Management Accounting Research and Analysis

VerifiedAdded on 2021/04/05

|20

|5724

|146

AI Summary

This assignment requires in-depth research and analysis of various management accounting topics, including the balanced scorecard, environmental management accounting adoption, contingency-based management accounting research, enterprise resource planning systems, and more. Students are expected to critically evaluate and discuss different management accounting concepts, techniques, and strategies, providing a comprehensive overview of the subject matter.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Higher Nationals

Higher National Diploma in Business

Student Name Georgiana Aura Pavel ID HE0799

2

Unit Number and Title Unit 5 – Management Accounting

Academic Year 2019/2020 Cohort Sept 19 Term Block 3

Unit Leader Alfred Agyeman Assess

or

Joseph Olaniyan

Assignment Title Management Accounting Concepts and Techniques

in Decision Making

Issue Date 09/03/2020

Submission Start Date

(Formative)

27/04/2020

Submission Summative 08/05/2020

IV Name Seethalakshmy Nagarajan

IV Date 25/02/2020

Learners Declaration: I certify that the work submitted for this unit is my own

and the research sources are fully acknowledged.

Learners Name: Georgiana Aura Pavel

Date:23.05.2020

1

Higher National Diploma in Business

Student Name Georgiana Aura Pavel ID HE0799

2

Unit Number and Title Unit 5 – Management Accounting

Academic Year 2019/2020 Cohort Sept 19 Term Block 3

Unit Leader Alfred Agyeman Assess

or

Joseph Olaniyan

Assignment Title Management Accounting Concepts and Techniques

in Decision Making

Issue Date 09/03/2020

Submission Start Date

(Formative)

27/04/2020

Submission Summative 08/05/2020

IV Name Seethalakshmy Nagarajan

IV Date 25/02/2020

Learners Declaration: I certify that the work submitted for this unit is my own

and the research sources are fully acknowledged.

Learners Name: Georgiana Aura Pavel

Date:23.05.2020

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

Please copy the above and insert into your assignment’s front page.

Academic Misconduct:

Any act of Academic Misconduct will be seriously dealt with according to the College’s

and awarding bodies’ regulations.

Academic misconduct includes, but is not limited to, the following: Verbatim (word

for word) quotation without clear acknowledgement, cutting and pasting from the

Internet without clear acknowledgement, collusion, inaccurate citation and failure to

acknowledge assistance.

Plagiarism is presenting someone’s work as your own. It includes copying information

directly from the web or books without referencing the material; submitting joint

coursework as an individual effort; copying another student’s coursework; stealing

coursework from another student and submitting it as your own work.

Suspected plagiarism, and any other cases of suspected academic misconduct, will

be investigated and if found to have occurred will be dealt with according to the

College procedure. (For further details please refer to 5o.i the Academic Misconduct

Policy and Procedure; 5o.ii Academic Misconduct Student Guide; Academic Good

Practice Handbook, all available on HELP.)

Please copy the above and insert into your assignment’s front page.

Academic Misconduct:

Any act of Academic Misconduct will be seriously dealt with according to the College’s

and awarding bodies’ regulations.

Academic misconduct includes, but is not limited to, the following: Verbatim (word

for word) quotation without clear acknowledgement, cutting and pasting from the

Internet without clear acknowledgement, collusion, inaccurate citation and failure to

acknowledge assistance.

Plagiarism is presenting someone’s work as your own. It includes copying information

directly from the web or books without referencing the material; submitting joint

coursework as an individual effort; copying another student’s coursework; stealing

coursework from another student and submitting it as your own work.

Suspected plagiarism, and any other cases of suspected academic misconduct, will

be investigated and if found to have occurred will be dealt with according to the

College procedure. (For further details please refer to 5o.i the Academic Misconduct

Policy and Procedure; 5o.ii Academic Misconduct Student Guide; Academic Good

Practice Handbook, all available on HELP.)

UNIT 5

MANAGEMENT ACCOUNTING

STUDENT NAME: GERGIANA AURA PAVEL

3

MANAGEMENT ACCOUNTING

STUDENT NAME: GERGIANA AURA PAVEL

3

Table of Contents

Introduction......................................................................................................................................3

LO1: Discuss the MAS....................................................................................................................3

P1: Types of management accounting......................................................................................3

P2: Methods of management reporting...................................................................................4

Benefits ofmanagementaccounting for the business...............................................................5

Evaluation of management reportingand accounting............................................................5

LO2: Steps of management accounting...........................................................................................5

P3: Analysis of price techniques for statement of income......................................................5

Statementof income under costing marginal and costing of absorption when there is production

but no sales of Cream Ltd. The data are given below:-...............................................................5

Application of management accounting for reporting for financial.....................................9

Discuss the finance report of business activities....................................................................10

LO3: Tools for management accounting.......................................................................................10

P4: Advantages and disadvantages of planning tools...........................................................10

Analysis of tools and application on budgets.........................................................................11

LO4: Respond to financial problems.............................................................................................12

P5: Management responding to financial problems.............................................................12

Organisation sustainable success............................................................................................13

Conclusion.....................................................................................................................................14

Reference list.................................................................................................................................16

4

Introduction......................................................................................................................................3

LO1: Discuss the MAS....................................................................................................................3

P1: Types of management accounting......................................................................................3

P2: Methods of management reporting...................................................................................4

Benefits ofmanagementaccounting for the business...............................................................5

Evaluation of management reportingand accounting............................................................5

LO2: Steps of management accounting...........................................................................................5

P3: Analysis of price techniques for statement of income......................................................5

Statementof income under costing marginal and costing of absorption when there is production

but no sales of Cream Ltd. The data are given below:-...............................................................5

Application of management accounting for reporting for financial.....................................9

Discuss the finance report of business activities....................................................................10

LO3: Tools for management accounting.......................................................................................10

P4: Advantages and disadvantages of planning tools...........................................................10

Analysis of tools and application on budgets.........................................................................11

LO4: Respond to financial problems.............................................................................................12

P5: Management responding to financial problems.............................................................12

Organisation sustainable success............................................................................................13

Conclusion.....................................................................................................................................14

Reference list.................................................................................................................................16

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Introduction

In this study on accounting management of Cream ltd. the process of accounting management is

being elaborated. The requirement of different types of management accounting systems in

Cream ltd. is going to be explained. The discussion explains the management accounting system

and their application in the organisation. It also focuses on the accounting management system

and management accounting reporting. The study is based on understanding the integration with

the organisational processes. The study is on the understanding of management accounting

technique, calculation of the cost to prepare statement of income using absorption and cost of

marginal. The comparison will be done on organisation adaption to the management accounting

system to revert to issues of finance.

Discuss the MAS

Types of management accounting

The accounting process of Cream Ltd consists of management accounting and accounting of

cost which means analysing the cost of business and the operations to draw up reports of

finance internally, the account which the managers used, records which assists making of

decision process in attaining the organisational goals (van Helden et al. 2016). Different

types of MAS are:

1. Inventory system of accounting which facilitates stock placement in the company. This

system is vital to track the stocks in different locations and managing the supply network

effectively. It is present in all location to plan the production process and stock related

issues.

2. The cost accounting system is utilized to check stock manufacturing activities and for

recording inventories. This system is used by the top-level positions to track the stages of

inventory from manufacturing to finished product.

3. Job system costing is used to analyse the amount incurred in a product manufactured

with involvement in the business. This system is vital for industry construction and

mention to assigning a cost to the individual project of construction at the company.

5

In this study on accounting management of Cream ltd. the process of accounting management is

being elaborated. The requirement of different types of management accounting systems in

Cream ltd. is going to be explained. The discussion explains the management accounting system

and their application in the organisation. It also focuses on the accounting management system

and management accounting reporting. The study is based on understanding the integration with

the organisational processes. The study is on the understanding of management accounting

technique, calculation of the cost to prepare statement of income using absorption and cost of

marginal. The comparison will be done on organisation adaption to the management accounting

system to revert to issues of finance.

Discuss the MAS

Types of management accounting

The accounting process of Cream Ltd consists of management accounting and accounting of

cost which means analysing the cost of business and the operations to draw up reports of

finance internally, the account which the managers used, records which assists making of

decision process in attaining the organisational goals (van Helden et al. 2016). Different

types of MAS are:

1. Inventory system of accounting which facilitates stock placement in the company. This

system is vital to track the stocks in different locations and managing the supply network

effectively. It is present in all location to plan the production process and stock related

issues.

2. The cost accounting system is utilized to check stock manufacturing activities and for

recording inventories. This system is used by the top-level positions to track the stages of

inventory from manufacturing to finished product.

3. Job system costing is used to analyse the amount incurred in a product manufactured

with involvement in the business. This system is vital for industry construction and

mention to assigning a cost to the individual project of construction at the company.

5

4. Price system for optimisation is used to change the price in accordance with customer

willingness to pay. The company focuses on price optimizing critically as the need to sell

where the product can be easily purchased at given prices whether it is B2B or B2C.

Price optimizing system facilitates selling of a product in such price that company profits

goals are maintained and customer experience is also enhanced.

Methods of management reporting

Different types of methods used in management reporting like

Budgets are related to financial documents in cost allocations are mentioned for future

goals. The financial documents represent income and expenses of Cream ltd. The budget

is basically associated with forecasting the costs in present. Budgets consist of all

expenses like Direct overhead, labour expenses, and purchase of materials.

Variance analysis is used by the company to accumulate the cost involved and what was

estimated and look out for the difference and taking corrective measures for improving

the difference (Ittner et al. 2017). Cost estimation is done by the company for allocating

cost as per the requirement. Sometimes cost estimated exceeds the cost in that case

managers’ needs to check the reason and correct that accordingly.

Cost reports state that the determination of price in accordance with management

accounting. Labour cost, overhead cost, product cost all is taken into contemplation.

Total items are divided by the product cost for the calculation of the entire cost. This cost

report helps the manager to check the cost of the product and selling product price

(Owusu et al. 2016). This cost report assists in managing the plans of manager and limit

of incomes.

Execution reports are used to analyse the data of disbursing the plans with estimated

sums. After making the plan analysis is being done on the whole data. The performance

report is analysed each year, or some company does that quarterly. This data is utilized to

get prepared for the forthcoming call on production and changes (Ioppolo et al. 2019).

