Sample Assignment on Indirect Tax (doc)

VerifiedAdded on 2020/12/18

|17

|4257

|150

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

INDIRECT TAX

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

1.1 Identification of sources of information on VAT.............................................................1

1.2 Explanation on interaction of organisations to relevant government agency...................2

1.3 Explanation of VAT registration requirements................................................................2

1.4 Information which needs to be included on business documentation of VAT registration

businesses...............................................................................................................................3

1.5 Explanation on the requirements and frequency of reporting for these VAT schemes:. .4

1.6 Knowledge of changes to codes of practice, regulation or legislation.............................4

2.1 Relevant data for a specific period from accounting system............................................5

2.2 Calculation of relevant inputs and outputs.......................................................................5

2.3 Calculation of VAT due of relevant tax authority............................................................6

2.4 Submission of VAT return...............................................................................................7

3.1 Explanation on the implications and penalties for organisation resulting from failure to

abide by VAT regulations......................................................................................................8

3.2 Adjustments and declaration for any type of errors or omissions which identified in

previous VAT periods............................................................................................................8

4.1 Impact of VAT payment on organisation's cash flow and financial forecasts.................9

4.2 Impact of changes in VAT legislation which would have an effect on an organisation's

recording systems.................................................................................................................10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

APPENDIX....................................................................................................................................15

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

1.1 Identification of sources of information on VAT.............................................................1

1.2 Explanation on interaction of organisations to relevant government agency...................2

1.3 Explanation of VAT registration requirements................................................................2

1.4 Information which needs to be included on business documentation of VAT registration

businesses...............................................................................................................................3

1.5 Explanation on the requirements and frequency of reporting for these VAT schemes:. .4

1.6 Knowledge of changes to codes of practice, regulation or legislation.............................4

2.1 Relevant data for a specific period from accounting system............................................5

2.2 Calculation of relevant inputs and outputs.......................................................................5

2.3 Calculation of VAT due of relevant tax authority............................................................6

2.4 Submission of VAT return...............................................................................................7

3.1 Explanation on the implications and penalties for organisation resulting from failure to

abide by VAT regulations......................................................................................................8

3.2 Adjustments and declaration for any type of errors or omissions which identified in

previous VAT periods............................................................................................................8

4.1 Impact of VAT payment on organisation's cash flow and financial forecasts.................9

4.2 Impact of changes in VAT legislation which would have an effect on an organisation's

recording systems.................................................................................................................10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

APPENDIX....................................................................................................................................15

INTRODUCTION

Indirect Tax is the type of tax which is collected by one entity usually by producer or

retailer and paid to government. This type of tax passed on to consumers in the form of goods

and services. The following assessment will develop to provide information on one type of

indirect tax that is VAT. Its regulations and code of practises will be explained in this report.

Further, in this report VAT penalties and impact of VAT payment on organisation will also be

discussed.

MAIN BODY

1.1 Identification of sources of information on VAT

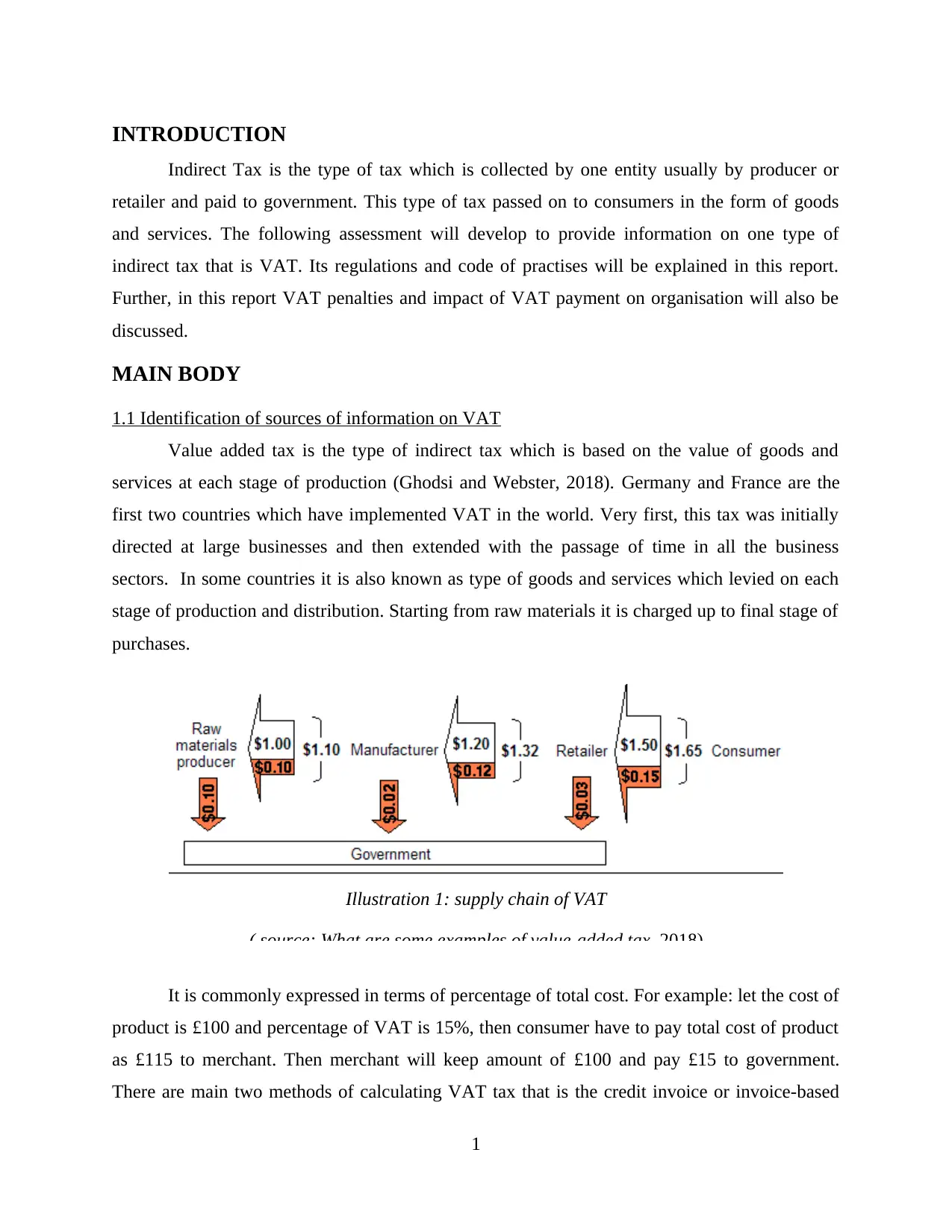

Value added tax is the type of indirect tax which is based on the value of goods and

services at each stage of production (Ghodsi and Webster, 2018). Germany and France are the

first two countries which have implemented VAT in the world. Very first, this tax was initially

directed at large businesses and then extended with the passage of time in all the business

sectors. In some countries it is also known as type of goods and services which levied on each

stage of production and distribution. Starting from raw materials it is charged up to final stage of

purchases.

It is commonly expressed in terms of percentage of total cost. For example: let the cost of

product is £100 and percentage of VAT is 15%, then consumer have to pay total cost of product

as £115 to merchant. Then merchant will keep amount of £100 and pay £15 to government.

There are main two methods of calculating VAT tax that is the credit invoice or invoice-based

1

Illustration 1: supply chain of VAT

( source: What are some examples of value-added tax, 2018)

Indirect Tax is the type of tax which is collected by one entity usually by producer or

retailer and paid to government. This type of tax passed on to consumers in the form of goods

and services. The following assessment will develop to provide information on one type of

indirect tax that is VAT. Its regulations and code of practises will be explained in this report.

Further, in this report VAT penalties and impact of VAT payment on organisation will also be

discussed.

MAIN BODY

1.1 Identification of sources of information on VAT

Value added tax is the type of indirect tax which is based on the value of goods and

services at each stage of production (Ghodsi and Webster, 2018). Germany and France are the

first two countries which have implemented VAT in the world. Very first, this tax was initially

directed at large businesses and then extended with the passage of time in all the business

sectors. In some countries it is also known as type of goods and services which levied on each

stage of production and distribution. Starting from raw materials it is charged up to final stage of

purchases.

