Finance and Mortgage Broking Written Project

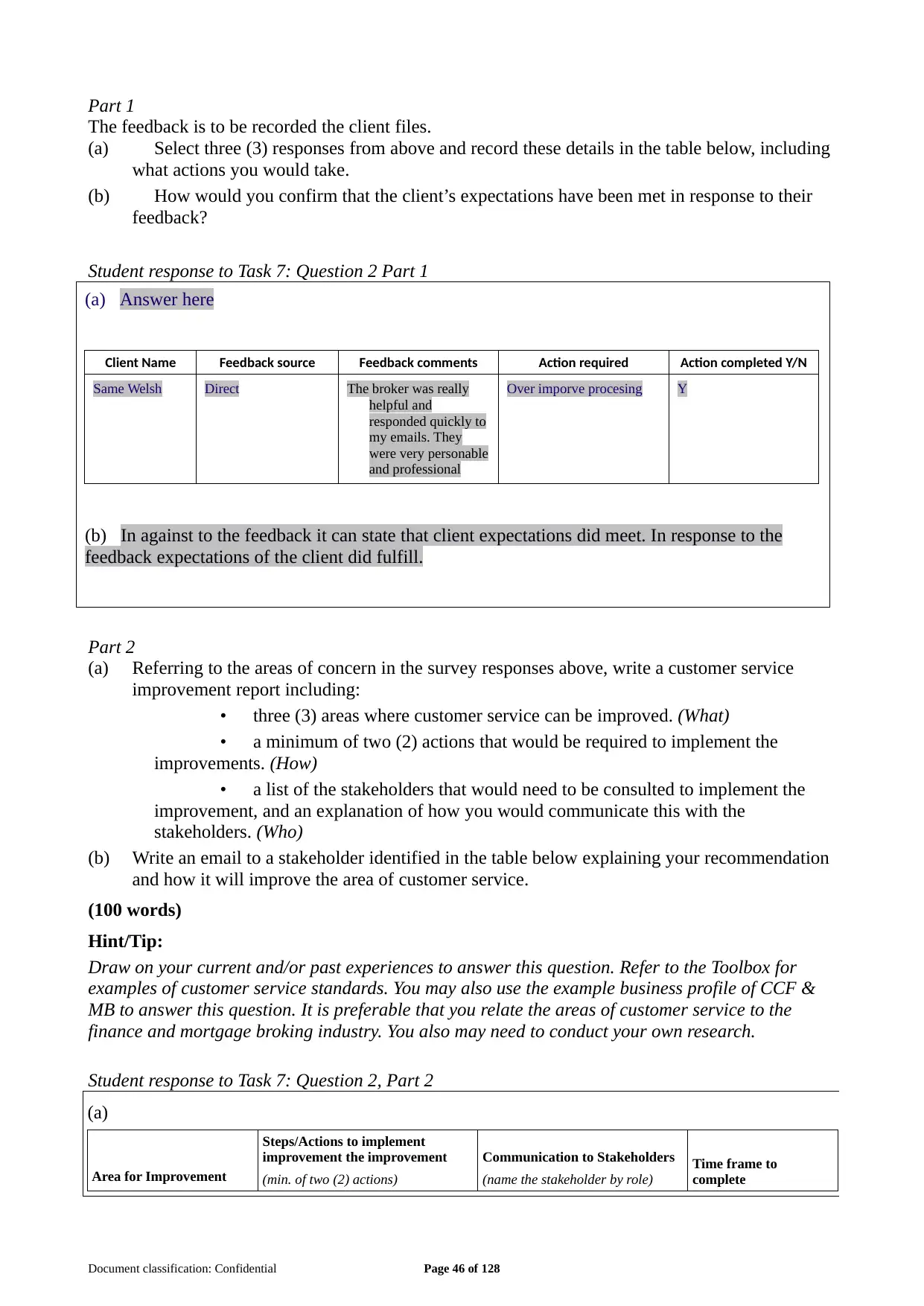

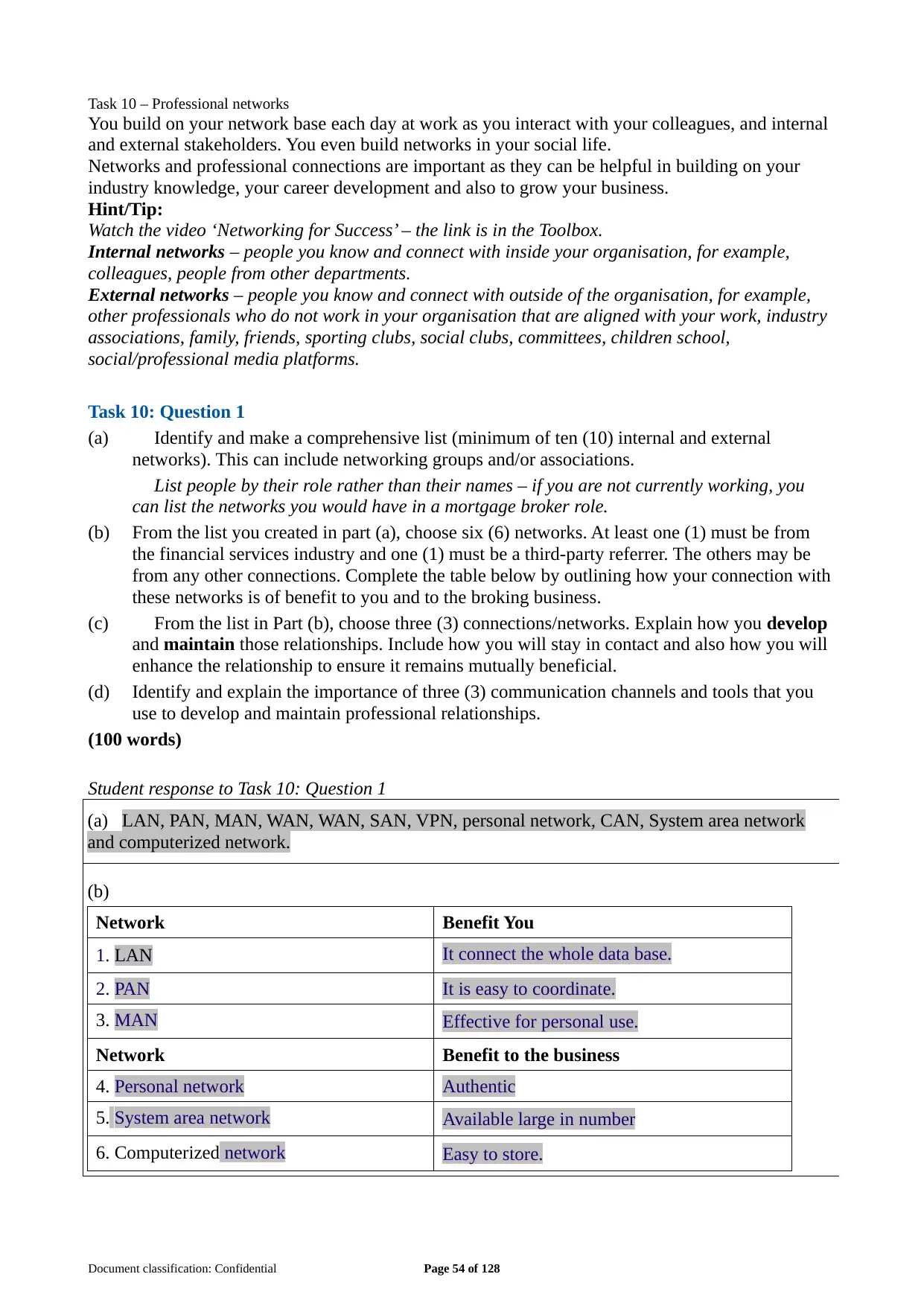

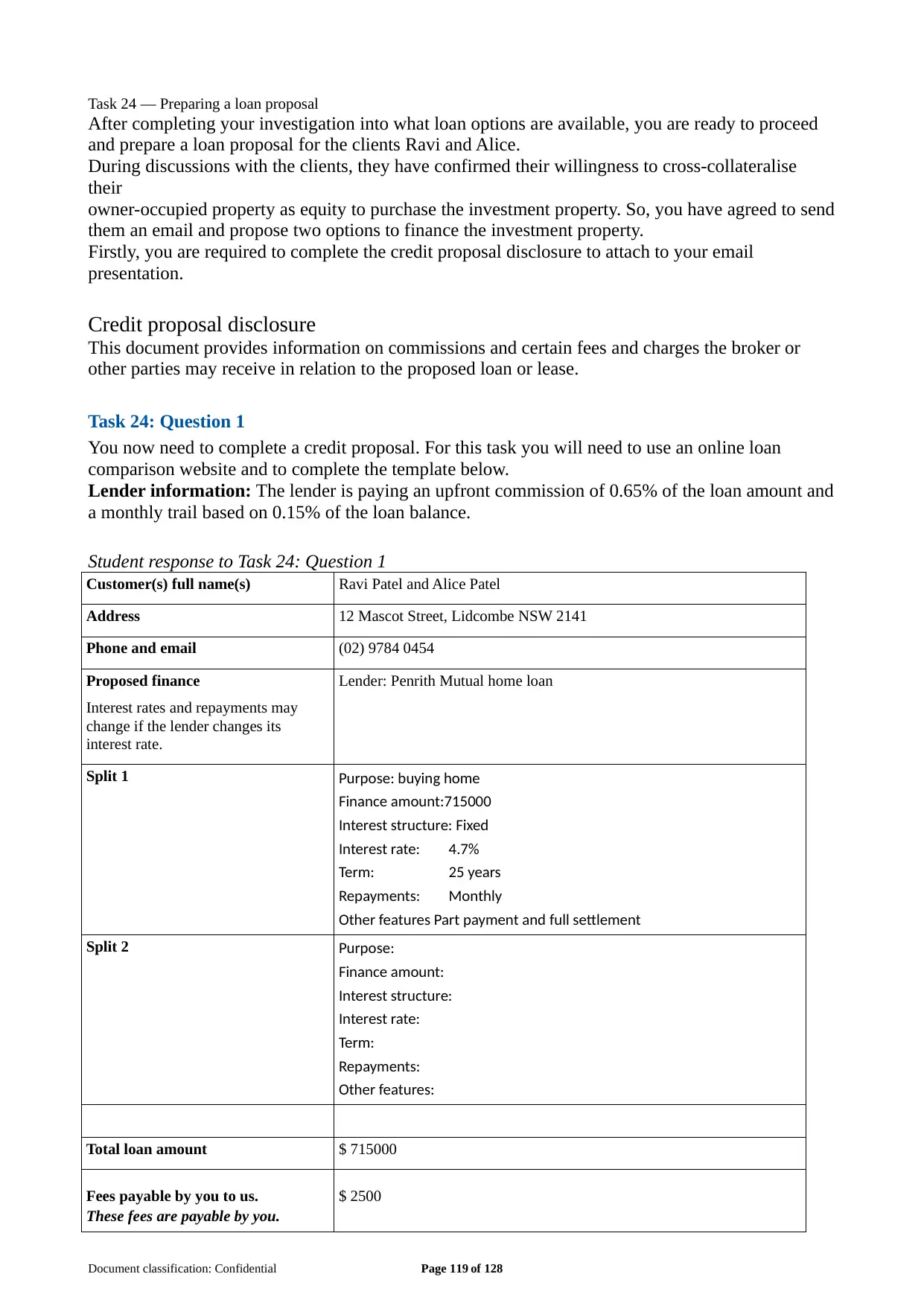

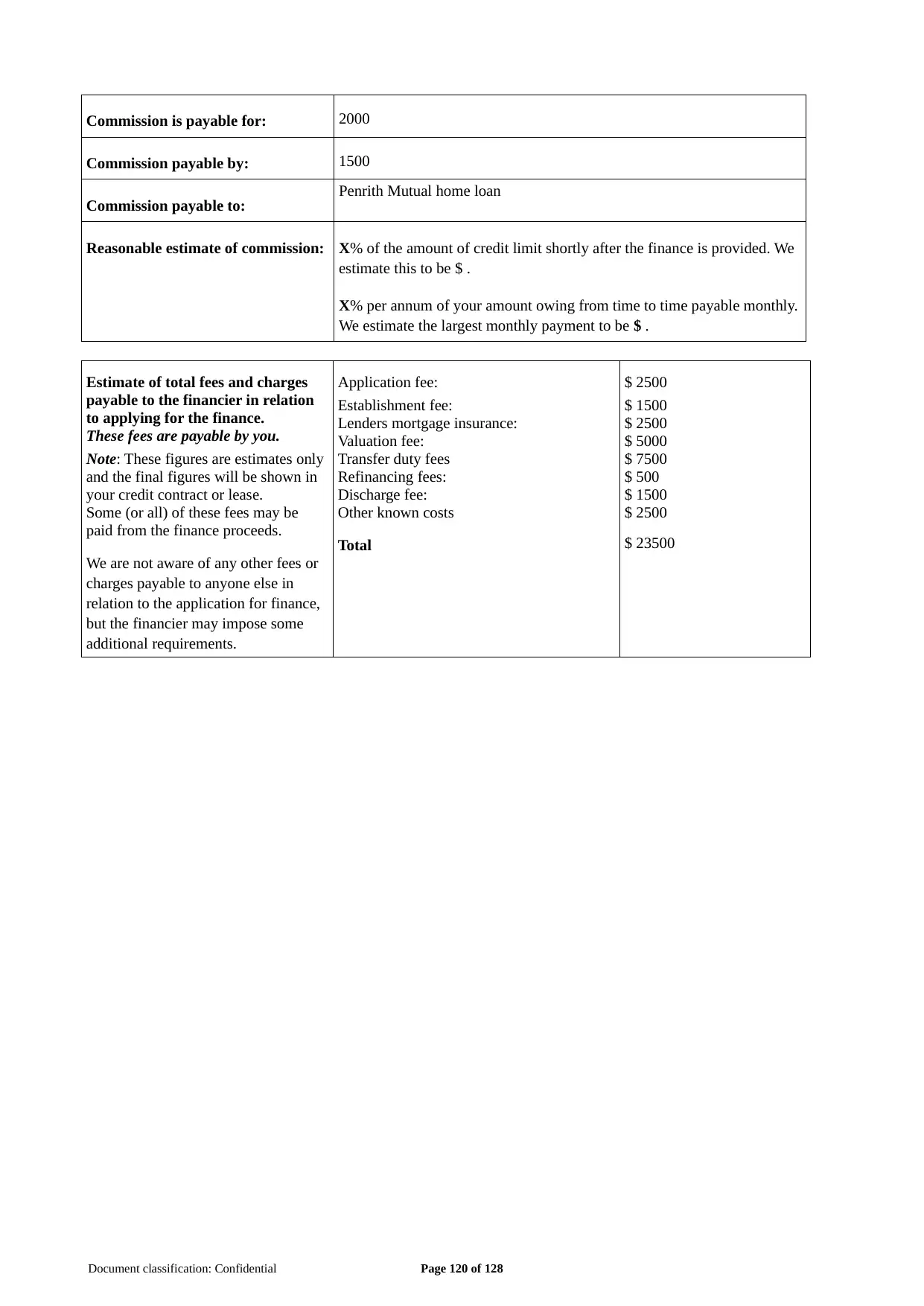

VerifiedAdded on 2023/06/15

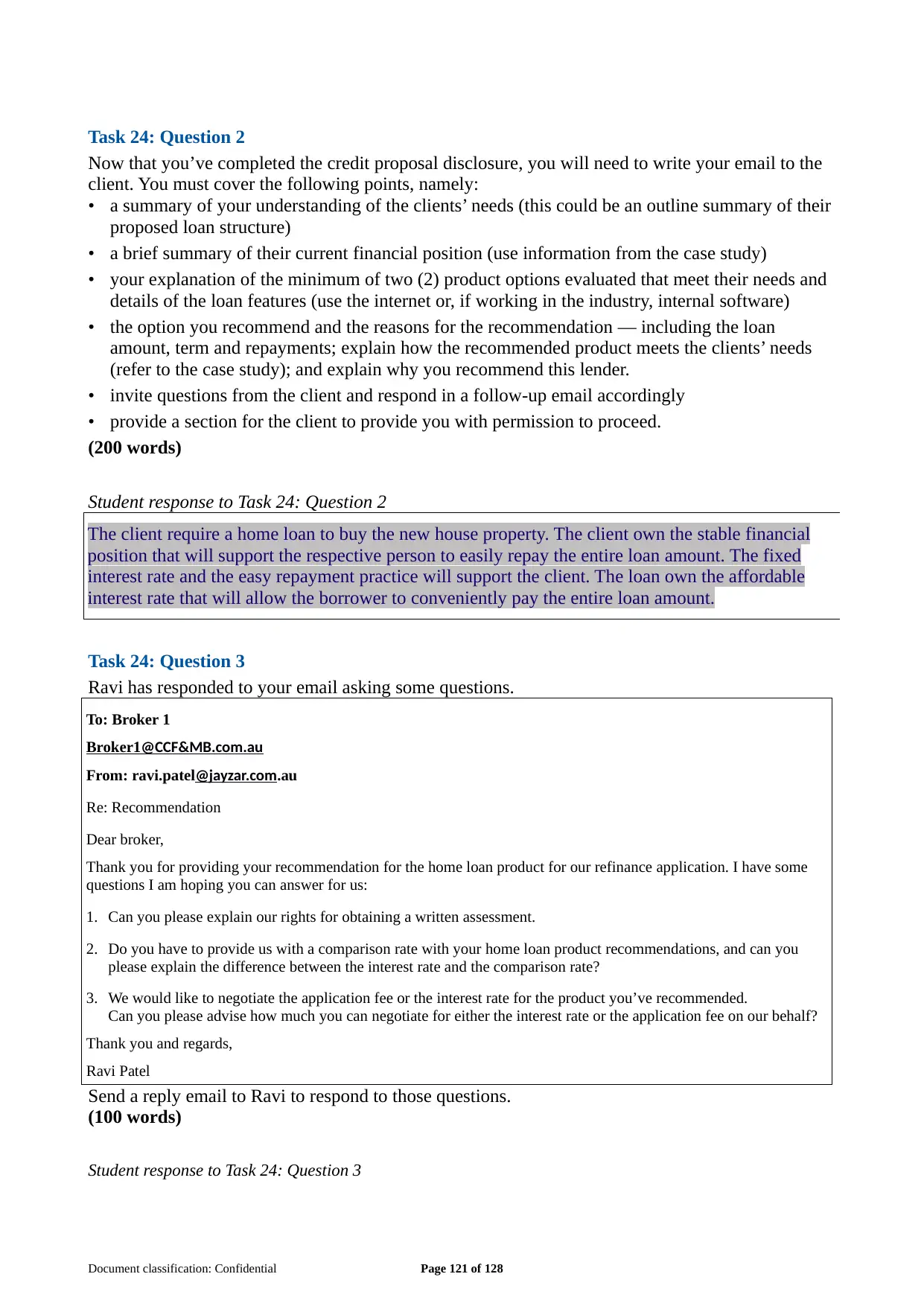

|128

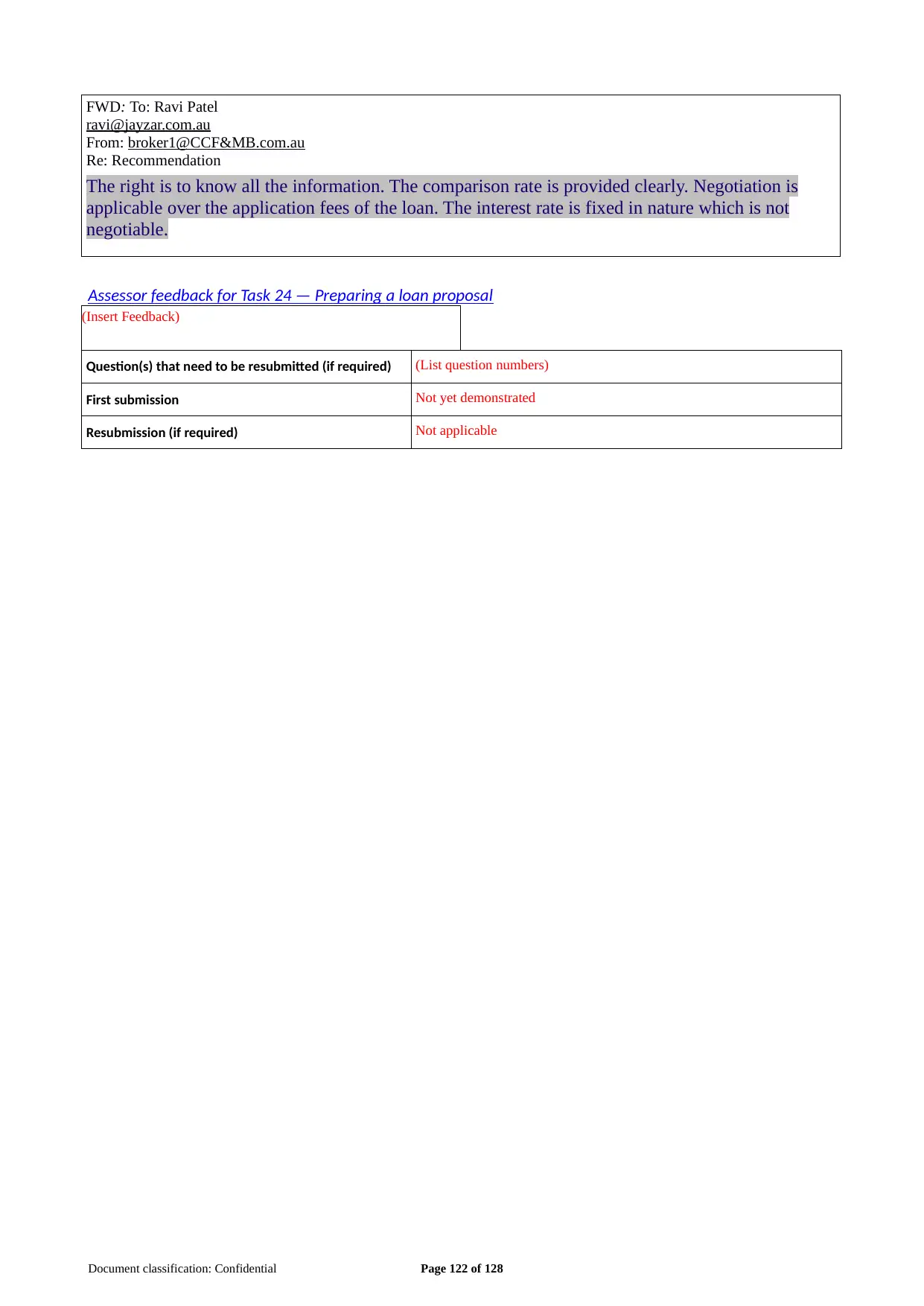

|29309

|153

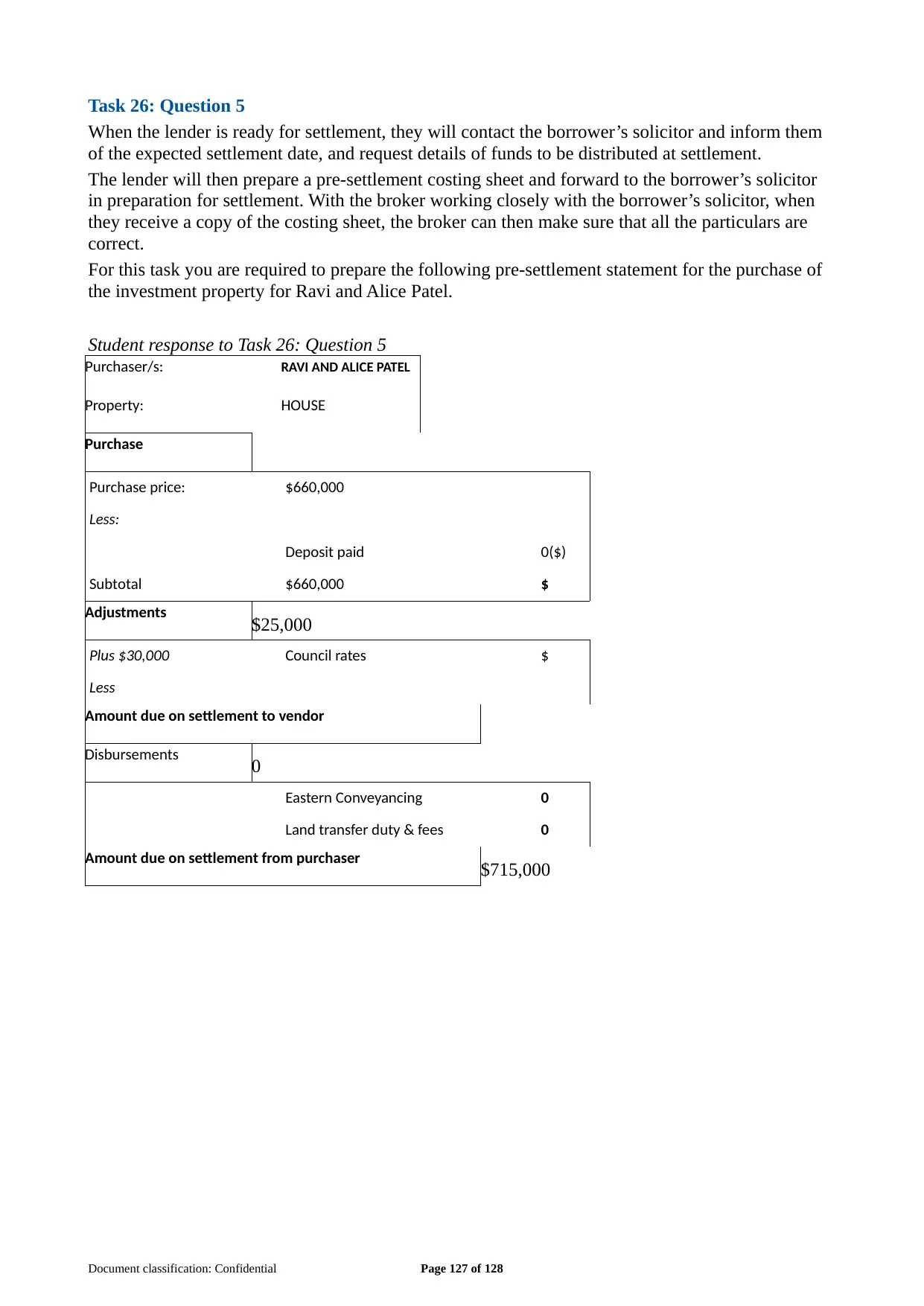

AI Summary

This task requires the student to define and explain loan transaction terminology and match document names with their definitions. The task aims to test the student's understanding of the common terms and document names used in the finance and mortgage broking industry.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

