Financial Management and Control: Investment Appraisal and Budgeting

VerifiedAdded on 2023/01/10

|19

|4439

|96

Report

AI Summary

This report provides a comprehensive analysis of financial management and control. It begins with an introduction to the subject, emphasizing its importance in organizational success. Part A focuses on ratio analysis, calculating and interpreting profitability, liquidity, gearing, asset utilization, and investor ratios for a company over two years. Part B delves into investment appraisal techniques, including payback period, discounted payback period, accounting rate of return (ARR), and net present value (NPV), comparing the viability of different investment options. Part C examines the budgeting process, critically evaluating the relationship between strategic plans, objectives, and budgets. The report concludes with a summary of the key findings and their implications for effective financial management. The report also includes the calculation of working capital cycle, which helps in identifying the time taken by a company in converting its current assets and liabilities into cash.

Financial Management and

control

control

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

PART A...........................................................................................................................................1

1. .................................................................................................................................................1

b...................................................................................................................................................4

PART B............................................................................................................................................6

1 Calculation of investment appraisal techniques.......................................................................6

2 Evaluation of key benefits and the limitations of investment appraisal techniques...............10

3 Suitable sources of finance for funding the investments. .....................................................12

PART C..........................................................................................................................................12

1. Critically evaluating process of budgeting and the manner in which strategic plan,

objectives and the budgets are inter-related..............................................................................12

CONCLUSION..............................................................................................................................14

REFERENCES .............................................................................................................................15

INTRODUCTION...........................................................................................................................1

PART A...........................................................................................................................................1

1. .................................................................................................................................................1

b...................................................................................................................................................4

PART B............................................................................................................................................6

1 Calculation of investment appraisal techniques.......................................................................6

2 Evaluation of key benefits and the limitations of investment appraisal techniques...............10

3 Suitable sources of finance for funding the investments. .....................................................12

PART C..........................................................................................................................................12

1. Critically evaluating process of budgeting and the manner in which strategic plan,

objectives and the budgets are inter-related..............................................................................12

CONCLUSION..............................................................................................................................14

REFERENCES .............................................................................................................................15

INTRODUCTION

It is vital activity of the organisation. This is process to plan, organise, control and to

monitor the financial resources with view of achieving the organisational goals & objectives.

This is related with the practice to control financial activities of organisation like funds

procurement, utilisation of the funds, payments, accounting, assessment of risks and other factors

related with money. It is the application of management principles to possessions of the

enterprise. Management of the organisational finance provides quality fuel & regular services for

ensuring efficient functioning. Present report will enhance the strategic financial statement of the

enterprise. It will analyse the use of qualitative and quantitative accounting information in the

organisation. Report will will provide the understanding and knowledge of the theoretical

frameworks and concepts to the range of practical situations for proposing the solutions to the

strategic business problems.

PART A

1.

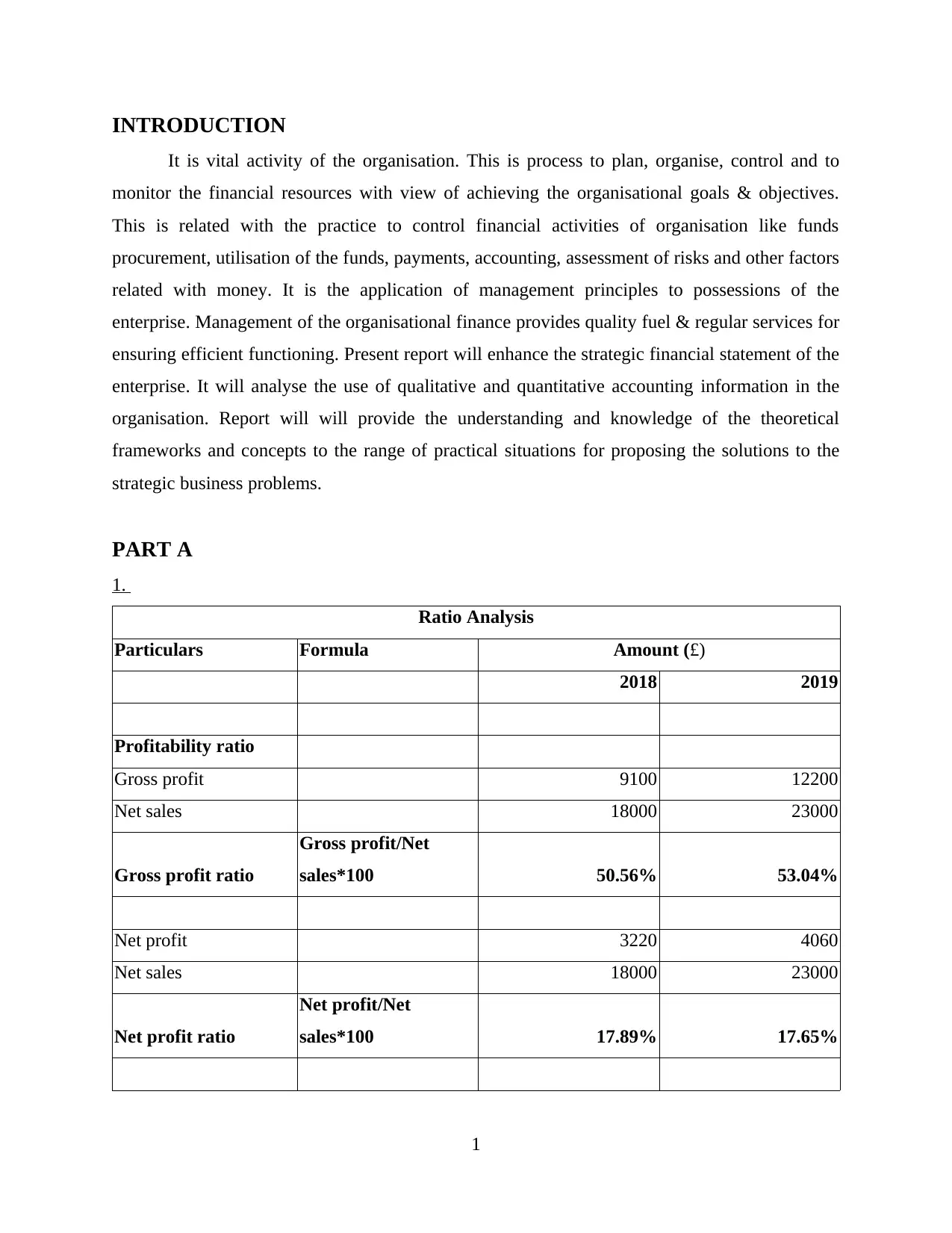

Ratio Analysis

Particulars Formula Amount (£)

2018 2019

Profitability ratio

Gross profit 9100 12200

Net sales 18000 23000

Gross profit ratio

Gross profit/Net

sales*100 50.56% 53.04%

Net profit 3220 4060

Net sales 18000 23000

Net profit ratio

Net profit/Net

sales*100 17.89% 17.65%

1

It is vital activity of the organisation. This is process to plan, organise, control and to

monitor the financial resources with view of achieving the organisational goals & objectives.

