MGT723 Research Project: Green Gas Emission and Firm Disclosure

VerifiedAdded on 2023/06/12

|10

|1644

|302

Report

AI Summary

This research project investigates the relationship between green gas emissions and firm disclosure levels, applying agency theory to understand the dynamics between firms and stakeholders. The study examines the influence of carbon risk management, voluntary disclosure, and firm size on carbon emission levels. Data from 60 companies were analyzed using descriptive and inferential statistics. Key findings indicate that firms with future risk considerations and integrated climate change strategies exhibit higher disclosure scores. While disclosure scores do not directly correlate with reduced carbon emissions, they enhance a firm's positive image, attracting clients and stakeholders. The research emphasizes the importance of aligning agent-principal relationships with CDP goals to reduce carbon emissions and promote transparency, mitigating potential financial losses for shareholders. Desklib provides access to similar research projects and solved assignments for students.

MGT723 Research Project

Semester 1 2018

Assessment Task: Research Proposal

Student Name:

Title:

Submission Date:

Topic: Agency theory

Question: Relationship between green gas emission and

firm disclosure level

Semester 1 2018

Assessment Task: Research Proposal

Student Name:

Title:

Submission Date:

Topic: Agency theory

Question: Relationship between green gas emission and

firm disclosure level

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Acknowledgement:

I certify that I have carefully reviewed the university’s academic misconduct policy. I understand that the

source of ideas must be referenced and that quotation marks and a reference are required when

directly quoting anyone else’s words.

I certify that I have carefully reviewed the university’s academic misconduct policy. I understand that the

source of ideas must be referenced and that quotation marks and a reference are required when

directly quoting anyone else’s words.

Introduction

The research question is how firm risk consideration and disclosure level affect the level of carbon

emission that company. Global warming has brought advance climatic changes and more risk to the

plant. This has attracted more research and policy making to mitigate the risk caused by green gas

emission. CDP a company tasked to reduce the risk of green gas emission and to reduce companies’

carbon emission. The study will try to explain the relation between company size and carbon emission.

Literature Review

The agency theory is based on problems caused when an agent is acting on behalf of the principal.

Agency theory looks at the connection and relationship between a principal and agent. This connection

may between executive and stakeholders or executive and key publics. An agent is a representative of a

principal in any business transaction and is expected to represent the principal to the best interest.

Think of principal as person who owns the company and agent as the director. The agency theory

explains the relationships between the director and auditor (CDP). We will try to establish the

relationship of CDP with level of carbon emission by the organisations. The auditor is an agent to the

shareholder (Freeman et al, 2013).

Many studies have been carried out to explain relationship between carbon emission and size of the

company. No consistency has been established by these researches. Eleftheriadis & Anagnostopoulou

(2015) found a negative relationship between firm size and the level of green gas emission. Small firms

had low carbon emission and higher disclosure level. Small firms are ready to compile with the law

stated with fear forced closure as compared to large firms.

Clarkson et al (2008) found a positive relationship between green gas emission and firm size and

disclosure level and firm size. Large firms release verifiable information on carbon emission and their

good performance to differentiate these firms from the inferior firms. These brought about the new

measures environmental performance which is firm size, risk management and disclosure level.

