Tax Implications of Fringe Benefits

VerifiedAdded on 2020/05/11

|14

|2594

|117

AI Summary

This assignment analyzes the tax implications for Joyce based on various fringe benefits received from their employer. It examines issues like membership fees, gold lounge access, mobile phone expenses, a provided loan, and car usage. The analysis applies relevant provisions of the Fringe Benefits Tax Assessment Act 1986 (FBTAA 1986) and the Income Tax Assessment Act 1997 (ITAA 1997), determining allowable deductions and fringe benefit tax consequences.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1TAXATION LAW

Table of Contents

Answer to question 1:..................................................................................2

Answer to requirement (I):..........................................................................2

Introduction:................................................................................................2

The domicile Test:.......................................................................................3

The 183-Day test:........................................................................................3

Superannuation test:...................................................................................4

Conclusion:..................................................................................................4

Answer to requirement (II):.........................................................................5

Answer to question 2:..................................................................................5

Answer to requirement (I):..........................................................................5

Salary and superannuation benefit of Joyce:...............................................6

Payment of school fees:..............................................................................7

Expenditure on travelling:...........................................................................7

Membership Cost:........................................................................................7

Payment of Mobile Phone and Loan:...........................................................8

Car fringe benefit:.......................................................................................8

Conclusion:..................................................................................................9

Answer to requirement (II):.........................................................................9

Table of Contents

Answer to question 1:..................................................................................2

Answer to requirement (I):..........................................................................2

Introduction:................................................................................................2

The domicile Test:.......................................................................................3

The 183-Day test:........................................................................................3

Superannuation test:...................................................................................4

Conclusion:..................................................................................................4

Answer to requirement (II):.........................................................................5

Answer to question 2:..................................................................................5

Answer to requirement (I):..........................................................................5

Salary and superannuation benefit of Joyce:...............................................6

Payment of school fees:..............................................................................7

Expenditure on travelling:...........................................................................7

Membership Cost:........................................................................................7

Payment of Mobile Phone and Loan:...........................................................8

Car fringe benefit:.......................................................................................8

Conclusion:..................................................................................................9

Answer to requirement (II):.........................................................................9

2TAXATION LAW

Answer to question 1:

Answer to requirement (I):

Introduction:

The present study takes into the considerations the residential status

of Daniel in order to determine the consequences of tax. It is understood

from the current study of Daniel that he is working with the mining

company and lived in Malaysia. Additionally, he was given with the chance

of expanding his career in Australia during his employment. In reference

to subsection 6 (1) of the Income Tax Assessment Act 1936 the

expression resident and resident of Australia has been defined.

The method through which a person shapes their domestic and

economic circumstances as the part of their life becomes an important

factor in ascertaining the status of residency. A person is treated as the

resident of Australia who is present in Australia or they are present either

constantly or in breaks for no less than half of the income year provided

the commissioner is content that the person’s permanent place of abode

is out of Australia and there is no intention of taking up the Australian

residency.

The taxation rulings of 98/17 is concerned with the determination tax

liability arising out of the question whether the taxpayer resides should be

determined yearly in accordance with the facts that are application during

the particular year of income under the considerations.

Answer to question 1:

Answer to requirement (I):

Introduction:

The present study takes into the considerations the residential status

of Daniel in order to determine the consequences of tax. It is understood

from the current study of Daniel that he is working with the mining

company and lived in Malaysia. Additionally, he was given with the chance

of expanding his career in Australia during his employment. In reference

to subsection 6 (1) of the Income Tax Assessment Act 1936 the

expression resident and resident of Australia has been defined.

The method through which a person shapes their domestic and

economic circumstances as the part of their life becomes an important

factor in ascertaining the status of residency. A person is treated as the

resident of Australia who is present in Australia or they are present either

constantly or in breaks for no less than half of the income year provided

the commissioner is content that the person’s permanent place of abode

is out of Australia and there is no intention of taking up the Australian

residency.

The taxation rulings of 98/17 is concerned with the determination tax

liability arising out of the question whether the taxpayer resides should be

determined yearly in accordance with the facts that are application during

the particular year of income under the considerations.

3TAXATION LAW

Considering the present situation of Daniel, the taxation ruling of IT

2681 is considered in order to determine the residential status of a

businessman for taxation purpose that comes to Australia for business

migration programme.

