Comprehensive Financial Analysis of Alina Ltd: Performance Review

VerifiedAdded on 2023/06/12

|10

|1250

|432

Report

AI Summary

This report provides a comprehensive financial analysis of Alina Ltd as of December 31, 2021. It includes a trial balance, profit and loss account, and balance sheet, followed by a detailed ratio analysis covering gross profit margin, net profit margin, current ratio, acid test ratio, and return on capital employed (ROCE). The report interprets these ratios to assess Alina Ltd's profitability, liquidity, and overall financial performance, concluding that the company demonstrates a healthy financial position and the ability to meet its objectives. This document is available on Desklib, a platform offering a range of study tools and solved assignments for students.

Assessment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

ASESSMENT 1...............................................................................................................................1

TASK 1............................................................................................................................................1

Trial balance for Alina Ltd as at 31st December 2021 ..............................................................1

TASK 2............................................................................................................................................1

Formulating P&L account...........................................................................................................1

ASESSMENT 2...............................................................................................................................3

TASK ..............................................................................................................................................3

Calculating ratios........................................................................................................................3

Interpreting the financial performance........................................................................................5

CONCLUSION ...............................................................................................................................6

REFERENCES................................................................................................................................7

INTRODUCTION...........................................................................................................................1

ASESSMENT 1...............................................................................................................................1

TASK 1............................................................................................................................................1

Trial balance for Alina Ltd as at 31st December 2021 ..............................................................1

TASK 2............................................................................................................................................1

Formulating P&L account...........................................................................................................1

ASESSMENT 2...............................................................................................................................3

TASK ..............................................................................................................................................3

Calculating ratios........................................................................................................................3

Interpreting the financial performance........................................................................................5

CONCLUSION ...............................................................................................................................6

REFERENCES................................................................................................................................7

INTRODUCTION

Financial information plays significant role in offering the understanding of the

prevailing circumstances of business. In the current era, it is important for the organization to

give emphasis on having relevant ability to gather financial information so that proper decision-

making can become possible. The current report will pay attention on formulating trial balance.,

income statement and financial position. It will give emphasis on calculating & interpreting

ratios in the present study.

