Avoiding Financial Distress in Intensive Care Unit

VerifiedAdded on 2019/10/31

|25

|6449

|186

Report

AI Summary

The provided content includes various research papers and books on topics such as financial analysis, data mining, risk management, financial statement analysis, cost accounting, and project management. The papers cover themes like avoiding server saturation, evaluating the effectiveness of data mining, quantitative risk management, plant growth analysis, bank branch efficiency, and more. The assignment aims to summarize these diverse research studies in a concise manner.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: FINANCIAL STATEMENT ANALYSIS

Financial Statement Analysis

Name of the Student:

Name of the University:

Authors Note:

Financial Statement Analysis

Name of the Student:

Name of the University:

Authors Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

BUSINESS LAW

Table of Contents

Answer to part 1:.............................................................................................................................3

Answer to part 2:...........................................................................................................................12

Answer to part 3:...........................................................................................................................18

References:....................................................................................................................................24

BUSINESS LAW

Table of Contents

Answer to part 1:.............................................................................................................................3

Answer to part 2:...........................................................................................................................12

Answer to part 3:...........................................................................................................................18

References:....................................................................................................................................24

3

BUSINESS LAW

Answer to part 1:

Introduction:

Established in the year 2002, DAMAC Properties is an integral part of DAMAC Group which

was formed by Hussain Sajwani in the year 1992. Over the last 15 years since its formation

DAMAC properties have become an essential part of DAMAC Group with increase amount of

contribution to the overall market capitalization of the Group. The success and expansion of

DAMAC Properties, here in after to be referred to only as Damac in this document, can be

assessed from the fact that in the month of January of 2015 it became one of the very first real

estate companies in the United Arab and Emirates to list on the Dubai Financial Market

(Stawicki 2017). Even more impressive fact was the listing of Damac in the London Stock

Exchange as it became the first real estate company from the Middle East to list on London

Stock Exchange in December, 2013.

Overview of the business:

Across Dubai and in other parts of UAE, Damac has completed several projects, commercial,

residential and mixed use projects. Apart from Dubai the company has fair share of market

presence in Abu Dhabi, Qatar, and Kingdom of Saudi Arabia. Apart from these cities and regions

where the company has progressed fair bit regions such as Jordan, Lebanon and United Kingdom

are also on the radar of company and the company has started making headways in these areas

too (Badea, R.A. and Borcoci 2014).

Financial statement analysis:

BUSINESS LAW

Answer to part 1:

Introduction:

Established in the year 2002, DAMAC Properties is an integral part of DAMAC Group which

was formed by Hussain Sajwani in the year 1992. Over the last 15 years since its formation

DAMAC properties have become an essential part of DAMAC Group with increase amount of

contribution to the overall market capitalization of the Group. The success and expansion of

DAMAC Properties, here in after to be referred to only as Damac in this document, can be

assessed from the fact that in the month of January of 2015 it became one of the very first real

estate companies in the United Arab and Emirates to list on the Dubai Financial Market

(Stawicki 2017). Even more impressive fact was the listing of Damac in the London Stock

Exchange as it became the first real estate company from the Middle East to list on London

Stock Exchange in December, 2013.

Overview of the business:

Across Dubai and in other parts of UAE, Damac has completed several projects, commercial,

residential and mixed use projects. Apart from Dubai the company has fair share of market

presence in Abu Dhabi, Qatar, and Kingdom of Saudi Arabia. Apart from these cities and regions

where the company has progressed fair bit regions such as Jordan, Lebanon and United Kingdom

are also on the radar of company and the company has started making headways in these areas

too (Badea, R.A. and Borcoci 2014).

Financial statement analysis:

4

BUSINESS LAW

Financial statement analysis is a major weapon in the hands of the stakeholders of an

organization to assess the financial position and condition of an organization and the

performance of it in a particular year. Due to the sheer importance of analyzing financial

statements properly a whole new subject has come into financial reporting concept known as

Financial Statement Analysis, FSA in short. The techniques and methods of analyzing financial

statements have undergone numerous changes over the years to make it more effective and

efficient. The better the analysis of financial statements the better would be the chances of

stakeholders taking correct decisions that affects their interests in an organization. An

organization generally requires to prepare a statement of financial position which shall include

all the assets and liabilities of such organization; a statement of profit and loss showing incomes

and expenditures of such an organization in a particular period, a statement of showing cash

flows, a statement showing changes in equity and notes forming part of accounts (Taleb and

Mohamed 2015). All these statements are to be prepared by an organization in according with

the relevant guidelines provided in domestic and international accounting standards

(International Financial Reporting Standards are the main international accounting standards).

Adhering to these accounting standards and following the financial reporting quality

enhancement guidance in preparation and presentation of financial statements will enhance the

ability of an organization to show its true and fair financial position and performance for a

particular period through its financial statements (Martellini et al. 2015).

Importance of ratio analysis:

Apart from normal assessment and verification of items of profit and loss to assess the

operating performance of an organization from the statement of financial position ratio analysis

such as gross profit margin over the last few years, operating profit ratios in the last few years,

BUSINESS LAW

Financial statement analysis is a major weapon in the hands of the stakeholders of an

organization to assess the financial position and condition of an organization and the

performance of it in a particular year. Due to the sheer importance of analyzing financial

statements properly a whole new subject has come into financial reporting concept known as

Financial Statement Analysis, FSA in short. The techniques and methods of analyzing financial

statements have undergone numerous changes over the years to make it more effective and

efficient. The better the analysis of financial statements the better would be the chances of

stakeholders taking correct decisions that affects their interests in an organization. An

organization generally requires to prepare a statement of financial position which shall include

all the assets and liabilities of such organization; a statement of profit and loss showing incomes

and expenditures of such an organization in a particular period, a statement of showing cash

flows, a statement showing changes in equity and notes forming part of accounts (Taleb and

Mohamed 2015). All these statements are to be prepared by an organization in according with

the relevant guidelines provided in domestic and international accounting standards

(International Financial Reporting Standards are the main international accounting standards).

Adhering to these accounting standards and following the financial reporting quality

enhancement guidance in preparation and presentation of financial statements will enhance the

ability of an organization to show its true and fair financial position and performance for a

particular period through its financial statements (Martellini et al. 2015).

Importance of ratio analysis:

Apart from normal assessment and verification of items of profit and loss to assess the

operating performance of an organization from the statement of financial position ratio analysis

such as gross profit margin over the last few years, operating profit ratios in the last few years,

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5

BUSINESS LAW

return on capital employed and comparison of these ratios with the corresponding ratios of the

previous years would help us to identify the progress or lack of it. Also this will help us to

identify certain abnormal fluctuations in case such fluctuations occur. For example suppose an

organization was earning a gross profit margin of 25% on sales in the last five years suddenly

experienced a huge dip in the gross profit margin as the current year gross profit margin fell to

10 or 15% of the revenue. This will indicate us that either there has been a mistake in keeping

accounting records of the organization or the management has miserably failed to use resources

of the organization properly. Similarly items of balance sheet from normal reading might only

tell us about the total liabilities and total assets of an organization. However, calculations of

current ratio, acid test ratio, capital gearing or debt to equity ratio from these items of balance

sheet would help us to assess the financial, liquidity and solvency strengths of such organization

(Grant 2016).

Assessment of profitability and financial health of the company:

In case of Damac, the annual reports of 2015 and 2016 have helped us to analyze the

financial position and operating results of organization. Using the information provided in the

profit and loss statement and balance sheet some profitability, liquidity and solvency ratios have

been calculated to assess the financial position and condition of the company better (Beadle

2014).

Profitability ratios:

Profitability ratios include gross profit margin, operating margin, net profit margin, return on

capital employed, return on equity etc. These ratios will help us to understand how the company

has been able to use its resources to earn profit from its business operations. Comparative

BUSINESS LAW

return on capital employed and comparison of these ratios with the corresponding ratios of the

previous years would help us to identify the progress or lack of it. Also this will help us to

identify certain abnormal fluctuations in case such fluctuations occur. For example suppose an

organization was earning a gross profit margin of 25% on sales in the last five years suddenly

experienced a huge dip in the gross profit margin as the current year gross profit margin fell to

10 or 15% of the revenue. This will indicate us that either there has been a mistake in keeping

accounting records of the organization or the management has miserably failed to use resources

of the organization properly. Similarly items of balance sheet from normal reading might only

tell us about the total liabilities and total assets of an organization. However, calculations of

current ratio, acid test ratio, capital gearing or debt to equity ratio from these items of balance

sheet would help us to assess the financial, liquidity and solvency strengths of such organization

(Grant 2016).

Assessment of profitability and financial health of the company:

In case of Damac, the annual reports of 2015 and 2016 have helped us to analyze the

financial position and operating results of organization. Using the information provided in the

profit and loss statement and balance sheet some profitability, liquidity and solvency ratios have

been calculated to assess the financial position and condition of the company better (Beadle

2014).

Profitability ratios:

Profitability ratios include gross profit margin, operating margin, net profit margin, return on

capital employed, return on equity etc. These ratios will help us to understand how the company

has been able to use its resources to earn profit from its business operations. Comparative

6

BUSINESS LAW

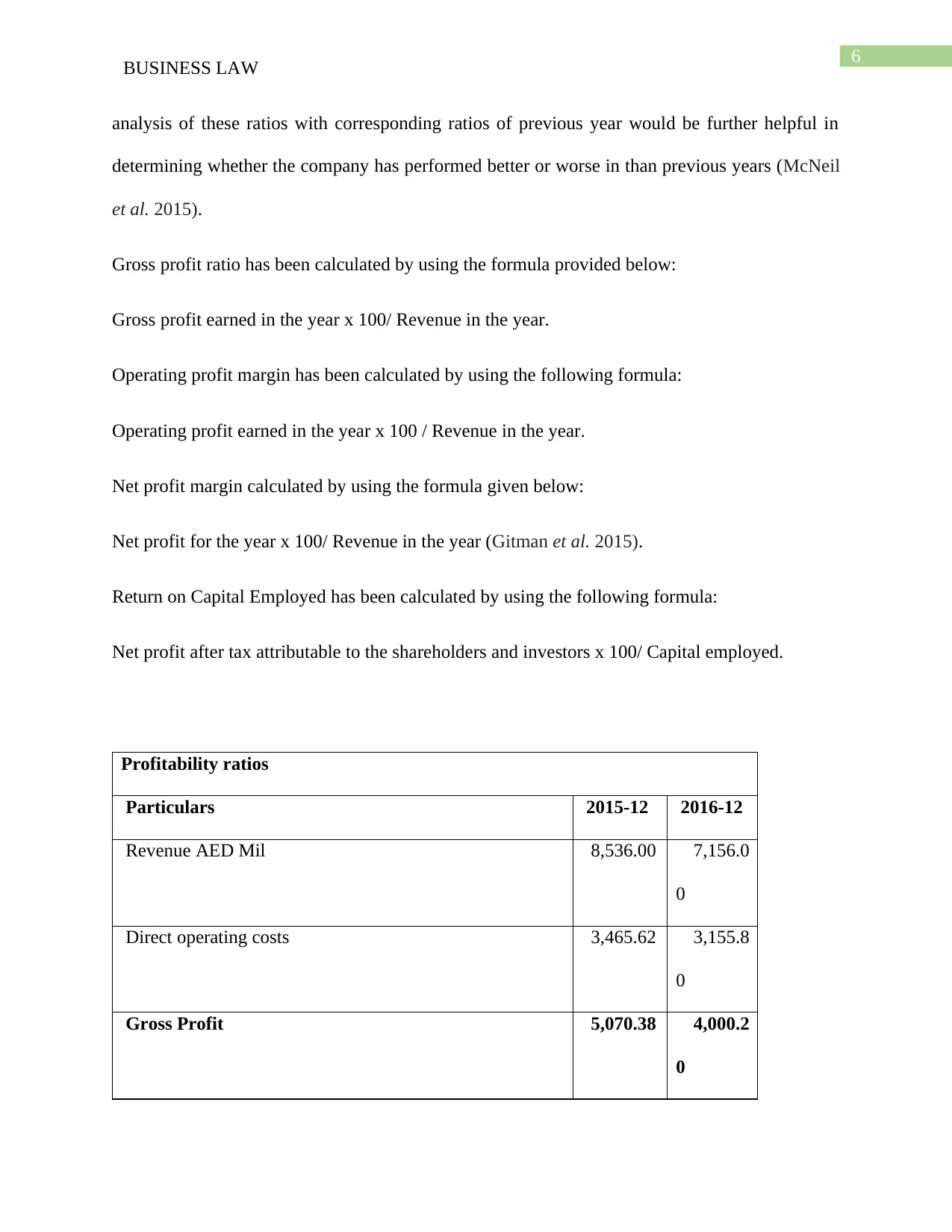

analysis of these ratios with corresponding ratios of previous year would be further helpful in

determining whether the company has performed better or worse in than previous years (McNeil

et al. 2015).

Gross profit ratio has been calculated by using the formula provided below:

Gross profit earned in the year x 100/ Revenue in the year.

