Auditing and Reporting Assessment 1

VerifiedAdded on 2023/04/26

|18

|4988

|361

AI Summary

This assessment is designed to assess the student in the learning elements and performance criteria of the unit FNSACC602 Audit and report on financial systems and records and FNSACC606 Conduct internal audit. The assessment includes a portfolio of activities and is worth 40% of the total marks. The assessment covers topics such as identifying statutory requirements, developing financial audit methodologies, identifying audit financial data sources, establishing client financial business characteristics, and more. The assessment is for the course FNS60217 Advanced Diploma of Accounting and is due in Week 8.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

T-1.8.1

Details of Assessment

Term and Year T4, 2018 Time allowed Week 2 – Week 5

Assessment No 1 Assessment

Weighting

40%

Assessment

Type

Portfolio of Activity

Due Date Week 8 Room

Details of Subject

Qualification FNS60217 Advanced Diploma of Accounting

Subject Name Auditing and Reporting

Details of Unit(s) of competency

Unit Code and

Title

FNSACC602 Audit and report on financial systems and records

FNSACC606 Conduct internal audit

Details of Student

Student

Name

Student ID College

Student Declaration: I declare that the

work submitted is my own, and has not been

copied or plagiarised from any person or

source.

Signature: ___________________________

Date: _______/________/_______________

Details of Assessor

Assessor’s Name

Assessment Outcome

Results Competent Not Yet

Competent Marks / 40

FEEDBACK TO STUDENT

Progressive feedback to students, identifying gaps in competency and comments on positive

improvements:

______________________________________________________________________________

______________________________________________________________________________

Auditing and Reporting, Assessment 1, v1.0 Page 1

Details of Assessment

Term and Year T4, 2018 Time allowed Week 2 – Week 5

Assessment No 1 Assessment

Weighting

40%

Assessment

Type

Portfolio of Activity

Due Date Week 8 Room

Details of Subject

Qualification FNS60217 Advanced Diploma of Accounting

Subject Name Auditing and Reporting

Details of Unit(s) of competency

Unit Code and

Title

FNSACC602 Audit and report on financial systems and records

FNSACC606 Conduct internal audit

Details of Student

Student

Name

Student ID College

Student Declaration: I declare that the

work submitted is my own, and has not been

copied or plagiarised from any person or

source.

Signature: ___________________________

Date: _______/________/_______________

Details of Assessor

Assessor’s Name

Assessment Outcome

Results Competent Not Yet

Competent Marks / 40

FEEDBACK TO STUDENT

Progressive feedback to students, identifying gaps in competency and comments on positive

improvements:

______________________________________________________________________________

______________________________________________________________________________

Auditing and Reporting, Assessment 1, v1.0 Page 1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

T-1.8.1

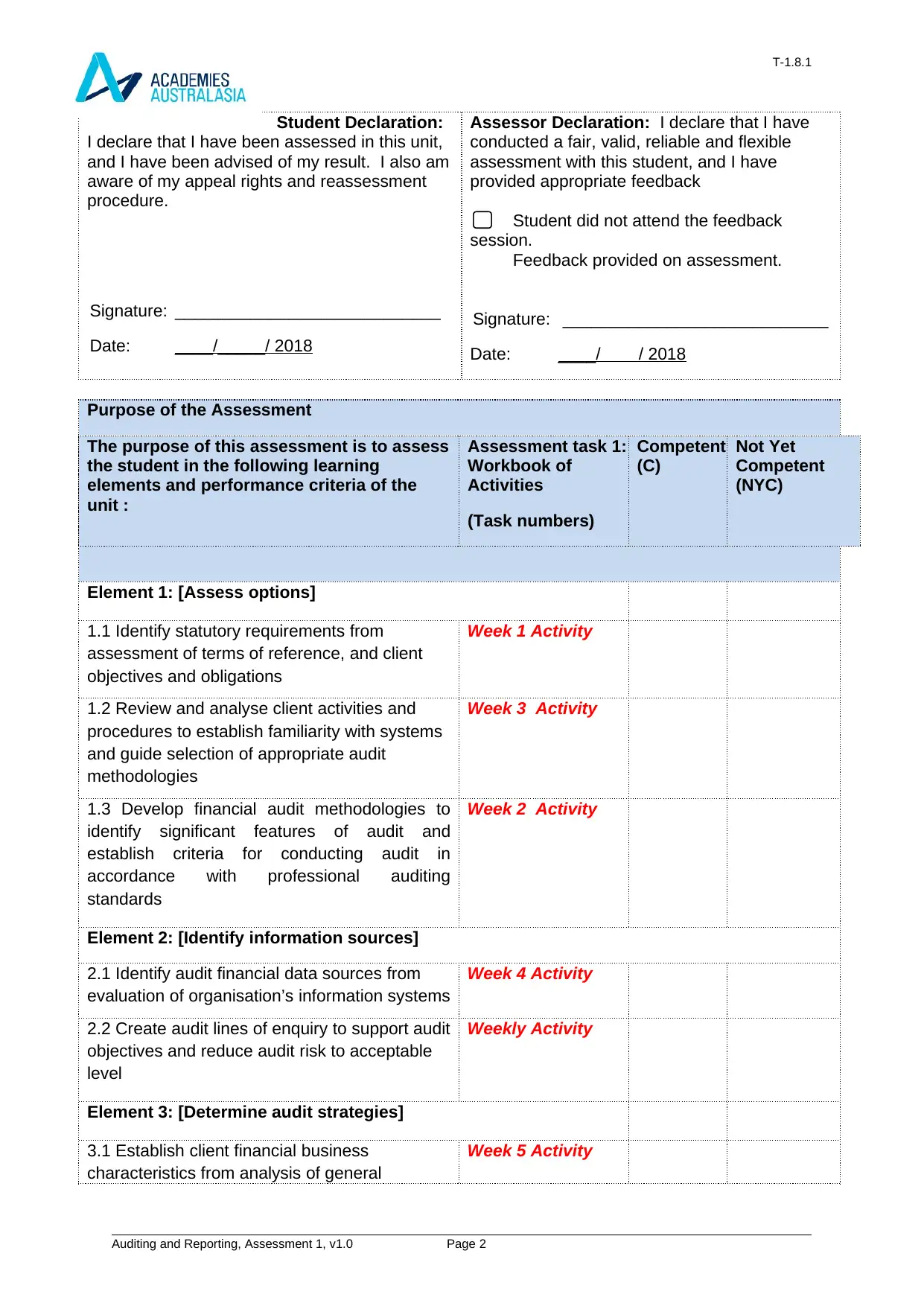

Student Declaration:

I declare that I have been assessed in this unit,

and I have been advised of my result. I also am

aware of my appeal rights and reassessment

procedure.

Signature: ____________________________

Date: ____/_____/ 2018

Assessor Declaration: I declare that I have

conducted a fair, valid, reliable and flexible

assessment with this student, and I have

provided appropriate feedback

Student did not attend the feedback

session.

Feedback provided on assessment.

Signature: ____________________________

Date: ____/ / 2018

Purpose of the Assessment

Element 1: [Assess options]

1.1 Identify statutory requirements from

assessment of terms of reference, and client

objectives and obligations

Week 1 Activity

1.2 Review and analyse client activities and

procedures to establish familiarity with systems

and guide selection of appropriate audit

methodologies

Week 3 Activity

1.3 Develop financial audit methodologies to

identify significant features of audit and

establish criteria for conducting audit in

accordance with professional auditing

standards

Week 2 Activity

Element 2: [Identify information sources]

2.1 Identify audit financial data sources from

evaluation of organisation’s information systems

Week 4 Activity

2.2 Create audit lines of enquiry to support audit

objectives and reduce audit risk to acceptable

level

Weekly Activity

Element 3: [Determine audit strategies]

3.1 Establish client financial business

characteristics from analysis of general

Week 5 Activity

Auditing and Reporting, Assessment 1, v1.0 Page 2

The purpose of this assessment is to assess

the student in the following learning

elements and performance criteria of the

unit :

Assessment task 1:

Workbook of

Activities

(Task numbers)

Competent

(C)

Not Yet

Competent

(NYC)

Student Declaration:

I declare that I have been assessed in this unit,

and I have been advised of my result. I also am

aware of my appeal rights and reassessment

procedure.

Signature: ____________________________

Date: ____/_____/ 2018

Assessor Declaration: I declare that I have

conducted a fair, valid, reliable and flexible

assessment with this student, and I have

provided appropriate feedback

Student did not attend the feedback

session.

