HI5020 Corporate Accounting: Detailed Financial Statement Analysis

VerifiedAdded on 2024/05/31

|14

|2816

|407

Report

AI Summary

This report provides a comprehensive analysis of corporate accounting principles, focusing on the financial statements of BlueScope Steel Limited. It examines the cash flow statement, differentiating between operating, investing, and financing activities, and offers a comparative analysis across multiple years. The report also discusses the other comprehensive income statement, explaining items that may or may not be reclassified to profit or loss. Furthermore, it delves into accounting for corporate income tax, reconciling the company's tax expense with its accounting income, and analyzing deferred tax assets and liabilities. The analysis includes interesting observations and insights gained from examining the company's tax treatment in its financial statements. Desklib provides this and other solved assignments to aid students in their studies.

HI5020 Corporate Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction:

The financial report relating to corporate accounting has been prepared to develop the knowledge

of users regarding various concepts and fundamentals related to accounting work conducted in

the business. The report will include the analysis of cash flow statement of company and the

items relating to operating, investing and financing activities of company will be differentiated in

this report. The comprehensive income statement of the company will be discussed in this report

and various interpretations will be made according to the types of items reported in this

assignment. The report will involve accounting for income taxes which ill involve recognising

the income tax expense for the company and identifying the reconciliation provided in this

behalf. The report will also include an explanation about the deferred tax assets and liabilities

reported in the annual report of company and the interest or confusing facts recognized will be

described appropriately in this report.

2

The financial report relating to corporate accounting has been prepared to develop the knowledge

of users regarding various concepts and fundamentals related to accounting work conducted in

the business. The report will include the analysis of cash flow statement of company and the

items relating to operating, investing and financing activities of company will be differentiated in

this report. The comprehensive income statement of the company will be discussed in this report

and various interpretations will be made according to the types of items reported in this

assignment. The report will involve accounting for income taxes which ill involve recognising

the income tax expense for the company and identifying the reconciliation provided in this

behalf. The report will also include an explanation about the deferred tax assets and liabilities

reported in the annual report of company and the interest or confusing facts recognized will be

described appropriately in this report.

2

Contents

Introduction:....................................................................................................................................2

CASH FLOWS STATEMENT...................................................................................................4

OTHER COMPREHENSIVE INCOME STATEMENT............................................................8

ACCOUNTING FOR CORPORATE INCOME TAX...............................................................9

Conclusion:....................................................................................................................................12

References:....................................................................................................................................13

3

Introduction:....................................................................................................................................2

CASH FLOWS STATEMENT...................................................................................................4

OTHER COMPREHENSIVE INCOME STATEMENT............................................................8

ACCOUNTING FOR CORPORATE INCOME TAX...............................................................9

Conclusion:....................................................................................................................................12

References:....................................................................................................................................13

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CASH FLOWS STATEMENT

The various items reported in the cash flow statement of the company for the year ending 2017

has been presented below:

Receipts form customers – The revenues received form the customer represents the amount

which have been obtained in consideration of the goods and services given to the customers of

company.

Payment to suppliers and employees – The payment made to suppliers and employees of the

company is concerned with the amounts which have been paid by the company to the suppliers

for their purchases and the payment made for labour to the employees (Blue Scope Steel

Limited, 2017).

Finance cost paid – The finance cost paid refers to the amount of interest paid by the company

towards the amount of credit received in ordinary business operations.

Income taxes paid – The income taxes represents the amount of current tax liability paid by the

company during the year and includes the past taxes as well as present taxes.

Payments made for purchases of subsidiaries and business asserts – This is the type of

investing activity of the company which includes the amount paid for acquiring the joint ventures

or associate and the business assets of company during the year.

Payments made for property, plant and equipment and intangible assets – The cash outflow

can be in the form of amount to be paid by the company for acquisition of property, plant and

equipment for the company along with the intangible assets.

4

The various items reported in the cash flow statement of the company for the year ending 2017

has been presented below:

Receipts form customers – The revenues received form the customer represents the amount

which have been obtained in consideration of the goods and services given to the customers of

company.

Payment to suppliers and employees – The payment made to suppliers and employees of the

company is concerned with the amounts which have been paid by the company to the suppliers

for their purchases and the payment made for labour to the employees (Blue Scope Steel

Limited, 2017).

Finance cost paid – The finance cost paid refers to the amount of interest paid by the company

towards the amount of credit received in ordinary business operations.

Income taxes paid – The income taxes represents the amount of current tax liability paid by the

company during the year and includes the past taxes as well as present taxes.

Payments made for purchases of subsidiaries and business asserts – This is the type of

investing activity of the company which includes the amount paid for acquiring the joint ventures

or associate and the business assets of company during the year.

