Micro Environment - Assignment

VerifiedAdded on 2021/01/19

|28

|7443

|159

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1

Industry/Micro Environment

Report

By: Group 4 – Fantastic Four

Industry/Micro Environment

Report

By: Group 4 – Fantastic Four

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

Executive Summary

The Australian Activewear industry has experienced record growth in recent years, and is

expected to continue to thrive in coming years.

In 2019 alone, sales are expected to grow by 3.3%, an increase which is fuelled by the

popular athleisure trend; consumers are becoming more inclined to wear comfortable and

fashionable sportswear in day-to-day activities than ever before. This trend, along with

greater demand for luxury activewear items, has greatly driven sales within the industry, and

is highlighted through the success of brands such as Lululemon Athletica who offer high-

quality garments that are stylish, comfortable and flexible (Euromonitor, 2017).

Consumer attitudes favouring ethical and environmentally-conscious companies are also

increasing demand for products made with bamboo-fibre, which is considered a sustainable

and eco-friendly material (Imadi, Mahood, & Kazi, 2014).

Strong competitors in this industry include Nike (8.5% of market share) and Adidas (7.1% of

market share) who provide technologically superior products. Nike is considered a market

leader, while Adidas is considered a market challenger through their focus on the experiential

value of sportswear products (Euromonitor, 2019).

Increased online sales suggest offering activewear products from online-platforms, especially

through intermediaries such as eBay, can promote brand awareness and increase sales for

smaller activewear companies, who are attempting to compete with larger, well-established

brands such as Nike.

While the 35-54 year-old age group has generally dominated sales in this industry, consumers

within the 15-34 year old age group are becoming the main target group for activewear

companies as consumers from this demographic generally drive fashion trends and are

considered early-adopters of new styles entering the market. Promotion through social media

campaigns proves a highly effective way of targeting this audience (Still, 2014).

If companies new to the industry can harness the power of eco-friendly and sustainable fabric

options (bamboo) and provide personalised customer service they will engender a large

following from environmentally and health-conscious consumers (Business Insider, 2019)

and will be able to differentiate themselves in the market (McCann, 2015). Companies with

such positioning are expected to maintain steady future growth and benefit from overall

industry revenue growth, which is estimated to reach $2.4 billion in 2024 (Do, 2018).

Executive Summary

The Australian Activewear industry has experienced record growth in recent years, and is

expected to continue to thrive in coming years.

In 2019 alone, sales are expected to grow by 3.3%, an increase which is fuelled by the

popular athleisure trend; consumers are becoming more inclined to wear comfortable and

fashionable sportswear in day-to-day activities than ever before. This trend, along with

greater demand for luxury activewear items, has greatly driven sales within the industry, and

is highlighted through the success of brands such as Lululemon Athletica who offer high-

quality garments that are stylish, comfortable and flexible (Euromonitor, 2017).

Consumer attitudes favouring ethical and environmentally-conscious companies are also

increasing demand for products made with bamboo-fibre, which is considered a sustainable

and eco-friendly material (Imadi, Mahood, & Kazi, 2014).

Strong competitors in this industry include Nike (8.5% of market share) and Adidas (7.1% of

market share) who provide technologically superior products. Nike is considered a market

leader, while Adidas is considered a market challenger through their focus on the experiential

value of sportswear products (Euromonitor, 2019).

Increased online sales suggest offering activewear products from online-platforms, especially

through intermediaries such as eBay, can promote brand awareness and increase sales for

smaller activewear companies, who are attempting to compete with larger, well-established

brands such as Nike.

While the 35-54 year-old age group has generally dominated sales in this industry, consumers

within the 15-34 year old age group are becoming the main target group for activewear

companies as consumers from this demographic generally drive fashion trends and are

considered early-adopters of new styles entering the market. Promotion through social media

campaigns proves a highly effective way of targeting this audience (Still, 2014).

If companies new to the industry can harness the power of eco-friendly and sustainable fabric

options (bamboo) and provide personalised customer service they will engender a large

following from environmentally and health-conscious consumers (Business Insider, 2019)

and will be able to differentiate themselves in the market (McCann, 2015). Companies with

such positioning are expected to maintain steady future growth and benefit from overall

industry revenue growth, which is estimated to reach $2.4 billion in 2024 (Do, 2018).

3

Contents

Industry Overview: ............................................................................................................................. 4

PESTEL Factors: ................................................................................................................................ 5

Political: ....................................................................................................................................... 5

Economic: .................................................................................................................................... 6

Legal: ........................................................................................................................................... 7

Demographic: .............................................................................................................................. 8

Social: ......................................................................................................................................... 10

Environmental: ......................................................................................................................... 11

Technological: ........................................................................................................................... 12

Competitor Analysis: ........................................................................................................................ 13

Collaborator Analysis:...................................................................................................................... 17

Customer Analysis: ........................................................................................................................... 22

Key Success Factors: ........................................................................................................................ 24

Reference List: .................................................................................................................................. 25

Contents

Industry Overview: ............................................................................................................................. 4

PESTEL Factors: ................................................................................................................................ 5

Political: ....................................................................................................................................... 5

Economic: .................................................................................................................................... 6

Legal: ........................................................................................................................................... 7

Demographic: .............................................................................................................................. 8

Social: ......................................................................................................................................... 10

Environmental: ......................................................................................................................... 11

Technological: ........................................................................................................................... 12

Competitor Analysis: ........................................................................................................................ 13

Collaborator Analysis:...................................................................................................................... 17

Customer Analysis: ........................................................................................................................... 22

Key Success Factors: ........................................................................................................................ 24

Reference List: .................................................................................................................................. 25

4

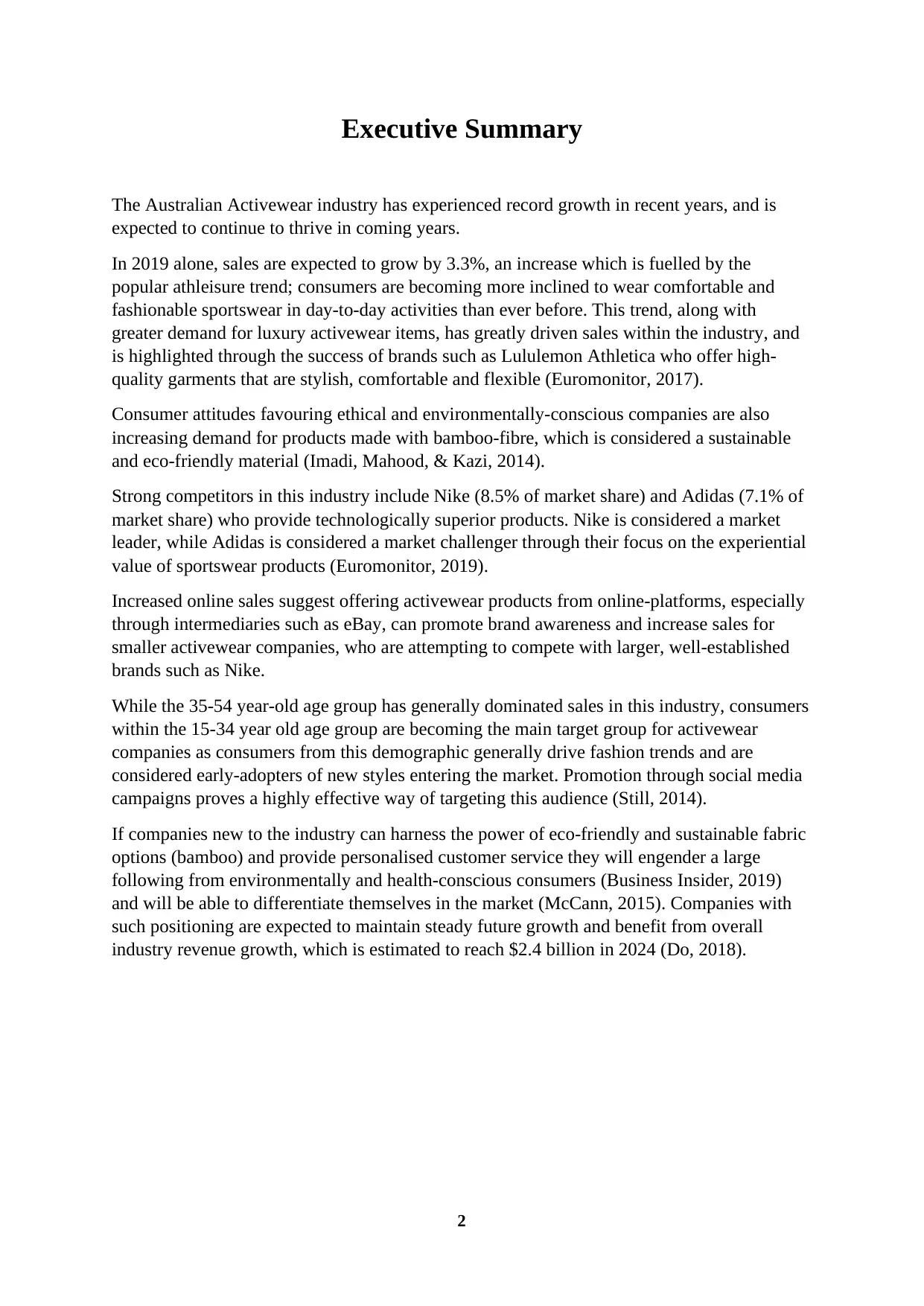

Industry Overview:

Industry:

Figure 1 shows that activewear falls

under the sporting apparel category of

the clothing industry. It includes clothing

items such as tops, bottoms, and

footwear, which include items that fit

each section (Eg. T-shirts for tops).

Activewear can also be represented by

discount apparel category, due to brands

such as Kmart selling similar items.

Market:

Figure 1.1 depicts the two segments of

Australian clothing buyers; retailer and

consumers. Retail clothing purchasers fall

under five main segments, with the most

relevant one being sport apparel retailers,

which includes activewear. Within the

consumer segment, activewear buyers are

most likely to come from the leisure

segment, with sub-segments such as

fitness fanatics and activity-specific (Eg.

gym-goers) being the most important.

There is however also an increasing trend

in individuals wearing activewear as

stylish everyday wear, as only 19% of

people who own activewear actually wear

it to the gym (Elle, 2016), thus meaning

the fashion segment is becoming more

prevalent.

Australian Clothing

Industry (Figure 1)

Sport

Apparel

Sport-specific

Clothing Activewear

Tops

T-Shirts

Crop

Tops

Tank

Tops

Sports

Bras

Long

Sleeve

Bottoms

Leggings

Shorts

Gym

Pants

Yoga

Pants

Footwear

Sneakers

Running

Shoes

Fast

Fashion

Discount

Apparel

Luxury

Apparel

Australian

Clothing Buyers

(Figure 1.1)

Retailer

Sport

Apparel

Fast

Fashion

Discount

Apparel

Luxury

Apparel

Utility

Apparel

Consumer

Leisure

Fitness

Fanatics

Sports

Players

Outdoorsy

Types

Activity-

specific

Utility

Fashion

Industry Overview:

Industry:

Figure 1 shows that activewear falls

under the sporting apparel category of

the clothing industry. It includes clothing

items such as tops, bottoms, and

footwear, which include items that fit

each section (Eg. T-shirts for tops).

Activewear can also be represented by

discount apparel category, due to brands

such as Kmart selling similar items.

Market:

Figure 1.1 depicts the two segments of

Australian clothing buyers; retailer and

consumers. Retail clothing purchasers fall

under five main segments, with the most

relevant one being sport apparel retailers,

which includes activewear. Within the

consumer segment, activewear buyers are

most likely to come from the leisure

segment, with sub-segments such as

fitness fanatics and activity-specific (Eg.

gym-goers) being the most important.

There is however also an increasing trend

in individuals wearing activewear as

stylish everyday wear, as only 19% of

people who own activewear actually wear

it to the gym (Elle, 2016), thus meaning

the fashion segment is becoming more

prevalent.

Australian Clothing

Industry (Figure 1)

Sport

Apparel

Sport-specific

Clothing Activewear

Tops

T-Shirts

Crop

Tops

Tank

Tops

Sports

Bras

Long

Sleeve

Bottoms

Leggings

Shorts

Gym

Pants

Yoga

Pants

Footwear

Sneakers

Running

Shoes

Fast

Fashion

Discount

Apparel

Luxury

Apparel

Australian

Clothing Buyers

(Figure 1.1)

Retailer

Sport

Apparel

Fast

Fashion

Discount

Apparel

Luxury

Apparel

Utility

Apparel

Consumer

Leisure

Fitness

Fanatics

Sports

Players

Outdoorsy

Types

Activity-

specific

Utility

Fashion

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5

PESTEL Factors:

Political:

Free Trade Agreements:

Australia currently has 11 free trade agreements, with the purpose of reducing and

eliminating trade barriers, thus encouraging international trade/investment. These are listed

below:

These agreements can be beneficial (mineral/ore industry), or detrimental (car industry) to

local industries in regards to exporting/importing.

The 2016 census showed that the number of manufacturing workers has decreased by 24%

over the five years leading up to 2016 (Hutchens, 2017).

These agreements will be beneficial for companies that manufacture in places such as China

or Thailand (and sell in Australia), but detrimental to companies (E.g. Activewear

companies) that produce and sell in Australia (due to the high production costs associated).

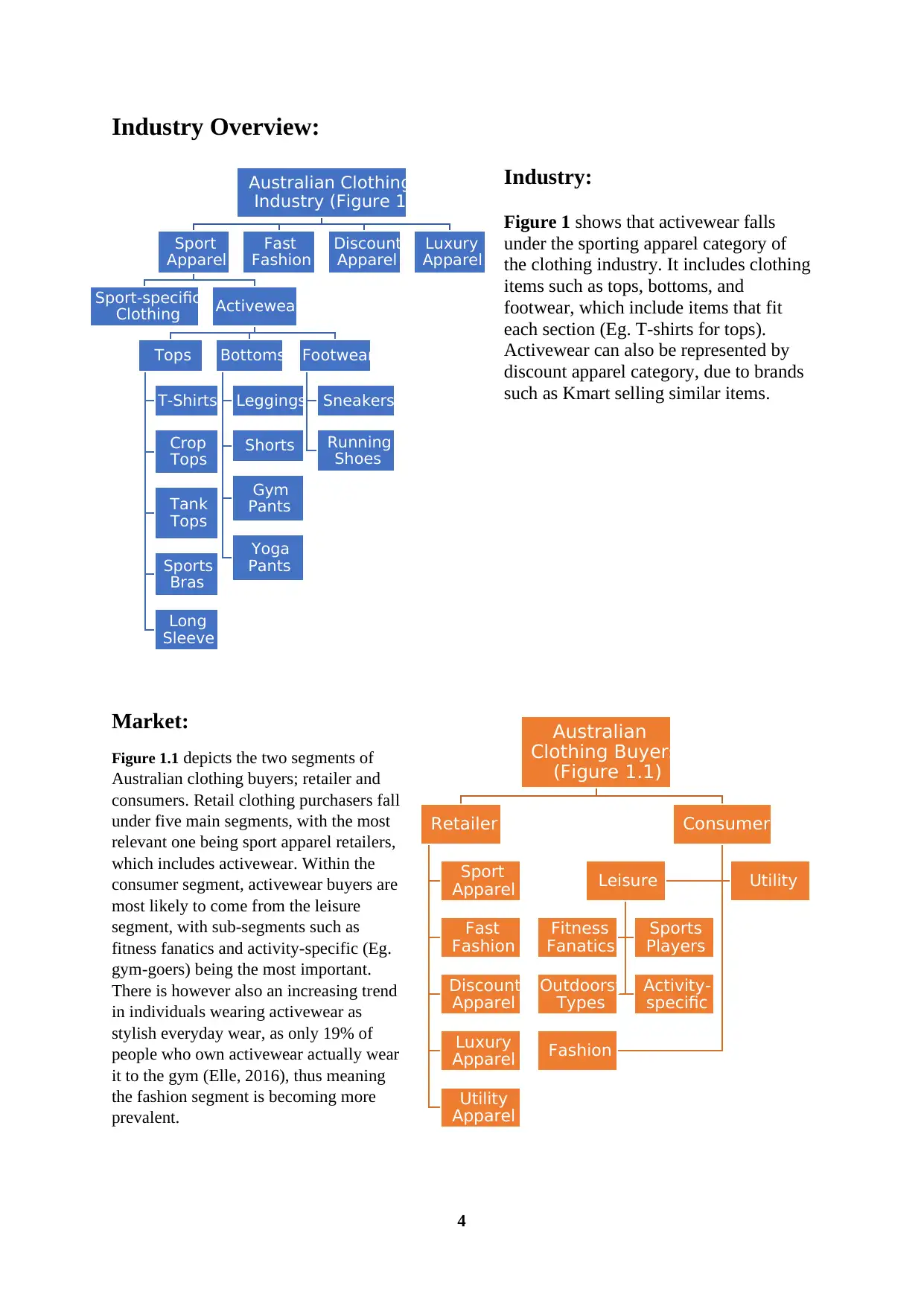

Proposed Income Tax Cuts:

Proposed tax cuts to personal income could

significantly increase sales in the

Australian activewear industry. The 2019

Federal Budget announced plans to give

immediate tax relief to individuals earning

$126,000 a year or lower, along with

individuals earning between $45,000 and

$200,000, reducing their tax rate by 2.5%

(Gothe-Snape, 2019). These reductions

would increase levels of disposable income

(as seen in figure 2.1), thus allowing

increased expenditure on non-essential

items, such as activewear (Rushton, 2019). (Figure 2.1)

PESTEL Factors:

Political:

Free Trade Agreements:

Australia currently has 11 free trade agreements, with the purpose of reducing and

eliminating trade barriers, thus encouraging international trade/investment. These are listed

below:

These agreements can be beneficial (mineral/ore industry), or detrimental (car industry) to

local industries in regards to exporting/importing.

