Comparative Financial Analysis of Apple and Samsung (2014-2017)

VerifiedAdded on 2021/01/02

|38

|3940

|89

Report

AI Summary

This report provides a comprehensive financial analysis comparing the performance of Apple and Samsung from 2014 to 2017. The analysis employs ratio analysis, horizontal, and vertical analysis techniques to assess profitability and financial health. The report includes detailed financial ratios for both companies, enabling a critical comparison of their performance over the four-year period. In addition to financial data, the report also examines the Corporate Social Responsibility (CSR) sections of both companies, providing insights into their social and ethical practices. The findings of the analysis are interpreted to determine the better-performing firm, offering a clear understanding of their financial strengths and weaknesses. The report is designed to provide a clear and concise overview of each company's financial position and performance.

FAME

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

1. Critically comparing and contrasting financial performance of Samsung and Apple for last

four years.....................................................................................................................................1

.....................................................................................................................................................3

.....................................................................................................................................................4

2. Analysing CSR sections of companies and commenting on findings...................................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................18

APPENDIXES...............................................................................................................................19

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

1. Critically comparing and contrasting financial performance of Samsung and Apple for last

four years.....................................................................................................................................1

.....................................................................................................................................................3

.....................................................................................................................................................4

2. Analysing CSR sections of companies and commenting on findings...................................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................18

APPENDIXES...............................................................................................................................19

INTRODUCTION

Financial management and information have significant role in assessing overall financial

position in effective manner. Present report deals with Apple and Samsung both are tech-giants

and comparison of financial performance of companies will be undertaken in the report. For

accomplishing this, widely used technique, ratio analysis will be applied for assessing

performance over four years starting from 2014-2017. Moreover, vertical and horizontal analysis

for both companies will be applied for same period. Apart from it, CSR sections of companies

will be analysed and explained in report. Thus, overall financial performance of organisations

will be assessed and interpreted and better performing firm will be analysed.

MAIN BODY

1. Critically comparing and contrasting financial performance of Samsung and Apple for last

four years

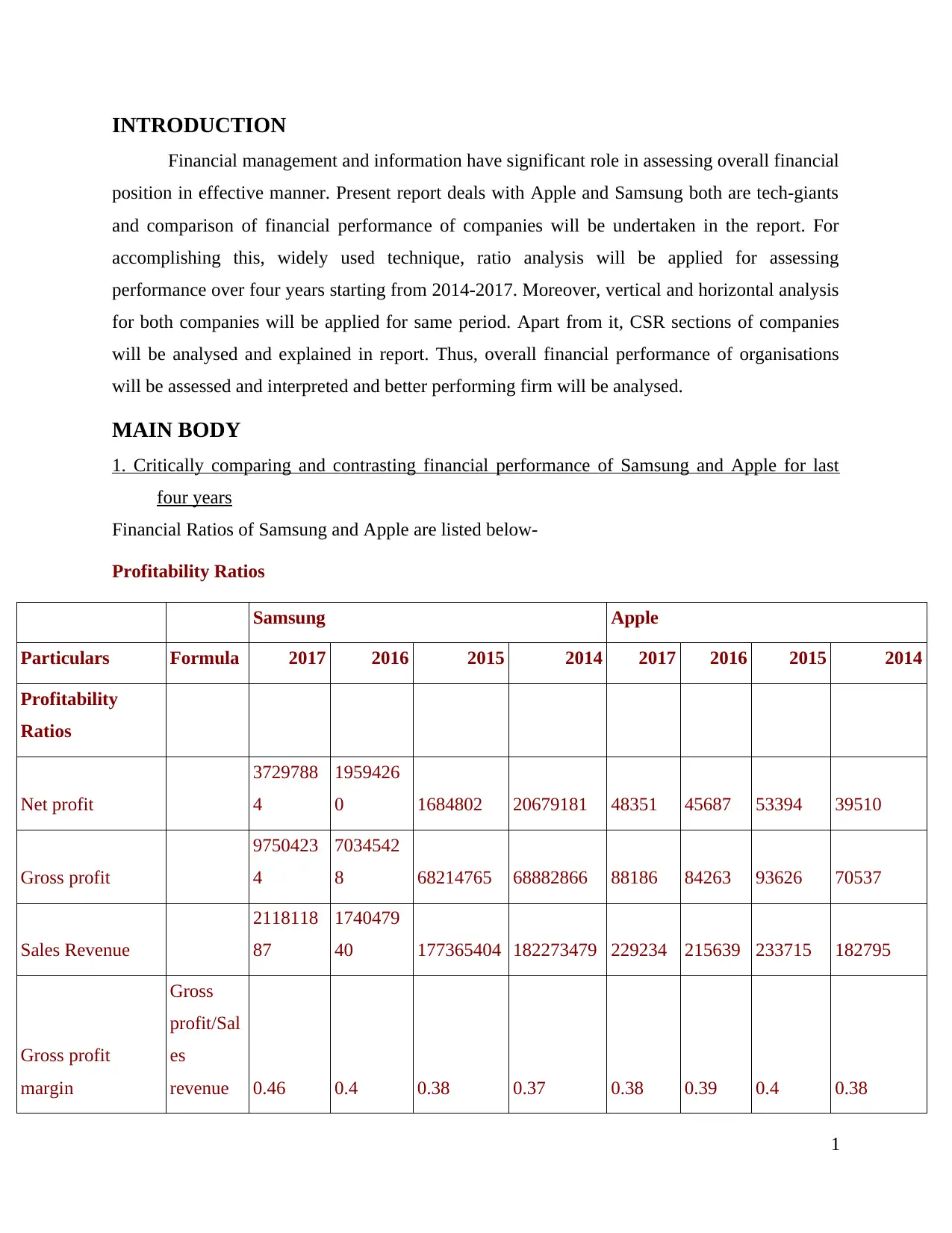

Financial Ratios of Samsung and Apple are listed below-

Profitability Ratios

Samsung Apple

Particulars Formula 2017 2016 2015 2014 2017 2016 2015 2014

Profitability

Ratios

Net profit

3729788

4

1959426

0 1684802 20679181 48351 45687 53394 39510

Gross profit

9750423

4

7034542

8 68214765 68882866 88186 84263 93626 70537

Sales Revenue

2118118

87

1740479

40 177365404 182273479 229234 215639 233715 182795

Gross profit

margin

Gross

profit/Sal

es

revenue 0.46 0.4 0.38 0.37 0.38 0.39 0.4 0.38

1

Financial management and information have significant role in assessing overall financial

position in effective manner. Present report deals with Apple and Samsung both are tech-giants

and comparison of financial performance of companies will be undertaken in the report. For

accomplishing this, widely used technique, ratio analysis will be applied for assessing

performance over four years starting from 2014-2017. Moreover, vertical and horizontal analysis

for both companies will be applied for same period. Apart from it, CSR sections of companies

will be analysed and explained in report. Thus, overall financial performance of organisations

will be assessed and interpreted and better performing firm will be analysed.