Payments made for property, plant and equipment and intangible assets – The cash outflow

can be in the form of amount to be paid by the company for acquisition of property, plant and

equipment for the company along with the intangible assets.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Proceeds from sale of property, plant and equipment and investments – The cash inflow can

be in the form of cash received form the selling of property, plant and equipment and the other

investments of the company.

Proceeds and repayments form borrowings – The type of cash inflow or outflow is concerned

with the amount received or paid for the repayments or acquisition of long term loan by the

company. This will be a financing activity for the company (Blue Scope Steel Limited, 2017).

Dividends paid – the dividends paid by the company will be recognized as financing activity

which will be concerned with paying the dividend to shareholders.

5

be in the form of cash received form the selling of property, plant and equipment and the other

investments of the company.

Proceeds and repayments form borrowings – The type of cash inflow or outflow is concerned

with the amount received or paid for the repayments or acquisition of long term loan by the

company. This will be a financing activity for the company (Blue Scope Steel Limited, 2017).

Dividends paid – the dividends paid by the company will be recognized as financing activity

which will be concerned with paying the dividend to shareholders.

5

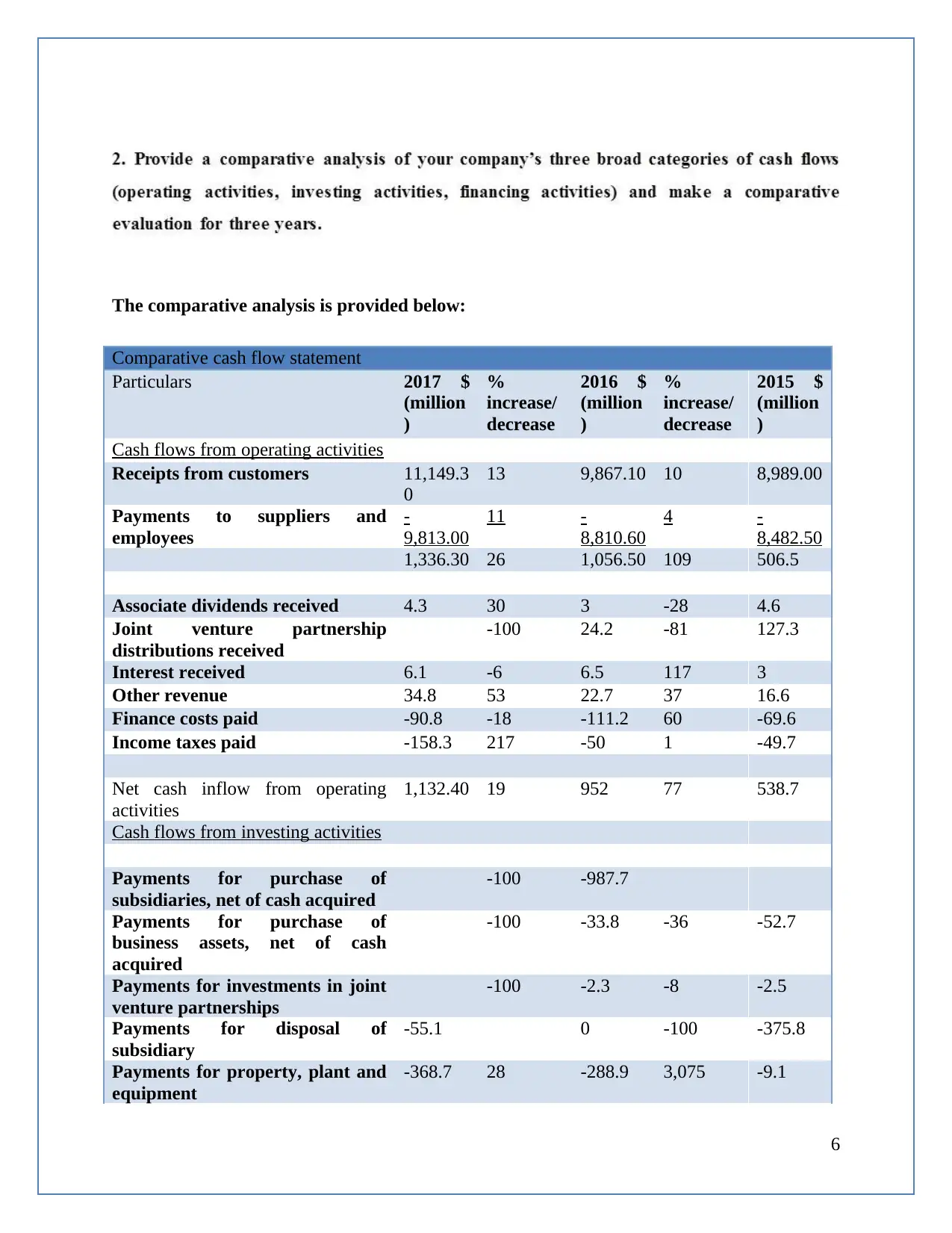

The comparative analysis is provided below:

