Management Accounting Research Topics

VerifiedAdded on 2020/11/23

|19

|5040

|406

Literature Review

AI Summary

This assignment presents a collection of academic articles focusing on current trends and potential research directions in management accounting. The provided bibliography covers diverse themes like structuration theory, the balanced scorecard, lean manufacturing, psychological influences, family businesses, safety management, and regulatory changes within management accounting.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

MANAGEMENT ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

A. Explaining management accounting and different type of management accounting system

................................................................................................................................................1

B Different management accounting reports and their importance in organisation...............3

C. Benefits of management accounting system in Vectair Holdings Ltd...............................4

D). The integration of management accounting system and management reporting in

organisation............................................................................................................................5

TASK 2............................................................................................................................................6

A.1 Absorption costing and Marginal costing........................................................................6

A.2 Calculation of absorption and marginal costing..............................................................6

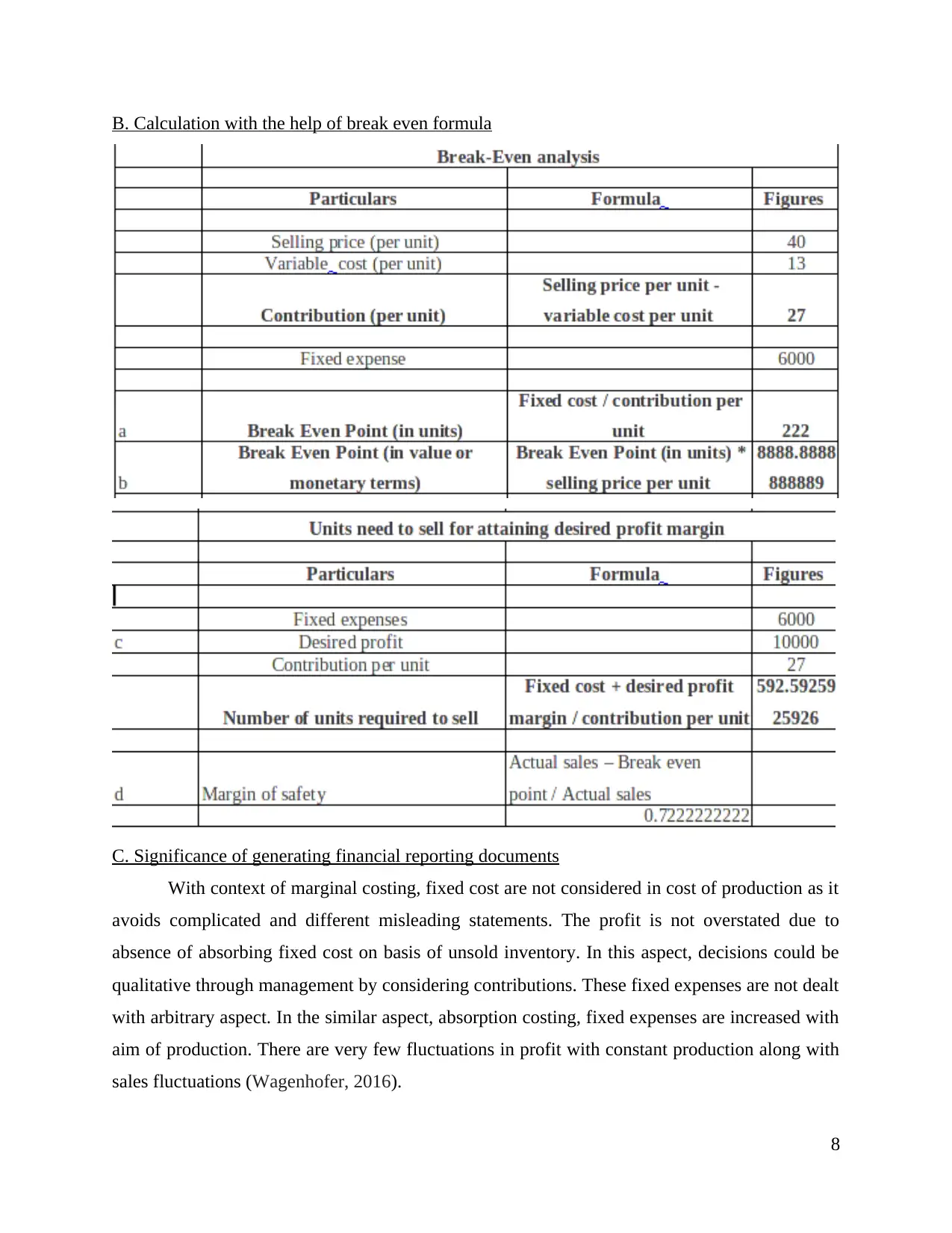

B. Calculation with the help of break even formula...............................................................8

..........................................................................................................................................................8

C. Significance of generating financial reporting documents................................................8

D. Interpreting data of business activities performed in above case......................................9

TASK 3............................................................................................................................................9

A. Advantages and Disadvantages of different types of planning tools used for budgetary

control.....................................................................................................................................9

C. Comparison of Vectair Holdings with Nisa in adapting different management accounting

systems to respond financial problems.................................................................................10

C. Representing application of planning tools for purpose of forecasting, analysing and

preparing budget...................................................................................................................12

D. Analysation of management accounting techniques for sustainable success..................12

E. Evaluation of planning tools that could be used to solve financial problems..................13

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

A. Explaining management accounting and different type of management accounting system

................................................................................................................................................1

B Different management accounting reports and their importance in organisation...............3

C. Benefits of management accounting system in Vectair Holdings Ltd...............................4

D). The integration of management accounting system and management reporting in

organisation............................................................................................................................5

TASK 2............................................................................................................................................6

A.1 Absorption costing and Marginal costing........................................................................6

A.2 Calculation of absorption and marginal costing..............................................................6

B. Calculation with the help of break even formula...............................................................8

..........................................................................................................................................................8

C. Significance of generating financial reporting documents................................................8

D. Interpreting data of business activities performed in above case......................................9

TASK 3............................................................................................................................................9

A. Advantages and Disadvantages of different types of planning tools used for budgetary

control.....................................................................................................................................9

C. Comparison of Vectair Holdings with Nisa in adapting different management accounting

systems to respond financial problems.................................................................................10

C. Representing application of planning tools for purpose of forecasting, analysing and

preparing budget...................................................................................................................12

D. Analysation of management accounting techniques for sustainable success..................12

E. Evaluation of planning tools that could be used to solve financial problems..................13

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION

Management accounting is referred as specialised branch of accounting as it plays very

important role for surviving and accomplishing growth in business entity. In the present scenario,

there is huge requirement for presence of appropriate management accounting system for

ensuring about proper and efficient day to day non financial and financial activities. The present

report will discuss about its significance and types on basis of Vectair Holding (SME). In the

similar aspect, it will show various information related to management accounting reports and its

significance to management. This report will represent advantages and limitations of accounting

systems along with their application. It will articulate about different range of management

accounting techniques such as absorption and marginal costing. This report will also provide

importance of these techniques along with Break even and Margin of safety. Furthermore, it will

discus about different planning tools on basis of budgetary control with their merits, demerits

and its application. For comparing various parameters for responding to financial problems,

NISA has been considered with proper evaluation.

