Financial Decision Making: Elton PLC Performance and Investment

VerifiedAdded on 2023/04/20

|16

|5154

|94

Report

AI Summary

This report provides a comprehensive financial analysis of Elton PLC, evaluating its performance through ratio analysis of its profit and loss statement, statement of financial position, and cash flow statement. The analysis reveals both strengths and weaknesses in the company's financial health, including declining gross profit margins and a need for improved asset utilization. The report then critically assesses investment appraisal techniques (NPV, ARR, payback period) for a potential expansion, concluding with a recommendation to reject the investment proposal. Finally, the report advises Elton PLC's management on potential sources of finance, including bank loans and the issuance of shares, to address the company's financial needs and improve its liquidity position. The report also discusses the limitations of financial statements, and provides a revised financial ratio analysis.

FINANCIAL DECISION MAKING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Executive summary..............................................................................................................................

Part 1: Business performance Analysis................................................................................................

Interpretation of statement of profit or loss.................................................................................1

Analysis of the Profit and Loss statement is as follows..............................................................2

Assessment of statement of financial position.............................................................................3

Analyzing the cash flow statement..............................................................................................5

Limitations of financial statements..............................................................................................6

Part 2: Investment Appraisal................................................................................................................

Critically evaluating investment appraisal techniques by taking into account the benefits and

limitations of each method...........................................................................................................7

Advising the Board of Directors about the non-financial factors which Elton Plc need to

consider while expanding business operations in international market.....................................10

Advising higher management in relation to the sources of finance which they need to

undertake for raising finance.....................................................................................................11

Conclusion..........................................................................................................................................

References..........................................................................................................................................

Executive summary..............................................................................................................................

Part 1: Business performance Analysis................................................................................................

Interpretation of statement of profit or loss.................................................................................1

Analysis of the Profit and Loss statement is as follows..............................................................2

Assessment of statement of financial position.............................................................................3

Analyzing the cash flow statement..............................................................................................5

Limitations of financial statements..............................................................................................6

Part 2: Investment Appraisal................................................................................................................

Critically evaluating investment appraisal techniques by taking into account the benefits and

limitations of each method...........................................................................................................7

Advising the Board of Directors about the non-financial factors which Elton Plc need to

consider while expanding business operations in international market.....................................10

Advising higher management in relation to the sources of finance which they need to

undertake for raising finance.....................................................................................................11

Conclusion..........................................................................................................................................

References..........................................................................................................................................

EXECUTIVE SUMMARY

Present report emphasis on assessing the financial performance of Elton plc. However,

with the help of ratio analysis, financial position of cited firm has been analysed and it resulted

that company is unable to maintain adequate amount of finance to carry out business operations.

But liquidity position of firm is suitable enough to overcome short term financial obligations.

Along with this researcher focuses on assessing the viability of available investment proposal for

Elton plc through tools like NPV, ARR and payback period and it has been suggested that firm

should reject the proposal. Lastly, two sources of funds has been suggested to top level

management of Elton plc i.e. bank loan and issue of shares.

PART 1: BUSINESS PERFORMANCE ANALYSIS

Interpretation of statement of profit or loss

In general, ratio analysis refers to the financial tool of assessing the performance of

business on the four components of business i.e. profitability, solvency, efficiency and liquidity

(Uechi and et.al, 2015). Through the means of this, managers can easily evaluate the financial

health and performance of business in comparison to previous year performance, competitors

and industry averages. According to the given case, ratio analysis is an effective tool for the

management of Elton plc in regards to make strategic framework for improving the overall

performance of the company (Hatzinger, Böhlke and Sturchio, 2013).