Comparative cash flow statement

Particulars 2017 $

(million

)

%

increase/

decrease

2016 $

(million

)

%

increase/

decrease

2015 $

(million

)

Cash flows from operating activities

Receipts from customers 11,149.3

0

13 9,867.10 10 8,989.00

Payments to suppliers and

employees

-

9,813.00

11 -

8,810.60

4 -

8,482.50

1,336.30 26 1,056.50 109 506.5

Associate dividends received 4.3 30 3 -28 4.6

Joint venture partnership

distributions received

-100 24.2 -81 127.3

Interest received 6.1 -6 6.5 117 3

Other revenue 34.8 53 22.7 37 16.6

Finance costs paid -90.8 -18 -111.2 60 -69.6

Income taxes paid -158.3 217 -50 1 -49.7

Net cash inflow from operating

activities

1,132.40 19 952 77 538.7

Cash flows from investing activities

Payments for purchase of

subsidiaries, net of cash acquired

-100 -987.7

Payments for purchase of

business assets, net of cash

acquired

-100 -33.8 -36 -52.7

Payments for investments in joint

venture partnerships

-100 -2.3 -8 -2.5

Payments for disposal of

subsidiary

-55.1 0 -100 -375.8

Payments for property, plant and

equipment

-368.7 28 -288.9 3,075 -9.1

6

Comparative cash flow statement

Particulars 2017 $

(million

)

%

increase/

decrease

2016 $

(million

)

%

increase/

decrease

2015 $

(million

)

