Financial Decision Making: Analysis of Genting Singapore plc Ltd

VerifiedAdded on 2023/06/06

|34

|5604

|411

Report

AI Summary

This report provides a comprehensive financial analysis of Genting Singapore plc, a Singapore-based hospitality and integrated resort company. It includes a horizontal and vertical analysis of the company's financial statements, highlighting trends in revenue, profits, assets, and liabilities. The report also examines the economic condition of the hospitality and entertainment industry in Singapore, noting its significant contribution to the country's revenue. Key profitability ratios such as gross profit ratio, net margin, return on assets, and return on equity are analyzed, along with dividend ratios like dividend yield and payout ratio, and the price-earnings ratio. Stability and liquidity ratios, including debt-to-equity, interest coverage, current, and quick ratios, are assessed to determine the company's financial health. Efficiency ratios such as asset turnover, inventory turnover, and debtor’s turnover are also evaluated. Furthermore, the report compares Genting Singapore's performance with industry averages and discusses non-financial parameters and corporate governance compliance. The analysis aims to provide insights into the company's financial decision-making processes and their impact on its brand and reputation.

Financial Decision Making 1

Financial Decision Making

Author

Course Title

Professor

City

Date

Financial Decision Making

Author

Course Title

Professor

City

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Decision Making 2

Table of Contents

SECTION A...............................................................................................................................3

Introduction................................................................................................................................3

Horizontal Analysis and Vertical Analysis................................................................................3

Economic Condition of the Hospitality and Entertainment Industry in Singapore...................7

PROFITABILITY......................................................................................................................8

Gross profit ratio....................................................................................................................8

Figure 1: Graph of gross profit ratio Net Margin...................................................................9

Return on assets....................................................................................................................10

Return on Equity..................................................................................................................11

DIVIDEND RATIOS...............................................................................................................12

Dividend Yield ratio.............................................................................................................12

Figure 5: Dividend Yield Dividend Payout ratio.................................................................13

Figure 5: dividend payout Price earnings ratio....................................................................14

Figure 7: P/E ratio Earnings per share.................................................................................15

STABILITY AND LIQUIDITY RATIOS...............................................................................16

Debt to Equity ratio..............................................................................................................16

Figure 9: Debt/equity ratio Interest coverage ratio..............................................................17

Current ratio.........................................................................................................................18

Figure 11: Current ratio Quick ratio.....................................................................................19

EFFICIENCY Ratios...............................................................................................................20

Asset Turnover ratio.............................................................................................................20

Inventory turnover ratio.......................................................................................................21

Debtor’s turnover ratio.........................................................................................................22

Cash Cycle...........................................................................................................................23

Comparative of Genting Singapore with Industry Average.....................................................24

Returns on Investment..........................................................................................................24

Return on Assets..................................................................................................................24

Return on Equity..................................................................................................................25

Risk......................................................................................................................................25

Asset Value per Share as well as Genting Singapore Ltd Market Share Price Compared to

STI............................................................................................................................................26

Non-Financial Parameters for Genting Singapore plc.............................................................26

Section B..................................................................................................................................27

Genting Singapore Ltd Corporate Governance Compliance...............................................27

Impact of Proposed Policies on Company’s Brand and Reputation....................................28

Table of Contents

SECTION A...............................................................................................................................3

Introduction................................................................................................................................3

Horizontal Analysis and Vertical Analysis................................................................................3

Economic Condition of the Hospitality and Entertainment Industry in Singapore...................7

PROFITABILITY......................................................................................................................8

Gross profit ratio....................................................................................................................8

Figure 1: Graph of gross profit ratio Net Margin...................................................................9

Return on assets....................................................................................................................10

Return on Equity..................................................................................................................11

DIVIDEND RATIOS...............................................................................................................12

Dividend Yield ratio.............................................................................................................12

Figure 5: Dividend Yield Dividend Payout ratio.................................................................13

Figure 5: dividend payout Price earnings ratio....................................................................14

Figure 7: P/E ratio Earnings per share.................................................................................15

STABILITY AND LIQUIDITY RATIOS...............................................................................16

Debt to Equity ratio..............................................................................................................16

Figure 9: Debt/equity ratio Interest coverage ratio..............................................................17

Current ratio.........................................................................................................................18

Figure 11: Current ratio Quick ratio.....................................................................................19

EFFICIENCY Ratios...............................................................................................................20

Asset Turnover ratio.............................................................................................................20

Inventory turnover ratio.......................................................................................................21

Debtor’s turnover ratio.........................................................................................................22

Cash Cycle...........................................................................................................................23

Comparative of Genting Singapore with Industry Average.....................................................24

Returns on Investment..........................................................................................................24

Return on Assets..................................................................................................................24

Return on Equity..................................................................................................................25

Risk......................................................................................................................................25

Asset Value per Share as well as Genting Singapore Ltd Market Share Price Compared to

STI............................................................................................................................................26

Non-Financial Parameters for Genting Singapore plc.............................................................26

Section B..................................................................................................................................27

Genting Singapore Ltd Corporate Governance Compliance...............................................27

Impact of Proposed Policies on Company’s Brand and Reputation....................................28

Financial Decision Making 3

Review of corporate governance..........................................................................................28

Directors and their role.....................................................................................................28

Non-Executive Directors and Their Role.........................................................................28

Conclusion................................................................................................................................29

REFERENCES.........................................................................................................................31

Review of corporate governance..........................................................................................28

Directors and their role.....................................................................................................28

Non-Executive Directors and Their Role.........................................................................28

Conclusion................................................................................................................................29

REFERENCES.........................................................................................................................31

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Decision Making 4

Financial Decision Making

SECTION A

Introduction

Genting Singapore Plc is the Singapore-based regional hospitality, leisure as well as

integrated resorts listed on Singapore Stock Exchange (Reuters.com 2018). Through its

subsidiaries, Genting Singapore plc is usually engaged in development as well as operations

of casinos, integrated resort, provision of marketing and sales support services to hospitality

and leisure related investment and businesses. The company operates through hospitality and

leisure operations segment in Singapore. It also carries its operations in the other regions such

as Asia Pacific including development of integrated resort within Korea (Genting Singapore

plc 2017). To be more specific, Genting Singapore plc is engaged in operation and

development of the integrated resorts, comprising of gaming, incentives, hospitality, casino,

meetings and conferences. The company also provides international marketing, information

technology and sales services. It gaming plan is usually owning and operating hospitality,

entertainment, gaming and leisure facilities (Reuters.com 2018). The company operates under

gabling, lodging and entertainment industry. Its main competitors include 2016 GCG

Limited, Las Vegas Sands Corporation as well as Melco Resorts and Entertainment Ltd.

