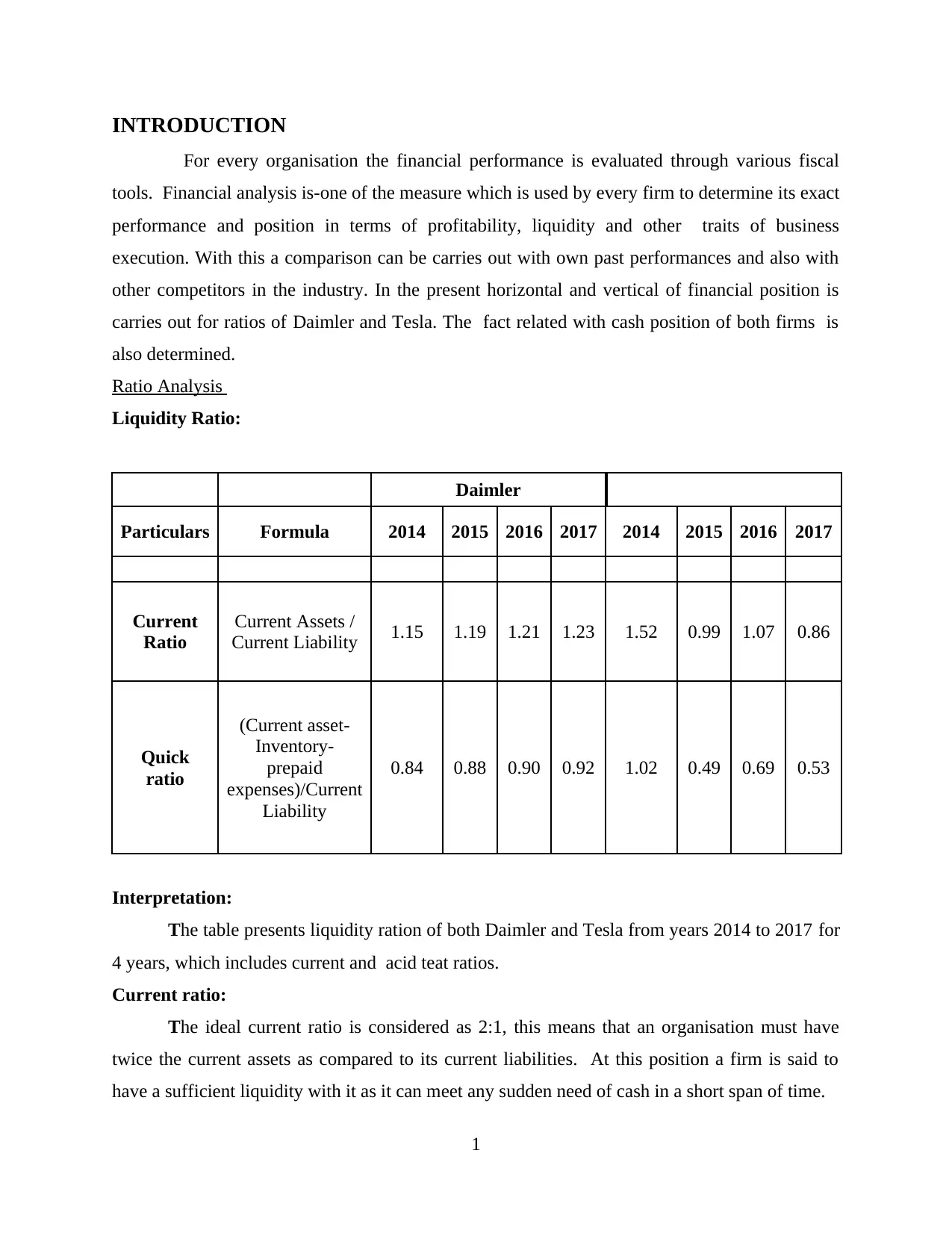

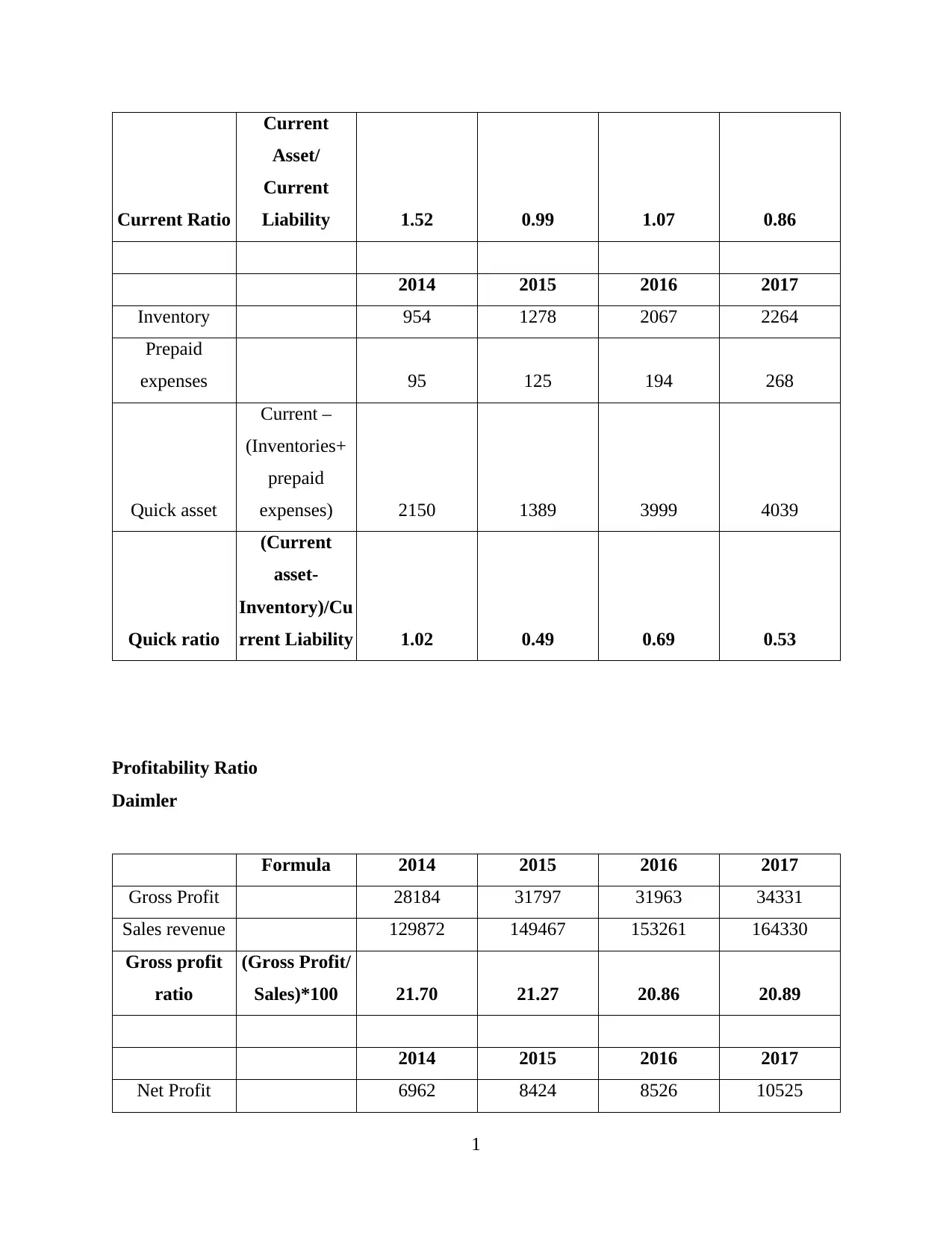

Liquidity Ratio:

Daimler

Particulars Formula 2014 2015 2016 2017 2014 2015 2016 2017

Current

Ratio

Current Assets /

Current Liability 1.15 1.19 1.21 1.23 1.52 0.99 1.07 0.86

Quick

ratio

(Current asset-

Inventory-

prepaid

expenses)/Current

Liability

0.84 0.88 0.90 0.92 1.02 0.49 0.69 0.53

Interpretation:

The table presents liquidity ration of both Daimler and Tesla from years 2014 to 2017 for

4 years, which includes current and acid teat ratios.

Current ratio:

The ideal current ratio is considered as 2:1, this means that an organisation must have

twice the current assets as compared to its current liabilities. At this position a firm is said to

have a sufficient liquidity with it as it can meet any sudden need of cash in a short span of time.

1

For every organisation the financial performance is evaluated through various fiscal

tools. Financial analysis is-one of the measure which is used by every firm to determine its exact

performance and position in terms of profitability, liquidity and other traits of business

execution. With this a comparison can be carries out with own past performances and also with

other competitors in the industry. In the present horizontal and vertical of financial position is

carries out for ratios of Daimler and Tesla. The fact related with cash position of both firms is

also determined.

Ratio Analysis

Liquidity Ratio:

Daimler

Particulars Formula 2014 2015 2016 2017 2014 2015 2016 2017

Current

Ratio

Current Assets /

Current Liability 1.15 1.19 1.21 1.23 1.52 0.99 1.07 0.86

Quick

ratio

(Current asset-

Inventory-

prepaid

expenses)/Current

Liability

0.84 0.88 0.90 0.92 1.02 0.49 0.69 0.53

Interpretation:

The table presents liquidity ration of both Daimler and Tesla from years 2014 to 2017 for

4 years, which includes current and acid teat ratios.

Current ratio:

The ideal current ratio is considered as 2:1, this means that an organisation must have

twice the current assets as compared to its current liabilities. At this position a firm is said to

have a sufficient liquidity with it as it can meet any sudden need of cash in a short span of time.

1

For Daimler it can be seen that the ratio have seen a downfall from 2014 to 2017. Yet is

can reach the idea ratio in time frame of 4 years. But the fact is that has been in a good liquidity

position as it has more current assets than this current liability that shows that after repaying its

all current liabilities it will still be left with some amount of cash. On the other hand Tesla is not

in a good liquidity position as it can be seen from the table that the current ration is below 1 for 2

years for 2015 and 2017 and this is not a good indicator of the firm. The organization do not

have sufficient funds to meet all its current abilities.

Quick ratio:

The ideal acid test ration is considered as 1:1, this means a firm must have cash and cash

equivalents to meet its immediate current liabilities. For Daimler it can be interpreted that it

does not have sufficient funds to meet its immediate current liabilities. On the contrary Tesla

had a good position in 2017 but in after year the ration falls down by 5% in next two years it

has gained a growth but is still not near the ideal ratio.

With a comparison it can be stated that for both the ratios Daimler is at front foot as its have

better liquidity position as compared to Tesla.

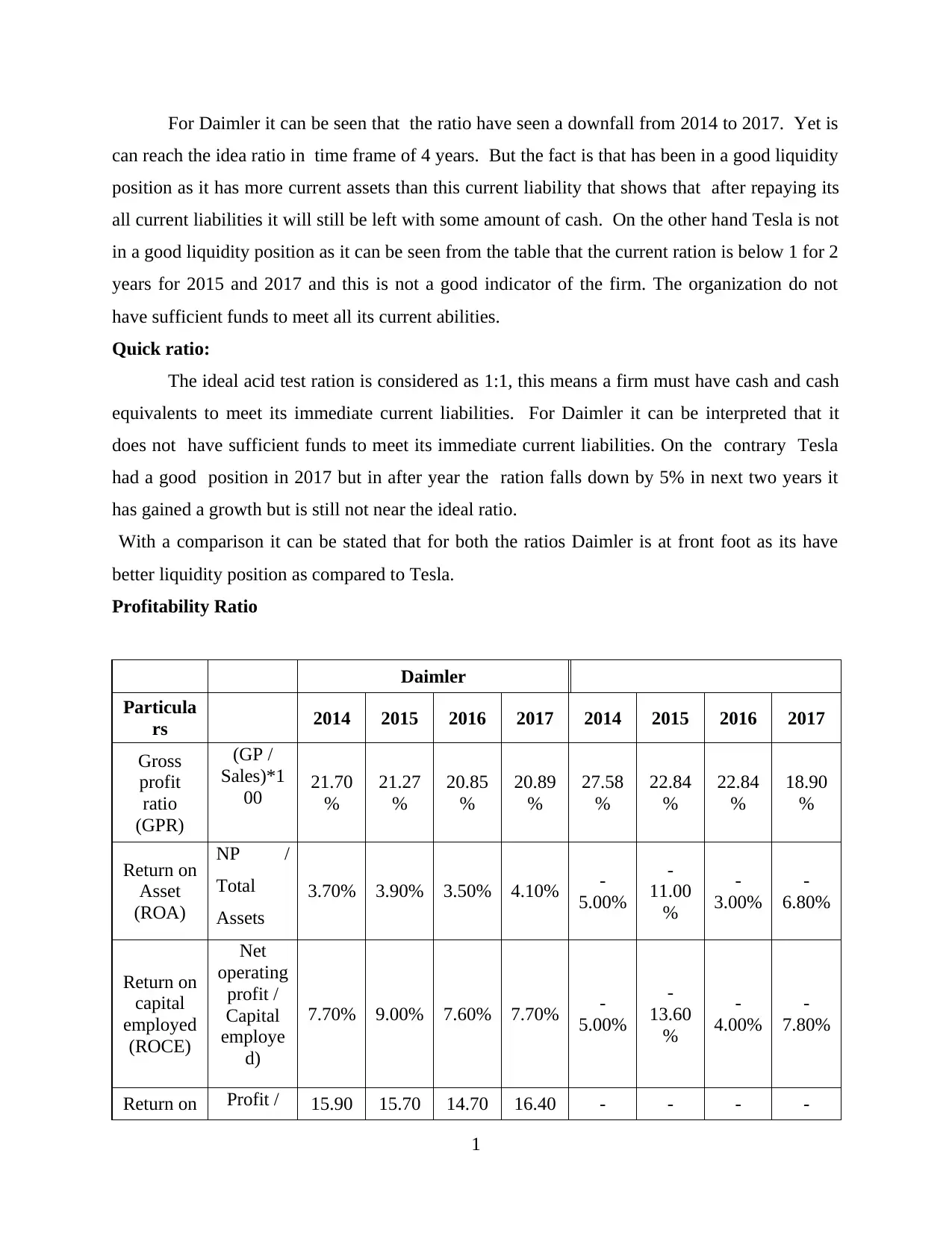

Profitability Ratio

Daimler

Particula

rs 2014 2015 2016 2017 2014 2015 2016 2017

Gross

profit

ratio

(GPR)

(GP /

Sales)*1

00 21.70

%

21.27

%

20.85

%

20.89

%

27.58

%

22.84

%

22.84

%

18.90

%

Return on

Asset

(ROA)

NP /

Total

Assets

3.70% 3.90% 3.50% 4.10% -

5.00%

-

11.00

%

-

3.00%

-

6.80%

Return on

capital

employed

(ROCE)

Net

operating

profit /

Capital

employe

d)

7.70% 9.00% 7.60% 7.70% -

5.00%

-

13.60

%

-

4.00%

-

7.80%

Return on Profit / 15.90 15.70 14.70 16.40 - - - -

1

can reach the idea ratio in time frame of 4 years. But the fact is that has been in a good liquidity

position as it has more current assets than this current liability that shows that after repaying its

all current liabilities it will still be left with some amount of cash. On the other hand Tesla is not

in a good liquidity position as it can be seen from the table that the current ration is below 1 for 2

years for 2015 and 2017 and this is not a good indicator of the firm. The organization do not

have sufficient funds to meet all its current abilities.

Quick ratio:

The ideal acid test ration is considered as 1:1, this means a firm must have cash and cash

equivalents to meet its immediate current liabilities. For Daimler it can be interpreted that it

does not have sufficient funds to meet its immediate current liabilities. On the contrary Tesla

had a good position in 2017 but in after year the ration falls down by 5% in next two years it

has gained a growth but is still not near the ideal ratio.

With a comparison it can be stated that for both the ratios Daimler is at front foot as its have

better liquidity position as compared to Tesla.

Profitability Ratio

Daimler

Particula

rs 2014 2015 2016 2017 2014 2015 2016 2017

Gross

profit

ratio

(GPR)

(GP /

Sales)*1

00 21.70

%

21.27

%

20.85

%

20.89

%

27.58

%

22.84

%

22.84

%

18.90

%

Return on

Asset

(ROA)

NP /

Total

Assets

3.70% 3.90% 3.50% 4.10% -

5.00%

-

11.00

%

-

3.00%

-

6.80%

Return on

capital

employed

(ROCE)

Net

operating

profit /

Capital

employe

d)

7.70% 9.00% 7.60% 7.70% -

5.00%

-

13.60

%

-

4.00%

-

7.80%

Return on Profit / 15.90 15.70 14.70 16.40 - - - -

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Equity

(ROE)

Net

worth % % % % 32.20

%

81.60

%

14.20

%

46.30

%

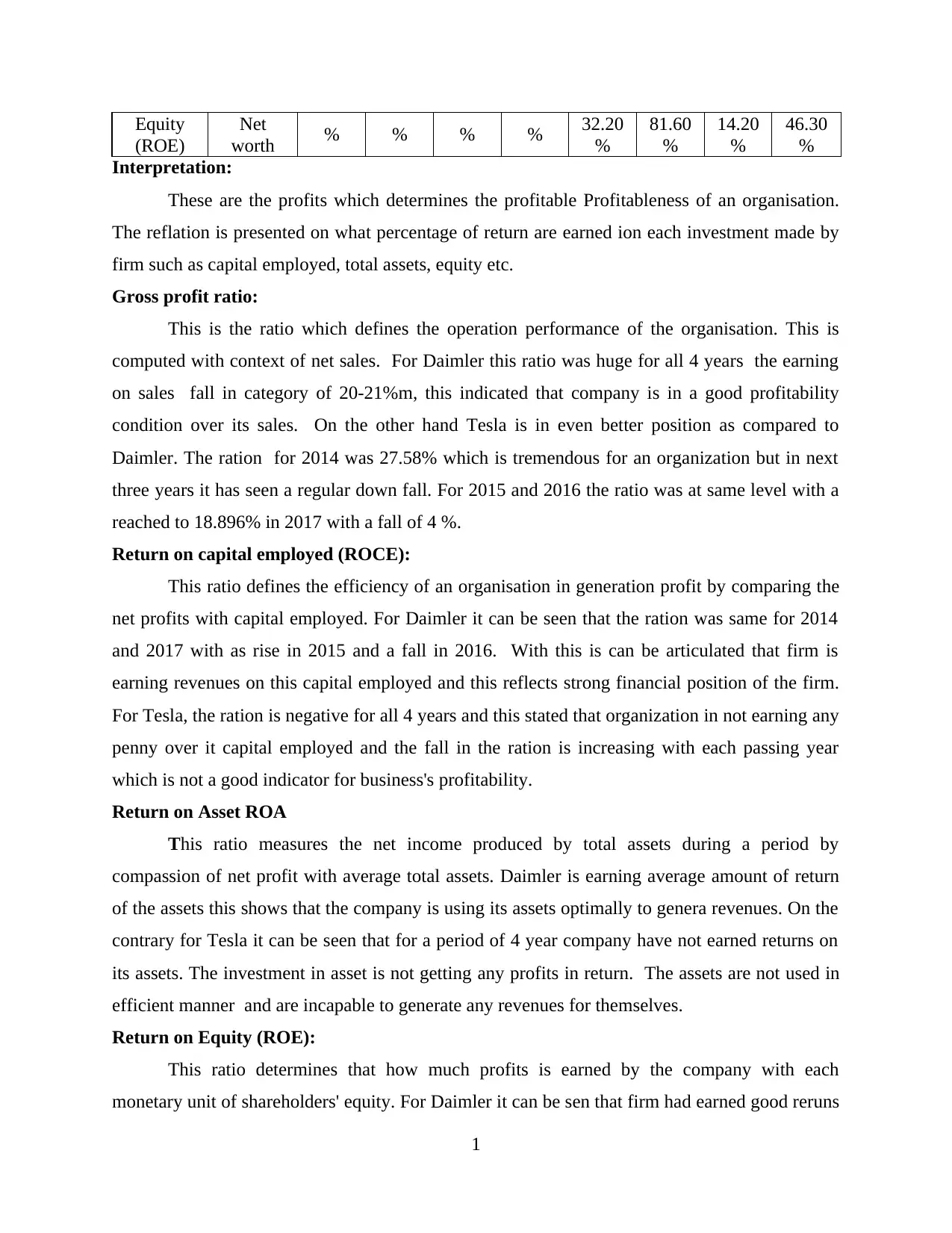

Interpretation:

These are the profits which determines the profitable Profitableness of an organisation.