MAIN BODY

1. Critically comparing and contrasting financial performance of Samsung and Apple for last

four years

Financial Ratios of Samsung and Apple are listed below-

Profitability Ratios

Samsung Apple

Particulars Formula 2017 2016 2015 2014 2017 2016 2015 2014

Profitability

Ratios

Net profit

3729788

4

1959426

0 1684802 20679181 48351 45687 53394 39510

Gross profit

9750423

4

7034542

8 68214765 68882866 88186 84263 93626 70537

Sales Revenue

2118118

87

1740479

40 177365404 182273479 229234 215639 233715 182795

Gross profit

margin

Gross

profit/Sal

es

revenue 0.46 0.4 0.38 0.37 0.38 0.39 0.4 0.38

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

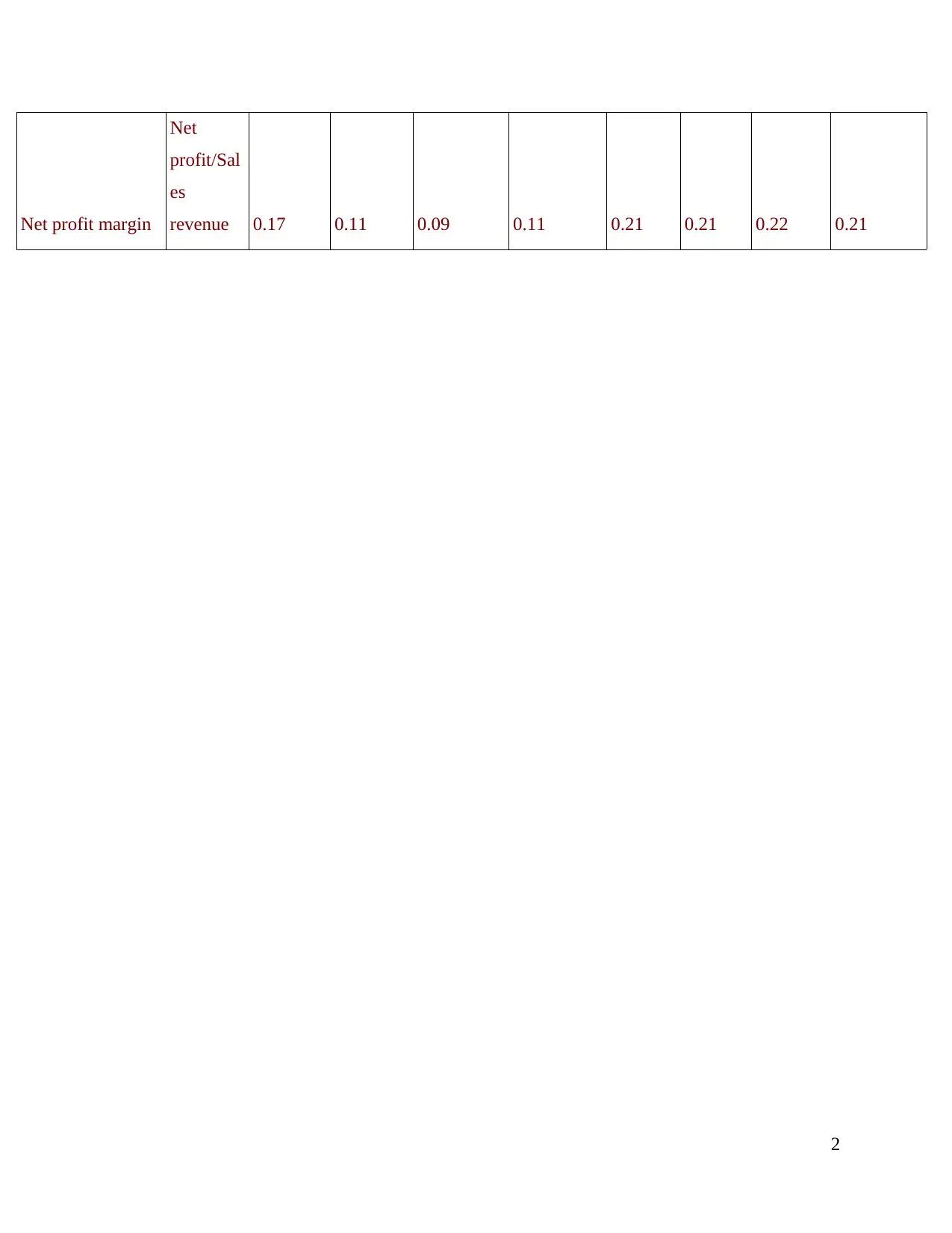

Net profit margin

Net

profit/Sal

es

revenue 0.17 0.11 0.09 0.11 0.21 0.21 0.22 0.21

2

Net

profit/Sal

es

revenue 0.17 0.11 0.09 0.11 0.21 0.21 0.22 0.21

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

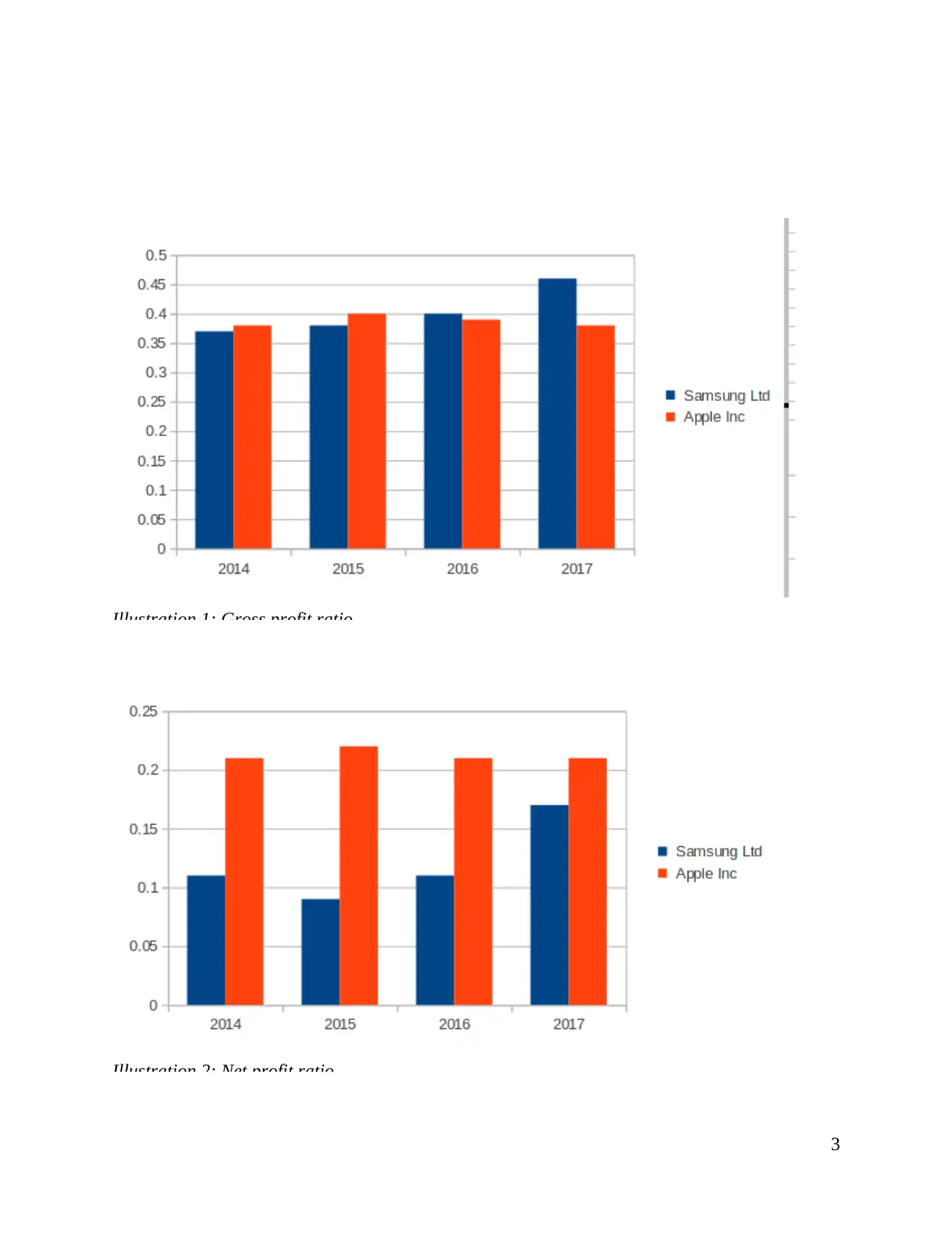

Illustration 1: Gross profit ratio

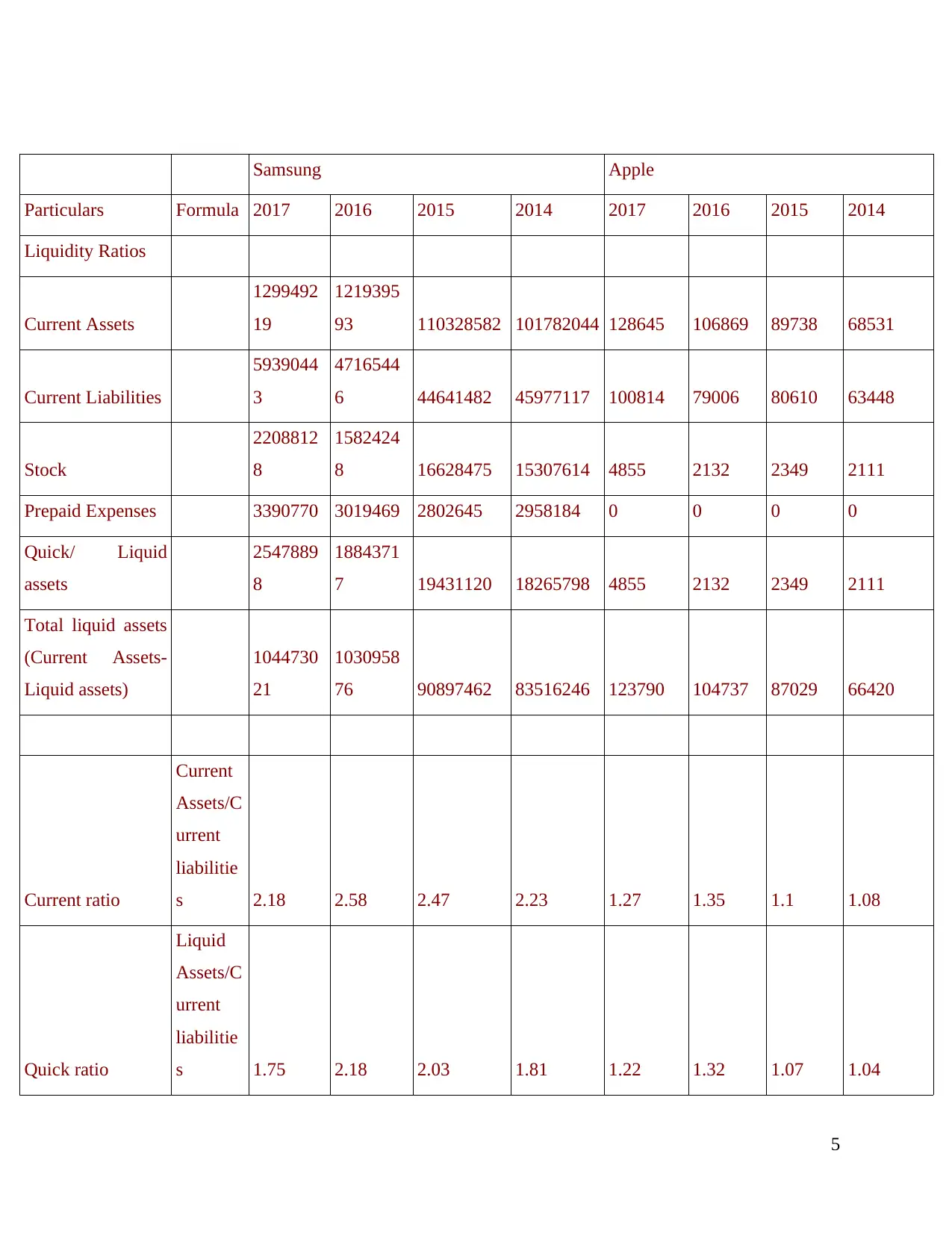

Illustration 2: Net profit ratio

3

Illustration 2: Net profit ratio

3

Interpretation-

It can be interpreted from above graphs that profitability ratios are being computed for

both companies. Gross profit is one of the important profitability measure which is carried out by

deducting cost of goods manufactured from sales revenue. It can be analysed that Apple had

