Macroeconomics: Interest Rates and the Australian Housing Market

VerifiedAdded on 2023/06/09

|13

|2037

|97

Essay

AI Summary

This essay provides a detailed macroeconomic analysis of the Australian housing market, focusing on the impact of interest rates and the recommendations of the OECD. It employs the Aggregate Expenditure (AE) model, the Static Aggregate Demand and Aggregate Supply (AD-AS) model, and the Dynamic AD-AS model to evaluate the effects of interest rate policies on investment, output, and price levels. The analysis considers both short-run and long-run implications, including potential recessionary scenarios and the limitations of land resources. The essay concludes by examining the dynamic interactions between aggregate demand and aggregate supply, highlighting the potential for decreased output and employment if interest rate increases lead to a long-term decline in investment and economic activity. Desklib offers a range of study tools and resources for students.

Running head: MACROECONOMICS ASSIGNMENT

Macroeconomics Assignment

Name of the Student

Name of the University

Author Note

Macroeconomics Assignment

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MACROECONOMICS ASSIGNMENT

Table of Contents

Answer 1a...................................................................................................................................2

Answer 1b..................................................................................................................................4

Answer 2....................................................................................................................................5

Answer 3....................................................................................................................................8

References................................................................................................................................11

Table of Contents

Answer 1a...................................................................................................................................2

Answer 1b..................................................................................................................................4

Answer 2....................................................................................................................................5

Answer 3....................................................................................................................................8

References................................................................................................................................11

2MACROECONOMICS ASSIGNMENT

Answer 1a

In the conceptual framework of economics, the Aggregate Expenditure refers to the

current value of the finished products and commodities produced in an economy, within a

period of time. Thus, the aggregate expenditure consists of the following components:

AE = C+I+G+NX

[Where, C is the consumption expenditure, G shows the expenditures on part of the

government, I denote the investment expenditures in the economy and NX refers to the net

exports (exports-imports) of the concerned country] (Johnson 2017)

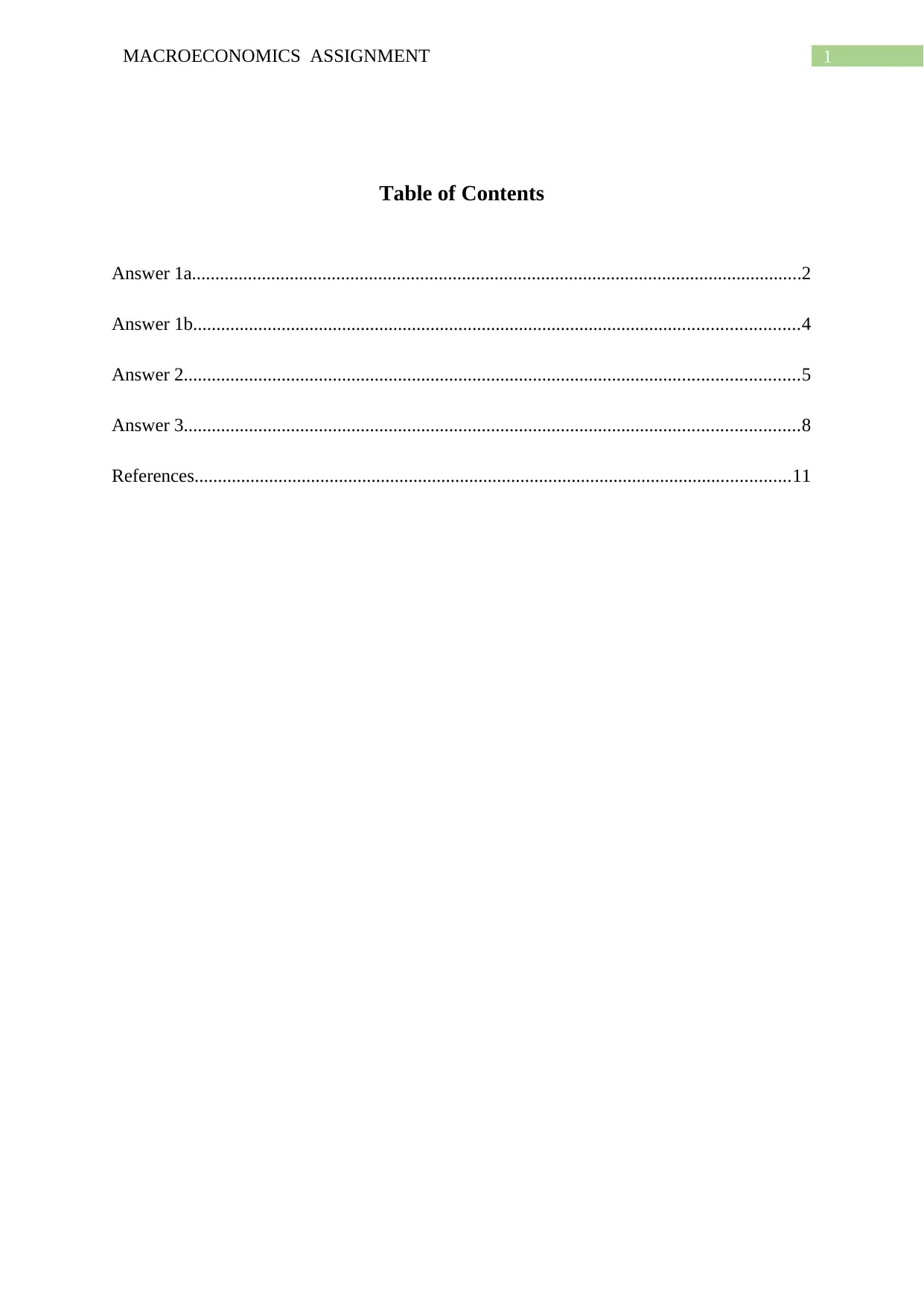

In the AE Model, thus, the equilibrium occurs at the point where the aggregate supply

is equal to the aggregate demand in the economy and in the Classical AE Model:

AE = C+I, with the equilibrium being shown as follows:

Figure 1: Equilibrium in the AE Model

Answer 1a

In the conceptual framework of economics, the Aggregate Expenditure refers to the

current value of the finished products and commodities produced in an economy, within a

period of time. Thus, the aggregate expenditure consists of the following components:

AE = C+I+G+NX

[Where, C is the consumption expenditure, G shows the expenditures on part of the

government, I denote the investment expenditures in the economy and NX refers to the net

exports (exports-imports) of the concerned country] (Johnson 2017)

In the AE Model, thus, the equilibrium occurs at the point where the aggregate supply

is equal to the aggregate demand in the economy and in the Classical AE Model:

AE = C+I, with the equilibrium being shown as follows:

Figure 1: Equilibrium in the AE Model

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MACROECONOMICS ASSIGNMENT

(Source: As created by the author)

As can be seen from the above figure, the equilibrium occurs at the point where AE =

Y, which is drawn with the help of the 45-degree line, which equates the horizontal axis with

that of the vertical axis, thereby equating the Aggregate Expenditure with that of the

Aggregate Output in the economy (Persson and Tabellini 2012).

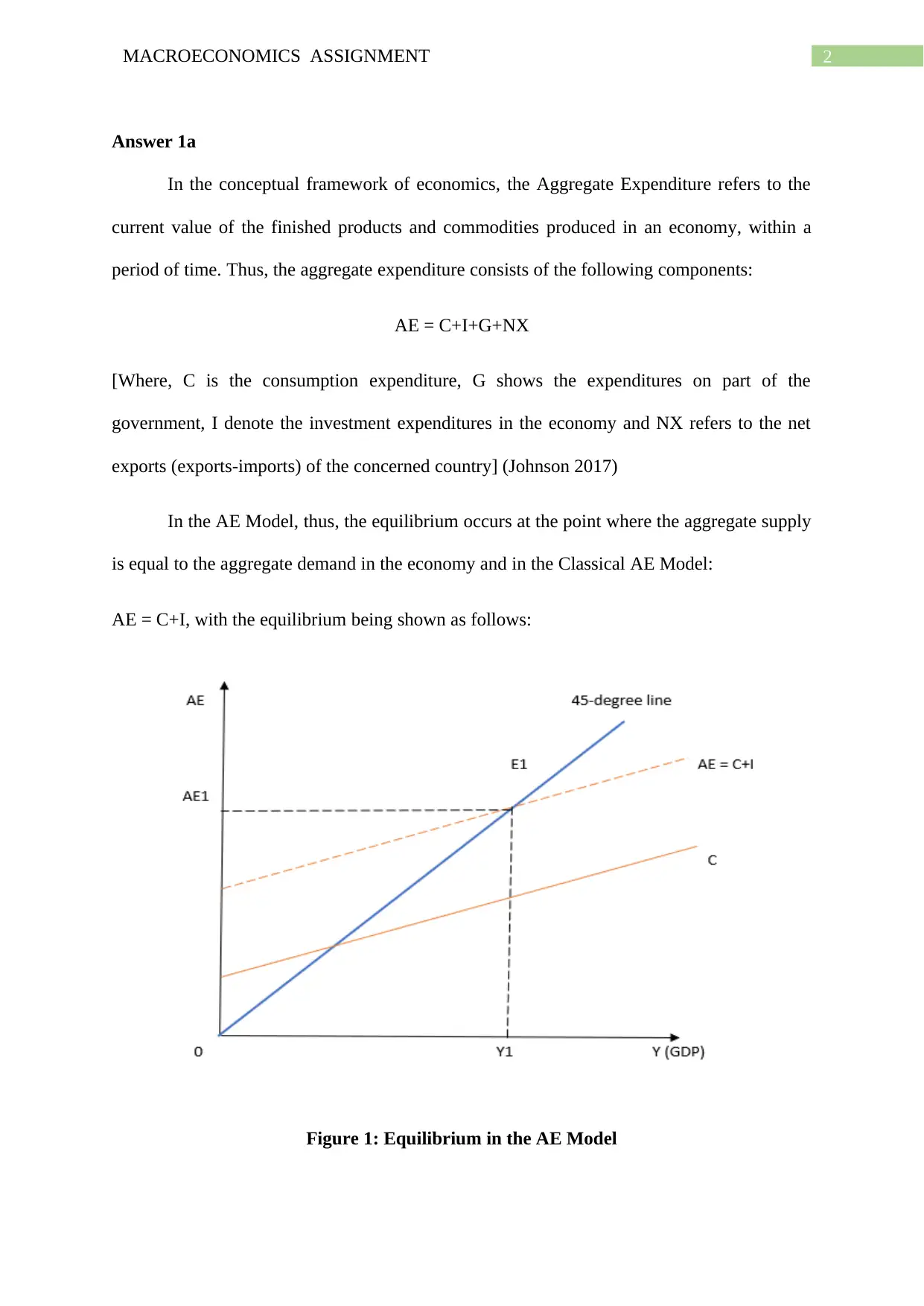

Keeping this into consideration, in the current scenario taken into consideration, of

that of the growing housing market of Australia, the investment in the housing sector can be

seen to be increasing, the effects of which can be seen on the overall economy, with the help

of the AE Model as follows (Afr.com 2018).

