Investment Growth Bond Application Form

VerifiedAdded on 2023/01/23

|6

|3963

|35

AI Summary

This document is the application form for an Investment Growth Bond. It provides instructions and fields to be completed by the applicant(s) and includes sections for personal details, investment options, automatic withdrawal facility details, adviser service fees, and more.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Before you sign this Application, you must read the Product Disclosure Statement

(PDS) dated 18 March 2013. The PDS will help you to understand the product and

decide whether it’s appropriate to your needs. Policy No:

Office Use Only

The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AFSL 235035 (CMLA)

CommInsure is a registered business name of CMLA

• All Applicants need to complete this section.

• If there is more than one Applicant, they will own the policy as joint tenants.

• If the Applicant is a child between 10 and 16 years old then please ensure Section 4 is completed.

• If this Application is a Child Advancement Policy then please ensure both Sections 2 and 3 are completed.

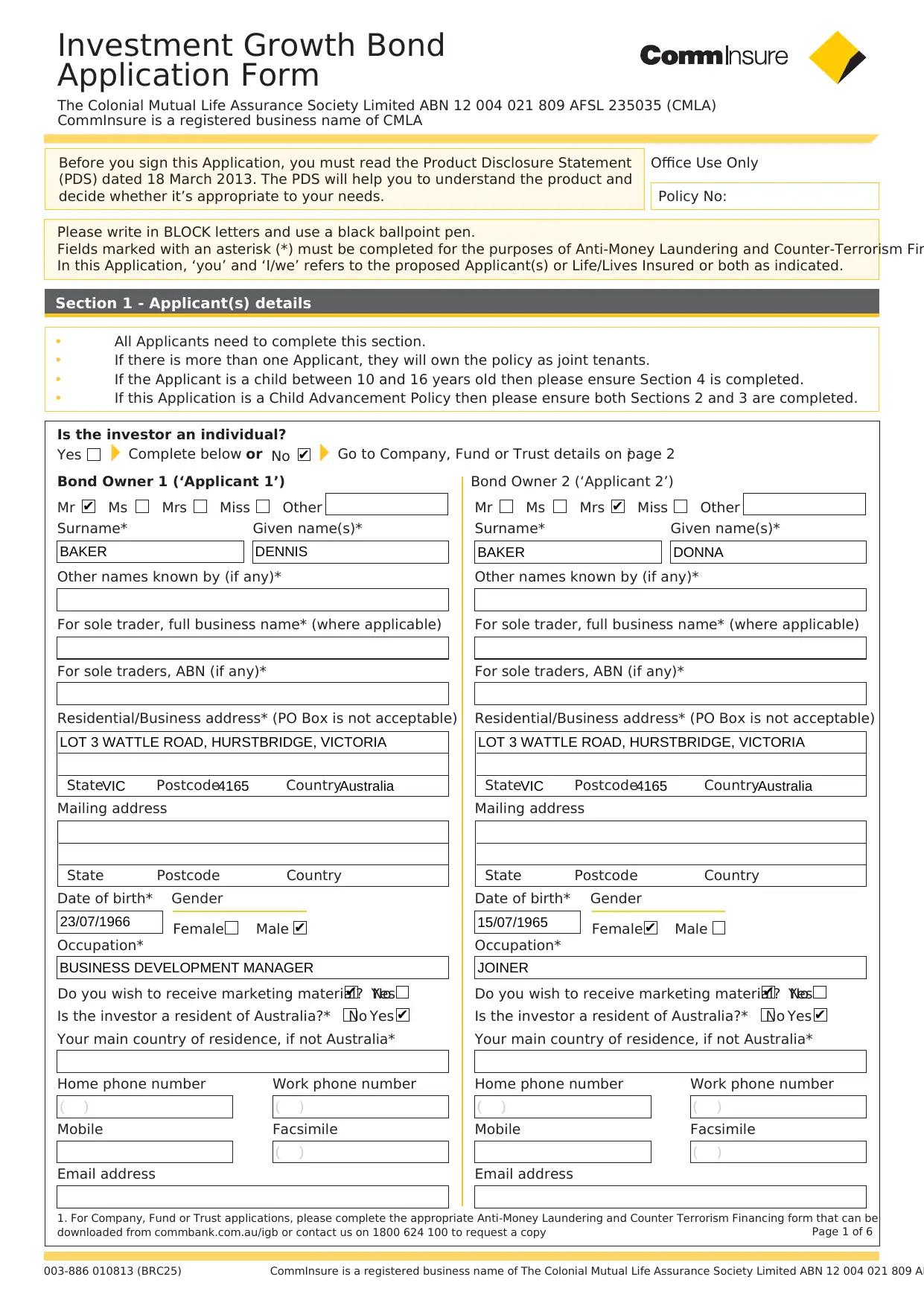

Section 1 - Applicant(s) details

Please write in BLOCK letters and use a black ballpoint pen.

Fields marked with an asterisk (*) must be completed for the purposes of Anti-Money Laundering and Counter-Terrorism Fin

In this Application, ‘you’ and ‘I/we’ refers to the proposed Applicant(s) or Life/Lives Insured or both as indicated.

CommInsure is a registered business name of The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AF003-886 010813 (BRC25)

Page 1 of 6

Investment Growth Bond

Application Form

Is the investor an individual?

Yes NoComplete below or Go to Company, Fund or Trust details on page 21

Bond Owner 1 (‘Applicant 1’)

Surname* Surname*

Other names known by (if any)* Other names known by (if any)*

For sole trader, full business name* (where applicable) For sole trader, full business name* (where applicable)

Given name(s)* Given name(s)*

Date of birth* Date of birth*

Residential/Business address* (PO Box is not acceptable) Residential/Business address* (PO Box is not acceptable)

Mailing address Mailing address

Home phone number Work phone number

Mobile Facsimile

Email address

Home phone number Work phone number

Mobile Facsimile

Email address

Gender

Female Male

Gender

Female Male

Bond Owner 2 (‘Applicant 2’)

Your main country of residence, if not Australia*

Occupation*

Is the investor a resident of Australia?* No Yes

Your main country of residence, if not Australia*

Occupation*

Is the investor a resident of Australia?* No Yes

For sole traders, ABN (if any)* For sole traders, ABN (if any)*

State Postcode Country State Postcode Country

State Postcode Country State Postcode Country

1. For Company, Fund or Trust applications, please complete the appropriate Anti-Money Laundering and Counter Terrorism Financing form that can be

downloaded from commbank.com.au/igb or contact us on 1800 624 100 to request a copy

OtherMr Ms Mrs Miss OtherMr Ms Mrs Miss

Do you wish to receive marketing material? NoYes Do you wish to receive marketing material? NoYes

✔

✔

BAKER DENNIS

LOT 3 WATTLE ROAD, HURSTBRIDGE, VICTORIA

VIC 4165 Australia

23/07/1966 ✔

BUSINESS DEVELOPMENT MANAGER

✔

✔

( ) ( )

( )

✔

BAKER DONNA

LOT 3 WATTLE ROAD, HURSTBRIDGE, VICTORIA

VIC 4165 Australia

15/07/1965 ✔

JOINER

✔

✔

( ) ( )

( )

(PDS) dated 18 March 2013. The PDS will help you to understand the product and

decide whether it’s appropriate to your needs. Policy No:

Office Use Only

The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AFSL 235035 (CMLA)

CommInsure is a registered business name of CMLA

• All Applicants need to complete this section.

