Financial Management Report: Tesco Ratio Analysis

VerifiedAdded on 2019/12/03

|24

|4852

|496

Report

AI Summary

This report provides a comprehensive analysis of financial management concepts, focusing on ratio analysis of Tesco and investment appraisal for PLC. The first part calculates and analyzes various financial ratios for Tesco over three years, including profitability, performance, liquidity, and efficiency ratios. The second part evaluates two investment projects using Net Present Value (NPV), Internal Rate of Return (IRR), Average Rate of Return (ARR), and Payback Period methods. The report concludes that based on the analysis, PLC should invest in project 1. The report also discusses the advantages and disadvantages of each investment appraisal method.

Financial Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

PART 1: RATIO ANALYSIS OF TESCO.....................................................................................2

1.1: Calculation of Ratios............................................................................................................2

1.2: Ratio Analysis.......................................................................................................................6

1.3: Summarized Report..............................................................................................................9

PART 2: INVESTMENT APPRAISAL FOR PLC Plc................................................................10

2.1: Project Appraisal................................................................................................................10

2.2: Payback Period Method......................................................................................................13

2.3: Advantages and disadvantages of the investment appraisal methods................................14

2.4: Summarized Report............................................................................................................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

APPENDIX....................................................................................................................................19

Financial Statements of TESCO................................................................................................19

INTRODUCTION...........................................................................................................................1

PART 1: RATIO ANALYSIS OF TESCO.....................................................................................2

1.1: Calculation of Ratios............................................................................................................2

1.2: Ratio Analysis.......................................................................................................................6

1.3: Summarized Report..............................................................................................................9

PART 2: INVESTMENT APPRAISAL FOR PLC Plc................................................................10

2.1: Project Appraisal................................................................................................................10

2.2: Payback Period Method......................................................................................................13

2.3: Advantages and disadvantages of the investment appraisal methods................................14

2.4: Summarized Report............................................................................................................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

APPENDIX....................................................................................................................................19

Financial Statements of TESCO................................................................................................19

List of Tables

Table 1: Ratios of Tesco..................................................................................................................5

Table 2: Summarized Report...........................................................................................................9

Table 3: Cash Flow for Two Projects............................................................................................10

Table 4: NPV at 10%.....................................................................................................................10

Table 5: NPV of Project 1 at 11%.................................................................................................11

Table 6: NPV of Project 2 at 9%...................................................................................................12

Table 7: Payback Period of Project 1............................................................................................13

Table 8: Payback Period of Project 2............................................................................................14

Table 9: Summarized Report.........................................................................................................16

Table 1: Ratios of Tesco..................................................................................................................5

Table 2: Summarized Report...........................................................................................................9

Table 3: Cash Flow for Two Projects............................................................................................10

Table 4: NPV at 10%.....................................................................................................................10

Table 5: NPV of Project 1 at 11%.................................................................................................11

Table 6: NPV of Project 2 at 9%...................................................................................................12

Table 7: Payback Period of Project 1............................................................................................13

Table 8: Payback Period of Project 2............................................................................................14

Table 9: Summarized Report.........................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Financial management is a very important tool for the managers. Earlier this subject was

limited to raising funds for the companies, but later on its scope widened up and is used by the

organizations for procuring funds and to analyze the effectiveness of resources employed by the

firm. The modern concept of financial management focuses on analytical and conceptual

structure for decision making. Some of the major concerning areas of this subject are: volume of

funds an organization must have, type of assets the company must have, sources of raising funds

etc. Thus, it plays significant role in decision pertaining to investment, dividend policy and

financing (Dittenhofer, 2001).

Financing decision of the company involves analyzing different ratios of the firm. Ratio

analysis helps in evaluating the financial performance and standing of the company. It evaluates

organization’s profitability, liquidity, solvency and efficiency. On the basis of these four kinds of

ratios, performance of any firm can be judged. It not only helps in comparing the current

performance of the company with its past, but also aids in comparing the performance of two

organizations operating in the same sector or industry (Arnold, 2005).

On the other hand, investment appraisal in any business is done by using some of the

capital budgeting methods such as net present value, internal rate of return, profitability index,

average rate of return etc. While net present value and internal rate of return methods follow the

concept of time value of money, average rate of return is not based on it. These methods help in

analyzing any investment made by the company. Through these appraisal methods, organization

can decide whether they should invest in a particular project or not. It helps in determining the

profitability of the project. Simultaneously, these methods also assist investors in deciding in

which project they should invest so as to make maximum profits (Fairchild, 2002).

In the following study, performance of TESCO will be analyzed by determining the

major ratios of the company and comparing them with its past performance. In the second part,

two projects will be appraised by applying capital budgeting tools, so as to identify in which

project the company PLC should invest.

PART 1: RATIO ANALYSIS OF TESCO

1.1: Calculation of Ratios

Solution:

1 | P a g e

Financial management is a very important tool for the managers. Earlier this subject was

limited to raising funds for the companies, but later on its scope widened up and is used by the

organizations for procuring funds and to analyze the effectiveness of resources employed by the

firm. The modern concept of financial management focuses on analytical and conceptual

structure for decision making. Some of the major concerning areas of this subject are: volume of

funds an organization must have, type of assets the company must have, sources of raising funds

etc. Thus, it plays significant role in decision pertaining to investment, dividend policy and

financing (Dittenhofer, 2001).