These reports are summarized by the accountants of the company and utilized

accordingly. Order place reports are made to place an order and to check whether the

6

willingness to pay. The company focuses on price optimizing critically as the need to sell

where the product can be easily purchased at given prices whether it is B2B or B2C.

Price optimizing system facilitates selling of a product in such price that company profits

goals are maintained and customer experience is also enhanced.

Methods of management reporting

Different types of methods used in management reporting like

Budgets are related to financial documents in cost allocations are mentioned for future

goals. The financial documents represent income and expenses of Cream ltd. The budget

is basically associated with forecasting the costs in present. Budgets consist of all

expenses like Direct overhead, labour expenses, and purchase of materials.

Variance analysis is used by the company to accumulate the cost involved and what was

estimated and look out for the difference and taking corrective measures for improving

the difference (Ittner et al. 2017). Cost estimation is done by the company for allocating

cost as per the requirement. Sometimes cost estimated exceeds the cost in that case

managers’ needs to check the reason and correct that accordingly.

Cost reports state that the determination of price in accordance with management

accounting. Labour cost, overhead cost, product cost all is taken into contemplation.

Total items are divided by the product cost for the calculation of the entire cost. This cost

report helps the manager to check the cost of the product and selling product price

(Owusu et al. 2016). This cost report assists in managing the plans of manager and limit

of incomes.

Execution reports are used to analyse the data of disbursing the plans with estimated

sums. After making the plan analysis is being done on the whole data. The performance

report is analysed each year, or some company does that quarterly. This data is utilized to

get prepared for the forthcoming call on production and changes (Ioppolo et al. 2019).

These reports are summarized by the accountants of the company and utilized

accordingly. Order place reports are made to place an order and to check whether the

6

order placed is enough or not. The business reports are made for making an alternative to

present and upcoming situation of the business in a company.

Benefits of management accounting for the business

The management accounting system in Cream Ltd is beneficial in terms of increasing efficiency

of the company. Inventory system of accounting helps the company to manage the supply chain

of the product from manufacturing to the finished product (Lugli et al. 2017). The cost

accounting systems assist the business in tracking the product amount in each level of

production. The job costing systems helps in allocating the cost to a project which is involved in

the business. The price optimization system assists the business in optimizing the product price.

The customer willingness to pay needs to match with the product price. This system helps in

optimizing the cost in the way in which company profits are not hampered.

Evaluation of management reporting and accounting

The management accounting systems and management reporting accounting is integrated within

or business processes as management accounting provides information regarding quantitative

and qualitative on financial and operational production (Ferdous et al. 2019).The management

accounting is associated with the creditors and assets of the business while management

accounting system is enclosed with operational planning and controlling for successful support.

Management accounting facilitates the planning of money and controlling it. Management

accounting system helps the business to use the internal factors like price and quality of product

efficiently to deploy the best customer service.