Figure 2: Effects of increase in the investment expenditure

(Source: As created by the author)

(Source: As created by the author)

As can be seen from the above figure, the equilibrium occurs at the point where AE =

Y, which is drawn with the help of the 45-degree line, which equates the horizontal axis with

that of the vertical axis, thereby equating the Aggregate Expenditure with that of the

Aggregate Output in the economy (Persson and Tabellini 2012).

Keeping this into consideration, in the current scenario taken into consideration, of

that of the growing housing market of Australia, the investment in the housing sector can be

seen to be increasing, the effects of which can be seen on the overall economy, with the help

of the AE Model as follows (Afr.com 2018).

Figure 2: Effects of increase in the investment expenditure

(Source: As created by the author)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MACROECONOMICS ASSIGNMENT

The increase in the investment expenditure (due to the growth in the housing market)

leads to an increase in the Aggregate Expenditure in the economy, which in turn, leads to an

increase in the overall output (GDP) of the economy, with the equilibrium in the economy,

shifting from the point E0 to E1, as can be seen from the above figure (Burke 2012).

Answer 1b

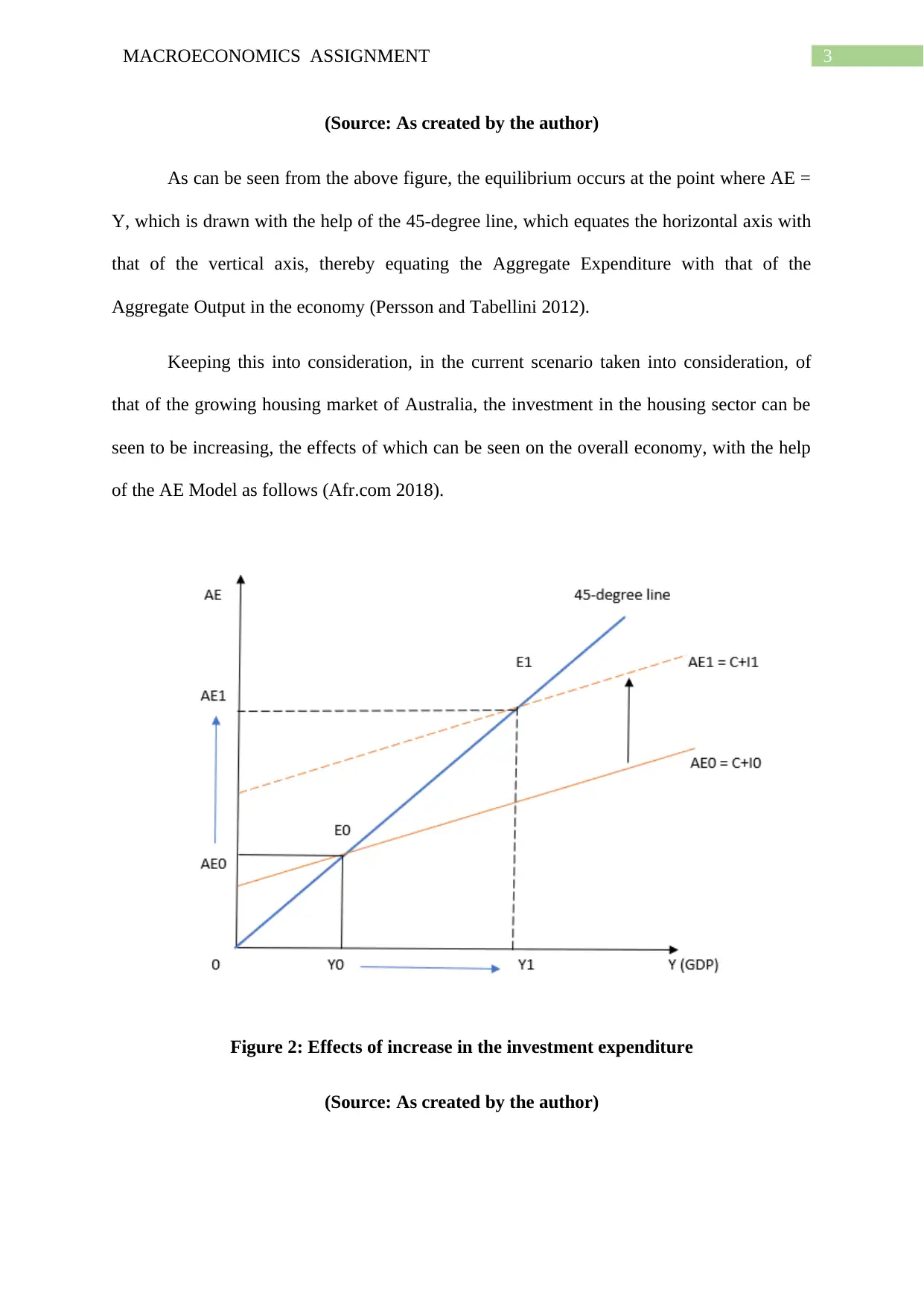

In this context, the OPEC can be seen to be urging Australia to increase the rate of

interest in the economy, in order to cool down the boom and growth in the housing market.

This is suggested, because the rate of interest is inversely related to that of the investment

expenditure component of the aggregate expenditure in a country, which can be shown as

follows:

Figure 3: Relationship between Investment and Rate of Interest

(Source: As created by the author)

The increase in the investment expenditure (due to the growth in the housing market)

leads to an increase in the Aggregate Expenditure in the economy, which in turn, leads to an

increase in the overall output (GDP) of the economy, with the equilibrium in the economy,

shifting from the point E0 to E1, as can be seen from the above figure (Burke 2012).

Answer 1b

In this context, the OPEC can be seen to be urging Australia to increase the rate of

interest in the economy, in order to cool down the boom and growth in the housing market.

