ACCT20075 - Auditing and Assurance: Janus Henderson Group Analysis

VerifiedAdded on 2023/06/08

|10

|2412

|464

Report

AI Summary

This report provides a detailed analysis of the audit and assurance processes for the Janus Henderson Group, focusing on the financial year 2017. It begins by explaining the concept of materiality and its application in auditing, including the calculation of a materiality level for the Janus Henderson Group based on its net income. The report then examines the use of preliminary analytical reviews, key ratios, and risk assessment procedures to identify potential areas of concern in the company's financial statements. Specific audit procedures are recommended to address these risks, focusing on areas like fixed assets, trade receivables, sales turnover, and current liabilities. Furthermore, the cash flow statement is reviewed to assess the company's investing and financing activities, and the audit report is analyzed to confirm the unqualified opinion. The report concludes that the audit provides a fair presentation of the company's financial information, highlighting the importance of adhering to applicable laws and regulations to ensure transparency and maintain stakeholder trust. Desklib offers a range of solved assignments and past papers to aid students in their studies.

Janus Henderson Group

Auditing reporting and assurance

Auditing and assurance

Name of the Author

University Name-

Auditing reporting and assurance

Auditing and assurance

Name of the Author

University Name-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION.................................................................................................................................2

Answer to section-1...............................................................................................................................2

Answer to section- 2..............................................................................................................................3

Answer to section- 3..............................................................................................................................7

REVIEW OF STATEMENT OF CASH FLOW...............................................................................7

REVIEW OF AUDIT REPORT........................................................................................................8

Conclusion.............................................................................................................................................8

REFERENCES......................................................................................................................................9

1

INTRODUCTION.................................................................................................................................2

Answer to section-1...............................................................................................................................2

Answer to section- 2..............................................................................................................................3

Answer to section- 3..............................................................................................................................7

REVIEW OF STATEMENT OF CASH FLOW...............................................................................7

REVIEW OF AUDIT REPORT........................................................................................................8

Conclusion.............................................................................................................................................8

REFERENCES......................................................................................................................................9

1

INTRODUCTION

With the ramified economic changes and complex business structure, the concept of

audit and assurances of the financial statement of company has been gaining momentum

throughout the time. Audit function helps to strengthen the trust that shareholders and other

users can lay over the financial statements of an entity. The main purpose of audit and

assurance is to strengthen the transparency and truthfulness of the financial statement of

company. The current report highlights the benefit of the concepts of materiality and

analytical procedures in any audit. The company used for the research purpose is Janus

Henderson Group. In the later sections of report the cash flow statement and the audit report

for financial year 2017 are also reviewed.

Answer to section-1

In simple words, materiality defines the quantity that can make a difference in the user’s

opinion. It is important to consider materiality because audit is able to provide only a

reasonable level of assurance. It means that all the errors or frauds could not be detected by

an audit due to the inherent limitations of the Janus Henderson Group. So the focus area is

brought in limelight by using the materiality levels (Chan, & Vasarhelyi, 2018). Materiality

represents that amount which is expected to create an influence on the users of the financial

statements. This happens when the misstatements and the omissions either individually or as

a sum total are reaching or exceeding this materiality amount. The ASA 320, Materiality in

Planning and Performing Audit puts emphasis on the auditor’s responsibility to determine

materiality for the financial statements. Materiality is decided right from the start of the audit

(Christensen, Eilifsen, Glover & Messier, 2018).

Choosing any materiality level is a matter of professional judgement. Further, for certain

account balances or the class of transactions, the auditor can choose a lower amount to be the

materiality level, if the risk level is expected to be high. This is known as performance

materiality. Different basis can be used for calculating a quantitative level of materiality.

They can be (Eilifsen, Hamilton, & Messier Jr,. 2017).

1 % of revenue

5 % of net income

½ to 1 % of net asset value

2

With the ramified economic changes and complex business structure, the concept of

audit and assurances of the financial statement of company has been gaining momentum

throughout the time. Audit function helps to strengthen the trust that shareholders and other

users can lay over the financial statements of an entity. The main purpose of audit and

assurance is to strengthen the transparency and truthfulness of the financial statement of

company. The current report highlights the benefit of the concepts of materiality and

analytical procedures in any audit. The company used for the research purpose is Janus

Henderson Group. In the later sections of report the cash flow statement and the audit report

for financial year 2017 are also reviewed.

Answer to section-1

In simple words, materiality defines the quantity that can make a difference in the user’s

opinion. It is important to consider materiality because audit is able to provide only a

reasonable level of assurance. It means that all the errors or frauds could not be detected by

an audit due to the inherent limitations of the Janus Henderson Group. So the focus area is

brought in limelight by using the materiality levels (Chan, & Vasarhelyi, 2018). Materiality

represents that amount which is expected to create an influence on the users of the financial

statements. This happens when the misstatements and the omissions either individually or as

a sum total are reaching or exceeding this materiality amount. The ASA 320, Materiality in

Planning and Performing Audit puts emphasis on the auditor’s responsibility to determine

materiality for the financial statements. Materiality is decided right from the start of the audit

(Christensen, Eilifsen, Glover & Messier, 2018).