The ruling further lay down the direction in determining the status of

residency for taxation purpose visiting Australia. In order to understand

the residential status of Daniel the below stated test has been carried out

in determining Australian residency;

a. The 183-day test

b. The Domicile Test

c. The commonwealth superannuation test

The domicile Test:

The legal concept of Domicile has been defined under the Domicile

Act 1982. As per the guidelines of the common law, a person acquires

the residence by birth in their origin country in the form of permanent

residency. Nevertheless, few exceptions are present in this rule. An

individual will be able to keep the residence of their source if he or she

undertakes the residence of their personal choice in other nation or state

through the procedure of law. From the present situation of Daniel, it is

understood that he undertook the decision of applying for the permanent

visa of living in Australia after his son has returned home to Perth from

US.

As per the section 10 of the Domicile Act 1982, an individual’s

intention of acquiring the domicile of their own choice can make their

Considering the present situation of Daniel, the taxation ruling of IT

2681 is considered in order to determine the residential status of a

businessman for taxation purpose that comes to Australia for business

migration programme.

The ruling further lay down the direction in determining the status of

residency for taxation purpose visiting Australia. In order to understand

the residential status of Daniel the below stated test has been carried out

in determining Australian residency;

a. The 183-day test

b. The Domicile Test

c. The commonwealth superannuation test

The domicile Test:

The legal concept of Domicile has been defined under the Domicile

Act 1982. As per the guidelines of the common law, a person acquires

the residence by birth in their origin country in the form of permanent

residency. Nevertheless, few exceptions are present in this rule. An

individual will be able to keep the residence of their source if he or she

undertakes the residence of their personal choice in other nation or state

through the procedure of law. From the present situation of Daniel, it is

understood that he undertook the decision of applying for the permanent

visa of living in Australia after his son has returned home to Perth from

US.

As per the section 10 of the Domicile Act 1982, an individual’s

intention of acquiring the domicile of their own choice can make their

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4TAXATION LAW

home absolutely. To ascertain the domicile of a person it is vital to take

into the considerations the intention of the person in compliance with

subsection 6 (1) as to where the intention of the person is, to certainty

make their home. Citing the judgement of the full federal court in the case

of Henderson v. Henderson (1965) 1 All E.R. 179 an individual

intentions of undertaking the domicile of their own choice in country is

regarded as vital1.

As understood in the study of Daniel in respect of Domicile Act

1982 he has expressed his intention of residing in Australia by applying

for the permanent visa. In respect of the reference made in the case of

Bell v. Kennedy (1868) it is understood that Daniel intends to take up

the residency according to his personal choice to make his permanent

place indefinitely.

The 183-Day test:

The 183-Day test states that a person have been present in

Australia for no less than half of the year in Australia whether in breaks or

constantly will be treated as Australian resident. However, there is an

exception to this test where the commissioner believes that permanent

place of dwelling is outside of Australia and there is no intention of taking

the residency of Australia. The judgement held in the case of F.C of T v.

Applegate (1979), stated that the concept of place of residence is

important in ascertaining the physical surrounding where an individual

1 Krever, Richard E, Australian Taxation Law Cases 2013 (Thomson Reuters, 2013)

home absolutely. To ascertain the domicile of a person it is vital to take

into the considerations the intention of the person in compliance with

subsection 6 (1) as to where the intention of the person is, to certainty

make their home. Citing the judgement of the full federal court in the case

of Henderson v. Henderson (1965) 1 All E.R. 179 an individual

intentions of undertaking the domicile of their own choice in country is

regarded as vital1.

As understood in the study of Daniel in respect of Domicile Act

1982 he has expressed his intention of residing in Australia by applying

for the permanent visa. In respect of the reference made in the case of

Bell v. Kennedy (1868) it is understood that Daniel intends to take up

the residency according to his personal choice to make his permanent

place indefinitely.

The 183-Day test:

The 183-Day test states that a person have been present in

Australia for no less than half of the year in Australia whether in breaks or

constantly will be treated as Australian resident. However, there is an

exception to this test where the commissioner believes that permanent

place of dwelling is outside of Australia and there is no intention of taking

the residency of Australia. The judgement held in the case of F.C of T v.

Applegate (1979), stated that the concept of place of residence is

important in ascertaining the physical surrounding where an individual

1 Krever, Richard E, Australian Taxation Law Cases 2013 (Thomson Reuters, 2013)

5TAXATION LAW

resides. From the current study, it is understood that Daniel has been

physically residing in Australia despite having his permanent place of

residence in Malaysia and expressed his intention of residing in Australia.

As understood Daniel was living in Australia for greater than six months in

the income year and satisfactorily meets the criteria of 183 days’ test. In

accordance with the analysis performed it can be stated that Daniel would

be considered as the part time resident of Australia.

