Comprehensive Financial Report: Tesco PLC Analysis and Improvement

VerifiedAdded on 2023/01/13

|17

|4140

|85

Report

AI Summary

This report provides a detailed financial analysis of Tesco PLC, a leading supermarket chain, evaluating its performance through various financial measures. It examines the company's balance sheet, income statement, and cash flow statement for the years 2018 and 2019. The analysis includes profitability ratios, liquidity ratios, efficiency ratios, and market-based ratios to assess Tesco's financial health. The report identifies areas where Tesco can improve its profitability, such as removing unprofitable products, attracting more customers, increasing conversion rates, reviewing pricing structures, and optimizing inventory management. It also recommends a new investment project for the company and discusses whether the company should pay return earnings. The report concludes with actionable recommendations aimed at enhancing Tesco's financial performance and strategic positioning. Desklib provides this and other solved assignments to aid students in their studies.

Financial Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................1

MAIN BODY...................................................................................................................................1

Performance evaluation...............................................................................................................5

Recommendations for improving profitability............................................................................8

Recommend one new investment project to the company........................................................10

Decide whether or not the company should pay return earnings or not....................................11

CONCLUSION..............................................................................................................................12

REFERENCES .............................................................................................................................13

INTRODUCTION ..........................................................................................................................1

MAIN BODY...................................................................................................................................1

Performance evaluation...............................................................................................................5

Recommendations for improving profitability............................................................................8

Recommend one new investment project to the company........................................................10

Decide whether or not the company should pay return earnings or not....................................11

CONCLUSION..............................................................................................................................12

REFERENCES .............................................................................................................................13

INTRODUCTION

Financial management is indeed an necessary activity to control the financial capital for

every entity in modern dynamic environment (Antonopoulos and Hall, 2016). This is basically

related with financial plan for certain tasks, such as strategic forecasting, arranging, handling

and monitoring corporate assets. Financial management is exactly the job of financial executives

in order to accomplish the targets of companies in a specific period. Financial analysis is defined

as a means of analysing company numerical knowledge over a particular time period. In other

terms, this should be interpreted as a means of evaluating firms, programs and expenditures with

a view to determining the financial position of companies. In order to better understand the

crucial about FM Tesco Plc have been selected which is leading supermarket in present time.

In this report, performance evaluation by analysing the different performance measures,

recommendations for improving the profitability is discussed. In addition, recommendation for

one new investment project and discussion about company should pay return earnings or not is

also discussed.

MAIN BODY

Overview of company

Tesco is a very well-known supermarket that offers its non-food customers a range of

items, including food. It is among the UK's biggest supermarkets and one of globe's growing

grocery distributors. Jack Cohen began offering extra food in the Eastern suburbs area in

Brixton, London in 1919 this lead establishment to greatest London retail shop. The business

works continuously these comprise a wide variety of grocery and oil store stores via Tesco

Express fascia, the local highway outlets via Tesco Metro, super centres via Tesco Extra and

semi-food providers through Tesco Home plus (Banerjee, 2016). Tesco has consolidated to cover

book shopping, clothes, appliances, accessories, toys, energy, tech, financial services,

telecommunications and Internet. In recent trade of marketing Tesco established a new retail

store in 2018, Jack's, to deal with Lidl and Aldi. In April 2013, in its recording costs of £ 1.2

trillion Tesco announced that this was stepping back from the US sector. On 27 January 2017 the

firm revealed that Tesco had entered into an deal to combine with the largest retailer Company in

Britain, Booker, to form the World's largest grocery business. However this was obsessed with

controlling the British sector.

1

Financial management is indeed an necessary activity to control the financial capital for

every entity in modern dynamic environment (Antonopoulos and Hall, 2016). This is basically

related with financial plan for certain tasks, such as strategic forecasting, arranging, handling

and monitoring corporate assets. Financial management is exactly the job of financial executives

in order to accomplish the targets of companies in a specific period. Financial analysis is defined

as a means of analysing company numerical knowledge over a particular time period. In other

terms, this should be interpreted as a means of evaluating firms, programs and expenditures with

a view to determining the financial position of companies. In order to better understand the

crucial about FM Tesco Plc have been selected which is leading supermarket in present time.

In this report, performance evaluation by analysing the different performance measures,

recommendations for improving the profitability is discussed. In addition, recommendation for

one new investment project and discussion about company should pay return earnings or not is

also discussed.

MAIN BODY

Overview of company

Tesco is a very well-known supermarket that offers its non-food customers a range of

items, including food. It is among the UK's biggest supermarkets and one of globe's growing

grocery distributors. Jack Cohen began offering extra food in the Eastern suburbs area in

Brixton, London in 1919 this lead establishment to greatest London retail shop. The business

works continuously these comprise a wide variety of grocery and oil store stores via Tesco

Express fascia, the local highway outlets via Tesco Metro, super centres via Tesco Extra and

semi-food providers through Tesco Home plus (Banerjee, 2016). Tesco has consolidated to cover

book shopping, clothes, appliances, accessories, toys, energy, tech, financial services,

telecommunications and Internet. In recent trade of marketing Tesco established a new retail

store in 2018, Jack's, to deal with Lidl and Aldi. In April 2013, in its recording costs of £ 1.2

trillion Tesco announced that this was stepping back from the US sector. On 27 January 2017 the

firm revealed that Tesco had entered into an deal to combine with the largest retailer Company in

Britain, Booker, to form the World's largest grocery business. However this was obsessed with

controlling the British sector.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