It is commonly expressed in terms of percentage of total cost. For example: let the cost of

product is £100 and percentage of VAT is 15%, then consumer have to pay total cost of product

as £115 to merchant. Then merchant will keep amount of £100 and pay £15 to government.

There are main two methods of calculating VAT tax that is the credit invoice or invoice-based

1

Illustration 1: supply chain of VAT

( source: What are some examples of value-added tax, 2018)

method. Credit-invoice is the method where customers are already informed on the VAT

transaction and then sales transaction are taxed. In return, business may received a credit on

input material and services (Wales and et.al., 2018).

1.2 Explanation on interaction of organisations to relevant government agency

VAT is known as one of the key consideration for every size of business in UK. If it is a

new established organisation, every type of business sector needs to remit tax to government

agency. Amount which is charged to organisation as VAT is determined by value of goods and

services according to stages of productions. Standard rate of VAT in UK in 20% but there are

some items which is exempted from VAT tax that is property and financial transactions.

However, organisation which has turnover greater than £85000 in 12 months period are

obliged to register for VAT. If supplier buys goods of more than £85000, then they also need to

register themselves. Other than this, companies which are fulfilling following three conditions

must also have to register in VAT (Liu and Lockwood, 2016).

If an impression is given by entity regarding their large business and it is not then also

organisation have to register themselves.

For building trust of company.

If money spend more on VAT than also organisation have to register.

Once company is registered for VAT regulations, then they are obliged to add VAT in their cost

of goods and services. Companies also need to display VAT number on receipts and invoices.

Organisations also have to complete their VAT return once in three months as per the accounting

period.

1.3 Explanation of VAT registration requirements

The compulsory registration of threshold limit in UK for VAT is £83000. Limit for

registration commencement for distance selling is £70000 (How to register for VAT in the UK,

2019). This threshold limit was based on taxable turnover of VAT. Further, registration is also

required if goods have been received from EU which is of more than £83000. Any type of

business which is engaged in selling types of goods and services which are exempted by

government did not have to register themselves for VAT.

Distance selling goods will take place when a type of business which have registered themselves

for VAT in one EU country but they are selling goods to another EU country. Such type of

businesses did not have to registered themselves of VAT. Companies which do not have any

2

transaction and then sales transaction are taxed. In return, business may received a credit on

input material and services (Wales and et.al., 2018).

1.2 Explanation on interaction of organisations to relevant government agency

VAT is known as one of the key consideration for every size of business in UK. If it is a

new established organisation, every type of business sector needs to remit tax to government

agency. Amount which is charged to organisation as VAT is determined by value of goods and

services according to stages of productions. Standard rate of VAT in UK in 20% but there are

some items which is exempted from VAT tax that is property and financial transactions.

However, organisation which has turnover greater than £85000 in 12 months period are

obliged to register for VAT. If supplier buys goods of more than £85000, then they also need to

register themselves. Other than this, companies which are fulfilling following three conditions

must also have to register in VAT (Liu and Lockwood, 2016).

If an impression is given by entity regarding their large business and it is not then also

organisation have to register themselves.

For building trust of company.

If money spend more on VAT than also organisation have to register.

Once company is registered for VAT regulations, then they are obliged to add VAT in their cost

of goods and services. Companies also need to display VAT number on receipts and invoices.

Organisations also have to complete their VAT return once in three months as per the accounting

period.

1.3 Explanation of VAT registration requirements

The compulsory registration of threshold limit in UK for VAT is £83000. Limit for

registration commencement for distance selling is £70000 (How to register for VAT in the UK,

2019). This threshold limit was based on taxable turnover of VAT. Further, registration is also

required if goods have been received from EU which is of more than £83000. Any type of

business which is engaged in selling types of goods and services which are exempted by

government did not have to register themselves for VAT.

Distance selling goods will take place when a type of business which have registered themselves

for VAT in one EU country but they are selling goods to another EU country. Such type of

businesses did not have to registered themselves of VAT. Companies which do not have any

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

physical presence but they are doing business in UK will have to demonstrate their market sales.

Information which needed in order to register for VAT is national insurance number, tax

identifier number, certificate of incorporation, business bank account details and information

which associate with business within last two years (Zu, 2018).

1.4 Information which needs to be included on business documentation of VAT registration

businesses

Information which required on the documentation of VAT registration process are as

follows-

Type of corporate body.

Information on whether registering as representative member or nominated corporate

body of VAT group.

Business contact details such as address, Non UK address and other contact details.

Type of business activity.

Information on involvement whether currently involved or involved with last 2 years

either as sole proprietorship or as partner or director.

Details of UK bank or building society account.

Reason for registering in VAT. Whether taken over a business or has changes legal status

of already VAT registered business.

Want to keep previous owner's VAT number or not.

Whether applying for voluntary registration.

Are you registering because of exceed turnover from last 12 months.

Whether applying for exemption from registration or not?

Application for earlier registration

estimate of taxable supplies in next 12 months

Expecting to make any exempt supplies.

Whether buying goods from other EU member states within next 12 months.

Applicant details.

Use of checklist.

1.5 Explanation on the requirements and frequency of reporting for these VAT schemes:

Annual accounting:

3

Information which needed in order to register for VAT is national insurance number, tax

identifier number, certificate of incorporation, business bank account details and information

which associate with business within last two years (Zu, 2018).

1.4 Information which needs to be included on business documentation of VAT registration

businesses

Information which required on the documentation of VAT registration process are as

follows-

Type of corporate body.

Information on whether registering as representative member or nominated corporate

body of VAT group.

Business contact details such as address, Non UK address and other contact details.

Type of business activity.

Information on involvement whether currently involved or involved with last 2 years

either as sole proprietorship or as partner or director.

Details of UK bank or building society account.

Reason for registering in VAT. Whether taken over a business or has changes legal status

of already VAT registered business.

Want to keep previous owner's VAT number or not.

Whether applying for voluntary registration.

Are you registering because of exceed turnover from last 12 months.

Whether applying for exemption from registration or not?

Application for earlier registration

estimate of taxable supplies in next 12 months

Expecting to make any exempt supplies.

Whether buying goods from other EU member states within next 12 months.

Applicant details.

Use of checklist.

1.5 Explanation on the requirements and frequency of reporting for these VAT schemes:

Annual accounting:

3

Annual accounting scheme is the type of scheme which allows a person or entity to complete

their VAT return each year (Downing and Langli, 2019). Person or entity which registered under

this scheme have to pay instalments so that they did not have to face with large type of VAT bill

at the end of year. They may choose period of 3 quarter or 9 quarter. Payment of VAT liabilities

must need to pay in direct debit, standing order or with other electronic device.

Cash accounting:

It is the scheme of VAT in which particular method have to follow by registered member in

order to report VAT. This will record on the basis of payment made or received. This scheme

follows principle of cash accounting in which income is recorded when it gets received and

expenses are recorded when get paid.

Flat rate scheme:

This is method which provides a way to business in order to pay VAT (Brusca and et.al., 2015).

With this method, a fixed percentage of annual turnover of business is been paid by its owners.

This scheme designed to simplify VAT return process so that small businesses did not have to

face any problem in order to pay VAT.

Standard scheme:

It is a method of reporting VAT where it is recorded and paid on the basis on invoices which are

issued to entity. With this scheme, businesses submit their VAT return in four times per year.

Any VAT return which gets due will also repay quarterly.

1.6 Knowledge of changes to codes of practice, regulation or legislation

Update code of practises in accordance with regulation or legislation are as follows-

HMRC body of UK has brought some changes with Notice 700 for VAT regulation. This notice

will provide guide to all the main VAT rules and procedures (Obeng, 2018). This notice will also

help in solving problems which is faced by the bushiness. Changes are implemented in paragraph

8.3 and 8.14 in previous notice of VAT.