The reflation is presented on what percentage of return are earned ion each investment made by

firm such as capital employed, total assets, equity etc.

Gross profit ratio:

This is the ratio which defines the operation performance of the organisation. This is

computed with context of net sales. For Daimler this ratio was huge for all 4 years the earning

on sales fall in category of 20-21%m, this indicated that company is in a good profitability

condition over its sales. On the other hand Tesla is in even better position as compared to

Daimler. The ration for 2014 was 27.58% which is tremendous for an organization but in next

three years it has seen a regular down fall. For 2015 and 2016 the ratio was at same level with a

reached to 18.896% in 2017 with a fall of 4 %.

Return on capital employed (ROCE):

This ratio defines the efficiency of an organisation in generation profit by comparing the

net profits with capital employed. For Daimler it can be seen that the ration was same for 2014

and 2017 with as rise in 2015 and a fall in 2016. With this is can be articulated that firm is

earning revenues on this capital employed and this reflects strong financial position of the firm.

For Tesla, the ration is negative for all 4 years and this stated that organization in not earning any

penny over it capital employed and the fall in the ration is increasing with each passing year

which is not a good indicator for business's profitability.

Return on Asset ROA

This ratio measures the net income produced by total assets during a period by

compassion of net profit with average total assets. Daimler is earning average amount of return

of the assets this shows that the company is using its assets optimally to genera revenues. On the

contrary for Tesla it can be seen that for a period of 4 year company have not earned returns on

its assets. The investment in asset is not getting any profits in return. The assets are not used in

efficient manner and are incapable to generate any revenues for themselves.

Return on Equity (ROE):

This ratio determines that how much profits is earned by the company with each

monetary unit of shareholders' equity. For Daimler it can be sen that firm had earned good reruns

1

(ROE)

Net

worth % % % % 32.20

%

81.60

%

14.20

%

46.30

%

Interpretation:

These are the profits which determines the profitable Profitableness of an organisation.

The reflation is presented on what percentage of return are earned ion each investment made by

firm such as capital employed, total assets, equity etc.

Gross profit ratio:

This is the ratio which defines the operation performance of the organisation. This is

computed with context of net sales. For Daimler this ratio was huge for all 4 years the earning

on sales fall in category of 20-21%m, this indicated that company is in a good profitability

condition over its sales. On the other hand Tesla is in even better position as compared to

Daimler. The ration for 2014 was 27.58% which is tremendous for an organization but in next

three years it has seen a regular down fall. For 2015 and 2016 the ratio was at same level with a

reached to 18.896% in 2017 with a fall of 4 %.

Return on capital employed (ROCE):

This ratio defines the efficiency of an organisation in generation profit by comparing the

net profits with capital employed. For Daimler it can be seen that the ration was same for 2014

and 2017 with as rise in 2015 and a fall in 2016. With this is can be articulated that firm is

earning revenues on this capital employed and this reflects strong financial position of the firm.

For Tesla, the ration is negative for all 4 years and this stated that organization in not earning any

penny over it capital employed and the fall in the ration is increasing with each passing year

which is not a good indicator for business's profitability.

Return on Asset ROA

This ratio measures the net income produced by total assets during a period by

compassion of net profit with average total assets. Daimler is earning average amount of return

of the assets this shows that the company is using its assets optimally to genera revenues. On the

contrary for Tesla it can be seen that for a period of 4 year company have not earned returns on

its assets. The investment in asset is not getting any profits in return. The assets are not used in

efficient manner and are incapable to generate any revenues for themselves.

Return on Equity (ROE):

This ratio determines that how much profits is earned by the company with each

monetary unit of shareholders' equity. For Daimler it can be sen that firm had earned good reruns

1

on the shareholders' equity with investment. For time frame of 4 year it can be articulated that

the earning have increased. On the other hand for Tesla it can be interpreted that for each year

there was no earnings on equity of shareholders. The gap between net profits earned and total

equity is raising with each year.

Efficiency Ratio

Particulars Formula 2014 2015 2016 2017 2014 2015 2016 2017

Asset

Turnover

Ratio (in

times)

Net sales /

Average

total asset

0.73 0.74 0.67 0.66 0.77 0.58 0.46 0.46

Inventory

turnover

ratio (In

times)

COGS /

Average

stock

5.32 5.27 4.94 5.09 3.58 2.80 3.23 4.40

Stock

turnover

ratio (in

days)

(Closing

inventory /

COGS)*365

74.89 73.70 76.38 72.12 150.29 149.37 139.69 86.66

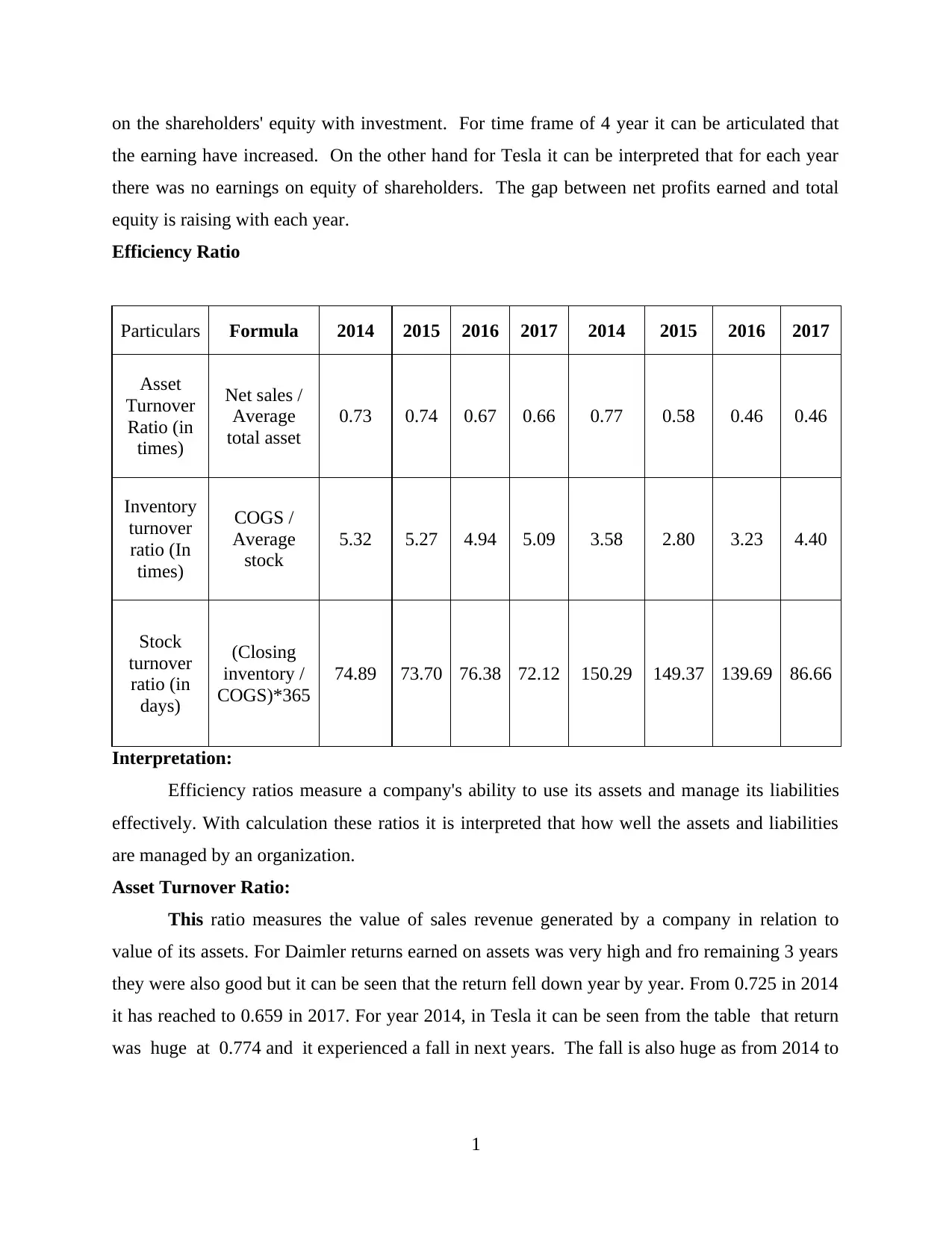

Interpretation:

Efficiency ratios measure a company's ability to use its assets and manage its liabilities

effectively. With calculation these ratios it is interpreted that how well the assets and liabilities

are managed by an organization.

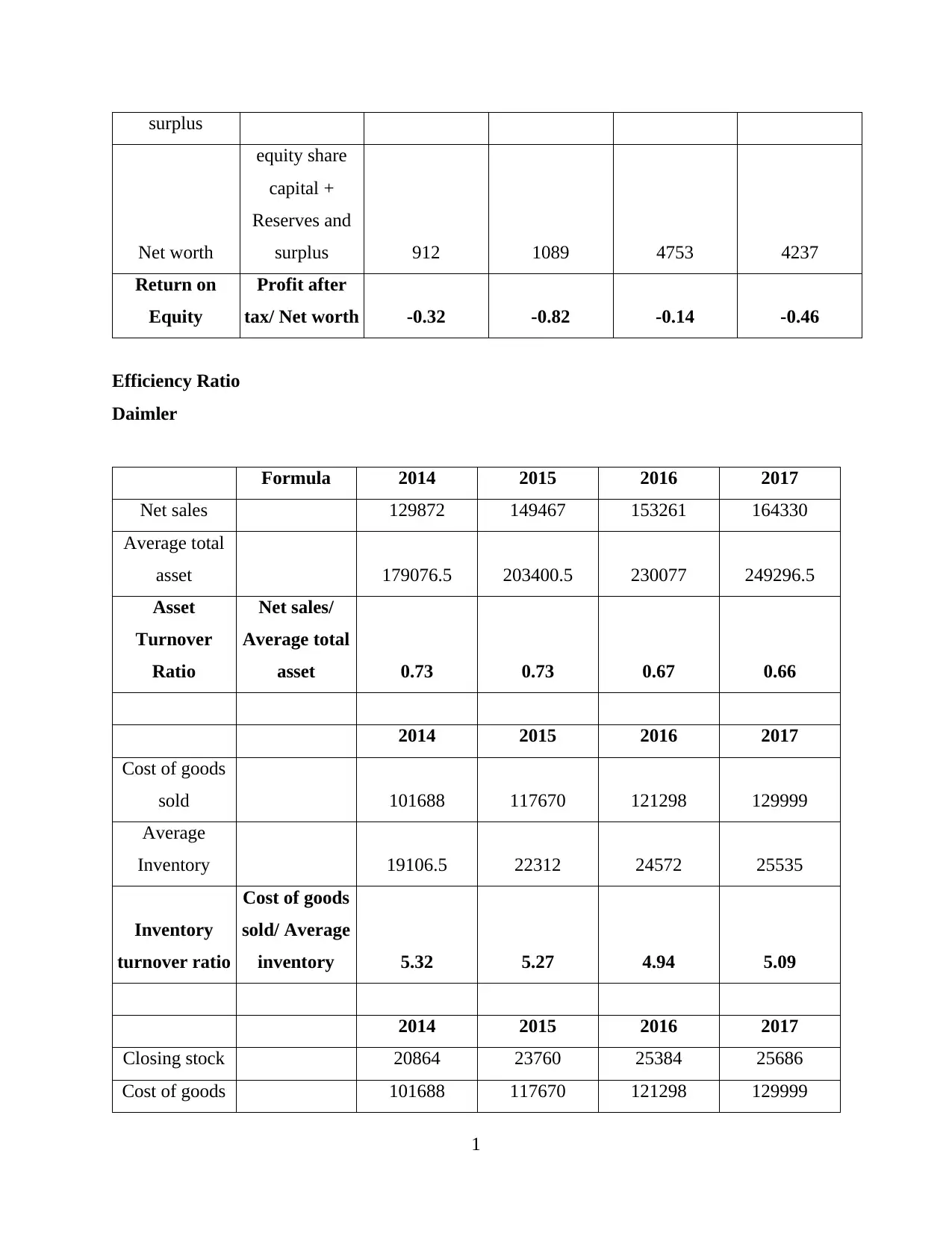

Asset Turnover Ratio:

This ratio measures the value of sales revenue generated by a company in relation to

value of its assets. For Daimler returns earned on assets was very high and fro remaining 3 years

they were also good but it can be seen that the return fell down year by year. From 0.725 in 2014

it has reached to 0.659 in 2017. For year 2014, in Tesla it can be seen from the table that return

was huge at 0.774 and it experienced a fall in next years. The fall is also huge as from 2014 to

1

the earning have increased. On the other hand for Tesla it can be interpreted that for each year

there was no earnings on equity of shareholders. The gap between net profits earned and total

equity is raising with each year.

Efficiency Ratio

Particulars Formula 2014 2015 2016 2017 2014 2015 2016 2017

Asset

Turnover

Ratio (in

times)

Net sales /

Average

total asset

0.73 0.74 0.67 0.66 0.77 0.58 0.46 0.46

Inventory

turnover

ratio (In

times)

COGS /

Average

stock

5.32 5.27 4.94 5.09 3.58 2.80 3.23 4.40

Stock

turnover

ratio (in

days)

(Closing

inventory /

COGS)*365

74.89 73.70 76.38 72.12 150.29 149.37 139.69 86.66

Interpretation:

Efficiency ratios measure a company's ability to use its assets and manage its liabilities

effectively. With calculation these ratios it is interpreted that how well the assets and liabilities

are managed by an organization.

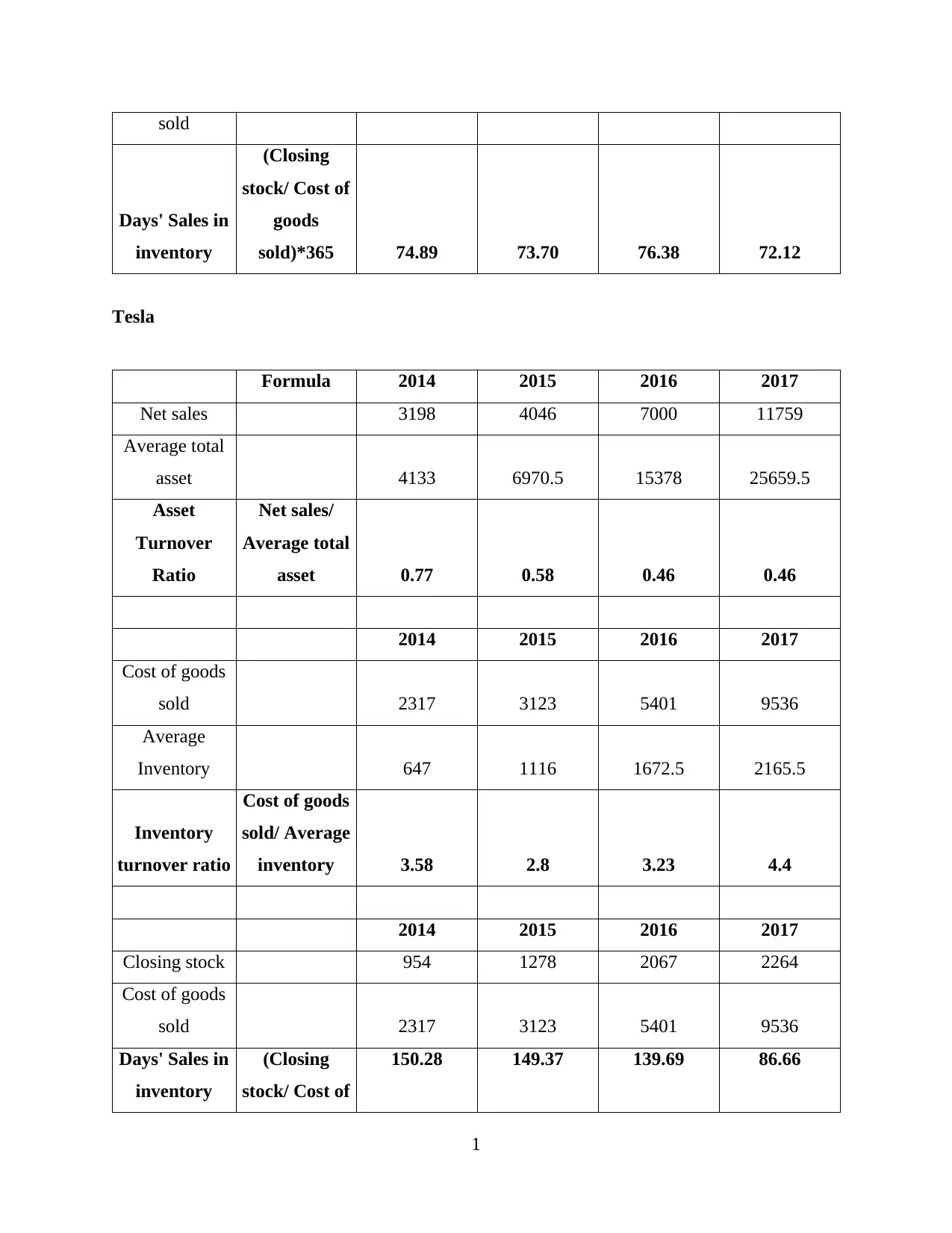

Asset Turnover Ratio:

This ratio measures the value of sales revenue generated by a company in relation to

value of its assets. For Daimler returns earned on assets was very high and fro remaining 3 years

they were also good but it can be seen that the return fell down year by year. From 0.725 in 2014

it has reached to 0.659 in 2017. For year 2014, in Tesla it can be seen from the table that return

was huge at 0.774 and it experienced a fall in next years. The fall is also huge as from 2014 to

1

2017 the ratio reduced to .458, an with this rate of fall down it can be a big concern for the

organisation.

Inventory turnover ratio

This reflects the efficiency in managing the inventory by a firm with respect to cost of

goods sold and average inventory for a given period. For Daimler it can be interpreted that the

organization is effective managing its inventory as the ratio was 5.322 in 2014 and shows slight

change in next year (Annual report of Daimler, 2017). In 2016 it fell down to 4.936 but again in

2017 it reached to 5.091. This reflect that company is vigilantly managing its inventory and try to

mention its ration at a specific point. For Tesla it can be seen that the ratio was lower as

compared to Daimler but still is in good position. In 2014 ratio was at 3.58, in next two year the

ratio fell down but again in 2017 it reached to 4.40, which shows that company is trying its best

to increase efficiency in managing its inventory.

Inventory period:

This ration defines the days for which inventory is held by an organization before selling it. The

period of keeping inventory for Daimler is between 74 to 72 approximately for all 4 years. Foe

2014 it was 74.889 which increased to 76.383 in 2016 but again in 2017 it was reduced to

72.119/ this shows that company is trying to lessen the days for which inventory is held in stock.

For Tesla, the inventory period was very high in 2014 at 150.285 and with time it has been

reduced to 86.657 in 2017. This reflects the fact that organisation is effective putting efforts to

reduce inventory holding period.