Operating profit margin has been calculated by using the following formula:

Operating profit earned in the year x 100 / Revenue in the year.

Net profit margin calculated by using the formula given below:

Net profit for the year x 100/ Revenue in the year (Gitman et al. 2015).

Return on Capital Employed has been calculated by using the following formula:

Net profit after tax attributable to the shareholders and investors x 100/ Capital employed.

Profitability ratios

Particulars 2015-12 2016-12

Revenue AED Mil 8,536.00 7,156.0

0

Direct operating costs 3,465.62 3,155.8

0

Gross Profit 5,070.38 4,000.2

0

BUSINESS LAW

analysis of these ratios with corresponding ratios of previous year would be further helpful in

determining whether the company has performed better or worse in than previous years (McNeil

et al. 2015).

Gross profit ratio has been calculated by using the formula provided below:

Gross profit earned in the year x 100/ Revenue in the year.

Operating profit margin has been calculated by using the following formula:

Operating profit earned in the year x 100 / Revenue in the year.

Net profit margin calculated by using the formula given below:

Net profit for the year x 100/ Revenue in the year (Gitman et al. 2015).

Return on Capital Employed has been calculated by using the following formula:

Net profit after tax attributable to the shareholders and investors x 100/ Capital employed.

Profitability ratios

Particulars 2015-12 2016-12

Revenue AED Mil 8,536.00 7,156.0

0

Direct operating costs 3,465.62 3,155.8

0

Gross Profit 5,070.38 4,000.2

0

7

BUSINESS LAW

Gross Margin % 59.40 55.9

0

Operating Income AED Mil 4,544.00 3,717.0

0

Operating Margin % 53.23 51.9

4

Net Income AED Mil 4,515.00 3,695.0

0

Net Income Margin 52.89 51.6

3

Earnings Per Share AED 0.75 0.6

1

Book Value Per Share * AED 1.49 1.9

4

Price Earnings ratio 1.99 3.1

8

Return on Invested Capital % 43.50 23.6

7

(Gitman et al. 2015)

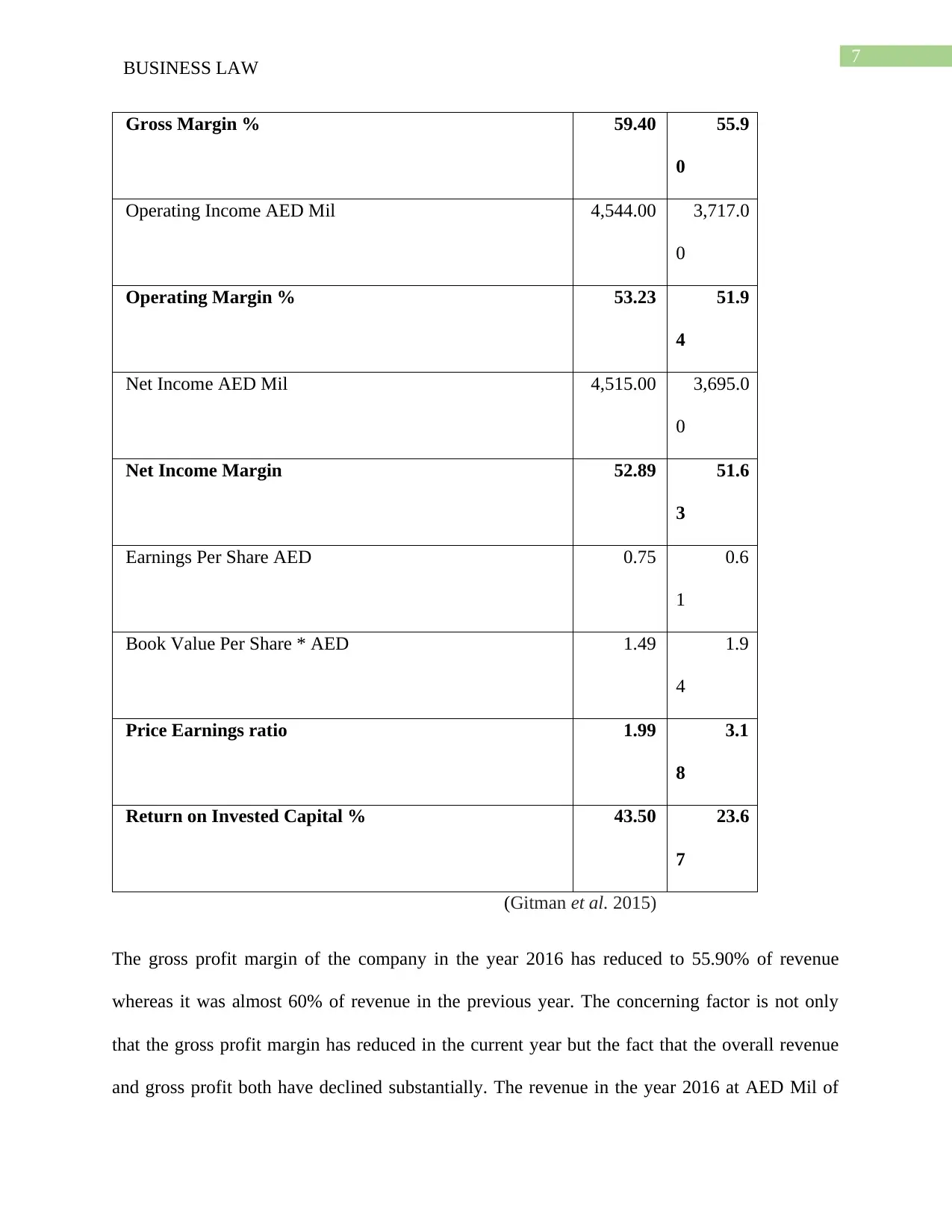

The gross profit margin of the company in the year 2016 has reduced to 55.90% of revenue

whereas it was almost 60% of revenue in the previous year. The concerning factor is not only

that the gross profit margin has reduced in the current year but the fact that the overall revenue

and gross profit both have declined substantially. The revenue in the year 2016 at AED Mil of

BUSINESS LAW

Gross Margin % 59.40 55.9

0

Operating Income AED Mil 4,544.00 3,717.0

0

Operating Margin % 53.23 51.9

4

Net Income AED Mil 4,515.00 3,695.0

0

Net Income Margin 52.89 51.6

3

Earnings Per Share AED 0.75 0.6

1

Book Value Per Share * AED 1.49 1.9

4

Price Earnings ratio 1.99 3.1

8

Return on Invested Capital % 43.50 23.6

7

(Gitman et al. 2015)

The gross profit margin of the company in the year 2016 has reduced to 55.90% of revenue

whereas it was almost 60% of revenue in the previous year. The concerning factor is not only

that the gross profit margin has reduced in the current year but the fact that the overall revenue

and gross profit both have declined substantially. The revenue in the year 2016 at AED Mil of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

BUSINESS LAW

7156 has reduced by AED Mil 1380 from the year 2015. The gross profit margin generally

reduces as the revenue increases and in such situations the slight decrease is accepted and taken

as a positive to a business. However, here it is not the case the revenue in the year has reduced

substantially by almost 17% from the year 2015 and to make the matter further worst the

company has suffered significant reduction in gross profit margin as already mentioned. New

competitors have entered the market with huge capital has taken certain bit of market share is a

reason that the company has suffered loss of revenue in the year 2016 compare to the revenue it

generated in the year 2015 (Palepu et al. 2013).

Operating income as well as operating income margin in the year 2016 both have reduced

significantly, as it took a downward turn from 53.23% of revenue in the year 2015 to 51.63% in

the year 2016. Compare the figure of 51.63% of 2016 with 86.50% of 2014 would further make

the matter worst as it would bring to a light ever increasing problem of the company to reduce its

operating expenses in running the business operations of the company. Arrival of fair bit of

competition and inability of the management to deal with the competition properly are the main

two reasons behind sudden drop in revenue as well as gross, operating and net profit margins of

the company (Robinson et al. 2015).

In short the management needs to take some measures to ensure that the decline in revenue and

profitability rates are only a passing phase and does not hand at the head of the company in the

future. Innovative and modern ideas such as new designs of multi-level buildings, new and

attractive office and home designs would help the company to attract new customers and

subsequently the revenue of the company. Efficient and effective use of resources of the

company would help the management to increase the profits and subsequently the profitability

ratios would also improve (Entwistle 2015).

BUSINESS LAW

7156 has reduced by AED Mil 1380 from the year 2015. The gross profit margin generally

reduces as the revenue increases and in such situations the slight decrease is accepted and taken

as a positive to a business. However, here it is not the case the revenue in the year has reduced

substantially by almost 17% from the year 2015 and to make the matter further worst the

company has suffered significant reduction in gross profit margin as already mentioned. New

competitors have entered the market with huge capital has taken certain bit of market share is a

reason that the company has suffered loss of revenue in the year 2016 compare to the revenue it

generated in the year 2015 (Palepu et al. 2013).

Operating income as well as operating income margin in the year 2016 both have reduced

significantly, as it took a downward turn from 53.23% of revenue in the year 2015 to 51.63% in

the year 2016. Compare the figure of 51.63% of 2016 with 86.50% of 2014 would further make

the matter worst as it would bring to a light ever increasing problem of the company to reduce its

operating expenses in running the business operations of the company. Arrival of fair bit of

competition and inability of the management to deal with the competition properly are the main

two reasons behind sudden drop in revenue as well as gross, operating and net profit margins of

the company (Robinson et al. 2015).

In short the management needs to take some measures to ensure that the decline in revenue and

profitability rates are only a passing phase and does not hand at the head of the company in the

future. Innovative and modern ideas such as new designs of multi-level buildings, new and

attractive office and home designs would help the company to attract new customers and

subsequently the revenue of the company. Efficient and effective use of resources of the

company would help the management to increase the profits and subsequently the profitability

ratios would also improve (Entwistle 2015).