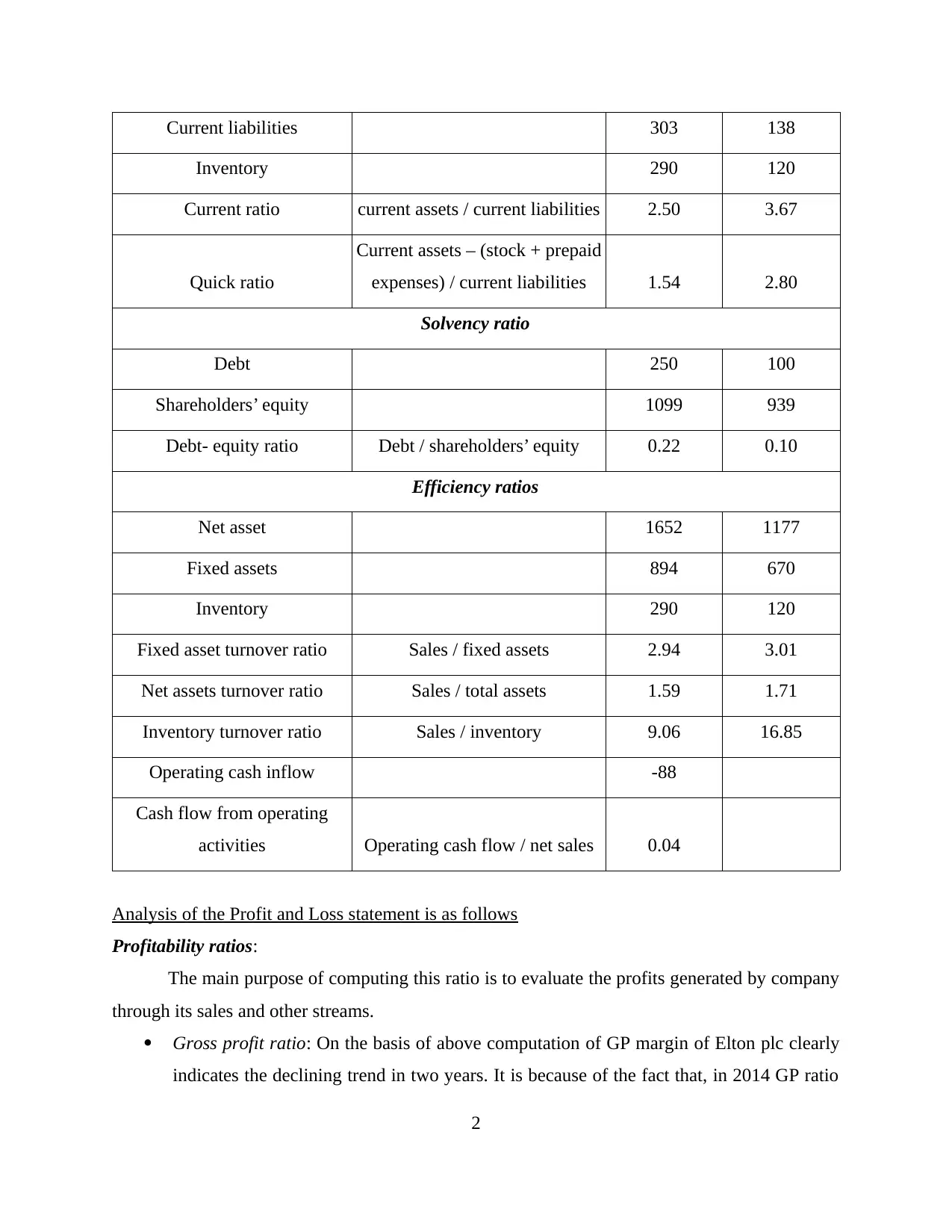

Ratio analysis of Elton Plc for the year of 2014 and 2015 are as follows:

Ratios Formula 2015 2014

Profitability ratios

Net sales 2630 2022

Gross profit 572 517

Net profit 160 82

Gross profit ratio GP/ net sales * 100 21.75% 25.57%

Net profit ratio Net profit / net sales * 100 6.08% 4.06%

Liquidity ratios

Current assets 758 507

1

Present report emphasis on assessing the financial performance of Elton plc. However,

with the help of ratio analysis, financial position of cited firm has been analysed and it resulted

that company is unable to maintain adequate amount of finance to carry out business operations.

But liquidity position of firm is suitable enough to overcome short term financial obligations.

Along with this researcher focuses on assessing the viability of available investment proposal for

Elton plc through tools like NPV, ARR and payback period and it has been suggested that firm

should reject the proposal. Lastly, two sources of funds has been suggested to top level

management of Elton plc i.e. bank loan and issue of shares.

PART 1: BUSINESS PERFORMANCE ANALYSIS

Interpretation of statement of profit or loss

In general, ratio analysis refers to the financial tool of assessing the performance of

business on the four components of business i.e. profitability, solvency, efficiency and liquidity

(Uechi and et.al, 2015). Through the means of this, managers can easily evaluate the financial

health and performance of business in comparison to previous year performance, competitors

and industry averages. According to the given case, ratio analysis is an effective tool for the

management of Elton plc in regards to make strategic framework for improving the overall

performance of the company (Hatzinger, Böhlke and Sturchio, 2013).

Ratio analysis of Elton Plc for the year of 2014 and 2015 are as follows:

Ratios Formula 2015 2014

Profitability ratios

Net sales 2630 2022

Gross profit 572 517

Net profit 160 82

Gross profit ratio GP/ net sales * 100 21.75% 25.57%

Net profit ratio Net profit / net sales * 100 6.08% 4.06%

Liquidity ratios

Current assets 758 507

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Current liabilities 303 138

Inventory 290 120

Current ratio current assets / current liabilities 2.50 3.67

Quick ratio

Current assets – (stock + prepaid

expenses) / current liabilities 1.54 2.80

Solvency ratio

Debt 250 100

Shareholders’ equity 1099 939

Debt- equity ratio Debt / shareholders’ equity 0.22 0.10

Efficiency ratios

Net asset 1652 1177

Fixed assets 894 670

Inventory 290 120

Fixed asset turnover ratio Sales / fixed assets 2.94 3.01

Net assets turnover ratio Sales / total assets 1.59 1.71

Inventory turnover ratio Sales / inventory 9.06 16.85

Operating cash inflow -88

Cash flow from operating

activities Operating cash flow / net sales 0.04

Analysis of the Profit and Loss statement is as follows

Profitability ratios:

The main purpose of computing this ratio is to evaluate the profits generated by company

through its sales and other streams.