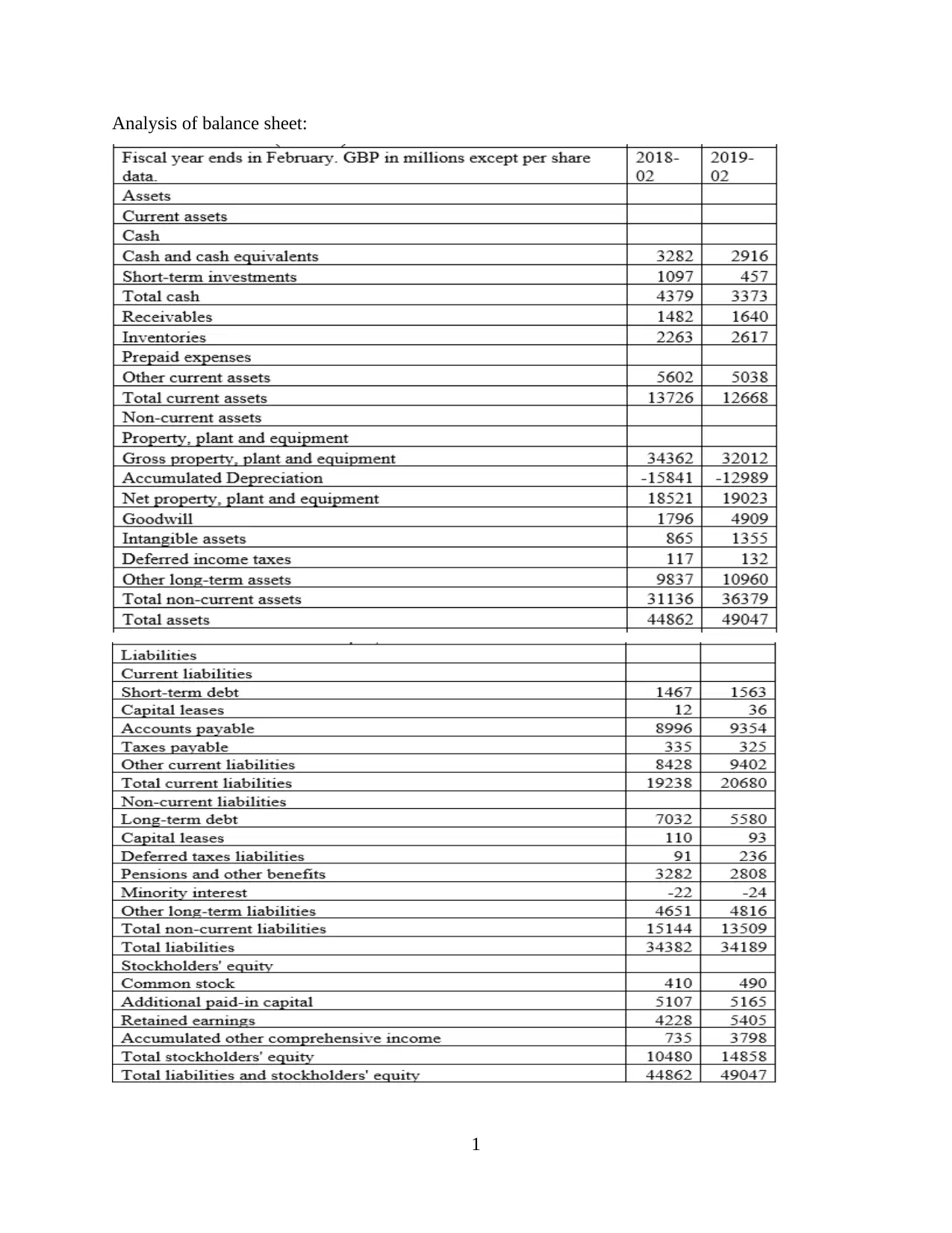

Analysis of balance sheet:

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Analysis – On the basis of above presented balance sheet, this can be find out that company’s

performance is different in both of years. In the context of volume of total assets of company this

can be find out that they had of 44862 GBP million in year 2018 which raised in next year and

became of 49047 GBP million. This is showing that company made purchase of more assets in

year 2019. Herein, this is important to know that current assets of company have been decreased

in year 2019 in compare to year 2018. Such as in year 2018, their current assets were of 13726

GBP million which reduced and became of 12668 GBP million. It is indicating that company’s

liquidity position has been decreased in year 2019. In the context of total liabilities, this can be

assessed that in year 2018, their liabilities were of 34382 GBP million which reduced and

became of 34189 GBP million. It is showing that company managed their total debts and

liabilities in year 2019. That is why the amount of total liabilities decreased in this year. On the

other hand, in the aspect of current liabilities this can be stated that in year 2018, current

liabilities were of 19238 GBP million which increased and became of 20680 GBP million in next

year 2019. It is indicating that company’s efficiency of managing short term debts has been

decreased in an effective manner (Yulihantini and Wardayati, S2017).

In addition, the value of total stakeholder’s equity also increased in year 2019 as

compared to year 2018. Such as in year 2018, total stakeholder’s equities were of 10480 GBP

million which increased and became of 14858 GBP million in year 2019.

Analysis of income statement:

2

performance is different in both of years. In the context of volume of total assets of company this

can be find out that they had of 44862 GBP million in year 2018 which raised in next year and

became of 49047 GBP million. This is showing that company made purchase of more assets in

year 2019. Herein, this is important to know that current assets of company have been decreased

in year 2019 in compare to year 2018. Such as in year 2018, their current assets were of 13726

GBP million which reduced and became of 12668 GBP million. It is indicating that company’s

liquidity position has been decreased in year 2019. In the context of total liabilities, this can be

assessed that in year 2018, their liabilities were of 34382 GBP million which reduced and

became of 34189 GBP million. It is showing that company managed their total debts and

liabilities in year 2019. That is why the amount of total liabilities decreased in this year. On the

other hand, in the aspect of current liabilities this can be stated that in year 2018, current

liabilities were of 19238 GBP million which increased and became of 20680 GBP million in next

year 2019. It is indicating that company’s efficiency of managing short term debts has been

decreased in an effective manner (Yulihantini and Wardayati, S2017).

In addition, the value of total stakeholder’s equity also increased in year 2019 as

compared to year 2018. Such as in year 2018, total stakeholder’s equities were of 10480 GBP

million which increased and became of 14858 GBP million in year 2019.