9

BUSINESS LAW

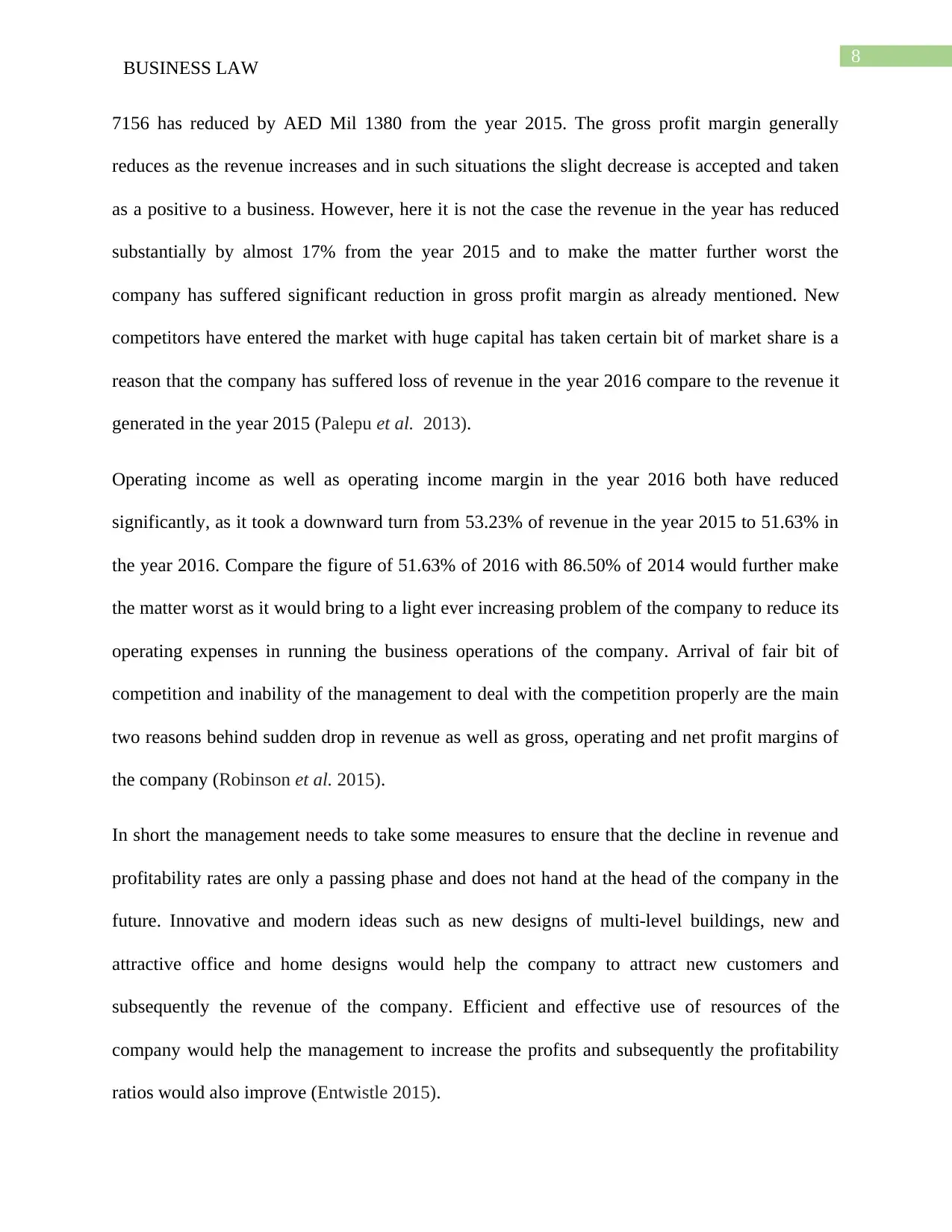

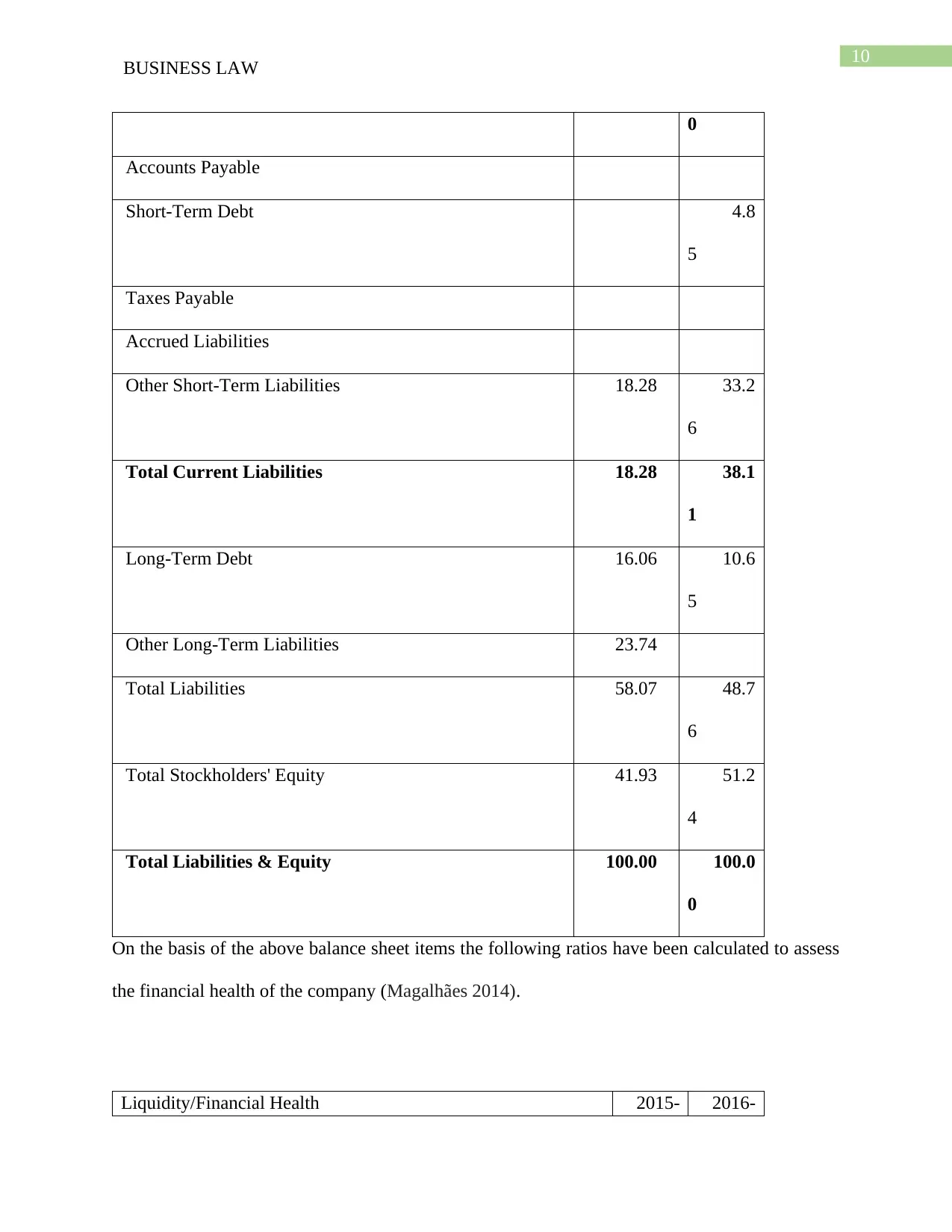

Let us now talk about the balance sheet items to compute liquidity and solvency related ratios of

Damac to assess its financial health in addition to its financial position as on 31 December, 2016.

Financial health ratios: Financial health ratios can mainly be segregated into two primary

categories, these are liquidity ratios and solvency ratios. Liquidity ratios include current ratio,

acid-test ratio; current ratio shows the proportion of current assets to current liabilities of an

organization as on a particular date whereas the acid test ratio helps us to find to ability to pay

quick liabilities from quick assets (Dalnial et al. 2014).

Balance Sheet Items (in %) 2015-12 2016-12

Cash & Short-Term Investments 40.52 33.7

7

Accounts Receivable

Inventory

Other Current Assets 16.22 19.5

1

Total Current Assets 56.74 53.2

8

Net PP&E 0.27 0.2

4

Intangibles

Other Long-Term Assets 42.99 46.4

8

Total Assets 100.00 100.0

BUSINESS LAW

Let us now talk about the balance sheet items to compute liquidity and solvency related ratios of

Damac to assess its financial health in addition to its financial position as on 31 December, 2016.

Financial health ratios: Financial health ratios can mainly be segregated into two primary

categories, these are liquidity ratios and solvency ratios. Liquidity ratios include current ratio,

acid-test ratio; current ratio shows the proportion of current assets to current liabilities of an

organization as on a particular date whereas the acid test ratio helps us to find to ability to pay

quick liabilities from quick assets (Dalnial et al. 2014).

Balance Sheet Items (in %) 2015-12 2016-12

Cash & Short-Term Investments 40.52 33.7

7

Accounts Receivable

Inventory

Other Current Assets 16.22 19.5

1

Total Current Assets 56.74 53.2

8

Net PP&E 0.27 0.2

4

Intangibles

Other Long-Term Assets 42.99 46.4

8

Total Assets 100.00 100.0

10

BUSINESS LAW

0

Accounts Payable

Short-Term Debt 4.8

5

Taxes Payable

Accrued Liabilities

Other Short-Term Liabilities 18.28 33.2

6

Total Current Liabilities 18.28 38.1

1

Long-Term Debt 16.06 10.6

5

Other Long-Term Liabilities 23.74

Total Liabilities 58.07 48.7

6

Total Stockholders' Equity 41.93 51.2

4

Total Liabilities & Equity 100.00 100.0

0

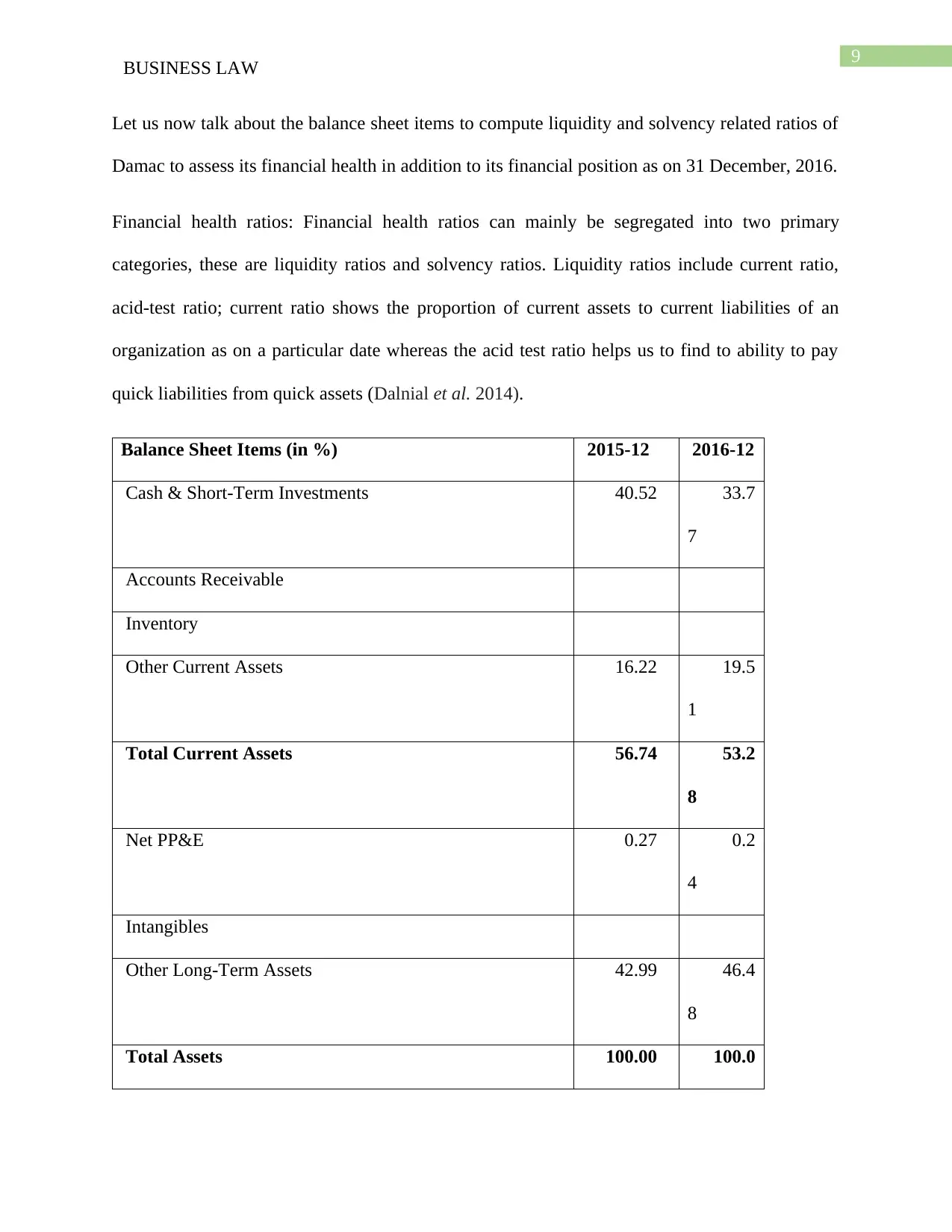

On the basis of the above balance sheet items the following ratios have been calculated to assess

the financial health of the company (Magalhães 2014).

Liquidity/Financial Health 2015- 2016-

BUSINESS LAW

0

Accounts Payable

Short-Term Debt 4.8

5

Taxes Payable

Accrued Liabilities

Other Short-Term Liabilities 18.28 33.2

6

Total Current Liabilities 18.28 38.1

1

Long-Term Debt 16.06 10.6

5

Other Long-Term Liabilities 23.74

Total Liabilities 58.07 48.7

6

Total Stockholders' Equity 41.93 51.2

4

Total Liabilities & Equity 100.00 100.0

0

On the basis of the above balance sheet items the following ratios have been calculated to assess

the financial health of the company (Magalhães 2014).

Liquidity/Financial Health 2015- 2016-

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11

BUSINESS LAW

12 12

Current Ratio 3.

10

1.

40

Acid test ratio 3.

10

1.

40

Financial Leverage 2.

39

1.

95

Gearing ratio 0.

38

0.