Gross profit ratio: On the basis of above computation of GP margin of Elton plc clearly

indicates the declining trend in two years. It is because of the fact that, in 2014 GP ratio

2

Inventory 290 120

Current ratio current assets / current liabilities 2.50 3.67

Quick ratio

Current assets – (stock + prepaid

expenses) / current liabilities 1.54 2.80

Solvency ratio

Debt 250 100

Shareholders’ equity 1099 939

Debt- equity ratio Debt / shareholders’ equity 0.22 0.10

Efficiency ratios

Net asset 1652 1177

Fixed assets 894 670

Inventory 290 120

Fixed asset turnover ratio Sales / fixed assets 2.94 3.01

Net assets turnover ratio Sales / total assets 1.59 1.71

Inventory turnover ratio Sales / inventory 9.06 16.85

Operating cash inflow -88

Cash flow from operating

activities Operating cash flow / net sales 0.04

Analysis of the Profit and Loss statement is as follows

Profitability ratios:

The main purpose of computing this ratio is to evaluate the profits generated by company

through its sales and other streams.

Gross profit ratio: On the basis of above computation of GP margin of Elton plc clearly

indicates the declining trend in two years. It is because of the fact that, in 2014 GP ratio

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

of cited firm was 25.57% which has been declined to 21.75% in 2015. The main reason

behind declining results is increased cost of sales which directly impacted on the gross

profit (Edmister, 1972). However, despite of increasing revenue, company has generate

lower GP margin which shows that COGS has also increased parallel to the revenue.

Thus, it is important for the management of Elton plc to undertake potential measure for

controlling and managing direct expenses as with the help of which firm would be able

to increase its gross profit margin.

Net profit ratio: From the analysis of profit and loss statement of Elton plc it has been

evaluated that the net profit of the firm is showing increasing result from 4.06% to

4.05% in the year 2015. This is because, indirect expenses of the firm are showing

decreasing results that indeed assisted the course of company to generate increasing net

profit (Vogel, 2014). In particular, administration expenditure of the firm has decreased

significantly from £163 to £114. In addition to this, tax paid by the firm is relatively low

in comparison to the profit margin earned. In this it is recommended that firm should

constantly focus on promotional campaign so as to increase the sales of different

portfolios and generate higher profitability.

Assessment of statement of financial position

Liquidity ratios:

The main purpose of these ratios is to assess the capability of firm to meet is short term

financial obligations. Through the means of this manager can make decisions regarding whether

Elton’s liquidity position is sound or not.

Current Ratio: This ratio assist in evaluating the availability of current assets to

overcome firm’s current liabilities. However, on the basis of given information, current

ratio of Elton plc for 2014 is 3.67:1 which has been decreased to 2.5:1 in year 2015. This

states that, management has used current assets to overcome short term financial

obligations (Al Karim and Alam, 2013). In 2015, investment has been made in plant and

machinery as well as £30 for development costs which indeed decreased the ratio. On the

positive prospects these investments has helped firm in generating fruitful results. Despite

of declining result, current ratio of 2.5:1 is ideal from the industry perspective which

clearly indicates the capability of firm in meeting its financial needs and commitments of

time.

3

behind declining results is increased cost of sales which directly impacted on the gross

profit (Edmister, 1972). However, despite of increasing revenue, company has generate

lower GP margin which shows that COGS has also increased parallel to the revenue.

Thus, it is important for the management of Elton plc to undertake potential measure for

controlling and managing direct expenses as with the help of which firm would be able

to increase its gross profit margin.

Net profit ratio: From the analysis of profit and loss statement of Elton plc it has been

evaluated that the net profit of the firm is showing increasing result from 4.06% to

4.05% in the year 2015. This is because, indirect expenses of the firm are showing

decreasing results that indeed assisted the course of company to generate increasing net

profit (Vogel, 2014). In particular, administration expenditure of the firm has decreased

significantly from £163 to £114. In addition to this, tax paid by the firm is relatively low

in comparison to the profit margin earned. In this it is recommended that firm should

constantly focus on promotional campaign so as to increase the sales of different

portfolios and generate higher profitability.

Assessment of statement of financial position

Liquidity ratios:

The main purpose of these ratios is to assess the capability of firm to meet is short term

financial obligations. Through the means of this manager can make decisions regarding whether

Elton’s liquidity position is sound or not.

