IFRS Harmonization: A Case Study of Amara Holdings Limited

VerifiedAdded on 2023/06/10

|25

|4830

|435

Report

AI Summary

This report provides an in-depth analysis of International Financial Reporting Standards (IFRS) harmonization, focusing on the case of Amara Holdings Limited in Singapore. It begins with an executive summary, followed by an introduction to IFRS and the reasons driving harmonization, such as the reduction of cross-country accounting disparities and increased access to international capital markets. The report then addresses the issues and challenges in the harmonization process, including regulatory compliance, staff training, cultural differences, and taxation. A detailed case study of Amara Holdings is presented, examining the company's financial statements, including equity, capitalization of development costs, and deferred taxes. The study also highlights the impact of Singapore's adoption of IFRS. The report concludes with recommendations for improving the harmonization process and a self-reflection on the research, along with relevant references and appendices, including financial statements from Amara Holdings' annual reports. The report provides a comprehensive overview of IFRS adoption and its implications for businesses in Singapore.

Amara HOlding

International Accounting

Harmonization in IFRS rules and regulations

Name of the Author

University Name-

International Accounting

Harmonization in IFRS rules and regulations

Name of the Author

University Name-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

With the increasing ramified economic changes, every organization needs to comply

with the domestic and international financial standards to mitigate the harmonization issues in

their international reporting frameworks. Current report under study deals with certain

discussions related to International Financial Reporting Standards (IFRS). The limelight topic

is the critical evaluation of the success of harmonisation in adoption of IFRS. The country

chosen for examination purpose is Singapore. For case study purposes, the company

illustrated is Amara Holdings Limited. The series in which report is presented involves the

reasons of harmonisation, issues involved, case study on Amara Holdings Limited depicting

the company’s financials consisting of equity, capitalization of development costs, effect of

deferred taxes, etc. Along with the case study involves, a statement pinpointing the basis of

research, and the issues involved. The report ends with certain conclusions and

recommendations. It is analysed that the main reason of harmonization is related to mitigate

the regulatory compliance issues related to domestic and international accounting standards.

THE adoption of IFRS was done with view to strengthen the transparency of the regulatory

compliance and accounting standard reporting framework of organization in long run.

With the increasing ramified economic changes, every organization needs to comply

with the domestic and international financial standards to mitigate the harmonization issues in

their international reporting frameworks. Current report under study deals with certain

discussions related to International Financial Reporting Standards (IFRS). The limelight topic

is the critical evaluation of the success of harmonisation in adoption of IFRS. The country

chosen for examination purpose is Singapore. For case study purposes, the company

illustrated is Amara Holdings Limited. The series in which report is presented involves the

reasons of harmonisation, issues involved, case study on Amara Holdings Limited depicting

the company’s financials consisting of equity, capitalization of development costs, effect of

deferred taxes, etc. Along with the case study involves, a statement pinpointing the basis of

research, and the issues involved. The report ends with certain conclusions and

recommendations. It is analysed that the main reason of harmonization is related to mitigate

the regulatory compliance issues related to domestic and international accounting standards.

THE adoption of IFRS was done with view to strengthen the transparency of the regulatory

compliance and accounting standard reporting framework of organization in long run.

Table of Contents

EXECUTIVE SUMMARY...................................................................................................................1

INTRODUCTION.................................................................................................................................3

REASONS FOR HARMONISATION..................................................................................................3

ISSUES IN HARMONISATION..........................................................................................................5

CASE STUDY OF AMARA HOLDINGS LIMITED...........................................................................6

RECOMMENDATIONS.......................................................................................................................8

Conclusion...........................................................................................................................................10

COMMENT ON RESEARCH (Self Reflection).................................................................................10

REFERENCES....................................................................................................................................12

Appendix.............................................................................................................................................14

Appendix-2..........................................................................................................................................17

FROM THE ANNUAL REPORT OF FINANCIAL YEAR 2017......................................................................17

Balance sheet of 2017.........................................................................................................................18

Profit and loss for 2017.......................................................................................................................18

OUTSTANDING LEASE COMMITMENTS 2017......................................................................................19

OUTSTANDING LEASE 2016.................................................................................................................19

FINANCIAL INSTRUMENTS 2016 AND 2017.........................................................................................20

BALANCE SHEET 2016..........................................................................................................................20

EXECUTIVE SUMMARY...................................................................................................................1

INTRODUCTION.................................................................................................................................3

REASONS FOR HARMONISATION..................................................................................................3

ISSUES IN HARMONISATION..........................................................................................................5

CASE STUDY OF AMARA HOLDINGS LIMITED...........................................................................6

RECOMMENDATIONS.......................................................................................................................8

Conclusion...........................................................................................................................................10

COMMENT ON RESEARCH (Self Reflection).................................................................................10

REFERENCES....................................................................................................................................12

Appendix.............................................................................................................................................14

Appendix-2..........................................................................................................................................17

FROM THE ANNUAL REPORT OF FINANCIAL YEAR 2017......................................................................17

Balance sheet of 2017.........................................................................................................................18

Profit and loss for 2017.......................................................................................................................18

OUTSTANDING LEASE COMMITMENTS 2017......................................................................................19

OUTSTANDING LEASE 2016.................................................................................................................19

FINANCIAL INSTRUMENTS 2016 AND 2017.........................................................................................20

BALANCE SHEET 2016..........................................................................................................................20

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

IFRS is like a common communication tool for business affairs so that the accounts of

the companies on a global platform seem comparable and streamlined. These are the

accounting standards that are issues by International Accounting Standards Board (IASB)

(Larson & Herz, 2013). Harmonisation with IFRS stands as an effort to gradually bring a

reduction in the diversities involved in several accounting practices at the global level.