This is suggested, because the rate of interest is inversely related to that of the investment

expenditure component of the aggregate expenditure in a country, which can be shown as

follows:

Figure 3: Relationship between Investment and Rate of Interest

(Source: As created by the author)

5MACROECONOMICS ASSIGNMENT

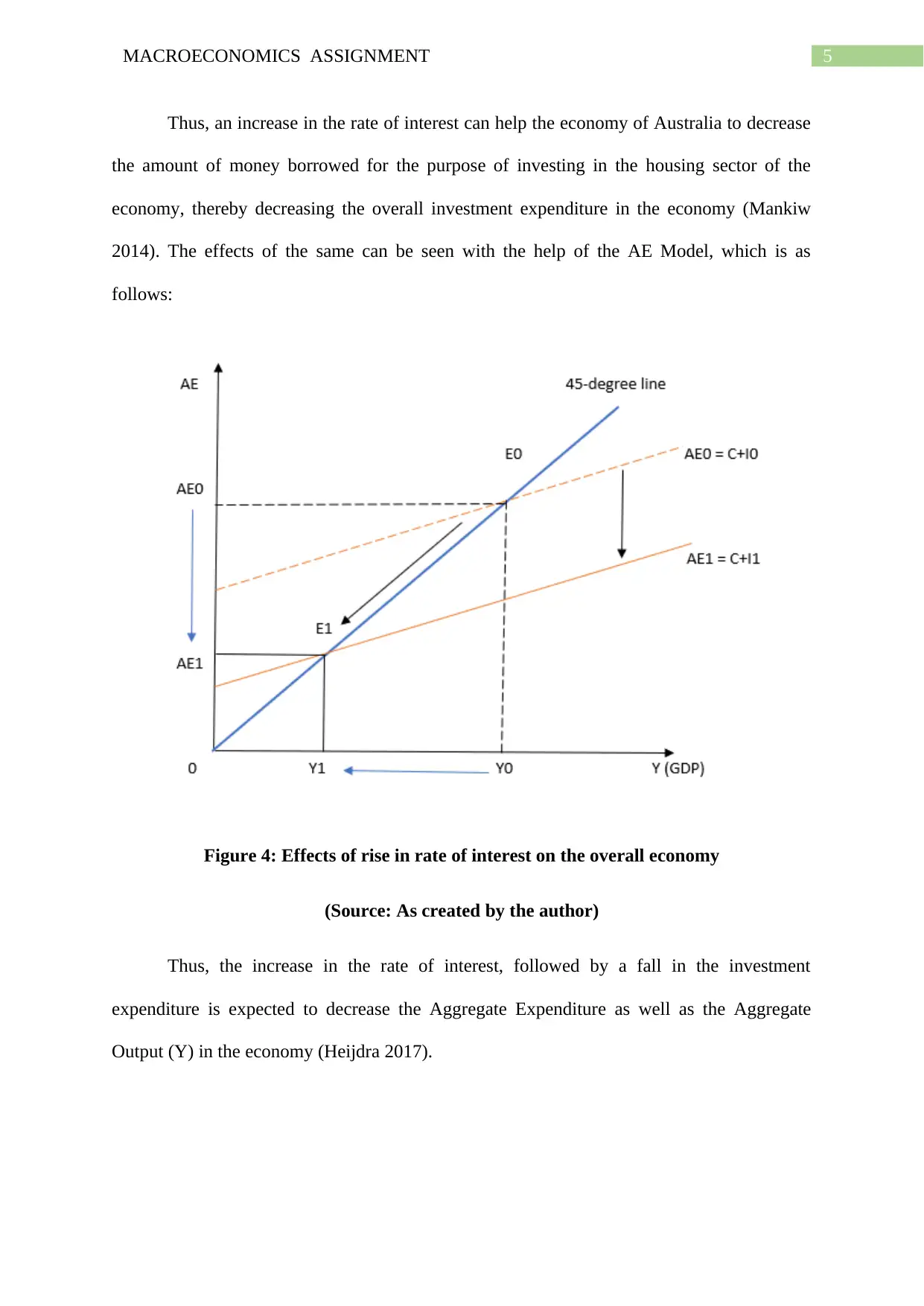

Thus, an increase in the rate of interest can help the economy of Australia to decrease

the amount of money borrowed for the purpose of investing in the housing sector of the

economy, thereby decreasing the overall investment expenditure in the economy (Mankiw

2014). The effects of the same can be seen with the help of the AE Model, which is as

follows:

Figure 4: Effects of rise in rate of interest on the overall economy

(Source: As created by the author)

Thus, the increase in the rate of interest, followed by a fall in the investment

expenditure is expected to decrease the Aggregate Expenditure as well as the Aggregate

Output (Y) in the economy (Heijdra 2017).

Thus, an increase in the rate of interest can help the economy of Australia to decrease

the amount of money borrowed for the purpose of investing in the housing sector of the

economy, thereby decreasing the overall investment expenditure in the economy (Mankiw

2014). The effects of the same can be seen with the help of the AE Model, which is as

follows:

Figure 4: Effects of rise in rate of interest on the overall economy

(Source: As created by the author)

Thus, the increase in the rate of interest, followed by a fall in the investment

expenditure is expected to decrease the Aggregate Expenditure as well as the Aggregate

Output (Y) in the economy (Heijdra 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MACROECONOMICS ASSIGNMENT