TASK 1

A. Explaining management accounting and different type of management accounting system

It is a process which manages income and expenses of a business. Accounting is a

process of systematic recording, measuring and communicating information about day to day

financial transactions of company.

Financial and management accounting are two main type of accounting system:

Financial accounting: this accounting system keep record of all transactions in an

organisation. As per the guidelines, all the transactions in a company are recorded, summarized

and presented in a financial report which helps in evaluating overall financial performance. .

These statements are considered to be used by external people like shareholders, investors,

government, auditors etc. to evaluate the financial strength of an enterprise. Examples are

Income statement and balance sheet (Otley, 2016).

Management Accounting is a process which helps in identifying, measuring, analysing

and communicating information to managers so that organisational goals and objectives can be

determined. The basic difference between management and financial accounting is the users of

1

Management accounting is referred as specialised branch of accounting as it plays very

important role for surviving and accomplishing growth in business entity. In the present scenario,

there is huge requirement for presence of appropriate management accounting system for

ensuring about proper and efficient day to day non financial and financial activities. The present

report will discuss about its significance and types on basis of Vectair Holding (SME). In the

similar aspect, it will show various information related to management accounting reports and its

significance to management. This report will represent advantages and limitations of accounting

systems along with their application. It will articulate about different range of management

accounting techniques such as absorption and marginal costing. This report will also provide

importance of these techniques along with Break even and Margin of safety. Furthermore, it will

discus about different planning tools on basis of budgetary control with their merits, demerits

and its application. For comparing various parameters for responding to financial problems,

NISA has been considered with proper evaluation.

TASK 1

A. Explaining management accounting and different type of management accounting system

It is a process which manages income and expenses of a business. Accounting is a

process of systematic recording, measuring and communicating information about day to day

financial transactions of company.

Financial and management accounting are two main type of accounting system:

Financial accounting: this accounting system keep record of all transactions in an

organisation. As per the guidelines, all the transactions in a company are recorded, summarized

and presented in a financial report which helps in evaluating overall financial performance. .

These statements are considered to be used by external people like shareholders, investors,

government, auditors etc. to evaluate the financial strength of an enterprise. Examples are

Income statement and balance sheet (Otley, 2016).

Management Accounting is a process which helps in identifying, measuring, analysing

and communicating information to managers so that organisational goals and objectives can be

determined. The basic difference between management and financial accounting is the users of

1

the information. Managerial information provided by management accounting is used by

management of company, where financial information is used by both outsiders and management

of company. Management accounting helps in determining business expenses to maintain

internal fiscal report and record, which help in decision making process of management of

company in achieving pre-determined goals.

Different types of management accounting system that are required by Vectair Holdings

are:1. Cost accounting system: This system is used by manufacturers to record the flow of

inventory through various production stages. It helps in estimating the expenses of the

goods produced for determining revenue, inventory valuation and cost- effectiveness. It is

important for a firm to know which products are profitable and can be determined by

knowing accurate cost of production (Cost Accounting system, 2018). Cost accounting

system involves actual costing, nominal costing and standard costing. It consists of

actual, normal and standard cost which are described as follows: Actual cost is referred as an expense on actual aspect which are used for acquiring asset

along with supplier invoiced expense and delivering cost and appropriate setup. Normal cost is used for proper valuation of products which were manufactured as it

comprises direct material, direct labour and manufacturing overhead is identified on its

particular rate (Fullerton, Kennedy and Widener, 2014).

Standard cost is replicated as practice for substituting expected cost on actual aspect with

reference to accounting records and periodically differences in expected and actual cost.2. Inventory management system: it is a system that uses company's inventory, ordering

and storing it. Vectair Holding's input and finished goods and services are essential part

of the business activity. This system is important as it lets the production department the

need to restock certain items, purchasing of raw material and at what price should be

purchased. The main objective of this system is to check the requirement of more

inventory or the extra inventory level or shortage of stock . It should consider various

techniques such as Just in Time, FIFO, LIFO and periodic inventory in Vectair Holding.

2

management of company, where financial information is used by both outsiders and management

of company. Management accounting helps in determining business expenses to maintain

internal fiscal report and record, which help in decision making process of management of

company in achieving pre-determined goals.

Different types of management accounting system that are required by Vectair Holdings

are:1. Cost accounting system: This system is used by manufacturers to record the flow of

inventory through various production stages. It helps in estimating the expenses of the

goods produced for determining revenue, inventory valuation and cost- effectiveness. It is

important for a firm to know which products are profitable and can be determined by

knowing accurate cost of production (Cost Accounting system, 2018). Cost accounting

system involves actual costing, nominal costing and standard costing. It consists of

actual, normal and standard cost which are described as follows: Actual cost is referred as an expense on actual aspect which are used for acquiring asset

along with supplier invoiced expense and delivering cost and appropriate setup. Normal cost is used for proper valuation of products which were manufactured as it

comprises direct material, direct labour and manufacturing overhead is identified on its

particular rate (Fullerton, Kennedy and Widener, 2014).

Standard cost is replicated as practice for substituting expected cost on actual aspect with

reference to accounting records and periodically differences in expected and actual cost.2. Inventory management system: it is a system that uses company's inventory, ordering

and storing it. Vectair Holding's input and finished goods and services are essential part

of the business activity. This system is important as it lets the production department the

need to restock certain items, purchasing of raw material and at what price should be

purchased. The main objective of this system is to check the requirement of more

inventory or the extra inventory level or shortage of stock . It should consider various

techniques such as Just in Time, FIFO, LIFO and periodic inventory in Vectair Holding.

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

3. Just in Time (JIT): It is referred as common method for increasing efficiency and to

reduce cost. It would decrease waste by attaining goods with basic necessity.

4. Periodic inventory: This system is updated on periodic duration with absence of effort to

record sales of inventory as well.

5. Job costing System: It is a process of assigning costs that is incurred by a specific job

done by company. It systematically divides overhead, direct material and direct labour

cost to estimate their real cost. it is an essential system for allocation of expenses of every

goods and maintain record of every expenses.

B Different management accounting reports and their importance in organisation

Accounting reports are significant part which helps the management of company to know

the actual picture of company's overall performance. The management of large-scale business

makes the accounting reports on quarterly which will help them to make important strategic

decisions to improve company's performance.

There are many types of management accounting records which are important to provide

accurate information from different departments of Vectair Holdings Ltd:

1. Cost Accounting reports: A cost report offers information to the management about all

raw material costs, overhead, labour cost etc. This report helps the manager to know the

cost price of items and their selling prices. The profit margins of the products are

estimated on the basis of information provided by these reports (Cooper, Ezzamel and

Qu, 2017).

2. Inventory management report: These reports help centralised record on stock

expenses, workers, and other overhead expenses in the process of production activity.

3. Budget reports: These reports are fundamental for any management accounting

information and are vital in measuring company’s performance by preparing it

department wise. A budget is prepared on the historic performance of company. Budgets

are also prepared to meet any unforeseen circumstances, like shortage of financial needs,

inclusion of all sources for earning and expenses. This helps the management to control

complete expenses of company.