This is related with the practice to control financial activities of organisation like funds

procurement, utilisation of the funds, payments, accounting, assessment of risks and other factors

related with money. It is the application of management principles to possessions of the

enterprise. Management of the organisational finance provides quality fuel & regular services for

ensuring efficient functioning. Present report will enhance the strategic financial statement of the

enterprise. It will analyse the use of qualitative and quantitative accounting information in the

organisation. Report will will provide the understanding and knowledge of the theoretical

frameworks and concepts to the range of practical situations for proposing the solutions to the

strategic business problems.

PART A

1.

Ratio Analysis

Particulars Formula Amount (£)

2018 2019

Profitability ratio

Gross profit 9100 12200

Net sales 18000 23000

Gross profit ratio

Gross profit/Net

sales*100 50.56% 53.04%

Net profit 3220 4060

Net sales 18000 23000

Net profit ratio

Net profit/Net

sales*100 17.89% 17.65%

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Liquidity ratio

Current assets 4150 5160

Current liabilities 14000 19260

Current ratio

Current

assets/Current

liabilities 0.29 0.26

Current assets 4150 5160

Inventory 1800 2360

Quick assets

Current assets-

inventory 2350 2800

Current liabilities 14000 19260

Quick ratio

Quick assets/Current

liabilities 0.16 0.14

Gearing ratio

Debt 2000 3500

Equity 10000 10000

Debt equity ratio Debt/Equity 0.2 0.35

Earnings before interest

and tax 5100 6800

Interest expense 500 1000

Interest coverage ratio

EBIT/Interest

expense 10.2 6.8

Asset utilisation ratio

Net sales 18000 23000

Average total assets 12000 15760

2

Current assets 4150 5160

Current liabilities 14000 19260

Current ratio

Current

assets/Current

liabilities 0.29 0.26

Current assets 4150 5160

Inventory 1800 2360

Quick assets

Current assets-

inventory 2350 2800

Current liabilities 14000 19260

Quick ratio

Quick assets/Current

liabilities 0.16 0.14

Gearing ratio

Debt 2000 3500

Equity 10000 10000

Debt equity ratio Debt/Equity 0.2 0.35

Earnings before interest

and tax 5100 6800

Interest expense 500 1000

Interest coverage ratio

EBIT/Interest

expense 10.2 6.8

Asset utilisation ratio

Net sales 18000 23000

Average total assets 12000 15760

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Asset turnover ratio

Net sales/Avg total

assets 1.5 1.4593908629

Investors ratio

Net income 3220 4060

Average shares

outstanding 10000 10000

Earning per share

ratio

Net income/ Average

shares outstanding 0.32 0.41

Total dividends paid 200 300

Number of the ordinary

shares 10000 10000

DPS

Total dividend paid/

Number of ordinary

shares 0.02 0.03

Profitability- It refers to the class of the financial metric which is been used for accessing

an ability of the business in generating the earnings in relation its operating cost, revenue,

balance sheet and shareholders funds over the time by making use of the data at specific point

time period. It includes gross and net margin ratio that are considered as the major profitability

ratio which reflects the operational and overall performance of an enterprise. Gross margin

indicates the operational performance of the company by measuring capability of the company

in meeting its variable expenses by generating sales (Murad and et.al., 2019). Over the period of

2 years, GP ratio of Bitmap Plc is increasing which means that its revenue increases and this

shows better operations of company. However, net profit margin reflects ab ability of an entity in

gaining profits after making payment of all its income, expenses and tax obligation. The NP ratio

of Bitmap Plc is declining from one period to other which depicts that company is bearing high

operating expense that results to gaining of lower margins against the high sales. Overall the

3

Net sales/Avg total

assets 1.5 1.4593908629

Investors ratio

Net income 3220 4060

Average shares

outstanding 10000 10000

Earning per share

ratio

Net income/ Average

shares outstanding 0.32 0.41

Total dividends paid 200 300

Number of the ordinary

shares 10000 10000

DPS

Total dividend paid/

Number of ordinary

shares 0.02 0.03

Profitability- It refers to the class of the financial metric which is been used for accessing

an ability of the business in generating the earnings in relation its operating cost, revenue,

balance sheet and shareholders funds over the time by making use of the data at specific point

time period. It includes gross and net margin ratio that are considered as the major profitability

ratio which reflects the operational and overall performance of an enterprise. Gross margin

indicates the operational performance of the company by measuring capability of the company

in meeting its variable expenses by generating sales (Murad and et.al., 2019). Over the period of

2 years, GP ratio of Bitmap Plc is increasing which means that its revenue increases and this

shows better operations of company. However, net profit margin reflects ab ability of an entity in

gaining profits after making payment of all its income, expenses and tax obligation. The NP ratio

of Bitmap Plc is declining from one period to other which depicts that company is bearing high

operating expense that results to gaining of lower margins against the high sales. Overall the

3

profitability performance of Bitmap Plc is seen as good but is required to take measures like

increasing price, ensuring control on expenses etc. it could improve its NP ratio.