gross profit ratio of 0.38 in 2014 which reached to 0.40 in 2015. This clearly shows that firm is

able to reduce expenses on sales and thus, ratio is improved. Moreover, in 2016, it was reduced

and come to 0.39 and further to 0.38 in 2017. It shows that ratio is steady over last four years. On

the other hand, Samsung had ratio of 0.37 in 2014. While, in next year, 0.38 was attained and

0.40 in 2016. In 2017, gross profit ratio had reached record high of 0.46 (Annual report of

Samsung. 2017). This shows that firm is able to initiate reduction upon its expenses in the best

manner possible.

Net profit is calculated which shows operational and non-operational expenditures which

are deducted from gross profit to arrive at net income. Taxes and interest are accounted for and

subtracted from profit and as a result, it is also known as PAT (Profit After Tax). It can be

assessed that Samsung had net profit ratio of 0.11 in 2014, reached to 0.09 in 2015. It reached to

0.11 in 2016 and increased to 0.17 in next period. This shows that it has initiated good control

over the expenses in order to ascertain good quantum of profits in the best manner possible.

Apple had ratio of 0.21 in 2014 which increased in 2015 to 0.22 showing that it had good

position in comparison to Samsung in following two years. On the other hand, it can be analysed

that in 2016 and 2017, ratio was 0.21.