3

reduce cost. It would decrease waste by attaining goods with basic necessity.

4. Periodic inventory: This system is updated on periodic duration with absence of effort to

record sales of inventory as well.

5. Job costing System: It is a process of assigning costs that is incurred by a specific job

done by company. It systematically divides overhead, direct material and direct labour

cost to estimate their real cost. it is an essential system for allocation of expenses of every

goods and maintain record of every expenses.

B Different management accounting reports and their importance in organisation

Accounting reports are significant part which helps the management of company to know

the actual picture of company's overall performance. The management of large-scale business

makes the accounting reports on quarterly which will help them to make important strategic

decisions to improve company's performance.

There are many types of management accounting records which are important to provide

accurate information from different departments of Vectair Holdings Ltd:

1. Cost Accounting reports: A cost report offers information to the management about all

raw material costs, overhead, labour cost etc. This report helps the manager to know the

cost price of items and their selling prices. The profit margins of the products are

estimated on the basis of information provided by these reports (Cooper, Ezzamel and

Qu, 2017).

2. Inventory management report: These reports help centralised record on stock

expenses, workers, and other overhead expenses in the process of production activity.

3. Budget reports: These reports are fundamental for any management accounting

information and are vital in measuring company’s performance by preparing it

department wise. A budget is prepared on the historic performance of company. Budgets

are also prepared to meet any unforeseen circumstances, like shortage of financial needs,

inclusion of all sources for earning and expenses. This helps the management to control

complete expenses of company.

3

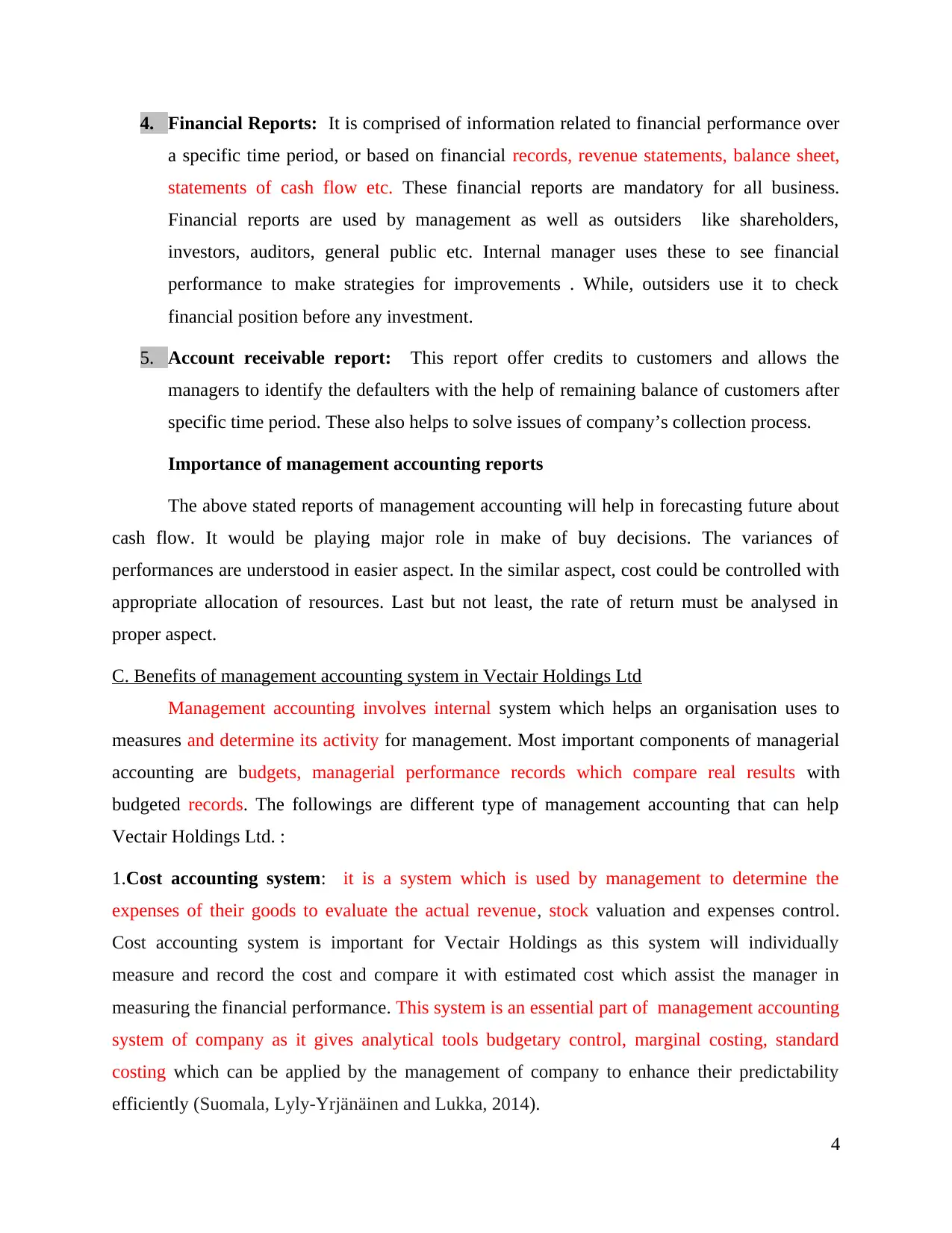

4. Financial Reports: It is comprised of information related to financial performance over

a specific time period, or based on financial records, revenue statements, balance sheet,

statements of cash flow etc. These financial reports are mandatory for all business.

Financial reports are used by management as well as outsiders like shareholders,

investors, auditors, general public etc. Internal manager uses these to see financial

performance to make strategies for improvements . While, outsiders use it to check

financial position before any investment.

5. Account receivable report: This report offer credits to customers and allows the

managers to identify the defaulters with the help of remaining balance of customers after

specific time period. These also helps to solve issues of company’s collection process.

Importance of management accounting reports

The above stated reports of management accounting will help in forecasting future about

cash flow. It would be playing major role in make of buy decisions. The variances of

performances are understood in easier aspect. In the similar aspect, cost could be controlled with

appropriate allocation of resources. Last but not least, the rate of return must be analysed in

proper aspect.

C. Benefits of management accounting system in Vectair Holdings Ltd

Management accounting involves internal system which helps an organisation uses to

measures and determine its activity for management. Most important components of managerial

accounting are budgets, managerial performance records which compare real results with

budgeted records. The followings are different type of management accounting that can help

Vectair Holdings Ltd. :

1.Cost accounting system: it is a system which is used by management to determine the

expenses of their goods to evaluate the actual revenue, stock valuation and expenses control.

Cost accounting system is important for Vectair Holdings as this system will individually

measure and record the cost and compare it with estimated cost which assist the manager in

measuring the financial performance. This system is an essential part of management accounting

system of company as it gives analytical tools budgetary control, marginal costing, standard

costing which can be applied by the management of company to enhance their predictability

efficiently (Suomala, Lyly-Yrjänäinen and Lukka, 2014).

4

a specific time period, or based on financial records, revenue statements, balance sheet,

statements of cash flow etc. These financial reports are mandatory for all business.