• If there is more than one Applicant, they will own the policy as joint tenants.

• If the Applicant is a child between 10 and 16 years old then please ensure Section 4 is completed.

• If this Application is a Child Advancement Policy then please ensure both Sections 2 and 3 are completed.

Section 1 - Applicant(s) details

Please write in BLOCK letters and use a black ballpoint pen.

Fields marked with an asterisk (*) must be completed for the purposes of Anti-Money Laundering and Counter-Terrorism Fin

In this Application, ‘you’ and ‘I/we’ refers to the proposed Applicant(s) or Life/Lives Insured or both as indicated.

CommInsure is a registered business name of The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AF003-886 010813 (BRC25)

Page 1 of 6

Investment Growth Bond

Application Form

Is the investor an individual?

Yes NoComplete below or Go to Company, Fund or Trust details on page 21

Bond Owner 1 (‘Applicant 1’)

Surname* Surname*

Other names known by (if any)* Other names known by (if any)*

For sole trader, full business name* (where applicable) For sole trader, full business name* (where applicable)

Given name(s)* Given name(s)*

Date of birth* Date of birth*

Residential/Business address* (PO Box is not acceptable) Residential/Business address* (PO Box is not acceptable)

Mailing address Mailing address

Home phone number Work phone number

Mobile Facsimile

Email address

Home phone number Work phone number

Mobile Facsimile

Email address

Gender

Female Male

Gender

Female Male

Bond Owner 2 (‘Applicant 2’)

Your main country of residence, if not Australia*

Occupation*

Is the investor a resident of Australia?* No Yes

Your main country of residence, if not Australia*

Occupation*

Is the investor a resident of Australia?* No Yes

For sole traders, ABN (if any)* For sole traders, ABN (if any)*

State Postcode Country State Postcode Country

State Postcode Country State Postcode Country

1. For Company, Fund or Trust applications, please complete the appropriate Anti-Money Laundering and Counter Terrorism Financing form that can be

downloaded from commbank.com.au/igb or contact us on 1800 624 100 to request a copy

OtherMr Ms Mrs Miss OtherMr Ms Mrs Miss

Do you wish to receive marketing material? NoYes Do you wish to receive marketing material? NoYes

✔

✔

BAKER DENNIS

LOT 3 WATTLE ROAD, HURSTBRIDGE, VICTORIA

VIC 4165 Australia

23/07/1966 ✔

BUSINESS DEVELOPMENT MANAGER

✔

✔

( ) ( )

( )

✔

BAKER DONNA

LOT 3 WATTLE ROAD, HURSTBRIDGE, VICTORIA

VIC 4165 Australia

15/07/1965 ✔

JOINER

✔

✔

( ) ( )

( )

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

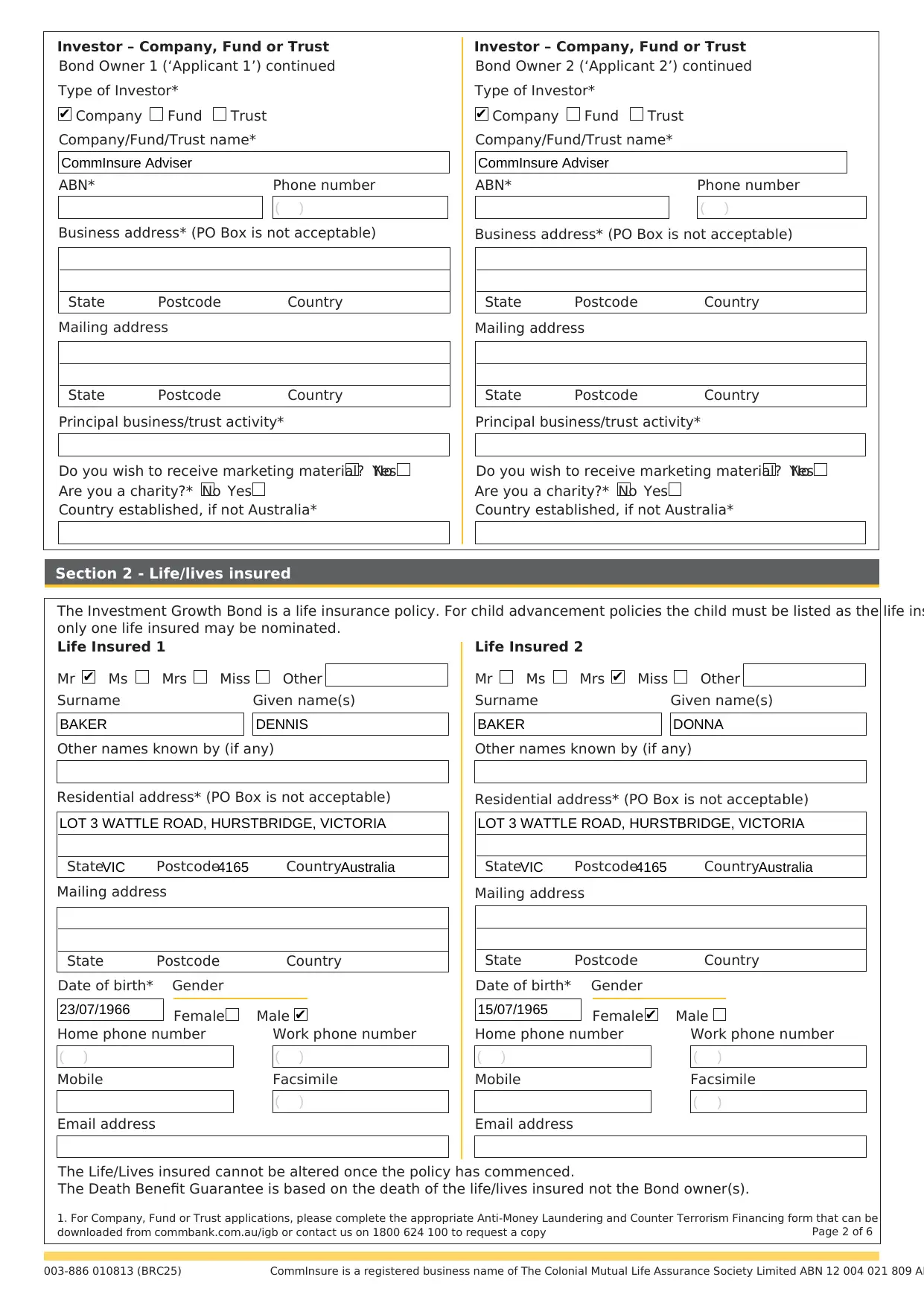

Section 2 - Life/lives insured

The Investment Growth Bond is a life insurance policy. For child advancement policies the child must be listed as the life ins

only one life insured may be nominated.