Current Ratio: This ratio assist in evaluating the availability of current assets to

overcome firm’s current liabilities. However, on the basis of given information, current

ratio of Elton plc for 2014 is 3.67:1 which has been decreased to 2.5:1 in year 2015. This

states that, management has used current assets to overcome short term financial

obligations (Al Karim and Alam, 2013). In 2015, investment has been made in plant and

machinery as well as £30 for development costs which indeed decreased the ratio. On the

positive prospects these investments has helped firm in generating fruitful results. Despite

of declining result, current ratio of 2.5:1 is ideal from the industry perspective which

clearly indicates the capability of firm in meeting its financial needs and commitments of

time.

3

Quick ratio: This ratio helps in evaluating the current assets of firm that can be easily

converted into cash for meeting financial commitments. On the basis of ratio analysis

table, quick ratio of Elton plc indicates that, it possess adequate amount of assets which

can be easily converted into cash for the immediate needs (Delen, Kuzey and Uyar,

2013). However, quick ratio of cited firm in 2014 was 2.8 which has been declined to 1.5

in year 2015 clearly indicates that management has used different quick assets to satisfy

financial needs of the company. Therefore, it can be suggested that senior authority must

focus on releasing the current assets as it will help in attaining competitive edge within

the target market.

Solvency ratio:

Solvency ratio of the firm illustrates the insight information regarding the capital

structure of the firm. This is quite beneficial for the external stakeholders because on the basis of

this they can make decisions regarding future investment or contingency (Brigham and Ehrhardt,

2013).

Debt/equity ratio: The main aim of evaluating this ratio is that it assist in indicating the

relative proportion of shareholder’s equity and debt used to finance firm’s assets. In other

words, it is also assist in measuring firm’s financial leverage. On the basis of accounting

standards, the ideal position of debt to equity ratio is 0.5:1 which means company should

raise 50% of funds from debt financing and remaining 50% from equity financing to

balance the risks and uncertainties. From the given case, debt to equity of Elton plc is

0.16 and 0.23 in 2014-15 (Healy and Palepu, 2012). This indicates, management has

raised its funds by using debt financing in year 2015 as compared to 2014. Further, this

has increased the long term liability of firm as they are oblige to make payment of

periodical interest to institution or party.

Efficiency ratio:

Through the means of this ratio, top level management of Elton plc can easily evaluate

the extent to which its human resource has made use of available resources in carrying out

business activities and generating desired results (Hatzinger, Böhlke and Sturchio, 2013).

Asset turnover ratio: The main purpose of computing this ratio is to assess the extent to

which business has made use of its available assets to generate sales revenue. However,

higher the ratio indicates better or optimum use of available assets and vice-verse (Ratio

4

converted into cash for meeting financial commitments. On the basis of ratio analysis

table, quick ratio of Elton plc indicates that, it possess adequate amount of assets which

can be easily converted into cash for the immediate needs (Delen, Kuzey and Uyar,

2013). However, quick ratio of cited firm in 2014 was 2.8 which has been declined to 1.5

in year 2015 clearly indicates that management has used different quick assets to satisfy

financial needs of the company. Therefore, it can be suggested that senior authority must

focus on releasing the current assets as it will help in attaining competitive edge within

the target market.

Solvency ratio:

Solvency ratio of the firm illustrates the insight information regarding the capital

structure of the firm. This is quite beneficial for the external stakeholders because on the basis of

this they can make decisions regarding future investment or contingency (Brigham and Ehrhardt,

2013).

Debt/equity ratio: The main aim of evaluating this ratio is that it assist in indicating the

relative proportion of shareholder’s equity and debt used to finance firm’s assets. In other

words, it is also assist in measuring firm’s financial leverage. On the basis of accounting

standards, the ideal position of debt to equity ratio is 0.5:1 which means company should

raise 50% of funds from debt financing and remaining 50% from equity financing to

balance the risks and uncertainties. From the given case, debt to equity of Elton plc is

0.16 and 0.23 in 2014-15 (Healy and Palepu, 2012). This indicates, management has

raised its funds by using debt financing in year 2015 as compared to 2014. Further, this

has increased the long term liability of firm as they are oblige to make payment of

periodical interest to institution or party.

Efficiency ratio:

Through the means of this ratio, top level management of Elton plc can easily evaluate

the extent to which its human resource has made use of available resources in carrying out

business activities and generating desired results (Hatzinger, Böhlke and Sturchio, 2013).

Asset turnover ratio: The main purpose of computing this ratio is to assess the extent to

which business has made use of its available assets to generate sales revenue. However,

higher the ratio indicates better or optimum use of available assets and vice-verse (Ratio

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Analysis, 2015). On the basis of generated outcome of asset turnover ratio for 1.59 which

is lower than 1.71 of 2014 indicates that firm failed to make adequate use of its assets as

compared to previous year.