Superannuation test:

This test is applicable to the employees of Australia employed in the

overseas post in Australia and will be treated as Australian resident. The

present situation of Daniel states that he is working in an Australian

subsidiary company and will be treated as working under the Australian

government overseas post. As a result of this Daniel is regarded as the

resident of Australia since he meets the criteria of superannuation of test.

Conclusion:

The above stated discussion can be bought to conclusion by

defining that Denial is regarded as the resident of Australia because he

has successfully met the criteria of test prescribed above. It is understood

from the situation of Daniel that he has expressed his intention of taking

up the Australian residency by applying for the permanent visa and will be

regarded as the resident of Australia.

resides. From the current study, it is understood that Daniel has been

physically residing in Australia despite having his permanent place of

residence in Malaysia and expressed his intention of residing in Australia.

As understood Daniel was living in Australia for greater than six months in

the income year and satisfactorily meets the criteria of 183 days’ test. In

accordance with the analysis performed it can be stated that Daniel would

be considered as the part time resident of Australia.

Superannuation test:

This test is applicable to the employees of Australia employed in the

overseas post in Australia and will be treated as Australian resident. The

present situation of Daniel states that he is working in an Australian

subsidiary company and will be treated as working under the Australian

government overseas post. As a result of this Daniel is regarded as the

resident of Australia since he meets the criteria of superannuation of test.

Conclusion:

The above stated discussion can be bought to conclusion by

defining that Denial is regarded as the resident of Australia because he

has successfully met the criteria of test prescribed above. It is understood

from the situation of Daniel that he has expressed his intention of taking

up the Australian residency by applying for the permanent visa and will be

regarded as the resident of Australia.

