Financial Management Report: Right Issues, Appraisal and Dividends

VerifiedAdded on 2021/02/20

|13

|3946

|244

Report

AI Summary

This report delves into the core aspects of financial management, encompassing planning, organizing, and controlling financial activities. It explores equity finance, specifically focusing on right issues, detailing their concept, advantages, and limitations through practical problem-solving. The report provides a comprehensive analysis of various investment appraisal techniques, such as payback period and accounting rate of return, evaluating their economic feasibility and benefits. Furthermore, it examines scrip dividends, outlining their advantages from both shareholder and company perspectives, while also acknowledging potential drawbacks. The report includes detailed calculations and tabular presentations to support the analysis, offering recommendations for financial decisions based on the findings.

Financial Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................4

Question 2: ......................................................................................................................................4

(a) Right issue concept:................................................................................................................4

(b) Scrip dividends and its advantages: ......................................................................................6

Question 3: ......................................................................................................................................7

(a) Determination of economic feasibility of project by using various investment appraisal

techniques: .................................................................................................................................7

(b) Evaluation of benefits and limitations of different investment techniques:.........................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................4

Question 2: ......................................................................................................................................4

(a) Right issue concept:................................................................................................................4

(b) Scrip dividends and its advantages: ......................................................................................6

Question 3: ......................................................................................................................................7

(a) Determination of economic feasibility of project by using various investment appraisal

techniques: .................................................................................................................................7

(b) Evaluation of benefits and limitations of different investment techniques:.........................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

Financial management means planning, organising, directing and controlling the financial

activities which includes raising of funds (finance) and utilising the funds of enterprises. It have

main aim to is calculating ratio analysis, equities and debts related aspects. Financial

management helps the the company in reducing its cost of raising finance and ensure sufficient

availability of finance. A company can raise funds for its business operations In this report,

different appraisal techniques are explained to understand the various capital budgeting decision

very well along with there benefits and limitations ( Nelson and Murray, 2012). This report

provides information about equity finance and right issues by solving a practical problem.

Various investment appraisal techniques are explained in detail by solving a practical problem.

Question 2:

(a) Right issue concept:

Right issue is an option given to the existing shareholders to purchase the additional new

equity shares in the company, this is known as right given to the existing shareholders and these

additional shares are known as right shares. There are various benefits of issuing right shares that

are as follows:

The main benefits of this to the shareholders is that shares are issued at discount price to

encourage them to purchase the rights issue.

Company can save significant amount of money by issuing such right shares such as

underwriting commission, advertisements cost and other related cost.

By issuing these types of shares, company make equitable distribution of shares along

with same proportion of voting rights.

These rights may have some types that may be understood as follows:

Renounce-able Rights Issue: In this types of issue of right shares, the existing

shareholders have right to transfer their rights to any other person even if to a person that

is not company's shareholder (YI, 2016).

Renounce-able Rights Issue: in this type, the existing shareholders has not right to

transfer their rights to anyone.

Some limitations of right issue:

Financial management means planning, organising, directing and controlling the financial

activities which includes raising of funds (finance) and utilising the funds of enterprises. It have

main aim to is calculating ratio analysis, equities and debts related aspects. Financial

management helps the the company in reducing its cost of raising finance and ensure sufficient

availability of finance. A company can raise funds for its business operations In this report,

different appraisal techniques are explained to understand the various capital budgeting decision

very well along with there benefits and limitations ( Nelson and Murray, 2012). This report

provides information about equity finance and right issues by solving a practical problem.

Various investment appraisal techniques are explained in detail by solving a practical problem.

Question 2:

(a) Right issue concept:

Right issue is an option given to the existing shareholders to purchase the additional new

equity shares in the company, this is known as right given to the existing shareholders and these

additional shares are known as right shares. There are various benefits of issuing right shares that

are as follows:

The main benefits of this to the shareholders is that shares are issued at discount price to

encourage them to purchase the rights issue.

Company can save significant amount of money by issuing such right shares such as

underwriting commission, advertisements cost and other related cost.

By issuing these types of shares, company make equitable distribution of shares along

with same proportion of voting rights.

These rights may have some types that may be understood as follows:

Renounce-able Rights Issue: In this types of issue of right shares, the existing

shareholders have right to transfer their rights to any other person even if to a person that

is not company's shareholder (YI, 2016).

Renounce-able Rights Issue: in this type, the existing shareholders has not right to

transfer their rights to anyone.

Some limitations of right issue:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In this method, company may not able to raise more funds and not able to achieve its

target.

The value of each shares may get diluted if there are increased number of share issued.

It right issue is issued by the well known company, then it has give a wrong impression in

the market that company has not sufficient money and it is struggling to run its business

activities smoothly (Graves and Ringuest, 2012).

This concept can be understood by solving the practical problem which is as follows:

Information given in the question:

Profit after tax (PAT) = 20 percent of share holders funds

ordinary shares of 50p each = 300000 (i.e. 6000 shares of 50 pound each)

Reserves = 400000

700000

Amount which is required through right issue = £180000

current ex-dividend market price of Lexbel plc = £ 1.90

Different rights issues prices suggested by the management = £1.80, £1.60 and £1.40

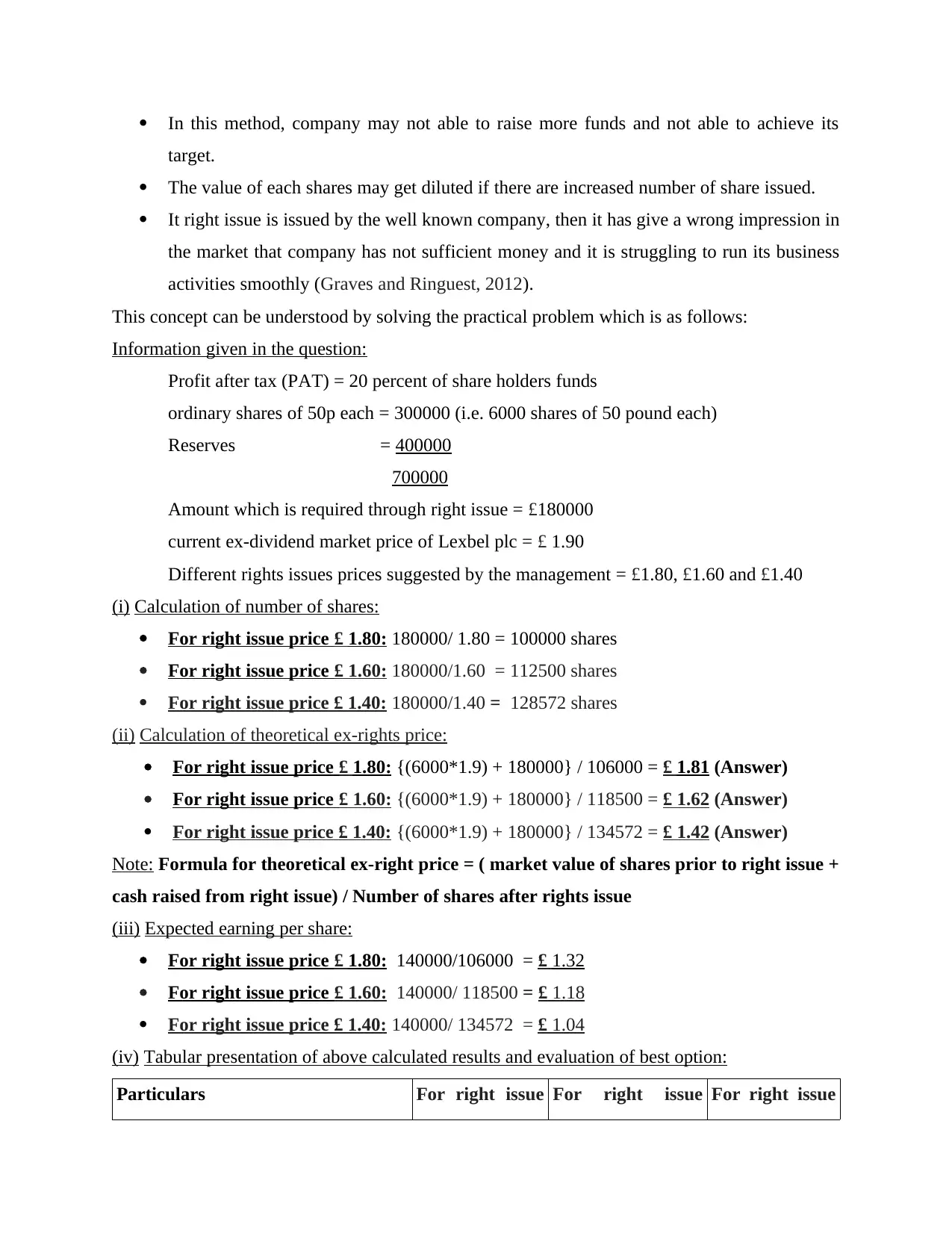

(i) Calculation of number of shares:

For right issue price £ 1.80: 180000/ 1.80 = 100000 shares

For right issue price £ 1.60: 180000/1.60 = 112500 shares

For right issue price £ 1.40: 180000/1.40 = 128572 shares

(ii) Calculation of theoretical ex-rights price:

For right issue price £ 1.80: {(6000*1.9) + 180000} / 106000 = £ 1.81 (Answer)

For right issue price £ 1.60: {(6000*1.9) + 180000} / 118500 = £ 1.62 (Answer)

For right issue price £ 1.40: {(6000*1.9) + 180000} / 134572 = £ 1.42 (Answer)

Note: Formula for theoretical ex-right price = ( market value of shares prior to right issue +

cash raised from right issue) / Number of shares after rights issue

(iii) Expected earning per share:

For right issue price £ 1.80: 140000/106000 = £ 1.32

For right issue price £ 1.60: 140000/ 118500 = £ 1.18

For right issue price £ 1.40: 140000/ 134572 = £ 1.04

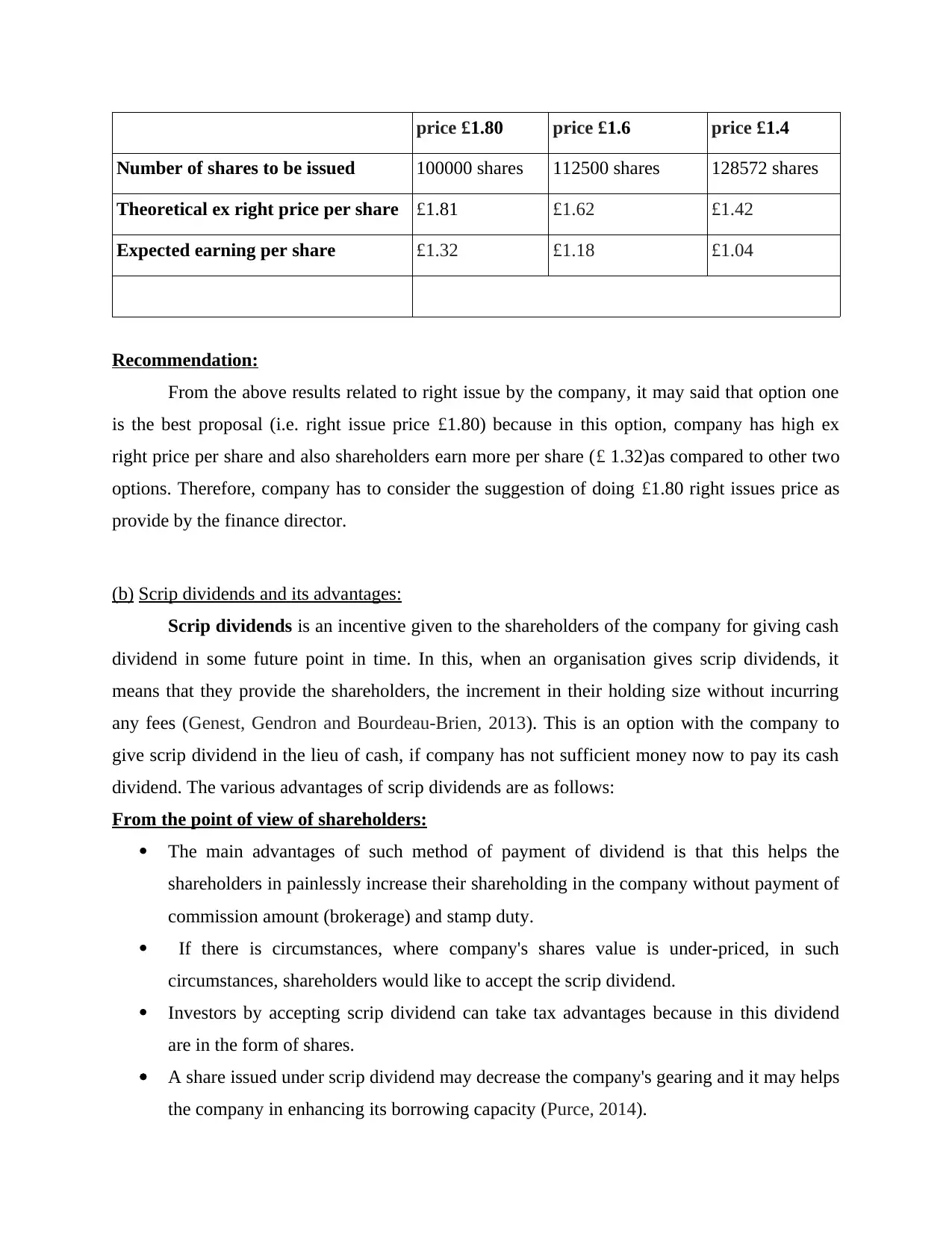

(iv) Tabular presentation of above calculated results and evaluation of best option:

Particulars For right issue For right issue For right issue

target.

The value of each shares may get diluted if there are increased number of share issued.

It right issue is issued by the well known company, then it has give a wrong impression in

the market that company has not sufficient money and it is struggling to run its business

activities smoothly (Graves and Ringuest, 2012).

This concept can be understood by solving the practical problem which is as follows:

Information given in the question:

Profit after tax (PAT) = 20 percent of share holders funds

ordinary shares of 50p each = 300000 (i.e. 6000 shares of 50 pound each)

Reserves = 400000

700000

Amount which is required through right issue = £180000

current ex-dividend market price of Lexbel plc = £ 1.90

Different rights issues prices suggested by the management = £1.80, £1.60 and £1.40

(i) Calculation of number of shares:

For right issue price £ 1.80: 180000/ 1.80 = 100000 shares

For right issue price £ 1.60: 180000/1.60 = 112500 shares

For right issue price £ 1.40: 180000/1.40 = 128572 shares

(ii) Calculation of theoretical ex-rights price:

For right issue price £ 1.80: {(6000*1.9) + 180000} / 106000 = £ 1.81 (Answer)

For right issue price £ 1.60: {(6000*1.9) + 180000} / 118500 = £ 1.62 (Answer)

For right issue price £ 1.40: {(6000*1.9) + 180000} / 134572 = £ 1.42 (Answer)

Note: Formula for theoretical ex-right price = ( market value of shares prior to right issue +

cash raised from right issue) / Number of shares after rights issue

(iii) Expected earning per share:

For right issue price £ 1.80: 140000/106000 = £ 1.32

For right issue price £ 1.60: 140000/ 118500 = £ 1.18

For right issue price £ 1.40: 140000/ 134572 = £ 1.04

(iv) Tabular presentation of above calculated results and evaluation of best option:

Particulars For right issue For right issue For right issue

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

price £1.80 price £1.6 price £1.4

Number of shares to be issued 100000 shares 112500 shares 128572 shares

Theoretical ex right price per share £1.81 £1.62 £1.42

Expected earning per share £1.32 £1.18 £1.04

Recommendation:

From the above results related to right issue by the company, it may said that option one

is the best proposal (i.e. right issue price £1.80) because in this option, company has high ex

right price per share and also shareholders earn more per share (£ 1.32)as compared to other two

options. Therefore, company has to consider the suggestion of doing £1.80 right issues price as

provide by the finance director.