Choosing any materiality level is a matter of professional judgement. Further, for certain

account balances or the class of transactions, the auditor can choose a lower amount to be the

materiality level, if the risk level is expected to be high. This is known as performance

materiality. Different basis can be used for calculating a quantitative level of materiality.

They can be (Eilifsen, Hamilton, & Messier Jr,. 2017).

1 % of revenue

5 % of net income

½ to 1 % of net asset value

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

½ to 2 % of the revenues or expenses

The most common criteria usually selected are the percentage of the net income. The

percentage usually taken lies between ranges of 5% to 10%. However, when Janus

Henderson Group is tend to be highly volatile or there lies huge risk on the profit earning

capacity, other benchmarks are used. They can be the revenue, or expenses as discussed

above or even a certain percentage of owner’s equity can also be taken. Further adjustment of

this amount should be made owing to the various qualitative aspects. These can be related to

past materiality levels, industry conditions, misstatements identified due to fraud, etc.

(Eilifsen, Hamilton & Messier, 2017). The audit procedure which need to be followed in this

would be assertion test.

On looking at the financial statements of the Janus Henderson Group by reading, the net

income is selected as the perfect basis. The net income after taxes turns out to be $

655,500,000. 5% of the same comes down to be $ 32,775,000. This figure needs to be

adjusted for the changes observed in the income tax patterns. The reason is that because of

tax patterns the income after tax is varying largely as compared to previous years. So, for the

audit purpose the materiality level is assumed to be AUD 33,000,000 (Jans, Alles, &

Vasarhelyi, (2014).

The most highlighting disclosure made in the Janus Henderson Group’s annual report is of

the merger that completed on May 30, 2017. This merger has contributed a net income of

around $ 173.1 million. Further, there is a one-time tax benefit that the company has attained

for $ 340.7 million. This is on account of changes in U.S tax laws. Specific audit procedures

are required to be performed to gather knowledge regarding the reliability of these

transactions. The auditor needs to conduct specific external analysis too for the same. Written

confirmations from the management should be obtained regarding the accuracy of merger

operation (Czerney, Schmidt, & Thompson, 2014).

Answer to section- 2

Preliminary Analytical Reviews are applied at the planning stage of any audit. These reviews

help the auditor to obtain a clear understanding regarding the entity and the environment in

which it operates. ASA 300, planning an Audit of Financial Report states that these reviews

are a significant component of the risk assessment procedures. Further, ASA 520 Analytical

Procedures defines the analytical procedures. As per the ASA, these procedures analyses the

3

The most common criteria usually selected are the percentage of the net income. The

percentage usually taken lies between ranges of 5% to 10%. However, when Janus

Henderson Group is tend to be highly volatile or there lies huge risk on the profit earning

capacity, other benchmarks are used. They can be the revenue, or expenses as discussed

above or even a certain percentage of owner’s equity can also be taken. Further adjustment of

this amount should be made owing to the various qualitative aspects. These can be related to

past materiality levels, industry conditions, misstatements identified due to fraud, etc.

(Eilifsen, Hamilton & Messier, 2017). The audit procedure which need to be followed in this

would be assertion test.

On looking at the financial statements of the Janus Henderson Group by reading, the net

income is selected as the perfect basis. The net income after taxes turns out to be $

655,500,000. 5% of the same comes down to be $ 32,775,000. This figure needs to be

adjusted for the changes observed in the income tax patterns. The reason is that because of

tax patterns the income after tax is varying largely as compared to previous years. So, for the

audit purpose the materiality level is assumed to be AUD 33,000,000 (Jans, Alles, &

Vasarhelyi, (2014).

The most highlighting disclosure made in the Janus Henderson Group’s annual report is of

the merger that completed on May 30, 2017. This merger has contributed a net income of

around $ 173.1 million. Further, there is a one-time tax benefit that the company has attained

for $ 340.7 million. This is on account of changes in U.S tax laws. Specific audit procedures

are required to be performed to gather knowledge regarding the reliability of these

transactions. The auditor needs to conduct specific external analysis too for the same. Written

confirmations from the management should be obtained regarding the accuracy of merger

operation (Czerney, Schmidt, & Thompson, 2014).