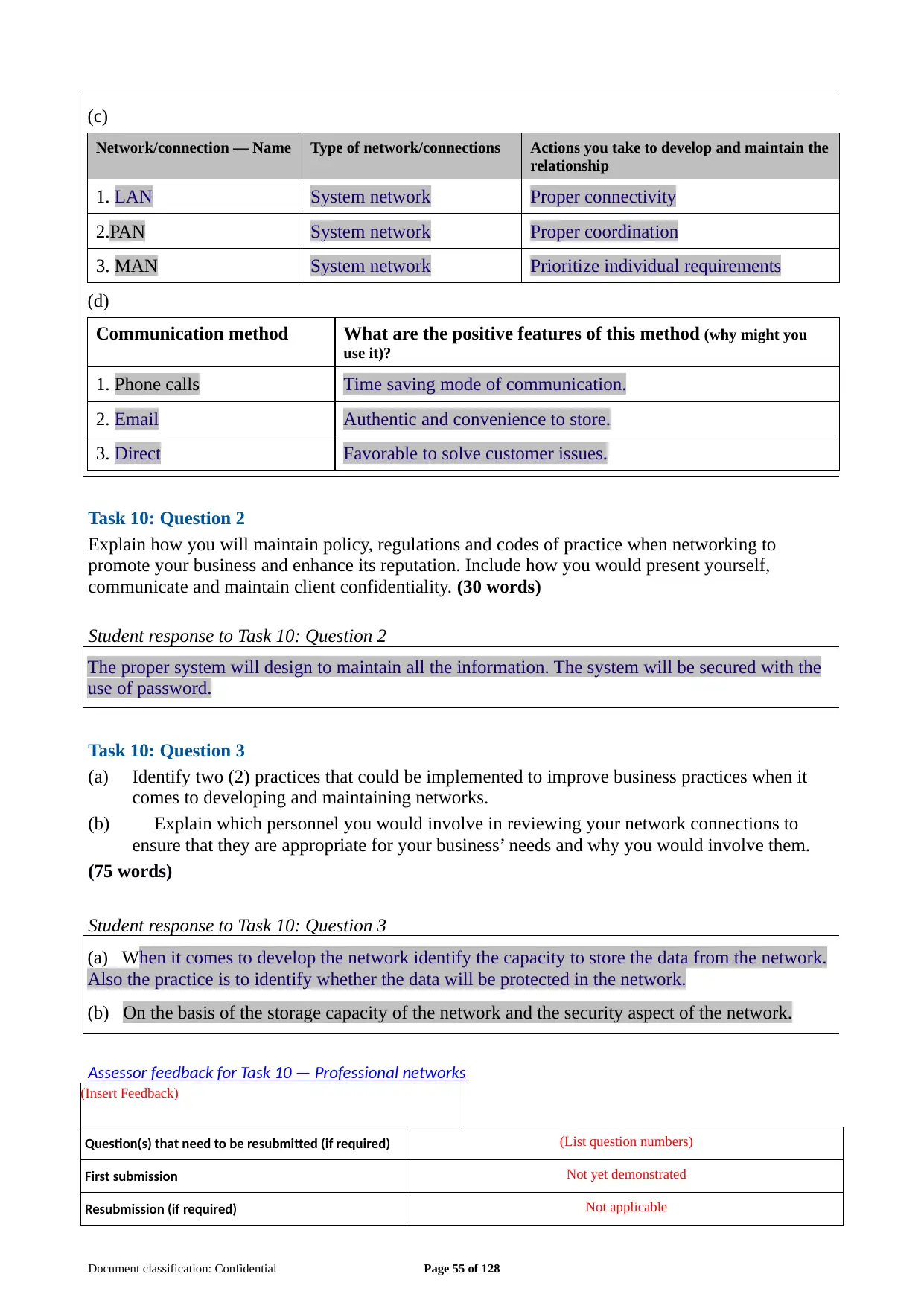

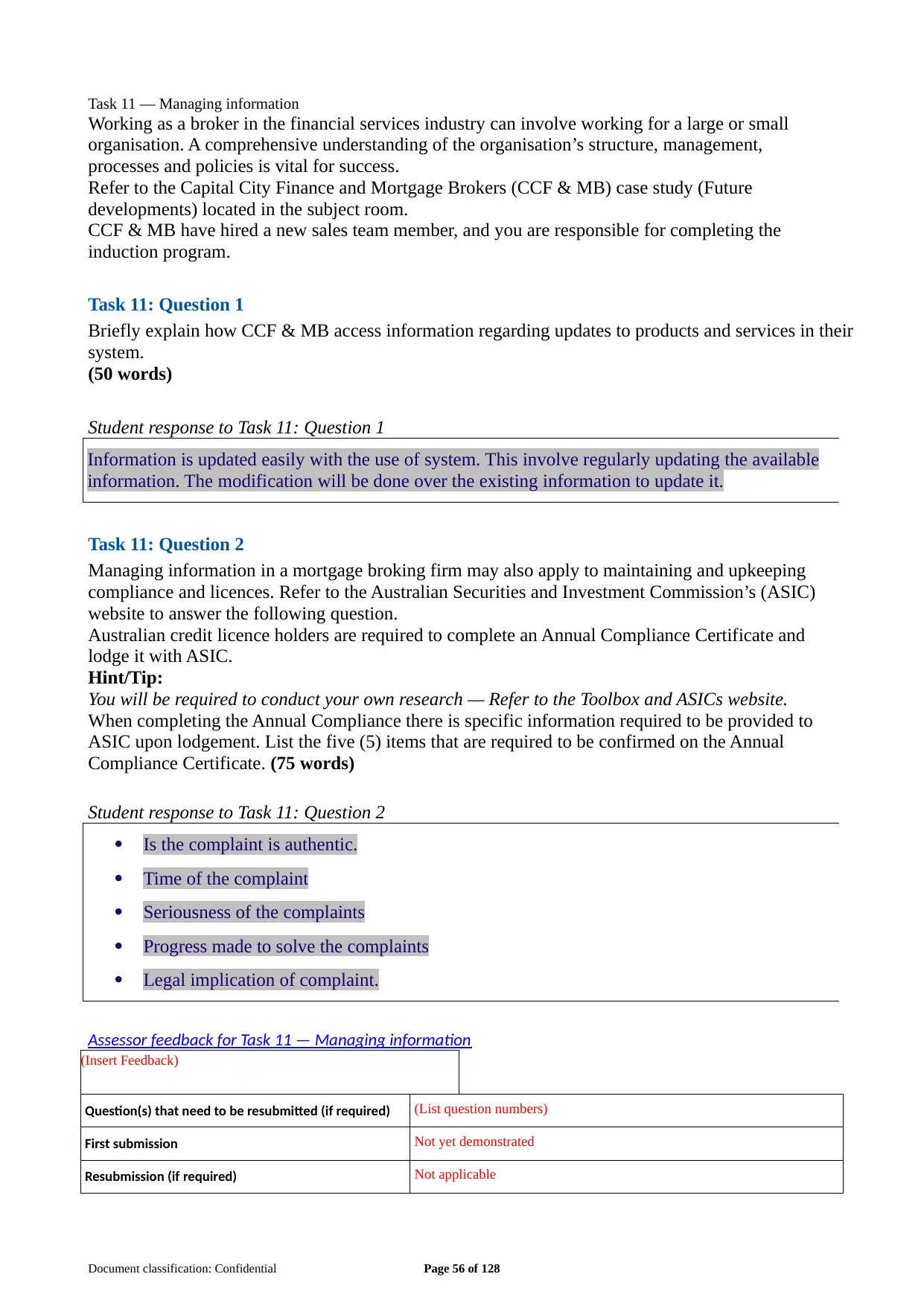

Written Project

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Certificate IV in Finance and Mortgage Broking

(CFMB_ASMG_v1A1)

Document classification: Confidential Page 2 of 128

(CFMB_ASMG_v1A1)

Document classification: Confidential Page 2 of 128

Student identification (student to complete)

Please complete the fields shaded grey.

Student number

Document classification: Confidential Page 3 of 128

Please complete the fields shaded grey.

Student number

Document classification: Confidential Page 3 of 128

Written project overall result (assessor to complete)

First submission Not yet demonstrated

Resubmission (if applicable) Not applicable

Document classification: Confidential Page 4 of 128

First submission Not yet demonstrated

Resubmission (if applicable) Not applicable

Document classification: Confidential Page 4 of 128

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

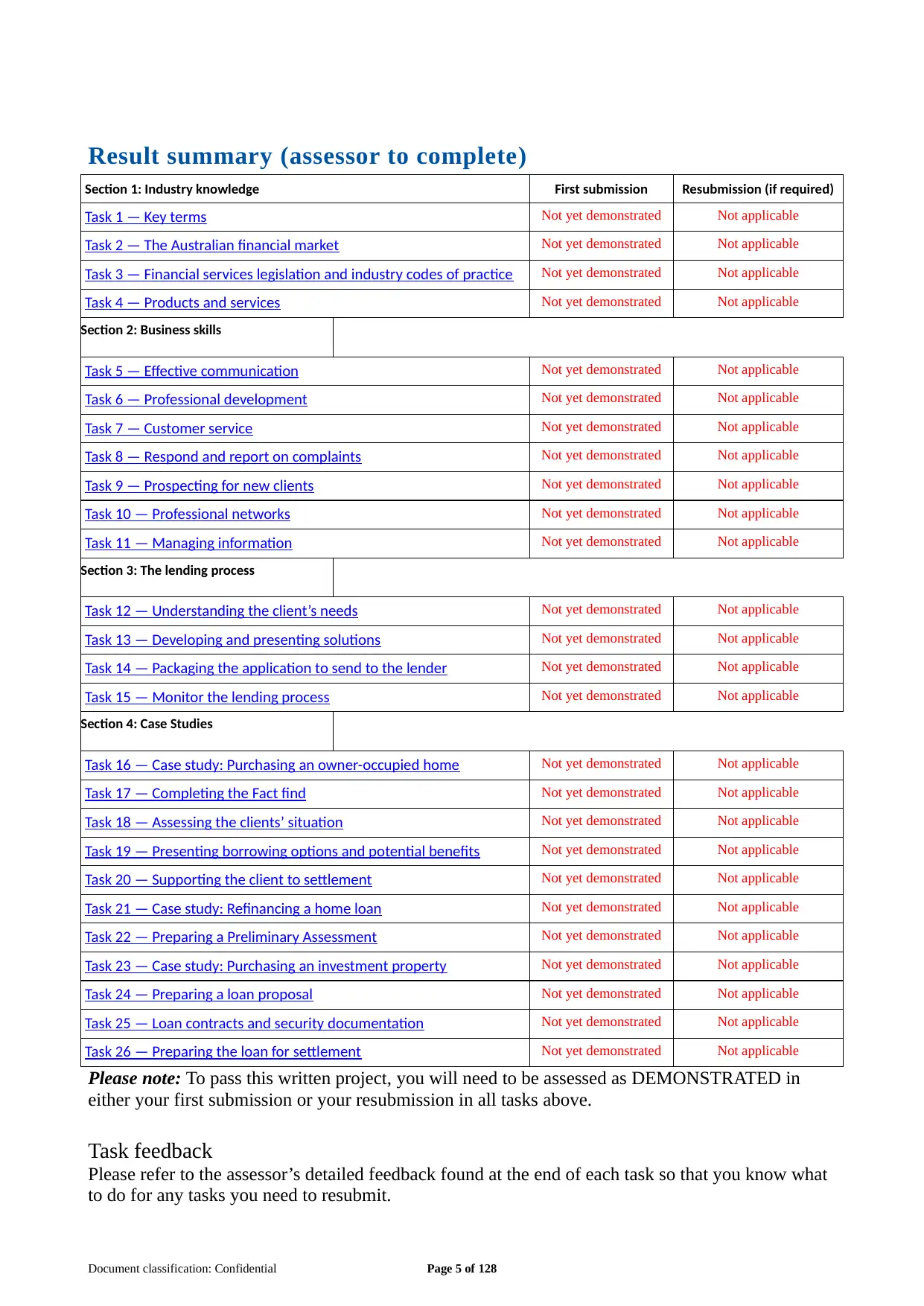

Result summary (assessor to complete)

Section 1: Industry knowledge First submission Resubmission (if required)

Task 1 — Key terms Not yet demonstrated Not applicable

Task 2 — The Australian financial market Not yet demonstrated Not applicable

Task 3 — Financial services legislation and industry codes of practice Not yet demonstrated Not applicable