(b) Scrip dividends and its advantages:

Scrip dividends is an incentive given to the shareholders of the company for giving cash

dividend in some future point in time. In this, when an organisation gives scrip dividends, it

means that they provide the shareholders, the increment in their holding size without incurring

any fees (Genest, Gendron and Bourdeau-Brien, 2013). This is an option with the company to

give scrip dividend in the lieu of cash, if company has not sufficient money now to pay its cash

dividend. The various advantages of scrip dividends are as follows:

From the point of view of shareholders:

The main advantages of such method of payment of dividend is that this helps the

shareholders in painlessly increase their shareholding in the company without payment of

commission amount (brokerage) and stamp duty.

If there is circumstances, where company's shares value is under-priced, in such

circumstances, shareholders would like to accept the scrip dividend.

Investors by accepting scrip dividend can take tax advantages because in this dividend

are in the form of shares.

A share issued under scrip dividend may decrease the company's gearing and it may helps

the company in enhancing its borrowing capacity (Purce, 2014).

Number of shares to be issued 100000 shares 112500 shares 128572 shares

Theoretical ex right price per share £1.81 £1.62 £1.42

Expected earning per share £1.32 £1.18 £1.04

Recommendation:

From the above results related to right issue by the company, it may said that option one

is the best proposal (i.e. right issue price £1.80) because in this option, company has high ex

right price per share and also shareholders earn more per share (£ 1.32)as compared to other two

options. Therefore, company has to consider the suggestion of doing £1.80 right issues price as

provide by the finance director.

(b) Scrip dividends and its advantages:

Scrip dividends is an incentive given to the shareholders of the company for giving cash

dividend in some future point in time. In this, when an organisation gives scrip dividends, it

means that they provide the shareholders, the increment in their holding size without incurring

any fees (Genest, Gendron and Bourdeau-Brien, 2013). This is an option with the company to

give scrip dividend in the lieu of cash, if company has not sufficient money now to pay its cash

dividend. The various advantages of scrip dividends are as follows:

From the point of view of shareholders:

The main advantages of such method of payment of dividend is that this helps the

shareholders in painlessly increase their shareholding in the company without payment of

commission amount (brokerage) and stamp duty.

If there is circumstances, where company's shares value is under-priced, in such

circumstances, shareholders would like to accept the scrip dividend.

Investors by accepting scrip dividend can take tax advantages because in this dividend

are in the form of shares.

A share issued under scrip dividend may decrease the company's gearing and it may helps

the company in enhancing its borrowing capacity (Purce, 2014).

From the point of view of company:

The main advantages of scrip dividend is that company does not need to spend its cash to

pay such dividend and in certain circumstances it helps the company in tax saving.

It helps the company in saving of cash for diversification of its business operations and

for reinvestment purposes (Power, 2012).

There also some disadvantages in scrip dividends which are as follows:

In case of dividend per share is maintained or increased then total cash paid shall

increased.

It may be seen as a negative signal by the market that company has not enough money to

pay its dividend and it suffers some cash flow Mazanai, M. and Fatoki, O., 2012Ayoub,

S., 2014YI, X.H. and ZHOU, Z.F., 2012Hofmann, E. and Johnson, M., 2016problems.

It may not be beneficial for the shareholders to accept scrip dividend in lieu of cash

dividend in case, where shareholders requires cash and the main income source of such

shareholders is only cash dividend.

Scrip dividend is also not suitable for the company where it does not want to issue

additional shares and does not want to increase its share capital but due to cash flow

issue, it has to pay scrip dividend (Fayol, 2016).

Question 3:

(a) Determination of economic feasibility of project by using various investment appraisal

techniques:

In an business organisation, there are various proposed projects are come in front of the

company, it shall need to evaluate these projects to choose best one by using several investment

techniques. The detailed discussion of these investment appraisal are as follows by solving a

practical question:

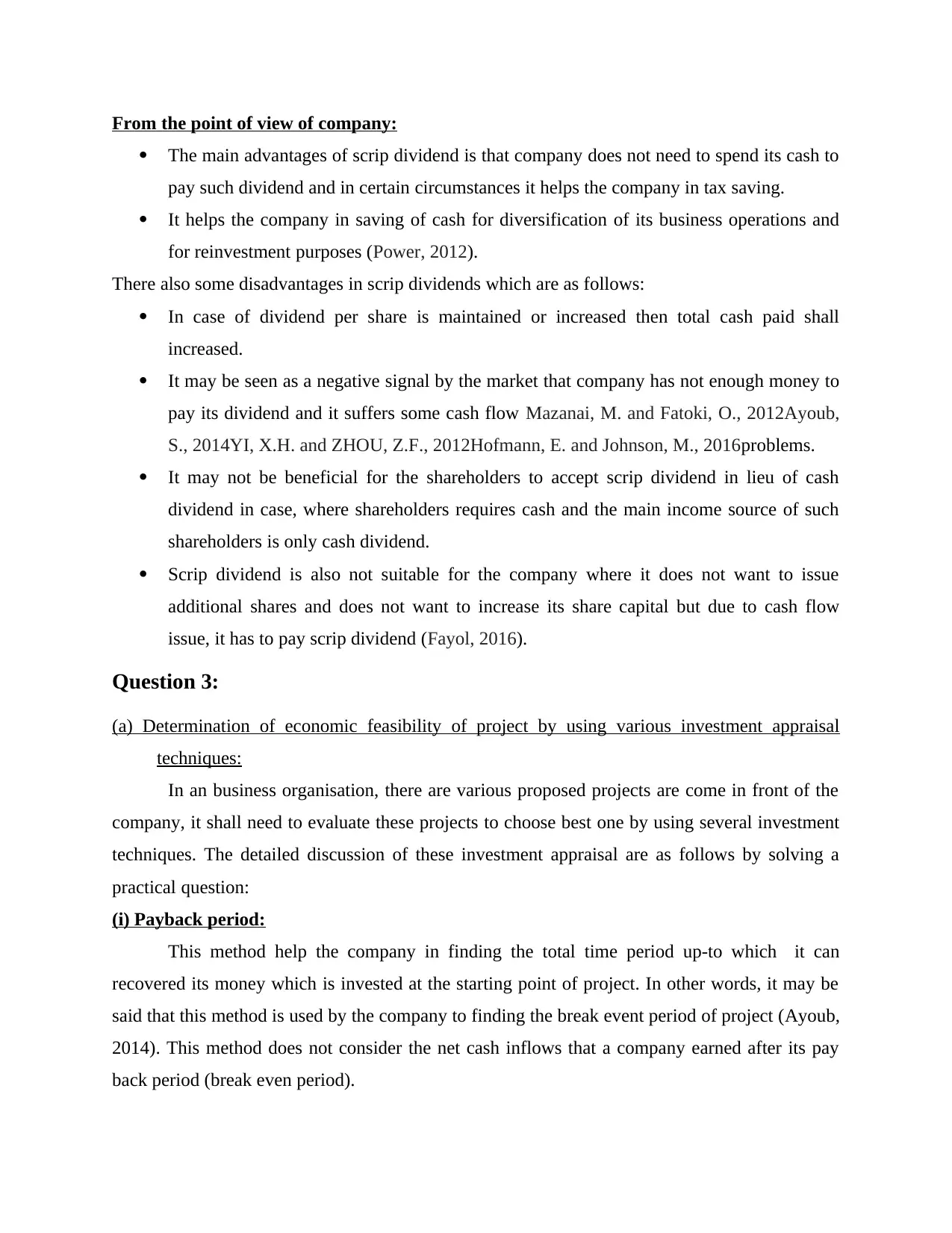

(i) Payback period:

This method help the company in finding the total time period up-to which it can

recovered its money which is invested at the starting point of project. In other words, it may be

said that this method is used by the company to finding the break event period of project (Ayoub,

2014). This method does not consider the net cash inflows that a company earned after its pay

back period (break even period).