ASESSMENT 1

TASK 1

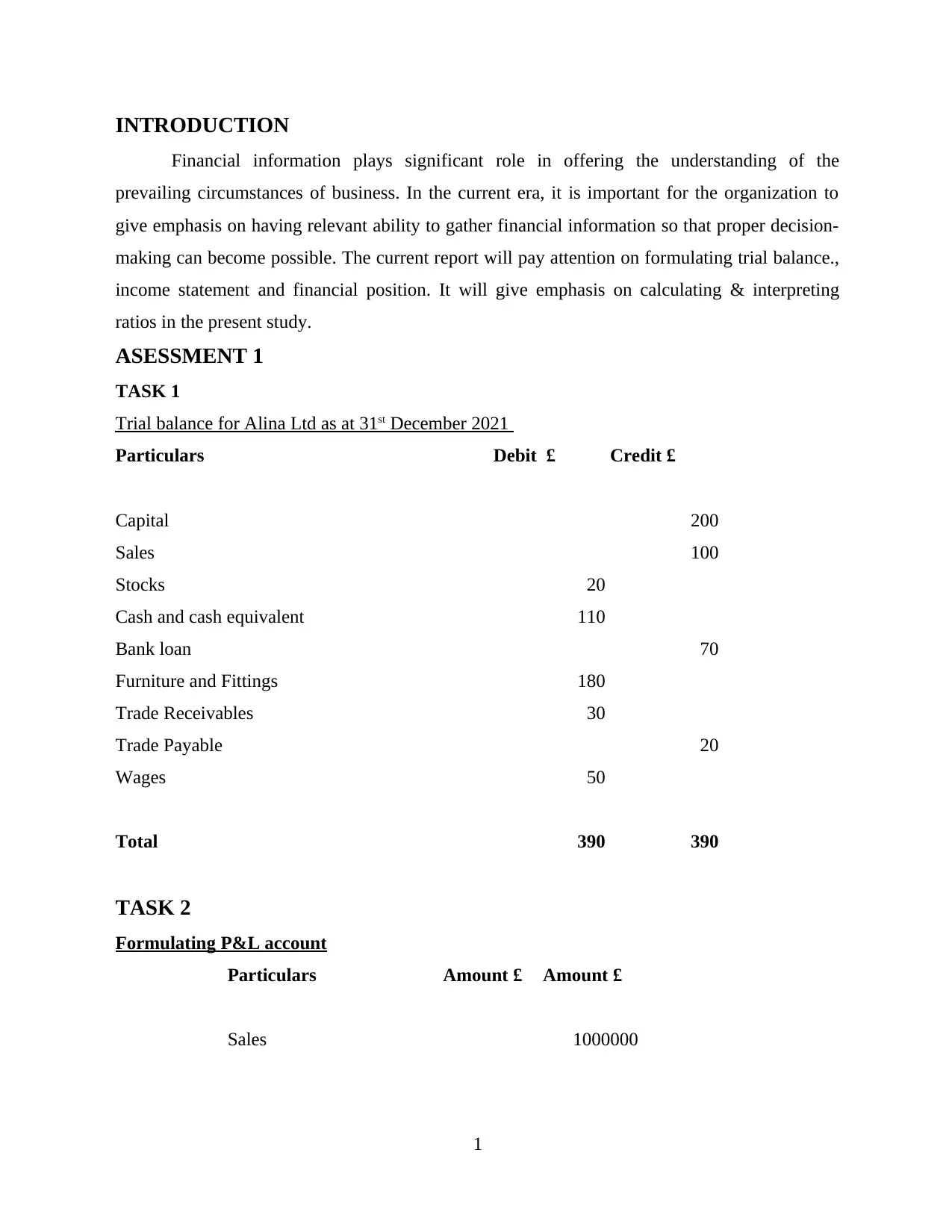

Trial balance for Alina Ltd as at 31st December 2021

Particulars Debit £ Credit £

Capital 200

Sales 100

Stocks 20

Cash and cash equivalent 110

Bank loan 70

Furniture and Fittings 180

Trade Receivables 30

Trade Payable 20

Wages 50

Total 390 390

TASK 2

Formulating P&L account

Particulars Amount £ Amount £

Sales 1000000

1

Financial information plays significant role in offering the understanding of the

prevailing circumstances of business. In the current era, it is important for the organization to

give emphasis on having relevant ability to gather financial information so that proper decision-

making can become possible. The current report will pay attention on formulating trial balance.,

income statement and financial position. It will give emphasis on calculating & interpreting

ratios in the present study.