Answer to section- 2

Preliminary Analytical Reviews are applied at the planning stage of any audit. These reviews

help the auditor to obtain a clear understanding regarding the entity and the environment in

which it operates. ASA 300, planning an Audit of Financial Report states that these reviews

are a significant component of the risk assessment procedures. Further, ASA 520 Analytical

Procedures defines the analytical procedures. As per the ASA, these procedures analyses the

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

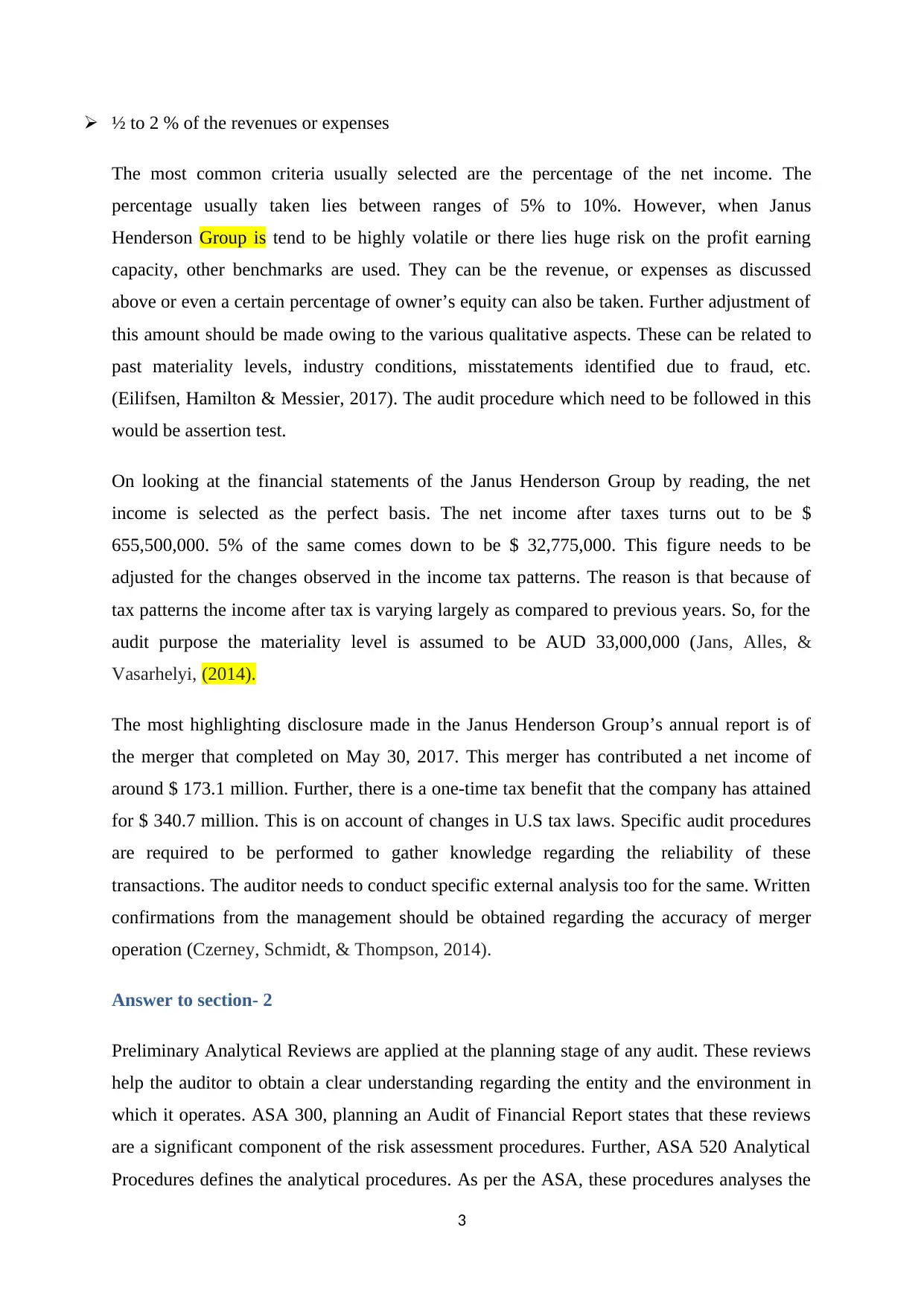

relationship that lies between the financial and non-financial information. This analysis helps

to evaluate the financial information (Jans, Alles & Vasarhelyi, 2014).