The 2016 census showed that the number of manufacturing workers has decreased by 24%

over the five years leading up to 2016 (Hutchens, 2017).

These agreements will be beneficial for companies that manufacture in places such as China

or Thailand (and sell in Australia), but detrimental to companies (E.g. Activewear

companies) that produce and sell in Australia (due to the high production costs associated).

Proposed Income Tax Cuts:

Proposed tax cuts to personal income could

significantly increase sales in the

Australian activewear industry. The 2019

Federal Budget announced plans to give

immediate tax relief to individuals earning

$126,000 a year or lower, along with

individuals earning between $45,000 and

$200,000, reducing their tax rate by 2.5%

(Gothe-Snape, 2019). These reductions

would increase levels of disposable income

(as seen in figure 2.1), thus allowing

increased expenditure on non-essential

items, such as activewear (Rushton, 2019). (Figure 2.1)

6

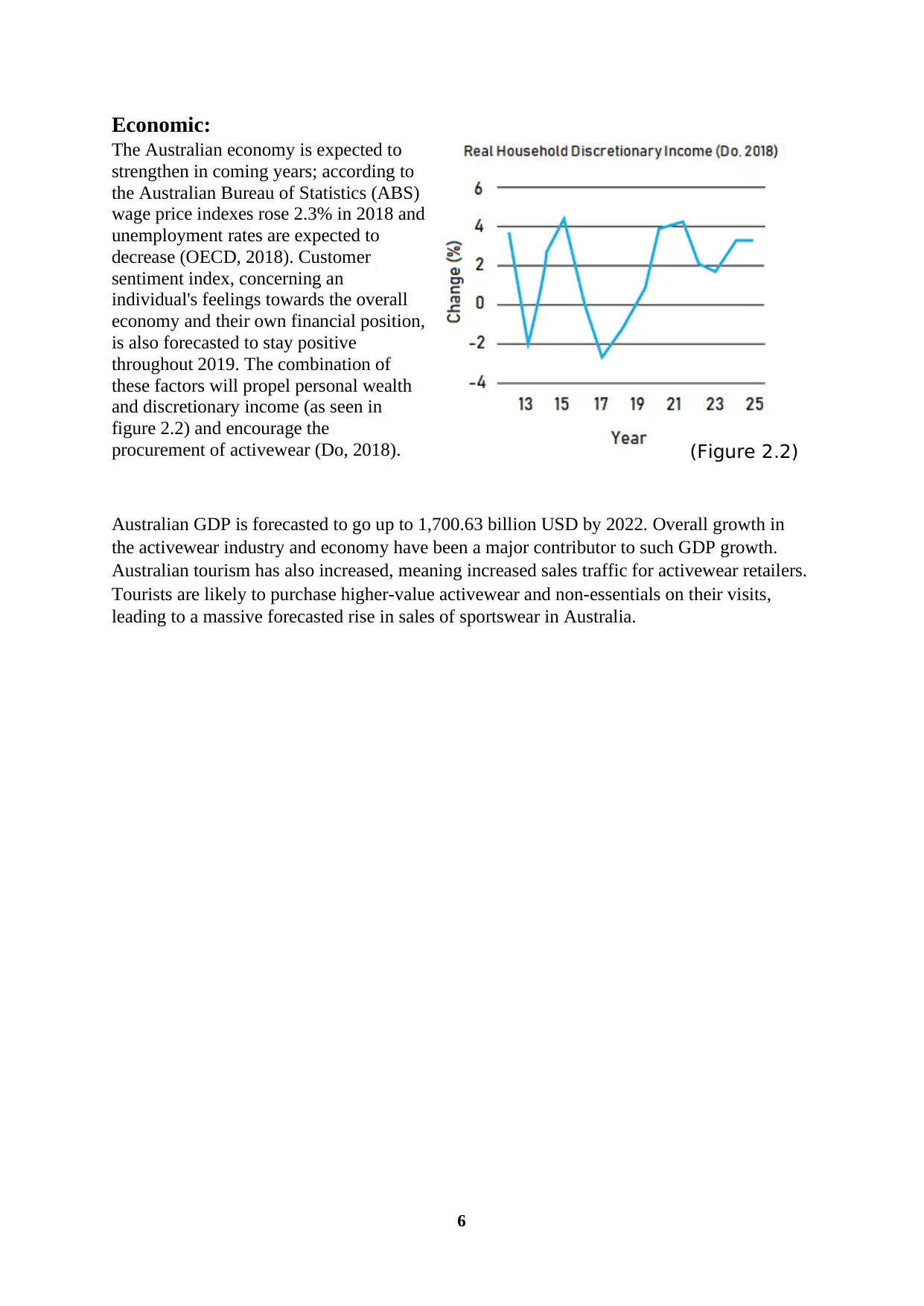

Economic:

The Australian economy is expected to

strengthen in coming years; according to

the Australian Bureau of Statistics (ABS)

wage price indexes rose 2.3% in 2018 and

unemployment rates are expected to

decrease (OECD, 2018). Customer

sentiment index, concerning an

individual's feelings towards the overall

economy and their own financial position,

is also forecasted to stay positive

throughout 2019. The combination of

these factors will propel personal wealth

and discretionary income (as seen in

figure 2.2) and encourage the

procurement of activewear (Do, 2018).

Australian GDP is forecasted to go up to 1,700.63 billion USD by 2022. Overall growth in

the activewear industry and economy have been a major contributor to such GDP growth.

Australian tourism has also increased, meaning increased sales traffic for activewear retailers.

Tourists are likely to purchase higher-value activewear and non-essentials on their visits,

leading to a massive forecasted rise in sales of sportswear in Australia.

(Figure 2.2)

Economic:

The Australian economy is expected to

strengthen in coming years; according to

the Australian Bureau of Statistics (ABS)

wage price indexes rose 2.3% in 2018 and

unemployment rates are expected to

decrease (OECD, 2018). Customer

sentiment index, concerning an

individual's feelings towards the overall

economy and their own financial position,

is also forecasted to stay positive

throughout 2019. The combination of

these factors will propel personal wealth

and discretionary income (as seen in

figure 2.2) and encourage the

procurement of activewear (Do, 2018).

Australian GDP is forecasted to go up to 1,700.63 billion USD by 2022. Overall growth in

the activewear industry and economy have been a major contributor to such GDP growth.

Australian tourism has also increased, meaning increased sales traffic for activewear retailers.

Tourists are likely to purchase higher-value activewear and non-essentials on their visits,

leading to a massive forecasted rise in sales of sportswear in Australia.

(Figure 2.2)

7

Legal:

Penalty Rates:

From the 1st of November 2018, increases in the General Retail Industry award rate were

implemented. This means an increase of 15% pay for work performed on Saturday, and a 5%

increase in pay for work that is performed after 6pm on weekdays (Elmas, 2018).

By 2020, there will be a 25% penalty rate implemented on Saturdays, and an extra 15%

loading rate after 6pm on weekdays (Elmas, 2018).

The implication of such an increase in penalty rates on the retail sector will mean that it is

more costly to have operate retail stores during Saturdays and weekdays (after 6pm). This

will discourage retail stores from staying open past 6pm, or for long periods on Saturdays. If

they do decide to stay open during these times, they will incur a higher cost of operating each

store. This may lead to an increase in prices or a reduction in the price margins of products,

which will discourage current and prospective brands from becoming part of the Australian

retail sector.

GST on low value imported goods:

The Federal Parliament implemented a law on the 1st of July 2018 intending to extend the

goods and services tax (10%) to goods that are imported by consumers (valued at $1,000 or

under) (Australian Taxation Office, 2018).

The law will positively impact the whole industry, including the activewear aspect of the

sportswear/clothing industry. It will cause importers of activewear (on marketplaces like

eBay) to increase their prices or reduce their margins when selling their clothing in Australia,

giving the local competitors an advantage (Youl, 2018)

Retail Regulations:

The Competition and Consumer Act 2010 covers largely all parts of the market (suppliers,

retailers, consumers, etc.); and laws on product safety and labelling, unfair market practices,

price monitoring, industry codes, industry regulation – airports, electricity, gas,

telecommunications, mergers and acquisitions (ACCC, 2010).

Thus, activewear businesses can’t create their own monopoly to surge prices, put smaller

businesses out of business, perform under-the-table deals which intermediaries and be unfair

to customers.

Store trading hours regulation are also established to protect smaller players in the activewear

market. However, the government are becoming more lenient towards the law as it does

constrain growth and activity.

Legal:

Penalty Rates:

From the 1st of November 2018, increases in the General Retail Industry award rate were

implemented. This means an increase of 15% pay for work performed on Saturday, and a 5%

increase in pay for work that is performed after 6pm on weekdays (Elmas, 2018).

By 2020, there will be a 25% penalty rate implemented on Saturdays, and an extra 15%

loading rate after 6pm on weekdays (Elmas, 2018).

The implication of such an increase in penalty rates on the retail sector will mean that it is

more costly to have operate retail stores during Saturdays and weekdays (after 6pm). This

will discourage retail stores from staying open past 6pm, or for long periods on Saturdays. If

they do decide to stay open during these times, they will incur a higher cost of operating each

store. This may lead to an increase in prices or a reduction in the price margins of products,

which will discourage current and prospective brands from becoming part of the Australian

retail sector.

GST on low value imported goods:

The Federal Parliament implemented a law on the 1st of July 2018 intending to extend the

goods and services tax (10%) to goods that are imported by consumers (valued at $1,000 or

under) (Australian Taxation Office, 2018).

The law will positively impact the whole industry, including the activewear aspect of the

sportswear/clothing industry. It will cause importers of activewear (on marketplaces like

eBay) to increase their prices or reduce their margins when selling their clothing in Australia,

giving the local competitors an advantage (Youl, 2018)

Retail Regulations:

The Competition and Consumer Act 2010 covers largely all parts of the market (suppliers,

retailers, consumers, etc.); and laws on product safety and labelling, unfair market practices,

price monitoring, industry codes, industry regulation – airports, electricity, gas,

telecommunications, mergers and acquisitions (ACCC, 2010).

Thus, activewear businesses can’t create their own monopoly to surge prices, put smaller

businesses out of business, perform under-the-table deals which intermediaries and be unfair

to customers.

Store trading hours regulation are also established to protect smaller players in the activewear

market. However, the government are becoming more lenient towards the law as it does

constrain growth and activity.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