Feedback provided on assessment.

Signature: ____________________________

Date: ____/ / 2018

Purpose of the Assessment

Element 1: [Assess options]

1.1 Identify statutory requirements from

assessment of terms of reference, and client

objectives and obligations

Week 1 Activity

1.2 Review and analyse client activities and

procedures to establish familiarity with systems

and guide selection of appropriate audit

methodologies

Week 3 Activity

1.3 Develop financial audit methodologies to

identify significant features of audit and

establish criteria for conducting audit in

accordance with professional auditing

standards

Week 2 Activity

Element 2: [Identify information sources]

2.1 Identify audit financial data sources from

evaluation of organisation’s information systems

Week 4 Activity

2.2 Create audit lines of enquiry to support audit

objectives and reduce audit risk to acceptable

level

Weekly Activity

Element 3: [Determine audit strategies]

3.1 Establish client financial business

characteristics from analysis of general

Week 5 Activity

Auditing and Reporting, Assessment 1, v1.0 Page 2

The purpose of this assessment is to assess

the student in the following learning

elements and performance criteria of the

unit :

Assessment task 1:

Workbook of

Activities

(Task numbers)

Competent

(C)

Not Yet

Competent

(NYC)

T-1.8.1

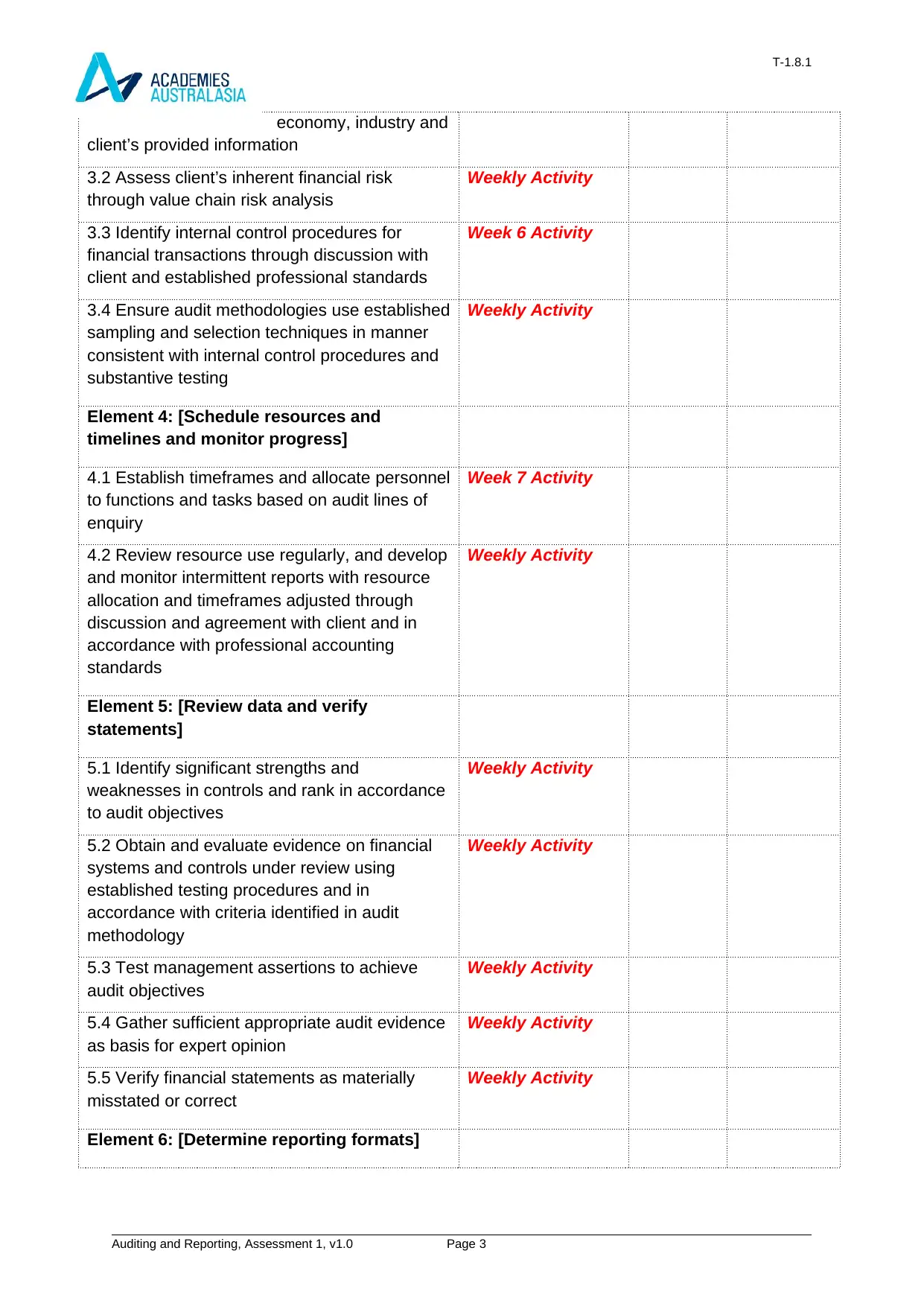

economy, industry and

client’s provided information

3.2 Assess client’s inherent financial risk

through value chain risk analysis

Weekly Activity

3.3 Identify internal control procedures for

financial transactions through discussion with

client and established professional standards

Week 6 Activity

3.4 Ensure audit methodologies use established

sampling and selection techniques in manner

consistent with internal control procedures and

substantive testing

Weekly Activity

Element 4: [Schedule resources and

timelines and monitor progress]

4.1 Establish timeframes and allocate personnel

to functions and tasks based on audit lines of

enquiry

Week 7 Activity

4.2 Review resource use regularly, and develop

and monitor intermittent reports with resource

allocation and timeframes adjusted through

discussion and agreement with client and in

accordance with professional accounting

standards

Weekly Activity

Element 5: [Review data and verify

statements]

5.1 Identify significant strengths and

weaknesses in controls and rank in accordance

to audit objectives

Weekly Activity

5.2 Obtain and evaluate evidence on financial

systems and controls under review using

established testing procedures and in

accordance with criteria identified in audit

methodology

Weekly Activity

5.3 Test management assertions to achieve

audit objectives

Weekly Activity

5.4 Gather sufficient appropriate audit evidence

as basis for expert opinion

Weekly Activity

5.5 Verify financial statements as materially

misstated or correct

Weekly Activity

Element 6: [Determine reporting formats]

Auditing and Reporting, Assessment 1, v1.0 Page 3

economy, industry and

client’s provided information

3.2 Assess client’s inherent financial risk

through value chain risk analysis

Weekly Activity

3.3 Identify internal control procedures for

financial transactions through discussion with

client and established professional standards

Week 6 Activity

3.4 Ensure audit methodologies use established

sampling and selection techniques in manner

consistent with internal control procedures and

substantive testing

Weekly Activity

Element 4: [Schedule resources and

timelines and monitor progress]

4.1 Establish timeframes and allocate personnel

to functions and tasks based on audit lines of

enquiry

Week 7 Activity

4.2 Review resource use regularly, and develop

and monitor intermittent reports with resource

allocation and timeframes adjusted through

discussion and agreement with client and in

accordance with professional accounting

standards

Weekly Activity

Element 5: [Review data and verify

statements]

5.1 Identify significant strengths and

weaknesses in controls and rank in accordance

to audit objectives

Weekly Activity

5.2 Obtain and evaluate evidence on financial

systems and controls under review using

established testing procedures and in

accordance with criteria identified in audit

methodology

Weekly Activity

5.3 Test management assertions to achieve

audit objectives

Weekly Activity

5.4 Gather sufficient appropriate audit evidence

as basis for expert opinion

Weekly Activity

5.5 Verify financial statements as materially

misstated or correct

Weekly Activity

Element 6: [Determine reporting formats]