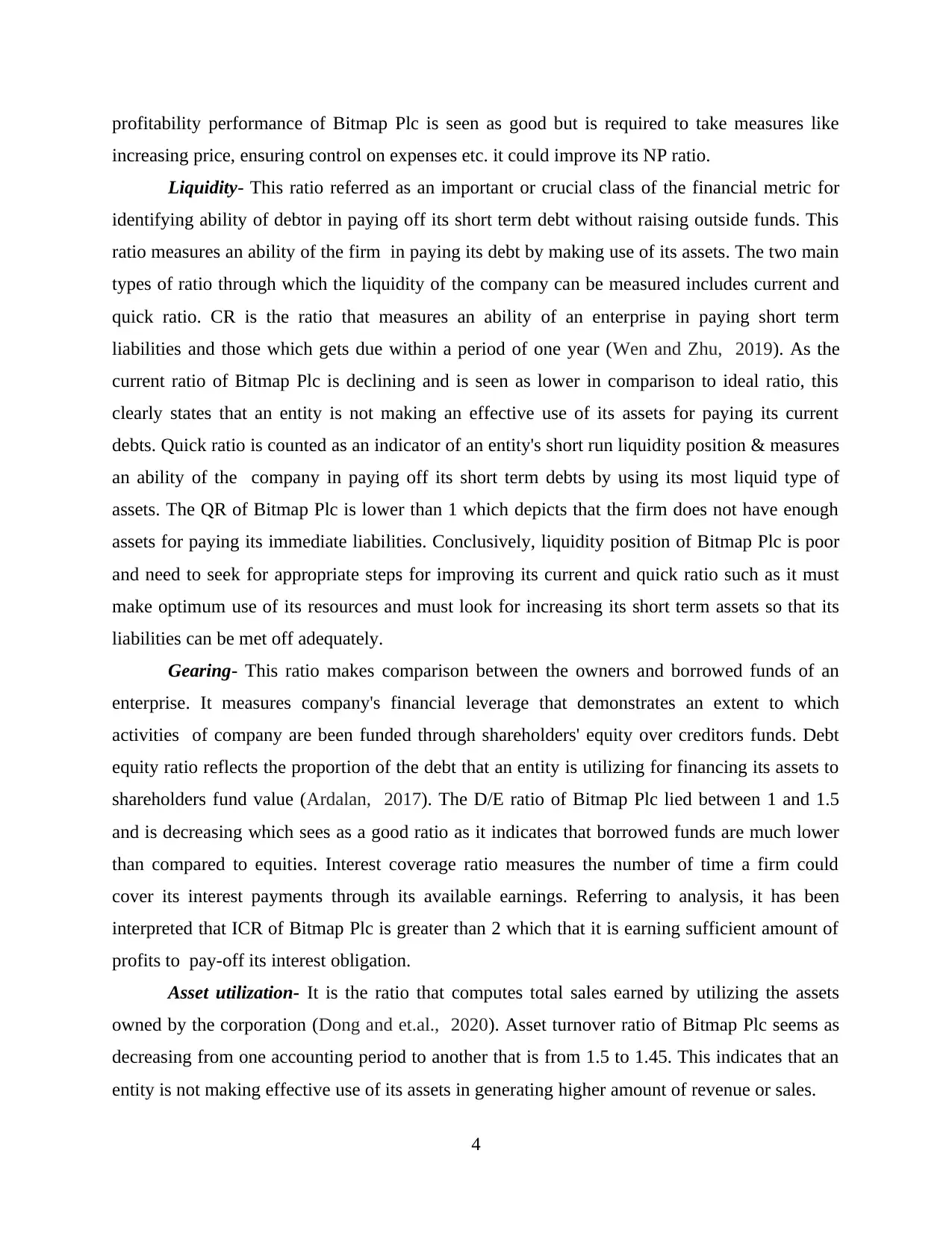

Liquidity- This ratio referred as an important or crucial class of the financial metric for

identifying ability of debtor in paying off its short term debt without raising outside funds. This

ratio measures an ability of the firm in paying its debt by making use of its assets. The two main

types of ratio through which the liquidity of the company can be measured includes current and

quick ratio. CR is the ratio that measures an ability of an enterprise in paying short term

liabilities and those which gets due within a period of one year (Wen and Zhu, 2019). As the

current ratio of Bitmap Plc is declining and is seen as lower in comparison to ideal ratio, this

clearly states that an entity is not making an effective use of its assets for paying its current

debts. Quick ratio is counted as an indicator of an entity's short run liquidity position & measures

an ability of the company in paying off its short term debts by using its most liquid type of

assets. The QR of Bitmap Plc is lower than 1 which depicts that the firm does not have enough

assets for paying its immediate liabilities. Conclusively, liquidity position of Bitmap Plc is poor

and need to seek for appropriate steps for improving its current and quick ratio such as it must

make optimum use of its resources and must look for increasing its short term assets so that its

liabilities can be met off adequately.

Gearing- This ratio makes comparison between the owners and borrowed funds of an

enterprise. It measures company's financial leverage that demonstrates an extent to which

activities of company are been funded through shareholders' equity over creditors funds. Debt

equity ratio reflects the proportion of the debt that an entity is utilizing for financing its assets to

shareholders fund value (Ardalan, 2017). The D/E ratio of Bitmap Plc lied between 1 and 1.5

and is decreasing which sees as a good ratio as it indicates that borrowed funds are much lower

than compared to equities. Interest coverage ratio measures the number of time a firm could

cover its interest payments through its available earnings. Referring to analysis, it has been

interpreted that ICR of Bitmap Plc is greater than 2 which that it is earning sufficient amount of

profits to pay-off its interest obligation.

Asset utilization- It is the ratio that computes total sales earned by utilizing the assets

owned by the corporation (Dong and et.al., 2020). Asset turnover ratio of Bitmap Plc seems as

decreasing from one accounting period to another that is from 1.5 to 1.45. This indicates that an

entity is not making effective use of its assets in generating higher amount of revenue or sales.

4

increasing price, ensuring control on expenses etc. it could improve its NP ratio.

Liquidity- This ratio referred as an important or crucial class of the financial metric for

identifying ability of debtor in paying off its short term debt without raising outside funds. This

ratio measures an ability of the firm in paying its debt by making use of its assets. The two main

types of ratio through which the liquidity of the company can be measured includes current and

quick ratio. CR is the ratio that measures an ability of an enterprise in paying short term

liabilities and those which gets due within a period of one year (Wen and Zhu, 2019). As the

current ratio of Bitmap Plc is declining and is seen as lower in comparison to ideal ratio, this

clearly states that an entity is not making an effective use of its assets for paying its current

debts. Quick ratio is counted as an indicator of an entity's short run liquidity position & measures

an ability of the company in paying off its short term debts by using its most liquid type of

assets. The QR of Bitmap Plc is lower than 1 which depicts that the firm does not have enough

assets for paying its immediate liabilities. Conclusively, liquidity position of Bitmap Plc is poor

and need to seek for appropriate steps for improving its current and quick ratio such as it must

make optimum use of its resources and must look for increasing its short term assets so that its

liabilities can be met off adequately.

Gearing- This ratio makes comparison between the owners and borrowed funds of an

enterprise. It measures company's financial leverage that demonstrates an extent to which

activities of company are been funded through shareholders' equity over creditors funds. Debt

equity ratio reflects the proportion of the debt that an entity is utilizing for financing its assets to

shareholders fund value (Ardalan, 2017). The D/E ratio of Bitmap Plc lied between 1 and 1.5

and is decreasing which sees as a good ratio as it indicates that borrowed funds are much lower

than compared to equities. Interest coverage ratio measures the number of time a firm could

cover its interest payments through its available earnings. Referring to analysis, it has been

interpreted that ICR of Bitmap Plc is greater than 2 which that it is earning sufficient amount of

profits to pay-off its interest obligation.

Asset utilization- It is the ratio that computes total sales earned by utilizing the assets

owned by the corporation (Dong and et.al., 2020). Asset turnover ratio of Bitmap Plc seems as

decreasing from one accounting period to another that is from 1.5 to 1.45. This indicates that an

entity is not making effective use of its assets in generating higher amount of revenue or sales.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Investors potential- It reveals an ability of business for earning sufficient returns for

owners of business. EPS is seen as an essential financial measure that indicates profitability of an

organization. Higher EPS reflects that a company is earning better amount of profits by

increasing wealth of shareholders (Bragg, 2018). EPS of Bitmap Plc is increasing which clearly

states that it is earning high profits on its shares. On other side, DPS reflects the amount of

divided distributed by the company to its shareholders as per their holding. As the ratio is rising

over 2 the period, it means that it is distributing the dividend with higher value every year.