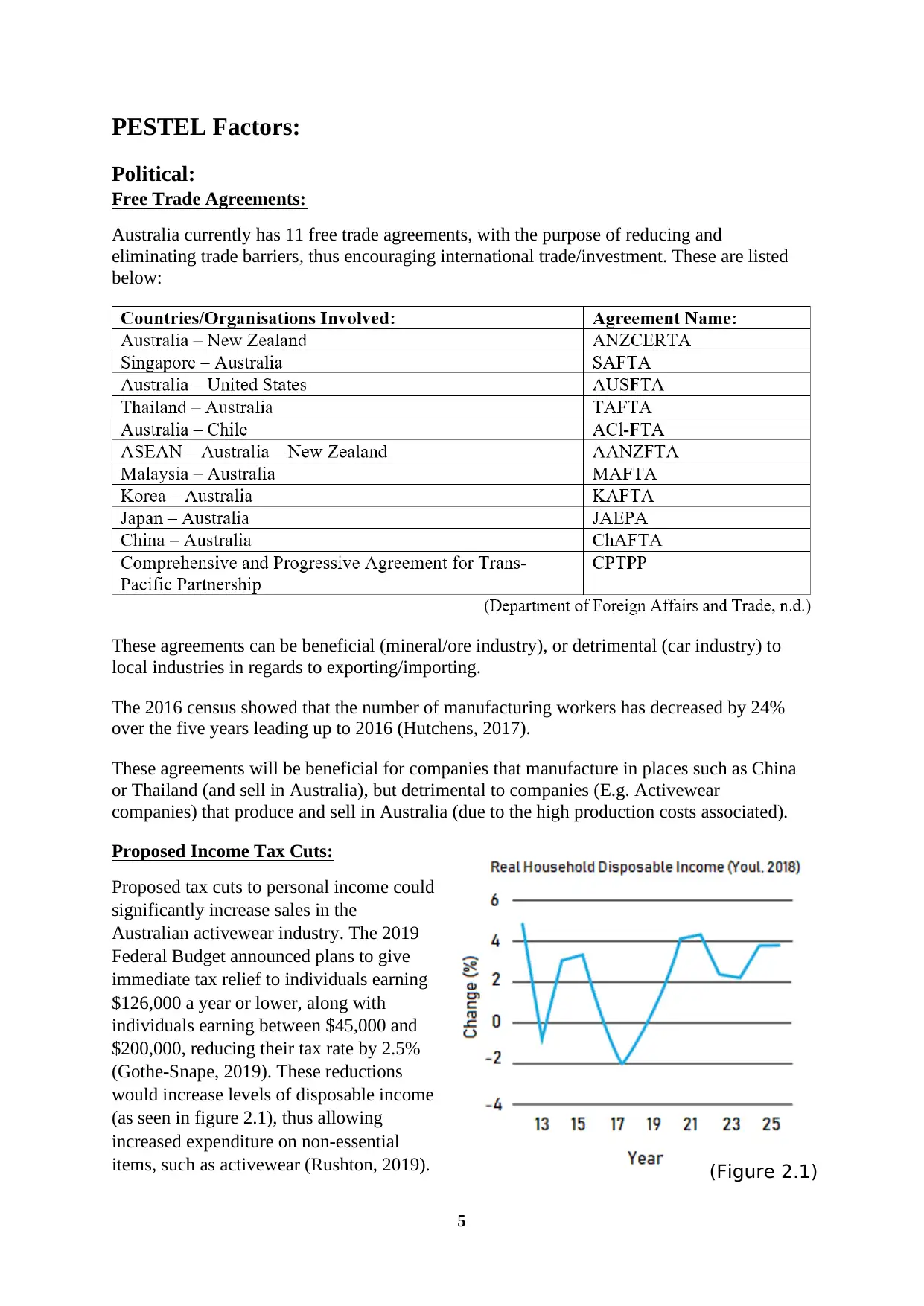

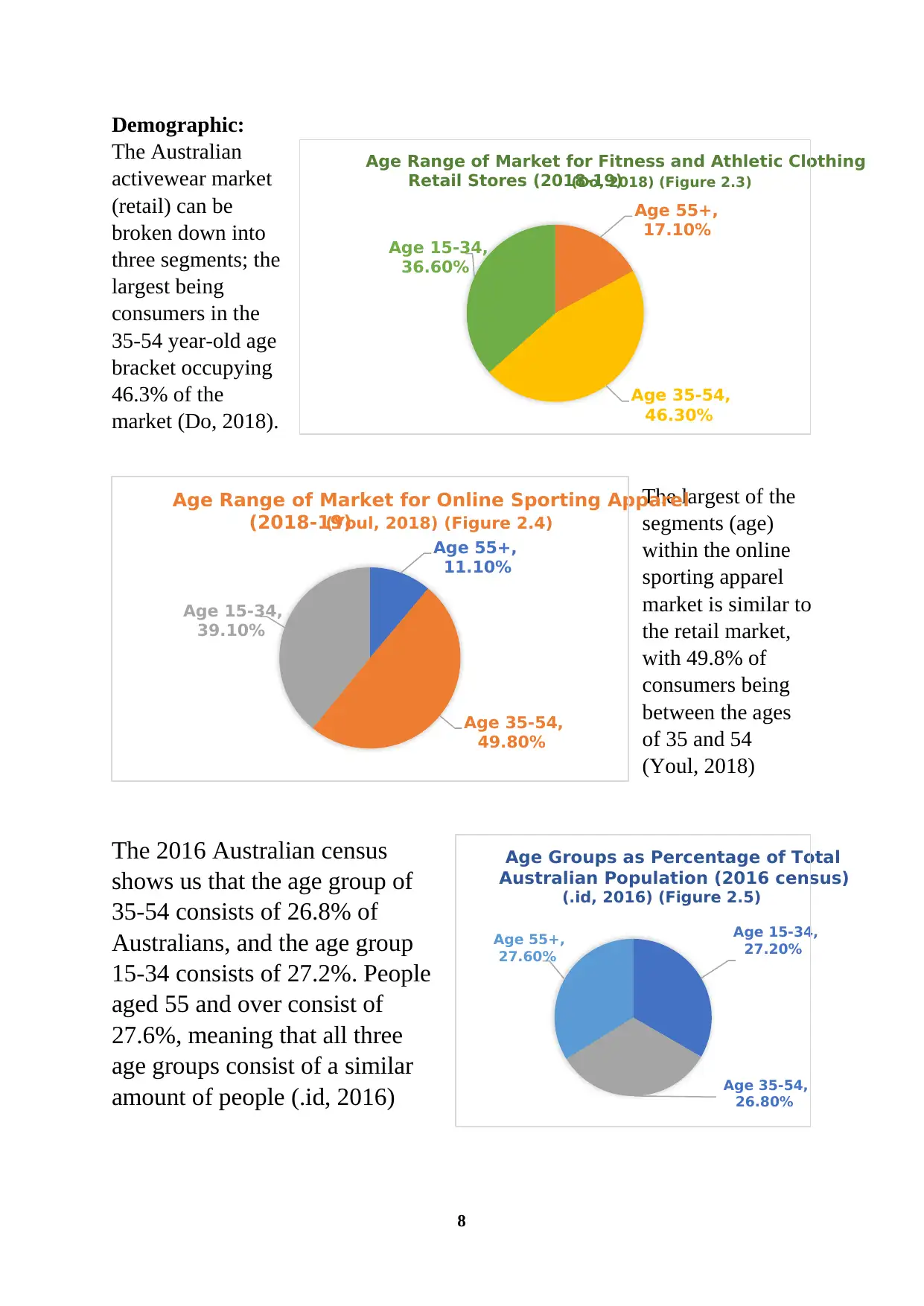

Demographic:

The Australian

activewear market

(retail) can be

broken down into

three segments; the

largest being

consumers in the

35-54 year-old age

bracket occupying

46.3% of the

market (Do, 2018).

The largest of the

segments (age)

within the online

sporting apparel

market is similar to

the retail market,

with 49.8% of

consumers being

between the ages

of 35 and 54

(Youl, 2018)

The 2016 Australian census

shows us that the age group of

35-54 consists of 26.8% of

Australians, and the age group

15-34 consists of 27.2%. People

aged 55 and over consist of

27.6%, meaning that all three

age groups consist of a similar

amount of people (.id, 2016)

Age 55+,

17.10%

Age 35-54,

46.30%

Age 15-34,

36.60%

Age Range of Market for Fitness and Athletic Clothing

Retail Stores (2018-19)(Do, 2018) (Figure 2.3)

Age 55+,

11.10%

Age 35-54,

49.80%

Age 15-34,

39.10%

Age Range of Market for Online Sporting Apparel

(2018-19)(Youl, 2018) (Figure 2.4)

Age 15-34,

27.20%

Age 35-54,

26.80%

Age 55+,

27.60%

Age Groups as Percentage of Total

Australian Population (2016 census)

(.id, 2016) (Figure 2.5)

Demographic:

The Australian

activewear market

(retail) can be

broken down into

three segments; the

largest being

consumers in the

35-54 year-old age

bracket occupying

46.3% of the

market (Do, 2018).

The largest of the

segments (age)

within the online

sporting apparel

market is similar to

the retail market,

with 49.8% of

consumers being

between the ages

of 35 and 54

(Youl, 2018)

The 2016 Australian census

shows us that the age group of

35-54 consists of 26.8% of

Australians, and the age group

15-34 consists of 27.2%. People

aged 55 and over consist of

27.6%, meaning that all three

age groups consist of a similar

amount of people (.id, 2016)

Age 55+,

17.10%

Age 35-54,

46.30%

Age 15-34,

36.60%

Age Range of Market for Fitness and Athletic Clothing

Retail Stores (2018-19)(Do, 2018) (Figure 2.3)

Age 55+,

11.10%

Age 35-54,

49.80%

Age 15-34,

39.10%

Age Range of Market for Online Sporting Apparel

(2018-19)(Youl, 2018) (Figure 2.4)

Age 15-34,

27.20%

Age 35-54,

26.80%

Age 55+,

27.60%

Age Groups as Percentage of Total

Australian Population (2016 census)

(.id, 2016) (Figure 2.5)

9

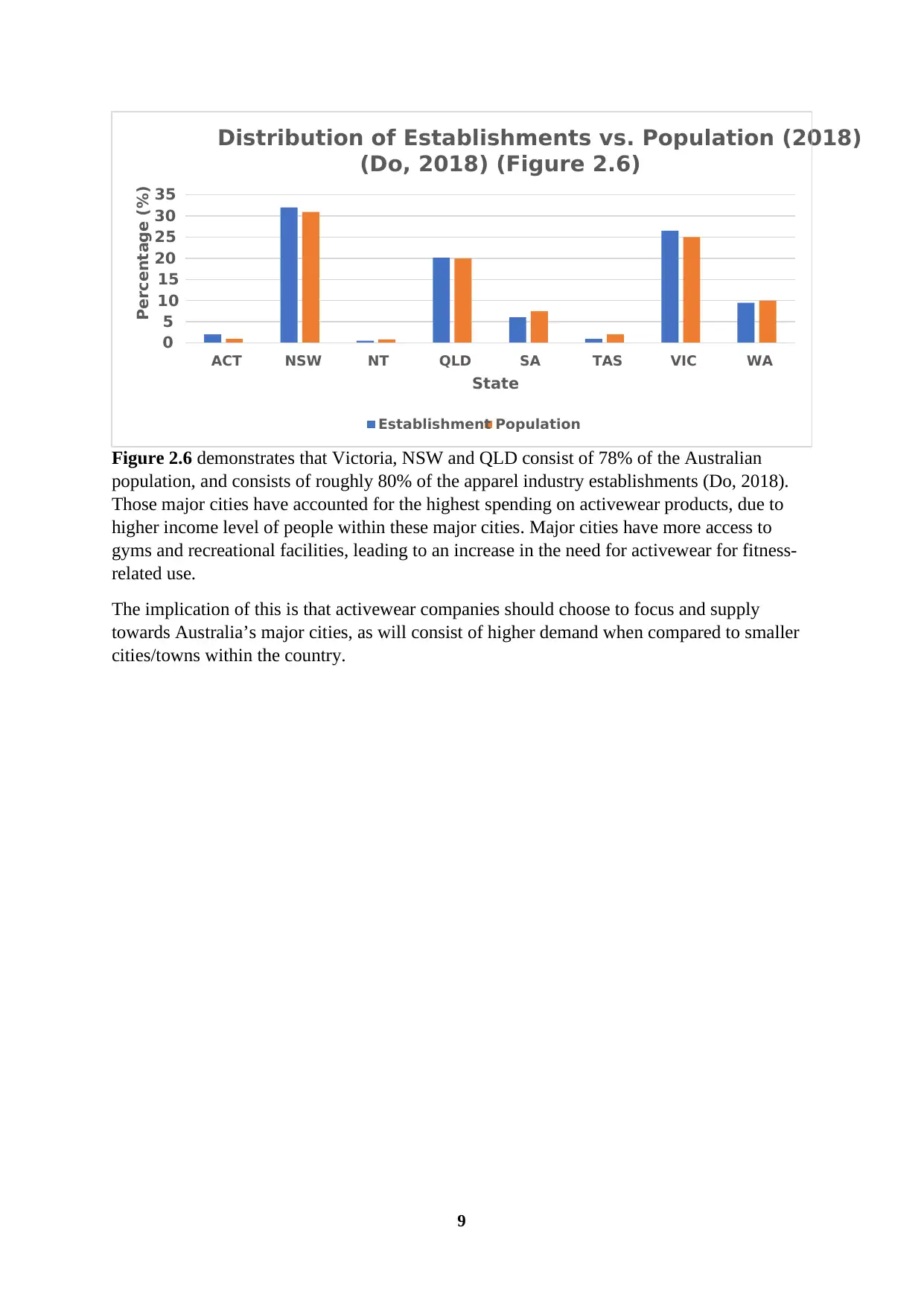

Figure 2.6 demonstrates that Victoria, NSW and QLD consist of 78% of the Australian

population, and consists of roughly 80% of the apparel industry establishments (Do, 2018).

Those major cities have accounted for the highest spending on activewear products, due to

higher income level of people within these major cities. Major cities have more access to

gyms and recreational facilities, leading to an increase in the need for activewear for fitness-

related use.

The implication of this is that activewear companies should choose to focus and supply

towards Australia’s major cities, as will consist of higher demand when compared to smaller

cities/towns within the country.

0

5

10

15

20

25

30

35

ACT NSW NT QLD SA TAS VIC WA

Percentage (%)

State

Distribution of Establishments vs. Population (2018)

(Do, 2018) (Figure 2.6)

Establishment Population

Figure 2.6 demonstrates that Victoria, NSW and QLD consist of 78% of the Australian

population, and consists of roughly 80% of the apparel industry establishments (Do, 2018).

Those major cities have accounted for the highest spending on activewear products, due to

higher income level of people within these major cities. Major cities have more access to

gyms and recreational facilities, leading to an increase in the need for activewear for fitness-

related use.

The implication of this is that activewear companies should choose to focus and supply

towards Australia’s major cities, as will consist of higher demand when compared to smaller

cities/towns within the country.

0

5

10

15

20

25

30

35

ACT NSW NT QLD SA TAS VIC WA

Percentage (%)

State

Distribution of Establishments vs. Population (2018)

(Do, 2018) (Figure 2.6)

Establishment Population

10

Social:

Athleisure Trend:

Consumers are increasingly choosing luxury sportswear products that can be worn during

exercise and casually too. According to Cheng (2018) sales of specialised performance

activewear are declining in comparison to ‘sports leisure’ products. Industry players must

take note of this trend and consider expanding their product into the ‘Athleisure’ market.

Social trends:

Consumers are also becoming more environmentally conscious; over 90% of Australians are

concerned about sustainability and the environment. This trend which is propelled by social

media marketing campaigns, such as Greenpeace’s, which campaigns for retail companies to

omit hazardous chemicals in their production process (Still, 2014). Companies which are

recognised as acting in an ethical and socially-responsible manner are preferred by consumers

and thus attract more sales and profits (Retail Insight Network, 2018).

Social:

Athleisure Trend:

Consumers are increasingly choosing luxury sportswear products that can be worn during

exercise and casually too. According to Cheng (2018) sales of specialised performance

activewear are declining in comparison to ‘sports leisure’ products. Industry players must

take note of this trend and consider expanding their product into the ‘Athleisure’ market.

Social trends:

Consumers are also becoming more environmentally conscious; over 90% of Australians are

concerned about sustainability and the environment. This trend which is propelled by social

media marketing campaigns, such as Greenpeace’s, which campaigns for retail companies to

omit hazardous chemicals in their production process (Still, 2014). Companies which are

recognised as acting in an ethical and socially-responsible manner are preferred by consumers

and thus attract more sales and profits (Retail Insight Network, 2018).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11

Environmental:

Polyester Properties:

Most activewear brands in the industry rely on polyester as the main material of their

clothing. This is because it possesses strength and durability properties (Lee, 2017). Polyester

also possesses negative properties, such as non-environmentally friendly dyes used in

colouring, the non-biodegradable properties of the fabric, and the large use of water in the

production process. Polyester is also derived from petroleum, which is produced by

processing oil, which is the largest pollutant on the plant (Uren, 2018).

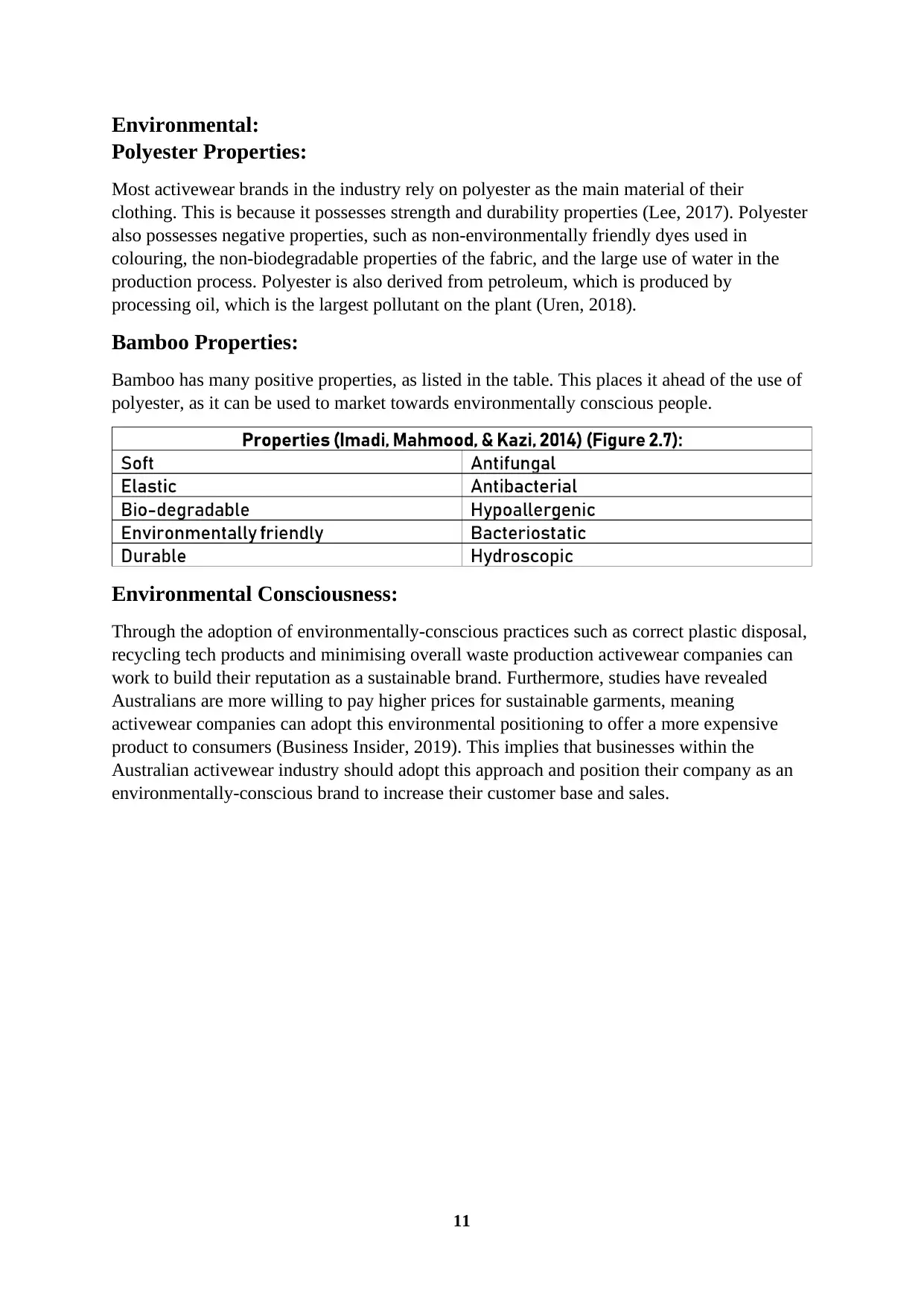

Bamboo Properties:

Bamboo has many positive properties, as listed in the table. This places it ahead of the use of

polyester, as it can be used to market towards environmentally conscious people.