Task 4 — Products and services Not yet demonstrated Not applicable

Section 2: Business skills

Task 5 — Effective communication Not yet demonstrated Not applicable

Task 6 — Professional development Not yet demonstrated Not applicable

Task 7 — Customer service Not yet demonstrated Not applicable

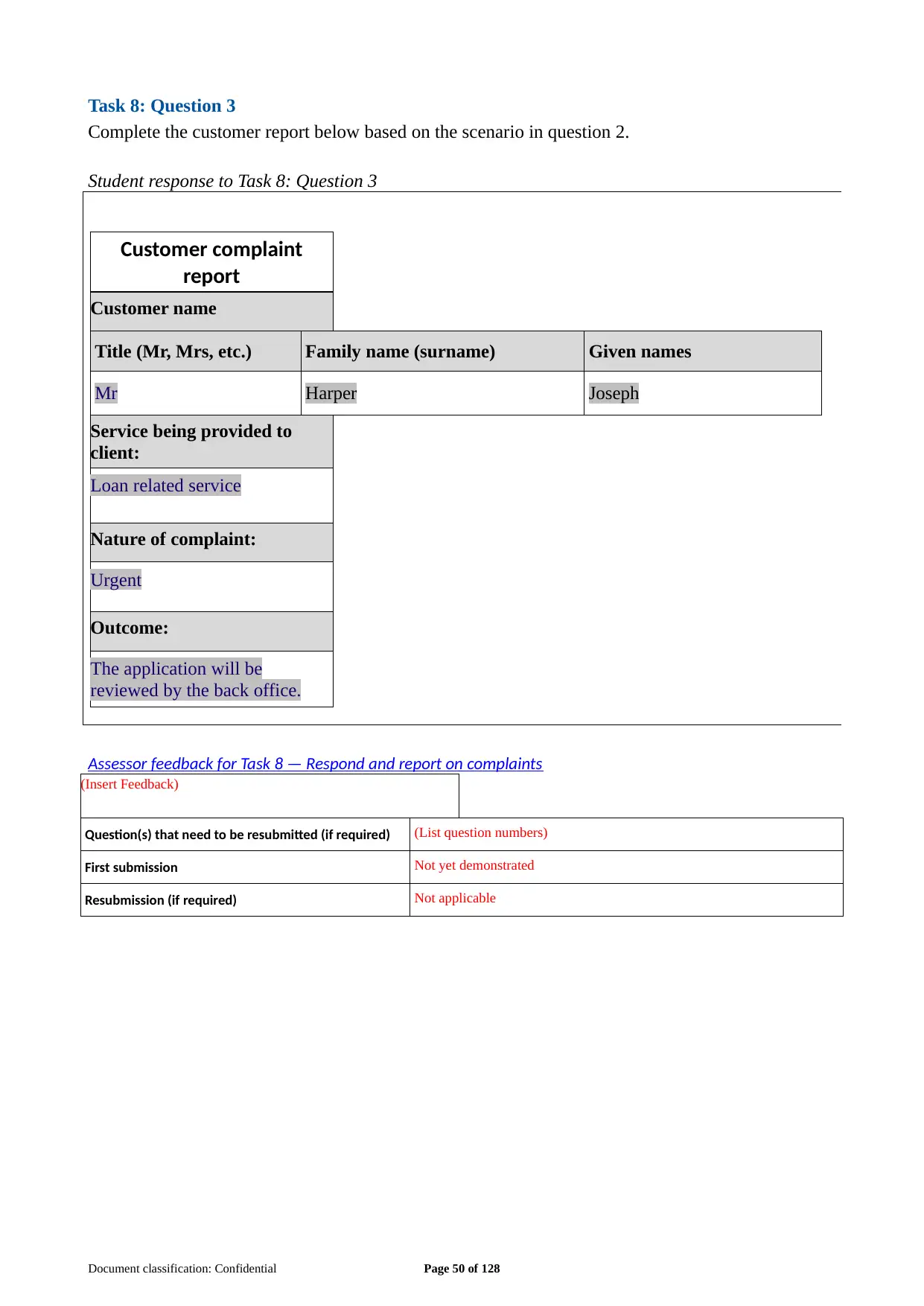

Task 8 — Respond and report on complaints Not yet demonstrated Not applicable

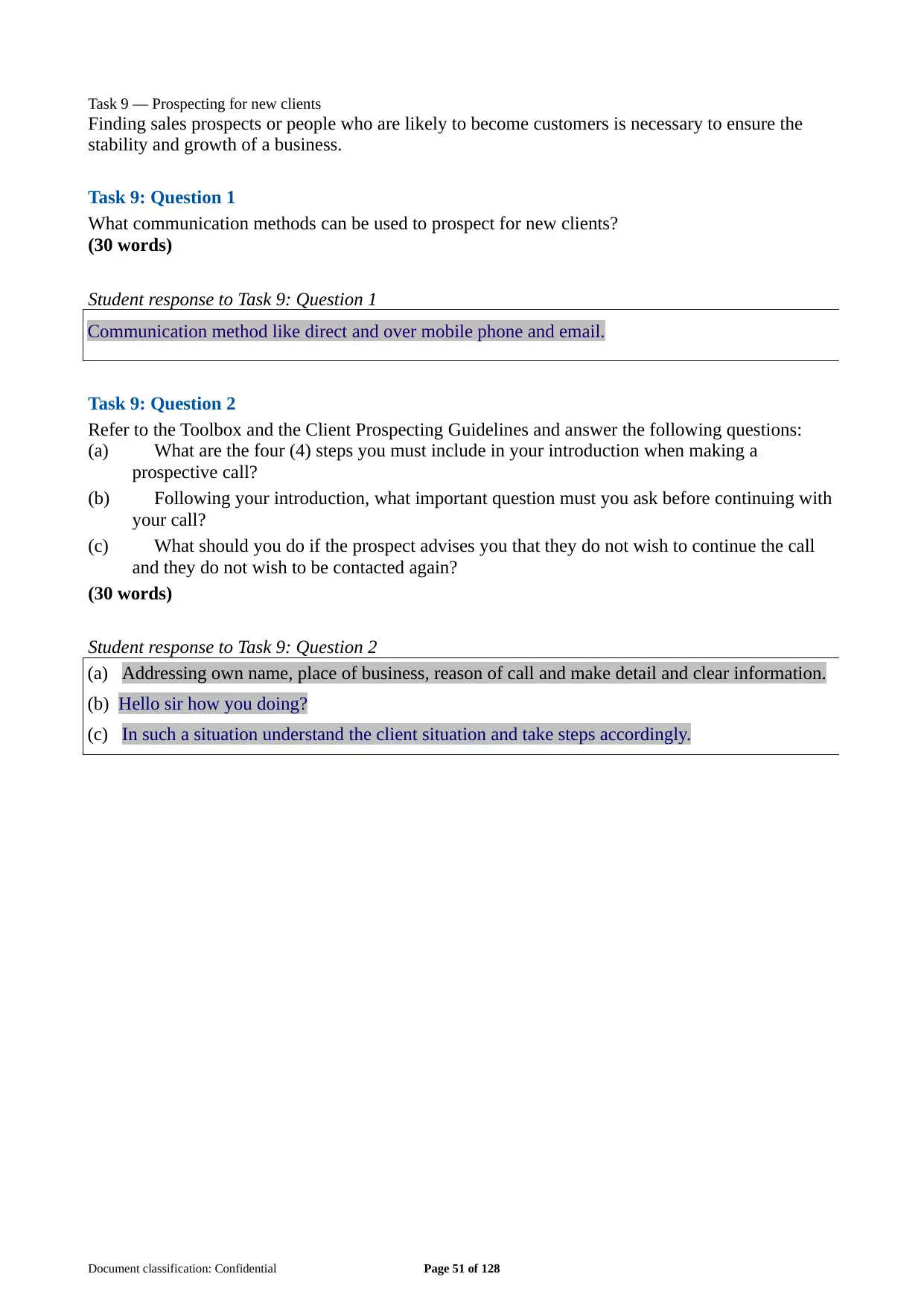

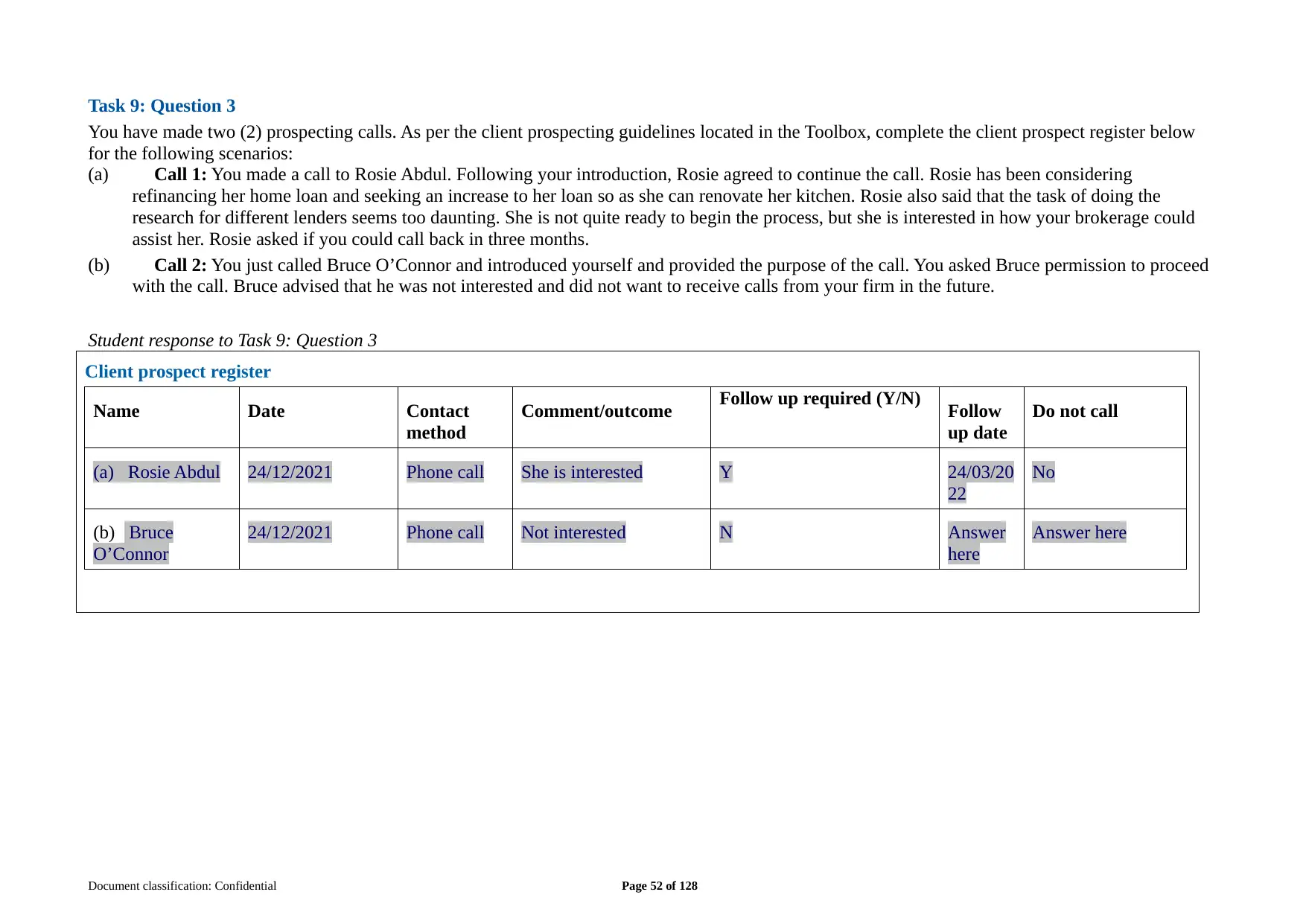

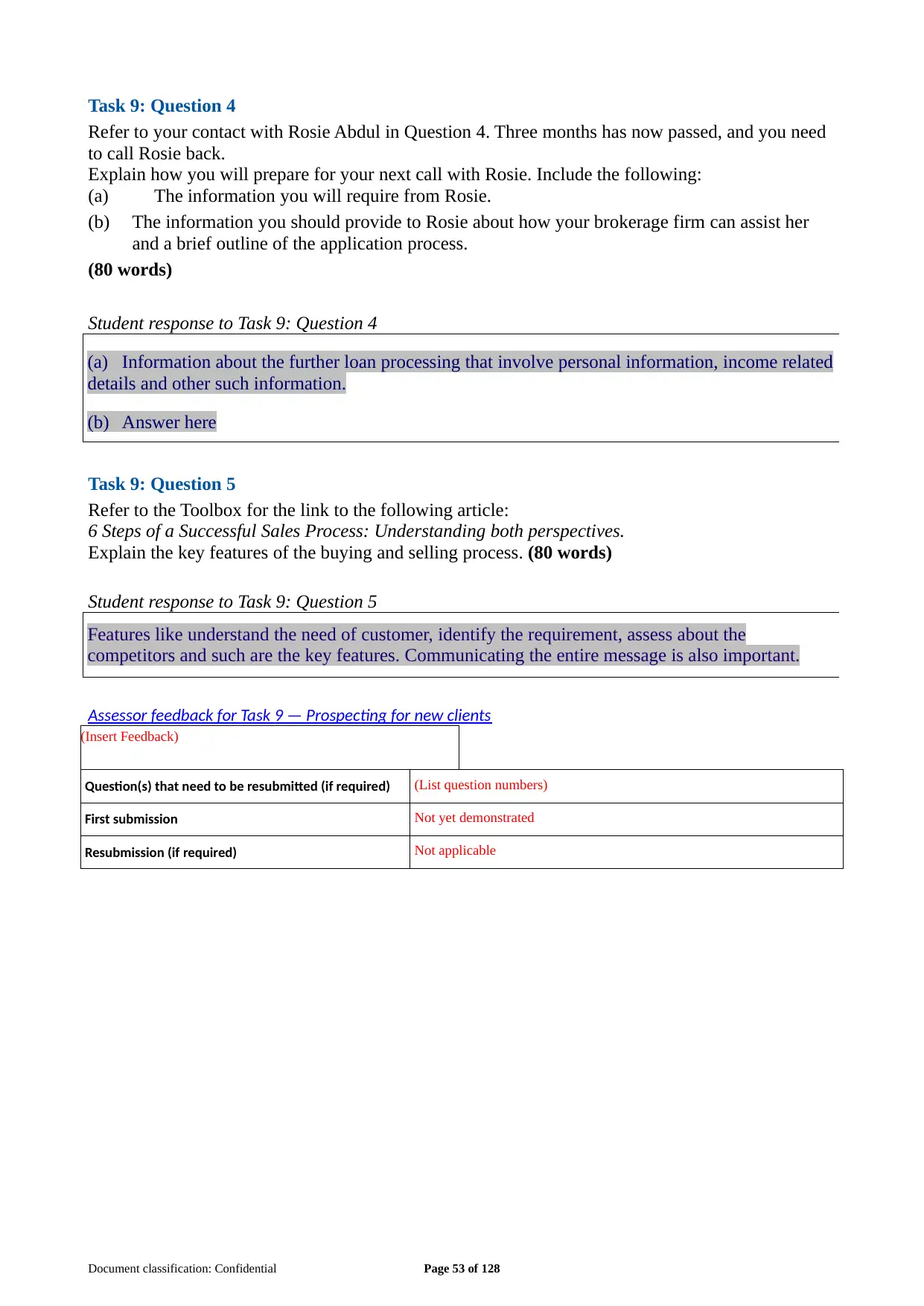

Task 9 — Prospecting for new clients Not yet demonstrated Not applicable

Task 10 — Professional networks Not yet demonstrated Not applicable

Task 11 — Managing information Not yet demonstrated Not applicable

Section 3: The lending process

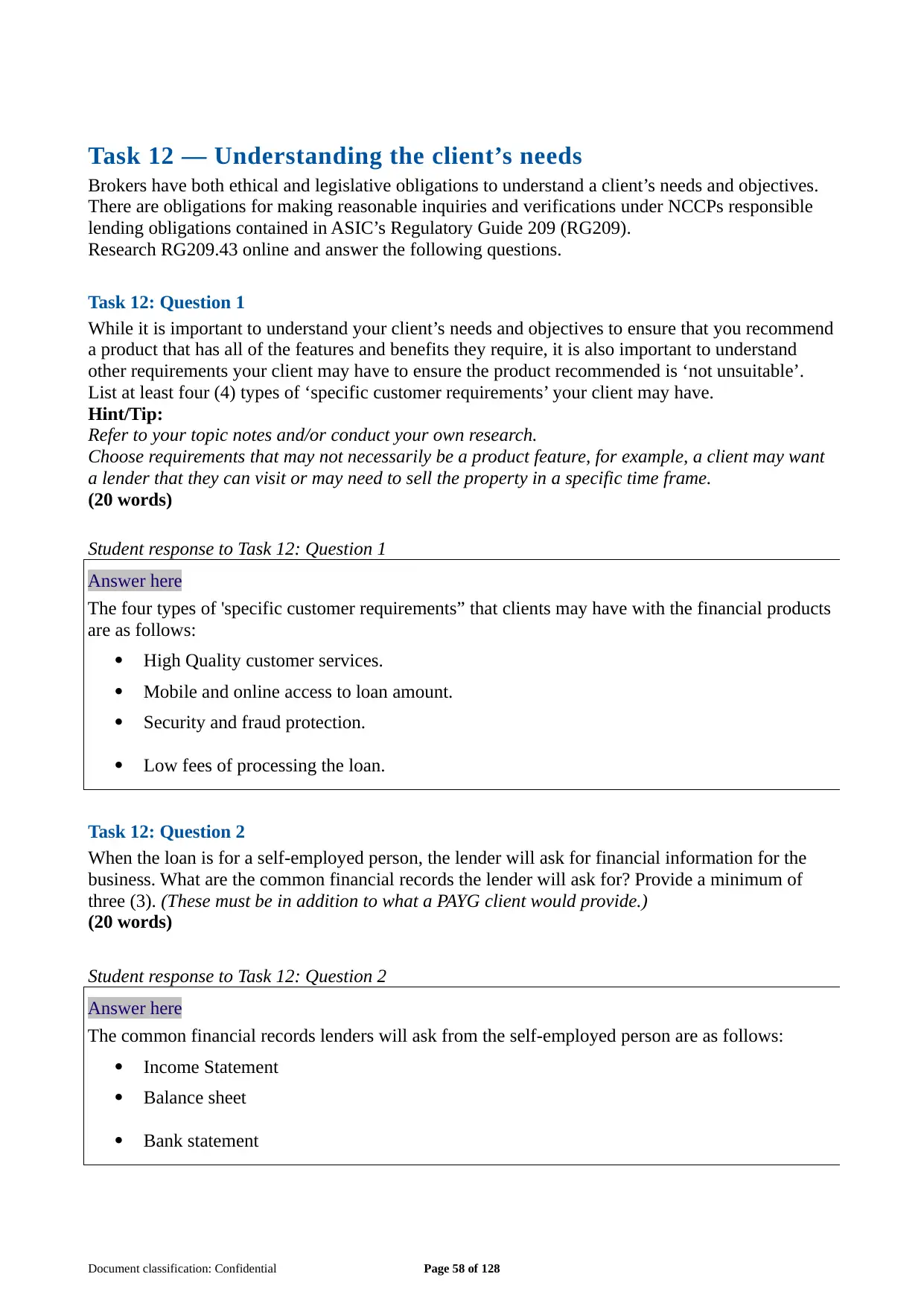

Task 12 — Understanding the client’s needs Not yet demonstrated Not applicable

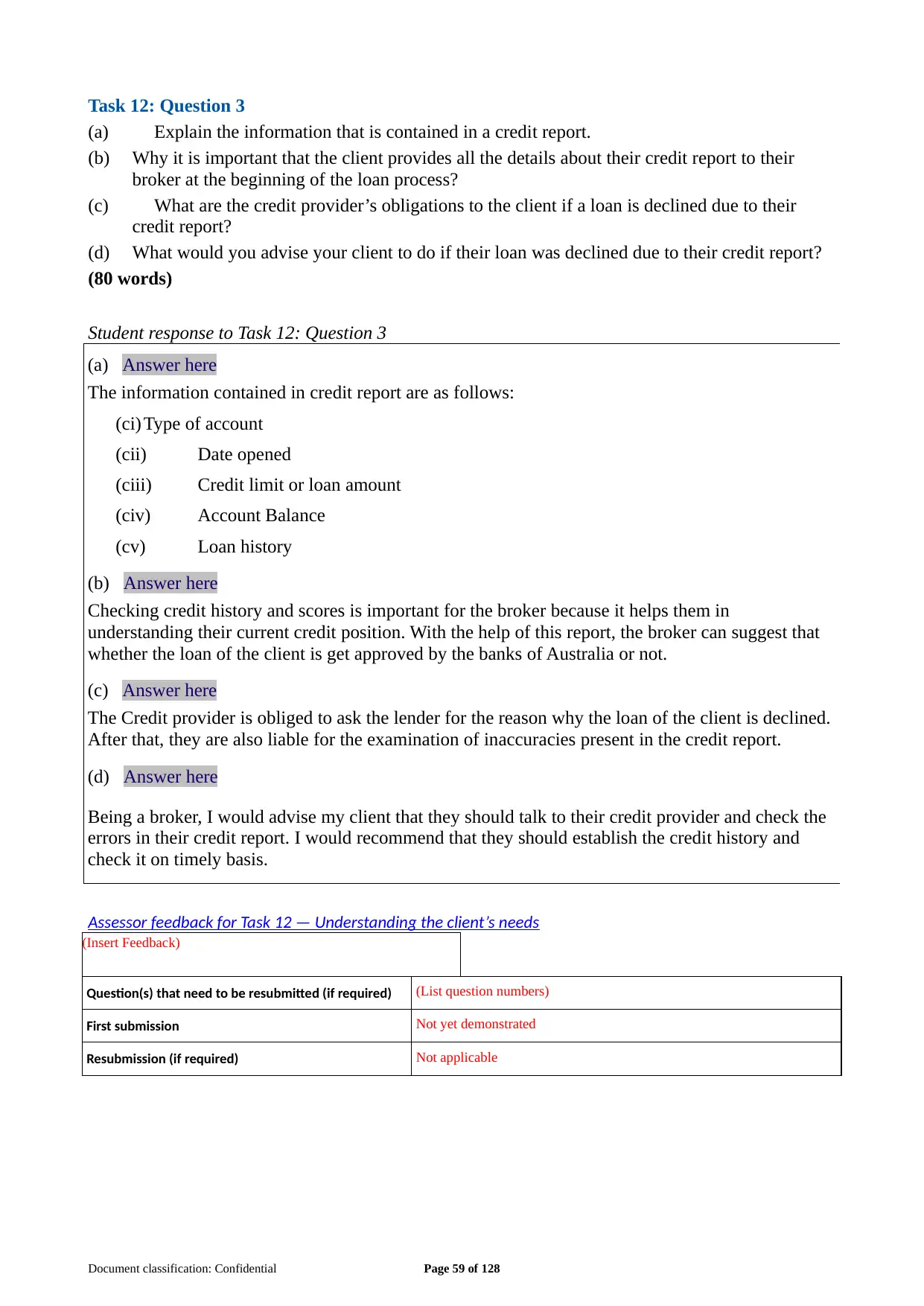

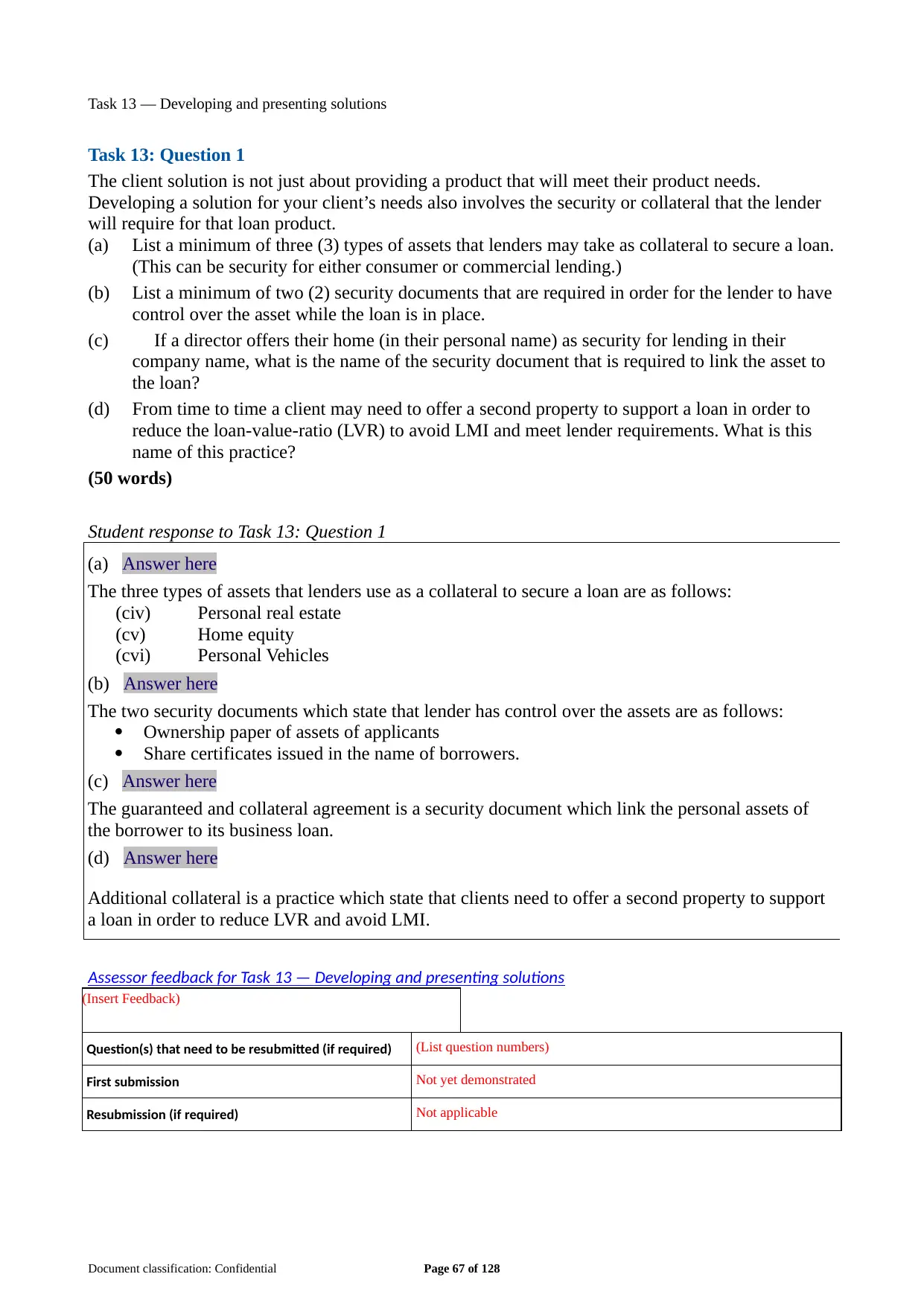

Task 13 — Developing and presenting solutions Not yet demonstrated Not applicable