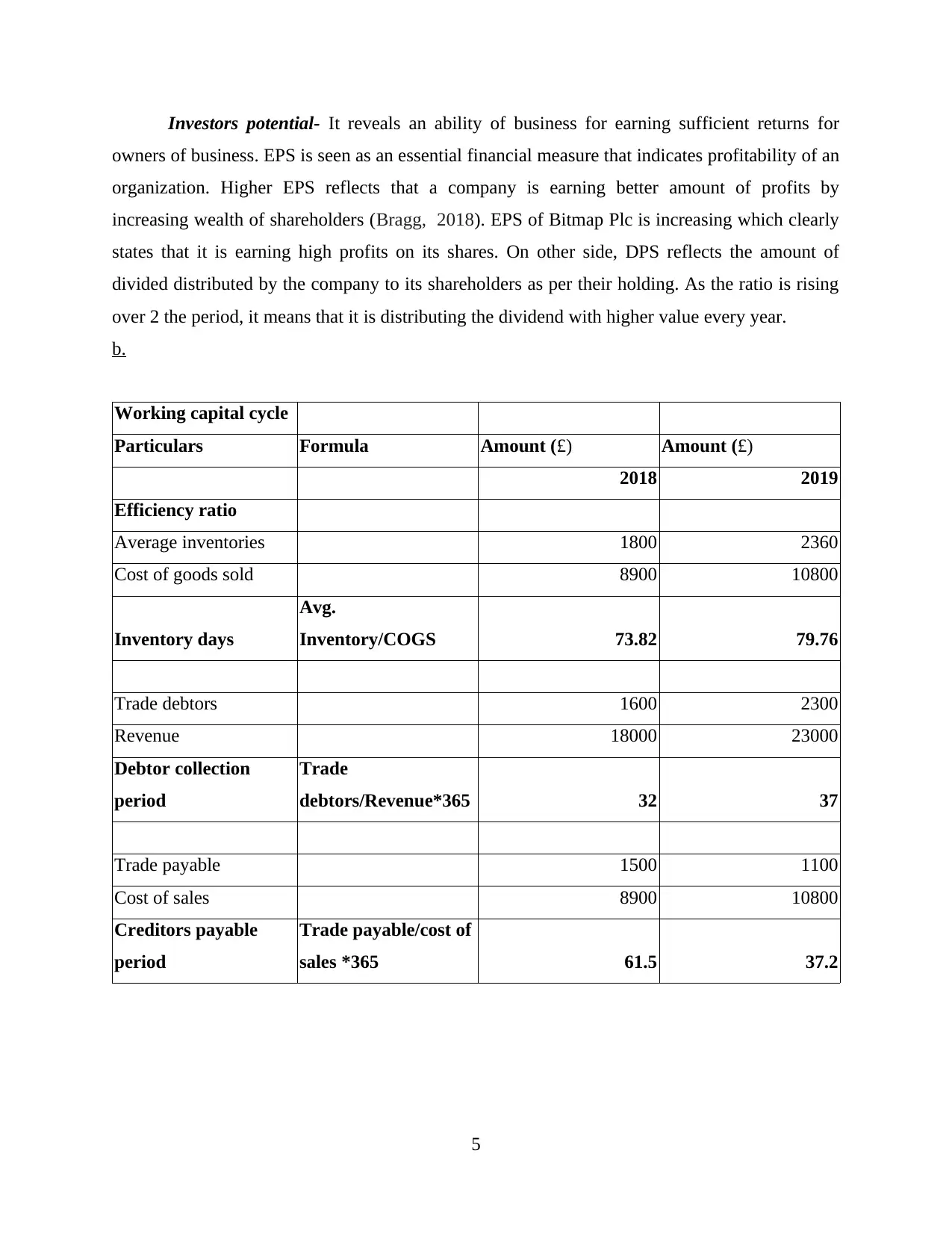

b.

Working capital cycle

Particulars Formula Amount (£) Amount (£)

2018 2019

Efficiency ratio

Average inventories 1800 2360

Cost of goods sold 8900 10800

Inventory days

Avg.

Inventory/COGS 73.82 79.76

Trade debtors 1600 2300

Revenue 18000 23000

Debtor collection

period

Trade

debtors/Revenue*365 32 37

Trade payable 1500 1100

Cost of sales 8900 10800

Creditors payable

period

Trade payable/cost of

sales *365 61.5 37.2

5

owners of business. EPS is seen as an essential financial measure that indicates profitability of an

organization. Higher EPS reflects that a company is earning better amount of profits by

increasing wealth of shareholders (Bragg, 2018). EPS of Bitmap Plc is increasing which clearly

states that it is earning high profits on its shares. On other side, DPS reflects the amount of

divided distributed by the company to its shareholders as per their holding. As the ratio is rising

over 2 the period, it means that it is distributing the dividend with higher value every year.

b.

Working capital cycle

Particulars Formula Amount (£) Amount (£)

2018 2019

Efficiency ratio

Average inventories 1800 2360

Cost of goods sold 8900 10800

Inventory days

Avg.

