Financial Reporting and Acquisition Analysis for Sunshine Ltd

VerifiedAdded on 2023/06/18

|10

|2414

|382

AI Summary

This article discusses financial reporting and acquisition analysis for Sunshine Ltd, including the impact of dividend payable by the subsidiary entity Valley Ltd and the correct presentation of journal entries. It also covers the subject of goodwill and its calculation, as well as the technical issues that may arise during the acquisition process.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Statement of Advice

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

INTRODUCTION...........................................................................................................................................4

MAIN BODY..................................................................................................................................................4

Will the dividend payable by the subsidiary entity Valley Ltd impact the acquisition analysis?..............4

Presenting correct journal entries and reason for eliminating the same................................................6

PART B ........................................................................................................................................................8

REFERENCES................................................................................................................................................9

INTRODUCTION...........................................................................................................................................4

MAIN BODY..................................................................................................................................................4

Will the dividend payable by the subsidiary entity Valley Ltd impact the acquisition analysis?..............4

Presenting correct journal entries and reason for eliminating the same................................................6

PART B ........................................................................................................................................................8

REFERENCES................................................................................................................................................9

INTRODUCTION

Financial reporting is disclosing financial information to decision makers regarding the

firm's performance and corporate condition over a predetermined amount of time. Bankers,

lenders, the general public, loan suppliers, legislatures, and federal agencies are among the

participants (Ongayi and et.al, 2021). Financial reporting is done regularly and annually for

publicly traded firms. The present research will explore genuine goodwill and the reasons for it.

It will deliver a message to the board of directors in order to provide data.

MAIN BODY

Will the dividend payable by the subsidiary entity Valley Ltd impact the acquisition analysis?