Analysis of income statement:

2

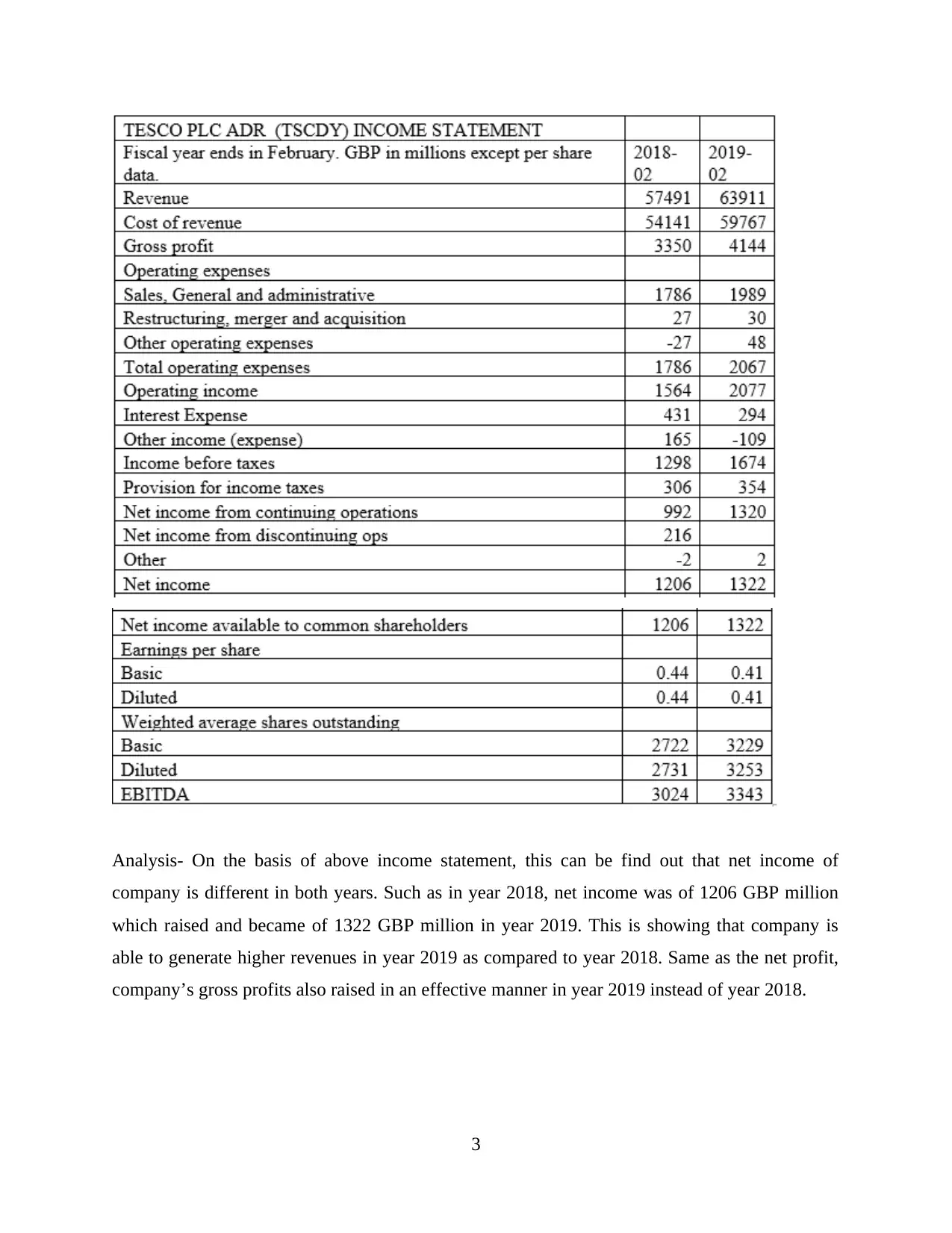

Analysis- On the basis of above income statement, this can be find out that net income of

company is different in both years. Such as in year 2018, net income was of 1206 GBP million

which raised and became of 1322 GBP million in year 2019. This is showing that company is

able to generate higher revenues in year 2019 as compared to year 2018. Same as the net profit,

company’s gross profits also raised in an effective manner in year 2019 instead of year 2018.

3

company is different in both years. Such as in year 2018, net income was of 1206 GBP million

which raised and became of 1322 GBP million in year 2019. This is showing that company is

able to generate higher revenues in year 2019 as compared to year 2018. Same as the net profit,

company’s gross profits also raised in an effective manner in year 2019 instead of year 2018.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Analysis of cash flow:

4

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

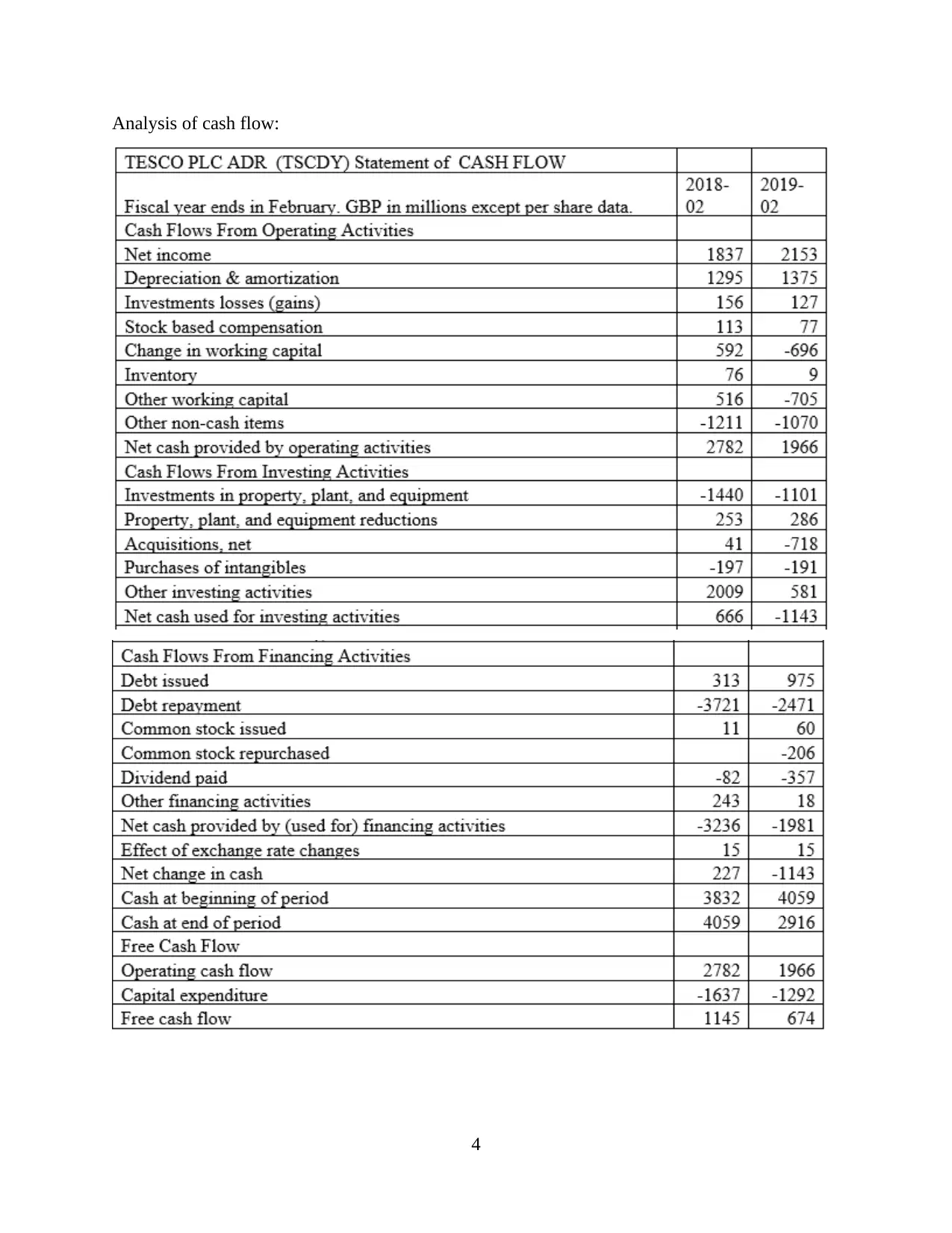

Analysis- The cash flow of above company has been prepared by three different methods which

are operating, financing and investing activities. In the financing activity company is getting net

cash outflow that is of 3236 GBP million and 1981 GBP million for year 2018 and 2019. While

from operating activities, company is generating cash inflow in both of the years. In the end,

company has free cash flow of 1145 GBP million in year 2018 and 674 GBP million in year

2019.