Fixed assets turnover ratio: Similar to asset turnover, this ratio also generate decreasing

results as in 2014 it was 3.01 and in 2015 it is 2.94. However, this is not a positive sign

for the Elton plc because it directly effects on the growth and profit margin of the

business entity. In this regard, senior authority of Elton plc is recommended to train

workers so that they can work efficiently and make use of available assets in appropriate

manner to generate desired outcome for the firm (Financial Ratio Analysis, 2014).

Inventory turnover ratio: This ratio helps in evaluating the information about how

effectively inventory is used to generate sales and replacement during the accounting

period. However, inventory turnover ratio of the cited firm has shown decreasing results

from 16.85 to 9.07 and it is because of increasing level of competition as well as dynamic

business arena, sales has been adversely affected to a great extent.

Analyzing the cash flow statement

Cash flow statement assist in evaluating the inflow and outflow of cash during the

financial period. However, it is one of the major statement that company has to prepare in order

to record all the transaction taken place related to the cash and cash equivalents (Brigham and

Ehrhardt, 2013). In general, this statement consist of three major components i.e. cash flow from

operating, investing and financing activities.

On the basis of evaluating of cash flow statement of Elton plc it has been evaluated that,

top level management is unable to generate inflow wherein, there is increasing cash outflow in

the operating activities. However, in the reporting period of 2015 negative cash flow of £88

million has been recorded in the cash position of cited firm (Baum and Crosby, 2014). Further,

during the accounting period of 2015, company had made several investments in intangible

assets, properties, plant and equipment’s has decreased the cash balance. This is due to which,

there is high outflow of cash during the whole year. In this regard, it is recommended to senior

authority of Elton plc that they need to concentrate on making suitable and reliable financial plan

for making adequate use of available funds or money.

5

is lower than 1.71 of 2014 indicates that firm failed to make adequate use of its assets as

compared to previous year.

Fixed assets turnover ratio: Similar to asset turnover, this ratio also generate decreasing

results as in 2014 it was 3.01 and in 2015 it is 2.94. However, this is not a positive sign

for the Elton plc because it directly effects on the growth and profit margin of the

business entity. In this regard, senior authority of Elton plc is recommended to train

workers so that they can work efficiently and make use of available assets in appropriate

manner to generate desired outcome for the firm (Financial Ratio Analysis, 2014).

Inventory turnover ratio: This ratio helps in evaluating the information about how

effectively inventory is used to generate sales and replacement during the accounting

period. However, inventory turnover ratio of the cited firm has shown decreasing results

from 16.85 to 9.07 and it is because of increasing level of competition as well as dynamic

business arena, sales has been adversely affected to a great extent.

Analyzing the cash flow statement

Cash flow statement assist in evaluating the inflow and outflow of cash during the

financial period. However, it is one of the major statement that company has to prepare in order

to record all the transaction taken place related to the cash and cash equivalents (Brigham and

Ehrhardt, 2013). In general, this statement consist of three major components i.e. cash flow from

operating, investing and financing activities.

On the basis of evaluating of cash flow statement of Elton plc it has been evaluated that,

top level management is unable to generate inflow wherein, there is increasing cash outflow in

the operating activities. However, in the reporting period of 2015 negative cash flow of £88

million has been recorded in the cash position of cited firm (Baum and Crosby, 2014). Further,

during the accounting period of 2015, company had made several investments in intangible

assets, properties, plant and equipment’s has decreased the cash balance. This is due to which,

there is high outflow of cash during the whole year. In this regard, it is recommended to senior

authority of Elton plc that they need to concentrate on making suitable and reliable financial plan

for making adequate use of available funds or money.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Limitations of financial statements

There are several limitations of financial statements and it is important for the finance

manager understand so that they can make adequate use of the accounting standards. Following

are the limitations of the prepared statements:

Accuracy of financial statements high depends upon the historical costs. Thus, if input

figures are wrong then overall statements are invalid for the decision making purpose

(Liesen, Figge and Hahn, 2013).

In addition to this, financial statements does not provide qualitative information which is

associated with the business unit. Because, with quantitative information, stakeholders

require qualitative base to make smart and reliable decisions.

It is important for the managers to gather adequate amount of data otherwise it may leads

to misleading results of financial statements (Kumbaroğlu and Madlener, 2012).

Revised financial statements ratio analysis:

Ratios Formula

Revised

statements

(2015)

Non-revised

statements

(2015)

Liquidity ratios

Current assets 608 758

Current liabilities 303 303

Inventory 290 290

Current ratio current assets / current liabilities 2.01 2.50

Quick ratio

Current assets – (stock + prepaid expenses)

/ current liabilities 1.05 1.54

Solvency ratio

Debt 250 250

Shareholders’

equity 949 1099

Debt- equity ratio Debt / shareholders’ equity 0.26 0.22

6

There are several limitations of financial statements and it is important for the finance

manager understand so that they can make adequate use of the accounting standards. Following

are the limitations of the prepared statements:

Accuracy of financial statements high depends upon the historical costs. Thus, if input

figures are wrong then overall statements are invalid for the decision making purpose

(Liesen, Figge and Hahn, 2013).