Environmental Consciousness:

Through the adoption of environmentally-conscious practices such as correct plastic disposal,

recycling tech products and minimising overall waste production activewear companies can

work to build their reputation as a sustainable brand. Furthermore, studies have revealed

Australians are more willing to pay higher prices for sustainable garments, meaning

activewear companies can adopt this environmental positioning to offer a more expensive

product to consumers (Business Insider, 2019). This implies that businesses within the

Australian activewear industry should adopt this approach and position their company as an

environmentally-conscious brand to increase their customer base and sales.

Environmental:

Polyester Properties:

Most activewear brands in the industry rely on polyester as the main material of their

clothing. This is because it possesses strength and durability properties (Lee, 2017). Polyester

also possesses negative properties, such as non-environmentally friendly dyes used in

colouring, the non-biodegradable properties of the fabric, and the large use of water in the

production process. Polyester is also derived from petroleum, which is produced by

processing oil, which is the largest pollutant on the plant (Uren, 2018).

Bamboo Properties:

Bamboo has many positive properties, as listed in the table. This places it ahead of the use of

polyester, as it can be used to market towards environmentally conscious people.

Environmental Consciousness:

Through the adoption of environmentally-conscious practices such as correct plastic disposal,

recycling tech products and minimising overall waste production activewear companies can

work to build their reputation as a sustainable brand. Furthermore, studies have revealed

Australians are more willing to pay higher prices for sustainable garments, meaning

activewear companies can adopt this environmental positioning to offer a more expensive

product to consumers (Business Insider, 2019). This implies that businesses within the

Australian activewear industry should adopt this approach and position their company as an

environmentally-conscious brand to increase their customer base and sales.

12

Technological:

Online Shopping:

Online shopping has dramatically increased accessibility to activewear garments through e-

commerce development and represents an increasing sales trend in the fashion industry.

AusPost Industry report stated 35.6% of sales have been online fashion-apparel purchases,

including an 11.7% increase in sales in the activewear sector compared to the previous year

(Yip, Lieu & Foo, 2018).

This implies sellers could greatly benefit from developing an online platform for their brand

as online apparel purchases are on the rise. Moreover, online retailing saves organisation

costs through the reduction of staff wages and allows them to process sales transactions at

any time of day or night.

Buy Now Pay Later:

One considerable e-commerce development has been the introduction of “buy now, pay later”

options such as Afterpay and ZipPay, which offer customers interest-free payment plans on

purchases via regular weekly, fortnightly or monthly instalments. This new innovation has

resulted in a 289% surge in online sales between 2017 and 2018, concluding a total of $2.2

billion Afterpay sales, 25% of which was from the fashion retail industry alone (Wu, 2018).

Offering payment options such as Afterpay is an effective way to increase activewear sales

from younger, lower-income demographics. 60% of Afterpay users are aged between 18 and

34 years, demonstrating these services lower the price barrier many young people face when

purchasing expensive activewear products (Wu, 2018). Therefore, activewear companies

should consider adopting such payments plans to increase sales from younger demographics

who largely drive fashion trends.

Technological:

Online Shopping:

Online shopping has dramatically increased accessibility to activewear garments through e-

commerce development and represents an increasing sales trend in the fashion industry.

AusPost Industry report stated 35.6% of sales have been online fashion-apparel purchases,

including an 11.7% increase in sales in the activewear sector compared to the previous year

(Yip, Lieu & Foo, 2018).

This implies sellers could greatly benefit from developing an online platform for their brand

as online apparel purchases are on the rise. Moreover, online retailing saves organisation

costs through the reduction of staff wages and allows them to process sales transactions at

any time of day or night.

Buy Now Pay Later:

One considerable e-commerce development has been the introduction of “buy now, pay later”

options such as Afterpay and ZipPay, which offer customers interest-free payment plans on

purchases via regular weekly, fortnightly or monthly instalments. This new innovation has

resulted in a 289% surge in online sales between 2017 and 2018, concluding a total of $2.2

billion Afterpay sales, 25% of which was from the fashion retail industry alone (Wu, 2018).

Offering payment options such as Afterpay is an effective way to increase activewear sales

from younger, lower-income demographics. 60% of Afterpay users are aged between 18 and

34 years, demonstrating these services lower the price barrier many young people face when

purchasing expensive activewear products (Wu, 2018). Therefore, activewear companies

should consider adopting such payments plans to increase sales from younger demographics

who largely drive fashion trends.

13

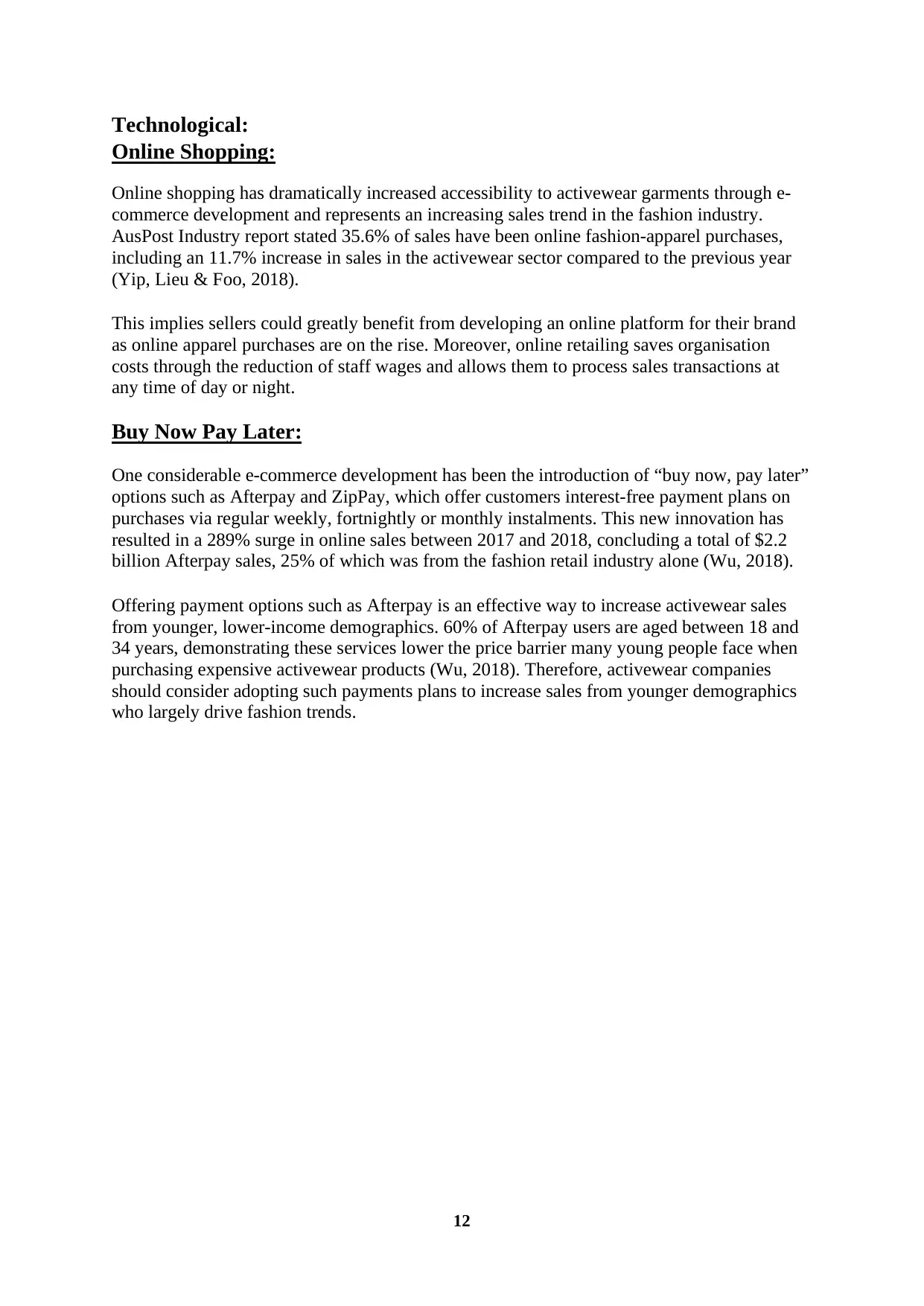

Competitor Analysis:

Companies compete on various levels in the activewear industry. In competitors’ analysis, we

will mainly focus on the customer and resource-oriented forms.

Four levels of competition:

In the diagram below, the four levels of competition are shown. For the need of consumers,

one of the main factors includes the textile of the product. Customers expect soft, durable

fabric, with moisture-wicking and insulating properties sportswear (McCann, 2015).

Consumers exercise by wearing bamboo fibre sportswear to achieve physical and

psychological pleasure. Bamboo fibre is currently being marketed as an ‘eco-green-sustainable

fibre’, which fulfils consumers’ environmentally-friendly goals (Downward & Dawson, 2016).

Figure 3 Four levels of competition

‘Product form’ is most closely related to the products we need to analyse. The activewear

products in this level use bamboo fibre as their main textile. The main competitive brands are

Nike and Adidas. Both brands have bamboo fibre sportswear production lines which focus on

bamboo fibre t-shirts and leggings (Downward & Dawson, 2016).

Competitor Analysis:

Companies compete on various levels in the activewear industry. In competitors’ analysis, we

will mainly focus on the customer and resource-oriented forms.

Four levels of competition:

In the diagram below, the four levels of competition are shown. For the need of consumers,

one of the main factors includes the textile of the product. Customers expect soft, durable

fabric, with moisture-wicking and insulating properties sportswear (McCann, 2015).

Consumers exercise by wearing bamboo fibre sportswear to achieve physical and

psychological pleasure. Bamboo fibre is currently being marketed as an ‘eco-green-sustainable

fibre’, which fulfils consumers’ environmentally-friendly goals (Downward & Dawson, 2016).

Figure 3 Four levels of competition

‘Product form’ is most closely related to the products we need to analyse. The activewear

products in this level use bamboo fibre as their main textile. The main competitive brands are

Nike and Adidas. Both brands have bamboo fibre sportswear production lines which focus on

bamboo fibre t-shirts and leggings (Downward & Dawson, 2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14

The second level of competition is ‘category’, in this level, other materials are used within

competitors’ products, such as cotton and chemical fibres. The main brands in this level are

Nike, Adidas, Asics and Kathmandu. Under Armour and Asics are both looking to incorporate

use of a fabric which is made with coffee grounds and can be recycled (Euromonitor

International, 2017). Additionally, Asics is a strong competitor of this level, although there is

no industrial line of bamboo fibre sportswear, Asics regular sportswear still has a place in the

market (Euromonitor International, 2017).

In generic, the competitors at this level are different types of clothing categories excluding

activewear. These competitors are everyday clothing, fur, and even home-wear — these

garments are not necessarily suitable for the sportswear market. In ‘budget’, the competitors

within this level are products which can also meet consumer needs. For example, these are

products and/or activities which can make consumers feel comfortable.

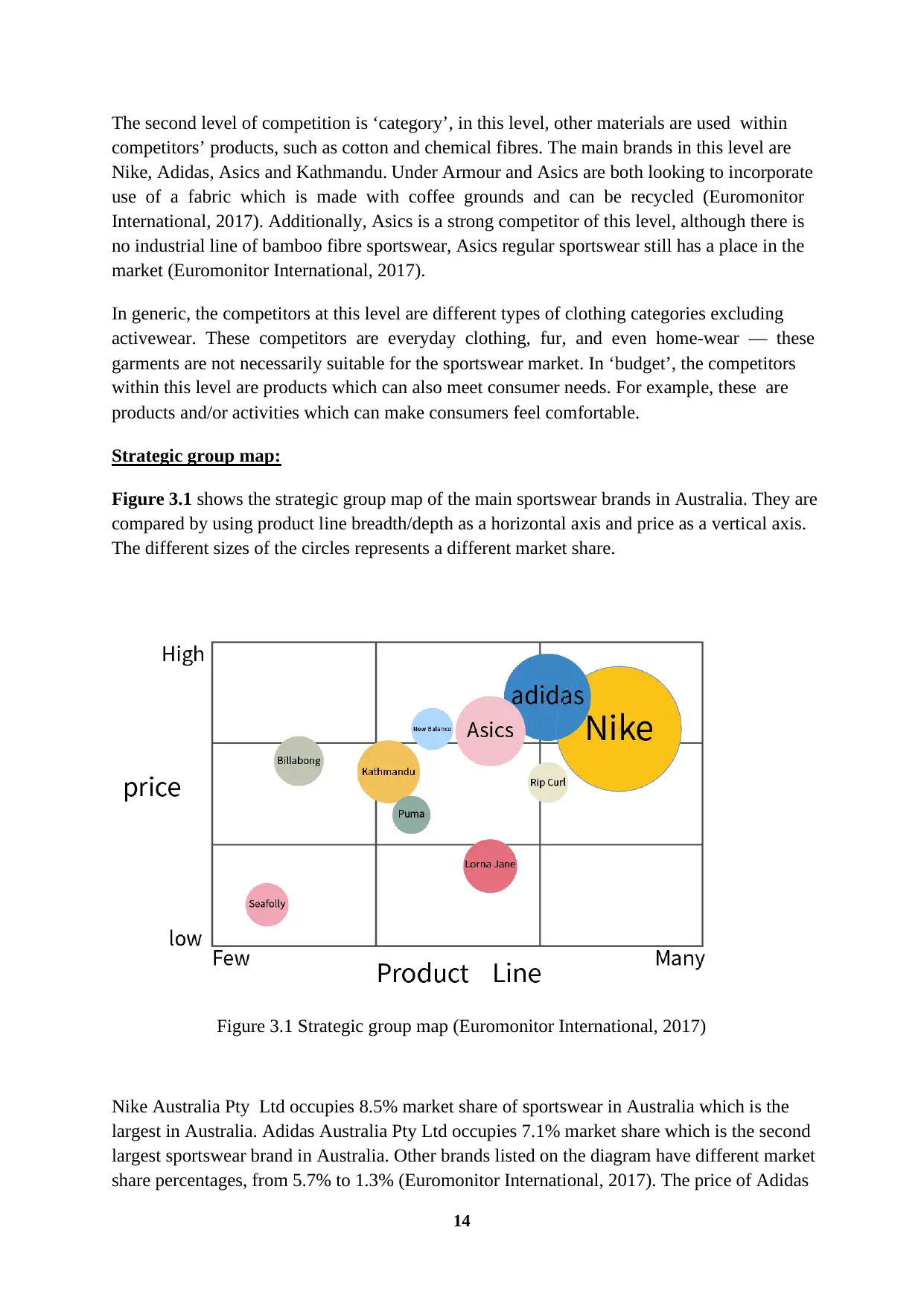

Strategic group map:

Figure 3.1 shows the strategic group map of the main sportswear brands in Australia. They are

compared by using product line breadth/depth as a horizontal axis and price as a vertical axis.