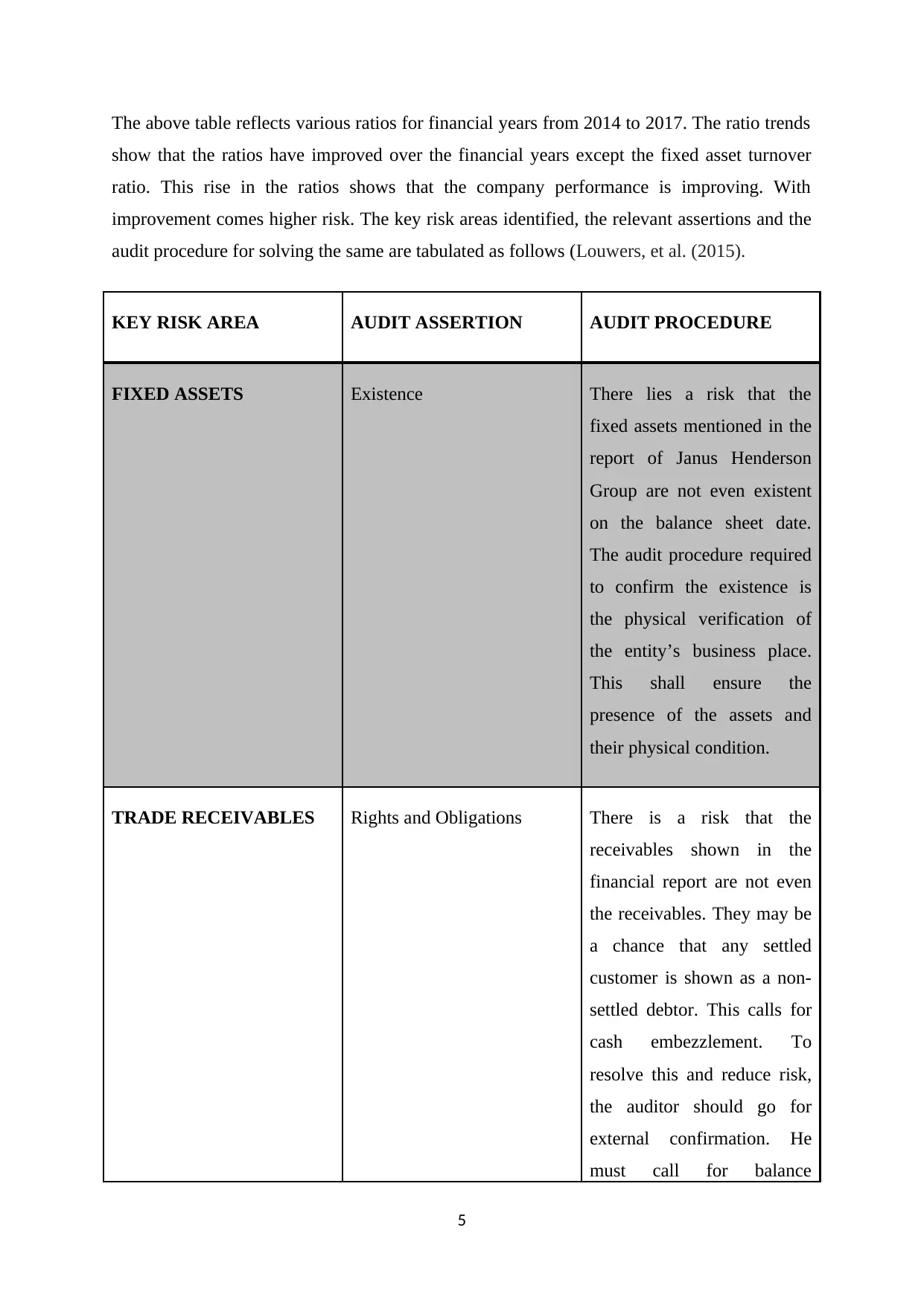

KEY RATIOS 2014 2015 2016 2017

CURRENT

RATIO

1.91 1.47 1.73 2.23

FINANCIAL

LEVERAGE

1.61 1.63 1.52 1.50

NET MARGIN

(%)

39.70 21.32 14.85 37.59

RETURN ON

ASSETS (%)

16.34 9.45 6.01 14.15

RETURN ON

EQUITY (%)

27.20 15.32 9.49 21.31

RETURN ON

INVESTED

CAPITAL (%)

23.86 13.80 9.25 17.17

RECEIVABLES

TURNOVER

2.57 2.89 2.66 4.60

FIXED ASSETS

TURNOVER

39.33 49.96 47.32 39.74

4

to evaluate the financial information (Jans, Alles & Vasarhelyi, 2014).

KEY RATIOS 2014 2015 2016 2017

CURRENT

RATIO

1.91 1.47 1.73 2.23

FINANCIAL

LEVERAGE

1.61 1.63 1.52 1.50

NET MARGIN

(%)

39.70 21.32 14.85 37.59

RETURN ON

ASSETS (%)

16.34 9.45 6.01 14.15

RETURN ON

EQUITY (%)

27.20 15.32 9.49 21.31

RETURN ON

INVESTED

CAPITAL (%)

