CSR, Competitive Advantage, Reputation, and Firm Financial Performance

VerifiedAdded on 2023/04/08

|10

|11944

|352

Literature Review

AI Summary

This paper reviews the relationship between corporate social responsibility (CSR) and firm performance, noting the inconclusive nature of direct relationship studies. It investigates the mediating roles of sustainable competitive advantage, reputation, and customer satisfaction in this relationship, using data from 205 Iranian manufacturing and consumer product firms. The findings suggest that the link between CSR and firm performance is fully mediated, primarily through reputation and competitive advantage, while customer satisfaction plays a less significant role. The study highlights the importance of considering these mediating factors when assessing the impact of CSR on financial outcomes, particularly in developing country contexts like Iran, where CSR practices are still evolving. Desklib provides access to similar studies and solved assignments for students and researchers.

How does corporate social responsibility contribute to firm financial

performance? The mediating role of competitive advantage, reputation,

and customer satisfaction

Sayedeh Parastoo Saeidia,b,

⁎, Saudah Sofiana,b

, Parvaneh Saeidia,b

,

Sayyedeh Parisa Saeidia, Seyyed Alireza Saaeidic

a Faculty of Management, Universiti Teknologi Malaysia, UTM Skudai, 81310 Johor Bahru, Malaysia

b Department of Accounting and Finance, Universiti Teknologi Malaysia, UTM Skudai, 81310 Johor Bahru, Malaysia

c Higher Education Institute of Faran-Mehr Danesh, Valeeasr Street, Tehran, Iran

a b s t r a c ta r t i c l e i n f o

Article history:

Received 16 May 2013

Received in revised form 21 June 2014

Accepted 25 June 2014

Available online 23 July 2014

Keywords:

Corporate social responsibility

Reputation

Customer satisfaction

Competitive advantage

Firm performance

Iran

Direct relationship between corporate social responsibility (CSR) and firm performance has been examined

many scholars, but this direct test seems to be spurious and imprecise. This is because many factors indirec

influence this relation. Therefore, this study considers sustainable competitive advantage, reputation, and c

tomer satisfaction as three probable mediators in the relationship between CSR and firm performance. The

ings from 205 Iranian manufacturing and consumer product firms reveal that the link between CSR and firm

performance is a fully mediated relationship. The positive effect of CSR on firm performance is due to the p

effect CSR has on competitive advantage, reputation, and customer satisfaction. The final findings show tha

reputation and competitive advantage mediate the relationship between CSR and firm performance. Taken

together, these findings suggest a role for CSR in indirectly promoting firm performance through enhancing

reputation and competitive advantage while improving the level of customer satisfaction.

© 2014 Elsevier Inc. All rights reserved.

1. Introduction

Recognition of the direct relationship between CSR and firm perfor-

mance has garnered much interest among authors recently. The find-

ings are rather inconclusive and misleading (Margolis & Walsh, 2003;

Mishra & Suar, 2010; Vogel, 2005). This is because, while a positive as-

sociation between CSR and firm performance has been a dominant

theme in many articles,universally,(e.g.Abu Bakar & Ameer,2011;

Oeyono,Samy,& Bampton,2011; Orlitzky,Schmidt,& Rynes,2003;

Roshayani,Faizah, Suaini, Mustaffa, & Tay, 2009; Van Beurden &

Gössling,2008), others suggested a negative or no correlation (e.g.

ACCA, 2009; Aupperle, Carroll, & Hatfield, 1985; Crisóstomo, Freire, &

Vasconcellos, 2011; Malcolm, Khadijah, & Ahmad Marzuki, 2007).

Some scholars (e.g. Alafi & Hasoneh, 2012; Galbreath & Shum, 2012;

Griffin & Mahon, 1997; Margolis & Walsh, 2003; Rowley & Berman, 2000;

Wood & Jones, 1995) questioned the applied approach taken by the major-

ity of studies which have examined the direct relationship between CSR

and firm performance. They claim that positive, negative or neutral results

obtained by examining the direct relationship between CSR and firm pe

formance cannot be 100% reliable, as this link may be affected by some

other intervening factors which many studies have omitted.

Finally, it can be concluded that the relationship between CSR and

firm performance is more complicated than the results of many previous

studies indicate. Accordingly, this study attempts to extend previous re-

searches on the relationship between CSR and firm performance.In

doing so, a new question that will be asked in this study is: ‘Are compet

itive advantage, reputation, and customer satisfaction mediators in the

relationship between CSR and firm performance?’ In undertaking this

study, and in addition to verifying some predicted CSR benefits such as

customer satisfaction, reputation, and competitive advantage, the rela-

tionship between CSR and firm performance, which is more complex

than most studies showed, will be tested.

Previous studies in different environmental management domains

have predicted that customer satisfaction, reputation, and competitive

advantage are three outcomes of CSR (e.g.Mulki & Jaramillo, 2011;

Salmones, Perez, & Bosque, 2009; Walsh & Beatty, 2007). Firm perfor-

mance is also positively affected by these three interdependent vari-

ables (Li,Ragu-Nathan,Ragu-Nathan,& Subba Rao,2006; Matzler &

Hinterhuber,1998; Mulki & Jaramillo,2011; Yamin,Gunasekaran, &

Mavondo, 1999). Evidence has revealed that high levels of customer

satisfaction have two main consequences for a firm including reputation

Journal of Business Research 68 (2015) 341–350

⁎ Corresponding author. Tel.: +60 1112701548.

E-mail addresses: pari.saeidi@gmail.com, parastoo_saeidi@ymail.com (S.P. Saeidi),

Saudah@utm.my (S. Sofian), parvaneh.saeidi81@gmail.com (P. Saeidi),

saeidi55@yahoo.com (S.P. Saeidi), saaeidi@gmail.com (S.A. Saaeidi).

http://dx.doi.org/10.1016/j.jbusres.2014.06.024

0148-2963/© 2014 Elsevier Inc. All rights reserved.

Contents lists available at ScienceDirect

Journal of Business Research

performance? The mediating role of competitive advantage, reputation,

and customer satisfaction

Sayedeh Parastoo Saeidia,b,

⁎, Saudah Sofiana,b

, Parvaneh Saeidia,b

,

Sayyedeh Parisa Saeidia, Seyyed Alireza Saaeidic

a Faculty of Management, Universiti Teknologi Malaysia, UTM Skudai, 81310 Johor Bahru, Malaysia

b Department of Accounting and Finance, Universiti Teknologi Malaysia, UTM Skudai, 81310 Johor Bahru, Malaysia

c Higher Education Institute of Faran-Mehr Danesh, Valeeasr Street, Tehran, Iran

a b s t r a c ta r t i c l e i n f o

Article history:

Received 16 May 2013

Received in revised form 21 June 2014

Accepted 25 June 2014

Available online 23 July 2014

Keywords:

Corporate social responsibility

Reputation

Customer satisfaction

Competitive advantage

Firm performance

Iran

Direct relationship between corporate social responsibility (CSR) and firm performance has been examined

many scholars, but this direct test seems to be spurious and imprecise. This is because many factors indirec

influence this relation. Therefore, this study considers sustainable competitive advantage, reputation, and c

tomer satisfaction as three probable mediators in the relationship between CSR and firm performance. The

ings from 205 Iranian manufacturing and consumer product firms reveal that the link between CSR and firm

performance is a fully mediated relationship. The positive effect of CSR on firm performance is due to the p

effect CSR has on competitive advantage, reputation, and customer satisfaction. The final findings show tha

reputation and competitive advantage mediate the relationship between CSR and firm performance. Taken

together, these findings suggest a role for CSR in indirectly promoting firm performance through enhancing

reputation and competitive advantage while improving the level of customer satisfaction.

© 2014 Elsevier Inc. All rights reserved.

1. Introduction

Recognition of the direct relationship between CSR and firm perfor-

mance has garnered much interest among authors recently. The find-

ings are rather inconclusive and misleading (Margolis & Walsh, 2003;

Mishra & Suar, 2010; Vogel, 2005). This is because, while a positive as-

sociation between CSR and firm performance has been a dominant

theme in many articles,universally,(e.g.Abu Bakar & Ameer,2011;

Oeyono,Samy,& Bampton,2011; Orlitzky,Schmidt,& Rynes,2003;

Roshayani,Faizah, Suaini, Mustaffa, & Tay, 2009; Van Beurden &

Gössling,2008), others suggested a negative or no correlation (e.g.

ACCA, 2009; Aupperle, Carroll, & Hatfield, 1985; Crisóstomo, Freire, &

Vasconcellos, 2011; Malcolm, Khadijah, & Ahmad Marzuki, 2007).

Some scholars (e.g. Alafi & Hasoneh, 2012; Galbreath & Shum, 2012;

Griffin & Mahon, 1997; Margolis & Walsh, 2003; Rowley & Berman, 2000;

Wood & Jones, 1995) questioned the applied approach taken by the major-

ity of studies which have examined the direct relationship between CSR

and firm performance. They claim that positive, negative or neutral results

obtained by examining the direct relationship between CSR and firm pe

formance cannot be 100% reliable, as this link may be affected by some

other intervening factors which many studies have omitted.