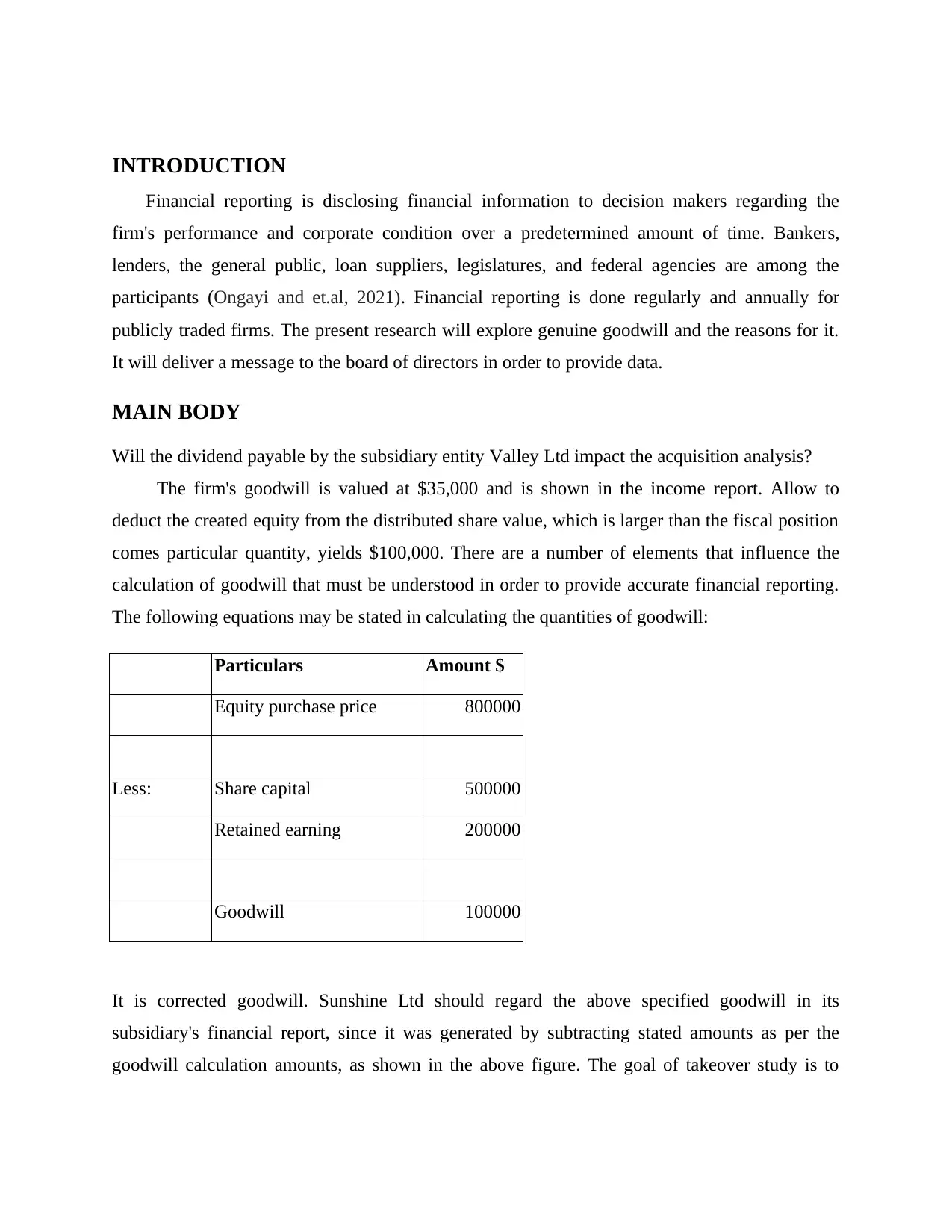

The firm's goodwill is valued at $35,000 and is shown in the income report. Allow to

deduct the created equity from the distributed share value, which is larger than the fiscal position

comes particular quantity, yields $100,000. There are a number of elements that influence the

calculation of goodwill that must be understood in order to provide accurate financial reporting.

The following equations may be stated in calculating the quantities of goodwill:

Particulars Amount $

Equity purchase price 800000

Less: Share capital 500000

Retained earning 200000

Goodwill 100000

It is corrected goodwill. Sunshine Ltd should regard the above specified goodwill in its

subsidiary's financial report, since it was generated by subtracting stated amounts as per the

goodwill calculation amounts, as shown in the above figure. The goal of takeover study is to

Financial reporting is disclosing financial information to decision makers regarding the

firm's performance and corporate condition over a predetermined amount of time. Bankers,

lenders, the general public, loan suppliers, legislatures, and federal agencies are among the

participants (Ongayi and et.al, 2021). Financial reporting is done regularly and annually for

publicly traded firms. The present research will explore genuine goodwill and the reasons for it.

It will deliver a message to the board of directors in order to provide data.

MAIN BODY

Will the dividend payable by the subsidiary entity Valley Ltd impact the acquisition analysis?

The firm's goodwill is valued at $35,000 and is shown in the income report. Allow to

deduct the created equity from the distributed share value, which is larger than the fiscal position

comes particular quantity, yields $100,000. There are a number of elements that influence the

calculation of goodwill that must be understood in order to provide accurate financial reporting.

The following equations may be stated in calculating the quantities of goodwill:

Particulars Amount $

Equity purchase price 800000

Less: Share capital 500000

Retained earning 200000

Goodwill 100000

It is corrected goodwill. Sunshine Ltd should regard the above specified goodwill in its

subsidiary's financial report, since it was generated by subtracting stated amounts as per the

goodwill calculation amounts, as shown in the above figure. The goal of takeover study is to

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

examine a variety of elements by examining a financial position of a company (Botez and

Enachi, 2021).

In attempt to decide the quantities of goodwill that have been indicated in the financial

report, a variety of explanations must be given. There are a number of elements that must be

considered while assessing good in a reasonable fashion. It covers things like effective

management, place of work, quality of products and services, benefits for businesses, customer

loyalty, and patents held by the firm, patent holders, and so on.

In order to buy a business, it is critical for Sunshine Limited to focus on the proper

calculation of goodwill, which can have a significant negative impact on the firm's economic

situations. It can have an effect on customers, borrowers, and financial firms by lowering their

reputation and reliability. Furthermore, it will have an impact on investments ability, decreased

liquidity produced from sales, a negative reputation in the sector, and so on. On this basis, it may

be concluded that Valley Ltd has immaterial goodwill knowledge, which may lead to a reduction

in the company's international popularity (Chuang, 2021). To avoid having a negative influence

on its customers, it is necessary for the company to keep good records of its image by taking into

account factors such as time worth of currency so that net present value may be applied.