Horizontal Analysis and Vertical Analysis

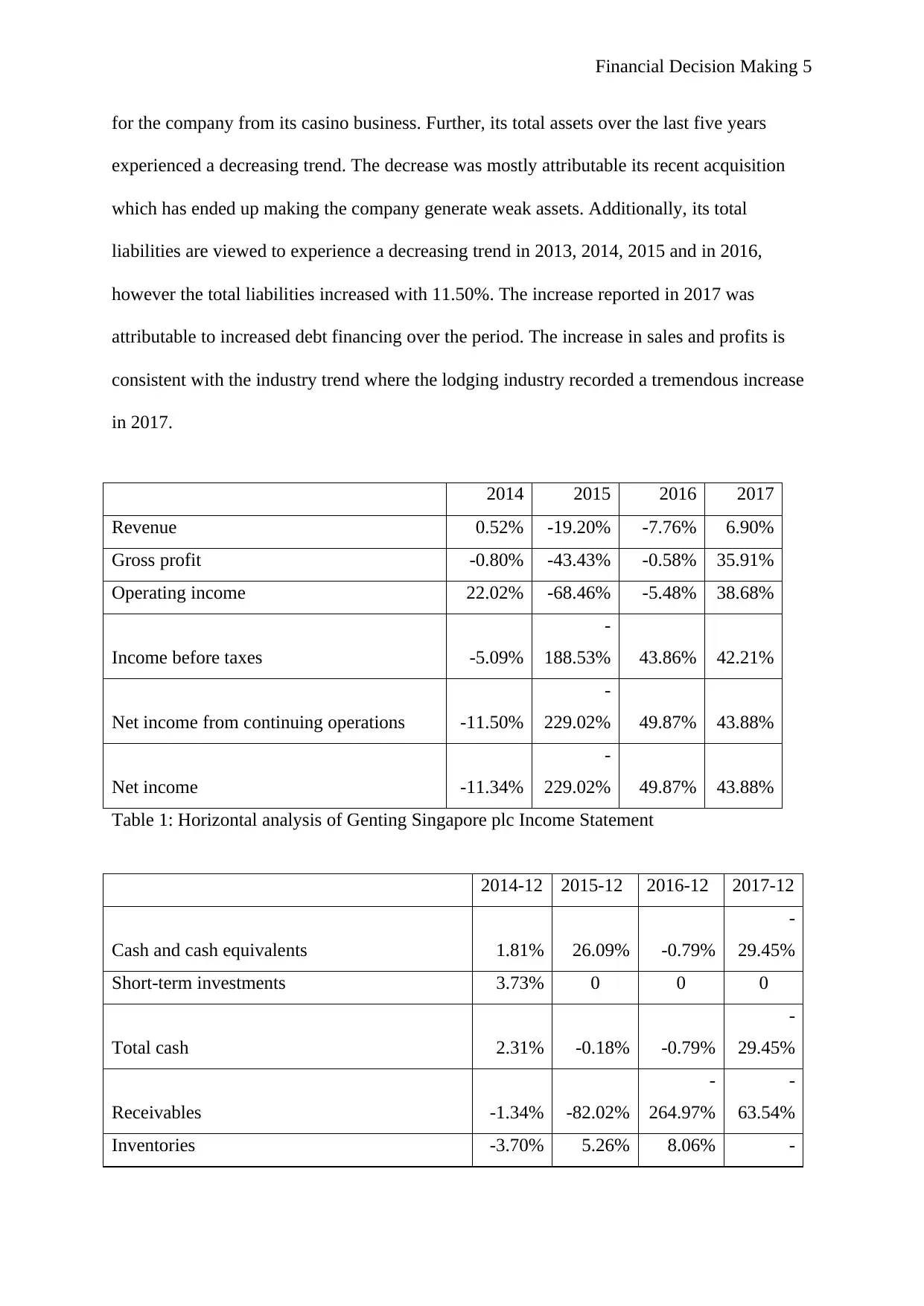

Based on the company’s horizontal analysis presented in Table 1 and 2 below, it is evident

that Genting Singapore plc revenue experienced a significant increase in the year 2014. The

decrease in total revenue over the two years was attributable to the stiff competition within

the industry resulting in decreased sales. Nonetheless, in the year 2017, Genting Singapore

plc is found to have enjoyed increment in its revenue. Its profits both net profit, operating and

gross profit experienced decrease in 2013, 2014, 2015 and 2016; nonetheless, the profits

increased in 2017. The increase in profits in 2017 was attributable to higher business volume

Financial Decision Making

SECTION A

Introduction

Genting Singapore Plc is the Singapore-based regional hospitality, leisure as well as

integrated resorts listed on Singapore Stock Exchange (Reuters.com 2018). Through its

subsidiaries, Genting Singapore plc is usually engaged in development as well as operations

of casinos, integrated resort, provision of marketing and sales support services to hospitality

and leisure related investment and businesses. The company operates through hospitality and

leisure operations segment in Singapore. It also carries its operations in the other regions such

as Asia Pacific including development of integrated resort within Korea (Genting Singapore

plc 2017). To be more specific, Genting Singapore plc is engaged in operation and

development of the integrated resorts, comprising of gaming, incentives, hospitality, casino,

meetings and conferences. The company also provides international marketing, information

technology and sales services. It gaming plan is usually owning and operating hospitality,

entertainment, gaming and leisure facilities (Reuters.com 2018). The company operates under

gabling, lodging and entertainment industry. Its main competitors include 2016 GCG

Limited, Las Vegas Sands Corporation as well as Melco Resorts and Entertainment Ltd.

Horizontal Analysis and Vertical Analysis

Based on the company’s horizontal analysis presented in Table 1 and 2 below, it is evident

that Genting Singapore plc revenue experienced a significant increase in the year 2014. The

decrease in total revenue over the two years was attributable to the stiff competition within

the industry resulting in decreased sales. Nonetheless, in the year 2017, Genting Singapore

plc is found to have enjoyed increment in its revenue. Its profits both net profit, operating and

gross profit experienced decrease in 2013, 2014, 2015 and 2016; nonetheless, the profits

increased in 2017. The increase in profits in 2017 was attributable to higher business volume