VAT Notice 700/12 will guide businesses in order to filling and submitting their VAT

returns and VAT Notice 700/21 will help then in keeping records of VAT. Legislation of VAT

bodies also brought a retail scheme for people who are engaged in business of retail sale to

public. If businesses involved in business within EU then they have to take proper guide from

VAT Notice 725 which is known for single market. Businesses which involved in supply of

4

their VAT return each year (Downing and Langli, 2019). Person or entity which registered under

this scheme have to pay instalments so that they did not have to face with large type of VAT bill

at the end of year. They may choose period of 3 quarter or 9 quarter. Payment of VAT liabilities

must need to pay in direct debit, standing order or with other electronic device.

Cash accounting:

It is the scheme of VAT in which particular method have to follow by registered member in

order to report VAT. This will record on the basis of payment made or received. This scheme

follows principle of cash accounting in which income is recorded when it gets received and

expenses are recorded when get paid.

Flat rate scheme:

This is method which provides a way to business in order to pay VAT (Brusca and et.al., 2015).

With this method, a fixed percentage of annual turnover of business is been paid by its owners.

This scheme designed to simplify VAT return process so that small businesses did not have to

face any problem in order to pay VAT.

Standard scheme:

It is a method of reporting VAT where it is recorded and paid on the basis on invoices which are

issued to entity. With this scheme, businesses submit their VAT return in four times per year.

Any VAT return which gets due will also repay quarterly.

1.6 Knowledge of changes to codes of practice, regulation or legislation

Update code of practises in accordance with regulation or legislation are as follows-

HMRC body of UK has brought some changes with Notice 700 for VAT regulation. This notice

will provide guide to all the main VAT rules and procedures (Obeng, 2018). This notice will also

help in solving problems which is faced by the bushiness. Changes are implemented in paragraph

8.3 and 8.14 in previous notice of VAT.

VAT Notice 700/12 will guide businesses in order to filling and submitting their VAT

returns and VAT Notice 700/21 will help then in keeping records of VAT. Legislation of VAT

bodies also brought a retail scheme for people who are engaged in business of retail sale to

public. If businesses involved in business within EU then they have to take proper guide from

VAT Notice 725 which is known for single market. Businesses which involved in supply of

4

digital services will also have to update their VAT payment in accordance with new guild lines

developed by government agencies.

This is the current up-to date knowledge which is developed by legislation for entities who are

registered for payment of VAT (Merkx and et.al., 2018).

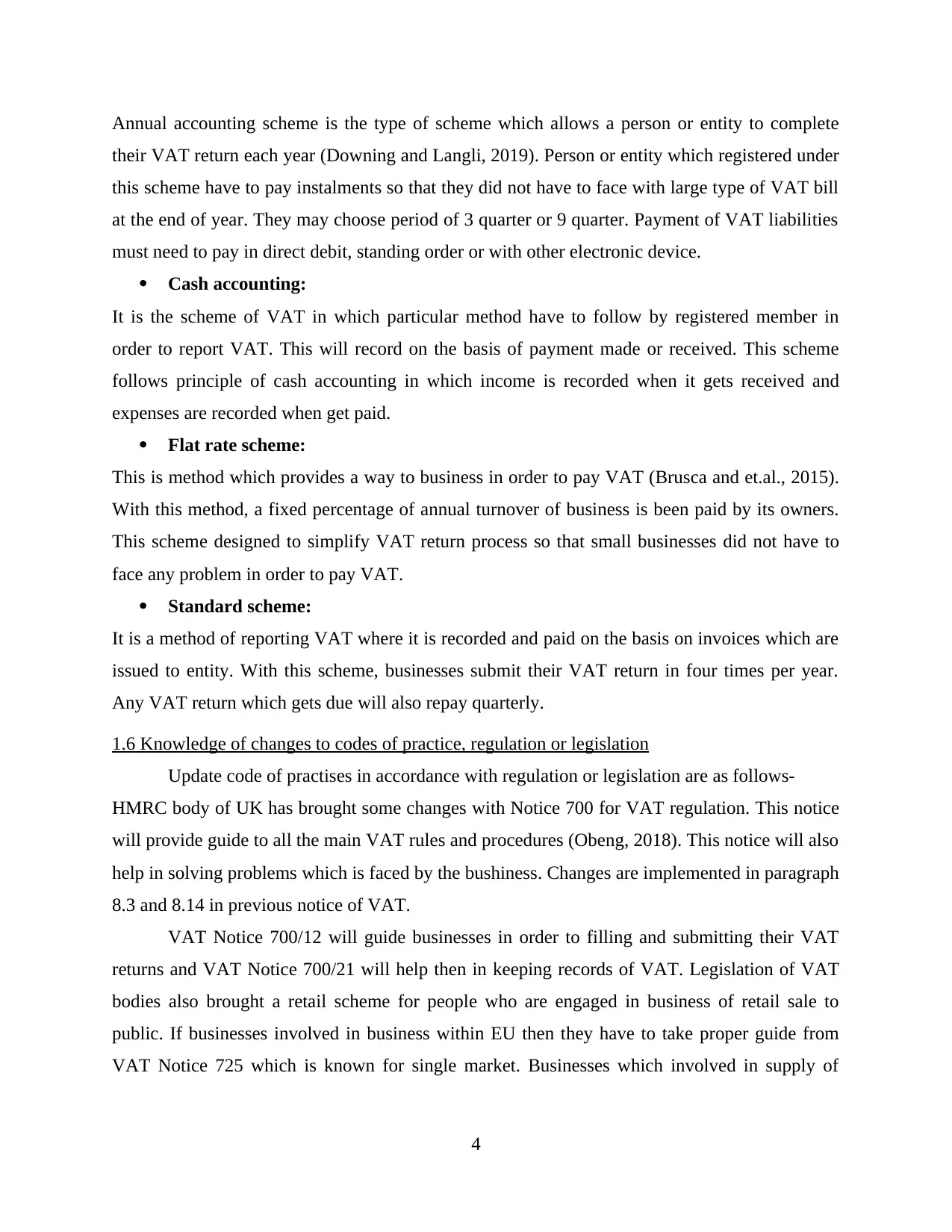

2.1 Relevant data for a specific period from accounting system

For representing specific period of accounting system, we have gathered information

from annual report of Marks and Spencer. VAT will be charged on every stage in production

process of company.

Data 2018

Revenue 10698

cost of revenue 6651

gross profit 4047

operating expenses

sales, general and administration 524

other operating expenses 2852

total operating expenses 3377

operating income 671

income before income tax 67

2.2 Calculation of relevant inputs and outputs

Standard supplies

It is a supply of goods and services which considered under VAT reporting at the rate of 20%.

Supply of all goods and services are taxable with this standard rate. Products which are

mentioned as exempt and zero-rated will not be included in this method. Some example of this

rate are land and building, fees for professional services, accommodations etc.