It will aid in the proper recording of numbers, which will aid in the retention of

shareholders, borrowers, and other stakeholders by verifying organizational decisions and

displaying goodwill in a fair manner. The dividend payment by the subordinate entity Valley

Ltd, which has engaged in the subordinate by acquiring the designated organisation on the base

of cum dividend, may have an impact on the purchase assessment. This specific research aids in

determining the market dominance and possibility of achievement, allowing for increased

investment efficiency. Sunshine Limited is a company based in the United Kingdom.

Acquisition analysis can get affected by dividend payable by the subsidiary entity Valley

Ltd. As it has invested into the subsidiary by purchasing the specified organization on the basis

of cum dividend. This particular analysis provides guidance in assessing the market position and

likelihood success so that higher profitability from investment can be derived. Sunshine Ltd.

may be impacted by Valley Ltd's dividend payment. In a bad way, because it spent a significant

sum for the purchase and now needs to pay a stipulated additional sum to cover the

Enachi, 2021).

In attempt to decide the quantities of goodwill that have been indicated in the financial

report, a variety of explanations must be given. There are a number of elements that must be

considered while assessing good in a reasonable fashion. It covers things like effective

management, place of work, quality of products and services, benefits for businesses, customer

loyalty, and patents held by the firm, patent holders, and so on.

In order to buy a business, it is critical for Sunshine Limited to focus on the proper

calculation of goodwill, which can have a significant negative impact on the firm's economic

situations. It can have an effect on customers, borrowers, and financial firms by lowering their

reputation and reliability. Furthermore, it will have an impact on investments ability, decreased

liquidity produced from sales, a negative reputation in the sector, and so on. On this basis, it may

be concluded that Valley Ltd has immaterial goodwill knowledge, which may lead to a reduction

in the company's international popularity (Chuang, 2021). To avoid having a negative influence

on its customers, it is necessary for the company to keep good records of its image by taking into

account factors such as time worth of currency so that net present value may be applied.

It will aid in the proper recording of numbers, which will aid in the retention of

shareholders, borrowers, and other stakeholders by verifying organizational decisions and

displaying goodwill in a fair manner. The dividend payment by the subordinate entity Valley

Ltd, which has engaged in the subordinate by acquiring the designated organisation on the base

of cum dividend, may have an impact on the purchase assessment. This specific research aids in

determining the market dominance and possibility of achievement, allowing for increased

investment efficiency. Sunshine Limited is a company based in the United Kingdom.

Acquisition analysis can get affected by dividend payable by the subsidiary entity Valley

Ltd. As it has invested into the subsidiary by purchasing the specified organization on the basis

of cum dividend. This particular analysis provides guidance in assessing the market position and

likelihood success so that higher profitability from investment can be derived. Sunshine Ltd.

may be impacted by Valley Ltd's dividend payment. In a bad way, because it spent a significant

sum for the purchase and now needs to pay a stipulated additional sum to cover the

responsibility. Addressable market, diversification, share of main rivals, corporate strengths and

weaknesses, significant findings, future trends, laws, substitutes, liabilities, reputation, and

reliability are all elements to consider in a purchase study. Those are all assessed in a more

detailed manner in order to obtain the required information and efficacy of the business in order

to determine if the buyer will be useful to the particular judgment process or not (Committe,

2021). From the foregoing, it can be deduced that Valley Ltd's financial leverage contains a

greater amount of equity that is a favorable indicator of final health and the potential for

considerable revenue. According to Valley's purchase study, Sunshine will be capable to have a

favorable impact on its reputation by focusing on its greater make worth in the company, which

also will significantly improve general revenues and profits. Here on base of the purchase

review, it can be concluded that reputation has a significant influence on the firm's growth

prospects. Furthermore, dividends payable might raise Sunshine Ltd's present obligation while

also providing longer-term profits, indicating that the firm's development will be favorably

impacted (Siladjaja and Anwar, 2021).