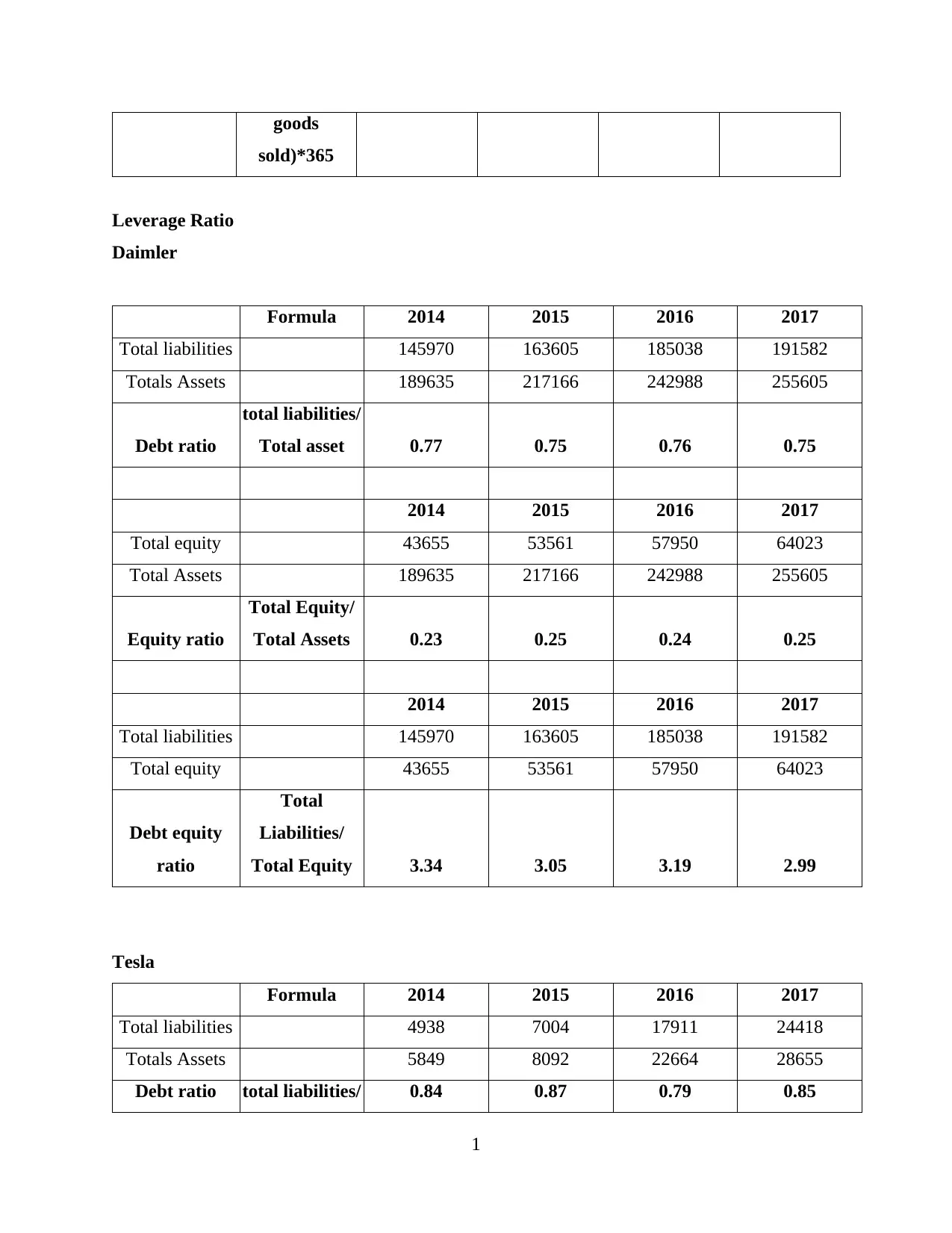

Leverage Ratio

Daimler

Formula 2014 2015 201

6 2017 2014 2015 2016 2017

Debt

ratio

Total

liabilities

/ Total

asset

0.77 0.75 0.76 0.75 0.84 0.87 0.79 0.85

Equit

y ratio

Total

Equity /

Total

Assets

0.23 0.25 0.24 0.25 0.16 0.14 0.21 0.15

1

organisation.

Inventory turnover ratio

This reflects the efficiency in managing the inventory by a firm with respect to cost of

goods sold and average inventory for a given period. For Daimler it can be interpreted that the

organization is effective managing its inventory as the ratio was 5.322 in 2014 and shows slight

change in next year (Annual report of Daimler, 2017). In 2016 it fell down to 4.936 but again in

2017 it reached to 5.091. This reflect that company is vigilantly managing its inventory and try to

mention its ration at a specific point. For Tesla it can be seen that the ratio was lower as

compared to Daimler but still is in good position. In 2014 ratio was at 3.58, in next two year the

ratio fell down but again in 2017 it reached to 4.40, which shows that company is trying its best

to increase efficiency in managing its inventory.

Inventory period:

This ration defines the days for which inventory is held by an organization before selling it. The

period of keeping inventory for Daimler is between 74 to 72 approximately for all 4 years. Foe

2014 it was 74.889 which increased to 76.383 in 2016 but again in 2017 it was reduced to

72.119/ this shows that company is trying to lessen the days for which inventory is held in stock.

For Tesla, the inventory period was very high in 2014 at 150.285 and with time it has been

reduced to 86.657 in 2017. This reflects the fact that organisation is effective putting efforts to

reduce inventory holding period.

Leverage Ratio

Daimler

Formula 2014 2015 201

6 2017 2014 2015 2016 2017

Debt

ratio

Total

liabilities

/ Total

asset

0.77 0.75 0.76 0.75 0.84 0.87 0.79 0.85

Equit

y ratio

Total

Equity /

Total

Assets

0.23 0.25 0.24 0.25 0.16 0.14 0.21 0.15

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Debt

equity

ratio

Total

Liabilities

/ Total

Equity

3.34 3.06 3.19 2.99 5.41 6.43 3.77 5.76

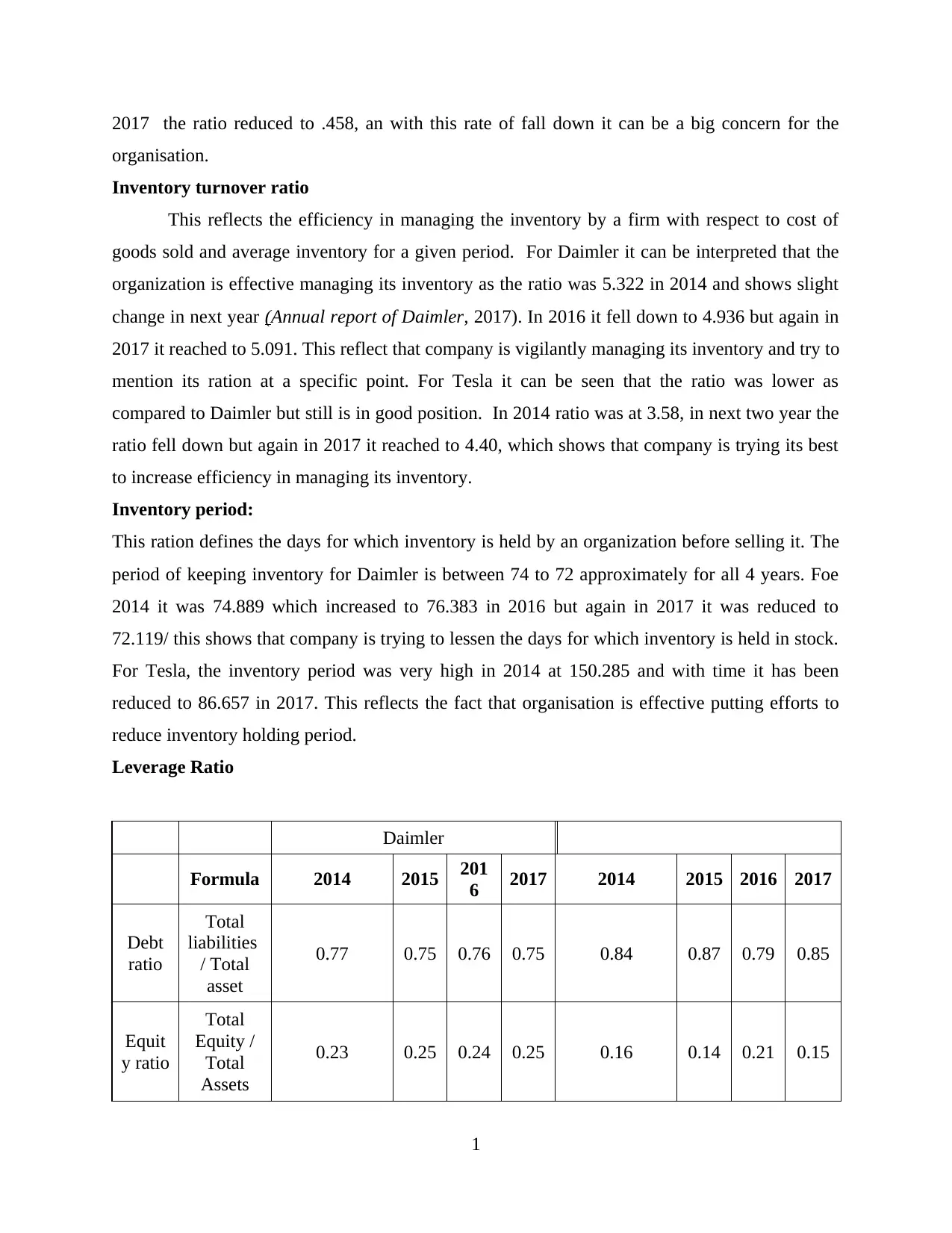

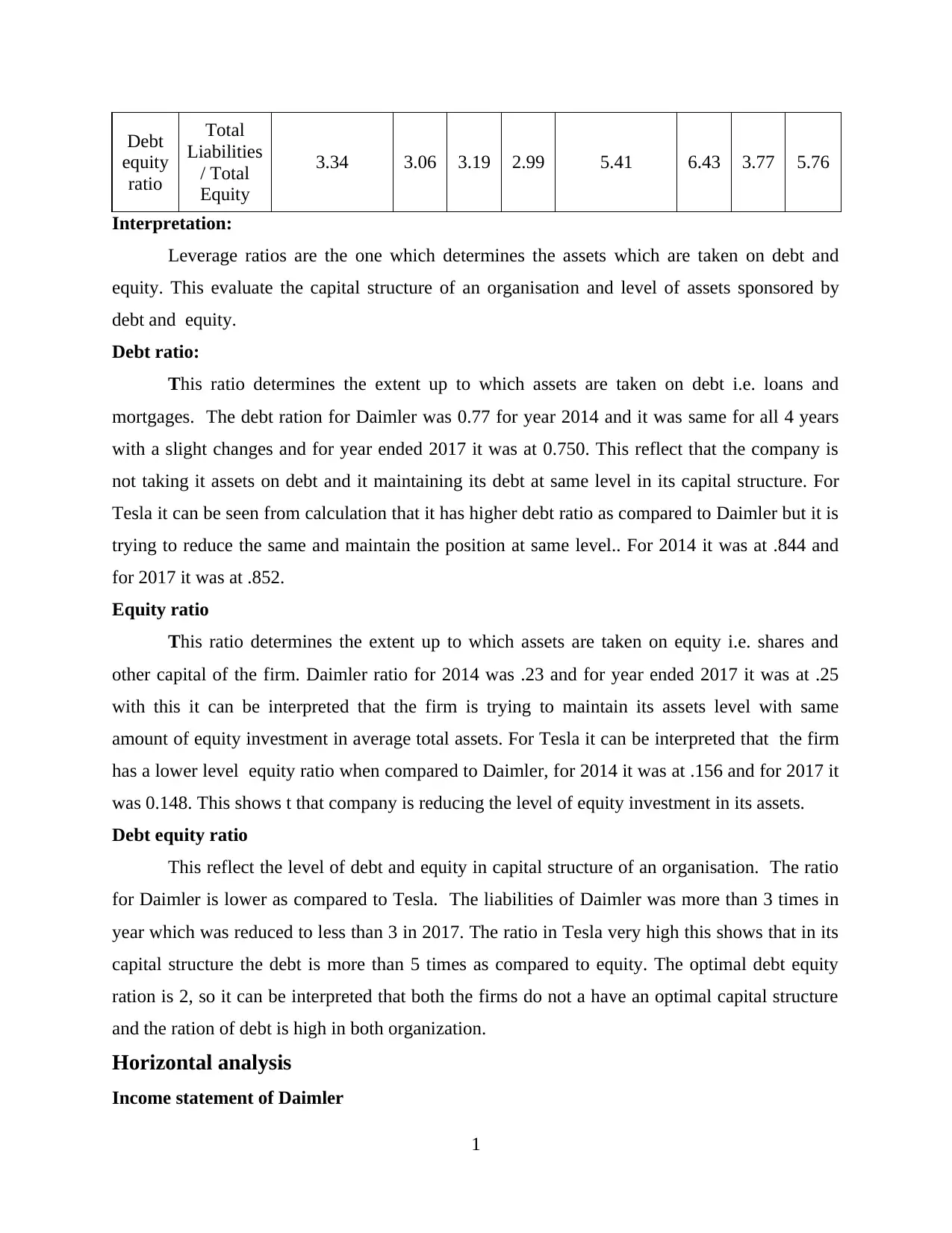

Interpretation:

Leverage ratios are the one which determines the assets which are taken on debt and

equity. This evaluate the capital structure of an organisation and level of assets sponsored by

debt and equity.

Debt ratio:

This ratio determines the extent up to which assets are taken on debt i.e. loans and

mortgages. The debt ration for Daimler was 0.77 for year 2014 and it was same for all 4 years

with a slight changes and for year ended 2017 it was at 0.750. This reflect that the company is

not taking it assets on debt and it maintaining its debt at same level in its capital structure. For

Tesla it can be seen from calculation that it has higher debt ratio as compared to Daimler but it is

trying to reduce the same and maintain the position at same level.. For 2014 it was at .844 and

for 2017 it was at .852.

Equity ratio

This ratio determines the extent up to which assets are taken on equity i.e. shares and

other capital of the firm. Daimler ratio for 2014 was .23 and for year ended 2017 it was at .25

with this it can be interpreted that the firm is trying to maintain its assets level with same

amount of equity investment in average total assets. For Tesla it can be interpreted that the firm

has a lower level equity ratio when compared to Daimler, for 2014 it was at .156 and for 2017 it

was 0.148. This shows t that company is reducing the level of equity investment in its assets.

Debt equity ratio

This reflect the level of debt and equity in capital structure of an organisation. The ratio

for Daimler is lower as compared to Tesla. The liabilities of Daimler was more than 3 times in

year which was reduced to less than 3 in 2017. The ratio in Tesla very high this shows that in its

capital structure the debt is more than 5 times as compared to equity. The optimal debt equity

ration is 2, so it can be interpreted that both the firms do not a have an optimal capital structure

and the ration of debt is high in both organization.

Horizontal analysis

Income statement of Daimler

1

equity

ratio

Total

Liabilities

/ Total

Equity

3.34 3.06 3.19 2.99 5.41 6.43 3.77 5.76

Interpretation:

Leverage ratios are the one which determines the assets which are taken on debt and

equity. This evaluate the capital structure of an organisation and level of assets sponsored by

debt and equity.

Debt ratio:

This ratio determines the extent up to which assets are taken on debt i.e. loans and

mortgages. The debt ration for Daimler was 0.77 for year 2014 and it was same for all 4 years

with a slight changes and for year ended 2017 it was at 0.750. This reflect that the company is

not taking it assets on debt and it maintaining its debt at same level in its capital structure. For

Tesla it can be seen from calculation that it has higher debt ratio as compared to Daimler but it is

trying to reduce the same and maintain the position at same level.. For 2014 it was at .844 and

for 2017 it was at .852.

Equity ratio

This ratio determines the extent up to which assets are taken on equity i.e. shares and

other capital of the firm. Daimler ratio for 2014 was .23 and for year ended 2017 it was at .25

with this it can be interpreted that the firm is trying to maintain its assets level with same

amount of equity investment in average total assets. For Tesla it can be interpreted that the firm

has a lower level equity ratio when compared to Daimler, for 2014 it was at .156 and for 2017 it

was 0.148. This shows t that company is reducing the level of equity investment in its assets.

Debt equity ratio

This reflect the level of debt and equity in capital structure of an organisation. The ratio

for Daimler is lower as compared to Tesla. The liabilities of Daimler was more than 3 times in

year which was reduced to less than 3 in 2017. The ratio in Tesla very high this shows that in its

capital structure the debt is more than 5 times as compared to equity. The optimal debt equity

ration is 2, so it can be interpreted that both the firms do not a have an optimal capital structure

and the ration of debt is high in both organization.