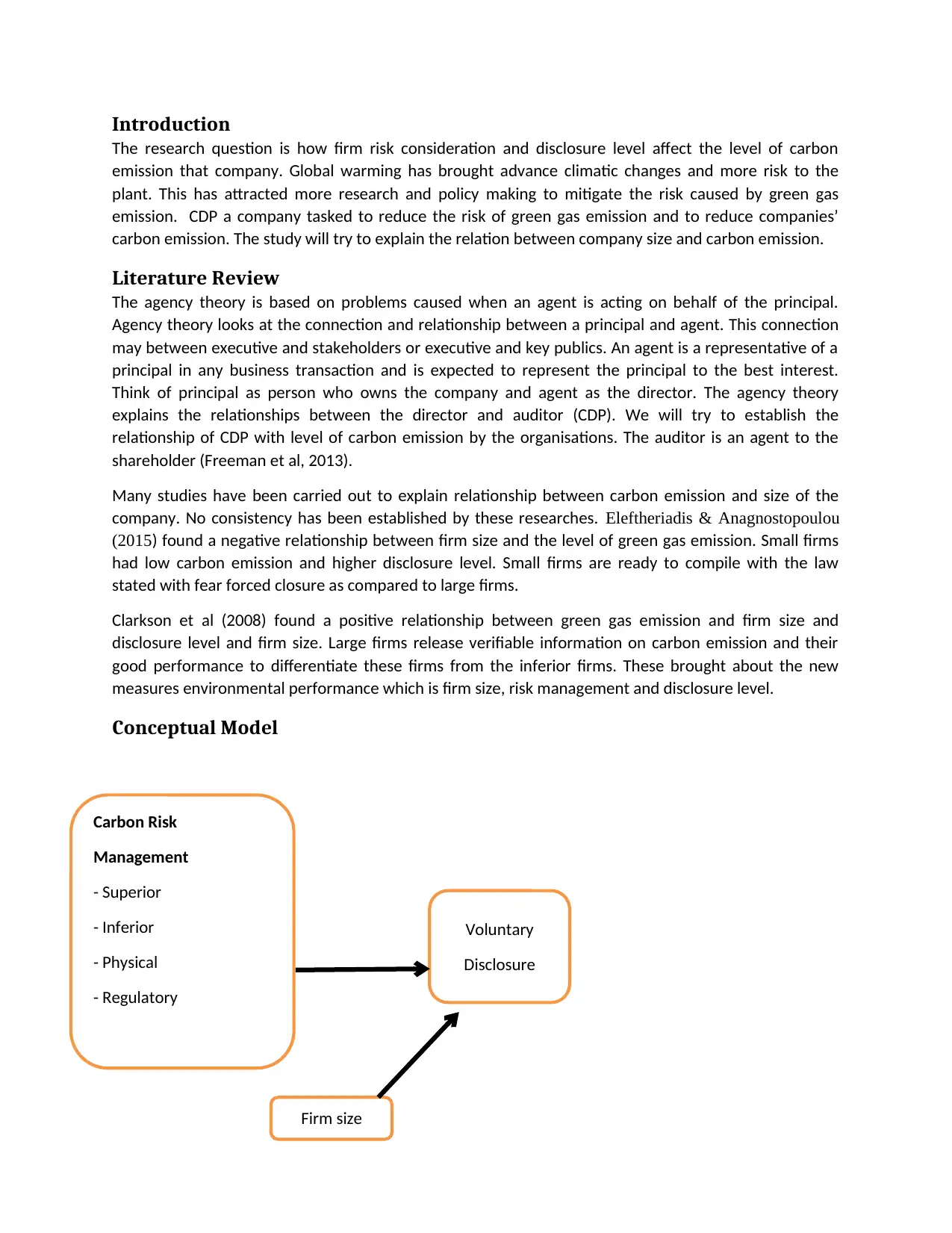

Conceptual Model

Carbon Risk

Management

- Superior

- Inferior

- Physical

- Regulatory

Voluntary

Disclosure

Firm size

The research question is how firm risk consideration and disclosure level affect the level of carbon

emission that company. Global warming has brought advance climatic changes and more risk to the

plant. This has attracted more research and policy making to mitigate the risk caused by green gas

emission. CDP a company tasked to reduce the risk of green gas emission and to reduce companies’

carbon emission. The study will try to explain the relation between company size and carbon emission.

Literature Review

The agency theory is based on problems caused when an agent is acting on behalf of the principal.

Agency theory looks at the connection and relationship between a principal and agent. This connection

may between executive and stakeholders or executive and key publics. An agent is a representative of a

principal in any business transaction and is expected to represent the principal to the best interest.

Think of principal as person who owns the company and agent as the director. The agency theory

explains the relationships between the director and auditor (CDP). We will try to establish the

relationship of CDP with level of carbon emission by the organisations. The auditor is an agent to the

shareholder (Freeman et al, 2013).

Many studies have been carried out to explain relationship between carbon emission and size of the

company. No consistency has been established by these researches. Eleftheriadis & Anagnostopoulou

(2015) found a negative relationship between firm size and the level of green gas emission. Small firms

had low carbon emission and higher disclosure level. Small firms are ready to compile with the law

stated with fear forced closure as compared to large firms.

Clarkson et al (2008) found a positive relationship between green gas emission and firm size and

disclosure level and firm size. Large firms release verifiable information on carbon emission and their

good performance to differentiate these firms from the inferior firms. These brought about the new

measures environmental performance which is firm size, risk management and disclosure level.