Further harmonisation with IFRS deals with removing the hindrances that obstruct purposeful

integration of IFRS with current financial system. But the process of harmonisation is not as

easy as the theory speaks about. The upcoming sections describe in detail the exact situation.

In Singapore, all companies that have their incorporation done in Singapore and the

Singapore branches of foreign companies are required to present their financial statements as

per Singapore Financial Reporting Standards (SFRS) as per the requirement of companies act

(Joshi, Yapa & Kraal, 2016). The substance of Singapore financial reporting standards is

same as International Financial Reporting Standards. It will not only strengthen the

disclosure and financial reporting standards process which will strengthen the disclosure

requirement of organization. However, after adopting the IFRS rules and regulations in

Singapore, the major changes in the accounting standards and applicable laws have been

found is related to contract laws, lease agreement and impairment test undertaken by the

companies.

REASONS FOR HARMONISATION

Before any particular reason can be established as a motivating factor behind

harmonisation, the most certain deal is the reduction of cross country diversities in

accounting practices. With the onset of globalisation, the whole world is working at the same

parlance with their own set of opportunities. However, at the international level the financial

reporting disparities probed a big issue. In order to mitigate the reporting and accounting

issues arise due to the domestic and international accounting standards, Singapore accepted

the parlances of the harmonization in its listed companies reporting. Researches have

suggested that the main reason behind the adoption of IFRS is getting larger access to

overseas and international capital markets (Garanina & Kormiltseva, 2014). It is so because,

with financial instruments prepared with the help of globally accepted accounting policies,

IFRS is like a common communication tool for business affairs so that the accounts of

the companies on a global platform seem comparable and streamlined. These are the

accounting standards that are issues by International Accounting Standards Board (IASB)

(Larson & Herz, 2013). Harmonisation with IFRS stands as an effort to gradually bring a

reduction in the diversities involved in several accounting practices at the global level.

Further harmonisation with IFRS deals with removing the hindrances that obstruct purposeful

integration of IFRS with current financial system. But the process of harmonisation is not as

easy as the theory speaks about. The upcoming sections describe in detail the exact situation.

In Singapore, all companies that have their incorporation done in Singapore and the

Singapore branches of foreign companies are required to present their financial statements as

per Singapore Financial Reporting Standards (SFRS) as per the requirement of companies act

(Joshi, Yapa & Kraal, 2016). The substance of Singapore financial reporting standards is

same as International Financial Reporting Standards. It will not only strengthen the

disclosure and financial reporting standards process which will strengthen the disclosure

requirement of organization. However, after adopting the IFRS rules and regulations in

Singapore, the major changes in the accounting standards and applicable laws have been

found is related to contract laws, lease agreement and impairment test undertaken by the

companies.

REASONS FOR HARMONISATION

Before any particular reason can be established as a motivating factor behind

harmonisation, the most certain deal is the reduction of cross country diversities in

accounting practices. With the onset of globalisation, the whole world is working at the same

parlance with their own set of opportunities. However, at the international level the financial

reporting disparities probed a big issue. In order to mitigate the reporting and accounting

issues arise due to the domestic and international accounting standards, Singapore accepted

the parlances of the harmonization in its listed companies reporting. Researches have

suggested that the main reason behind the adoption of IFRS is getting larger access to

overseas and international capital markets (Garanina & Kormiltseva, 2014). It is so because,

with financial instruments prepared with the help of globally accepted accounting policies,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

they become widely accepted (Biddle, Callahan, Hong & Knowles, 2016). This is in line with

increasing the capital investment made in country.

Along with the access which the Singapore will get much widely after adoption, the

adoption of IFRS ensures the investors that they are getting the best quality reports. The other

benefit which is a great driver when it comes to harmonisation is the reduction of

reconciliation costs because, now entities need not to converge with different countries’

accounting policies and prepare separate statements.

It is analyzed that if Singapore adopts the IFRS rules and regulations then it will result

to less reporting issues for the international companies which are working on international

level. It will also lead to cost benefits due to elimination of preparation of financial accounts

in accordance with different countries’ accounting policies, harmonisation brings into light

effective audit being conducted (Kusnadi, Leong, Suwardy & Wang, 2016) .