Finally, it can be concluded that the relationship between CSR and

firm performance is more complicated than the results of many previous

studies indicate. Accordingly, this study attempts to extend previous re-

searches on the relationship between CSR and firm performance.In

doing so, a new question that will be asked in this study is: ‘Are compet

itive advantage, reputation, and customer satisfaction mediators in the

relationship between CSR and firm performance?’ In undertaking this

study, and in addition to verifying some predicted CSR benefits such as

customer satisfaction, reputation, and competitive advantage, the rela-

tionship between CSR and firm performance, which is more complex

than most studies showed, will be tested.

Previous studies in different environmental management domains

have predicted that customer satisfaction, reputation, and competitive

advantage are three outcomes of CSR (e.g.Mulki & Jaramillo, 2011;

Salmones, Perez, & Bosque, 2009; Walsh & Beatty, 2007). Firm perfor-

mance is also positively affected by these three interdependent vari-

ables (Li,Ragu-Nathan,Ragu-Nathan,& Subba Rao,2006; Matzler &

Hinterhuber,1998; Mulki & Jaramillo,2011; Yamin,Gunasekaran, &

Mavondo, 1999). Evidence has revealed that high levels of customer

satisfaction have two main consequences for a firm including reputation

Journal of Business Research 68 (2015) 341–350

⁎ Corresponding author. Tel.: +60 1112701548.

E-mail addresses: pari.saeidi@gmail.com, parastoo_saeidi@ymail.com (S.P. Saeidi),

Saudah@utm.my (S. Sofian), parvaneh.saeidi81@gmail.com (P. Saeidi),

saeidi55@yahoo.com (S.P. Saeidi), saaeidi@gmail.com (S.A. Saaeidi).

http://dx.doi.org/10.1016/j.jbusres.2014.06.024

0148-2963/© 2014 Elsevier Inc. All rights reserved.

Contents lists available at ScienceDirect

Journal of Business Research

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

and competitive advantage (Anderson & Sullivan,1993; Matzler &

Hinterhuber,1998; Walsh,Dinnie, & Wiedmann, 2006). Therefore,

customer satisfaction,reputation,and competitive advantage should

be included together in studies on the relationship between CSR and

firm performance.

Some authors attempted to identify the role of these variables as the

main intervening variables in the relationship between CSR and firm

performance (e.g.Alafi & Hasoneh,2012; Galbreath & Shum,2012;

Luo & Bhattacharya, 2006; Margolis, Elfenbein, & Walsh, 2008;

Margolis & Walsh, 2003; Rowley & Berman, 2000; Ullmann, 1985). For

example, Luo and Bhattacharya (2006) and Alafi and Hasoneh (2012)

examined only the role of customer satisfaction as a mediator in this

relationship.Later Galbreath and Shum (2012) expanded Luo and

Bhattacharya's (2006) and Alafi and Hasoneh's (2012) works by adding

reputation as another mediator.

This study argues that the relationship between CSR and firm perfor-

mance is more complex that previous researches have revealed. There-

fore, sustainable competitive advantage which has been omitted as the

final outcome of customer satisfaction and reputation (Awang & Jusoff,

2009) is assumed to be another effective mediator in this relationship.

Accordingly, this study tests and develops a more complex relationship

between CSR and firm performance by including three mediators

(customer satisfaction, reputation, and sustainable competitive advan-

tage) as three predicted benefits of CSR. Mediating these three variables

directs future researches away from an indefensible direct relationship

between CSR and firm performance.

It is worth noting that most studies on CSR and firm performance

have been done in developed countries based on European and US

data. Therefore, a sample from Iran as a developing country could be

helpful in demonstrating CSR outcomes in a worldwide context. This

is important as CSR has never been adequately addressed in Iranian

businesses in practical terms and in the academic environment in theo-

retical terms (Chapardar & Khanlari, 2011). Moreover, evidence shows

that expectation of CSR level among Iranian firm's stakeholders is higher

than the actual level of CSR practiced by firms (Salehi & Azary, 2009).

Therefore,sufficient ground exists for such studies in Iran which is

mainly outside the scope of international researches and is under-

utilized as a selected sample in the area of CSR (Chapardar & Khanlari,

2011; Nejati & Ghasemi, 2012).

2. Literature and hypotheses development

2.1. Corporate social responsibility (CSR)

Over the last few decades, researchers have paid considerable atten-

tion to CSR. Therefore, it has become a prominent concept in manage-

ment literature (de Bakker, Groenewegen, & den Hond, 2005; Dobers,

2009; Nejati & Ghasemi, 2012). In addition to theoretical aspects, com-

panies have also become more active in engaging CSR in practice

(Dahlsrud,2008; McWilliams, Siegel,& Wright, 2006). The driving

force behind this is an upsurge in environmentally sensitive consumers

who are demanding sustainable and more environmentally friendly

products and services (Gauthier, 2005; Van Beurden & Gössling, 2008).

Despite the large body of literature on CSR, there is still no unified

and precise definition (Scherer & Palazzo, 2007; Wood,2010).Thus,

CSR does not mean the same thing to everybody (Van Marrewijk,

2003).Wood (2010) contends that this is because CSR is difficult to

conceptualize.Talaei and Nejati (2008) also claimed that the lack of

clear conceptual boundaries has led to these diverse definitions.In

light of these claims, some authors (e.g. Lozano, 2008; Orlitzky, Siegel,

& Waldman,2011; Van Beurden & Gössling,2008) believe that the

lack of a clear definition makes it difficult to conduct empirical studies

on CSR.

Despite the lack of a clear definition, all contending definitions of

CSR agree on one thing, which is that firms must meet the expectations

of society when planning their environmental management strategies

(Gossling & Vocht,2007). According to Van Beurden and Gössling

(2008) CSR answers the uncertainties that business corporations have

to cope with in terms of the social context of the dynamic, global, and

technological business arena that we witness today. In a well-known

definition of CSR by Carroll (1979), CSR is the social responsibility of a

business which includes the economic, legal, ethical, and discretionary

expectations that society has of organizations at a given point in time.

Carroll's (1979) definition is the clearest conceptualization of CSR

because, in addition to identifying the firm's obligations toward society,

it systematically differentiates the firms'responsibilities from mere

profit making and from the socialresponsibilities ofgovernments

(Chen,Chang,& Lin,2012; Lozano,2008; Wood,2010).Proof of the

strength of this claim is the variety of scholars who have used this def-

inition in their studies (e.g. Galbreath, 2008; Galbreath & Shum, 2012;

Sheth & Babiak, 2010; Shum & Yam, 2011).

This study considers the economic and ethical dimensions of CSR as

presented by Carroll (1979).It is also argued by Turker (2009) that

while economic responsibility should be distinguished from other

responsibilities, they should be considered together in addressing CSR

because financial interests are the fundamental reason for establishing

a business,and corporate ethicalbehaviors,which are something

beyond mere financial issues, are the main factor influencing an

organization's survival (Nejati & Ghasemi, 2012).

2.2. CSR and firm performance

In the history of development economics, CSR has been thought of as

a key factor in attaining economic goals and wealth generation (Garriga

& Mele, 2004). Therefore, many studies attempted to find a global link

between CSR and firm performance (e.g.Alafi & Hasoneh, 2012;

Galbreath & Shum, 2012; Lin, Yang, & Liou, 2009; Luo & Bhattacharya,

2006; Margolis et al., 2008; Orlitzky et al., 2003; Rettab,Brik, &

Mellahi, 2009; Shen & Chang,2008; Van Beurden & Gössling, 2008).

For example, empirical findings by some (e.g. Alafi & Hasoneh, 2012;

Galbreath & Shum,2012; Luo & Bhattacharya,2006; Margolis et al.,

2008; Shen & Chang, 2008) researchers showed a positive association

between CSR and firm performance.Orlitzky et al.'s (2003) findings

further support the idea presented by Garriga and Mele (2004). Their

study, which involved a review of all 52 earlier surveys about the corre-

lation between CSR and company performance, showed that more so-

cially responsible companies had stronger economic results.Later,

survey data was adopted from 280 companies in UAE by Rettab et al.

(2009) to examine the connection between CSR operations and compa-

ny performance; the outcome indicated that CSR has a positive associa-

tion with all three determinants of company performance: monetary

performance,personnelcommitment,and corporate integrity.The

impact of CSR on firm performance among 1000 Taiwanese cases was

also examined and a positive association between CSR and monetary

performance was identified (Lin et al.,2009).Galbreath (2008) also

found strong positive links between CSR and organizational benefits

among Australian firms. Consistent with previous studies, after examin-

ing 34 previews studies on CSR and firm performance linkage by Van

Beurden and Gössling (2008), it was found that 68% of studies demon-

strated a positive association. Lastly, the positive and strong relevance

of CSR and firm performance was clearly supported by Alafi and

Hasoneh's (2012) findings which had been done based on Housing

Banks in Jordan.