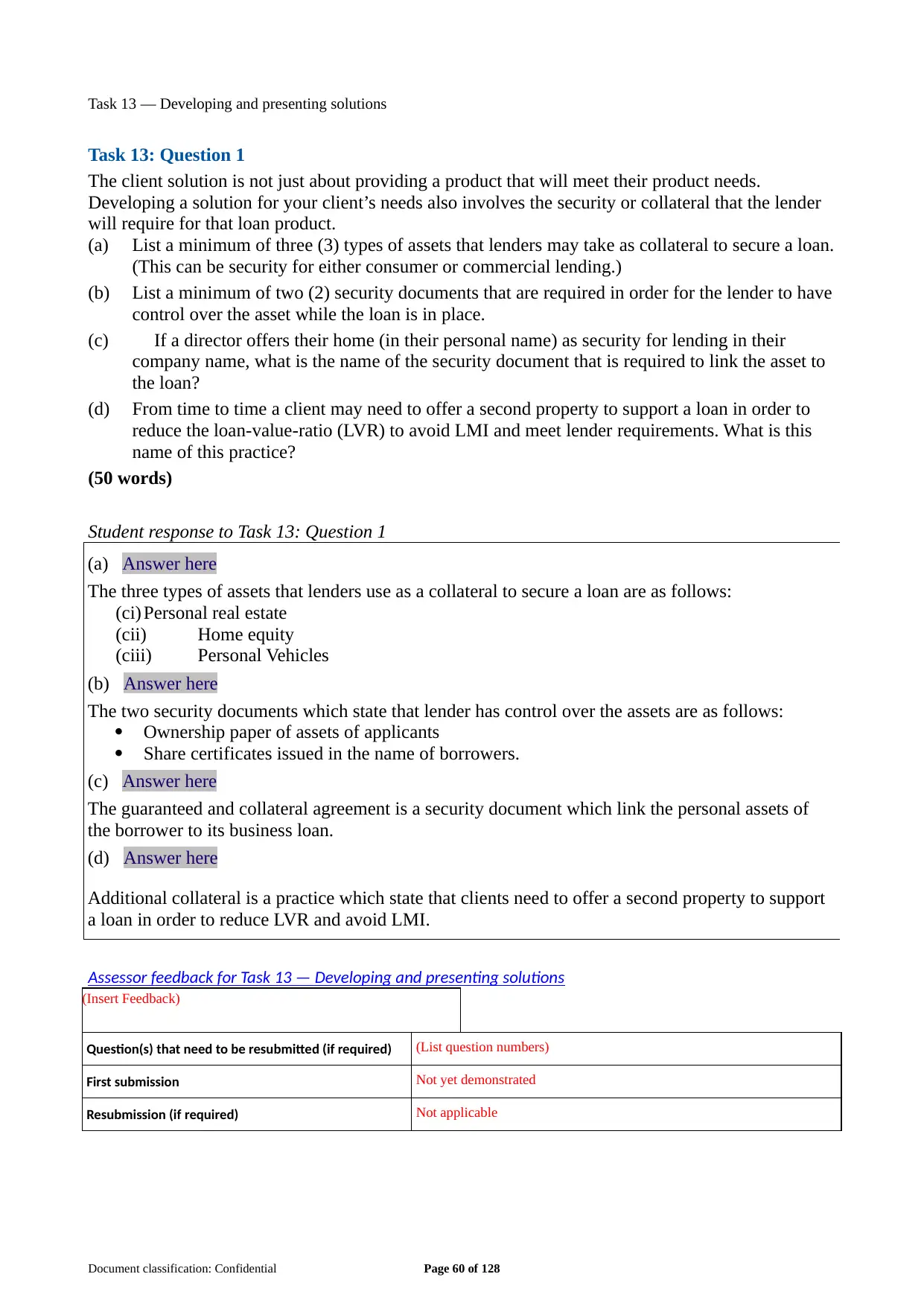

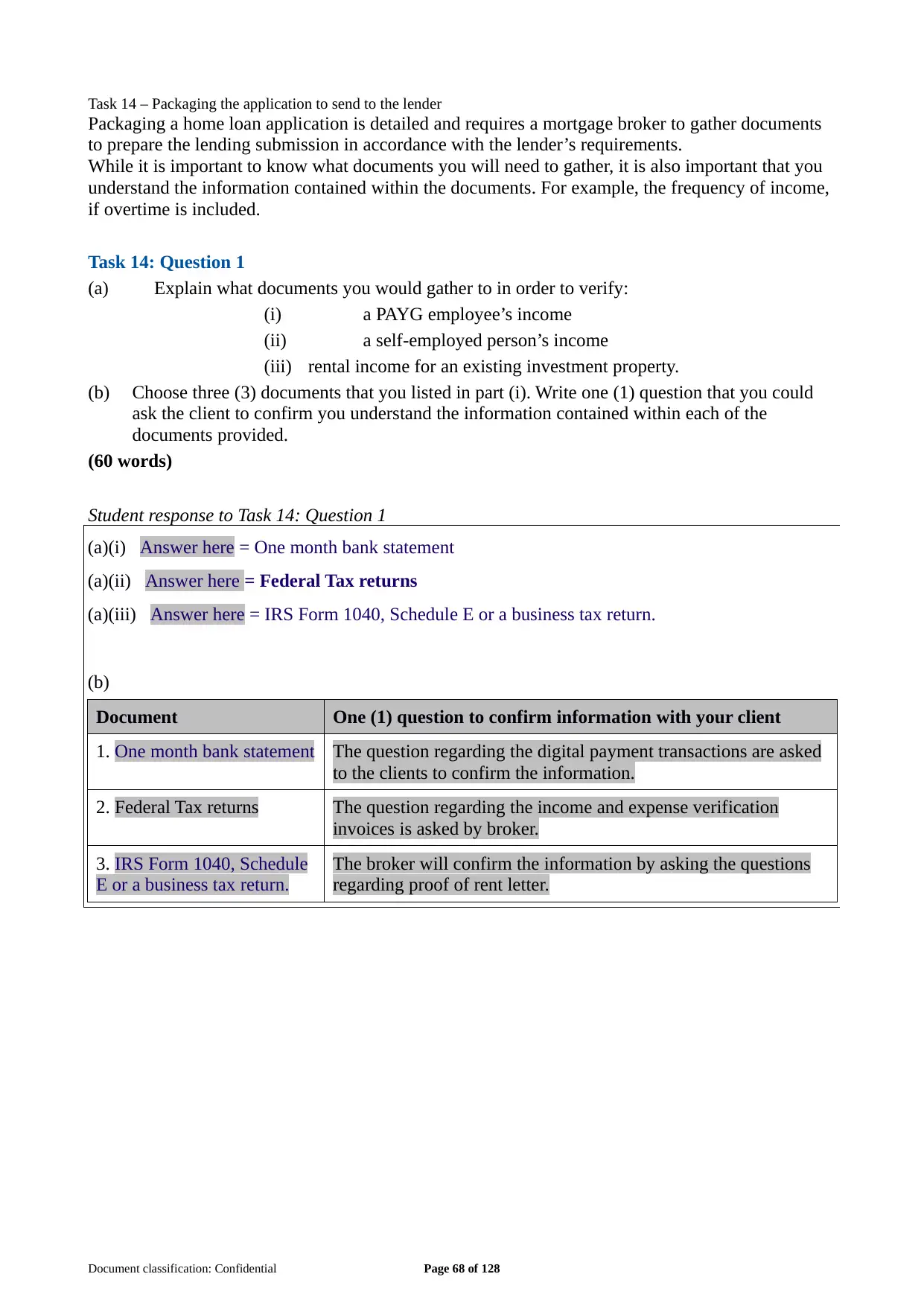

Task 14 — Packaging the application to send to the lender Not yet demonstrated Not applicable

Task 15 — Monitor the lending process Not yet demonstrated Not applicable

Section 4: Case Studies

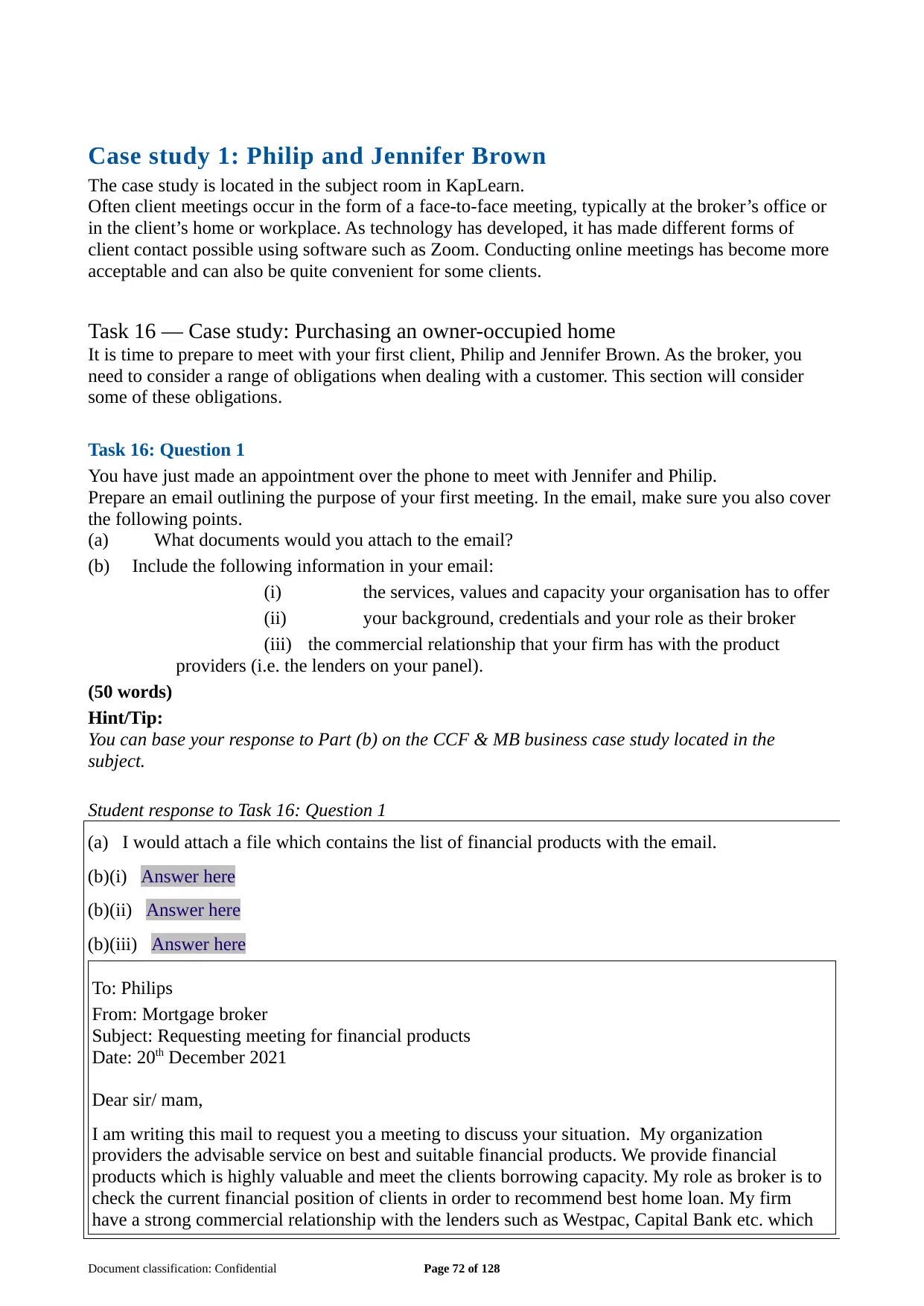

Task 16 — Case study: Purchasing an owner-occupied home Not yet demonstrated Not applicable

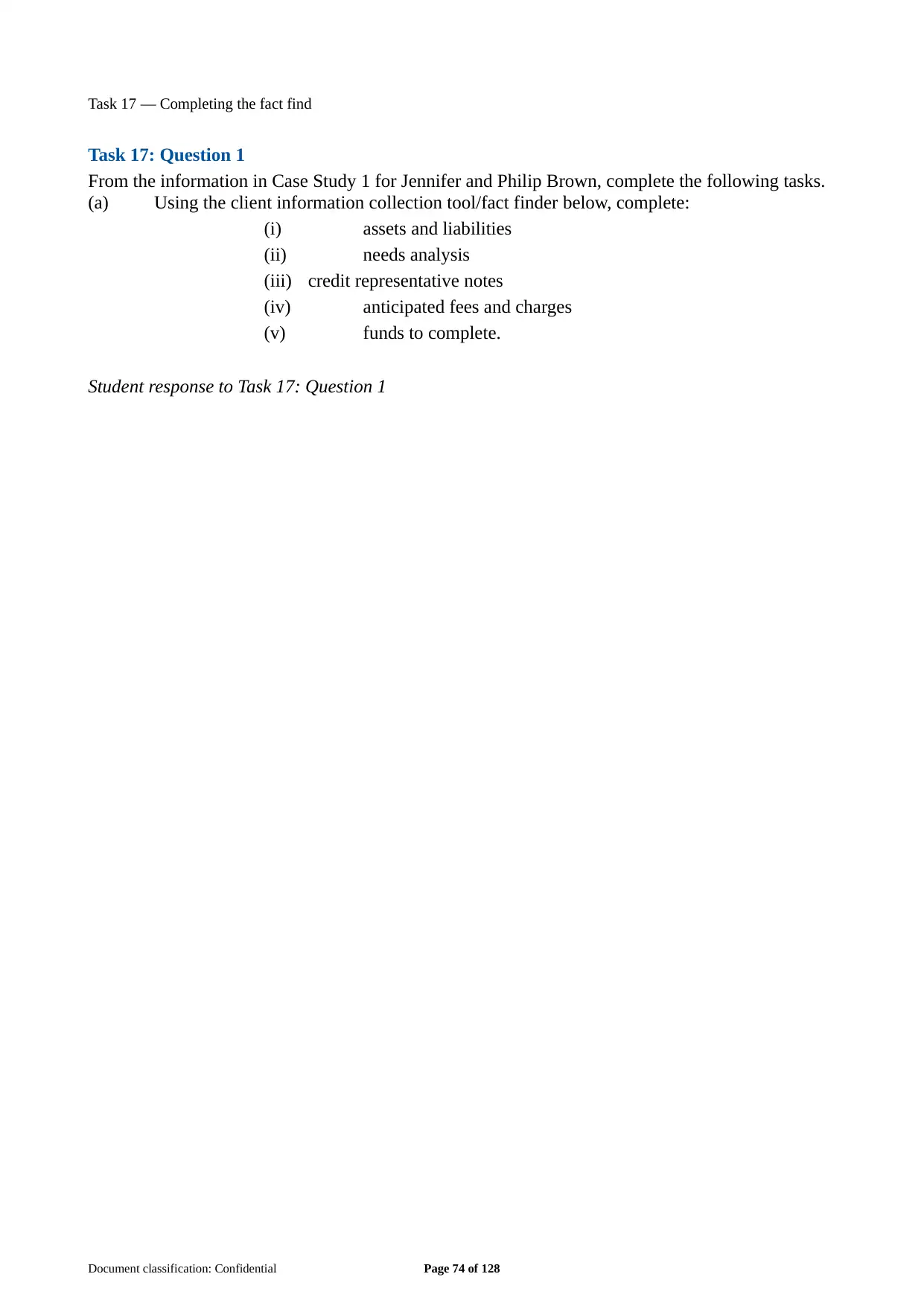

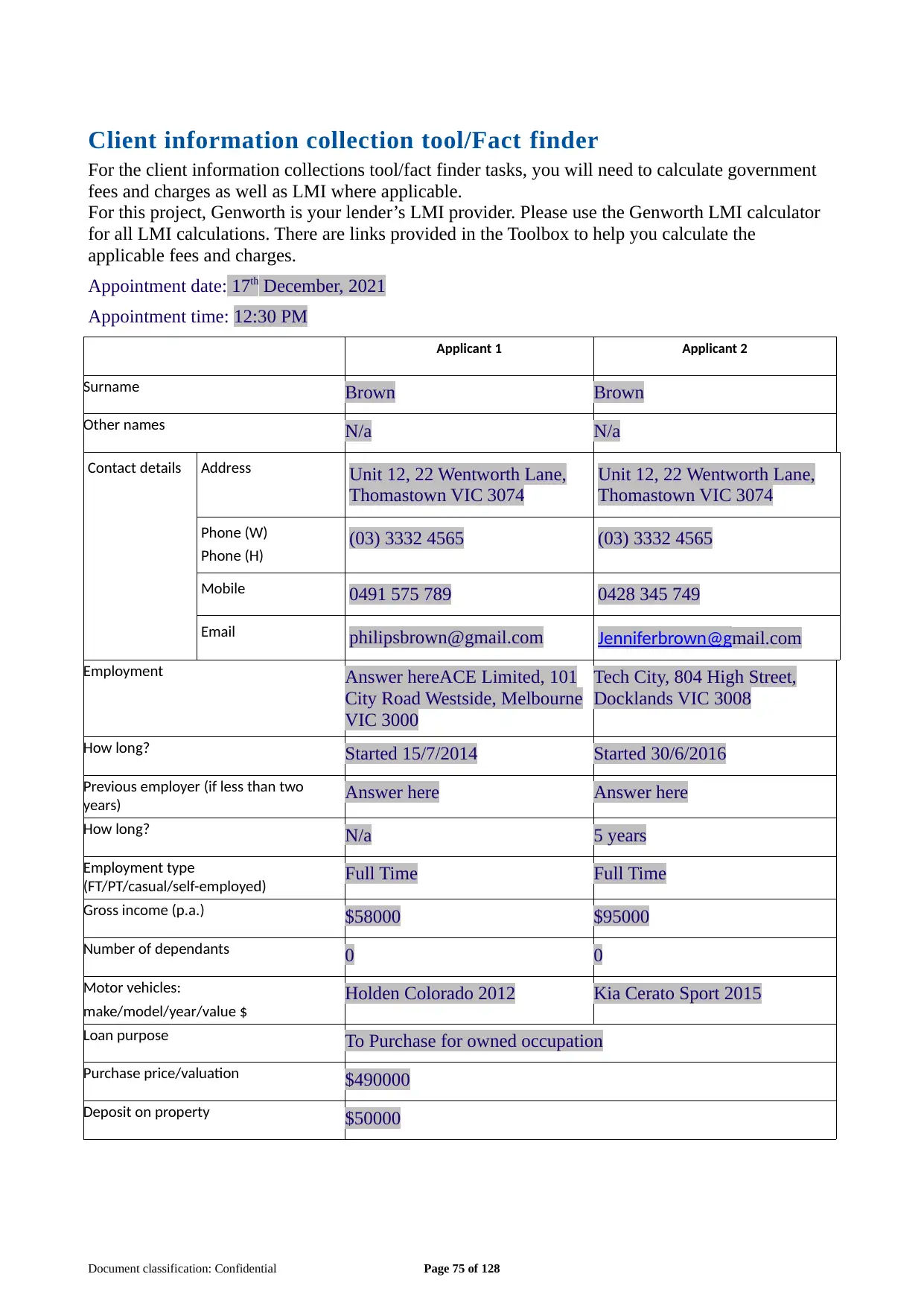

Task 17 — Completing the Fact find Not yet demonstrated Not applicable

Task 18 — Assessing the clients’ situation Not yet demonstrated Not applicable

Task 19 — Presenting borrowing options and potential benefits Not yet demonstrated Not applicable

Task 20 — Supporting the client to settlement Not yet demonstrated Not applicable

Task 21 — Case study: Refinancing a home loan Not yet demonstrated Not applicable