Singapore will strengthen its reporting requirement and transparent accounting busienss

practice if it adopts the IFRS rules and regulation in its economic. It will frame of policies in

preparation of accounts which makes it easier to audit them and at the same time gives results

that are internationally accepted. If company follow the IFRS rules and regulations then it

will avoid the unnecessary costing and charges of company in preparation of the financial

statement which will eventually make the business more cost effective. It is further analysed

that in case of conflict arise in the international financial reporting standards and domestic

reporting standards, company will comply with the IFRS rules and regulation. Singapore has

made mandatory for all the listed companies to comply with the IFRS rules and regulations as

it lower down the conflicts in domestic and international reporting frameworks and make

easy for the international companies to comply with the reporting compliance laws.

The process of harmonisation had been a well-planned and well-articulated process

for the country. The opinions of users across overseas as well as the organisations have been

considered before any finalisation. This had made IFRS much wide in scope and better than

any country’s individual accounting practice. Adoption of IFRS is being considered as the

‘best practice’ among almost countries of the world as it accrues certain benefits as reduction

in costs, wider access to overseas markets, standard benchmark for preparation of financial

instruments, better and highly efficient allocation of resources, decreased chances of resorting

to earnings management to manipulate accounts and etc.

increasing the capital investment made in country.

Along with the access which the Singapore will get much widely after adoption, the

adoption of IFRS ensures the investors that they are getting the best quality reports. The other

benefit which is a great driver when it comes to harmonisation is the reduction of

reconciliation costs because, now entities need not to converge with different countries’

accounting policies and prepare separate statements.

It is analyzed that if Singapore adopts the IFRS rules and regulations then it will result

to less reporting issues for the international companies which are working on international

level. It will also lead to cost benefits due to elimination of preparation of financial accounts

in accordance with different countries’ accounting policies, harmonisation brings into light

effective audit being conducted (Kusnadi, Leong, Suwardy & Wang, 2016) .

Singapore will strengthen its reporting requirement and transparent accounting busienss

practice if it adopts the IFRS rules and regulation in its economic. It will frame of policies in

preparation of accounts which makes it easier to audit them and at the same time gives results

that are internationally accepted. If company follow the IFRS rules and regulations then it

will avoid the unnecessary costing and charges of company in preparation of the financial

statement which will eventually make the business more cost effective. It is further analysed

that in case of conflict arise in the international financial reporting standards and domestic

reporting standards, company will comply with the IFRS rules and regulation. Singapore has

made mandatory for all the listed companies to comply with the IFRS rules and regulations as

it lower down the conflicts in domestic and international reporting frameworks and make

easy for the international companies to comply with the reporting compliance laws.

The process of harmonisation had been a well-planned and well-articulated process

for the country. The opinions of users across overseas as well as the organisations have been

considered before any finalisation. This had made IFRS much wide in scope and better than

any country’s individual accounting practice. Adoption of IFRS is being considered as the

‘best practice’ among almost countries of the world as it accrues certain benefits as reduction

in costs, wider access to overseas markets, standard benchmark for preparation of financial

instruments, better and highly efficient allocation of resources, decreased chances of resorting

to earnings management to manipulate accounts and etc.

ISSUES IN HARMONISATION

As already discussed, implementation of IFRS doesn’t seem as easy as the text says.

IFRS involves a drastic change in the accounting policies that are being followed by an

entity. The key decision of adopting the IFRS is related to that demanded attention included,

retention of optional accounting treatments; retention of Singapore specific disclosures; the

extent of application of IFRS (Edogbanya, Adejoh & Kamardin, 2014). The various

challenges involved in the process of harmonisation are discussed as follows: These issues

and challenges have emerged due to the different regulatory compliance program and less

effective harmonization process which each and every company needs to adopt in their

reporting frameworks. The Harmonization process is promoted so that every company could

adopt the standard reporting frameworks on the international level so that it would be less

confusing for the stakeholder in the interpretation of the financial transactions reported in the

financial statement. However, there are some of the issues have been found in the

harmonization process of accounting standard (Christensen, Lee, & Walker, 2007).

Singapore faced the issues while adopting the IFRS by the rulling party in its economic but at

the same time it was opposed by the opposition party as they lead the case towards the

overriding domestic compliance program and may result to domination on the domestic

regulatory accounting reporting compliance. The main issues which Singapore faced in

adoption of the IFRS were related to changes in the several acts such as Corporation act,

listing requirements and accounting rules. It leaded to big level of complexity and issues for

the Singapore while adopting the harmonization in its financial reporting. The staffs of any

organisation are well trained to follow the existing policies. Any change or updating in the

structure needs the requirement of change management. The staffs are required to get

acquainted with the benefits that the new system shall bring to them and the organisation.

This may call for union movements across the country and shall cause a situation of tension.

Accountant and financial mangers needs to learn all the IFRS and domestic accounting

standards to mitigate the international financial reporting issues with the international

business growth.

The employees are required to be trained about the changed policies and the procedures that

they need to learn and follow. The training needs to be done with the help of training

consultants which also adds to the cost. Government may need to extend financial aid to the

organisations. Different countries have different scope of accounting work and hence the

As already discussed, implementation of IFRS doesn’t seem as easy as the text says.