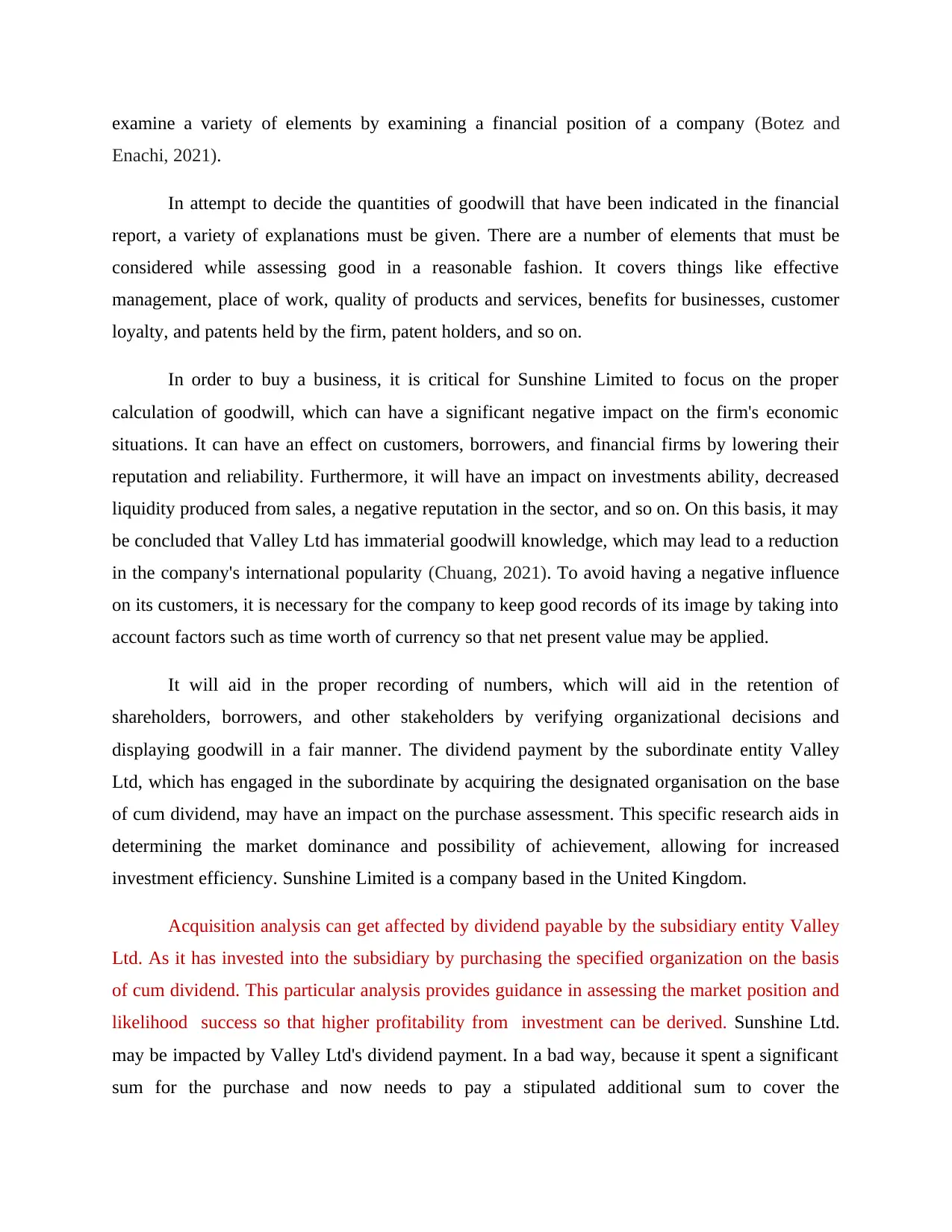

Presenting correct journal entries and reason for eliminating the same

Particulars L.F Debit Credit

1 Cash A/c Dr. 260000

Accumulated Depreciation Dr. 17500

To Gain on assets 127500

To Machinery 150000

(Being gain profit on selling of

machinery)

2 Cash A/c Dr. 6000

To profit on sales 2000

To sale 4000

weaknesses, significant findings, future trends, laws, substitutes, liabilities, reputation, and

reliability are all elements to consider in a purchase study. Those are all assessed in a more

detailed manner in order to obtain the required information and efficacy of the business in order

to determine if the buyer will be useful to the particular judgment process or not (Committe,

2021). From the foregoing, it can be deduced that Valley Ltd's financial leverage contains a

greater amount of equity that is a favorable indicator of final health and the potential for

considerable revenue. According to Valley's purchase study, Sunshine will be capable to have a

favorable impact on its reputation by focusing on its greater make worth in the company, which

also will significantly improve general revenues and profits. Here on base of the purchase

review, it can be concluded that reputation has a significant influence on the firm's growth

prospects. Furthermore, dividends payable might raise Sunshine Ltd's present obligation while

also providing longer-term profits, indicating that the firm's development will be favorably

impacted (Siladjaja and Anwar, 2021).