Answer 2

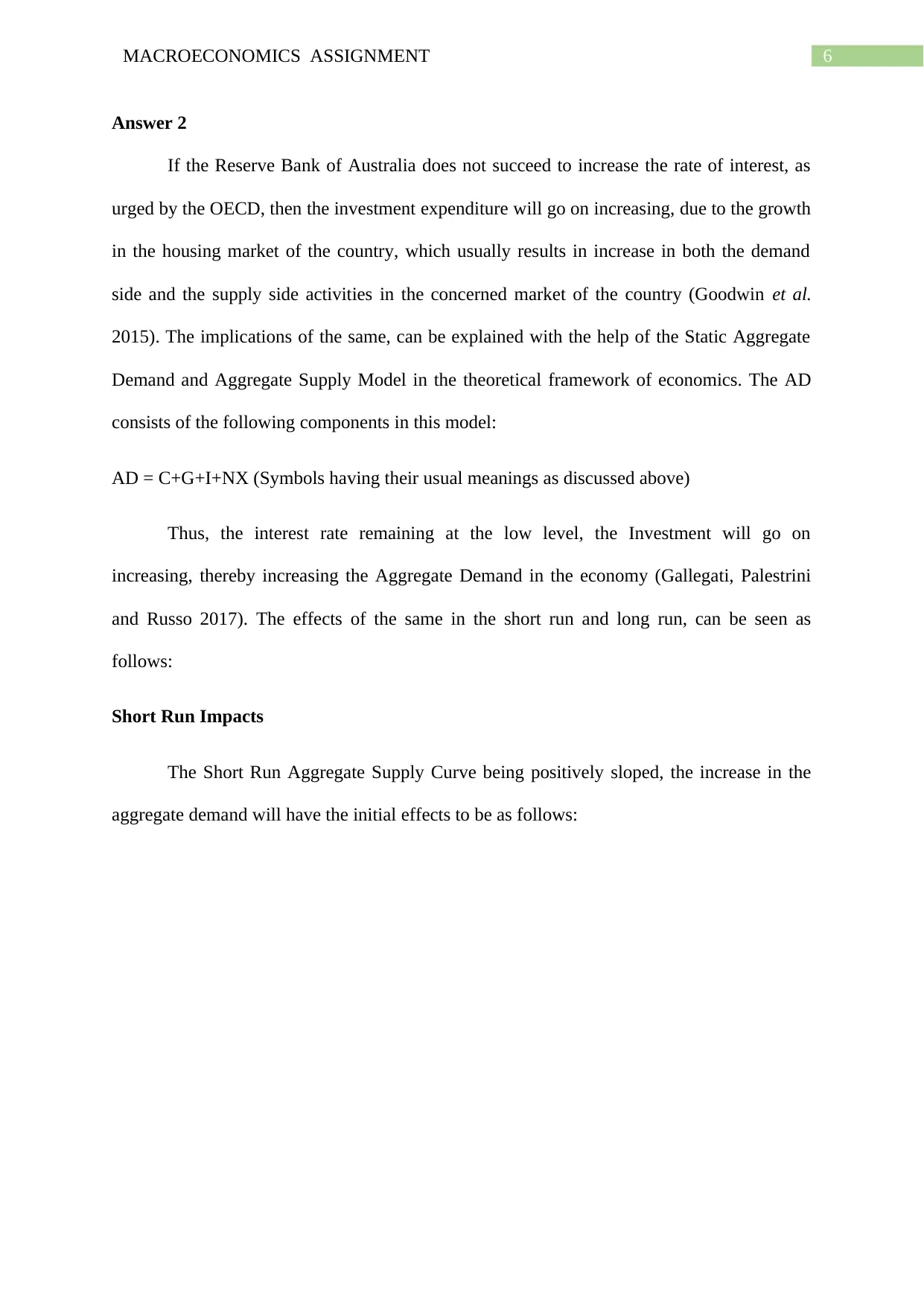

If the Reserve Bank of Australia does not succeed to increase the rate of interest, as

urged by the OECD, then the investment expenditure will go on increasing, due to the growth

in the housing market of the country, which usually results in increase in both the demand

side and the supply side activities in the concerned market of the country (Goodwin et al.

2015). The implications of the same, can be explained with the help of the Static Aggregate

Demand and Aggregate Supply Model in the theoretical framework of economics. The AD

consists of the following components in this model:

AD = C+G+I+NX (Symbols having their usual meanings as discussed above)

Thus, the interest rate remaining at the low level, the Investment will go on

increasing, thereby increasing the Aggregate Demand in the economy (Gallegati, Palestrini

and Russo 2017). The effects of the same in the short run and long run, can be seen as

follows:

Short Run Impacts

The Short Run Aggregate Supply Curve being positively sloped, the increase in the

aggregate demand will have the initial effects to be as follows:

Answer 2

If the Reserve Bank of Australia does not succeed to increase the rate of interest, as

urged by the OECD, then the investment expenditure will go on increasing, due to the growth

in the housing market of the country, which usually results in increase in both the demand

side and the supply side activities in the concerned market of the country (Goodwin et al.

2015). The implications of the same, can be explained with the help of the Static Aggregate

Demand and Aggregate Supply Model in the theoretical framework of economics. The AD

consists of the following components in this model:

AD = C+G+I+NX (Symbols having their usual meanings as discussed above)

Thus, the interest rate remaining at the low level, the Investment will go on

increasing, thereby increasing the Aggregate Demand in the economy (Gallegati, Palestrini

and Russo 2017). The effects of the same in the short run and long run, can be seen as

follows:

Short Run Impacts

The Short Run Aggregate Supply Curve being positively sloped, the increase in the

aggregate demand will have the initial effects to be as follows:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MACROECONOMICS ASSIGNMENT

Figure 5: Initial Impact of Interest Rate Stagnancy

(Source: As created by the author)

Thus, in the short run, due to the presence of positively sloped SRAS curve, the

increase in the aggregate demand (due to increase in the investment expenditure), leads to

both increase in the output level (GDP level) as well as increase in the overall price level in

the housing market (Carlin and Soskice 2014).