IFRS involves a drastic change in the accounting policies that are being followed by an

entity. The key decision of adopting the IFRS is related to that demanded attention included,

retention of optional accounting treatments; retention of Singapore specific disclosures; the

extent of application of IFRS (Edogbanya, Adejoh & Kamardin, 2014). The various

challenges involved in the process of harmonisation are discussed as follows: These issues

and challenges have emerged due to the different regulatory compliance program and less

effective harmonization process which each and every company needs to adopt in their

reporting frameworks. The Harmonization process is promoted so that every company could

adopt the standard reporting frameworks on the international level so that it would be less

confusing for the stakeholder in the interpretation of the financial transactions reported in the

financial statement. However, there are some of the issues have been found in the

harmonization process of accounting standard (Christensen, Lee, & Walker, 2007).

Singapore faced the issues while adopting the IFRS by the rulling party in its economic but at

the same time it was opposed by the opposition party as they lead the case towards the

overriding domestic compliance program and may result to domination on the domestic

regulatory accounting reporting compliance. The main issues which Singapore faced in

adoption of the IFRS were related to changes in the several acts such as Corporation act,

listing requirements and accounting rules. It leaded to big level of complexity and issues for

the Singapore while adopting the harmonization in its financial reporting. The staffs of any

organisation are well trained to follow the existing policies. Any change or updating in the

structure needs the requirement of change management. The staffs are required to get

acquainted with the benefits that the new system shall bring to them and the organisation.

This may call for union movements across the country and shall cause a situation of tension.

Accountant and financial mangers needs to learn all the IFRS and domestic accounting

standards to mitigate the international financial reporting issues with the international

business growth.

The employees are required to be trained about the changed policies and the procedures that

they need to learn and follow. The training needs to be done with the help of training

consultants which also adds to the cost. Government may need to extend financial aid to the

organisations. Different countries have different scope of accounting work and hence the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

work varies differently. As the work is very different, so the process of work also differs

significantly. The IFRS being a standard benchmark are not consistent with every country’s

accounting procedures. Even the processes vary within a country. The cultural diversities also

hamper the harmonisation process. The developed countries stand at a dominant position in

formation of IFRS (Sharma, Joshi & Kansal, 2017). Even when it’s mandated to adopt IFRS,

certain entities do not comply with them completely. Different levels of compliance are seen

to be followed. Even the auditors are not completely able to express an opinion regarding the

compliance of IFRS.

It is analyzed that the cultural differences and issues will also prone to the harmonization in

IFRS rules in Singapore. For instance, Cultural differences are not easy to be avoided because

even at the notch of every changing city there is a different perspective regarding cultural

values. Harmonisation needs to deal with the cultural differences which are not easy to

implement (Christensen, Lee, & Walker, 2007).

In terms of Taxation, we have observed that Singapore is following different taxation

policies. The rates, computation of income, deductions allowed, incomes considered are all

different for different countries. Harmonisation has to completely do with these different

taxation policies for its successful implementation. As a result, they may stand contradictory

to that of Singapore. In addition to this, in context with the multinational companies, it is

observed that implementation of IFRS ETR (effective tax rates) or more volatile ETR..

Singapore will also have to face lower down its government fund due to the changes in

taxation rules. Furthermore, adoption of IFRS will lower down the foreign tax collected by

company from different multinational organization (Jackling, 2013).

Another significant issue is the monopoly standing of certain countries over Singapore in the

policy making hearing for harmonisation. Countries that are on a stronger footing to call for

their rights and put up their own recommendations in priority over that of Singapore probe

issues for adoption of harmonisation in Singapore (Sharma, Joshi & Kansal, 2017). Singapore

will have to change all of its financial reporting laws and regulations as per the IFRS rules

and regulation which might make companies more prone to increased cases of insider trading

in Singapore market (Bloomfield, et al. 2017).

Apart from the employees, the investors; accountants; auditors; users and preparers of

financial reports, needs to be taught well about the IFRS process and techniques. The main

significantly. The IFRS being a standard benchmark are not consistent with every country’s

accounting procedures. Even the processes vary within a country. The cultural diversities also

hamper the harmonisation process. The developed countries stand at a dominant position in

formation of IFRS (Sharma, Joshi & Kansal, 2017). Even when it’s mandated to adopt IFRS,

certain entities do not comply with them completely. Different levels of compliance are seen

to be followed. Even the auditors are not completely able to express an opinion regarding the

compliance of IFRS.

It is analyzed that the cultural differences and issues will also prone to the harmonization in

IFRS rules in Singapore. For instance, Cultural differences are not easy to be avoided because

even at the notch of every changing city there is a different perspective regarding cultural

values. Harmonisation needs to deal with the cultural differences which are not easy to

implement (Christensen, Lee, & Walker, 2007).

In terms of Taxation, we have observed that Singapore is following different taxation

policies. The rates, computation of income, deductions allowed, incomes considered are all

different for different countries. Harmonisation has to completely do with these different

taxation policies for its successful implementation. As a result, they may stand contradictory

to that of Singapore. In addition to this, in context with the multinational companies, it is

observed that implementation of IFRS ETR (effective tax rates) or more volatile ETR..

Singapore will also have to face lower down its government fund due to the changes in

taxation rules. Furthermore, adoption of IFRS will lower down the foreign tax collected by

company from different multinational organization (Jackling, 2013).