21

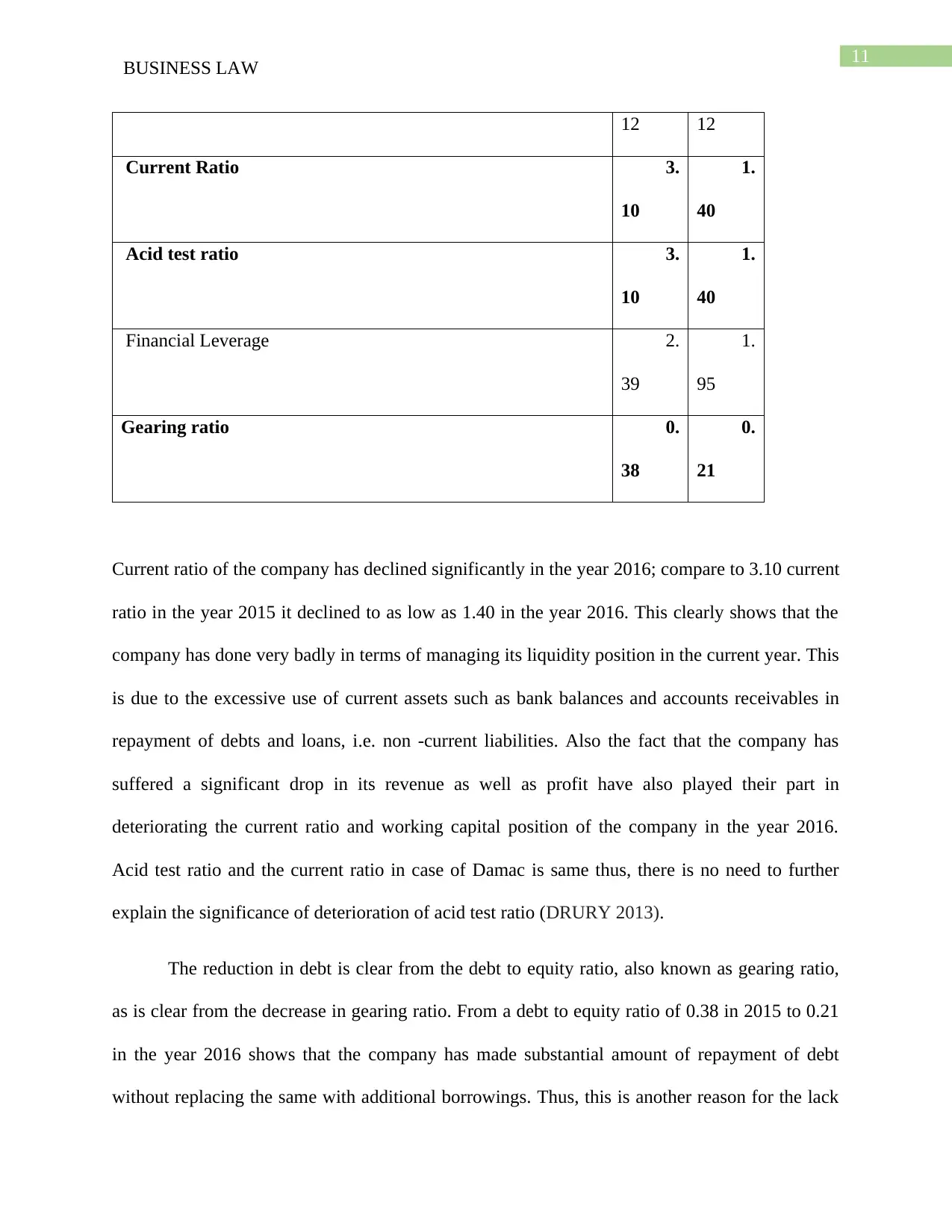

Current ratio of the company has declined significantly in the year 2016; compare to 3.10 current

ratio in the year 2015 it declined to as low as 1.40 in the year 2016. This clearly shows that the

company has done very badly in terms of managing its liquidity position in the current year. This

is due to the excessive use of current assets such as bank balances and accounts receivables in

repayment of debts and loans, i.e. non -current liabilities. Also the fact that the company has

suffered a significant drop in its revenue as well as profit have also played their part in

deteriorating the current ratio and working capital position of the company in the year 2016.

Acid test ratio and the current ratio in case of Damac is same thus, there is no need to further

explain the significance of deterioration of acid test ratio (DRURY 2013).

The reduction in debt is clear from the debt to equity ratio, also known as gearing ratio,

as is clear from the decrease in gearing ratio. From a debt to equity ratio of 0.38 in 2015 to 0.21

in the year 2016 shows that the company has made substantial amount of repayment of debt

without replacing the same with additional borrowings. Thus, this is another reason for the lack

BUSINESS LAW

12 12

Current Ratio 3.

10

1.

40

Acid test ratio 3.

10

1.

40

Financial Leverage 2.

39

1.

95

Gearing ratio 0.

38

0.

21

Current ratio of the company has declined significantly in the year 2016; compare to 3.10 current

ratio in the year 2015 it declined to as low as 1.40 in the year 2016. This clearly shows that the

company has done very badly in terms of managing its liquidity position in the current year. This

is due to the excessive use of current assets such as bank balances and accounts receivables in

repayment of debts and loans, i.e. non -current liabilities. Also the fact that the company has

suffered a significant drop in its revenue as well as profit have also played their part in

deteriorating the current ratio and working capital position of the company in the year 2016.

Acid test ratio and the current ratio in case of Damac is same thus, there is no need to further

explain the significance of deterioration of acid test ratio (DRURY 2013).

The reduction in debt is clear from the debt to equity ratio, also known as gearing ratio,

as is clear from the decrease in gearing ratio. From a debt to equity ratio of 0.38 in 2015 to 0.21

in the year 2016 shows that the company has made substantial amount of repayment of debt

without replacing the same with additional borrowings. Thus, this is another reason for the lack

12

BUSINESS LAW

of revenue, as it shows that the company has not made any significant investment in new projects

thus, the sudden drop in revenue.

Answer to part 2:

A company has the option to use numerous sources from which the funds can be arranged to

finance different expansion projects. Unlike other forms of organization a company is at a huge

advantage as it can get access to both equity market as well as debt market with ease to collect

funds necessary to finance different expansion projects. DAMAC Properties has also decided to

start a huge expansion project at the start of 2018 and accordingly has made plan to move

towards that goal by arranging necessary funds to finance the expansion. According to the

management expectation the company will need additional 15% of net assets employed by it at

present in the business, i.e. net asset of the company as on 31 December, 2016 to swiftly run the

expansion operations. In this part of the document a detailed discussion shall be made on the

various sources that the company can use to arrange the necessary funds required for expansion

keeping in mind the current capital structure of the company and its suitability. Thus, the first

priority of us is to calculate the net current asset of the company as on December 31, 2016 and

then to find out the amount of additional capital required by Damac to fiancé its expansion

project at the beginning of 2018 (Schoenebeck and Holtzman 2013).

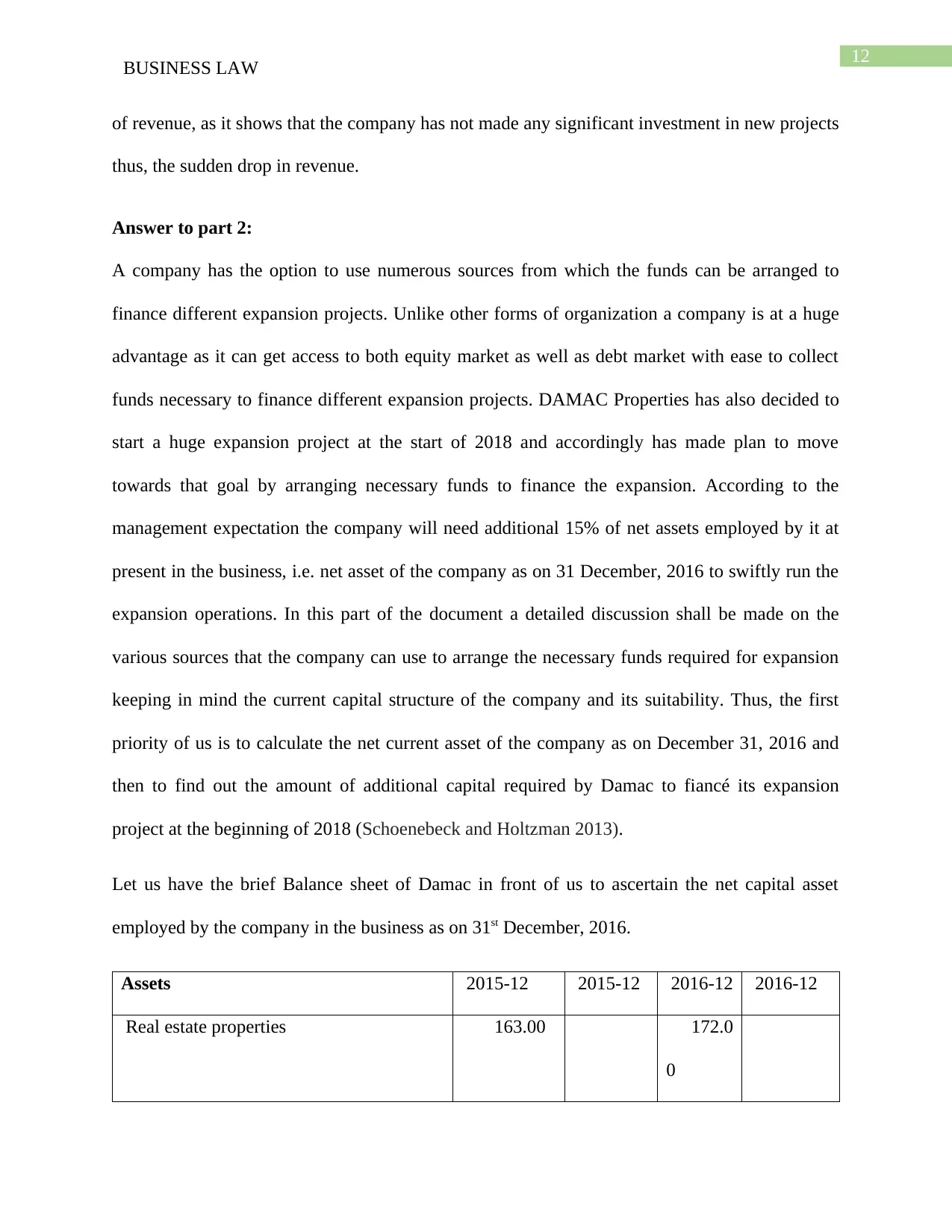

Let us have the brief Balance sheet of Damac in front of us to ascertain the net capital asset

employed by the company in the business as on 31st December, 2016.

Assets 2015-12 2015-12 2016-12 2016-12

Real estate properties 163.00 172.0

0

BUSINESS LAW

of revenue, as it shows that the company has not made any significant investment in new projects

thus, the sudden drop in revenue.

Answer to part 2:

A company has the option to use numerous sources from which the funds can be arranged to

finance different expansion projects. Unlike other forms of organization a company is at a huge

advantage as it can get access to both equity market as well as debt market with ease to collect

funds necessary to finance different expansion projects. DAMAC Properties has also decided to

start a huge expansion project at the start of 2018 and accordingly has made plan to move

towards that goal by arranging necessary funds to finance the expansion. According to the

management expectation the company will need additional 15% of net assets employed by it at

present in the business, i.e. net asset of the company as on 31 December, 2016 to swiftly run the

expansion operations. In this part of the document a detailed discussion shall be made on the

various sources that the company can use to arrange the necessary funds required for expansion

keeping in mind the current capital structure of the company and its suitability. Thus, the first

priority of us is to calculate the net current asset of the company as on December 31, 2016 and

then to find out the amount of additional capital required by Damac to fiancé its expansion

project at the beginning of 2018 (Schoenebeck and Holtzman 2013).

Let us have the brief Balance sheet of Damac in front of us to ascertain the net capital asset

employed by the company in the business as on 31st December, 2016.

Assets 2015-12 2015-12 2016-12 2016-12

Real estate properties 163.00 172.0

0

13

BUSINESS LAW

Accumulated depreciation (99.00) (113.0

0)

Real estate properties, net 64.0

0

59.0

0

Cash and cash equivalents 9,501.0

0

8,316.0

0

Other assets 13,883.0

0

16,251.0

0

Total assets 23,448.0

0

24,626.0

0

Liabilities and stockholders' equity

Liabilities

Short-term borrowing 1,194.0

0

Long-term debt 3,765.00 2,622.0

0

Other liabilities 9,852.00 8,192.0

0

Total liabilities 13,617.0

0

12,008.0

0

Stockholders' equity

Retained earnings 8,160.00 5,934.0

0

BUSINESS LAW

Accumulated depreciation (99.00) (113.0

0)