It can be assessed that in accordance to gross profit ratio, Samsung has more of it as it is

able to control its expenses in a better manner. On the other hand, net profit ratio of Apple is

good as overall expenditures are being controlled in a better manner. This shows that collectively

Apple has good profitability position as all expenses are being controlled and monitored from

time-to-time leading to have profitable position in effective manner (Annual report of Apple.

2017). It is required that Samsung should control its manufacturing and interest expenses so that

higher profits may be attained in a better manner. This will be beneficial for the firm in long run

and rivalries will be outreached with ease. Hence, profitability ratios shows financial health of

company which is required to ascertained in a better way.

Liquidity Ratios

4

It can be interpreted from above graphs that profitability ratios are being computed for

both companies. Gross profit is one of the important profitability measure which is carried out by

deducting cost of goods manufactured from sales revenue. It can be analysed that Apple had

gross profit ratio of 0.38 in 2014 which reached to 0.40 in 2015. This clearly shows that firm is

able to reduce expenses on sales and thus, ratio is improved. Moreover, in 2016, it was reduced

and come to 0.39 and further to 0.38 in 2017. It shows that ratio is steady over last four years. On

the other hand, Samsung had ratio of 0.37 in 2014. While, in next year, 0.38 was attained and

0.40 in 2016. In 2017, gross profit ratio had reached record high of 0.46 (Annual report of

Samsung. 2017). This shows that firm is able to initiate reduction upon its expenses in the best

manner possible.

Net profit is calculated which shows operational and non-operational expenditures which

are deducted from gross profit to arrive at net income. Taxes and interest are accounted for and

subtracted from profit and as a result, it is also known as PAT (Profit After Tax). It can be

assessed that Samsung had net profit ratio of 0.11 in 2014, reached to 0.09 in 2015. It reached to

0.11 in 2016 and increased to 0.17 in next period. This shows that it has initiated good control

over the expenses in order to ascertain good quantum of profits in the best manner possible.

Apple had ratio of 0.21 in 2014 which increased in 2015 to 0.22 showing that it had good

position in comparison to Samsung in following two years. On the other hand, it can be analysed

that in 2016 and 2017, ratio was 0.21.

It can be assessed that in accordance to gross profit ratio, Samsung has more of it as it is

able to control its expenses in a better manner. On the other hand, net profit ratio of Apple is

good as overall expenditures are being controlled in a better manner. This shows that collectively

Apple has good profitability position as all expenses are being controlled and monitored from

time-to-time leading to have profitable position in effective manner (Annual report of Apple.

2017). It is required that Samsung should control its manufacturing and interest expenses so that

higher profits may be attained in a better manner. This will be beneficial for the firm in long run

and rivalries will be outreached with ease. Hence, profitability ratios shows financial health of

company which is required to ascertained in a better way.

Liquidity Ratios

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Samsung Apple

Particulars Formula 2017 2016 2015 2014 2017 2016 2015 2014

Liquidity Ratios

Current Assets

1299492

19

1219395

93 110328582 101782044 128645 106869 89738 68531

Current Liabilities

5939044

3

4716544

6 44641482 45977117 100814 79006 80610 63448

Stock

2208812

8

1582424

8 16628475 15307614 4855 2132 2349 2111

Prepaid Expenses 3390770 3019469 2802645 2958184 0 0 0 0

Quick/ Liquid

assets

2547889

8

1884371

7 19431120 18265798 4855 2132 2349 2111

Total liquid assets

(Current Assets-

Liquid assets)

1044730

21

1030958

76 90897462 83516246 123790 104737 87029 66420

Current ratio

Current

Assets/C

urrent

liabilitie

s 2.18 2.58 2.47 2.23 1.27 1.35 1.1 1.08

Quick ratio

Liquid

Assets/C

urrent

liabilitie

s 1.75 2.18 2.03 1.81 1.22 1.32 1.07 1.04

5

Particulars Formula 2017 2016 2015 2014 2017 2016 2015 2014

Liquidity Ratios

Current Assets

1299492

19

1219395

93 110328582 101782044 128645 106869 89738 68531

Current Liabilities

5939044

3

4716544

6 44641482 45977117 100814 79006 80610 63448

Stock

2208812

8

1582424

8 16628475 15307614 4855 2132 2349 2111

Prepaid Expenses 3390770 3019469 2802645 2958184 0 0 0 0

Quick/ Liquid

assets

2547889

8

1884371

7 19431120 18265798 4855 2132 2349 2111

Total liquid assets

(Current Assets-

Liquid assets)