In addition to this, financial statements does not provide qualitative information which is

associated with the business unit. Because, with quantitative information, stakeholders

require qualitative base to make smart and reliable decisions.

It is important for the managers to gather adequate amount of data otherwise it may leads

to misleading results of financial statements (Kumbaroğlu and Madlener, 2012).

Revised financial statements ratio analysis:

Ratios Formula

Revised

statements

(2015)

Non-revised

statements

(2015)

Liquidity ratios

Current assets 608 758

Current liabilities 303 303

Inventory 290 290

Current ratio current assets / current liabilities 2.01 2.50

Quick ratio

Current assets – (stock + prepaid expenses)

/ current liabilities 1.05 1.54

Solvency ratio

Debt 250 250

Shareholders’

equity 949 1099

Debt- equity ratio Debt / shareholders’ equity 0.26 0.22

6

Interpretation:

On the basis of above table it has been evaluated that, current and quick ratio of Elton plc

are 2.1 and 1.05 according to the revised statements. However, the main reason behind which

company was able to generate the better liquidity position is because of recording receivables

worth of £150 million in year 2015. Along with this, external auditor evaluated that

shareholder’s equity of Elton plc was 949 rather than 1099. Therefore, it can be said that, revised

financial statements generate higher debt equity ratio as compared to non-revised statements.

PART 2: INVESTMENT APPRAISAL

Critically evaluating investment appraisal techniques by taking into account the benefits and

limitations of each method

In general, investment appraisal techniques can be defined as the financial tool of

assessing the reliability and suitability of investment proposal. There are several appraisal

techniques that can be incorporated to carry out the assessment i.e. net present value, accounting

rate of return and payback period etc. Through the means of these tools, managers can easily

determine the profitability aspect of different proposals (Mizobuchi and Takeuchi, 2013). The

main purpose behind undertaking capital budgeting techniques is that these approaches assist

managers or entrepreneurs in making smart and reliable decisions regarding future contingency

of available funds.

According to the present given case scenario, top level management of Elton plc planning

to expand its business operations in African, Asian, Middle Eastern and South American

markets. In order to expand business, management requires initial investment of £500 millions.

On the basis of given information in (exhibit 4) following outcomes generated by manager in

relation to the investment proposal.

Investment appraisal tool Outcomes

Net present value (NPV) £110 million

Accounting rate of return (ARR) 18.00%

Payback period 4 years

Net present value:

7

On the basis of above table it has been evaluated that, current and quick ratio of Elton plc

are 2.1 and 1.05 according to the revised statements. However, the main reason behind which

company was able to generate the better liquidity position is because of recording receivables

worth of £150 million in year 2015. Along with this, external auditor evaluated that

shareholder’s equity of Elton plc was 949 rather than 1099. Therefore, it can be said that, revised

financial statements generate higher debt equity ratio as compared to non-revised statements.

PART 2: INVESTMENT APPRAISAL

Critically evaluating investment appraisal techniques by taking into account the benefits and

limitations of each method

In general, investment appraisal techniques can be defined as the financial tool of

assessing the reliability and suitability of investment proposal. There are several appraisal

techniques that can be incorporated to carry out the assessment i.e. net present value, accounting

rate of return and payback period etc. Through the means of these tools, managers can easily

determine the profitability aspect of different proposals (Mizobuchi and Takeuchi, 2013). The

main purpose behind undertaking capital budgeting techniques is that these approaches assist

managers or entrepreneurs in making smart and reliable decisions regarding future contingency

of available funds.

According to the present given case scenario, top level management of Elton plc planning

to expand its business operations in African, Asian, Middle Eastern and South American

markets. In order to expand business, management requires initial investment of £500 millions.

On the basis of given information in (exhibit 4) following outcomes generated by manager in

relation to the investment proposal.

Investment appraisal tool Outcomes

Net present value (NPV) £110 million

Accounting rate of return (ARR) 18.00%

Payback period 4 years

Net present value:

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The main purpose of this method is to present the information regarding the return that

business will gain after predetermined period of time by taking into consideration the

discounting factor. However, according to the concept of this appraisal technique, higher the

NPV is better for the future investments (Project and Investment Appraisal for Sustainable

Value Creation, 2013). On the basis of outcome generated it has been evaluated that, cited firm

will gain the net present value of £110 million after the period of five years from the investment

in available expansion proposal. Further, comparing it to the initial investment it is way beyond

the expectations of the investors. Therefore, it is not feasible for the Elton plc to invest in the

given proposal as it will not generate beneficial outcomes.