Conceptual Model

Carbon Risk

Management

- Superior

- Inferior

- Physical

- Regulatory

Voluntary

Disclosure

Firm size

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

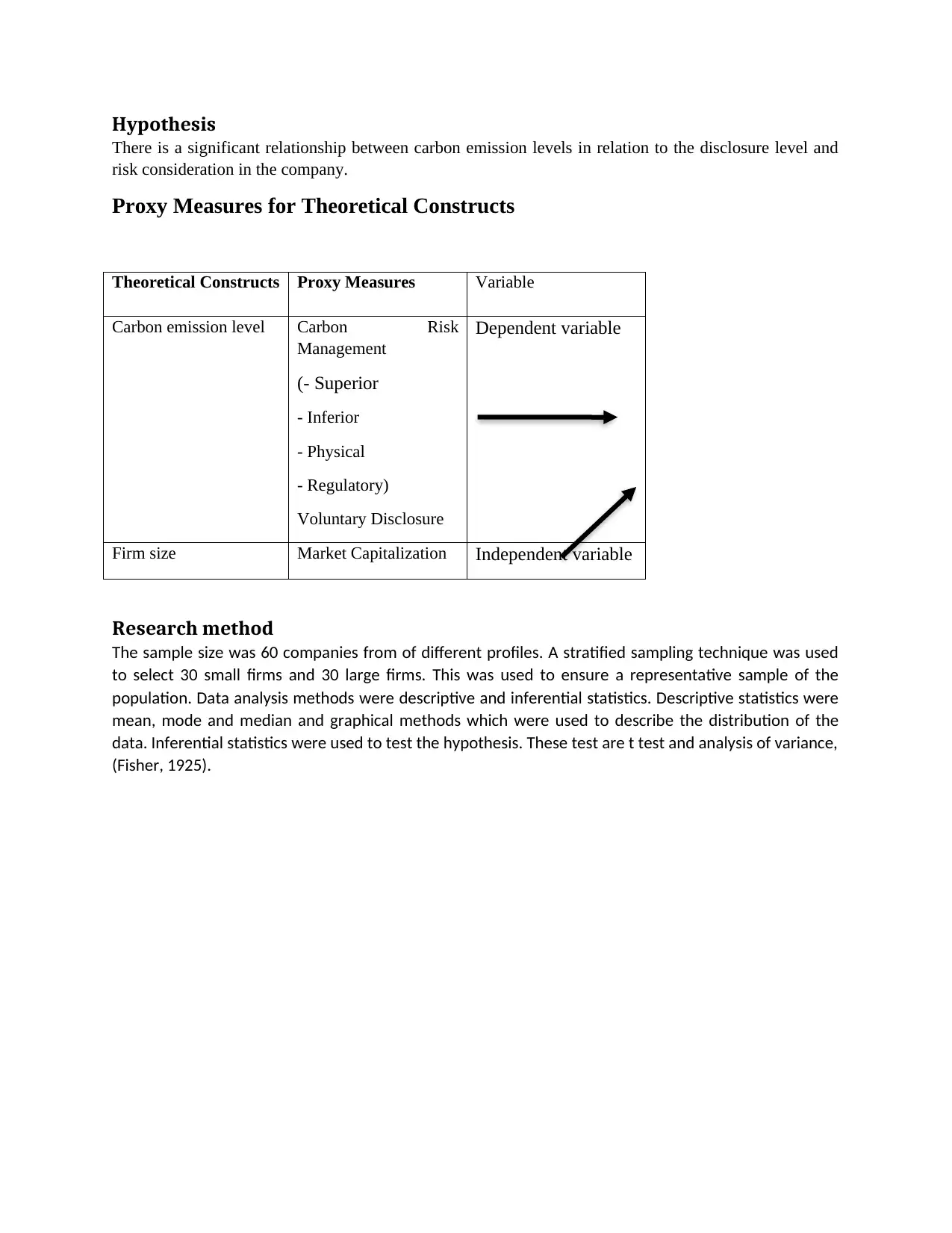

Hypothesis

There is a significant relationship between carbon emission levels in relation to the disclosure level and

risk consideration in the company.

Proxy Measures for Theoretical Constructs

Theoretical Constructs Proxy Measures Variable

Carbon emission level Carbon Risk

Management

(- Superior

- Inferior

- Physical

- Regulatory)

Voluntary Disclosure

Dependent variable

Firm size Market Capitalization Independent variable

Research method

The sample size was 60 companies from of different profiles. A stratified sampling technique was used

to select 30 small firms and 30 large firms. This was used to ensure a representative sample of the

population. Data analysis methods were descriptive and inferential statistics. Descriptive statistics were

mean, mode and median and graphical methods which were used to describe the distribution of the

data. Inferential statistics were used to test the hypothesis. These test are t test and analysis of variance,

(Fisher, 1925).

There is a significant relationship between carbon emission levels in relation to the disclosure level and

risk consideration in the company.

Proxy Measures for Theoretical Constructs

Theoretical Constructs Proxy Measures Variable

Carbon emission level Carbon Risk

Management

(- Superior

- Inferior

- Physical

- Regulatory)

Voluntary Disclosure

Dependent variable

Firm size Market Capitalization Independent variable

Research method

The sample size was 60 companies from of different profiles. A stratified sampling technique was used

to select 30 small firms and 30 large firms. This was used to ensure a representative sample of the

population. Data analysis methods were descriptive and inferential statistics. Descriptive statistics were

mean, mode and median and graphical methods which were used to describe the distribution of the

data. Inferential statistics were used to test the hypothesis. These test are t test and analysis of variance,

(Fisher, 1925).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Data analysis –Descriptive statistics