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Decision Making 5

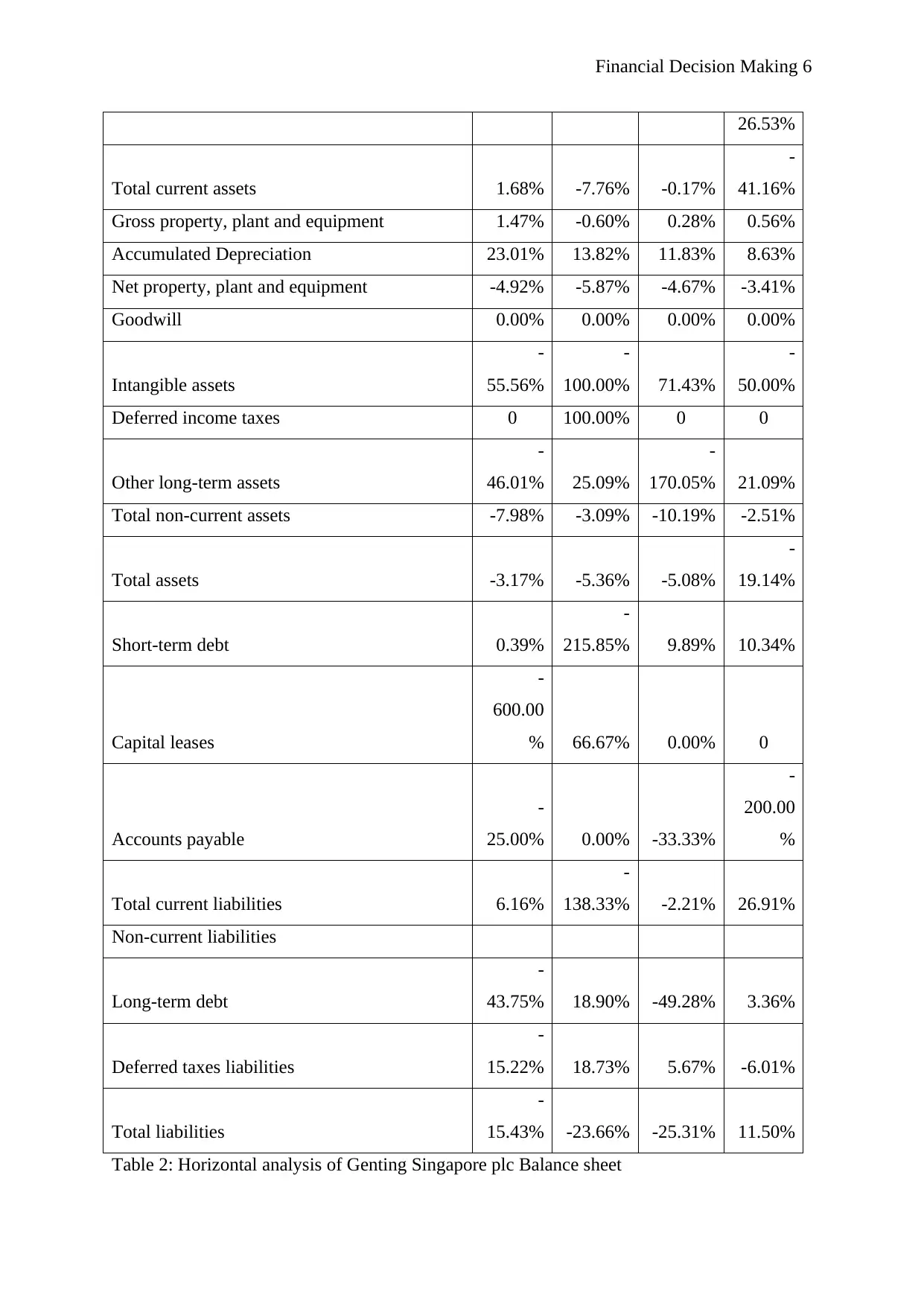

for the company from its casino business. Further, its total assets over the last five years

experienced a decreasing trend. The decrease was mostly attributable its recent acquisition

which has ended up making the company generate weak assets. Additionally, its total

liabilities are viewed to experience a decreasing trend in 2013, 2014, 2015 and in 2016,

however the total liabilities increased with 11.50%. The increase reported in 2017 was

attributable to increased debt financing over the period. The increase in sales and profits is

consistent with the industry trend where the lodging industry recorded a tremendous increase

in 2017.

2014 2015 2016 2017

Revenue 0.52% -19.20% -7.76% 6.90%

Gross profit -0.80% -43.43% -0.58% 35.91%

Operating income 22.02% -68.46% -5.48% 38.68%

Income before taxes -5.09%

-

188.53% 43.86% 42.21%

Net income from continuing operations -11.50%

-

229.02% 49.87% 43.88%

Net income -11.34%

-

229.02% 49.87% 43.88%

Table 1: Horizontal analysis of Genting Singapore plc Income Statement

2014-12 2015-12 2016-12 2017-12

Cash and cash equivalents 1.81% 26.09% -0.79%

-

29.45%

Short-term investments 3.73% 0 0 0

Total cash 2.31% -0.18% -0.79%

-

29.45%

Receivables -1.34% -82.02%

-

264.97%

-

63.54%

Inventories -3.70% 5.26% 8.06% -

for the company from its casino business. Further, its total assets over the last five years

experienced a decreasing trend. The decrease was mostly attributable its recent acquisition

which has ended up making the company generate weak assets. Additionally, its total

liabilities are viewed to experience a decreasing trend in 2013, 2014, 2015 and in 2016,

however the total liabilities increased with 11.50%. The increase reported in 2017 was

attributable to increased debt financing over the period. The increase in sales and profits is

consistent with the industry trend where the lodging industry recorded a tremendous increase

in 2017.