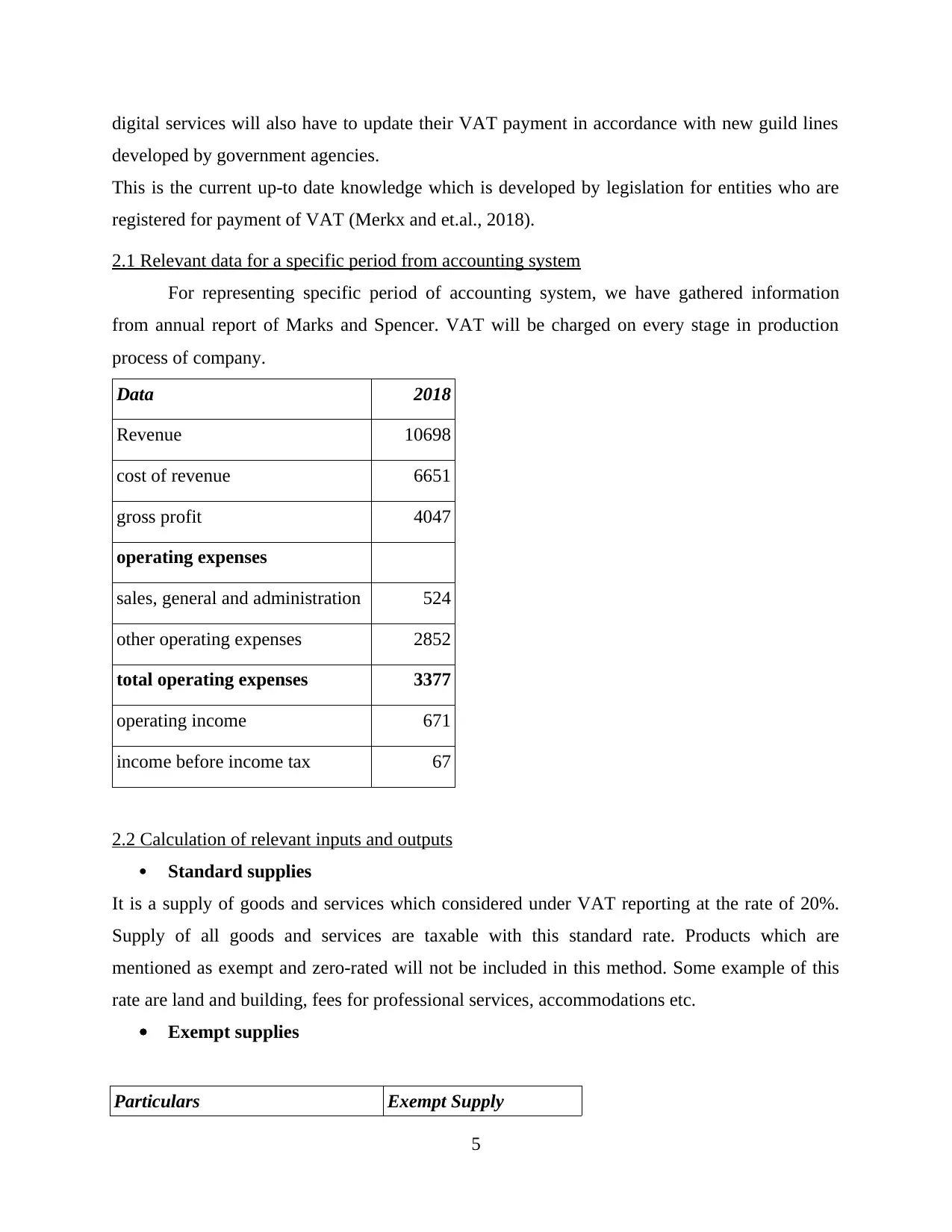

Exempt supplies

Particulars Exempt Supply

5

developed by government agencies.

This is the current up-to date knowledge which is developed by legislation for entities who are

registered for payment of VAT (Merkx and et.al., 2018).

2.1 Relevant data for a specific period from accounting system

For representing specific period of accounting system, we have gathered information

from annual report of Marks and Spencer. VAT will be charged on every stage in production

process of company.

Data 2018

Revenue 10698

cost of revenue 6651

gross profit 4047

operating expenses

sales, general and administration 524

other operating expenses 2852

total operating expenses 3377

operating income 671

income before income tax 67

2.2 Calculation of relevant inputs and outputs

Standard supplies

It is a supply of goods and services which considered under VAT reporting at the rate of 20%.

Supply of all goods and services are taxable with this standard rate. Products which are

mentioned as exempt and zero-rated will not be included in this method. Some example of this

rate are land and building, fees for professional services, accommodations etc.

Exempt supplies

Particulars Exempt Supply

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Supply of services 150000

output VAT NIL

Purchase of goods and services 75000

Input VAT 2500

VAT liability NIL

Business expenses for the

purpose of calculation profit

77500

*75000 taxable value+

2500 VAT

Goods or services which comes under exempted rate are batting and gaming, Bingo,

lottery ticket sales, online lottery games and retailer commission lottery ticket sales, admission

charges by public authorities, antiques, admission charges by charities, etc.

Zero-rated supplies

Goods and services which comes under these supplies are advertising services for charities,

certain goods sold at charitable fundraising event, charity shops, construction and sale of new

buildings for relevant charitable purpose, building services for disabled people, equipments for

blind or partially sighted people etc.

Export

Goods and services which exported outside EU and it has been sent to another EU country will

consider as Zero-rated such as goods dispatched by post, dispatch by courier etc.

Import

Goods and services which received from EU countries or with another country which registered

under VAT are considered under Import supplies.

An example of zero-rated supplies, import and export are as follows-

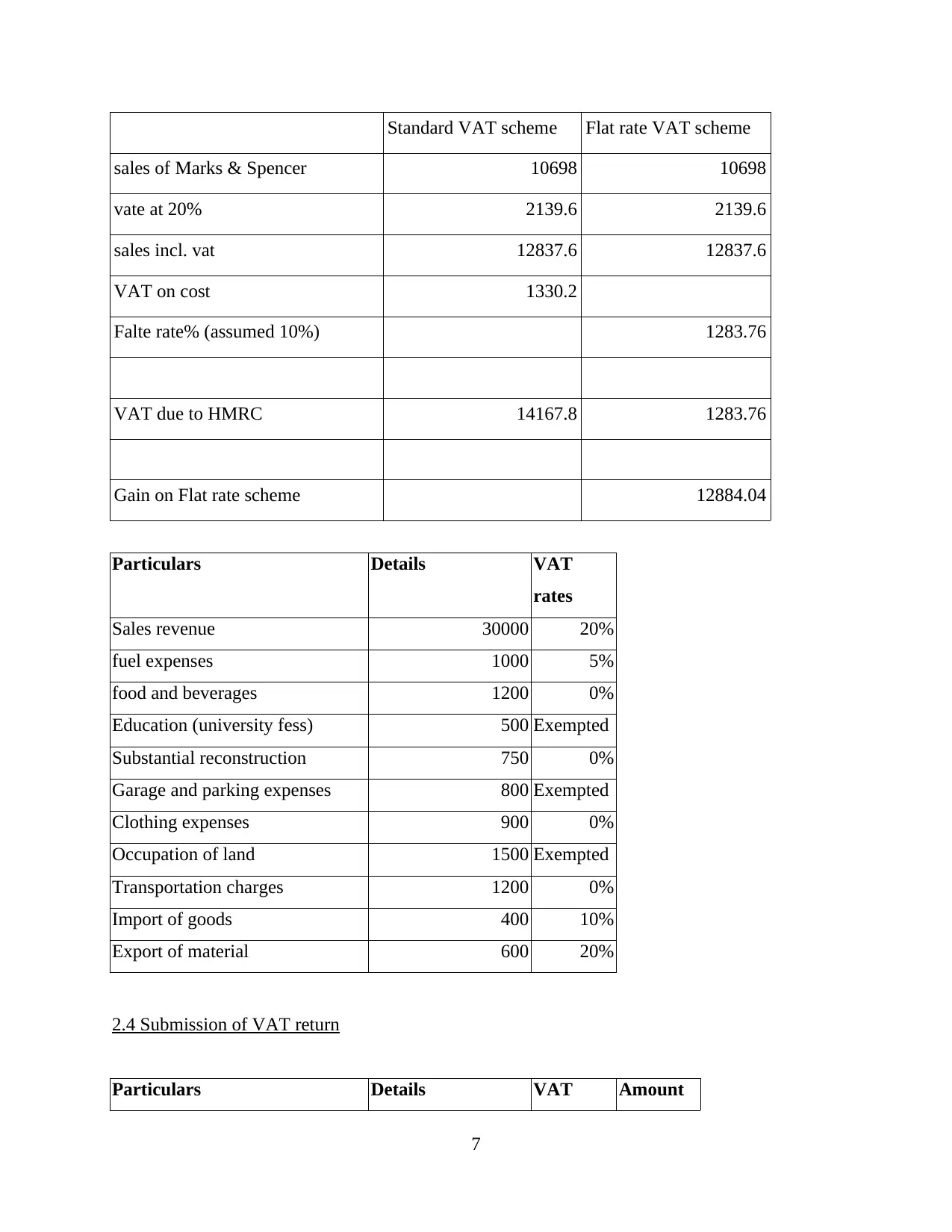

2.3 Calculation of VAT due of relevant tax authority

6

output VAT NIL

Purchase of goods and services 75000

Input VAT 2500

VAT liability NIL

Business expenses for the

purpose of calculation profit

77500

*75000 taxable value+

2500 VAT

Goods or services which comes under exempted rate are batting and gaming, Bingo,

lottery ticket sales, online lottery games and retailer commission lottery ticket sales, admission

charges by public authorities, antiques, admission charges by charities, etc.