Task 22 — Preparing a Preliminary Assessment Not yet demonstrated Not applicable

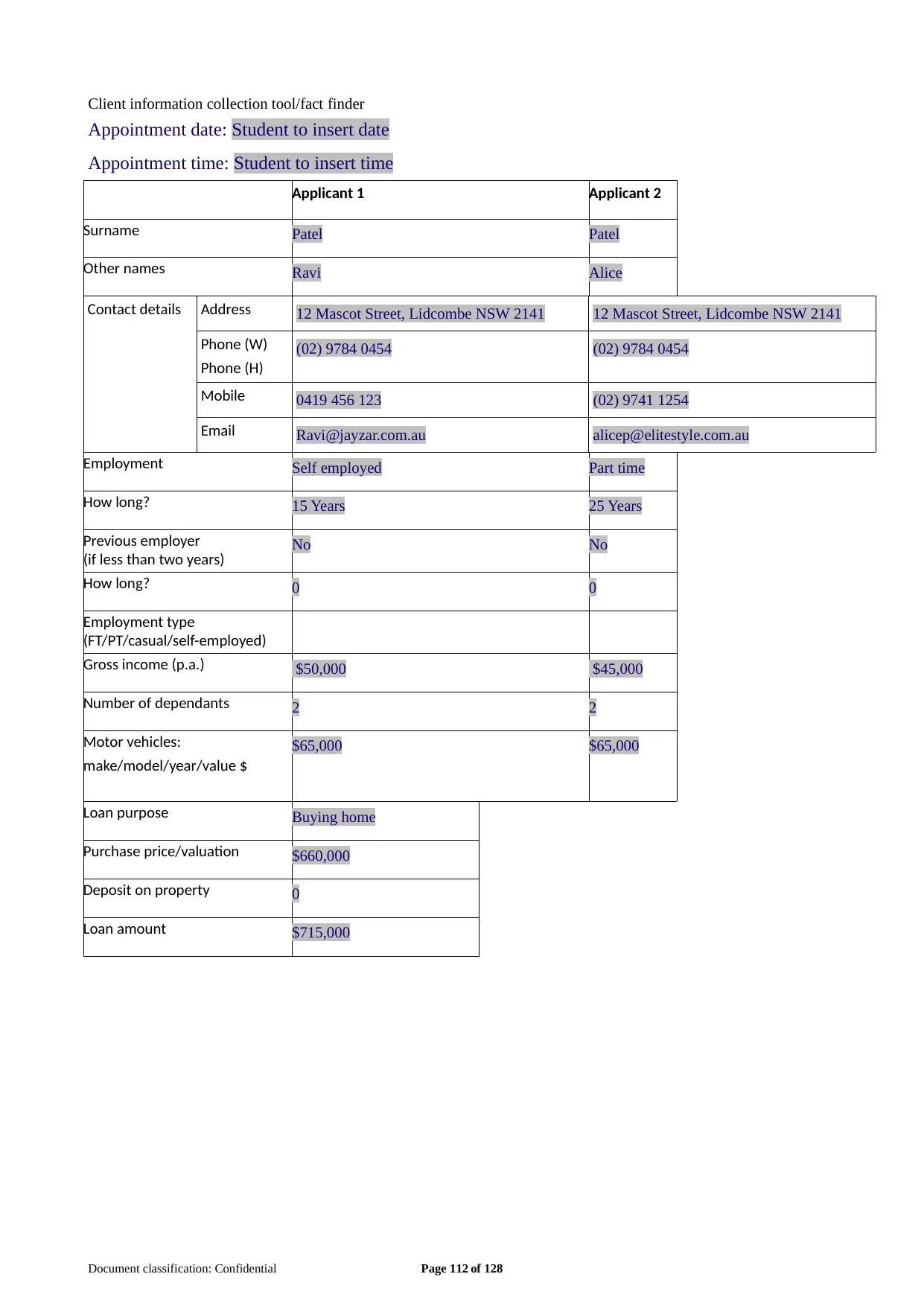

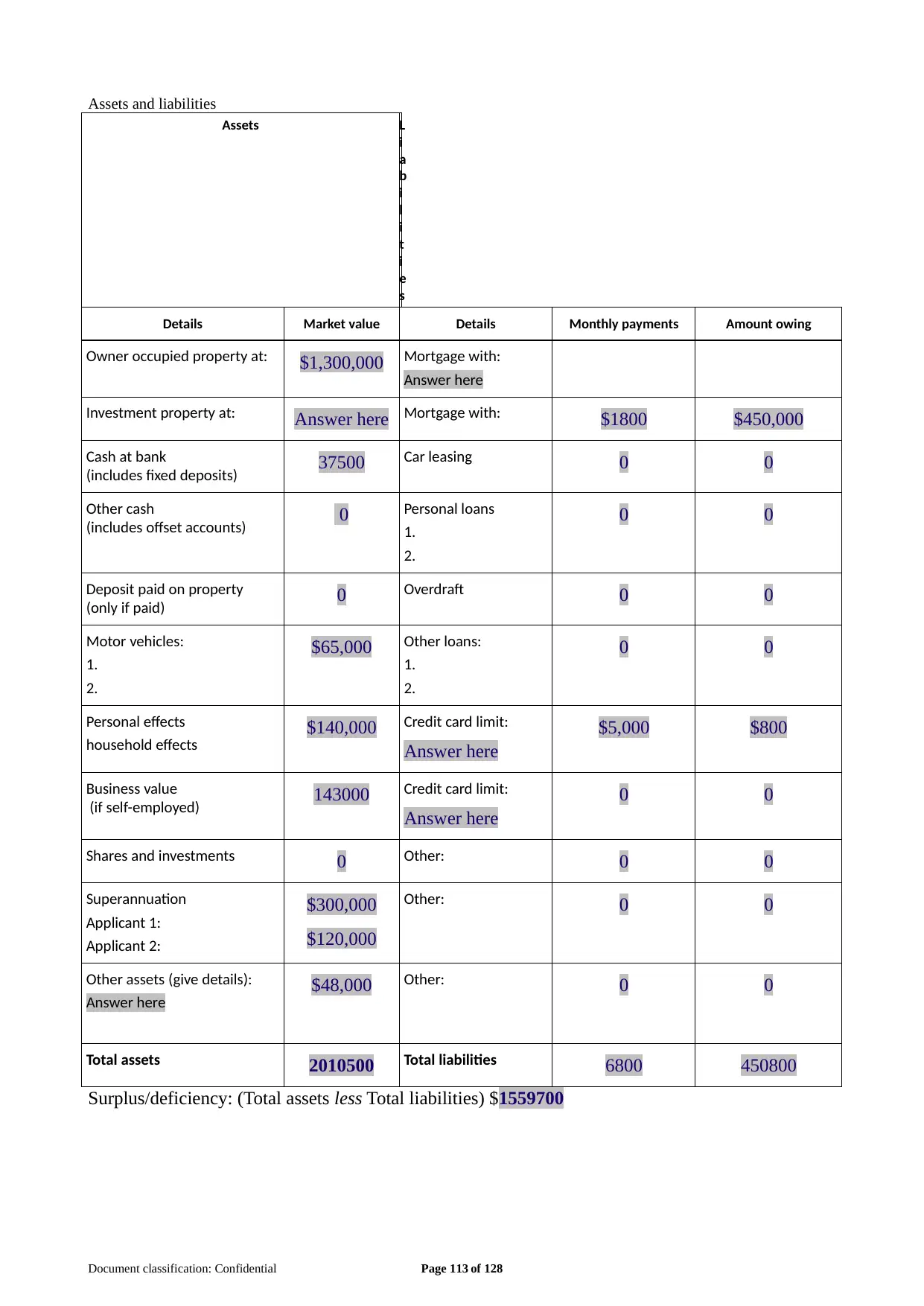

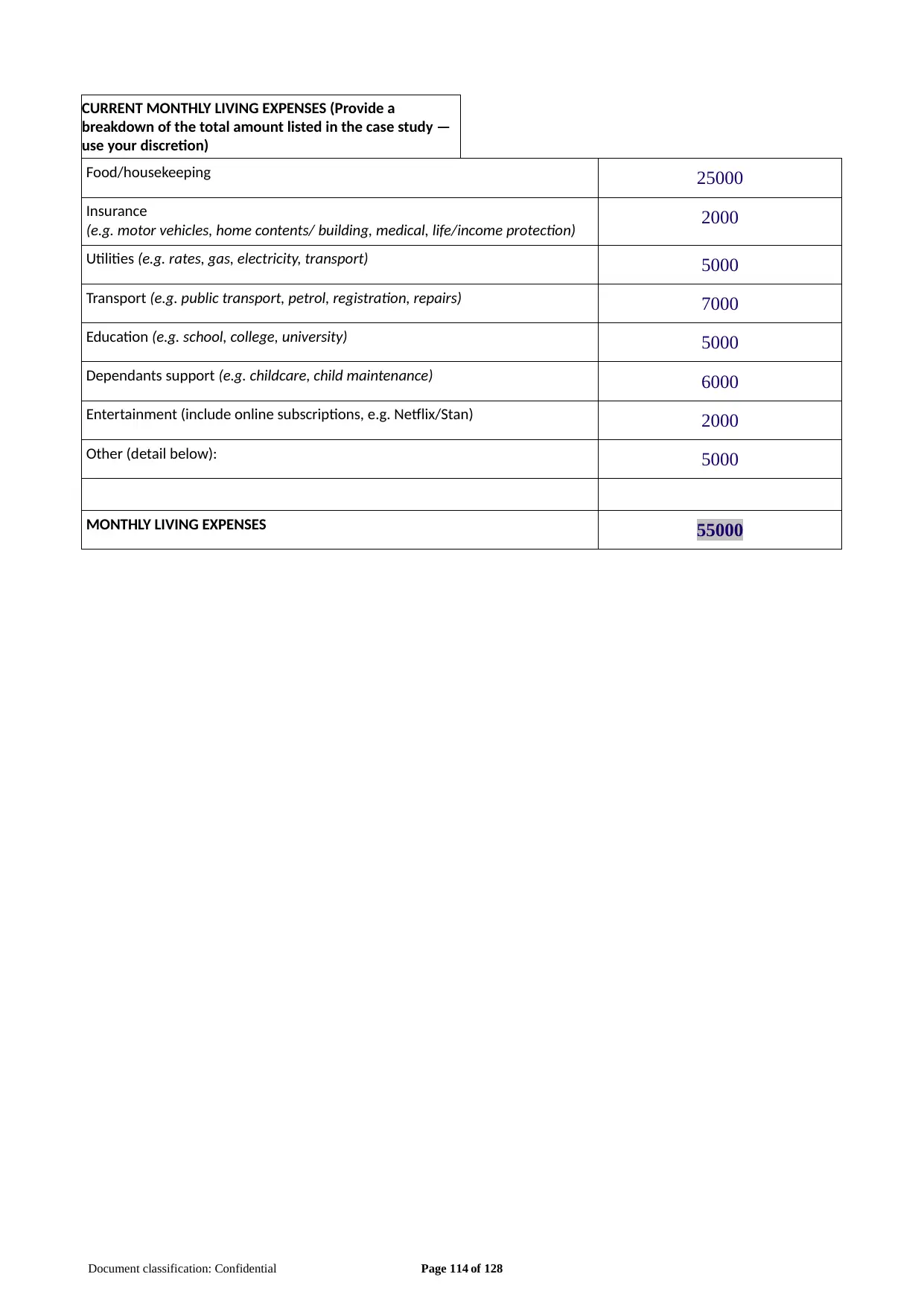

Task 23 — Case study: Purchasing an investment property Not yet demonstrated Not applicable

Task 24 — Preparing a loan proposal Not yet demonstrated Not applicable

Task 25 — Loan contracts and security documentation Not yet demonstrated Not applicable

Task 26 — Preparing the loan for settlement Not yet demonstrated Not applicable

Please note: To pass this written project, you will need to be assessed as DEMONSTRATED in

either your first submission or your resubmission in all tasks above.

Task feedback

Please refer to the assessor’s detailed feedback found at the end of each task so that you know what

to do for any tasks you need to resubmit.

Document classification: Confidential Page 5 of 128

Section 1: Industry knowledge First submission Resubmission (if required)

Task 1 — Key terms Not yet demonstrated Not applicable

Task 2 — The Australian financial market Not yet demonstrated Not applicable

Task 3 — Financial services legislation and industry codes of practice Not yet demonstrated Not applicable

Task 4 — Products and services Not yet demonstrated Not applicable

Section 2: Business skills

Task 5 — Effective communication Not yet demonstrated Not applicable

Task 6 — Professional development Not yet demonstrated Not applicable

Task 7 — Customer service Not yet demonstrated Not applicable

Task 8 — Respond and report on complaints Not yet demonstrated Not applicable

Task 9 — Prospecting for new clients Not yet demonstrated Not applicable

Task 10 — Professional networks Not yet demonstrated Not applicable

Task 11 — Managing information Not yet demonstrated Not applicable

Section 3: The lending process

Task 12 — Understanding the client’s needs Not yet demonstrated Not applicable

Task 13 — Developing and presenting solutions Not yet demonstrated Not applicable

Task 14 — Packaging the application to send to the lender Not yet demonstrated Not applicable

Task 15 — Monitor the lending process Not yet demonstrated Not applicable

Section 4: Case Studies

Task 16 — Case study: Purchasing an owner-occupied home Not yet demonstrated Not applicable

Task 17 — Completing the Fact find Not yet demonstrated Not applicable

Task 18 — Assessing the clients’ situation Not yet demonstrated Not applicable

Task 19 — Presenting borrowing options and potential benefits Not yet demonstrated Not applicable

Task 20 — Supporting the client to settlement Not yet demonstrated Not applicable

Task 21 — Case study: Refinancing a home loan Not yet demonstrated Not applicable

Task 22 — Preparing a Preliminary Assessment Not yet demonstrated Not applicable

Task 23 — Case study: Purchasing an investment property Not yet demonstrated Not applicable

Task 24 — Preparing a loan proposal Not yet demonstrated Not applicable

Task 25 — Loan contracts and security documentation Not yet demonstrated Not applicable

Task 26 — Preparing the loan for settlement Not yet demonstrated Not applicable

Please note: To pass this written project, you will need to be assessed as DEMONSTRATED in

either your first submission or your resubmission in all tasks above.

Task feedback

Please refer to the assessor’s detailed feedback found at the end of each task so that you know what

to do for any tasks you need to resubmit.

Document classification: Confidential Page 5 of 128

Before you begin

Read everything in this document before you start your written project for Certificate IV in Finance

and Mortgage Broking (CFMB_v1).

Document classification: Confidential Page 6 of 128

Read everything in this document before you start your written project for Certificate IV in Finance

and Mortgage Broking (CFMB_v1).

Document classification: Confidential Page 6 of 128

About this document

This document is the written project — half of the overall Written and Oral Project.

This document includes the following parts:

• Instructions for completing and submitting this project

• Section 1: Working in financial services

A case study with a series of short-answer questions:

– Task 1 — Key terms

– Task 2 — Establishing a level of financial knowledge

– Task 3 — Financial services legislation and industry codes of practice

– Task 4 — Products and services.

• Section 2: Business skills

– Task 5 — Effective communication

– Task 6 — Professional development

– Task 7 — Customer service

– Task 8 — Respond and report on complaints

– Task 9 — Prospecting for new clients

– Task 10 — Professional networks

– Task 11 — Managing information.

• Section 3: The lending process

A case study with a series of short-answer questions:

– Task 12 — Understanding the client’s needs

– Task 13 — Developing and presenting solutions

– Task 14 — Packaging the application to send to the lender

– Task 15 — Monitor the lending process.

• Section 4: Case studies

– Task 16 — Case study — Purchasing an owner-occupied home

– Task 17 — Completing the Fact find

– Task 18 — Assessing the clients’ situation

– Task 19 — Presenting borrowing options and potential benefits

– Task 20 — Supporting the client to settlement

– Task 21 — Case study – Refinancing a home loan

– Task 22 — Preparing a preliminary assessment

– Task 23 — Case study – Purchasing an investment property

– Task 24 — Preparing a loan proposal

– Task 25 — Loan contracts and security documentation

– Task 26 — Preparing the loan for settlement.

Document classification: Confidential Page 7 of 128

This document is the written project — half of the overall Written and Oral Project.

This document includes the following parts:

• Instructions for completing and submitting this project

• Section 1: Working in financial services

A case study with a series of short-answer questions:

– Task 1 — Key terms

– Task 2 — Establishing a level of financial knowledge

– Task 3 — Financial services legislation and industry codes of practice

– Task 4 — Products and services.

• Section 2: Business skills

– Task 5 — Effective communication

– Task 6 — Professional development

– Task 7 — Customer service

– Task 8 — Respond and report on complaints

– Task 9 — Prospecting for new clients

– Task 10 — Professional networks

– Task 11 — Managing information.

• Section 3: The lending process

A case study with a series of short-answer questions:

– Task 12 — Understanding the client’s needs

– Task 13 — Developing and presenting solutions

– Task 14 — Packaging the application to send to the lender

– Task 15 — Monitor the lending process.

• Section 4: Case studies

– Task 16 — Case study — Purchasing an owner-occupied home

– Task 17 — Completing the Fact find

– Task 18 — Assessing the clients’ situation

– Task 19 — Presenting borrowing options and potential benefits

– Task 20 — Supporting the client to settlement

– Task 21 — Case study – Refinancing a home loan

– Task 22 — Preparing a preliminary assessment

– Task 23 — Case study – Purchasing an investment property

– Task 24 — Preparing a loan proposal

– Task 25 — Loan contracts and security documentation

– Task 26 — Preparing the loan for settlement.

Document classification: Confidential Page 7 of 128

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

How to use the study plan

We recommend that you use the study plan for this subject to help you manage your time to

complete the written project within your enrolment period. Your study plan is in the KapLearn

Certificate IV in Finance and Mortgage Broking (CFMBv1) subject room.

Document classification: Confidential Page 8 of 128

We recommend that you use the study plan for this subject to help you manage your time to

complete the written project within your enrolment period. Your study plan is in the KapLearn

Certificate IV in Finance and Mortgage Broking (CFMBv1) subject room.

Document classification: Confidential Page 8 of 128

Instructions for completing and submitting the

written project

Document classification: Confidential Page 9 of 128

written project

Document classification: Confidential Page 9 of 128

Completing the written project

Document classification: Confidential Page 10 of 128

Document classification: Confidential Page 10 of 128

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Saving your work

Download this document to your desktop, type your answers in the spaces provided and save your

work regularly.

• Use the template provided, as other formats will not be accepted for these projects.

• Name your file as follows:

Studentnumber_SubjectCode_Project_versionnumber_Submissionnumber

(e.g. 12345678_CFMB_AS_v1A1_Submission1).

• Include your student ID on the first page of the project.

Before you submit your work, please do a spell check and proofread your work to ensure that

everything is clear and unambiguous.

Document classification: Confidential Page 11 of 128

Download this document to your desktop, type your answers in the spaces provided and save your

work regularly.

• Use the template provided, as other formats will not be accepted for these projects.

• Name your file as follows:

Studentnumber_SubjectCode_Project_versionnumber_Submissionnumber

(e.g. 12345678_CFMB_AS_v1A1_Submission1).

• Include your student ID on the first page of the project.

Before you submit your work, please do a spell check and proofread your work to ensure that

everything is clear and unambiguous.

Document classification: Confidential Page 11 of 128

Word count

The word count shown with each question is indicative only. You will not be penalised for

exceeding the suggested word count. Please do not include additional information which is outside

the scope of the question.

Document classification: Confidential Page 12 of 128

The word count shown with each question is indicative only. You will not be penalised for

exceeding the suggested word count. Please do not include additional information which is outside

the scope of the question.

Document classification: Confidential Page 12 of 128

Additional research

When completing the ‘Client information collection tools’, assumptions are permitted although they

must not be in conflict with the information provided in the Case Studies. All assumptions must be

noted.

You may be required to conduct your own research in addition to the topic notes provided to source

information to answer some of the project questions. You may also be required to source additional

information from other organisations within the finance industry to find the products or services to

meet your client’s requirements, to source indicative interest rates and to calculate any fees and

charges that may be applicable.

Document classification: Confidential Page 13 of 128

When completing the ‘Client information collection tools’, assumptions are permitted although they

must not be in conflict with the information provided in the Case Studies. All assumptions must be

noted.

You may be required to conduct your own research in addition to the topic notes provided to source

information to answer some of the project questions. You may also be required to source additional

information from other organisations within the finance industry to find the products or services to

meet your client’s requirements, to source indicative interest rates and to calculate any fees and

charges that may be applicable.

Document classification: Confidential Page 13 of 128

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Submitting the written project

Only Microsoft Office compatible written projects submitted in the template file will be accepted

for marking by Kaplan Professional Education. You need to save and submit this entire document.

Do not remove any sections of the document.

Do not save your completed project as a PDF.

The written project must be completed before submitting it to Kaplan Professional Education.

Incomplete written projects will be returned to you unmarked. The written project must be

submitted together with the oral project. If you do not submit both completed projects at the

one time it will be returned to you unmarked.

The maximum file size is 20MB for the written and oral project. Once you submit your

written project for marking you will be unable to make any further changes to it.

Once you submit your written project for marking you will be unable to make any further changes to

it.

You are able to submit both projects earlier than the deadline if you are confident you have

completed all parts and have prepared a quality submission.

Please refer to the Project submission/resubmission videos in the Assessment section of KapLearn

under your ‘Project Enrolment’ for details on how to submit/resubmit your written project.

Your Written Project and Oral Project must be submitted together on or before your due date.

Please check KapLearn for the due date.

Document classification: Confidential Page 14 of 128

Only Microsoft Office compatible written projects submitted in the template file will be accepted

for marking by Kaplan Professional Education. You need to save and submit this entire document.

Do not remove any sections of the document.

Do not save your completed project as a PDF.

The written project must be completed before submitting it to Kaplan Professional Education.

Incomplete written projects will be returned to you unmarked. The written project must be

submitted together with the oral project. If you do not submit both completed projects at the

one time it will be returned to you unmarked.

The maximum file size is 20MB for the written and oral project. Once you submit your

written project for marking you will be unable to make any further changes to it.

Once you submit your written project for marking you will be unable to make any further changes to

it.

You are able to submit both projects earlier than the deadline if you are confident you have

completed all parts and have prepared a quality submission.

Please refer to the Project submission/resubmission videos in the Assessment section of KapLearn

under your ‘Project Enrolment’ for details on how to submit/resubmit your written project.

Your Written Project and Oral Project must be submitted together on or before your due date.

Please check KapLearn for the due date.

Document classification: Confidential Page 14 of 128

The written project marking process

You have 26 weeks from the date of your enrolment in this subject to submit your

completed project.

If you reach the end of your initial enrolment period and have been deemed ‘Not yet demonstrated’

in one or more assessment items, then an additional four (4) weeks will be granted, provided you

attempted all assessment tasks during the initial enrolment period.

Your assessor will mark your written and oral project and return it to you in the Certificate IV in

Finance and Mortgage Broking (CFMBv1) subject room in KapLearn under the ‘Assessment’ tab.

Document classification: Confidential Page 15 of 128

You have 26 weeks from the date of your enrolment in this subject to submit your

completed project.

If you reach the end of your initial enrolment period and have been deemed ‘Not yet demonstrated’

in one or more assessment items, then an additional four (4) weeks will be granted, provided you

attempted all assessment tasks during the initial enrolment period.

Your assessor will mark your written and oral project and return it to you in the Certificate IV in

Finance and Mortgage Broking (CFMBv1) subject room in KapLearn under the ‘Assessment’ tab.

Document classification: Confidential Page 15 of 128

Make a reasonable attempt

You must demonstrate that you have made a reasonable attempt to answer all of the questions in

your written project. Failure to do so will mean that your project will not be accepted for marking;

therefore, you will not receive the benefit of feedback on your submission.

If you do not meet these requirements, you will be notified. You will then have until your

submission deadline to submit your completed written and oral project.

Document classification: Confidential Page 16 of 128

You must demonstrate that you have made a reasonable attempt to answer all of the questions in

your written project. Failure to do so will mean that your project will not be accepted for marking;

therefore, you will not receive the benefit of feedback on your submission.

If you do not meet these requirements, you will be notified. You will then have until your

submission deadline to submit your completed written and oral project.

Document classification: Confidential Page 16 of 128

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

How your written project is graded

Project tasks are used to determine your ‘competence’ in demonstrating the required knowledge

and/or skills for each subject. As a result, you will be graded as either Demonstrated or Not yet

demonstrated.

Your assessor will follow the below process when marking your project:

• Assess your responses to each question, and sub-parts if applicable, and then determine whether

you have demonstrated competence in each question.

• Determine if, on a holistic basis, your responses to the questions have demonstrated overall

competence.

You must be deemed to be demonstrated in all assessment items in order to be awarded the units

of competency in this subject, including:

• all of the exam questions

• the written and oral project.

‘Not yet demonstrated’ and resubmissions

Should sections of your project be marked as ‘not yet demonstrated’ you will be given an additional

opportunity to amend your responses so that you can demonstrate your competency to the

required level.

You must address the assessor’s feedback in your amended responses. You only need amend those

sections where the assessor has determined you are ‘not yet demonstrated’.

Make changes to your original submission. Use a different text colour for your resubmission.

Your assessor will be in a better position to gauge the quality and nature of your changes. Ensure

you leave your first assessor’s comments in your project, so your second assessor can see the

instructions that were originally provided for you. Do not change any comments made by a

Kaplan assessor.

Units of competency

This written project is your opportunity to demonstrate your competency against these units:

BSBPEF501 Manage personal and professional development

FNSCUS511 Develop and maintain professional relationships in financial services industry

FNSFMB411 Prepare loan applications on behalf of clients

FNSFMB412 Identify client needs and present broking options

FNSFMK515 Comply with financial services regulation and industry codes of practice

FNSINC411 Conduct work according to professional practices in the financial services industry

FNSINC412 Apply and maintain knowledge of financial products and services

FNSSAM411 Sell financial products and services

FNSFMB511 Implement credit contracts in preparation for settlement

FNSSAM403 Prospect for new clients

BSBOPS304 Deliver and monitor a service to customers

BSBOPS404 Implement customer service strategies

Note that the written and oral project is one of two assessments required to meet the requirements

of the units of competency.

Document classification: Confidential Page 17 of 128

Project tasks are used to determine your ‘competence’ in demonstrating the required knowledge

and/or skills for each subject. As a result, you will be graded as either Demonstrated or Not yet

demonstrated.

Your assessor will follow the below process when marking your project:

• Assess your responses to each question, and sub-parts if applicable, and then determine whether

you have demonstrated competence in each question.

• Determine if, on a holistic basis, your responses to the questions have demonstrated overall

competence.

You must be deemed to be demonstrated in all assessment items in order to be awarded the units

of competency in this subject, including:

• all of the exam questions

• the written and oral project.

‘Not yet demonstrated’ and resubmissions

Should sections of your project be marked as ‘not yet demonstrated’ you will be given an additional

opportunity to amend your responses so that you can demonstrate your competency to the

required level.

You must address the assessor’s feedback in your amended responses. You only need amend those

sections where the assessor has determined you are ‘not yet demonstrated’.

Make changes to your original submission. Use a different text colour for your resubmission.

Your assessor will be in a better position to gauge the quality and nature of your changes. Ensure

you leave your first assessor’s comments in your project, so your second assessor can see the

instructions that were originally provided for you. Do not change any comments made by a

Kaplan assessor.

Units of competency

This written project is your opportunity to demonstrate your competency against these units:

BSBPEF501 Manage personal and professional development

FNSCUS511 Develop and maintain professional relationships in financial services industry

FNSFMB411 Prepare loan applications on behalf of clients

FNSFMB412 Identify client needs and present broking options

FNSFMK515 Comply with financial services regulation and industry codes of practice

FNSINC411 Conduct work according to professional practices in the financial services industry

FNSINC412 Apply and maintain knowledge of financial products and services

FNSSAM411 Sell financial products and services

FNSFMB511 Implement credit contracts in preparation for settlement

FNSSAM403 Prospect for new clients

BSBOPS304 Deliver and monitor a service to customers

BSBOPS404 Implement customer service strategies

Note that the written and oral project is one of two assessments required to meet the requirements

of the units of competency.

Document classification: Confidential Page 17 of 128

We are here to help

If you have any questions about this written project, you can post your query at the ‘Ask your Tutor’

forum in your subject room. You can expect an answer within 24 hours of your posting from one of

our technical advisers or student support staff.

Document classification: Confidential Page 18 of 128

If you have any questions about this written project, you can post your query at the ‘Ask your Tutor’

forum in your subject room. You can expect an answer within 24 hours of your posting from one of

our technical advisers or student support staff.

Document classification: Confidential Page 18 of 128

Project tasks (student to complete)

Please note: Throughout the project, you are to assume that you are a finance and mortgage broker.

If you are not currently in a finance and mortgage broker role, your answers are to reflect what you

would do if you were working in the finance and mortgage broking industry. You can also draw on

your current and past work experiences and refer to the topic notes. You may also need to conduct

your own research and consult with people who currently work within the finance and mortgage

broking industry.

Document classification: Confidential Page 19 of 128

Please note: Throughout the project, you are to assume that you are a finance and mortgage broker.

If you are not currently in a finance and mortgage broker role, your answers are to reflect what you

would do if you were working in the finance and mortgage broking industry. You can also draw on

your current and past work experiences and refer to the topic notes. You may also need to conduct

your own research and consult with people who currently work within the finance and mortgage

broking industry.