Company descriptions

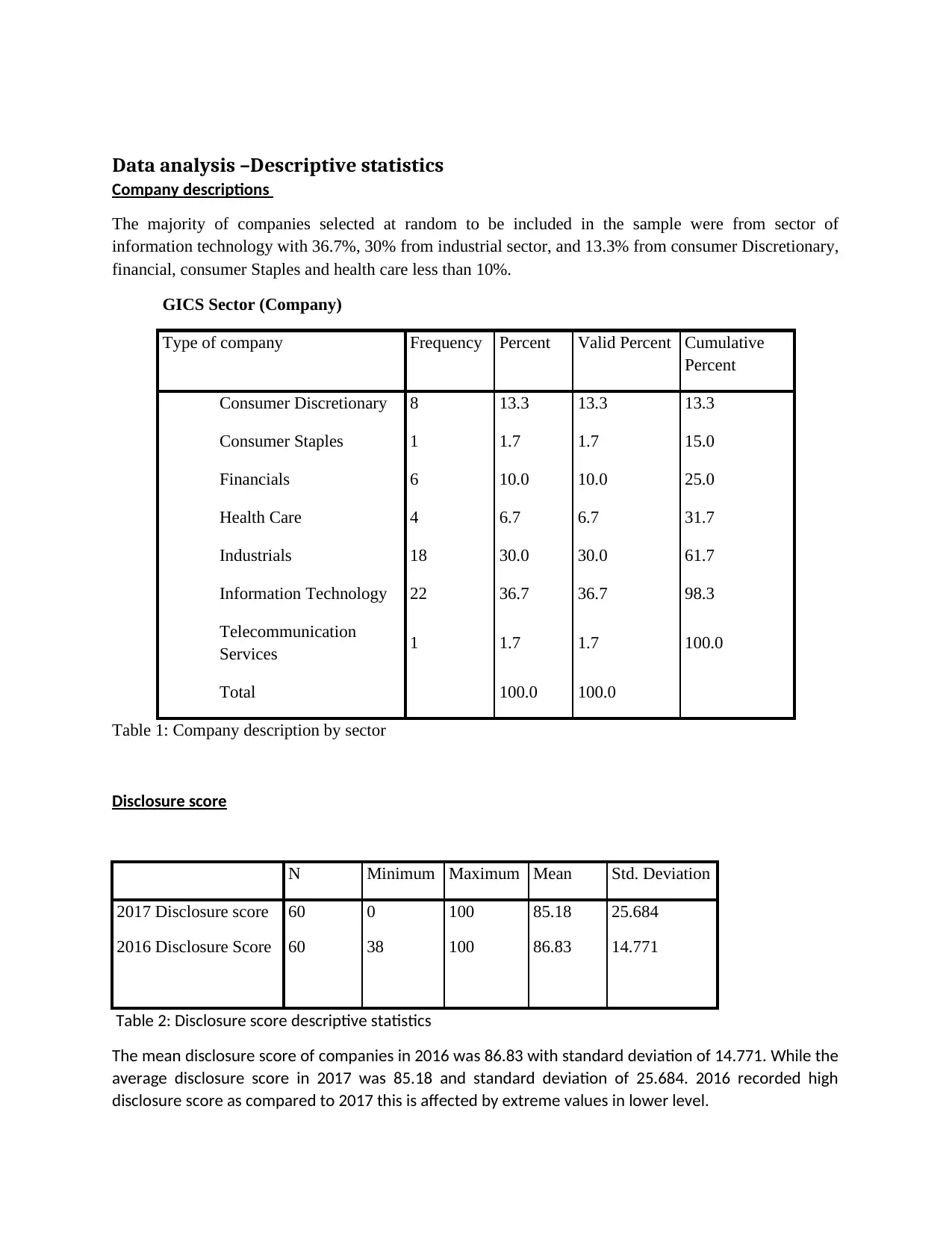

The majority of companies selected at random to be included in the sample were from sector of

information technology with 36.7%, 30% from industrial sector, and 13.3% from consumer Discretionary,

financial, consumer Staples and health care less than 10%.

GICS Sector (Company)

Type of company Frequency Percent Valid Percent Cumulative

Percent

Consumer Discretionary 8 13.3 13.3 13.3

Consumer Staples 1 1.7 1.7 15.0

Financials 6 10.0 10.0 25.0

Health Care 4 6.7 6.7 31.7

Industrials 18 30.0 30.0 61.7

Information Technology 22 36.7 36.7 98.3

Telecommunication

Services 1 1.7 1.7 100.0

Total 100.0 100.0

Table 1: Company description by sector

Disclosure score

N Minimum Maximum Mean Std. Deviation

2017 Disclosure score 60 0 100 85.18 25.684

2016 Disclosure Score 60 38 100 86.83 14.771

Table 2: Disclosure score descriptive statistics

The mean disclosure score of companies in 2016 was 86.83 with standard deviation of 14.771. While the

average disclosure score in 2017 was 85.18 and standard deviation of 25.684. 2016 recorded high

disclosure score as compared to 2017 this is affected by extreme values in lower level.

Company descriptions

The majority of companies selected at random to be included in the sample were from sector of

information technology with 36.7%, 30% from industrial sector, and 13.3% from consumer Discretionary,

financial, consumer Staples and health care less than 10%.

GICS Sector (Company)

Type of company Frequency Percent Valid Percent Cumulative

Percent

Consumer Discretionary 8 13.3 13.3 13.3

Consumer Staples 1 1.7 1.7 15.0

Financials 6 10.0 10.0 25.0

Health Care 4 6.7 6.7 31.7

Industrials 18 30.0 30.0 61.7

Information Technology 22 36.7 36.7 98.3

Telecommunication

Services 1 1.7 1.7 100.0

Total 100.0 100.0

Table 1: Company description by sector

Disclosure score

N Minimum Maximum Mean Std. Deviation

2017 Disclosure score 60 0 100 85.18 25.684

2016 Disclosure Score 60 38 100 86.83 14.771

Table 2: Disclosure score descriptive statistics

The mean disclosure score of companies in 2016 was 86.83 with standard deviation of 14.771. While the

average disclosure score in 2017 was 85.18 and standard deviation of 25.684. 2016 recorded high

disclosure score as compared to 2017 this is affected by extreme values in lower level.