Financing decision of the company involves analyzing different ratios of the firm. Ratio

analysis helps in evaluating the financial performance and standing of the company. It evaluates

organization’s profitability, liquidity, solvency and efficiency. On the basis of these four kinds of

ratios, performance of any firm can be judged. It not only helps in comparing the current

performance of the company with its past, but also aids in comparing the performance of two

organizations operating in the same sector or industry (Arnold, 2005).

On the other hand, investment appraisal in any business is done by using some of the

capital budgeting methods such as net present value, internal rate of return, profitability index,

average rate of return etc. While net present value and internal rate of return methods follow the

concept of time value of money, average rate of return is not based on it. These methods help in

analyzing any investment made by the company. Through these appraisal methods, organization

can decide whether they should invest in a particular project or not. It helps in determining the

profitability of the project. Simultaneously, these methods also assist investors in deciding in

which project they should invest so as to make maximum profits (Fairchild, 2002).

In the following study, performance of TESCO will be analyzed by determining the

major ratios of the company and comparing them with its past performance. In the second part,

two projects will be appraised by applying capital budgeting tools, so as to identify in which

project the company PLC should invest.

PART 1: RATIO ANALYSIS OF TESCO

1.1: Calculation of Ratios

Solution:

1 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Profitability Ratios: Profitability of any firm can be determined by calculating different

profitability ratios. These can be categorized in two forms: profitability related to sales and

investment.

Gross Profit Margin: It determines the gross profitability by comparing gross profit of the

company with its sales.

Gross Profit Margin= Gross Profit

Net Sales ∗100

Net Profit Margin: It tells about the net profitability of the organization by drawing relationship

between net profit and sales (Atrill and McLaney, 2008).

Net Profit Margin= Net Profit

Net Sales ∗100

Performance Ratios: Performance of the company can be determined by calculating some of the

related ratios such as:

Return on Assets: It exhibits the relationship between net profit and assets of the company. It can

be determined as follows:

Returnon Assets= Net Profit after Tax

Average Total Assets∗100

Return on Capital Employed: It draws the relationship between net profit and average capital

employed by the company. It can be computed as:

Returnon Capital Employed= Net Profit after Tax

Total capital employed ∗100

Return on Equity: It tells how much returns the firm is making on the equity capital. It is

calculated as follows:

Returnon Equity= Net Profit after Tax

Total Shareholde r' s Equity∗100

Earnings per Share: It determines the profit that is available to the shareholders at the end of the

year. It is computed as follows:

2 | P a g e

profitability ratios. These can be categorized in two forms: profitability related to sales and

investment.

Gross Profit Margin: It determines the gross profitability by comparing gross profit of the

company with its sales.

Gross Profit Margin= Gross Profit

Net Sales ∗100

Net Profit Margin: It tells about the net profitability of the organization by drawing relationship

between net profit and sales (Atrill and McLaney, 2008).

Net Profit Margin= Net Profit

Net Sales ∗100

Performance Ratios: Performance of the company can be determined by calculating some of the

related ratios such as:

Return on Assets: It exhibits the relationship between net profit and assets of the company. It can

be determined as follows:

Returnon Assets= Net Profit after Tax

Average Total Assets∗100

Return on Capital Employed: It draws the relationship between net profit and average capital

employed by the company. It can be computed as:

Returnon Capital Employed= Net Profit after Tax

Total capital employed ∗100

Return on Equity: It tells how much returns the firm is making on the equity capital. It is

calculated as follows:

Returnon Equity= Net Profit after Tax

Total Shareholde r' s Equity∗100

Earnings per Share: It determines the profit that is available to the shareholders at the end of the

year. It is computed as follows:

2 | P a g e

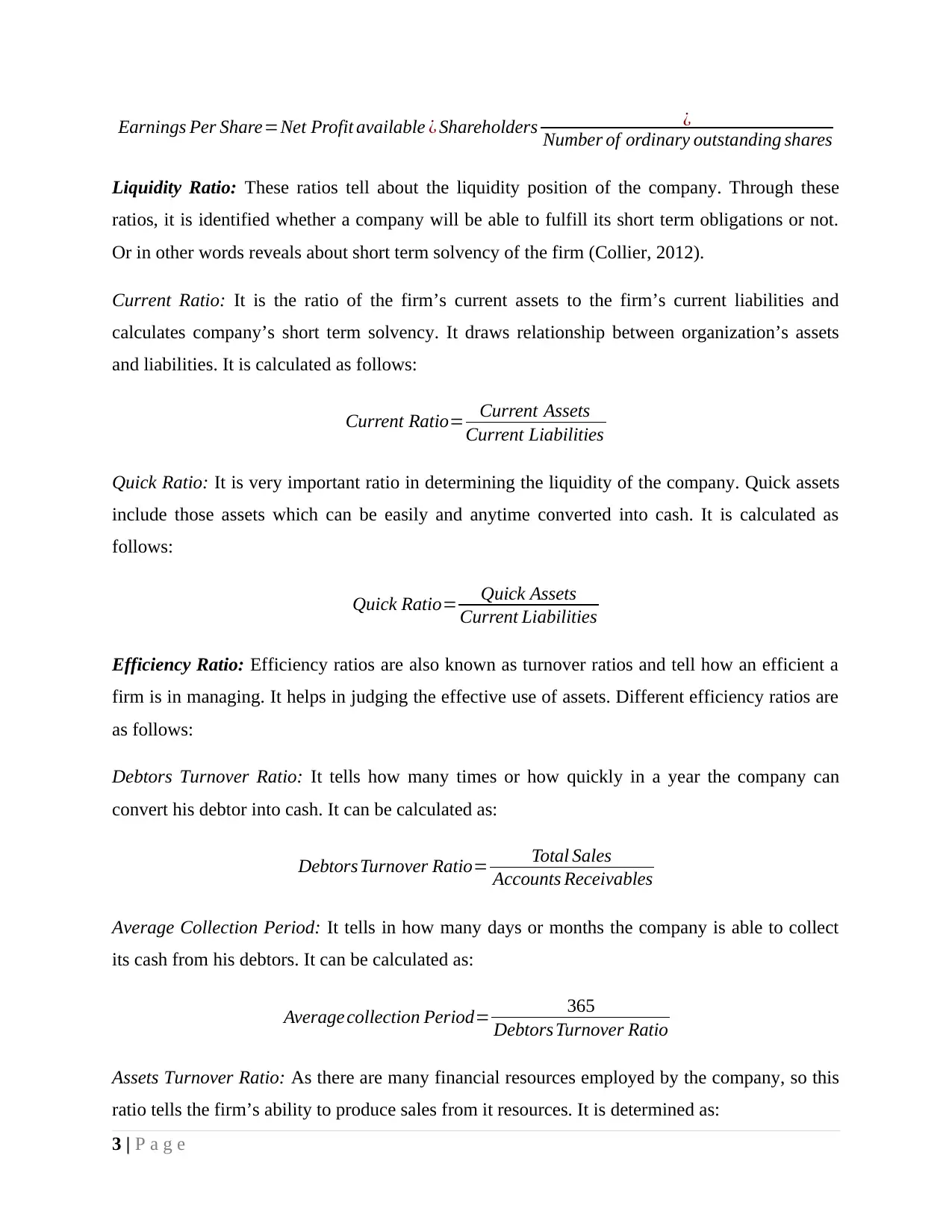

Earnings Per Share=Net Profit available ¿ Shareholders ¿

Number of ordinary outstanding shares

Liquidity Ratio: These ratios tell about the liquidity position of the company. Through these

ratios, it is identified whether a company will be able to fulfill its short term obligations or not.

Or in other words reveals about short term solvency of the firm (Collier, 2012).

Current Ratio: It is the ratio of the firm’s current assets to the firm’s current liabilities and

calculates company’s short term solvency. It draws relationship between organization’s assets

and liabilities. It is calculated as follows:

Current Ratio= Current Assets

Current Liabilities

Quick Ratio: It is very important ratio in determining the liquidity of the company. Quick assets

include those assets which can be easily and anytime converted into cash. It is calculated as

follows:

Quick Ratio= Quick Assets

Current Liabilities

Efficiency Ratio: Efficiency ratios are also known as turnover ratios and tell how an efficient a

firm is in managing. It helps in judging the effective use of assets. Different efficiency ratios are

as follows:

Debtors Turnover Ratio: It tells how many times or how quickly in a year the company can

convert his debtor into cash. It can be calculated as:

Debtors Turnover Ratio= Total Sales

Accounts Receivables

Average Collection Period: It tells in how many days or months the company is able to collect

its cash from his debtors. It can be calculated as:

Average collection Period= 365

Debtors Turnover Ratio

Assets Turnover Ratio: As there are many financial resources employed by the company, so this

ratio tells the firm’s ability to produce sales from it resources. It is determined as:

3 | P a g e

Number of ordinary outstanding shares

Liquidity Ratio: These ratios tell about the liquidity position of the company. Through these

ratios, it is identified whether a company will be able to fulfill its short term obligations or not.

Or in other words reveals about short term solvency of the firm (Collier, 2012).