Steps of management accounting

Analysis of price techniques for statement of income

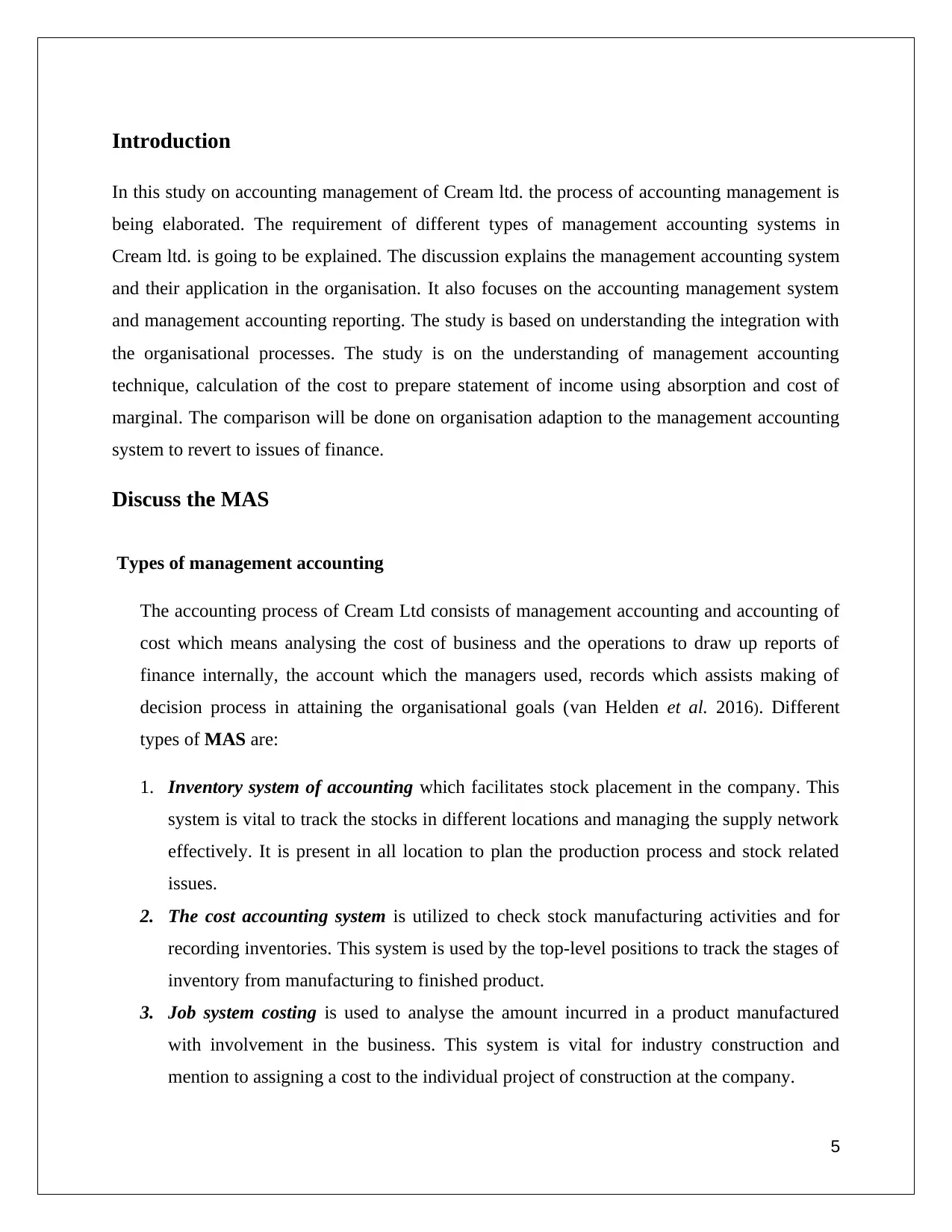

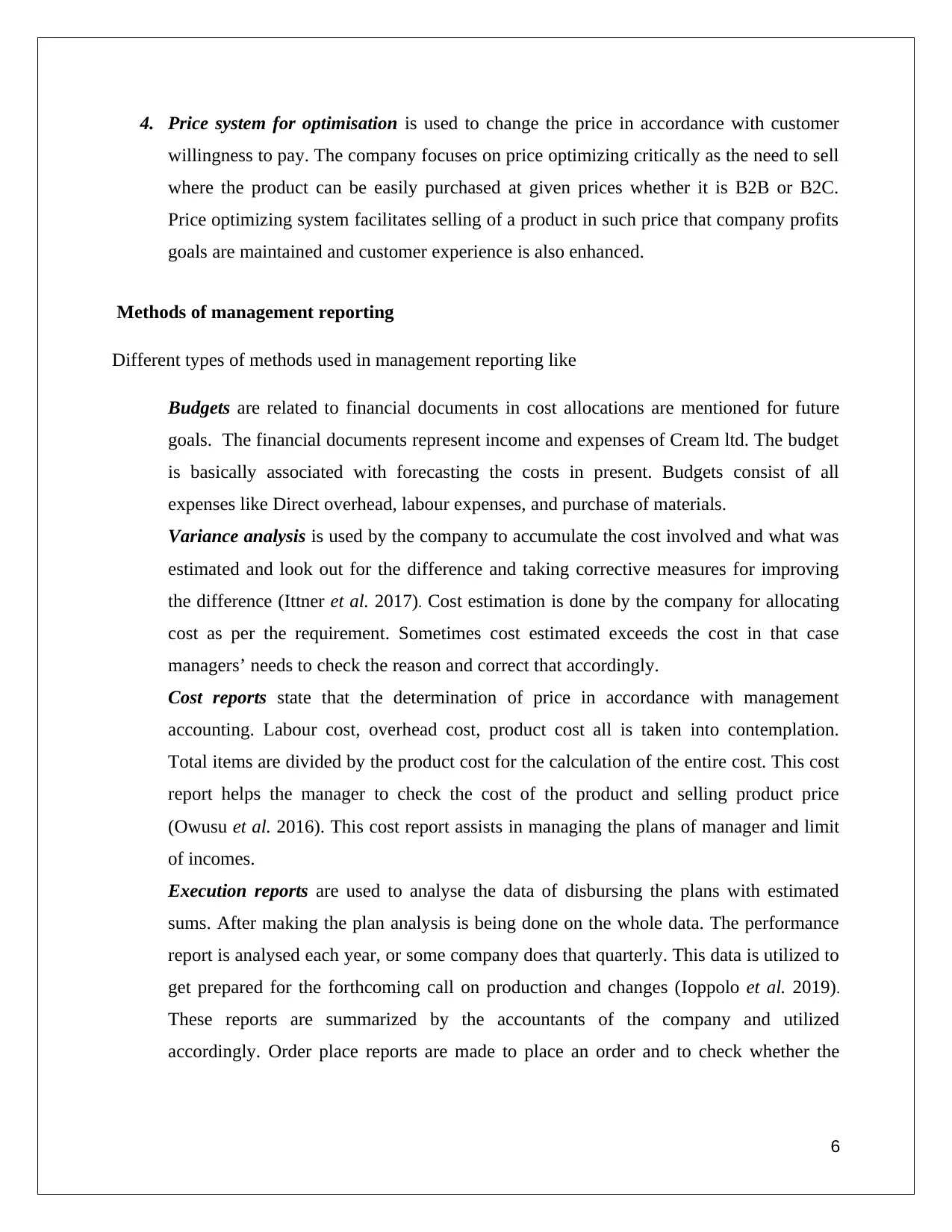

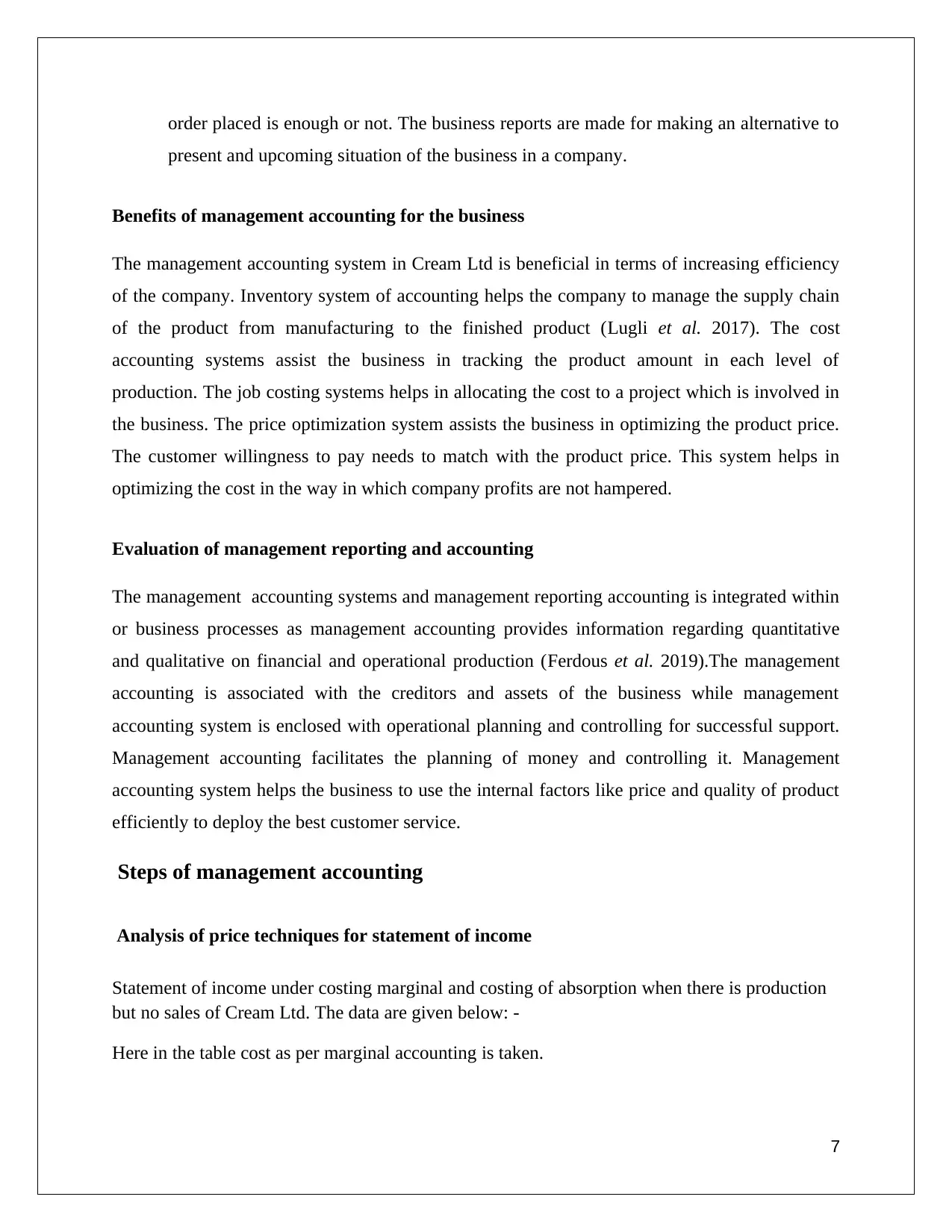

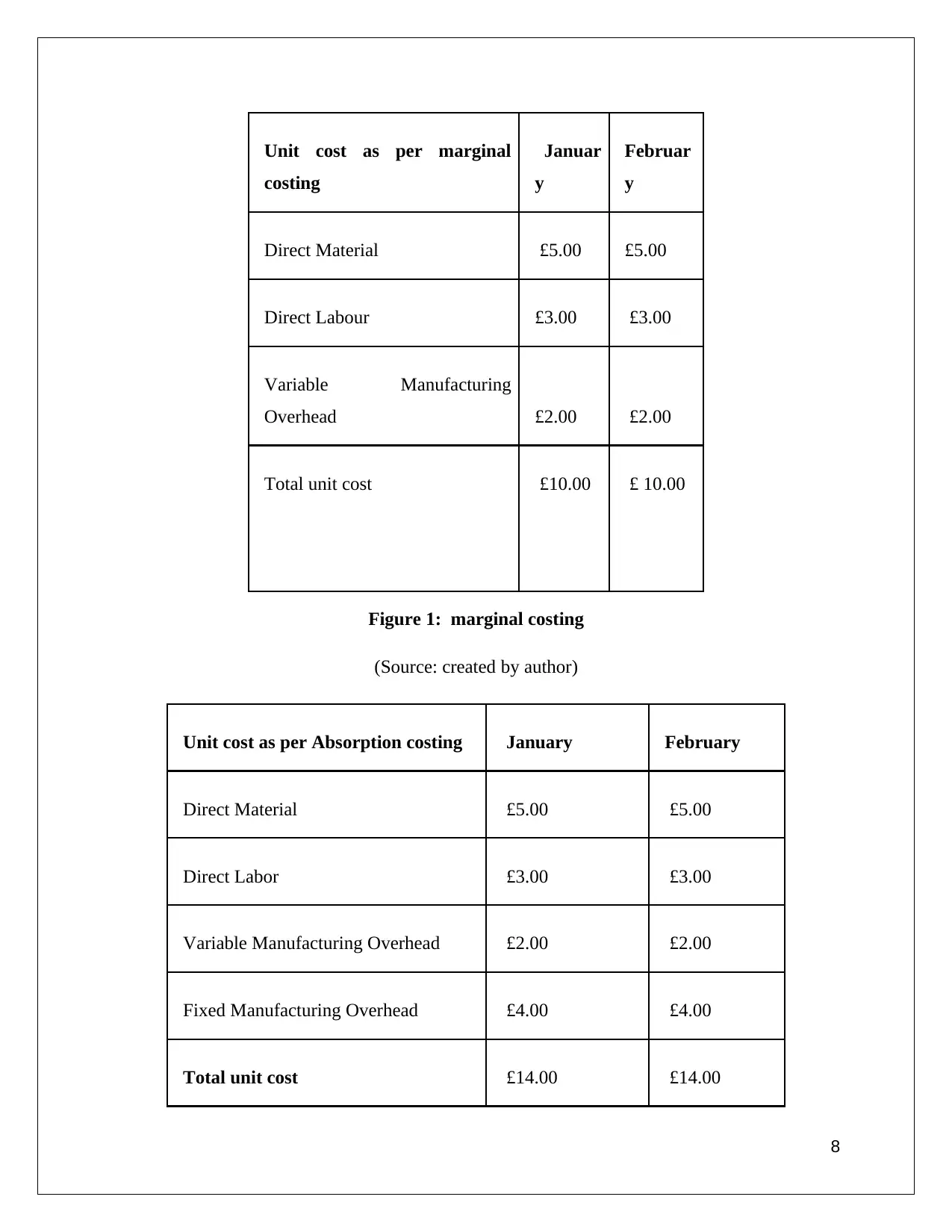

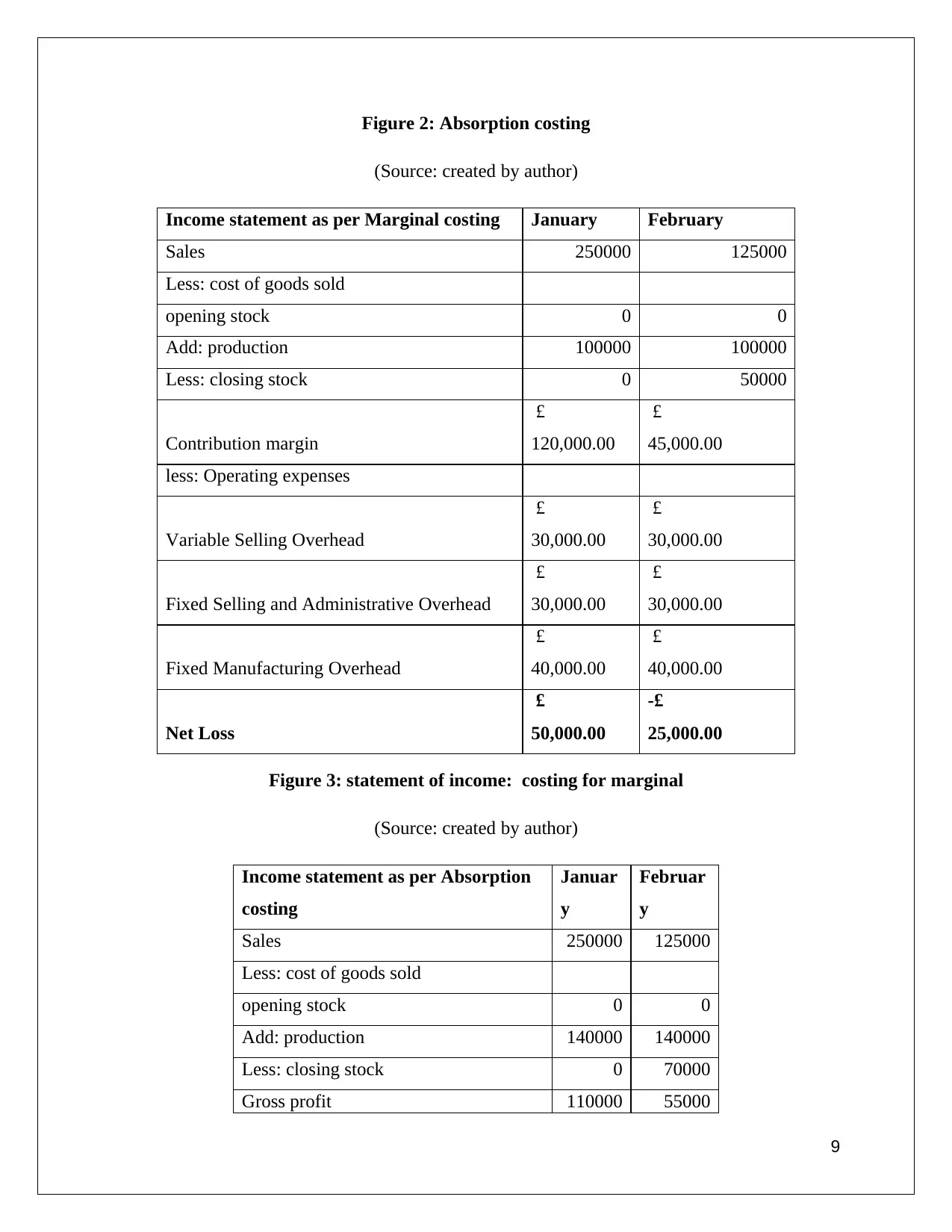

Statement of income under costing marginal and costing of absorption when there is production

but no sales of Cream Ltd. The data are given below: -

Here in the table cost as per marginal accounting is taken.