The main advantages of scrip dividend is that company does not need to spend its cash to

pay such dividend and in certain circumstances it helps the company in tax saving.

It helps the company in saving of cash for diversification of its business operations and

for reinvestment purposes (Power, 2012).

There also some disadvantages in scrip dividends which are as follows:

In case of dividend per share is maintained or increased then total cash paid shall

increased.

It may be seen as a negative signal by the market that company has not enough money to

pay its dividend and it suffers some cash flow Mazanai, M. and Fatoki, O., 2012Ayoub,

S., 2014YI, X.H. and ZHOU, Z.F., 2012Hofmann, E. and Johnson, M., 2016problems.

It may not be beneficial for the shareholders to accept scrip dividend in lieu of cash

dividend in case, where shareholders requires cash and the main income source of such

shareholders is only cash dividend.

Scrip dividend is also not suitable for the company where it does not want to issue

additional shares and does not want to increase its share capital but due to cash flow

issue, it has to pay scrip dividend (Fayol, 2016).

Question 3:

(a) Determination of economic feasibility of project by using various investment appraisal

techniques:

In an business organisation, there are various proposed projects are come in front of the

company, it shall need to evaluate these projects to choose best one by using several investment

techniques. The detailed discussion of these investment appraisal are as follows by solving a

practical question:

(i) Payback period:

This method help the company in finding the total time period up-to which it can

recovered its money which is invested at the starting point of project. In other words, it may be

said that this method is used by the company to finding the break event period of project (Ayoub,

2014). This method does not consider the net cash inflows that a company earned after its pay

back period (break even period).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Calculation of Payback Period for Happy Meal Limited:

Particulars Amount(£)

Starting or Initial Investment 320000

Particulars Y 1 Y 2 Y 3 Y 4 Y 5 Y 6

Annual Cash Inflows ( as given) 105000 105000 105000 105000 105000 105000

Less: Annual Cash Outflows ( As

given)

15500 15500 15500 15500 15500 15500

Net annual Cash Inflows 89500 89500 89500 89500 89500 89500

Total payback period (years) 3.58

Recommendations:

After considering the above calculations related to pay back period, it is clearly evident

that payback period is 3.58 years. This means that its payback period is less than total project

period.

Therefore, it can be said that, it is a viable project and need to investment in it.

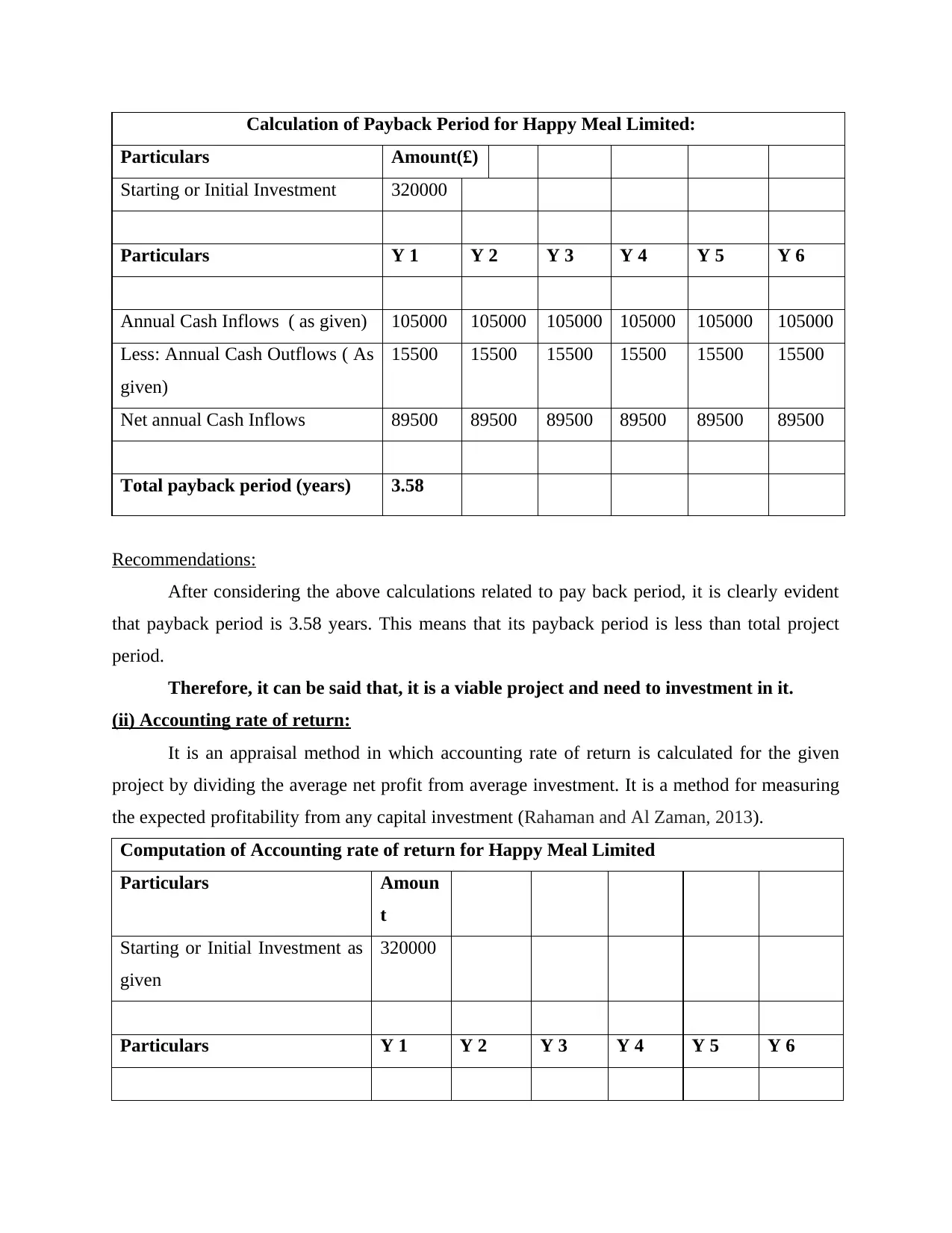

(ii) Accounting rate of return:

It is an appraisal method in which accounting rate of return is calculated for the given

project by dividing the average net profit from average investment. It is a method for measuring

the expected profitability from any capital investment (Rahaman and Al Zaman, 2013).

Computation of Accounting rate of return for Happy Meal Limited

Particulars Amoun

t

Starting or Initial Investment as

given

320000

Particulars Y 1 Y 2 Y 3 Y 4 Y 5 Y 6

Particulars Amount(£)

Starting or Initial Investment 320000

Particulars Y 1 Y 2 Y 3 Y 4 Y 5 Y 6

Annual Cash Inflows ( as given) 105000 105000 105000 105000 105000 105000

Less: Annual Cash Outflows ( As

given)

15500 15500 15500 15500 15500 15500

Net annual Cash Inflows 89500 89500 89500 89500 89500 89500

Total payback period (years) 3.58

Recommendations:

After considering the above calculations related to pay back period, it is clearly evident

that payback period is 3.58 years. This means that its payback period is less than total project

period.

Therefore, it can be said that, it is a viable project and need to investment in it.

(ii) Accounting rate of return:

It is an appraisal method in which accounting rate of return is calculated for the given

project by dividing the average net profit from average investment. It is a method for measuring

the expected profitability from any capital investment (Rahaman and Al Zaman, 2013).

Computation of Accounting rate of return for Happy Meal Limited

Particulars Amoun

t

Starting or Initial Investment as

given

320000

Particulars Y 1 Y 2 Y 3 Y 4 Y 5 Y 6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Annual Cash Inflows (As given) 105000 105000 105000 105000 105000 105000

Less: Annual Cash Outflows 15500 15500 15500 15500 15500 15500

Net annual Cash Inflows 89500 89500 89500 89500 89500 89500

Less: Depreciation @ 20% 57600 46080 36864 29491.

20

23592.