23.86 13.80 9.25 17.17

RECEIVABLES

TURNOVER

2.57 2.89 2.66 4.60

FIXED ASSETS

TURNOVER

39.33 49.96 47.32 39.74

4

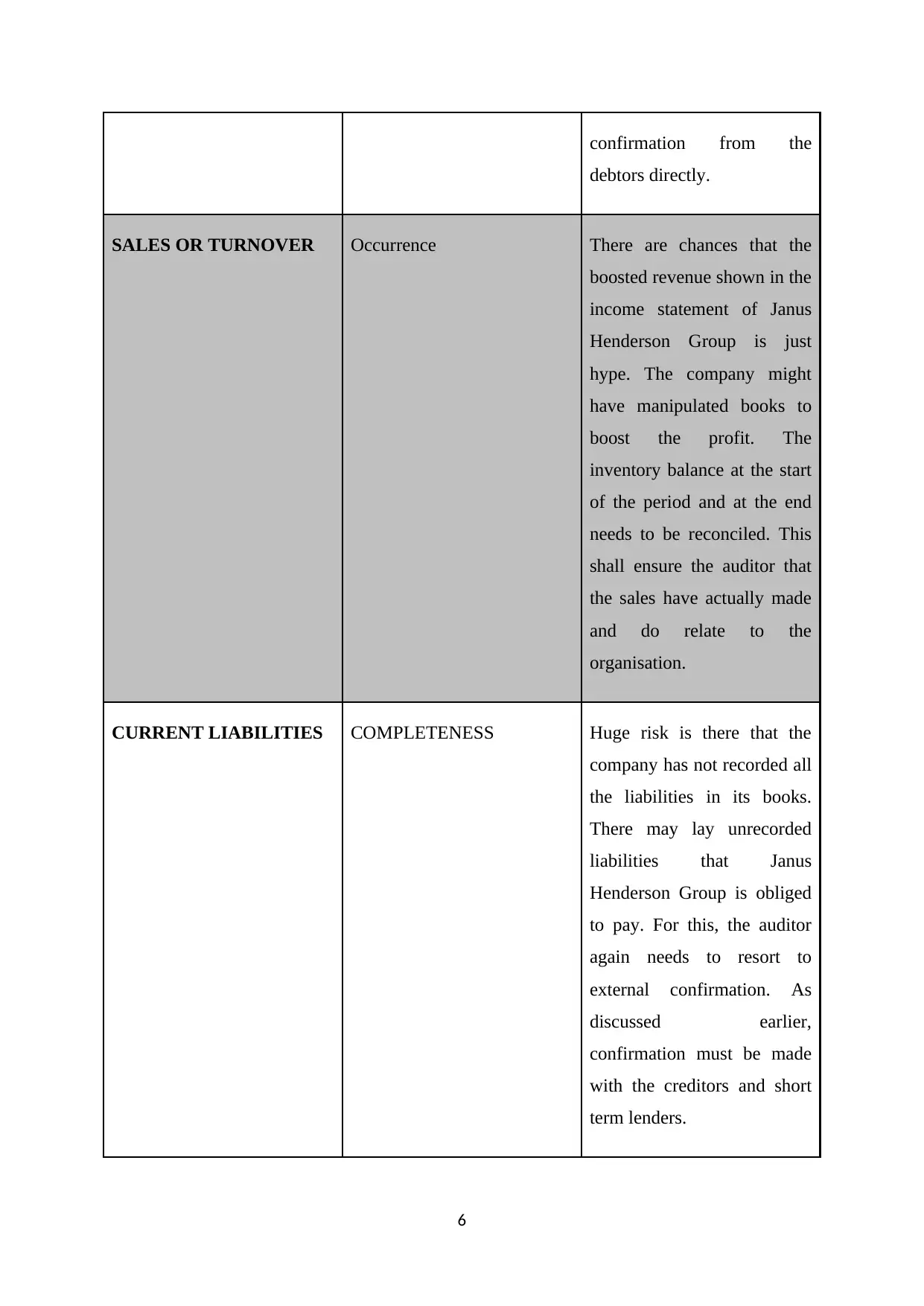

The above table reflects various ratios for financial years from 2014 to 2017. The ratio trends

show that the ratios have improved over the financial years except the fixed asset turnover

ratio. This rise in the ratios shows that the company performance is improving. With

improvement comes higher risk. The key risk areas identified, the relevant assertions and the

audit procedure for solving the same are tabulated as follows (Louwers, et al. (2015).

KEY RISK AREA AUDIT ASSERTION AUDIT PROCEDURE

FIXED ASSETS Existence There lies a risk that the

fixed assets mentioned in the

report of Janus Henderson

Group are not even existent

on the balance sheet date.

The audit procedure required

to confirm the existence is

the physical verification of

the entity’s business place.

This shall ensure the

presence of the assets and

their physical condition.

TRADE RECEIVABLES Rights and Obligations There is a risk that the

receivables shown in the

financial report are not even

the receivables. They may be

a chance that any settled

customer is shown as a non-

settled debtor. This calls for

cash embezzlement. To

resolve this and reduce risk,

the auditor should go for

external confirmation. He

must call for balance

5

show that the ratios have improved over the financial years except the fixed asset turnover

ratio. This rise in the ratios shows that the company performance is improving. With

improvement comes higher risk. The key risk areas identified, the relevant assertions and the

audit procedure for solving the same are tabulated as follows (Louwers, et al. (2015).

KEY RISK AREA AUDIT ASSERTION AUDIT PROCEDURE

FIXED ASSETS Existence There lies a risk that the

fixed assets mentioned in the

report of Janus Henderson

Group are not even existent

on the balance sheet date.

The audit procedure required

to confirm the existence is

the physical verification of

the entity’s business place.

This shall ensure the

presence of the assets and

their physical condition.