The disclosure level was very high with over 90% of the firms disclosing their carbon emission

information to the public.

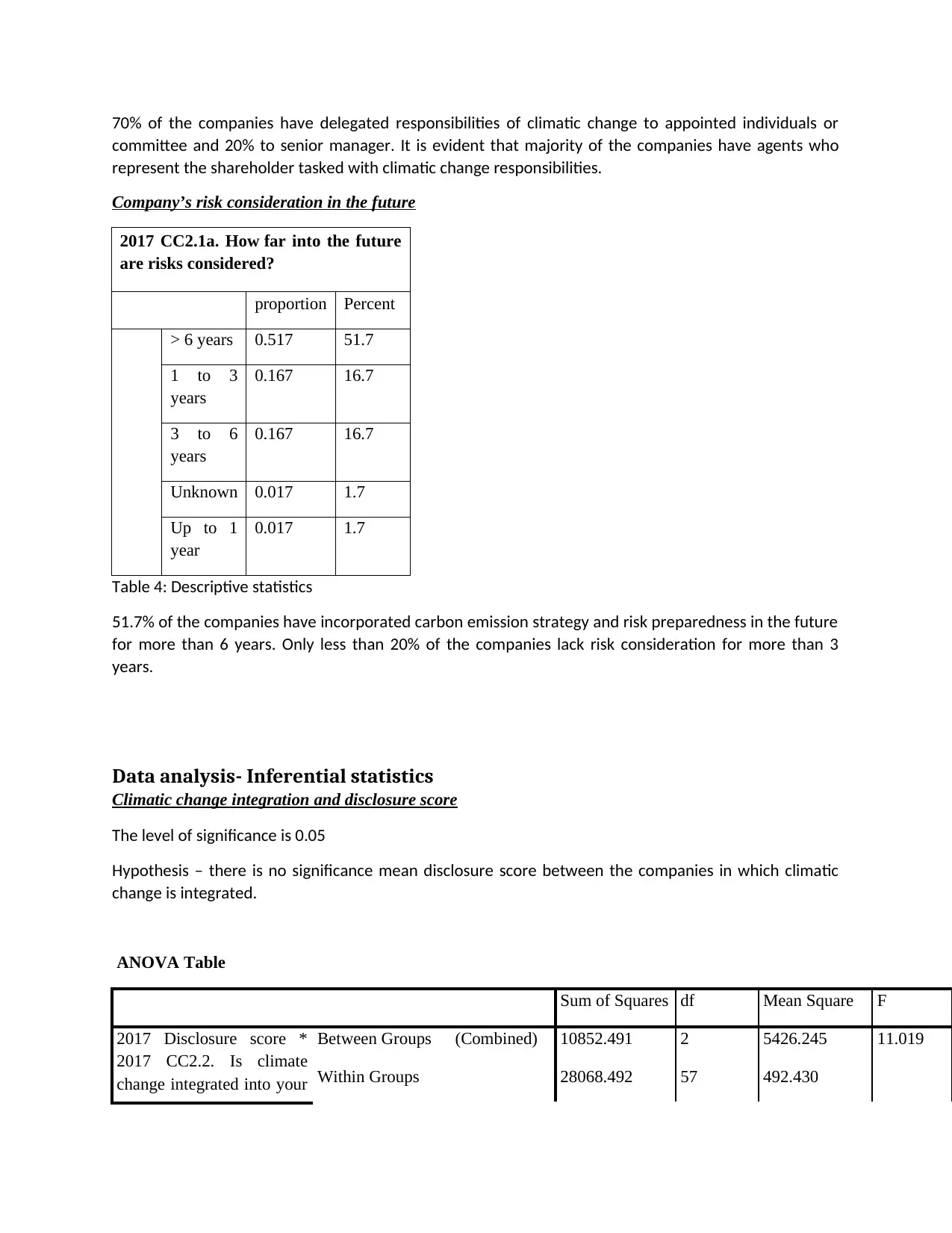

Climatic change responsibility in organization

Responsibility

of climatic

change with the

organization Frequency Percent

Board or

individual/sub-

set of the Board

or other

committee

appointed by the

Board

42 70.0

No individual or

committee with

overall

responsibility

for climate

change

1 1.7

Other

Manager/Office

r

3 5.0

Senior

Manager/Office

r

12 20.0

Total 100.0

Table 3: Climatic change responsibility frequency table

information to the public.

Climatic change responsibility in organization

Responsibility

of climatic

change with the

organization Frequency Percent

Board or

individual/sub-

set of the Board

or other

committee

appointed by the

Board

42 70.0

No individual or

committee with

overall

responsibility

for climate

change

1 1.7

Other

Manager/Office

r

3 5.0

Senior

Manager/Office

r

12 20.0

Total 100.0

Table 3: Climatic change responsibility frequency table

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

70% of the companies have delegated responsibilities of climatic change to appointed individuals or

committee and 20% to senior manager. It is evident that majority of the companies have agents who

represent the shareholder tasked with climatic change responsibilities.