96

18874.3

7

Net annual Cash Inflows after

providing depreciation

31900 43420 52636 60008.

80

65907.

04

70625.6

3

Average net accounting profit

(Net annual Cash inflows –

Average amount of

Depreciation)

54082.9

1

Initial Investment (as given) 320000

Accounting Rate of return 16.90 %

Accounting Rate of Return is computed by dividing Average Accounting Profit by Initial

Investment in respect of Happy Meal.

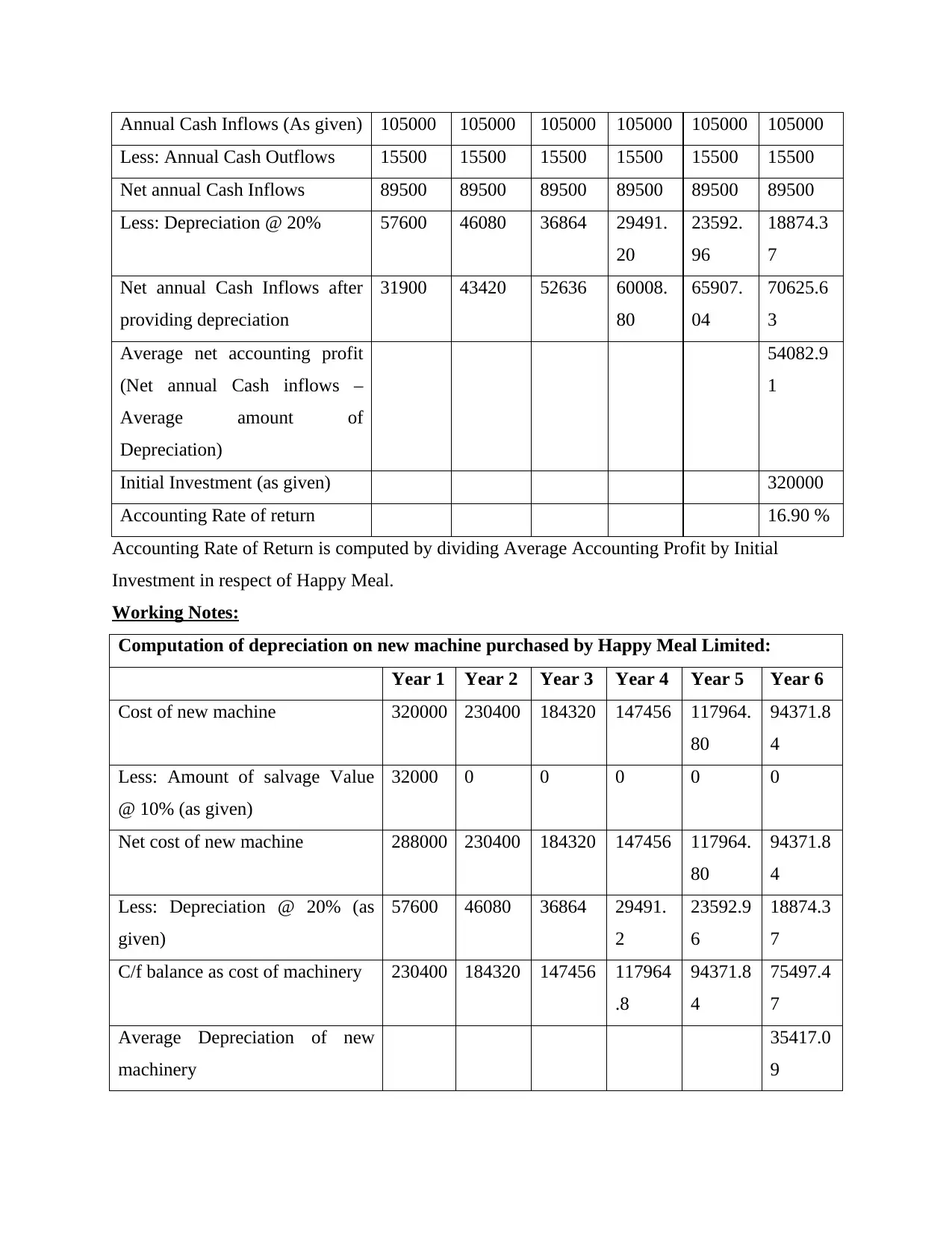

Working Notes:

Computation of depreciation on new machine purchased by Happy Meal Limited:

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Cost of new machine 320000 230400 184320 147456 117964.

80

94371.8

4

Less: Amount of salvage Value

@ 10% (as given)

32000 0 0 0 0 0

Net cost of new machine 288000 230400 184320 147456 117964.

80

94371.8

4

Less: Depreciation @ 20% (as

given)

57600 46080 36864 29491.

2

23592.9

6

18874.3

7

C/f balance as cost of machinery 230400 184320 147456 117964

.8

94371.8

4

75497.4

7

Average Depreciation of new

machinery

35417.0

9

Less: Annual Cash Outflows 15500 15500 15500 15500 15500 15500

Net annual Cash Inflows 89500 89500 89500 89500 89500 89500

Less: Depreciation @ 20% 57600 46080 36864 29491.

20

23592.

96

18874.3

7

Net annual Cash Inflows after

providing depreciation

31900 43420 52636 60008.

80

65907.

04

70625.6

3

Average net accounting profit

(Net annual Cash inflows –

Average amount of

Depreciation)

54082.9

1

Initial Investment (as given) 320000

Accounting Rate of return 16.90 %

Accounting Rate of Return is computed by dividing Average Accounting Profit by Initial

Investment in respect of Happy Meal.

Working Notes:

Computation of depreciation on new machine purchased by Happy Meal Limited:

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Cost of new machine 320000 230400 184320 147456 117964.

80

94371.8

4

Less: Amount of salvage Value

@ 10% (as given)

32000 0 0 0 0 0

Net cost of new machine 288000 230400 184320 147456 117964.

80

94371.8

4

Less: Depreciation @ 20% (as

given)

57600 46080 36864 29491.

2

23592.9

6

18874.3

7

C/f balance as cost of machinery 230400 184320 147456 117964

.8

94371.8

4

75497.4

7

Average Depreciation of new

machinery

35417.0

9

Recommendation:

From the above calculations related to accounting rate of return, it is clearly evident that

the accounting rate of return (16.9 %) is high from its cost of capital (12%).

Therefore, such investment proposal is viable and company should invest into such

project.