Review of the available literature reveals that the majority of studies

cited use developed European or US samples (Galbreath & Shum, 2012).

Despite (1) the lack of study on CSR and firm performance in developing

countries, especially in an Iranian context; (2) being underutilized as a

selected sample in international researches (Chapardar & Khanlari,

2011; Nejati & Ghasemi,2012); and (3) the existence of a negative

gap between actual and expected level of CSR among Iranian firms

(Salehi & Azary, 2009), we predict that similar results to that of Western

countries will be found in Iran, a developing Asian country. It is worth

342 S.P. Saeidi et al. / Journal of Business Research 68 (2015) 341–350

Hinterhuber,1998; Walsh,Dinnie, & Wiedmann, 2006). Therefore,

customer satisfaction,reputation,and competitive advantage should

be included together in studies on the relationship between CSR and

firm performance.

Some authors attempted to identify the role of these variables as the

main intervening variables in the relationship between CSR and firm

performance (e.g.Alafi & Hasoneh,2012; Galbreath & Shum,2012;

Luo & Bhattacharya, 2006; Margolis, Elfenbein, & Walsh, 2008;

Margolis & Walsh, 2003; Rowley & Berman, 2000; Ullmann, 1985). For

example, Luo and Bhattacharya (2006) and Alafi and Hasoneh (2012)

examined only the role of customer satisfaction as a mediator in this

relationship.Later Galbreath and Shum (2012) expanded Luo and

Bhattacharya's (2006) and Alafi and Hasoneh's (2012) works by adding

reputation as another mediator.

This study argues that the relationship between CSR and firm perfor-

mance is more complex that previous researches have revealed. There-

fore, sustainable competitive advantage which has been omitted as the

final outcome of customer satisfaction and reputation (Awang & Jusoff,

2009) is assumed to be another effective mediator in this relationship.

Accordingly, this study tests and develops a more complex relationship

between CSR and firm performance by including three mediators

(customer satisfaction, reputation, and sustainable competitive advan-

tage) as three predicted benefits of CSR. Mediating these three variables

directs future researches away from an indefensible direct relationship

between CSR and firm performance.

It is worth noting that most studies on CSR and firm performance

have been done in developed countries based on European and US

data. Therefore, a sample from Iran as a developing country could be

helpful in demonstrating CSR outcomes in a worldwide context. This

is important as CSR has never been adequately addressed in Iranian

businesses in practical terms and in the academic environment in theo-

retical terms (Chapardar & Khanlari, 2011). Moreover, evidence shows

that expectation of CSR level among Iranian firm's stakeholders is higher

than the actual level of CSR practiced by firms (Salehi & Azary, 2009).

Therefore,sufficient ground exists for such studies in Iran which is

mainly outside the scope of international researches and is under-

utilized as a selected sample in the area of CSR (Chapardar & Khanlari,

2011; Nejati & Ghasemi, 2012).

2. Literature and hypotheses development

2.1. Corporate social responsibility (CSR)

Over the last few decades, researchers have paid considerable atten-

tion to CSR. Therefore, it has become a prominent concept in manage-

ment literature (de Bakker, Groenewegen, & den Hond, 2005; Dobers,

2009; Nejati & Ghasemi, 2012). In addition to theoretical aspects, com-

panies have also become more active in engaging CSR in practice

(Dahlsrud,2008; McWilliams, Siegel,& Wright, 2006). The driving

force behind this is an upsurge in environmentally sensitive consumers

who are demanding sustainable and more environmentally friendly

products and services (Gauthier, 2005; Van Beurden & Gössling, 2008).

Despite the large body of literature on CSR, there is still no unified

and precise definition (Scherer & Palazzo, 2007; Wood,2010).Thus,

CSR does not mean the same thing to everybody (Van Marrewijk,

2003).Wood (2010) contends that this is because CSR is difficult to

conceptualize.Talaei and Nejati (2008) also claimed that the lack of

clear conceptual boundaries has led to these diverse definitions.In

light of these claims, some authors (e.g. Lozano, 2008; Orlitzky, Siegel,

& Waldman,2011; Van Beurden & Gössling,2008) believe that the

lack of a clear definition makes it difficult to conduct empirical studies

on CSR.

Despite the lack of a clear definition, all contending definitions of

CSR agree on one thing, which is that firms must meet the expectations

of society when planning their environmental management strategies

(Gossling & Vocht,2007). According to Van Beurden and Gössling

(2008) CSR answers the uncertainties that business corporations have

to cope with in terms of the social context of the dynamic, global, and

technological business arena that we witness today. In a well-known

definition of CSR by Carroll (1979), CSR is the social responsibility of a

business which includes the economic, legal, ethical, and discretionary

expectations that society has of organizations at a given point in time.

Carroll's (1979) definition is the clearest conceptualization of CSR

because, in addition to identifying the firm's obligations toward society,

it systematically differentiates the firms'responsibilities from mere

profit making and from the socialresponsibilities ofgovernments

(Chen,Chang,& Lin,2012; Lozano,2008; Wood,2010).Proof of the

strength of this claim is the variety of scholars who have used this def-

inition in their studies (e.g. Galbreath, 2008; Galbreath & Shum, 2012;

Sheth & Babiak, 2010; Shum & Yam, 2011).

This study considers the economic and ethical dimensions of CSR as

presented by Carroll (1979).It is also argued by Turker (2009) that

while economic responsibility should be distinguished from other

responsibilities, they should be considered together in addressing CSR

because financial interests are the fundamental reason for establishing

a business,and corporate ethicalbehaviors,which are something

beyond mere financial issues, are the main factor influencing an

organization's survival (Nejati & Ghasemi, 2012).

2.2. CSR and firm performance

In the history of development economics, CSR has been thought of as

a key factor in attaining economic goals and wealth generation (Garriga

& Mele, 2004). Therefore, many studies attempted to find a global link

between CSR and firm performance (e.g.Alafi & Hasoneh, 2012;

Galbreath & Shum, 2012; Lin, Yang, & Liou, 2009; Luo & Bhattacharya,

2006; Margolis et al., 2008; Orlitzky et al., 2003; Rettab,Brik, &

Mellahi, 2009; Shen & Chang,2008; Van Beurden & Gössling, 2008).

For example, empirical findings by some (e.g. Alafi & Hasoneh, 2012;

Galbreath & Shum,2012; Luo & Bhattacharya,2006; Margolis et al.,

2008; Shen & Chang, 2008) researchers showed a positive association

between CSR and firm performance.Orlitzky et al.'s (2003) findings

further support the idea presented by Garriga and Mele (2004). Their

study, which involved a review of all 52 earlier surveys about the corre-

lation between CSR and company performance, showed that more so-

cially responsible companies had stronger economic results.Later,

survey data was adopted from 280 companies in UAE by Rettab et al.

(2009) to examine the connection between CSR operations and compa-

ny performance; the outcome indicated that CSR has a positive associa-

tion with all three determinants of company performance: monetary

performance,personnelcommitment,and corporate integrity.The

impact of CSR on firm performance among 1000 Taiwanese cases was

also examined and a positive association between CSR and monetary

performance was identified (Lin et al.,2009).Galbreath (2008) also

found strong positive links between CSR and organizational benefits

among Australian firms. Consistent with previous studies, after examin-

ing 34 previews studies on CSR and firm performance linkage by Van

Beurden and Gössling (2008), it was found that 68% of studies demon-

strated a positive association. Lastly, the positive and strong relevance

of CSR and firm performance was clearly supported by Alafi and

Hasoneh's (2012) findings which had been done based on Housing

Banks in Jordan.

Review of the available literature reveals that the majority of studies

cited use developed European or US samples (Galbreath & Shum, 2012).

Despite (1) the lack of study on CSR and firm performance in developing

countries, especially in an Iranian context; (2) being underutilized as a

selected sample in international researches (Chapardar & Khanlari,

2011; Nejati & Ghasemi,2012); and (3) the existence of a negative

gap between actual and expected level of CSR among Iranian firms

(Salehi & Azary, 2009), we predict that similar results to that of Western

countries will be found in Iran, a developing Asian country. It is worth

342 S.P. Saeidi et al. / Journal of Business Research 68 (2015) 341–350

noting that the main perspective of the current study is based on the

indirect effect of CSR on firm performance. Since the Baron and Kenny

(1986) procedure is employed in this study to test hypotheses,the

direct relationship between CSR and firm performance should be tested

in the first stage. Therefore, it is hypothesized that:

H1. CSR is positively associated with firm performance.

2.3. Sustainable competitive advantage, reputation, customer satisfaction

and firm performance

Margolis and Walsh (2003) remark that many studies focused only

on testing the direct relationship between CSR and firm performance,

while some scholars (e.g.Alafi & Hasoneh, 2012; Galbreath & Shum,

2012; Luo & Bhattacharya, 2006; Ullmann, 1985; Wood, 2010) claim

that testing the direct relationship between CSR and firm performance

only serves to obscure many influential factors in this relationship and

that the final findings will be unreliable. Therefore, in order to obtain

reliable results,influential variables which are omitted and ignored

should be considered and empirically examined. Three interconnected

variables, customer satisfaction, reputation, and sustainable competi-

tive advantage, will be included in this study as variables that should

be included in order to obtain a reliable result.