Inventory/COGS 73.82 79.76

Trade debtors 1600 2300

Revenue 18000 23000

Debtor collection

period

Trade

debtors/Revenue*365 32 37

Trade payable 1500 1100

Cost of sales 8900 10800

Creditors payable

period

Trade payable/cost of

sales *365 61.5 37.2

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

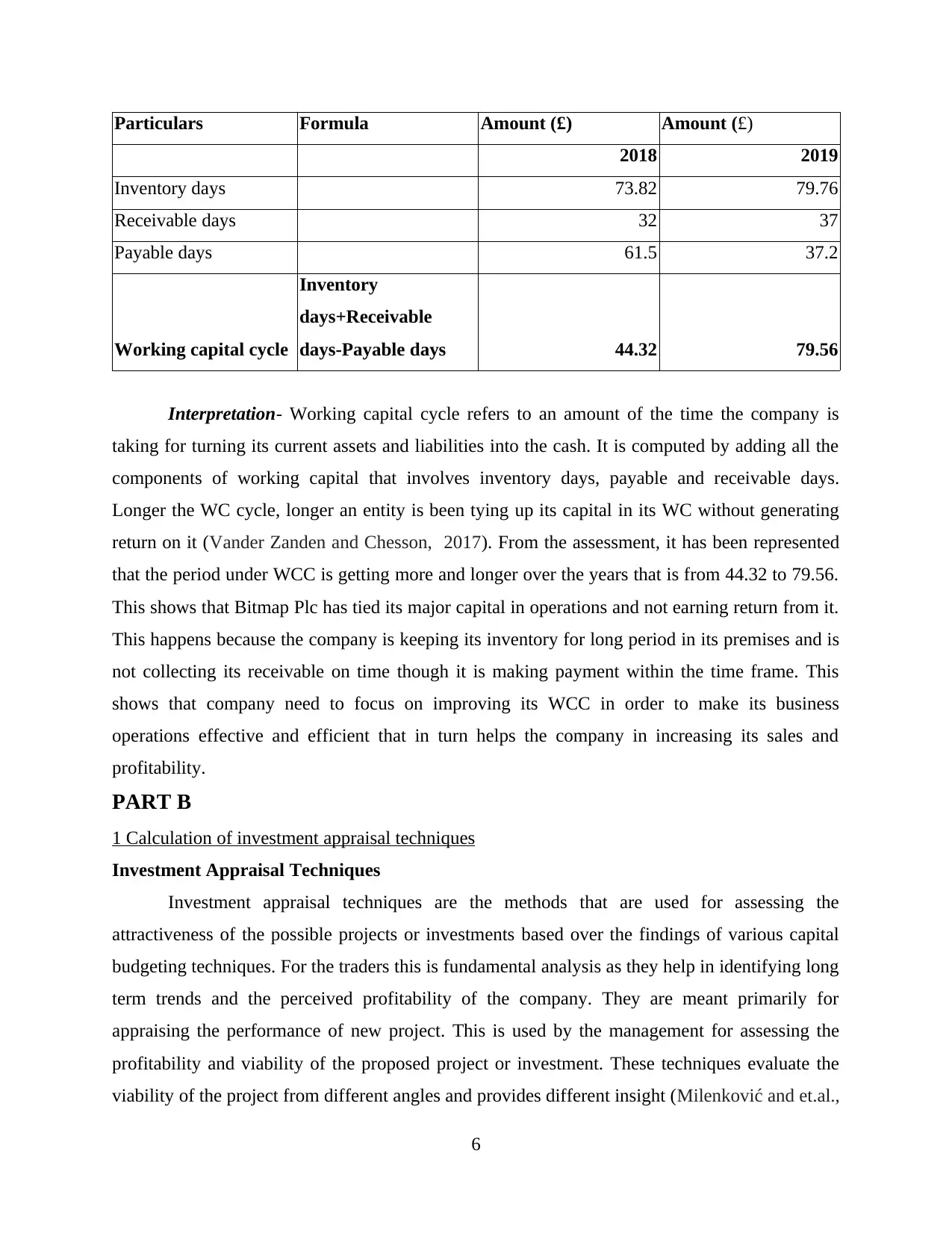

Particulars Formula Amount (£) Amount (£)

2018 2019

Inventory days 73.82 79.76

Receivable days 32 37

Payable days 61.5 37.2

Working capital cycle

Inventory

days+Receivable

days-Payable days 44.32 79.56

Interpretation- Working capital cycle refers to an amount of the time the company is

taking for turning its current assets and liabilities into the cash. It is computed by adding all the

components of working capital that involves inventory days, payable and receivable days.

Longer the WC cycle, longer an entity is been tying up its capital in its WC without generating

return on it (Vander Zanden and Chesson, 2017). From the assessment, it has been represented

that the period under WCC is getting more and longer over the years that is from 44.32 to 79.56.

This shows that Bitmap Plc has tied its major capital in operations and not earning return from it.

This happens because the company is keeping its inventory for long period in its premises and is

not collecting its receivable on time though it is making payment within the time frame. This

shows that company need to focus on improving its WCC in order to make its business

operations effective and efficient that in turn helps the company in increasing its sales and

profitability.

PART B

1 Calculation of investment appraisal techniques

Investment Appraisal Techniques

Investment appraisal techniques are the methods that are used for assessing the

attractiveness of the possible projects or investments based over the findings of various capital

budgeting techniques. For the traders this is fundamental analysis as they help in identifying long

term trends and the perceived profitability of the company. They are meant primarily for

appraising the performance of new project. This is used by the management for assessing the

profitability and viability of the proposed project or investment. These techniques evaluate the

viability of the project from different angles and provides different insight (Milenković and et.al.,

6

2018 2019

Inventory days 73.82 79.76

Receivable days 32 37

Payable days 61.5 37.2

Working capital cycle

Inventory

days+Receivable

days-Payable days 44.32 79.56

Interpretation- Working capital cycle refers to an amount of the time the company is

taking for turning its current assets and liabilities into the cash. It is computed by adding all the

components of working capital that involves inventory days, payable and receivable days.

Longer the WC cycle, longer an entity is been tying up its capital in its WC without generating

return on it (Vander Zanden and Chesson, 2017). From the assessment, it has been represented

that the period under WCC is getting more and longer over the years that is from 44.32 to 79.56.

This shows that Bitmap Plc has tied its major capital in operations and not earning return from it.

This happens because the company is keeping its inventory for long period in its premises and is

not collecting its receivable on time though it is making payment within the time frame. This

shows that company need to focus on improving its WCC in order to make its business

operations effective and efficient that in turn helps the company in increasing its sales and

profitability.

PART B

1 Calculation of investment appraisal techniques

Investment Appraisal Techniques

Investment appraisal techniques are the methods that are used for assessing the

attractiveness of the possible projects or investments based over the findings of various capital

budgeting techniques. For the traders this is fundamental analysis as they help in identifying long

term trends and the perceived profitability of the company. They are meant primarily for

appraising the performance of new project. This is used by the management for assessing the

profitability and viability of the proposed project or investment. These techniques evaluate the

viability of the project from different angles and provides different insight (Milenković and et.al.,

6

2016). There are different investment appraisal techniques used by the management and analysts

such as payback period, discounted payback period, IRR, ARR and the net present value.