Presenting correct journal entries and reason for eliminating the same

Particulars L.F Debit Credit

1 Cash A/c Dr. 260000

Accumulated Depreciation Dr. 17500

To Gain on assets 127500

To Machinery 150000

(Being gain profit on selling of

machinery)

2 Cash A/c Dr. 6000

To profit on sales 2000

To sale 4000

(Being selling machinery in cash)

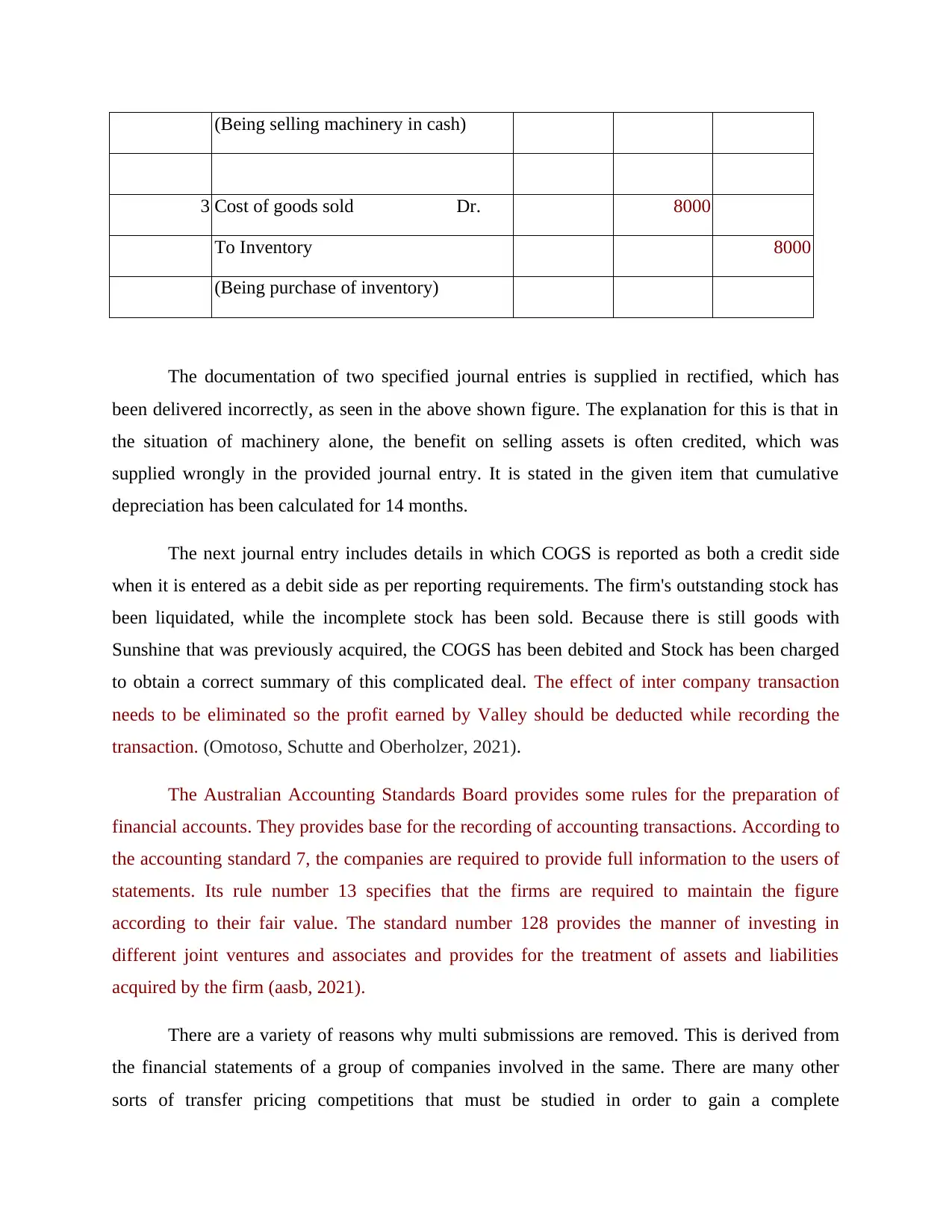

3 Cost of goods sold Dr. 8000

To Inventory 8000

(Being purchase of inventory)

The documentation of two specified journal entries is supplied in rectified, which has

been delivered incorrectly, as seen in the above shown figure. The explanation for this is that in

the situation of machinery alone, the benefit on selling assets is often credited, which was

supplied wrongly in the provided journal entry. It is stated in the given item that cumulative

depreciation has been calculated for 14 months.