Document classification: Confidential Page 19 of 128

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Section 1: Industry knowledge

Document classification: Confidential Page 20 of 128

Document classification: Confidential Page 20 of 128

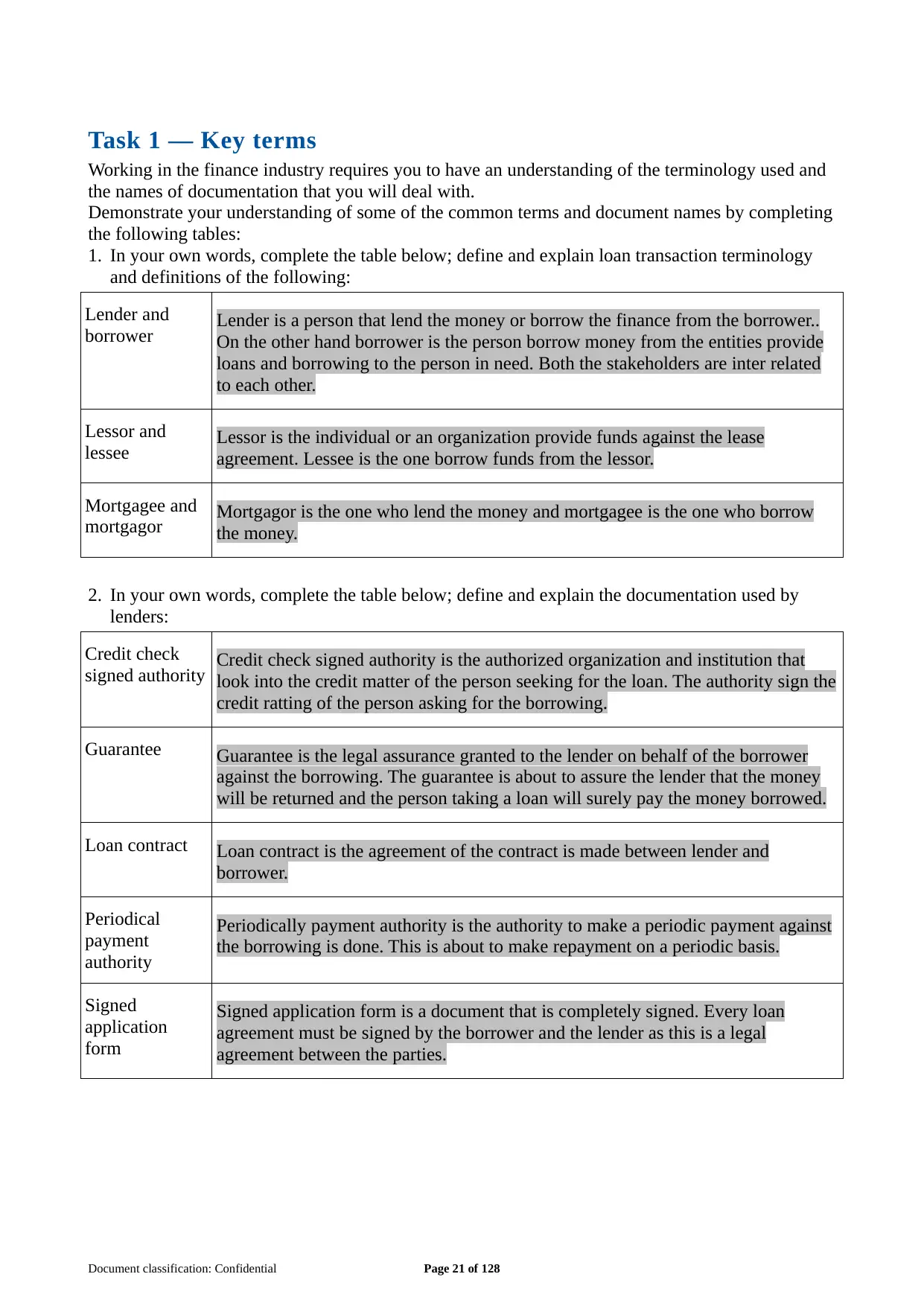

Task 1 — Key terms

Working in the finance industry requires you to have an understanding of the terminology used and

the names of documentation that you will deal with.

Demonstrate your understanding of some of the common terms and document names by completing

the following tables:

1. In your own words, complete the table below; define and explain loan transaction terminology

and definitions of the following:

Lender and

borrower Lender is a person that lend the money or borrow the finance from the borrower..

On the other hand borrower is the person borrow money from the entities provide

loans and borrowing to the person in need. Both the stakeholders are inter related

to each other.

Lessor and

lessee Lessor is the individual or an organization provide funds against the lease

agreement. Lessee is the one borrow funds from the lessor.

Mortgagee and

mortgagor Mortgagor is the one who lend the money and mortgagee is the one who borrow

the money.

2. In your own words, complete the table below; define and explain the documentation used by

lenders:

Credit check

signed authority Credit check signed authority is the authorized organization and institution that

look into the credit matter of the person seeking for the loan. The authority sign the

credit ratting of the person asking for the borrowing.

Guarantee Guarantee is the legal assurance granted to the lender on behalf of the borrower

against the borrowing. The guarantee is about to assure the lender that the money

will be returned and the person taking a loan will surely pay the money borrowed.

Loan contract Loan contract is the agreement of the contract is made between lender and

borrower.

Periodical

payment

authority

Periodically payment authority is the authority to make a periodic payment against

the borrowing is done. This is about to make repayment on a periodic basis.

Signed

application

form

Signed application form is a document that is completely signed. Every loan

agreement must be signed by the borrower and the lender as this is a legal

agreement between the parties.

Document classification: Confidential Page 21 of 128

Working in the finance industry requires you to have an understanding of the terminology used and

the names of documentation that you will deal with.

Demonstrate your understanding of some of the common terms and document names by completing

the following tables:

1. In your own words, complete the table below; define and explain loan transaction terminology

and definitions of the following:

Lender and

borrower Lender is a person that lend the money or borrow the finance from the borrower..

On the other hand borrower is the person borrow money from the entities provide

loans and borrowing to the person in need. Both the stakeholders are inter related

to each other.

Lessor and

lessee Lessor is the individual or an organization provide funds against the lease

agreement. Lessee is the one borrow funds from the lessor.

Mortgagee and

mortgagor Mortgagor is the one who lend the money and mortgagee is the one who borrow

the money.

2. In your own words, complete the table below; define and explain the documentation used by

lenders:

Credit check

signed authority Credit check signed authority is the authorized organization and institution that

look into the credit matter of the person seeking for the loan. The authority sign the

credit ratting of the person asking for the borrowing.

Guarantee Guarantee is the legal assurance granted to the lender on behalf of the borrower

against the borrowing. The guarantee is about to assure the lender that the money

will be returned and the person taking a loan will surely pay the money borrowed.

Loan contract Loan contract is the agreement of the contract is made between lender and

borrower.

Periodical

payment

authority

Periodically payment authority is the authority to make a periodic payment against

the borrowing is done. This is about to make repayment on a periodic basis.

Signed

application

form

Signed application form is a document that is completely signed. Every loan

agreement must be signed by the borrower and the lender as this is a legal

agreement between the parties.

Document classification: Confidential Page 21 of 128

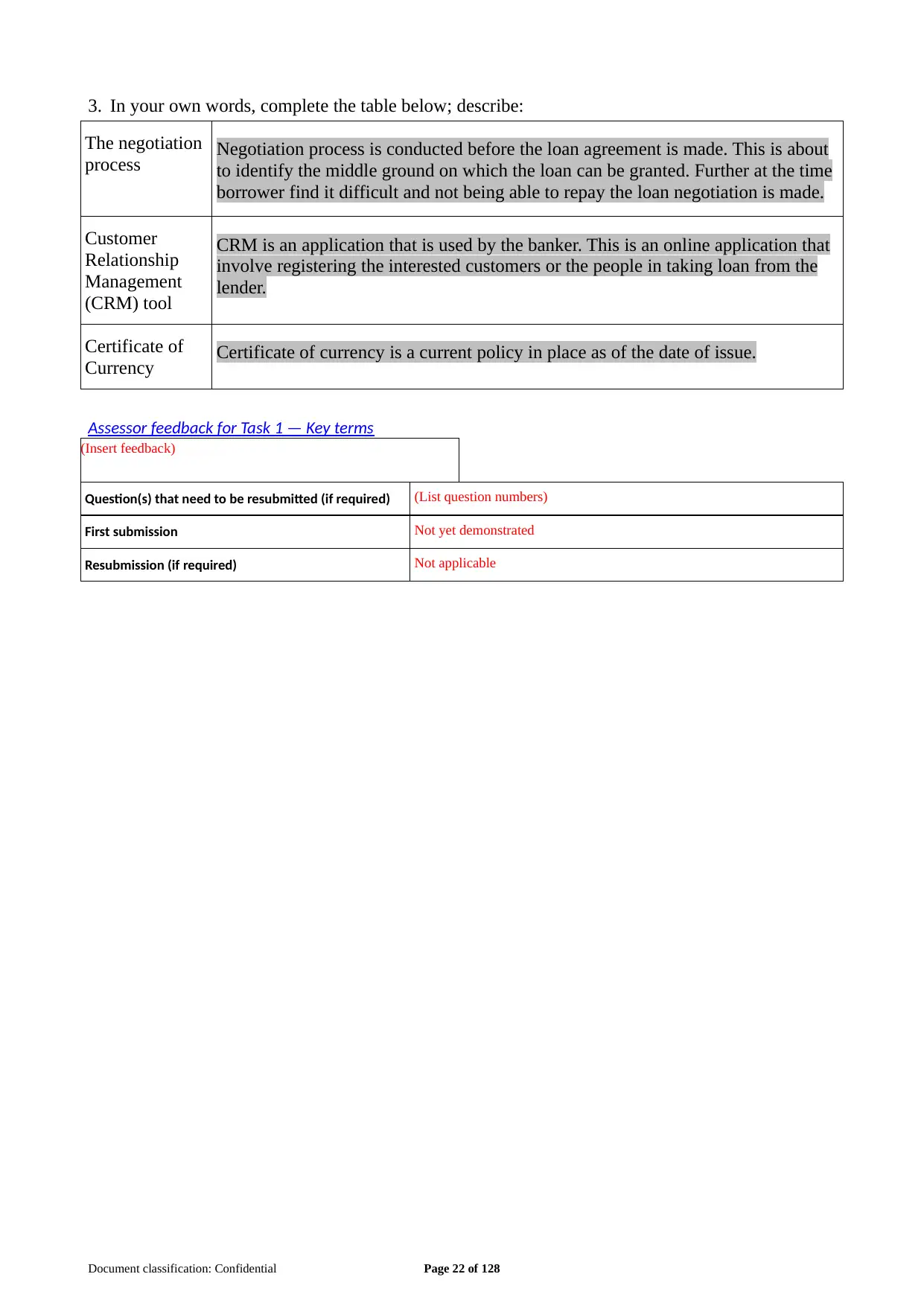

3. In your own words, complete the table below; describe:

The negotiation

process Negotiation process is conducted before the loan agreement is made. This is about

to identify the middle ground on which the loan can be granted. Further at the time

borrower find it difficult and not being able to repay the loan negotiation is made.

Customer

Relationship

Management

(CRM) tool

CRM is an application that is used by the banker. This is an online application that

involve registering the interested customers or the people in taking loan from the

lender.

Certificate of

Currency Certificate of currency is a current policy in place as of the date of issue.

Assessor feedback for Task 1 — Key terms

(Insert feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Not yet demonstrated

Resubmission (if required) Not applicable

Document classification: Confidential Page 22 of 128

The negotiation

process Negotiation process is conducted before the loan agreement is made. This is about

to identify the middle ground on which the loan can be granted. Further at the time

borrower find it difficult and not being able to repay the loan negotiation is made.

Customer

Relationship

Management

(CRM) tool

CRM is an application that is used by the banker. This is an online application that

involve registering the interested customers or the people in taking loan from the

lender.

Certificate of

Currency Certificate of currency is a current policy in place as of the date of issue.

Assessor feedback for Task 1 — Key terms

(Insert feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Not yet demonstrated

Resubmission (if required) Not applicable

Document classification: Confidential Page 22 of 128

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

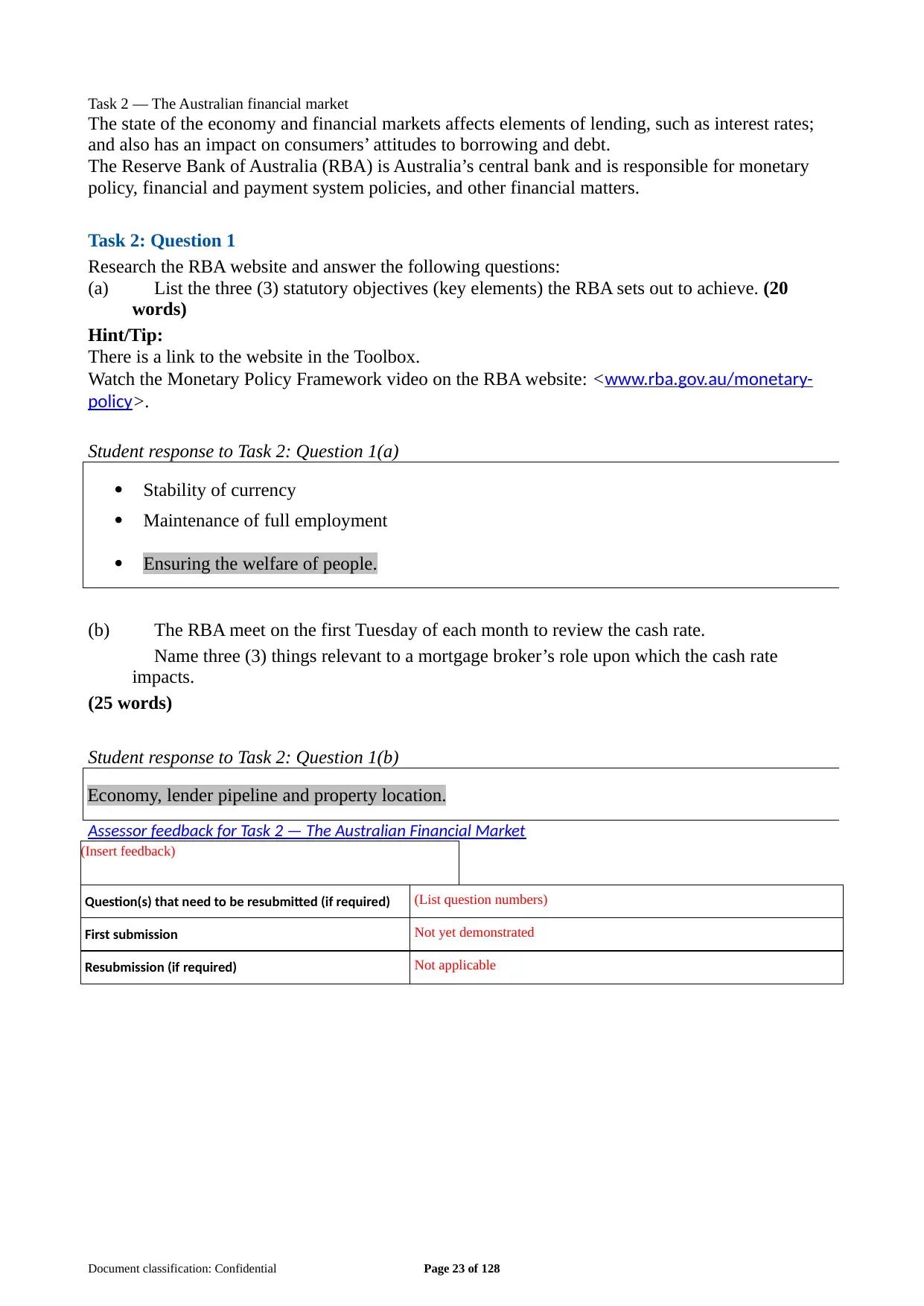

Task 2 ― The Australian financial market

The state of the economy and financial markets affects elements of lending, such as interest rates;

and also has an impact on consumers’ attitudes to borrowing and debt.

The Reserve Bank of Australia (RBA) is Australia’s central bank and is responsible for monetary

policy, financial and payment system policies, and other financial matters.

Task 2: Question 1

Research the RBA website and answer the following questions:

(a) List the three (3) statutory objectives (key elements) the RBA sets out to achieve. (20

words)

Hint/Tip:

There is a link to the website in the Toolbox.

Watch the Monetary Policy Framework video on the RBA website: <www.rba.gov.au/monetary-

policy>.

Student response to Task 2: Question 1(a)

Stability of currency

Maintenance of full employment

Ensuring the welfare of people.

(b) The RBA meet on the first Tuesday of each month to review the cash rate.

Name three (3) things relevant to a mortgage broker’s role upon which the cash rate

impacts.

(25 words)

Student response to Task 2: Question 1(b)

Economy, lender pipeline and property location.

Assessor feedback for Task 2 — The Australian Financial Market

(Insert feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Not yet demonstrated

Resubmission (if required) Not applicable

Document classification: Confidential Page 23 of 128

The state of the economy and financial markets affects elements of lending, such as interest rates;

and also has an impact on consumers’ attitudes to borrowing and debt.

The Reserve Bank of Australia (RBA) is Australia’s central bank and is responsible for monetary

policy, financial and payment system policies, and other financial matters.

Task 2: Question 1

Research the RBA website and answer the following questions:

(a) List the three (3) statutory objectives (key elements) the RBA sets out to achieve. (20

words)

Hint/Tip:

There is a link to the website in the Toolbox.

Watch the Monetary Policy Framework video on the RBA website: <www.rba.gov.au/monetary-

policy>.

Student response to Task 2: Question 1(a)

Stability of currency

Maintenance of full employment

Ensuring the welfare of people.

(b) The RBA meet on the first Tuesday of each month to review the cash rate.

Name three (3) things relevant to a mortgage broker’s role upon which the cash rate

impacts.

(25 words)

Student response to Task 2: Question 1(b)

Economy, lender pipeline and property location.

Assessor feedback for Task 2 — The Australian Financial Market

(Insert feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Not yet demonstrated

Resubmission (if required) Not applicable

Document classification: Confidential Page 23 of 128

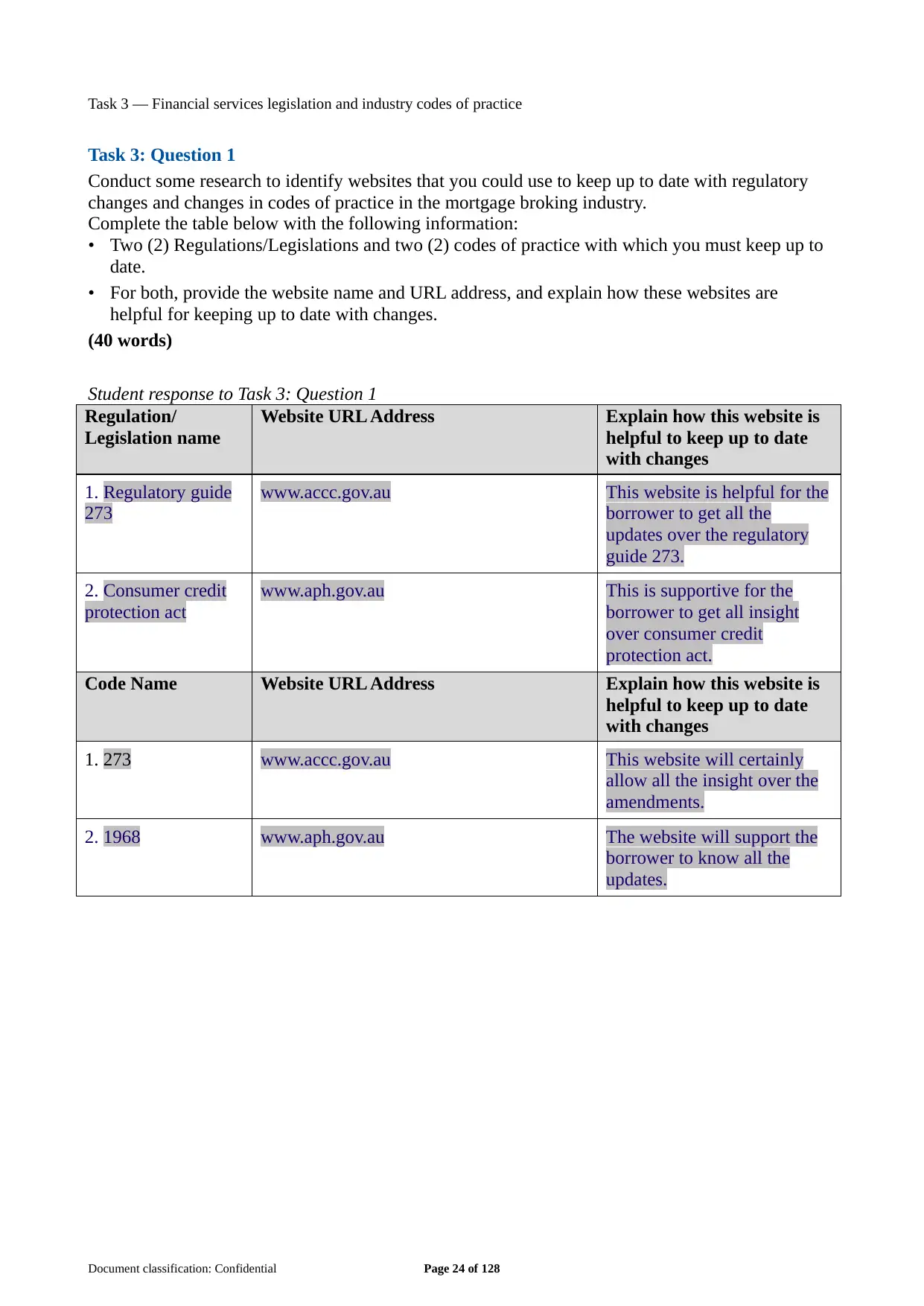

Task 3 — Financial services legislation and industry codes of practice

Task 3: Question 1

Conduct some research to identify websites that you could use to keep up to date with regulatory

changes and changes in codes of practice in the mortgage broking industry.

Complete the table below with the following information:

• Two (2) Regulations/Legislations and two (2) codes of practice with which you must keep up to

date.

• For both, provide the website name and URL address, and explain how these websites are

helpful for keeping up to date with changes.

(40 words)

Student response to Task 3: Question 1

Regulation/

Legislation name

Website URL Address Explain how this website is

helpful to keep up to date

with changes

1. Regulatory guide

273

www.accc.gov.au This website is helpful for the

borrower to get all the

updates over the regulatory

guide 273.

2. Consumer credit

protection act

www.aph.gov.au This is supportive for the

borrower to get all insight

over consumer credit

protection act.

Code Name Website URL Address Explain how this website is

helpful to keep up to date

with changes

1. 273 www.accc.gov.au This website will certainly

allow all the insight over the

amendments.

2. 1968 www.aph.gov.au The website will support the

borrower to know all the

updates.

Document classification: Confidential Page 24 of 128

Task 3: Question 1

Conduct some research to identify websites that you could use to keep up to date with regulatory

changes and changes in codes of practice in the mortgage broking industry.

Complete the table below with the following information:

• Two (2) Regulations/Legislations and two (2) codes of practice with which you must keep up to

date.

• For both, provide the website name and URL address, and explain how these websites are

helpful for keeping up to date with changes.

(40 words)

Student response to Task 3: Question 1

Regulation/

Legislation name

Website URL Address Explain how this website is

helpful to keep up to date

with changes

1. Regulatory guide

273

www.accc.gov.au This website is helpful for the

borrower to get all the

updates over the regulatory

guide 273.

2. Consumer credit

protection act

www.aph.gov.au This is supportive for the

borrower to get all insight

over consumer credit

protection act.

Code Name Website URL Address Explain how this website is

helpful to keep up to date

with changes

1. 273 www.accc.gov.au This website will certainly

allow all the insight over the

amendments.

2. 1968 www.aph.gov.au The website will support the

borrower to know all the

updates.

Document classification: Confidential Page 24 of 128

Task 3: Question 2

List two (2) risks and the consequences that are associated with not complying with the NCCP Act.

(30 words)

Student response to Task 3: Question 2

Legal license may ban by the authority. Charges may also imposed on the basis of the

seriousness of the fact not being complying with the act. Imprisonment is also permissible in case

the judge find it necessary.

Task 3: Question 3

In your own words, describe the key features of the Privacy Act 1988.

(30 words)

Student response to Task 3: Question 3

The privacy act 1988 involve collecting, use, storage and disclosure of personal information in the

federal public sector and private sector. This is about to protect the personal information by

disclosing into public domain.