Cash flows from operating activities

Receipts from customers 11,149.3

0

13 9,867.10 10 8,989.00

Payments to suppliers and

employees

-

9,813.00

11 -

8,810.60

4 -

8,482.50

1,336.30 26 1,056.50 109 506.5

Associate dividends received 4.3 30 3 -28 4.6

Joint venture partnership

distributions received

-100 24.2 -81 127.3

Interest received 6.1 -6 6.5 117 3

Other revenue 34.8 53 22.7 37 16.6

Finance costs paid -90.8 -18 -111.2 60 -69.6

Income taxes paid -158.3 217 -50 1 -49.7

Net cash inflow from operating

activities

1,132.40 19 952 77 538.7

Cash flows from investing activities

Payments for purchase of

subsidiaries, net of cash acquired

-100 -987.7

Payments for purchase of

business assets, net of cash

acquired

-100 -33.8 -36 -52.7

Payments for investments in joint

venture partnerships

-100 -2.3 -8 -2.5

Payments for disposal of

subsidiary

-55.1 0 -100 -375.8

Payments for property, plant and

equipment

-368.7 28 -288.9 3,075 -9.1

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

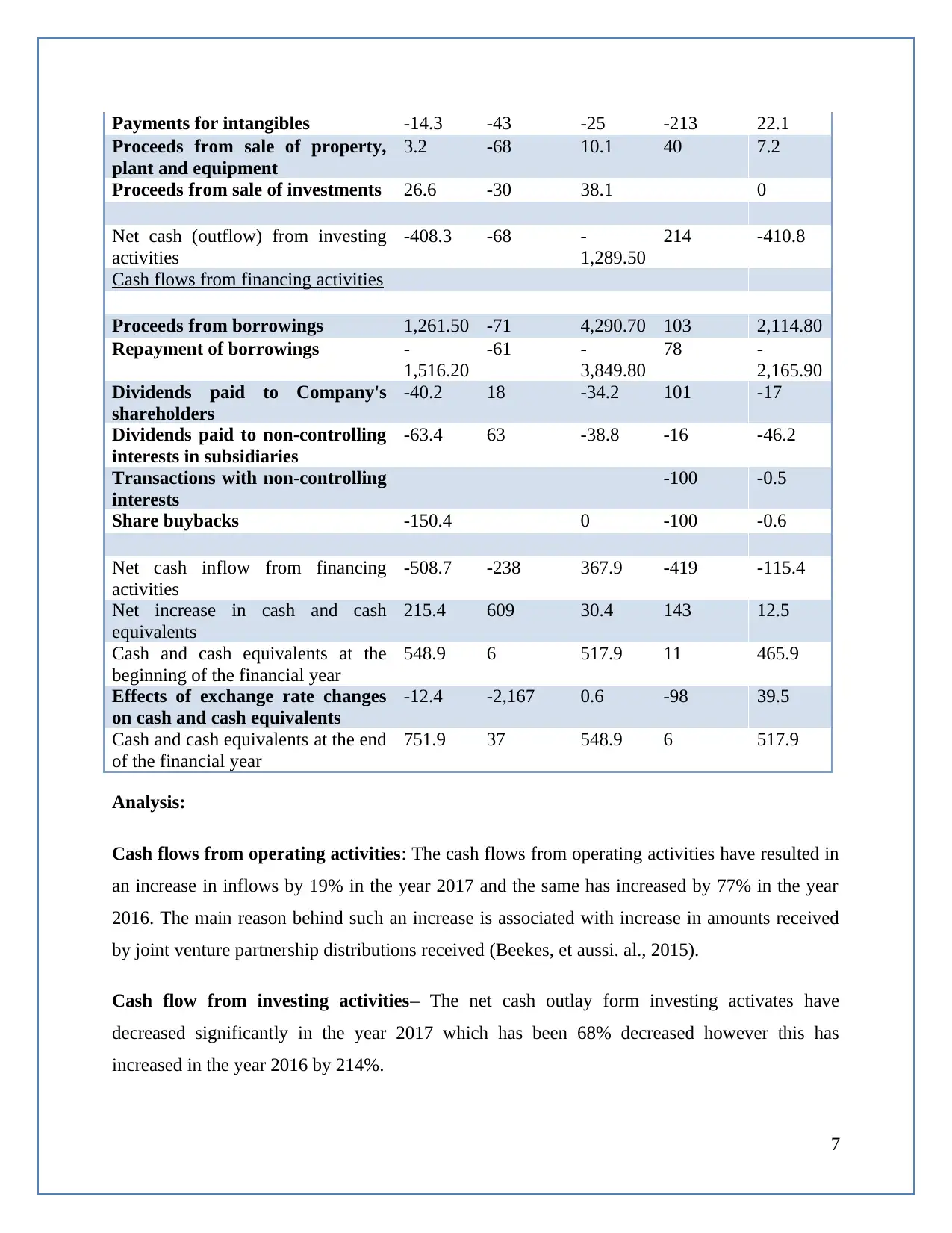

Payments for intangibles -14.3 -43 -25 -213 22.1

Proceeds from sale of property,

plant and equipment

3.2 -68 10.1 40 7.2

Proceeds from sale of investments 26.6 -30 38.1 0

Net cash (outflow) from investing

activities

-408.3 -68 -

1,289.50

214 -410.8

Cash flows from financing activities

Proceeds from borrowings 1,261.50 -71 4,290.70 103 2,114.80

Repayment of borrowings -

1,516.20

-61 -

3,849.80

78 -

2,165.90

Dividends paid to Company's

shareholders

-40.2 18 -34.2 101 -17

Dividends paid to non-controlling

interests in subsidiaries

-63.4 63 -38.8 -16 -46.2

Transactions with non-controlling

interests

-100 -0.5

Share buybacks -150.4 0 -100 -0.6

Net cash inflow from financing

activities

-508.7 -238 367.9 -419 -115.4

Net increase in cash and cash

equivalents

215.4 609 30.4 143 12.5

Cash and cash equivalents at the

beginning of the financial year

548.9 6 517.9 11 465.9

Effects of exchange rate changes

on cash and cash equivalents

-12.4 -2,167 0.6 -98 39.5

Cash and cash equivalents at the end

of the financial year

751.9 37 548.9 6 517.9

Analysis:

Cash flows from operating activities: The cash flows from operating activities have resulted in

an increase in inflows by 19% in the year 2017 and the same has increased by 77% in the year

2016. The main reason behind such an increase is associated with increase in amounts received

by joint venture partnership distributions received (Beekes, et aussi. al., 2015).

Cash flow from investing activities– The net cash outlay form investing activates have

decreased significantly in the year 2017 which has been 68% decreased however this has

increased in the year 2016 by 214%.

7

Proceeds from sale of property,

plant and equipment

3.2 -68 10.1 40 7.2

Proceeds from sale of investments 26.6 -30 38.1 0

Net cash (outflow) from investing

activities

-408.3 -68 -

1,289.50

214 -410.8

Cash flows from financing activities

Proceeds from borrowings 1,261.50 -71 4,290.70 103 2,114.80

Repayment of borrowings -

1,516.20

-61 -

3,849.80

78 -

2,165.90

Dividends paid to Company's

shareholders

-40.2 18 -34.2 101 -17

Dividends paid to non-controlling

interests in subsidiaries

-63.4 63 -38.8 -16 -46.2

Transactions with non-controlling

interests

-100 -0.5

Share buybacks -150.4 0 -100 -0.6

Net cash inflow from financing

activities

-508.7 -238 367.9 -419 -115.4

Net increase in cash and cash

equivalents

215.4 609 30.4 143 12.5

Cash and cash equivalents at the

beginning of the financial year

548.9 6 517.9 11 465.9

Effects of exchange rate changes

on cash and cash equivalents

-12.4 -2,167 0.6 -98 39.5

Cash and cash equivalents at the end

of the financial year

751.9 37 548.9 6 517.9

Analysis:

Cash flows from operating activities: The cash flows from operating activities have resulted in

an increase in inflows by 19% in the year 2017 and the same has increased by 77% in the year

2016. The main reason behind such an increase is associated with increase in amounts received

by joint venture partnership distributions received (Beekes, et aussi. al., 2015).