2014 2015 2016 2017

Revenue 0.52% -19.20% -7.76% 6.90%

Gross profit -0.80% -43.43% -0.58% 35.91%

Operating income 22.02% -68.46% -5.48% 38.68%

Income before taxes -5.09%

-

188.53% 43.86% 42.21%

Net income from continuing operations -11.50%

-

229.02% 49.87% 43.88%

Net income -11.34%

-

229.02% 49.87% 43.88%

Table 1: Horizontal analysis of Genting Singapore plc Income Statement

2014-12 2015-12 2016-12 2017-12

Cash and cash equivalents 1.81% 26.09% -0.79%

-

29.45%

Short-term investments 3.73% 0 0 0

Total cash 2.31% -0.18% -0.79%

-

29.45%

Receivables -1.34% -82.02%

-

264.97%

-

63.54%

Inventories -3.70% 5.26% 8.06% -

Financial Decision Making 6

26.53%

Total current assets 1.68% -7.76% -0.17%

-

41.16%

Gross property, plant and equipment 1.47% -0.60% 0.28% 0.56%

Accumulated Depreciation 23.01% 13.82% 11.83% 8.63%

Net property, plant and equipment -4.92% -5.87% -4.67% -3.41%

Goodwill 0.00% 0.00% 0.00% 0.00%

Intangible assets

-

55.56%

-

100.00% 71.43%

-

50.00%

Deferred income taxes 0 100.00% 0 0

Other long-term assets

-

46.01% 25.09%

-

170.05% 21.09%

Total non-current assets -7.98% -3.09% -10.19% -2.51%

Total assets -3.17% -5.36% -5.08%

-

19.14%

Short-term debt 0.39%

-

215.85% 9.89% 10.34%

Capital leases

-

600.00

% 66.67% 0.00% 0

Accounts payable

-

25.00% 0.00% -33.33%

-

200.00

%

Total current liabilities 6.16%

-

138.33% -2.21% 26.91%

Non-current liabilities

Long-term debt

-

43.75% 18.90% -49.28% 3.36%

Deferred taxes liabilities

-

15.22% 18.73% 5.67% -6.01%

Total liabilities

-

15.43% -23.66% -25.31% 11.50%

Table 2: Horizontal analysis of Genting Singapore plc Balance sheet

26.53%

Total current assets 1.68% -7.76% -0.17%

-

41.16%

Gross property, plant and equipment 1.47% -0.60% 0.28% 0.56%

Accumulated Depreciation 23.01% 13.82% 11.83% 8.63%

Net property, plant and equipment -4.92% -5.87% -4.67% -3.41%

Goodwill 0.00% 0.00% 0.00% 0.00%

Intangible assets

-

55.56%

-

100.00% 71.43%

-

50.00%

Deferred income taxes 0 100.00% 0 0

Other long-term assets

-

46.01% 25.09%

-

170.05% 21.09%

Total non-current assets -7.98% -3.09% -10.19% -2.51%

Total assets -3.17% -5.36% -5.08%

-

19.14%

Short-term debt 0.39%

-

215.85% 9.89% 10.34%

Capital leases

-

600.00

% 66.67% 0.00% 0

Accounts payable

-

25.00% 0.00% -33.33%

-

200.00

%

Total current liabilities 6.16%

-

138.33% -2.21% 26.91%

Non-current liabilities

Long-term debt

-

43.75% 18.90% -49.28% 3.36%

Deferred taxes liabilities

-

15.22% 18.73% 5.67% -6.01%

Total liabilities

-

15.43% -23.66% -25.31% 11.50%

Table 2: Horizontal analysis of Genting Singapore plc Balance sheet

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Decision Making 7

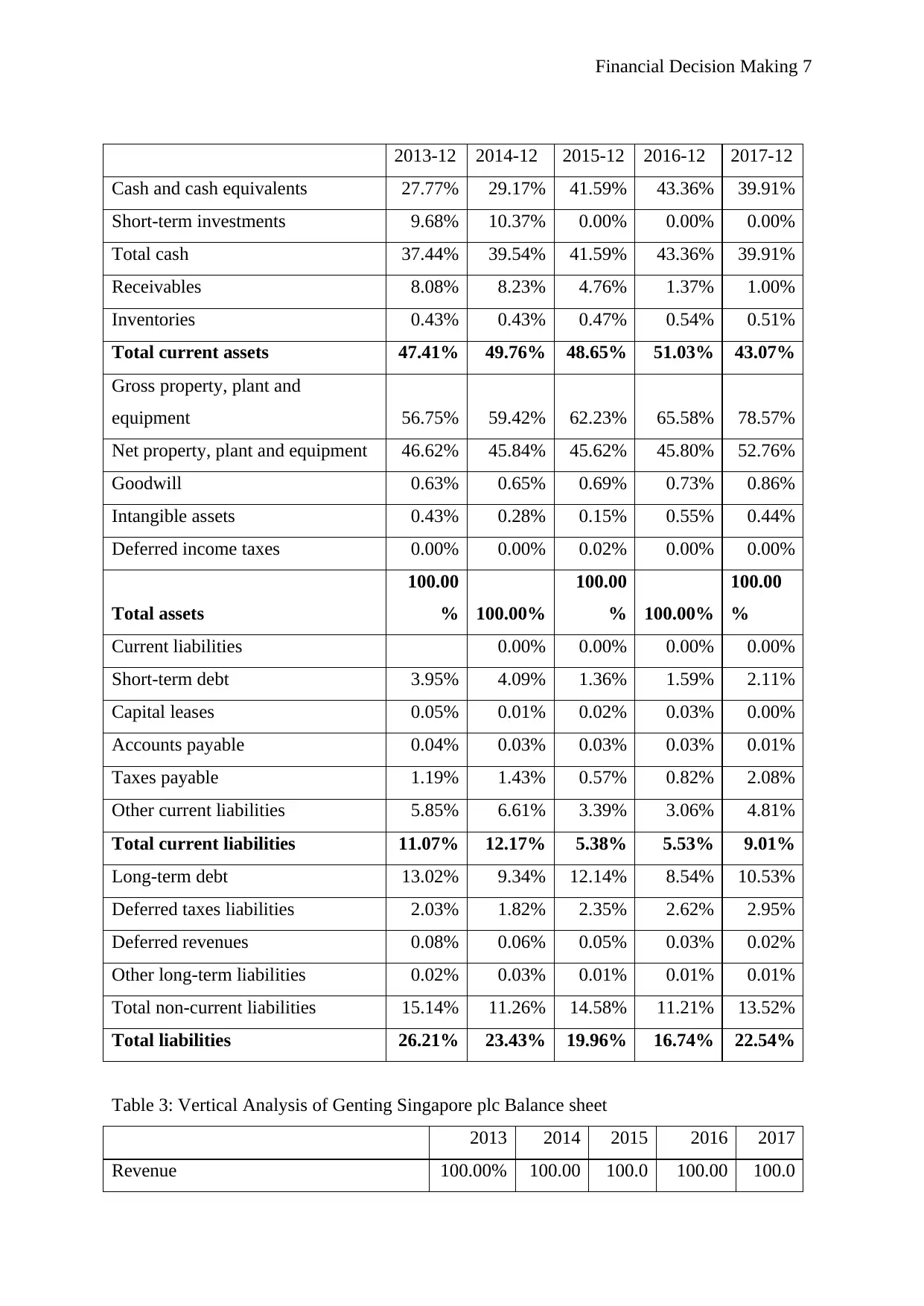

2013-12 2014-12 2015-12 2016-12 2017-12

Cash and cash equivalents 27.77% 29.17% 41.59% 43.36% 39.91%

Short-term investments 9.68% 10.37% 0.00% 0.00% 0.00%

Total cash 37.44% 39.54% 41.59% 43.36% 39.91%

Receivables 8.08% 8.23% 4.76% 1.37% 1.00%

Inventories 0.43% 0.43% 0.47% 0.54% 0.51%

Total current assets 47.41% 49.76% 48.65% 51.03% 43.07%

Gross property, plant and

equipment 56.75% 59.42% 62.23% 65.58% 78.57%

Net property, plant and equipment 46.62% 45.84% 45.62% 45.80% 52.76%

Goodwill 0.63% 0.65% 0.69% 0.73% 0.86%

Intangible assets 0.43% 0.28% 0.15% 0.55% 0.44%

Deferred income taxes 0.00% 0.00% 0.02% 0.00% 0.00%

Total assets

100.00

% 100.00%

100.00

% 100.00%

100.00

%

Current liabilities 0.00% 0.00% 0.00% 0.00%

Short-term debt 3.95% 4.09% 1.36% 1.59% 2.11%

Capital leases 0.05% 0.01% 0.02% 0.03% 0.00%

Accounts payable 0.04% 0.03% 0.03% 0.03% 0.01%

Taxes payable 1.19% 1.43% 0.57% 0.82% 2.08%

Other current liabilities 5.85% 6.61% 3.39% 3.06% 4.81%

Total current liabilities 11.07% 12.17% 5.38% 5.53% 9.01%

Long-term debt 13.02% 9.34% 12.14% 8.54% 10.53%

Deferred taxes liabilities 2.03% 1.82% 2.35% 2.62% 2.95%

Deferred revenues 0.08% 0.06% 0.05% 0.03% 0.02%

Other long-term liabilities 0.02% 0.03% 0.01% 0.01% 0.01%

Total non-current liabilities 15.14% 11.26% 14.58% 11.21% 13.52%

Total liabilities 26.21% 23.43% 19.96% 16.74% 22.54%