Current Ratio: It is the ratio of the firm’s current assets to the firm’s current liabilities and

calculates company’s short term solvency. It draws relationship between organization’s assets

and liabilities. It is calculated as follows:

Current Ratio= Current Assets

Current Liabilities

Quick Ratio: It is very important ratio in determining the liquidity of the company. Quick assets

include those assets which can be easily and anytime converted into cash. It is calculated as

follows:

Quick Ratio= Quick Assets

Current Liabilities

Efficiency Ratio: Efficiency ratios are also known as turnover ratios and tell how an efficient a

firm is in managing. It helps in judging the effective use of assets. Different efficiency ratios are

as follows:

Debtors Turnover Ratio: It tells how many times or how quickly in a year the company can

convert his debtor into cash. It can be calculated as:

Debtors Turnover Ratio= Total Sales

Accounts Receivables

Average Collection Period: It tells in how many days or months the company is able to collect

its cash from his debtors. It can be calculated as:

Average collection Period= 365

Debtors Turnover Ratio

Assets Turnover Ratio: As there are many financial resources employed by the company, so this

ratio tells the firm’s ability to produce sales from it resources. It is determined as:

3 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

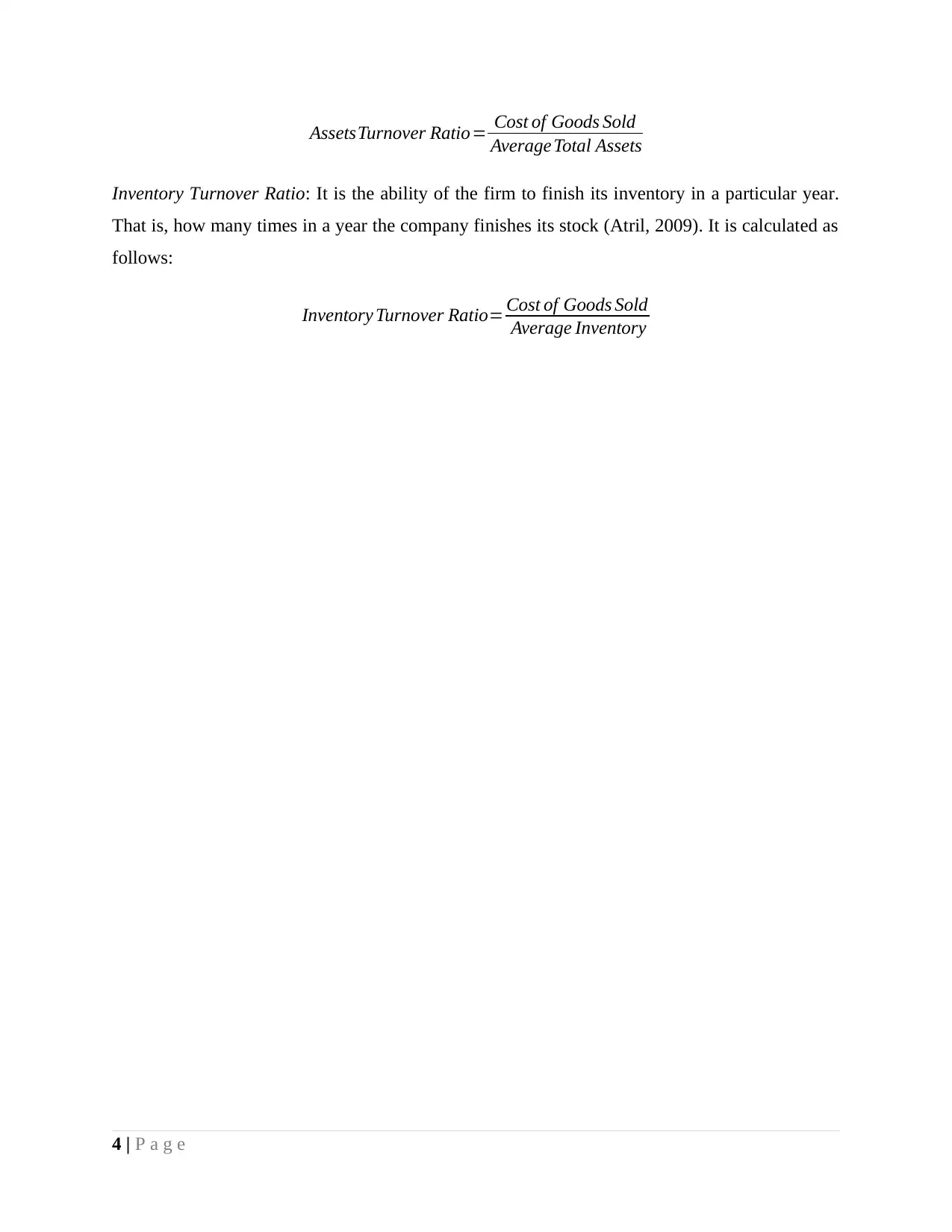

AssetsTurnover Ratio= Cost of Goods Sold

Average Total Assets

Inventory Turnover Ratio: It is the ability of the firm to finish its inventory in a particular year.

That is, how many times in a year the company finishes its stock (Atril, 2009). It is calculated as

follows:

Inventory Turnover Ratio= Cost of Goods Sold

Average Inventory

4 | P a g e

Average Total Assets

Inventory Turnover Ratio: It is the ability of the firm to finish its inventory in a particular year.