TRADE RECEIVABLES Rights and Obligations There is a risk that the

receivables shown in the

financial report are not even

the receivables. They may be

a chance that any settled

customer is shown as a non-

settled debtor. This calls for

cash embezzlement. To

resolve this and reduce risk,

the auditor should go for

external confirmation. He

must call for balance

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

confirmation from the

debtors directly.

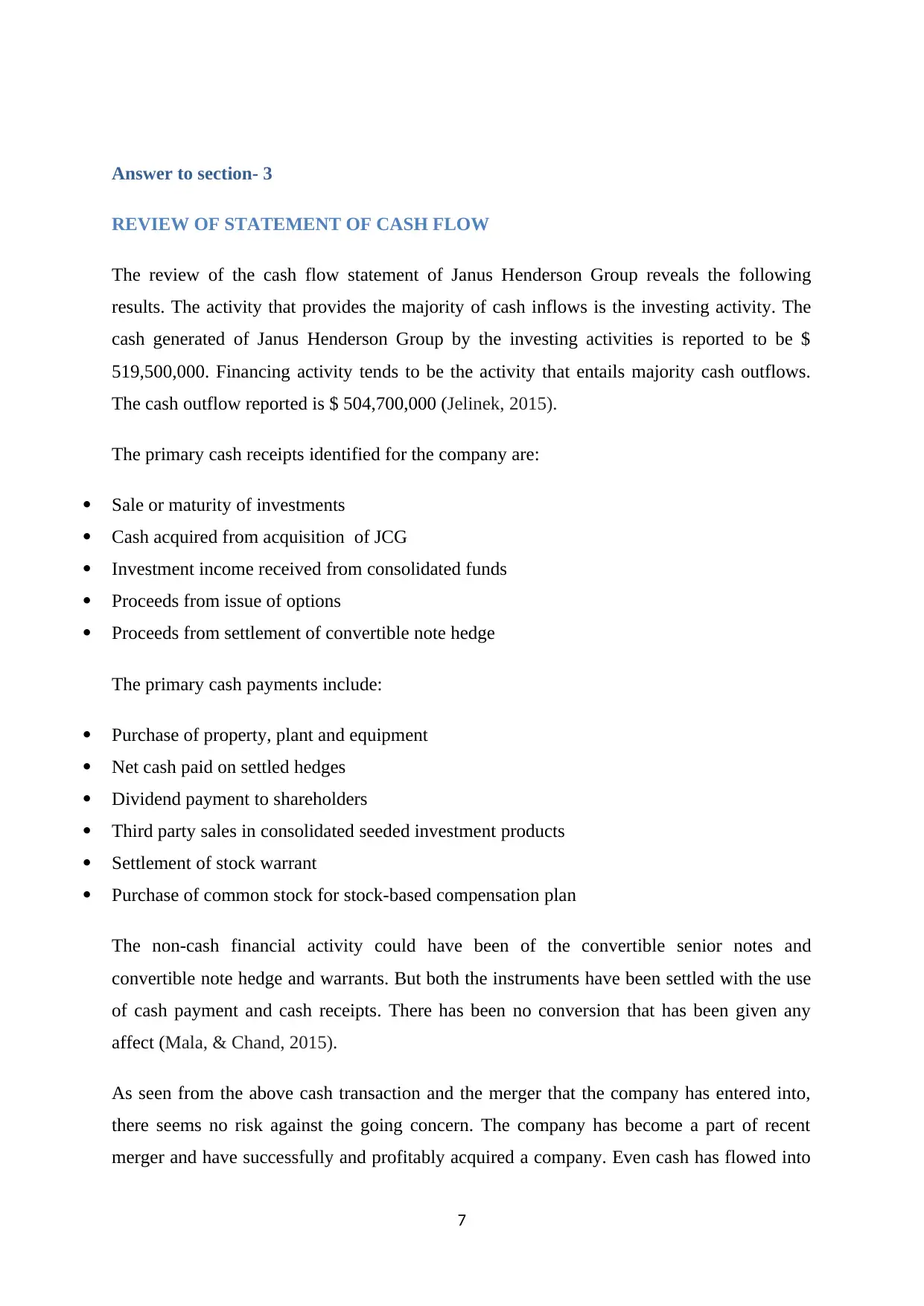

SALES OR TURNOVER Occurrence There are chances that the

boosted revenue shown in the

income statement of Janus

Henderson Group is just

hype. The company might

have manipulated books to

boost the profit. The

inventory balance at the start

of the period and at the end

needs to be reconciled. This

shall ensure the auditor that

the sales have actually made

and do relate to the

organisation.

CURRENT LIABILITIES COMPLETENESS Huge risk is there that the

company has not recorded all

the liabilities in its books.

There may lay unrecorded

liabilities that Janus

Henderson Group is obliged

to pay. For this, the auditor

again needs to resort to

external confirmation. As

discussed earlier,

confirmation must be made

with the creditors and short

term lenders.

6

debtors directly.