Another significant issue is the monopoly standing of certain countries over Singapore in the

policy making hearing for harmonisation. Countries that are on a stronger footing to call for

their rights and put up their own recommendations in priority over that of Singapore probe

issues for adoption of harmonisation in Singapore (Sharma, Joshi & Kansal, 2017). Singapore

will have to change all of its financial reporting laws and regulations as per the IFRS rules

and regulation which might make companies more prone to increased cases of insider trading

in Singapore market (Bloomfield, et al. 2017).

Apart from the employees, the investors; accountants; auditors; users and preparers of

financial reports, needs to be taught well about the IFRS process and techniques. The main

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

challenge for Singapore comes up as being a follower of international standards than the

developer of standards for domestic entities (Nobes, 2013). Every company needs to hire the

legal compliance officer and public account who could record the financial transactions in the

books of accounts as per the domestic and international financial accounting standards

(Bloomfield, et al. 2017).

CASE STUDY OF AMARA HOLDINGS LIMITED

In this case, Singapore Company Amara Holding Company has been taken into consideration

to evaluate the consideration of harmonization of international and domestic financial

accounting rules in preparation and reporting of financial statements. Amara Holdings

Limited had been required to adopt the Singapore Financial Reporting Standards for the

presentation of financial statements. They have been found substantially similar to the

International Financial Reporting Standards. As evident, the historical cost method is used

except a few exceptions (Strouhal,, Horák, & Boksova, 2017).

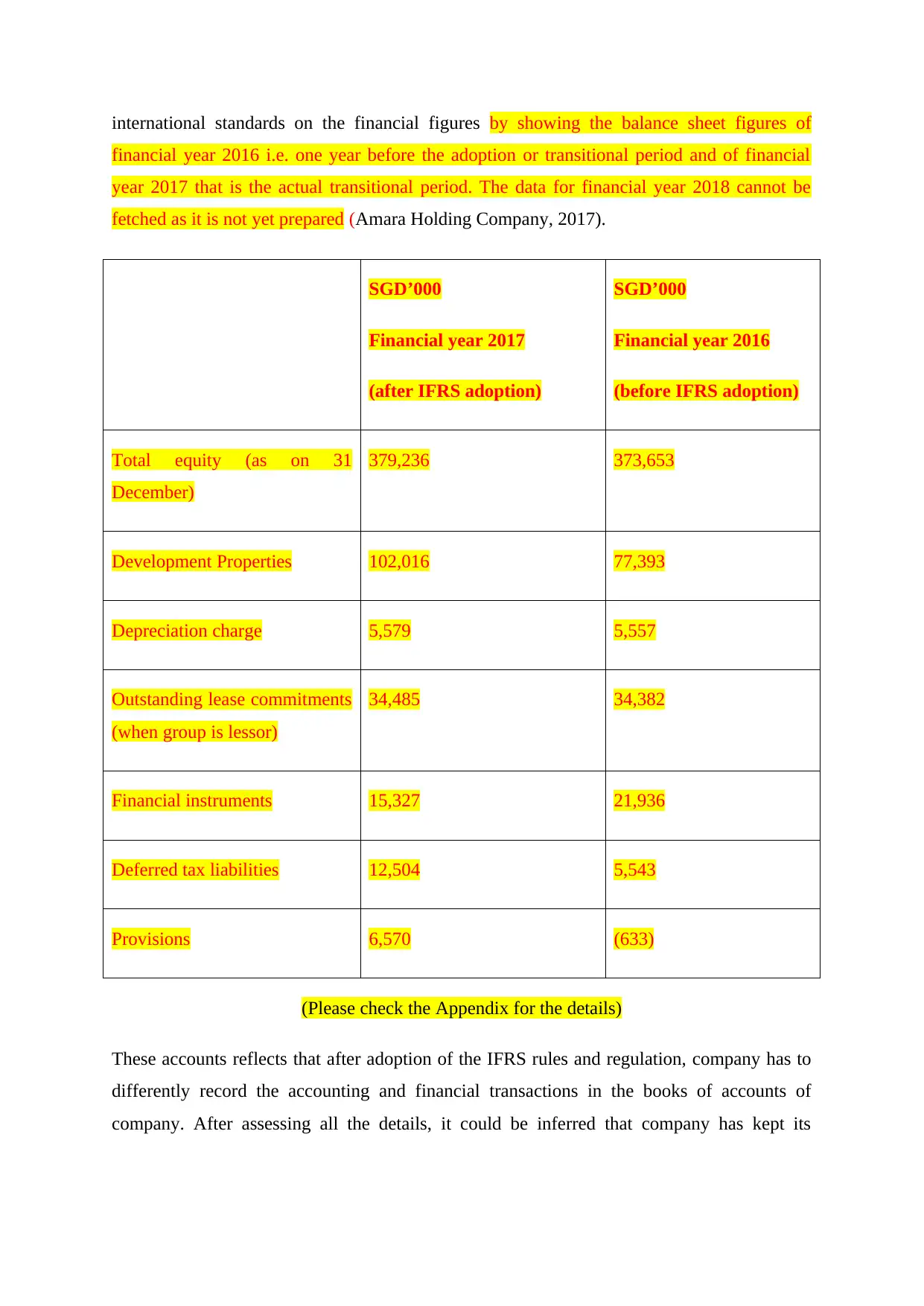

As from January 1, 2017 the company has successfully adopted every new and revised