Cash flow from investing activities– The net cash outlay form investing activates have

decreased significantly in the year 2017 which has been 68% decreased however this has

increased in the year 2016 by 214%.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cash flows from financing activities– The net cash outlay concerned with the financing

activities in the year 2017 is amounting to $508 million which is a major issue of concern for the

company.

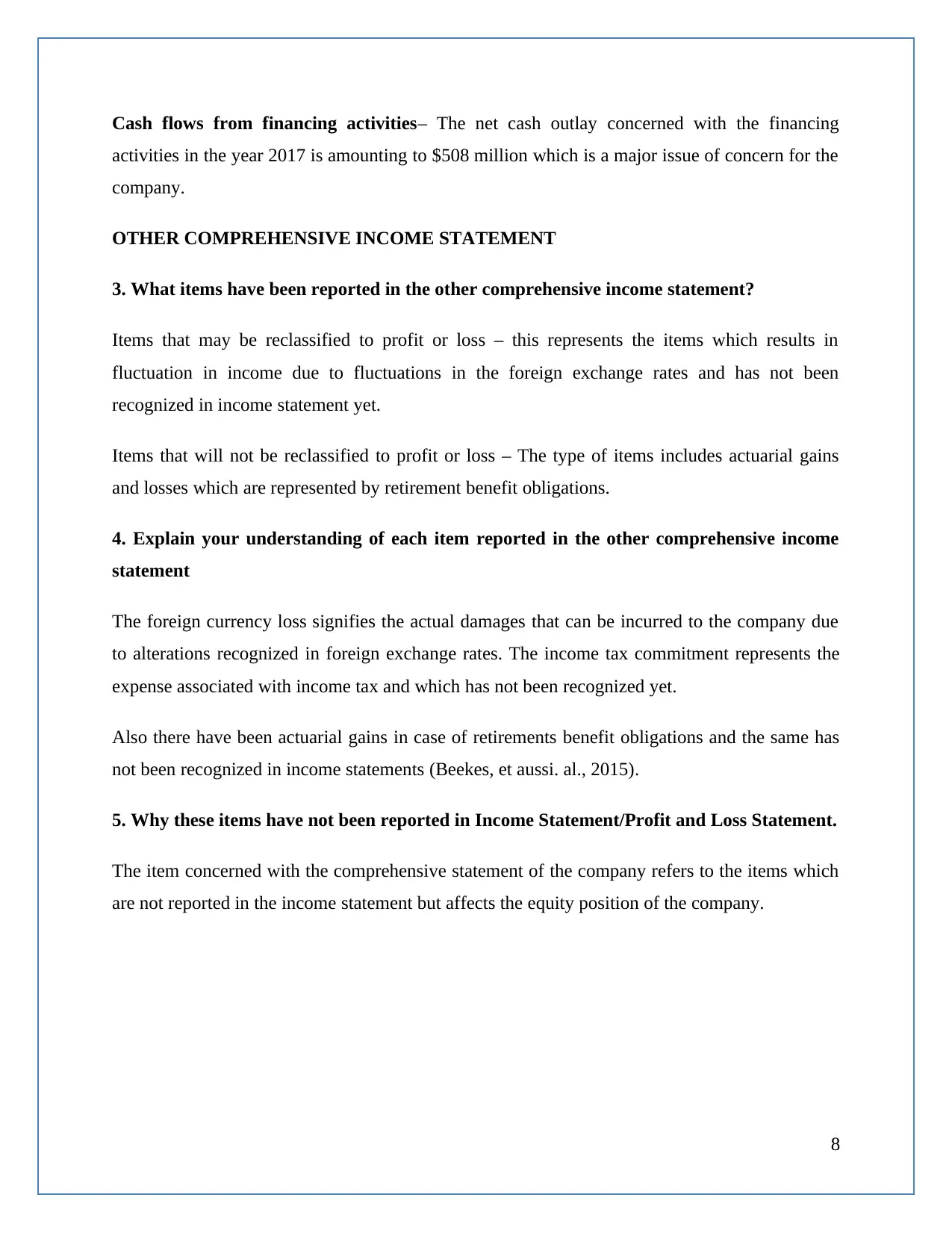

OTHER COMPREHENSIVE INCOME STATEMENT

3. What items have been reported in the other comprehensive income statement?

Items that may be reclassified to profit or loss – this represents the items which results in

fluctuation in income due to fluctuations in the foreign exchange rates and has not been

recognized in income statement yet.