6TAXATION LAW

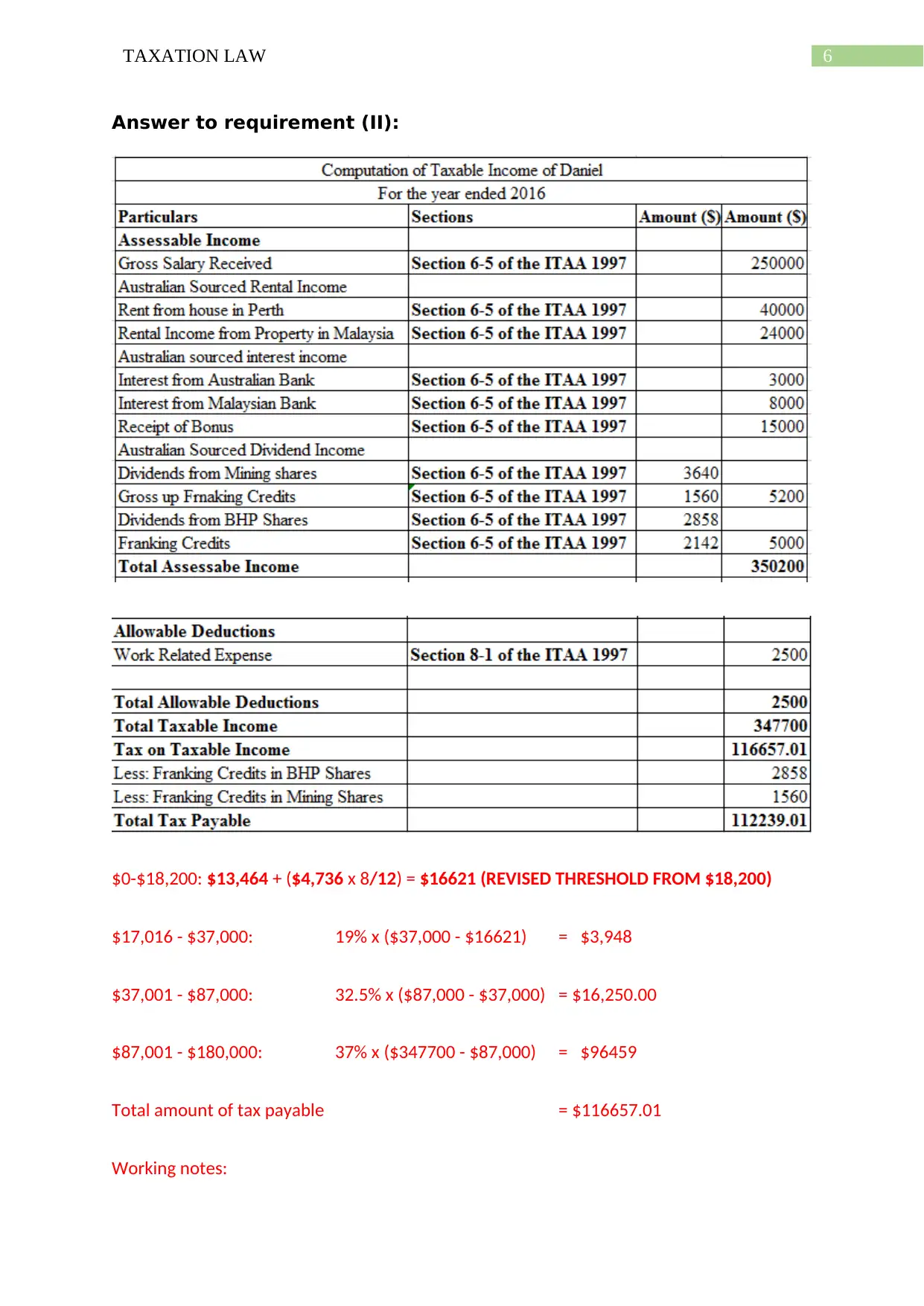

Answer to requirement (II):

$0-$18,200: $13,464 + ($4,736 x 8/12) = $16621 (REVISED THRESHOLD FROM $18,200)

$17,016 - $37,000: 19% x ($37,000 - $16621) = $3,948

$37,001 - $87,000: 32.5% x ($87,000 - $37,000) = $16,250.00

$87,001 - $180,000: 37% x ($347700 - $87,000) = $96459

Total amount of tax payable = $116657.01

Working notes:

Answer to requirement (II):

$0-$18,200: $13,464 + ($4,736 x 8/12) = $16621 (REVISED THRESHOLD FROM $18,200)

$17,016 - $37,000: 19% x ($37,000 - $16621) = $3,948

$37,001 - $87,000: 32.5% x ($87,000 - $37,000) = $16,250.00

$87,001 - $180,000: 37% x ($347700 - $87,000) = $96459

Total amount of tax payable = $116657.01

Working notes:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

a. It must be noted that the minimum amount of threshold limit is $13,464 for a person

who is a part time resident of Australia in taxation year.

b. Only the remaining $3,948 is pro-rated

c. Given that Daniel was the part of the resident for the part of the year only a for a

period of period eight months and the remaining amount of $3,948 of the entire tax-

free threshold is pro-rated according to number of months resided by Daniel

$13,464 + $4,736 x 8 = 16621.33

12

Answer to question 2:

Answer to requirement (I):

The current situation of Joyce is based on the ascertainment of

consequences of the Fringe Benefit Tax since he is treated as the resident

of Australia. The situation here determines the inferences arising from the

fringe benefit together with the consequences of income tax for numerous

transactions that is enumerated in this case. The current situation of Joyce

will take into the account the rules set under the “ITAA 1997” and

“ITAA 1936” in order to ascertain the significances of the applicable

transactions. In addition to this, appropriate rulings of taxation,

legislations and interpretative decisions stated by the Australian taxation

office is considered to determine implications of the income tax and fringe

a. It must be noted that the minimum amount of threshold limit is $13,464 for a person

who is a part time resident of Australia in taxation year.

b. Only the remaining $3,948 is pro-rated

c. Given that Daniel was the part of the resident for the part of the year only a for a

period of period eight months and the remaining amount of $3,948 of the entire tax-

free threshold is pro-rated according to number of months resided by Daniel

$13,464 + $4,736 x 8 = 16621.33

12

Answer to question 2:

Answer to requirement (I):

The current situation of Joyce is based on the ascertainment of

consequences of the Fringe Benefit Tax since he is treated as the resident

of Australia. The situation here determines the inferences arising from the

fringe benefit together with the consequences of income tax for numerous

transactions that is enumerated in this case. The current situation of Joyce

will take into the account the rules set under the “ITAA 1997” and

“ITAA 1936” in order to ascertain the significances of the applicable

transactions. In addition to this, appropriate rulings of taxation,

legislations and interpretative decisions stated by the Australian taxation

office is considered to determine implications of the income tax and fringe

8TAXATION LAW

benefit. In the current study of Joyce the FBTAA 1986 has been taken into

the considerations to arrive at the income tax consequences.