Company’s risk consideration in the future

2017 CC2.1a. How far into the future

are risks considered?

proportion Percent

> 6 years 0.517 51.7

1 to 3

years

0.167 16.7

3 to 6

years

0.167 16.7

Unknown 0.017 1.7

Up to 1

year

0.017 1.7

Table 4: Descriptive statistics

51.7% of the companies have incorporated carbon emission strategy and risk preparedness in the future

for more than 6 years. Only less than 20% of the companies lack risk consideration for more than 3

years.

Data analysis- Inferential statistics

Climatic change integration and disclosure score

The level of significance is 0.05

Hypothesis – there is no significance mean disclosure score between the companies in which climatic

change is integrated.

ANOVA Table

Sum of Squares df Mean Square F

2017 Disclosure score *

2017 CC2.2. Is climate

change integrated into your

Between Groups (Combined) 10852.491 2 5426.245 11.019

Within Groups 28068.492 57 492.430

committee and 20% to senior manager. It is evident that majority of the companies have agents who

represent the shareholder tasked with climatic change responsibilities.

Company’s risk consideration in the future

2017 CC2.1a. How far into the future

are risks considered?

proportion Percent

> 6 years 0.517 51.7

1 to 3

years

0.167 16.7

3 to 6

years

0.167 16.7

Unknown 0.017 1.7

Up to 1

year

0.017 1.7

Table 4: Descriptive statistics

51.7% of the companies have incorporated carbon emission strategy and risk preparedness in the future

for more than 6 years. Only less than 20% of the companies lack risk consideration for more than 3

years.

Data analysis- Inferential statistics

Climatic change integration and disclosure score

The level of significance is 0.05

Hypothesis – there is no significance mean disclosure score between the companies in which climatic

change is integrated.

ANOVA Table

Sum of Squares df Mean Square F

2017 Disclosure score *

2017 CC2.2. Is climate

change integrated into your

Between Groups (Combined) 10852.491 2 5426.245 11.019

Within Groups 28068.492 57 492.430

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

business strategy?

Total 38920.983 59

The p value is 0.0 which is less than 0.05 therefore we reject null hypothesis and conclude that the mean

disclosure score is statistically different. Firms which have integrated climatic strategy in business have

mean disclosure different from those who do not have climatic change strategy.

Risk consideration and disclosure score

ANOVA Table

Sum of Squares df Mean Square F

2017 Disclosure score *

2017 CC2.1a. How far into

the future are risks

considered?

Between Groups (Combined) 8449.358 5 1689.872 2.995

Within Groups 30471.625 54 564.289

Total 38920.983 59

The p-value is 0.019 which is less than the level of significance 0.05 thus we reject null hypothesis. We

conclude that the mean disclosure score is statistically different depending on how far the firm has

considered future risks of not managing the level of green gas emission.