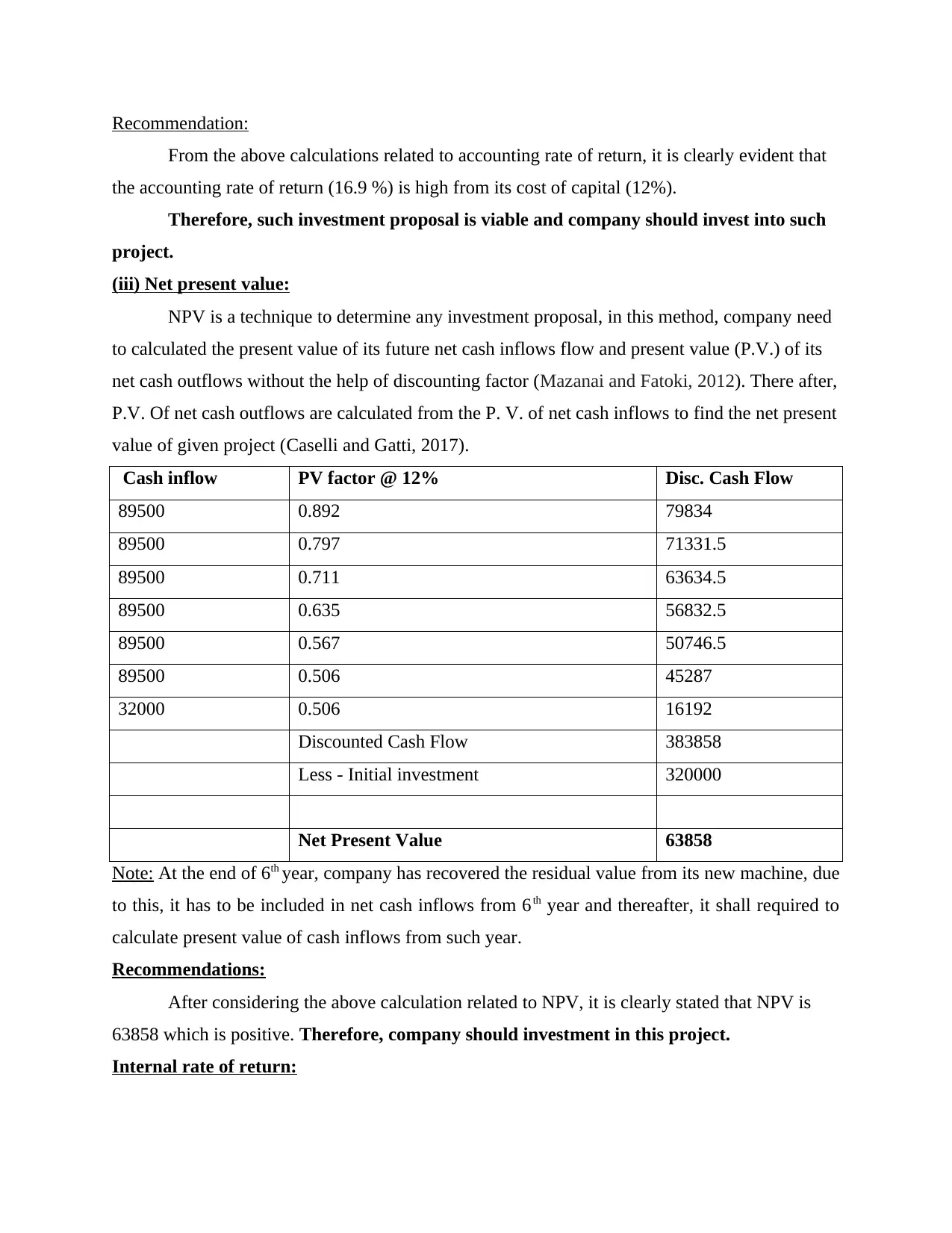

(iii) Net present value:

NPV is a technique to determine any investment proposal, in this method, company need

to calculated the present value of its future net cash inflows flow and present value (P.V.) of its

net cash outflows without the help of discounting factor (Mazanai and Fatoki, 2012). There after,

P.V. Of net cash outflows are calculated from the P. V. of net cash inflows to find the net present

value of given project (Caselli and Gatti, 2017).

Cash inflow PV factor @ 12% Disc. Cash Flow

89500 0.892 79834

89500 0.797 71331.5

89500 0.711 63634.5

89500 0.635 56832.5

89500 0.567 50746.5

89500 0.506 45287

32000 0.506 16192

Discounted Cash Flow 383858

Less - Initial investment 320000

Net Present Value 63858

Note: At the end of 6th year, company has recovered the residual value from its new machine, due

to this, it has to be included in net cash inflows from 6th year and thereafter, it shall required to

calculate present value of cash inflows from such year.

Recommendations:

After considering the above calculation related to NPV, it is clearly stated that NPV is

63858 which is positive. Therefore, company should investment in this project.

Internal rate of return:

From the above calculations related to accounting rate of return, it is clearly evident that

the accounting rate of return (16.9 %) is high from its cost of capital (12%).

Therefore, such investment proposal is viable and company should invest into such

project.

(iii) Net present value:

NPV is a technique to determine any investment proposal, in this method, company need

to calculated the present value of its future net cash inflows flow and present value (P.V.) of its

net cash outflows without the help of discounting factor (Mazanai and Fatoki, 2012). There after,

P.V. Of net cash outflows are calculated from the P. V. of net cash inflows to find the net present

value of given project (Caselli and Gatti, 2017).

Cash inflow PV factor @ 12% Disc. Cash Flow

89500 0.892 79834

89500 0.797 71331.5

89500 0.711 63634.5

89500 0.635 56832.5

89500 0.567 50746.5

89500 0.506 45287

32000 0.506 16192

Discounted Cash Flow 383858

Less - Initial investment 320000

Net Present Value 63858

Note: At the end of 6th year, company has recovered the residual value from its new machine, due

to this, it has to be included in net cash inflows from 6th year and thereafter, it shall required to

calculate present value of cash inflows from such year.

Recommendations:

After considering the above calculation related to NPV, it is clearly stated that NPV is

63858 which is positive. Therefore, company should investment in this project.

Internal rate of return:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

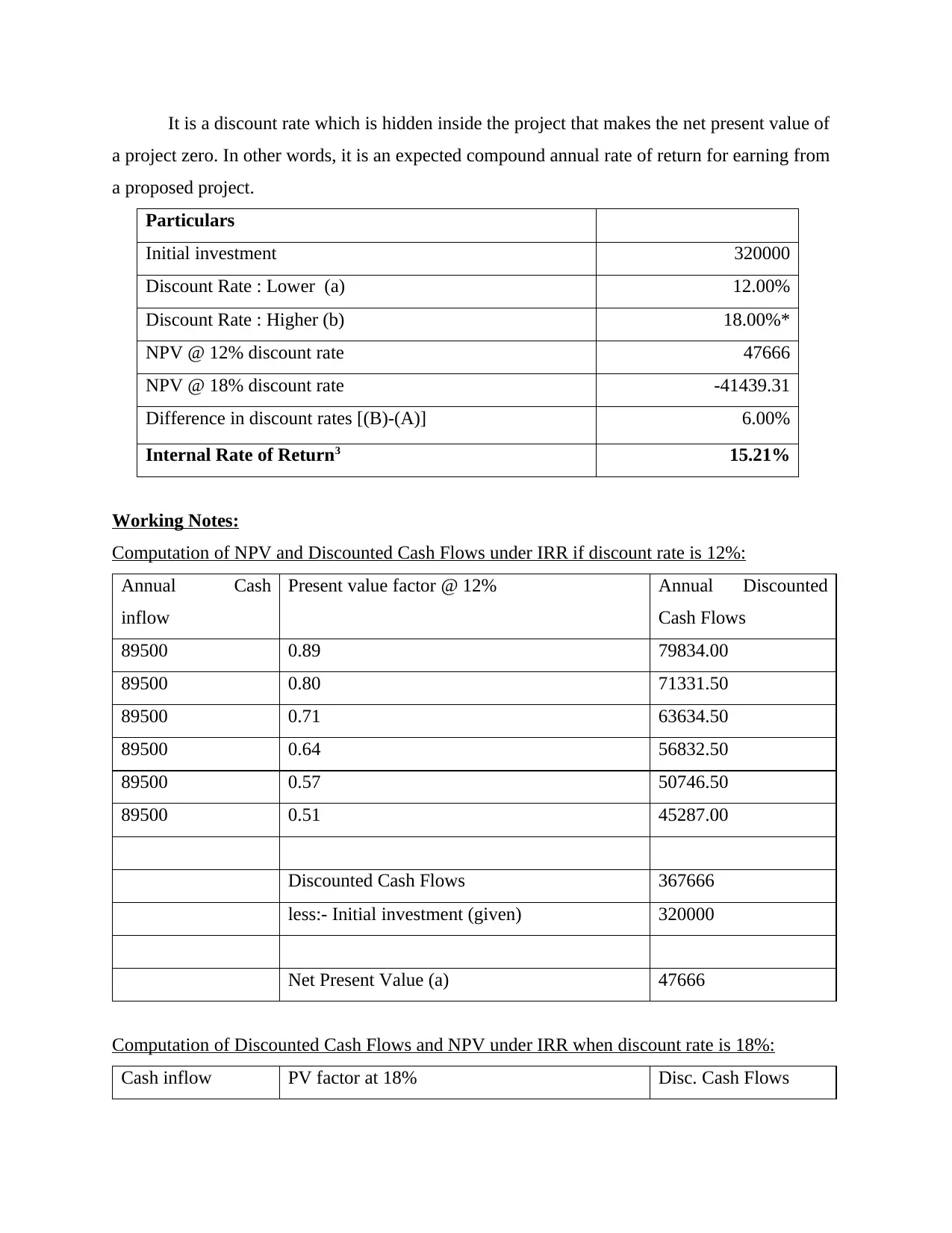

It is a discount rate which is hidden inside the project that makes the net present value of

a project zero. In other words, it is an expected compound annual rate of return for earning from

a proposed project.