Horizontal analysis

Income statement of Daimler

1

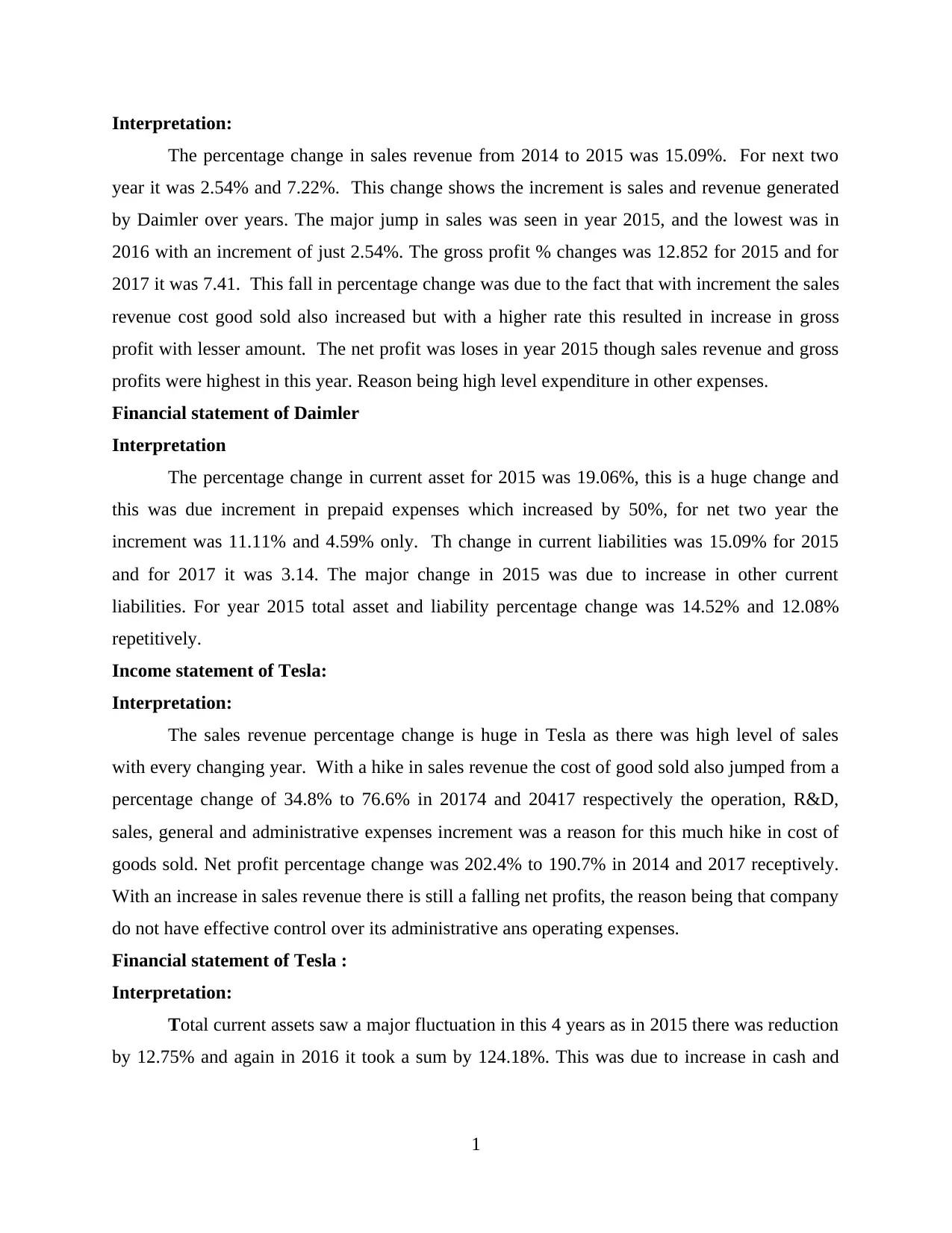

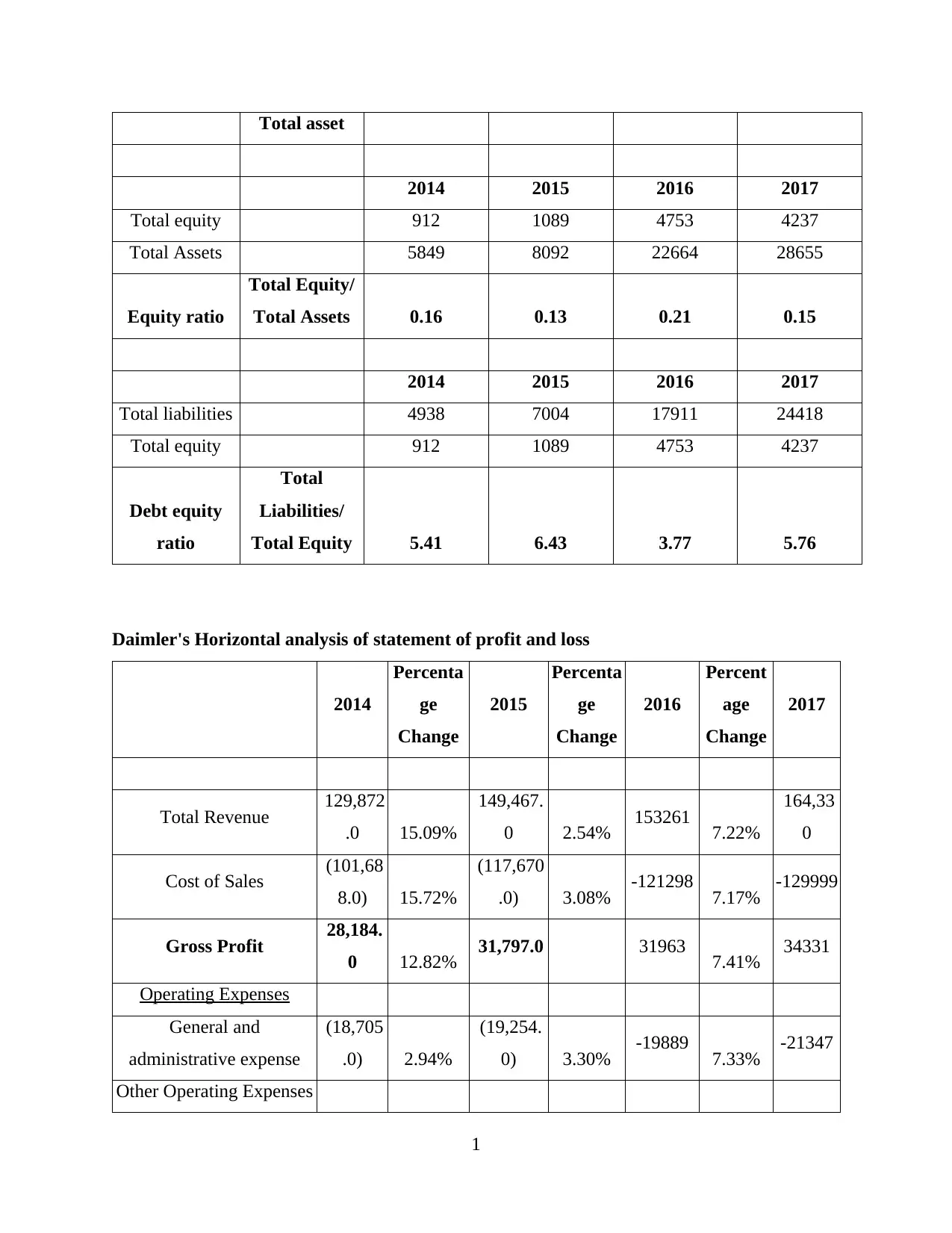

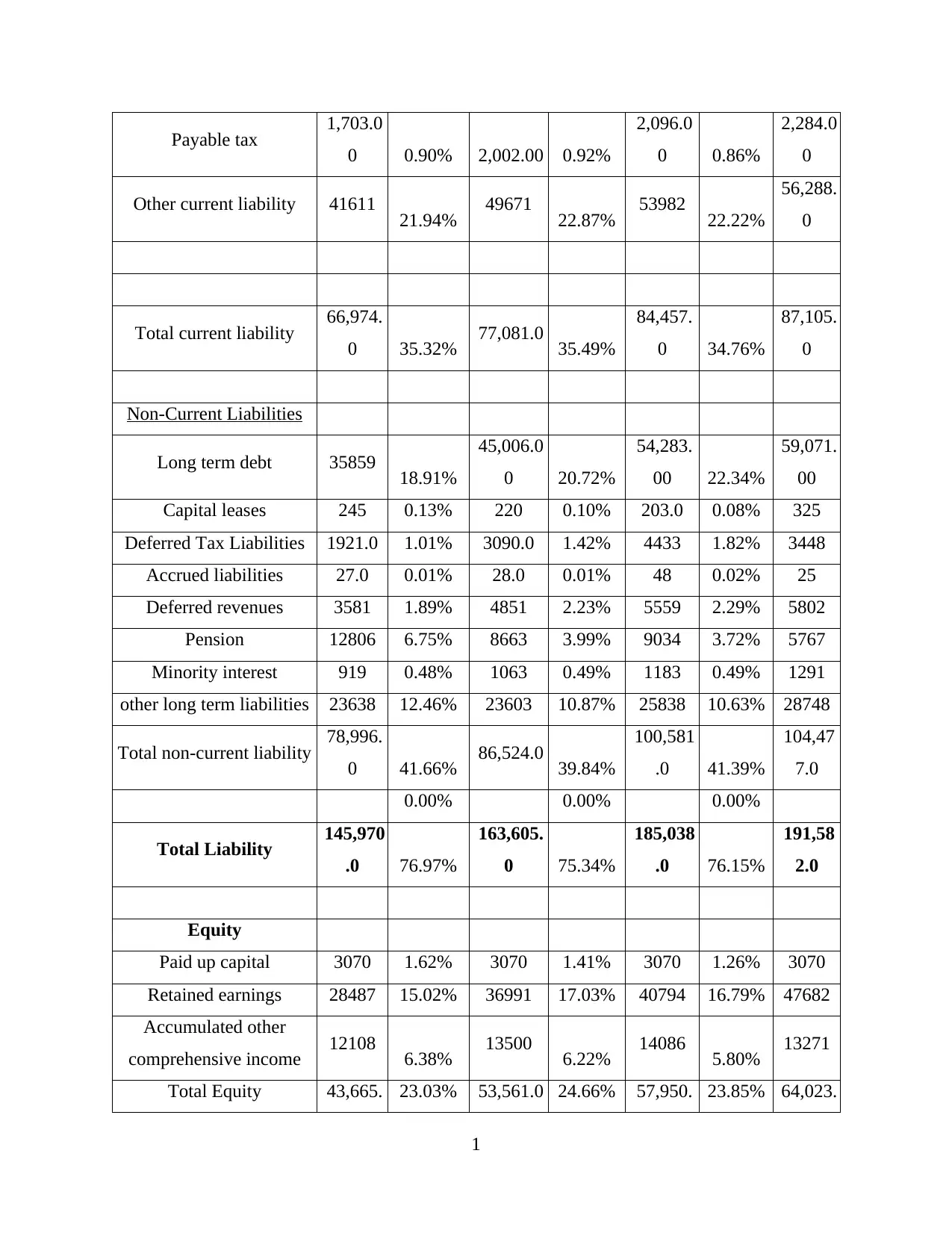

Interpretation:

The percentage change in sales revenue from 2014 to 2015 was 15.09%. For next two

year it was 2.54% and 7.22%. This change shows the increment is sales and revenue generated

by Daimler over years. The major jump in sales was seen in year 2015, and the lowest was in

2016 with an increment of just 2.54%. The gross profit % changes was 12.852 for 2015 and for

2017 it was 7.41. This fall in percentage change was due to the fact that with increment the sales

revenue cost good sold also increased but with a higher rate this resulted in increase in gross

profit with lesser amount. The net profit was loses in year 2015 though sales revenue and gross

profits were highest in this year. Reason being high level expenditure in other expenses.

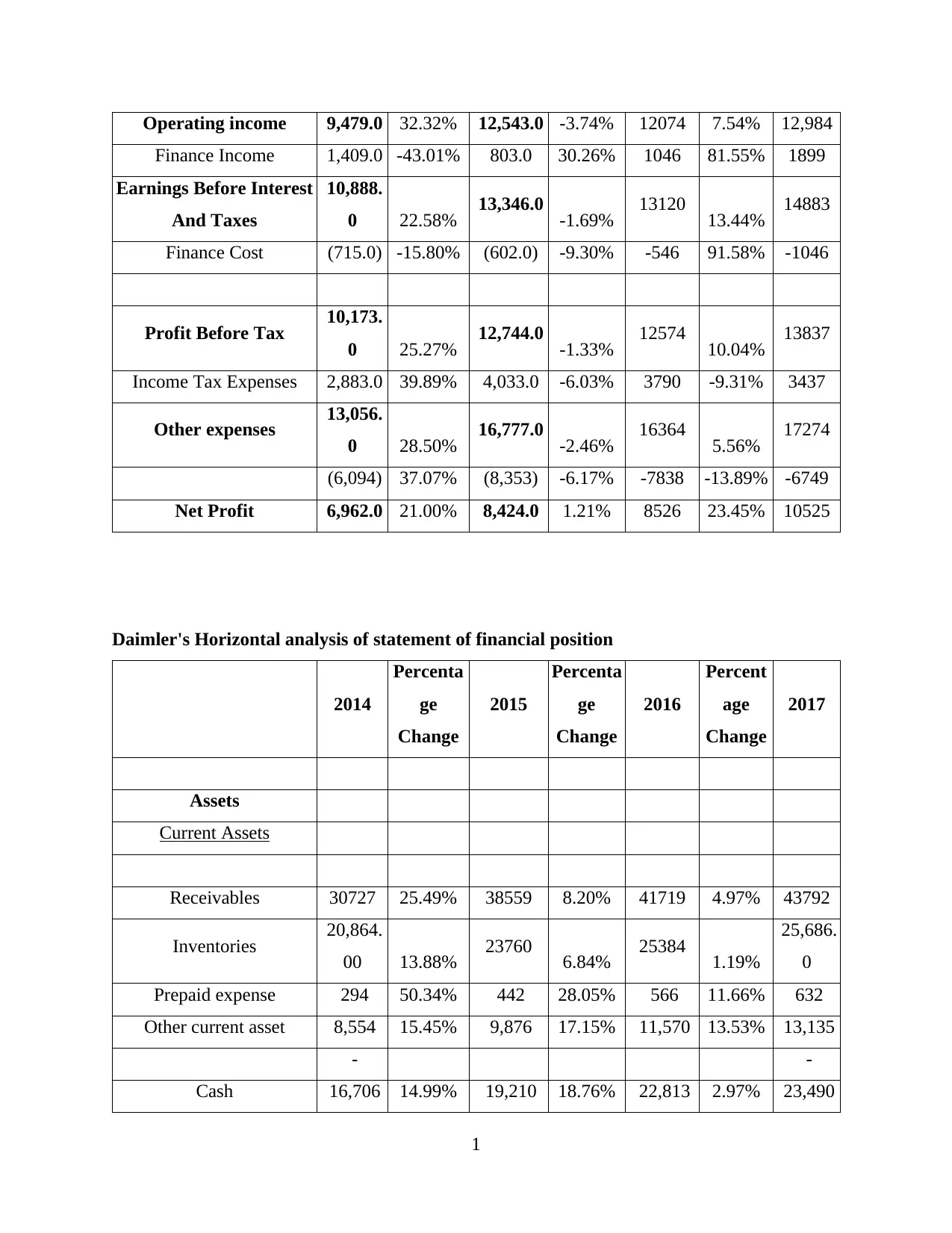

Financial statement of Daimler

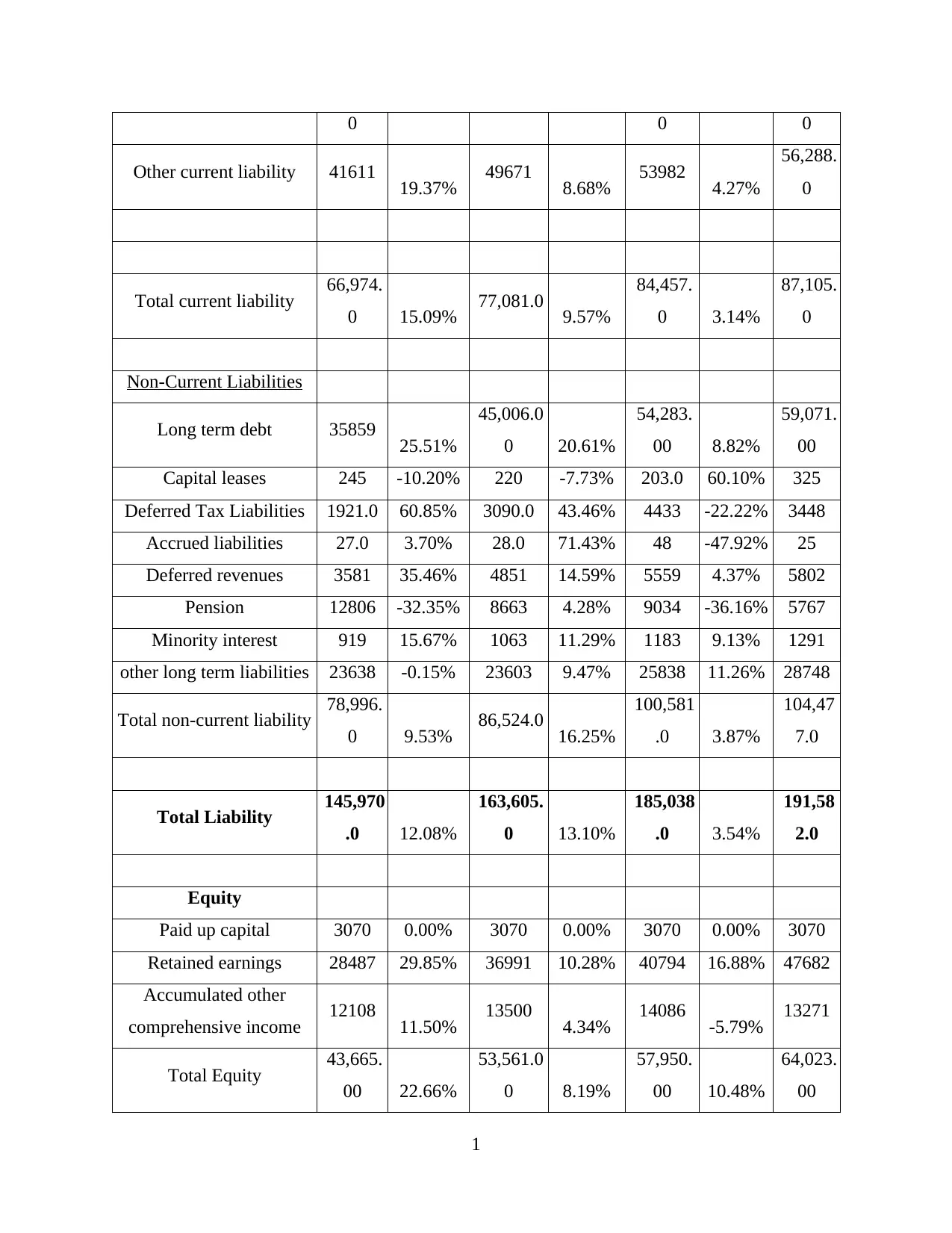

Interpretation

The percentage change in current asset for 2015 was 19.06%, this is a huge change and

this was due increment in prepaid expenses which increased by 50%, for net two year the

increment was 11.11% and 4.59% only. Th change in current liabilities was 15.09% for 2015

and for 2017 it was 3.14. The major change in 2015 was due to increase in other current

liabilities. For year 2015 total asset and liability percentage change was 14.52% and 12.08%

repetitively.