Financial Reporting Standard. Further the Accounting Standards Council (ASC) has come up

with the direction in December 2017 for adoption of a complete new framework being

Singapore Financial Reporting Standard (International) to be adopted by all Singapore-

incorporated companies listed on Singapore Exchange (SGX) for periods beginning on or

after 1 January 2018. These are to be applied retrospectively. Though management feel that,

the change shall not bring any material effect on the financials. The financial year 2017 is the

transitional period for which the new standards are being adopted just to see the change they

bring in the whole accounting presentation and financial figures.

Similarly, SFRS (I) 16, Leases, changes the method of accounting in case where the group is

a lessee when it comes to operating leases. And where the group is a lessor, the additional

disclosure requirements shall include group’s exposure to asset and credit risk. The table

shown below presents the financial figures available from the annual reports for financial

year 2017 that is depicted from the website of the company. However, management

anticipates that the adoption of this standard might result in the revenue figures of certain

revenue items to be changed. The disclosures mentioned above need to be made too.

Although the management doesn’t plan to adopt the standard in rush. All the figures are in

Singapore dollars and have been shown on a company basis and depicts the effect of

developer of standards for domestic entities (Nobes, 2013). Every company needs to hire the

legal compliance officer and public account who could record the financial transactions in the

books of accounts as per the domestic and international financial accounting standards

(Bloomfield, et al. 2017).

CASE STUDY OF AMARA HOLDINGS LIMITED

In this case, Singapore Company Amara Holding Company has been taken into consideration

to evaluate the consideration of harmonization of international and domestic financial

accounting rules in preparation and reporting of financial statements. Amara Holdings

Limited had been required to adopt the Singapore Financial Reporting Standards for the

presentation of financial statements. They have been found substantially similar to the

International Financial Reporting Standards. As evident, the historical cost method is used

except a few exceptions (Strouhal,, Horák, & Boksova, 2017).

As from January 1, 2017 the company has successfully adopted every new and revised

Financial Reporting Standard. Further the Accounting Standards Council (ASC) has come up

with the direction in December 2017 for adoption of a complete new framework being

Singapore Financial Reporting Standard (International) to be adopted by all Singapore-

incorporated companies listed on Singapore Exchange (SGX) for periods beginning on or

after 1 January 2018. These are to be applied retrospectively. Though management feel that,

the change shall not bring any material effect on the financials. The financial year 2017 is the

transitional period for which the new standards are being adopted just to see the change they

bring in the whole accounting presentation and financial figures.

Similarly, SFRS (I) 16, Leases, changes the method of accounting in case where the group is

a lessee when it comes to operating leases. And where the group is a lessor, the additional

disclosure requirements shall include group’s exposure to asset and credit risk. The table

shown below presents the financial figures available from the annual reports for financial

year 2017 that is depicted from the website of the company. However, management

anticipates that the adoption of this standard might result in the revenue figures of certain

revenue items to be changed. The disclosures mentioned above need to be made too.

Although the management doesn’t plan to adopt the standard in rush. All the figures are in

Singapore dollars and have been shown on a company basis and depicts the effect of

international standards on the financial figures by showing the balance sheet figures of

financial year 2016 i.e. one year before the adoption or transitional period and of financial

year 2017 that is the actual transitional period. The data for financial year 2018 cannot be

fetched as it is not yet prepared (Amara Holding Company, 2017).

SGD’000

Financial year 2017

(after IFRS adoption)

SGD’000

Financial year 2016

(before IFRS adoption)

Total equity (as on 31

December)

379,236 373,653

Development Properties 102,016 77,393

Depreciation charge 5,579 5,557

Outstanding lease commitments

(when group is lessor)

34,485 34,382

Financial instruments 15,327 21,936

Deferred tax liabilities 12,504 5,543

Provisions 6,570 (633)

(Please check the Appendix for the details)

These accounts reflects that after adoption of the IFRS rules and regulation, company has to

differently record the accounting and financial transactions in the books of accounts of

company. After assessing all the details, it could be inferred that company has kept its

financial year 2016 i.e. one year before the adoption or transitional period and of financial

year 2017 that is the actual transitional period. The data for financial year 2018 cannot be

fetched as it is not yet prepared (Amara Holding Company, 2017).

SGD’000

Financial year 2017

(after IFRS adoption)

SGD’000

Financial year 2016

(before IFRS adoption)

Total equity (as on 31

December)

379,236 373,653

Development Properties 102,016 77,393

Depreciation charge 5,579 5,557

Outstanding lease commitments

(when group is lessor)

34,485 34,382

Financial instruments 15,327 21,936

Deferred tax liabilities 12,504 5,543

Provisions 6,570 (633)

(Please check the Appendix for the details)

These accounts reflects that after adoption of the IFRS rules and regulation, company has to

differently record the accounting and financial transactions in the books of accounts of

company. After assessing all the details, it could be inferred that company has kept its

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

business more transparent and strengthen its disclosure requirement to make its stakeholders

aware with its all the financial and non-financial transaction.