The different sizes of the circles represents a different market share.

Figure 3.1 Strategic group map (Euromonitor International, 2017)

Nike Australia Pty Ltd occupies 8.5% market share of sportswear in Australia which is the

largest in Australia. Adidas Australia Pty Ltd occupies 7.1% market share which is the second

largest sportswear brand in Australia. Other brands listed on the diagram have different market

share percentages, from 5.7% to 1.3% (Euromonitor International, 2017). The price of Adidas

The second level of competition is ‘category’, in this level, other materials are used within

competitors’ products, such as cotton and chemical fibres. The main brands in this level are

Nike, Adidas, Asics and Kathmandu. Under Armour and Asics are both looking to incorporate

use of a fabric which is made with coffee grounds and can be recycled (Euromonitor

International, 2017). Additionally, Asics is a strong competitor of this level, although there is

no industrial line of bamboo fibre sportswear, Asics regular sportswear still has a place in the

market (Euromonitor International, 2017).

In generic, the competitors at this level are different types of clothing categories excluding

activewear. These competitors are everyday clothing, fur, and even home-wear — these

garments are not necessarily suitable for the sportswear market. In ‘budget’, the competitors

within this level are products which can also meet consumer needs. For example, these are

products and/or activities which can make consumers feel comfortable.

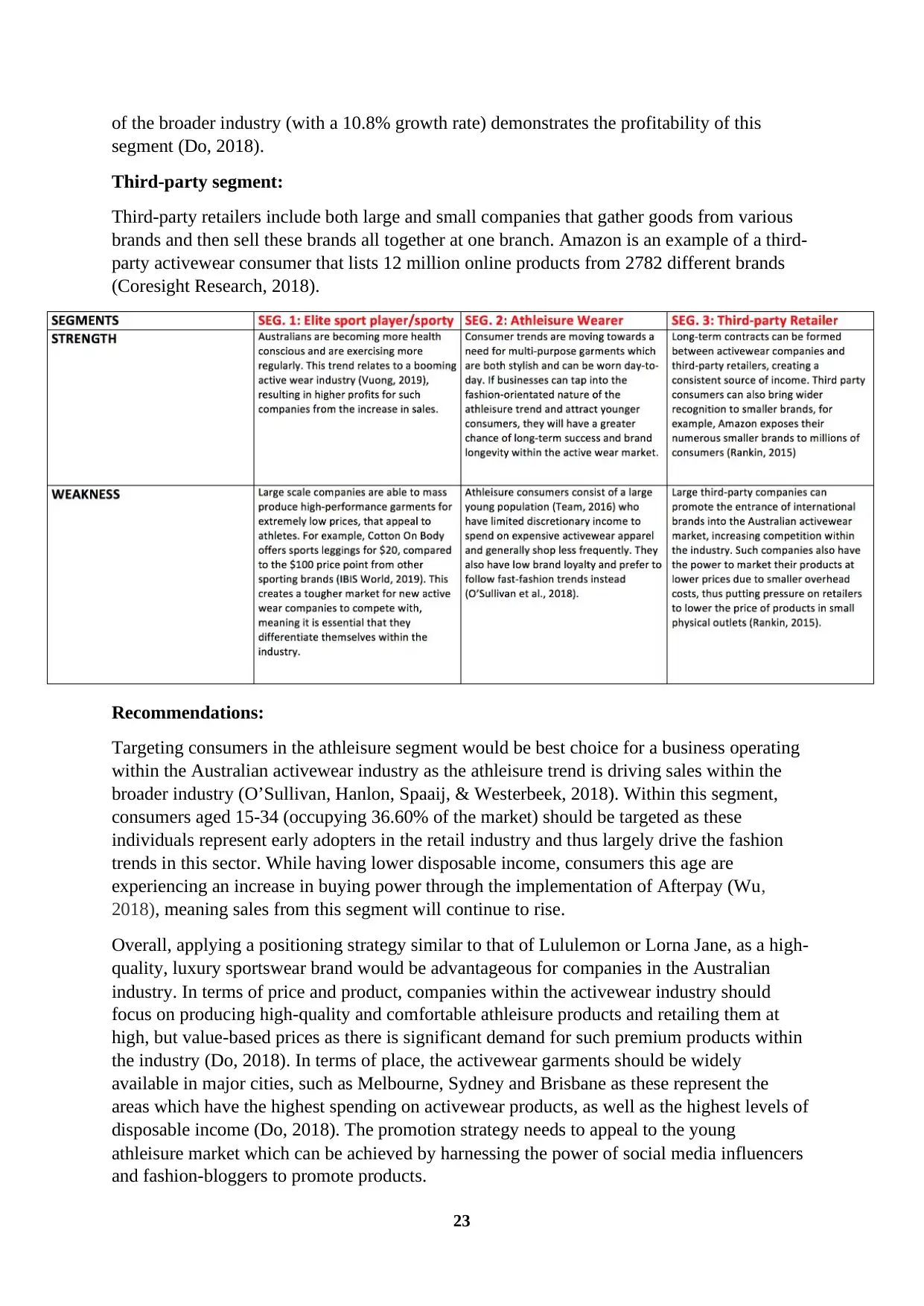

Strategic group map:

Figure 3.1 shows the strategic group map of the main sportswear brands in Australia. They are

compared by using product line breadth/depth as a horizontal axis and price as a vertical axis.

The different sizes of the circles represents a different market share.

Figure 3.1 Strategic group map (Euromonitor International, 2017)

Nike Australia Pty Ltd occupies 8.5% market share of sportswear in Australia which is the

largest in Australia. Adidas Australia Pty Ltd occupies 7.1% market share which is the second

largest sportswear brand in Australia. Other brands listed on the diagram have different market

share percentages, from 5.7% to 1.3% (Euromonitor International, 2017). The price of Adidas

15

products is the higher than the rest. Due to the product line, Nike offers its products through 6

retailers, such as Hurley, Jordan, and NikeLab (IBISWorld, 2018). However, Billabong

International Limited only covers surf, skate and snow apparel and accessories (IBISWorld,

2018). Seafolly mainly focuses on bikinis and beachwear.

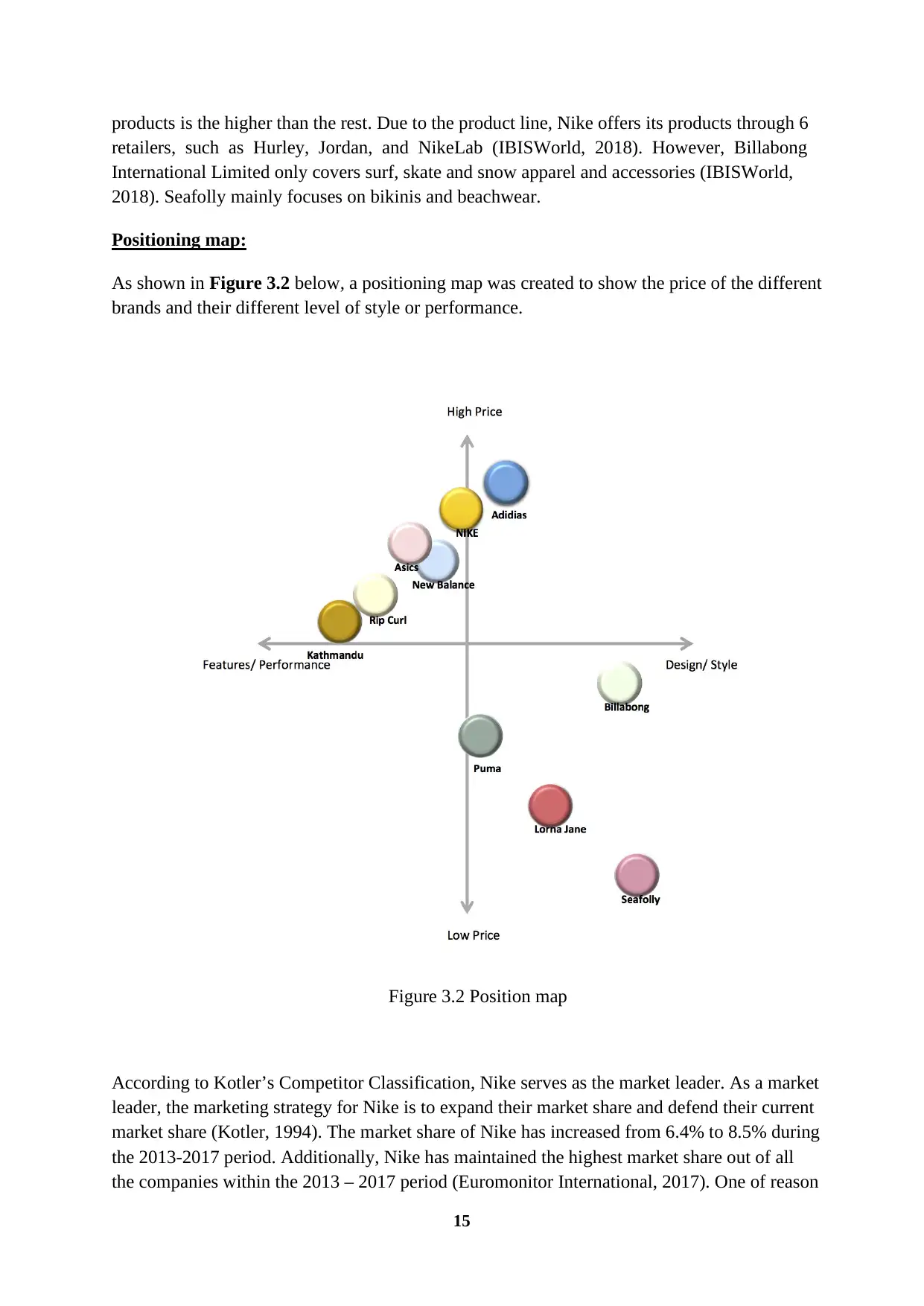

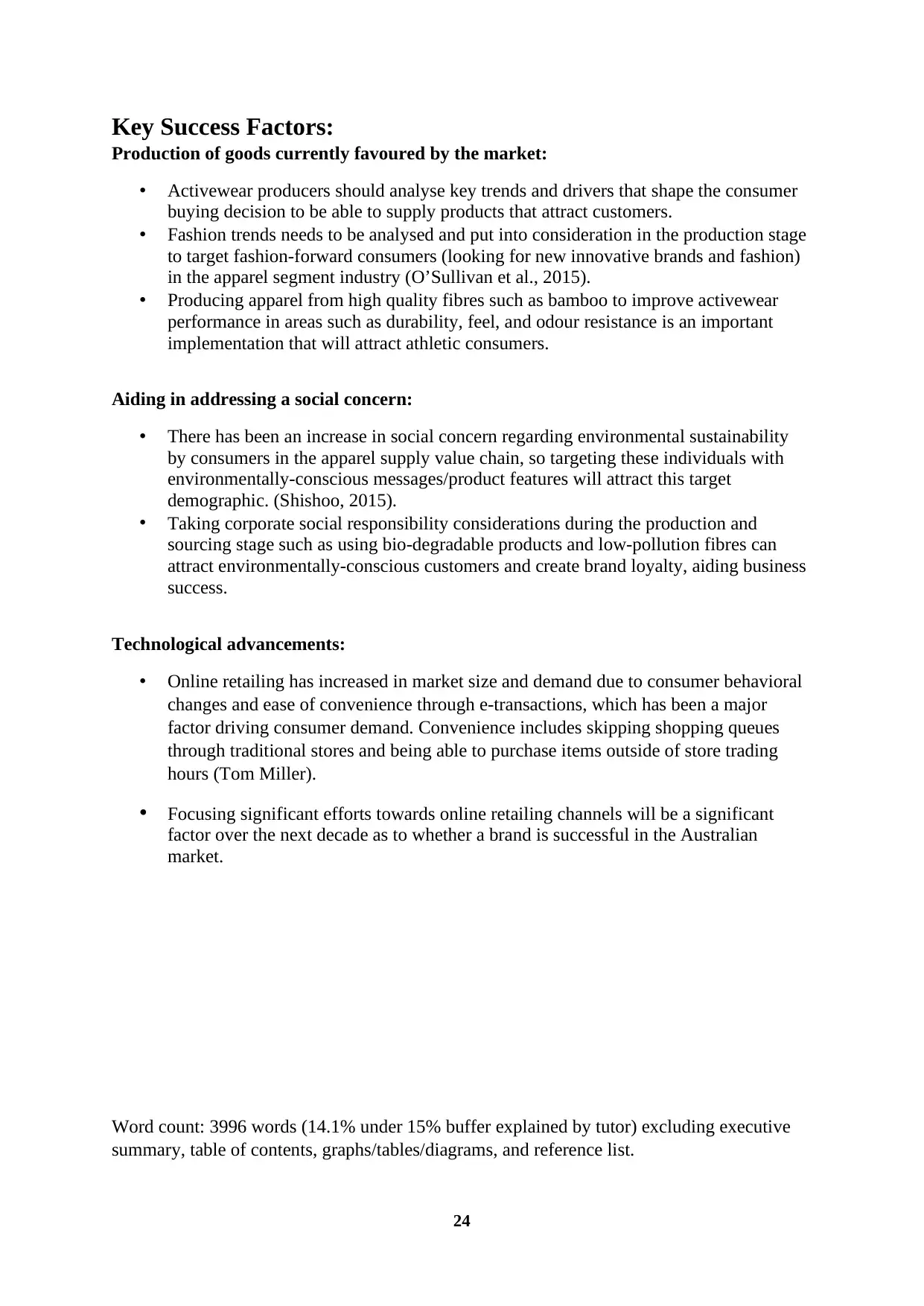

Positioning map:

As shown in Figure 3.2 below, a positioning map was created to show the price of the different

brands and their different level of style or performance.

Figure 3.2 Position map

According to Kotler’s Competitor Classification, Nike serves as the market leader. As a market

leader, the marketing strategy for Nike is to expand their market share and defend their current

market share (Kotler, 1994). The market share of Nike has increased from 6.4% to 8.5% during

the 2013-2017 period. Additionally, Nike has maintained the highest market share out of all

the companies within the 2013 – 2017 period (Euromonitor International, 2017). One of reason

products is the higher than the rest. Due to the product line, Nike offers its products through 6

retailers, such as Hurley, Jordan, and NikeLab (IBISWorld, 2018). However, Billabong

International Limited only covers surf, skate and snow apparel and accessories (IBISWorld,

2018). Seafolly mainly focuses on bikinis and beachwear.

Positioning map:

As shown in Figure 3.2 below, a positioning map was created to show the price of the different

brands and their different level of style or performance.

Figure 3.2 Position map

According to Kotler’s Competitor Classification, Nike serves as the market leader. As a market

leader, the marketing strategy for Nike is to expand their market share and defend their current

market share (Kotler, 1994). The market share of Nike has increased from 6.4% to 8.5% during

the 2013-2017 period. Additionally, Nike has maintained the highest market share out of all

the companies within the 2013 – 2017 period (Euromonitor International, 2017). One of reason

16

Nike has achieved success in Australia is because of their aggressive marketing campaigns.