Auditing and Reporting, Assessment 1, v1.0 Page 3

T-1.8.1

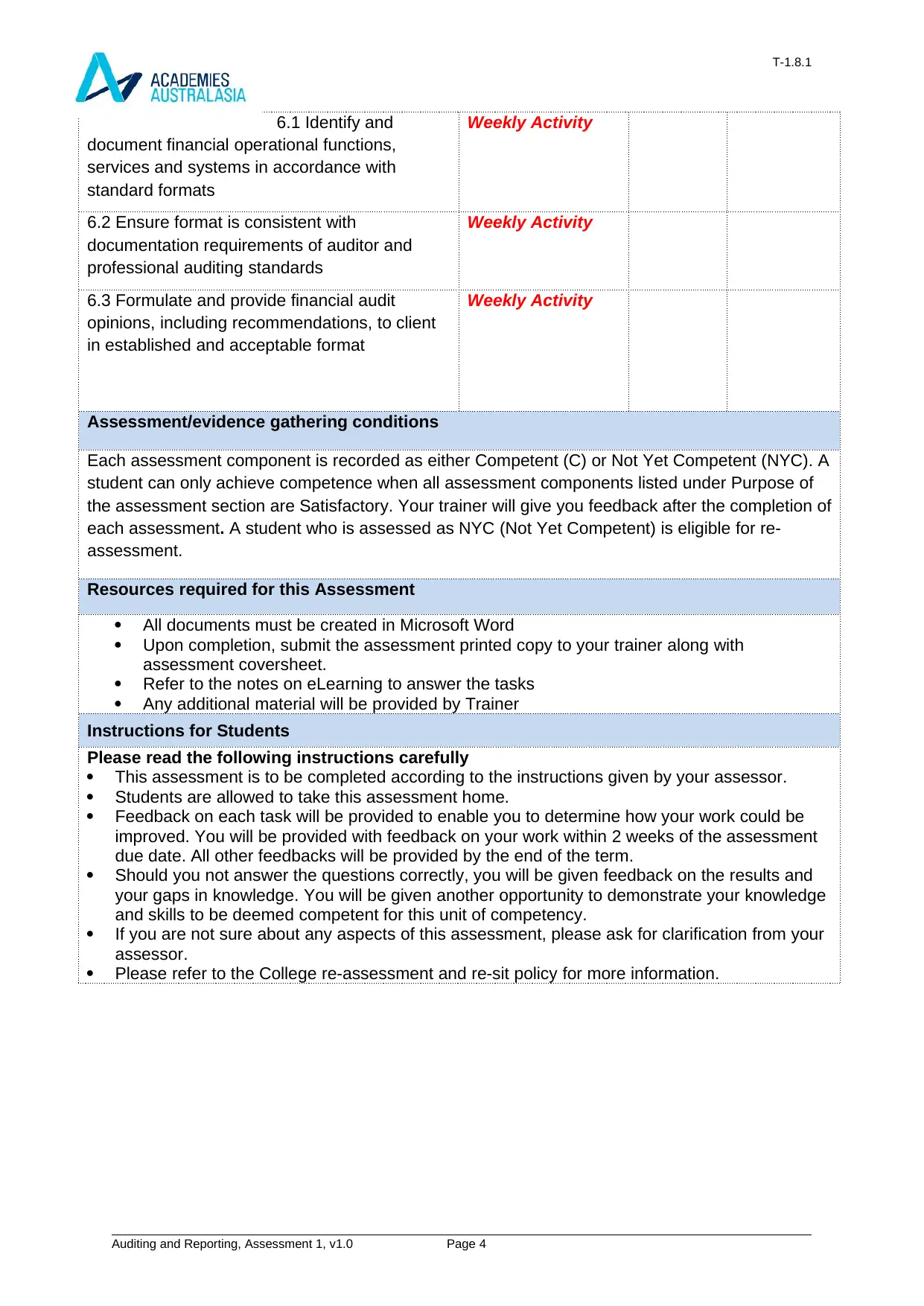

6.1 Identify and

document financial operational functions,

services and systems in accordance with

standard formats

Weekly Activity

6.2 Ensure format is consistent with

documentation requirements of auditor and

professional auditing standards

Weekly Activity

6.3 Formulate and provide financial audit

opinions, including recommendations, to client

in established and acceptable format

Weekly Activity

Assessment/evidence gathering conditions

Each assessment component is recorded as either Competent (C) or Not Yet Competent (NYC). A

student can only achieve competence when all assessment components listed under Purpose of

the assessment section are Satisfactory. Your trainer will give you feedback after the completion of

each assessment. A student who is assessed as NYC (Not Yet Competent) is eligible for re-

assessment.

Resources required for this Assessment

All documents must be created in Microsoft Word

Upon completion, submit the assessment printed copy to your trainer along with

assessment coversheet.

Refer to the notes on eLearning to answer the tasks

Any additional material will be provided by Trainer

Instructions for Students

Please read the following instructions carefully

This assessment is to be completed according to the instructions given by your assessor.

Students are allowed to take this assessment home.

Feedback on each task will be provided to enable you to determine how your work could be

improved. You will be provided with feedback on your work within 2 weeks of the assessment

due date. All other feedbacks will be provided by the end of the term.

Should you not answer the questions correctly, you will be given feedback on the results and

your gaps in knowledge. You will be given another opportunity to demonstrate your knowledge

and skills to be deemed competent for this unit of competency.

If you are not sure about any aspects of this assessment, please ask for clarification from your

assessor.

Please refer to the College re-assessment and re-sit policy for more information.

Auditing and Reporting, Assessment 1, v1.0 Page 4

6.1 Identify and

document financial operational functions,

services and systems in accordance with

standard formats

Weekly Activity

6.2 Ensure format is consistent with

documentation requirements of auditor and

professional auditing standards

Weekly Activity

6.3 Formulate and provide financial audit

opinions, including recommendations, to client

in established and acceptable format

Weekly Activity

Assessment/evidence gathering conditions

Each assessment component is recorded as either Competent (C) or Not Yet Competent (NYC). A

student can only achieve competence when all assessment components listed under Purpose of

the assessment section are Satisfactory. Your trainer will give you feedback after the completion of

each assessment. A student who is assessed as NYC (Not Yet Competent) is eligible for re-

assessment.

Resources required for this Assessment

All documents must be created in Microsoft Word

Upon completion, submit the assessment printed copy to your trainer along with

assessment coversheet.

Refer to the notes on eLearning to answer the tasks

Any additional material will be provided by Trainer

Instructions for Students

Please read the following instructions carefully

This assessment is to be completed according to the instructions given by your assessor.

Students are allowed to take this assessment home.

Feedback on each task will be provided to enable you to determine how your work could be

improved. You will be provided with feedback on your work within 2 weeks of the assessment

due date. All other feedbacks will be provided by the end of the term.

Should you not answer the questions correctly, you will be given feedback on the results and

your gaps in knowledge. You will be given another opportunity to demonstrate your knowledge

and skills to be deemed competent for this unit of competency.

If you are not sure about any aspects of this assessment, please ask for clarification from your

assessor.

Please refer to the College re-assessment and re-sit policy for more information.

Auditing and Reporting, Assessment 1, v1.0 Page 4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

T-1.8.1

Class Activity Portfolio Total Marks - 40

WEEK-1-CLASS ACTIVITY

1. Distinguish between Australian auditing standards and Australian accounting standards,

and give two examples of each.

Solution:

Australian auditing standards

The auditing standards are generally set guidelines for the commonness of all practising

auditors in Australia. These standards abide to all appropriate ethical requirements that pertains

to audit plan and service. Example is the Auditing Standard ASA101 is based on compliance.

Auditing Standards like Auditing standard ASA 200 overview objectives of the independence of

auditors alongside the conduct of auditors in accordance with Australian Auditing Standards

Australian accounting standards are specific rules for accounting for transactions occurring

Accounting standards are the standards generally set as guidelines for the commonness

of all practising accounting recording and record keeping in Australia. The compliance with

Australian Accounting Standards by profit seeking entities results in compliance with

IFRS……… any of the AASBs.

Assignment

Consumers Union is a non-profit organisation that provides information and counsel on

consumer goods and services. A major part of its function is the testing of different brands of

consumer products that are purchased on the open market and then reporting the results of

the tests in Consumer Reports, a monthly publication. Examples of the types of products it

tests are motor vehicles, residential air-conditioners, canned tuna and jeans.

a. In what ways are the services provided by Consumers Union similar to assurance

services provided by public accounting firms?

Auditing and Reporting, Assessment 1, v1.0 Page 5

Class Activity Portfolio Total Marks - 40

WEEK-1-CLASS ACTIVITY

1. Distinguish between Australian auditing standards and Australian accounting standards,

and give two examples of each.

Solution:

Australian auditing standards

The auditing standards are generally set guidelines for the commonness of all practising

auditors in Australia. These standards abide to all appropriate ethical requirements that pertains

to audit plan and service. Example is the Auditing Standard ASA101 is based on compliance.