ASESSMENT 1

TASK 1

Trial balance for Alina Ltd as at 31st December 2021

Particulars Debit £ Credit £

Capital 200

Sales 100

Stocks 20

Cash and cash equivalent 110

Bank loan 70

Furniture and Fittings 180

Trade Receivables 30

Trade Payable 20

Wages 50

Total 390 390

TASK 2

Formulating P&L account

Particulars Amount £ Amount £

Sales 1000000

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

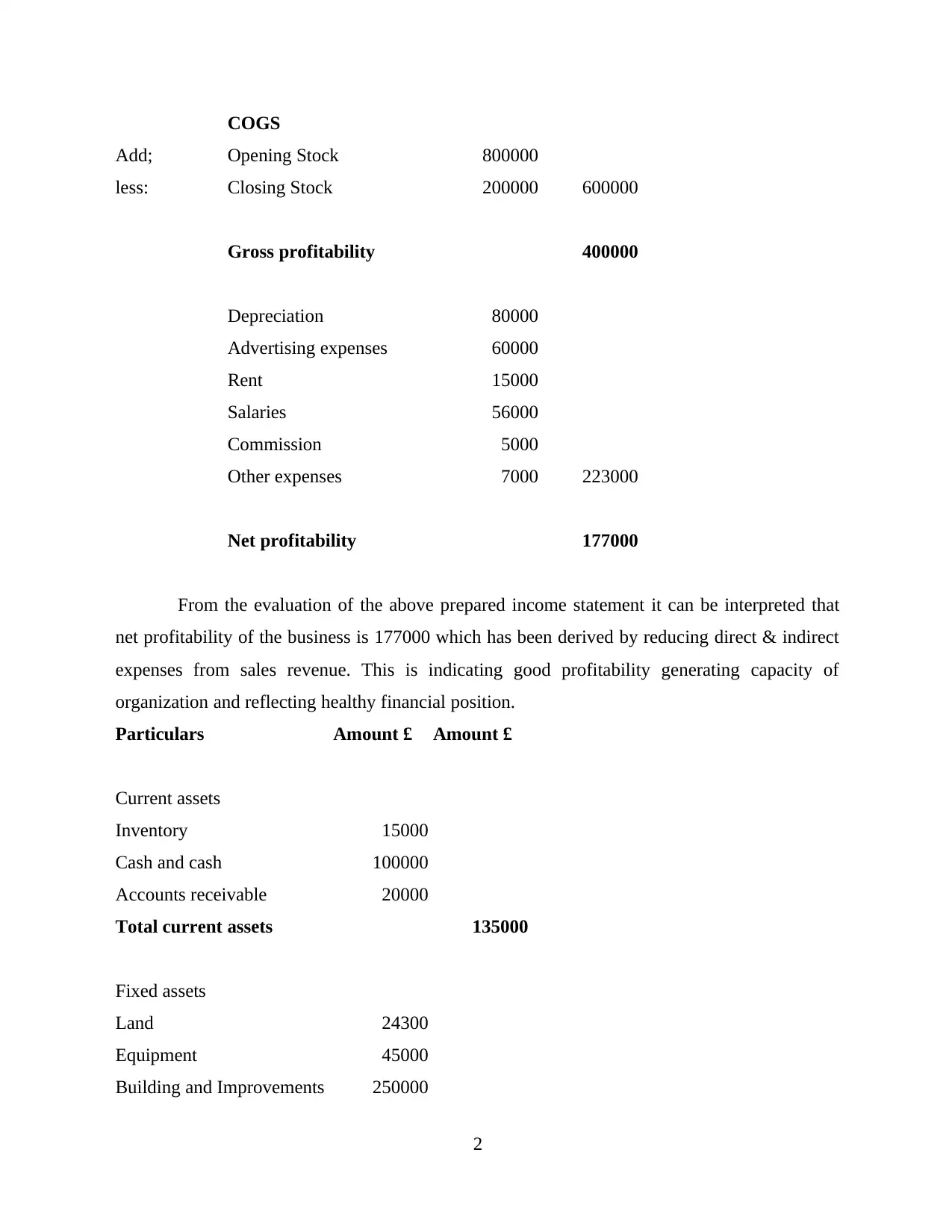

COGS

Add; Opening Stock 800000

less: Closing Stock 200000 600000

Gross profitability 400000

Depreciation 80000

Advertising expenses 60000

Rent 15000

Salaries 56000

Commission 5000

Other expenses 7000 223000

Net profitability 177000

From the evaluation of the above prepared income statement it can be interpreted that

net profitability of the business is 177000 which has been derived by reducing direct & indirect

expenses from sales revenue. This is indicating good profitability generating capacity of

organization and reflecting healthy financial position.

Particulars Amount £ Amount £

Current assets

Inventory 15000

Cash and cash 100000

Accounts receivable 20000

Total current assets 135000

Fixed assets

Land 24300

Equipment 45000

Building and Improvements 250000

2

Add; Opening Stock 800000

less: Closing Stock 200000 600000

Gross profitability 400000

Depreciation 80000

Advertising expenses 60000

Rent 15000

Salaries 56000

Commission 5000

Other expenses 7000 223000

Net profitability 177000

From the evaluation of the above prepared income statement it can be interpreted that

net profitability of the business is 177000 which has been derived by reducing direct & indirect

expenses from sales revenue. This is indicating good profitability generating capacity of

organization and reflecting healthy financial position.