Existing literature reveals that customer satisfaction, reputation, and

competitive advantage are positively related to firm performance.

Researches on the relationship between reputation and firm perfor-

mance showed that not only financial benefits but also non-financial

advantages are outcomes ofa good reputation (Black, Carnes,&

Richardson,2000; Brown & Perry, 1994; Flatt & Kowalczyk,2011;

Roberts & Dowling, 2002; Sabate & Puente, 2003). For example, Helm

(2007) claimed that a company with a good reputation is perceived to

be ‘less risky than companies with equivalent financial performance,

but with a less well-established reputation’.From the view point of

financial advantage,Kotha, Rindova, and Rothaermel (2001) and

Roberts and Dowling (2002) found that firms with higher reputation

enjoy higher sales growth and higher return on assets (ROA). In confir-

mation of such studies,Shamsie (2003) and Fombrun and Shanley

(1990) found a positive relationship between reputation and firm

performance. Finally, Cabral (2012)claimed that a firm's performance

depends on its reputation, and that reputation depends stochastically

on the firm's efforts and strategies to maintain and improve it. An effec-

tive effort that helps firms to maintain and improve their long-term

reputation is increasing customer satisfaction (Anderson & Sullivan,

1993), a finding confirmed by Galbreath and Shum (2012) who agree

that reputation is an outcome of customer satisfaction.

Customer satisfaction is a measure of how products and services

supplied by a company meet or surpass customer expectations

(Ahmed, Gul, Hayat, & Qasim, 2001). More and more firms use satisfac-

tion ratings as an indicator of performance (Matzler & Hinterhuber,

1998). Therefore, it could be claimed that higher levels of performance

are affected by higher levels of customer satisfaction. The findings of

Anderson,Claes, and Rust (1997) indicate that customer satisfaction

leads to higher levels of return on investment (ROI) by improving pro-

ductivity. In addition, Lombart and Louis (2012) and Gallarza,Gil-

Saura, and Holbrook (2011) claimed that customer loyalty is a conse-

quence of customer satisfaction. This claim was supported by authors

who contend that increased customer satisfaction leads to increased

customer loyalty which in turn helps firms to obtain higher levels of fi-

nancial performance (e.g. Cronin, Brady, & Hult, 2000; Fornell, 1992;

Rust & Zahorik, 1993). Therefore, the findings support Galbreath and

Shum's (2012) finding that there is no direct and positive association

between customer satisfaction and firm performance, and that this rela-

tionship is mediated by reputation. In a comprehensive study, Reichheld

and Earl Sasser (1990) tried to link customer satisfaction, loyalty, and fi-

nancial performance.Their findings support the claim that loyalty

mediates the effect of customer satisfaction on financial performance

as satisfied customers are likely to buy more frequently and in greater

volume. In addition, satisfied customers will also be more likely to pur-

chase other goods and services offered by the firm, thereby becoming

increasingly loyal to the firms' products and services. All these results

show that firm performance is not directly associated with customer

satisfaction, but that performance is mediated by some intervening var-

iables. Therefore, customer satisfaction cannot be considered as the sol

mediator in the relationship between CSR and firm performance.

According to Gupta (2002), customer satisfaction and reputation are

the main components of competitive advantage. In their study, Awang

and Jusoff (2009)also found that corporate reputation has an influential

impact on competitive advantage. Gupta (2002) also showed empirical

evidence in support of the positive effect of corporate reputation on

competitive advantage by successfully differentiating it from competi-

tors. Therefore, according to previous studies, there is a positive rela-

tionship between customer satisfaction and corporate reputation,a

relationship that finally leads to competitive advantage.

Factoring in this evidence,research findings suggestthat CSR,

customer satisfaction,reputation, and competitive advantage have a

positive effect on firm performance either directly or indirectly. Howev-

er, available evidence justifies the main axis research in this study whic

is the probable mediating role that customer satisfaction, reputation,

and finally competitive advantage might have on the relationship be-

tween CSR and firm performance. Accordingly it is hypothesized that:

H2. CSR and firm performance is a mediated rather than direct

relationship.

2.4. Mediating role of customer satisfaction, reputation, and competitive

advantage

Rising sophistication of stakeholders and environment, sharp com-

petition, growing demand for corporate transparency and social respon-

sibility have gradually become the new corporate challenges of the 21st

century which have caused firms to be increasingly concerned about

corporate reputation. It is assumed by Cabral (2012) that a firm's perfor

mance depends on its reputation. Corporate reputation is a reflection of

the degree to which the public is satisfied that firms are meeting their

expectations with their products and services (Brammer & Pavelin,

2006). According to Walsh et al.(2006), and Walsh, Mitchell, and

Jackson (2009) reputation is one of the consequences of high customer

satisfaction over the long term. Gupta (2002) pointed to the firm's CSR

ability as a prerequisite of a company's reputation. This finding supports

the popular view in business literature that when customers are faced

with parity in product price and quality, they would prefer to choose

products from companies that contribute to environmental manage-

ment practices such as CSR.In this case,firms should be aware that

the best way to demonstrate a high level of CSR, and to increase custom

er satisfaction, is to do all they can to understand stakeholder expecta-

tions and to design and implement their CSR accordingly.

Carroll (1979, 2004) believed that improvement in product quality

as a socially responsible practice enhances the level of satisfaction. In

another study by Alafi and Hasoneh (2012) customer satisfaction is pos-

itively affected by CSR. In the wake of improved customer satisfaction,

financial benefit will increase through lower customer defection and

more repeat businesses because it reduces costs,increases returns,

and generates more sales (Bhote,1996; Galbreath,2002). Clarkson

(1995) also stated that the ability to build a positive reputation followed

by increasing customer satisfaction is critical to a firm's survival and

performance. Later, some authors (e.g. Davies, Chun, da Silva, & Roper,

2003; Galbreath & Shum, 2012; Walsh et al., 2006, 2009) found that cor

porate reputation and customer satisfaction are strongly correlated and

that customer satisfaction has a positive impact on corporate reputa-

tion. Nguyen and Leblanc (2001) also believed that a firm's reputation

is a reliable indicator of whether or not a firm's customers are satisfied.

343S.P. Saeidi et al. / Journal of Business Research 68 (2015) 341–350

indirect effect of CSR on firm performance. Since the Baron and Kenny

(1986) procedure is employed in this study to test hypotheses,the

direct relationship between CSR and firm performance should be tested

in the first stage. Therefore, it is hypothesized that:

H1. CSR is positively associated with firm performance.

2.3. Sustainable competitive advantage, reputation, customer satisfaction

and firm performance

Margolis and Walsh (2003) remark that many studies focused only

on testing the direct relationship between CSR and firm performance,

while some scholars (e.g.Alafi & Hasoneh, 2012; Galbreath & Shum,

2012; Luo & Bhattacharya, 2006; Ullmann, 1985; Wood, 2010) claim

that testing the direct relationship between CSR and firm performance

only serves to obscure many influential factors in this relationship and

that the final findings will be unreliable. Therefore, in order to obtain

reliable results,influential variables which are omitted and ignored

should be considered and empirically examined. Three interconnected

variables, customer satisfaction, reputation, and sustainable competi-

tive advantage, will be included in this study as variables that should

be included in order to obtain a reliable result.

Existing literature reveals that customer satisfaction, reputation, and

competitive advantage are positively related to firm performance.

Researches on the relationship between reputation and firm perfor-

mance showed that not only financial benefits but also non-financial

advantages are outcomes ofa good reputation (Black, Carnes,&

Richardson,2000; Brown & Perry, 1994; Flatt & Kowalczyk,2011;

Roberts & Dowling, 2002; Sabate & Puente, 2003). For example, Helm

(2007) claimed that a company with a good reputation is perceived to

be ‘less risky than companies with equivalent financial performance,

but with a less well-established reputation’.From the view point of

financial advantage,Kotha, Rindova, and Rothaermel (2001) and

Roberts and Dowling (2002) found that firms with higher reputation

enjoy higher sales growth and higher return on assets (ROA). In confir-

mation of such studies,Shamsie (2003) and Fombrun and Shanley

(1990) found a positive relationship between reputation and firm

performance. Finally, Cabral (2012)claimed that a firm's performance

depends on its reputation, and that reputation depends stochastically

on the firm's efforts and strategies to maintain and improve it. An effec-

tive effort that helps firms to maintain and improve their long-term

reputation is increasing customer satisfaction (Anderson & Sullivan,

1993), a finding confirmed by Galbreath and Shum (2012) who agree

that reputation is an outcome of customer satisfaction.