Real estate properties, net 64.0

0

59.0

0

Cash and cash equivalents 9,501.0

0

8,316.0

0

Other assets 13,883.0

0

16,251.0

0

Total assets 23,448.0

0

24,626.0

0

Liabilities and stockholders' equity

Liabilities

Short-term borrowing 1,194.0

0

Long-term debt 3,765.00 2,622.0

0

Other liabilities 9,852.00 8,192.0

0

Total liabilities 13,617.0

0

12,008.0

0

Stockholders' equity

Retained earnings 8,160.00 5,934.0

0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14

BUSINESS LAW

Accumulated other comprehensive

income

1,671.00 6,684.0

0

Total stockholders' equity 9,831.0

0

12,618.0

0

Total liabilities and stockholders'

equity

23,448.0

0

24,626.0

0

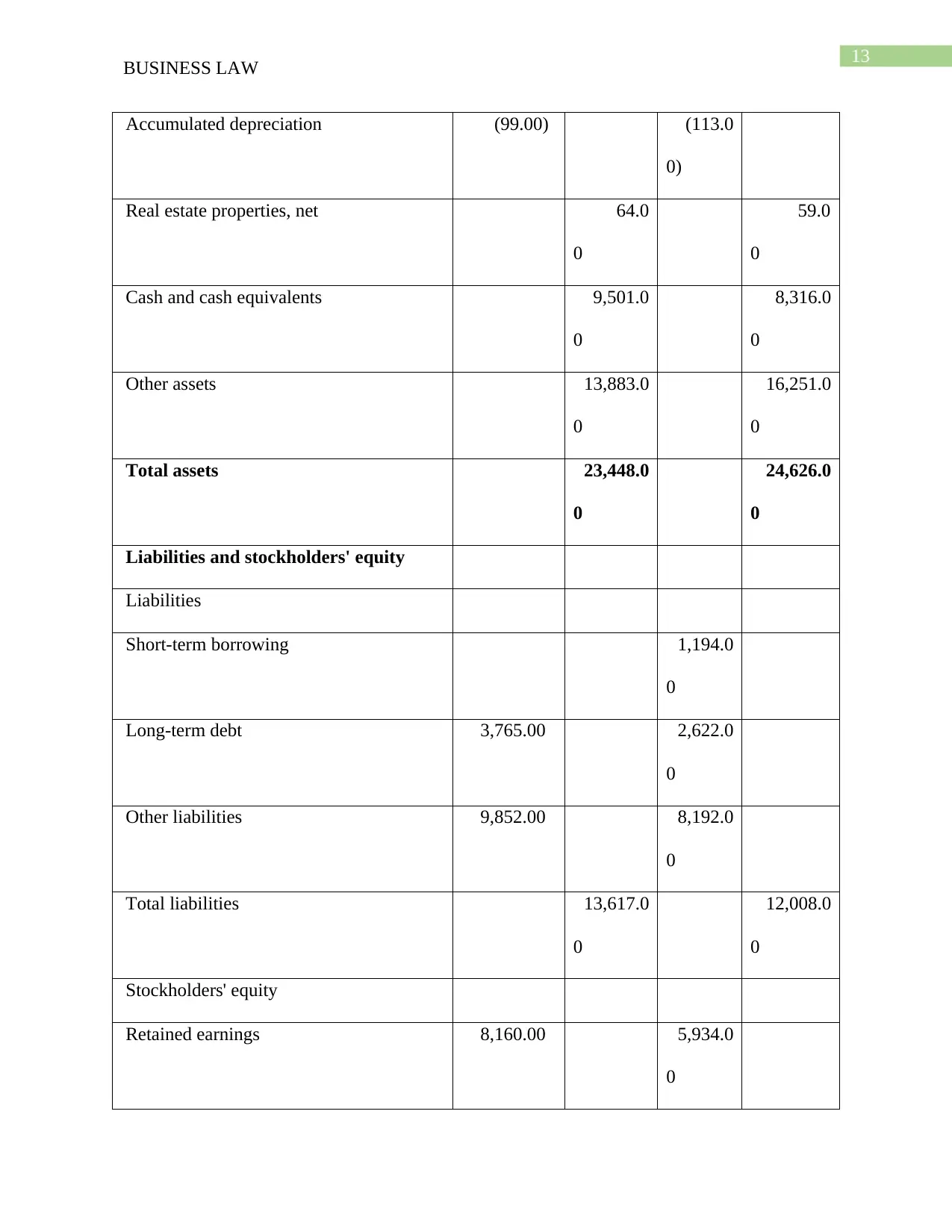

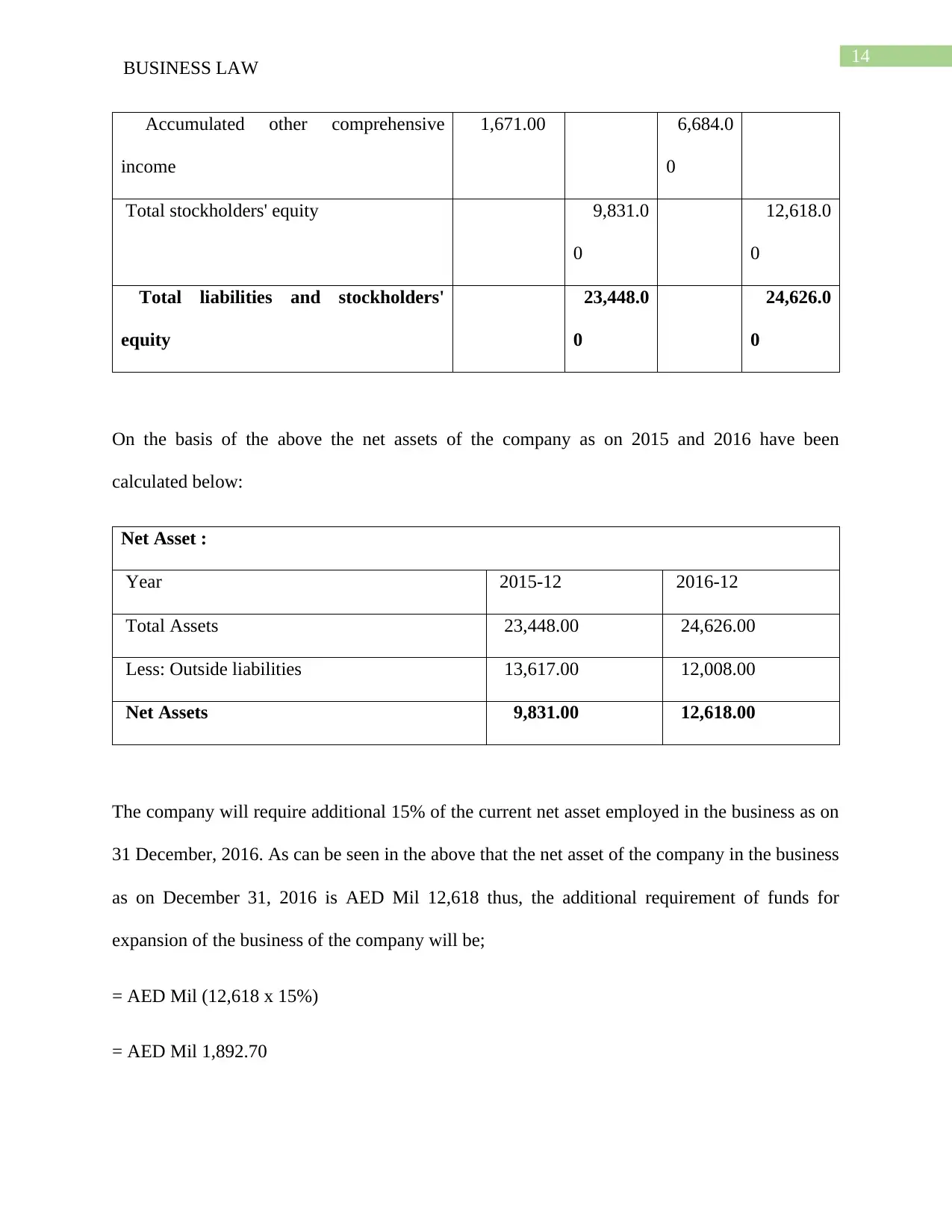

On the basis of the above the net assets of the company as on 2015 and 2016 have been

calculated below:

Net Asset :

Year 2015-12 2016-12

Total Assets 23,448.00 24,626.00

Less: Outside liabilities 13,617.00 12,008.00

Net Assets 9,831.00 12,618.00

The company will require additional 15% of the current net asset employed in the business as on

31 December, 2016. As can be seen in the above that the net asset of the company in the business

as on December 31, 2016 is AED Mil 12,618 thus, the additional requirement of funds for

expansion of the business of the company will be;

= AED Mil (12,618 x 15%)

= AED Mil 1,892.70

BUSINESS LAW

Accumulated other comprehensive

income

1,671.00 6,684.0

0

Total stockholders' equity 9,831.0

0

12,618.0

0

Total liabilities and stockholders'

equity

23,448.0

0

24,626.0

0

On the basis of the above the net assets of the company as on 2015 and 2016 have been

calculated below:

Net Asset :

Year 2015-12 2016-12

Total Assets 23,448.00 24,626.00

Less: Outside liabilities 13,617.00 12,008.00

Net Assets 9,831.00 12,618.00

The company will require additional 15% of the current net asset employed in the business as on

31 December, 2016. As can be seen in the above that the net asset of the company in the business

as on December 31, 2016 is AED Mil 12,618 thus, the additional requirement of funds for

expansion of the business of the company will be;

= AED Mil (12,618 x 15%)

= AED Mil 1,892.70

15

BUSINESS LAW

Thus, approximately the company will need an additional capital of AED Mil 1,893 to finance

the expansion of the business at the start of 2018.

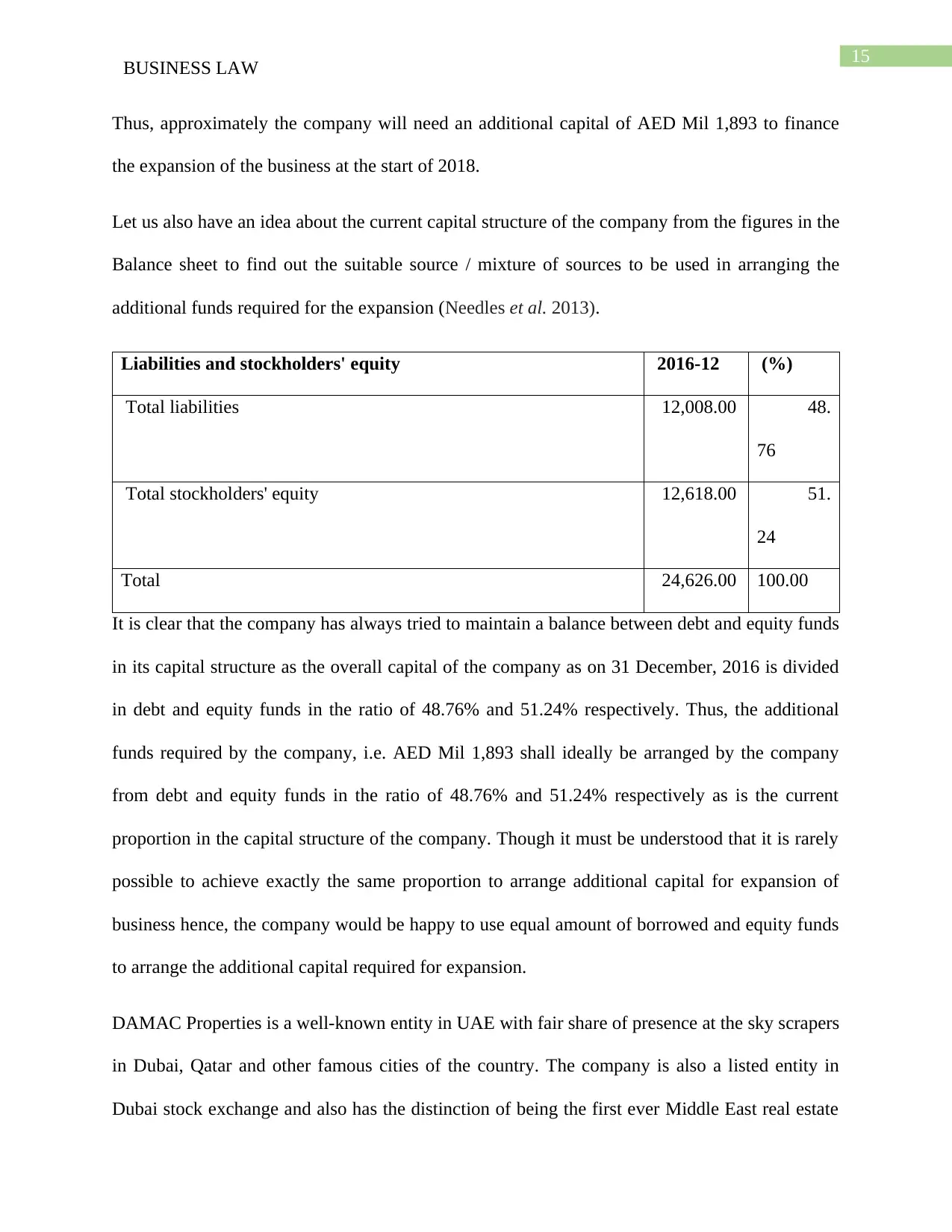

Let us also have an idea about the current capital structure of the company from the figures in the

Balance sheet to find out the suitable source / mixture of sources to be used in arranging the

additional funds required for the expansion (Needles et al. 2013).

Liabilities and stockholders' equity 2016-12 (%)

Total liabilities 12,008.00 48.

76

Total stockholders' equity 12,618.00 51.

24

Total 24,626.00 100.00

It is clear that the company has always tried to maintain a balance between debt and equity funds

in its capital structure as the overall capital of the company as on 31 December, 2016 is divided

in debt and equity funds in the ratio of 48.76% and 51.24% respectively. Thus, the additional

funds required by the company, i.e. AED Mil 1,893 shall ideally be arranged by the company

from debt and equity funds in the ratio of 48.76% and 51.24% respectively as is the current

proportion in the capital structure of the company. Though it must be understood that it is rarely

possible to achieve exactly the same proportion to arrange additional capital for expansion of

business hence, the company would be happy to use equal amount of borrowed and equity funds

to arrange the additional capital required for expansion.

DAMAC Properties is a well-known entity in UAE with fair share of presence at the sky scrapers

in Dubai, Qatar and other famous cities of the country. The company is also a listed entity in

Dubai stock exchange and also has the distinction of being the first ever Middle East real estate

BUSINESS LAW

Thus, approximately the company will need an additional capital of AED Mil 1,893 to finance

the expansion of the business at the start of 2018.