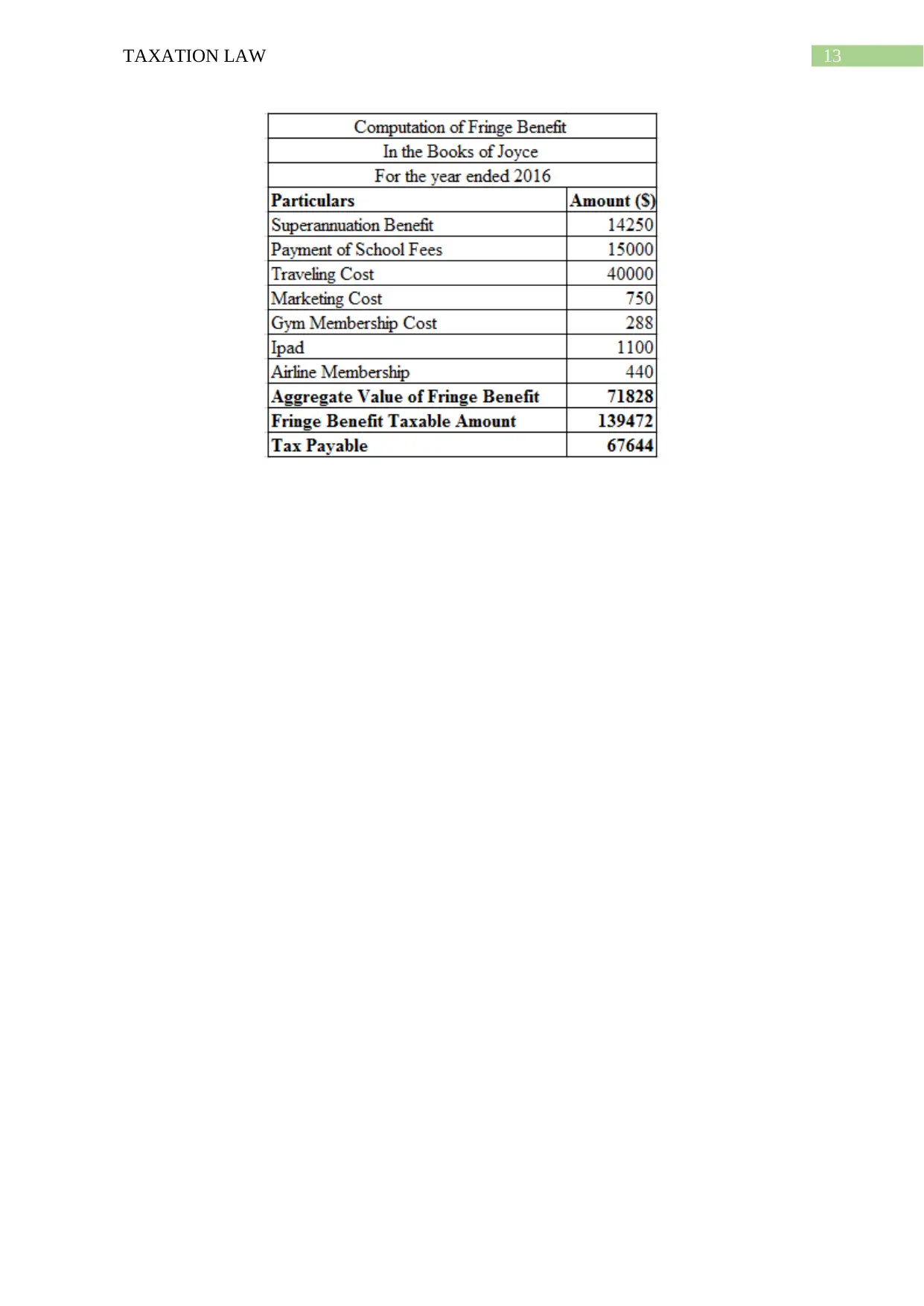

Salary and superannuation benefit of Joyce:

From the present situation of Joyce, it is understood that the receipt

of salary additionally comprised of the superannuation benefit. Section 6-

5 of the ITAA 1997 defines that income which is generated from the

ordinary concept will be accounted as the taxable earnings of an

individual. The salary that has been derived by Joyce will attract income

tax consequences and it will accounted as the taxable earnings under the

ordinary concept of the section 6-5 of the ITAA 1997. On the other

hand, the contribution that has been made by the employer will be

accounted as the assessable when a contribution is made.

In respect of section 8-1 of the ITAA an individual taxpayer will be

entitled for permissible deductions for the taxation purpose relating to

outlay which is occurred in deriving taxable earnings and the

superannuation contributions will attract income tax liability2. From the

current state of affairs, it is understood that Joyce will be able to bring

forward the claim of permissible deductions for the purpose of

superannuation contribution made.

2 Miller, Angharad, and Lynne Oats. Principles of international taxation. Bloomsbury

Publishing, 2016.

benefit. In the current study of Joyce the FBTAA 1986 has been taken into

the considerations to arrive at the income tax consequences.