7

present and upcoming situation of the business in a company.

Benefits of management accounting for the business

The management accounting system in Cream Ltd is beneficial in terms of increasing efficiency

of the company. Inventory system of accounting helps the company to manage the supply chain

of the product from manufacturing to the finished product (Lugli et al. 2017). The cost

accounting systems assist the business in tracking the product amount in each level of

production. The job costing systems helps in allocating the cost to a project which is involved in

the business. The price optimization system assists the business in optimizing the product price.

The customer willingness to pay needs to match with the product price. This system helps in

optimizing the cost in the way in which company profits are not hampered.

Evaluation of management reporting and accounting

The management accounting systems and management reporting accounting is integrated within

or business processes as management accounting provides information regarding quantitative

and qualitative on financial and operational production (Ferdous et al. 2019).The management

accounting is associated with the creditors and assets of the business while management

accounting system is enclosed with operational planning and controlling for successful support.

Management accounting facilitates the planning of money and controlling it. Management

accounting system helps the business to use the internal factors like price and quality of product

efficiently to deploy the best customer service.

Steps of management accounting

Analysis of price techniques for statement of income

Statement of income under costing marginal and costing of absorption when there is production

but no sales of Cream Ltd. The data are given below: -

Here in the table cost as per marginal accounting is taken.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Unit cost as per marginal

costing

Januar

y

Februar

y

Direct Material £5.00 £5.00

Direct Labour £3.00 £3.00

Variable Manufacturing

Overhead £2.00 £2.00

Total unit cost £10.00 £ 10.00

Figure 1: marginal costing

(Source: created by author)

Unit cost as per Absorption costing January February

Direct Material £5.00 £5.00

Direct Labor £3.00 £3.00

Variable Manufacturing Overhead £2.00 £2.00

Fixed Manufacturing Overhead £4.00 £4.00

Total unit cost £14.00 £14.00

8

costing

Januar

y

Februar

y

Direct Material £5.00 £5.00

Direct Labour £3.00 £3.00

Variable Manufacturing

Overhead £2.00 £2.00

Total unit cost £10.00 £ 10.00

Figure 1: marginal costing

(Source: created by author)

Unit cost as per Absorption costing January February

Direct Material £5.00 £5.00

Direct Labor £3.00 £3.00

Variable Manufacturing Overhead £2.00 £2.00

Fixed Manufacturing Overhead £4.00 £4.00

Total unit cost £14.00 £14.00

8

Figure 2: Absorption costing

(Source: created by author)

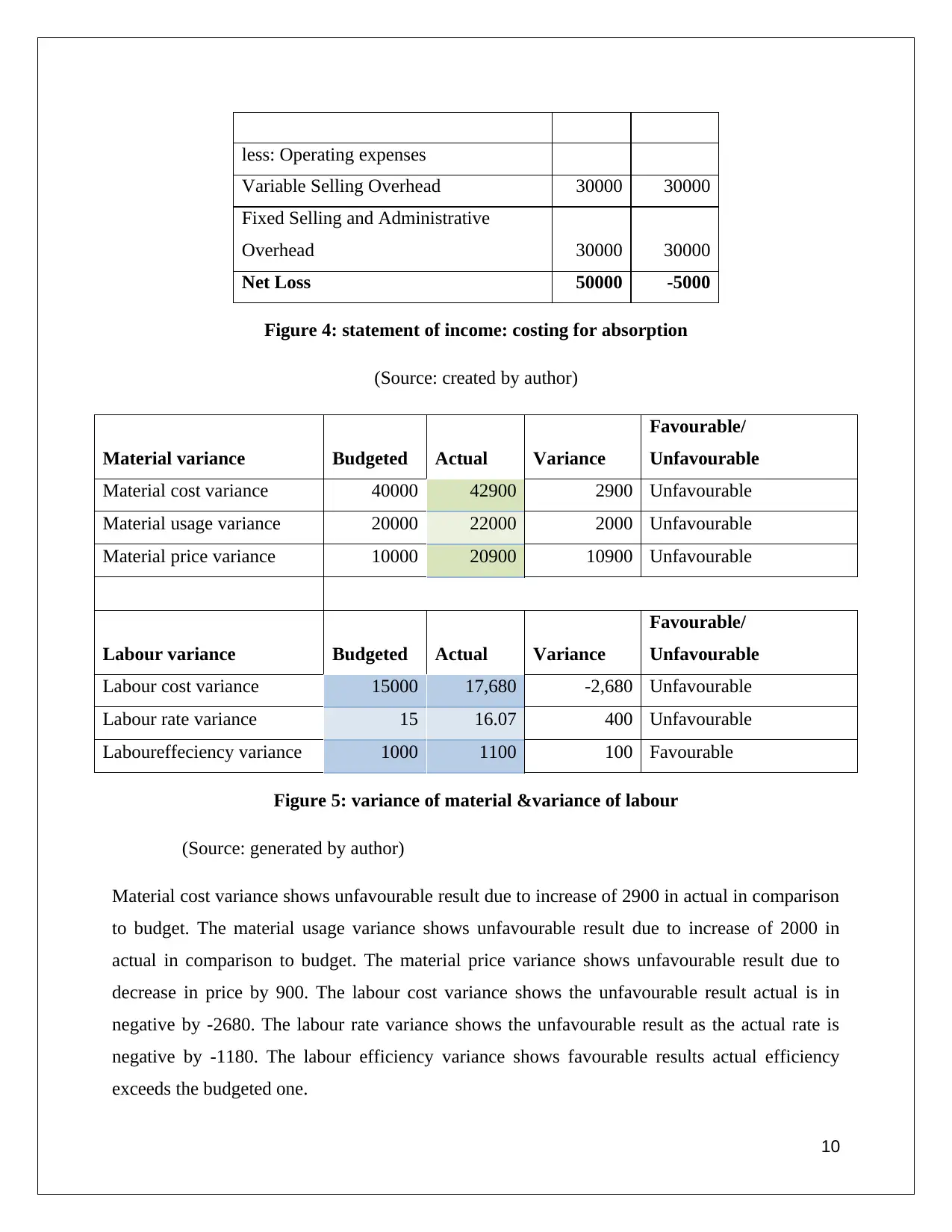

Income statement as per Marginal costing January February

Sales 250000 125000

Less: cost of goods sold

opening stock 0 0

Add: production 100000 100000

Less: closing stock 0 50000

Contribution margin

£

120,000.00

£

45,000.00

less: Operating expenses

Variable Selling Overhead

£

30,000.00

£

30,000.00

Fixed Selling and Administrative Overhead

£

30,000.00

£

30,000.00

Fixed Manufacturing Overhead

£

40,000.00

£

40,000.00

Net Loss

£

50,000.00

-£

25,000.00

Figure 3: statement of income: costing for marginal

(Source: created by author)

Income statement as per Absorption

costing

Januar

y

Februar

y

Sales 250000 125000

Less: cost of goods sold

opening stock 0 0

Add: production 140000 140000

Less: closing stock 0 70000

Gross profit 110000 55000

9

(Source: created by author)

Income statement as per Marginal costing January February

Sales 250000 125000

Less: cost of goods sold

opening stock 0 0

Add: production 100000 100000

Less: closing stock 0 50000

Contribution margin

£

120,000.00

£

45,000.00

less: Operating expenses

Variable Selling Overhead

£

30,000.00

£

30,000.00

Fixed Selling and Administrative Overhead

£

30,000.00

£

30,000.00

Fixed Manufacturing Overhead

£

40,000.00

£

40,000.00

Net Loss

£

50,000.00

-£

25,000.00

Figure 3: statement of income: costing for marginal

(Source: created by author)

Income statement as per Absorption

costing

Januar

y

Februar

y

Sales 250000 125000

Less: cost of goods sold

opening stock 0 0

Add: production 140000 140000

Less: closing stock 0 70000

Gross profit 110000 55000

9

less: Operating expenses

Variable Selling Overhead 30000 30000

Fixed Selling and Administrative

Overhead 30000 30000

Net Loss 50000 -5000

Figure 4: statement of income: costing for absorption

(Source: created by author)