Table 3: Vertical Analysis of Genting Singapore plc Balance sheet

2013 2014 2015 2016 2017

Revenue 100.00% 100.00 100.0 100.00 100.0

2013-12 2014-12 2015-12 2016-12 2017-12

Cash and cash equivalents 27.77% 29.17% 41.59% 43.36% 39.91%

Short-term investments 9.68% 10.37% 0.00% 0.00% 0.00%

Total cash 37.44% 39.54% 41.59% 43.36% 39.91%

Receivables 8.08% 8.23% 4.76% 1.37% 1.00%

Inventories 0.43% 0.43% 0.47% 0.54% 0.51%

Total current assets 47.41% 49.76% 48.65% 51.03% 43.07%

Gross property, plant and

equipment 56.75% 59.42% 62.23% 65.58% 78.57%

Net property, plant and equipment 46.62% 45.84% 45.62% 45.80% 52.76%

Goodwill 0.63% 0.65% 0.69% 0.73% 0.86%

Intangible assets 0.43% 0.28% 0.15% 0.55% 0.44%

Deferred income taxes 0.00% 0.00% 0.02% 0.00% 0.00%

Total assets

100.00

% 100.00%

100.00

% 100.00%

100.00

%

Current liabilities 0.00% 0.00% 0.00% 0.00%

Short-term debt 3.95% 4.09% 1.36% 1.59% 2.11%

Capital leases 0.05% 0.01% 0.02% 0.03% 0.00%

Accounts payable 0.04% 0.03% 0.03% 0.03% 0.01%

Taxes payable 1.19% 1.43% 0.57% 0.82% 2.08%

Other current liabilities 5.85% 6.61% 3.39% 3.06% 4.81%

Total current liabilities 11.07% 12.17% 5.38% 5.53% 9.01%

Long-term debt 13.02% 9.34% 12.14% 8.54% 10.53%

Deferred taxes liabilities 2.03% 1.82% 2.35% 2.62% 2.95%

Deferred revenues 0.08% 0.06% 0.05% 0.03% 0.02%

Other long-term liabilities 0.02% 0.03% 0.01% 0.01% 0.01%

Total non-current liabilities 15.14% 11.26% 14.58% 11.21% 13.52%

Total liabilities 26.21% 23.43% 19.96% 16.74% 22.54%

Table 3: Vertical Analysis of Genting Singapore plc Balance sheet

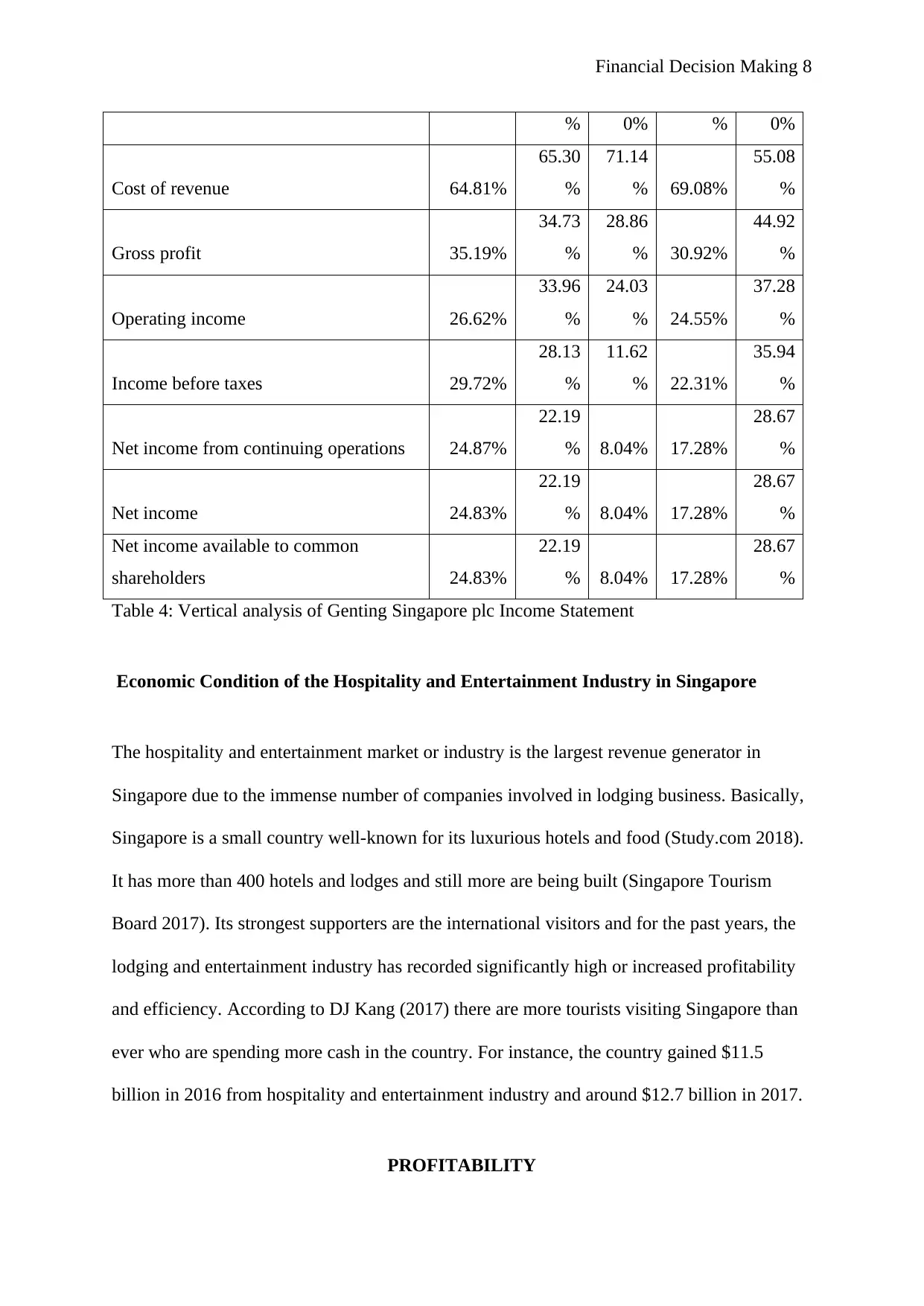

2013 2014 2015 2016 2017

Revenue 100.00% 100.00 100.0 100.00 100.0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Decision Making 8

% 0% % 0%

Cost of revenue 64.81%

65.30

%

71.14

% 69.08%

55.08

%

Gross profit 35.19%

34.73

%

28.86

% 30.92%

44.92

%

Operating income 26.62%

33.96

%

24.03

% 24.55%

37.28

%

Income before taxes 29.72%

28.13

%

11.62

% 22.31%

35.94

%

Net income from continuing operations 24.87%

22.19

% 8.04% 17.28%

28.67

%

Net income 24.83%

22.19

% 8.04% 17.28%

28.67

%

Net income available to common

shareholders 24.83%

22.19

% 8.04% 17.28%

28.67

%

Table 4: Vertical analysis of Genting Singapore plc Income Statement

Economic Condition of the Hospitality and Entertainment Industry in Singapore

The hospitality and entertainment market or industry is the largest revenue generator in

Singapore due to the immense number of companies involved in lodging business. Basically,

Singapore is a small country well-known for its luxurious hotels and food (Study.com 2018).

It has more than 400 hotels and lodges and still more are being built (Singapore Tourism

Board 2017). Its strongest supporters are the international visitors and for the past years, the

lodging and entertainment industry has recorded significantly high or increased profitability

and efficiency. According to DJ Kang (2017) there are more tourists visiting Singapore than

ever who are spending more cash in the country. For instance, the country gained $11.5

billion in 2016 from hospitality and entertainment industry and around $12.7 billion in 2017.

PROFITABILITY

% 0% % 0%

Cost of revenue 64.81%

65.30

%

71.14

% 69.08%

55.08

%

Gross profit 35.19%

34.73

%

28.86

% 30.92%

44.92

%

Operating income 26.62%

33.96

%

24.03

% 24.55%

37.28

%

Income before taxes 29.72%

28.13

%

11.62

% 22.31%

35.94

%

Net income from continuing operations 24.87%

22.19

% 8.04% 17.28%

28.67

%

Net income 24.83%

22.19

% 8.04% 17.28%

28.67

%

Net income available to common

shareholders 24.83%

22.19

% 8.04% 17.28%

28.67

%

Table 4: Vertical analysis of Genting Singapore plc Income Statement

Economic Condition of the Hospitality and Entertainment Industry in Singapore

The hospitality and entertainment market or industry is the largest revenue generator in

Singapore due to the immense number of companies involved in lodging business. Basically,

Singapore is a small country well-known for its luxurious hotels and food (Study.com 2018).