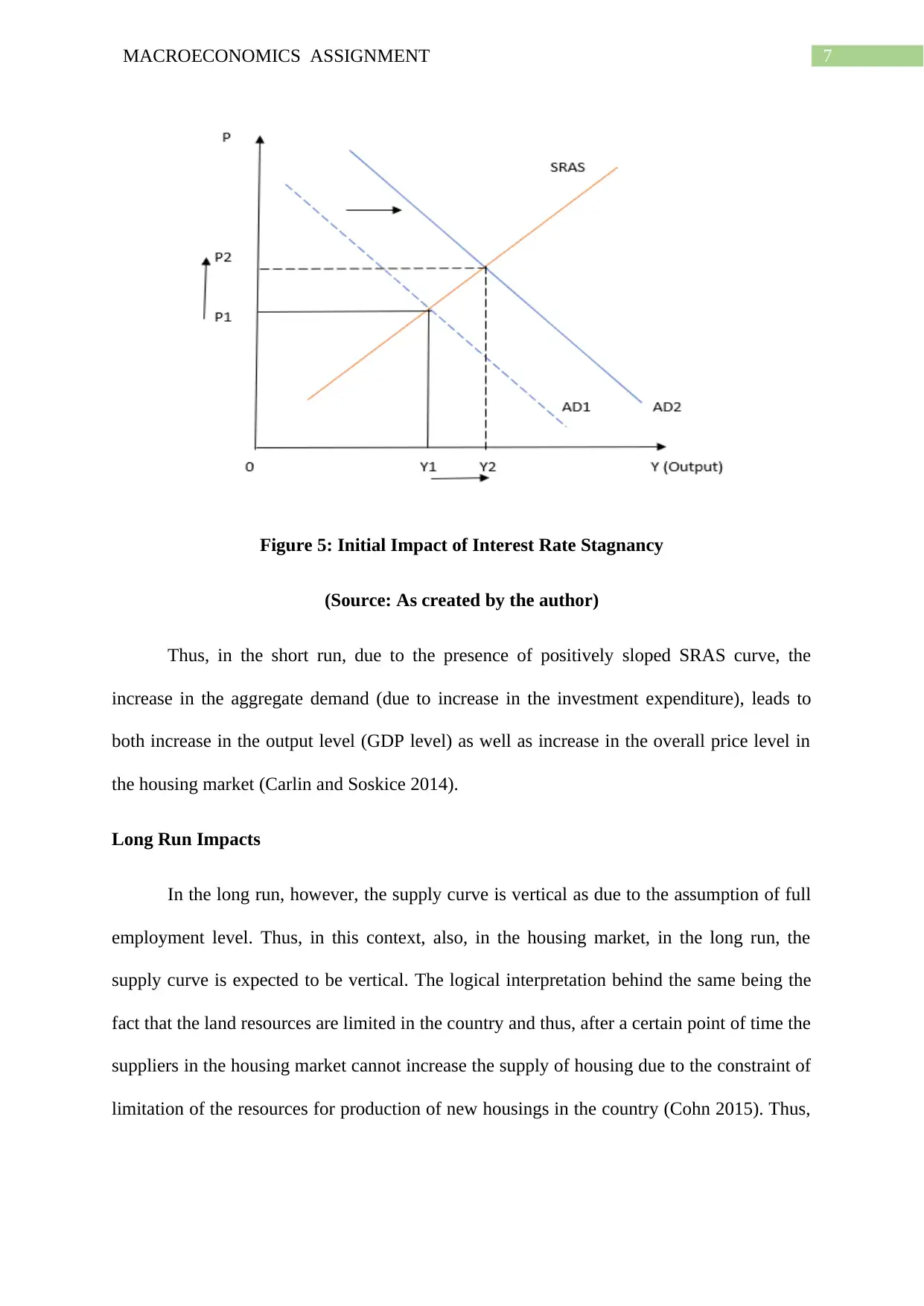

Long Run Impacts

In the long run, however, the supply curve is vertical as due to the assumption of full

employment level. Thus, in this context, also, in the housing market, in the long run, the

supply curve is expected to be vertical. The logical interpretation behind the same being the

fact that the land resources are limited in the country and thus, after a certain point of time the

suppliers in the housing market cannot increase the supply of housing due to the constraint of

limitation of the resources for production of new housings in the country (Cohn 2015). Thus,

Figure 5: Initial Impact of Interest Rate Stagnancy

(Source: As created by the author)

Thus, in the short run, due to the presence of positively sloped SRAS curve, the

increase in the aggregate demand (due to increase in the investment expenditure), leads to

both increase in the output level (GDP level) as well as increase in the overall price level in

the housing market (Carlin and Soskice 2014).

Long Run Impacts

In the long run, however, the supply curve is vertical as due to the assumption of full

employment level. Thus, in this context, also, in the housing market, in the long run, the

supply curve is expected to be vertical. The logical interpretation behind the same being the

fact that the land resources are limited in the country and thus, after a certain point of time the

suppliers in the housing market cannot increase the supply of housing due to the constraint of

limitation of the resources for production of new housings in the country (Cohn 2015). Thus,

8MACROECONOMICS ASSIGNMENT

in this context due to the increase in the investment and continuous increase in the aggregate

demand, the impacts are expected to be as follows:

Figure 6: Long run impacts of interest rate stagnancy

(Source: As created by the author)

Thus, in the long run, the LRAS being vertical, the output is expected to stay at a

constant level, while due to the continuous increase in the aggregate demand (due to the

increase in the investment expenditure in response to a stagnated rate of interest), the price

level in the economy will go on increasing.