Performance evaluation

Profitability ratio

Year 2018 Year 2019

Gross Profit 3350.00 4144.00

Revenues 57491.00 63911.00

Gross Profit Margin 5.83% 6.48%

Year 2018 Year 2019

Net Profits 13 -163

Revenues 57491 63911

Net Profit Margin 0.02% -0.26%

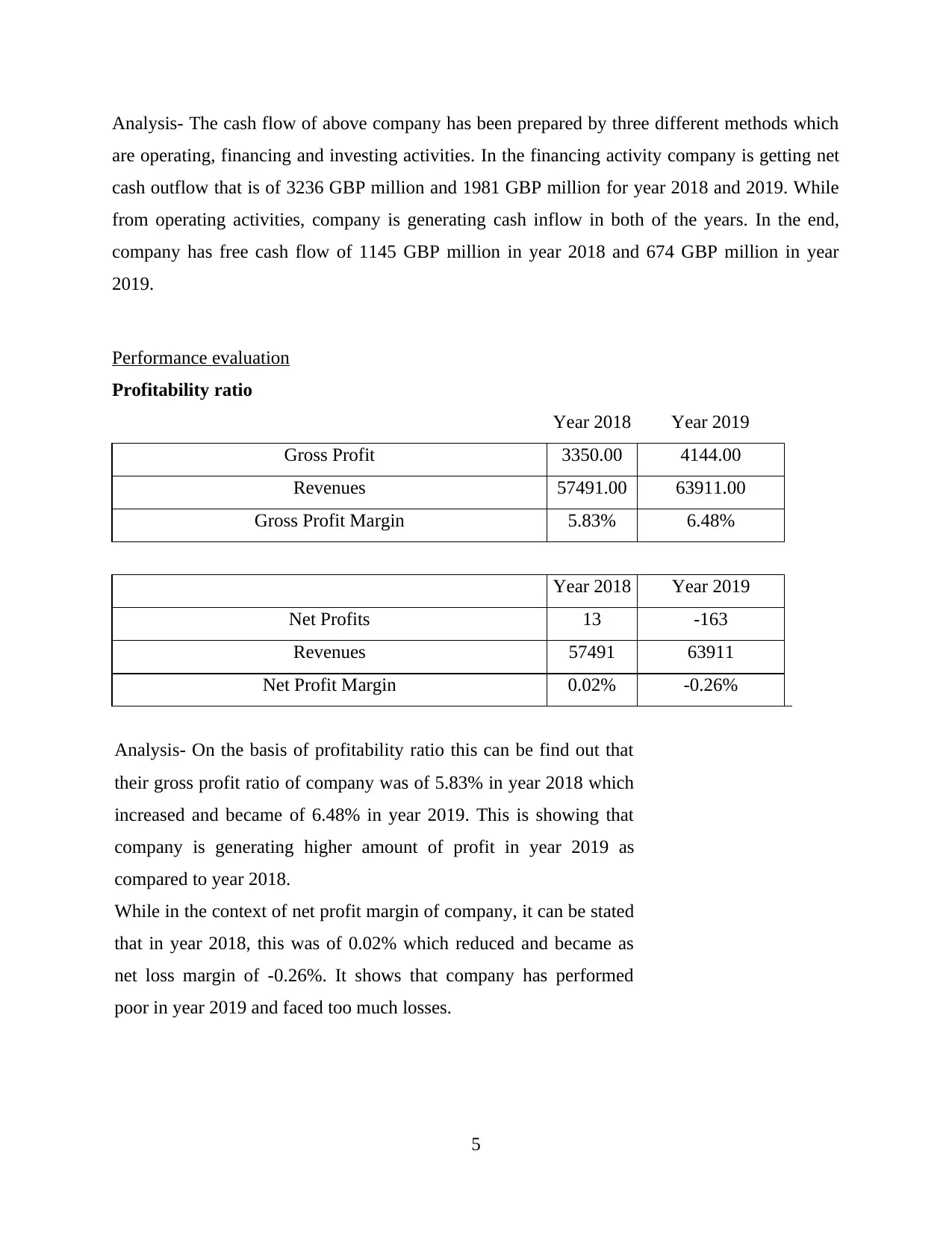

Analysis- On the basis of profitability ratio this can be find out that

their gross profit ratio of company was of 5.83% in year 2018 which

increased and became of 6.48% in year 2019. This is showing that

company is generating higher amount of profit in year 2019 as

compared to year 2018.

While in the context of net profit margin of company, it can be stated

that in year 2018, this was of 0.02% which reduced and became as

net loss margin of -0.26%. It shows that company has performed

poor in year 2019 and faced too much losses.

5

are operating, financing and investing activities. In the financing activity company is getting net

cash outflow that is of 3236 GBP million and 1981 GBP million for year 2018 and 2019. While

from operating activities, company is generating cash inflow in both of the years. In the end,

company has free cash flow of 1145 GBP million in year 2018 and 674 GBP million in year

2019.

Performance evaluation

Profitability ratio

Year 2018 Year 2019

Gross Profit 3350.00 4144.00

Revenues 57491.00 63911.00

Gross Profit Margin 5.83% 6.48%

Year 2018 Year 2019

Net Profits 13 -163

Revenues 57491 63911

Net Profit Margin 0.02% -0.26%

Analysis- On the basis of profitability ratio this can be find out that

their gross profit ratio of company was of 5.83% in year 2018 which

increased and became of 6.48% in year 2019. This is showing that

company is generating higher amount of profit in year 2019 as

compared to year 2018.

While in the context of net profit margin of company, it can be stated

that in year 2018, this was of 0.02% which reduced and became as

net loss margin of -0.26%. It shows that company has performed

poor in year 2019 and faced too much losses.