Bond Owner 1 (‘Applicant 1’) continued Bond Owner 2 (‘Applicant 2’) continued

Investor – Company, Fund or Trust1 Investor – Company, Fund or Trust1

Company/Fund/Trust name* Company/Fund/Trust name*

Type of Investor* Type of Investor*

Company Fund Trust Company Fund Trust

Principal business/trust activity* Principal business/trust activity*

Country established, if not Australia* Country established, if not Australia*

Phone numberPhone numberABN* ABN*

Are you a charity?* No Yes Are you a charity?* No Yes

CommInsure is a registered business name of The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AF003-886 010813 (BRC25)

Page 2 of 6

Business address* (PO Box is not acceptable) Business address* (PO Box is not acceptable)

Mailing address Mailing address

State Postcode Country State Postcode Country

State Postcode Country State Postcode Country

Life Insured 1 Life Insured 2

Surname Surname

Other names known by (if any) Other names known by (if any)

Given name(s) Given name(s)

Home phone number Home phone numberWork phone number Work phone number

Mobile MobileFacsimile Facsimile

Email address Email address

The Life/Lives insured cannot be altered once the policy has commenced.

The Death Benefit Guarantee is based on the death of the life/lives insured not the Bond owner(s).

Residential address* (PO Box is not acceptable) Residential address* (PO Box is not acceptable)

Mailing address Mailing address

State Postcode Country State Postcode Country

State Postcode Country State Postcode Country

1. For Company, Fund or Trust applications, please complete the appropriate Anti-Money Laundering and Counter Terrorism Financing form that can be

downloaded from commbank.com.au/igb or contact us on 1800 624 100 to request a copy

OtherMr Ms Mrs Miss OtherMr Ms Mrs Miss

Date of birth* Date of birth*Gender

Female Male

Gender

Female Male

Do you wish to receive marketing material? NoYes Do you wish to receive marketing material? NoYes

✔

CommInsure Adviser

( )

✔

CommInsure Adviser

( )

✔

BAKER DENNIS

LOT 3 WATTLE ROAD, HURSTBRIDGE, VICTORIA

VIC 4165 Australia

23/07/1966 ✔

( ) ( )

( )

✔

BAKER DONNA

LOT 3 WATTLE ROAD, HURSTBRIDGE, VICTORIA

VIC 4165 Australia

15/07/1965 ✔

( ) ( )

( )

The Investment Growth Bond is a life insurance policy. For child advancement policies the child must be listed as the life ins

only one life insured may be nominated.

Bond Owner 1 (‘Applicant 1’) continued Bond Owner 2 (‘Applicant 2’) continued

Investor – Company, Fund or Trust1 Investor – Company, Fund or Trust1

Company/Fund/Trust name* Company/Fund/Trust name*

Type of Investor* Type of Investor*

Company Fund Trust Company Fund Trust

Principal business/trust activity* Principal business/trust activity*

Country established, if not Australia* Country established, if not Australia*

Phone numberPhone numberABN* ABN*

Are you a charity?* No Yes Are you a charity?* No Yes

CommInsure is a registered business name of The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AF003-886 010813 (BRC25)

Page 2 of 6

Business address* (PO Box is not acceptable) Business address* (PO Box is not acceptable)

Mailing address Mailing address

State Postcode Country State Postcode Country

State Postcode Country State Postcode Country

Life Insured 1 Life Insured 2

Surname Surname

Other names known by (if any) Other names known by (if any)

Given name(s) Given name(s)

Home phone number Home phone numberWork phone number Work phone number

Mobile MobileFacsimile Facsimile

Email address Email address

The Life/Lives insured cannot be altered once the policy has commenced.

The Death Benefit Guarantee is based on the death of the life/lives insured not the Bond owner(s).

Residential address* (PO Box is not acceptable) Residential address* (PO Box is not acceptable)

Mailing address Mailing address

State Postcode Country State Postcode Country

State Postcode Country State Postcode Country

1. For Company, Fund or Trust applications, please complete the appropriate Anti-Money Laundering and Counter Terrorism Financing form that can be

downloaded from commbank.com.au/igb or contact us on 1800 624 100 to request a copy

OtherMr Ms Mrs Miss OtherMr Ms Mrs Miss

Date of birth* Date of birth*Gender

Female Male

Gender

Female Male

Do you wish to receive marketing material? NoYes Do you wish to receive marketing material? NoYes

✔

CommInsure Adviser

( )

✔

CommInsure Adviser

( )

✔

BAKER DENNIS

LOT 3 WATTLE ROAD, HURSTBRIDGE, VICTORIA

VIC 4165 Australia

23/07/1966 ✔

( ) ( )

( )

✔

BAKER DONNA

LOT 3 WATTLE ROAD, HURSTBRIDGE, VICTORIA

VIC 4165 Australia

15/07/1965 ✔

( ) ( )

( )

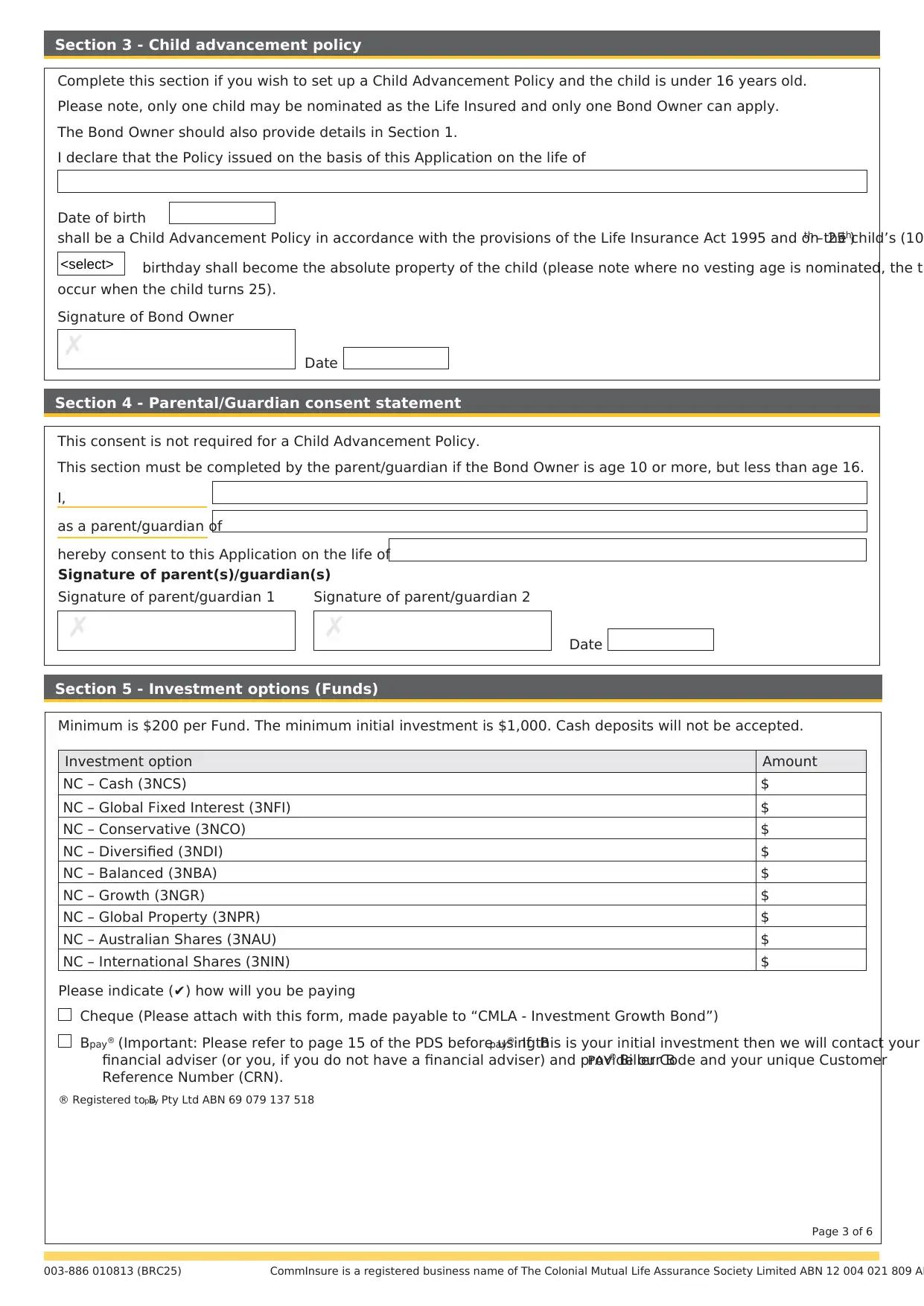

Section 5 - Investment options (Funds)

Minimum is $200 per Fund. The minimum initial investment is $1,000. Cash deposits will not be accepted.