Auditing Standards like Auditing standard ASA 200 overview objectives of the independence of

auditors alongside the conduct of auditors in accordance with Australian Auditing Standards

Australian accounting standards are specific rules for accounting for transactions occurring

Accounting standards are the standards generally set as guidelines for the commonness

of all practising accounting recording and record keeping in Australia. The compliance with

Australian Accounting Standards by profit seeking entities results in compliance with

IFRS……… any of the AASBs.

Assignment

Consumers Union is a non-profit organisation that provides information and counsel on

consumer goods and services. A major part of its function is the testing of different brands of

consumer products that are purchased on the open market and then reporting the results of

the tests in Consumer Reports, a monthly publication. Examples of the types of products it

tests are motor vehicles, residential air-conditioners, canned tuna and jeans.

a. In what ways are the services provided by Consumers Union similar to assurance

services provided by public accounting firms?

Auditing and Reporting, Assessment 1, v1.0 Page 5

T-1.8.1

b. Compare the concept of information risk introduced with the

information risk problem faced by a buyer of a motor vehicle.

c. Compare the four causes of information risk faced by users of financial statements as

discussed with those faced by a buyer of a motor vehicle.

d. Compare the three ways that users of financial statements can reduce information risk

with the ways available to a buyer of a motor vehicle.

Solution

(a) The services provided by Consumers Union are very similar to assurance services

provided by CPA firms. The services provided by Consumers Union and assurance

services provided by CPA firms are designed to improve the quality of information for

decision makers. CPAs are valued for their independence, and the reports provided

by Consumers Union are valued because Consumers Union is independent of the

products tested.

(b)

The concepts of information risk for the buyer of an automobile and for

the user of financial statements are essentially the same. They are both

concerned with the problem of unreliable information being provided. In the

case of the auditor, the user is concerned about unreliable information being

provided in the financial statements. The buyer of an automobile is likely to be

concerned about the manufacturer or dealer providing unreliable information.

(c) The four causes of information risk are essentially the same for a buyer of a motor

vehicle and a user of financial statements:

1. Remoteness of information:

Remoteness of information It is difficult for a user to obtain much information about

either an automobile manufacturer or the automobile itself without incurring considerable

cost. The automobile buyer does have the advantage of possibly knowing other users who

are satisfied or dissatisfied with a similar automobile.

2. Biases and motives of provider:

Biases and motives of provider, here is a conflict between the

Auditing and Reporting, Assessment 1, v1.0 Page 6

b. Compare the concept of information risk introduced with the

information risk problem faced by a buyer of a motor vehicle.

c. Compare the four causes of information risk faced by users of financial statements as

discussed with those faced by a buyer of a motor vehicle.

d. Compare the three ways that users of financial statements can reduce information risk

with the ways available to a buyer of a motor vehicle.

Solution

(a) The services provided by Consumers Union are very similar to assurance services

provided by CPA firms. The services provided by Consumers Union and assurance

services provided by CPA firms are designed to improve the quality of information for

decision makers. CPAs are valued for their independence, and the reports provided

by Consumers Union are valued because Consumers Union is independent of the

products tested.

(b)

The concepts of information risk for the buyer of an automobile and for

the user of financial statements are essentially the same. They are both

concerned with the problem of unreliable information being provided. In the

case of the auditor, the user is concerned about unreliable information being

provided in the financial statements. The buyer of an automobile is likely to be

concerned about the manufacturer or dealer providing unreliable information.

(c) The four causes of information risk are essentially the same for a buyer of a motor

vehicle and a user of financial statements:

1. Remoteness of information:

Remoteness of information It is difficult for a user to obtain much information about

either an automobile manufacturer or the automobile itself without incurring considerable

cost. The automobile buyer does have the advantage of possibly knowing other users who

are satisfied or dissatisfied with a similar automobile.

2. Biases and motives of provider:

Biases and motives of provider, here is a conflict between the

Auditing and Reporting, Assessment 1, v1.0 Page 6

T-1.8.1

automobile buyer and the manufacturer. The buyer wants to buy a

high quality product at minimum cost whereas the seller wants to

maximize the selling price and quantity sold.

3. Voluminous data:

Voluminous data is a large amount of available information

about automobiles that users might like to have in order to evaluate an

automobile. Either that information is not available or too costly to

obtain.

4. Complex exchange transactions:

For Complex exchange transactions, the acquisition of an automobile is expensive

and certainly a complex decision because of all the components that go into making a good

automobile and choosing between a large numbers of alternatives.

The three ways users of financial statements and buyers of motor vehicles reduce

information risk are also similar:

1. User verifies information him or herself:

User verifies information himself or herself- this can be

obtained by driving different automobiles, examining the specifications

of the automobiles, talking to other users and doing research in

various magazines.

Auditing and Reporting, Assessment 1, v1.0 Page 7

automobile buyer and the manufacturer. The buyer wants to buy a

high quality product at minimum cost whereas the seller wants to

maximize the selling price and quantity sold.

3. Voluminous data:

Voluminous data is a large amount of available information

about automobiles that users might like to have in order to evaluate an

automobile. Either that information is not available or too costly to

obtain.

4. Complex exchange transactions:

For Complex exchange transactions, the acquisition of an automobile is expensive

and certainly a complex decision because of all the components that go into making a good

automobile and choosing between a large numbers of alternatives.

The three ways users of financial statements and buyers of motor vehicles reduce

information risk are also similar:

1. User verifies information him or herself:

User verifies information himself or herself- this can be

obtained by driving different automobiles, examining the specifications

of the automobiles, talking to other users and doing research in

various magazines.

Auditing and Reporting, Assessment 1, v1.0 Page 7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

T-1.8.1

2. User shares information risk with management:

Here, the manufacturer of a product has a responsibility to meet its warranties and to

provide a reasonable product. The buyer of an automobile can return the automobile for

correction of defects. In some cases a refund may be obtained.

3. Examine the information prepared by Consumer Reports:

This is similar to an audit in the sense that independent information is provided by an

independent party. The information provided by Consumer Reports is comparable to that

provided by a CPA firm that audited financial statements.

WEEK-2-CLASS ACTIVITY

1. Explain the role of auditing in corporate governance.

Auditing and Reporting, Assessment 1, v1.0 Page 8

2. User shares information risk with management:

Here, the manufacturer of a product has a responsibility to meet its warranties and to

provide a reasonable product. The buyer of an automobile can return the automobile for

correction of defects. In some cases a refund may be obtained.

3. Examine the information prepared by Consumer Reports:

This is similar to an audit in the sense that independent information is provided by an

independent party. The information provided by Consumer Reports is comparable to that

provided by a CPA firm that audited financial statements.

WEEK-2-CLASS ACTIVITY

1. Explain the role of auditing in corporate governance.

Auditing and Reporting, Assessment 1, v1.0 Page 8

T-1.8.1

-Protecting the interests of shareholders- external audition reports are

conducted independent of the company’s influence. External auditors report the state of a

company's finance and attest to the validity of financial reports that may have been released

alongside ensuring that the board receives accurate and reliable information

-Promoting accountability-They can introduce measures and policies designed to compel

accountability in the workplace as well as having capacity to recommend penalties for

officers who manipulate financial statements by inflating figures or cooking accounting

numbers

-conducting period risk assessment- auditors promote corporate governance as they review

the security measures that a company has in place against corporate fraud or corruption. In

addition to assessing potential risks, auditors also analyze the overall risk tolerance of the

company as well as the efforts the company has made toward mitigating risks.

-Strong Relationship with Regulators maintained-auditors evaluate the organization of a

company for compliance with regulations. Regulators are also more likely to trust company

disclosures after an auditor attests to them.

-Enhance crisis management- this because they assist in developing efficient crisis-

management plans to be used in the event of allegations of fraud or corruption.

2. After accepting an engagement, an audit firm discovers that the client’s industry is

more technical than it had realized and that it is not competent in certain areas of the

operation. What are the firm’s options?

-One of the firms option is to hire qualified personnel, conduct training for them alongsise

very proper supervision.

-They can also follow the standards of profession strictly.

-They should also maintain maintain confidence relations

-They also have an option to seek legal counsel

3. Each of the following situations involves a possible violation of the relevant ethical

rules or legal obligations. For each one, state any applicable ethical rules and

Corporations Act provisions and whether it is a violation.