SALES OR TURNOVER Occurrence There are chances that the

boosted revenue shown in the

income statement of Janus

Henderson Group is just

hype. The company might

have manipulated books to

boost the profit. The

inventory balance at the start

of the period and at the end

needs to be reconciled. This

shall ensure the auditor that

the sales have actually made

and do relate to the

organisation.

CURRENT LIABILITIES COMPLETENESS Huge risk is there that the

company has not recorded all

the liabilities in its books.

There may lay unrecorded

liabilities that Janus

Henderson Group is obliged

to pay. For this, the auditor

again needs to resort to

external confirmation. As

discussed earlier,

confirmation must be made

with the creditors and short

term lenders.

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Answer to section- 3

REVIEW OF STATEMENT OF CASH FLOW

The review of the cash flow statement of Janus Henderson Group reveals the following

results. The activity that provides the majority of cash inflows is the investing activity. The

cash generated of Janus Henderson Group by the investing activities is reported to be $

519,500,000. Financing activity tends to be the activity that entails majority cash outflows.

The cash outflow reported is $ 504,700,000 (Jelinek, 2015).

The primary cash receipts identified for the company are:

Sale or maturity of investments

Cash acquired from acquisition of JCG

Investment income received from consolidated funds

Proceeds from issue of options

Proceeds from settlement of convertible note hedge

The primary cash payments include:

Purchase of property, plant and equipment

Net cash paid on settled hedges

Dividend payment to shareholders

Third party sales in consolidated seeded investment products

Settlement of stock warrant

Purchase of common stock for stock-based compensation plan

The non-cash financial activity could have been of the convertible senior notes and

convertible note hedge and warrants. But both the instruments have been settled with the use

of cash payment and cash receipts. There has been no conversion that has been given any

affect (Mala, & Chand, 2015).

As seen from the above cash transaction and the merger that the company has entered into,

there seems no risk against the going concern. The company has become a part of recent

merger and have successfully and profitably acquired a company. Even cash has flowed into

7

REVIEW OF STATEMENT OF CASH FLOW

The review of the cash flow statement of Janus Henderson Group reveals the following

results. The activity that provides the majority of cash inflows is the investing activity. The

cash generated of Janus Henderson Group by the investing activities is reported to be $

519,500,000. Financing activity tends to be the activity that entails majority cash outflows.

The cash outflow reported is $ 504,700,000 (Jelinek, 2015).

The primary cash receipts identified for the company are:

Sale or maturity of investments

Cash acquired from acquisition of JCG

Investment income received from consolidated funds

Proceeds from issue of options

Proceeds from settlement of convertible note hedge

The primary cash payments include:

Purchase of property, plant and equipment

Net cash paid on settled hedges

Dividend payment to shareholders

Third party sales in consolidated seeded investment products

Settlement of stock warrant

Purchase of common stock for stock-based compensation plan

The non-cash financial activity could have been of the convertible senior notes and

convertible note hedge and warrants. But both the instruments have been settled with the use

of cash payment and cash receipts. There has been no conversion that has been given any

affect (Mala, & Chand, 2015).

As seen from the above cash transaction and the merger that the company has entered into,

there seems no risk against the going concern. The company has become a part of recent

merger and have successfully and profitably acquired a company. Even cash has flowed into

7

the newly merged company out of the acquisition. There is cash inflow even on account of

changed taxation policies of U.S. This makes it sure that there is no visible risk on the going

concern of the company. However, there can be a fraud that is hidden and that can harm the

going concern capacity. To reduce the risk of the same, the auditor should try to gather

sufficient and appropriate audit evidence. The control environment should be analysed. Risk

level should be ascertained to identify the level of trust that could be done on entity’s internal

control. Analytical procedures should be performed near the end of audit too to identify any

significant changes (Czerney, Schmidt & Thompson, 2014).

REVIEW OF AUDIT REPORT

The opinion presented in the audit report for financial year of Janus Henderson Group 2017 is

unqualified opinion. The auditor has clearly stated that the presentation of the financial

information is fair in terms with the requirements. There is no qualification or modification or

adversity represented in the audit report by the auditor. The report is issued all clean. The

same is observed from the analysis made in the report. No discrepancies have been observed

in the financial information (Brown-Liburd, Issa, & Lombardi, 2015).

Conclusion

After evaluating all the details and facts about the audit and assurance of the financial

statement of Janus Henderson Group, it could be inferred that auditors needs to comply with

the all the applicable laws and regulations which could be used to strengthen the true and fair

view of the financial statements of company. It has been observed that auditors evaluate

whether company has complied with the accounting standards and applicable laws while

formulating the financial statements. In this assignment, is Janus Henderson Group was

assessed and it was found that auditors gave the non-qualified audit report which reflects that

company has complied with the all the applicable laws and regulations and kept its business

more transparent to its stakeholders.