Cheque (Please attach with this form, made payable to “CMLA - Investment Growth Bond”)

Bpay® (Important: Please refer to page 15 of the PDS before using Bpay®. If this is your initial investment then we will contact your

financial adviser (or you, if you do not have a financial adviser) and provide our BPAY® Biller Code and your unique Customer

Reference Number (CRN).

® Registered to Bpay Pty Ltd ABN 69 079 137 518

Investment option Amount

NC – Cash (3NCS) $

NC – Global Fixed Interest (3NFI) $

NC – Conservative (3NCO) $

NC – Diversified (3NDI) $

NC – Balanced (3NBA) $

NC – Growth (3NGR) $

NC – Global Property (3NPR) $

NC – Australian Shares (3NAU) $

NC – International Shares (3NIN) $

Please indicate (✔) how will you be paying

CommInsure is a registered business name of The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AF003-886 010813 (BRC25)

Page 3 of 6

Complete this section if you wish to set up a Child Advancement Policy and the child is under 16 years old.

Please note, only one child may be nominated as the Life Insured and only one Bond Owner can apply.

The Bond Owner should also provide details in Section 1.

I declare that the Policy issued on the basis of this Application on the life of

shall be a Child Advancement Policy in accordance with the provisions of the Life Insurance Act 1995 and on the child’s (10th – 25th)

birthday shall become the absolute property of the child (please note where no vesting age is nominated, the tr

occur when the child turns 25).

Date

Signature of Bond Owner

✗

Date of birth

Section 3 - Child advancement policy

This consent is not required for a Child Advancement Policy.

This section must be completed by the parent/guardian if the Bond Owner is age 10 or more, but less than age 16.

I,

as a parent/guardian of

hereby consent to this Application on the life of

Section 4 - Parental/Guardian consent statement

Signature of parent(s)/guardian(s)

Date

Signature of parent/guardian 1

✗

Signature of parent/guardian 2

✗

<select>

Minimum is $200 per Fund. The minimum initial investment is $1,000. Cash deposits will not be accepted.

Cheque (Please attach with this form, made payable to “CMLA - Investment Growth Bond”)

Bpay® (Important: Please refer to page 15 of the PDS before using Bpay®. If this is your initial investment then we will contact your

financial adviser (or you, if you do not have a financial adviser) and provide our BPAY® Biller Code and your unique Customer

Reference Number (CRN).

® Registered to Bpay Pty Ltd ABN 69 079 137 518

Investment option Amount

NC – Cash (3NCS) $

NC – Global Fixed Interest (3NFI) $

NC – Conservative (3NCO) $

NC – Diversified (3NDI) $

NC – Balanced (3NBA) $

NC – Growth (3NGR) $

NC – Global Property (3NPR) $

NC – Australian Shares (3NAU) $

NC – International Shares (3NIN) $

Please indicate (✔) how will you be paying

CommInsure is a registered business name of The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AF003-886 010813 (BRC25)

Page 3 of 6

Complete this section if you wish to set up a Child Advancement Policy and the child is under 16 years old.

Please note, only one child may be nominated as the Life Insured and only one Bond Owner can apply.

The Bond Owner should also provide details in Section 1.

I declare that the Policy issued on the basis of this Application on the life of

shall be a Child Advancement Policy in accordance with the provisions of the Life Insurance Act 1995 and on the child’s (10th – 25th)

birthday shall become the absolute property of the child (please note where no vesting age is nominated, the tr

occur when the child turns 25).

Date

Signature of Bond Owner

✗

Date of birth

Section 3 - Child advancement policy

This consent is not required for a Child Advancement Policy.

This section must be completed by the parent/guardian if the Bond Owner is age 10 or more, but less than age 16.

I,

as a parent/guardian of

hereby consent to this Application on the life of

Section 4 - Parental/Guardian consent statement

Signature of parent(s)/guardian(s)