Items that will not be reclassified to profit or loss – The type of items includes actuarial gains

and losses which are represented by retirement benefit obligations.

4. Explain your understanding of each item reported in the other comprehensive income

statement

The foreign currency loss signifies the actual damages that can be incurred to the company due

to alterations recognized in foreign exchange rates. The income tax commitment represents the

expense associated with income tax and which has not been recognized yet.

Also there have been actuarial gains in case of retirements benefit obligations and the same has

not been recognized in income statements (Beekes, et aussi. al., 2015).

5. Why these items have not been reported in Income Statement/Profit and Loss Statement.

The item concerned with the comprehensive statement of the company refers to the items which

are not reported in the income statement but affects the equity position of the company.

8

activities in the year 2017 is amounting to $508 million which is a major issue of concern for the

company.

OTHER COMPREHENSIVE INCOME STATEMENT

3. What items have been reported in the other comprehensive income statement?

Items that may be reclassified to profit or loss – this represents the items which results in

fluctuation in income due to fluctuations in the foreign exchange rates and has not been

recognized in income statement yet.

Items that will not be reclassified to profit or loss – The type of items includes actuarial gains

and losses which are represented by retirement benefit obligations.

4. Explain your understanding of each item reported in the other comprehensive income

statement

The foreign currency loss signifies the actual damages that can be incurred to the company due

to alterations recognized in foreign exchange rates. The income tax commitment represents the

expense associated with income tax and which has not been recognized yet.

Also there have been actuarial gains in case of retirements benefit obligations and the same has

not been recognized in income statements (Beekes, et aussi. al., 2015).

5. Why these items have not been reported in Income Statement/Profit and Loss Statement.

The item concerned with the comprehensive statement of the company refers to the items which

are not reported in the income statement but affects the equity position of the company.