5

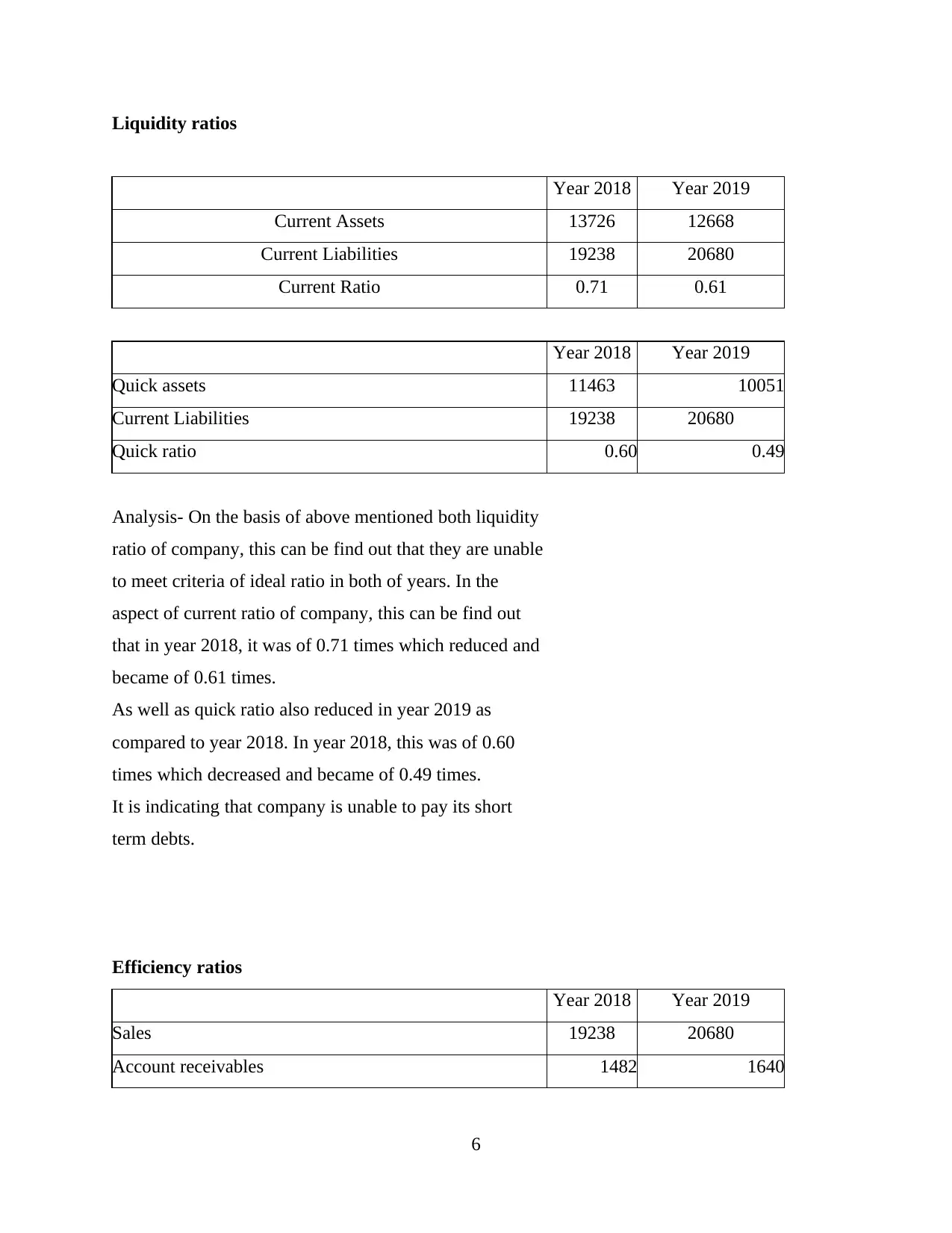

Liquidity ratios

Year 2018 Year 2019

Current Assets 13726 12668

Current Liabilities 19238 20680

Current Ratio 0.71 0.61

Year 2018 Year 2019

Quick assets 11463 10051

Current Liabilities 19238 20680

Quick ratio 0.60 0.49

Analysis- On the basis of above mentioned both liquidity

ratio of company, this can be find out that they are unable

to meet criteria of ideal ratio in both of years. In the

aspect of current ratio of company, this can be find out

that in year 2018, it was of 0.71 times which reduced and

became of 0.61 times.

As well as quick ratio also reduced in year 2019 as

compared to year 2018. In year 2018, this was of 0.60

times which decreased and became of 0.49 times.

It is indicating that company is unable to pay its short

term debts.

Efficiency ratios

Year 2018 Year 2019

Sales 19238 20680

Account receivables 1482 1640

6

Year 2018 Year 2019

Current Assets 13726 12668

Current Liabilities 19238 20680

Current Ratio 0.71 0.61

Year 2018 Year 2019

Quick assets 11463 10051

Current Liabilities 19238 20680

Quick ratio 0.60 0.49

Analysis- On the basis of above mentioned both liquidity

ratio of company, this can be find out that they are unable

to meet criteria of ideal ratio in both of years. In the

aspect of current ratio of company, this can be find out

that in year 2018, it was of 0.71 times which reduced and

became of 0.61 times.

As well as quick ratio also reduced in year 2019 as

compared to year 2018. In year 2018, this was of 0.60

times which decreased and became of 0.49 times.

It is indicating that company is unable to pay its short

term debts.

Efficiency ratios

Year 2018 Year 2019

Sales 19238 20680

Account receivables 1482 1640

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

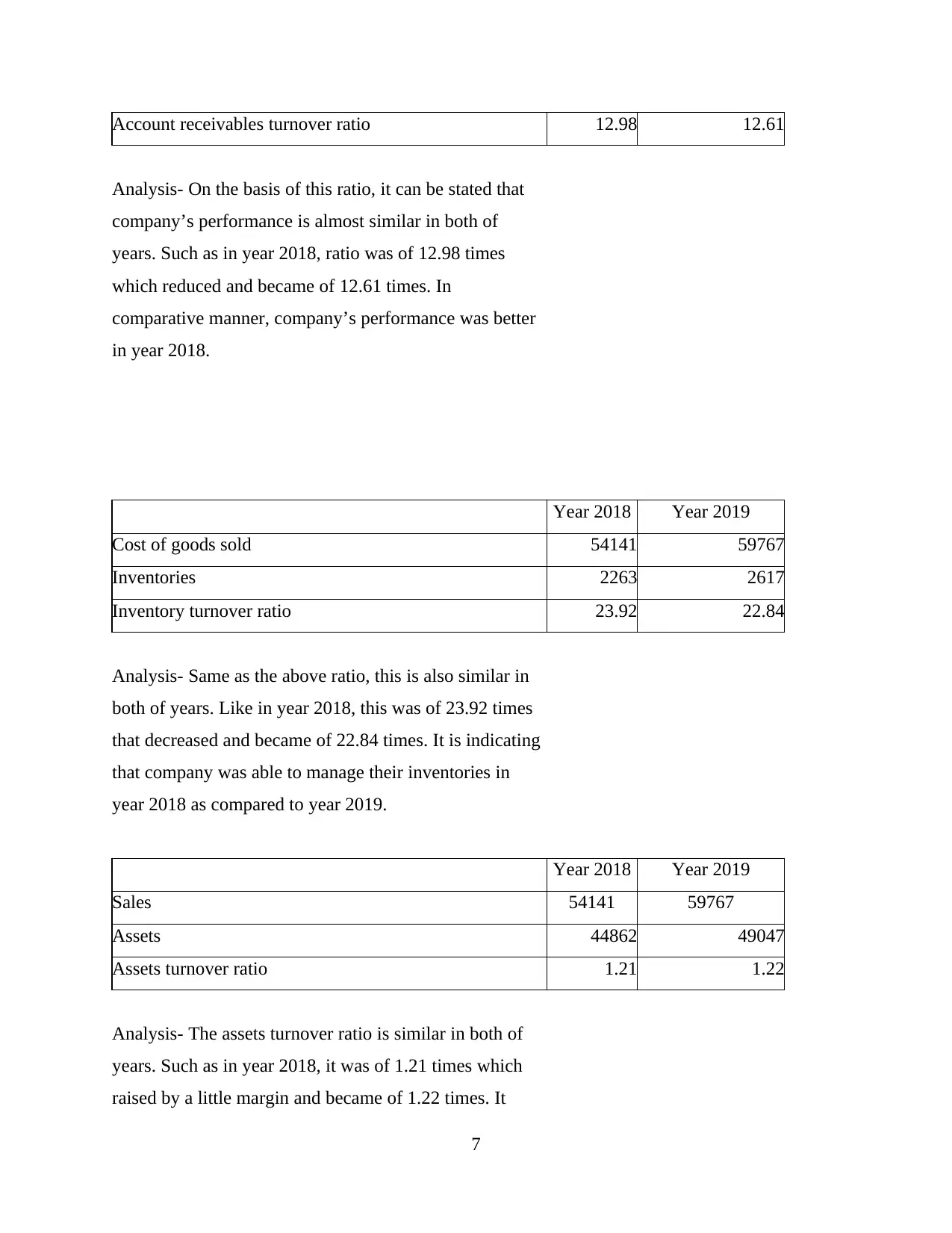

Account receivables turnover ratio 12.98 12.61

Analysis- On the basis of this ratio, it can be stated that

company’s performance is almost similar in both of

years. Such as in year 2018, ratio was of 12.98 times

which reduced and became of 12.61 times. In

comparative manner, company’s performance was better

in year 2018.