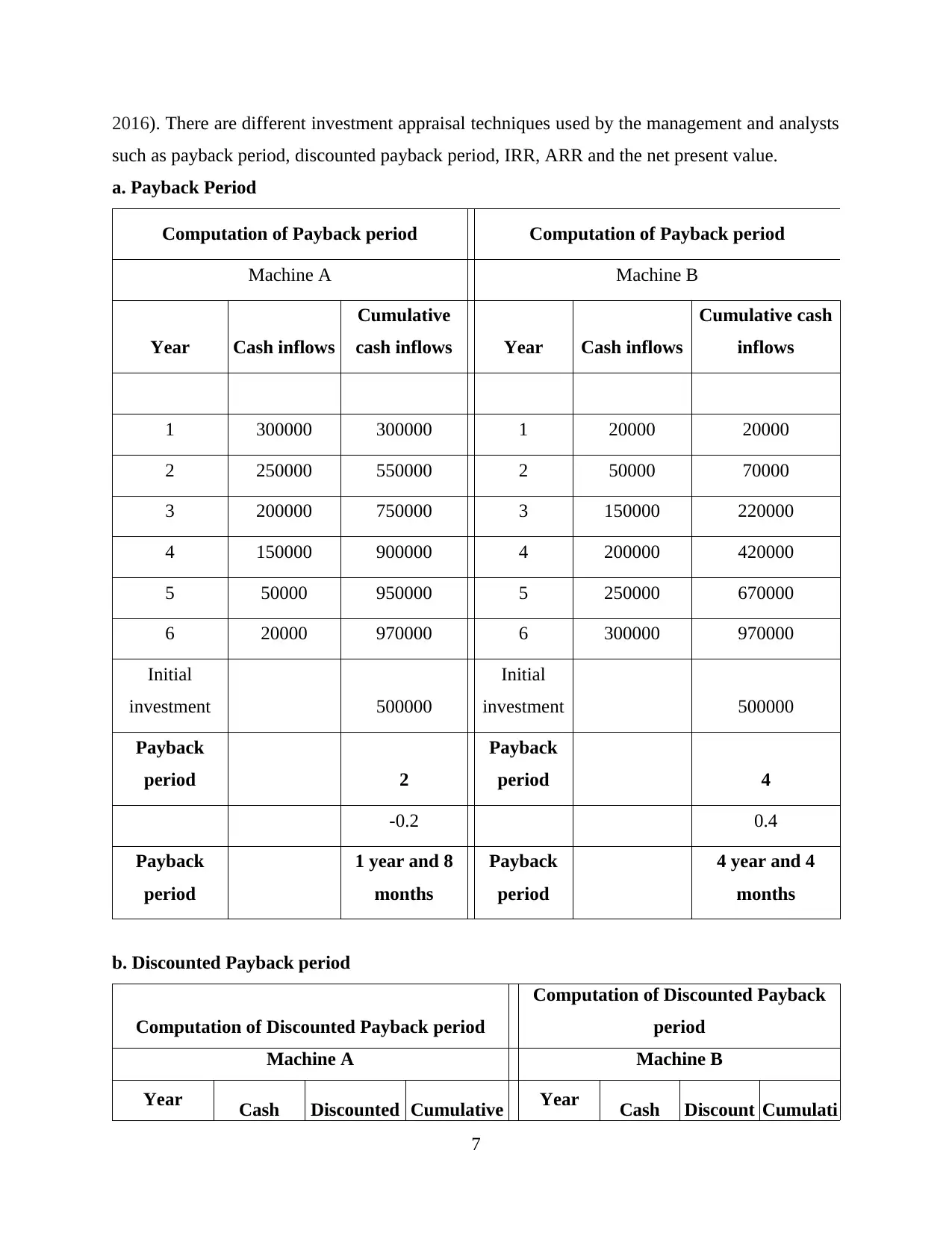

a. Payback Period

Computation of Payback period Computation of Payback period

Machine A Machine B

Year Cash inflows

Cumulative

cash inflows Year Cash inflows

Cumulative cash

inflows

1 300000 300000 1 20000 20000

2 250000 550000 2 50000 70000

3 200000 750000 3 150000 220000

4 150000 900000 4 200000 420000

5 50000 950000 5 250000 670000

6 20000 970000 6 300000 970000

Initial

investment 500000

Initial

investment 500000

Payback

period 2

Payback

period 4

-0.2 0.4

Payback

period

1 year and 8

months

Payback

period

4 year and 4

months

b. Discounted Payback period

Computation of Discounted Payback period

Computation of Discounted Payback

period

Machine A Machine B

Year Cash Discounted Cumulative Year Cash Discount Cumulati

7

such as payback period, discounted payback period, IRR, ARR and the net present value.