Particulars

Initial investment 320000

Discount Rate : Lower (a) 12.00%

Discount Rate : Higher (b) 18.00%*

NPV @ 12% discount rate 47666

NPV @ 18% discount rate -41439.31

Difference in discount rates [(B)-(A)] 6.00%

Internal Rate of Return3 15.21%

Working Notes:

Computation of NPV and Discounted Cash Flows under IRR if discount rate is 12%:

Annual Cash

inflow

Present value factor @ 12% Annual Discounted

Cash Flows

89500 0.89 79834.00

89500 0.80 71331.50

89500 0.71 63634.50

89500 0.64 56832.50

89500 0.57 50746.50

89500 0.51 45287.00

Discounted Cash Flows 367666

less:- Initial investment (given) 320000

Net Present Value (a) 47666

Computation of Discounted Cash Flows and NPV under IRR when discount rate is 18%:

Cash inflow PV factor at 18% Disc. Cash Flows

a project zero. In other words, it is an expected compound annual rate of return for earning from

a proposed project.

Particulars

Initial investment 320000

Discount Rate : Lower (a) 12.00%

Discount Rate : Higher (b) 18.00%*

NPV @ 12% discount rate 47666

NPV @ 18% discount rate -41439.31

Difference in discount rates [(B)-(A)] 6.00%

Internal Rate of Return3 15.21%

Working Notes:

Computation of NPV and Discounted Cash Flows under IRR if discount rate is 12%:

Annual Cash

inflow

Present value factor @ 12% Annual Discounted

Cash Flows

89500 0.89 79834.00

89500 0.80 71331.50

89500 0.71 63634.50

89500 0.64 56832.50

89500 0.57 50746.50

89500 0.51 45287.00

Discounted Cash Flows 367666

less:- Initial investment (given) 320000

Net Present Value (a) 47666

Computation of Discounted Cash Flows and NPV under IRR when discount rate is 18%:

Cash inflow PV factor at 18% Disc. Cash Flows

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

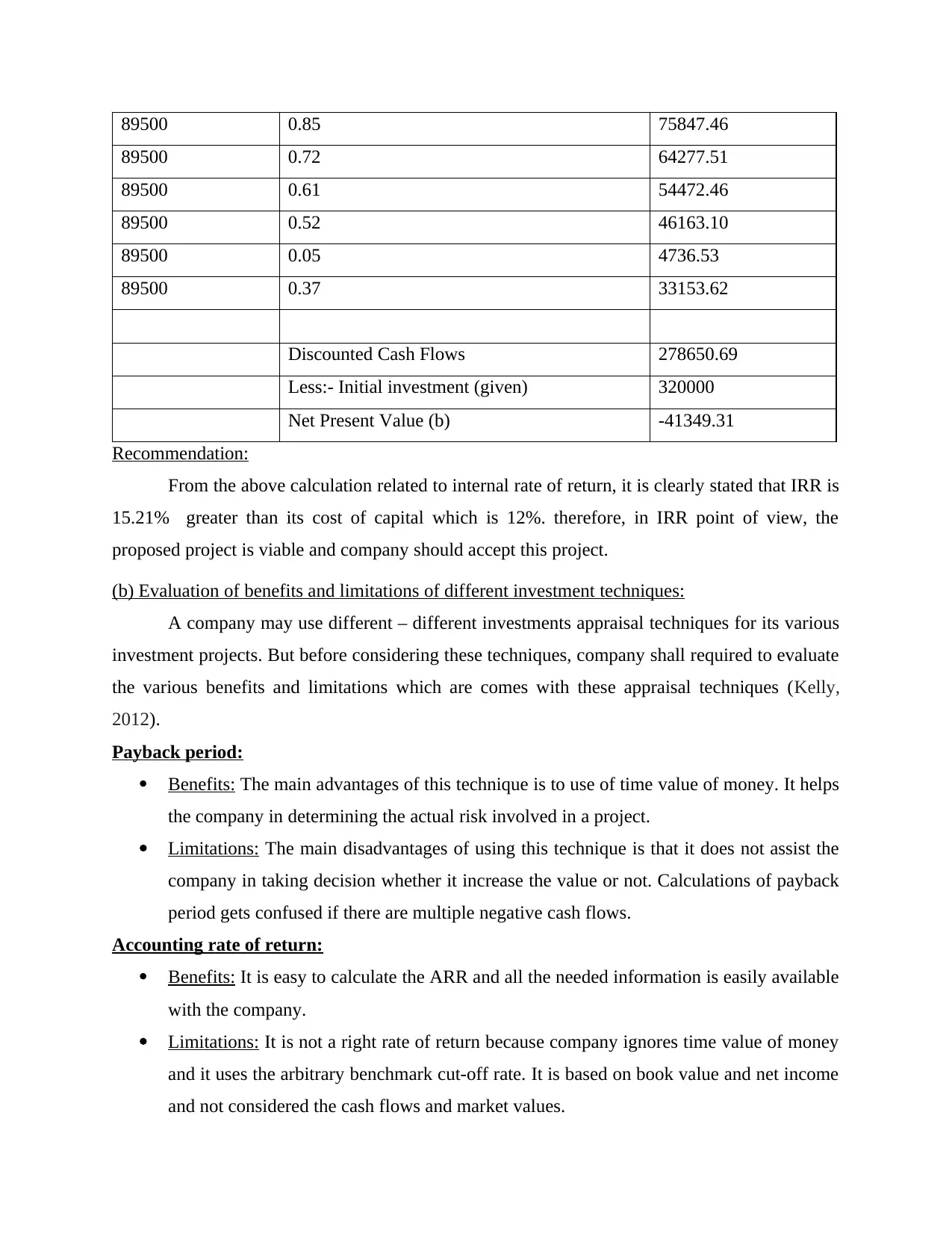

89500 0.85 75847.46

89500 0.72 64277.51

89500 0.61 54472.46

89500 0.52 46163.10

89500 0.05 4736.53

89500 0.37 33153.62

Discounted Cash Flows 278650.69

Less:- Initial investment (given) 320000

Net Present Value (b) -41349.31

Recommendation:

From the above calculation related to internal rate of return, it is clearly stated that IRR is

15.21% greater than its cost of capital which is 12%. therefore, in IRR point of view, the

proposed project is viable and company should accept this project.