Zero-rated supplies

Goods and services which comes under these supplies are advertising services for charities,

certain goods sold at charitable fundraising event, charity shops, construction and sale of new

buildings for relevant charitable purpose, building services for disabled people, equipments for

blind or partially sighted people etc.

Export

Goods and services which exported outside EU and it has been sent to another EU country will

consider as Zero-rated such as goods dispatched by post, dispatch by courier etc.

Import

Goods and services which received from EU countries or with another country which registered

under VAT are considered under Import supplies.

An example of zero-rated supplies, import and export are as follows-

2.3 Calculation of VAT due of relevant tax authority

6

Standard VAT scheme Flat rate VAT scheme

sales of Marks & Spencer 10698 10698

vate at 20% 2139.6 2139.6

sales incl. vat 12837.6 12837.6

VAT on cost 1330.2

Falte rate% (assumed 10%) 1283.76

VAT due to HMRC 14167.8 1283.76

Gain on Flat rate scheme 12884.04

Particulars Details VAT

rates

Sales revenue 30000 20%

fuel expenses 1000 5%

food and beverages 1200 0%

Education (university fess) 500 Exempted

Substantial reconstruction 750 0%

Garage and parking expenses 800 Exempted

Clothing expenses 900 0%

Occupation of land 1500 Exempted

Transportation charges 1200 0%

Import of goods 400 10%

Export of material 600 20%

2.4 Submission of VAT return

Particulars Details VAT Amount

7

sales of Marks & Spencer 10698 10698

vate at 20% 2139.6 2139.6

sales incl. vat 12837.6 12837.6

VAT on cost 1330.2

Falte rate% (assumed 10%) 1283.76

VAT due to HMRC 14167.8 1283.76

Gain on Flat rate scheme 12884.04

Particulars Details VAT

rates

Sales revenue 30000 20%

fuel expenses 1000 5%

food and beverages 1200 0%

Education (university fess) 500 Exempted

Substantial reconstruction 750 0%

Garage and parking expenses 800 Exempted

Clothing expenses 900 0%

Occupation of land 1500 Exempted

Transportation charges 1200 0%

Import of goods 400 10%

Export of material 600 20%

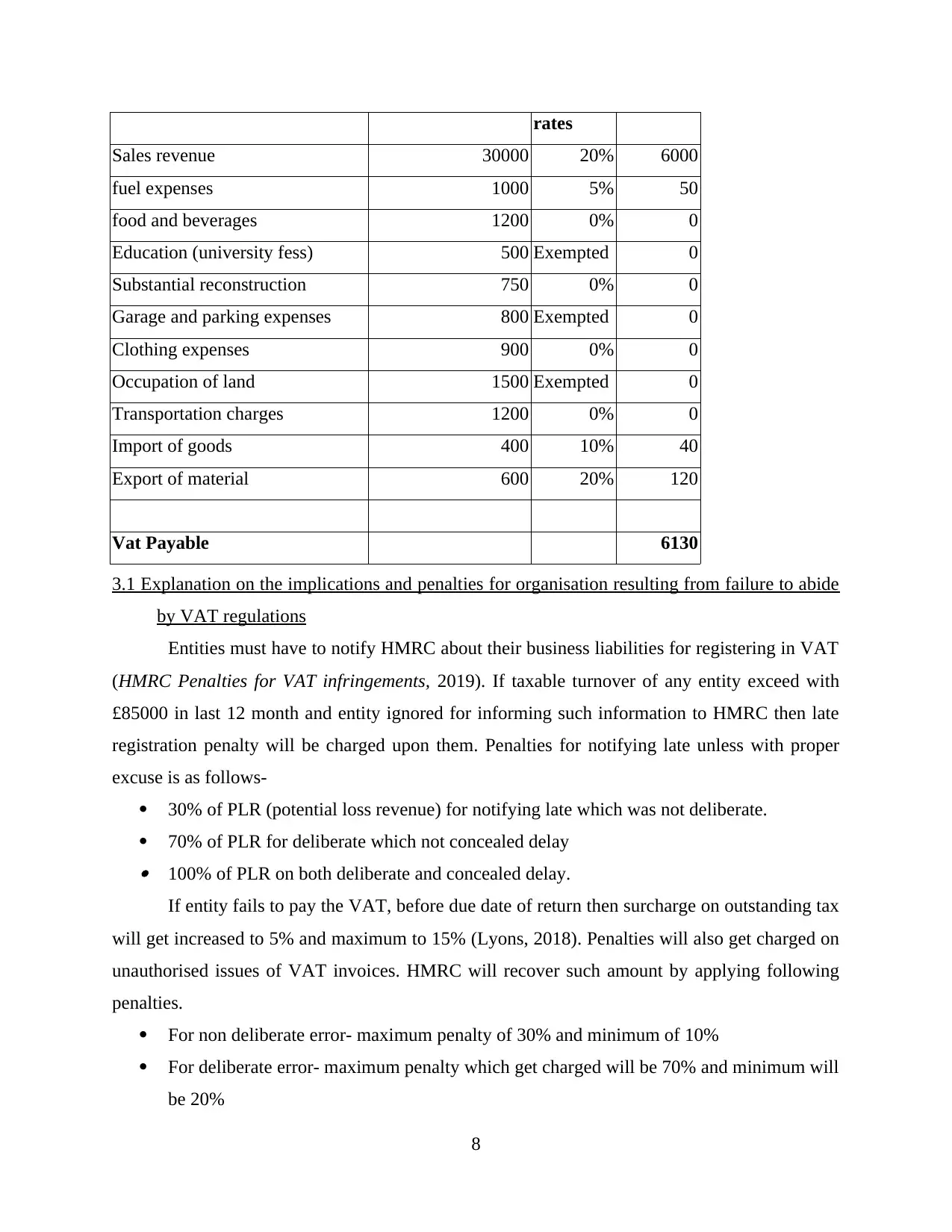

2.4 Submission of VAT return

Particulars Details VAT Amount

7

rates

Sales revenue 30000 20% 6000

fuel expenses 1000 5% 50

food and beverages 1200 0% 0

Education (university fess) 500 Exempted 0

Substantial reconstruction 750 0% 0

Garage and parking expenses 800 Exempted 0

Clothing expenses 900 0% 0

Occupation of land 1500 Exempted 0

Transportation charges 1200 0% 0

Import of goods 400 10% 40

Export of material 600 20% 120

Vat Payable 6130

3.1 Explanation on the implications and penalties for organisation resulting from failure to abide

by VAT regulations

Entities must have to notify HMRC about their business liabilities for registering in VAT

(HMRC Penalties for VAT infringements, 2019). If taxable turnover of any entity exceed with

£85000 in last 12 month and entity ignored for informing such information to HMRC then late

registration penalty will be charged upon them. Penalties for notifying late unless with proper

excuse is as follows-

30% of PLR (potential loss revenue) for notifying late which was not deliberate.

70% of PLR for deliberate which not concealed delay 100% of PLR on both deliberate and concealed delay.

If entity fails to pay the VAT, before due date of return then surcharge on outstanding tax

will get increased to 5% and maximum to 15% (Lyons, 2018). Penalties will also get charged on

unauthorised issues of VAT invoices. HMRC will recover such amount by applying following

penalties.