Auditing and Reporting, Assessment 1, v1.0 Page 9

-Protecting the interests of shareholders- external audition reports are

conducted independent of the company’s influence. External auditors report the state of a

company's finance and attest to the validity of financial reports that may have been released

alongside ensuring that the board receives accurate and reliable information

-Promoting accountability-They can introduce measures and policies designed to compel

accountability in the workplace as well as having capacity to recommend penalties for

officers who manipulate financial statements by inflating figures or cooking accounting

numbers

-conducting period risk assessment- auditors promote corporate governance as they review

the security measures that a company has in place against corporate fraud or corruption. In

addition to assessing potential risks, auditors also analyze the overall risk tolerance of the

company as well as the efforts the company has made toward mitigating risks.

-Strong Relationship with Regulators maintained-auditors evaluate the organization of a

company for compliance with regulations. Regulators are also more likely to trust company

disclosures after an auditor attests to them.

-Enhance crisis management- this because they assist in developing efficient crisis-

management plans to be used in the event of allegations of fraud or corruption.

2. After accepting an engagement, an audit firm discovers that the client’s industry is

more technical than it had realized and that it is not competent in certain areas of the

operation. What are the firm’s options?

-One of the firms option is to hire qualified personnel, conduct training for them alongsise

very proper supervision.

-They can also follow the standards of profession strictly.

-They should also maintain maintain confidence relations

-They also have an option to seek legal counsel

3. Each of the following situations involves a possible violation of the relevant ethical

rules or legal obligations. For each one, state any applicable ethical rules and

Corporations Act provisions and whether it is a violation.

Auditing and Reporting, Assessment 1, v1.0 Page 9

T-1.8.1

a. A client requests assistance of J. Shik, a chartered accountant, in

the installation of a computer system for maintaining production records. Shik has no

experience in this type of work and no knowledge of the client’s production records, so he

obtains assistance from a computer consultant. The consultant is not in the practice of public

accounting, but Shik is confident of his professional skills. Because of the highly technical

nature of the work, Shik is not able to review the consultant’s work.

Solution

A member in a public practice cannot disclose client Information. If this is violated,

there is a Violation of Rule 301suggested that the company hire the consultant directly.

b. Five small Sydney public accounting firms have become involved in an information project

by taking part in an inter-firm working paper review program. Under the program, each firm

designates two partners to review the working papers, including the tax returns and the

financial statements of another public accounting firm taking part in the program. At the end

of each review, the auditors who prepared the working papers and the reviewers have a

conference to discuss the strengths and weaknesses of the audit. They do not obtain

authorisation from the client before the review takes place.

Solution

A member in an organization that is certified by state law can practice public Accounting.

If this is violated, there is a Violation of Rule 505.

c. Shirley Morris, a public accountant, applies to Apple & George, public accountants, for a

permanent job as a senior auditor. Morris informs Apple & George that she works for another

public accounting firm in the same city but will not permit them to contact her present

employer. Apple & George hire Morris without contacting the other public accounting firm.

Solution

If existing loan, no violation, if loan does not exist, then it is a Violation of Rule 101

because it is a new loan.

d. Bill Wendal, a chartered accountant, sets up a casualty and fire insurance agency to

complement his auditing and tax services. He does not use his own name on anything

pertaining to the insurance agency and has a highly competent manager, Sandra Jones,

who runs it. Wendal often requests that Jones review the adequacy of a client’s insurance

Auditing and Reporting, Assessment 1, v1.0 Page 10

a. A client requests assistance of J. Shik, a chartered accountant, in

the installation of a computer system for maintaining production records. Shik has no

experience in this type of work and no knowledge of the client’s production records, so he

obtains assistance from a computer consultant. The consultant is not in the practice of public

accounting, but Shik is confident of his professional skills. Because of the highly technical

nature of the work, Shik is not able to review the consultant’s work.

Solution

A member in a public practice cannot disclose client Information. If this is violated,

there is a Violation of Rule 301suggested that the company hire the consultant directly.

b. Five small Sydney public accounting firms have become involved in an information project

by taking part in an inter-firm working paper review program. Under the program, each firm

designates two partners to review the working papers, including the tax returns and the

financial statements of another public accounting firm taking part in the program. At the end

of each review, the auditors who prepared the working papers and the reviewers have a

conference to discuss the strengths and weaknesses of the audit. They do not obtain

authorisation from the client before the review takes place.

Solution

A member in an organization that is certified by state law can practice public Accounting.

If this is violated, there is a Violation of Rule 505.

c. Shirley Morris, a public accountant, applies to Apple & George, public accountants, for a

permanent job as a senior auditor. Morris informs Apple & George that she works for another

public accounting firm in the same city but will not permit them to contact her present

employer. Apple & George hire Morris without contacting the other public accounting firm.

Solution

If existing loan, no violation, if loan does not exist, then it is a Violation of Rule 101

because it is a new loan.

d. Bill Wendal, a chartered accountant, sets up a casualty and fire insurance agency to

complement his auditing and tax services. He does not use his own name on anything

pertaining to the insurance agency and has a highly competent manager, Sandra Jones,

who runs it. Wendal often requests that Jones review the adequacy of a client’s insurance

Auditing and Reporting, Assessment 1, v1.0 Page 10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

T-1.8.1

with management if it seems underinsured. He feels that he provides a

valuable service to clients by informing them when they are underinsured.

Solution

No Violation

4. The following relate to auditors’ independence.

a

b

C

d

f

a. Why is independence so essential for auditors?

The primary reason for the auditor’s independency is so that the audit opinion will not be

influenced by any relationship between the auditors and the client company. Independence is

essential for auditor because a user of financials statements need a better view of a CPA’s fairness of

financial statements. An audit functions value will be considered nothing if users knew that the auditors

weren’t independent. The auditors are expected to give an unbiased and honest professional

opinion on the financial statements to the shareholders.

b. Compare the importance of independence of auditors with that of other professionals, such as

solicitors.

Independence is not required for most professions because most other professions represent clients and

offer services to assist clients. Some professions are doctors, lawyers or solitators, and dentists.

Audit independence is the auditor’s ability to take an unbiased viewpoint in the performance of

professional services whereas other professions like solicitor independence is whether they are able to

act in their client's best interest without fear of interference.

The auditors independence is at standalone basis distanced from the client whereas for solicitors’

independence, both of the individual solicitor as practitioner, and the regulation of lawyers collectively

Lack of auditors’ independence can lead to corruption practices and vices whereas luck of solicitors’

independence can facilitate criminal activities by whenever they failing to maintain their independence.

Auditing and Reporting, Assessment 1, v1.0 Page 11

with management if it seems underinsured. He feels that he provides a

valuable service to clients by informing them when they are underinsured.

Solution

No Violation

4. The following relate to auditors’ independence.

a

b

C

d

f

a. Why is independence so essential for auditors?

The primary reason for the auditor’s independency is so that the audit opinion will not be

influenced by any relationship between the auditors and the client company. Independence is

essential for auditor because a user of financials statements need a better view of a CPA’s fairness of

financial statements. An audit functions value will be considered nothing if users knew that the auditors

weren’t independent. The auditors are expected to give an unbiased and honest professional

opinion on the financial statements to the shareholders.

b. Compare the importance of independence of auditors with that of other professionals, such as

solicitors.

Independence is not required for most professions because most other professions represent clients and

offer services to assist clients. Some professions are doctors, lawyers or solitators, and dentists.

Audit independence is the auditor’s ability to take an unbiased viewpoint in the performance of

professional services whereas other professions like solicitor independence is whether they are able to

act in their client's best interest without fear of interference.

The auditors independence is at standalone basis distanced from the client whereas for solicitors’

independence, both of the individual solicitor as practitioner, and the regulation of lawyers collectively

Lack of auditors’ independence can lead to corruption practices and vices whereas luck of solicitors’

independence can facilitate criminal activities by whenever they failing to maintain their independence.

Auditing and Reporting, Assessment 1, v1.0 Page 11

T-1.8.1

c. Explain the difference between independence in appearance and in fact.

Independence in appearance is how independent the auditor appears to outside people like clients

and users of financial statements. Independence of mind is how independent the auditor is during an

engagement. An example of this can be if a person was walking down the street and they saw a person

that he/she knew that owed him/her money drop money on the floor. If the person picked up the money

and decided to keep it because the other owed that person money, this would violate independence of

appearance. If the person decide to give it back then it would not violate independence of appearance by

the person might not feel it’s the right decision.

d. Assume that a partner of a public accounting firm owns 200 shares in a large client. The

ownership is an insignificant part of his total wealth.