That is, how many times in a year the company finishes its stock (Atril, 2009). It is calculated as

follows:

Inventory Turnover Ratio= Cost of Goods Sold

Average Inventory

4 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

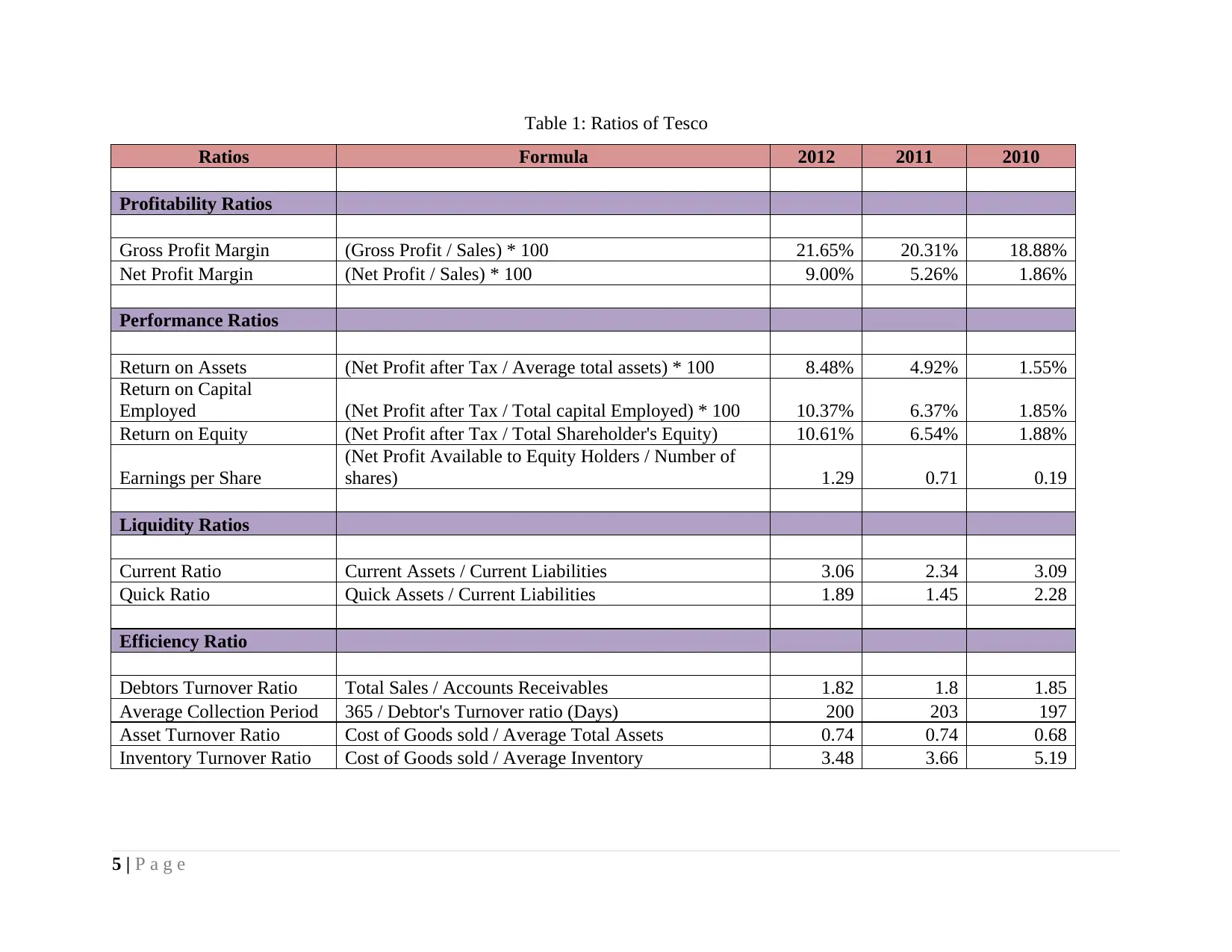

Table 1: Ratios of Tesco

Ratios Formula 2012 2011 2010

Profitability Ratios

Gross Profit Margin (Gross Profit / Sales) * 100 21.65% 20.31% 18.88%

Net Profit Margin (Net Profit / Sales) * 100 9.00% 5.26% 1.86%

Performance Ratios

Return on Assets (Net Profit after Tax / Average total assets) * 100 8.48% 4.92% 1.55%

Return on Capital

Employed (Net Profit after Tax / Total capital Employed) * 100 10.37% 6.37% 1.85%

Return on Equity (Net Profit after Tax / Total Shareholder's Equity) 10.61% 6.54% 1.88%

Earnings per Share

(Net Profit Available to Equity Holders / Number of

shares) 1.29 0.71 0.19

Liquidity Ratios

Current Ratio Current Assets / Current Liabilities 3.06 2.34 3.09

Quick Ratio Quick Assets / Current Liabilities 1.89 1.45 2.28

Efficiency Ratio

Debtors Turnover Ratio Total Sales / Accounts Receivables 1.82 1.8 1.85

Average Collection Period 365 / Debtor's Turnover ratio (Days) 200 203 197

Asset Turnover Ratio Cost of Goods sold / Average Total Assets 0.74 0.74 0.68

Inventory Turnover Ratio Cost of Goods sold / Average Inventory 3.48 3.66 5.19

5 | P a g e

Ratios Formula 2012 2011 2010

Profitability Ratios

Gross Profit Margin (Gross Profit / Sales) * 100 21.65% 20.31% 18.88%

Net Profit Margin (Net Profit / Sales) * 100 9.00% 5.26% 1.86%

Performance Ratios

Return on Assets (Net Profit after Tax / Average total assets) * 100 8.48% 4.92% 1.55%