Particulars Amount £ Amount £

Current assets

Inventory 15000

Cash and cash 100000

Accounts receivable 20000

Total current assets 135000

Fixed assets

Land 24300

Equipment 45000

Building and Improvements 250000

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

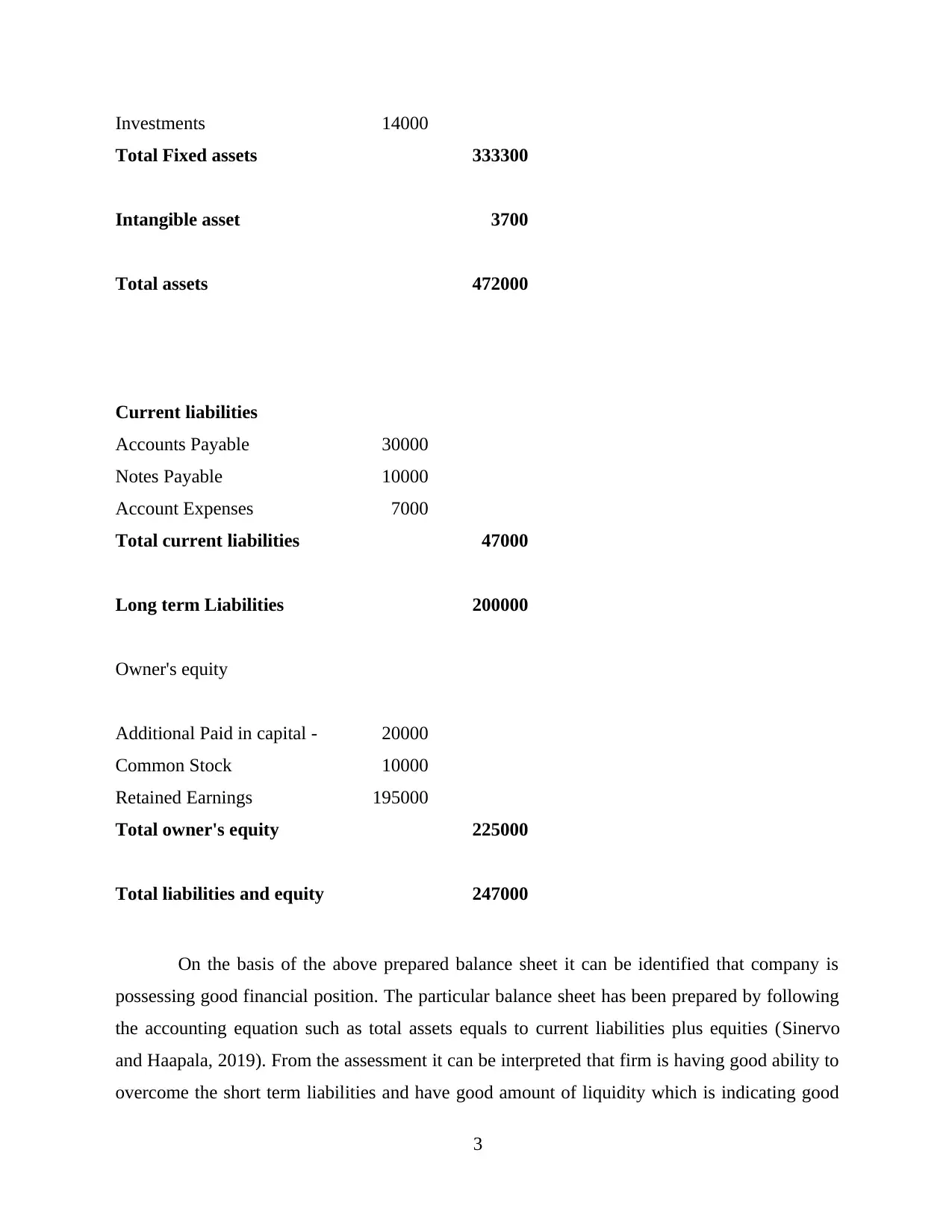

Investments 14000

Total Fixed assets 333300

Intangible asset 3700

Total assets 472000

Current liabilities

Accounts Payable 30000

Notes Payable 10000

Account Expenses 7000

Total current liabilities 47000

Long term Liabilities 200000

Owner's equity

Additional Paid in capital - 20000

Common Stock 10000

Retained Earnings 195000

Total owner's equity 225000

Total liabilities and equity 247000

On the basis of the above prepared balance sheet it can be identified that company is

possessing good financial position. The particular balance sheet has been prepared by following

the accounting equation such as total assets equals to current liabilities plus equities (Sinervo

and Haapala, 2019). From the assessment it can be interpreted that firm is having good ability to

overcome the short term liabilities and have good amount of liquidity which is indicating good

3

Total Fixed assets 333300

Intangible asset 3700

Total assets 472000

Current liabilities

Accounts Payable 30000

Notes Payable 10000

Account Expenses 7000

Total current liabilities 47000

Long term Liabilities 200000

Owner's equity

Additional Paid in capital - 20000

Common Stock 10000

Retained Earnings 195000

Total owner's equity 225000

Total liabilities and equity 247000

On the basis of the above prepared balance sheet it can be identified that company is

possessing good financial position. The particular balance sheet has been prepared by following

the accounting equation such as total assets equals to current liabilities plus equities (Sinervo

and Haapala, 2019). From the assessment it can be interpreted that firm is having good ability to

overcome the short term liabilities and have good amount of liquidity which is indicating good

3

credibility in market. The present performance of firm is positive which is helpful in

understanding that good position in sector is achieved by business.