Date

Signature of parent/guardian 1

✗

Signature of parent/guardian 2

✗

<select>

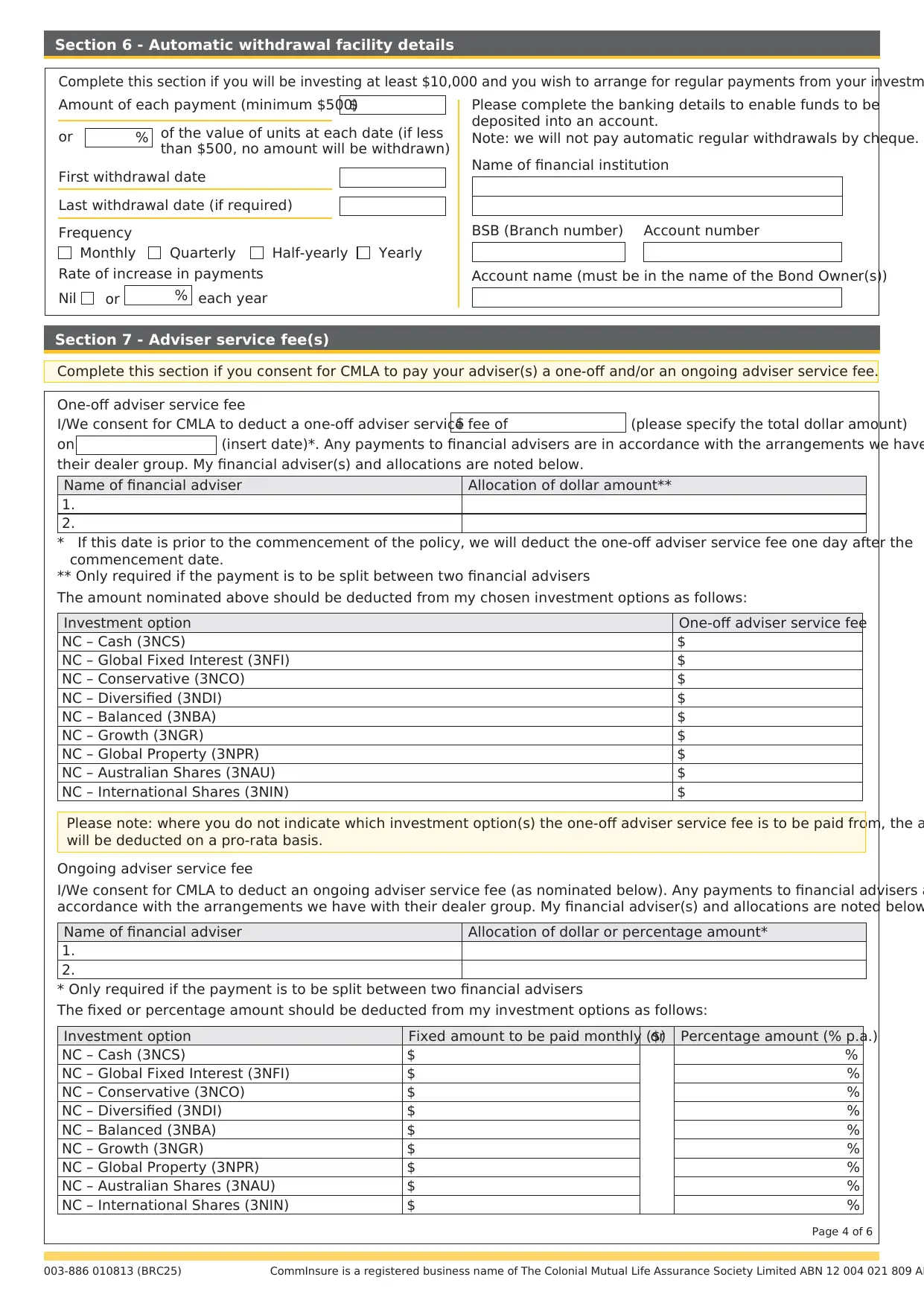

Section 6 - Automatic withdrawal facility details

or

Complete this section if you will be investing at least $10,000 and you wish to arrange for regular payments from your investm

% of the value of units at each date (if less

than $500, no amount will be withdrawn)

$Amount of each payment (minimum $500)

First withdrawal date

Last withdrawal date (if required)

Frequency

Monthly Quarterly YearlyHalf-yearly

Please complete the banking details to enable funds to be

deposited into an account.

Note: we will not pay automatic regular withdrawals by cheque.

Name of financial institution

BSB (Branch number) Account number

Rate of increase in payments

orNil % each year

Account name (must be in the name of the Bond Owner(s))

Section 7 - Adviser service fee(s)

Complete this section if you consent for CMLA to pay your adviser(s) a one-off and/or an ongoing adviser service fee.

One-off adviser service fee

I/We consent for CMLA to deduct a one-off adviser service fee of$ (please specify the total dollar amount)

on (insert date)*. Any payments to financial advisers are in accordance with the arrangements we have

their dealer group. My financial adviser(s) and allocations are noted below.

Name of financial adviser Allocation of dollar amount**

1.

2.

* If this date is prior to the commencement of the policy, we will deduct the one-off adviser service fee one day after the

commencement date.

** Only required if the payment is to be split between two financial advisers

The amount nominated above should be deducted from my chosen investment options as follows:

Investment option One-off adviser service fee

NC – Cash (3NCS) $

NC – Global Fixed Interest (3NFI) $

NC – Conservative (3NCO) $

NC – Diversified (3NDI) $

NC – Balanced (3NBA) $

NC – Growth (3NGR) $

NC – Global Property (3NPR) $

NC – Australian Shares (3NAU) $

NC – International Shares (3NIN) $

Please note: where you do not indicate which investment option(s) the one-off adviser service fee is to be paid from, the a

will be deducted on a pro-rata basis.

Ongoing adviser service fee

I/We consent for CMLA to deduct an ongoing adviser service fee (as nominated below). Any payments to financial advisers a

accordance with the arrangements we have with their dealer group. My financial adviser(s) and allocations are noted below

Name of financial adviser Allocation of dollar or percentage amount*

1.

2.

* Only required if the payment is to be split between two financial advisers

The fixed or percentage amount should be deducted from my investment options as follows:

Investment option Fixed amount to be paid monthly ($)or Percentage amount (% p.a.)

NC – Cash (3NCS) $ %

NC – Global Fixed Interest (3NFI) $ %

NC – Conservative (3NCO) $ %

NC – Diversified (3NDI) $ %

NC – Balanced (3NBA) $ %

NC – Growth (3NGR) $ %

NC – Global Property (3NPR) $ %

NC – Australian Shares (3NAU) $ %

NC – International Shares (3NIN) $ %

CommInsure is a registered business name of The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AF003-886 010813 (BRC25)

Page 4 of 6

or

Complete this section if you will be investing at least $10,000 and you wish to arrange for regular payments from your investm

% of the value of units at each date (if less

than $500, no amount will be withdrawn)

$Amount of each payment (minimum $500)

First withdrawal date

Last withdrawal date (if required)

Frequency

Monthly Quarterly YearlyHalf-yearly

Please complete the banking details to enable funds to be

deposited into an account.

Note: we will not pay automatic regular withdrawals by cheque.

Name of financial institution

BSB (Branch number) Account number

Rate of increase in payments

orNil % each year

Account name (must be in the name of the Bond Owner(s))

Section 7 - Adviser service fee(s)

Complete this section if you consent for CMLA to pay your adviser(s) a one-off and/or an ongoing adviser service fee.

One-off adviser service fee

I/We consent for CMLA to deduct a one-off adviser service fee of$ (please specify the total dollar amount)

on (insert date)*. Any payments to financial advisers are in accordance with the arrangements we have

their dealer group. My financial adviser(s) and allocations are noted below.

Name of financial adviser Allocation of dollar amount**

1.

2.

* If this date is prior to the commencement of the policy, we will deduct the one-off adviser service fee one day after the

commencement date.

** Only required if the payment is to be split between two financial advisers

The amount nominated above should be deducted from my chosen investment options as follows:

Investment option One-off adviser service fee

NC – Cash (3NCS) $

NC – Global Fixed Interest (3NFI) $

NC – Conservative (3NCO) $

NC – Diversified (3NDI) $

NC – Balanced (3NBA) $

NC – Growth (3NGR) $

NC – Global Property (3NPR) $

NC – Australian Shares (3NAU) $

NC – International Shares (3NIN) $

Please note: where you do not indicate which investment option(s) the one-off adviser service fee is to be paid from, the a

will be deducted on a pro-rata basis.

Ongoing adviser service fee

I/We consent for CMLA to deduct an ongoing adviser service fee (as nominated below). Any payments to financial advisers a

accordance with the arrangements we have with their dealer group. My financial adviser(s) and allocations are noted below

Name of financial adviser Allocation of dollar or percentage amount*

1.

2.

* Only required if the payment is to be split between two financial advisers

The fixed or percentage amount should be deducted from my investment options as follows:

Investment option Fixed amount to be paid monthly ($)or Percentage amount (% p.a.)