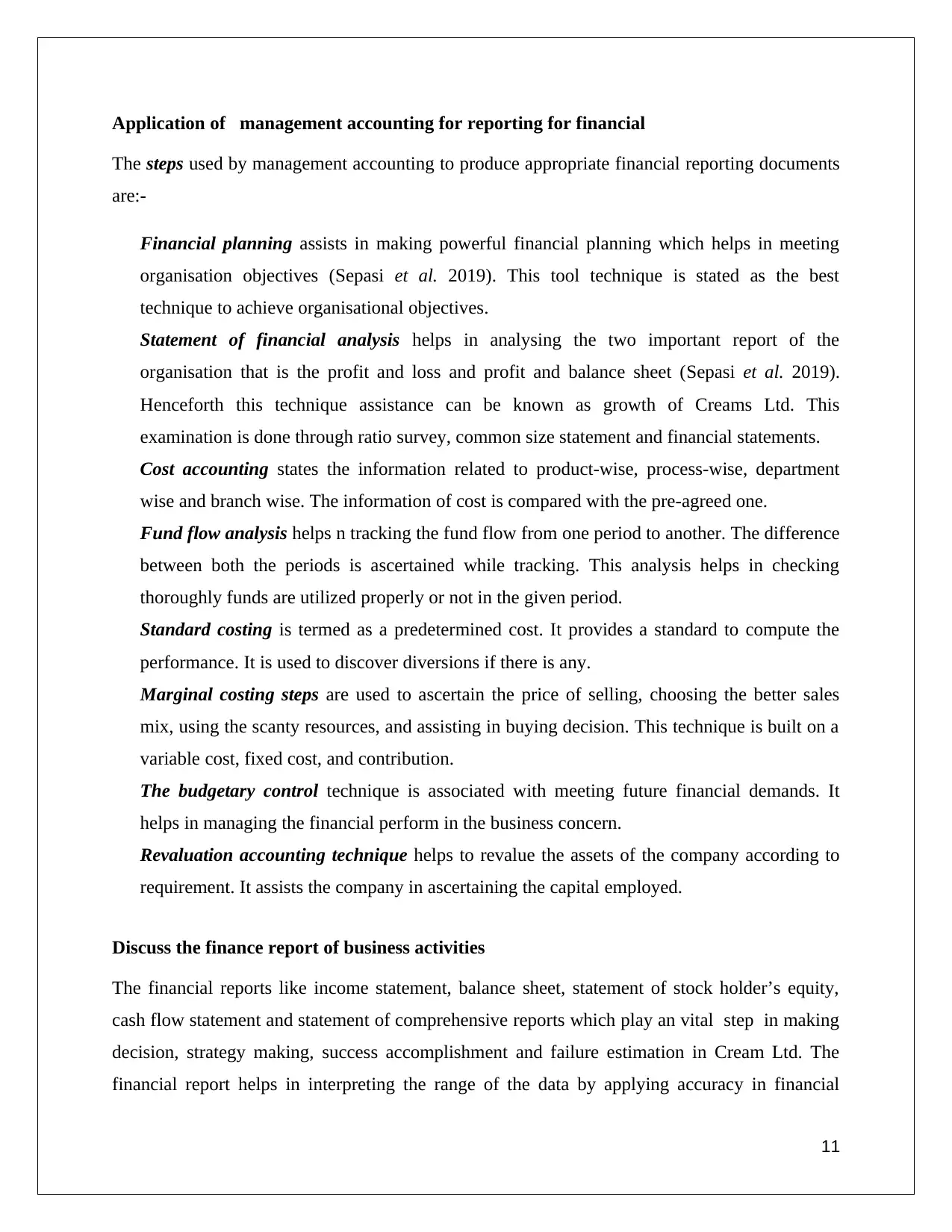

Material variance Budgeted Actual Variance

Favourable/

Unfavourable

Material cost variance 40000 42900 2900 Unfavourable

Material usage variance 20000 22000 2000 Unfavourable

Material price variance 10000 20900 10900 Unfavourable

Labour variance Budgeted Actual Variance

Favourable/

Unfavourable

Labour cost variance 15000 17,680 -2,680 Unfavourable

Labour rate variance 15 16.07 400 Unfavourable

Laboureffeciency variance 1000 1100 100 Favourable

Figure 5: variance of material &variance of labour

(Source: generated by author)

Material cost variance shows unfavourable result due to increase of 2900 in actual in comparison

to budget. The material usage variance shows unfavourable result due to increase of 2000 in

actual in comparison to budget. The material price variance shows unfavourable result due to

decrease in price by 900. The labour cost variance shows the unfavourable result actual is in

negative by -2680. The labour rate variance shows the unfavourable result as the actual rate is

negative by -1180. The labour efficiency variance shows favourable results actual efficiency

exceeds the budgeted one.

10

Variable Selling Overhead 30000 30000

Fixed Selling and Administrative

Overhead 30000 30000

Net Loss 50000 -5000

Figure 4: statement of income: costing for absorption

(Source: created by author)

Material variance Budgeted Actual Variance

Favourable/

Unfavourable

Material cost variance 40000 42900 2900 Unfavourable

Material usage variance 20000 22000 2000 Unfavourable

Material price variance 10000 20900 10900 Unfavourable

Labour variance Budgeted Actual Variance

Favourable/

Unfavourable

Labour cost variance 15000 17,680 -2,680 Unfavourable

Labour rate variance 15 16.07 400 Unfavourable

Laboureffeciency variance 1000 1100 100 Favourable

Figure 5: variance of material &variance of labour

(Source: generated by author)

Material cost variance shows unfavourable result due to increase of 2900 in actual in comparison

to budget. The material usage variance shows unfavourable result due to increase of 2000 in

actual in comparison to budget. The material price variance shows unfavourable result due to

decrease in price by 900. The labour cost variance shows the unfavourable result actual is in

negative by -2680. The labour rate variance shows the unfavourable result as the actual rate is

negative by -1180. The labour efficiency variance shows favourable results actual efficiency

exceeds the budgeted one.

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Application of management accounting for reporting for financial

The steps used by management accounting to produce appropriate financial reporting documents

are:-

Financial planning assists in making powerful financial planning which helps in meeting

organisation objectives (Sepasi et al. 2019). This tool technique is stated as the best

technique to achieve organisational objectives.

Statement of financial analysis helps in analysing the two important report of the

organisation that is the profit and loss and profit and balance sheet (Sepasi et al. 2019).

Henceforth this technique assistance can be known as growth of Creams Ltd. This

examination is done through ratio survey, common size statement and financial statements.

Cost accounting states the information related to product-wise, process-wise, department

wise and branch wise. The information of cost is compared with the pre-agreed one.

Fund flow analysis helps n tracking the fund flow from one period to another. The difference

between both the periods is ascertained while tracking. This analysis helps in checking

thoroughly funds are utilized properly or not in the given period.

Standard costing is termed as a predetermined cost. It provides a standard to compute the

performance. It is used to discover diversions if there is any.

Marginal costing steps are used to ascertain the price of selling, choosing the better sales

mix, using the scanty resources, and assisting in buying decision. This technique is built on a

variable cost, fixed cost, and contribution.

The budgetary control technique is associated with meeting future financial demands. It

helps in managing the financial perform in the business concern.

Revaluation accounting technique helps to revalue the assets of the company according to

requirement. It assists the company in ascertaining the capital employed.

Discuss the finance report of business activities

The financial reports like income statement, balance sheet, statement of stock holder’s equity,

cash flow statement and statement of comprehensive reports which play an vital step in making

decision, strategy making, success accomplishment and failure estimation in Cream Ltd. The

financial report helps in interpreting the range of the data by applying accuracy in financial

11

The steps used by management accounting to produce appropriate financial reporting documents

are:-

Financial planning assists in making powerful financial planning which helps in meeting

organisation objectives (Sepasi et al. 2019). This tool technique is stated as the best

technique to achieve organisational objectives.

Statement of financial analysis helps in analysing the two important report of the

organisation that is the profit and loss and profit and balance sheet (Sepasi et al. 2019).

Henceforth this technique assistance can be known as growth of Creams Ltd. This

examination is done through ratio survey, common size statement and financial statements.

Cost accounting states the information related to product-wise, process-wise, department

wise and branch wise. The information of cost is compared with the pre-agreed one.

Fund flow analysis helps n tracking the fund flow from one period to another. The difference

between both the periods is ascertained while tracking. This analysis helps in checking

thoroughly funds are utilized properly or not in the given period.

Standard costing is termed as a predetermined cost. It provides a standard to compute the

performance. It is used to discover diversions if there is any.

Marginal costing steps are used to ascertain the price of selling, choosing the better sales

mix, using the scanty resources, and assisting in buying decision. This technique is built on a

variable cost, fixed cost, and contribution.

The budgetary control technique is associated with meeting future financial demands. It

helps in managing the financial perform in the business concern.

Revaluation accounting technique helps to revalue the assets of the company according to

requirement. It assists the company in ascertaining the capital employed.

Discuss the finance report of business activities

The financial reports like income statement, balance sheet, statement of stock holder’s equity,

cash flow statement and statement of comprehensive reports which play an vital step in making

decision, strategy making, success accomplishment and failure estimation in Cream Ltd. The

financial report helps in interpreting the range of the data by applying accuracy in financial

11

transparency by showing the correct amount in the report of finance of the business. The tax

liability of the company should be correct in accordance with financial report no flaws should

exist (Cooper et al. 2017). The balance sheet of the business contains the assets and liability of

the organisation which help the business activities to work effectively using the assets of the

company properly. The statement of income of the business is a yardstick to measure the success

of the business workings for a specific period of time. The report of cash flow of the

businessstates the flow of fund inside the company and outside the company. It also states the

cash flows of the business activities outside and the speculations in a given period of time. The

statement cash flow is the most important financial report as it shows the flow of cash by which

the investors ascertain the state of the company.

Tools for management accounting

Advantages and disadvantages of planning tools

The positives and negatives of different types of tools of planning used for control of budgets are

Budget is a report which is prepared in each period which is presented by top position in

which allocation of funds is mentioned. The Advantages of the budget are it helps in the

bond building between all the departments of the Cream Ltd. It converts the strategy into

activity. It sates the revenue and expenses requirement for carrying out a plan. It provides

documentation of the activities which are going on in the organisation (Rikhardsson et al.

2018). The disadvantages of the budget are budget is followed rigidly which affects the

motivation of employees and which results in ineffective production. The rigid budget

structure will mitigate the innovation of ideas in the company.

Operational budgets: They are termed to be the plan of finances which is equipped with the

ability for meeting the obligations of debts along with sustainability over longer terms for the

company. In front of Creams Ltd., it can be sated advantageous through letting it know how

they are spending their money along with the area of cash management. However, use of

such tools can be disadvantages for the company also. Creams Ltd. is likely to face

inaccuracies within the financial budget which is likely to change on a frequent basis (Ittner

et al. 2017). In another direction, it can also be disadvantageous to Creams Ltd. through

12

liability of the company should be correct in accordance with financial report no flaws should

exist (Cooper et al. 2017). The balance sheet of the business contains the assets and liability of

the organisation which help the business activities to work effectively using the assets of the

company properly. The statement of income of the business is a yardstick to measure the success

of the business workings for a specific period of time. The report of cash flow of the

businessstates the flow of fund inside the company and outside the company. It also states the

cash flows of the business activities outside and the speculations in a given period of time. The

statement cash flow is the most important financial report as it shows the flow of cash by which

the investors ascertain the state of the company.