It has more than 400 hotels and lodges and still more are being built (Singapore Tourism

Board 2017). Its strongest supporters are the international visitors and for the past years, the

lodging and entertainment industry has recorded significantly high or increased profitability

and efficiency. According to DJ Kang (2017) there are more tourists visiting Singapore than

ever who are spending more cash in the country. For instance, the country gained $11.5

billion in 2016 from hospitality and entertainment industry and around $12.7 billion in 2017.

PROFITABILITY

Financial Decision Making 9

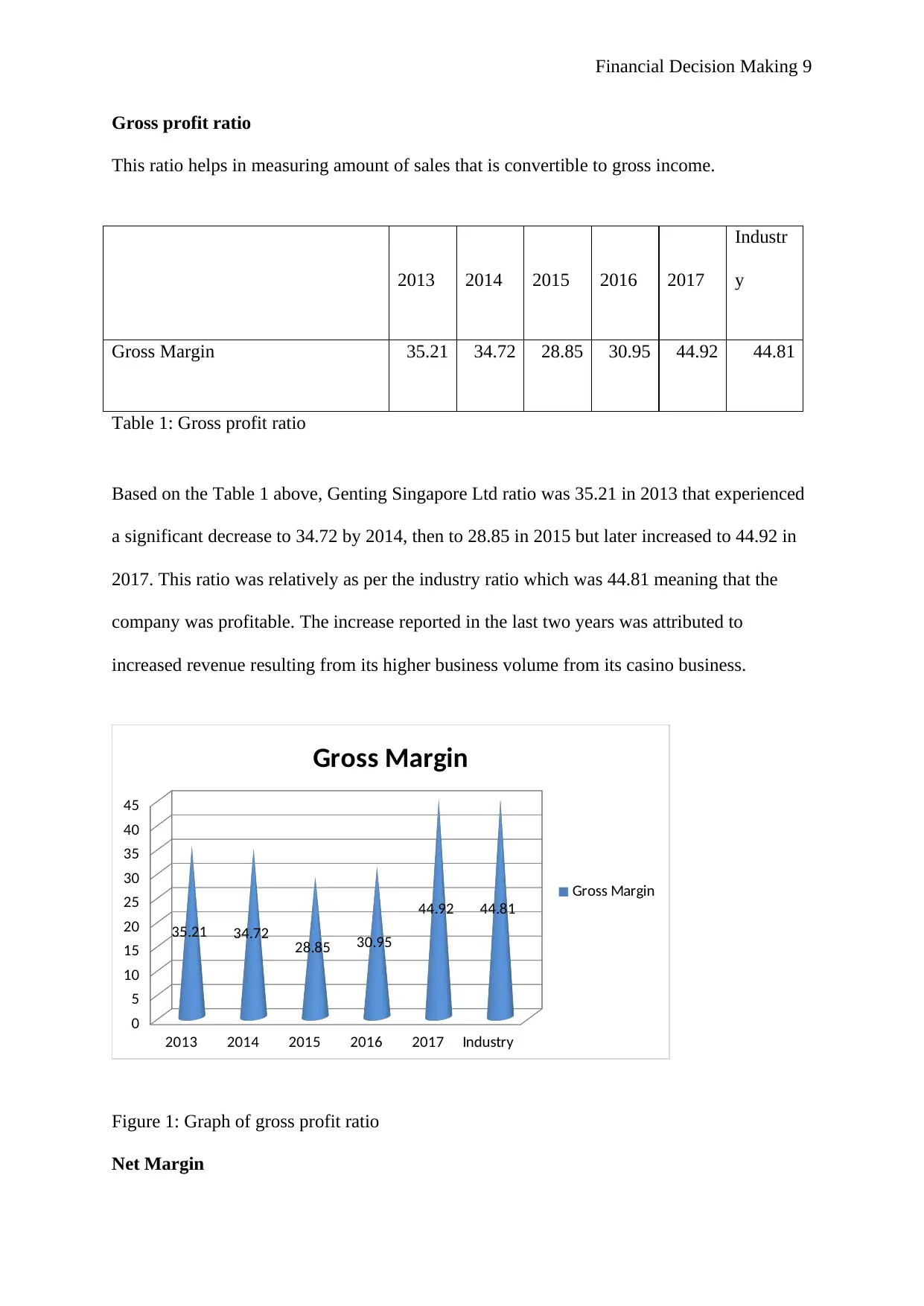

Gross profit ratio

This ratio helps in measuring amount of sales that is convertible to gross income.

2013 2014 2015 2016 2017

Industr

y

Gross Margin 35.21 34.72 28.85 30.95 44.92 44.81

Table 1: Gross profit ratio

Based on the Table 1 above, Genting Singapore Ltd ratio was 35.21 in 2013 that experienced

a significant decrease to 34.72 by 2014, then to 28.85 in 2015 but later increased to 44.92 in

2017. This ratio was relatively as per the industry ratio which was 44.81 meaning that the

company was profitable. The increase reported in the last two years was attributed to

increased revenue resulting from its higher business volume from its casino business.

2013 2014 2015 2016 2017 Industry

0

5

10

15

20

25

30

35

40

45

35.21 34.72 28.85 30.95

44.92 44.81

Gross Margin

Gross Margin

Figure 1: Graph of gross profit ratio

Net Margin

Gross profit ratio

This ratio helps in measuring amount of sales that is convertible to gross income.

2013 2014 2015 2016 2017

Industr

y

Gross Margin 35.21 34.72 28.85 30.95 44.92 44.81

Table 1: Gross profit ratio

Based on the Table 1 above, Genting Singapore Ltd ratio was 35.21 in 2013 that experienced

a significant decrease to 34.72 by 2014, then to 28.85 in 2015 but later increased to 44.92 in

2017. This ratio was relatively as per the industry ratio which was 44.81 meaning that the

company was profitable. The increase reported in the last two years was attributed to

increased revenue resulting from its higher business volume from its casino business.