Customer satisfaction is a measure of how products and services

supplied by a company meet or surpass customer expectations

(Ahmed, Gul, Hayat, & Qasim, 2001). More and more firms use satisfac-

tion ratings as an indicator of performance (Matzler & Hinterhuber,

1998). Therefore, it could be claimed that higher levels of performance

are affected by higher levels of customer satisfaction. The findings of

Anderson,Claes, and Rust (1997) indicate that customer satisfaction

leads to higher levels of return on investment (ROI) by improving pro-

ductivity. In addition, Lombart and Louis (2012) and Gallarza,Gil-

Saura, and Holbrook (2011) claimed that customer loyalty is a conse-

quence of customer satisfaction. This claim was supported by authors

who contend that increased customer satisfaction leads to increased

customer loyalty which in turn helps firms to obtain higher levels of fi-

nancial performance (e.g. Cronin, Brady, & Hult, 2000; Fornell, 1992;

Rust & Zahorik, 1993). Therefore, the findings support Galbreath and

Shum's (2012) finding that there is no direct and positive association

between customer satisfaction and firm performance, and that this rela-

tionship is mediated by reputation. In a comprehensive study, Reichheld

and Earl Sasser (1990) tried to link customer satisfaction, loyalty, and fi-

nancial performance.Their findings support the claim that loyalty

mediates the effect of customer satisfaction on financial performance

as satisfied customers are likely to buy more frequently and in greater

volume. In addition, satisfied customers will also be more likely to pur-

chase other goods and services offered by the firm, thereby becoming

increasingly loyal to the firms' products and services. All these results

show that firm performance is not directly associated with customer

satisfaction, but that performance is mediated by some intervening var-

iables. Therefore, customer satisfaction cannot be considered as the sol

mediator in the relationship between CSR and firm performance.

According to Gupta (2002), customer satisfaction and reputation are

the main components of competitive advantage. In their study, Awang

and Jusoff (2009)also found that corporate reputation has an influential

impact on competitive advantage. Gupta (2002) also showed empirical

evidence in support of the positive effect of corporate reputation on

competitive advantage by successfully differentiating it from competi-

tors. Therefore, according to previous studies, there is a positive rela-

tionship between customer satisfaction and corporate reputation,a

relationship that finally leads to competitive advantage.

Factoring in this evidence,research findings suggestthat CSR,

customer satisfaction,reputation, and competitive advantage have a

positive effect on firm performance either directly or indirectly. Howev-

er, available evidence justifies the main axis research in this study whic

is the probable mediating role that customer satisfaction, reputation,

and finally competitive advantage might have on the relationship be-

tween CSR and firm performance. Accordingly it is hypothesized that:

H2. CSR and firm performance is a mediated rather than direct

relationship.

2.4. Mediating role of customer satisfaction, reputation, and competitive

advantage

Rising sophistication of stakeholders and environment, sharp com-

petition, growing demand for corporate transparency and social respon-

sibility have gradually become the new corporate challenges of the 21st

century which have caused firms to be increasingly concerned about

corporate reputation. It is assumed by Cabral (2012) that a firm's perfor

mance depends on its reputation. Corporate reputation is a reflection of

the degree to which the public is satisfied that firms are meeting their

expectations with their products and services (Brammer & Pavelin,

2006). According to Walsh et al.(2006), and Walsh, Mitchell, and

Jackson (2009) reputation is one of the consequences of high customer

satisfaction over the long term. Gupta (2002) pointed to the firm's CSR

ability as a prerequisite of a company's reputation. This finding supports

the popular view in business literature that when customers are faced

with parity in product price and quality, they would prefer to choose

products from companies that contribute to environmental manage-

ment practices such as CSR.In this case,firms should be aware that

the best way to demonstrate a high level of CSR, and to increase custom

er satisfaction, is to do all they can to understand stakeholder expecta-

tions and to design and implement their CSR accordingly.

Carroll (1979, 2004) believed that improvement in product quality

as a socially responsible practice enhances the level of satisfaction. In

another study by Alafi and Hasoneh (2012) customer satisfaction is pos-

itively affected by CSR. In the wake of improved customer satisfaction,

financial benefit will increase through lower customer defection and

more repeat businesses because it reduces costs,increases returns,

and generates more sales (Bhote,1996; Galbreath,2002). Clarkson

(1995) also stated that the ability to build a positive reputation followed

by increasing customer satisfaction is critical to a firm's survival and

performance. Later, some authors (e.g. Davies, Chun, da Silva, & Roper,

2003; Galbreath & Shum, 2012; Walsh et al., 2006, 2009) found that cor

porate reputation and customer satisfaction are strongly correlated and

that customer satisfaction has a positive impact on corporate reputa-

tion. Nguyen and Leblanc (2001) also believed that a firm's reputation

is a reliable indicator of whether or not a firm's customers are satisfied.

343S.P. Saeidi et al. / Journal of Business Research 68 (2015) 341–350

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cabral (2012) later augmented previous studies by adding the vari-

able of sustainable competitive advantage to the final outcome or mea-

sure of customer satisfaction and reputation. Previous to that, Matzler

and Hinterhuber (1998) also found that corporate reputation gained

through long periods of high customer satisfaction is a source of sustain-

able competitive advantage for firms. They argued that in order to know

whether improvements in certain product attributes lead to competi-

tive advantage,it is necessary to compare the customers'perceived

product quality with that of competitors' products. If customers are sat-

isfied with perceived product quality, reputation will be the firms' main

reward. Davies et al.(2003) also claimed that corporate reputation

enables firms to repeatedly attract customers. More satisfied customers

means enhanced reputation, more sales growth, more competitive ad-

vantage, and finally higher levels of firm performance. All this evidence

shows that there is a tripartite relationship between customer satisfac-

tion, reputation, and gaining competitive advantage and that it can be

posited that reputation and competitive advantage are influenced by

customer satisfaction.

Since CSR is an environment-oriented approach to product/process

quality development that supports design teams in developing new

products and processes in a structured way based on further ecological

protection and assessment of customers'needs and expectations,it

could be argued that CSR could not have a direct effect on firm perfor-

mance, but is fully mediated by customer satisfaction, reputation, and

competitive advantage. Therefore, given the previous discussions it is

hypothesized that:

H3. In the mediated relationship between CSR and firm performance,

competitive advantage and reputation act as the mediating factors via

improving customer satisfaction.

3. Methods

3.1. Sample and data collection

In order to select samples and measure CSR,annual reports,

Fortune's Most Admired Companies,and Kinder, Lyndenberg and

Domini (KLD) ratings have been widely used by studies (e.g.

Backhaus,Stone, & Heiner, 2002; Hillman & Keim, 2001; Hull &

Rothenberg,2008; Mattingly & Berman,2006; Schnietz & Epstein,

2005; Scholtens & Zhou, 2008). While Fortune's Most Admired Compa-

nies and KLD are two databases dominated by United State samples, an-

nual report databases also have their own critics (Galbreath & Shum,

2012; Huse, Hoskisson, & Zattoni, 2011; Jarvis, MacKenzie, &

Podsakoff, 2003). Since the sample of this study is Iran and there is no

wide database such as Fortune's Most Admired Companies and KLD,

the survey approach is suitable for gathering data, especially when sec-

ondary sources are not available. The related survey, at the first stage, is

developed through an extensive literature review. Then, 10 executives

who are not included in the sample assessed the content validity. Final-

ly, after making some minor changes, the final and corrected version of

survey instrument was prepared. In order to reduce various biases of

survey studies, this study undertakes the suggestions of Spector and

Brannick (1995), in which we do not prepare any preferred response

in questionnaire items; the instrument is kept as short as possible;

close attention is paid to wording; and in the survey, independent and

dependent variables are placed far apart from each other.

The only firms which are included and relevant to this study are

those in industrial manufacturing and consumer products. These sectors

are chosen because among different sectors in the market,product

and consumer industries have the most influence on the environment

and society (Burritt, Schaltegger, Bennett, Pohjola, & Csutora, 2011; de

Beer & Friend, 2006; Molina-Azorín, Claver-Cortés, Pereira-Moliner, &

Tarí,2009; Schaltegger, Bennett, Burritt, & Jasch, 2009). 1250 manu-

facturing and consumer product firms are listed for this study.Top

managers are chosen as respondents because they are directly involved

in the management of organizational affairs and have first-hand knowl-

edge on organizational improvement processes.

The overall response rate was 16.4%. At first glance, the rate seems

low. However, similar response rates have been reported by various

CSR scholars who have tried to survey top managers. For instance, in a

study carried out by Mishra and Suar (2010) among manufacturing

companies in India, only 10% of respondents (top managers) returned

the questionnaire. A decade earlier, Spence and Lozano (2000) claimed

that the subject matter of CSR is likely to lead to a low response rate.

Other researchers, including Maignan and Ferrell (2001) and Simons,

Pelled, and Smith (1999) reported response rates in these kinds of stud-

ies as low as six percent.From another perspective,Welford (2005)

found that response rate is a function of how important the concept of

CSR is perceived in each country, so that high response rate in devel-

oped countries shows that CSR is an issue on the business agenda,

while lower response rates in less developed countries might imply

that it is less of an issue among business owners. Later, in response to

previous claims,Galbreath and Galvin (2008) and Galbreath and

Shum (2012) expressed that a response rate as low as 10%, is acceptable

in countries which suffer from a lack of serious survey work on CSR.