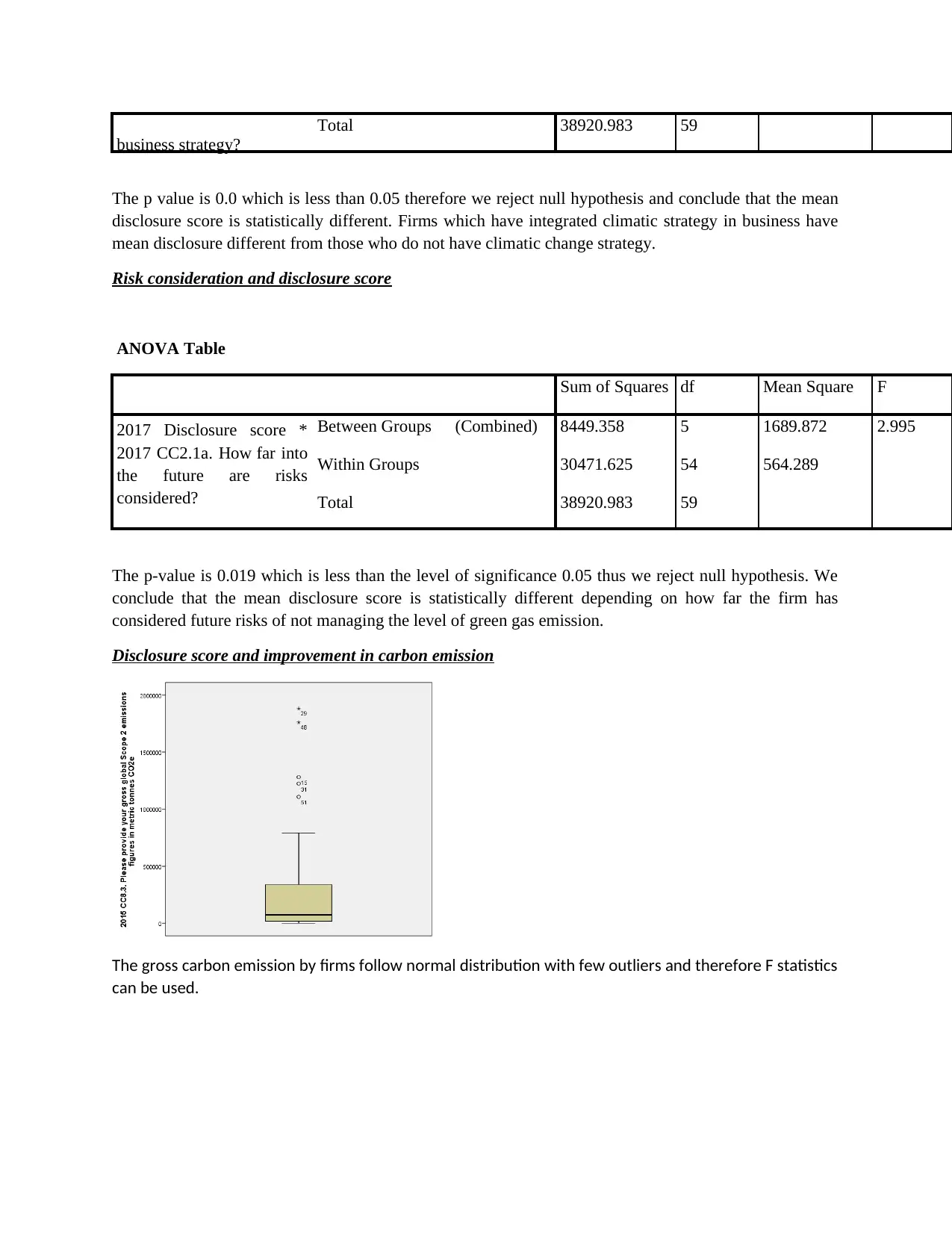

Disclosure score and improvement in carbon emission

The gross carbon emission by firms follow normal distribution with few outliers and therefore F statistics

can be used.

Total 38920.983 59

The p value is 0.0 which is less than 0.05 therefore we reject null hypothesis and conclude that the mean

disclosure score is statistically different. Firms which have integrated climatic strategy in business have

mean disclosure different from those who do not have climatic change strategy.

Risk consideration and disclosure score

ANOVA Table

Sum of Squares df Mean Square F

2017 Disclosure score *

2017 CC2.1a. How far into

the future are risks

considered?

Between Groups (Combined) 8449.358 5 1689.872 2.995

Within Groups 30471.625 54 564.289

Total 38920.983 59

The p-value is 0.019 which is less than the level of significance 0.05 thus we reject null hypothesis. We

conclude that the mean disclosure score is statistically different depending on how far the firm has

considered future risks of not managing the level of green gas emission.