1044730

21

1030958

76 90897462 83516246 123790 104737 87029 66420

Current ratio

Current

Assets/C

urrent

liabilitie

s 2.18 2.58 2.47 2.23 1.27 1.35 1.1 1.08

Quick ratio

Liquid

Assets/C

urrent

liabilitie

s 1.75 2.18 2.03 1.81 1.22 1.32 1.07 1.04

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

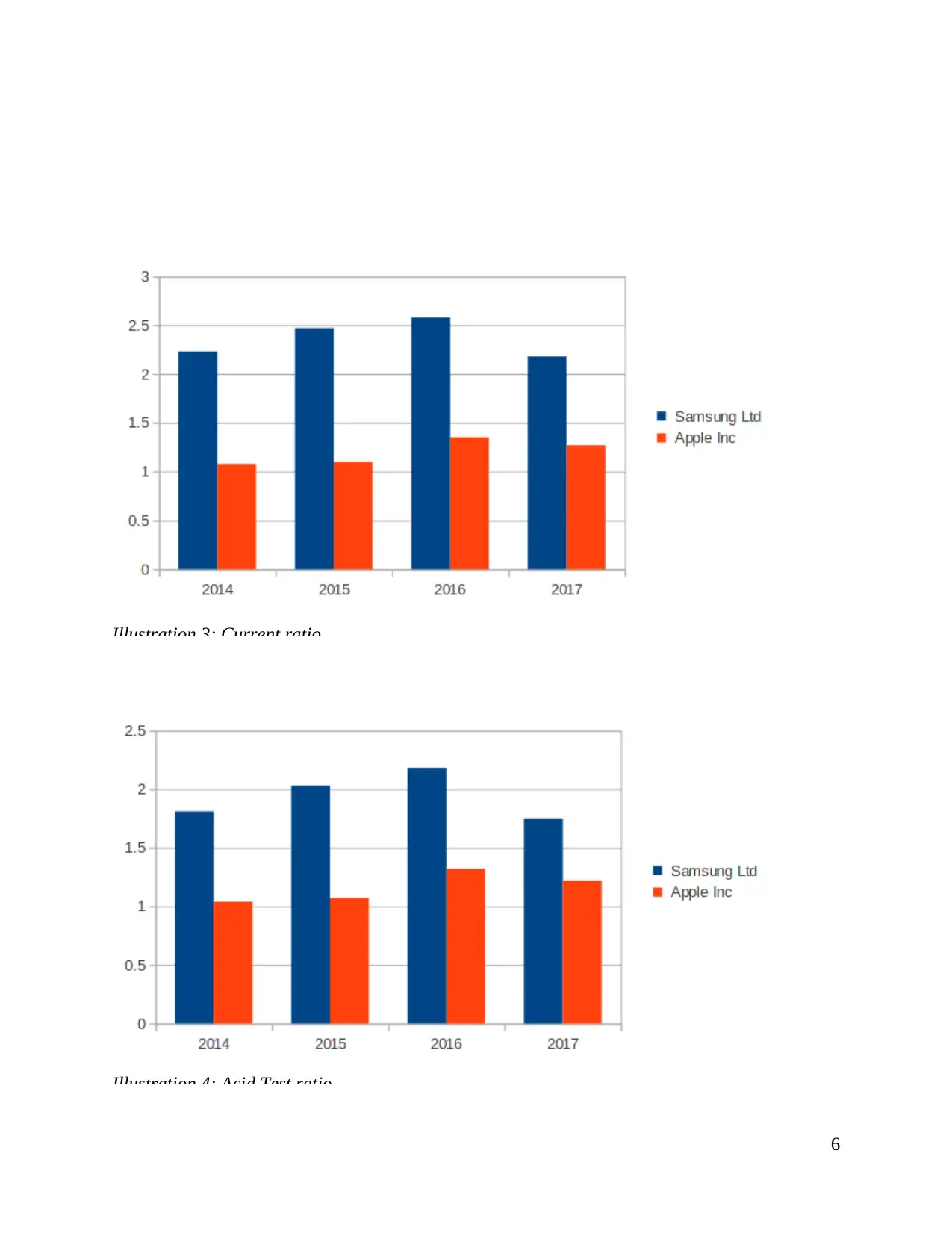

Illustration 3: Current ratio

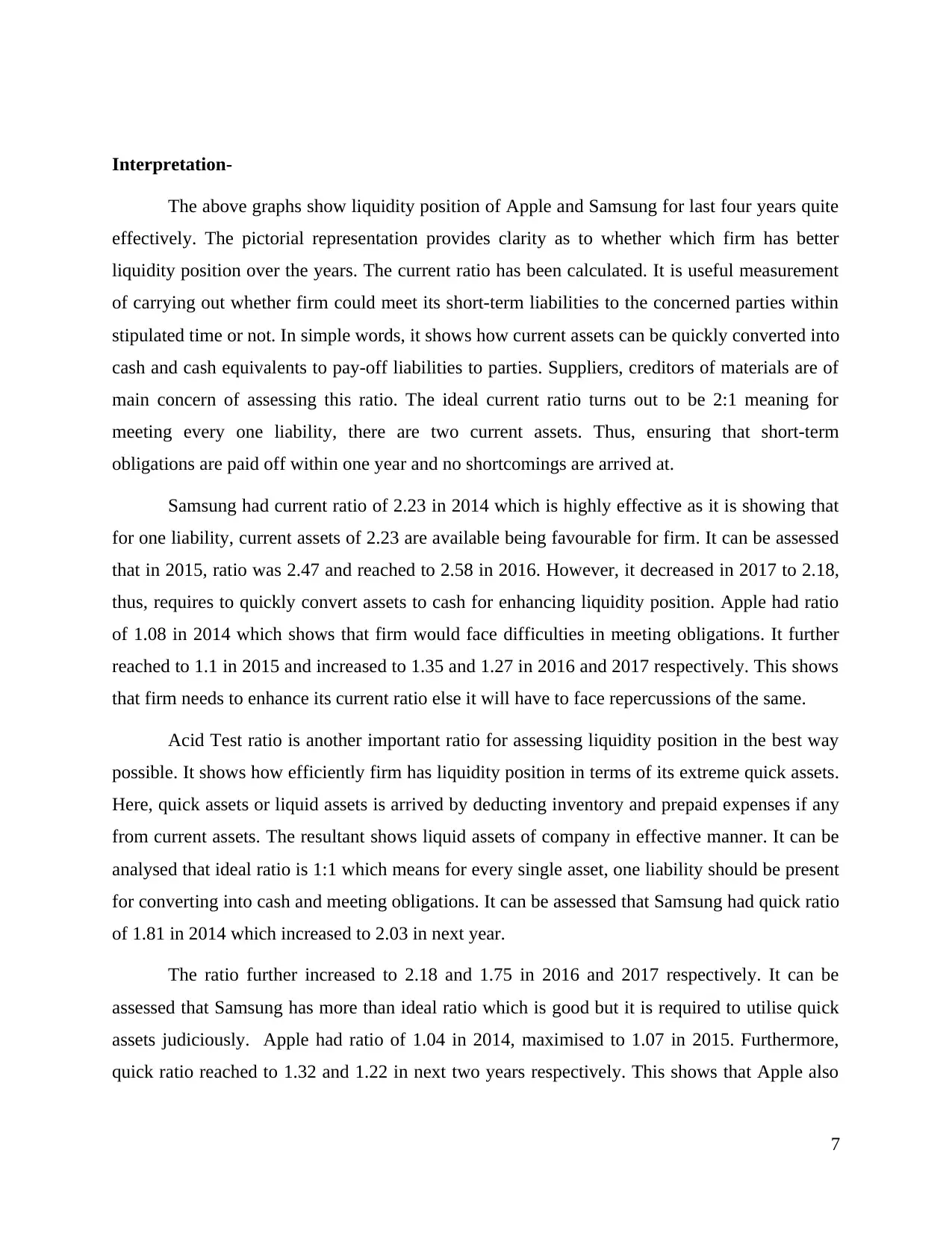

Illustration 4: Acid Test ratio

6

Illustration 4: Acid Test ratio

6

Interpretation-

The above graphs show liquidity position of Apple and Samsung for last four years quite

effectively. The pictorial representation provides clarity as to whether which firm has better

liquidity position over the years. The current ratio has been calculated. It is useful measurement

of carrying out whether firm could meet its short-term liabilities to the concerned parties within

stipulated time or not. In simple words, it shows how current assets can be quickly converted into

cash and cash equivalents to pay-off liabilities to parties. Suppliers, creditors of materials are of

main concern of assessing this ratio. The ideal current ratio turns out to be 2:1 meaning for

meeting every one liability, there are two current assets. Thus, ensuring that short-term

obligations are paid off within one year and no shortcomings are arrived at.

Samsung had current ratio of 2.23 in 2014 which is highly effective as it is showing that

for one liability, current assets of 2.23 are available being favourable for firm. It can be assessed

that in 2015, ratio was 2.47 and reached to 2.58 in 2016. However, it decreased in 2017 to 2.18,

thus, requires to quickly convert assets to cash for enhancing liquidity position. Apple had ratio

of 1.08 in 2014 which shows that firm would face difficulties in meeting obligations. It further

reached to 1.1 in 2015 and increased to 1.35 and 1.27 in 2016 and 2017 respectively. This shows

that firm needs to enhance its current ratio else it will have to face repercussions of the same.