(1) Has he violated the Code of Professional Conduct?

He has violated the Code of Professional Conduct because rule 101 prohibits any direct

ownership to a partner or a shareholder.

(2) Explain whether the ownership is likely to affect the partner’s independence of mind.

The ownership is small; therefore it is unlikely that the partner will have any impact on

evaluating financial statements. It shouldn’t affect the partner’s independence of mind.

(3) Explain the reason for the strict requirements about stock ownership in the rules of

conduct.

Strict requirements eliminate controversy between the line of material and immaterial ownership,

and it shows others the importance of independence when it comes to auditors therefore improving the

reputation of the profession.

1. He has not violikely to affect the partner's independence in fact.

3. Ownership of material shareholdings could affect the appearance of independence and therefore

Auditing and Reporting, Assessment 1, v1.0 Page 12

c. Explain the difference between independence in appearance and in fact.

Independence in appearance is how independent the auditor appears to outside people like clients

and users of financial statements. Independence of mind is how independent the auditor is during an

engagement. An example of this can be if a person was walking down the street and they saw a person

that he/she knew that owed him/her money drop money on the floor. If the person picked up the money

and decided to keep it because the other owed that person money, this would violate independence of

appearance. If the person decide to give it back then it would not violate independence of appearance by

the person might not feel it’s the right decision.

d. Assume that a partner of a public accounting firm owns 200 shares in a large client. The

ownership is an insignificant part of his total wealth.

(1) Has he violated the Code of Professional Conduct?

He has violated the Code of Professional Conduct because rule 101 prohibits any direct

ownership to a partner or a shareholder.

(2) Explain whether the ownership is likely to affect the partner’s independence of mind.

The ownership is small; therefore it is unlikely that the partner will have any impact on

evaluating financial statements. It shouldn’t affect the partner’s independence of mind.

(3) Explain the reason for the strict requirements about stock ownership in the rules of

conduct.

Strict requirements eliminate controversy between the line of material and immaterial ownership,

and it shows others the importance of independence when it comes to auditors therefore improving the

reputation of the profession.

1. He has not violikely to affect the partner's independence in fact.

3. Ownership of material shareholdings could affect the appearance of independence and therefore

Auditing and Reporting, Assessment 1, v1.0 Page 12

T-1.8.1

WEEK-3-CLASS ACTIVITY

1. Auditors seek to acquire background knowledge of the client’s industry as an aid to

their audit work. How would the acquisition of this knowledge aid the auditor in

distinguishing between obsolete and current inventory.

There are three primary benefits from planning audits: it helps the auditor obtain

sufficient appropriate evidence for the circumstances, helps keep audit costs reasonable,

and helps avoid misunderstandings with the client. The information and knowledge of the

client’s industry is essential in helping the auditor evaluate whether the client's inventory may

be obsolete or have a market value lower than cost.

2. For the audit of Radline Manufacturing Limited, the audit partner asks you to read

carefully the new mortgage loan contract with the National Bank and abstract all

pertinent information. List the information in the mortgage document that is likely to

be relevant to the auditor.

a) Engagement letter-this is that agreement between the CPA firm and the client as to

the terms of the engagement for the conduct of the audit and related service

b) Corporate minutes-the official record of the meetings of a corporations' board of

directors and stockholders, in which corporate issues such as the declaration of

dividends and the approval of contracts are documented

c) Known misstatements-specific misstatements in a class of transactions or account

balance identified during the audit

d) Performance materiality-the materiality amount(s) for segments of the audit, set by

the auditor at less than materiality for the financial statements as a whole

Auditing and Reporting, Assessment 1, v1.0 Page 13

WEEK-3-CLASS ACTIVITY

1. Auditors seek to acquire background knowledge of the client’s industry as an aid to

their audit work. How would the acquisition of this knowledge aid the auditor in

distinguishing between obsolete and current inventory.

There are three primary benefits from planning audits: it helps the auditor obtain

sufficient appropriate evidence for the circumstances, helps keep audit costs reasonable,

and helps avoid misunderstandings with the client. The information and knowledge of the

client’s industry is essential in helping the auditor evaluate whether the client's inventory may

be obsolete or have a market value lower than cost.

2. For the audit of Radline Manufacturing Limited, the audit partner asks you to read

carefully the new mortgage loan contract with the National Bank and abstract all

pertinent information. List the information in the mortgage document that is likely to

be relevant to the auditor.

a) Engagement letter-this is that agreement between the CPA firm and the client as to

the terms of the engagement for the conduct of the audit and related service

b) Corporate minutes-the official record of the meetings of a corporations' board of

directors and stockholders, in which corporate issues such as the declaration of

dividends and the approval of contracts are documented

c) Known misstatements-specific misstatements in a class of transactions or account

balance identified during the audit

d) Performance materiality-the materiality amount(s) for segments of the audit, set by

the auditor at less than materiality for the financial statements as a whole

Auditing and Reporting, Assessment 1, v1.0 Page 13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

T-1.8.1

e) Related party-affiliated company, principal owner of the client

company, or any other party with which the client deals, where one of the parties can

influence the management or operating policies of the other

f) Related party transaction-any transaction between the client and a related party.

3. List the purpose of Audit Documentation (Working Papers) and explain why each

purpose is important.

- Audit quality control- audit working papers are necessary for audit quality control purposes

- Provides assurance- provide assurance that the work delegated by the audit partner has

been properly completed

-Boosting confidence-working papers are important as they provide evidence that an

effective audit has been carried out

-increase the economy, efficiency, and effectiveness of the audit

-Provides justifications- the up-to-date facts contained in the working papers justify the

reasonableness of the auditor’s conclusions

- Records maintenance- audit working papers retain a record of matters of continuing

significance to future audits.

WEEK 4 CLASS ACTIVITY

1. Explain why it is common for auditors to send confirmation requests to

vendors with ‘zero balances’ on the accounts payable listing but uncommon to

follow the same approach in verifying accounts receivable.

Auditors prefers to follow a conservative approach in selecting vendors for accounts

payable confirmations and customers for accounts receivable confirmations. The auditor

assumes that the client is more likely to understate accounts payable, and therefore

concentrates on the vendors with whom the client deals actively, especially if that vendors

balance appears to be lower than normal on the clients’ accounts payable listing at the

confirmation date. In verifying accounts receivable, the auditor assumes that the client is

more likely to overstate account balances; and for that reason concentrates more on the

larger amount balances and is not as concerned with zero balances.

2. List several audit procedures that the auditor can use to determine whether

Auditing and Reporting, Assessment 1, v1.0 Page 14

e) Related party-affiliated company, principal owner of the client

company, or any other party with which the client deals, where one of the parties can

influence the management or operating policies of the other

f) Related party transaction-any transaction between the client and a related party.

3. List the purpose of Audit Documentation (Working Papers) and explain why each

purpose is important.

- Audit quality control- audit working papers are necessary for audit quality control purposes

- Provides assurance- provide assurance that the work delegated by the audit partner has

been properly completed

-Boosting confidence-working papers are important as they provide evidence that an

effective audit has been carried out

-increase the economy, efficiency, and effectiveness of the audit

-Provides justifications- the up-to-date facts contained in the working papers justify the

reasonableness of the auditor’s conclusions

- Records maintenance- audit working papers retain a record of matters of continuing

significance to future audits.

WEEK 4 CLASS ACTIVITY

1. Explain why it is common for auditors to send confirmation requests to

vendors with ‘zero balances’ on the accounts payable listing but uncommon to

follow the same approach in verifying accounts receivable.

Auditors prefers to follow a conservative approach in selecting vendors for accounts

payable confirmations and customers for accounts receivable confirmations. The auditor

assumes that the client is more likely to understate accounts payable, and therefore

concentrates on the vendors with whom the client deals actively, especially if that vendors

balance appears to be lower than normal on the clients’ accounts payable listing at the

confirmation date. In verifying accounts receivable, the auditor assumes that the client is

more likely to overstate account balances; and for that reason concentrates more on the

larger amount balances and is not as concerned with zero balances.

2. List several audit procedures that the auditor can use to determine whether

Auditing and Reporting, Assessment 1, v1.0 Page 14

T-1.8.1

payroll transactions are recorded at the proper amount.

-Recompute hours worked from time cards.

-Compare pay rates with union contract, approved by the board of directors

-Recompute gross pay.

-Check withholdings by reference to tax tables and authorization forms.