Financial reports are used by management as well as outsiders like shareholders,

investors, auditors, general public etc. Internal manager uses these to see financial

performance to make strategies for improvements . While, outsiders use it to check

financial position before any investment.

5. Account receivable report: This report offer credits to customers and allows the

managers to identify the defaulters with the help of remaining balance of customers after

specific time period. These also helps to solve issues of company’s collection process.

Importance of management accounting reports

The above stated reports of management accounting will help in forecasting future about

cash flow. It would be playing major role in make of buy decisions. The variances of

performances are understood in easier aspect. In the similar aspect, cost could be controlled with

appropriate allocation of resources. Last but not least, the rate of return must be analysed in

proper aspect.

C. Benefits of management accounting system in Vectair Holdings Ltd

Management accounting involves internal system which helps an organisation uses to

measures and determine its activity for management. Most important components of managerial

accounting are budgets, managerial performance records which compare real results with

budgeted records. The followings are different type of management accounting that can help

Vectair Holdings Ltd. :

1.Cost accounting system: it is a system which is used by management to determine the

expenses of their goods to evaluate the actual revenue, stock valuation and expenses control.

Cost accounting system is important for Vectair Holdings as this system will individually

measure and record the cost and compare it with estimated cost which assist the manager in

measuring the financial performance. This system is an essential part of management accounting

system of company as it gives analytical tools budgetary control, marginal costing, standard

costing which can be applied by the management of company to enhance their predictability

efficiently (Suomala, Lyly-Yrjänäinen and Lukka, 2014).

4

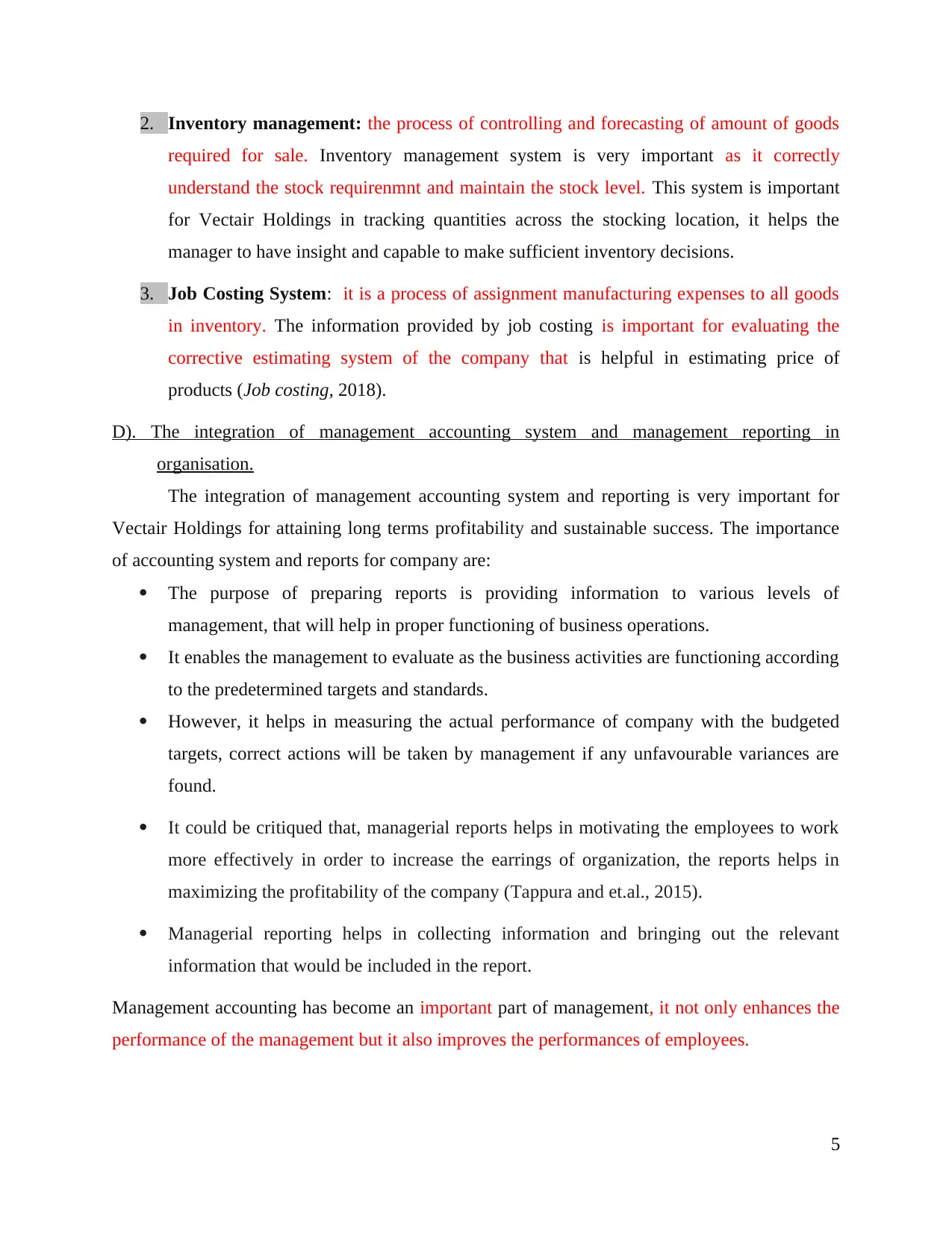

2. Inventory management: the process of controlling and forecasting of amount of goods

required for sale. Inventory management system is very important as it correctly

understand the stock requirenmnt and maintain the stock level. This system is important

for Vectair Holdings in tracking quantities across the stocking location, it helps the

manager to have insight and capable to make sufficient inventory decisions.

3. Job Costing System: it is a process of assignment manufacturing expenses to all goods

in inventory. The information provided by job costing is important for evaluating the

corrective estimating system of the company that is helpful in estimating price of

products (Job costing, 2018).

D). The integration of management accounting system and management reporting in

organisation.

The integration of management accounting system and reporting is very important for

Vectair Holdings for attaining long terms profitability and sustainable success. The importance

of accounting system and reports for company are:

The purpose of preparing reports is providing information to various levels of

management, that will help in proper functioning of business operations.

It enables the management to evaluate as the business activities are functioning according

to the predetermined targets and standards.

However, it helps in measuring the actual performance of company with the budgeted

targets, correct actions will be taken by management if any unfavourable variances are

found.

It could be critiqued that, managerial reports helps in motivating the employees to work

more effectively in order to increase the earrings of organization, the reports helps in

maximizing the profitability of the company (Tappura and et.al., 2015).

Managerial reporting helps in collecting information and bringing out the relevant

information that would be included in the report.

Management accounting has become an important part of management, it not only enhances the

performance of the management but it also improves the performances of employees.

5

required for sale. Inventory management system is very important as it correctly

understand the stock requirenmnt and maintain the stock level. This system is important

for Vectair Holdings in tracking quantities across the stocking location, it helps the

manager to have insight and capable to make sufficient inventory decisions.