Acid Test ratio is another important ratio for assessing liquidity position in the best way

possible. It shows how efficiently firm has liquidity position in terms of its extreme quick assets.

Here, quick assets or liquid assets is arrived by deducting inventory and prepaid expenses if any

from current assets. The resultant shows liquid assets of company in effective manner. It can be

analysed that ideal ratio is 1:1 which means for every single asset, one liability should be present

for converting into cash and meeting obligations. It can be assessed that Samsung had quick ratio

of 1.81 in 2014 which increased to 2.03 in next year.

The ratio further increased to 2.18 and 1.75 in 2016 and 2017 respectively. It can be

assessed that Samsung has more than ideal ratio which is good but it is required to utilise quick

assets judiciously. Apple had ratio of 1.04 in 2014, maximised to 1.07 in 2015. Furthermore,

quick ratio reached to 1.32 and 1.22 in next two years respectively. This shows that Apple also

7

The above graphs show liquidity position of Apple and Samsung for last four years quite

effectively. The pictorial representation provides clarity as to whether which firm has better

liquidity position over the years. The current ratio has been calculated. It is useful measurement

of carrying out whether firm could meet its short-term liabilities to the concerned parties within

stipulated time or not. In simple words, it shows how current assets can be quickly converted into

cash and cash equivalents to pay-off liabilities to parties. Suppliers, creditors of materials are of

main concern of assessing this ratio. The ideal current ratio turns out to be 2:1 meaning for

meeting every one liability, there are two current assets. Thus, ensuring that short-term

obligations are paid off within one year and no shortcomings are arrived at.

Samsung had current ratio of 2.23 in 2014 which is highly effective as it is showing that

for one liability, current assets of 2.23 are available being favourable for firm. It can be assessed

that in 2015, ratio was 2.47 and reached to 2.58 in 2016. However, it decreased in 2017 to 2.18,

thus, requires to quickly convert assets to cash for enhancing liquidity position. Apple had ratio

of 1.08 in 2014 which shows that firm would face difficulties in meeting obligations. It further

reached to 1.1 in 2015 and increased to 1.35 and 1.27 in 2016 and 2017 respectively. This shows

that firm needs to enhance its current ratio else it will have to face repercussions of the same.

Acid Test ratio is another important ratio for assessing liquidity position in the best way

possible. It shows how efficiently firm has liquidity position in terms of its extreme quick assets.

Here, quick assets or liquid assets is arrived by deducting inventory and prepaid expenses if any

from current assets. The resultant shows liquid assets of company in effective manner. It can be

analysed that ideal ratio is 1:1 which means for every single asset, one liability should be present

for converting into cash and meeting obligations. It can be assessed that Samsung had quick ratio

of 1.81 in 2014 which increased to 2.03 in next year.

The ratio further increased to 2.18 and 1.75 in 2016 and 2017 respectively. It can be

assessed that Samsung has more than ideal ratio which is good but it is required to utilise quick

assets judiciously. Apple had ratio of 1.04 in 2014, maximised to 1.07 in 2015. Furthermore,

quick ratio reached to 1.32 and 1.22 in next two years respectively. This shows that Apple also

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

has good liquidity position as per ideal ratio. However, by referring to overall liquidity position

of both companies, Samsung has better position.

Efficiency Ratios

Samsung Apple

Particulars Formula 2017 2016 2015 2014 2017 2016 2015 2014

Efficiency Ratios

Cost of Goods

manufactured

1143076

53 103702512

10915063

9 113390613 141048 131376 140089 112258

Stock

2208812

8 15824248 16628475 15307614 4855 2132 2349 2111

Total assets

2667831

76 226044667

21407188

3 203679800 375319 321686 290479 231839

Sales Revenue

2118118

87 174047940

17736540

4 182273479 229234 215639 233715 182795

Inventory turnover

ratio

Cost of

Goods

manufact

ured/Ave

rage

inventory 5.17 5.47 6.7 7.1 29.05 37.6 62.52 50.33

Asset turnover

ratio

Sales

revenue/

Average

total

assets 0.79 0.7 0.8 0.87 0.61 0.61 0.76 0.69

8

of both companies, Samsung has better position.