a. Payback Period

Computation of Payback period Computation of Payback period

Machine A Machine B

Year Cash inflows

Cumulative

cash inflows Year Cash inflows

Cumulative cash

inflows

1 300000 300000 1 20000 20000

2 250000 550000 2 50000 70000

3 200000 750000 3 150000 220000

4 150000 900000 4 200000 420000

5 50000 950000 5 250000 670000

6 20000 970000 6 300000 970000

Initial

investment 500000

Initial

investment 500000

Payback

period 2

Payback

period 4

-0.2 0.4

Payback

period

1 year and 8

months

Payback

period

4 year and 4

months

b. Discounted Payback period

Computation of Discounted Payback period

Computation of Discounted Payback

period

Machine A Machine B

Year Cash Discounted Cumulative Year Cash Discount Cumulati

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

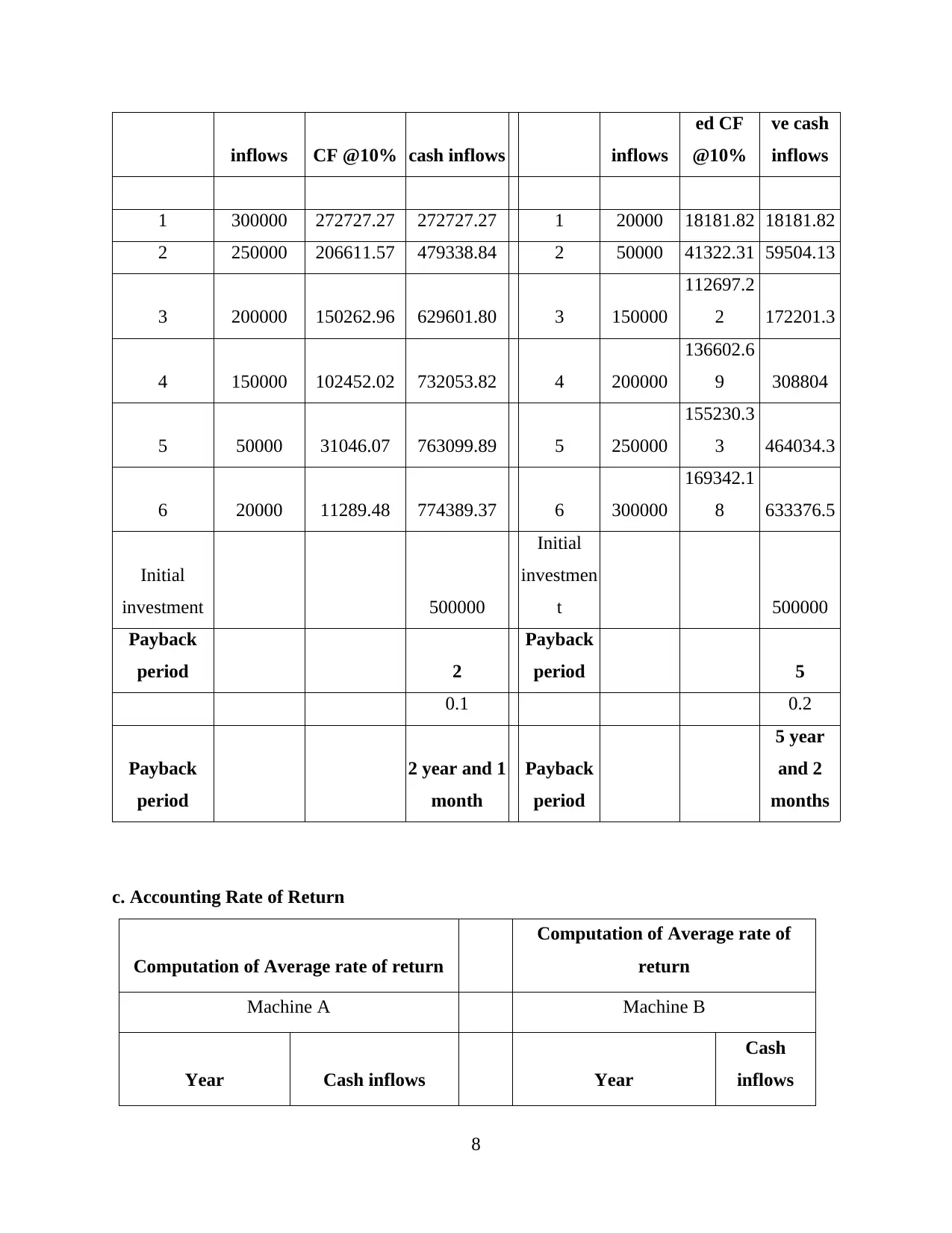

inflows CF @10% cash inflows inflows

ed CF

@10%

ve cash

inflows

1 300000 272727.27 272727.27 1 20000 18181.82 18181.82

2 250000 206611.57 479338.84 2 50000 41322.31 59504.13

3 200000 150262.96 629601.80 3 150000

112697.2

2 172201.3

4 150000 102452.02 732053.82 4 200000

136602.6

9 308804

5 50000 31046.07 763099.89 5 250000

155230.3

3 464034.3

6 20000 11289.48 774389.37 6 300000

169342.1

8 633376.5

Initial

investment 500000

Initial

investmen

t 500000

Payback

period 2

Payback

period 5

0.1 0.2

Payback

period

2 year and 1

month

Payback

period

5 year

and 2

months

c. Accounting Rate of Return

Computation of Average rate of return

Computation of Average rate of

return

Machine A Machine B

Year Cash inflows Year

Cash

inflows

8

ed CF

@10%

ve cash

inflows

1 300000 272727.27 272727.27 1 20000 18181.82 18181.82

2 250000 206611.57 479338.84 2 50000 41322.31 59504.13

3 200000 150262.96 629601.80 3 150000

112697.2

2 172201.3

4 150000 102452.02 732053.82 4 200000

136602.6

9 308804

5 50000 31046.07 763099.89 5 250000

155230.3

3 464034.3

6 20000 11289.48 774389.37 6 300000

169342.1

8 633376.5

Initial

investment 500000

Initial

investmen

t 500000

Payback

period 2

Payback

period 5

0.1 0.2

Payback

period

2 year and 1

month

Payback

period

5 year

and 2

months

c. Accounting Rate of Return

Computation of Average rate of return

Computation of Average rate of

return

Machine A Machine B

Year Cash inflows Year

Cash

inflows

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1 300000 1 20000

2 250000 2 50000

3 200000 3 150000

4 150000 4 200000

5 50000 5 250000

6 20000 6 300000

Average profit or

cash inflow 161666.67

Average profit or cash

inflow 161666.67

Average initial

investment 500000

Average initial

investment 500000

average initial

investment [(initial

investment + scrap

value) / 2]

average initial

investment [(initial

investment + scrap value)

/ 2]