Salary and superannuation benefit of Joyce:

From the present situation of Joyce, it is understood that the receipt

of salary additionally comprised of the superannuation benefit. Section 6-

5 of the ITAA 1997 defines that income which is generated from the

ordinary concept will be accounted as the taxable earnings of an

individual. The salary that has been derived by Joyce will attract income

tax consequences and it will accounted as the taxable earnings under the

ordinary concept of the section 6-5 of the ITAA 1997. On the other

hand, the contribution that has been made by the employer will be

accounted as the assessable when a contribution is made.

In respect of section 8-1 of the ITAA an individual taxpayer will be

entitled for permissible deductions for the taxation purpose relating to

outlay which is occurred in deriving taxable earnings and the

superannuation contributions will attract income tax liability2. From the

current state of affairs, it is understood that Joyce will be able to bring

forward the claim of permissible deductions for the purpose of

superannuation contribution made.

2 Miller, Angharad, and Lynne Oats. Principles of international taxation. Bloomsbury

Publishing, 2016.

9TAXATION LAW

Payment of school fees:

The fringe benefit tax will be applied for the benefit that is given to

the employee from the employer for their family benefit or other

associates. Such benefit provided to the employee usually becomes the

share of salary and wages. As understood from the current situation of

Joyce, it is found that the employer of Joyce paid the fees of school for

Joyce children. Hence, an assertion can be bought forward that school

fees paid will be treated as the fringe benefit which will be having tax

liability.

Expenditure on travelling:

The ruling of TR 2017/D6 states the situations when an expense

that is occurred by the taxpayer on traveling will be treated for allowable

deductions. The ruling states the guidelines for ascertaining whether a

person will be entitled for bringing forward the claim of allowable

deductions for incurrence of travelling expenditure derived under section

8-1 of the ITAA 1997. Section 8-1 of the ITAA 1997 brings forward

that outlay or expense occurred at the time of performing the work of

employee with no part of the expenses is occurred for personal, capital or

domestic form will be wholly treated for allowable deductions. The

expenses occurred in the present situation by Joyce will be treated as

wholly for allowable deductions in respect of section 8-1 of the ITAA

1997. Travelling cost incurred on 6 potential client by liable for income

tax deductions since these expenses were entirely incurred on gaining

assessable income.

Payment of school fees:

The fringe benefit tax will be applied for the benefit that is given to

the employee from the employer for their family benefit or other

associates. Such benefit provided to the employee usually becomes the

share of salary and wages. As understood from the current situation of

Joyce, it is found that the employer of Joyce paid the fees of school for

Joyce children. Hence, an assertion can be bought forward that school

fees paid will be treated as the fringe benefit which will be having tax

liability.

Expenditure on travelling:

The ruling of TR 2017/D6 states the situations when an expense

that is occurred by the taxpayer on traveling will be treated for allowable

deductions. The ruling states the guidelines for ascertaining whether a

person will be entitled for bringing forward the claim of allowable

deductions for incurrence of travelling expenditure derived under section

8-1 of the ITAA 1997. Section 8-1 of the ITAA 1997 brings forward

that outlay or expense occurred at the time of performing the work of

employee with no part of the expenses is occurred for personal, capital or

domestic form will be wholly treated for allowable deductions. The

expenses occurred in the present situation by Joyce will be treated as

wholly for allowable deductions in respect of section 8-1 of the ITAA

1997. Travelling cost incurred on 6 potential client by liable for income

tax deductions since these expenses were entirely incurred on gaining

assessable income.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10TAXATION LAW

Membership Cost:

The present situation of Joyce brings forward that Joyce has

occurred an expense on the membership fees for the marketing institute

which was paid by his employer. The cost of membership fees that is paid

will be treated as the fringe benefit and will result in tax in respect of

FBTAA 1986. In the current context the membership benefit incurred by

Joyce represents a Tier 1 benefit. Additionally, it is found that the

employer that reflect fringe benefit paid Joyce Gym membership and

because of this, there will be fringe benefit tax consequences under the

FBTAA 1986. On the other hand, Joyce was provided with an entitlement

of gold membership lounge out of which 80% of such facilities were used

for business purpose which represents fringe benefit tax implications,

however for the trips that were used for private purpose will not be

allowed as allowable deductions under section 8-1 of the ITAA 1997

since they were not related to the gaining of employment income.

However, the escape vacation being the employer of the Joyce will be able

to claim allowable deductions under section 8-1 of the ITAA 1997.