For non deliberate error- maximum penalty of 30% and minimum of 10%

For deliberate error- maximum penalty which get charged will be 70% and minimum will

be 20%

8

Sales revenue 30000 20% 6000

fuel expenses 1000 5% 50

food and beverages 1200 0% 0

Education (university fess) 500 Exempted 0

Substantial reconstruction 750 0% 0

Garage and parking expenses 800 Exempted 0

Clothing expenses 900 0% 0

Occupation of land 1500 Exempted 0

Transportation charges 1200 0% 0

Import of goods 400 10% 40

Export of material 600 20% 120

Vat Payable 6130

3.1 Explanation on the implications and penalties for organisation resulting from failure to abide

by VAT regulations

Entities must have to notify HMRC about their business liabilities for registering in VAT

(HMRC Penalties for VAT infringements, 2019). If taxable turnover of any entity exceed with

£85000 in last 12 month and entity ignored for informing such information to HMRC then late

registration penalty will be charged upon them. Penalties for notifying late unless with proper

excuse is as follows-

30% of PLR (potential loss revenue) for notifying late which was not deliberate.

70% of PLR for deliberate which not concealed delay 100% of PLR on both deliberate and concealed delay.

If entity fails to pay the VAT, before due date of return then surcharge on outstanding tax

will get increased to 5% and maximum to 15% (Lyons, 2018). Penalties will also get charged on

unauthorised issues of VAT invoices. HMRC will recover such amount by applying following

penalties.

For non deliberate error- maximum penalty of 30% and minimum of 10%

For deliberate error- maximum penalty which get charged will be 70% and minimum will

be 20%

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

For both type of error- maximum penalty will be 100% and minimum will be 30%.

For breaches of regulations penalty will get charged with minimum of £5 per day which will get

increased to £10 per day (Smulders and Evans, 2017). Daily penalties will be charged as

maximum 100 times per day.

3.2 Adjustments and declaration for any type of errors or omissions which identified in previous

VAT periods

According to guidelines which introduced by Federal Tax Authority in a form of 211-

VAT, any type of error or omission will get rectify. These guidelines will help taxpayer to rectify

their error they committed while filling VAT return. According to guidelines of FTA, taxpayer

has an option to rectify contents of VAT return which mistakenly mentioned by them. With the

option of voluntary disclosure, taxpayer will able to rectify the error which was submitted by

them. After the use of this option tax payer must have to disclose information to authority. Any

type of error or omission if finds by tax payer than he/she can log in to official website of FTA

with their own user id and password.

VAT return can be adjusted if the net value of the error is less than £10000. To make an

adjustment, taxpayer needs to add the net value to box 1 regarding their due tax to HMRC

(Troyer, 2018). Taxpayer needs to mention details of inaccuracy so that proper value and

explanation included in VAT account. If any help is needed by taxpayer, then they may contact

VAT error correction team. Error which are above the threshold limit of VAT and error which

made for more than four years ago needs to be notified to HM revenue and commission body,

Error which arise because of carelessness and with dishonest behaviour, then interest and

penalties will get charged upon taxpayer.

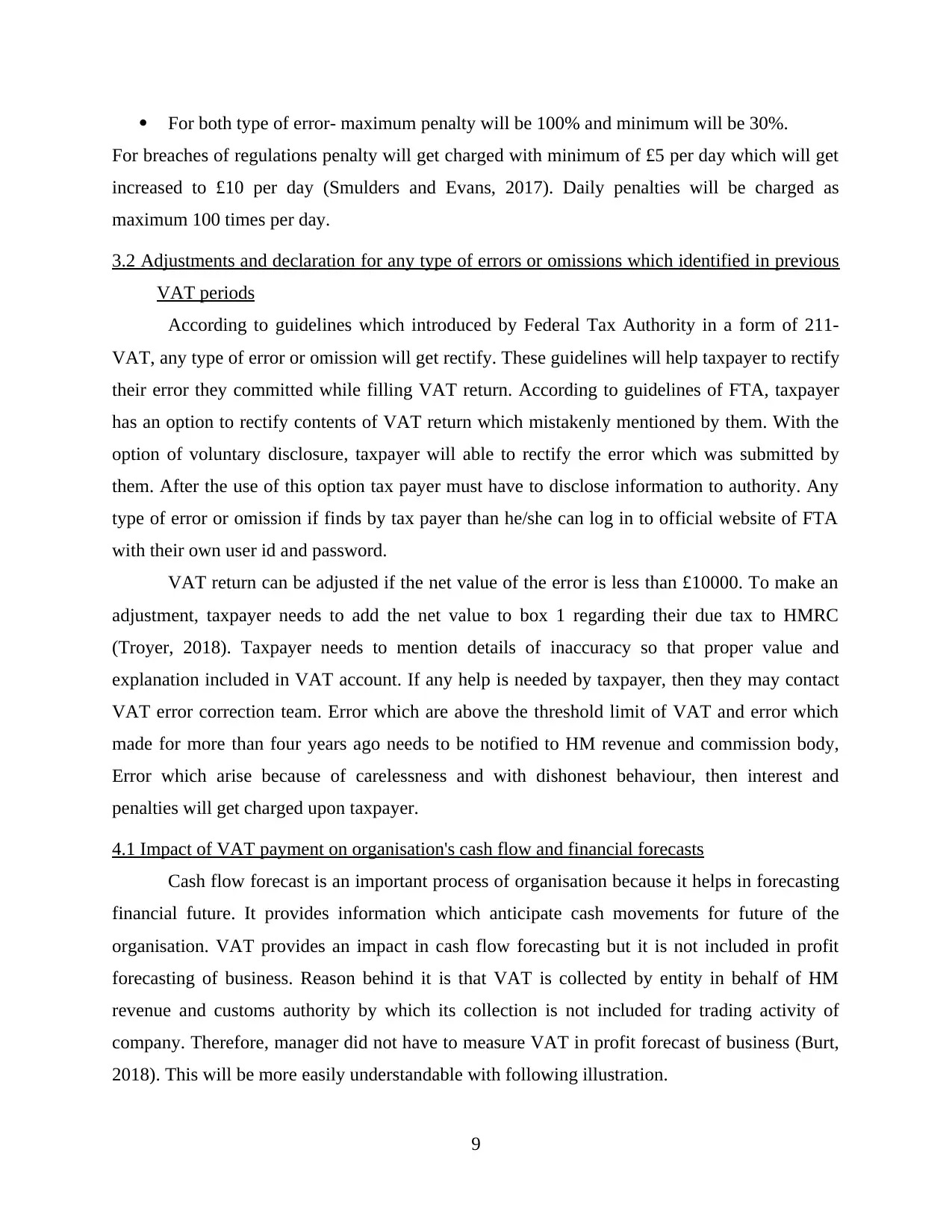

4.1 Impact of VAT payment on organisation's cash flow and financial forecasts

Cash flow forecast is an important process of organisation because it helps in forecasting

financial future. It provides information which anticipate cash movements for future of the

organisation. VAT provides an impact in cash flow forecasting but it is not included in profit

forecasting of business. Reason behind it is that VAT is collected by entity in behalf of HM

revenue and customs authority by which its collection is not included for trading activity of

company. Therefore, manager did not have to measure VAT in profit forecast of business (Burt,

2018). This will be more easily understandable with following illustration.

9

For breaches of regulations penalty will get charged with minimum of £5 per day which will get

increased to £10 per day (Smulders and Evans, 2017). Daily penalties will be charged as

maximum 100 times per day.

3.2 Adjustments and declaration for any type of errors or omissions which identified in previous

VAT periods

According to guidelines which introduced by Federal Tax Authority in a form of 211-

VAT, any type of error or omission will get rectify. These guidelines will help taxpayer to rectify

their error they committed while filling VAT return. According to guidelines of FTA, taxpayer

has an option to rectify contents of VAT return which mistakenly mentioned by them. With the

option of voluntary disclosure, taxpayer will able to rectify the error which was submitted by

them. After the use of this option tax payer must have to disclose information to authority. Any

type of error or omission if finds by tax payer than he/she can log in to official website of FTA

with their own user id and password.