Benefits of NPV:

One of the major benefits of NPV is that it is capable to generate realistic outcomes by

considering the concept of time value of money (Afonso, 2009). However, by the means of this

method managers can easily assess whether investment proposal will enhance the value of firm

in near future or not. In addition to this, every company invest with the aim of maximizing the

profits and for which managers are responsible to assess the reliability of the option available.

Lastly, cited method assist business entity in making smart decisions on the basis of discounting

factor and cost of capital.

Drawbacks of NPV:

Contrary to the benefits there are certain drawbacks that NPV method consist of such as

it generates results in absolute figures rather than percentage which indeed affects the

significance of the approach (Malik, Rehman and Khan, 2013). Further, if manager is unable to

select the suitable discounting rate or cost of capital than this method will generate

Accounting rate of return:

The main purpose behind computing ARR of a project is that it assist in illustrating the

information regarding net income which firm will acquire from the proposed investment. Herein,

by dividing the average profit from initial investment, business entity can evaluate the average

return on investment proposal (Cheung and Sengupta, 2013). On the basis of given information,

it is evaluated that Elton plc will gain 18% of profit margin on the investment proposal after the

expansion which indeed is considered as the low on the basis of industry in which cited firm is

expanding its business operations. In this regard, it is recommended that top level management

8

business will gain after predetermined period of time by taking into consideration the

discounting factor. However, according to the concept of this appraisal technique, higher the

NPV is better for the future investments (Project and Investment Appraisal for Sustainable

Value Creation, 2013). On the basis of outcome generated it has been evaluated that, cited firm

will gain the net present value of £110 million after the period of five years from the investment

in available expansion proposal. Further, comparing it to the initial investment it is way beyond

the expectations of the investors. Therefore, it is not feasible for the Elton plc to invest in the

given proposal as it will not generate beneficial outcomes.

Benefits of NPV:

One of the major benefits of NPV is that it is capable to generate realistic outcomes by

considering the concept of time value of money (Afonso, 2009). However, by the means of this

method managers can easily assess whether investment proposal will enhance the value of firm

in near future or not. In addition to this, every company invest with the aim of maximizing the

profits and for which managers are responsible to assess the reliability of the option available.

Lastly, cited method assist business entity in making smart decisions on the basis of discounting

factor and cost of capital.

Drawbacks of NPV:

Contrary to the benefits there are certain drawbacks that NPV method consist of such as

it generates results in absolute figures rather than percentage which indeed affects the

significance of the approach (Malik, Rehman and Khan, 2013). Further, if manager is unable to

select the suitable discounting rate or cost of capital than this method will generate

Accounting rate of return:

The main purpose behind computing ARR of a project is that it assist in illustrating the

information regarding net income which firm will acquire from the proposed investment. Herein,

by dividing the average profit from initial investment, business entity can evaluate the average

return on investment proposal (Cheung and Sengupta, 2013). On the basis of given information,

it is evaluated that Elton plc will gain 18% of profit margin on the investment proposal after the

expansion which indeed is considered as the low on the basis of industry in which cited firm is

expanding its business operations. In this regard, it is recommended that top level management

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

of Elton plc should reject the proposal. Following are the benefits and drawbacks of accounting

rate of return:

Benefits of ARR:

ARR assist in providing information regarding the degree to which proposed investment

will impact on the profitability of the firm (Tarca, Morris and Moy, 2013). On the basis of this

information managers can easily assess the capability of project to satisfy the corporate

objectives of business.

Drawbacks of ARR:

The major con of ARR method is that while assessing the reliability or suitability of the

project this tool undertakes profit margin rather than cash flows. In addition to this, accounting

rate of return does not consider time value of money concept which is important at the time of

making decisions regarding future investments (Osei-Assibey, 2013).

Payback period:

This tool of investment appraisal assist in evaluating the time required by the investment

proposal to recover its initial investment. However, payback period of project showing lesser

time is feasible to invest as compared to more time. According to the given case scenario,

payback period of available proposal is 4 years which indicates, defined time will be required by

the proposal to recover its initial investment. Considering the average payback period of the

proposals which is 2 to 2.5 years, generated outcome is relatively high (Project and Investment

Appraisal for Sustainable Value Creation, 2013). Thus, it is not feasible for the top level

management of Elton plc to invest in the proposal. Following are the benefits and drawbacks of

the payback period method:

Benefits of payback period:

Through the help of payback period, manager can easily assess the recovery period of

initial investment. On the basis of this, managerial level people can frame competent and

strategic policies for the future contingency of business enterprise (Baum and Crosby, 2014).

Drawbacks of payback period:

The main drawback of this method is that it only illustrates the information regarding the

time require by a project to regain its initial investment. In this regard, it does not undertake cash

flows during the computation which indeed restricts the importance of this method to a great

extent (Malik, Rehman and Khan, 2013).

9

rate of return:

Benefits of ARR:

ARR assist in providing information regarding the degree to which proposed investment

will impact on the profitability of the firm (Tarca, Morris and Moy, 2013). On the basis of this

information managers can easily assess the capability of project to satisfy the corporate

objectives of business.