The next journal entry includes details in which COGS is reported as both a credit side

when it is entered as a debit side as per reporting requirements. The firm's outstanding stock has

been liquidated, while the incomplete stock has been sold. Because there is still goods with

Sunshine that was previously acquired, the COGS has been debited and Stock has been charged

to obtain a correct summary of this complicated deal. The effect of inter company transaction

needs to be eliminated so the profit earned by Valley should be deducted while recording the

transaction. (Omotoso, Schutte and Oberholzer, 2021).

The Australian Accounting Standards Board provides some rules for the preparation of

financial accounts. They provides base for the recording of accounting transactions. According to

the accounting standard 7, the companies are required to provide full information to the users of

statements. Its rule number 13 specifies that the firms are required to maintain the figure

according to their fair value. The standard number 128 provides the manner of investing in

different joint ventures and associates and provides for the treatment of assets and liabilities

acquired by the firm (aasb, 2021).

There are a variety of reasons why multi submissions are removed. This is derived from

the financial statements of a group of companies involved in the same. There are many other

sorts of transfer pricing competitions that must be studied in order to gain a complete

3 Cost of goods sold Dr. 8000

To Inventory 8000

(Being purchase of inventory)

The documentation of two specified journal entries is supplied in rectified, which has

been delivered incorrectly, as seen in the above shown figure. The explanation for this is that in

the situation of machinery alone, the benefit on selling assets is often credited, which was

supplied wrongly in the provided journal entry. It is stated in the given item that cumulative

depreciation has been calculated for 14 months.

The next journal entry includes details in which COGS is reported as both a credit side

when it is entered as a debit side as per reporting requirements. The firm's outstanding stock has

been liquidated, while the incomplete stock has been sold. Because there is still goods with

Sunshine that was previously acquired, the COGS has been debited and Stock has been charged

to obtain a correct summary of this complicated deal. The effect of inter company transaction

needs to be eliminated so the profit earned by Valley should be deducted while recording the

transaction. (Omotoso, Schutte and Oberholzer, 2021).

The Australian Accounting Standards Board provides some rules for the preparation of

financial accounts. They provides base for the recording of accounting transactions. According to

the accounting standard 7, the companies are required to provide full information to the users of

statements. Its rule number 13 specifies that the firms are required to maintain the figure

according to their fair value. The standard number 128 provides the manner of investing in

different joint ventures and associates and provides for the treatment of assets and liabilities

acquired by the firm (aasb, 2021).

There are a variety of reasons why multi submissions are removed. This is derived from

the financial statements of a group of companies involved in the same. There are many other

sorts of transfer pricing competitions that must be studied in order to gain a complete

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

understanding. It includes cross debt, income, costs, stock holdings, and other items that are

tough for the parent business to track down. This needs a method of control to guarantee that

accurate accounting records are kept in accordance with nature. It may be interpreted as

necessary for Sunshine Ltd to remove certain activities, resulting in increased performance in

better decision making of revenue recognition and, as a result, increased capacity to make

decisions. It is recommended that the company delete both of the aforementioned transactions in

order to increase efficiency and simplicity by removing the aforementioned types of transactions

(Hunter and et.al, 2021).

According to the findings, a firm's requirement is to minimize such 3 kinds of inter-

company transactions, which will enhance the effectiveness of making appropriate choices by

incorporating such stages into procurement analyses in order to extract effective operation via

key choices. Sunshine Ltd will benefit from having a thorough understanding of the current

situation, allowing valuable data to be collected. It may be deduced that the firm has to conduct a

few modifications by omitting the stated journal entries in order to obtain adequate material

knowledge for key decision.

Technical issue

1. A incompatibility: Usually, the combined entity and the purchasing corporation both have

their own finance system, partnerships, apps, and so on, rendering seamless innovation

problematic. This can cause system requirements to slow down, ranging from ERP to marketing

to HR and everywhere in between. The need to synchronies and standardize as soon as feasible is

important.