Efficiency Ratios

Samsung Apple

Particulars Formula 2017 2016 2015 2014 2017 2016 2015 2014

Efficiency Ratios

Cost of Goods

manufactured

1143076

53 103702512

10915063

9 113390613 141048 131376 140089 112258

Stock

2208812

8 15824248 16628475 15307614 4855 2132 2349 2111

Total assets

2667831

76 226044667

21407188

3 203679800 375319 321686 290479 231839

Sales Revenue

2118118

87 174047940

17736540

4 182273479 229234 215639 233715 182795

Inventory turnover

ratio

Cost of

Goods

manufact

ured/Ave

rage

inventory 5.17 5.47 6.7 7.1 29.05 37.6 62.52 50.33

Asset turnover

ratio

Sales

revenue/

Average

total

assets 0.79 0.7 0.8 0.87 0.61 0.61 0.76 0.69

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

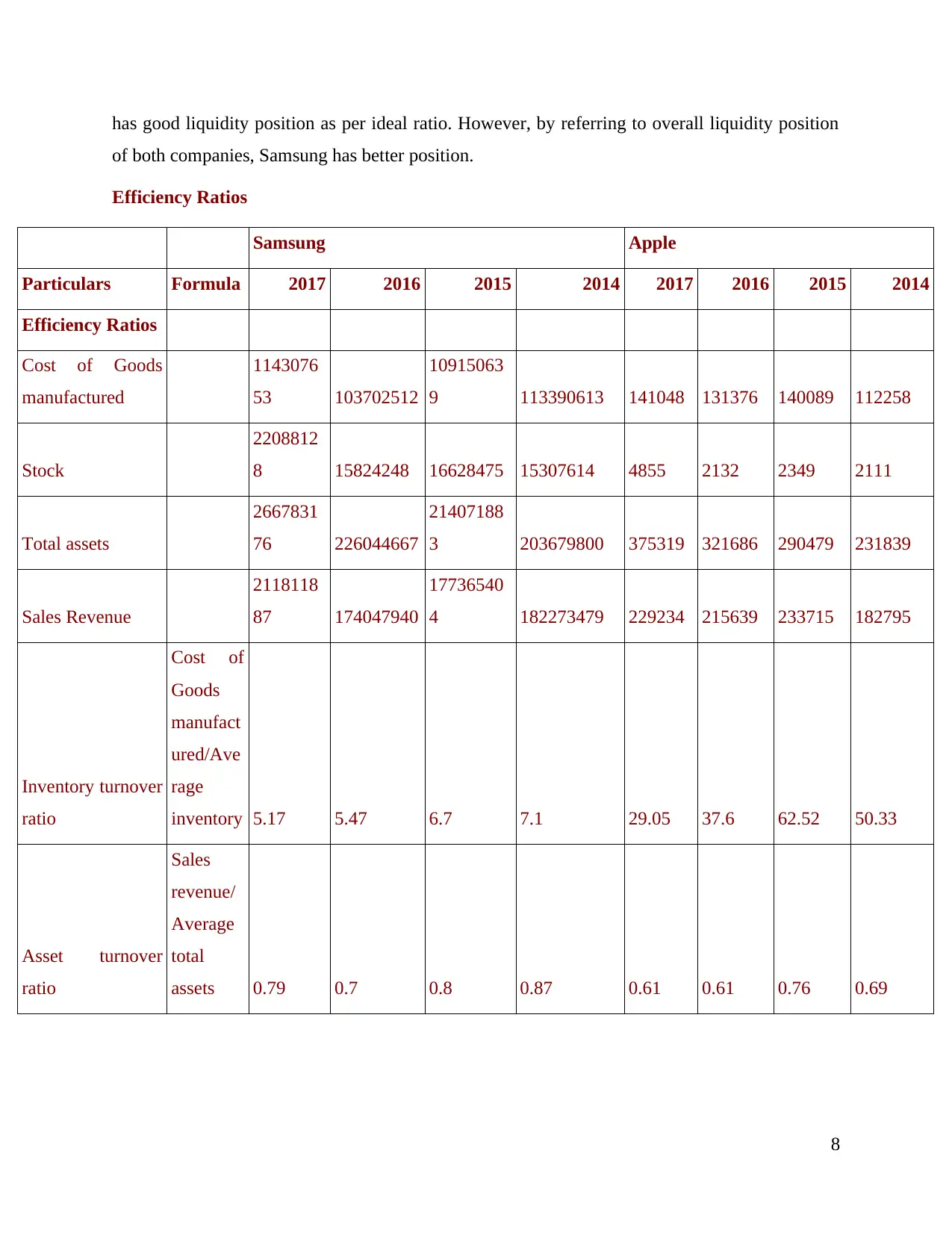

Illustration 5: Inventory Turnover ratio

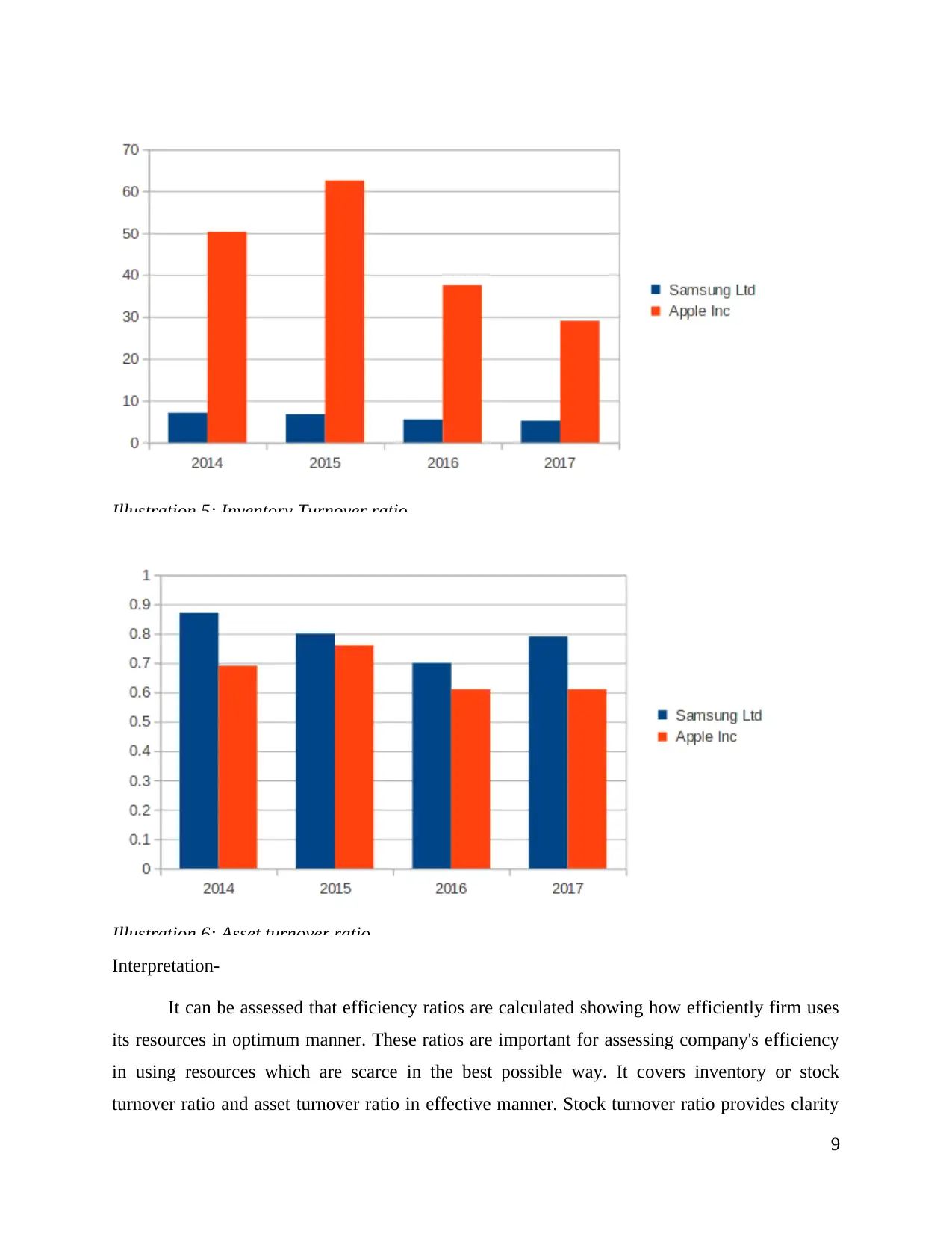

Illustration 6: Asset turnover ratio

Interpretation-

It can be assessed that efficiency ratios are calculated showing how efficiently firm uses

its resources in optimum manner. These ratios are important for assessing company's efficiency

in using resources which are scarce in the best possible way. It covers inventory or stock

turnover ratio and asset turnover ratio in effective manner. Stock turnover ratio provides clarity

9

Illustration 6: Asset turnover ratio

Interpretation-

It can be assessed that efficiency ratios are calculated showing how efficiently firm uses

its resources in optimum manner. These ratios are important for assessing company's efficiency

in using resources which are scarce in the best possible way. It covers inventory or stock

turnover ratio and asset turnover ratio in effective manner. Stock turnover ratio provides clarity

9

as to how efficiently firm uses its inventory for converting the same into sales revenue. Less the

ratio, better health of company. Apple had inventory ratio of 50.33 in 2014 which reached to

62.52 in next year. Furthermore, figure reached to 37.6 and 29.05 in 2016 and 2017 respectively.

It implies that organisation has improved its ratio by utilising inventory in effective manner.