3. Job Costing System: it is a process of assignment manufacturing expenses to all goods

in inventory. The information provided by job costing is important for evaluating the

corrective estimating system of the company that is helpful in estimating price of

products (Job costing, 2018).

D). The integration of management accounting system and management reporting in

organisation.

The integration of management accounting system and reporting is very important for

Vectair Holdings for attaining long terms profitability and sustainable success. The importance

of accounting system and reports for company are:

The purpose of preparing reports is providing information to various levels of

management, that will help in proper functioning of business operations.

It enables the management to evaluate as the business activities are functioning according

to the predetermined targets and standards.

However, it helps in measuring the actual performance of company with the budgeted

targets, correct actions will be taken by management if any unfavourable variances are

found.

It could be critiqued that, managerial reports helps in motivating the employees to work

more effectively in order to increase the earrings of organization, the reports helps in

maximizing the profitability of the company (Tappura and et.al., 2015).

Managerial reporting helps in collecting information and bringing out the relevant

information that would be included in the report.

Management accounting has become an important part of management, it not only enhances the

performance of the management but it also improves the performances of employees.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

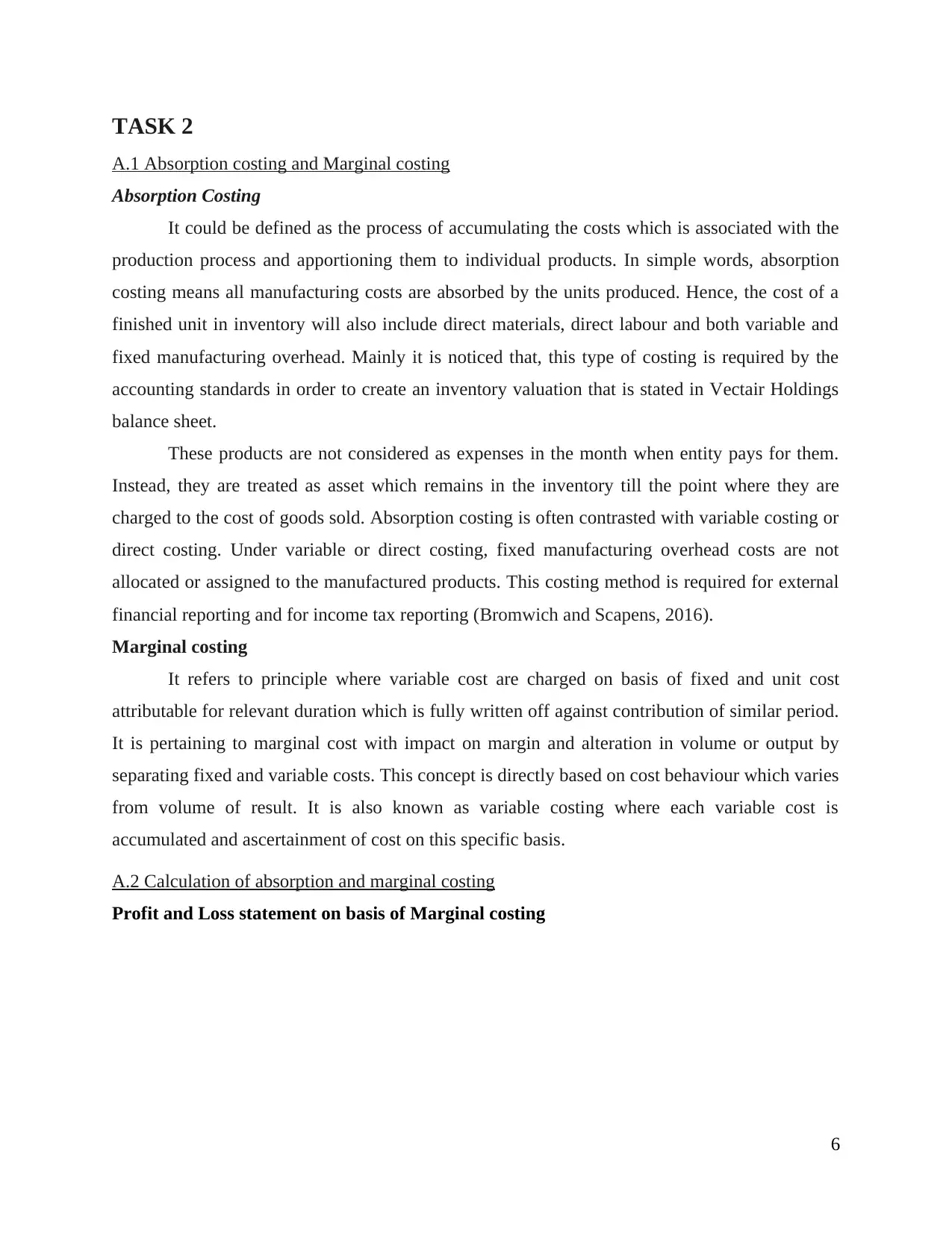

TASK 2

A.1 Absorption costing and Marginal costing

Absorption Costing

It could be defined as the process of accumulating the costs which is associated with the

production process and apportioning them to individual products. In simple words, absorption

costing means all manufacturing costs are absorbed by the units produced. Hence, the cost of a

finished unit in inventory will also include direct materials, direct labour and both variable and

fixed manufacturing overhead. Mainly it is noticed that, this type of costing is required by the

accounting standards in order to create an inventory valuation that is stated in Vectair Holdings

balance sheet.

These products are not considered as expenses in the month when entity pays for them.

Instead, they are treated as asset which remains in the inventory till the point where they are

charged to the cost of goods sold. Absorption costing is often contrasted with variable costing or

direct costing. Under variable or direct costing, fixed manufacturing overhead costs are not

allocated or assigned to the manufactured products. This costing method is required for external

financial reporting and for income tax reporting (Bromwich and Scapens, 2016).

Marginal costing

It refers to principle where variable cost are charged on basis of fixed and unit cost

attributable for relevant duration which is fully written off against contribution of similar period.

It is pertaining to marginal cost with impact on margin and alteration in volume or output by

separating fixed and variable costs. This concept is directly based on cost behaviour which varies

from volume of result. It is also known as variable costing where each variable cost is

accumulated and ascertainment of cost on this specific basis.

A.2 Calculation of absorption and marginal costing

Profit and Loss statement on basis of Marginal costing

6

A.1 Absorption costing and Marginal costing

Absorption Costing

It could be defined as the process of accumulating the costs which is associated with the

production process and apportioning them to individual products. In simple words, absorption

costing means all manufacturing costs are absorbed by the units produced. Hence, the cost of a

finished unit in inventory will also include direct materials, direct labour and both variable and

fixed manufacturing overhead. Mainly it is noticed that, this type of costing is required by the

accounting standards in order to create an inventory valuation that is stated in Vectair Holdings

balance sheet.

These products are not considered as expenses in the month when entity pays for them.

Instead, they are treated as asset which remains in the inventory till the point where they are

charged to the cost of goods sold. Absorption costing is often contrasted with variable costing or

direct costing. Under variable or direct costing, fixed manufacturing overhead costs are not

allocated or assigned to the manufactured products. This costing method is required for external

financial reporting and for income tax reporting (Bromwich and Scapens, 2016).