Let us also have an idea about the current capital structure of the company from the figures in the

Balance sheet to find out the suitable source / mixture of sources to be used in arranging the

additional funds required for the expansion (Needles et al. 2013).

Liabilities and stockholders' equity 2016-12 (%)

Total liabilities 12,008.00 48.

76

Total stockholders' equity 12,618.00 51.

24

Total 24,626.00 100.00

It is clear that the company has always tried to maintain a balance between debt and equity funds

in its capital structure as the overall capital of the company as on 31 December, 2016 is divided

in debt and equity funds in the ratio of 48.76% and 51.24% respectively. Thus, the additional

funds required by the company, i.e. AED Mil 1,893 shall ideally be arranged by the company

from debt and equity funds in the ratio of 48.76% and 51.24% respectively as is the current

proportion in the capital structure of the company. Though it must be understood that it is rarely

possible to achieve exactly the same proportion to arrange additional capital for expansion of

business hence, the company would be happy to use equal amount of borrowed and equity funds

to arrange the additional capital required for expansion.

DAMAC Properties is a well-known entity in UAE with fair share of presence at the sky scrapers

in Dubai, Qatar and other famous cities of the country. The company is also a listed entity in

Dubai stock exchange and also has the distinction of being the first ever Middle East real estate

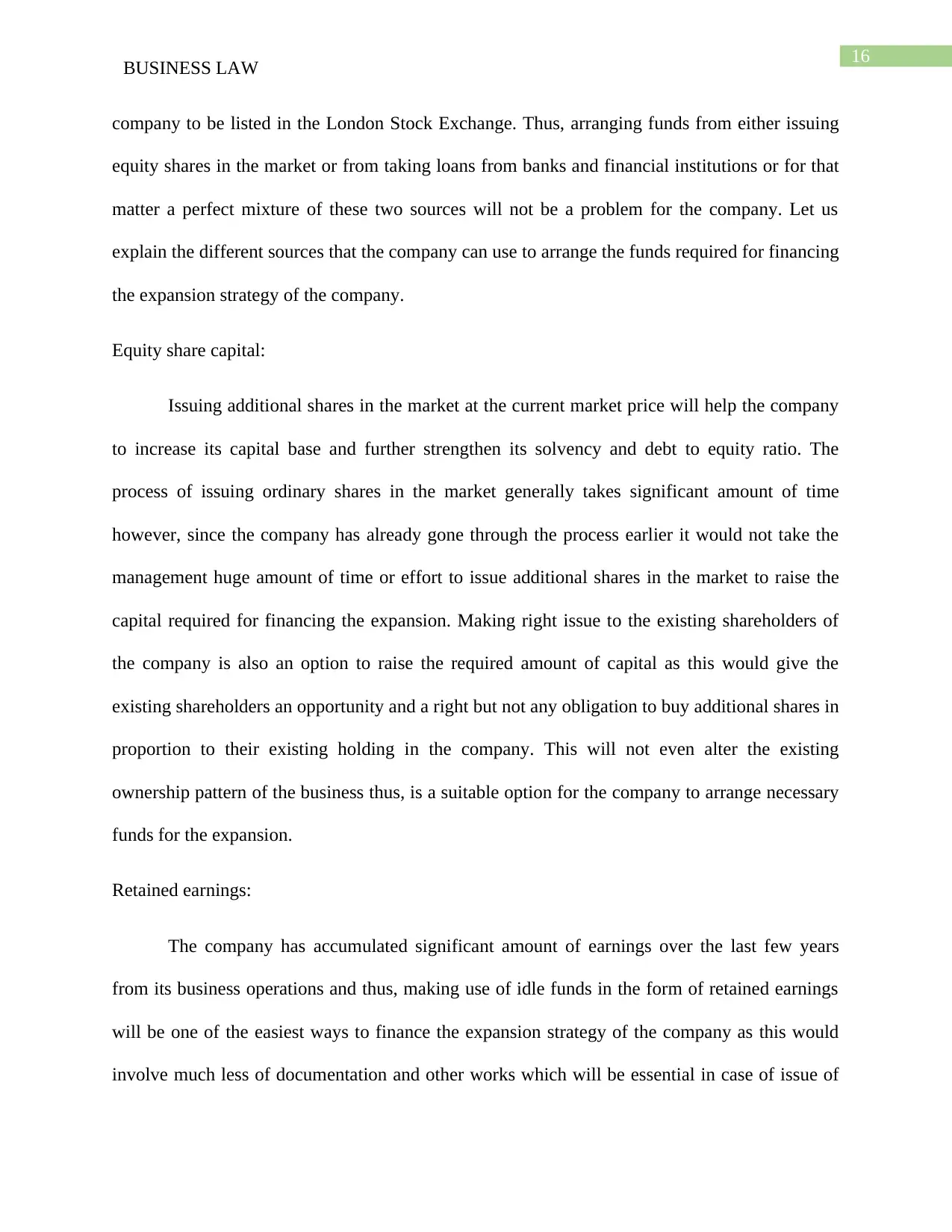

16

BUSINESS LAW

company to be listed in the London Stock Exchange. Thus, arranging funds from either issuing

equity shares in the market or from taking loans from banks and financial institutions or for that

matter a perfect mixture of these two sources will not be a problem for the company. Let us

explain the different sources that the company can use to arrange the funds required for financing

the expansion strategy of the company.

Equity share capital:

Issuing additional shares in the market at the current market price will help the company

to increase its capital base and further strengthen its solvency and debt to equity ratio. The

process of issuing ordinary shares in the market generally takes significant amount of time

however, since the company has already gone through the process earlier it would not take the

management huge amount of time or effort to issue additional shares in the market to raise the

capital required for financing the expansion. Making right issue to the existing shareholders of

the company is also an option to raise the required amount of capital as this would give the

existing shareholders an opportunity and a right but not any obligation to buy additional shares in

proportion to their existing holding in the company. This will not even alter the existing

ownership pattern of the business thus, is a suitable option for the company to arrange necessary

funds for the expansion.

Retained earnings:

The company has accumulated significant amount of earnings over the last few years

from its business operations and thus, making use of idle funds in the form of retained earnings

will be one of the easiest ways to finance the expansion strategy of the company as this would

involve much less of documentation and other works which will be essential in case of issue of

BUSINESS LAW

company to be listed in the London Stock Exchange. Thus, arranging funds from either issuing

equity shares in the market or from taking loans from banks and financial institutions or for that

matter a perfect mixture of these two sources will not be a problem for the company. Let us

explain the different sources that the company can use to arrange the funds required for financing

the expansion strategy of the company.

Equity share capital:

Issuing additional shares in the market at the current market price will help the company

to increase its capital base and further strengthen its solvency and debt to equity ratio. The

process of issuing ordinary shares in the market generally takes significant amount of time

however, since the company has already gone through the process earlier it would not take the

management huge amount of time or effort to issue additional shares in the market to raise the

capital required for financing the expansion. Making right issue to the existing shareholders of

the company is also an option to raise the required amount of capital as this would give the

existing shareholders an opportunity and a right but not any obligation to buy additional shares in

proportion to their existing holding in the company. This will not even alter the existing

ownership pattern of the business thus, is a suitable option for the company to arrange necessary

funds for the expansion.

Retained earnings:

The company has accumulated significant amount of earnings over the last few years

from its business operations and thus, making use of idle funds in the form of retained earnings

will be one of the easiest ways to finance the expansion strategy of the company as this would

involve much less of documentation and other works which will be essential in case of issue of

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

17

BUSINESS LAW

additional shares or for that matter taking additional loans from banks. The cost of using retained

earnings is generally the lowest amongst all the other sources to finance a project thus, the

management should consider the use of retained earnings to finance the expansion project.

Borrowings:

Borrowing funds is one of the easiest and least costly methods of financing. Not only

companies but also other forms of organizations which do not have the right to issue shares to

the public to raise funds for financing their business operations can take loans and borrow funds

from banks and financial institutions to finance different projects. The advantage of borrowing is

that interest costs for such borrowings are allowed as deduction in computation of taxable

income thus, Damac will be able to use the tax shield to reduce its taxable profit and resultant tax

from business operations.

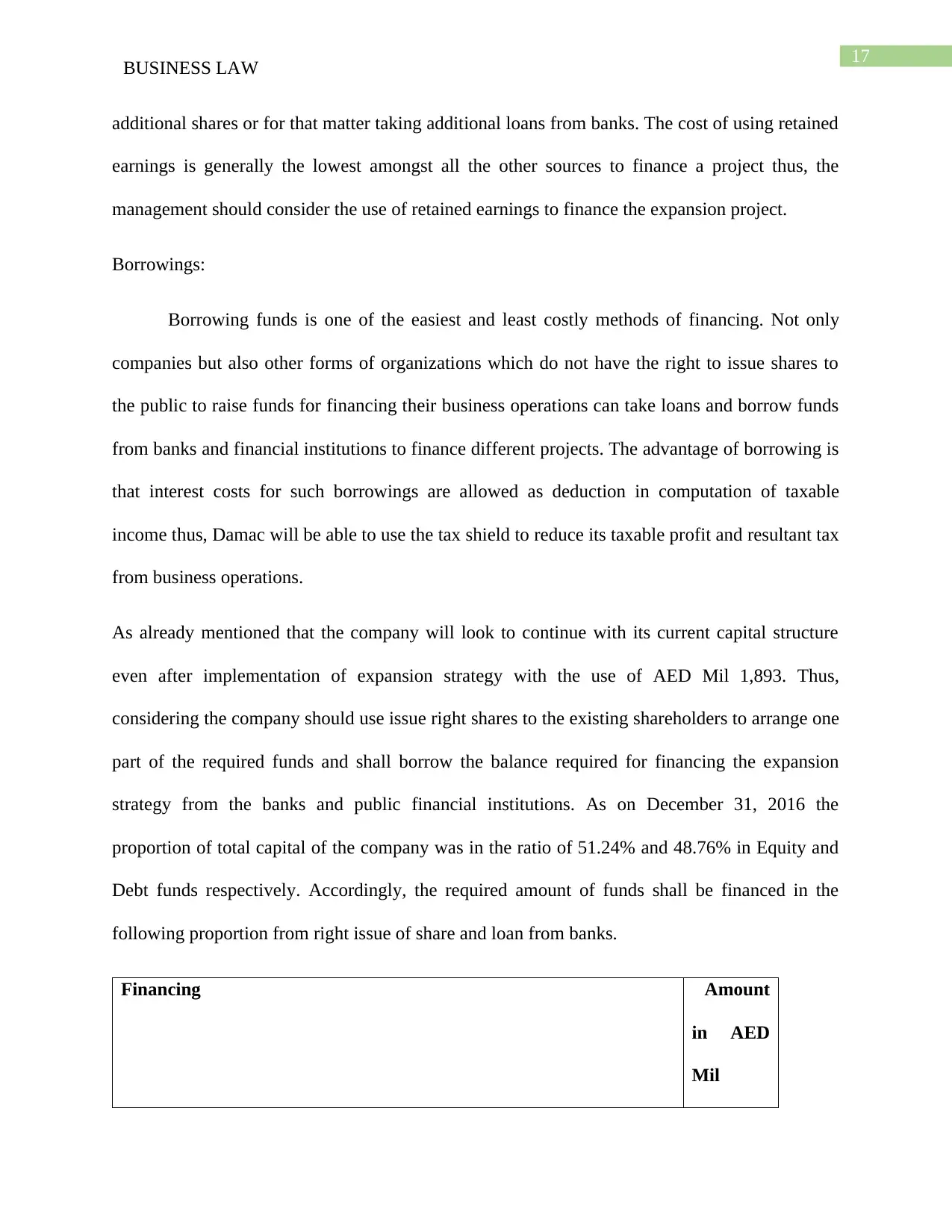

As already mentioned that the company will look to continue with its current capital structure

even after implementation of expansion strategy with the use of AED Mil 1,893. Thus,

considering the company should use issue right shares to the existing shareholders to arrange one

part of the required funds and shall borrow the balance required for financing the expansion

strategy from the banks and public financial institutions. As on December 31, 2016 the

proportion of total capital of the company was in the ratio of 51.24% and 48.76% in Equity and

Debt funds respectively. Accordingly, the required amount of funds shall be financed in the

following proportion from right issue of share and loan from banks.

Financing Amount

in AED

Mil

BUSINESS LAW

additional shares or for that matter taking additional loans from banks. The cost of using retained

earnings is generally the lowest amongst all the other sources to finance a project thus, the

management should consider the use of retained earnings to finance the expansion project.

Borrowings:

Borrowing funds is one of the easiest and least costly methods of financing. Not only

companies but also other forms of organizations which do not have the right to issue shares to

the public to raise funds for financing their business operations can take loans and borrow funds

from banks and financial institutions to finance different projects. The advantage of borrowing is

that interest costs for such borrowings are allowed as deduction in computation of taxable

income thus, Damac will be able to use the tax shield to reduce its taxable profit and resultant tax

from business operations.