They launched the 'No Turning Back' marketing campaign in 2017, which targeted young

consumers who do not frequently participate in exercising activities (Euromonitor

International, 2017).

On the other hand, Adidas is one of the market challengers, it mainly focuses on customer

experience, and product innovation. For fashion and luxury factors, Adidas have a long-term

collaboration with Kanye West’s Yeezy, Yeezy x Adidas. “Hype” products are a key to brand

awareness and help individuals gain fashion “clout” during sportswear competitions

(Euromonitor International, 2019). Kathmandu serves as another market challenger, and is

continuing an ambitious expansion strategy. They project there will be 170 new stores which

are expected to open in Australia and New Zealand during a forecasted period. Furthermore,

Kathmandu intends to integrate omni-channel offerings, by improving the mobile channels and

options for global shipping (Euromonitor International, 2014).

Therefore, Nike and Adidas as the most powerful competitors have irreplaceable advantages:

a wider variety of products and a broader consumer base, higher visibility, and the same product

line of bamboo fibre sportswear. “Bam-ba-lam Active” can increase investment in research

and development, enhance the comfort of sportswear, and ensure that our products can provide

consumers with a better experience under the same materials. Moreover, “Bam-ba-lam Active”

should also pay attention to these following business competition strategies: marketing

campaigns, fashionable design, ambitious expansion strategy and improving omni-channel

offering.

Nike has achieved success in Australia is because of their aggressive marketing campaigns.

They launched the 'No Turning Back' marketing campaign in 2017, which targeted young

consumers who do not frequently participate in exercising activities (Euromonitor

International, 2017).

On the other hand, Adidas is one of the market challengers, it mainly focuses on customer

experience, and product innovation. For fashion and luxury factors, Adidas have a long-term

collaboration with Kanye West’s Yeezy, Yeezy x Adidas. “Hype” products are a key to brand

awareness and help individuals gain fashion “clout” during sportswear competitions

(Euromonitor International, 2019). Kathmandu serves as another market challenger, and is

continuing an ambitious expansion strategy. They project there will be 170 new stores which

are expected to open in Australia and New Zealand during a forecasted period. Furthermore,

Kathmandu intends to integrate omni-channel offerings, by improving the mobile channels and

options for global shipping (Euromonitor International, 2014).

Therefore, Nike and Adidas as the most powerful competitors have irreplaceable advantages:

a wider variety of products and a broader consumer base, higher visibility, and the same product

line of bamboo fibre sportswear. “Bam-ba-lam Active” can increase investment in research

and development, enhance the comfort of sportswear, and ensure that our products can provide

consumers with a better experience under the same materials. Moreover, “Bam-ba-lam Active”

should also pay attention to these following business competition strategies: marketing

campaigns, fashionable design, ambitious expansion strategy and improving omni-channel

offering.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

17

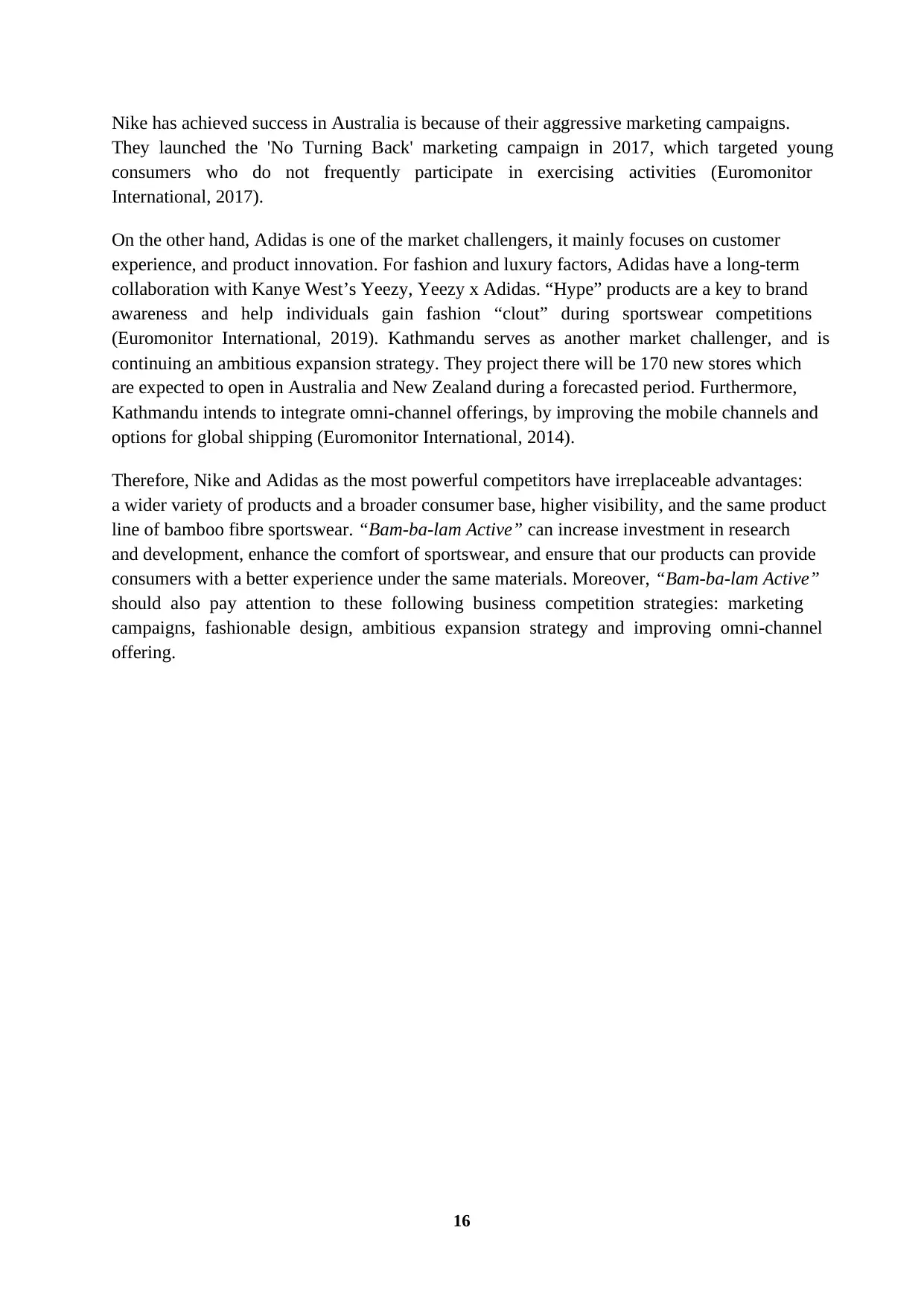

Collaborator Analysis:

(Figure 4)

Collaborator Analysis:

(Figure 4)

18

Tier 3:

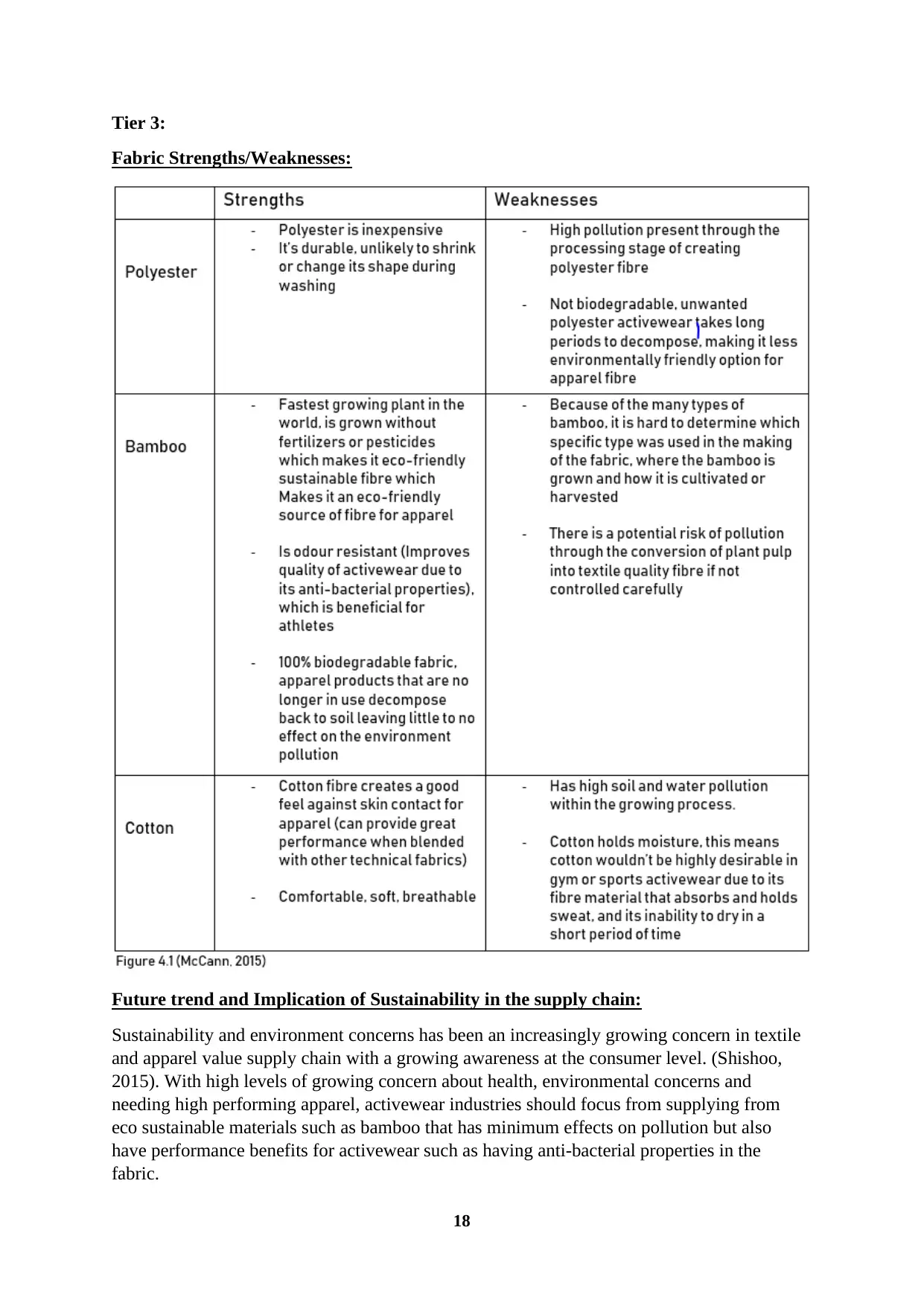

Fabric Strengths/Weaknesses:

Future trend and Implication of Sustainability in the supply chain:

Sustainability and environment concerns has been an increasingly growing concern in textile

and apparel value supply chain with a growing awareness at the consumer level. (Shishoo,

2015). With high levels of growing concern about health, environmental concerns and

needing high performing apparel, activewear industries should focus from supplying from

eco sustainable materials such as bamboo that has minimum effects on pollution but also

have performance benefits for activewear such as having anti-bacterial properties in the

fabric.

Tier 3:

Fabric Strengths/Weaknesses:

Future trend and Implication of Sustainability in the supply chain:

Sustainability and environment concerns has been an increasingly growing concern in textile

and apparel value supply chain with a growing awareness at the consumer level. (Shishoo,

2015). With high levels of growing concern about health, environmental concerns and

needing high performing apparel, activewear industries should focus from supplying from

eco sustainable materials such as bamboo that has minimum effects on pollution but also

have performance benefits for activewear such as having anti-bacterial properties in the

fabric.

19

Tiers 2 and 3:

Outsourcing and its implications:

Like many other industries, the apparel industry outsources the production/manufacturing of

their products to different manufacturers for their products in lower cost countries in South

Asian regions (Ali, 2018). For example, as a producer of technical sportswear, Lululemon has

contracted around 65 suppliers to source their fabrics from, and 35 manufacturers to produce

their products. Of these 35 manufacturers, five produce around 63% of the company’s total

products. Lululemon’s production mainly takes place in various parts of Asia (Euromonitor

International, 2017).

Through outsourcing activities, apparel companies can focus its resources, both financial and

human, on areas that can increase revenue and profit margins. Manufacturing outsourcing

saves on operation costs through the use of cheaper labour and improves quality (Ali, 2018).

Through the use of outsourcing, apparel companies can increase profit margins and focus on

improving their sales and marketing campaigns instead of focusing on manufacturing

operations. However, difficulty in monitoring different outsourced manufacturers is one

reason why the use of outsourcing for manufacturing can be detrimental.