2. A lack of transparency: Whereas if purchased and buying companies are in the same sector,

then may have identical customer data, but a lack of sight can make sales and business expansion

challenging.

PART B

To Sunshine Ltd.

Subject: For outlining concerns and arguments for the firm's acquisition

Dear Directors

This letter is to tell you that the firm has made just several measures that are now being

tough for the parent business to track down. This needs a method of control to guarantee that

accurate accounting records are kept in accordance with nature. It may be interpreted as

necessary for Sunshine Ltd to remove certain activities, resulting in increased performance in

better decision making of revenue recognition and, as a result, increased capacity to make

decisions. It is recommended that the company delete both of the aforementioned transactions in

order to increase efficiency and simplicity by removing the aforementioned types of transactions

(Hunter and et.al, 2021).

According to the findings, a firm's requirement is to minimize such 3 kinds of inter-

company transactions, which will enhance the effectiveness of making appropriate choices by

incorporating such stages into procurement analyses in order to extract effective operation via

key choices. Sunshine Ltd will benefit from having a thorough understanding of the current

situation, allowing valuable data to be collected. It may be deduced that the firm has to conduct a

few modifications by omitting the stated journal entries in order to obtain adequate material

knowledge for key decision.

Technical issue

1. A incompatibility: Usually, the combined entity and the purchasing corporation both have

their own finance system, partnerships, apps, and so on, rendering seamless innovation

problematic. This can cause system requirements to slow down, ranging from ERP to marketing

to HR and everywhere in between. The need to synchronies and standardize as soon as feasible is

important.

2. A lack of transparency: Whereas if purchased and buying companies are in the same sector,

then may have identical customer data, but a lack of sight can make sales and business expansion

challenging.

PART B

To Sunshine Ltd.

Subject: For outlining concerns and arguments for the firm's acquisition

Dear Directors

This letter is to tell you that the firm has made just several measures that are now being

rectified in order to get accurate financial statements and therefore communication for making

decisions. These measures are according to the accounting standards followed in the country.

The changes are made to rectify the incorrect posting of various transactions at the time of

acquisition. Companies should regard $ 100000 in terms of goodwill, since Valley Ltd has

invoiced this sum for the image it has built. It will be extremely beneficial to the organization

success. The cause for this is that it will damage the group firm's economic state as well as the

goodwill of the subordinate business. Numerous elements, such as time worth of currency,

market dynamics, and so forth, account for the stated quantity of reputation. Dividend due is a

current responsibility of the company that may have a significant impact on Sunshine Ltd's

posture, which will benefit the group company in the long-term.

These two parts work together to analyses purchase evaluation so that better sustainable may be

achieved by implementing all necessary steps. The main problem highlighted is the incorrect

reporting of goodwill in accounting records, which can have an influence on the company. It is

recommended that the business maintain appropriate operating by documenting the present and

real goodwill value as it has increased. Dividend payments owed are advised to be paid in order

to offer pleasure to shareholders (Johnson, and Ejimofor, 2021).

Ledgers were incorrectly recorded for a myriad of purposes, including poor

implementation of accounting concepts, which resulted in erroneous data being recorded. Cross

transactions are determined to be crucial to eliminate since they add complication, among other

things. One of the most important reasons is that the company is unable to recognize income

from sales since the company is no longer an independent legal entity. It is recommended that

the firm has undertaken appropriate steps to eliminate the problem.

If you have any query feel free to contact me any time.

Yours Sincerely,

Sharp Accounting Group Co

decisions. These measures are according to the accounting standards followed in the country.

The changes are made to rectify the incorrect posting of various transactions at the time of

acquisition. Companies should regard $ 100000 in terms of goodwill, since Valley Ltd has

invoiced this sum for the image it has built. It will be extremely beneficial to the organization

success. The cause for this is that it will damage the group firm's economic state as well as the

goodwill of the subordinate business. Numerous elements, such as time worth of currency,

market dynamics, and so forth, account for the stated quantity of reputation. Dividend due is a

current responsibility of the company that may have a significant impact on Sunshine Ltd's

posture, which will benefit the group company in the long-term.