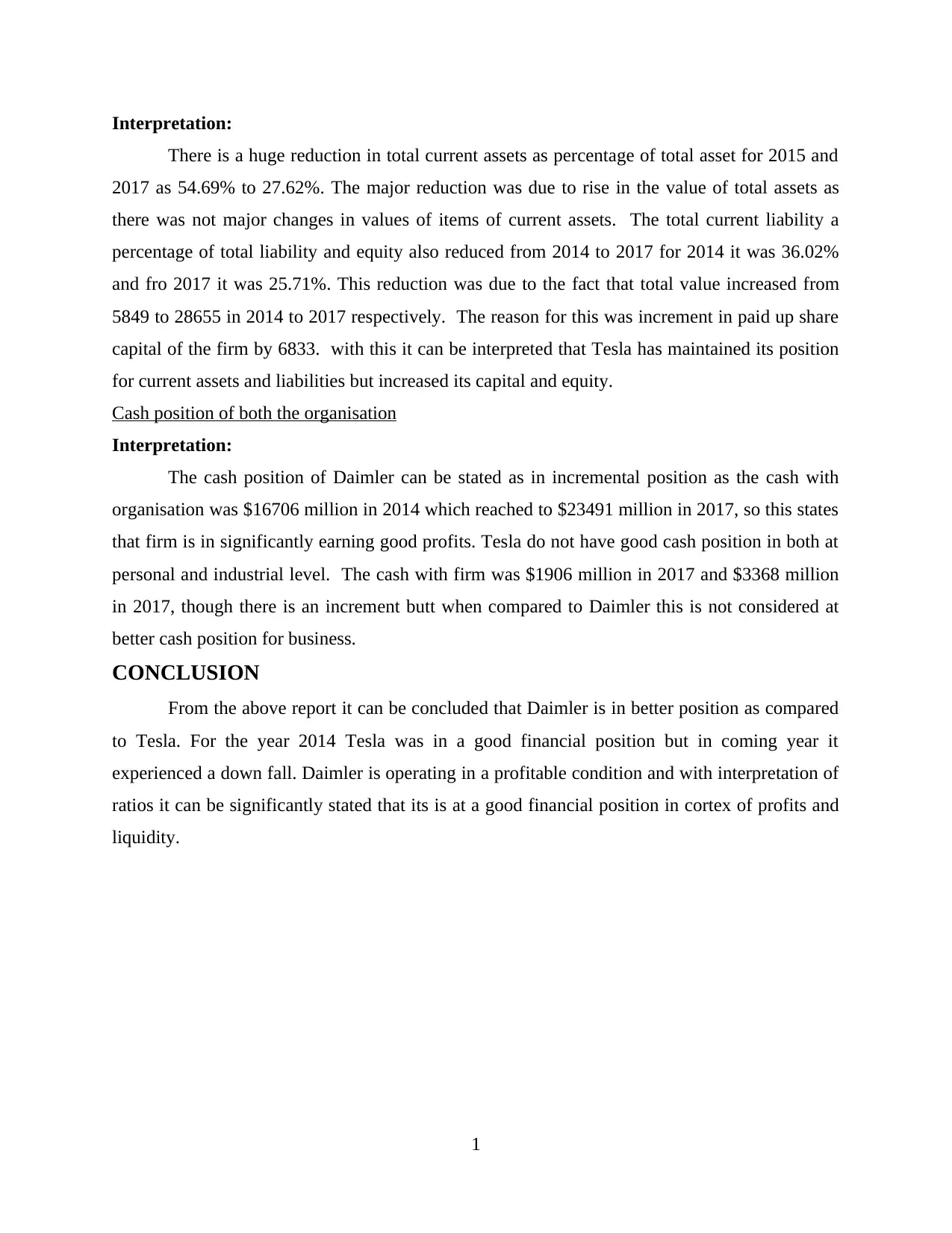

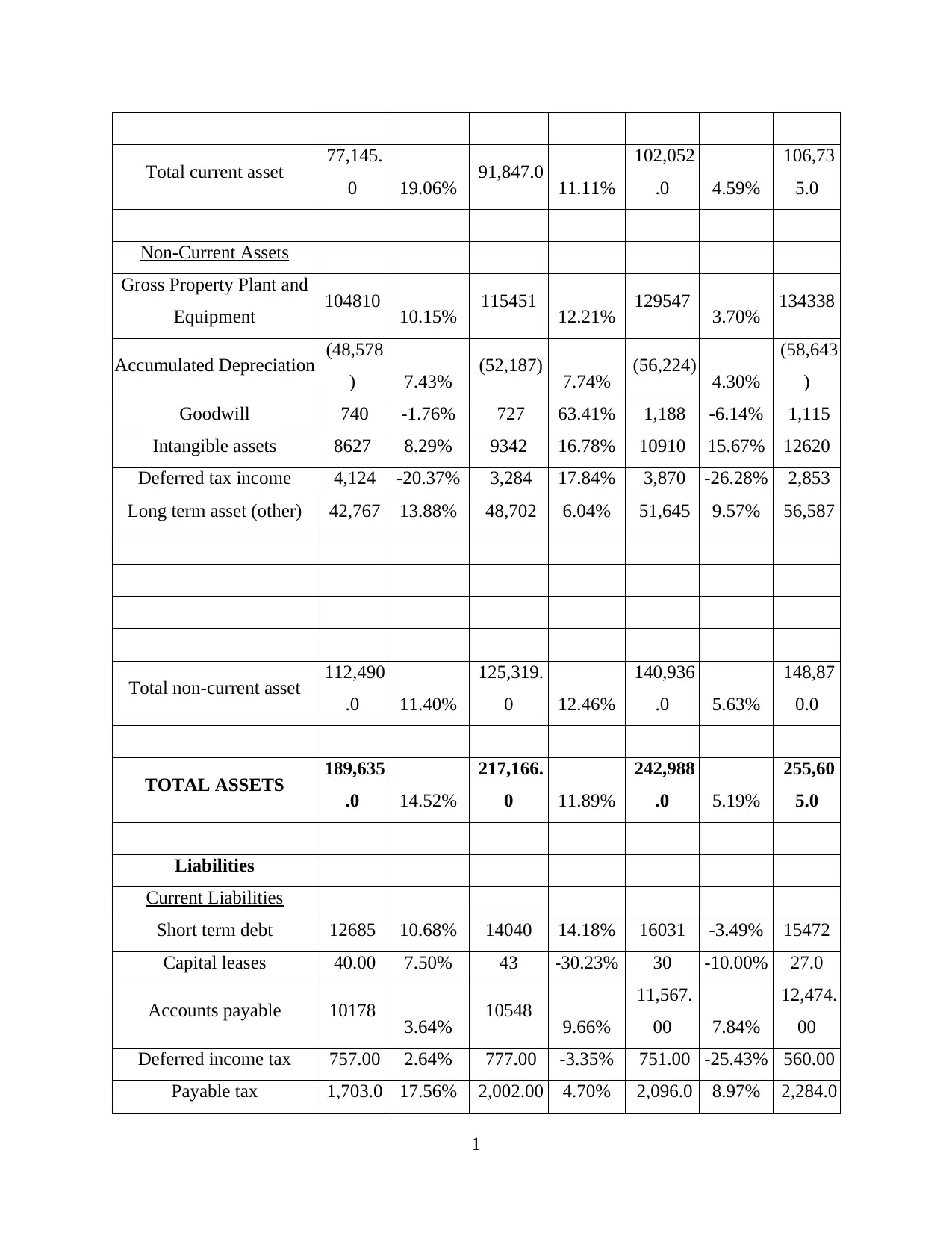

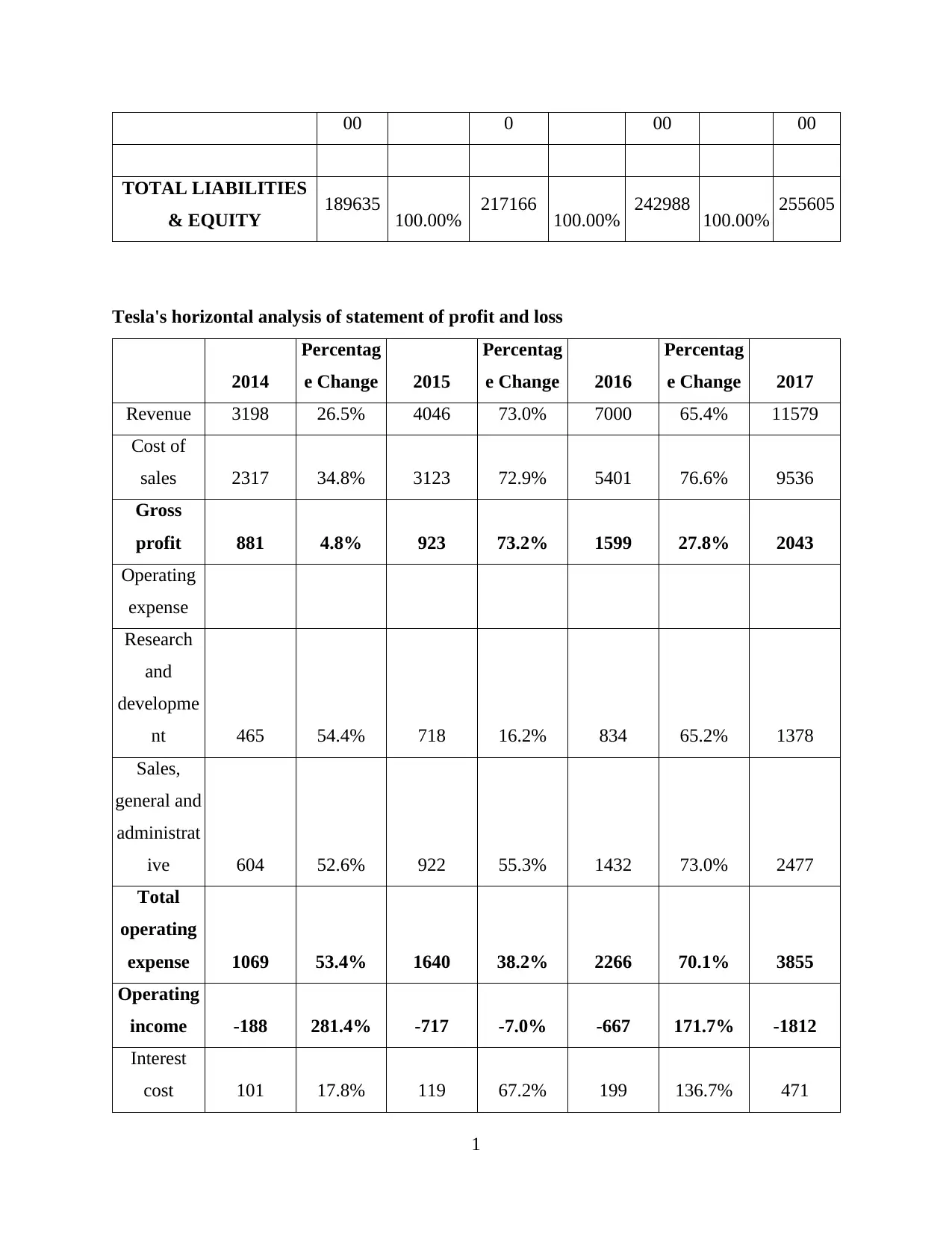

Income statement of Tesla:

Interpretation:

The sales revenue percentage change is huge in Tesla as there was high level of sales

with every changing year. With a hike in sales revenue the cost of good sold also jumped from a

percentage change of 34.8% to 76.6% in 20174 and 20417 respectively the operation, R&D,

sales, general and administrative expenses increment was a reason for this much hike in cost of

goods sold. Net profit percentage change was 202.4% to 190.7% in 2014 and 2017 receptively.

With an increase in sales revenue there is still a falling net profits, the reason being that company

do not have effective control over its administrative ans operating expenses.

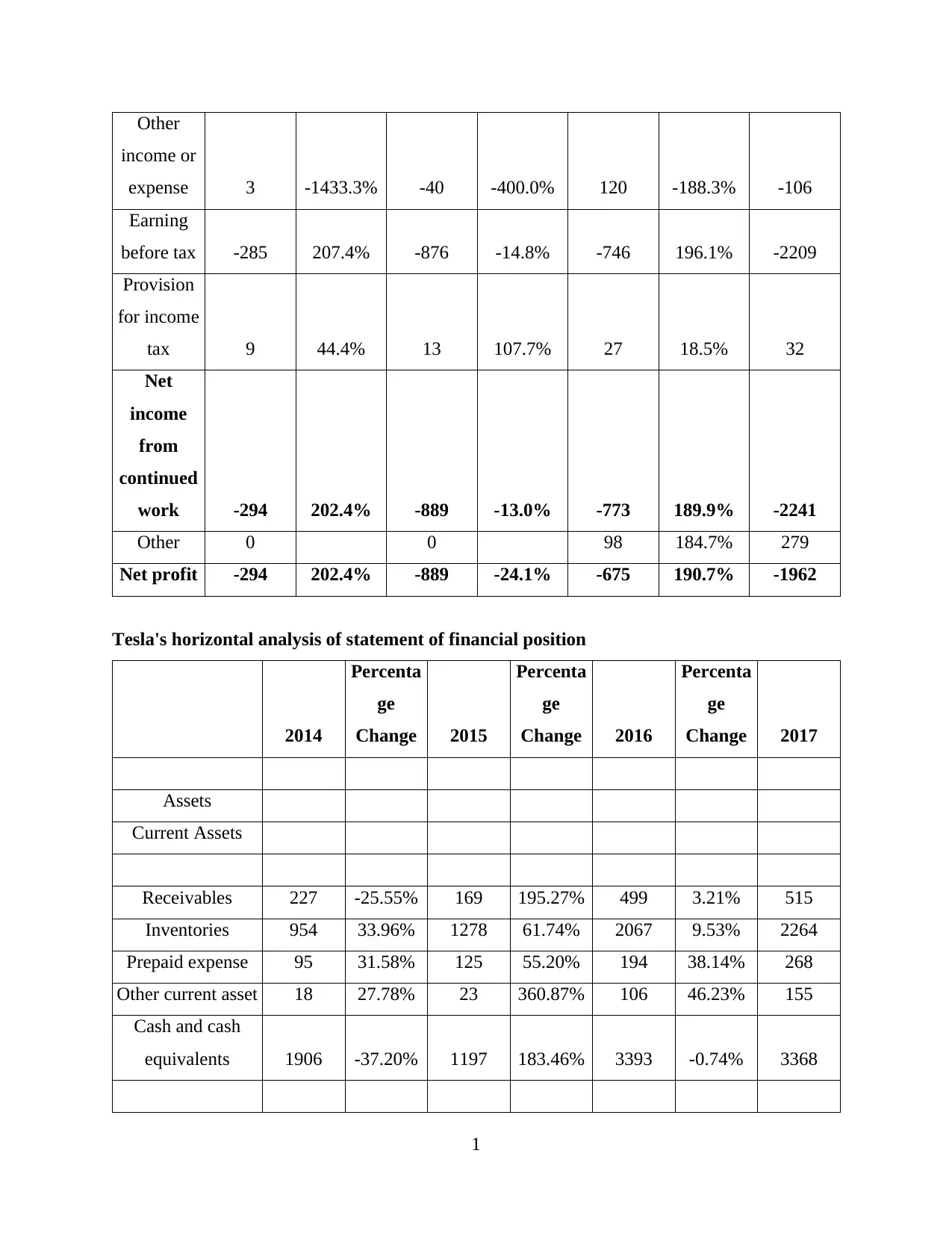

Financial statement of Tesla :

Interpretation:

Total current assets saw a major fluctuation in this 4 years as in 2015 there was reduction

by 12.75% and again in 2016 it took a sum by 124.18%. This was due to increase in cash and

1

The percentage change in sales revenue from 2014 to 2015 was 15.09%. For next two

year it was 2.54% and 7.22%. This change shows the increment is sales and revenue generated

by Daimler over years. The major jump in sales was seen in year 2015, and the lowest was in

2016 with an increment of just 2.54%. The gross profit % changes was 12.852 for 2015 and for

2017 it was 7.41. This fall in percentage change was due to the fact that with increment the sales

revenue cost good sold also increased but with a higher rate this resulted in increase in gross

profit with lesser amount. The net profit was loses in year 2015 though sales revenue and gross

profits were highest in this year. Reason being high level expenditure in other expenses.

Financial statement of Daimler

Interpretation

The percentage change in current asset for 2015 was 19.06%, this is a huge change and

this was due increment in prepaid expenses which increased by 50%, for net two year the

increment was 11.11% and 4.59% only. Th change in current liabilities was 15.09% for 2015

and for 2017 it was 3.14. The major change in 2015 was due to increase in other current

liabilities. For year 2015 total asset and liability percentage change was 14.52% and 12.08%

repetitively.

Income statement of Tesla:

Interpretation:

The sales revenue percentage change is huge in Tesla as there was high level of sales

with every changing year. With a hike in sales revenue the cost of good sold also jumped from a

percentage change of 34.8% to 76.6% in 20174 and 20417 respectively the operation, R&D,

sales, general and administrative expenses increment was a reason for this much hike in cost of

goods sold. Net profit percentage change was 202.4% to 190.7% in 2014 and 2017 receptively.

With an increase in sales revenue there is still a falling net profits, the reason being that company

do not have effective control over its administrative ans operating expenses.

Financial statement of Tesla :

Interpretation:

Total current assets saw a major fluctuation in this 4 years as in 2015 there was reduction

by 12.75% and again in 2016 it took a sum by 124.18%. This was due to increase in cash and

1

cash equivalents. The total asset percentage change decreased from 383.32% in 2014 to 26.44%

in 2017, this was due to decrease in total non current asset from 99.96% to 34.63%.

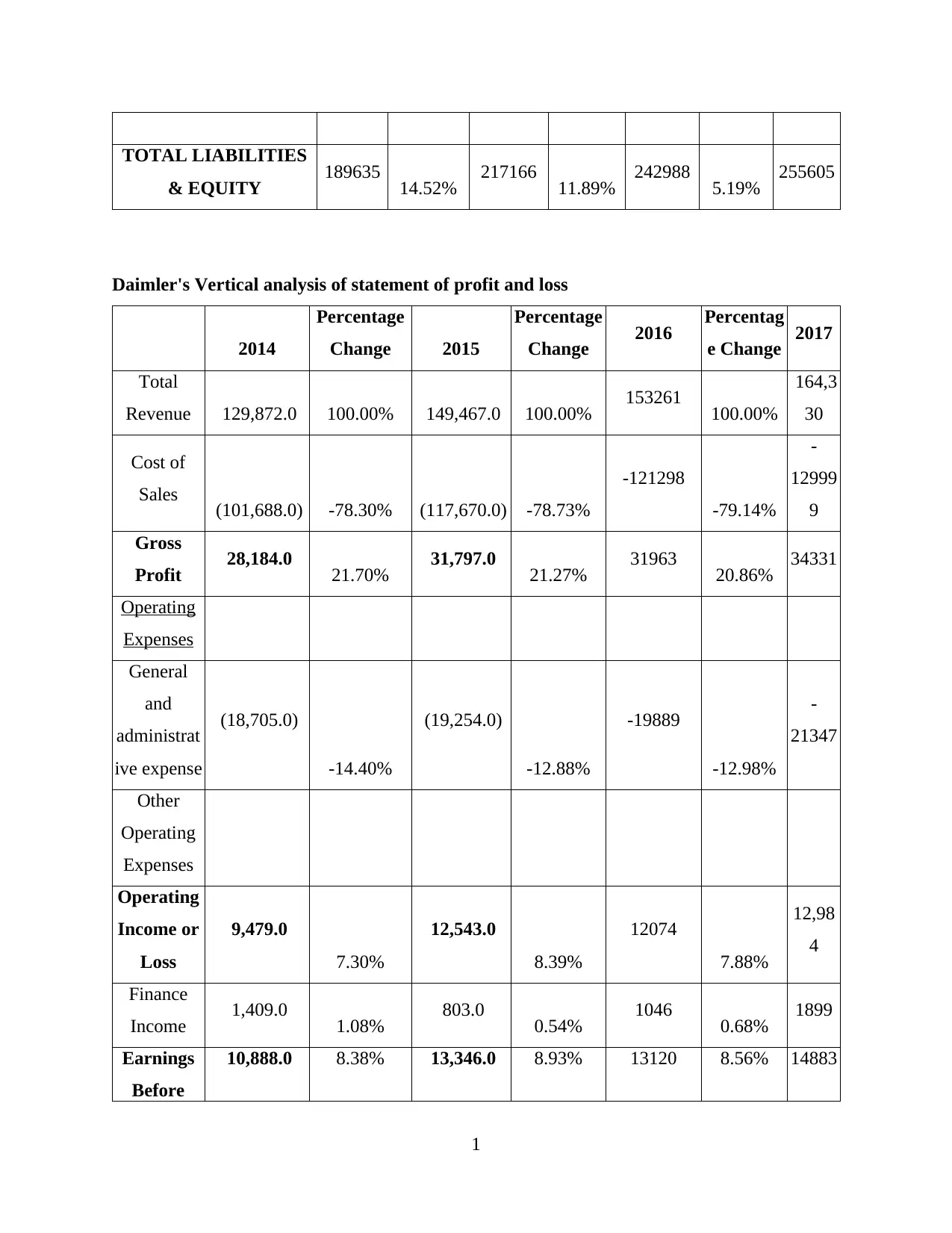

Vertical analysis

Income statement of Daimler

Interpretation:

The cost of good sold for year 2014 and 2015 was almost same and maintained at a level

of near 78% of the sales revenue. For 20165 the is an increment in 1 % in cogs this can be due

increase in price of direct material or labor rates. The company had maintained a control over its

operating expense have decreased over years. The expanses of taxes also have reduces over a

period of 4 years. This reflects the fact that company have gained a control over its operating and

administrative expanses and this resulted in increment of the profits of the firm over years.