-Recompute net pay.

-Compare cancelled check with payroll journal or listing for amount.

WEEK 5 CLASS ACTIVITY CASE STUDY

Question 1

ABC Company Limited declares dividends based on its profit. A newspaper ranked the

company as number one in the country for its best performance and goodwill in the market in

the last three years. In the fourth year (2010), company’s profit dramatically declined, its

cash flows from the operations resulted in a negative figure and a negligible amount of

dividend was declared from the reserve. These concerns drew attention of the securities

regulators and other oversight bodies. The media immediately took these issues and

published special comments on the internal governance and auditor’s independence

problems.

The audit committee of the company looked influential in the corporate governance process.

It had two members including the chairman of the board as the chairman of this committee.

The CEO was the second member of this committee. Both of them were graduates (MBAs)

from marketing discipline of Harvard University.

The external auditor was a Big 4 audit firm that continuously acted as the auditor of ABC

Company Limited for the last six years. At the request of the CEO, the auditor provided

consultancy services for 11 hours in 2010 and 10 hours in 2009. Given the financial

Auditing and Reporting, Assessment 1, v1.0 Page 15

payroll transactions are recorded at the proper amount.

-Recompute hours worked from time cards.

-Compare pay rates with union contract, approved by the board of directors

-Recompute gross pay.

-Check withholdings by reference to tax tables and authorization forms.

-Recompute net pay.

-Compare cancelled check with payroll journal or listing for amount.

WEEK 5 CLASS ACTIVITY CASE STUDY

Question 1

ABC Company Limited declares dividends based on its profit. A newspaper ranked the

company as number one in the country for its best performance and goodwill in the market in

the last three years. In the fourth year (2010), company’s profit dramatically declined, its

cash flows from the operations resulted in a negative figure and a negligible amount of

dividend was declared from the reserve. These concerns drew attention of the securities

regulators and other oversight bodies. The media immediately took these issues and

published special comments on the internal governance and auditor’s independence

problems.

The audit committee of the company looked influential in the corporate governance process.

It had two members including the chairman of the board as the chairman of this committee.

The CEO was the second member of this committee. Both of them were graduates (MBAs)

from marketing discipline of Harvard University.

The external auditor was a Big 4 audit firm that continuously acted as the auditor of ABC

Company Limited for the last six years. At the request of the CEO, the auditor provided

consultancy services for 11 hours in 2010 and 10 hours in 2009. Given the financial

Auditing and Reporting, Assessment 1, v1.0 Page 15

T-1.8.1

condition of the company in the fourth year and friendly relationships

with the auditor, the CEO asked the external auditor to change the audit practice for 2010.

When the ABC Company’s annual report for 2010 was published in 2011, there was no

auditor’s independence declaration in the company’s annual report.

Required:

Read the above case carefully referring to the Corporations Act 2001, APES 110 Code of

Ethics for Professional Accountants and other related regulations, and then answer the

following questions

(a) Discuss in your group the issues relating to independence and expertise of the audit

committee. Confirm corporate audit requirements and procedures using questioning

and active listening.

The corporate requirements for auditabele financial statements include the state that

the directors must ensure the company’s annual financial statements are audited in

accordance with section 709 (1). This in this context is not on light.

(b) Present your finding in a group about the problems relating to auditor’s independence.

Keep in mind about the diverse cultural background of your Audience and

use appropriate language.

The auditors’ independence is at the state of questionability. The company’s

management has not been on proper record keeping and has therefore not in totality

disclosed all the information. This has been a great challenge as the management is likely to

attempt to influence auditing process for their own desires contrary to auditors’

independence.

The following skills must be displayed to gain competency in this unit of competency:

Skills S NS Assessor Comments

determine and confirm corporate audit

requirements and procedures using

Auditing and Reporting, Assessment 1, v1.0 Page 16

condition of the company in the fourth year and friendly relationships

with the auditor, the CEO asked the external auditor to change the audit practice for 2010.

When the ABC Company’s annual report for 2010 was published in 2011, there was no

auditor’s independence declaration in the company’s annual report.

Required:

Read the above case carefully referring to the Corporations Act 2001, APES 110 Code of

Ethics for Professional Accountants and other related regulations, and then answer the

following questions

(a) Discuss in your group the issues relating to independence and expertise of the audit

committee. Confirm corporate audit requirements and procedures using questioning

and active listening.

The corporate requirements for auditabele financial statements include the state that

the directors must ensure the company’s annual financial statements are audited in

accordance with section 709 (1). This in this context is not on light.

(b) Present your finding in a group about the problems relating to auditor’s independence.

Keep in mind about the diverse cultural background of your Audience and

use appropriate language.

The auditors’ independence is at the state of questionability. The company’s

management has not been on proper record keeping and has therefore not in totality

disclosed all the information. This has been a great challenge as the management is likely to

attempt to influence auditing process for their own desires contrary to auditors’

independence.

The following skills must be displayed to gain competency in this unit of competency:

Skills S NS Assessor Comments

determine and confirm corporate audit

requirements and procedures using

Auditing and Reporting, Assessment 1, v1.0 Page 16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

T-1.8.1

questioning

and active listening as required

liaise with others, share information,

listen and understand while

maintaining confidences and ethical

practices

use language and concepts

appropriate to cultural differences

Question 2

(a) Explain the audit risk model.

The audit risk model a type of framework that is used in determining the total

amount of risk associated with an audit, and describes how this risk can be managed

(b) Explain two (2) methods audit practitioners use to assess acceptable audit risk.

-Analyze financial statements for difficulties using ratios-this incorporate the concept of

Materiality to the audit duties.

-Examine inflows and outflows of cash flow statements- the examination as well takes into

consideration the materiality concept for maximum best audit performance.

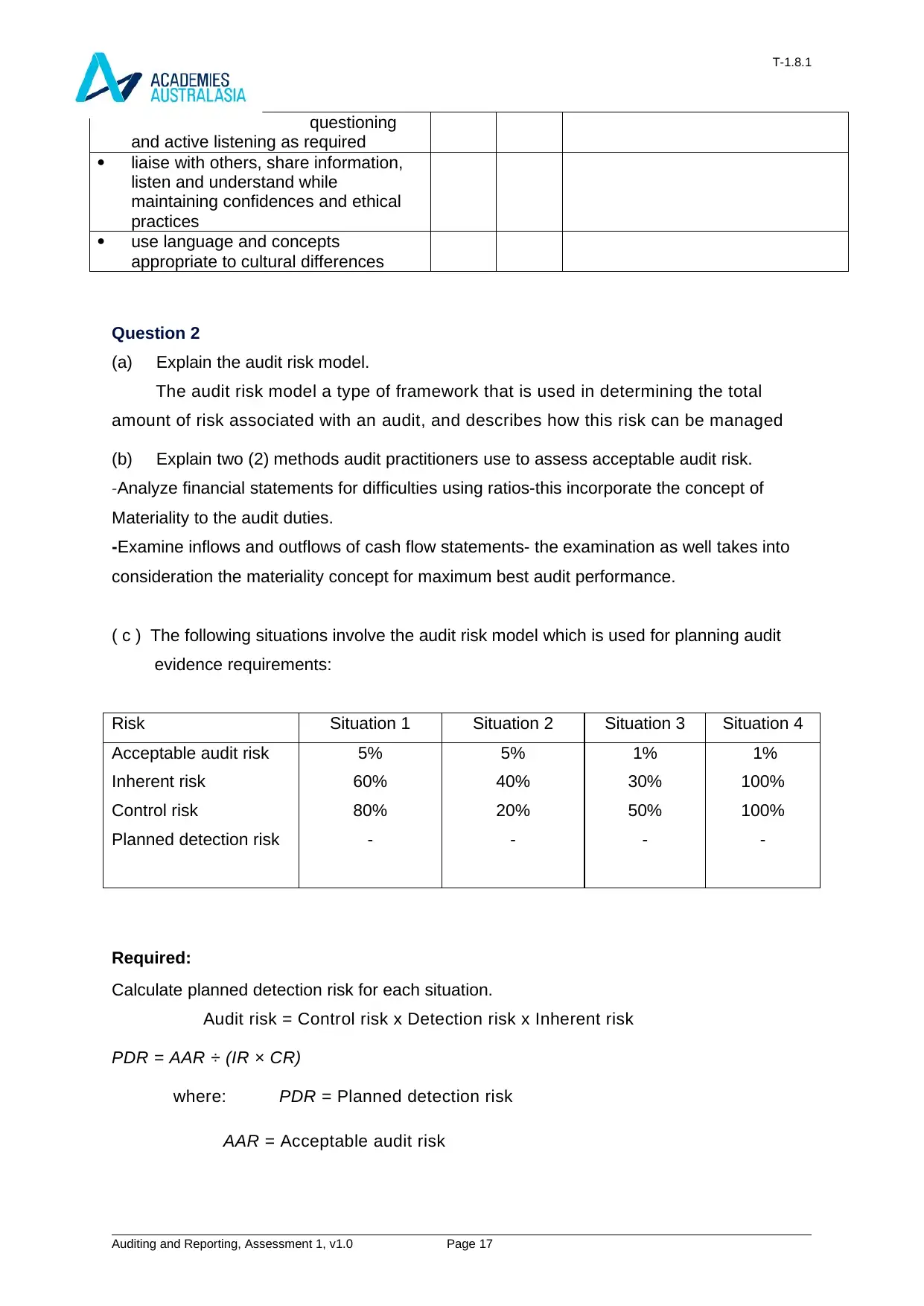

( c ) The following situations involve the audit risk model which is used for planning audit

evidence requirements:

Risk Situation 1 Situation 2 Situation 3 Situation 4

Acceptable audit risk

Inherent risk

Control risk

Planned detection risk

5%

60%

80%

-

5%

40%

20%

-

1%

30%

50%

-

1%

100%

100%

-

Required:

Calculate planned detection risk for each situation.

Audit risk = Control risk x Detection risk x Inherent risk

PDR = AAR ÷ (IR × CR)

where: PDR = Planned detection risk

AAR = Acceptable audit risk

Auditing and Reporting, Assessment 1, v1.0 Page 17

questioning

and active listening as required

liaise with others, share information,

listen and understand while

maintaining confidences and ethical

practices

use language and concepts

appropriate to cultural differences

Question 2

(a) Explain the audit risk model.

The audit risk model a type of framework that is used in determining the total

amount of risk associated with an audit, and describes how this risk can be managed

(b) Explain two (2) methods audit practitioners use to assess acceptable audit risk.

-Analyze financial statements for difficulties using ratios-this incorporate the concept of

Materiality to the audit duties.

-Examine inflows and outflows of cash flow statements- the examination as well takes into

consideration the materiality concept for maximum best audit performance.

( c ) The following situations involve the audit risk model which is used for planning audit

evidence requirements:

Risk Situation 1 Situation 2 Situation 3 Situation 4

Acceptable audit risk

Inherent risk

Control risk

Planned detection risk

5%

60%

80%

-

5%

40%

20%

-

1%

30%

50%

-

1%

100%

100%

-

Required:

Calculate planned detection risk for each situation.

Audit risk = Control risk x Detection risk x Inherent risk

PDR = AAR ÷ (IR × CR)

where: PDR = Planned detection risk

AAR = Acceptable audit risk

Auditing and Reporting, Assessment 1, v1.0 Page 17

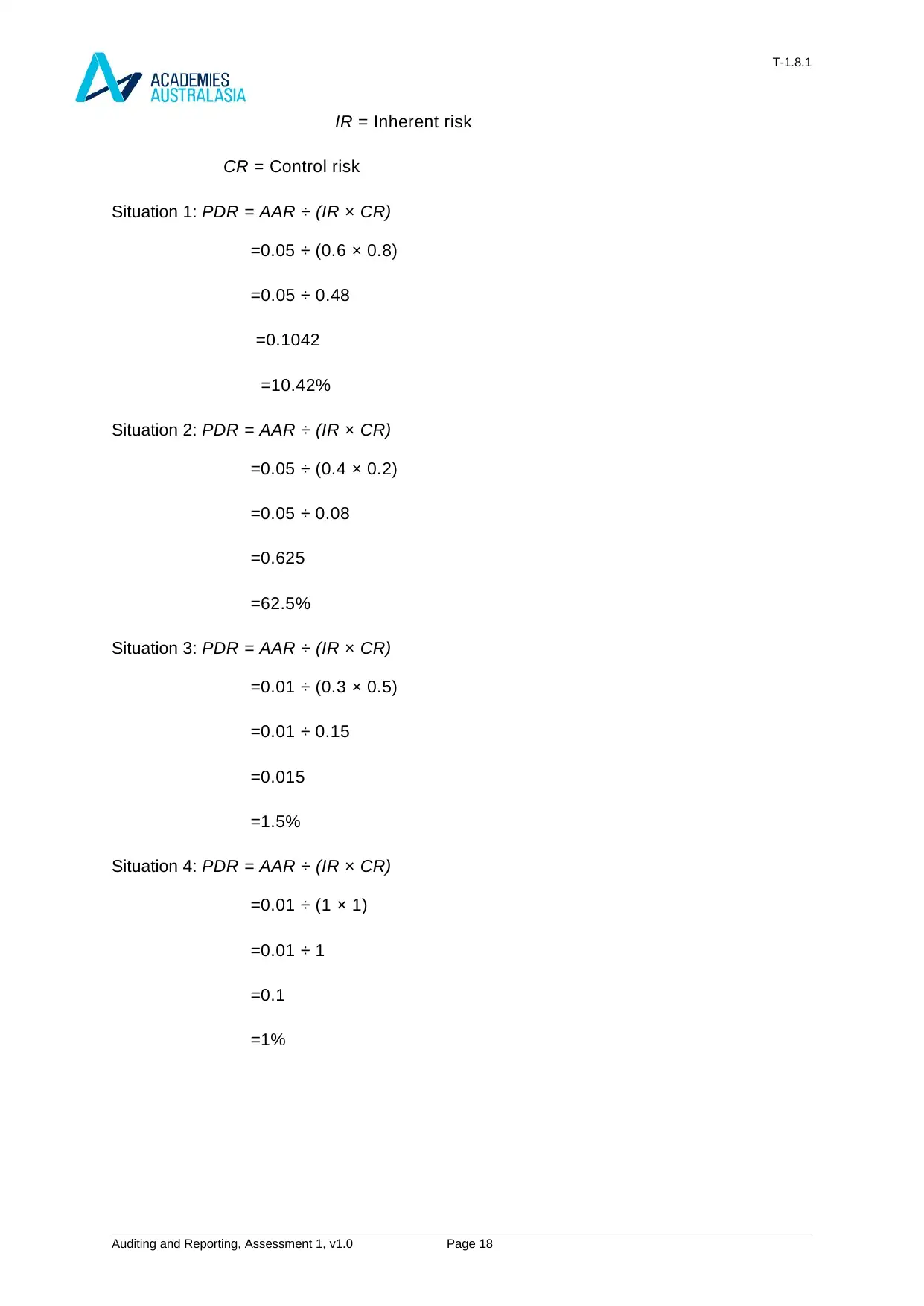

T-1.8.1

IR = Inherent risk

CR = Control risk

Situation 1: PDR = AAR ÷ (IR × CR)

=0.05 ÷ (0.6 × 0.8)

=0.05 ÷ 0.48

=0.1042

=10.42%

Situation 2: PDR = AAR ÷ (IR × CR)

=0.05 ÷ (0.4 × 0.2)

=0.05 ÷ 0.08

=0.625

=62.5%

Situation 3: PDR = AAR ÷ (IR × CR)

=0.01 ÷ (0.3 × 0.5)

=0.01 ÷ 0.15

=0.015

=1.5%

Situation 4: PDR = AAR ÷ (IR × CR)

=0.01 ÷ (1 × 1)

=0.01 ÷ 1

=0.1

=1%

Auditing and Reporting, Assessment 1, v1.0 Page 18

IR = Inherent risk

CR = Control risk

Situation 1: PDR = AAR ÷ (IR × CR)

=0.05 ÷ (0.6 × 0.8)

=0.05 ÷ 0.48

=0.1042

=10.42%

Situation 2: PDR = AAR ÷ (IR × CR)

=0.05 ÷ (0.4 × 0.2)

=0.05 ÷ 0.08

=0.625

=62.5%

Situation 3: PDR = AAR ÷ (IR × CR)

=0.01 ÷ (0.3 × 0.5)

=0.01 ÷ 0.15

=0.015

=1.5%

Situation 4: PDR = AAR ÷ (IR × CR)

=0.01 ÷ (1 × 1)

=0.01 ÷ 1

=0.1

=1%

Auditing and Reporting, Assessment 1, v1.0 Page 18

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.