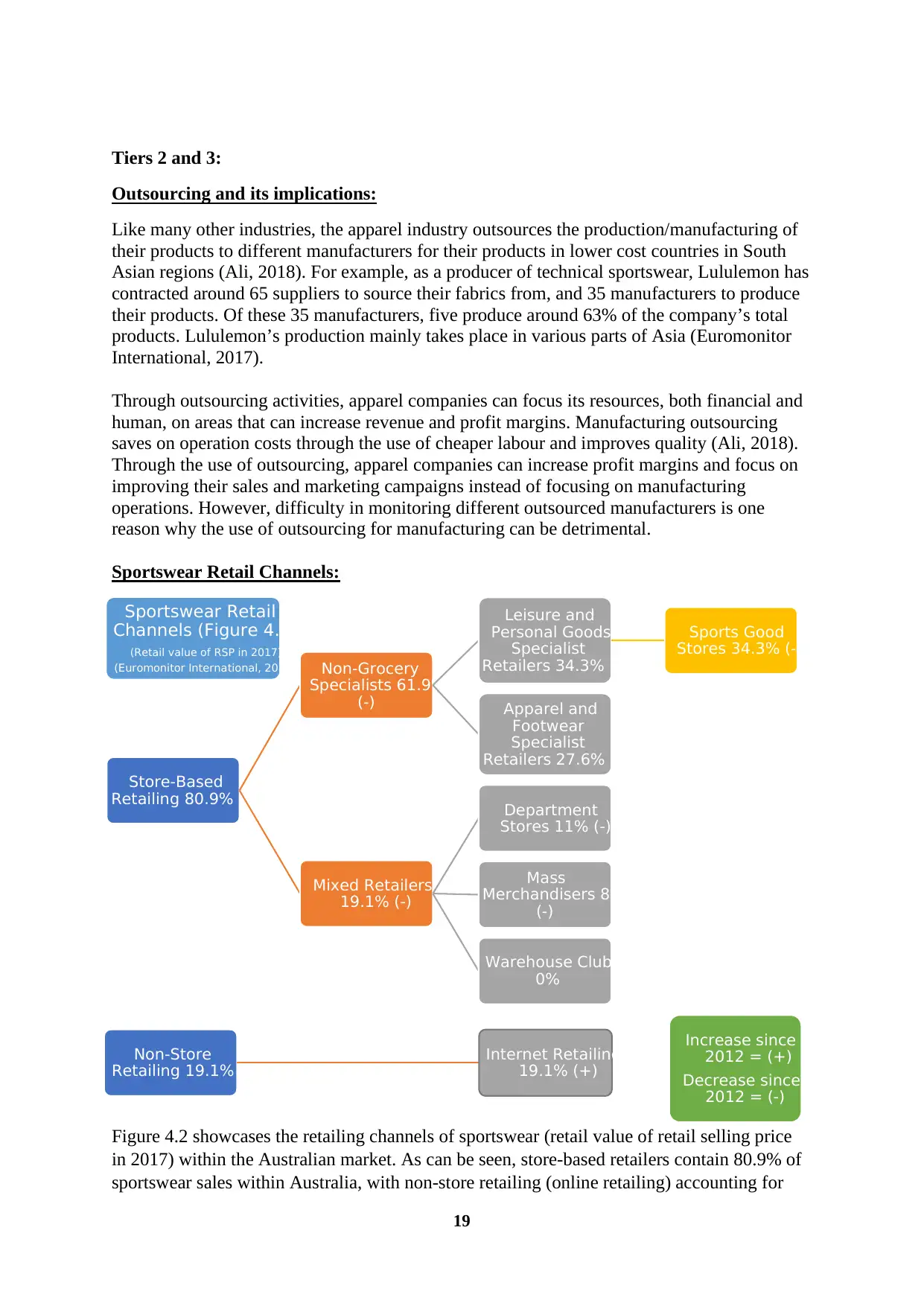

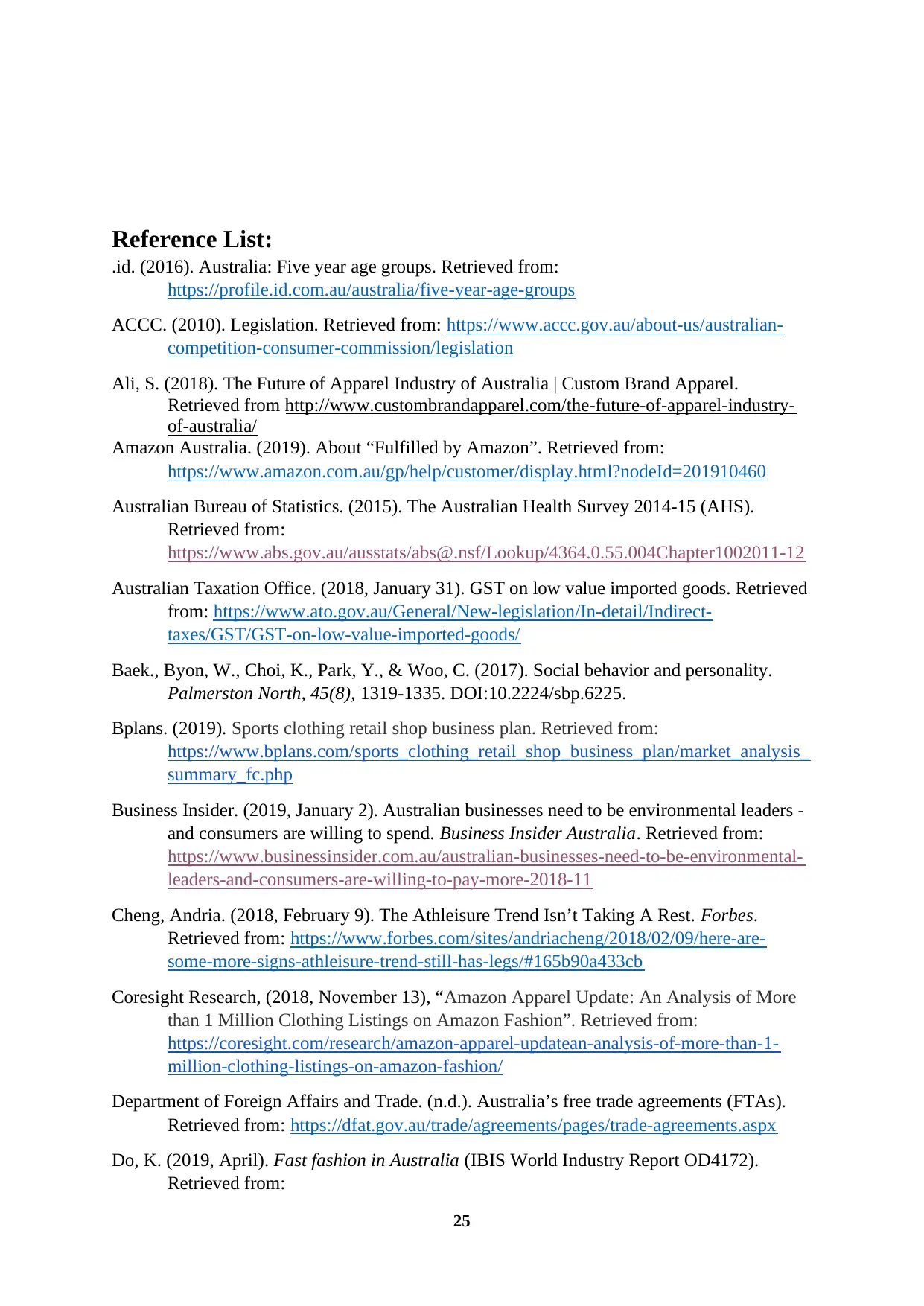

Sportswear Retail Channels:

Figure 4.2 showcases the retailing channels of sportswear (retail value of retail selling price

in 2017) within the Australian market. As can be seen, store-based retailers contain 80.9% of

sportswear sales within Australia, with non-store retailing (online retailing) accounting for

Store-Based

Retailing 80.9% (-)

Non-Grocery

Specialists 61.9%

(-)

Leisure and

Personal Goods

Specialist

Retailers 34.3% (-)

Sports Good

Stores 34.3% (-)

Apparel and

Footwear

Specialist

Retailers 27.6% (-)

Mixed Retailers

19.1% (-)

Department

Stores 11% (-)

Mass

Merchandisers 8%

(-)

Warehouse Clubs

0%

Non-Store

Retailing 19.1% (+)

Internet Retailing

19.1% (+)

Sportswear Retail

Channels (Figure 4.2)

(Retail value of RSP in 2017)

(Euromonitor International, 2017)

Increase since

2012 = (+)

Decrease since

2012 = (-)

Tiers 2 and 3:

Outsourcing and its implications:

Like many other industries, the apparel industry outsources the production/manufacturing of

their products to different manufacturers for their products in lower cost countries in South

Asian regions (Ali, 2018). For example, as a producer of technical sportswear, Lululemon has

contracted around 65 suppliers to source their fabrics from, and 35 manufacturers to produce

their products. Of these 35 manufacturers, five produce around 63% of the company’s total

products. Lululemon’s production mainly takes place in various parts of Asia (Euromonitor

International, 2017).

Through outsourcing activities, apparel companies can focus its resources, both financial and

human, on areas that can increase revenue and profit margins. Manufacturing outsourcing

saves on operation costs through the use of cheaper labour and improves quality (Ali, 2018).

Through the use of outsourcing, apparel companies can increase profit margins and focus on

improving their sales and marketing campaigns instead of focusing on manufacturing

operations. However, difficulty in monitoring different outsourced manufacturers is one

reason why the use of outsourcing for manufacturing can be detrimental.

Sportswear Retail Channels:

Figure 4.2 showcases the retailing channels of sportswear (retail value of retail selling price

in 2017) within the Australian market. As can be seen, store-based retailers contain 80.9% of

sportswear sales within Australia, with non-store retailing (online retailing) accounting for

Store-Based

Retailing 80.9% (-)

Non-Grocery

Specialists 61.9%

(-)

Leisure and

Personal Goods

Specialist

Retailers 34.3% (-)

Sports Good

Stores 34.3% (-)

Apparel and

Footwear

Specialist

Retailers 27.6% (-)

Mixed Retailers

19.1% (-)

Department

Stores 11% (-)

Mass

Merchandisers 8%

(-)

Warehouse Clubs

0%

Non-Store

Retailing 19.1% (+)

Internet Retailing

19.1% (+)

Sportswear Retail

Channels (Figure 4.2)

(Retail value of RSP in 2017)

(Euromonitor International, 2017)

Increase since

2012 = (+)

Decrease since

2012 = (-)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

20

19.1%. The graph indicates that non-store-based retailing is increasing in market share, while

store-based retailing is decreasing in market share. The biggest retail sections are in the non-

grocery specialist section, with sports good stores accounting for 34.4% (decreasing), and

apparel and footwear specialist retailers accounting for 27.6% (decreasing) of sales within

this channel. Department stores (11% and decreasing) and mass merchandisers (8% and

decreasing) only account for 19% of sales within the market (mixed retailers) (Euromonitor,

2018).

As sales of sportswear through the online retailing channel is increasing and holds almost

20% of all sales of sportswear in Australia, more focus should be allocated towards targeting

consumers through e-commerce platforms. However, even with the increase in sales through

online retailing channels, distribution of sportswear through store-based retailing is still

required as it still possesses a high level of sales within the sportswear industry (80.9%, with

a decreasing trend). Within the apparel industry, consumers require the ability to assess and

try on clothing, as the ability to assess the product physically can help influence their

purchasing decision (Eg. the fit, feel, and style of the apparel).

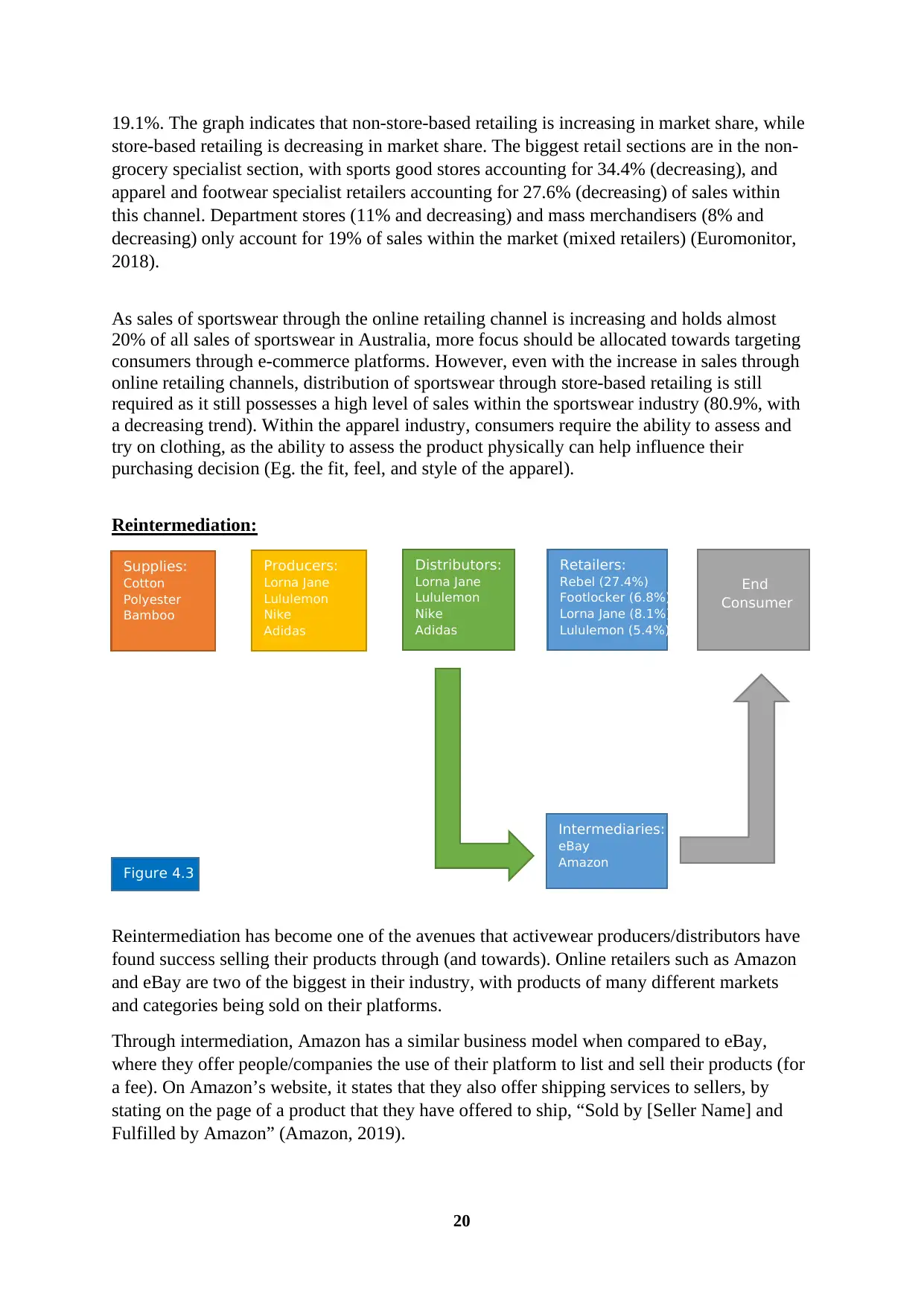

Reintermediation:

Reintermediation has become one of the avenues that activewear producers/distributors have

found success selling their products through (and towards). Online retailers such as Amazon

and eBay are two of the biggest in their industry, with products of many different markets

and categories being sold on their platforms.

Through intermediation, Amazon has a similar business model when compared to eBay,

where they offer people/companies the use of their platform to list and sell their products (for

a fee). On Amazon’s website, it states that they also offer shipping services to sellers, by

stating on the page of a product that they have offered to ship, “Sold by [Seller Name] and

Fulfilled by Amazon” (Amazon, 2019).

Figure 4.3

Supplies:

Cotton

Polyester

Bamboo

Producers:

Lorna Jane

Lululemon

Nike

Adidas

Distributors:

Lorna Jane

Lululemon

Nike

Adidas

Retailers:

Rebel (27.4%)

Footlocker (6.8%)

Lorna Jane (8.1%)

Lululemon (5.4%)

End

Consumer

Intermediaries:

eBay

Amazon

19.1%. The graph indicates that non-store-based retailing is increasing in market share, while

store-based retailing is decreasing in market share. The biggest retail sections are in the non-

grocery specialist section, with sports good stores accounting for 34.4% (decreasing), and

apparel and footwear specialist retailers accounting for 27.6% (decreasing) of sales within

this channel. Department stores (11% and decreasing) and mass merchandisers (8% and

decreasing) only account for 19% of sales within the market (mixed retailers) (Euromonitor,

2018).

As sales of sportswear through the online retailing channel is increasing and holds almost

20% of all sales of sportswear in Australia, more focus should be allocated towards targeting

consumers through e-commerce platforms. However, even with the increase in sales through

online retailing channels, distribution of sportswear through store-based retailing is still

required as it still possesses a high level of sales within the sportswear industry (80.9%, with

a decreasing trend). Within the apparel industry, consumers require the ability to assess and

try on clothing, as the ability to assess the product physically can help influence their

purchasing decision (Eg. the fit, feel, and style of the apparel).

Reintermediation:

Reintermediation has become one of the avenues that activewear producers/distributors have

found success selling their products through (and towards). Online retailers such as Amazon

and eBay are two of the biggest in their industry, with products of many different markets

and categories being sold on their platforms.

Through intermediation, Amazon has a similar business model when compared to eBay,

where they offer people/companies the use of their platform to list and sell their products (for

a fee). On Amazon’s website, it states that they also offer shipping services to sellers, by

stating on the page of a product that they have offered to ship, “Sold by [Seller Name] and

Fulfilled by Amazon” (Amazon, 2019).

Figure 4.3

Supplies:

Cotton

Polyester

Bamboo

Producers:

Lorna Jane

Lululemon

Nike

Adidas

Distributors:

Lorna Jane

Lululemon

Nike

Adidas

Retailers:

Rebel (27.4%)

Footlocker (6.8%)

Lorna Jane (8.1%)

Lululemon (5.4%)

End

Consumer

Intermediaries:

eBay

Amazon

21

One prominent Australian activewear brand known as Lorna Jane sells their activewear

garments to Amazon Australia (As seen here: Lorna Jane Amazon Australia Listing), who

then transports them to their own distribution centres waiting for a sale. They will then ship

the product to the customer once a sale is made. This indicates that Amazon is also a retailer,

as well as an intermediary, as they are purchasing products from brands such as Lorna Jane to

sell towards the Australian public through their online platform.

As seen in Figure 4.3, online retailing is increasing in retail value which is an indication that

this section of the market may be beneficial to focus on. Thus, selling activewear through

intermediaries/online retailers such as Amazon and eBay will help these brands reach more

people, and facilitate the ease at which transactions can occur.

One prominent Australian activewear brand known as Lorna Jane sells their activewear

garments to Amazon Australia (As seen here: Lorna Jane Amazon Australia Listing), who

then transports them to their own distribution centres waiting for a sale. They will then ship

the product to the customer once a sale is made. This indicates that Amazon is also a retailer,

as well as an intermediary, as they are purchasing products from brands such as Lorna Jane to

sell towards the Australian public through their online platform.