Financial statement of Daimler

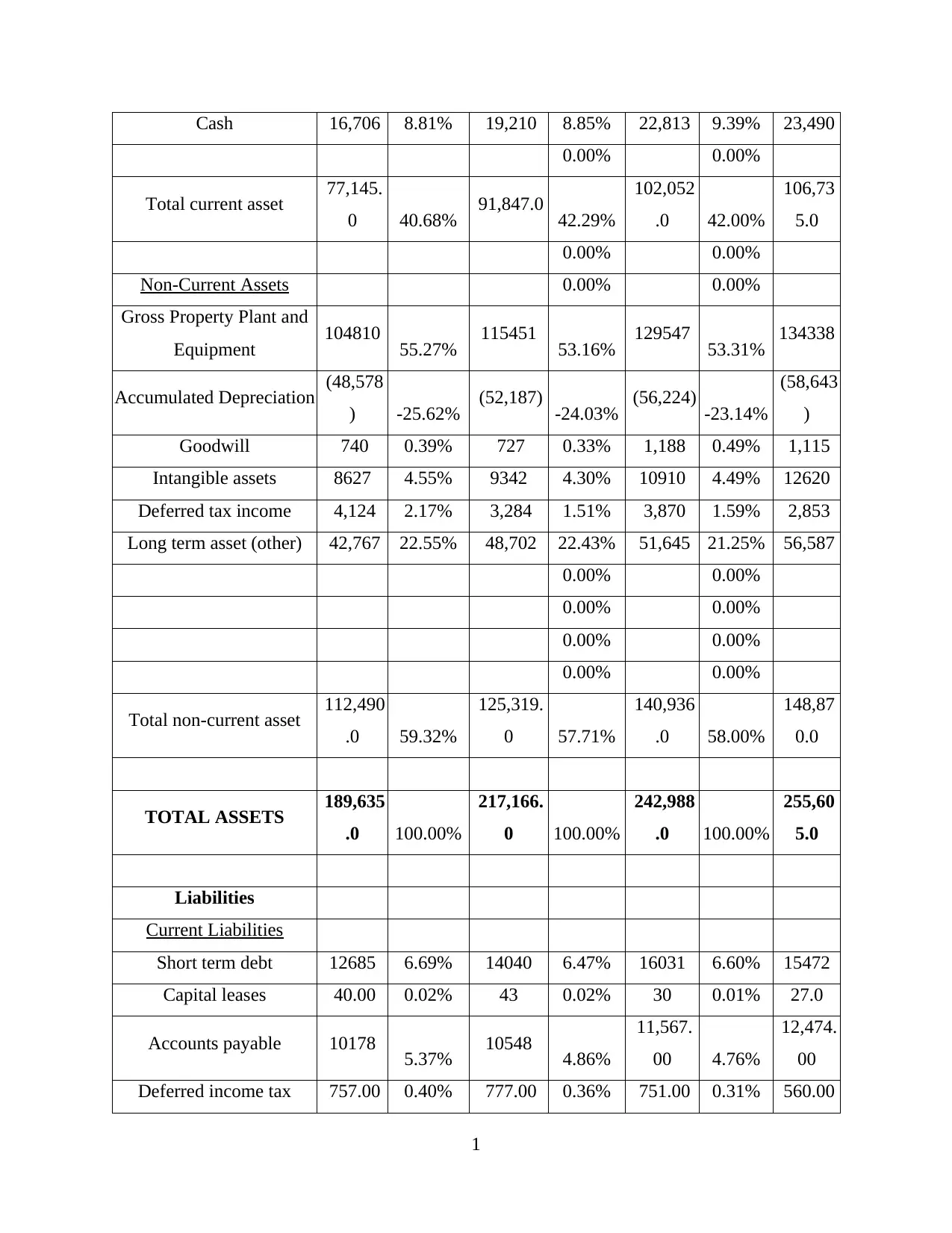

Interpretation:

Under vertical analysis all item do assets side are calculated as a % of total asset. In 2015

the current assets were 40.68% of the total assets and in year 2017 it was 42%. There was an

increment of 2|% and this was due the fact that total assets increased by almost 60000 and total

current asset increased by 30000 approx. this resulted in increment in percentage of current asset

over total asset of Daimler. Current liability as % of total was 35.32% in 2014 and for 2017 it

was 34.76%, here also an increment of 2% can be observed. The non current liability percentage

did not see a major change as for 2014 and 2017 it was 41.66% and 41.39% respectively. There

was nothing much change in equity percentage as to total liability and equity. For 2014 it was

23.03% and for 2017 it was 23.85%. A slight increment is due to increase in retained earnings.

Income statement of Tesla

Interpretation:

The cost of good sole as a percentage of total sales was 72.5% in 2015 which increased to

77.2% in 2017 and this decreased the percentage of gross profit to sales from 27.55 in 2014 to

22.8% in 2017. The reason for increment in cost of goods sold over years was rise in both Sales,

general and administrative and R&D cost. The net profit to percentage of sales was in negative

for all years. The reason behind this is that operating expenses are always higher than the gross

profits so net profits always negative.

Financial statement of Tesla

1

in 2017, this was due to decrease in total non current asset from 99.96% to 34.63%.

Vertical analysis

Income statement of Daimler

Interpretation:

The cost of good sold for year 2014 and 2015 was almost same and maintained at a level

of near 78% of the sales revenue. For 20165 the is an increment in 1 % in cogs this can be due

increase in price of direct material or labor rates. The company had maintained a control over its

operating expense have decreased over years. The expanses of taxes also have reduces over a

period of 4 years. This reflects the fact that company have gained a control over its operating and

administrative expanses and this resulted in increment of the profits of the firm over years.

Financial statement of Daimler

Interpretation:

Under vertical analysis all item do assets side are calculated as a % of total asset. In 2015

the current assets were 40.68% of the total assets and in year 2017 it was 42%. There was an

increment of 2|% and this was due the fact that total assets increased by almost 60000 and total

current asset increased by 30000 approx. this resulted in increment in percentage of current asset

over total asset of Daimler. Current liability as % of total was 35.32% in 2014 and for 2017 it

was 34.76%, here also an increment of 2% can be observed. The non current liability percentage

did not see a major change as for 2014 and 2017 it was 41.66% and 41.39% respectively. There

was nothing much change in equity percentage as to total liability and equity. For 2014 it was

23.03% and for 2017 it was 23.85%. A slight increment is due to increase in retained earnings.

Income statement of Tesla

Interpretation:

The cost of good sole as a percentage of total sales was 72.5% in 2015 which increased to

77.2% in 2017 and this decreased the percentage of gross profit to sales from 27.55 in 2014 to

22.8% in 2017. The reason for increment in cost of goods sold over years was rise in both Sales,

general and administrative and R&D cost. The net profit to percentage of sales was in negative

for all years. The reason behind this is that operating expenses are always higher than the gross

profits so net profits always negative.

Financial statement of Tesla

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

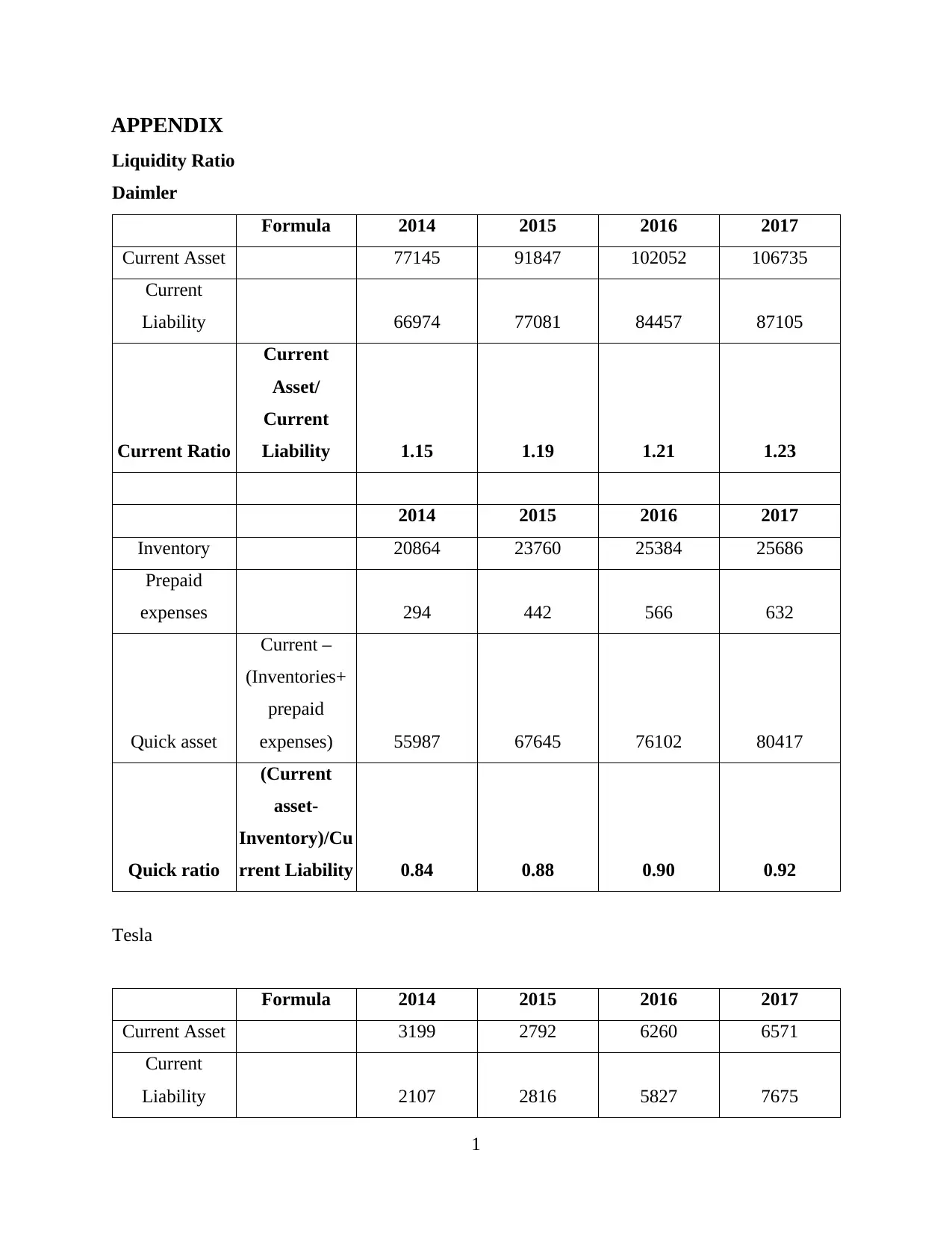

Interpretation:

There is a huge reduction in total current assets as percentage of total asset for 2015 and

2017 as 54.69% to 27.62%. The major reduction was due to rise in the value of total assets as

there was not major changes in values of items of current assets. The total current liability a

percentage of total liability and equity also reduced from 2014 to 2017 for 2014 it was 36.02%

and fro 2017 it was 25.71%. This reduction was due to the fact that total value increased from

5849 to 28655 in 2014 to 2017 respectively. The reason for this was increment in paid up share

capital of the firm by 6833. with this it can be interpreted that Tesla has maintained its position

for current assets and liabilities but increased its capital and equity.

Cash position of both the organisation

Interpretation:

The cash position of Daimler can be stated as in incremental position as the cash with

organisation was $16706 million in 2014 which reached to $23491 million in 2017, so this states

that firm is in significantly earning good profits. Tesla do not have good cash position in both at

personal and industrial level. The cash with firm was $1906 million in 2017 and $3368 million

in 2017, though there is an increment butt when compared to Daimler this is not considered at

better cash position for business.

CONCLUSION

From the above report it can be concluded that Daimler is in better position as compared

to Tesla. For the year 2014 Tesla was in a good financial position but in coming year it

experienced a down fall. Daimler is operating in a profitable condition and with interpretation of

ratios it can be significantly stated that its is at a good financial position in cortex of profits and

liquidity.

1

There is a huge reduction in total current assets as percentage of total asset for 2015 and

2017 as 54.69% to 27.62%. The major reduction was due to rise in the value of total assets as

there was not major changes in values of items of current assets. The total current liability a

percentage of total liability and equity also reduced from 2014 to 2017 for 2014 it was 36.02%

and fro 2017 it was 25.71%. This reduction was due to the fact that total value increased from

5849 to 28655 in 2014 to 2017 respectively. The reason for this was increment in paid up share

capital of the firm by 6833. with this it can be interpreted that Tesla has maintained its position

for current assets and liabilities but increased its capital and equity.

Cash position of both the organisation

Interpretation:

The cash position of Daimler can be stated as in incremental position as the cash with

organisation was $16706 million in 2014 which reached to $23491 million in 2017, so this states

that firm is in significantly earning good profits. Tesla do not have good cash position in both at

personal and industrial level. The cash with firm was $1906 million in 2017 and $3368 million

in 2017, though there is an increment butt when compared to Daimler this is not considered at

better cash position for business.

CONCLUSION

From the above report it can be concluded that Daimler is in better position as compared

to Tesla. For the year 2014 Tesla was in a good financial position but in coming year it

experienced a down fall. Daimler is operating in a profitable condition and with interpretation of

ratios it can be significantly stated that its is at a good financial position in cortex of profits and

liquidity.

1

REFERENCES

ONLINE

Annual report of Daimler. 2017. [Online]. Available through

<https://www.daimler.com/downloads/en/>.

Annual report of Tesla. 2017. [Online]. Available through <http://ir.tesla.com/financial-

information/quarterly-results>.

1

ONLINE

Annual report of Daimler. 2017. [Online]. Available through

<https://www.daimler.com/downloads/en/>.

Annual report of Tesla. 2017. [Online]. Available through <http://ir.tesla.com/financial-

information/quarterly-results>.