Therefore,based on the allrelated evidence,a 16.4% response rate

should be sufficient for a developing country such as Iran, where CSR

has either not been adequately addressed practically, or its managers

do not have a high opinion of CSR.Finally, after removing unusable

surveys, only 205 are engaged in the analysis.

Early versus late respondents were compared on all variables in

order to test non-response bias.The logic of such testing is that in

comparison to early respondents, late respondents are more similar to

the broad population. No significant differences between variables in

this study are revealed by independent sample t-test.It shows that

non-response bias is not a problem in this study.

Of the 205 valid responses, 57.7% came from industrial manufactur-

ing firms and 42.3% from the consumer product manufacturing sector.

The average age of the firms is 28 and the mean number of employees

is 176. The annual sales revenue of the firms ranges between $100,000

and $2,000,000, with 60% of them between $100,000 and $1,000,000.

3.2. Independent variables

Some authors (e.g. Galbreath & Shum, 2012; Montiel, 2008;

O'Shaughnessy, Gedajlovic, & Reinmoeller, 2007) state that there is no

universal and united method with which to measure CSR.There are

two types of data collection; one is based on secondary data, and the

other on primary data. The CSR conceptualization presented by Carroll

(1979) which has been frequently cited in many studies did not collect

secondary data. This instrument consists of four main dimensions of CSR

(legal, economic, discretionary, ethical) to determine the firm's CSR ori-

entation. Since the aim of this study is to assess CSR activity and Carroll's

(1979) instrument only focuses on the degree of importance of different

dimensions of CSR, this instrument is not appropriate for the current

study.

The instrument presented by Carroll (1979) was later developed by

Maignan, Ferrell, and Hult (1999) and Maignan and Ferrell(2000,

2001). The orientation of Carroll's work was changed from an instru-

ment used to assess the degree to which a firm believes it has social re-

sponsibilities or how they rank those responsibilities to an assessment

of CSR activity,which is the aim of the current study.According to

their claim, the best overall CSR fit as presented by Carroll consists of

four correlated factors. In addition, previous studies developed a very

inflexible scale and used it in multiple countries and industries. In addi-

tion, in an assessment of six competing measurement models, Maignan

and Ferrell (2000) found that the model which included all four CSR di-

mensions (ethical, economic, discretionary, and legal) provided the best

overall fit. Therefore, this study selected the CSR measurement used by

Maignan et al. to measure firms' perception of each CSR dimension as

344 S.P. Saeidi et al. / Journal of Business Research 68 (2015) 341–350

able of sustainable competitive advantage to the final outcome or mea-

sure of customer satisfaction and reputation. Previous to that, Matzler

and Hinterhuber (1998) also found that corporate reputation gained

through long periods of high customer satisfaction is a source of sustain-

able competitive advantage for firms. They argued that in order to know

whether improvements in certain product attributes lead to competi-

tive advantage,it is necessary to compare the customers'perceived

product quality with that of competitors' products. If customers are sat-

isfied with perceived product quality, reputation will be the firms' main

reward. Davies et al.(2003) also claimed that corporate reputation

enables firms to repeatedly attract customers. More satisfied customers

means enhanced reputation, more sales growth, more competitive ad-

vantage, and finally higher levels of firm performance. All this evidence

shows that there is a tripartite relationship between customer satisfac-

tion, reputation, and gaining competitive advantage and that it can be

posited that reputation and competitive advantage are influenced by

customer satisfaction.

Since CSR is an environment-oriented approach to product/process

quality development that supports design teams in developing new

products and processes in a structured way based on further ecological

protection and assessment of customers'needs and expectations,it

could be argued that CSR could not have a direct effect on firm perfor-

mance, but is fully mediated by customer satisfaction, reputation, and

competitive advantage. Therefore, given the previous discussions it is

hypothesized that:

H3. In the mediated relationship between CSR and firm performance,

competitive advantage and reputation act as the mediating factors via

improving customer satisfaction.

3. Methods

3.1. Sample and data collection

In order to select samples and measure CSR,annual reports,

Fortune's Most Admired Companies,and Kinder, Lyndenberg and

Domini (KLD) ratings have been widely used by studies (e.g.

Backhaus,Stone, & Heiner, 2002; Hillman & Keim, 2001; Hull &

Rothenberg,2008; Mattingly & Berman,2006; Schnietz & Epstein,

2005; Scholtens & Zhou, 2008). While Fortune's Most Admired Compa-

nies and KLD are two databases dominated by United State samples, an-

nual report databases also have their own critics (Galbreath & Shum,

2012; Huse, Hoskisson, & Zattoni, 2011; Jarvis, MacKenzie, &

Podsakoff, 2003). Since the sample of this study is Iran and there is no

wide database such as Fortune's Most Admired Companies and KLD,

the survey approach is suitable for gathering data, especially when sec-

ondary sources are not available. The related survey, at the first stage, is

developed through an extensive literature review. Then, 10 executives

who are not included in the sample assessed the content validity. Final-

ly, after making some minor changes, the final and corrected version of

survey instrument was prepared. In order to reduce various biases of

survey studies, this study undertakes the suggestions of Spector and

Brannick (1995), in which we do not prepare any preferred response

in questionnaire items; the instrument is kept as short as possible;

close attention is paid to wording; and in the survey, independent and

dependent variables are placed far apart from each other.

The only firms which are included and relevant to this study are

those in industrial manufacturing and consumer products. These sectors

are chosen because among different sectors in the market,product

and consumer industries have the most influence on the environment

and society (Burritt, Schaltegger, Bennett, Pohjola, & Csutora, 2011; de

Beer & Friend, 2006; Molina-Azorín, Claver-Cortés, Pereira-Moliner, &

Tarí,2009; Schaltegger, Bennett, Burritt, & Jasch, 2009). 1250 manu-

facturing and consumer product firms are listed for this study.Top

managers are chosen as respondents because they are directly involved

in the management of organizational affairs and have first-hand knowl-

edge on organizational improvement processes.

The overall response rate was 16.4%. At first glance, the rate seems

low. However, similar response rates have been reported by various

CSR scholars who have tried to survey top managers. For instance, in a

study carried out by Mishra and Suar (2010) among manufacturing

companies in India, only 10% of respondents (top managers) returned

the questionnaire. A decade earlier, Spence and Lozano (2000) claimed

that the subject matter of CSR is likely to lead to a low response rate.

Other researchers, including Maignan and Ferrell (2001) and Simons,

Pelled, and Smith (1999) reported response rates in these kinds of stud-

ies as low as six percent.From another perspective,Welford (2005)

found that response rate is a function of how important the concept of

CSR is perceived in each country, so that high response rate in devel-

oped countries shows that CSR is an issue on the business agenda,

while lower response rates in less developed countries might imply

that it is less of an issue among business owners. Later, in response to

previous claims,Galbreath and Galvin (2008) and Galbreath and

Shum (2012) expressed that a response rate as low as 10%, is acceptable

in countries which suffer from a lack of serious survey work on CSR.

Therefore,based on the allrelated evidence,a 16.4% response rate

should be sufficient for a developing country such as Iran, where CSR

has either not been adequately addressed practically, or its managers

do not have a high opinion of CSR.Finally, after removing unusable

surveys, only 205 are engaged in the analysis.

Early versus late respondents were compared on all variables in

order to test non-response bias.The logic of such testing is that in

comparison to early respondents, late respondents are more similar to

the broad population. No significant differences between variables in

this study are revealed by independent sample t-test.It shows that

non-response bias is not a problem in this study.

Of the 205 valid responses, 57.7% came from industrial manufactur-

ing firms and 42.3% from the consumer product manufacturing sector.

The average age of the firms is 28 and the mean number of employees

is 176. The annual sales revenue of the firms ranges between $100,000

and $2,000,000, with 60% of them between $100,000 and $1,000,000.

3.2. Independent variables

Some authors (e.g. Galbreath & Shum, 2012; Montiel, 2008;

O'Shaughnessy, Gedajlovic, & Reinmoeller, 2007) state that there is no

universal and united method with which to measure CSR.There are

two types of data collection; one is based on secondary data, and the

other on primary data. The CSR conceptualization presented by Carroll

(1979) which has been frequently cited in many studies did not collect

secondary data. This instrument consists of four main dimensions of CSR

(legal, economic, discretionary, ethical) to determine the firm's CSR ori-

entation. Since the aim of this study is to assess CSR activity and Carroll's

(1979) instrument only focuses on the degree of importance of different

dimensions of CSR, this instrument is not appropriate for the current

study.