ASESSMENT 2

TASK

Calculating ratios

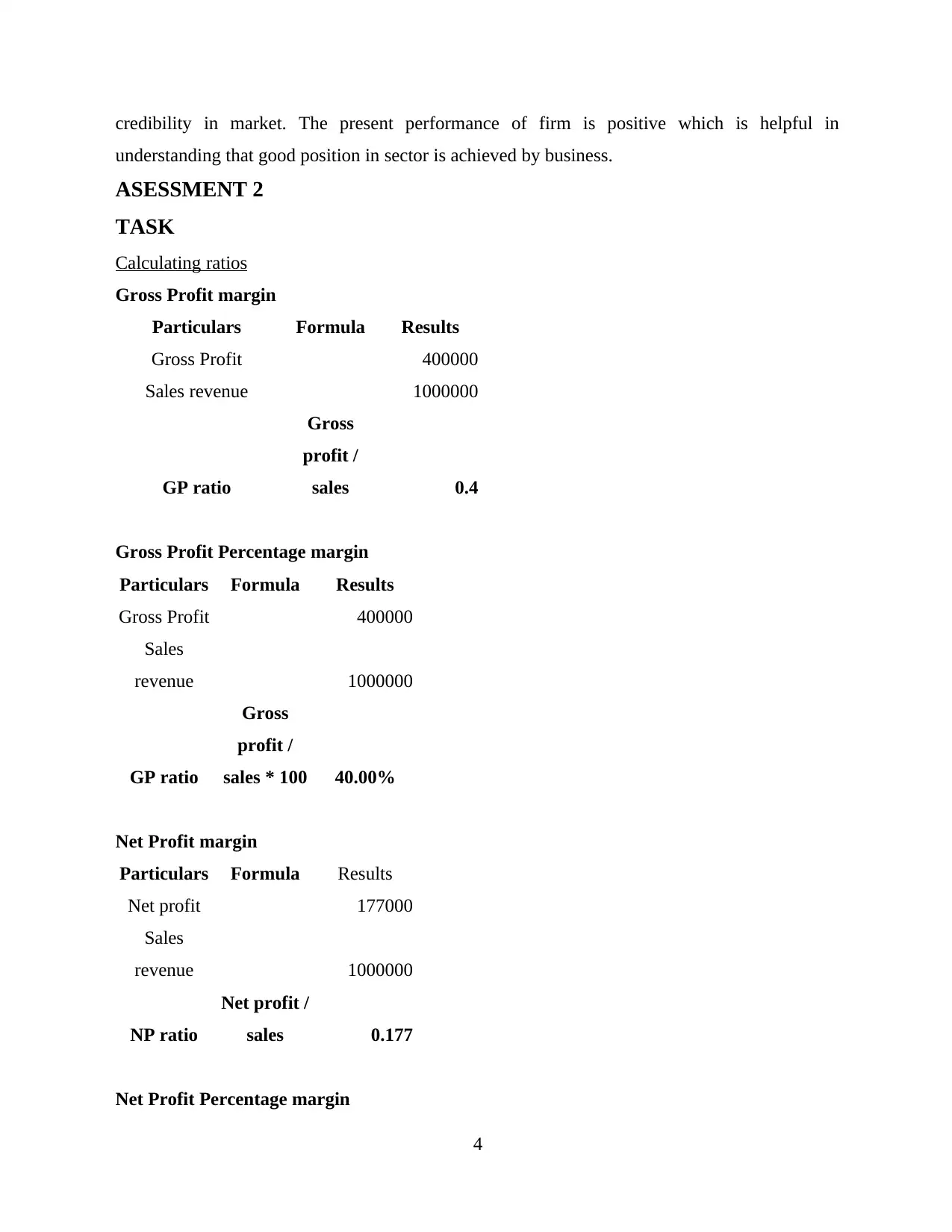

Gross Profit margin

Particulars Formula Results

Gross Profit 400000

Sales revenue 1000000

GP ratio

Gross

profit /

sales 0.4

Gross Profit Percentage margin

Particulars Formula Results

Gross Profit 400000

Sales

revenue 1000000

GP ratio

Gross

profit /

sales * 100 40.00%

Net Profit margin

Particulars Formula Results

Net profit 177000

Sales

revenue 1000000

NP ratio

Net profit /

sales 0.177

Net Profit Percentage margin

4

understanding that good position in sector is achieved by business.