8

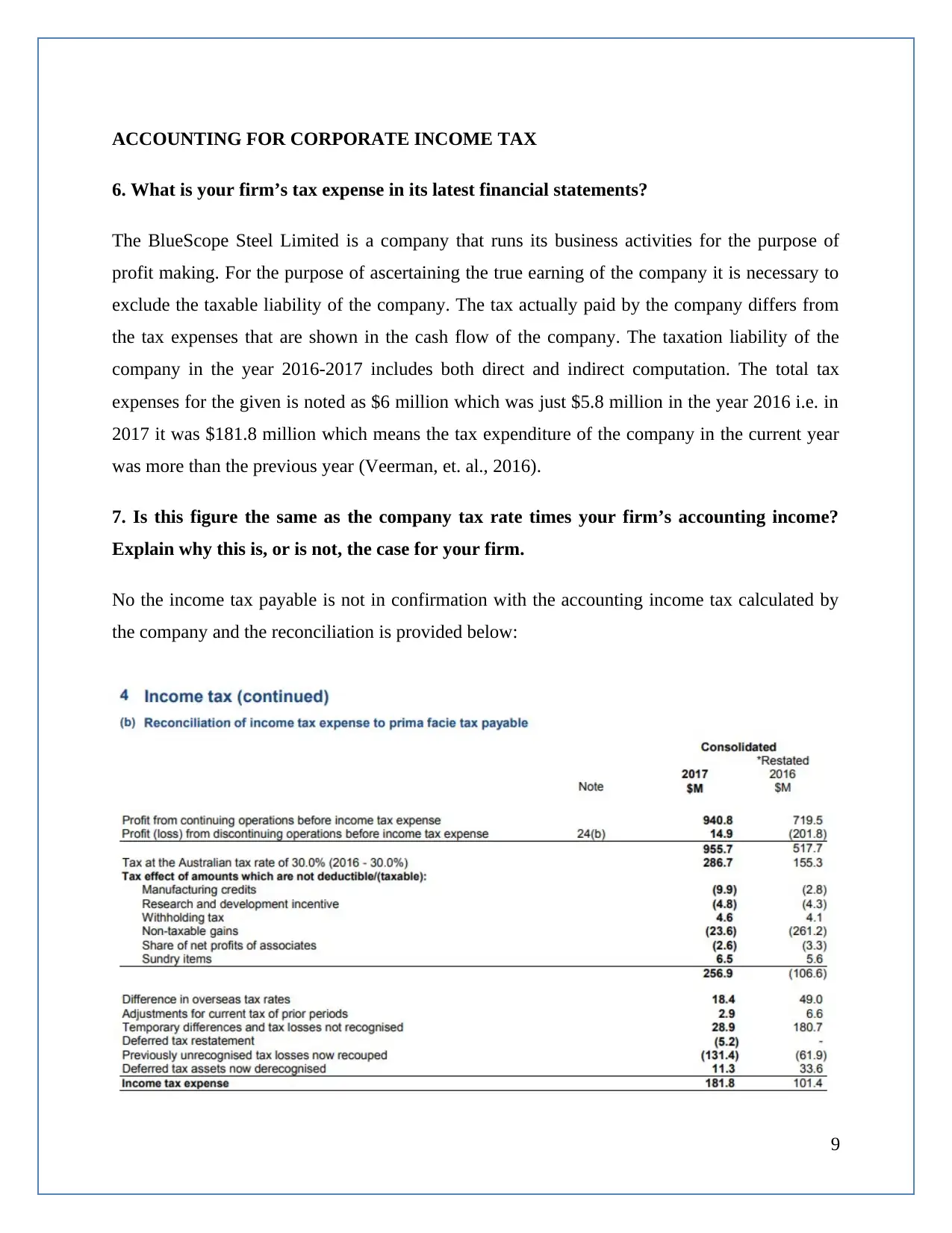

ACCOUNTING FOR CORPORATE INCOME TAX

6. What is your firm’s tax expense in its latest financial statements?

The BlueScope Steel Limited is a company that runs its business activities for the purpose of

profit making. For the purpose of ascertaining the true earning of the company it is necessary to

exclude the taxable liability of the company. The tax actually paid by the company differs from

the tax expenses that are shown in the cash flow of the company. The taxation liability of the

company in the year 2016-2017 includes both direct and indirect computation. The total tax

expenses for the given is noted as $6 million which was just $5.8 million in the year 2016 i.e. in

2017 it was $181.8 million which means the tax expenditure of the company in the current year

was more than the previous year (Veerman, et. al., 2016).

7. Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm.

No the income tax payable is not in confirmation with the accounting income tax calculated by

the company and the reconciliation is provided below:

9

6. What is your firm’s tax expense in its latest financial statements?

The BlueScope Steel Limited is a company that runs its business activities for the purpose of

profit making. For the purpose of ascertaining the true earning of the company it is necessary to

exclude the taxable liability of the company. The tax actually paid by the company differs from

the tax expenses that are shown in the cash flow of the company. The taxation liability of the

company in the year 2016-2017 includes both direct and indirect computation. The total tax

expenses for the given is noted as $6 million which was just $5.8 million in the year 2016 i.e. in

2017 it was $181.8 million which means the tax expenditure of the company in the current year

was more than the previous year (Veerman, et. al., 2016).

7. Is this figure the same as the company tax rate times your firm’s accounting income?

Explain why this is, or is not, the case for your firm.

No the income tax payable is not in confirmation with the accounting income tax calculated by

the company and the reconciliation is provided below:

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(Source: Blue Scope Steel Limited, 2017)

8. Comment on deferred tax assets/liabilities that are reported in the balance sheet

articulating the possible reasons why they have been recorded.

Deferred tax refers to the liability for tax which was overdue and had to be paid earlier but due to

improper calculation of tax value the same could not have been paid. The total deferred tax

assets for the year 2016 was $196 million and it was recoded as $155.3 million. The deferred tax

liability for the year 2016 was $162.4 million and in 2017 it was recoded as $175.9 million. The

deferred tax assets arises when the tax is calculated more than what was actually had to be paid

by the company and the deferred liabilities arises when the taxability for the given year is

calculated less than what was actually to be paid by the company. Like if the depreciation over

the assets of the company is calculated more than the actual deprecation to be deducted out of the

assets. The situation of deferred tax can also arise when the tax rate are changed (Payne and

Raiborn, 2018).

9. Is there any current tax assets or income tax payable recorded by your company? Why is

the income tax payable not the same as income tax expense?

The total income tax by the company in the year 2017 was $158.3 million which is higher than

the previous year with $50.0 million. However there are no current tax assets of the company for

the given financial year of 2017 and the total income tax liability of the company has been

recoded $5.0 million. Since there was no current tax assets of the company total taxable liability

of the company was recoded as $158. 3 million which includes both current tax of $154.0 million

and deferred tax of $24.9 million.

10. Is the income tax expense shown in the income statement same as the income tax paid

shown in the cash flow statement? If not why is the difference?

The total income tax expenses for the year 2016-2017 financial year was $181.8 million and the

total tax for the year was recorded as $158.3 million which is less than the total tax expenses

recorded in the cash flow. The differences between the recoded tax expenses for the year and the

total tax paid for the year is there as the tax paid actually includes the actual amount that has

been deducted out of the profit and the tax expenses also include the deferred taxes and other

10

8. Comment on deferred tax assets/liabilities that are reported in the balance sheet

articulating the possible reasons why they have been recorded.