VAT return can be adjusted if the net value of the error is less than £10000. To make an

adjustment, taxpayer needs to add the net value to box 1 regarding their due tax to HMRC

(Troyer, 2018). Taxpayer needs to mention details of inaccuracy so that proper value and

explanation included in VAT account. If any help is needed by taxpayer, then they may contact

VAT error correction team. Error which are above the threshold limit of VAT and error which

made for more than four years ago needs to be notified to HM revenue and commission body,

Error which arise because of carelessness and with dishonest behaviour, then interest and

penalties will get charged upon taxpayer.

4.1 Impact of VAT payment on organisation's cash flow and financial forecasts

Cash flow forecast is an important process of organisation because it helps in forecasting

financial future. It provides information which anticipate cash movements for future of the

organisation. VAT provides an impact in cash flow forecasting but it is not included in profit

forecasting of business. Reason behind it is that VAT is collected by entity in behalf of HM

revenue and customs authority by which its collection is not included for trading activity of

company. Therefore, manager did not have to measure VAT in profit forecast of business (Burt,

2018). This will be more easily understandable with following illustration.

9

With the above illustration it can be interpret that investment have only impact on the

cash flow statement not on the profit forecasting. Loan amount also not providing any impact on

profit forecasting. Treatment of VAT is clearly understandable that enterprise is registered in

VAT because of that they are charging VAT to its sales which is not showing in the statement of

profit forecasting. Therefore, when cash has been received by company, they have included VAT

at 17.5%. VAT payable only on the sub contractors, utilities and on fixed assets purchases which

means that it is not providing any impact on profit forecasting of company.

With the above calculation, managers will able to analyse that in the statement of proft

and loss of organisation, figures are shown as net of VAT and in the statement of cash flow

figures are calculated for including VAT amount (Terblanche, 2016).

10

cash flow statement not on the profit forecasting. Loan amount also not providing any impact on

profit forecasting. Treatment of VAT is clearly understandable that enterprise is registered in

VAT because of that they are charging VAT to its sales which is not showing in the statement of

profit forecasting. Therefore, when cash has been received by company, they have included VAT

at 17.5%. VAT payable only on the sub contractors, utilities and on fixed assets purchases which

means that it is not providing any impact on profit forecasting of company.

With the above calculation, managers will able to analyse that in the statement of proft

and loss of organisation, figures are shown as net of VAT and in the statement of cash flow

figures are calculated for including VAT amount (Terblanche, 2016).

10

4.2 Impact of changes in VAT legislation which would have an effect on an organisation's

recording systems

With the change in VAT legislation, organisation's also have to change their record

keeping. With the change in VAT legislation, business which in scope will no longer able to

keep its mutual records. In order to keep changes with new VAT legislation, there may be

chances of filling late returns and in late submission (de la Feria and Tanawong, 2015). For

filling VAT return, companies have to learn throughout new registration process which impact

company in year ahead. Some of its impact on organisation are as follows-

Increased Costs-

With the new VAT laws, new additional functions have to perform by organisation by

which implementation cost get increases. Company needs to update IT and internal system where

they have to invest extra cost to train employees for VAT process. Return which have fulfilled

through new process have more chances of error by which invest extra cost.

Change in business structure-

VAT is charged at each stage of production process of company and any change in its

legislation may be problematic for business entity for handling such products and services. This

impact will lead to change in whole business structure of organisation.

Being accountable-

For VAT registered companies, they legally have to prepare and keep business records in

order to provide details of effective business information to government. Legislation authority

may ask for annual accounts, general ledger, purchase day book and invoices by which company

have to keep records to ensure them regarding business activities.

With the new changes in VAT legislation, its positive impact on business activities are as

follows-

Improves business efficiency-

With the new changes in VAT legislation, company may able to see an initial rise in costs

and plenty of long term benefits which helps in gaining business efficiency. Once new changes

get implemented, organisation's may able to gain long term benefits form streamlining exercise

(Hoza and Wójcicki, 2017).

Advisory opportunities-

11

recording systems

With the change in VAT legislation, organisation's also have to change their record

keeping. With the change in VAT legislation, business which in scope will no longer able to

keep its mutual records. In order to keep changes with new VAT legislation, there may be

chances of filling late returns and in late submission (de la Feria and Tanawong, 2015). For

filling VAT return, companies have to learn throughout new registration process which impact

company in year ahead. Some of its impact on organisation are as follows-

Increased Costs-

With the new VAT laws, new additional functions have to perform by organisation by

which implementation cost get increases. Company needs to update IT and internal system where

they have to invest extra cost to train employees for VAT process. Return which have fulfilled

through new process have more chances of error by which invest extra cost.

Change in business structure-

VAT is charged at each stage of production process of company and any change in its

legislation may be problematic for business entity for handling such products and services. This

impact will lead to change in whole business structure of organisation.

Being accountable-

For VAT registered companies, they legally have to prepare and keep business records in

order to provide details of effective business information to government. Legislation authority

may ask for annual accounts, general ledger, purchase day book and invoices by which company

have to keep records to ensure them regarding business activities.

With the new changes in VAT legislation, its positive impact on business activities are as

follows-

Improves business efficiency-

With the new changes in VAT legislation, company may able to see an initial rise in costs

and plenty of long term benefits which helps in gaining business efficiency. Once new changes

get implemented, organisation's may able to gain long term benefits form streamlining exercise

(Hoza and Wójcicki, 2017).

Advisory opportunities-

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Companies which adjust with new VAT legislation will able to engage potentiality

opportunities for entrepreneurs in order to provide advisory information related to VAT terms.

Non financial benefits-

New tax regulations by legislation also brings many non-financial benefits to an

economy. Organisations are also able to improve their liability management which helps in

enhancing government accountability and democracy.

CONCLUSION

From the above report, it can be concluded that maintaining VAT registration is an

important process for every type of businesses whose turnover exceed £85000. In this report,

sources of information on VAT and its registration requirements is explained where

understandability get developed on supply chain of VAT in organisation. Further, VAT

registration requirements and types of VAT scheme is provided in which process of doing VAT

payment by taxpayers is explained. For better understanding of VAT return, example with

appropriate data of company is also summarised in this report.

12

opportunities for entrepreneurs in order to provide advisory information related to VAT terms.

Non financial benefits-

New tax regulations by legislation also brings many non-financial benefits to an

economy. Organisations are also able to improve their liability management which helps in

enhancing government accountability and democracy.

CONCLUSION

From the above report, it can be concluded that maintaining VAT registration is an

important process for every type of businesses whose turnover exceed £85000. In this report,

sources of information on VAT and its registration requirements is explained where

understandability get developed on supply chain of VAT in organisation. Further, VAT

registration requirements and types of VAT scheme is provided in which process of doing VAT

payment by taxpayers is explained. For better understanding of VAT return, example with

appropriate data of company is also summarised in this report.

12

REFERENCES

Books and Journals

Brusca, I and et.al., 2015. Comparing accounting systems in Europe. In Public Sector

Accounting and Auditing in Europe (pp. 235-251). Palgrave Macmillan, London.

Burt, K., 2018. Imposing understatement penalties: adopting the right

approach. TAXtalk. 2018(70). pp.48-51.

de la Feria, R. and Tanawong, P., 2015. Surcharges and penalties in UK tax law.

Downing, J. and Langli, J.C., 2019. Audit exemptions and compliance with tax and accounting

regulations. Accounting and Business Research. 49(1). pp.28-67.

Ghodsi, Z. and Webster, A., 2018. UK Taxes and Tax Revenues: Composition and Trends.

Hoza, B. and Wójcicki, M., 2017. Vat Fraud Prevention. Zeszyty Naukowe Wyższej Szkoły

Finansów i Prawa w Bielsku-Białej. (2). pp.44-58.

Liu, L. and Lockwood, B., 2016. VAT notches, voluntary registration and bunching: Theory and

UK evidence.

Lyons, T., 2018. UK Customs Penalties and EU Harmonization. Global Trade and Customs

Journal. 13(7). pp.347-353.