Return on Capital

Employed (Net Profit after Tax / Total capital Employed) * 100 10.37% 6.37% 1.85%

Return on Equity (Net Profit after Tax / Total Shareholder's Equity) 10.61% 6.54% 1.88%

Earnings per Share

(Net Profit Available to Equity Holders / Number of

shares) 1.29 0.71 0.19

Liquidity Ratios

Current Ratio Current Assets / Current Liabilities 3.06 2.34 3.09

Quick Ratio Quick Assets / Current Liabilities 1.89 1.45 2.28

Efficiency Ratio

Debtors Turnover Ratio Total Sales / Accounts Receivables 1.82 1.8 1.85

Average Collection Period 365 / Debtor's Turnover ratio (Days) 200 203 197

Asset Turnover Ratio Cost of Goods sold / Average Total Assets 0.74 0.74 0.68

Inventory Turnover Ratio Cost of Goods sold / Average Inventory 3.48 3.66 5.19

5 | P a g e

1.2: Ratio Analysis

Solution:

Profitability Ratio:

Gross Profit Margin:

2011-2012 2010-2011

1.34% 1.43%

From the calculated ratios, it is identified that the gross profit margin is continuously

increasing every year. In 2010, it was 18.88% and increased to 20.31% in 2011 and further

increased to 21.65% in 2012. It is good for the company as it is increasing every year, but the

growth from 2010 to 2011 was 1.43% whereas it was 1.34% from 2011 to 2012. This shows

there is slight drop in the margin due to increase in direct expenses. So, the company should try

to bring down theses expenses in order to increase gross profit margin.

Net Profit Margin:

2011-2012 2010-2011

3.74% 3.40%

The above table shows that the net profit of the company is increasing every year. In

2010, it was 1.86%, in the next year it rose to 5.26% and in 2012 it become 9%. This embarks

that the company is able to increase its profit every year. The growth from 2010 to 2011 was

around 3.40% which rose to 3.74% in the next period. It means the company is able to reduce its

operating expenses and simultaneously has reduced its debt due to which the interest expenses

went down (Ahrendsen and Katchova, 2012).

Performance Ratio:

Return on Assets:

2011-2012 2010-2011

3.56% 3.37%

The calculations show that return on assets is continuously increasing every year. In

2010, it was 1.55% and rose to 4.92% next year. Further in 2012, it increased to 8.48%. This

exhibits that company is improving the efficiency of the employed resources every year.

According to it, the increase from 2010 to 2011 was of 3.37% while increase from 2011 to 2012

6 | P a g e

Solution:

Profitability Ratio:

Gross Profit Margin:

2011-2012 2010-2011

1.34% 1.43%

From the calculated ratios, it is identified that the gross profit margin is continuously

increasing every year. In 2010, it was 18.88% and increased to 20.31% in 2011 and further

increased to 21.65% in 2012. It is good for the company as it is increasing every year, but the

growth from 2010 to 2011 was 1.43% whereas it was 1.34% from 2011 to 2012. This shows

there is slight drop in the margin due to increase in direct expenses. So, the company should try

to bring down theses expenses in order to increase gross profit margin.

Net Profit Margin:

2011-2012 2010-2011

3.74% 3.40%

The above table shows that the net profit of the company is increasing every year. In

2010, it was 1.86%, in the next year it rose to 5.26% and in 2012 it become 9%. This embarks

that the company is able to increase its profit every year. The growth from 2010 to 2011 was

around 3.40% which rose to 3.74% in the next period. It means the company is able to reduce its

operating expenses and simultaneously has reduced its debt due to which the interest expenses

went down (Ahrendsen and Katchova, 2012).

Performance Ratio:

Return on Assets:

2011-2012 2010-2011

3.56% 3.37%

The calculations show that return on assets is continuously increasing every year. In

2010, it was 1.55% and rose to 4.92% next year. Further in 2012, it increased to 8.48%. This

exhibits that company is improving the efficiency of the employed resources every year.

According to it, the increase from 2010 to 2011 was of 3.37% while increase from 2011 to 2012

6 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

was 3.56%. It denotes that with every passing year the company is increasing the efficiency of its

assets.

Return on Capital Employed:

2011-2012 2010-2011

4.00% 4.52%

This ratio tells about the effectiveness with which the funds are utilized by the

organization for long term. It is also increasing every year. In 2010, it was 1.85% and rose to

6.37% next year. Further, in 2012 10.37% was noticed. This shows that every year the company

is effectively utilizing the long term fund which is beneficial for the firm. But, if compared to the

last year’s performance, it was found that from 2010 to 2011 the return is increased by 4.52%,

whereas next year it only increased by 4%. This shows as compared to 2010 to 2011, the

employment of fund was somewhat less effective in 2011 - 2012. So, the company must look

after it and must properly utilize the long term funds (Altman, 2012).