Payment of Mobile Phone and Loan:

Expenditure incurred by Joyce on Mobile was entirely related for

work purpose and as defined under the taxation ruling of TR 98/5

expenditure incurred related to work purpose can be claimed as the

allowable deductions. As evident in the situation of Joyce, the expenditure

incurred on work will be considered for allowable deductions under

section 8-1 of the ITAA 1997 since the expenditure was incurred in

Membership Cost:

The present situation of Joyce brings forward that Joyce has

occurred an expense on the membership fees for the marketing institute

which was paid by his employer. The cost of membership fees that is paid

will be treated as the fringe benefit and will result in tax in respect of

FBTAA 1986. In the current context the membership benefit incurred by

Joyce represents a Tier 1 benefit. Additionally, it is found that the

employer that reflect fringe benefit paid Joyce Gym membership and

because of this, there will be fringe benefit tax consequences under the

FBTAA 1986. On the other hand, Joyce was provided with an entitlement

of gold membership lounge out of which 80% of such facilities were used

for business purpose which represents fringe benefit tax implications,

however for the trips that were used for private purpose will not be

allowed as allowable deductions under section 8-1 of the ITAA 1997

since they were not related to the gaining of employment income.

However, the escape vacation being the employer of the Joyce will be able

to claim allowable deductions under section 8-1 of the ITAA 1997.

Payment of Mobile Phone and Loan:

Expenditure incurred by Joyce on Mobile was entirely related for

work purpose and as defined under the taxation ruling of TR 98/5

expenditure incurred related to work purpose can be claimed as the

allowable deductions. As evident in the situation of Joyce, the expenditure

incurred on work will be considered for allowable deductions under

section 8-1 of the ITAA 1997 since the expenditure was incurred in

11TAXATION LAW

gaining the assessable income of Joyce. Conversely, Joyce was provided

with the loan of $22,000, which represents a fringe benefit. The amount

received as loan will be included in the determination of the fringe benefit

tax and the receipt of such loan amount by Joyce will be liable for loan

fringe benefit tax.