Tools for management accounting

Advantages and disadvantages of planning tools

The positives and negatives of different types of tools of planning used for control of budgets are

Budget is a report which is prepared in each period which is presented by top position in

which allocation of funds is mentioned. The Advantages of the budget are it helps in the

bond building between all the departments of the Cream Ltd. It converts the strategy into

activity. It sates the revenue and expenses requirement for carrying out a plan. It provides

documentation of the activities which are going on in the organisation (Rikhardsson et al.

2018). The disadvantages of the budget are budget is followed rigidly which affects the

motivation of employees and which results in ineffective production. The rigid budget

structure will mitigate the innovation of ideas in the company.

Operational budgets: They are termed to be the plan of finances which is equipped with the

ability for meeting the obligations of debts along with sustainability over longer terms for the

company. In front of Creams Ltd., it can be sated advantageous through letting it know how

they are spending their money along with the area of cash management. However, use of

such tools can be disadvantages for the company also. Creams Ltd. is likely to face

inaccuracies within the financial budget which is likely to change on a frequent basis (Ittner

et al. 2017). In another direction, it can also be disadvantageous to Creams Ltd. through

12

inaccurate projections that can ruin their abilities for meeting their financial obligations. The

cost volume profit analysis works on a period of time after that the data will be reckless.

Cash budget: Cash budget is yet another type of planning tool which can be used by Creams

Ltd. for their budget management. In light of this, the prime advantages of using such

criterion are termed to be advantageous through producing quick determination of the

amount of cash which would be enough for meeting the obligations. Use of financial position

such as present financial health can be another advantageous. However, it can be concluded

that it would be creating theft dangers followed by limiting spending powers. The

disadvantage is a company list the price of the product on their assumption which is not

necessarily effective for the consumer which will lead to a decrease in sales.

Analysis of tools and application on budgets

The analysis of different types of tools usage and their application on preparing the budget and

forecasting are Budgeting comes after the plan of Cream Ltd being made now the time comes

when there is a need for allocation of funds. Budget preparation is important to forecast the

future demand for funds in different activities (Owusu et al. 2016). The budgets help in finance

controlling, funding of plan strategies, decision-related to finance in an effective manner,

planning for the difficulties arisen in the strategy, plans measurement in accordance with future

needs. Budget is prepared in a long duration of time as it is going to apply in for all activities in

the business. The budget is reviewed on a regular basis to make changes as required according to

upcoming activities. An effective budget displays the plan for unforeseen happenings and

spotting the sectors on which cost can be mitigated.

Cash flow forecasting is also a tool for forecasting the business activities in a more efficient way

than budgeting. The cash flow forecasting helps Cream Ltd in pinpointing the crests and trench

in bank finance. It assists in detecting curb in the way growth can be attained. The cash flow

forecasting will help in discovering the requirements of money, cost areas to be reviewed, the

supply period that needs to change (Huang et al. 2019). It pins the business authorities if there

are any cash related issues. The cash flow forecast assists in analysis the business activities

carefully. It defines the ways in which area the cost need to be allocated or need to be cut which

will help the business taking effective steps regarding the problems which will ultimately land on

achieving business goals.

13

cost volume profit analysis works on a period of time after that the data will be reckless.

Cash budget: Cash budget is yet another type of planning tool which can be used by Creams

Ltd. for their budget management. In light of this, the prime advantages of using such

criterion are termed to be advantageous through producing quick determination of the

amount of cash which would be enough for meeting the obligations. Use of financial position

such as present financial health can be another advantageous. However, it can be concluded

that it would be creating theft dangers followed by limiting spending powers. The

disadvantage is a company list the price of the product on their assumption which is not

necessarily effective for the consumer which will lead to a decrease in sales.

Analysis of tools and application on budgets

The analysis of different types of tools usage and their application on preparing the budget and

forecasting are Budgeting comes after the plan of Cream Ltd being made now the time comes

when there is a need for allocation of funds. Budget preparation is important to forecast the

future demand for funds in different activities (Owusu et al. 2016). The budgets help in finance

controlling, funding of plan strategies, decision-related to finance in an effective manner,

planning for the difficulties arisen in the strategy, plans measurement in accordance with future

needs. Budget is prepared in a long duration of time as it is going to apply in for all activities in

the business. The budget is reviewed on a regular basis to make changes as required according to

upcoming activities. An effective budget displays the plan for unforeseen happenings and

spotting the sectors on which cost can be mitigated.

Cash flow forecasting is also a tool for forecasting the business activities in a more efficient way

than budgeting. The cash flow forecasting helps Cream Ltd in pinpointing the crests and trench

in bank finance. It assists in detecting curb in the way growth can be attained. The cash flow

forecasting will help in discovering the requirements of money, cost areas to be reviewed, the

supply period that needs to change (Huang et al. 2019). It pins the business authorities if there

are any cash related issues. The cash flow forecast assists in analysis the business activities

carefully. It defines the ways in which area the cost need to be allocated or need to be cut which

will help the business taking effective steps regarding the problems which will ultimately land on

achieving business goals.

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Respond to financial problems

Management responding to financial problems

One of the prime uses of MA techniques can be inform of applying benchmarking and KPI;

Benchmarking

Tesco company is the second biggest retail in Europe with a rapidity grow on market. Tesco

understood to avoid financial problems in terms of sales, must choose an incredibly good

location of stores.

Choosing a store location is perceived to be the single most crucial choice a retail company must

make, and accessibility and time restrictions, proximity to facilities, comfort for consumers, vend

ors and employees are a vital aspect of success.

The position can be understood as a influencing the cost of selling and delivery, and the

competition strength can vary because there are strong local rivals in certain areas. Management

can benefit from lower delivery, manufacturing, raw materials ar energy costs and administrative

considerations such as government regulations by enforcing their position in an acceptable

geographical area. (UKEssays. November 2018).

The company Creams works within an environment where the competition is fierce and mainly

sustains to maintain their scales on a higher note. The company is sometimes unaware of the

facts regarding the financial metrics and the required revenues scales to uplift their competitive

advantage (Ferdous et al. 2019). Here application of benchmarking can be termed helpful for the

company for chalking out relevant insights that would be helpful for development of strategies.

On the other hand, Barclays faces the financial issue of inability for judging the competitors

scales which was help them relevant for staying behind their productivity. Use of benchmarking

has helped them to regain their financial position through exampling the metrics and devise the

strength’s through analysing the market insights.

KPI

Creams ltd. is likely to face the problems while measuring their capital proportions which is

retarded after making sales from the goods. In light of this problem, it would be easier for the

14

Management responding to financial problems

One of the prime uses of MA techniques can be inform of applying benchmarking and KPI;

Benchmarking

Tesco company is the second biggest retail in Europe with a rapidity grow on market. Tesco

understood to avoid financial problems in terms of sales, must choose an incredibly good

location of stores.

Choosing a store location is perceived to be the single most crucial choice a retail company must

make, and accessibility and time restrictions, proximity to facilities, comfort for consumers, vend

ors and employees are a vital aspect of success.

The position can be understood as a influencing the cost of selling and delivery, and the

competition strength can vary because there are strong local rivals in certain areas. Management

can benefit from lower delivery, manufacturing, raw materials ar energy costs and administrative

considerations such as government regulations by enforcing their position in an acceptable

geographical area. (UKEssays. November 2018).

The company Creams works within an environment where the competition is fierce and mainly

sustains to maintain their scales on a higher note. The company is sometimes unaware of the

facts regarding the financial metrics and the required revenues scales to uplift their competitive

advantage (Ferdous et al. 2019). Here application of benchmarking can be termed helpful for the

company for chalking out relevant insights that would be helpful for development of strategies.

On the other hand, Barclays faces the financial issue of inability for judging the competitors

scales which was help them relevant for staying behind their productivity. Use of benchmarking

has helped them to regain their financial position through exampling the metrics and devise the

strength’s through analysing the market insights.

KPI

Creams ltd. is likely to face the problems while measuring their capital proportions which is

retarded after making sales from the goods. In light of this problem, it would be easier for the

14

company to take help of KPI’s for corresponding towards their analysing of gross profit margins.

This would helpful for justifying their company’s financial capabilities and health (Cooper et al.

2017). On the other hand, Barclays is likely to face the issue of inability for responding to their

financial obligations on short term aspects. The KPIs are helpful for the company to sustain their

working module. Use of working KPIs are considered by the company through use of short term

assets business liquidity.

The organisation is adapting to the management accounting system to acknowledge financial

problems (Weetman et al. 2019). Cream Ltd is applying different ways to overcome the financial

problems, for example, benchmarking which is used for measuring the working of the products

of the company. It is associated with comparing the policies, procedures, products and process of

the business to solve the financial problems. Further the company also uses the performance

appraisal technique for analysing the rate of satisfaction. In another direction, it can be analysed

that the apprehension of benchmarking has been applied for managing the financial transitions

The benchmarking procedure includes:

1. Recognition of the opportunity for up-gradation

2. Checking how the competitor is performing in targeted areas.

3. Upgrading the performance related to generating a plan for improvement.

4. Result reviewing and enhancing the areas of improvement.

While on the other hand, Barclays is adopting a cost accounting system which helps in solving

the financial issue of analysis of profits, inventory valuation and controlling the cost (Armitage

et al. 2016). Activity-based accounting is done in the cost accounting system to overcome the

allocation of cost. On the other hand, the company also uses their performance appraisal

technique for managing the retention rate along with ROE of the business. However, it can be

analysed that the Company has been using both internal as well as external benchmarking

procedure to highlight the consequences.