2013 2014 2015 2016 2017 Industry

0

5

10

15

20

25

30

35

40

45

35.21 34.72 28.85 30.95

44.92 44.81

Gross Margin

Gross Margin

Figure 1: Graph of gross profit ratio

Net Margin

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Decision Making 10

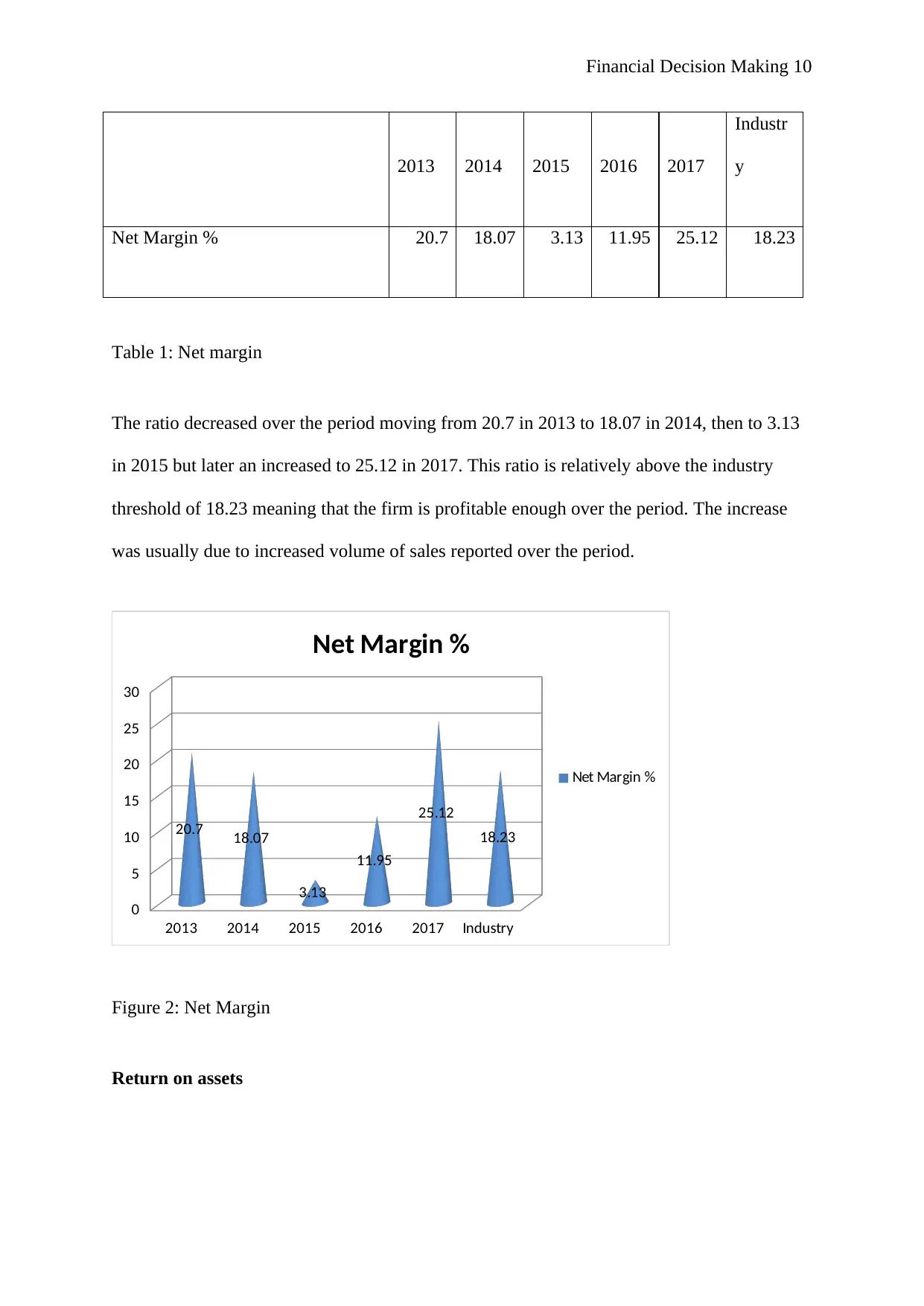

2013 2014 2015 2016 2017

Industr

y

Net Margin % 20.7 18.07 3.13 11.95 25.12 18.23

Table 1: Net margin

The ratio decreased over the period moving from 20.7 in 2013 to 18.07 in 2014, then to 3.13

in 2015 but later an increased to 25.12 in 2017. This ratio is relatively above the industry

threshold of 18.23 meaning that the firm is profitable enough over the period. The increase

was usually due to increased volume of sales reported over the period.

2013 2014 2015 2016 2017 Industry

0

5

10

15

20

25

30

20.7 18.07

3.13

11.95

25.12

18.23

Net Margin %

Net Margin %

Figure 2: Net Margin

Return on assets

2013 2014 2015 2016 2017

Industr

y

Net Margin % 20.7 18.07 3.13 11.95 25.12 18.23

Table 1: Net margin

The ratio decreased over the period moving from 20.7 in 2013 to 18.07 in 2014, then to 3.13

in 2015 but later an increased to 25.12 in 2017. This ratio is relatively above the industry

threshold of 18.23 meaning that the firm is profitable enough over the period. The increase

was usually due to increased volume of sales reported over the period.

2013 2014 2015 2016 2017 Industry

0

5

10

15

20

25

30

20.7 18.07

3.13

11.95

25.12

18.23

Net Margin %

Net Margin %

Figure 2: Net Margin

Return on assets

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Decision Making 11

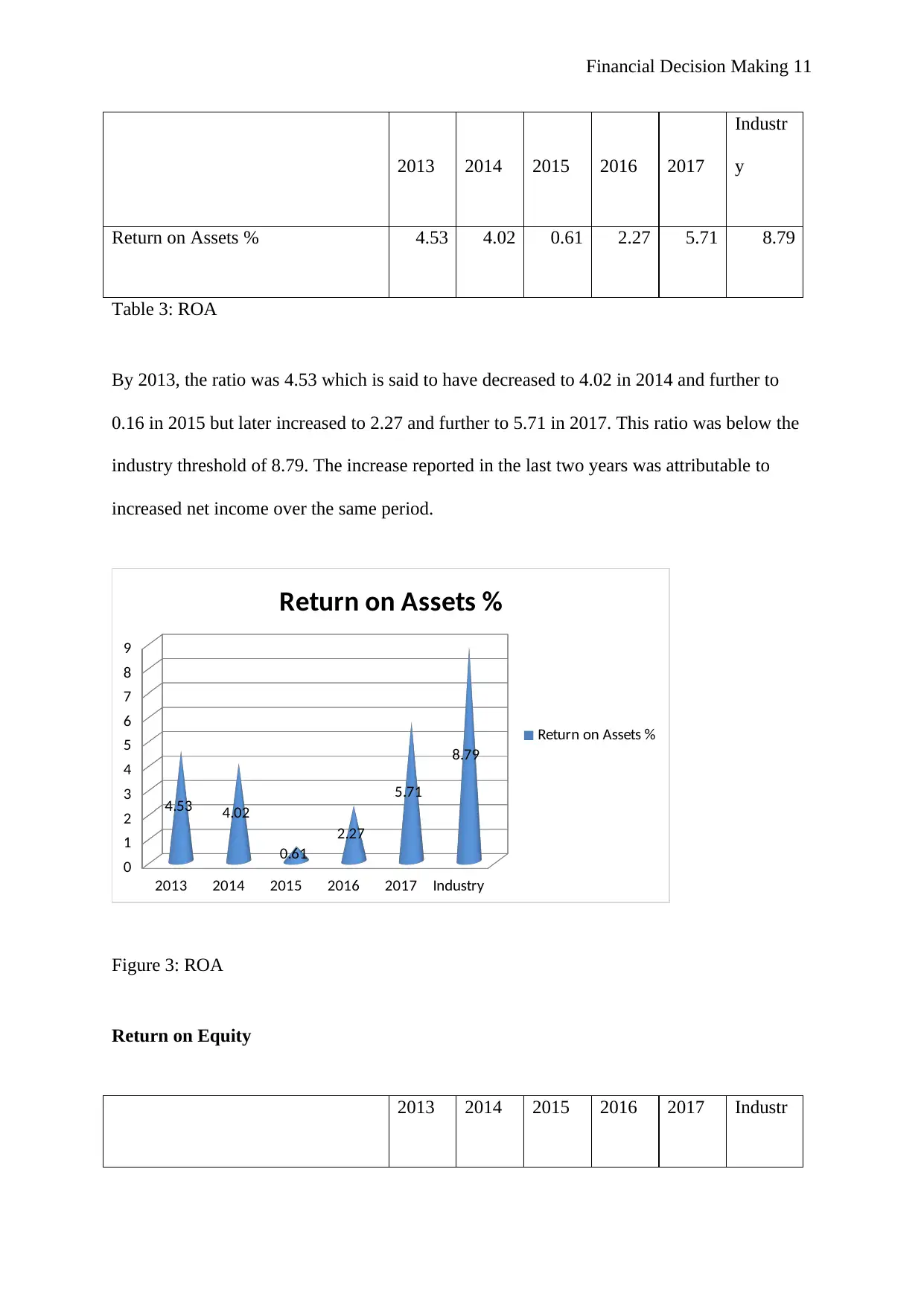

2013 2014 2015 2016 2017

Industr

y

Return on Assets % 4.53 4.02 0.61 2.27 5.71 8.79

Table 3: ROA

By 2013, the ratio was 4.53 which is said to have decreased to 4.02 in 2014 and further to

0.16 in 2015 but later increased to 2.27 and further to 5.71 in 2017. This ratio was below the

industry threshold of 8.79. The increase reported in the last two years was attributable to

increased net income over the same period.