Merkx, M and et.al., 2018. Definitive VAT Regime: Stairway to Heaven or Highway to

Hell?. EC Tax Review. 27(2). pp.74-82.

Obeng, G., 2018. Value Added Tax and Vat Flat Rate Scheme in Ghana, Any Cascading

Implications. Asian Development Policy Review. 6(4). pp.213-225.

Smulders, S. and Evans, C., 2017. Mitigating VAT compliance costs-A developing country

perspective. In Australian Tax Forum (Vol. 32, No. 2, p. 283). Tax Institute.

Terblanche, V., 2016. VAT year in review: the value adds & the value fads. TAXtalk. 2016(61).

pp.48-51.

Troyer, I.D., 2018. Interest on VAT Claims. EC Tax Review. 27(2). pp.83-95.

Wales, P and et.al., 2018. UK trade in goods and productivity: New findings (No. ESCoE DP-

2018-09). Economic Statistics Centre of Excellence (ESCoE).

Zu, Y., 2018. VAT/GST Thresholds and Small Businesses: Where to Draw the Line?.

Online

13

Books and Journals

Brusca, I and et.al., 2015. Comparing accounting systems in Europe. In Public Sector

Accounting and Auditing in Europe (pp. 235-251). Palgrave Macmillan, London.

Burt, K., 2018. Imposing understatement penalties: adopting the right

approach. TAXtalk. 2018(70). pp.48-51.

de la Feria, R. and Tanawong, P., 2015. Surcharges and penalties in UK tax law.

Downing, J. and Langli, J.C., 2019. Audit exemptions and compliance with tax and accounting

regulations. Accounting and Business Research. 49(1). pp.28-67.

Ghodsi, Z. and Webster, A., 2018. UK Taxes and Tax Revenues: Composition and Trends.

Hoza, B. and Wójcicki, M., 2017. Vat Fraud Prevention. Zeszyty Naukowe Wyższej Szkoły

Finansów i Prawa w Bielsku-Białej. (2). pp.44-58.

Liu, L. and Lockwood, B., 2016. VAT notches, voluntary registration and bunching: Theory and

UK evidence.

Lyons, T., 2018. UK Customs Penalties and EU Harmonization. Global Trade and Customs

Journal. 13(7). pp.347-353.

Merkx, M and et.al., 2018. Definitive VAT Regime: Stairway to Heaven or Highway to

Hell?. EC Tax Review. 27(2). pp.74-82.

Obeng, G., 2018. Value Added Tax and Vat Flat Rate Scheme in Ghana, Any Cascading

Implications. Asian Development Policy Review. 6(4). pp.213-225.

Smulders, S. and Evans, C., 2017. Mitigating VAT compliance costs-A developing country

perspective. In Australian Tax Forum (Vol. 32, No. 2, p. 283). Tax Institute.

Terblanche, V., 2016. VAT year in review: the value adds & the value fads. TAXtalk. 2016(61).

pp.48-51.

Troyer, I.D., 2018. Interest on VAT Claims. EC Tax Review. 27(2). pp.83-95.

Wales, P and et.al., 2018. UK trade in goods and productivity: New findings (No. ESCoE DP-

2018-09). Economic Statistics Centre of Excellence (ESCoE).

Zu, Y., 2018. VAT/GST Thresholds and Small Businesses: Where to Draw the Line?.

Online

13

HMRC Penalties for VAT infringements. 2019. [Online]. Available through

<https://www.plummer-parsons.co.uk/taxation-services/business-tax/value-added-tax-vat/

penalties-vat-infringements>

How to register for VAT in the UK. 2019. [Online]. Available through

<https://1office.co/blog/register-vat-uk/>

Maverick, J.B., 2018. What are some examples of value added tax. [Online]. Available through

<https://www.investopedia.com/ask/answers/042315/what-are-some-examples-value-

added-tax.asp>

14

<https://www.plummer-parsons.co.uk/taxation-services/business-tax/value-added-tax-vat/

penalties-vat-infringements>

How to register for VAT in the UK. 2019. [Online]. Available through

<https://1office.co/blog/register-vat-uk/>

Maverick, J.B., 2018. What are some examples of value added tax. [Online]. Available through

<https://www.investopedia.com/ask/answers/042315/what-are-some-examples-value-

added-tax.asp>

14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

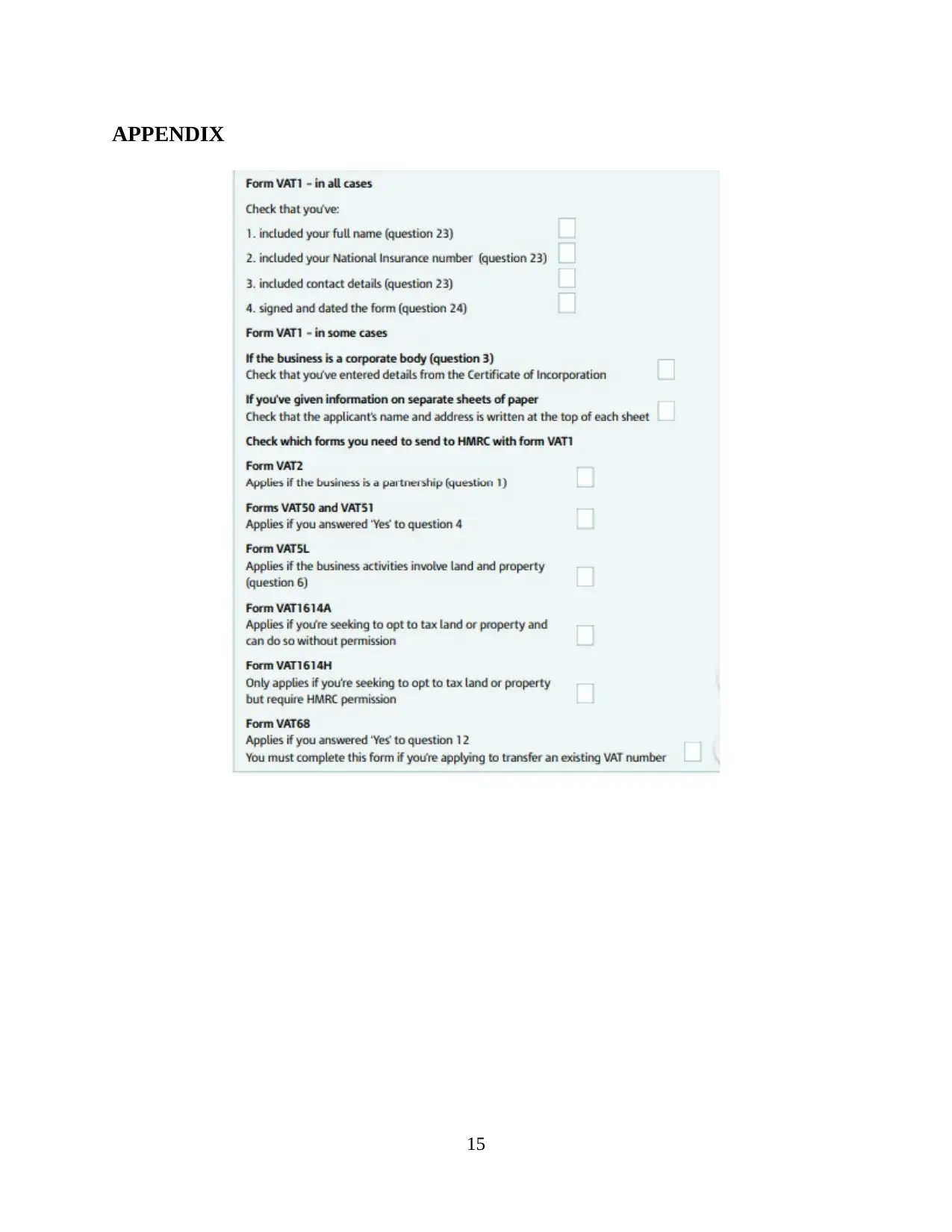

APPENDIX

15

15

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.