These two parts work together to analyses purchase evaluation so that better sustainable may be

achieved by implementing all necessary steps. The main problem highlighted is the incorrect

reporting of goodwill in accounting records, which can have an influence on the company. It is

recommended that the business maintain appropriate operating by documenting the present and

real goodwill value as it has increased. Dividend payments owed are advised to be paid in order

to offer pleasure to shareholders (Johnson, and Ejimofor, 2021).

Ledgers were incorrectly recorded for a myriad of purposes, including poor

implementation of accounting concepts, which resulted in erroneous data being recorded. Cross

transactions are determined to be crucial to eliminate since they add complication, among other

things. One of the most important reasons is that the company is unable to recognize income

from sales since the company is no longer an independent legal entity. It is recommended that

the firm has undertaken appropriate steps to eliminate the problem.

If you have any query feel free to contact me any time.

Yours Sincerely,

Sharp Accounting Group Co

REFERENCES

Books and Journal

Ongayi, W. and et.al, 2021. International Financial Reporting Standards Compliance, Disclosure

and Relevance of Financial Statements as Perceived by Investors with Regards to their

Decision Making. International Journal of Economics & Business Administration

(IJEBA). 9(3). pp.154-162.

Botez, D. and Enachi, M., 2021. SOME ASPECTS REGRADING THE FUTURE OF

FINANCIAL REPORTING. STUDIES AND SCIENTIFIC RESEARCHES.

ECONOMICS EDITION, (33).

Chuang, Z., 2021. Unethical Consequences in the Financial Reporting Process. International

Journal of Ethics and Society. 3(2). pp.1-5.

Committe, B., 2021. Proposal to use the Financial Reporting Provisions of the US Securities

Laws to Implement Economic Equity and Social Justice Reforms. Global Journal of

Management And Business Research.

Siladjaja, M. and Anwar, Y., 2021. The Mapping Of Investor Perception On The High Financial

Reporting Quality. The Accounting Journal of Binaniaga. 6(1). pp.1-18.

Omotoso, M. O., Schutte, D. P. and Oberholzer, M., 2021. The effect of the adoption of

International Financial Reporting Standards on foreign portfolio investment in

Africa. South African Journal of Accounting Research, pp.1-23.

Hunter, K. E. and et.al, 2021. Standard precision and aggressive financial reporting: the

influence of incentive horizon. Accounting and Business Research, pp.1-19.

Johnson, N. and Ejimofor, P., 2021. Forensic Accounting and Quality of Financial Reporting of

Quoted Banks in Nigeria. Global Journal of Management And Business Research.

Online

aasb, 2021[online] Available through <https://aasb.gov.au/pronouncements/accounting-

standards/>

Books and Journal

Ongayi, W. and et.al, 2021. International Financial Reporting Standards Compliance, Disclosure

and Relevance of Financial Statements as Perceived by Investors with Regards to their

Decision Making. International Journal of Economics & Business Administration

(IJEBA). 9(3). pp.154-162.

Botez, D. and Enachi, M., 2021. SOME ASPECTS REGRADING THE FUTURE OF

FINANCIAL REPORTING. STUDIES AND SCIENTIFIC RESEARCHES.

ECONOMICS EDITION, (33).

Chuang, Z., 2021. Unethical Consequences in the Financial Reporting Process. International

Journal of Ethics and Society. 3(2). pp.1-5.

Committe, B., 2021. Proposal to use the Financial Reporting Provisions of the US Securities

Laws to Implement Economic Equity and Social Justice Reforms. Global Journal of

Management And Business Research.

Siladjaja, M. and Anwar, Y., 2021. The Mapping Of Investor Perception On The High Financial

Reporting Quality. The Accounting Journal of Binaniaga. 6(1). pp.1-18.

Omotoso, M. O., Schutte, D. P. and Oberholzer, M., 2021. The effect of the adoption of

International Financial Reporting Standards on foreign portfolio investment in

Africa. South African Journal of Accounting Research, pp.1-23.

Hunter, K. E. and et.al, 2021. Standard precision and aggressive financial reporting: the

influence of incentive horizon. Accounting and Business Research, pp.1-19.

Johnson, N. and Ejimofor, P., 2021. Forensic Accounting and Quality of Financial Reporting of

Quoted Banks in Nigeria. Global Journal of Management And Business Research.

Online

aasb, 2021[online] Available through <https://aasb.gov.au/pronouncements/accounting-

standards/>

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.