Marginal costing

It refers to principle where variable cost are charged on basis of fixed and unit cost

attributable for relevant duration which is fully written off against contribution of similar period.

It is pertaining to marginal cost with impact on margin and alteration in volume or output by

separating fixed and variable costs. This concept is directly based on cost behaviour which varies

from volume of result. It is also known as variable costing where each variable cost is

accumulated and ascertainment of cost on this specific basis.

A.2 Calculation of absorption and marginal costing

Profit and Loss statement on basis of Marginal costing

6

Profit and Loss statement on basis of Absorption costing

7

7

B. Calculation with the help of break even formula

C. Significance of generating financial reporting documents

With context of marginal costing, fixed cost are not considered in cost of production as it

avoids complicated and different misleading statements. The profit is not overstated due to

absence of absorbing fixed cost on basis of unsold inventory. In this aspect, decisions could be

qualitative through management by considering contributions. These fixed expenses are not dealt

with arbitrary aspect. In the similar aspect, absorption costing, fixed expenses are increased with

aim of production. There are very few fluctuations in profit with constant production along with

sales fluctuations (Wagenhofer, 2016).

8

C. Significance of generating financial reporting documents

With context of marginal costing, fixed cost are not considered in cost of production as it

avoids complicated and different misleading statements. The profit is not overstated due to

absence of absorbing fixed cost on basis of unsold inventory. In this aspect, decisions could be

qualitative through management by considering contributions. These fixed expenses are not dealt

with arbitrary aspect. In the similar aspect, absorption costing, fixed expenses are increased with

aim of production. There are very few fluctuations in profit with constant production along with

sales fluctuations (Wagenhofer, 2016).

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Further, Break-even and margin of safety has been presented for appropriate business

plan which determines cost structure and units for recovering its initial investment cost. MOS is

used for extracting revenue amount will be decreased to give result on basis of break even.

D. Interpreting data of business activities performed in above case

There is extraction of net income on basis of marginal and absorption costing method on

basis of segregation of both fixed and variable cost. Vectair Holding must accept method of

absorption costing because of earning high net income as 17700 as compared to marginal costing

(17500). There is presence of huge production from sales and more profit in absorption costing

because of closing inventory valuation comprises portion of fixed cost of particular time which

was passed in next year.

TASK 3

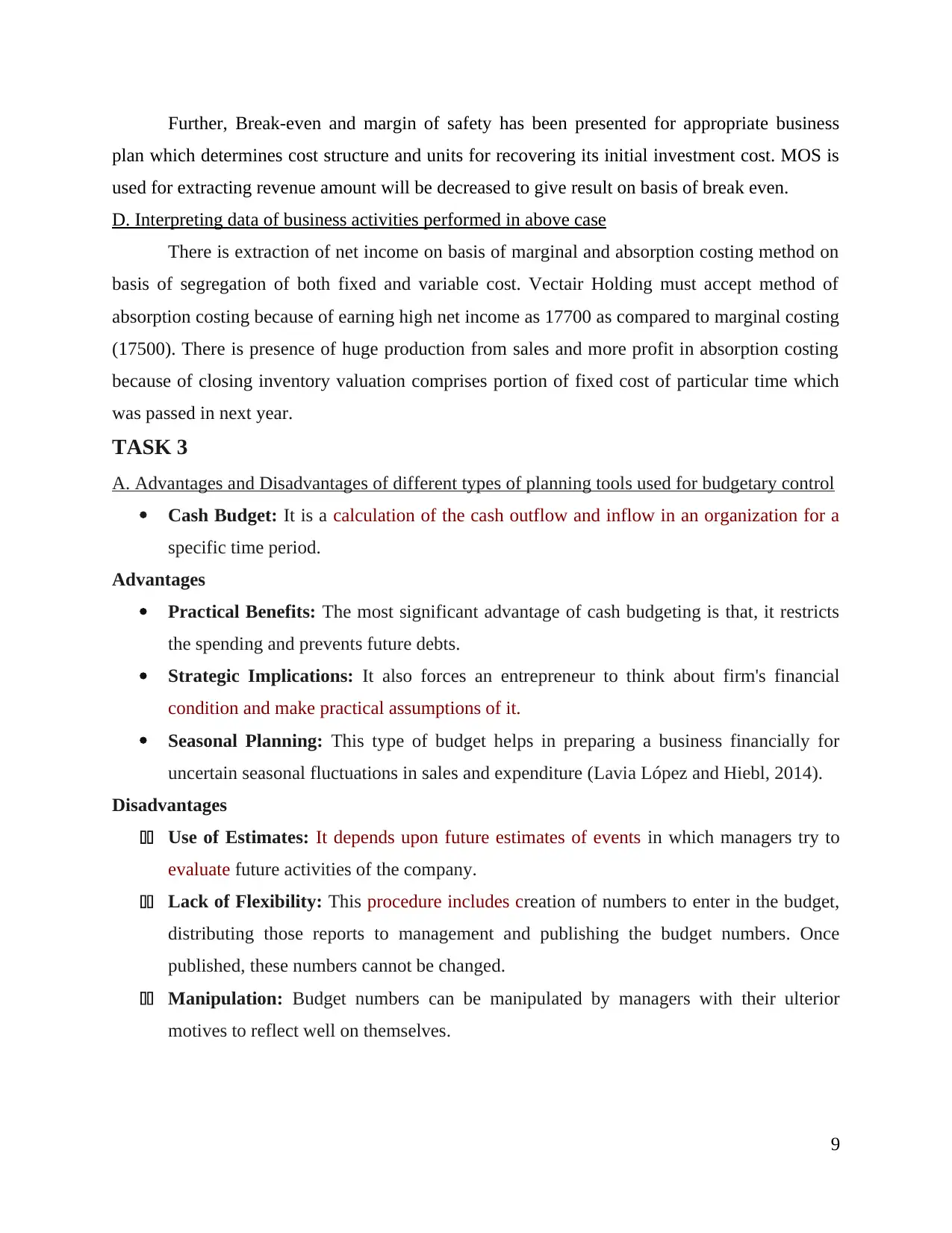

A. Advantages and Disadvantages of different types of planning tools used for budgetary control

Cash Budget: It is a calculation of the cash outflow and inflow in an organization for a

specific time period.

Advantages

Practical Benefits: The most significant advantage of cash budgeting is that, it restricts

the spending and prevents future debts.

Strategic Implications: It also forces an entrepreneur to think about firm's financial

condition and make practical assumptions of it.

Seasonal Planning: This type of budget helps in preparing a business financially for

uncertain seasonal fluctuations in sales and expenditure (Lavia López and Hiebl, 2014).

Disadvantages

11 Use of Estimates: It depends upon future estimates of events in which managers try to

evaluate future activities of the company.

11 Lack of Flexibility: This procedure includes creation of numbers to enter in the budget,

distributing those reports to management and publishing the budget numbers. Once

published, these numbers cannot be changed.

11 Manipulation: Budget numbers can be manipulated by managers with their ulterior

motives to reflect well on themselves.

9

plan which determines cost structure and units for recovering its initial investment cost. MOS is

used for extracting revenue amount will be decreased to give result on basis of break even.