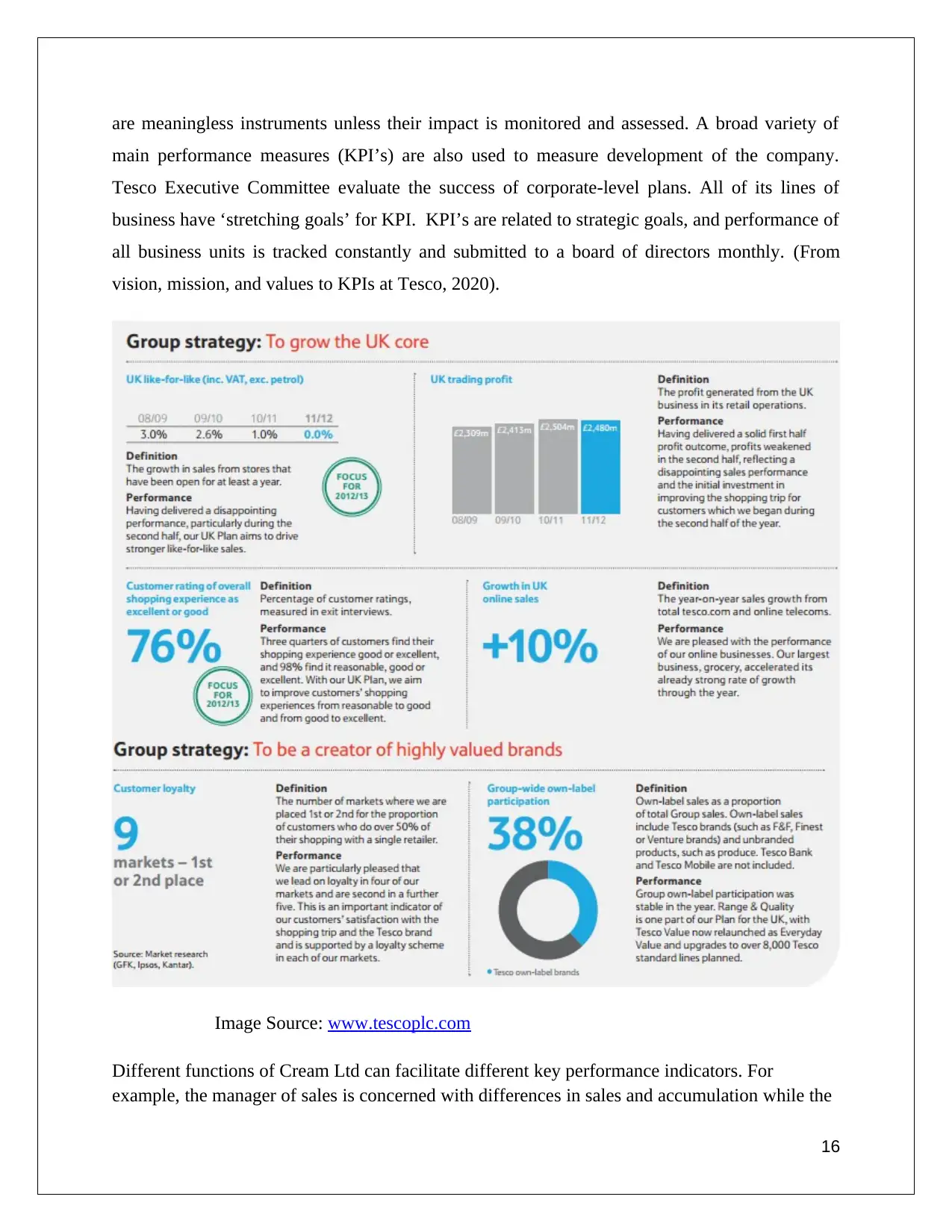

Tesco, one of the largest retails in the world is applying a small philosophy “every little help”

and is putting customers, employees, and communities at the heart of what his doing. Vision,

mission, and dreams interrelate and work forming the company’s image. They play a crucial role

in generating success along with Tesco’s approach. KPI’s vision, mission, values, and strategy

15

This would helpful for justifying their company’s financial capabilities and health (Cooper et al.

2017). On the other hand, Barclays is likely to face the issue of inability for responding to their

financial obligations on short term aspects. The KPIs are helpful for the company to sustain their

working module. Use of working KPIs are considered by the company through use of short term

assets business liquidity.

The organisation is adapting to the management accounting system to acknowledge financial

problems (Weetman et al. 2019). Cream Ltd is applying different ways to overcome the financial

problems, for example, benchmarking which is used for measuring the working of the products

of the company. It is associated with comparing the policies, procedures, products and process of

the business to solve the financial problems. Further the company also uses the performance

appraisal technique for analysing the rate of satisfaction. In another direction, it can be analysed

that the apprehension of benchmarking has been applied for managing the financial transitions

The benchmarking procedure includes:

1. Recognition of the opportunity for up-gradation

2. Checking how the competitor is performing in targeted areas.

3. Upgrading the performance related to generating a plan for improvement.

4. Result reviewing and enhancing the areas of improvement.

While on the other hand, Barclays is adopting a cost accounting system which helps in solving

the financial issue of analysis of profits, inventory valuation and controlling the cost (Armitage

et al. 2016). Activity-based accounting is done in the cost accounting system to overcome the

allocation of cost. On the other hand, the company also uses their performance appraisal

technique for managing the retention rate along with ROE of the business. However, it can be

analysed that the Company has been using both internal as well as external benchmarking

procedure to highlight the consequences.

Tesco, one of the largest retails in the world is applying a small philosophy “every little help”

and is putting customers, employees, and communities at the heart of what his doing. Vision,

mission, and dreams interrelate and work forming the company’s image. They play a crucial role

in generating success along with Tesco’s approach. KPI’s vision, mission, values, and strategy

15

are meaningless instruments unless their impact is monitored and assessed. A broad variety of

main performance measures (KPI’s) are also used to measure development of the company.

Tesco Executive Committee evaluate the success of corporate-level plans. All of its lines of

business have ‘stretching goals’ for KPI. KPI’s are related to strategic goals, and performance of

all business units is tracked constantly and submitted to a board of directors monthly. (From

vision, mission, and values to KPIs at Tesco, 2020).

Image Source: www.tescoplc.com

Different functions of Cream Ltd can facilitate different key performance indicators. For

example, the manager of sales is concerned with differences in sales and accumulation while the

16

main performance measures (KPI’s) are also used to measure development of the company.

Tesco Executive Committee evaluate the success of corporate-level plans. All of its lines of

business have ‘stretching goals’ for KPI. KPI’s are related to strategic goals, and performance of

all business units is tracked constantly and submitted to a board of directors monthly. (From

vision, mission, and values to KPIs at Tesco, 2020).

Image Source: www.tescoplc.com

Different functions of Cream Ltd can facilitate different key performance indicators. For

example, the manager of sales is concerned with differences in sales and accumulation while the

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

manager of the production will check on customer stock fulfilment. Business software can be put

in use for calculating the key performance indicator and to show the results of the management

presently with the help of the dashboard which is in their desktop. The management of key

performance indicators is checked by the management which will be corrected if they are not

matching with the presumptions (Samad et al. 2017). While on the other hand, Barclays is

adopting the Inventory management system which assists the company to overcome with making

better inventory decisions which help in solving the financial problems related to inventory.

Organisation sustainable success

In context of monetary related issues, the board bookkeeping can help Cream Ltd and Barclays

to accomplish manageable achievement in various manners. The administration bookkeeping

fundamental goal is to set out for dynamic reason. There are approaches to experience money

related issues like Forecasting the case flows will assist Cream Ltd and Barclays to get

represented with the coming excess in real money or deficit in real money which prompts

settling on a compelling choice in the association. It assists in the planning of taxation, purchase

of new products and loans securing. Forecasting cash flow helps the company for upcoming

business challenges and decision making. This forecasting will help the organizations to use the

funds effectively for example if the organisation is going hire a new employee for their

organisation then this forecasting cash flow will state the benefits if there any related to

particular hiring and how this hiring will help in meeting business objectives (Ferdous et al.

2019).

This forecasting will curb down the additional wastage of money and help to deploy the money

on other areas. Management accounting focuses on decision making for making a sustainable

success of the organisation. Management accounting can help the company by delivering

information which is useful for the process of decision making (Cooper et al. 2017). The data

gathered by the management accounting will help in settling on compelling choices which will

help with meeting practical development in future. This will likewise lead the route for upgrade

in the budgetary exhibition of Cream Ltd and Barclays. Management accounting can be

contemplated as it gives the managers the idea to make sustainable and profitable decisions (Hall

et al. 2016). The dynamic procedure help in organisation sustainability as the dynamic procedure

is related with subunits instead of just in the middle point. Dynamic assumes an indispensable

job in achieving reasonable achievement in Cream Ltd and Barclays.

17

in use for calculating the key performance indicator and to show the results of the management

presently with the help of the dashboard which is in their desktop. The management of key

performance indicators is checked by the management which will be corrected if they are not

matching with the presumptions (Samad et al. 2017). While on the other hand, Barclays is

adopting the Inventory management system which assists the company to overcome with making

better inventory decisions which help in solving the financial problems related to inventory.

Organisation sustainable success

In context of monetary related issues, the board bookkeeping can help Cream Ltd and Barclays

to accomplish manageable achievement in various manners. The administration bookkeeping

fundamental goal is to set out for dynamic reason. There are approaches to experience money

related issues like Forecasting the case flows will assist Cream Ltd and Barclays to get

represented with the coming excess in real money or deficit in real money which prompts

settling on a compelling choice in the association. It assists in the planning of taxation, purchase

of new products and loans securing. Forecasting cash flow helps the company for upcoming

business challenges and decision making. This forecasting will help the organizations to use the

funds effectively for example if the organisation is going hire a new employee for their

organisation then this forecasting cash flow will state the benefits if there any related to

particular hiring and how this hiring will help in meeting business objectives (Ferdous et al.

2019).

This forecasting will curb down the additional wastage of money and help to deploy the money

on other areas. Management accounting focuses on decision making for making a sustainable

success of the organisation. Management accounting can help the company by delivering

information which is useful for the process of decision making (Cooper et al. 2017). The data

gathered by the management accounting will help in settling on compelling choices which will

help with meeting practical development in future. This will likewise lead the route for upgrade

in the budgetary exhibition of Cream Ltd and Barclays. Management accounting can be

contemplated as it gives the managers the idea to make sustainable and profitable decisions (Hall

et al. 2016). The dynamic procedure help in organisation sustainability as the dynamic procedure

is related with subunits instead of just in the middle point. Dynamic assumes an indispensable

job in achieving reasonable achievement in Cream Ltd and Barclays.