NC – Cash (3NCS) $ %

NC – Global Fixed Interest (3NFI) $ %

NC – Conservative (3NCO) $ %

NC – Diversified (3NDI) $ %

NC – Balanced (3NBA) $ %

NC – Growth (3NGR) $ %

NC – Global Property (3NPR) $ %

NC – Australian Shares (3NAU) $ %

NC – International Shares (3NIN) $ %

CommInsure is a registered business name of The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AF003-886 010813 (BRC25)

Page 4 of 6

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Name of financial adviser 1 Name of financial adviser 2

Financial adviser number AFSL number Financial adviser number AFSL number

Company name of financial adviser (if applicable) Company name of financial adviser (if applicable)

Contact name Contact name

Telephone work Mobile Telephone work Mobile

Facsimile Facsimile

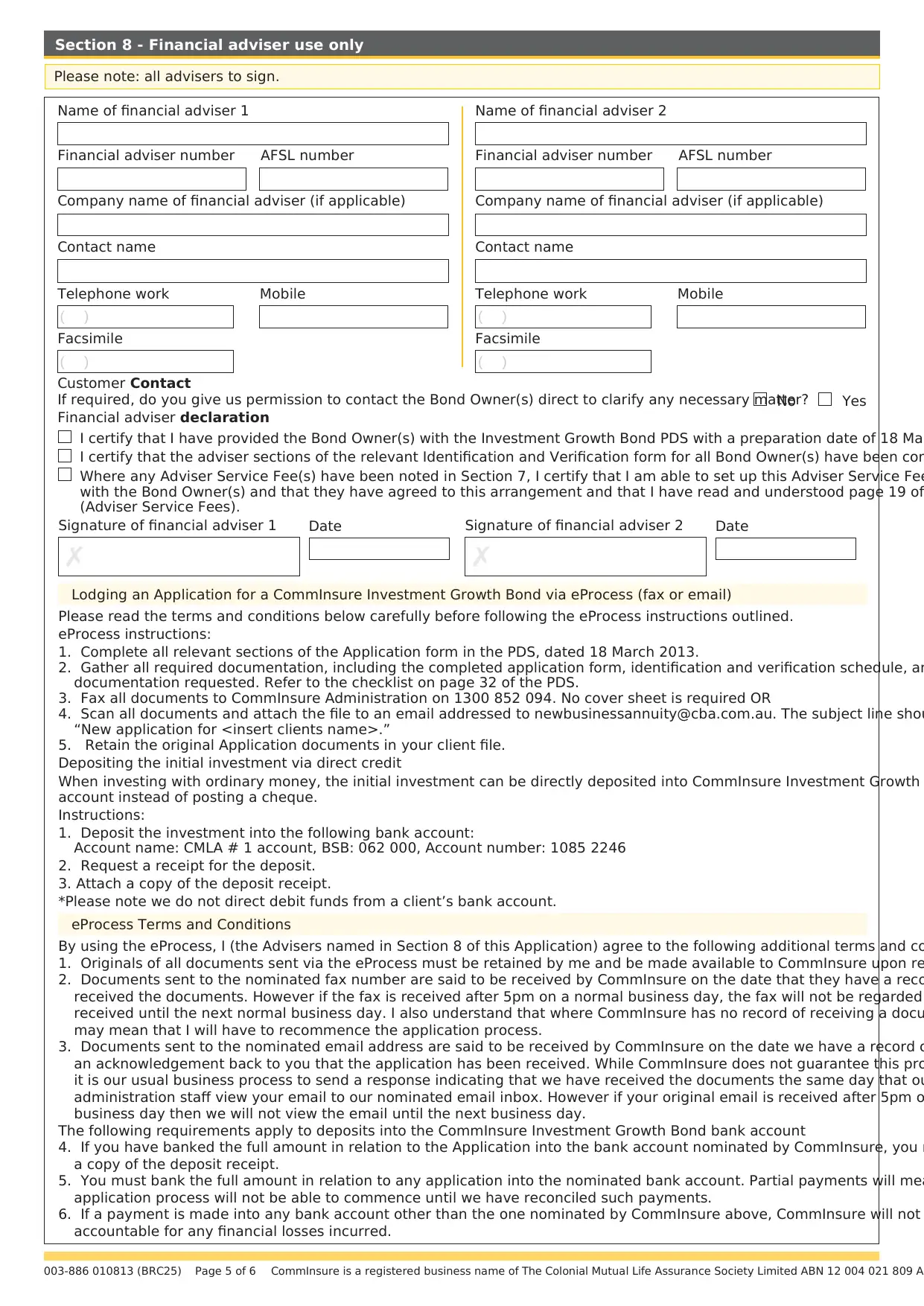

Section 8 - Financial adviser use only

Customer Contact

No YesIf required, do you give us permission to contact the Bond Owner(s) direct to clarify any necessary matter?

I certify that I have provided the Bond Owner(s) with the Investment Growth Bond PDS with a preparation date of 18 Mar

I certify that the adviser sections of the relevant Identification and Verification form for all Bond Owner(s) have been com

Where any Adviser Service Fee(s) have been noted in Section 7, I certify that I am able to set up this Adviser Service Fee

with the Bond Owner(s) and that they have agreed to this arrangement and that I have read and understood page 19 of

(Adviser Service Fees).

Financial adviser declaration

✗

Signature of financial adviser 1 Date

✗

Signature of financial adviser 2 Date

Please note: all advisers to sign.

Please read the terms and conditions below carefully before following the eProcess instructions outlined.

eProcess instructions:

1. Complete all relevant sections of the Application form in the PDS, dated 18 March 2013.

2. Gather all required documentation, including the completed application form, identification and verification schedule, an

documentation requested. Refer to the checklist on page 32 of the PDS.

3. Fax all documents to CommInsure Administration on 1300 852 094. No cover sheet is required OR

4. Scan all documents and attach the file to an email addressed to newbusinessannuity@cba.com.au. The subject line shou

“New application for <insert clients name>.”

5. Retain the original Application documents in your client file.

Depositing the initial investment via direct credit

When investing with ordinary money, the initial investment can be directly deposited into CommInsure Investment Growth

account instead of posting a cheque.

Instructions:

1. Deposit the investment into the following bank account:

Account name: CMLA # 1 account, BSB: 062 000, Account number: 1085 2246

2. Request a receipt for the deposit.

3. Attach a copy of the deposit receipt.

*Please note we do not direct debit funds from a client’s bank account.

By using the eProcess, I (the Advisers named in Section 8 of this Application) agree to the following additional terms and co

1. Originals of all documents sent via the eProcess must be retained by me and be made available to CommInsure upon re

2. Documents sent to the nominated fax number are said to be received by CommInsure on the date that they have a reco

received the documents. However if the fax is received after 5pm on a normal business day, the fax will not be regarded

received until the next normal business day. I also understand that where CommInsure has no record of receiving a docu

may mean that I will have to recommence the application process.

3. Documents sent to the nominated email address are said to be received by CommInsure on the date we have a record o

an acknowledgement back to you that the application has been received. While CommInsure does not guarantee this pro

it is our usual business process to send a response indicating that we have received the documents the same day that ou

administration staff view your email to our nominated email inbox. However if your original email is received after 5pm o

business day then we will not view the email until the next business day.

The following requirements apply to deposits into the CommInsure Investment Growth Bond bank account

4. If you have banked the full amount in relation to the Application into the bank account nominated by CommInsure, you m

a copy of the deposit receipt.

5. You must bank the full amount in relation to any application into the nominated bank account. Partial payments will mea

application process will not be able to commence until we have reconciled such payments.

6. If a payment is made into any bank account other than the one nominated by CommInsure above, CommInsure will not

accountable for any financial losses incurred.

eProcess Terms and Conditions

Lodging an Application for a CommInsure Investment Growth Bond via eProcess (fax or email)

003-886 010813 (BRC25) CommInsure is a registered business name of The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 APage 5 of 6

( )

( )

( )

( )

Financial adviser number AFSL number Financial adviser number AFSL number

Company name of financial adviser (if applicable) Company name of financial adviser (if applicable)

Contact name Contact name

Telephone work Mobile Telephone work Mobile

Facsimile Facsimile

Section 8 - Financial adviser use only

Customer Contact

No YesIf required, do you give us permission to contact the Bond Owner(s) direct to clarify any necessary matter?