RECOMMENDATIONS

There are several recommendations which need to be followed by organizations to mitigate

the IFRS harmonization issues and cases.

Though the IFRS have been implemented, though they still require certain modifications.

Modifications need to be implemented with proper planning and serious consideration. The

harmonisation process needs to be strategically planned and has to be in line with legal

requirements.

Just planning about the implementation and implementing the IFRS is not enough for the

success of harmonisation. It’s required that every user is communicated about the changes in

the financial reporting process that shall follow after implementation. Work should be done in

order to ensure transparency and accountability. The communication content should also

include the transition process and plans. This is necessary to make the users knowledgeable

to ensure successful implementation.

Successful harmonisation requires placing adequate resources for implementation of IFRS.

Various consultation lines must be opened that provide clarity to the users for proper

implementation of IFRS.

The IFRS shouldn’t focus only on the needs of large enterprises. The standards must

incorporate within areas that address the needs of small and medium enterprises. The

complexities involved in the large entities are different from the cases of small and medium

enterprises (Perera & Chand, 2015).

As discussed, proper training of the parties involved in use and implementation of IFRS

being the auditors, accountants, investors, analysts and others should be undertaken to

educate them about the same.

Greater autonomy should be provided to the oversight board because this board is responsible

for setting standards, reviewing implementation, etc. The board itself should improve its

processes by implementing people who are technically qualified and their continuous training

must be preferred.

aware with its all the financial and non-financial transaction.

RECOMMENDATIONS

There are several recommendations which need to be followed by organizations to mitigate

the IFRS harmonization issues and cases.

Though the IFRS have been implemented, though they still require certain modifications.

Modifications need to be implemented with proper planning and serious consideration. The

harmonisation process needs to be strategically planned and has to be in line with legal

requirements.

Just planning about the implementation and implementing the IFRS is not enough for the

success of harmonisation. It’s required that every user is communicated about the changes in

the financial reporting process that shall follow after implementation. Work should be done in

order to ensure transparency and accountability. The communication content should also

include the transition process and plans. This is necessary to make the users knowledgeable

to ensure successful implementation.

Successful harmonisation requires placing adequate resources for implementation of IFRS.

Various consultation lines must be opened that provide clarity to the users for proper

implementation of IFRS.

The IFRS shouldn’t focus only on the needs of large enterprises. The standards must

incorporate within areas that address the needs of small and medium enterprises. The

complexities involved in the large entities are different from the cases of small and medium

enterprises (Perera & Chand, 2015).

As discussed, proper training of the parties involved in use and implementation of IFRS

being the auditors, accountants, investors, analysts and others should be undertaken to

educate them about the same.

Greater autonomy should be provided to the oversight board because this board is responsible

for setting standards, reviewing implementation, etc. The board itself should improve its

processes by implementing people who are technically qualified and their continuous training

must be preferred.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Before any amendment is made, a draft should be made at prior end and the same should be

disseminated among the professionals and general public to demand their feedback and areas

of improvement and other constructive opinions.

Implementation of IFRS and to bring harmonisation should not be thought over as a one-

time process but it should be taken as an on-going activity which shall require continual

planning and modifications.

Continuous support must be extended by the related professional bodies for successful

harmonisation effort.

Further, the education of IFRS should be mandated from university accounting education.

Certification course for IFRS education must be initiated that will hold importance in

grasping better employment to the professionals (Jackling, 2013).

Further the Accounting Standards Council (ASC) has shown that company has adopted new

framework being Singapore Financial Reporting Standard (International) to be adopted by all

Singapore-incorporated companies listed on Singapore Exchange (SGX) for periods

beginning on or after 1 January 2018. These are to be applied retrospectively. Though

management feel that, the change shall not bring any material effect on the financial

statements which will strengthen the financial reporting frameworks on international level.

Conclusion

After analysing all the details and case study of harmonization of the IFRS in

Singapore, it could be inferred that harmonization in the domestic and international

accounting standards is very much necessary for the effective financial reporting of the in

country. The main complexity which Singapore has faced in adoption of IFRS rules in

reporting of the financial statement is related to disclosure or transparency, economic issues

and legal compliance program. It has been analysed that government of Singapore has

effectively manage the harmonization issues in its reporting framework which have

strengthen the reporting and accounting frameworks to international level. Now in the end, it

could be inferred that IFRS reporting frameworks have shown that Singapore has changed the

value of the amounts of financial transactions recorded by companies in its economic in 2016

and 2017 throughout the time.

disseminated among the professionals and general public to demand their feedback and areas

of improvement and other constructive opinions.

Implementation of IFRS and to bring harmonisation should not be thought over as a one-

time process but it should be taken as an on-going activity which shall require continual

planning and modifications.

Continuous support must be extended by the related professional bodies for successful

harmonisation effort.