Return on Equity:

2011-2012 2010-2011

4.07% 4.66%

The above calculated ratios reveals that the return on equity is increasing every year. It

shows that company is making enough profits that it can distribute handsome amount to its

equity holders. In 2010 it was 1.88%, which rose to 6.54% next year. In 2012, it rose to 10.61%.

It means that the firm is making profits every year. But, as compared to its last three

performances, it was found the increase was of 4.66% between 2010 and 2011, while it was only

4.07% between 2011 and 2012. This tells that although the company is making profit, but its

returns are declined. From this, it can be concluded that either the liabilities or the operating

expenses have increased due to which its profit is dropping a bit.

Earnings per Share:

2011-2012 2010-2011

0.58 0.52

A company which is distributing handsome earnings per shares shows that it is operating

well. Further, good earnings per share attract more investor towards it. Earnings are distributed

7 | P a g e

assets.

Return on Capital Employed:

2011-2012 2010-2011

4.00% 4.52%

This ratio tells about the effectiveness with which the funds are utilized by the

organization for long term. It is also increasing every year. In 2010, it was 1.85% and rose to

6.37% next year. Further, in 2012 10.37% was noticed. This shows that every year the company

is effectively utilizing the long term fund which is beneficial for the firm. But, if compared to the

last year’s performance, it was found that from 2010 to 2011 the return is increased by 4.52%,

whereas next year it only increased by 4%. This shows as compared to 2010 to 2011, the

employment of fund was somewhat less effective in 2011 - 2012. So, the company must look

after it and must properly utilize the long term funds (Altman, 2012).

Return on Equity:

2011-2012 2010-2011

4.07% 4.66%

The above calculated ratios reveals that the return on equity is increasing every year. It

shows that company is making enough profits that it can distribute handsome amount to its

equity holders. In 2010 it was 1.88%, which rose to 6.54% next year. In 2012, it rose to 10.61%.

It means that the firm is making profits every year. But, as compared to its last three

performances, it was found the increase was of 4.66% between 2010 and 2011, while it was only

4.07% between 2011 and 2012. This tells that although the company is making profit, but its

returns are declined. From this, it can be concluded that either the liabilities or the operating

expenses have increased due to which its profit is dropping a bit.

Earnings per Share:

2011-2012 2010-2011

0.58 0.52

A company which is distributing handsome earnings per shares shows that it is operating

well. Further, good earnings per share attract more investor towards it. Earnings are distributed

7 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

per share after meeting all the expenses. The table denotes earning per share was $0.19 in 2010

and increased to $0.71 next year. Further, it increased to $1.29 in 2012. It is good that with each

passing year earnings per share is increasing. If it’s past three years data is calculated, a

conclusion can be derieved that the company is distributing good earnings to its shareholders.

The increase was of $0.58 in 2011 – 2012 as compared with $0.52 in 2010 – 2011.

Liquidity Ratio:

Current Ratio: The current ratio of Tesco for the year 2010 was 3.09 which are very high. The

ideal current ratio should be around 2:1. Although, the firm tried and lowered its current ratio to

2.34 in 2011, but again in 2012 it rose up to 3.06. This means the company is not properly

utilizing its assets and just piling up the same. The company needs to look into this matter

seriously as it is not able to draw any benefits from the assets it has acquired revealing that it is

not utilizing its short term financing very effectively. Moreover, it shows the organization is not

able to manage its working capital properly. These can significantly affect the operations of the

firm in short run. It should try to bring it to near about 2.

Quick Ratio: quick ratio of Tesco was 2.28 in 2010 which is area of concern for the company. In

the next year, it was able to reduce it to 1.45 which is still not good figure. In 2012, it again rose

slightly to 1.89. Ideally, the quick ratio of any organization must be around 1.0, but the current

figures are very high as compared to ideal figure. This means, it is not able to invest its funds

properly for expansion or diversification of its operations. Further, if current and quick ratios are

compared simultaneously, it can be concluded that the company has invested lot in its inventory

which is also not good from the firm’s point of view. So, it should try to bring its current ratio to

1.0 and it can achieve it by properly deploying its short term liquidity (Bertoneche, 2001).

Efficiency Ratio:

Average Collection Period: the average collection period tells the rate at which the trade

receivables are received from the debtors. Tesco’s collection period for the year 2010 was 197

days which increased to 203 days in 2010. Further, the organization pulled it down to 200 days

in 2012. This shows it has improved its trade credit management. The trend shows the average

collection period of the firm is near about 6 months and it is able to maintain that. It means the

firm’s debtor has enough liquidity and the organization will not face any difficulty in collecting

its debt. Further, it shows the effectiveness of the company’s trade credit management.

8 | P a g e

and increased to $0.71 next year. Further, it increased to $1.29 in 2012. It is good that with each

passing year earnings per share is increasing. If it’s past three years data is calculated, a

conclusion can be derieved that the company is distributing good earnings to its shareholders.

The increase was of $0.58 in 2011 – 2012 as compared with $0.52 in 2010 – 2011.