Year 2018 Year 2019

Cost of goods sold 54141 59767

Inventories 2263 2617

Inventory turnover ratio 23.92 22.84

Analysis- Same as the above ratio, this is also similar in

both of years. Like in year 2018, this was of 23.92 times

that decreased and became of 22.84 times. It is indicating

that company was able to manage their inventories in

year 2018 as compared to year 2019.

Year 2018 Year 2019

Sales 54141 59767

Assets 44862 49047

Assets turnover ratio 1.21 1.22

Analysis- The assets turnover ratio is similar in both of

years. Such as in year 2018, it was of 1.21 times which

raised by a little margin and became of 1.22 times. It

7

Analysis- On the basis of this ratio, it can be stated that

company’s performance is almost similar in both of

years. Such as in year 2018, ratio was of 12.98 times

which reduced and became of 12.61 times. In

comparative manner, company’s performance was better

in year 2018.

Year 2018 Year 2019

Cost of goods sold 54141 59767

Inventories 2263 2617

Inventory turnover ratio 23.92 22.84

Analysis- Same as the above ratio, this is also similar in

both of years. Like in year 2018, this was of 23.92 times

that decreased and became of 22.84 times. It is indicating

that company was able to manage their inventories in

year 2018 as compared to year 2019.

Year 2018 Year 2019

Sales 54141 59767

Assets 44862 49047

Assets turnover ratio 1.21 1.22

Analysis- The assets turnover ratio is similar in both of

years. Such as in year 2018, it was of 1.21 times which

raised by a little margin and became of 1.22 times. It

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

shows that company is able to manage its assets

effectively in both of years.

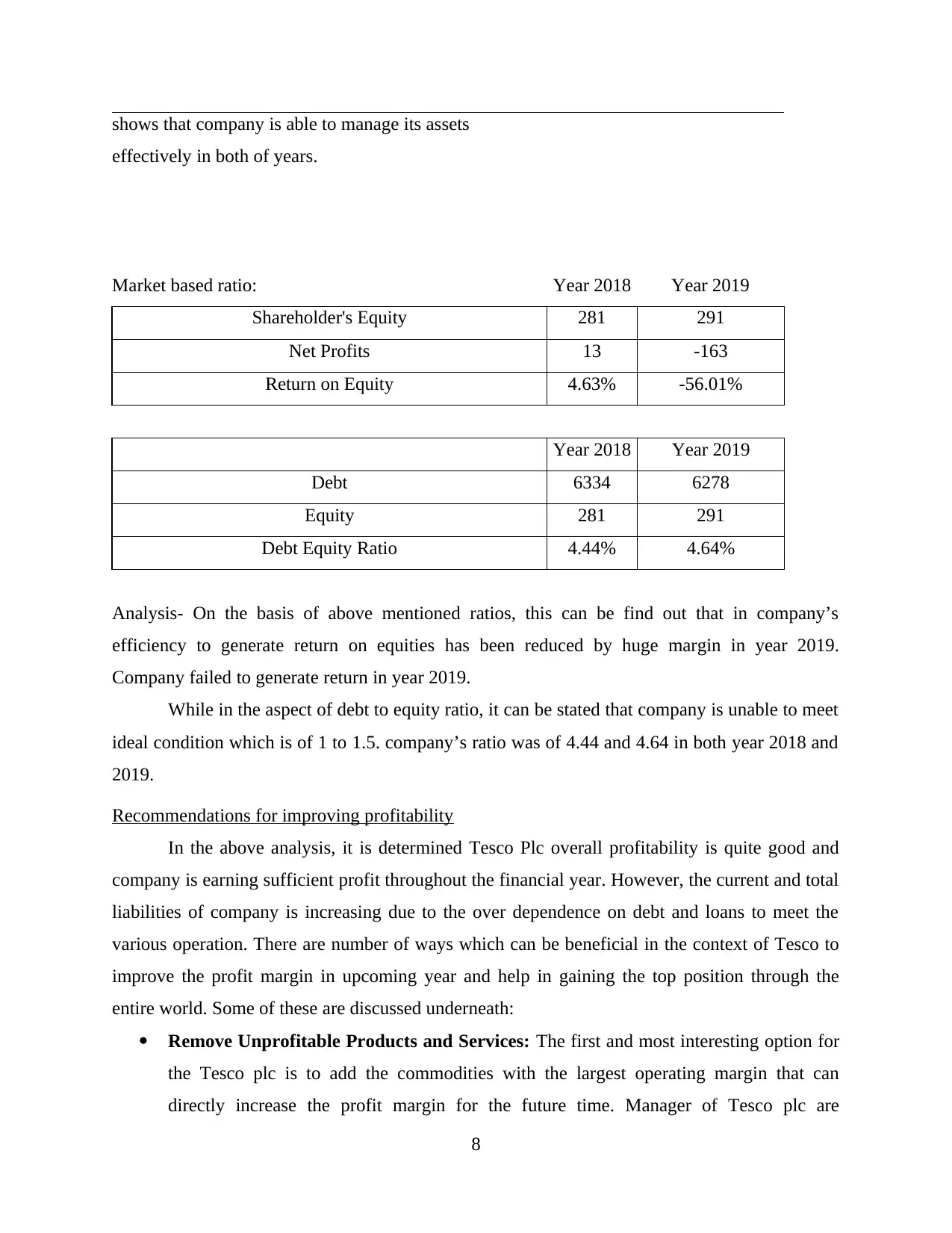

Market based ratio: Year 2018 Year 2019

Shareholder's Equity 281 291

Net Profits 13 -163

Return on Equity 4.63% -56.01%

Year 2018 Year 2019

Debt 6334 6278

Equity 281 291

Debt Equity Ratio 4.44% 4.64%

Analysis- On the basis of above mentioned ratios, this can be find out that in company’s

efficiency to generate return on equities has been reduced by huge margin in year 2019.