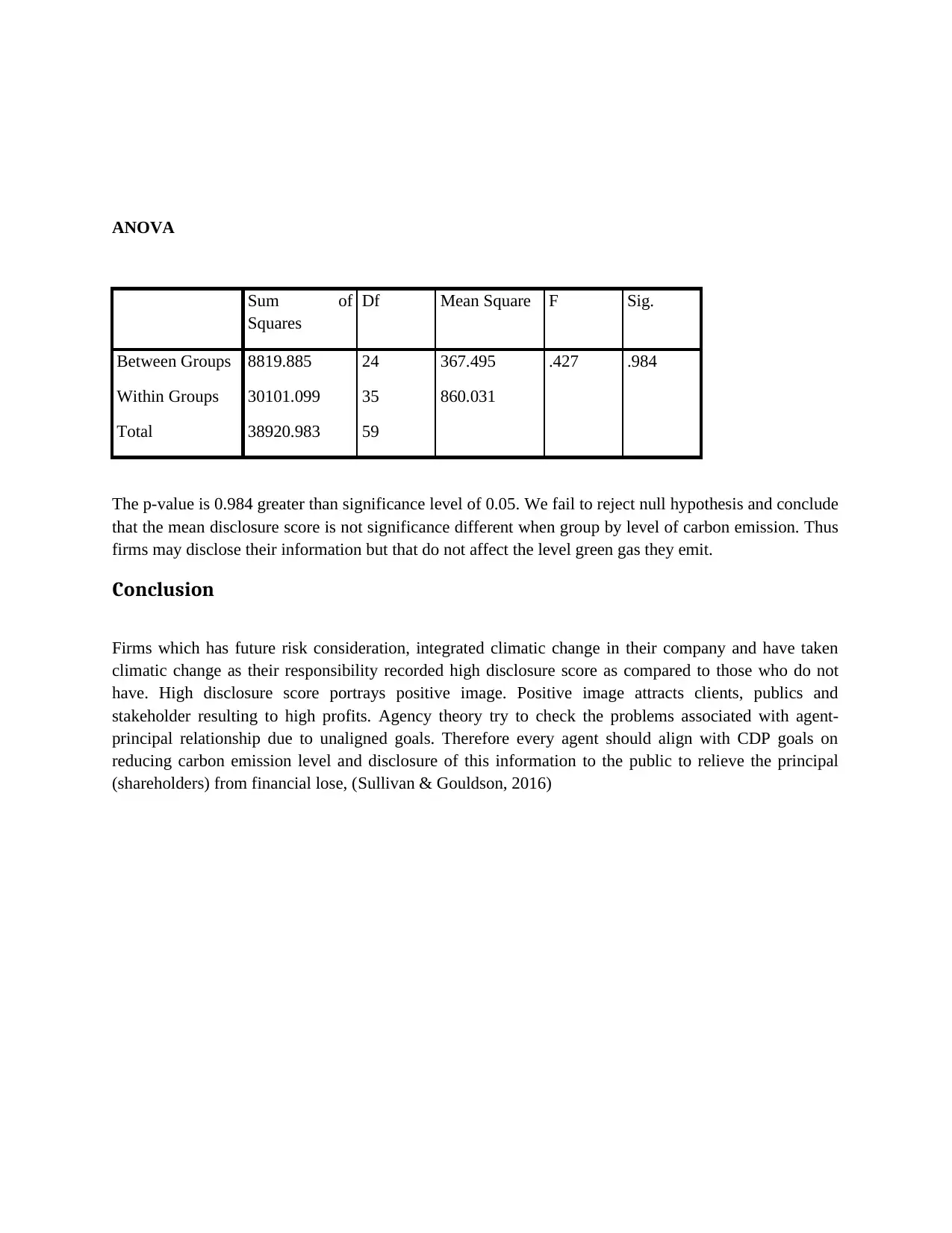

Disclosure score and improvement in carbon emission

The gross carbon emission by firms follow normal distribution with few outliers and therefore F statistics

can be used.

ANOVA

Sum of

Squares

Df Mean Square F Sig.

Between Groups 8819.885 24 367.495 .427 .984

Within Groups 30101.099 35 860.031

Total 38920.983 59

The p-value is 0.984 greater than significance level of 0.05. We fail to reject null hypothesis and conclude

that the mean disclosure score is not significance different when group by level of carbon emission. Thus

firms may disclose their information but that do not affect the level green gas they emit.

Conclusion

Firms which has future risk consideration, integrated climatic change in their company and have taken

climatic change as their responsibility recorded high disclosure score as compared to those who do not

have. High disclosure score portrays positive image. Positive image attracts clients, publics and

stakeholder resulting to high profits. Agency theory try to check the problems associated with agent-

principal relationship due to unaligned goals. Therefore every agent should align with CDP goals on

reducing carbon emission level and disclosure of this information to the public to relieve the principal

(shareholders) from financial lose, (Sullivan & Gouldson, 2016)

Sum of

Squares

Df Mean Square F Sig.

Between Groups 8819.885 24 367.495 .427 .984

Within Groups 30101.099 35 860.031

Total 38920.983 59

The p-value is 0.984 greater than significance level of 0.05. We fail to reject null hypothesis and conclude

that the mean disclosure score is not significance different when group by level of carbon emission. Thus

firms may disclose their information but that do not affect the level green gas they emit.

Conclusion

Firms which has future risk consideration, integrated climatic change in their company and have taken

climatic change as their responsibility recorded high disclosure score as compared to those who do not

have. High disclosure score portrays positive image. Positive image attracts clients, publics and

stakeholder resulting to high profits. Agency theory try to check the problems associated with agent-

principal relationship due to unaligned goals. Therefore every agent should align with CDP goals on

reducing carbon emission level and disclosure of this information to the public to relieve the principal

(shareholders) from financial lose, (Sullivan & Gouldson, 2016)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References

Clarkson P., Li, Y., Richardson G., & Vasvari F., 2008. 'Revisiting the relation between environmental

performance and environmental disclosure: an empirical analysis', Accounting, Organization and Society,

33:4-5, pp. 303-27.

Eleftheriadis M. & Anagnostopoulou G. 2015, "Relationship between Corporate Climate Change

Disclosures and Firm Factors", Business Strategy and the Environment, 24(8), pp. 780-789.

Fisher R.A. 1925. Methods For Research Work; Macmillan Publishers: London.

Freeman R., Edward E., Moutchnik M., & Alexande A. 2013. "Stakeholder management and CSR:

questions and answers.". UmweltWirtschaftsForum. 21 (1), pp. 5–9.

Sullivan R. & Gouldson A. 2016. "Comparing the Climate Change Actions, Targets and Performance of

UK and US Retailers", Corporate Social Responsibility and Environmental Management, 23(3), pp. 129-

139.

Clarkson P., Li, Y., Richardson G., & Vasvari F., 2008. 'Revisiting the relation between environmental

performance and environmental disclosure: an empirical analysis', Accounting, Organization and Society,

33:4-5, pp. 303-27.

Eleftheriadis M. & Anagnostopoulou G. 2015, "Relationship between Corporate Climate Change

Disclosures and Firm Factors", Business Strategy and the Environment, 24(8), pp. 780-789.

Fisher R.A. 1925. Methods For Research Work; Macmillan Publishers: London.

Freeman R., Edward E., Moutchnik M., & Alexande A. 2013. "Stakeholder management and CSR:

questions and answers.". UmweltWirtschaftsForum. 21 (1), pp. 5–9.

Sullivan R. & Gouldson A. 2016. "Comparing the Climate Change Actions, Targets and Performance of

UK and US Retailers", Corporate Social Responsibility and Environmental Management, 23(3), pp. 129-

139.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.