I certify that I have provided the Bond Owner(s) with the Investment Growth Bond PDS with a preparation date of 18 Mar

I certify that the adviser sections of the relevant Identification and Verification form for all Bond Owner(s) have been com

Where any Adviser Service Fee(s) have been noted in Section 7, I certify that I am able to set up this Adviser Service Fee

with the Bond Owner(s) and that they have agreed to this arrangement and that I have read and understood page 19 of

(Adviser Service Fees).

Financial adviser declaration

✗

Signature of financial adviser 1 Date

✗

Signature of financial adviser 2 Date

Please note: all advisers to sign.

Please read the terms and conditions below carefully before following the eProcess instructions outlined.

eProcess instructions:

1. Complete all relevant sections of the Application form in the PDS, dated 18 March 2013.

2. Gather all required documentation, including the completed application form, identification and verification schedule, an

documentation requested. Refer to the checklist on page 32 of the PDS.

3. Fax all documents to CommInsure Administration on 1300 852 094. No cover sheet is required OR

4. Scan all documents and attach the file to an email addressed to newbusinessannuity@cba.com.au. The subject line shou

“New application for <insert clients name>.”

5. Retain the original Application documents in your client file.

Depositing the initial investment via direct credit

When investing with ordinary money, the initial investment can be directly deposited into CommInsure Investment Growth

account instead of posting a cheque.

Instructions:

1. Deposit the investment into the following bank account:

Account name: CMLA # 1 account, BSB: 062 000, Account number: 1085 2246

2. Request a receipt for the deposit.

3. Attach a copy of the deposit receipt.

*Please note we do not direct debit funds from a client’s bank account.

By using the eProcess, I (the Advisers named in Section 8 of this Application) agree to the following additional terms and co

1. Originals of all documents sent via the eProcess must be retained by me and be made available to CommInsure upon re

2. Documents sent to the nominated fax number are said to be received by CommInsure on the date that they have a reco

received the documents. However if the fax is received after 5pm on a normal business day, the fax will not be regarded

received until the next normal business day. I also understand that where CommInsure has no record of receiving a docu

may mean that I will have to recommence the application process.

3. Documents sent to the nominated email address are said to be received by CommInsure on the date we have a record o

an acknowledgement back to you that the application has been received. While CommInsure does not guarantee this pro

it is our usual business process to send a response indicating that we have received the documents the same day that ou

administration staff view your email to our nominated email inbox. However if your original email is received after 5pm o

business day then we will not view the email until the next business day.

The following requirements apply to deposits into the CommInsure Investment Growth Bond bank account

4. If you have banked the full amount in relation to the Application into the bank account nominated by CommInsure, you m

a copy of the deposit receipt.

5. You must bank the full amount in relation to any application into the nominated bank account. Partial payments will mea

application process will not be able to commence until we have reconciled such payments.

6. If a payment is made into any bank account other than the one nominated by CommInsure above, CommInsure will not

accountable for any financial losses incurred.

eProcess Terms and Conditions

Lodging an Application for a CommInsure Investment Growth Bond via eProcess (fax or email)

003-886 010813 (BRC25) CommInsure is a registered business name of The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 APage 5 of 6

( )

( )

( )

( )

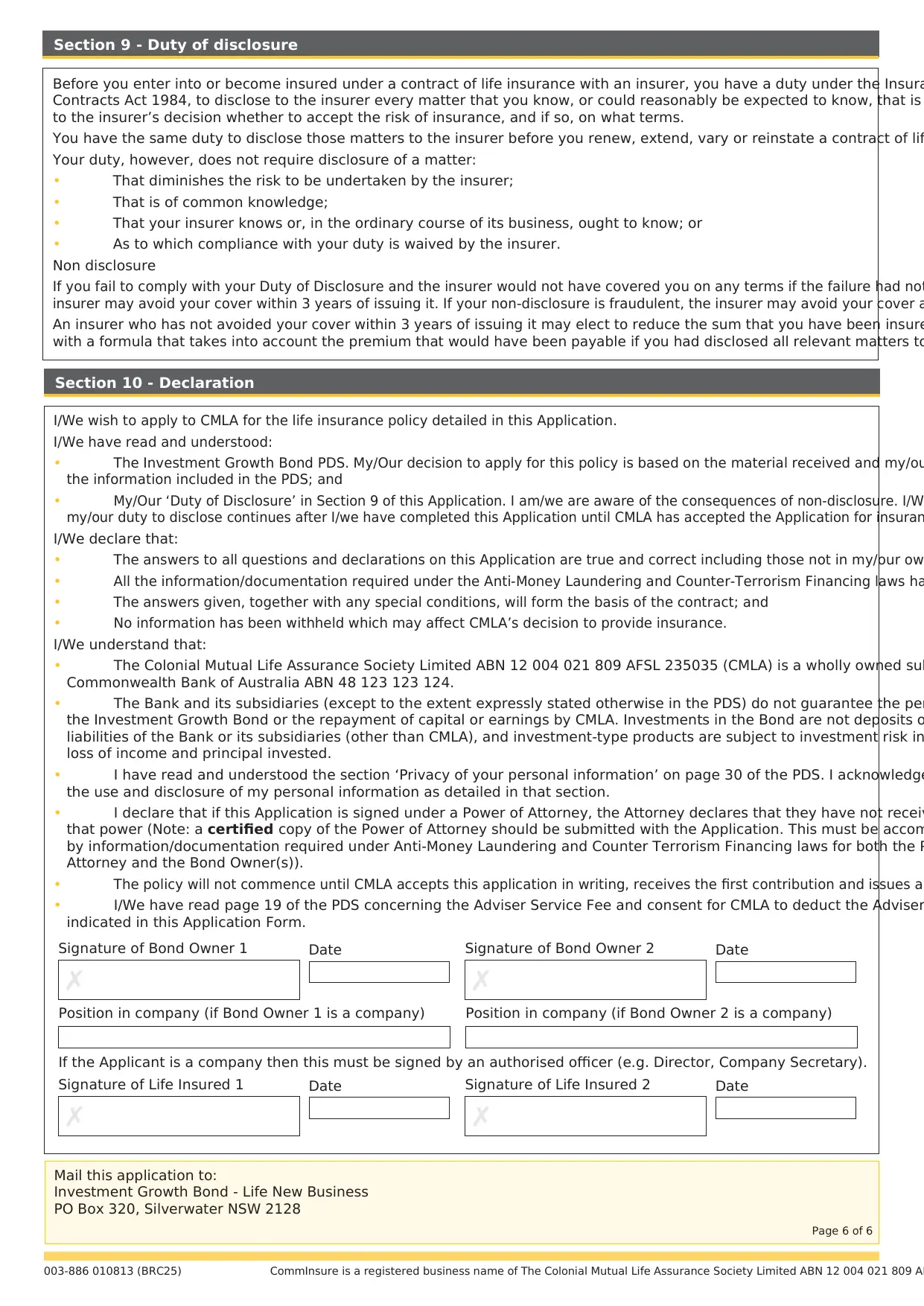

I/We wish to apply to CMLA for the life insurance policy detailed in this Application.