Company failed to generate return in year 2019.

While in the aspect of debt to equity ratio, it can be stated that company is unable to meet

ideal condition which is of 1 to 1.5. company’s ratio was of 4.44 and 4.64 in both year 2018 and

2019.

Recommendations for improving profitability

In the above analysis, it is determined Tesco Plc overall profitability is quite good and

company is earning sufficient profit throughout the financial year. However, the current and total

liabilities of company is increasing due to the over dependence on debt and loans to meet the

various operation. There are number of ways which can be beneficial in the context of Tesco to

improve the profit margin in upcoming year and help in gaining the top position through the

entire world. Some of these are discussed underneath:

Remove Unprofitable Products and Services: The first and most interesting option for

the Tesco plc is to add the commodities with the largest operating margin that can

directly increase the profit margin for the future time. Manager of Tesco plc are

8

effectively in both of years.

Market based ratio: Year 2018 Year 2019

Shareholder's Equity 281 291

Net Profits 13 -163

Return on Equity 4.63% -56.01%

Year 2018 Year 2019

Debt 6334 6278

Equity 281 291

Debt Equity Ratio 4.44% 4.64%

Analysis- On the basis of above mentioned ratios, this can be find out that in company’s

efficiency to generate return on equities has been reduced by huge margin in year 2019.

Company failed to generate return in year 2019.

While in the aspect of debt to equity ratio, it can be stated that company is unable to meet

ideal condition which is of 1 to 1.5. company’s ratio was of 4.44 and 4.64 in both year 2018 and

2019.

Recommendations for improving profitability

In the above analysis, it is determined Tesco Plc overall profitability is quite good and

company is earning sufficient profit throughout the financial year. However, the current and total

liabilities of company is increasing due to the over dependence on debt and loans to meet the

various operation. There are number of ways which can be beneficial in the context of Tesco to

improve the profit margin in upcoming year and help in gaining the top position through the

entire world. Some of these are discussed underneath:

Remove Unprofitable Products and Services: The first and most interesting option for

the Tesco plc is to add the commodities with the largest operating margin that can

directly increase the profit margin for the future time. Manager of Tesco plc are

8

recommended to focus on those valuable goods or services until company have

established the most profitable one as it can change the profit figures (Brusca, Gómez‐

villegas and Montesinos, 2016). They can also need to decide whether to delete the

unsustainable goods or services or even evaluate the opportunities of making any change

in existing product.

Find more and more customer: Potential customers could support Tesco Plc to expand

in more areas where growth can be attained as well as increase the overall profitability.

However, that may be the most costly method for raising extra sales as adding new

customer forces company to spend more on promotional activities so that customer can

know about Tesco Plc product. As it have been is observed that attracting a new

consumer costs six percent as much as maintaining an established client. The easiest and

most cost effective approach to attract potential consumers is to give rewards to the

existing clients which can inspire them and these existing customer of Tesco plc would

tell other customer to join company. In recent dynamic market circumstance word of

mouth is the most powerful form of advertising which can lead to higher profitability.

Increase your Conversion Rate: New lead generation is an vital part of doing business

development in today's business era (Cantillon, Maître and Watson, 2016). The facts is

that manager of Tesco plc must exactly t know which proportion of new leads can

actually transform into a sale and raise revenue. Rising conversion of revenue in Tesco

Plc is among the best and cheapest ways of raising profitability within an accounting

year. This can also be beneficial to reduce the current and other liabilities and increase

the total cash in hand for company which can be put into other operating and financing

activities.

Review Current Pricing Structure: Increasing inflation may be a frightening prospect

because a minor rise in Tesco costs will affect total operating income in a unsurprising

way. Thus manager of respective company are recommended to assign right cost of the

goods and services which is a quite necessary option to increase profit margin. They are

recommended to periodically check the quality of company goods and change their prices

accordingly.

Reduce your inventory: A smart way to simplify the Tesco plc profit margin and

increase the cash flow is stock management (Tang and Baker, 2016). Thus, putting less

9

established the most profitable one as it can change the profit figures (Brusca, Gómez‐

villegas and Montesinos, 2016). They can also need to decide whether to delete the

unsustainable goods or services or even evaluate the opportunities of making any change

in existing product.

Find more and more customer: Potential customers could support Tesco Plc to expand

in more areas where growth can be attained as well as increase the overall profitability.

However, that may be the most costly method for raising extra sales as adding new

customer forces company to spend more on promotional activities so that customer can

know about Tesco Plc product. As it have been is observed that attracting a new

consumer costs six percent as much as maintaining an established client. The easiest and

most cost effective approach to attract potential consumers is to give rewards to the

existing clients which can inspire them and these existing customer of Tesco plc would

tell other customer to join company. In recent dynamic market circumstance word of

mouth is the most powerful form of advertising which can lead to higher profitability.

Increase your Conversion Rate: New lead generation is an vital part of doing business

development in today's business era (Cantillon, Maître and Watson, 2016). The facts is

that manager of Tesco plc must exactly t know which proportion of new leads can

actually transform into a sale and raise revenue. Rising conversion of revenue in Tesco

Plc is among the best and cheapest ways of raising profitability within an accounting

year. This can also be beneficial to reduce the current and other liabilities and increase

the total cash in hand for company which can be put into other operating and financing

activities.

Review Current Pricing Structure: Increasing inflation may be a frightening prospect

because a minor rise in Tesco costs will affect total operating income in a unsurprising

way. Thus manager of respective company are recommended to assign right cost of the

goods and services which is a quite necessary option to increase profit margin. They are

recommended to periodically check the quality of company goods and change their prices

accordingly.

Reduce your inventory: A smart way to simplify the Tesco plc profit margin and

increase the cash flow is stock management (Tang and Baker, 2016). Thus, putting less

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.