Further, the education of IFRS should be mandated from university accounting education.

Certification course for IFRS education must be initiated that will hold importance in

grasping better employment to the professionals (Jackling, 2013).

Further the Accounting Standards Council (ASC) has shown that company has adopted new

framework being Singapore Financial Reporting Standard (International) to be adopted by all

Singapore-incorporated companies listed on Singapore Exchange (SGX) for periods

beginning on or after 1 January 2018. These are to be applied retrospectively. Though

management feel that, the change shall not bring any material effect on the financial

statements which will strengthen the financial reporting frameworks on international level.

Conclusion

After analysing all the details and case study of harmonization of the IFRS in

Singapore, it could be inferred that harmonization in the domestic and international

accounting standards is very much necessary for the effective financial reporting of the in

country. The main complexity which Singapore has faced in adoption of IFRS rules in

reporting of the financial statement is related to disclosure or transparency, economic issues

and legal compliance program. It has been analysed that government of Singapore has

effectively manage the harmonization issues in its reporting framework which have

strengthen the reporting and accounting frameworks to international level. Now in the end, it

could be inferred that IFRS reporting frameworks have shown that Singapore has changed the

value of the amounts of financial transactions recorded by companies in its economic in 2016

and 2017 throughout the time.

COMMENT ON RESEARCH (Self Reflection)

The research topic tends to be a burning issue as certain dilemmas regarding the

preparation of financial statements as per the internationally adopted IFRS. The focus is

shifted in the harmonisation process that follows the new implementation. The research is

conducted with the use of information available about the text of International Financial

Reporting Standards and the financials of company extracted from company’s (Amara

Holdings Limited Singapore) website as known to be annual reports. This research has been

conducted after collecting the required international financial reporting information and other

details shown in the annual reporting of company. In addition to this, secondary sources such

as use of journal articles, web information and official gazettes have been used to collect the

required amount of data. This information has assisted me to analysis the reasons and issues

related to harmonization of the international and domestic accounting standards in

preparation of the financial statement with the reporting authority.

The analysis done shows the transparency and accountability with which the company has

followed the standards issued as IFRS. At an initial stage the company has successfully

fragmented the whole process in three phases being the assessment and planning phase,

design phase and the implementation phase. Before the IFRS are completely complied with,

the group has adopted the Singapore Financial Reporting Standards. It is observed that a lot

of judgement is involved while adopting the IFRS. As available from the annual reports on

the website of company, the latest available is for the financial year 2008. The reports for

older financial years are not available on public portal. As a result the whole analysis is done

as per the availability of the reports.

The research required a lot of analysis and personal judgement to opine regarding the success

or failure. Though the adoption of IFRS and related harmonisation seems a success in case of

Amara Holdings Limited, but for the users of financial statements it becomes challenging to

understand the reconciliation figures presented in the annual reports that prevail between the

financial figures attributing to the accounts prepared in line with Singapore GAAP and

Singapore Financial Reporting Standards from the information evident from the financials

presented in the annual report for the financial year 2005. The main issue in communication

of finding is related to this challenge as it becomes difficult to interpret the information from

that report to get an idea and form an opinion regarding the effects that adoption of IFRS

brought in the financial information presentation and disclosure on a practical and not

The research topic tends to be a burning issue as certain dilemmas regarding the

preparation of financial statements as per the internationally adopted IFRS. The focus is

shifted in the harmonisation process that follows the new implementation. The research is

conducted with the use of information available about the text of International Financial

Reporting Standards and the financials of company extracted from company’s (Amara

Holdings Limited Singapore) website as known to be annual reports. This research has been

conducted after collecting the required international financial reporting information and other

details shown in the annual reporting of company. In addition to this, secondary sources such

as use of journal articles, web information and official gazettes have been used to collect the

required amount of data. This information has assisted me to analysis the reasons and issues

related to harmonization of the international and domestic accounting standards in

preparation of the financial statement with the reporting authority.

The analysis done shows the transparency and accountability with which the company has

followed the standards issued as IFRS. At an initial stage the company has successfully

fragmented the whole process in three phases being the assessment and planning phase,

design phase and the implementation phase. Before the IFRS are completely complied with,

the group has adopted the Singapore Financial Reporting Standards. It is observed that a lot

of judgement is involved while adopting the IFRS. As available from the annual reports on

the website of company, the latest available is for the financial year 2008. The reports for

older financial years are not available on public portal. As a result the whole analysis is done

as per the availability of the reports.

The research required a lot of analysis and personal judgement to opine regarding the success

or failure. Though the adoption of IFRS and related harmonisation seems a success in case of

Amara Holdings Limited, but for the users of financial statements it becomes challenging to

understand the reconciliation figures presented in the annual reports that prevail between the

financial figures attributing to the accounts prepared in line with Singapore GAAP and

Singapore Financial Reporting Standards from the information evident from the financials

presented in the annual report for the financial year 2005. The main issue in communication

of finding is related to this challenge as it becomes difficult to interpret the information from

that report to get an idea and form an opinion regarding the effects that adoption of IFRS

brought in the financial information presentation and disclosure on a practical and not

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.