The instrument presented by Carroll (1979) was later developed by

Maignan, Ferrell, and Hult (1999) and Maignan and Ferrell(2000,

2001). The orientation of Carroll's work was changed from an instru-

ment used to assess the degree to which a firm believes it has social re-

sponsibilities or how they rank those responsibilities to an assessment

of CSR activity,which is the aim of the current study.According to

their claim, the best overall CSR fit as presented by Carroll consists of

four correlated factors. In addition, previous studies developed a very

inflexible scale and used it in multiple countries and industries. In addi-

tion, in an assessment of six competing measurement models, Maignan

and Ferrell (2000) found that the model which included all four CSR di-

mensions (ethical, economic, discretionary, and legal) provided the best

overall fit. Therefore, this study selected the CSR measurement used by

Maignan et al. to measure firms' perception of each CSR dimension as

344 S.P. Saeidi et al. / Journal of Business Research 68 (2015) 341–350

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

listed above. A 29 item, 5 point Likert scale was used to cover all four

CSR dimensions,where ‘1 = strongly disagree’and ‘5 = strongly

agree’.

What are the main components, or measures, of corporate repu-

tation? Lloyd and Mortimer (2006) identified image,performance,

identity, brand, ethical leadership and management as the six core

components of corporate reputation.However, Schwaiger (2004)

identified ten components of corporate reputation (employee quali-

ty, management quality, financial performance, products and service

quality, market leadership, customer orientation or focus, attractive-

ness or emotional appeal of the organization,social responsibility,

ethical behavior,reliability), while Harrison (2009) also identified

the same ten components as Schwaiger.Martin de Castro, Navas

Lopez, and Saez (2006) identified eight such components,which

are innovation, ability to gather, develop, and retain talented people,

value of long term investments, social responsibility among the

community,use of corporate assets/efficiency, product and service

quality, financial strength, and managerial quality.

As can be seen,these components are quite similar to the ones

discussed to measure CSR dimensions. Therefore, in order to avoid the

problem of cross loading of factors in CSR and reputation measurement

in data analysis, the scale developed by Weiss, Anderson, and MacInnis

(1999) seems appropriate to measure corporate reputation in the

current study,because their developed scale is based on the general

perception of a firms' reputation, not on any specific part of reputation.

Using a 5 item 5 point Likert scale where “1 = strongly disagree and

5 = strongly agree” firms were asked to determine their customers'

perception of their overall reputation based on the following items:

‘We are seen by customers as being a very professional organization’,

‘Our firm is viewed by customers as one that is successful’, ‘Our firm's

reputation is highly regarded’, ‘Customers view our firm as one

that is stable’, and ‘Our firm is viewed as well-established by

customers’.

Andreassen and Lindestad (1998) suggest that customer satisfaction

indicators should tap into the construct by addressing an overall evalu-

ation of consumption experiences of a firm. A key component of the

relationship between customers and a firm is customer satisfaction

(Ping, 1993). Based on Ping's work, Galbreath and Shum (2012) devel-

oped four items related to customer expectations and the relationship

between customers and the firm. In addition to the initial four sugges-

tions, Galbreath adopted three more items that are commonly used in

customer satisfaction researches,resulting in a seven item scale de-

signed to gauge firms' perceptions of the satisfaction of their customers.

These seven items cover three main dimensions of customer satisfac-

tion: customer satisfaction with product or service quality, customer

satisfaction with value for price, and meeting customer expectations.

Balanced Scorecard (BSC)methodology also measures customer

perspective as a fundamental aspect of measuring overall firm perfor-

mance.It measures the customer's perspective through looking at

meeting customer expectations,quality of products/services,and

increases in the number of customers. This study measured customer

satisfaction by asking about three main dimensions (including quality,

cost, and meeting customer expectations) that are normally adopted

in customer satisfaction investigation by scholars (Choi& Eboch,

1998; Galbreath, 2010; Homburg & Rudolph, 2001; Kaplan & Norton,

1996).The related questionnaire was designed with seven items to

determine perceptions of degree of satisfaction of customers by partic-

ipant companies.All items employ five-point scales anchored by

“strongly dissatisfied” (1), and “strongly satisfied” (5).

Chang (2011) derived six items for measuring competitive advan-

tage based on Barney (1991), Coyne (1986), and Porter and van der

Linde (1995). Chang (2011) measured competitive advantage by the

degree of a firms' managerial capability, profitability, corporate image,

quality of products or services, and difficulties faced by competitors in

replacing the company's competitive advantage.Chen,Lai, and Wen

(2006) considered cost of products/services,company growth,and

being the first mover in some important fields in measuring competitive

advantage. Bataineh and Zoabi (2011) in their study about the effects o

intellectual capital on competitive advantage employed eight items for

measuring competitive advantage level. These items include leadership

strategy, position in the market, resources and capabilities of the busi-

ness, generating customer value, identifying its relevant competitors,

differentiation strategy, service flexibility, and speed of offering services

Competitive advantage wasmeasured by Flynn, Sakakibara,and

Schroeder (1995) through measuring five effective items in gaining

competitive advantage. Dunk (2007)also used Flynn et al.'s (1995) in-

strument to examine the effect of product quality on competitive advan

tage. Those five items include unit cost of manufacturing, fast delivery,

flexibility to change volume, inventory turnover, and cycle time (from re

ceipt of materials to shipment). Based on the literature, quality of prod-

ucts or services, corporate image, market position, differentiation and

diversity, growth of the company, and market leadership are the most

commonly used dimensions in measuring competitive advantage

among mentioned scholars. Therefore, this study employed these items

as dimensions for measuring competitive advantage level of participant

firms based on managers' perception in five items with five-point Likert

scales, where 1 = “strongly disagree” and 5 =“strongly agree”.

3.3. Dependent variable

Firm performance as the sole dependent variable in this study will

be measured through seven items which are related to financial perfor-

mance in Balanced Scorecard (BSC) methodology. Developed by Robert

Kaplan and David Norton in 1992 the Balanced Scorecard methodology

is a comprehensive approach that analyzes an organization's overall

performance in four ways.Measuring financialperspective in firm

performance is one of the dimensions in this methodology. Since this

study chooses to adopt market share growth and growth in sales as

the growth determinant, and Return on Equity (ROE), Return on Sales

(ROS) Return on Assets (ROA), Return on Investment (ROI), and net

profit margin of the firm as monetary accounting performance con-

structs, BSC could be the best instrument to measure financial perfor-

mance.The respondents were asked to compare themselves with

competitors and then select the appropriate option about their firms

on a 5 point Likert scale where 1 = “strongly disagree” and 5 =

“strongly agree”.

3.4. Control variables

There are different ideas about the effect of firm's size, age and rev-

enue on the relationship between CSR and firm performance (see,

Galbreath & Shum, 2012; Lee, Faff, & Langfield-Smith, 2009; Orlitzky

et al., 2011; Webb, 2004; Weber, 2008). Therefore, this study considers

firm size, age, and sale revenue as control variables. Each control vari-

able is measured with only a single question. Questions which address

firm age and firm size are related to the number of years in business

and the number of full time employees, respectively.