Drawbacks of ARR:

The major con of ARR method is that while assessing the reliability or suitability of the

project this tool undertakes profit margin rather than cash flows. In addition to this, accounting

rate of return does not consider time value of money concept which is important at the time of

making decisions regarding future investments (Osei-Assibey, 2013).

Payback period:

This tool of investment appraisal assist in evaluating the time required by the investment

proposal to recover its initial investment. However, payback period of project showing lesser

time is feasible to invest as compared to more time. According to the given case scenario,

payback period of available proposal is 4 years which indicates, defined time will be required by

the proposal to recover its initial investment. Considering the average payback period of the

proposals which is 2 to 2.5 years, generated outcome is relatively high (Project and Investment

Appraisal for Sustainable Value Creation, 2013). Thus, it is not feasible for the top level

management of Elton plc to invest in the proposal. Following are the benefits and drawbacks of

the payback period method:

Benefits of payback period:

Through the help of payback period, manager can easily assess the recovery period of

initial investment. On the basis of this, managerial level people can frame competent and

strategic policies for the future contingency of business enterprise (Baum and Crosby, 2014).

Drawbacks of payback period:

The main drawback of this method is that it only illustrates the information regarding the

time require by a project to regain its initial investment. In this regard, it does not undertake cash

flows during the computation which indeed restricts the importance of this method to a great

extent (Malik, Rehman and Khan, 2013).

9

Advising the Board of Directors about the non-financial factors which Elton Plc need to consider

while expanding business operations in international market

Looking at the present corporate environment it is important for the companies to expand

their business operations at appropriate intervals so that desired sustainability can be maintained

within the market (Tarca, Morris and Moy, 2013). As per the given scenario, Elton plc planning

to expand business operations in different locations around the globe require proper strategic

framework and methods to execute. In this regard, there are several non-financial factors that

managers need to assess which can have significant impact on the success and growth of

business. Thus, management is responsible to consider these factors while expanding business

operations and functions which are as follows:

Market conditions: Before making decision regarding expansion it is vital for the

managers to assess the conditions of market to understand the factors i.e. taste and

preferences of consumers, competitors, emerging trends, buying behaviour, spending

power etc (Hatzinger, Böhlke and Sturchio, 2013). On the basis of these information top

level management of Elton plc can easily make decision regarding entering into market

or not.

Legal framework: Every country has its own laws and legislations on the basis of sectors

or industries. However, to establish business in the new market, management of Elton

have to understand the legal framework of these nations and accordingly develop the

suitable and reliable policies and practices so that activities can be carried out in legal

manner.

Technological advancement: Looking at the nature of industry in which Elton plc

operates it can be said that technological advancement is one of the major non-financial

factor that senior authority need to take into consideration (Uechi and et.al, 2015). In

order to expand business operations in different market, it is important for the

management of Elton to inculcate technological updation in hardware and accessories it

offers in the market.

Internal management: Having proper internal management assist in enhancing the

execution of business operations and ensure long term sustainability of the company. For

Elton plc it is essential to have proper internal management so as to make sure that

available resources are utilized in optimum manner to generate desired results and

10

while expanding business operations in international market

Looking at the present corporate environment it is important for the companies to expand

their business operations at appropriate intervals so that desired sustainability can be maintained

within the market (Tarca, Morris and Moy, 2013). As per the given scenario, Elton plc planning

to expand business operations in different locations around the globe require proper strategic

framework and methods to execute. In this regard, there are several non-financial factors that

managers need to assess which can have significant impact on the success and growth of

business. Thus, management is responsible to consider these factors while expanding business

operations and functions which are as follows:

Market conditions: Before making decision regarding expansion it is vital for the

managers to assess the conditions of market to understand the factors i.e. taste and

preferences of consumers, competitors, emerging trends, buying behaviour, spending

power etc (Hatzinger, Böhlke and Sturchio, 2013). On the basis of these information top

level management of Elton plc can easily make decision regarding entering into market

or not.

Legal framework: Every country has its own laws and legislations on the basis of sectors

or industries. However, to establish business in the new market, management of Elton

have to understand the legal framework of these nations and accordingly develop the

suitable and reliable policies and practices so that activities can be carried out in legal

manner.

Technological advancement: Looking at the nature of industry in which Elton plc

operates it can be said that technological advancement is one of the major non-financial

factor that senior authority need to take into consideration (Uechi and et.al, 2015). In

order to expand business operations in different market, it is important for the

management of Elton to inculcate technological updation in hardware and accessories it

offers in the market.

Internal management: Having proper internal management assist in enhancing the

execution of business operations and ensure long term sustainability of the company. For

Elton plc it is essential to have proper internal management so as to make sure that

available resources are utilized in optimum manner to generate desired results and

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.