As already mentioned that the company will look to continue with its current capital structure

even after implementation of expansion strategy with the use of AED Mil 1,893. Thus,

considering the company should use issue right shares to the existing shareholders to arrange one

part of the required funds and shall borrow the balance required for financing the expansion

strategy from the banks and public financial institutions. As on December 31, 2016 the

proportion of total capital of the company was in the ratio of 51.24% and 48.76% in Equity and

Debt funds respectively. Accordingly, the required amount of funds shall be financed in the

following proportion from right issue of share and loan from banks.

Financing Amount

in AED

Mil

18

BUSINESS LAW

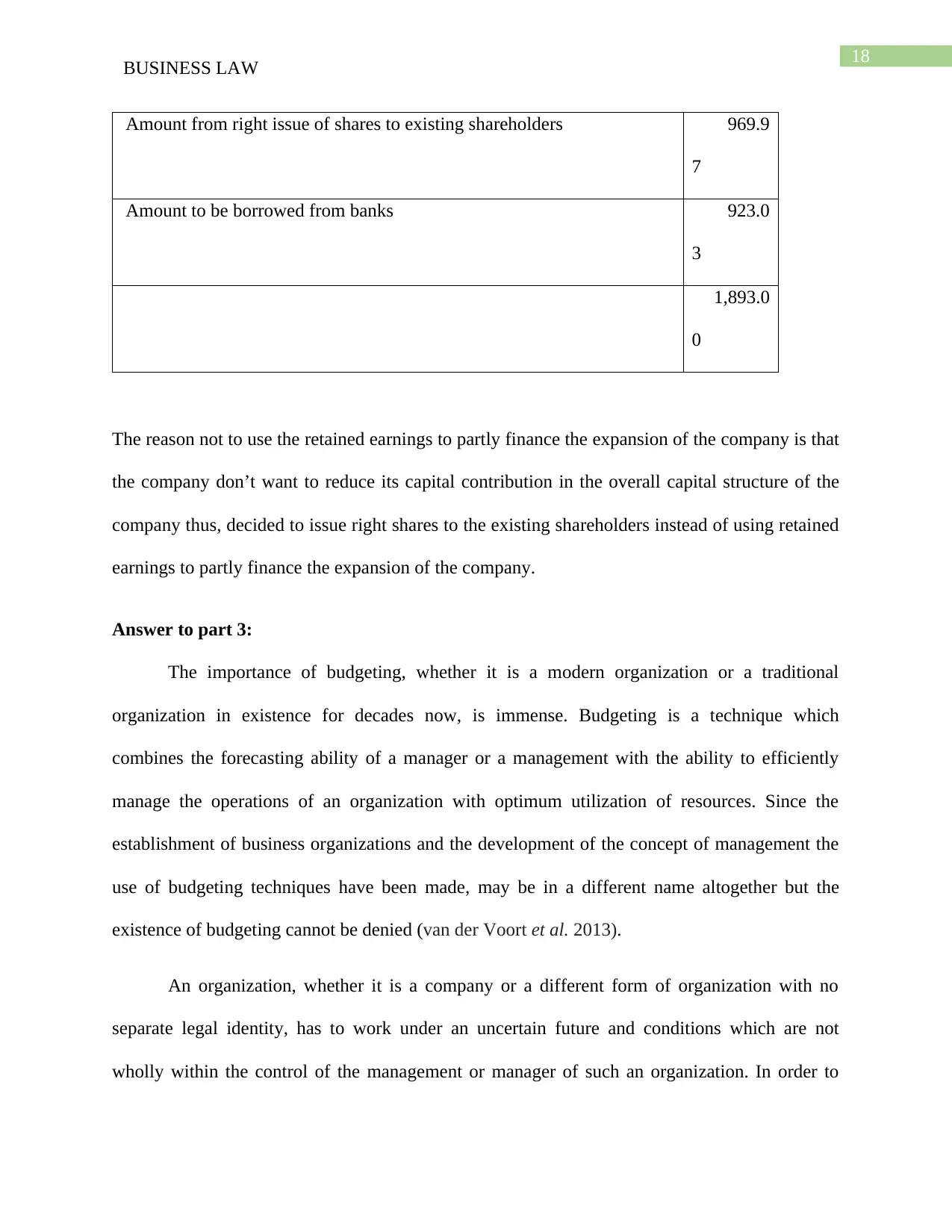

Amount from right issue of shares to existing shareholders 969.9

7

Amount to be borrowed from banks 923.0

3

1,893.0

0

The reason not to use the retained earnings to partly finance the expansion of the company is that

the company don’t want to reduce its capital contribution in the overall capital structure of the

company thus, decided to issue right shares to the existing shareholders instead of using retained

earnings to partly finance the expansion of the company.

Answer to part 3:

The importance of budgeting, whether it is a modern organization or a traditional

organization in existence for decades now, is immense. Budgeting is a technique which

combines the forecasting ability of a manager or a management with the ability to efficiently

manage the operations of an organization with optimum utilization of resources. Since the

establishment of business organizations and the development of the concept of management the

use of budgeting techniques have been made, may be in a different name altogether but the

existence of budgeting cannot be denied (van der Voort et al. 2013).

An organization, whether it is a company or a different form of organization with no

separate legal identity, has to work under an uncertain future and conditions which are not

wholly within the control of the management or manager of such an organization. In order to

BUSINESS LAW

Amount from right issue of shares to existing shareholders 969.9

7

Amount to be borrowed from banks 923.0

3

1,893.0

0

The reason not to use the retained earnings to partly finance the expansion of the company is that

the company don’t want to reduce its capital contribution in the overall capital structure of the

company thus, decided to issue right shares to the existing shareholders instead of using retained

earnings to partly finance the expansion of the company.

Answer to part 3:

The importance of budgeting, whether it is a modern organization or a traditional

organization in existence for decades now, is immense. Budgeting is a technique which

combines the forecasting ability of a manager or a management with the ability to efficiently

manage the operations of an organization with optimum utilization of resources. Since the

establishment of business organizations and the development of the concept of management the

use of budgeting techniques have been made, may be in a different name altogether but the

existence of budgeting cannot be denied (van der Voort et al. 2013).

An organization, whether it is a company or a different form of organization with no

separate legal identity, has to work under an uncertain future and conditions which are not

wholly within the control of the management or manager of such an organization. In order to

19

BUSINESS LAW

work efficiently an organization must have a plan in place to deal with the various uncertainties

that the future will throw in-front of it. Only by proper planning and subsequent preparation

according to such planning that it would be possible for an organization to deal with various

challenges and difficulties in the future (Bhattacharya 2014). Without a proper plan it would be

almost impossible to overcome various challenges that the uncertain future will throw at the

organization. The question now is how an organization prepare for the future which is

completely unknown and uncertain. Here lies the importance of budgeting. Budgeting is one of

the many techniques and methods that the managers generally use to forecast the possible future

and plan accordingly. Budgeting technique involves forecasting the possible scenario of the

future and how the conditions and situation in the future will unfold and be ready accordingly for

such situation and circumstances (Quattrone 2016).

Different types of budgets are generally prepared by an organization, from cash budget to

revenue budget, from operating budget to marketing budget etc. The importance of a budget is

that it tries to help an organization in its endeavor to achieve its desired objectives in the future.

Another important characteristics of budgeting that it motivates an organization to achieve

excellence in different areas relevant to different budgets. Let us explain the importance of

different types of budget to different departments of an organization to understand whether it is

still useful to prepare budgets for a modern day organization which has the availability of cutting

edge modern day technology to use in business operations (Hu et al. 2014).

A standard manufacturing organization will generally prepare the following budgets;

Production budget: Manufacturing or production department in a manufacturing organization is

primarily responsible to produce certain pre decided quantity of products to help an organization

in its objective of maximizing profit for sales and business operations. Production budget is

BUSINESS LAW

work efficiently an organization must have a plan in place to deal with the various uncertainties

that the future will throw in-front of it. Only by proper planning and subsequent preparation

according to such planning that it would be possible for an organization to deal with various

challenges and difficulties in the future (Bhattacharya 2014). Without a proper plan it would be

almost impossible to overcome various challenges that the uncertain future will throw at the

organization. The question now is how an organization prepare for the future which is

completely unknown and uncertain. Here lies the importance of budgeting. Budgeting is one of

the many techniques and methods that the managers generally use to forecast the possible future

and plan accordingly. Budgeting technique involves forecasting the possible scenario of the

future and how the conditions and situation in the future will unfold and be ready accordingly for

such situation and circumstances (Quattrone 2016).

Different types of budgets are generally prepared by an organization, from cash budget to

revenue budget, from operating budget to marketing budget etc. The importance of a budget is

that it tries to help an organization in its endeavor to achieve its desired objectives in the future.

Another important characteristics of budgeting that it motivates an organization to achieve

excellence in different areas relevant to different budgets. Let us explain the importance of

different types of budget to different departments of an organization to understand whether it is

still useful to prepare budgets for a modern day organization which has the availability of cutting

edge modern day technology to use in business operations (Hu et al. 2014).

A standard manufacturing organization will generally prepare the following budgets;

Production budget: Manufacturing or production department in a manufacturing organization is

primarily responsible to produce certain pre decided quantity of products to help an organization

in its objective of maximizing profit for sales and business operations. Production budget is

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

20

BUSINESS LAW

exactly the document which is used by the managers in the production department to ensure that

the production department is progressing in accordance with the expectation of the management

as envisaged in the production budget. Production budget includes the expected amount of

production that the management forecasts will be required to satisfy the demands and needs of

the customers of the company. In case the production department fails to produce the required

quantity of production then it could have huge financial ramification to the organization as a

whole (Burns and Walker 2015). As in such situation the organization will not be able to meet

the requirements of its customers and this could lead the customers to go away from the

organization and move to its competitors in the market.

A production budget can be further segregated into materials, labor, and overhead

budgets. These budgets will guide the managers in the production department to keep track of the

expenses and expenditures incurred in the production process. Thus, in case of any overshot of

the expenses the production department manager can immediately understand it and take

necessary action to ensure such expenditures remain in check (Chenhall and Moers 2015).

Revenue budget: Revenue budget is the forecast of the management to earn revenue from the

business operations of an organization. It can also be termed as a target revenue statement as

often organizations use revenue budget as a mechanism to fix target for itself to achieve certain

amount of revenue in a particular year (Nicholas and Steyn 2017). The managers based on the

past performance of an organization along with the study of the market which includes research

on the demand and supply trend in the particular market, ability of the competitors in the market

to satisfy the demand of the customers, ability of the organization to supply the required quality

of products at affordable prices to customers, prepare a statement to forecast the possible revenue

that the organization is going to generate in coming year, in case of yearly budget. The

BUSINESS LAW

exactly the document which is used by the managers in the production department to ensure that

the production department is progressing in accordance with the expectation of the management

as envisaged in the production budget. Production budget includes the expected amount of

production that the management forecasts will be required to satisfy the demands and needs of

the customers of the company. In case the production department fails to produce the required

quantity of production then it could have huge financial ramification to the organization as a

whole (Burns and Walker 2015). As in such situation the organization will not be able to meet

the requirements of its customers and this could lead the customers to go away from the

organization and move to its competitors in the market.

A production budget can be further segregated into materials, labor, and overhead

budgets. These budgets will guide the managers in the production department to keep track of the

expenses and expenditures incurred in the production process. Thus, in case of any overshot of

the expenses the production department manager can immediately understand it and take

necessary action to ensure such expenditures remain in check (Chenhall and Moers 2015).

Revenue budget: Revenue budget is the forecast of the management to earn revenue from the

business operations of an organization. It can also be termed as a target revenue statement as

often organizations use revenue budget as a mechanism to fix target for itself to achieve certain

amount of revenue in a particular year (Nicholas and Steyn 2017). The managers based on the

past performance of an organization along with the study of the market which includes research

on the demand and supply trend in the particular market, ability of the competitors in the market

to satisfy the demand of the customers, ability of the organization to supply the required quality

of products at affordable prices to customers, prepare a statement to forecast the possible revenue

that the organization is going to generate in coming year, in case of yearly budget. The

21

BUSINESS LAW

management will be on its toes and will try to take necessary steps to increase its revenue in a

period to ensure that the actual revenue in a year touches if not exceeds the budgeted revenue of

the organization. The manager in charge of an organization will also be responsible to achieve

the revenue target as set in revenue budget of the organization (Rosenberg Hansen and Ferlie

2016).

Operating expenses budget:

In order to control the overall operating expenses of running the business of an

organization the management generally uses operating budget. One of the main motives behind

preparation of operating budget is to make sure that the resources of the organization is used

effectively and efficiently. The operating budget estimates the amount of expenditures that the

organization will have to incur to run the business operations of such organization. Thus,

management can use this as a guiding line as far as incurring expenditures are concerned.

Optimum utilization of resources is one of the most important aspects of running a business

successfully and operating budgets would help an organization in achieving this objective

(Brooks 2015).