D. Interpreting data of business activities performed in above case

There is extraction of net income on basis of marginal and absorption costing method on

basis of segregation of both fixed and variable cost. Vectair Holding must accept method of

absorption costing because of earning high net income as 17700 as compared to marginal costing

(17500). There is presence of huge production from sales and more profit in absorption costing

because of closing inventory valuation comprises portion of fixed cost of particular time which

was passed in next year.

TASK 3

A. Advantages and Disadvantages of different types of planning tools used for budgetary control

Cash Budget: It is a calculation of the cash outflow and inflow in an organization for a

specific time period.

Advantages

Practical Benefits: The most significant advantage of cash budgeting is that, it restricts

the spending and prevents future debts.

Strategic Implications: It also forces an entrepreneur to think about firm's financial

condition and make practical assumptions of it.

Seasonal Planning: This type of budget helps in preparing a business financially for

uncertain seasonal fluctuations in sales and expenditure (Lavia López and Hiebl, 2014).

Disadvantages

11 Use of Estimates: It depends upon future estimates of events in which managers try to

evaluate future activities of the company.

11 Lack of Flexibility: This procedure includes creation of numbers to enter in the budget,

distributing those reports to management and publishing the budget numbers. Once

published, these numbers cannot be changed.

11 Manipulation: Budget numbers can be manipulated by managers with their ulterior

motives to reflect well on themselves.

9

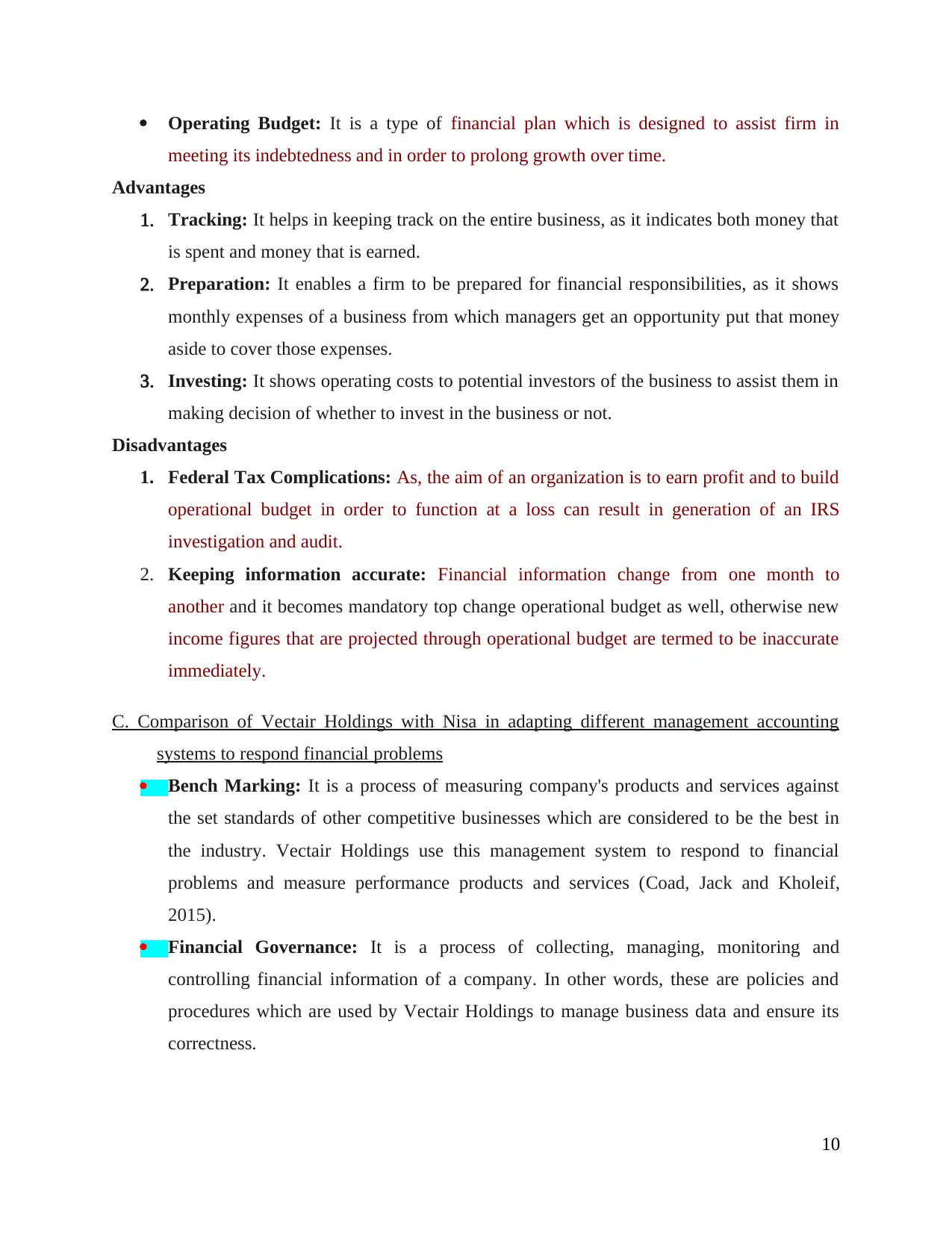

Operating Budget: It is a type of financial plan which is designed to assist firm in

meeting its indebtedness and in order to prolong growth over time.

Advantages

1. Tracking: It helps in keeping track on the entire business, as it indicates both money that

is spent and money that is earned.

2. Preparation: It enables a firm to be prepared for financial responsibilities, as it shows

monthly expenses of a business from which managers get an opportunity put that money

aside to cover those expenses.

3. Investing: It shows operating costs to potential investors of the business to assist them in

making decision of whether to invest in the business or not.

Disadvantages

1. Federal Tax Complications: As, the aim of an organization is to earn profit and to build

operational budget in order to function at a loss can result in generation of an IRS

investigation and audit.

2. Keeping information accurate: Financial information change from one month to

another and it becomes mandatory top change operational budget as well, otherwise new

income figures that are projected through operational budget are termed to be inaccurate

immediately.

C. Comparison of Vectair Holdings with Nisa in adapting different management accounting

systems to respond financial problems

Bench Marking: It is a process of measuring company's products and services against

the set standards of other competitive businesses which are considered to be the best in

the industry. Vectair Holdings use this management system to respond to financial

problems and measure performance products and services (Coad, Jack and Kholeif,

2015).

Financial Governance: It is a process of collecting, managing, monitoring and

controlling financial information of a company. In other words, these are policies and

procedures which are used by Vectair Holdings to manage business data and ensure its

correctness.

10

meeting its indebtedness and in order to prolong growth over time.

Advantages

1. Tracking: It helps in keeping track on the entire business, as it indicates both money that

is spent and money that is earned.

2. Preparation: It enables a firm to be prepared for financial responsibilities, as it shows

monthly expenses of a business from which managers get an opportunity put that money

aside to cover those expenses.

3. Investing: It shows operating costs to potential investors of the business to assist them in

making decision of whether to invest in the business or not.