Document classification: Confidential Page 25 of 128

List two (2) risks and the consequences that are associated with not complying with the NCCP Act.

(30 words)

Student response to Task 3: Question 2

Legal license may ban by the authority. Charges may also imposed on the basis of the

seriousness of the fact not being complying with the act. Imprisonment is also permissible in case

the judge find it necessary.

Task 3: Question 3

In your own words, describe the key features of the Privacy Act 1988.

(30 words)

Student response to Task 3: Question 3

The privacy act 1988 involve collecting, use, storage and disclosure of personal information in the

federal public sector and private sector. This is about to protect the personal information by

disclosing into public domain.

Document classification: Confidential Page 25 of 128

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Task 3: Question 4

(a) In your own words, describe the key features and the purpose of codes of practice.

(b) Provide one (1) example of how a code of practice would be implemented into a work

situation for a mortgage broker.

(50 words)

Student response to Task 3 Question 4

(a) Code of practice guide with the professional standards and code of conducts to maintain. This

involve the proper standards need to maintain based on the legal requirements.

(b) For example mortgage broker must not disclose the personal information of the client without

the consent of the customer.

Document classification: Confidential Page 26 of 128

(a) In your own words, describe the key features and the purpose of codes of practice.

(b) Provide one (1) example of how a code of practice would be implemented into a work

situation for a mortgage broker.

(50 words)

Student response to Task 3 Question 4

(a) Code of practice guide with the professional standards and code of conducts to maintain. This

involve the proper standards need to maintain based on the legal requirements.

(b) For example mortgage broker must not disclose the personal information of the client without

the consent of the customer.

Document classification: Confidential Page 26 of 128

Task 3: Question 5

(a) In your own words describe best interests duty.

(b) Provide one (1) example of how the best interests duty would be implemented into a work

situation for a mortgage broker.

(50 words)

Student response to Task 3: Question 5

(a) Best interest duty is a legislative requirement to ensure the processes and motivation of

financial advisor are focused on what is best for the client.

(b) For example mortgage broker can implement one single interest duty on the basis of its target

customers. This would involve the affordability of the client in against the loan is taken.

Task 3: Question 6

(a) How would you communicate changes in regulation, legislation, or codes of practice to

your colleagues?

(b) Explain how you would execute changes to your organisation’s policy, procedures and

practices to ensure that you are meeting the changes (for example, the introduction of best

interests duty).

(80 words)

Student response to Task 3: Question 6

(a) Communication can be done over phone calls, email and other form of communication.

Template can also be printed to provide the information. This would allow the colleagues to interact

about all the changes. Messenger tool can also be used by forming a group to communicate about all

the changes.

(b) Changes in the organisation policy can be implemented with the proper research about the

market and the target customers. This involves identifying the need and affordability of customer

and make changes accordingly.

Task 3: Question 7

If you were unsure of how to apply any regulation, legislation or codes of practice to your role or

interaction with a client, explain what you would do.

(30 words)

Student response to Task 3: Question 7

In case any misunderstanding about the information whole interacting with the client than

professional can verify the information before communicating with the customer. This would resist

the professional to misled client.

Task 3: Question 8

Remaining compliant with financial services regulation and industry codes of practice is vital.

One way to make sure compliance is being met is through monitoring or internal audits.

You have been asked by your manager to implement an internal monitoring/audit process for your

Document classification: Confidential Page 27 of 128

(a) In your own words describe best interests duty.

(b) Provide one (1) example of how the best interests duty would be implemented into a work

situation for a mortgage broker.

(50 words)

Student response to Task 3: Question 5

(a) Best interest duty is a legislative requirement to ensure the processes and motivation of

financial advisor are focused on what is best for the client.

(b) For example mortgage broker can implement one single interest duty on the basis of its target

customers. This would involve the affordability of the client in against the loan is taken.

Task 3: Question 6

(a) How would you communicate changes in regulation, legislation, or codes of practice to

your colleagues?

(b) Explain how you would execute changes to your organisation’s policy, procedures and

practices to ensure that you are meeting the changes (for example, the introduction of best

interests duty).

(80 words)

Student response to Task 3: Question 6

(a) Communication can be done over phone calls, email and other form of communication.

Template can also be printed to provide the information. This would allow the colleagues to interact

about all the changes. Messenger tool can also be used by forming a group to communicate about all

the changes.

(b) Changes in the organisation policy can be implemented with the proper research about the

market and the target customers. This involves identifying the need and affordability of customer

and make changes accordingly.

Task 3: Question 7

If you were unsure of how to apply any regulation, legislation or codes of practice to your role or

interaction with a client, explain what you would do.

(30 words)

Student response to Task 3: Question 7

In case any misunderstanding about the information whole interacting with the client than

professional can verify the information before communicating with the customer. This would resist

the professional to misled client.

Task 3: Question 8

Remaining compliant with financial services regulation and industry codes of practice is vital.

One way to make sure compliance is being met is through monitoring or internal audits.

You have been asked by your manager to implement an internal monitoring/audit process for your

Document classification: Confidential Page 27 of 128

mortgage broking firm to ensure that the credit representatives are meeting their obligations with

regulation, legislation and codes of practice.

Outline the monitoring/audit process that you have implemented to ensure compliance. You should

include the following:

• How you will monitor/audit compliance.

• Who will undertake the monitoring/audit process.

• What tools you will use.

• How or where you will record the outcomes.

(150 words)

Student response to Task 3: Question 8

Audit compliance can be monitored with the proper verification of the information. Evaluation

activities can planned at an individual level. Periodic basis of evaluation can be done to monitor the

whole process. The individual can set its own performance standards and on the basis of the

standards that are set performance evaluation can be conducted. Monitoring audit process is totally

based on the self evaluation so the auditor itself can design and plan the activity to monitor and

review the performance. Tools like software, format and such other tools can be used, The separate

document will be maintained to record the documents. This will involve recording all the progress

and success that is achieved in against to the monitoring process is implemented. Personal

evaluation will completely support the auditor to ensure the authenticity of the whole practice is

performed. This would allow the auditor to record and verify the information in the separate

document.

Task 3: Question 9

What information provided by a client needs to be retained by a financial services organisation, like

a brokerage? (50 words)

Student response to Task 3: Question 9

Information of a client such as personal information that involve name, address and such other.

Income related information that involve the salary or the tax return. Bank statement is also

necessary to retain by the financial institutions as it is important to assess that borrower will be able

to repay the funds.

Assessor feedback for Task 3 — Financial services legislation and industry codes of practice

(Insert Feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Not yet demonstrated

Resubmission (if required)

Document classification: Confidential Page 28 of 128

regulation, legislation and codes of practice.

Outline the monitoring/audit process that you have implemented to ensure compliance. You should

include the following:

• How you will monitor/audit compliance.

• Who will undertake the monitoring/audit process.

• What tools you will use.

• How or where you will record the outcomes.

(150 words)

Student response to Task 3: Question 8

Audit compliance can be monitored with the proper verification of the information. Evaluation

activities can planned at an individual level. Periodic basis of evaluation can be done to monitor the

whole process. The individual can set its own performance standards and on the basis of the

standards that are set performance evaluation can be conducted. Monitoring audit process is totally

based on the self evaluation so the auditor itself can design and plan the activity to monitor and

review the performance. Tools like software, format and such other tools can be used, The separate

document will be maintained to record the documents. This will involve recording all the progress

and success that is achieved in against to the monitoring process is implemented. Personal

evaluation will completely support the auditor to ensure the authenticity of the whole practice is

performed. This would allow the auditor to record and verify the information in the separate

document.

Task 3: Question 9

What information provided by a client needs to be retained by a financial services organisation, like

a brokerage? (50 words)

Student response to Task 3: Question 9

Information of a client such as personal information that involve name, address and such other.

Income related information that involve the salary or the tax return. Bank statement is also

necessary to retain by the financial institutions as it is important to assess that borrower will be able

to repay the funds.

Assessor feedback for Task 3 — Financial services legislation and industry codes of practice

(Insert Feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Not yet demonstrated

Resubmission (if required)

Document classification: Confidential Page 28 of 128

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Task 4 — Products and services

The financial services industry is very competitive, with many organisations offering a number of

different lending and transactional products and services.

Organisations use a variety of approaches to market and promote their products and services.

It is very important that brokers are able to determine the right product and service to meet the

needs and requirements of their clients.

Some clients like to be able to combine their lending products with other banking products and

services. While it is important to have a thorough knowledge of lending products, it is also

important to be able to identify other relevant products and services to accommodate your client’s

needs and requirements.

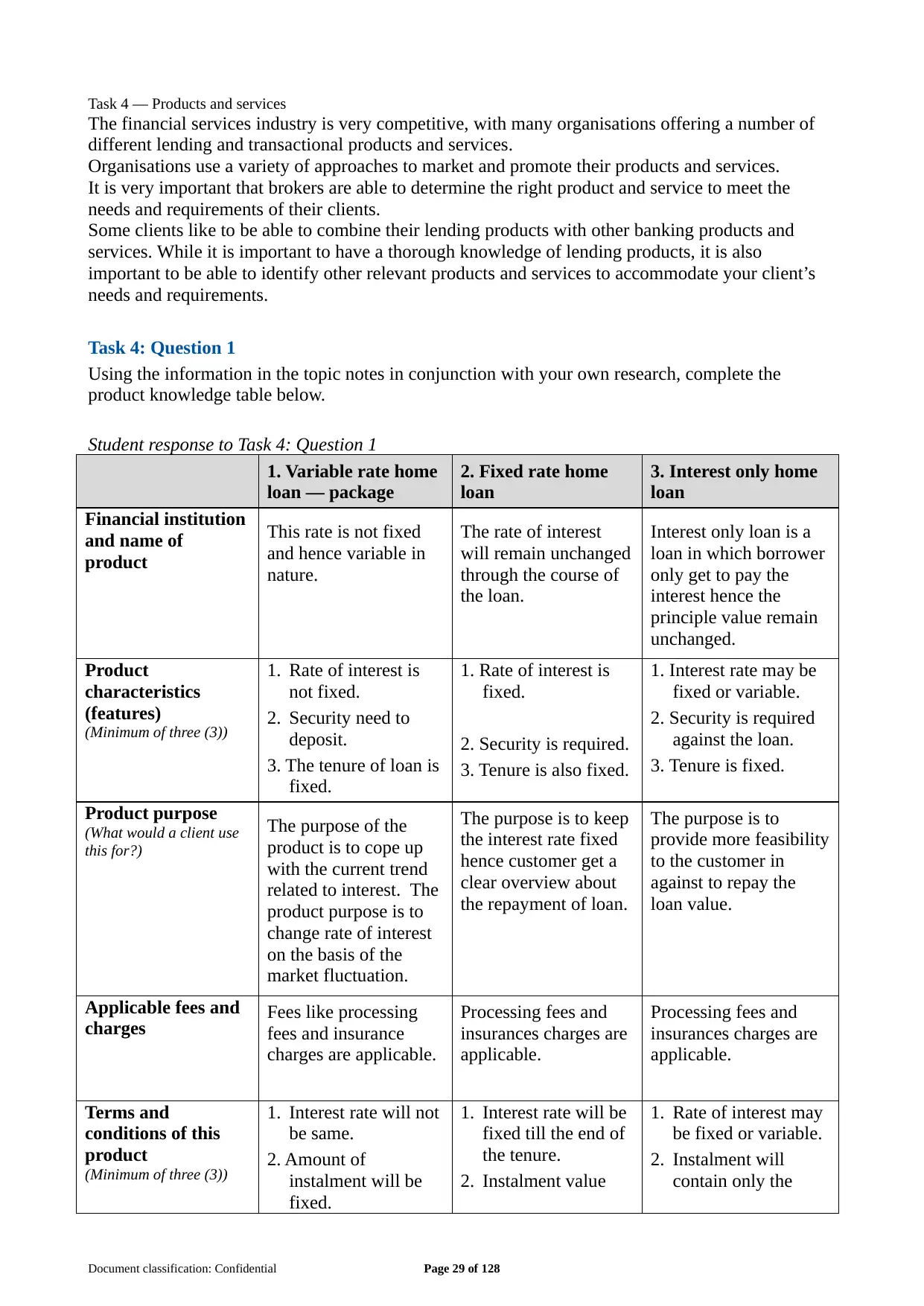

Task 4: Question 1

Using the information in the topic notes in conjunction with your own research, complete the

product knowledge table below.

Student response to Task 4: Question 1

1. Variable rate home

loan — package

2. Fixed rate home

loan

3. Interest only home

loan

Financial institution

and name of

product

This rate is not fixed

and hence variable in

nature.

The rate of interest

will remain unchanged

through the course of

the loan.

Interest only loan is a

loan in which borrower

only get to pay the

interest hence the

principle value remain

unchanged.

Product

characteristics

(features)

(Minimum of three (3))

1. Rate of interest is

not fixed.

2. Security need to

deposit.

3. The tenure of loan is

fixed.

1. Rate of interest is

fixed.

2. Security is required.

3. Tenure is also fixed.

1. Interest rate may be

fixed or variable.

2. Security is required

against the loan.

3. Tenure is fixed.

Product purpose

(What would a client use

this for?)

The purpose of the

product is to cope up

with the current trend

related to interest. The

product purpose is to

change rate of interest

on the basis of the

market fluctuation.

The purpose is to keep

the interest rate fixed

hence customer get a

clear overview about

the repayment of loan.

The purpose is to

provide more feasibility

to the customer in

against to repay the

loan value.

Applicable fees and

charges Fees like processing

fees and insurance

charges are applicable.

Processing fees and

insurances charges are

applicable.

Processing fees and

insurances charges are

applicable.

Terms and

conditions of this

product

(Minimum of three (3))

1. Interest rate will not

be same.

2. Amount of

instalment will be

fixed.

1. Interest rate will be

fixed till the end of

the tenure.

2. Instalment value

1. Rate of interest may

be fixed or variable.

2. Instalment will

contain only the

Document classification: Confidential Page 29 of 128

The financial services industry is very competitive, with many organisations offering a number of

different lending and transactional products and services.

Organisations use a variety of approaches to market and promote their products and services.

It is very important that brokers are able to determine the right product and service to meet the

needs and requirements of their clients.

Some clients like to be able to combine their lending products with other banking products and

services. While it is important to have a thorough knowledge of lending products, it is also

important to be able to identify other relevant products and services to accommodate your client’s

needs and requirements.

Task 4: Question 1

Using the information in the topic notes in conjunction with your own research, complete the

product knowledge table below.

Student response to Task 4: Question 1

1. Variable rate home

loan — package

2. Fixed rate home

loan

3. Interest only home

loan

Financial institution

and name of

product

This rate is not fixed

and hence variable in

nature.

The rate of interest

will remain unchanged

through the course of

the loan.

Interest only loan is a

loan in which borrower

only get to pay the

interest hence the

principle value remain

unchanged.

Product

characteristics

(features)

(Minimum of three (3))

1. Rate of interest is

not fixed.

2. Security need to

deposit.

3. The tenure of loan is

fixed.

1. Rate of interest is

fixed.

2. Security is required.

3. Tenure is also fixed.

1. Interest rate may be

fixed or variable.

2. Security is required

against the loan.

3. Tenure is fixed.

Product purpose

(What would a client use

this for?)

The purpose of the

product is to cope up

with the current trend

related to interest. The

product purpose is to

change rate of interest

on the basis of the

market fluctuation.

The purpose is to keep

the interest rate fixed

hence customer get a

clear overview about

the repayment of loan.

The purpose is to

provide more feasibility

to the customer in

against to repay the

loan value.

Applicable fees and

charges Fees like processing

fees and insurance

charges are applicable.

Processing fees and

insurances charges are

applicable.

Processing fees and

insurances charges are

applicable.

Terms and

conditions of this

product

(Minimum of three (3))

1. Interest rate will not

be same.

2. Amount of

instalment will be

fixed.

1. Interest rate will be

fixed till the end of

the tenure.

2. Instalment value

1. Rate of interest may

be fixed or variable.

2. Instalment will

contain only the

Document classification: Confidential Page 29 of 128

3. Tenure will fix will remain fixed.

3. Tenure is also fixed.

interest amount.

3. Tenure will be fixed.

List one (1) strength

and one (1)

weakness

Strength: Provide

advantage every time

interest rate decreases.

Weakness: In case of

increase in interest rate

will further improve

the interest burden.

Strength: Interest

remain fixed.

Weakness: Even if the

decline in interest rate

will not reduce the

interest for the

customer.

Strength: Only the

interest will involve in

installments of every

month.

Weakness: client need

to repay the entire loan

value in the end of the

tenure.

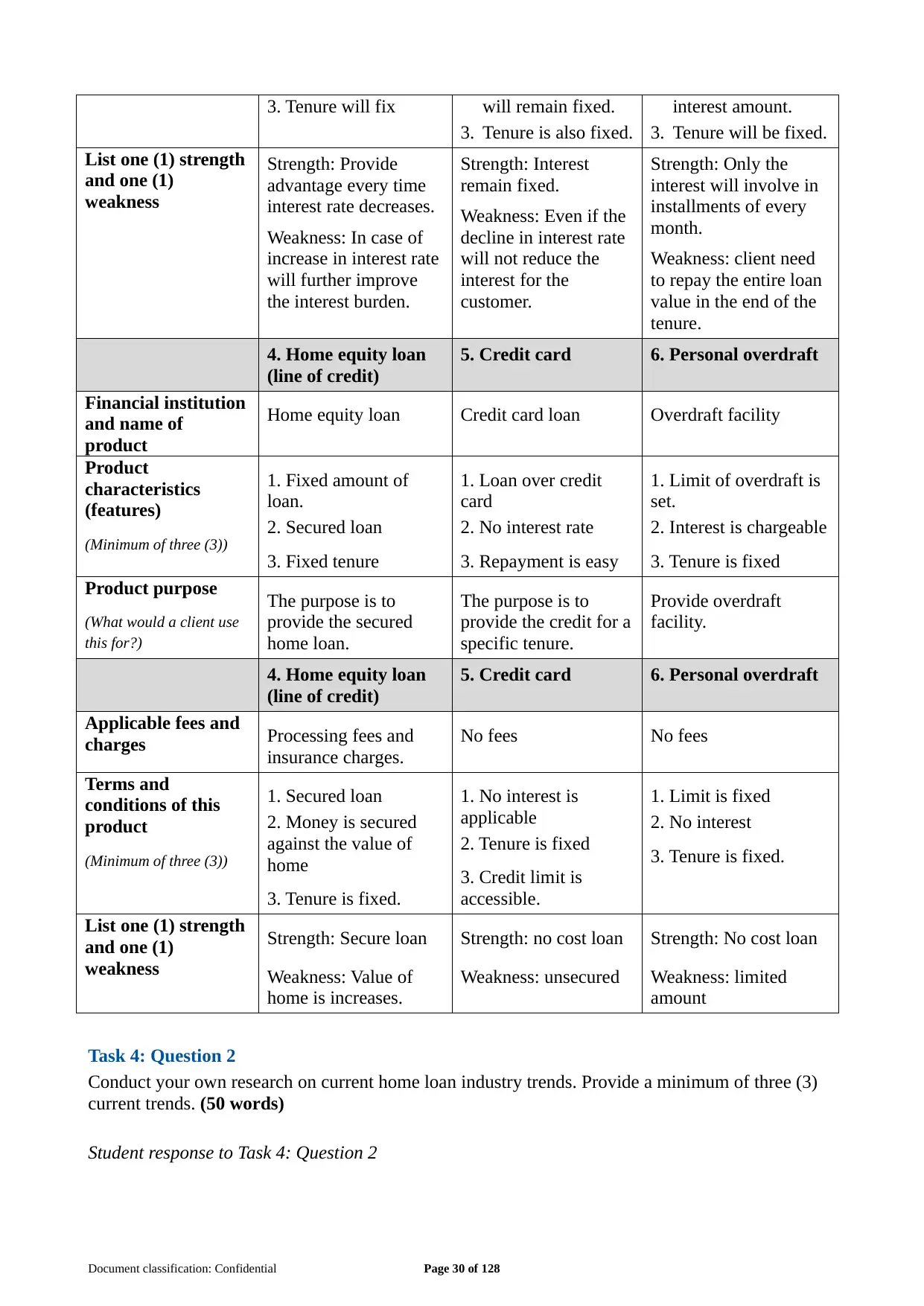

4. Home equity loan

(line of credit)

5. Credit card 6. Personal overdraft

Financial institution

and name of

product

Home equity loan Credit card loan Overdraft facility

Product

characteristics

(features)

(Minimum of three (3))

1. Fixed amount of

loan.

2. Secured loan

3. Fixed tenure

1. Loan over credit

card

2. No interest rate

3. Repayment is easy

1. Limit of overdraft is

set.

2. Interest is chargeable

3. Tenure is fixed

Product purpose

(What would a client use

this for?)

The purpose is to

provide the secured

home loan.

The purpose is to

provide the credit for a

specific tenure.

Provide overdraft

facility.

4. Home equity loan

(line of credit)

5. Credit card 6. Personal overdraft

Applicable fees and

charges Processing fees and

insurance charges.

No fees No fees

Terms and

conditions of this

product

(Minimum of three (3))

1. Secured loan

2. Money is secured

against the value of

home

3. Tenure is fixed.

1. No interest is

applicable

2. Tenure is fixed

3. Credit limit is

accessible.

1. Limit is fixed

2. No interest

3. Tenure is fixed.

List one (1) strength

and one (1)

weakness

Strength: Secure loan

Weakness: Value of

home is increases.

Strength: no cost loan

Weakness: unsecured

Strength: No cost loan

Weakness: limited

amount

Task 4: Question 2

Conduct your own research on current home loan industry trends. Provide a minimum of three (3)

current trends. (50 words)

Student response to Task 4: Question 2

Document classification: Confidential Page 30 of 128

3. Tenure is also fixed.

interest amount.

3. Tenure will be fixed.

List one (1) strength

and one (1)

weakness

Strength: Provide

advantage every time

interest rate decreases.

Weakness: In case of

increase in interest rate

will further improve

the interest burden.

Strength: Interest

remain fixed.

Weakness: Even if the

decline in interest rate

will not reduce the

interest for the

customer.

Strength: Only the

interest will involve in

installments of every

month.

Weakness: client need

to repay the entire loan

value in the end of the

tenure.

4. Home equity loan

(line of credit)

5. Credit card 6. Personal overdraft

Financial institution

and name of

product

Home equity loan Credit card loan Overdraft facility

Product

characteristics

(features)

(Minimum of three (3))

1. Fixed amount of

loan.

2. Secured loan

3. Fixed tenure

1. Loan over credit

card

2. No interest rate

3. Repayment is easy

1. Limit of overdraft is

set.

2. Interest is chargeable

3. Tenure is fixed

Product purpose

(What would a client use

this for?)

The purpose is to

provide the secured

home loan.

The purpose is to

provide the credit for a

specific tenure.

Provide overdraft

facility.

4. Home equity loan

(line of credit)

5. Credit card 6. Personal overdraft

Applicable fees and

charges Processing fees and

insurance charges.

No fees No fees

Terms and

conditions of this

product

(Minimum of three (3))

1. Secured loan

2. Money is secured

against the value of

home

3. Tenure is fixed.

1. No interest is

applicable

2. Tenure is fixed

3. Credit limit is

accessible.