ARR 32% ARR 32%

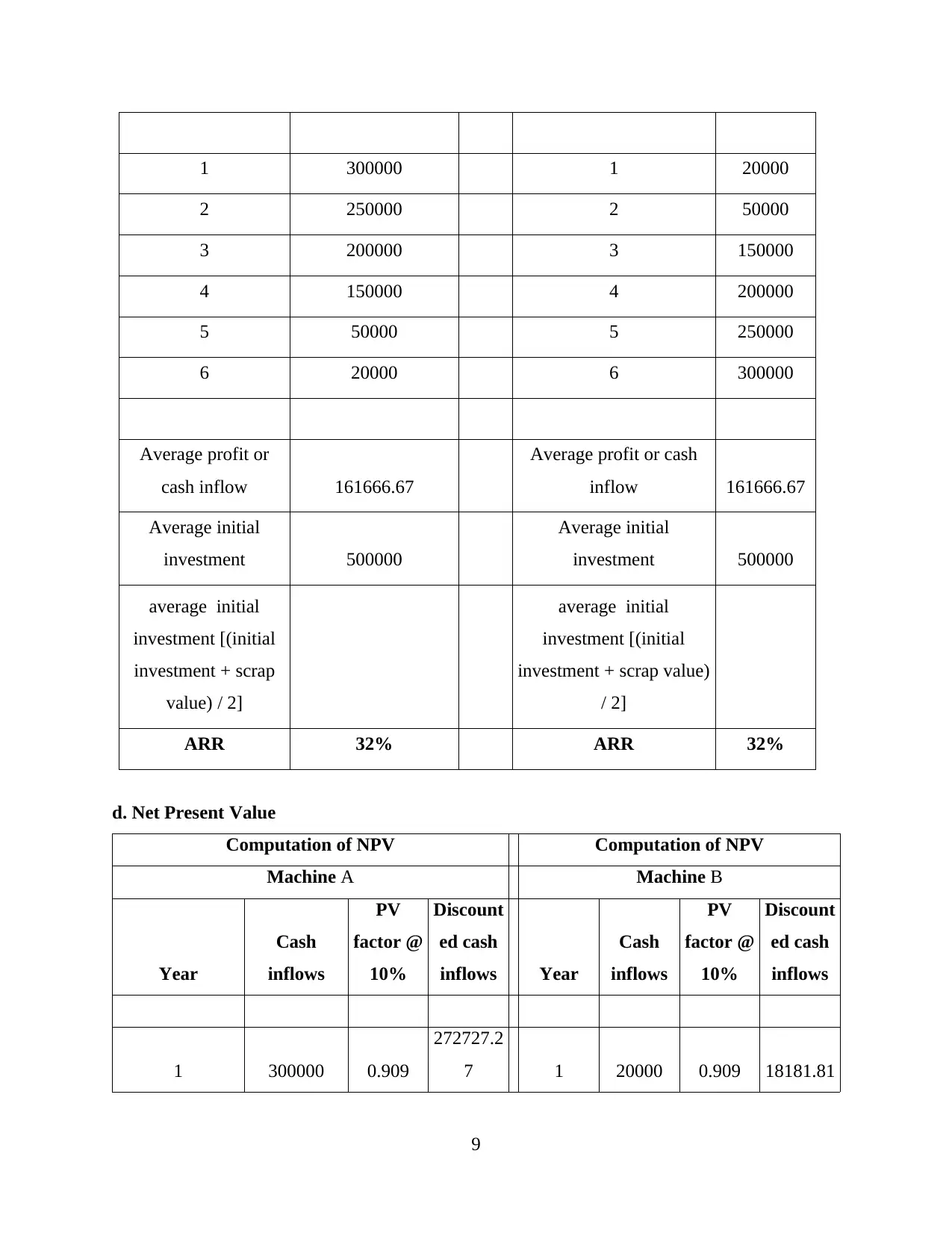

d. Net Present Value

Computation of NPV Computation of NPV

Machine A Machine B

Year

Cash

inflows

PV

factor @

10%

Discount

ed cash

inflows Year

Cash

inflows

PV

factor @

10%

Discount

ed cash

inflows

1 300000 0.909

272727.2

7 1 20000 0.909 18181.81

9

2 250000 2 50000

3 200000 3 150000

4 150000 4 200000

5 50000 5 250000

6 20000 6 300000

Average profit or

cash inflow 161666.67

Average profit or cash

inflow 161666.67

Average initial

investment 500000

Average initial

investment 500000

average initial

investment [(initial

investment + scrap

value) / 2]

average initial

investment [(initial

investment + scrap value)

/ 2]

ARR 32% ARR 32%

d. Net Present Value

Computation of NPV Computation of NPV

Machine A Machine B

Year

Cash

inflows

PV

factor @

10%

Discount

ed cash

inflows Year

Cash

inflows

PV

factor @

10%

Discount

ed cash

inflows

1 300000 0.909

272727.2

7 1 20000 0.909 18181.81

9

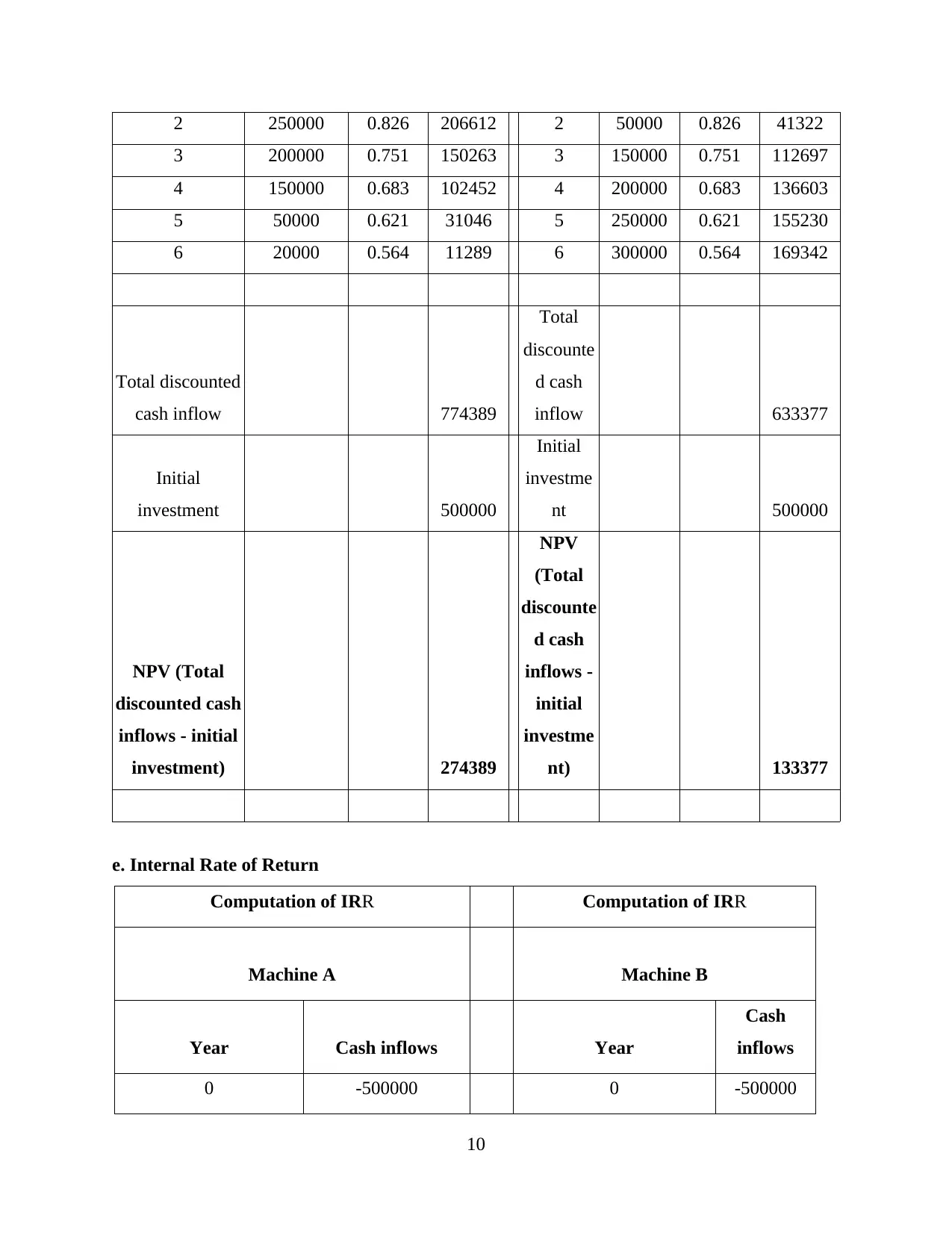

2 250000 0.826 206612 2 50000 0.826 41322

3 200000 0.751 150263 3 150000 0.751 112697

4 150000 0.683 102452 4 200000 0.683 136603

5 50000 0.621 31046 5 250000 0.621 155230

6 20000 0.564 11289 6 300000 0.564 169342

Total discounted

cash inflow 774389

Total

discounte

d cash

inflow 633377

Initial

investment 500000

Initial

investme

nt 500000

NPV (Total

discounted cash

inflows - initial

investment) 274389

NPV

(Total

discounte

d cash

inflows -

initial

investme

nt) 133377

e. Internal Rate of Return

Computation of IRR Computation of IRR

Machine A Machine B

Year Cash inflows Year

Cash

inflows

0 -500000 0 -500000

10

3 200000 0.751 150263 3 150000 0.751 112697

4 150000 0.683 102452 4 200000 0.683 136603

5 50000 0.621 31046 5 250000 0.621 155230

6 20000 0.564 11289 6 300000 0.564 169342

Total discounted

cash inflow 774389

Total

discounte

d cash

inflow 633377

Initial

investment 500000

Initial

investme

nt 500000

NPV (Total

discounted cash

inflows - initial

investment) 274389

NPV

(Total

discounte

d cash

inflows -

initial

investme

nt) 133377

e. Internal Rate of Return

Computation of IRR Computation of IRR

Machine A Machine B

Year Cash inflows Year

Cash

inflows

0 -500000 0 -500000

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.