However, it can be argued that since the organizations in modern world have so many options

available with the help of advanced technology to keep track of each and every single aspect of

business is it still necessary for business organization to prepare and plan with the help of

budgets. It is true that modern day companies and other forms of business organizations have

numerous tools in their disposals which they can use to manage different aspects of business

however, yet there have been no alternative to the effective management technique known as

budgeting even after number of years after its development. Despite the injunction of advanced

technology and innovation the modern business organizations are still taking advantage

BUSINESS LAW

management will be on its toes and will try to take necessary steps to increase its revenue in a

period to ensure that the actual revenue in a year touches if not exceeds the budgeted revenue of

the organization. The manager in charge of an organization will also be responsible to achieve

the revenue target as set in revenue budget of the organization (Rosenberg Hansen and Ferlie

2016).

Operating expenses budget:

In order to control the overall operating expenses of running the business of an

organization the management generally uses operating budget. One of the main motives behind

preparation of operating budget is to make sure that the resources of the organization is used

effectively and efficiently. The operating budget estimates the amount of expenditures that the

organization will have to incur to run the business operations of such organization. Thus,

management can use this as a guiding line as far as incurring expenditures are concerned.

Optimum utilization of resources is one of the most important aspects of running a business

successfully and operating budgets would help an organization in achieving this objective

(Brooks 2015).

However, it can be argued that since the organizations in modern world have so many options

available with the help of advanced technology to keep track of each and every single aspect of

business is it still necessary for business organization to prepare and plan with the help of

budgets. It is true that modern day companies and other forms of business organizations have

numerous tools in their disposals which they can use to manage different aspects of business

however, yet there have been no alternative to the effective management technique known as

budgeting even after number of years after its development. Despite the injunction of advanced

technology and innovation the modern business organizations are still taking advantage

22

BUSINESS LAW

budgeting process (Collier 2015). Budgeting process not only helps an organization to keep a lid

on expenditures of running the business operations in an organization but at the same time works

as a path director for an organization in an uncertain future. As already mentioned it is better to

be prepared for the future by making substantial plan for it on the basis of forecasts than to be

sitting ducks and waiting for the disaster not to strike. Preparation is a process of getting ready

for the future which is uncertainly with proper planning; budgeting is a technique which exactly

does that for an organization as it helps an organization to plan for an uncertain future and

accordingly, takes steps to deal with different uncertainties of the future (Benes et al. 2015).

Thus, from the above discussion it is amply clear that the process of budgeting is a help

to a company, whether it is a modern day organization or a traditional organization working for

number of years, and not a hinder. An organization looking to improve its operating efficiency

can certainly make best use of budgeting technique by preparing different types budgets and

accordingly, planning the future course of actions of the company. As far as the concern of a

company unable to keep pace with the rapid changes in commercial and economic environment

due to use of budgeting technique is far stretched than actual reality. This is because the

budgeting process has also developed significantly over the years and thus, came flexible budget

which allows organizations to make necessary adjustments to the budgeted figures as the

underlying conditions and assumptions on the basis of which the preliminary budgets were

prepared changes. Flexible budget allows organizations to firstly prepare preliminary budgets on

the basis of available information after making necessary assumptions (Zeff 2016). However, in

case the underlying assumptions change with change in time flexible budget allows business

organizations to make necessary modifications and adjustments to the preliminary budgets to be

relevant under the changed situation and circumstances that have led to change the underlying

BUSINESS LAW

budgeting process (Collier 2015). Budgeting process not only helps an organization to keep a lid

on expenditures of running the business operations in an organization but at the same time works

as a path director for an organization in an uncertain future. As already mentioned it is better to

be prepared for the future by making substantial plan for it on the basis of forecasts than to be

sitting ducks and waiting for the disaster not to strike. Preparation is a process of getting ready

for the future which is uncertainly with proper planning; budgeting is a technique which exactly

does that for an organization as it helps an organization to plan for an uncertain future and

accordingly, takes steps to deal with different uncertainties of the future (Benes et al. 2015).

Thus, from the above discussion it is amply clear that the process of budgeting is a help

to a company, whether it is a modern day organization or a traditional organization working for

number of years, and not a hinder. An organization looking to improve its operating efficiency

can certainly make best use of budgeting technique by preparing different types budgets and

accordingly, planning the future course of actions of the company. As far as the concern of a

company unable to keep pace with the rapid changes in commercial and economic environment

due to use of budgeting technique is far stretched than actual reality. This is because the

budgeting process has also developed significantly over the years and thus, came flexible budget

which allows organizations to make necessary adjustments to the budgeted figures as the

underlying conditions and assumptions on the basis of which the preliminary budgets were

prepared changes. Flexible budget allows organizations to firstly prepare preliminary budgets on

the basis of available information after making necessary assumptions (Zeff 2016). However, in

case the underlying assumptions change with change in time flexible budget allows business

organizations to make necessary modifications and adjustments to the preliminary budgets to be

relevant under the changed situation and circumstances that have led to change the underlying

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

23

BUSINESS LAW

assumptions on the basis of which preliminary budgets were prepared at the beginning. Thus, the

concern of inflexibility and inability to adapt to changed circumstances in modern and rapid fast

business world is also addressed with the help of flexible budgeting process (Sridharan 2015).

However, despite all these it must be understood that an organization works under

uncertain future environment and the process of budgeting only tries to play a small part in

preparing an organization to face the uncertain future. Thus, other factors and elements necessary

to allow an organization to deal with the uncertain business environment in the future also need

to work in a combination with the budgeting process to help an organization in its objective of

achieving desired success in the future. Thus, only budgeting technique is not enough for a

business organization to achieve its mission and objectives rather all the factors have to combine

to help an organization in its endeavor to success (Storey et al. 2016). It is also important to note

that at the end of the day it is the human resource and its ability to manage an organization

properly that will decide the ultimate outcome. Thus, if the management is inefficient and lacks

the ability to correctly forecast the possible future situation then the chances of preparing an

effective budget is close to nil. Hence, the skills and knowledge of the management along with

other human agencies of an organization will play the most crucial role in deciding the fate of an

organization, i.e. by properly using the forecasting ability to prepare and plan effectively with the

help of budgeting process and also in implementation of these plans in actions as at the end of

the day it is about implementation of these ideas in real world that will decide the future outcome

of an organization (Kerzner 2013.).

BUSINESS LAW

assumptions on the basis of which preliminary budgets were prepared at the beginning. Thus, the

concern of inflexibility and inability to adapt to changed circumstances in modern and rapid fast

business world is also addressed with the help of flexible budgeting process (Sridharan 2015).

However, despite all these it must be understood that an organization works under

uncertain future environment and the process of budgeting only tries to play a small part in

preparing an organization to face the uncertain future. Thus, other factors and elements necessary

to allow an organization to deal with the uncertain business environment in the future also need

to work in a combination with the budgeting process to help an organization in its objective of

achieving desired success in the future. Thus, only budgeting technique is not enough for a

business organization to achieve its mission and objectives rather all the factors have to combine

to help an organization in its endeavor to success (Storey et al. 2016). It is also important to note

that at the end of the day it is the human resource and its ability to manage an organization

properly that will decide the ultimate outcome. Thus, if the management is inefficient and lacks

the ability to correctly forecast the possible future situation then the chances of preparing an

effective budget is close to nil. Hence, the skills and knowledge of the management along with

other human agencies of an organization will play the most crucial role in deciding the fate of an

organization, i.e. by properly using the forecasting ability to prepare and plan effectively with the

help of budgeting process and also in implementation of these plans in actions as at the end of

the day it is about implementation of these ideas in real world that will decide the future outcome

of an organization (Kerzner 2013.).

24

BUSINESS LAW

References:

Stawicki, S.P., 2017. Republication: Application of financial analysis techniques to vital sign

data–A novel method of trend interpretation in the Intensive Care Unit. International Journal of

Academic Medicine, 3(3), p.119.

Badea, R.A. and Borcoci, E., 2014, November. Content server saturation avoidance algorithm

based on financial analysis techniques. In Telecommunications Forum Telfor (TELFOR), 2014

22nd (pp. 127-130). IEEE.

Taleb, N. and Mohamed, E.A., 2015. FRAMEWORK FOR EVALUATING THE

EFFECTIVENESS OF DATA MINING IN THE ANALYSIS OF DYNAMIC DATA FOR

SUPPORTING FINANCIAL DECISION-MAKING. Global Business & Economics

Anthology, 1.

Grant, R.M., 2016. Contemporary Strategy Analysis Text Only. John Wiley & Sons.

McNeil, A.J., Frey, R. and Embrechts, P., 2015. Quantitative risk management: Concepts,

techniques and tools. Princeton university press.

Beadle, C.L., 2014. Plant growth analysis. Techniques in bioproductivity and photosynthesis, 2,

pp.20-25.

Gitman, L.J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU.

c. A survey on bank branch efficiency and performance research with data envelopment

analysis. Omega, 41(1), pp.61-79.

BUSINESS LAW

References:

Stawicki, S.P., 2017. Republication: Application of financial analysis techniques to vital sign

data–A novel method of trend interpretation in the Intensive Care Unit. International Journal of

Academic Medicine, 3(3), p.119.

Badea, R.A. and Borcoci, E., 2014, November. Content server saturation avoidance algorithm

based on financial analysis techniques. In Telecommunications Forum Telfor (TELFOR), 2014

22nd (pp. 127-130). IEEE.

Taleb, N. and Mohamed, E.A., 2015. FRAMEWORK FOR EVALUATING THE

EFFECTIVENESS OF DATA MINING IN THE ANALYSIS OF DYNAMIC DATA FOR

SUPPORTING FINANCIAL DECISION-MAKING. Global Business & Economics

Anthology, 1.

Grant, R.M., 2016. Contemporary Strategy Analysis Text Only. John Wiley & Sons.

McNeil, A.J., Frey, R. and Embrechts, P., 2015. Quantitative risk management: Concepts,

techniques and tools. Princeton university press.

Beadle, C.L., 2014. Plant growth analysis. Techniques in bioproductivity and photosynthesis, 2,

pp.20-25.

Gitman, L.J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU.

c. A survey on bank branch efficiency and performance research with data envelopment

analysis. Omega, 41(1), pp.61-79.

25

BUSINESS LAW

Palepu, K.G., Healy, P.M. and Peek, E., 2013. Business analysis and valuation: IFRS edition.

Cengage Learning.

Robinson, T.R., Henry, E., Pirie, W.L. and Broihahn, M.A., 2015. International financial

statement analysis. John Wiley & Sons.

Entwistle, G., 2015. Reflections on Teaching Financial Statement Analysis. Accounting

Education, 24(6), pp.555-558.

Dalnial, H., Kamaluddin, A., Sanusi, Z.M. and Khairuddin, K.S., 2014. Detecting fraudulent

financial reporting through financial statement analysis. Journal of Advanced Management

Science Vol, 2(1).

Magalhães, M.M.C., 2014. Value investing and financial statement analysis(Doctoral

dissertation).

Sridharan, S.A., 2015. Volatility forecasting using financial statement information. The

Accounting Review, 90(5), pp.2079-2106.

Benes, J., Berg, A., Portillo, R.A. and Vavra, D., 2015. Modeling sterilized interventions and

balance sheet effects of monetary policy in a New-Keynesian framework. Open Economies

Review, 26(1), pp.81-108.

Schoenebeck, K.P. and Holtzman, M.P., 2013. Interpreting and analyzing financial statements.

Pearson Higher Ed.

Zeff, S.A., 2016. Forging accounting principles in five countries: A history and an analysis of

trends. Routledge.

DRURY, C.M., 2013. Management and cost accounting. Springer.

BUSINESS LAW

Palepu, K.G., Healy, P.M. and Peek, E., 2013. Business analysis and valuation: IFRS edition.

Cengage Learning.

Robinson, T.R., Henry, E., Pirie, W.L. and Broihahn, M.A., 2015. International financial

statement analysis. John Wiley & Sons.

Entwistle, G., 2015. Reflections on Teaching Financial Statement Analysis. Accounting

Education, 24(6), pp.555-558.

Dalnial, H., Kamaluddin, A., Sanusi, Z.M. and Khairuddin, K.S., 2014. Detecting fraudulent

financial reporting through financial statement analysis. Journal of Advanced Management

Science Vol, 2(1).

Magalhães, M.M.C., 2014. Value investing and financial statement analysis(Doctoral

dissertation).

Sridharan, S.A., 2015. Volatility forecasting using financial statement information. The

Accounting Review, 90(5), pp.2079-2106.

Benes, J., Berg, A., Portillo, R.A. and Vavra, D., 2015. Modeling sterilized interventions and

balance sheet effects of monetary policy in a New-Keynesian framework. Open Economies

Review, 26(1), pp.81-108.

Schoenebeck, K.P. and Holtzman, M.P., 2013. Interpreting and analyzing financial statements.

Pearson Higher Ed.

Zeff, S.A., 2016. Forging accounting principles in five countries: A history and an analysis of

trends. Routledge.

DRURY, C.M., 2013. Management and cost accounting. Springer.

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.