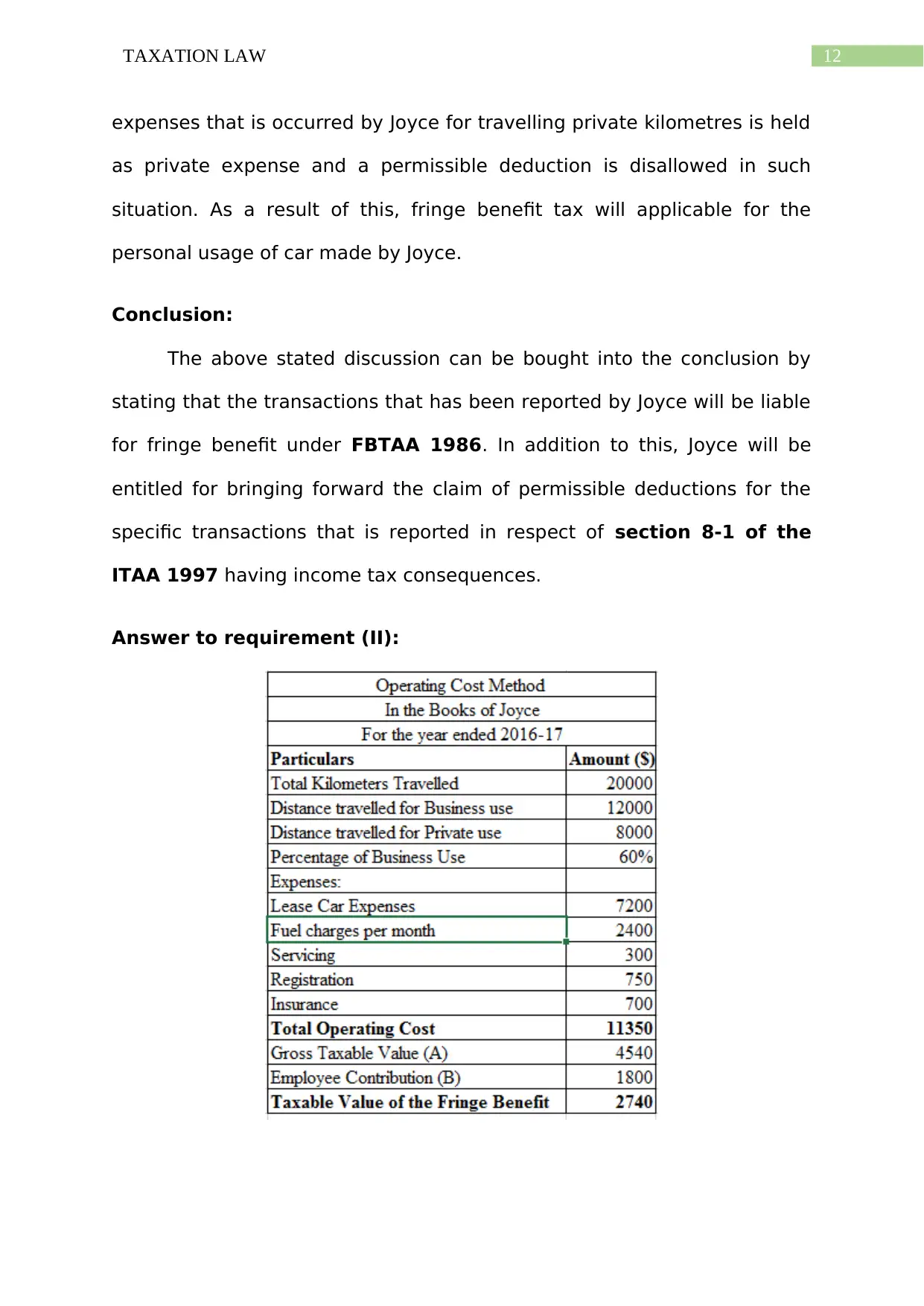

Car fringe benefit:

As it has been defined under the Section 7 of the FBTAA 1986 it

lay down the situations where car is treated as the fringe benefit. In

accordance with the definition that has been stated in the sub-section

136 (1) any employee or the associate making the usage of car having no

kind of relation in gaining taxable income will be treated as the private

usage. It has been found from the present situation of Joyce, the distance

travelled by Joyce also contained the private use and the outlay or the

expense that is generated from the personal use is disallowed from taking

into the considerations as the permissible deductions.

In order to ascertain the assessable benefit of the use of car

operating method of costing is considered in the present situation. The

business kilometres that has been travelled in regard to sub-section 136

(1) is deducted from the personal usage made. The full federal court has

confirmed in the case of Lunney and Hayley v FCT (1958) 100 CLR

that personal outlay occurred on car is disallowed from being treated as

the permissible deductions. Given that the outlay or expenses has

occurred business purpose wholly, a permissible deduction can be claimed

completely for income tax purpose. In the current situation of Joyce, the

gaining the assessable income of Joyce. Conversely, Joyce was provided

with the loan of $22,000, which represents a fringe benefit. The amount

received as loan will be included in the determination of the fringe benefit

tax and the receipt of such loan amount by Joyce will be liable for loan

fringe benefit tax.

Car fringe benefit:

As it has been defined under the Section 7 of the FBTAA 1986 it

lay down the situations where car is treated as the fringe benefit. In

accordance with the definition that has been stated in the sub-section

136 (1) any employee or the associate making the usage of car having no

kind of relation in gaining taxable income will be treated as the private

usage. It has been found from the present situation of Joyce, the distance

travelled by Joyce also contained the private use and the outlay or the

expense that is generated from the personal use is disallowed from taking

into the considerations as the permissible deductions.

In order to ascertain the assessable benefit of the use of car

operating method of costing is considered in the present situation. The

business kilometres that has been travelled in regard to sub-section 136

(1) is deducted from the personal usage made. The full federal court has

confirmed in the case of Lunney and Hayley v FCT (1958) 100 CLR

that personal outlay occurred on car is disallowed from being treated as

the permissible deductions. Given that the outlay or expenses has

occurred business purpose wholly, a permissible deduction can be claimed

completely for income tax purpose. In the current situation of Joyce, the

12TAXATION LAW

expenses that is occurred by Joyce for travelling private kilometres is held

as private expense and a permissible deduction is disallowed in such

situation. As a result of this, fringe benefit tax will applicable for the

personal usage of car made by Joyce.

Conclusion:

The above stated discussion can be bought into the conclusion by

stating that the transactions that has been reported by Joyce will be liable

for fringe benefit under FBTAA 1986. In addition to this, Joyce will be

entitled for bringing forward the claim of permissible deductions for the

specific transactions that is reported in respect of section 8-1 of the

ITAA 1997 having income tax consequences.

Answer to requirement (II):

expenses that is occurred by Joyce for travelling private kilometres is held

as private expense and a permissible deduction is disallowed in such

situation. As a result of this, fringe benefit tax will applicable for the

personal usage of car made by Joyce.

Conclusion:

The above stated discussion can be bought into the conclusion by

stating that the transactions that has been reported by Joyce will be liable

for fringe benefit under FBTAA 1986. In addition to this, Joyce will be

entitled for bringing forward the claim of permissible deductions for the

specific transactions that is reported in respect of section 8-1 of the

ITAA 1997 having income tax consequences.

Answer to requirement (II):

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13TAXATION LAW

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.