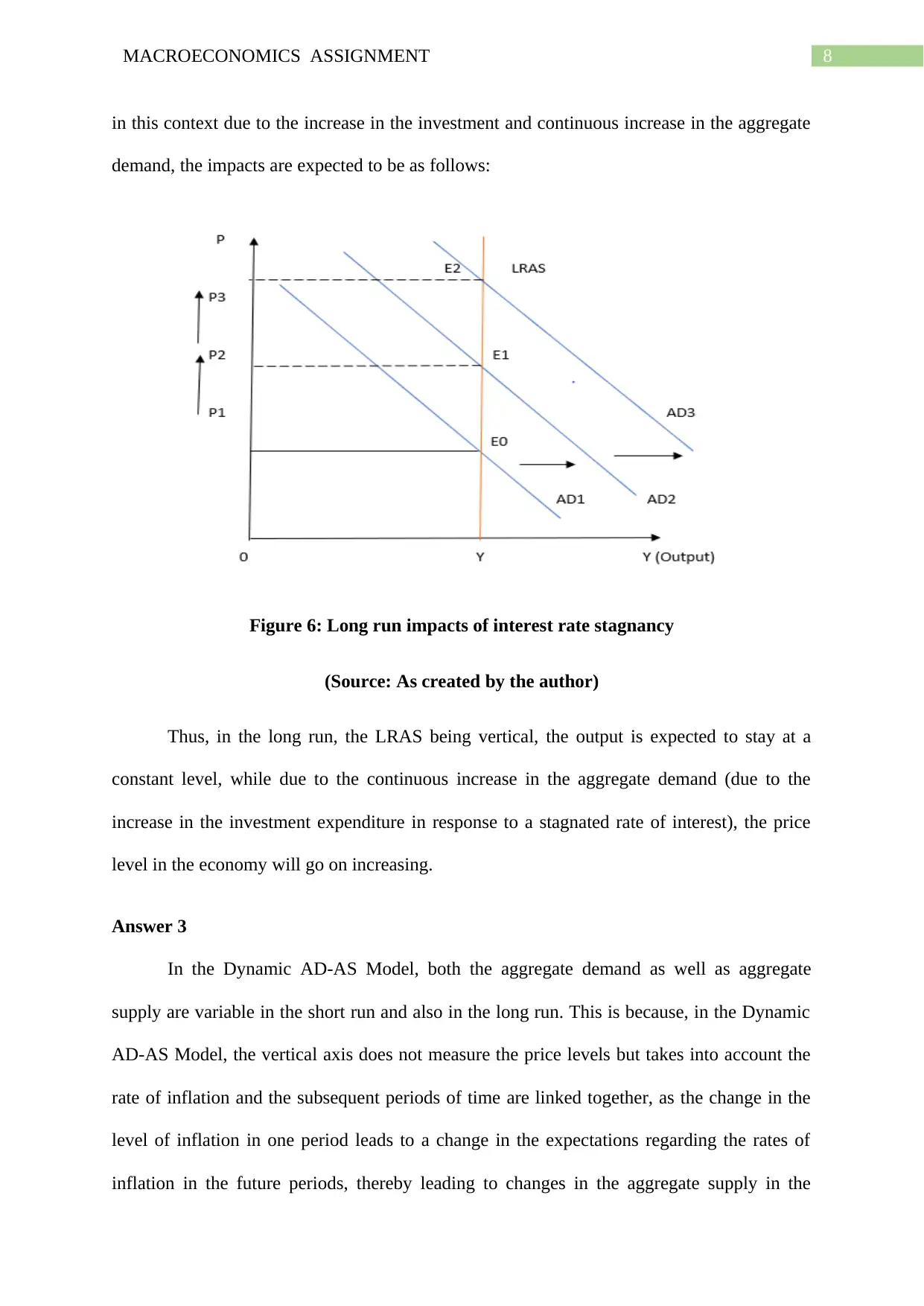

Answer 3

In the Dynamic AD-AS Model, both the aggregate demand as well as aggregate

supply are variable in the short run and also in the long run. This is because, in the Dynamic

AD-AS Model, the vertical axis does not measure the price levels but takes into account the

rate of inflation and the subsequent periods of time are linked together, as the change in the

level of inflation in one period leads to a change in the expectations regarding the rates of

inflation in the future periods, thereby leading to changes in the aggregate supply in the

in this context due to the increase in the investment and continuous increase in the aggregate

demand, the impacts are expected to be as follows:

Figure 6: Long run impacts of interest rate stagnancy

(Source: As created by the author)

Thus, in the long run, the LRAS being vertical, the output is expected to stay at a

constant level, while due to the continuous increase in the aggregate demand (due to the

increase in the investment expenditure in response to a stagnated rate of interest), the price

level in the economy will go on increasing.

Answer 3

In the Dynamic AD-AS Model, both the aggregate demand as well as aggregate

supply are variable in the short run and also in the long run. This is because, in the Dynamic

AD-AS Model, the vertical axis does not measure the price levels but takes into account the

rate of inflation and the subsequent periods of time are linked together, as the change in the

level of inflation in one period leads to a change in the expectations regarding the rates of

inflation in the future periods, thereby leading to changes in the aggregate supply in the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MACROECONOMICS ASSIGNMENT

coming periods, thereby differing from the Static AD-AS model (Gürkaynak and Wright

2012).