ASESSMENT 2

TASK

Calculating ratios

Gross Profit margin

Particulars Formula Results

Gross Profit 400000

Sales revenue 1000000

GP ratio

Gross

profit /

sales 0.4

Gross Profit Percentage margin

Particulars Formula Results

Gross Profit 400000

Sales

revenue 1000000

GP ratio

Gross

profit /

sales * 100 40.00%

Net Profit margin

Particulars Formula Results

Net profit 177000

Sales

revenue 1000000

NP ratio

Net profit /

sales 0.177

Net Profit Percentage margin

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

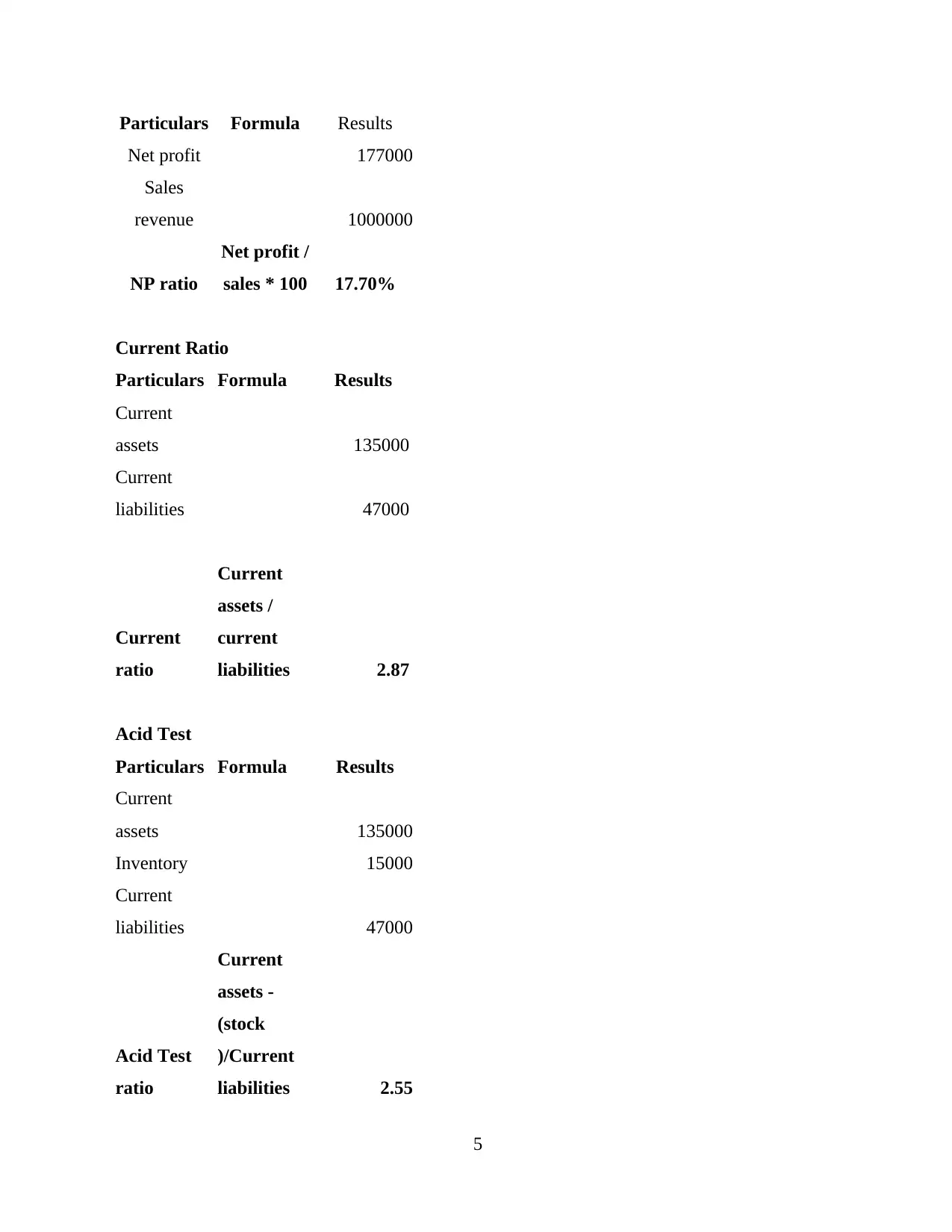

Particulars Formula Results

Net profit 177000

Sales

revenue 1000000

NP ratio

Net profit /

sales * 100 17.70%

Current Ratio

Particulars Formula Results

Current

assets 135000

Current

liabilities 47000

Current

ratio

Current

assets /

current

liabilities 2.87

Acid Test

Particulars Formula Results

Current

assets 135000

Inventory 15000

Current

liabilities 47000

Acid Test

ratio

Current

assets -

(stock

)/Current

liabilities 2.55

5

Net profit 177000

Sales

revenue 1000000

NP ratio

Net profit /

sales * 100 17.70%

Current Ratio

Particulars Formula Results

Current

assets 135000

Current

liabilities 47000

Current

ratio

Current

assets /

current

liabilities 2.87

Acid Test

Particulars Formula Results

Current

assets 135000

Inventory 15000

Current

liabilities 47000

Acid Test

ratio

Current

assets -

(stock

)/Current

liabilities 2.55

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

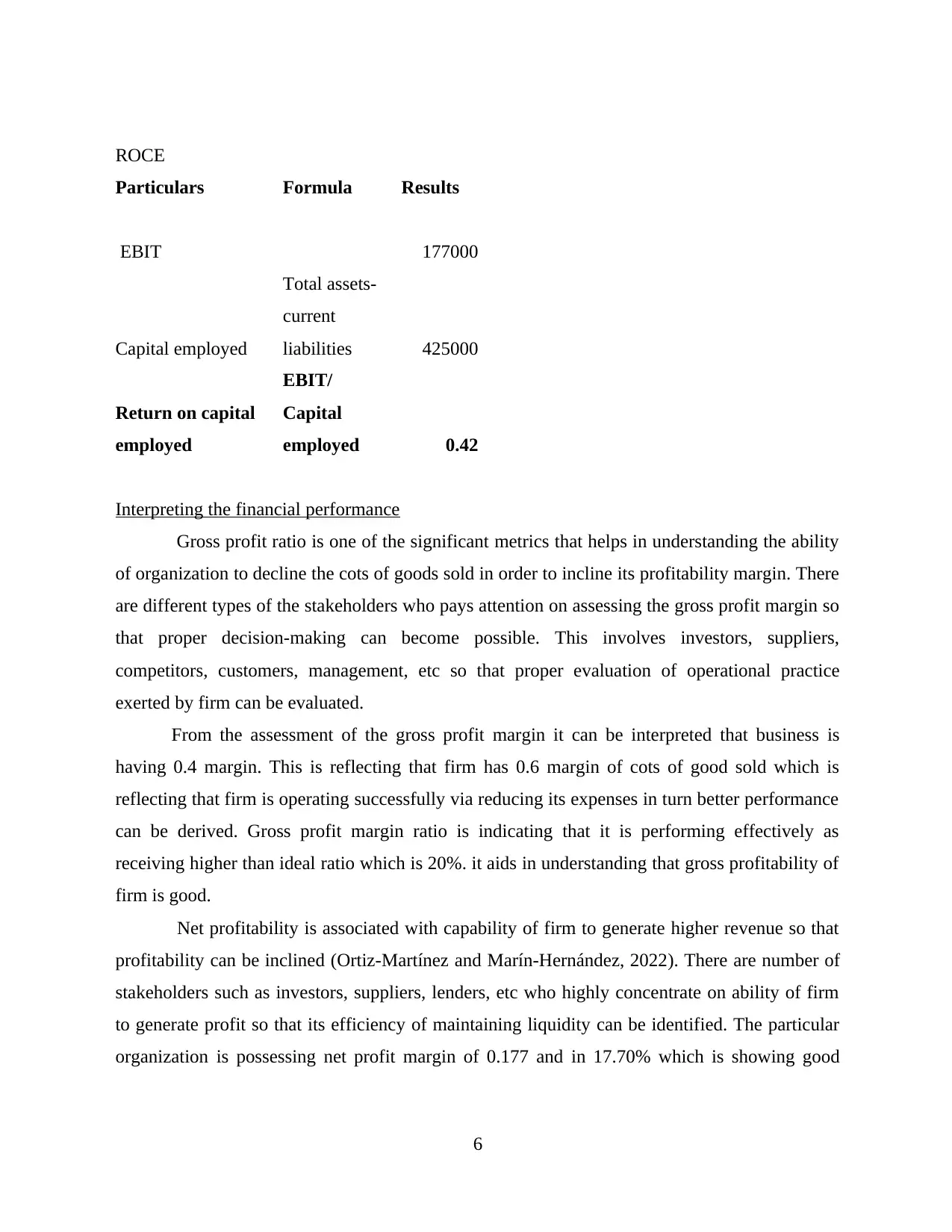

ROCE

Particulars Formula Results

EBIT 177000

Capital employed

Total assets-

current

liabilities 425000

Return on capital

employed

EBIT/

Capital

employed 0.42

Interpreting the financial performance

Gross profit ratio is one of the significant metrics that helps in understanding the ability

of organization to decline the cots of goods sold in order to incline its profitability margin. There