Deferred tax refers to the liability for tax which was overdue and had to be paid earlier but due to

improper calculation of tax value the same could not have been paid. The total deferred tax

assets for the year 2016 was $196 million and it was recoded as $155.3 million. The deferred tax

liability for the year 2016 was $162.4 million and in 2017 it was recoded as $175.9 million. The

deferred tax assets arises when the tax is calculated more than what was actually had to be paid

by the company and the deferred liabilities arises when the taxability for the given year is

calculated less than what was actually to be paid by the company. Like if the depreciation over

the assets of the company is calculated more than the actual deprecation to be deducted out of the

assets. The situation of deferred tax can also arise when the tax rate are changed (Payne and

Raiborn, 2018).

9. Is there any current tax assets or income tax payable recorded by your company? Why is

the income tax payable not the same as income tax expense?

The total income tax by the company in the year 2017 was $158.3 million which is higher than

the previous year with $50.0 million. However there are no current tax assets of the company for

the given financial year of 2017 and the total income tax liability of the company has been

recoded $5.0 million. Since there was no current tax assets of the company total taxable liability

of the company was recoded as $158. 3 million which includes both current tax of $154.0 million

and deferred tax of $24.9 million.

10. Is the income tax expense shown in the income statement same as the income tax paid

shown in the cash flow statement? If not why is the difference?

The total income tax expenses for the year 2016-2017 financial year was $181.8 million and the

total tax for the year was recorded as $158.3 million which is less than the total tax expenses

recorded in the cash flow. The differences between the recoded tax expenses for the year and the

total tax paid for the year is there as the tax paid actually includes the actual amount that has

been deducted out of the profit and the tax expenses also include the deferred taxes and other

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

connected expense thereto. The reason can also be that the expenses calculated involves

overvaluation of the profit of the company and on the final calculation of the same earning of the

company was found less (Karikari, 2014).

The expense of income tax are deducted on monthly basis from the accounts of the company so

as to reduce the tax liability burden of the company at the end of the year and in the end of the

year the tax is ultimately paid to the government by calculating at the rate at which it is

prevalent.

11. What do you find interesting, confusing, surprising or difficult to understand about the

treatment of tax in your firm’s financial statements? What new insights, if any, have you

gained about how companies account for income tax as a result of examining your firm’s

tax expense in its accounts?

On the basis of detail analysis of the annual report of the company for the financial year of 2016-

2017 to examine the taxation system that is prevalent in the country various difficulties and

interesting facts were find out. The change in the rate of tax causes difficulty and differentiation

in the amount of tax calculated for the purpose of deducting the tax and the amount of tax that is

finally calculated for payment. The deferred tax assets and liabilities also have to be considered

for the calculation of the present tax liability of the company and therefore they also increase the

difficulty of calculation of the tax liability of the company. The tax liability of the company

reduced the turnover and the earning of the company (Donohoe and Robert, 2014).

The instant fluctuation in tax causes the problem of maintaining the uniformity of deductions

which are made on monthly basis and this increases the issue of differed tax assets and liabilities

for the subsequent years as well. These issues causes the issue in understanding the real financial

position of the company.

11

overvaluation of the profit of the company and on the final calculation of the same earning of the

company was found less (Karikari, 2014).

The expense of income tax are deducted on monthly basis from the accounts of the company so

as to reduce the tax liability burden of the company at the end of the year and in the end of the

year the tax is ultimately paid to the government by calculating at the rate at which it is

prevalent.

11. What do you find interesting, confusing, surprising or difficult to understand about the

treatment of tax in your firm’s financial statements? What new insights, if any, have you

gained about how companies account for income tax as a result of examining your firm’s

tax expense in its accounts?

On the basis of detail analysis of the annual report of the company for the financial year of 2016-

2017 to examine the taxation system that is prevalent in the country various difficulties and

interesting facts were find out. The change in the rate of tax causes difficulty and differentiation

in the amount of tax calculated for the purpose of deducting the tax and the amount of tax that is

finally calculated for payment. The deferred tax assets and liabilities also have to be considered

for the calculation of the present tax liability of the company and therefore they also increase the

difficulty of calculation of the tax liability of the company. The tax liability of the company

reduced the turnover and the earning of the company (Donohoe and Robert, 2014).

The instant fluctuation in tax causes the problem of maintaining the uniformity of deductions

which are made on monthly basis and this increases the issue of differed tax assets and liabilities

for the subsequent years as well. These issues causes the issue in understanding the real financial

position of the company.

11

Conclusion:

It can be concluded that the corporate accounting work can be operationally affected when there

are presented the common size income statement and balance sheets of company. The analysis

performed above for Blue Scope Limited represents a sound situation of the company and the

profitability of the company will be increased in future years as per the healthy prospects.

12

It can be concluded that the corporate accounting work can be operationally affected when there

are presented the common size income statement and balance sheets of company. The analysis

performed above for Blue Scope Limited represents a sound situation of the company and the

profitability of the company will be increased in future years as per the healthy prospects.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.