Samsung had similar ratio of 7.1 in 2014 which has decreased to 6.7 in 2015. On the

other hand, ratio decreased to 5.47 in 2016 and 5.17 in 2017. These figures clearly shows that

firm is able to initiate healthy usage of stock for meeting demand of customers. It can be

analysed both Hi-Tech rivals have good inventory turnover ratio. Efficiency ratio such as asset

turnover ratio is also computed for both organisations. This ratio means how firm efficiently

utilises its assets for generating good sales in the best manner possible. It is quite useful for

business as it provides clarity of how asset is being used in the firm and how return is generated

from it for increasing sales.

It can be analysed that Samsung had asset turnover ratio of 0.87 in 2014 which decreased

to 0.80 in next year. Furthermore, it reduced to 0.70 in 20163 and increased in 2017 to 0.79. This

shows that asset turnover ratio is not steady and it requires using its assets for enhancing sales in

a better way. On the other hand, Apple had ratio of 0.69 in 2014, elevated to 0.76 in next period.

It remained unchanged in 2016 and 2017 as 0.61 was being attained. This shows that firm is

required to use asset in judicious manner for maximising revenue. Thus, Samsung had good asset

turnover ratio in comparison to Apple.

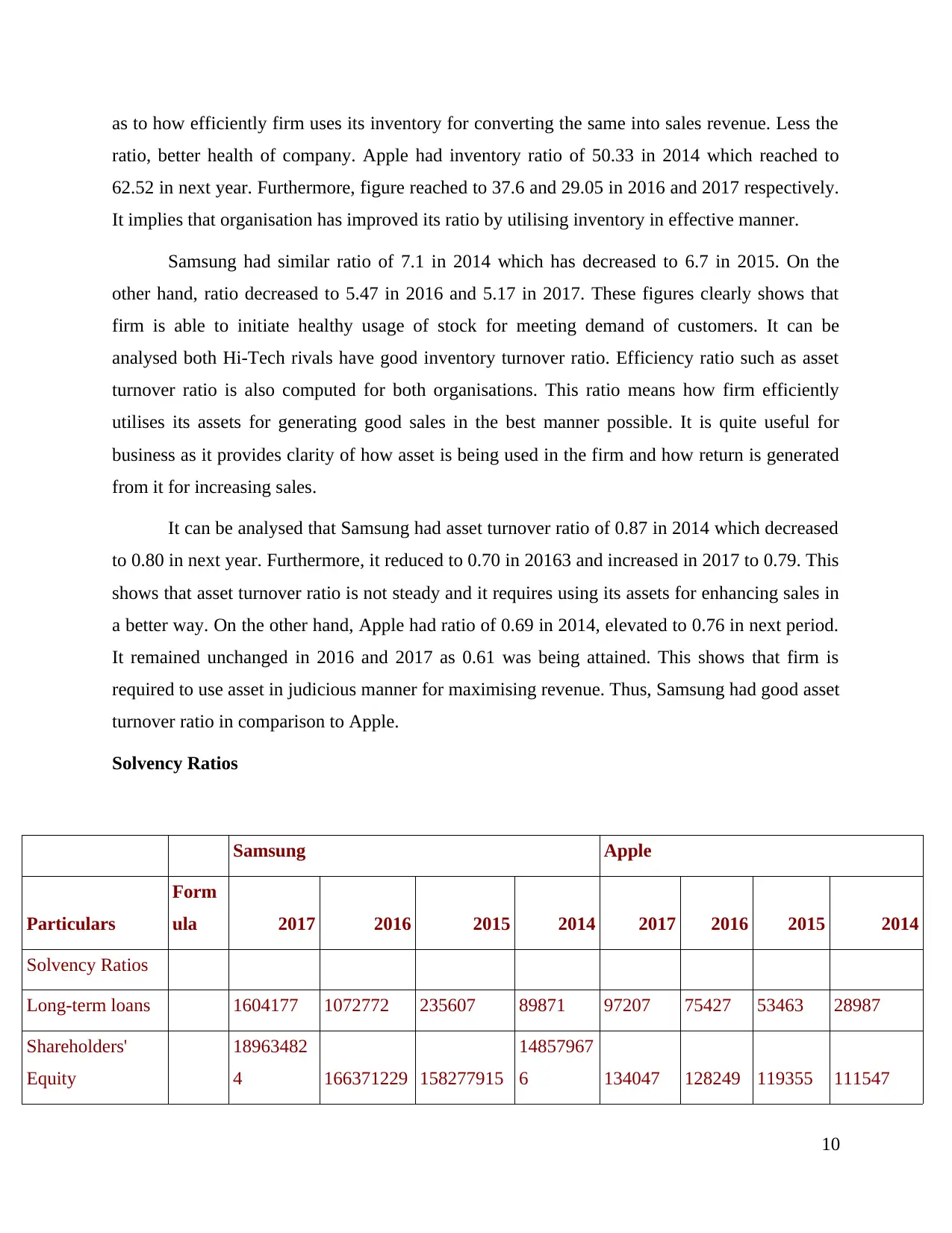

Solvency Ratios

Samsung Apple

Particulars

Form

ula 2017 2016 2015 2014 2017 2016 2015 2014

Solvency Ratios

Long-term loans 1604177 1072772 235607 89871 97207 75427 53463 28987

Shareholders'

Equity

18963482

4 166371229 158277915

14857967

6 134047 128249 119355 111547

10

ratio, better health of company. Apple had inventory ratio of 50.33 in 2014 which reached to

62.52 in next year. Furthermore, figure reached to 37.6 and 29.05 in 2016 and 2017 respectively.

It implies that organisation has improved its ratio by utilising inventory in effective manner.

Samsung had similar ratio of 7.1 in 2014 which has decreased to 6.7 in 2015. On the

other hand, ratio decreased to 5.47 in 2016 and 5.17 in 2017. These figures clearly shows that

firm is able to initiate healthy usage of stock for meeting demand of customers. It can be

analysed both Hi-Tech rivals have good inventory turnover ratio. Efficiency ratio such as asset

turnover ratio is also computed for both organisations. This ratio means how firm efficiently

utilises its assets for generating good sales in the best manner possible. It is quite useful for

business as it provides clarity of how asset is being used in the firm and how return is generated

from it for increasing sales.

It can be analysed that Samsung had asset turnover ratio of 0.87 in 2014 which decreased

to 0.80 in next year. Furthermore, it reduced to 0.70 in 20163 and increased in 2017 to 0.79. This

shows that asset turnover ratio is not steady and it requires using its assets for enhancing sales in

a better way. On the other hand, Apple had ratio of 0.69 in 2014, elevated to 0.76 in next period.

It remained unchanged in 2016 and 2017 as 0.61 was being attained. This shows that firm is

required to use asset in judicious manner for maximising revenue. Thus, Samsung had good asset

turnover ratio in comparison to Apple.

Solvency Ratios

Samsung Apple

Particulars

Form

ula 2017 2016 2015 2014 2017 2016 2015 2014

Solvency Ratios

Long-term loans 1604177 1072772 235607 89871 97207 75427 53463 28987

Shareholders'

Equity

18963482

4 166371229 158277915

14857967

6 134047 128249 119355 111547

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 38

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.