As seen in Figure 4.3, online retailing is increasing in retail value which is an indication that

this section of the market may be beneficial to focus on. Thus, selling activewear through

intermediaries/online retailers such as Amazon and eBay will help these brands reach more

people, and facilitate the ease at which transactions can occur.

22

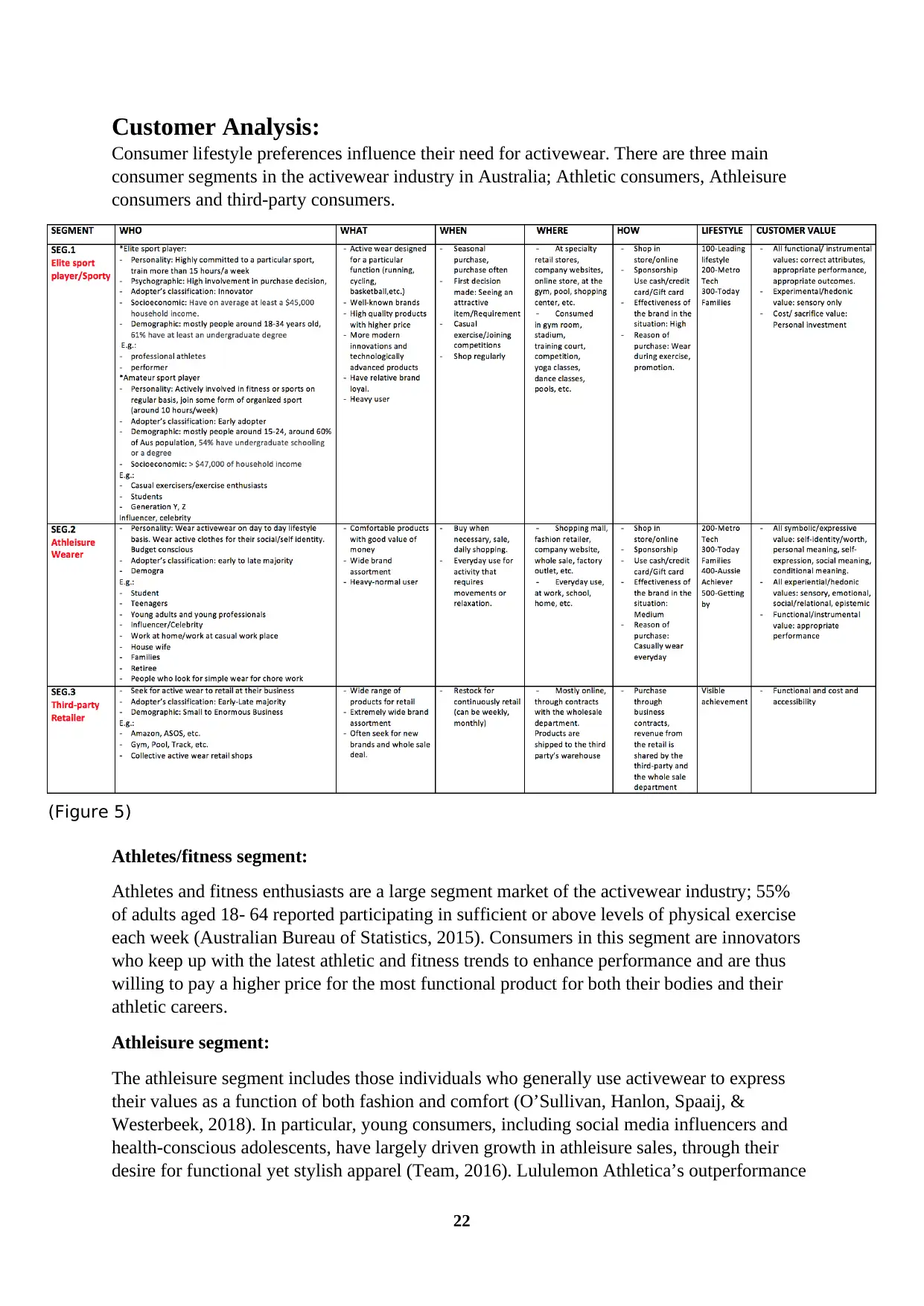

(Figure 5)

Customer Analysis:

Consumer lifestyle preferences influence their need for activewear. There are three main

consumer segments in the activewear industry in Australia; Athletic consumers, Athleisure

consumers and third-party consumers.

Athletes/fitness segment:

Athletes and fitness enthusiasts are a large segment market of the activewear industry; 55%

of adults aged 18- 64 reported participating in sufficient or above levels of physical exercise

each week (Australian Bureau of Statistics, 2015). Consumers in this segment are innovators

who keep up with the latest athletic and fitness trends to enhance performance and are thus

willing to pay a higher price for the most functional product for both their bodies and their

athletic careers.

Athleisure segment:

The athleisure segment includes those individuals who generally use activewear to express

their values as a function of both fashion and comfort (O’Sullivan, Hanlon, Spaaij, &

Westerbeek, 2018). In particular, young consumers, including social media influencers and

health-conscious adolescents, have largely driven growth in athleisure sales, through their

desire for functional yet stylish apparel (Team, 2016). Lululemon Athletica’s outperformance

(Figure 5)

Customer Analysis:

Consumer lifestyle preferences influence their need for activewear. There are three main

consumer segments in the activewear industry in Australia; Athletic consumers, Athleisure

consumers and third-party consumers.

Athletes/fitness segment:

Athletes and fitness enthusiasts are a large segment market of the activewear industry; 55%

of adults aged 18- 64 reported participating in sufficient or above levels of physical exercise

each week (Australian Bureau of Statistics, 2015). Consumers in this segment are innovators

who keep up with the latest athletic and fitness trends to enhance performance and are thus

willing to pay a higher price for the most functional product for both their bodies and their

athletic careers.

Athleisure segment:

The athleisure segment includes those individuals who generally use activewear to express

their values as a function of both fashion and comfort (O’Sullivan, Hanlon, Spaaij, &

Westerbeek, 2018). In particular, young consumers, including social media influencers and

health-conscious adolescents, have largely driven growth in athleisure sales, through their

desire for functional yet stylish apparel (Team, 2016). Lululemon Athletica’s outperformance

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

23

of the broader industry (with a 10.8% growth rate) demonstrates the profitability of this

segment (Do, 2018).

Third-party segment:

Third-party retailers include both large and small companies that gather goods from various

brands and then sell these brands all together at one branch. Amazon is an example of a third-

party activewear consumer that lists 12 million online products from 2782 different brands

(Coresight Research, 2018).

Recommendations:

Targeting consumers in the athleisure segment would be best choice for a business operating

within the Australian activewear industry as the athleisure trend is driving sales within the

broader industry (O’Sullivan, Hanlon, Spaaij, & Westerbeek, 2018). Within this segment,

consumers aged 15-34 (occupying 36.60% of the market) should be targeted as these

individuals represent early adopters in the retail industry and thus largely drive the fashion

trends in this sector. While having lower disposable income, consumers this age are

experiencing an increase in buying power through the implementation of Afterpay (Wu,

2018), meaning sales from this segment will continue to rise.

Overall, applying a positioning strategy similar to that of Lululemon or Lorna Jane, as a high-

quality, luxury sportswear brand would be advantageous for companies in the Australian

industry. In terms of price and product, companies within the activewear industry should

focus on producing high-quality and comfortable athleisure products and retailing them at

high, but value-based prices as there is significant demand for such premium products within

the industry (Do, 2018). In terms of place, the activewear garments should be widely

available in major cities, such as Melbourne, Sydney and Brisbane as these represent the

areas which have the highest spending on activewear products, as well as the highest levels of

disposable income (Do, 2018). The promotion strategy needs to appeal to the young

athleisure market which can be achieved by harnessing the power of social media influencers

and fashion-bloggers to promote products.

of the broader industry (with a 10.8% growth rate) demonstrates the profitability of this

segment (Do, 2018).

Third-party segment:

Third-party retailers include both large and small companies that gather goods from various

brands and then sell these brands all together at one branch. Amazon is an example of a third-

party activewear consumer that lists 12 million online products from 2782 different brands

(Coresight Research, 2018).

Recommendations:

Targeting consumers in the athleisure segment would be best choice for a business operating

within the Australian activewear industry as the athleisure trend is driving sales within the

broader industry (O’Sullivan, Hanlon, Spaaij, & Westerbeek, 2018). Within this segment,

consumers aged 15-34 (occupying 36.60% of the market) should be targeted as these

individuals represent early adopters in the retail industry and thus largely drive the fashion

trends in this sector. While having lower disposable income, consumers this age are

experiencing an increase in buying power through the implementation of Afterpay (Wu,

2018), meaning sales from this segment will continue to rise.

Overall, applying a positioning strategy similar to that of Lululemon or Lorna Jane, as a high-

quality, luxury sportswear brand would be advantageous for companies in the Australian

industry. In terms of price and product, companies within the activewear industry should

focus on producing high-quality and comfortable athleisure products and retailing them at

high, but value-based prices as there is significant demand for such premium products within

the industry (Do, 2018). In terms of place, the activewear garments should be widely

available in major cities, such as Melbourne, Sydney and Brisbane as these represent the

areas which have the highest spending on activewear products, as well as the highest levels of

disposable income (Do, 2018). The promotion strategy needs to appeal to the young

athleisure market which can be achieved by harnessing the power of social media influencers

and fashion-bloggers to promote products.

24

Key Success Factors:

Production of goods currently favoured by the market:

• Activewear producers should analyse key trends and drivers that shape the consumer

buying decision to be able to supply products that attract customers.

• Fashion trends needs to be analysed and put into consideration in the production stage

to target fashion-forward consumers (looking for new innovative brands and fashion)

in the apparel segment industry (O’Sullivan et al., 2015).

• Producing apparel from high quality fibres such as bamboo to improve activewear

performance in areas such as durability, feel, and odour resistance is an important

implementation that will attract athletic consumers.

Aiding in addressing a social concern:

• There has been an increase in social concern regarding environmental sustainability

by consumers in the apparel supply value chain, so targeting these individuals with

environmentally-conscious messages/product features will attract this target

demographic. (Shishoo, 2015).

• Taking corporate social responsibility considerations during the production and

sourcing stage such as using bio-degradable products and low-pollution fibres can

attract environmentally-conscious customers and create brand loyalty, aiding business

success.

Technological advancements:

• Online retailing has increased in market size and demand due to consumer behavioral

changes and ease of convenience through e-transactions, which has been a major

factor driving consumer demand. Convenience includes skipping shopping queues

through traditional stores and being able to purchase items outside of store trading

hours (Tom Miller).

• Focusing significant efforts towards online retailing channels will be a significant

factor over the next decade as to whether a brand is successful in the Australian

market.

Word count: 3996 words (14.1% under 15% buffer explained by tutor) excluding executive

summary, table of contents, graphs/tables/diagrams, and reference list.

Key Success Factors:

Production of goods currently favoured by the market:

• Activewear producers should analyse key trends and drivers that shape the consumer

buying decision to be able to supply products that attract customers.

• Fashion trends needs to be analysed and put into consideration in the production stage

to target fashion-forward consumers (looking for new innovative brands and fashion)

in the apparel segment industry (O’Sullivan et al., 2015).

• Producing apparel from high quality fibres such as bamboo to improve activewear

performance in areas such as durability, feel, and odour resistance is an important

implementation that will attract athletic consumers.

Aiding in addressing a social concern:

• There has been an increase in social concern regarding environmental sustainability

by consumers in the apparel supply value chain, so targeting these individuals with

environmentally-conscious messages/product features will attract this target

demographic. (Shishoo, 2015).

• Taking corporate social responsibility considerations during the production and

sourcing stage such as using bio-degradable products and low-pollution fibres can

attract environmentally-conscious customers and create brand loyalty, aiding business

success.

Technological advancements:

• Online retailing has increased in market size and demand due to consumer behavioral

changes and ease of convenience through e-transactions, which has been a major

factor driving consumer demand. Convenience includes skipping shopping queues

through traditional stores and being able to purchase items outside of store trading

hours (Tom Miller).

• Focusing significant efforts towards online retailing channels will be a significant

factor over the next decade as to whether a brand is successful in the Australian

market.

Word count: 3996 words (14.1% under 15% buffer explained by tutor) excluding executive

summary, table of contents, graphs/tables/diagrams, and reference list.

25

Reference List:

.id. (2016). Australia: Five year age groups. Retrieved from:

https://profile.id.com.au/australia/five-year-age-groups

ACCC. (2010). Legislation. Retrieved from: https://www.accc.gov.au/about-us/australian-

competition-consumer-commission/legislation

Ali, S. (2018). The Future of Apparel Industry of Australia | Custom Brand Apparel.

Retrieved from http://www.custombrandapparel.com/the-future-of-apparel-industry-

of-australia/

Amazon Australia. (2019). About “Fulfilled by Amazon”. Retrieved from:

https://www.amazon.com.au/gp/help/customer/display.html?nodeId=201910460

Australian Bureau of Statistics. (2015). The Australian Health Survey 2014-15 (AHS).

Retrieved from:

https://www.abs.gov.au/ausstats/abs@.nsf/Lookup/4364.0.55.004Chapter1002011-12

Australian Taxation Office. (2018, January 31). GST on low value imported goods. Retrieved

from: https://www.ato.gov.au/General/New-legislation/In-detail/Indirect-

taxes/GST/GST-on-low-value-imported-goods/

Baek., Byon, W., Choi, K., Park, Y., & Woo, C. (2017). Social behavior and personality.

Palmerston North, 45(8), 1319-1335. DOI:10.2224/sbp.6225.

Bplans. (2019). Sports clothing retail shop business plan. Retrieved from:

https://www.bplans.com/sports_clothing_retail_shop_business_plan/market_analysis_

summary_fc.php

Business Insider. (2019, January 2). Australian businesses need to be environmental leaders -

and consumers are willing to spend. Business Insider Australia. Retrieved from:

https://www.businessinsider.com.au/australian-businesses-need-to-be-environmental-

leaders-and-consumers-are-willing-to-pay-more-2018-11

Cheng, Andria. (2018, February 9). The Athleisure Trend Isn’t Taking A Rest. Forbes.

Retrieved from: https://www.forbes.com/sites/andriacheng/2018/02/09/here-are-

some-more-signs-athleisure-trend-still-has-legs/#165b90a433cb

Coresight Research, (2018, November 13), “Amazon Apparel Update: An Analysis of More

than 1 Million Clothing Listings on Amazon Fashion”. Retrieved from:

https://coresight.com/research/amazon-apparel-updatean-analysis-of-more-than-1-

million-clothing-listings-on-amazon-fashion/

Department of Foreign Affairs and Trade. (n.d.). Australia’s free trade agreements (FTAs).

Retrieved from: https://dfat.gov.au/trade/agreements/pages/trade-agreements.aspx

Do, K. (2019, April). Fast fashion in Australia (IBIS World Industry Report OD4172).

Retrieved from:

Reference List:

.id. (2016). Australia: Five year age groups. Retrieved from:

https://profile.id.com.au/australia/five-year-age-groups

ACCC. (2010). Legislation. Retrieved from: https://www.accc.gov.au/about-us/australian-

competition-consumer-commission/legislation

Ali, S. (2018). The Future of Apparel Industry of Australia | Custom Brand Apparel.

Retrieved from http://www.custombrandapparel.com/the-future-of-apparel-industry-

of-australia/

Amazon Australia. (2019). About “Fulfilled by Amazon”. Retrieved from:

https://www.amazon.com.au/gp/help/customer/display.html?nodeId=201910460

Australian Bureau of Statistics. (2015). The Australian Health Survey 2014-15 (AHS).

Retrieved from:

https://www.abs.gov.au/ausstats/abs@.nsf/Lookup/4364.0.55.004Chapter1002011-12

Australian Taxation Office. (2018, January 31). GST on low value imported goods. Retrieved