1

APPENDIX

Liquidity Ratio

Daimler

Formula 2014 2015 2016 2017

Current Asset 77145 91847 102052 106735

Current

Liability 66974 77081 84457 87105

Current Ratio

Current

Asset/

Current

Liability 1.15 1.19 1.21 1.23

2014 2015 2016 2017

Inventory 20864 23760 25384 25686

Prepaid

expenses 294 442 566 632

Quick asset

Current –

(Inventories+

prepaid

expenses) 55987 67645 76102 80417

Quick ratio

(Current

asset-

Inventory)/Cu

rrent Liability 0.84 0.88 0.90 0.92

Tesla

Formula 2014 2015 2016 2017

Current Asset 3199 2792 6260 6571

Current

Liability 2107 2816 5827 7675

1

Liquidity Ratio

Daimler

Formula 2014 2015 2016 2017

Current Asset 77145 91847 102052 106735

Current

Liability 66974 77081 84457 87105

Current Ratio

Current

Asset/

Current

Liability 1.15 1.19 1.21 1.23

2014 2015 2016 2017

Inventory 20864 23760 25384 25686

Prepaid

expenses 294 442 566 632

Quick asset

Current –

(Inventories+

prepaid

expenses) 55987 67645 76102 80417

Quick ratio

(Current

asset-

Inventory)/Cu

rrent Liability 0.84 0.88 0.90 0.92

Tesla

Formula 2014 2015 2016 2017

Current Asset 3199 2792 6260 6571

Current

Liability 2107 2816 5827 7675

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Current Ratio

Current

Asset/

Current

Liability 1.52 0.99 1.07 0.86

2014 2015 2016 2017

Inventory 954 1278 2067 2264

Prepaid

expenses 95 125 194 268

Quick asset

Current –

(Inventories+

prepaid

expenses) 2150 1389 3999 4039

Quick ratio

(Current

asset-

Inventory)/Cu

rrent Liability 1.02 0.49 0.69 0.53

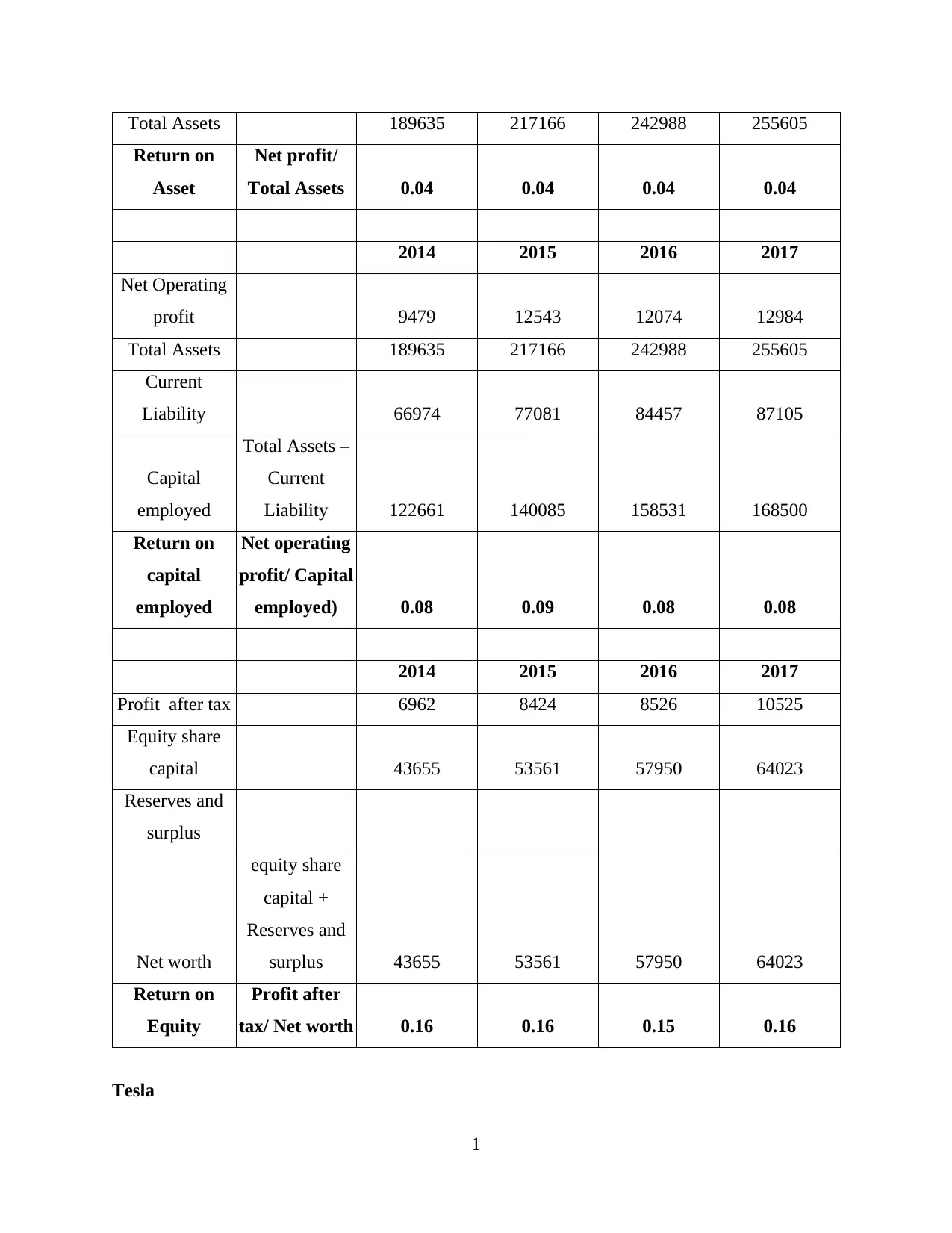

Profitability Ratio

Daimler

Formula 2014 2015 2016 2017

Gross Profit 28184 31797 31963 34331

Sales revenue 129872 149467 153261 164330

Gross profit

ratio

(Gross Profit/

Sales)*100 21.70 21.27 20.86 20.89

2014 2015 2016 2017

Net Profit 6962 8424 8526 10525

1

Current

Asset/

Current

Liability 1.52 0.99 1.07 0.86

2014 2015 2016 2017

Inventory 954 1278 2067 2264

Prepaid

expenses 95 125 194 268

Quick asset

Current –

(Inventories+

prepaid

expenses) 2150 1389 3999 4039

Quick ratio

(Current

asset-

Inventory)/Cu

rrent Liability 1.02 0.49 0.69 0.53

Profitability Ratio

Daimler

Formula 2014 2015 2016 2017

Gross Profit 28184 31797 31963 34331

Sales revenue 129872 149467 153261 164330

Gross profit

ratio

(Gross Profit/

Sales)*100 21.70 21.27 20.86 20.89

2014 2015 2016 2017

Net Profit 6962 8424 8526 10525

1

Total Assets 189635 217166 242988 255605

Return on

Asset

Net profit/

Total Assets 0.04 0.04 0.04 0.04

2014 2015 2016 2017

Net Operating

profit 9479 12543 12074 12984

Total Assets 189635 217166 242988 255605

Current

Liability 66974 77081 84457 87105

Capital

employed

Total Assets –

Current

Liability 122661 140085 158531 168500

Return on

capital

employed

Net operating

profit/ Capital

employed) 0.08 0.09 0.08 0.08

2014 2015 2016 2017

Profit after tax 6962 8424 8526 10525

Equity share

capital 43655 53561 57950 64023

Reserves and

surplus

Net worth

equity share

capital +

Reserves and

surplus 43655 53561 57950 64023

Return on

Equity

Profit after

tax/ Net worth 0.16 0.16 0.15 0.16

Tesla

1

Return on

Asset

Net profit/

Total Assets 0.04 0.04 0.04 0.04

2014 2015 2016 2017

Net Operating

profit 9479 12543 12074 12984

Total Assets 189635 217166 242988 255605

Current

Liability 66974 77081 84457 87105

Capital

employed

Total Assets –

Current

Liability 122661 140085 158531 168500

Return on

capital

employed

Net operating

profit/ Capital

employed) 0.08 0.09 0.08 0.08

2014 2015 2016 2017

Profit after tax 6962 8424 8526 10525

Equity share

capital 43655 53561 57950 64023

Reserves and

surplus

Net worth

equity share

capital +

Reserves and

surplus 43655 53561 57950 64023

Return on

Equity

Profit after

tax/ Net worth 0.16 0.16 0.15 0.16

Tesla

1

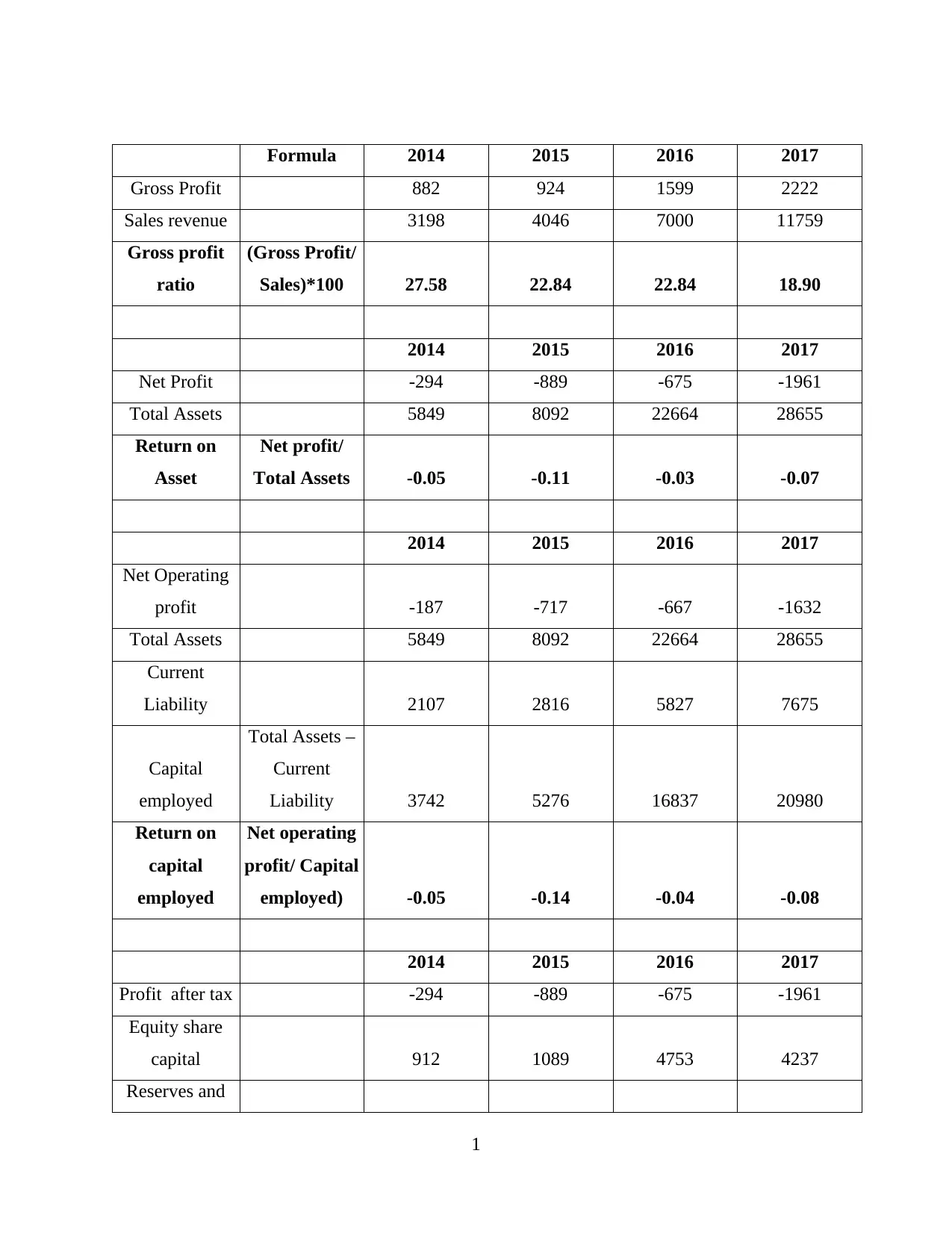

Formula 2014 2015 2016 2017

Gross Profit 882 924 1599 2222

Sales revenue 3198 4046 7000 11759

Gross profit

ratio

(Gross Profit/

Sales)*100 27.58 22.84 22.84 18.90

2014 2015 2016 2017

Net Profit -294 -889 -675 -1961

Total Assets 5849 8092 22664 28655

Return on

Asset

Net profit/

Total Assets -0.05 -0.11 -0.03 -0.07

2014 2015 2016 2017

Net Operating

profit -187 -717 -667 -1632

Total Assets 5849 8092 22664 28655

Current

Liability 2107 2816 5827 7675

Capital

employed

Total Assets –

Current

Liability 3742 5276 16837 20980

Return on

capital

employed

Net operating

profit/ Capital

employed) -0.05 -0.14 -0.04 -0.08

2014 2015 2016 2017

Profit after tax -294 -889 -675 -1961

Equity share

capital 912 1089 4753 4237

Reserves and

1

Gross Profit 882 924 1599 2222

Sales revenue 3198 4046 7000 11759

Gross profit

ratio

(Gross Profit/

Sales)*100 27.58 22.84 22.84 18.90

2014 2015 2016 2017

Net Profit -294 -889 -675 -1961

Total Assets 5849 8092 22664 28655

Return on

Asset

Net profit/

Total Assets -0.05 -0.11 -0.03 -0.07

2014 2015 2016 2017

Net Operating

profit -187 -717 -667 -1632

Total Assets 5849 8092 22664 28655

Current

Liability 2107 2816 5827 7675

Capital

employed

Total Assets –

Current

Liability 3742 5276 16837 20980

Return on

capital

employed

Net operating

profit/ Capital

employed) -0.05 -0.14 -0.04 -0.08

2014 2015 2016 2017

Profit after tax -294 -889 -675 -1961

Equity share

capital 912 1089 4753 4237

Reserves and

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

surplus

Net worth

equity share

capital +

Reserves and

surplus 912 1089 4753 4237

Return on

Equity

Profit after

tax/ Net worth -0.32 -0.82 -0.14 -0.46

Efficiency Ratio

Daimler

Formula 2014 2015 2016 2017

Net sales 129872 149467 153261 164330

Average total

asset 179076.5 203400.5 230077 249296.5

Asset

Turnover

Ratio

Net sales/

Average total

asset 0.73 0.73 0.67 0.66

2014 2015 2016 2017

Cost of goods

sold 101688 117670 121298 129999

Average

Inventory 19106.5 22312 24572 25535

Inventory

turnover ratio

Cost of goods

sold/ Average

inventory 5.32 5.27 4.94 5.09

2014 2015 2016 2017

Closing stock 20864 23760 25384 25686

Cost of goods 101688 117670 121298 129999

1

Net worth

equity share

capital +

Reserves and

surplus 912 1089 4753 4237

Return on

Equity

Profit after

tax/ Net worth -0.32 -0.82 -0.14 -0.46

Efficiency Ratio

Daimler

Formula 2014 2015 2016 2017

Net sales 129872 149467 153261 164330

Average total

asset 179076.5 203400.5 230077 249296.5

Asset

Turnover

Ratio

Net sales/

Average total

asset 0.73 0.73 0.67 0.66

2014 2015 2016 2017

Cost of goods

sold 101688 117670 121298 129999

Average

Inventory 19106.5 22312 24572 25535

Inventory

turnover ratio

Cost of goods

sold/ Average

inventory 5.32 5.27 4.94 5.09

2014 2015 2016 2017

Closing stock 20864 23760 25384 25686

Cost of goods 101688 117670 121298 129999

1

sold

Days' Sales in

inventory

(Closing

stock/ Cost of

goods

sold)*365 74.89 73.70 76.38 72.12

Tesla

Formula 2014 2015 2016 2017

Net sales 3198 4046 7000 11759

Average total

asset 4133 6970.5 15378 25659.5

Asset

Turnover

Ratio

Net sales/

Average total

asset 0.77 0.58 0.46 0.46

2014 2015 2016 2017

Cost of goods

sold 2317 3123 5401 9536

Average

Inventory 647 1116 1672.5 2165.5

Inventory

turnover ratio

Cost of goods

sold/ Average

inventory 3.58 2.8 3.23 4.4

2014 2015 2016 2017

Closing stock 954 1278 2067 2264

Cost of goods

sold 2317 3123 5401 9536

Days' Sales in

inventory

(Closing

stock/ Cost of

150.28 149.37 139.69 86.66

1

Days' Sales in

inventory

(Closing

stock/ Cost of

goods

sold)*365 74.89 73.70 76.38 72.12

Tesla

Formula 2014 2015 2016 2017

Net sales 3198 4046 7000 11759

Average total

asset 4133 6970.5 15378 25659.5

Asset

Turnover

Ratio

Net sales/

Average total

asset 0.77 0.58 0.46 0.46

2014 2015 2016 2017

Cost of goods

sold 2317 3123 5401 9536

Average

Inventory 647 1116 1672.5 2165.5

Inventory

turnover ratio

Cost of goods

sold/ Average

inventory 3.58 2.8 3.23 4.4

2014 2015 2016 2017

Closing stock 954 1278 2067 2264

Cost of goods

sold 2317 3123 5401 9536

Days' Sales in

inventory

(Closing

stock/ Cost of

150.28 149.37 139.69 86.66

1

goods

sold)*365

Leverage Ratio

Daimler

Formula 2014 2015 2016 2017

Total liabilities 145970 163605 185038 191582

Totals Assets 189635 217166 242988 255605

Debt ratio

total liabilities/

Total asset 0.77 0.75 0.76 0.75

2014 2015 2016 2017

Total equity 43655 53561 57950 64023

Total Assets 189635 217166 242988 255605

Equity ratio

Total Equity/

Total Assets 0.23 0.25 0.24 0.25

2014 2015 2016 2017

Total liabilities 145970 163605 185038 191582

Total equity 43655 53561 57950 64023

Debt equity

ratio

Total

Liabilities/

Total Equity 3.34 3.05 3.19 2.99

Tesla

Formula 2014 2015 2016 2017

Total liabilities 4938 7004 17911 24418

Totals Assets 5849 8092 22664 28655

Debt ratio total liabilities/ 0.84 0.87 0.79 0.85

1

sold)*365

Leverage Ratio

Daimler

Formula 2014 2015 2016 2017

Total liabilities 145970 163605 185038 191582

Totals Assets 189635 217166 242988 255605

Debt ratio

total liabilities/

Total asset 0.77 0.75 0.76 0.75

2014 2015 2016 2017

Total equity 43655 53561 57950 64023

Total Assets 189635 217166 242988 255605

Equity ratio

Total Equity/

Total Assets 0.23 0.25 0.24 0.25

2014 2015 2016 2017

Total liabilities 145970 163605 185038 191582

Total equity 43655 53561 57950 64023

Debt equity

ratio

Total

Liabilities/

Total Equity 3.34 3.05 3.19 2.99

Tesla

Formula 2014 2015 2016 2017

Total liabilities 4938 7004 17911 24418

Totals Assets 5849 8092 22664 28655

Debt ratio total liabilities/ 0.84 0.87 0.79 0.85

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Total asset

2014 2015 2016 2017

Total equity 912 1089 4753 4237

Total Assets 5849 8092 22664 28655

Equity ratio

Total Equity/

Total Assets 0.16 0.13 0.21 0.15

2014 2015 2016 2017

Total liabilities 4938 7004 17911 24418

Total equity 912 1089 4753 4237

Debt equity

ratio

Total

Liabilities/

Total Equity 5.41 6.43 3.77 5.76

Daimler's Horizontal analysis of statement of profit and loss

2014

Percenta

ge

Change

2015

Percenta

ge

Change

2016

Percent

age

Change

2017

Total Revenue 129,872

.0 15.09%

149,467.

0 2.54% 153261 7.22%

164,33

0

Cost of Sales (101,68

8.0) 15.72%

(117,670

.0) 3.08% -121298 7.17% -129999

Gross Profit 28,184.

0 12.82% 31,797.0 31963 7.41% 34331

Operating Expenses

General and

administrative expense

(18,705

.0) 2.94%

(19,254.

0) 3.30% -19889 7.33% -21347

Other Operating Expenses

1

2014 2015 2016 2017

Total equity 912 1089 4753 4237

Total Assets 5849 8092 22664 28655

Equity ratio

Total Equity/

Total Assets 0.16 0.13 0.21 0.15

2014 2015 2016 2017

Total liabilities 4938 7004 17911 24418

Total equity 912 1089 4753 4237

Debt equity

ratio

Total

Liabilities/

Total Equity 5.41 6.43 3.77 5.76

Daimler's Horizontal analysis of statement of profit and loss

2014

Percenta

ge

Change

2015

Percenta

ge

Change

2016

Percent

age

Change

2017

Total Revenue 129,872

.0 15.09%

149,467.

0 2.54% 153261 7.22%

164,33

0

Cost of Sales (101,68

8.0) 15.72%

(117,670

.0) 3.08% -121298 7.17% -129999

Gross Profit 28,184.

0 12.82% 31,797.0 31963 7.41% 34331

Operating Expenses

General and

administrative expense

(18,705

.0) 2.94%

(19,254.

0) 3.30% -19889 7.33% -21347

Other Operating Expenses

1

Operating income 9,479.0 32.32% 12,543.0 -3.74% 12074 7.54% 12,984

Finance Income 1,409.0 -43.01% 803.0 30.26% 1046 81.55% 1899

Earnings Before Interest

And Taxes

10,888.

0 22.58% 13,346.0 -1.69% 13120 13.44% 14883

Finance Cost (715.0) -15.80% (602.0) -9.30% -546 91.58% -1046

Profit Before Tax 10,173.

0 25.27% 12,744.0 -1.33% 12574 10.04% 13837

Income Tax Expenses 2,883.0 39.89% 4,033.0 -6.03% 3790 -9.31% 3437

Other expenses 13,056.

0 28.50% 16,777.0 -2.46% 16364 5.56% 17274

(6,094) 37.07% (8,353) -6.17% -7838 -13.89% -6749

Net Profit 6,962.0 21.00% 8,424.0 1.21% 8526 23.45% 10525

Daimler's Horizontal analysis of statement of financial position

2014

Percenta

ge

Change

2015

Percenta

ge

Change

2016

Percent

age

Change

2017

Assets

Current Assets

Receivables 30727 25.49% 38559 8.20% 41719 4.97% 43792

Inventories 20,864.

00 13.88% 23760 6.84% 25384 1.19%

25,686.

0

Prepaid expense 294 50.34% 442 28.05% 566 11.66% 632

Other current asset 8,554 15.45% 9,876 17.15% 11,570 13.53% 13,135

- -

Cash 16,706 14.99% 19,210 18.76% 22,813 2.97% 23,490

1

Finance Income 1,409.0 -43.01% 803.0 30.26% 1046 81.55% 1899

Earnings Before Interest

And Taxes

10,888.

0 22.58% 13,346.0 -1.69% 13120 13.44% 14883

Finance Cost (715.0) -15.80% (602.0) -9.30% -546 91.58% -1046

Profit Before Tax 10,173.

0 25.27% 12,744.0 -1.33% 12574 10.04% 13837

Income Tax Expenses 2,883.0 39.89% 4,033.0 -6.03% 3790 -9.31% 3437

Other expenses 13,056.

0 28.50% 16,777.0 -2.46% 16364 5.56% 17274

(6,094) 37.07% (8,353) -6.17% -7838 -13.89% -6749

Net Profit 6,962.0 21.00% 8,424.0 1.21% 8526 23.45% 10525

Daimler's Horizontal analysis of statement of financial position

2014

Percenta

ge

Change

2015

Percenta

ge

Change

2016

Percent

age

Change

2017

Assets

Current Assets

Receivables 30727 25.49% 38559 8.20% 41719 4.97% 43792

Inventories 20,864.

00 13.88% 23760 6.84% 25384 1.19%

25,686.

0

Prepaid expense 294 50.34% 442 28.05% 566 11.66% 632

Other current asset 8,554 15.45% 9,876 17.15% 11,570 13.53% 13,135

- -

Cash 16,706 14.99% 19,210 18.76% 22,813 2.97% 23,490

1

Total current asset 77,145.

0 19.06% 91,847.0 11.11%

102,052

.0 4.59%

106,73

5.0

Non-Current Assets

Gross Property Plant and

Equipment 104810 10.15% 115451 12.21% 129547 3.70% 134338

Accumulated Depreciation (48,578

) 7.43% (52,187) 7.74% (56,224) 4.30%

(58,643

)

Goodwill 740 -1.76% 727 63.41% 1,188 -6.14% 1,115

Intangible assets 8627 8.29% 9342 16.78% 10910 15.67% 12620

Deferred tax income 4,124 -20.37% 3,284 17.84% 3,870 -26.28% 2,853

Long term asset (other) 42,767 13.88% 48,702 6.04% 51,645 9.57% 56,587

Total non-current asset 112,490

.0 11.40%

125,319.

0 12.46%

140,936

.0 5.63%

148,87

0.0

TOTAL ASSETS 189,635

.0 14.52%

217,166.

0 11.89%

242,988

.0 5.19%

255,60

5.0

Liabilities

Current Liabilities

Short term debt 12685 10.68% 14040 14.18% 16031 -3.49% 15472

Capital leases 40.00 7.50% 43 -30.23% 30 -10.00% 27.0

Accounts payable 10178 3.64% 10548 9.66%

11,567.

00 7.84%

12,474.

00

Deferred income tax 757.00 2.64% 777.00 -3.35% 751.00 -25.43% 560.00

Payable tax 1,703.0 17.56% 2,002.00 4.70% 2,096.0 8.97% 2,284.0

1

0 19.06% 91,847.0 11.11%

102,052

.0 4.59%

106,73

5.0

Non-Current Assets

Gross Property Plant and

Equipment 104810 10.15% 115451 12.21% 129547 3.70% 134338

Accumulated Depreciation (48,578

) 7.43% (52,187) 7.74% (56,224) 4.30%

(58,643

)

Goodwill 740 -1.76% 727 63.41% 1,188 -6.14% 1,115

Intangible assets 8627 8.29% 9342 16.78% 10910 15.67% 12620

Deferred tax income 4,124 -20.37% 3,284 17.84% 3,870 -26.28% 2,853

Long term asset (other) 42,767 13.88% 48,702 6.04% 51,645 9.57% 56,587

Total non-current asset 112,490

.0 11.40%

125,319.