In this context, keeping into consideration the Dynamic AD-AS Model, if the Reserve

Bank of Australia succeeds to increase the rate of interest in future, then in response to the

same, the demand for borrowing of money for the purpose of investing in the housing market,

thereby decreasing the aggregate demand in the housing market. The effects can be seen as

follows:

Figure 7: Impacts of rise in rate of interest in the Dynamic AD-AS Model

(Source: As created by the author)

As is evident from the above figure, with the increase in the rate of interest and with

the subsequent decrease in the level of investment expenditures (due to fall in the borrowings

of people to invest in the housing market of the country), the aggregate demand is expected to

shift leftward (from DAD1 to DAD2). This fall in the aggregate demand in the housing

coming periods, thereby differing from the Static AD-AS model (Gürkaynak and Wright

2012).

In this context, keeping into consideration the Dynamic AD-AS Model, if the Reserve

Bank of Australia succeeds to increase the rate of interest in future, then in response to the

same, the demand for borrowing of money for the purpose of investing in the housing market,

thereby decreasing the aggregate demand in the housing market. The effects can be seen as

follows:

Figure 7: Impacts of rise in rate of interest in the Dynamic AD-AS Model

(Source: As created by the author)

As is evident from the above figure, with the increase in the rate of interest and with

the subsequent decrease in the level of investment expenditures (due to fall in the borrowings

of people to invest in the housing market of the country), the aggregate demand is expected to

shift leftward (from DAD1 to DAD2). This fall in the aggregate demand in the housing

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MACROECONOMICS ASSIGNMENT

market is expected to decreases the aggregate supply in the short run (from DAS1 to DAS2),

as lack of investment is expected to stall the growth in the housing market of the country

(Ascari and Sbordone 2014). If this trend continues for long-term, then in the long run, the

dynamic long run supply curve is also expected to move leftwards (from LRAS1 to LRAS1).

This in turn implies that the fall in aggregate demand results to short run decline in the

short run aggregate supply and this continues, resulting in the decline in the long run supply

in the economy, which in turn signifies that in the long run the equilibrium output decreases

(from E1 to E2), which in turn implies that in this scenario, the long run output as well

employment level decreases in the economy (Argy 2013). The problem becomes acute when

the expansion of the economy is below the predicted level by OECD as in such scenario the

fall in the equilibrium output and employment levels in the economy can lead to a

recessionary situation or situation of economic stagnation with lesser productive and

economic activities, thereby posing as an aggravated hurdle in the aspect of long run recovery

in the backdrop of a dampened future growth since the global recession and a situation of low

numbers of business creation in Australia.

market is expected to decreases the aggregate supply in the short run (from DAS1 to DAS2),

as lack of investment is expected to stall the growth in the housing market of the country

(Ascari and Sbordone 2014). If this trend continues for long-term, then in the long run, the

dynamic long run supply curve is also expected to move leftwards (from LRAS1 to LRAS1).

This in turn implies that the fall in aggregate demand results to short run decline in the

short run aggregate supply and this continues, resulting in the decline in the long run supply

in the economy, which in turn signifies that in the long run the equilibrium output decreases

(from E1 to E2), which in turn implies that in this scenario, the long run output as well

employment level decreases in the economy (Argy 2013). The problem becomes acute when

the expansion of the economy is below the predicted level by OECD as in such scenario the

fall in the equilibrium output and employment levels in the economy can lead to a

recessionary situation or situation of economic stagnation with lesser productive and

economic activities, thereby posing as an aggravated hurdle in the aspect of long run recovery

in the backdrop of a dampened future growth since the global recession and a situation of low

numbers of business creation in Australia.

11MACROECONOMICS ASSIGNMENT

References

Afr.com (2018). OECD says Australian economy ready for higher RBA rates. [online]

Financial Review. Available at: https://www.afr.com/news/economy/economy-ready-for-

higher-rba-rates-tighter-budget-oecd-says-20171128-gzua5y [Accessed 23 Jul. 2018].

Argy, V., 2013. International macroeconomics: theory and policy. Routledge.

Ascari, G. and Sbordone, A.M., 2014. The macroeconomics of trend inflation. Journal of

Economic Literature, 52(3), pp.679-739.

Backhouse, R.E., 2012. Interpreting Macroeconomics: Explorations in the History of

Macroeconomic Thought. Routledge.

Burke, T., 2012. The Australian residential housing market: institutions and

actors. Australia’s unintended cities, pp.35-49.

Carlin, W. and Soskice, D.W., 2014. Macroeconomics: Institutions, instability, and the

financial system. Oxford University Press, USA.

Cohn, S.M., 2015. Reintroducing Macroeconomics: A Critical Approach: A Critical

Approach. Routledge.

Gallegati, M., Palestrini, A. and Russo, A. eds., 2017. Introduction to agent-based

economics. Academic Press.

References

Afr.com (2018). OECD says Australian economy ready for higher RBA rates. [online]

Financial Review. Available at: https://www.afr.com/news/economy/economy-ready-for-

higher-rba-rates-tighter-budget-oecd-says-20171128-gzua5y [Accessed 23 Jul. 2018].

Argy, V., 2013. International macroeconomics: theory and policy. Routledge.

Ascari, G. and Sbordone, A.M., 2014. The macroeconomics of trend inflation. Journal of

Economic Literature, 52(3), pp.679-739.

Backhouse, R.E., 2012. Interpreting Macroeconomics: Explorations in the History of

Macroeconomic Thought. Routledge.

Burke, T., 2012. The Australian residential housing market: institutions and

actors. Australia’s unintended cities, pp.35-49.

Carlin, W. and Soskice, D.W., 2014. Macroeconomics: Institutions, instability, and the

financial system. Oxford University Press, USA.

Cohn, S.M., 2015. Reintroducing Macroeconomics: A Critical Approach: A Critical

Approach. Routledge.

Gallegati, M., Palestrini, A. and Russo, A. eds., 2017. Introduction to agent-based

economics. Academic Press.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.