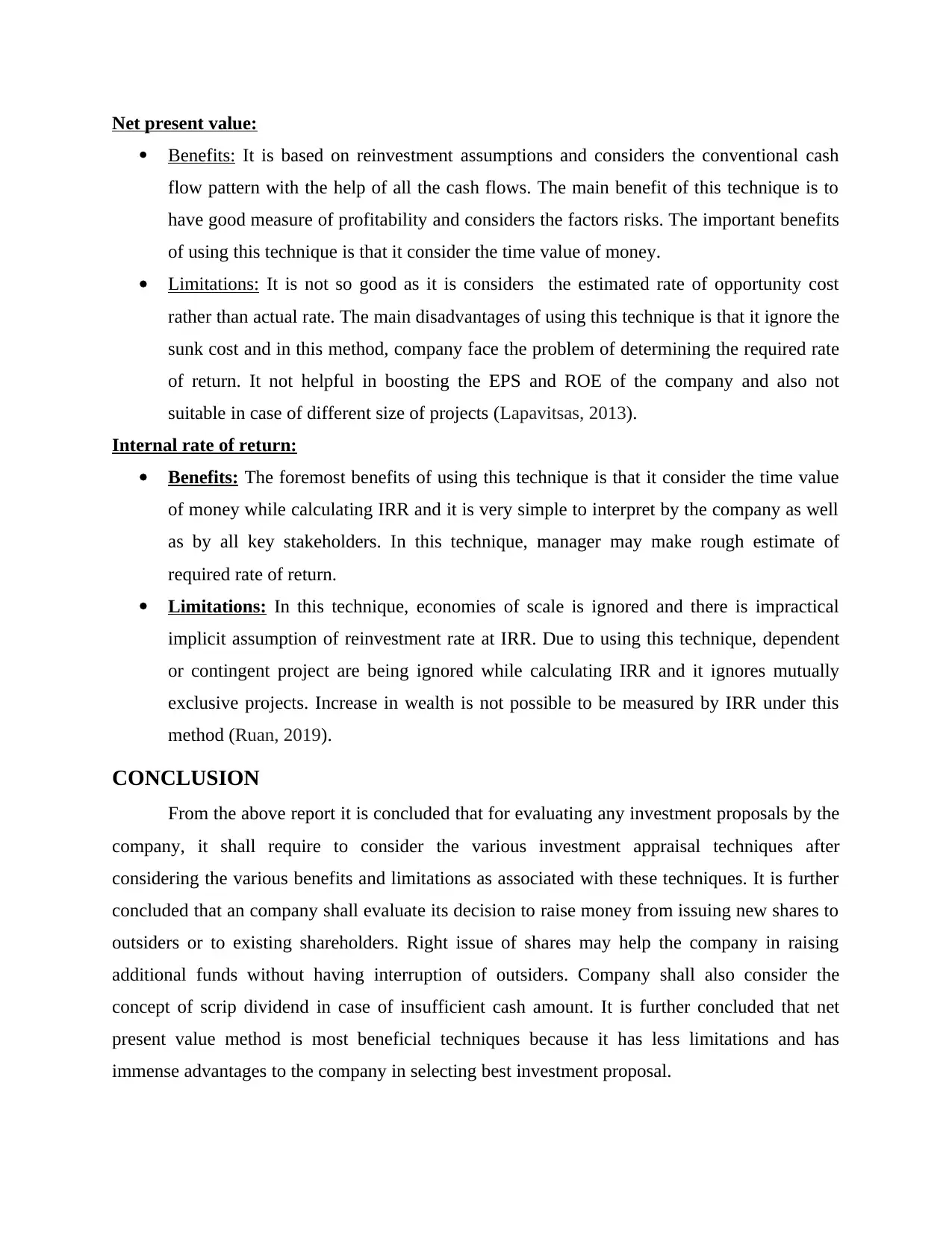

(b) Evaluation of benefits and limitations of different investment techniques:

A company may use different – different investments appraisal techniques for its various

investment projects. But before considering these techniques, company shall required to evaluate

the various benefits and limitations which are comes with these appraisal techniques (Kelly,

2012).

Payback period:

Benefits: The main advantages of this technique is to use of time value of money. It helps

the company in determining the actual risk involved in a project.

Limitations: The main disadvantages of using this technique is that it does not assist the

company in taking decision whether it increase the value or not. Calculations of payback

period gets confused if there are multiple negative cash flows.

Accounting rate of return:

Benefits: It is easy to calculate the ARR and all the needed information is easily available

with the company.

Limitations: It is not a right rate of return because company ignores time value of money

and it uses the arbitrary benchmark cut-off rate. It is based on book value and net income

and not considered the cash flows and market values.

89500 0.72 64277.51

89500 0.61 54472.46

89500 0.52 46163.10

89500 0.05 4736.53

89500 0.37 33153.62

Discounted Cash Flows 278650.69

Less:- Initial investment (given) 320000

Net Present Value (b) -41349.31

Recommendation:

From the above calculation related to internal rate of return, it is clearly stated that IRR is

15.21% greater than its cost of capital which is 12%. therefore, in IRR point of view, the

proposed project is viable and company should accept this project.

(b) Evaluation of benefits and limitations of different investment techniques:

A company may use different – different investments appraisal techniques for its various

investment projects. But before considering these techniques, company shall required to evaluate

the various benefits and limitations which are comes with these appraisal techniques (Kelly,

2012).

Payback period:

Benefits: The main advantages of this technique is to use of time value of money. It helps

the company in determining the actual risk involved in a project.

Limitations: The main disadvantages of using this technique is that it does not assist the

company in taking decision whether it increase the value or not. Calculations of payback

period gets confused if there are multiple negative cash flows.

Accounting rate of return:

Benefits: It is easy to calculate the ARR and all the needed information is easily available

with the company.

Limitations: It is not a right rate of return because company ignores time value of money

and it uses the arbitrary benchmark cut-off rate. It is based on book value and net income

and not considered the cash flows and market values.

Net present value:

Benefits: It is based on reinvestment assumptions and considers the conventional cash

flow pattern with the help of all the cash flows. The main benefit of this technique is to

have good measure of profitability and considers the factors risks. The important benefits

of using this technique is that it consider the time value of money.

Limitations: It is not so good as it is considers the estimated rate of opportunity cost

rather than actual rate. The main disadvantages of using this technique is that it ignore the

sunk cost and in this method, company face the problem of determining the required rate

of return. It not helpful in boosting the EPS and ROE of the company and also not

suitable in case of different size of projects (Lapavitsas, 2013).

Internal rate of return:

Benefits: The foremost benefits of using this technique is that it consider the time value

of money while calculating IRR and it is very simple to interpret by the company as well

as by all key stakeholders. In this technique, manager may make rough estimate of

required rate of return.

Limitations: In this technique, economies of scale is ignored and there is impractical

implicit assumption of reinvestment rate at IRR. Due to using this technique, dependent

or contingent project are being ignored while calculating IRR and it ignores mutually

exclusive projects. Increase in wealth is not possible to be measured by IRR under this

method (Ruan, 2019).

CONCLUSION

From the above report it is concluded that for evaluating any investment proposals by the

company, it shall require to consider the various investment appraisal techniques after

considering the various benefits and limitations as associated with these techniques. It is further

concluded that an company shall evaluate its decision to raise money from issuing new shares to

outsiders or to existing shareholders. Right issue of shares may help the company in raising

additional funds without having interruption of outsiders. Company shall also consider the

concept of scrip dividend in case of insufficient cash amount. It is further concluded that net

present value method is most beneficial techniques because it has less limitations and has

immense advantages to the company in selecting best investment proposal.

Benefits: It is based on reinvestment assumptions and considers the conventional cash

flow pattern with the help of all the cash flows. The main benefit of this technique is to

have good measure of profitability and considers the factors risks. The important benefits

of using this technique is that it consider the time value of money.

Limitations: It is not so good as it is considers the estimated rate of opportunity cost

rather than actual rate. The main disadvantages of using this technique is that it ignore the

sunk cost and in this method, company face the problem of determining the required rate

of return. It not helpful in boosting the EPS and ROE of the company and also not

suitable in case of different size of projects (Lapavitsas, 2013).

Internal rate of return:

Benefits: The foremost benefits of using this technique is that it consider the time value

of money while calculating IRR and it is very simple to interpret by the company as well

as by all key stakeholders. In this technique, manager may make rough estimate of

required rate of return.

Limitations: In this technique, economies of scale is ignored and there is impractical

implicit assumption of reinvestment rate at IRR. Due to using this technique, dependent

or contingent project are being ignored while calculating IRR and it ignores mutually

exclusive projects. Increase in wealth is not possible to be measured by IRR under this

method (Ruan, 2019).

CONCLUSION

From the above report it is concluded that for evaluating any investment proposals by the

company, it shall require to consider the various investment appraisal techniques after

considering the various benefits and limitations as associated with these techniques. It is further

concluded that an company shall evaluate its decision to raise money from issuing new shares to

outsiders or to existing shareholders. Right issue of shares may help the company in raising

additional funds without having interruption of outsiders. Company shall also consider the

concept of scrip dividend in case of insufficient cash amount. It is further concluded that net

present value method is most beneficial techniques because it has less limitations and has

immense advantages to the company in selecting best investment proposal.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.