0 12.46%

140,936

.0 5.63%

148,87

0.0

TOTAL ASSETS 189,635

.0 14.52%

217,166.

0 11.89%

242,988

.0 5.19%

255,60

5.0

Liabilities

Current Liabilities

Short term debt 12685 10.68% 14040 14.18% 16031 -3.49% 15472

Capital leases 40.00 7.50% 43 -30.23% 30 -10.00% 27.0

Accounts payable 10178 3.64% 10548 9.66%

11,567.

00 7.84%

12,474.

00

Deferred income tax 757.00 2.64% 777.00 -3.35% 751.00 -25.43% 560.00

Payable tax 1,703.0 17.56% 2,002.00 4.70% 2,096.0 8.97% 2,284.0

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

0 0 0

Other current liability 41611 19.37% 49671 8.68% 53982 4.27%

56,288.

0

Total current liability 66,974.

0 15.09% 77,081.0 9.57%

84,457.

0 3.14%

87,105.

0

Non-Current Liabilities

Long term debt 35859 25.51%

45,006.0

0 20.61%

54,283.

00 8.82%

59,071.

00

Capital leases 245 -10.20% 220 -7.73% 203.0 60.10% 325

Deferred Tax Liabilities 1921.0 60.85% 3090.0 43.46% 4433 -22.22% 3448

Accrued liabilities 27.0 3.70% 28.0 71.43% 48 -47.92% 25

Deferred revenues 3581 35.46% 4851 14.59% 5559 4.37% 5802

Pension 12806 -32.35% 8663 4.28% 9034 -36.16% 5767

Minority interest 919 15.67% 1063 11.29% 1183 9.13% 1291

other long term liabilities 23638 -0.15% 23603 9.47% 25838 11.26% 28748

Total non-current liability 78,996.

0 9.53% 86,524.0 16.25%

100,581

.0 3.87%

104,47

7.0

Total Liability 145,970

.0 12.08%

163,605.

0 13.10%

185,038

.0 3.54%

191,58

2.0

Equity

Paid up capital 3070 0.00% 3070 0.00% 3070 0.00% 3070

Retained earnings 28487 29.85% 36991 10.28% 40794 16.88% 47682

Accumulated other

comprehensive income 12108 11.50% 13500 4.34% 14086 -5.79% 13271

Total Equity 43,665.

00 22.66%

53,561.0

0 8.19%

57,950.

00 10.48%

64,023.

00

1

Other current liability 41611 19.37% 49671 8.68% 53982 4.27%

56,288.

0

Total current liability 66,974.

0 15.09% 77,081.0 9.57%

84,457.

0 3.14%

87,105.

0

Non-Current Liabilities

Long term debt 35859 25.51%

45,006.0

0 20.61%

54,283.

00 8.82%

59,071.

00

Capital leases 245 -10.20% 220 -7.73% 203.0 60.10% 325

Deferred Tax Liabilities 1921.0 60.85% 3090.0 43.46% 4433 -22.22% 3448

Accrued liabilities 27.0 3.70% 28.0 71.43% 48 -47.92% 25

Deferred revenues 3581 35.46% 4851 14.59% 5559 4.37% 5802

Pension 12806 -32.35% 8663 4.28% 9034 -36.16% 5767

Minority interest 919 15.67% 1063 11.29% 1183 9.13% 1291

other long term liabilities 23638 -0.15% 23603 9.47% 25838 11.26% 28748

Total non-current liability 78,996.

0 9.53% 86,524.0 16.25%

100,581

.0 3.87%

104,47

7.0

Total Liability 145,970

.0 12.08%

163,605.

0 13.10%

185,038

.0 3.54%

191,58

2.0

Equity

Paid up capital 3070 0.00% 3070 0.00% 3070 0.00% 3070

Retained earnings 28487 29.85% 36991 10.28% 40794 16.88% 47682

Accumulated other

comprehensive income 12108 11.50% 13500 4.34% 14086 -5.79% 13271

Total Equity 43,665.

00 22.66%

53,561.0

0 8.19%

57,950.

00 10.48%

64,023.

00

1

TOTAL LIABILITIES

& EQUITY 189635 14.52% 217166 11.89% 242988 5.19% 255605

Daimler's Vertical analysis of statement of profit and loss

2014

Percentage

Change 2015

Percentage

Change 2016 Percentag

e Change 2017

Total

Revenue 129,872.0 100.00% 149,467.0 100.00% 153261 100.00%

164,3

30

Cost of

Sales (101,688.0) -78.30% (117,670.0) -78.73%

-121298

-79.14%

-

12999

9

Gross

Profit 28,184.0 21.70% 31,797.0 21.27% 31963 20.86% 34331

Operating

Expenses

General

and

administrat

ive expense

(18,705.0)

-14.40%

(19,254.0)

-12.88%

-19889

-12.98%

-

21347

Other

Operating

Expenses

Operating

Income or

Loss

9,479.0

7.30%

12,543.0

8.39%

12074

7.88%

12,98

4

Finance

Income 1,409.0 1.08% 803.0 0.54% 1046 0.68% 1899

Earnings

Before

10,888.0 8.38% 13,346.0 8.93% 13120 8.56% 14883

1

& EQUITY 189635 14.52% 217166 11.89% 242988 5.19% 255605

Daimler's Vertical analysis of statement of profit and loss

2014

Percentage

Change 2015

Percentage

Change 2016 Percentag

e Change 2017

Total

Revenue 129,872.0 100.00% 149,467.0 100.00% 153261 100.00%

164,3

30

Cost of

Sales (101,688.0) -78.30% (117,670.0) -78.73%

-121298

-79.14%

-

12999

9

Gross

Profit 28,184.0 21.70% 31,797.0 21.27% 31963 20.86% 34331

Operating

Expenses

General

and

administrat

ive expense

(18,705.0)

-14.40%

(19,254.0)

-12.88%

-19889

-12.98%

-

21347

Other

Operating

Expenses

Operating

Income or

Loss

9,479.0

7.30%

12,543.0

8.39%

12074

7.88%

12,98

4

Finance

Income 1,409.0 1.08% 803.0 0.54% 1046 0.68% 1899

Earnings

Before

10,888.0 8.38% 13,346.0 8.93% 13120 8.56% 14883

1

Interest

And Taxes

Finance

Cost (715.0) -0.55% (602.0) -0.40% -546 -0.36% -1046

Profit

Before

Tax

10,173.0

7.83%

12,744.0

8.53%

12574

8.20%

13837

Income

Tax

Expenses

2,883.0

2.22%

4,033.0

2.70%

3790

2.47%

3437

Other

expenses 13,056.0 10.05% 16,777.0 11.22% 16364 10.68% 17274

(6,094) -4.69% (8,353) -5.59% -7838 -5.11% -6749

Net Profit 6,962.0 5.36% 8,424.0 5.64% 8526 5.56% 10525

Daimler's Vertical analysis of statement of financial position

2014

Percenta

ge

Change

2015

Percenta

ge

Change

2016

Percent

age

Change

2017

Assets

Current Assets

Receivables 30727 16.20% 38559 17.76% 41719 17.17% 43792

Inventories 20,864.

00 11.00% 23760 10.94% 25384 10.45%

25,686.

0

Prepaid expense 294 0.16% 442 0.20% 566 0.23% 632

Other current asset 8,554 4.51% 9,876 4.55% 11,570 4.76% 13,135

- 0.00% 0.00% 0.00% -

1

And Taxes

Finance

Cost (715.0) -0.55% (602.0) -0.40% -546 -0.36% -1046

Profit

Before

Tax

10,173.0

7.83%

12,744.0

8.53%

12574

8.20%

13837

Income

Tax

Expenses

2,883.0

2.22%

4,033.0

2.70%

3790

2.47%

3437

Other

expenses 13,056.0 10.05% 16,777.0 11.22% 16364 10.68% 17274

(6,094) -4.69% (8,353) -5.59% -7838 -5.11% -6749

Net Profit 6,962.0 5.36% 8,424.0 5.64% 8526 5.56% 10525

Daimler's Vertical analysis of statement of financial position

2014

Percenta

ge

Change

2015

Percenta

ge

Change

2016

Percent

age

Change

2017

Assets

Current Assets

Receivables 30727 16.20% 38559 17.76% 41719 17.17% 43792

Inventories 20,864.

00 11.00% 23760 10.94% 25384 10.45%

25,686.

0

Prepaid expense 294 0.16% 442 0.20% 566 0.23% 632

Other current asset 8,554 4.51% 9,876 4.55% 11,570 4.76% 13,135

- 0.00% 0.00% 0.00% -

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cash 16,706 8.81% 19,210 8.85% 22,813 9.39% 23,490

0.00% 0.00%

Total current asset 77,145.

0 40.68% 91,847.0 42.29%

102,052

.0 42.00%

106,73

5.0

0.00% 0.00%

Non-Current Assets 0.00% 0.00%

Gross Property Plant and

Equipment 104810 55.27% 115451 53.16% 129547 53.31% 134338

Accumulated Depreciation (48,578

) -25.62% (52,187) -24.03% (56,224) -23.14%

(58,643

)

Goodwill 740 0.39% 727 0.33% 1,188 0.49% 1,115

Intangible assets 8627 4.55% 9342 4.30% 10910 4.49% 12620

Deferred tax income 4,124 2.17% 3,284 1.51% 3,870 1.59% 2,853

Long term asset (other) 42,767 22.55% 48,702 22.43% 51,645 21.25% 56,587

0.00% 0.00%

0.00% 0.00%

0.00% 0.00%

0.00% 0.00%

Total non-current asset 112,490

.0 59.32%

125,319.

0 57.71%

140,936

.0 58.00%

148,87

0.0

TOTAL ASSETS 189,635

.0 100.00%

217,166.

0 100.00%

242,988

.0 100.00%

255,60

5.0

Liabilities

Current Liabilities

Short term debt 12685 6.69% 14040 6.47% 16031 6.60% 15472

Capital leases 40.00 0.02% 43 0.02% 30 0.01% 27.0

Accounts payable 10178 5.37% 10548 4.86%

11,567.

00 4.76%

12,474.

00

Deferred income tax 757.00 0.40% 777.00 0.36% 751.00 0.31% 560.00

1

0.00% 0.00%

Total current asset 77,145.

0 40.68% 91,847.0 42.29%

102,052

.0 42.00%

106,73

5.0

0.00% 0.00%

Non-Current Assets 0.00% 0.00%

Gross Property Plant and

Equipment 104810 55.27% 115451 53.16% 129547 53.31% 134338

Accumulated Depreciation (48,578

) -25.62% (52,187) -24.03% (56,224) -23.14%

(58,643

)

Goodwill 740 0.39% 727 0.33% 1,188 0.49% 1,115

Intangible assets 8627 4.55% 9342 4.30% 10910 4.49% 12620

Deferred tax income 4,124 2.17% 3,284 1.51% 3,870 1.59% 2,853

Long term asset (other) 42,767 22.55% 48,702 22.43% 51,645 21.25% 56,587

0.00% 0.00%

0.00% 0.00%

0.00% 0.00%

0.00% 0.00%

Total non-current asset 112,490

.0 59.32%

125,319.

0 57.71%

140,936

.0 58.00%

148,87

0.0

TOTAL ASSETS 189,635

.0 100.00%

217,166.

0 100.00%

242,988

.0 100.00%

255,60

5.0

Liabilities

Current Liabilities

Short term debt 12685 6.69% 14040 6.47% 16031 6.60% 15472

Capital leases 40.00 0.02% 43 0.02% 30 0.01% 27.0

Accounts payable 10178 5.37% 10548 4.86%

11,567.

00 4.76%

12,474.

00

Deferred income tax 757.00 0.40% 777.00 0.36% 751.00 0.31% 560.00

1

Payable tax 1,703.0

0 0.90% 2,002.00 0.92%

2,096.0

0 0.86%

2,284.0

0

Other current liability 41611 21.94% 49671 22.87% 53982 22.22%

56,288.

0

Total current liability 66,974.

0 35.32% 77,081.0 35.49%

84,457.

0 34.76%

87,105.

0

Non-Current Liabilities

Long term debt 35859 18.91%

45,006.0

0 20.72%

54,283.

00 22.34%

59,071.

00

Capital leases 245 0.13% 220 0.10% 203.0 0.08% 325

Deferred Tax Liabilities 1921.0 1.01% 3090.0 1.42% 4433 1.82% 3448

Accrued liabilities 27.0 0.01% 28.0 0.01% 48 0.02% 25

Deferred revenues 3581 1.89% 4851 2.23% 5559 2.29% 5802

Pension 12806 6.75% 8663 3.99% 9034 3.72% 5767

Minority interest 919 0.48% 1063 0.49% 1183 0.49% 1291

other long term liabilities 23638 12.46% 23603 10.87% 25838 10.63% 28748

Total non-current liability 78,996.

0 41.66% 86,524.0 39.84%

100,581

.0 41.39%

104,47

7.0

0.00% 0.00% 0.00%

Total Liability 145,970

.0 76.97%

163,605.

0 75.34%

185,038

.0 76.15%

191,58

2.0

Equity

Paid up capital 3070 1.62% 3070 1.41% 3070 1.26% 3070

Retained earnings 28487 15.02% 36991 17.03% 40794 16.79% 47682

Accumulated other

comprehensive income 12108 6.38% 13500 6.22% 14086 5.80% 13271

Total Equity 43,665. 23.03% 53,561.0 24.66% 57,950. 23.85% 64,023.

1

0 0.90% 2,002.00 0.92%

2,096.0

0 0.86%

2,284.0

0

Other current liability 41611 21.94% 49671 22.87% 53982 22.22%

56,288.

0

Total current liability 66,974.

0 35.32% 77,081.0 35.49%

84,457.

0 34.76%

87,105.

0

Non-Current Liabilities

Long term debt 35859 18.91%

45,006.0

0 20.72%

54,283.

00 22.34%

59,071.

00

Capital leases 245 0.13% 220 0.10% 203.0 0.08% 325

Deferred Tax Liabilities 1921.0 1.01% 3090.0 1.42% 4433 1.82% 3448

Accrued liabilities 27.0 0.01% 28.0 0.01% 48 0.02% 25

Deferred revenues 3581 1.89% 4851 2.23% 5559 2.29% 5802

Pension 12806 6.75% 8663 3.99% 9034 3.72% 5767

Minority interest 919 0.48% 1063 0.49% 1183 0.49% 1291

other long term liabilities 23638 12.46% 23603 10.87% 25838 10.63% 28748

Total non-current liability 78,996.

0 41.66% 86,524.0 39.84%

100,581

.0 41.39%

104,47

7.0

0.00% 0.00% 0.00%

Total Liability 145,970

.0 76.97%

163,605.

0 75.34%

185,038

.0 76.15%

191,58

2.0

Equity

Paid up capital 3070 1.62% 3070 1.41% 3070 1.26% 3070

Retained earnings 28487 15.02% 36991 17.03% 40794 16.79% 47682

Accumulated other

comprehensive income 12108 6.38% 13500 6.22% 14086 5.80% 13271

Total Equity 43,665. 23.03% 53,561.0 24.66% 57,950. 23.85% 64,023.

1

00 0 00 00

TOTAL LIABILITIES

& EQUITY 189635 100.00% 217166 100.00% 242988 100.00% 255605

Tesla's horizontal analysis of statement of profit and loss

2014

Percentag

e Change 2015

Percentag

e Change 2016

Percentag

e Change 2017

Revenue 3198 26.5% 4046 73.0% 7000 65.4% 11579

Cost of

sales 2317 34.8% 3123 72.9% 5401 76.6% 9536

Gross

profit 881 4.8% 923 73.2% 1599 27.8% 2043

Operating

expense

Research

and

developme

nt 465 54.4% 718 16.2% 834 65.2% 1378

Sales,

general and

administrat

ive 604 52.6% 922 55.3% 1432 73.0% 2477

Total

operating

expense 1069 53.4% 1640 38.2% 2266 70.1% 3855

Operating

income -188 281.4% -717 -7.0% -667 171.7% -1812

Interest

cost 101 17.8% 119 67.2% 199 136.7% 471

1

TOTAL LIABILITIES

& EQUITY 189635 100.00% 217166 100.00% 242988 100.00% 255605

Tesla's horizontal analysis of statement of profit and loss

2014

Percentag

e Change 2015

Percentag

e Change 2016

Percentag

e Change 2017

Revenue 3198 26.5% 4046 73.0% 7000 65.4% 11579

Cost of

sales 2317 34.8% 3123 72.9% 5401 76.6% 9536

Gross

profit 881 4.8% 923 73.2% 1599 27.8% 2043

Operating

expense

Research

and

developme

nt 465 54.4% 718 16.2% 834 65.2% 1378

Sales,

general and

administrat

ive 604 52.6% 922 55.3% 1432 73.0% 2477

Total

operating

expense 1069 53.4% 1640 38.2% 2266 70.1% 3855

Operating

income -188 281.4% -717 -7.0% -667 171.7% -1812

Interest

cost 101 17.8% 119 67.2% 199 136.7% 471

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Other

income or

expense 3 -1433.3% -40 -400.0% 120 -188.3% -106

Earning

before tax -285 207.4% -876 -14.8% -746 196.1% -2209

Provision

for income

tax 9 44.4% 13 107.7% 27 18.5% 32

Net

income

from

continued

work -294 202.4% -889 -13.0% -773 189.9% -2241

Other 0 0 98 184.7% 279

Net profit -294 202.4% -889 -24.1% -675 190.7% -1962

Tesla's horizontal analysis of statement of financial position

2014

Percenta

ge

Change 2015

Percenta

ge

Change 2016

Percenta

ge

Change 2017

Assets

Current Assets

Receivables 227 -25.55% 169 195.27% 499 3.21% 515

Inventories 954 33.96% 1278 61.74% 2067 9.53% 2264

Prepaid expense 95 31.58% 125 55.20% 194 38.14% 268

Other current asset 18 27.78% 23 360.87% 106 46.23% 155

Cash and cash

equivalents 1906 -37.20% 1197 183.46% 3393 -0.74% 3368

1

income or

expense 3 -1433.3% -40 -400.0% 120 -188.3% -106

Earning

before tax -285 207.4% -876 -14.8% -746 196.1% -2209

Provision

for income

tax 9 44.4% 13 107.7% 27 18.5% 32

Net

income

from

continued

work -294 202.4% -889 -13.0% -773 189.9% -2241

Other 0 0 98 184.7% 279

Net profit -294 202.4% -889 -24.1% -675 190.7% -1962

Tesla's horizontal analysis of statement of financial position

2014

Percenta

ge

Change 2015

Percenta

ge

Change 2016

Percenta

ge

Change 2017

Assets

Current Assets

Receivables 227 -25.55% 169 195.27% 499 3.21% 515

Inventories 954 33.96% 1278 61.74% 2067 9.53% 2264

Prepaid expense 95 31.58% 125 55.20% 194 38.14% 268

Other current asset 18 27.78% 23 360.87% 106 46.23% 155

Cash and cash

equivalents 1906 -37.20% 1197 183.46% 3393 -0.74% 3368

1

Total current

asset 3200 -12.75% 2792 124.18% 6259 4.97% 6570

Non-Current

Assets

Gross Property

Plant and

Equipment 2889 99.58% 5766 178.44% 16055 39.74% 22436

Accumulated

Depreciation -293 94.88% -571 78.28% -1018 90.96% -1944

Goodwill 0 0 0 60

Intangible assets 0 0 376 -3.72% 362

Long term asset

(other) 55 92.73% 106 834.91% 991 18.16% 1171

Total non-current

asset 2651 99.96% 5301 209.45% 16404 34.63% 22085