17

Evaluation of planning tools for the success of the organization

The management accounting tools supports Cream Ltd and Barclays to take care of budgetary

issues which lead to the supportable achievement of the association. The Management

accounting tools aid the age of investor worth and upgrade the money related execution of the

organization (Cooper et al. 2017). There are many tools which are implemented in the

organizations for attaining sustainable success, for example, activity-based costing. This tool

helps in allocating relevant information which assists in decision making. The balanced

scorecard tools help in evaluating the performance of finance, innovation, internal operations,

and learning’s. The balanced scorecard consists of four segments: internal operation, financial,

customers and learning outcomes.

Conclusion

Present study has concluded an understanding of management accounting system and its

application on Cream Ltd. Furthermore, different types of management systems have been

addressed that used by Cream Ltd along with the benefits associated with them. The explanation

is given on the integration of management accounting in context to an organisational process.

Discussion on management techniques has been done to prepare an income statement using

marginal costing and absorption costing. The use of planning tools in management accounting

has been explained with advantages and disadvantages. Analysis has been done on different

planning tools and their application for preparing budgets and forecasts. Comparison of

organizations management accounting and respond to financial problems has been provided. In

context of Cream Ltd and Barclays, this study has concluded financial issues along with the

effective strategies. Discussion on planning tools effectiveness for solving financial problems for

leading sustainable organisation and meeting a success. Detail analysis is provided on the income

statement by producing appropriate reporting documents.

18

The management accounting tools supports Cream Ltd and Barclays to take care of budgetary

issues which lead to the supportable achievement of the association. The Management

accounting tools aid the age of investor worth and upgrade the money related execution of the

organization (Cooper et al. 2017). There are many tools which are implemented in the

organizations for attaining sustainable success, for example, activity-based costing. This tool

helps in allocating relevant information which assists in decision making. The balanced

scorecard tools help in evaluating the performance of finance, innovation, internal operations,

and learning’s. The balanced scorecard consists of four segments: internal operation, financial,

customers and learning outcomes.

Conclusion

Present study has concluded an understanding of management accounting system and its

application on Cream Ltd. Furthermore, different types of management systems have been

addressed that used by Cream Ltd along with the benefits associated with them. The explanation

is given on the integration of management accounting in context to an organisational process.

Discussion on management techniques has been done to prepare an income statement using

marginal costing and absorption costing. The use of planning tools in management accounting

has been explained with advantages and disadvantages. Analysis has been done on different

planning tools and their application for preparing budgets and forecasts. Comparison of

organizations management accounting and respond to financial problems has been provided. In

context of Cream Ltd and Barclays, this study has concluded financial issues along with the

effective strategies. Discussion on planning tools effectiveness for solving financial problems for

leading sustainable organisation and meeting a success. Detail analysis is provided on the income

statement by producing appropriate reporting documents.

18

Reference list

Journals

Armitage, H.M., Webb, A. and Glynn, J., 2016. The use of management accounting techniques

by small and medium‐sized enterprises: a field study of Canadian and Australian

practice. Accounting Perspectives, 15(1), pp.31-69.

Cooper, D.J., Ezzamel, M. and Qu, S.Q., 2017. Popularizing a management accounting idea: The

case of the balanced scorecard. Contemporary Accounting Research, 34(2), pp.991-1025.

Cooper, D.J., Ezzamel, M. and Qu, S.Q., 2017. Popularizing a management accounting idea: The

case of the balanced scorecard. Contemporary Accounting Research, 34(2), pp.991-1025.

Ferdous, M.I., Adams, C.A. and Boyce, G., 2019. Institutional drivers of environmental

management accounting adoption in public sector water organisations. Accounting, Auditing &

Accountability Journal.

Ferdous, M.I., Adams, C.A. and Boyce, G., 2019. Institutional drivers of environmental

management accounting adoption in public sector water organisations. Accounting, Auditing &

Accountability Journal.

Hall, M., 2016. Realising the richness of psychology theory in contingency-based management

accounting research. Management Accounting Research, 31, pp.63-74.

Huang, S.Y., Chiu, A.A., Chao, P.C. and Arniati, A., 2019. Critical Success Factors in

Implementing Enterprise Resource Planning Systems for Sustainable

Corporations. Sustainability, 11(23), p.6785.

Ioppolo, G., Cucurachi, S., Salomone, R., Shi, L. and Yigitcanlar, T., 2019. Integrating strategic

environmental assessment and material flow accounting: a novel approach for moving towards

sustainable urban futures. The International Journal of Life Cycle Assessment, 24(7), pp.1269-

1284.

Ittner, C.D. and Michels, J., 2017. Risk-based forecasting and planning and management

earnings forecasts. Review of Accounting Studies, 22(3), pp.1005-1047.

Khan, I., Parvin, N. and Sayeeda, N., 2019. Cost Accounting Practices in Bangladesh: A Study

of the Pharmaceutical Sector.

Lugli, E. and Marchini, P.L., 2017. Performance measurement systems and management

accounting in supermarket chain sector: analysis in an Italian complex business entity.

19

Journals

Armitage, H.M., Webb, A. and Glynn, J., 2016. The use of management accounting techniques

by small and medium‐sized enterprises: a field study of Canadian and Australian

practice. Accounting Perspectives, 15(1), pp.31-69.

Cooper, D.J., Ezzamel, M. and Qu, S.Q., 2017. Popularizing a management accounting idea: The

case of the balanced scorecard. Contemporary Accounting Research, 34(2), pp.991-1025.

Cooper, D.J., Ezzamel, M. and Qu, S.Q., 2017. Popularizing a management accounting idea: The

case of the balanced scorecard. Contemporary Accounting Research, 34(2), pp.991-1025.

Ferdous, M.I., Adams, C.A. and Boyce, G., 2019. Institutional drivers of environmental

management accounting adoption in public sector water organisations. Accounting, Auditing &

Accountability Journal.

Ferdous, M.I., Adams, C.A. and Boyce, G., 2019. Institutional drivers of environmental

management accounting adoption in public sector water organisations. Accounting, Auditing &

Accountability Journal.

Hall, M., 2016. Realising the richness of psychology theory in contingency-based management

accounting research. Management Accounting Research, 31, pp.63-74.

Huang, S.Y., Chiu, A.A., Chao, P.C. and Arniati, A., 2019. Critical Success Factors in

Implementing Enterprise Resource Planning Systems for Sustainable

Corporations. Sustainability, 11(23), p.6785.

Ioppolo, G., Cucurachi, S., Salomone, R., Shi, L. and Yigitcanlar, T., 2019. Integrating strategic

environmental assessment and material flow accounting: a novel approach for moving towards

sustainable urban futures. The International Journal of Life Cycle Assessment, 24(7), pp.1269-

1284.

Ittner, C.D. and Michels, J., 2017. Risk-based forecasting and planning and management

earnings forecasts. Review of Accounting Studies, 22(3), pp.1005-1047.

Khan, I., Parvin, N. and Sayeeda, N., 2019. Cost Accounting Practices in Bangladesh: A Study

of the Pharmaceutical Sector.

Lugli, E. and Marchini, P.L., 2017. Performance measurement systems and management

accounting in supermarket chain sector: analysis in an Italian complex business entity.

19

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Owusu, M., 2016. Budget and budgetary control practices of some selected credit unions within

the Ashanti chapter (Doctoral dissertation).

Performancemagazine.org. 2020. From Vision, Mission And Values To Kpis At Tesco. [online]

Available at: <https://www.performancemagazine.org/from-vision-mission-and-values-to-kpis-

at-tesco/> [Accessed 18 July 2020].

Rikhardsson, P. and Yigitbasioglu, O., 2018. Business intelligence & analytics in management

accounting research: Status and future focus. International Journal of Accounting Information

Systems, 29, pp.37-58.

Samad, M.A., Shu, Y. and Ogar, K., 2017. Value Creation with Lean Accounting.

Sepasi, S. and Sirghani, S., 2019. The Utility of Applying Environmental Management

Accounting Techniques and Prioritizing them Using the AHP method in Companies with ISO

14001 in Iran. International Journal of Finance & Managerial Accounting, 4(13), pp.69-84.

Sridhar, M.S., 2017. Unit-11 Budgeting Techniques. IGNOU.

Tabitha, N. and Oluyinka, I.O., 2016. Cost Accounting Techniques Adopted By Manufacturing

And Service Industry Within The Last Decade. International Journal Of Advances In

Management And Economics, 5(1), pp.48-61.

UKEssays. November 2018. Organizational Profile And Tesco Market Strategy. [online].

Available from: https://www.ukessays.com/essays/commerce/organizational-profile-and-tesco-

market-strategy-commerce-essay.php?vref=1 [Accessed 24 July 2020].

Weetman, P., 2019. Financial and management accounting. Pearson UK.

20

the Ashanti chapter (Doctoral dissertation).

Performancemagazine.org. 2020. From Vision, Mission And Values To Kpis At Tesco. [online]

Available at: <https://www.performancemagazine.org/from-vision-mission-and-values-to-kpis-

at-tesco/> [Accessed 18 July 2020].

Rikhardsson, P. and Yigitbasioglu, O., 2018. Business intelligence & analytics in management

accounting research: Status and future focus. International Journal of Accounting Information

Systems, 29, pp.37-58.

Samad, M.A., Shu, Y. and Ogar, K., 2017. Value Creation with Lean Accounting.

Sepasi, S. and Sirghani, S., 2019. The Utility of Applying Environmental Management

Accounting Techniques and Prioritizing them Using the AHP method in Companies with ISO

14001 in Iran. International Journal of Finance & Managerial Accounting, 4(13), pp.69-84.

Sridhar, M.S., 2017. Unit-11 Budgeting Techniques. IGNOU.

Tabitha, N. and Oluyinka, I.O., 2016. Cost Accounting Techniques Adopted By Manufacturing

And Service Industry Within The Last Decade. International Journal Of Advances In

Management And Economics, 5(1), pp.48-61.

UKEssays. November 2018. Organizational Profile And Tesco Market Strategy. [online].

Available from: https://www.ukessays.com/essays/commerce/organizational-profile-and-tesco-

market-strategy-commerce-essay.php?vref=1 [Accessed 24 July 2020].

Weetman, P., 2019. Financial and management accounting. Pearson UK.

20

1 out of 20

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.