Liquidity Ratio:

Current Ratio: The current ratio of Tesco for the year 2010 was 3.09 which are very high. The

ideal current ratio should be around 2:1. Although, the firm tried and lowered its current ratio to

2.34 in 2011, but again in 2012 it rose up to 3.06. This means the company is not properly

utilizing its assets and just piling up the same. The company needs to look into this matter

seriously as it is not able to draw any benefits from the assets it has acquired revealing that it is

not utilizing its short term financing very effectively. Moreover, it shows the organization is not

able to manage its working capital properly. These can significantly affect the operations of the

firm in short run. It should try to bring it to near about 2.

Quick Ratio: quick ratio of Tesco was 2.28 in 2010 which is area of concern for the company. In

the next year, it was able to reduce it to 1.45 which is still not good figure. In 2012, it again rose

slightly to 1.89. Ideally, the quick ratio of any organization must be around 1.0, but the current

figures are very high as compared to ideal figure. This means, it is not able to invest its funds

properly for expansion or diversification of its operations. Further, if current and quick ratios are

compared simultaneously, it can be concluded that the company has invested lot in its inventory

which is also not good from the firm’s point of view. So, it should try to bring its current ratio to

1.0 and it can achieve it by properly deploying its short term liquidity (Bertoneche, 2001).

Efficiency Ratio:

Average Collection Period: the average collection period tells the rate at which the trade

receivables are received from the debtors. Tesco’s collection period for the year 2010 was 197

days which increased to 203 days in 2010. Further, the organization pulled it down to 200 days

in 2012. This shows it has improved its trade credit management. The trend shows the average

collection period of the firm is near about 6 months and it is able to maintain that. It means the

firm’s debtor has enough liquidity and the organization will not face any difficulty in collecting

its debt. Further, it shows the effectiveness of the company’s trade credit management.

8 | P a g e

Inventory Turnover Ratio: It tells about the frequency by which the inventory is restored during a

particular year. In year 2010, the inventory turnover ratio was 5.19, denoting that its inventory is

replaced around 5 times in a year. That is, the company is able to sell its inventory very quickly

in near about 2 months. But, in 2011 it reduced to 3.66 and further lowered down to 3.48 in

2012. It shows that the organization is not managing its inventory properly indicating the poor

inventory management of the firm. Earlier, it used to refill the inventory every third month, but

now it is being done in every fourth or fifth month showing that the sales of the company have

gone down. So, the management must look after this matter and try to improve its inventory

management and must do something to augment its sales (Brigham and Houston, 2009).

1.3: Summarized Report

Table 2: Summarized Report

.Ratios 2012 2011 2010 Remarks

Profitability

Ratios

Gross Profit

Margin 21.65% 20.31% 18.88%

The company should try to maintain the

existing rate

Net Profit

Margin 9.00% 5.26% 1.86%

It is performing well and must continue with

same trend

Performance

Ratios

Return on

Assets 8.48% 4.92% 1.55%

It has improved the efficiency of its resources

and try to maintain it

Return on

Capital

Employed 10.37% 6.37% 1.85% It is effectively employing its long term funds

Return on

Equity 10.61% 6.54% 1.88%

It has consistently improved this and it will

enhance its brand image

Earnings per

Share 1.29 0.71 0.19

the company has delivered good returns in

2012 and must try to maintain the pace

Liquidity

Ratios

Current Ratio 3.06 2.34 3.09 Needs to bring it down to around 2

Quick Ratio 1.89 1.45 2.28 Needs to lower it to 1

9 | P a g e

particular year. In year 2010, the inventory turnover ratio was 5.19, denoting that its inventory is

replaced around 5 times in a year. That is, the company is able to sell its inventory very quickly

in near about 2 months. But, in 2011 it reduced to 3.66 and further lowered down to 3.48 in

2012. It shows that the organization is not managing its inventory properly indicating the poor

inventory management of the firm. Earlier, it used to refill the inventory every third month, but

now it is being done in every fourth or fifth month showing that the sales of the company have

gone down. So, the management must look after this matter and try to improve its inventory

management and must do something to augment its sales (Brigham and Houston, 2009).

1.3: Summarized Report

Table 2: Summarized Report

.Ratios 2012 2011 2010 Remarks

Profitability

Ratios

Gross Profit

Margin 21.65% 20.31% 18.88%

The company should try to maintain the

existing rate

Net Profit

Margin 9.00% 5.26% 1.86%

It is performing well and must continue with

same trend

Performance

Ratios

Return on

Assets 8.48% 4.92% 1.55%

It has improved the efficiency of its resources

and try to maintain it

Return on

Capital

Employed 10.37% 6.37% 1.85% It is effectively employing its long term funds

Return on

Equity 10.61% 6.54% 1.88%

It has consistently improved this and it will

enhance its brand image

Earnings per

Share 1.29 0.71 0.19

the company has delivered good returns in

2012 and must try to maintain the pace

Liquidity

Ratios

Current Ratio 3.06 2.34 3.09 Needs to bring it down to around 2

Quick Ratio 1.89 1.45 2.28 Needs to lower it to 1

9 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.