are different types of the stakeholders who pays attention on assessing the gross profit margin so

that proper decision-making can become possible. This involves investors, suppliers,

competitors, customers, management, etc so that proper evaluation of operational practice

exerted by firm can be evaluated.

From the assessment of the gross profit margin it can be interpreted that business is

having 0.4 margin. This is reflecting that firm has 0.6 margin of cots of good sold which is

reflecting that firm is operating successfully via reducing its expenses in turn better performance

can be derived. Gross profit margin ratio is indicating that it is performing effectively as

receiving higher than ideal ratio which is 20%. it aids in understanding that gross profitability of

firm is good.

Net profitability is associated with capability of firm to generate higher revenue so that

profitability can be inclined (Ortiz-Martínez and Marín-Hernández, 2022). There are number of

stakeholders such as investors, suppliers, lenders, etc who highly concentrate on ability of firm

to generate profit so that its efficiency of maintaining liquidity can be identified. The particular

organization is possessing net profit margin of 0.177 and in 17.70% which is showing good

6

Particulars Formula Results

EBIT 177000

Capital employed

Total assets-

current

liabilities 425000

Return on capital

employed

EBIT/

Capital

employed 0.42

Interpreting the financial performance

Gross profit ratio is one of the significant metrics that helps in understanding the ability

of organization to decline the cots of goods sold in order to incline its profitability margin. There

are different types of the stakeholders who pays attention on assessing the gross profit margin so

that proper decision-making can become possible. This involves investors, suppliers,

competitors, customers, management, etc so that proper evaluation of operational practice

exerted by firm can be evaluated.