2013 2014 2015 2016 2017 Industry

0

1

2

3

4

5

6

7

8

9

4.53 4.02

0.61

2.27

5.71

8.79

Return on Assets %

Return on Assets %

Figure 3: ROA

Return on Equity

2013 2014 2015 2016 2017 Industr

2013 2014 2015 2016 2017

Industr

y

Return on Assets % 4.53 4.02 0.61 2.27 5.71 8.79

Table 3: ROA

By 2013, the ratio was 4.53 which is said to have decreased to 4.02 in 2014 and further to

0.16 in 2015 but later increased to 2.27 and further to 5.71 in 2017. This ratio was below the

industry threshold of 8.79. The increase reported in the last two years was attributable to

increased net income over the same period.

2013 2014 2015 2016 2017 Industry

0

1

2

3

4

5

6

7

8

9

4.53 4.02

0.61

2.27

5.71

8.79

Return on Assets %

Return on Assets %

Figure 3: ROA

Return on Equity

2013 2014 2015 2016 2017 Industr

Financial Decision Making 12

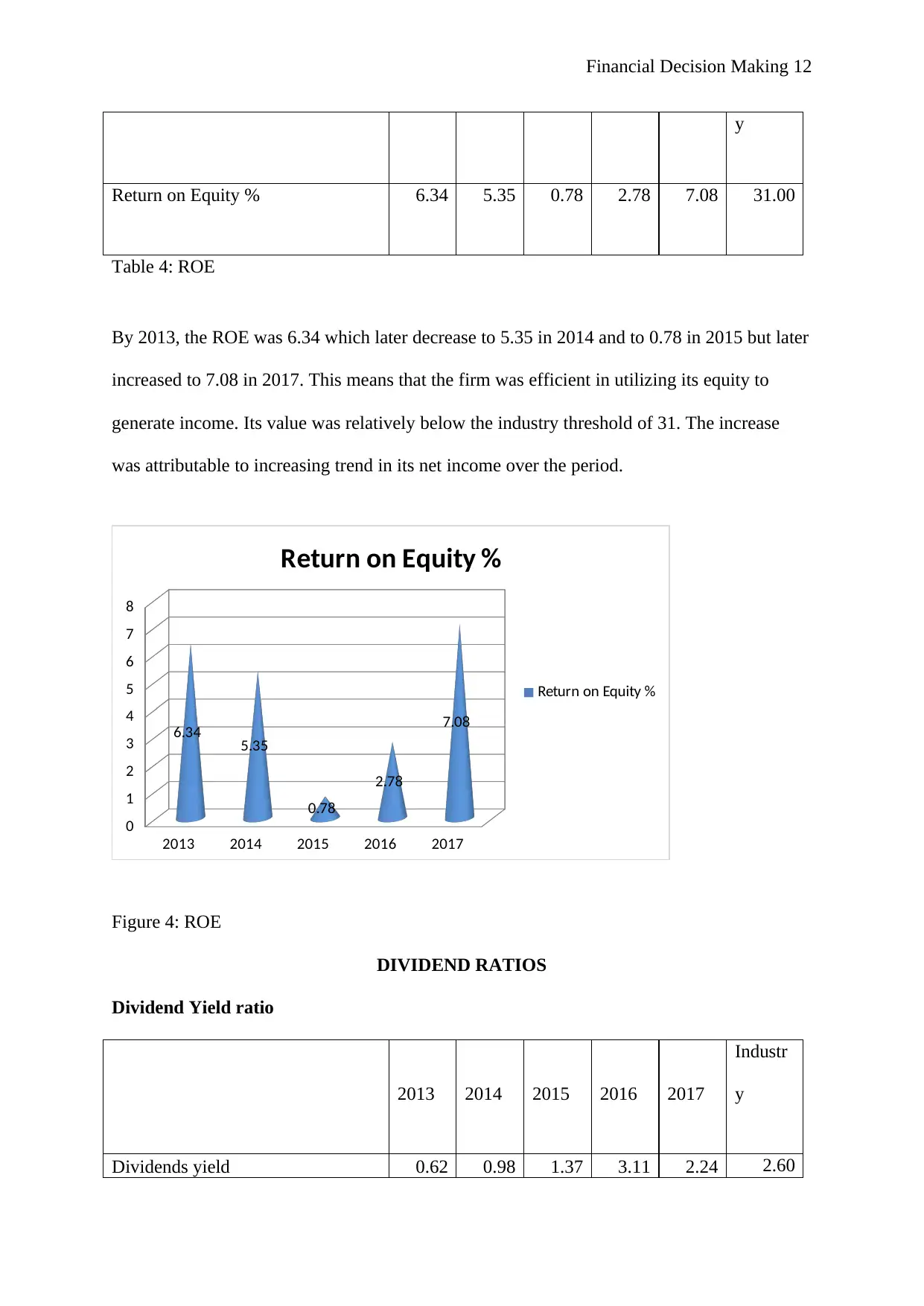

y

Return on Equity % 6.34 5.35 0.78 2.78 7.08 31.00

Table 4: ROE

By 2013, the ROE was 6.34 which later decrease to 5.35 in 2014 and to 0.78 in 2015 but later

increased to 7.08 in 2017. This means that the firm was efficient in utilizing its equity to

generate income. Its value was relatively below the industry threshold of 31. The increase

was attributable to increasing trend in its net income over the period.

2013 2014 2015 2016 2017

0

1

2

3

4

5

6

7

8

6.34 5.35

0.78

2.78

7.08

Return on Equity %

Return on Equity %

Figure 4: ROE

DIVIDEND RATIOS

Dividend Yield ratio

2013 2014 2015 2016 2017

Industr

y

Dividends yield 0.62 0.98 1.37 3.11 2.24 2.60

y

Return on Equity % 6.34 5.35 0.78 2.78 7.08 31.00

Table 4: ROE

By 2013, the ROE was 6.34 which later decrease to 5.35 in 2014 and to 0.78 in 2015 but later

increased to 7.08 in 2017. This means that the firm was efficient in utilizing its equity to

generate income. Its value was relatively below the industry threshold of 31. The increase

was attributable to increasing trend in its net income over the period.

2013 2014 2015 2016 2017

0

1

2

3

4

5

6

7

8

6.34 5.35

0.78

2.78

7.08

Return on Equity %

Return on Equity %

Figure 4: ROE

DIVIDEND RATIOS

Dividend Yield ratio

2013 2014 2015 2016 2017

Industr

y

Dividends yield 0.62 0.98 1.37 3.11 2.24 2.60

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 34

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.