1. Limit is fixed

2. No interest

3. Tenure is fixed.

List one (1) strength

and one (1)

weakness

Strength: Secure loan

Weakness: Value of

home is increases.

Strength: no cost loan

Weakness: unsecured

Strength: No cost loan

Weakness: limited

amount

Task 4: Question 2

Conduct your own research on current home loan industry trends. Provide a minimum of three (3)

current trends. (50 words)

Student response to Task 4: Question 2

Document classification: Confidential Page 30 of 128

Fixed interest home loan remain interest rate fixed.

Variable interest home contain variable interest rate.

Home equity loan provide secured home loan.

Task 4: Question 3

(a) How do financial service providers market and/or promote their products and services?

(b) Where can you locate a lending organisation’s current promotions and specials?

(c) Describe how you would identify clients whose needs match products and services that are

part of a current promotional strategy.

(d Describe how you can keep your product knowledge up to date. Include the methods

and/or systems you could use to maintain product knowledge.

(40 words)

Student response to Task 4: Question 3

(a) Advertisements channels are used to promote services.

(b) Promotions over social media and other advertisements sites.

(c) Analysis of the customer need and requirement will guide properly in such a matter.

(d) Regular studies, reading updates and such are the method to keep information up to date.

Document classification: Confidential Page 31 of 128

Variable interest home contain variable interest rate.

Home equity loan provide secured home loan.

Task 4: Question 3

(a) How do financial service providers market and/or promote their products and services?

(b) Where can you locate a lending organisation’s current promotions and specials?

(c) Describe how you would identify clients whose needs match products and services that are

part of a current promotional strategy.

(d Describe how you can keep your product knowledge up to date. Include the methods

and/or systems you could use to maintain product knowledge.

(40 words)

Student response to Task 4: Question 3

(a) Advertisements channels are used to promote services.

(b) Promotions over social media and other advertisements sites.

(c) Analysis of the customer need and requirement will guide properly in such a matter.

(d) Regular studies, reading updates and such are the method to keep information up to date.

Document classification: Confidential Page 31 of 128

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Task 4: Question 4

The Australian Banking Association’s (ABA) Banking Code of Practice (BCOP) outlines several

obligations for the provision of financial products and services. The Code can be downloaded from

the ABA website.

(a) List at least two (2) items of information that must be provided to a client when providing

financial products and services.

(b) Refer to the items you listed in part (a) and explain what the items clearly set out.

(c) What four (4) factors does the Code advise about providing banking services to vulnerable

clients?

(d) According to the BCOP, how would you identify (become aware of) a potentially

vulnerable client and a client on a low-income?

(100 words)

Student response to Task 4: Question 4

(a) List of document and loan repayment schedule.

(b) List of document involve complete details in respect to the documents that are required to grant

the loan. This involve the proper information about te type of document, legal charges and such

other information. Loan repayment schedule is a complete schedule to repay the entire loan value.

(c) Affordable EMI facilities, managing financial data effectively, communicate clearly in

respect to charges and proper support in case of any failure in loan repayment.

(d) Vulnerable customers are the one identify based on the extreme mood, poor concentration,

feeling overwhelmed by things and being emotional. Low income customer are identity based on

the income.

Task 4: Question 5

What is a deposit bond and when would it be suitable for a purchaser to use this product?

(Refer to the Toolbox or conduct your own research) (30 words)

Student response to Task 4: Question 5

Deposit bond allow the buyer to pay the security instead of cash up-to the value of 10% of the

purchase price. This is suitable in case of liquidity related issues face by the customer.

Assessor feedback for Task 4 — Products and services

Document classification: Confidential Page 32 of 128

The Australian Banking Association’s (ABA) Banking Code of Practice (BCOP) outlines several

obligations for the provision of financial products and services. The Code can be downloaded from

the ABA website.

(a) List at least two (2) items of information that must be provided to a client when providing

financial products and services.

(b) Refer to the items you listed in part (a) and explain what the items clearly set out.

(c) What four (4) factors does the Code advise about providing banking services to vulnerable

clients?

(d) According to the BCOP, how would you identify (become aware of) a potentially

vulnerable client and a client on a low-income?

(100 words)

Student response to Task 4: Question 4

(a) List of document and loan repayment schedule.

(b) List of document involve complete details in respect to the documents that are required to grant

the loan. This involve the proper information about te type of document, legal charges and such

other information. Loan repayment schedule is a complete schedule to repay the entire loan value.

(c) Affordable EMI facilities, managing financial data effectively, communicate clearly in

respect to charges and proper support in case of any failure in loan repayment.

(d) Vulnerable customers are the one identify based on the extreme mood, poor concentration,

feeling overwhelmed by things and being emotional. Low income customer are identity based on

the income.

Task 4: Question 5

What is a deposit bond and when would it be suitable for a purchaser to use this product?

(Refer to the Toolbox or conduct your own research) (30 words)

Student response to Task 4: Question 5

Deposit bond allow the buyer to pay the security instead of cash up-to the value of 10% of the

purchase price. This is suitable in case of liquidity related issues face by the customer.

Assessor feedback for Task 4 — Products and services

Document classification: Confidential Page 32 of 128

(Insert Feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Not yet demonstrated

Resubmission (if required) Not applicable

Document classification: Confidential Page 33 of 128

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Not yet demonstrated

Resubmission (if required) Not applicable

Document classification: Confidential Page 33 of 128

Section 2: Business skills

Document classification: Confidential Page 34 of 128

Document classification: Confidential Page 34 of 128

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Task 5 ― Effective communication

Communication is vital in all interactions, particularly for successful team and client relationships

in business.

Answer the following questions using the information from the topic notes in conjunction with your

own research.

Task 5: Question 1

List a minimum of four (4) types of communication skills and explain why each is important for

effective business communication. (40 words)

Student response to Task 5: Question 1

Communication skills are classifies as verbal communication, non-verbal communication, written

communication and visual communication. All types of communication skill is suitable to convey

all different ideas and aspects related to the venture.

Task 5: Question 2

(a) Explain why listening is so important for effective communication.

(b) List three (3) barriers to effective listening.

(30 words)

Student response to Task 5: Question 2

(a) Listening allow the person to understand the message the other person is trying to deliver in the

communication.

(b) Evaluative listening, assumptive listening and self protective listening.

Task 5: Question 3

List five (5) tips to help someone communicate more effectively with different types of clients

(e.g. when dealing with a someone from a different cultural background, whose first language may

not be English or a difficult client). (50 words)

Student response to Task 5: Question 3

Use the common language.

Communicate in a way client can easily understand everything.

Do not try to mislead customer in any given way.

Listen properly to the customer.

Solve all queries of client.

Document classification: Confidential Page 35 of 128

Communication is vital in all interactions, particularly for successful team and client relationships

in business.

Answer the following questions using the information from the topic notes in conjunction with your

own research.

Task 5: Question 1

List a minimum of four (4) types of communication skills and explain why each is important for

effective business communication. (40 words)

Student response to Task 5: Question 1

Communication skills are classifies as verbal communication, non-verbal communication, written

communication and visual communication. All types of communication skill is suitable to convey

all different ideas and aspects related to the venture.

Task 5: Question 2

(a) Explain why listening is so important for effective communication.

(b) List three (3) barriers to effective listening.

(30 words)

Student response to Task 5: Question 2

(a) Listening allow the person to understand the message the other person is trying to deliver in the

communication.

(b) Evaluative listening, assumptive listening and self protective listening.

Task 5: Question 3

List five (5) tips to help someone communicate more effectively with different types of clients

(e.g. when dealing with a someone from a different cultural background, whose first language may

not be English or a difficult client). (50 words)

Student response to Task 5: Question 3

Use the common language.

Communicate in a way client can easily understand everything.

Do not try to mislead customer in any given way.

Listen properly to the customer.

Solve all queries of client.

Document classification: Confidential Page 35 of 128

Assessor feedback for Task 5 — Effective communication

(Insert Feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Not yet demonstrated

Resubmission (if required) Not applicable

Document classification: Confidential Page 36 of 128

(Insert Feedback)

Question(s) that need to be resubmitted (if required) (List question numbers)

First submission Not yet demonstrated

Resubmission (if required) Not applicable

Document classification: Confidential Page 36 of 128

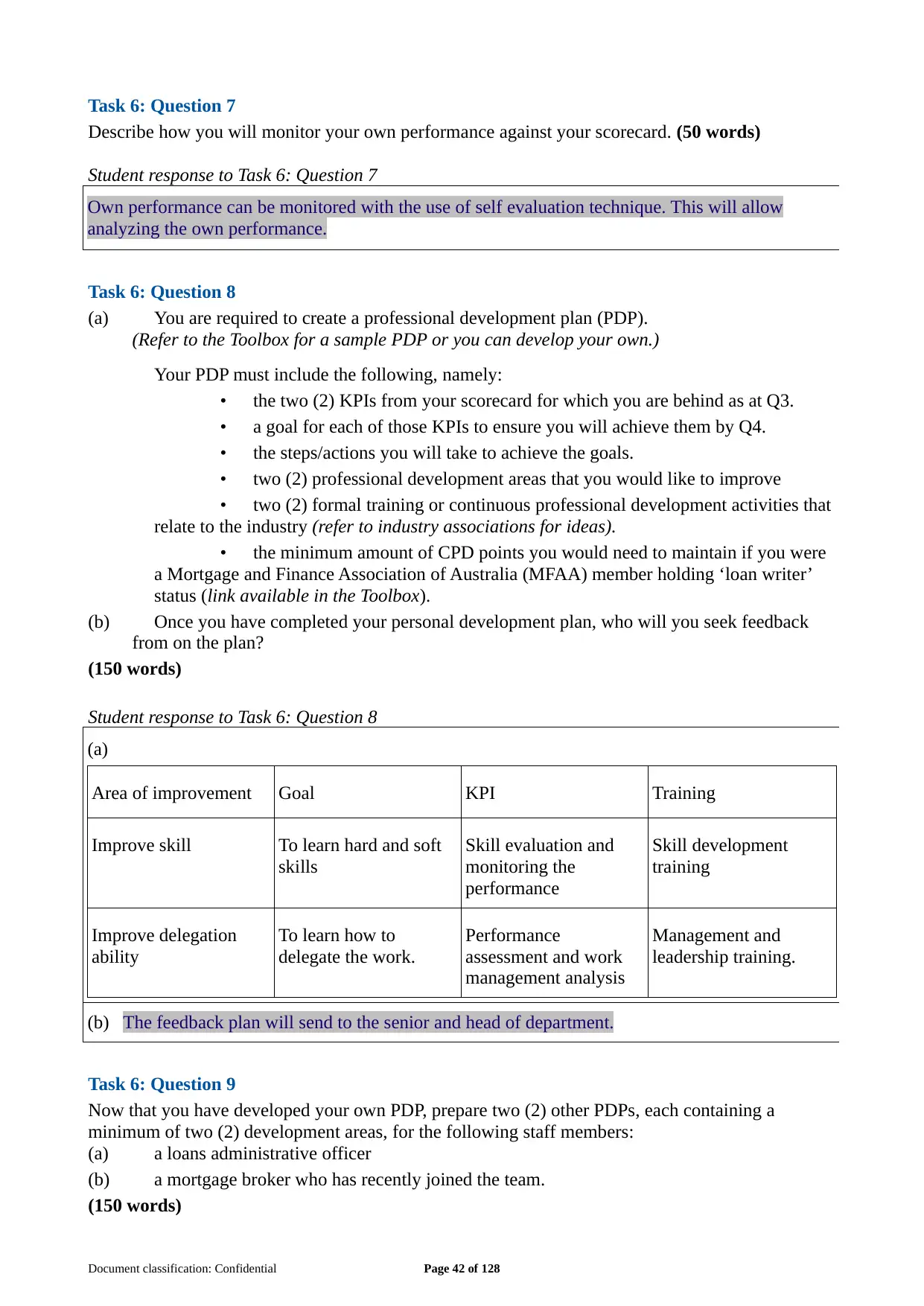

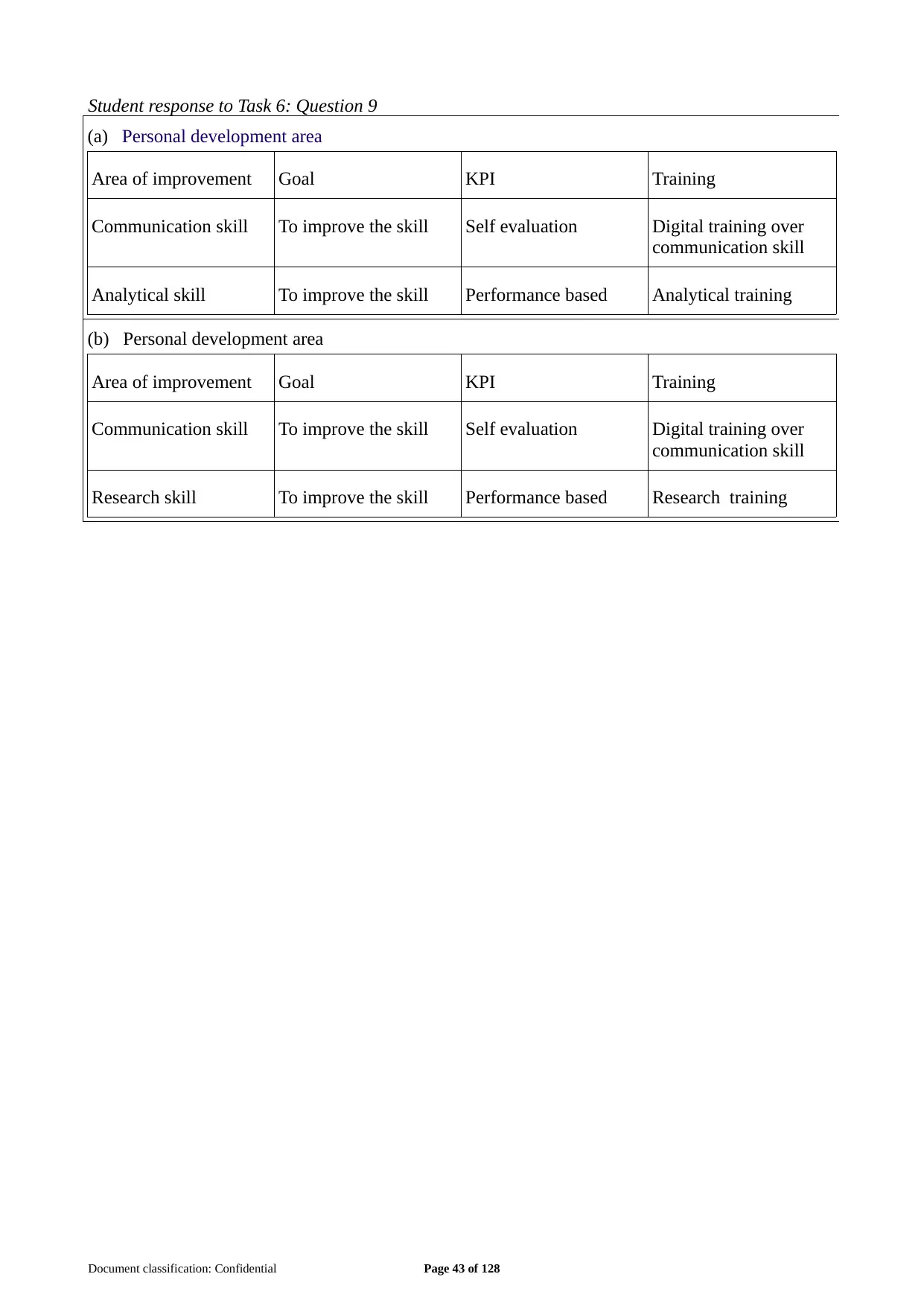

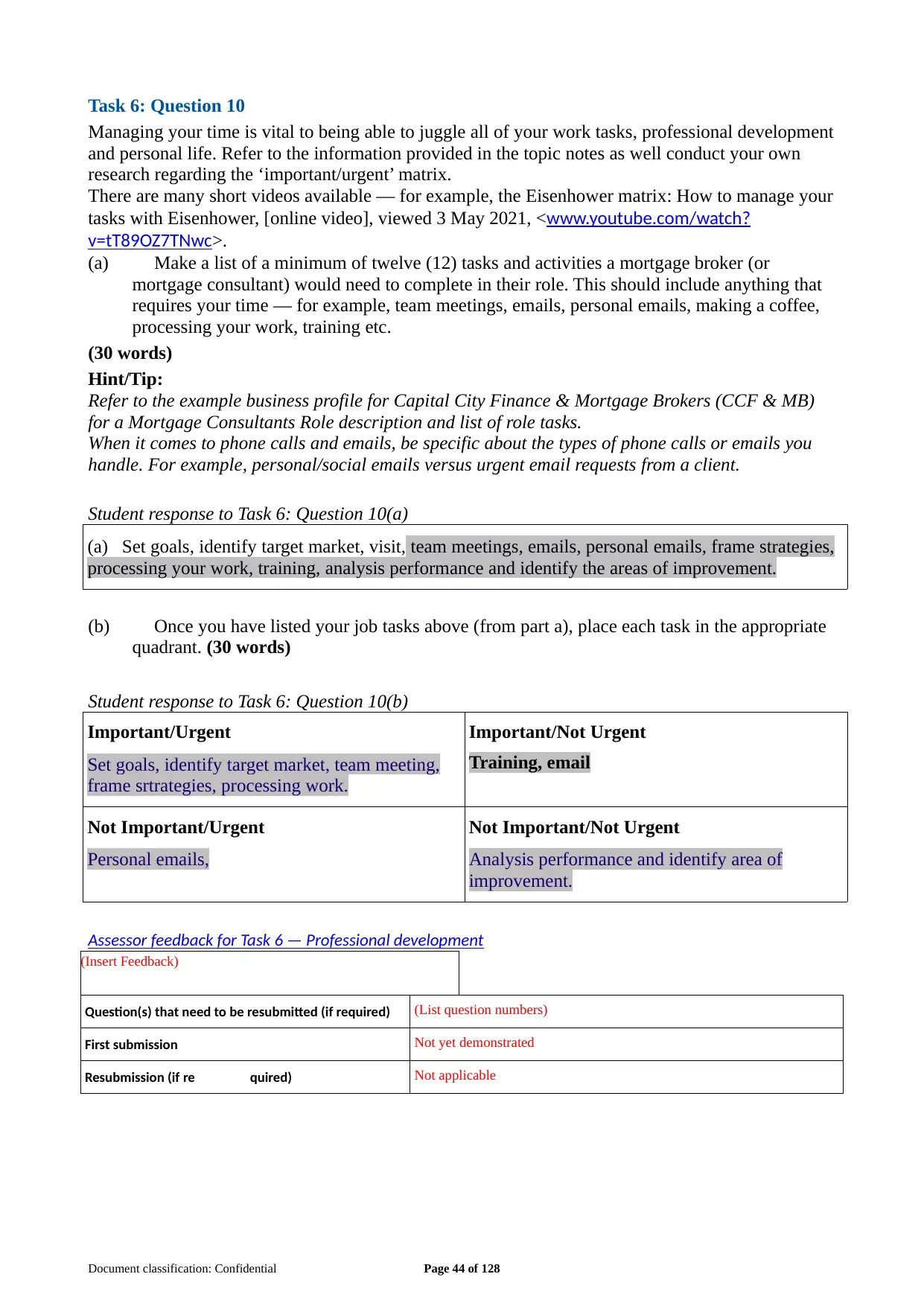

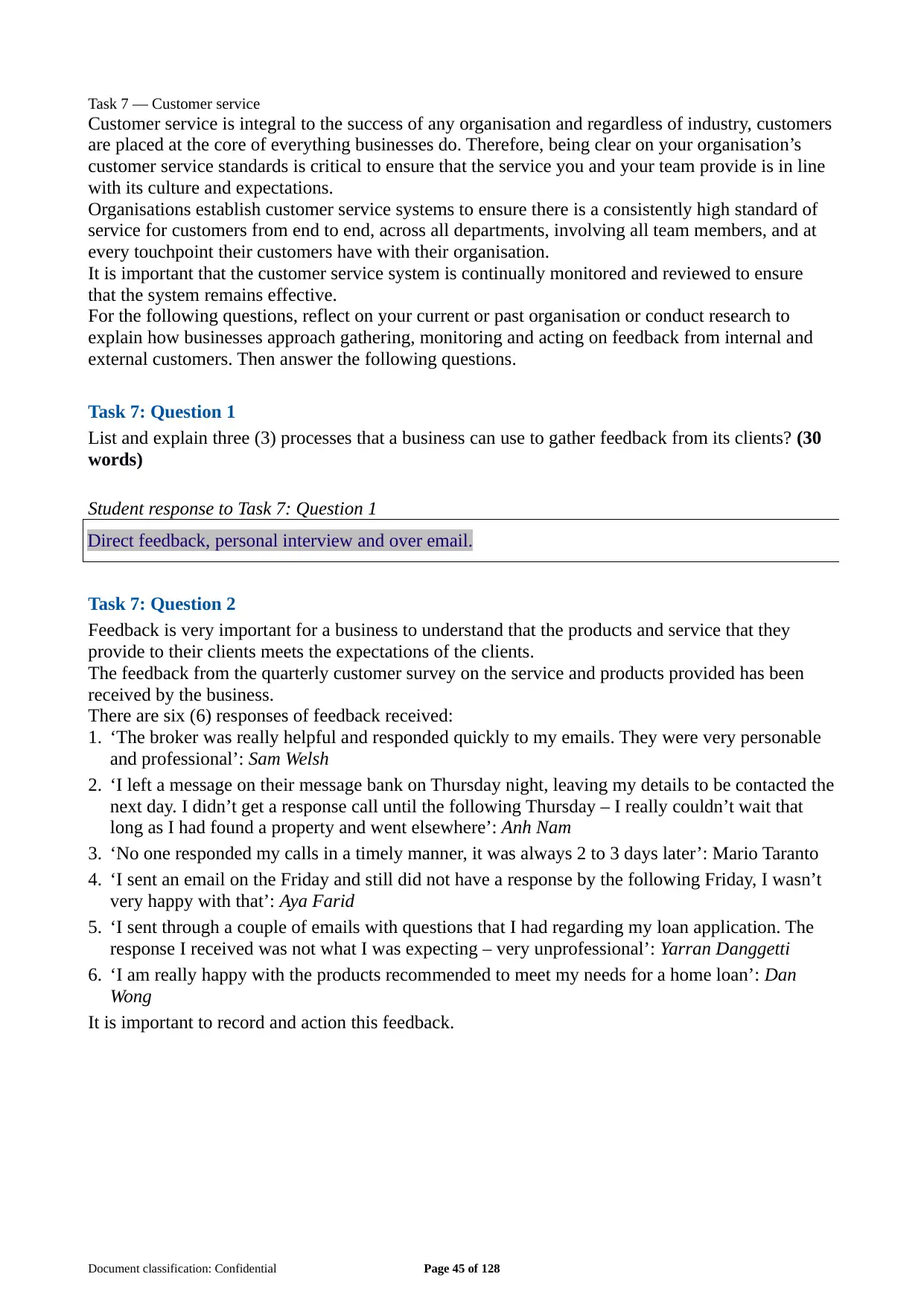

Task 6 — Professional development

Refer to the business profile for Capital City Finance and Mortgage Brokers (CCF & MB) located

in the subject room.

For this task you are to assume you are a mortgage consultant with the CCF & MB team.