I/We have read and understood:

• The Investment Growth Bond PDS. My/Our decision to apply for this policy is based on the material received and my/ou

the information included in the PDS; and

• My/Our ‘Duty of Disclosure’ in Section 9 of this Application. I am/we are aware of the consequences of non-disclosure. I/W

my/our duty to disclose continues after I/we have completed this Application until CMLA has accepted the Application for insuran

I/We declare that:

• The answers to all questions and declarations on this Application are true and correct including those not in my/our ow

• All the information/documentation required under the Anti-Money Laundering and Counter-Terrorism Financing laws ha

• The answers given, together with any special conditions, will form the basis of the contract; and

• No information has been withheld which may affect CMLA’s decision to provide insurance.

I/We understand that:

• The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AFSL 235035 (CMLA) is a wholly owned sub

Commonwealth Bank of Australia ABN 48 123 123 124.

• The Bank and its subsidiaries (except to the extent expressly stated otherwise in the PDS) do not guarantee the per

the Investment Growth Bond or the repayment of capital or earnings by CMLA. Investments in the Bond are not deposits o

liabilities of the Bank or its subsidiaries (other than CMLA), and investment-type products are subject to investment risk in

loss of income and principal invested.

• I have read and understood the section ‘Privacy of your personal information’ on page 30 of the PDS. I acknowledge

the use and disclosure of my personal information as detailed in that section.

• I declare that if this Application is signed under a Power of Attorney, the Attorney declares that they have not receiv

that power (Note: a certified copy of the Power of Attorney should be submitted with the Application. This must be accom

by information/documentation required under Anti-Money Laundering and Counter Terrorism Financing laws for both the P

Attorney and the Bond Owner(s)).

• The policy will not commence until CMLA accepts this application in writing, receives the first contribution and issues a

• I/We have read page 19 of the PDS concerning the Adviser Service Fee and consent for CMLA to deduct the Adviser

indicated in this Application Form.

Section 10 - Declaration

Position in company (if Bond Owner 1 is a company) Position in company (if Bond Owner 2 is a company)

If the Applicant is a company then this must be signed by an authorised officer (e.g. Director, Company Secretary).

✗

Signature of Bond Owner 1 Date

✗

Signature of Bond Owner 2 Date

✗

Signature of Life Insured 1 Date

✗

Signature of Life Insured 2 Date

Mail this application to:

Investment Growth Bond - Life New Business

PO Box 320, Silverwater NSW 2128

Section 9 - Duty of disclosure

Before you enter into or become insured under a contract of life insurance with an insurer, you have a duty under the Insura

Contracts Act 1984, to disclose to the insurer every matter that you know, or could reasonably be expected to know, that is

to the insurer’s decision whether to accept the risk of insurance, and if so, on what terms.

You have the same duty to disclose those matters to the insurer before you renew, extend, vary or reinstate a contract of lif

Your duty, however, does not require disclosure of a matter:

• That diminishes the risk to be undertaken by the insurer;

• That is of common knowledge;

• That your insurer knows or, in the ordinary course of its business, ought to know; or

• As to which compliance with your duty is waived by the insurer.

Non disclosure

If you fail to comply with your Duty of Disclosure and the insurer would not have covered you on any terms if the failure had not

insurer may avoid your cover within 3 years of issuing it. If your non-disclosure is fraudulent, the insurer may avoid your cover a

An insurer who has not avoided your cover within 3 years of issuing it may elect to reduce the sum that you have been insure

with a formula that takes into account the premium that would have been payable if you had disclosed all relevant matters to

CommInsure is a registered business name of The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AF003-886 010813 (BRC25)

Page 6 of 6

I/We have read and understood:

• The Investment Growth Bond PDS. My/Our decision to apply for this policy is based on the material received and my/ou

the information included in the PDS; and

• My/Our ‘Duty of Disclosure’ in Section 9 of this Application. I am/we are aware of the consequences of non-disclosure. I/W

my/our duty to disclose continues after I/we have completed this Application until CMLA has accepted the Application for insuran

I/We declare that:

• The answers to all questions and declarations on this Application are true and correct including those not in my/our ow

• All the information/documentation required under the Anti-Money Laundering and Counter-Terrorism Financing laws ha

• The answers given, together with any special conditions, will form the basis of the contract; and

• No information has been withheld which may affect CMLA’s decision to provide insurance.

I/We understand that:

• The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AFSL 235035 (CMLA) is a wholly owned sub

Commonwealth Bank of Australia ABN 48 123 123 124.

• The Bank and its subsidiaries (except to the extent expressly stated otherwise in the PDS) do not guarantee the per

the Investment Growth Bond or the repayment of capital or earnings by CMLA. Investments in the Bond are not deposits o

liabilities of the Bank or its subsidiaries (other than CMLA), and investment-type products are subject to investment risk in

loss of income and principal invested.

• I have read and understood the section ‘Privacy of your personal information’ on page 30 of the PDS. I acknowledge

the use and disclosure of my personal information as detailed in that section.

• I declare that if this Application is signed under a Power of Attorney, the Attorney declares that they have not receiv

that power (Note: a certified copy of the Power of Attorney should be submitted with the Application. This must be accom

by information/documentation required under Anti-Money Laundering and Counter Terrorism Financing laws for both the P

Attorney and the Bond Owner(s)).

• The policy will not commence until CMLA accepts this application in writing, receives the first contribution and issues a

• I/We have read page 19 of the PDS concerning the Adviser Service Fee and consent for CMLA to deduct the Adviser

indicated in this Application Form.

Section 10 - Declaration

Position in company (if Bond Owner 1 is a company) Position in company (if Bond Owner 2 is a company)

If the Applicant is a company then this must be signed by an authorised officer (e.g. Director, Company Secretary).

✗

Signature of Bond Owner 1 Date

✗

Signature of Bond Owner 2 Date

✗

Signature of Life Insured 1 Date

✗

Signature of Life Insured 2 Date

Mail this application to:

Investment Growth Bond - Life New Business

PO Box 320, Silverwater NSW 2128

Section 9 - Duty of disclosure

Before you enter into or become insured under a contract of life insurance with an insurer, you have a duty under the Insura

Contracts Act 1984, to disclose to the insurer every matter that you know, or could reasonably be expected to know, that is

to the insurer’s decision whether to accept the risk of insurance, and if so, on what terms.

You have the same duty to disclose those matters to the insurer before you renew, extend, vary or reinstate a contract of lif

Your duty, however, does not require disclosure of a matter:

• That diminishes the risk to be undertaken by the insurer;

• That is of common knowledge;

• That your insurer knows or, in the ordinary course of its business, ought to know; or

• As to which compliance with your duty is waived by the insurer.

Non disclosure

If you fail to comply with your Duty of Disclosure and the insurer would not have covered you on any terms if the failure had not

insurer may avoid your cover within 3 years of issuing it. If your non-disclosure is fraudulent, the insurer may avoid your cover a

An insurer who has not avoided your cover within 3 years of issuing it may elect to reduce the sum that you have been insure

with a formula that takes into account the premium that would have been payable if you had disclosed all relevant matters to

CommInsure is a registered business name of The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AF003-886 010813 (BRC25)

Page 6 of 6

1 out of 6

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.