From the assessment of the gross profit margin it can be interpreted that business is

having 0.4 margin. This is reflecting that firm has 0.6 margin of cots of good sold which is

reflecting that firm is operating successfully via reducing its expenses in turn better performance

can be derived. Gross profit margin ratio is indicating that it is performing effectively as

receiving higher than ideal ratio which is 20%. it aids in understanding that gross profitability of

firm is good.

Net profitability is associated with capability of firm to generate higher revenue so that

profitability can be inclined (Ortiz-Martínez and Marín-Hernández, 2022). There are number of

stakeholders such as investors, suppliers, lenders, etc who highly concentrate on ability of firm

to generate profit so that its efficiency of maintaining liquidity can be identified. The particular

organization is possessing net profit margin of 0.177 and in 17.70% which is showing good

6

performance of the business. On the basis of this, it can be articulated that firm is possessing

effectual efficiency in generating revenue.

Current ratio is related with evaluating the efficiency of enterprise to use current assets to

overcome short term liabilities. On the basis of computed figure it can be stated that particular

firm is having good level of efficiency as 2.87 times assets are more than current liabilities. This

can aid the firm to attract different stakeholders and retain them form longer duration in turn

achieving success can become possible.

Acid test ratio is related with evaluating how effectively particular firm is using cash &

equivalent assets to overcome current liabilities (Mancini and et.al., 2022). The computed result

is presenting 2.55 times cash & equivalent assets are greater than short term liabilities which

presents good liquidity position.

Return on capital employed is basically evaluated by investors, lenders, etc so that

information regarding how effectively particular business is using employed capital to offer

return to stakeholders. On the basis of evaluation it can be evaluated that firm offers 0.42 which

can aid ins satisfying current and potentials shareholders.

CONCLUSION

From the above report it can be concluded that having financial information is important

to make decision. The current report has involved financial statement like income and balance

sheet that is presenting goo monetary position. Ratio has been computed and that is indicating

that there is good ability to meet objectives of business.

7

effectual efficiency in generating revenue.

Current ratio is related with evaluating the efficiency of enterprise to use current assets to

overcome short term liabilities. On the basis of computed figure it can be stated that particular

firm is having good level of efficiency as 2.87 times assets are more than current liabilities. This

can aid the firm to attract different stakeholders and retain them form longer duration in turn

achieving success can become possible.

Acid test ratio is related with evaluating how effectively particular firm is using cash &

equivalent assets to overcome current liabilities (Mancini and et.al., 2022). The computed result

is presenting 2.55 times cash & equivalent assets are greater than short term liabilities which

presents good liquidity position.

Return on capital employed is basically evaluated by investors, lenders, etc so that

information regarding how effectively particular business is using employed capital to offer

return to stakeholders. On the basis of evaluation it can be evaluated that firm offers 0.42 which

can aid ins satisfying current and potentials shareholders.

CONCLUSION

From the above report it can be concluded that having financial information is important

to make decision. The current report has involved financial statement like income and balance

sheet that is presenting goo monetary position. Ratio has been computed and that is indicating

that there is good ability to meet objectives of business.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Mancini, D and et.al., 2022. Theories in Integrated Reporting and Non-financial Information

Research. In Non-financial Disclosure and Integrated Reporting (pp. 233-252). Springer,

Cham.

Ortiz-Martínez, E. and Marín-Hernández, S., 2022. European SMEs and non-financial

information on sustainability. International Journal of Sustainable Development & World

Ecology. 29(2). pp.112-124.

Sinervo, L.M. and Haapala, P., 2019. Presence of financial information in local politicians’

speech. Journal of Public Budgeting, Accounting & Financial Management.

8

Books and Journals

Mancini, D and et.al., 2022. Theories in Integrated Reporting and Non-financial Information

Research. In Non-financial Disclosure and Integrated Reporting (pp. 233-252). Springer,

Cham.

Ortiz-Martínez, E. and Marín-Hernández, S., 2022. European SMEs and non-financial

information on sustainability. International Journal of Sustainable Development & World

Ecology. 29(2). pp.112-124.

Sinervo, L.M. and Haapala, P., 2019. Presence of financial information in local politicians’

speech. Journal of Public Budgeting, Accounting & Financial Management.

8

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.