4. Analysis and results

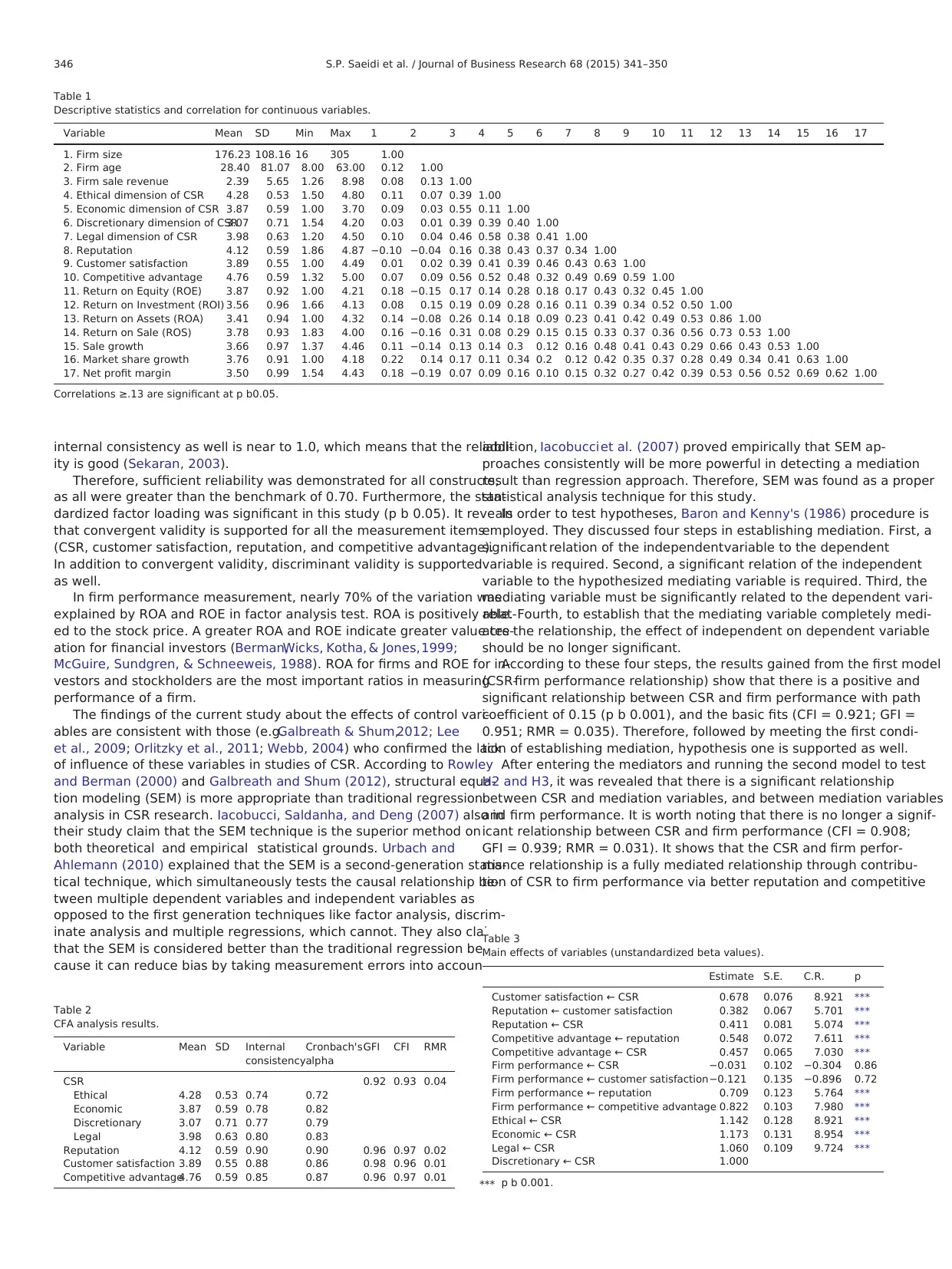

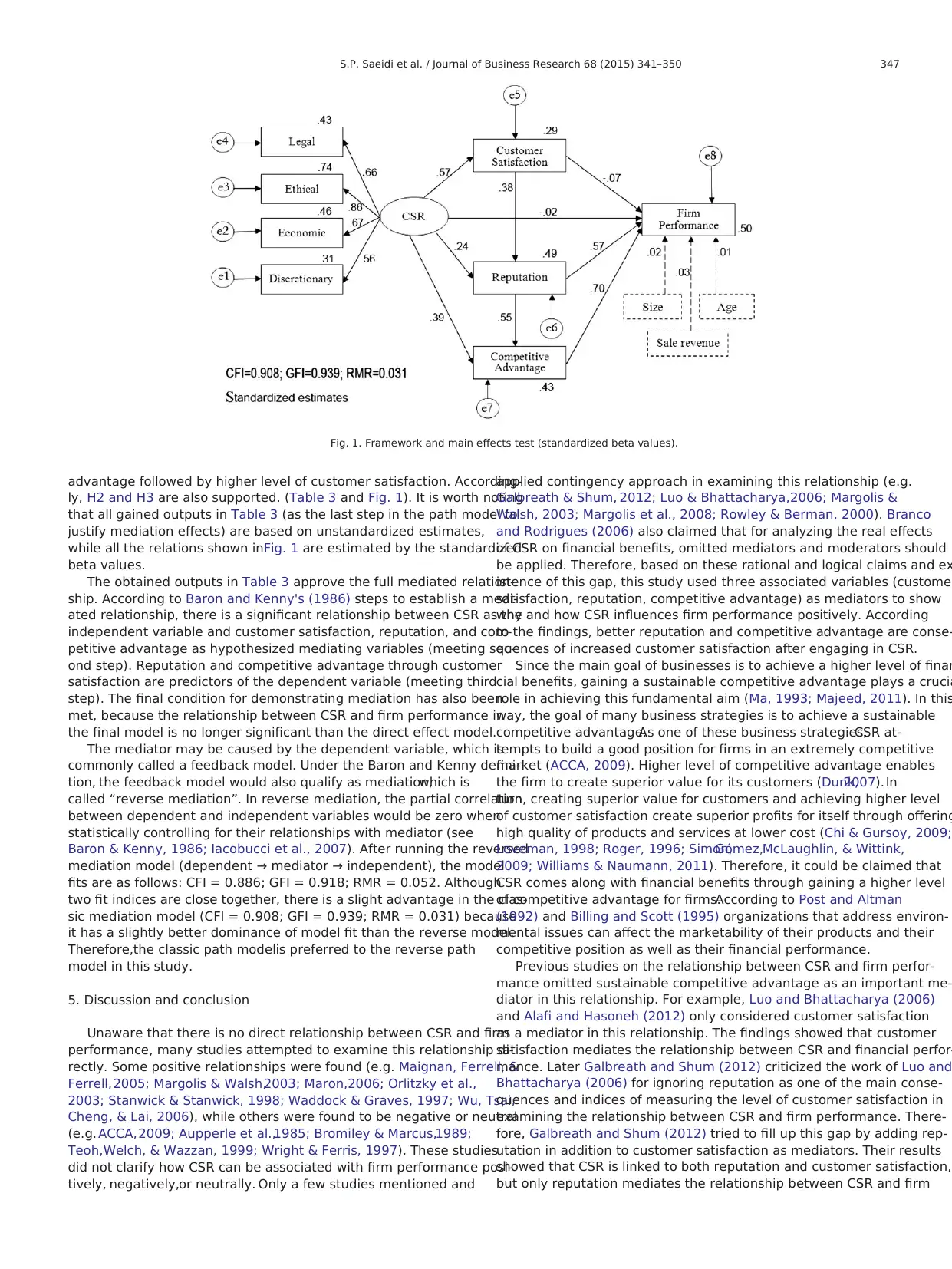

Mean and standard deviation (SD) as well as correlations are shown

in Table 1. According to Table 2, assessed levels of goodness offit index

(GFI), comparative fit index (CFI), and root mean square (RMR) that

should be more than 0.9 for GFI and CFI, and less than 0.05 for RMR

were in an acceptable range. Confirmatory factor analysis (CFA) through

SPSS is conducted by this study in order to evaluate the constructs' psy

chometric properties.

Sekaran (2003) and Hair, Money, Samouel, and Page (2007) opined

that an alpha value of less than 0.6 is seen as a weak reliability while an

alpha value of more than 0.7 is viewed as strong and better. Cronbach's

alpha value of a group of constructs which is calculated in Table 2 for

345S.P. Saeidi et al. / Journal of Business Research 68 (2015) 341–350

CSR dimensions,where ‘1 = strongly disagree’and ‘5 = strongly

agree’.

What are the main components, or measures, of corporate repu-

tation? Lloyd and Mortimer (2006) identified image,performance,

identity, brand, ethical leadership and management as the six core

components of corporate reputation.However, Schwaiger (2004)

identified ten components of corporate reputation (employee quali-

ty, management quality, financial performance, products and service

quality, market leadership, customer orientation or focus, attractive-

ness or emotional appeal of the organization,social responsibility,

ethical behavior,reliability), while Harrison (2009) also identified

the same ten components as Schwaiger.Martin de Castro, Navas

Lopez, and Saez (2006) identified eight such components,which

are innovation, ability to gather, develop, and retain talented people,

value of long term investments, social responsibility among the

community,use of corporate assets/efficiency, product and service

quality, financial strength, and managerial quality.

As can be seen,these components are quite similar to the ones

discussed to measure CSR dimensions. Therefore, in order to avoid the

problem of cross loading of factors in CSR and reputation measurement

in data analysis, the scale developed by Weiss, Anderson, and MacInnis

(1999) seems appropriate to measure corporate reputation in the

current study,because their developed scale is based on the general

perception of a firms' reputation, not on any specific part of reputation.

Using a 5 item 5 point Likert scale where “1 = strongly disagree and

5 = strongly agree” firms were asked to determine their customers'

perception of their overall reputation based on the following items:

‘We are seen by customers as being a very professional organization’,

‘Our firm is viewed by customers as one that is successful’, ‘Our firm's

reputation is highly regarded’, ‘Customers view our firm as one

that is stable’, and ‘Our firm is viewed as well-established by

customers’.

Andreassen and Lindestad (1998) suggest that customer satisfaction

indicators should tap into the construct by addressing an overall evalu-

ation of consumption experiences of a firm. A key component of the

relationship between customers and a firm is customer satisfaction

(Ping, 1993). Based on Ping's work, Galbreath and Shum (2012) devel-

oped four items related to customer expectations and the relationship

between customers and the firm. In addition to the initial four sugges-

tions, Galbreath adopted three more items that are commonly used in

customer satisfaction researches,resulting in a seven item scale de-

signed to gauge firms' perceptions of the satisfaction of their customers.

These seven items cover three main dimensions of customer satisfac-

tion: customer satisfaction with product or service quality, customer

satisfaction with value for price, and meeting customer expectations.

Balanced Scorecard (BSC)methodology also measures customer

perspective as a fundamental aspect of measuring overall firm perfor-

mance.It measures the customer's perspective through looking at

meeting customer expectations,quality of products/services,and

increases in the number of customers. This study measured customer

satisfaction by asking about three main dimensions (including quality,

cost, and meeting customer expectations) that are normally adopted

in customer satisfaction investigation by scholars (Choi& Eboch,

1998; Galbreath, 2010; Homburg & Rudolph, 2001; Kaplan & Norton,