8

changed taxation policies of U.S. This makes it sure that there is no visible risk on the going

concern of the company. However, there can be a fraud that is hidden and that can harm the

going concern capacity. To reduce the risk of the same, the auditor should try to gather

sufficient and appropriate audit evidence. The control environment should be analysed. Risk

level should be ascertained to identify the level of trust that could be done on entity’s internal

control. Analytical procedures should be performed near the end of audit too to identify any

significant changes (Czerney, Schmidt & Thompson, 2014).

REVIEW OF AUDIT REPORT

The opinion presented in the audit report for financial year of Janus Henderson Group 2017 is

unqualified opinion. The auditor has clearly stated that the presentation of the financial

information is fair in terms with the requirements. There is no qualification or modification or

adversity represented in the audit report by the auditor. The report is issued all clean. The

same is observed from the analysis made in the report. No discrepancies have been observed

in the financial information (Brown-Liburd, Issa, & Lombardi, 2015).

Conclusion

After evaluating all the details and facts about the audit and assurance of the financial

statement of Janus Henderson Group, it could be inferred that auditors needs to comply with

the all the applicable laws and regulations which could be used to strengthen the true and fair

view of the financial statements of company. It has been observed that auditors evaluate

whether company has complied with the accounting standards and applicable laws while

formulating the financial statements. In this assignment, is Janus Henderson Group was

assessed and it was found that auditors gave the non-qualified audit report which reflects that

company has complied with the all the applicable laws and regulations and kept its business

more transparent to its stakeholders.

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Brown-Liburd, H., Issa, H., & Lombardi, D. (2015). Behavioral implications of Big Data's

impact on audit judgment and decision making and future research

directions. Accounting Horizons, 29(2), 451-468.

Chan, D. Y., & Vasarhelyi, M. A. (2018). Innovation and practice of continuous auditing.

In Continuous Auditing: Theory and Application (pp. 271-283). Emerald Publishing

Limited.

Christensen, B. E., Eilifsen, A., Glover, S. M., & Messier, W. F. (2018). The Effect of

Materiality Disclosures on Investors’ Decision Making, (2), 451-468

Czerney, K., Schmidt, J. J., & Thompson, A. M. (2014). Does auditor explanatory language

in unqualified audit reports indicate increased financial misstatement risk?. The

Accounting Review, 89(6), 2115-2149.

Eilifsen, A., Hamilton, E. L., & Messier Jr, W. F. (2017). The Importance of Quantifying

Uncertainty: Examining the Effect of Audit Materiality and Sensitivity Analysis

Disclosures on Investors’ Judgments and Decisions, 9(6), 2115-2149.

Jans, M., Alles, M. G., & Vasarhelyi, M. A. (2014). A field study on the use of process

mining of event logs as an analytical procedure in auditing. The Accounting

Review, 89(5), 1751-1773.

Jelinek, K. (2015). The auditing profession: Accounting for some things. Business

Horizons, 5(8), 48-69

Louwers, T. J., Ramsay, R. J., Sinason, D. H., Strawser, J. R., & Thibodeau, J. C.

(2015). Auditing & assurance services. McGraw-Hill Education.

Mala, R., & Chand, P. (2015). Judgment and Decision‐Making Research in Auditing and

Accounting: Future Research Implications of Person, Task, and Environment

Perspective. Accounting Perspectives, 14(1), 1-50.

9

Brown-Liburd, H., Issa, H., & Lombardi, D. (2015). Behavioral implications of Big Data's

impact on audit judgment and decision making and future research

directions. Accounting Horizons, 29(2), 451-468.

Chan, D. Y., & Vasarhelyi, M. A. (2018). Innovation and practice of continuous auditing.

In Continuous Auditing: Theory and Application (pp. 271-283). Emerald Publishing

Limited.

Christensen, B. E., Eilifsen, A., Glover, S. M., & Messier, W. F. (2018). The Effect of

Materiality Disclosures on Investors’ Decision Making, (2), 451-468

Czerney, K., Schmidt, J. J., & Thompson, A. M. (2014). Does auditor explanatory language

in unqualified audit reports indicate increased financial misstatement risk?. The

Accounting Review, 89(6), 2115-2149.

Eilifsen, A., Hamilton, E. L., & Messier Jr, W. F. (2017). The Importance of Quantifying

Uncertainty: Examining the Effect of Audit Materiality and Sensitivity Analysis

Disclosures on Investors’ Judgments and Decisions, 9(6), 2115-2149.

Jans, M., Alles, M. G., & Vasarhelyi, M. A. (2014). A field study on the use of process

mining of event logs as an analytical procedure in auditing. The Accounting

Review, 89(5), 1751-1773.

Jelinek, K. (2015). The auditing profession: Accounting for some things. Business

Horizons, 5(8), 48-69

Louwers, T. J., Ramsay, R. J., Sinason, D. H., Strawser, J. R., & Thibodeau, J. C.

(2015). Auditing & assurance services. McGraw-Hill Education.

Mala, R., & Chand, P. (2015). Judgment and Decision‐Making Research in Auditing and

Accounting: Future Research Implications of Person, Task, and Environment

Perspective. Accounting Perspectives, 14(1), 1-50.

9

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.