Disadvantages

1. Federal Tax Complications: As, the aim of an organization is to earn profit and to build

operational budget in order to function at a loss can result in generation of an IRS

investigation and audit.

2. Keeping information accurate: Financial information change from one month to

another and it becomes mandatory top change operational budget as well, otherwise new

income figures that are projected through operational budget are termed to be inaccurate

immediately.

C. Comparison of Vectair Holdings with Nisa in adapting different management accounting

systems to respond financial problems

Bench Marking: It is a process of measuring company's products and services against

the set standards of other competitive businesses which are considered to be the best in

the industry. Vectair Holdings use this management system to respond to financial

problems and measure performance products and services (Coad, Jack and Kholeif,

2015).

Financial Governance: It is a process of collecting, managing, monitoring and

controlling financial information of a company. In other words, these are policies and

procedures which are used by Vectair Holdings to manage business data and ensure its

correctness.

10

KPIs Key Performance Indicators: It is a process of measuring effectiveness of

company in achieving its main objectives through value. Vectair Holdings use this for

achieving its key objectives to respond financial problems.

Following are some techniques which are used by Nisa to respond financial problems:

Balanced score Card: It is metric which is used to show performance and strategical

management to find and improve different internal functions with their resultant

outcomes. Nisa use this technique to improve their internal management function and

resulting outcome. Budgetary Target: The basic motive of it is to derive cost targets in a goal oriented

manner. Use of this helps Nisa in deriving their cost targets for effective production and

is efficient as compared to Vectair Holdings (Hall, 2016).

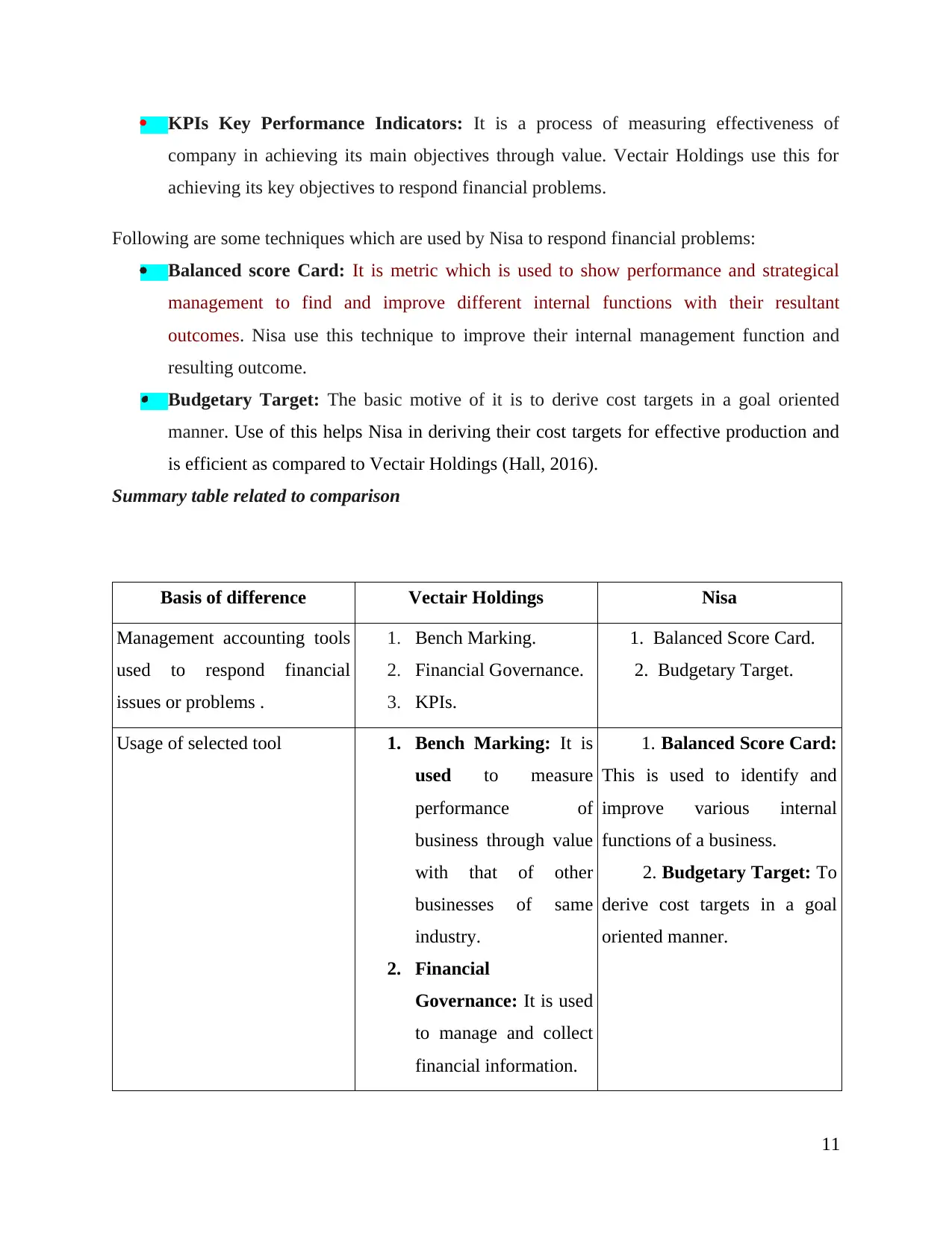

Summary table related to comparison

Basis of difference Vectair Holdings Nisa

Management accounting tools

used to respond financial

issues or problems .

1. Bench Marking.

2. Financial Governance.

3. KPIs.

1. Balanced Score Card.

2. Budgetary Target.

Usage of selected tool 1. Bench Marking: It is

used to measure

performance of

business through value

with that of other

businesses of same

industry.

2. Financial

Governance: It is used

to manage and collect

financial information.

1. Balanced Score Card:

This is used to identify and

improve various internal

functions of a business.

2. Budgetary Target: To

derive cost targets in a goal

oriented manner.

11

company in achieving its main objectives through value. Vectair Holdings use this for

achieving its key objectives to respond financial problems.

Following are some techniques which are used by Nisa to respond financial problems:

Balanced score Card: It is metric which is used to show performance and strategical

management to find and improve different internal functions with their resultant

outcomes. Nisa use this technique to improve their internal management function and

resulting outcome. Budgetary Target: The basic motive of it is to derive cost targets in a goal oriented

manner. Use of this helps Nisa in deriving their cost targets for effective production and

is efficient as compared to Vectair Holdings (Hall, 2016).

Summary table related to comparison

Basis of difference Vectair Holdings Nisa

Management accounting tools

used to respond financial

issues or problems .

1. Bench Marking.

2. Financial Governance.

3. KPIs.

1. Balanced Score Card.

2. Budgetary Target.

Usage of selected tool 1. Bench Marking: It is

used to measure

performance of

business through value

with that of other

businesses of same

industry.

2. Financial

Governance: It is used

to manage and collect

financial information.

1. Balanced Score Card:

This is used to identify and

improve various internal

functions of a business.

2. Budgetary Target: To

derive cost targets in a goal

oriented manner.

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3. KPIs: It is a value

which is used in

measuring efficiency of

company in achieving

its key business

objectives.

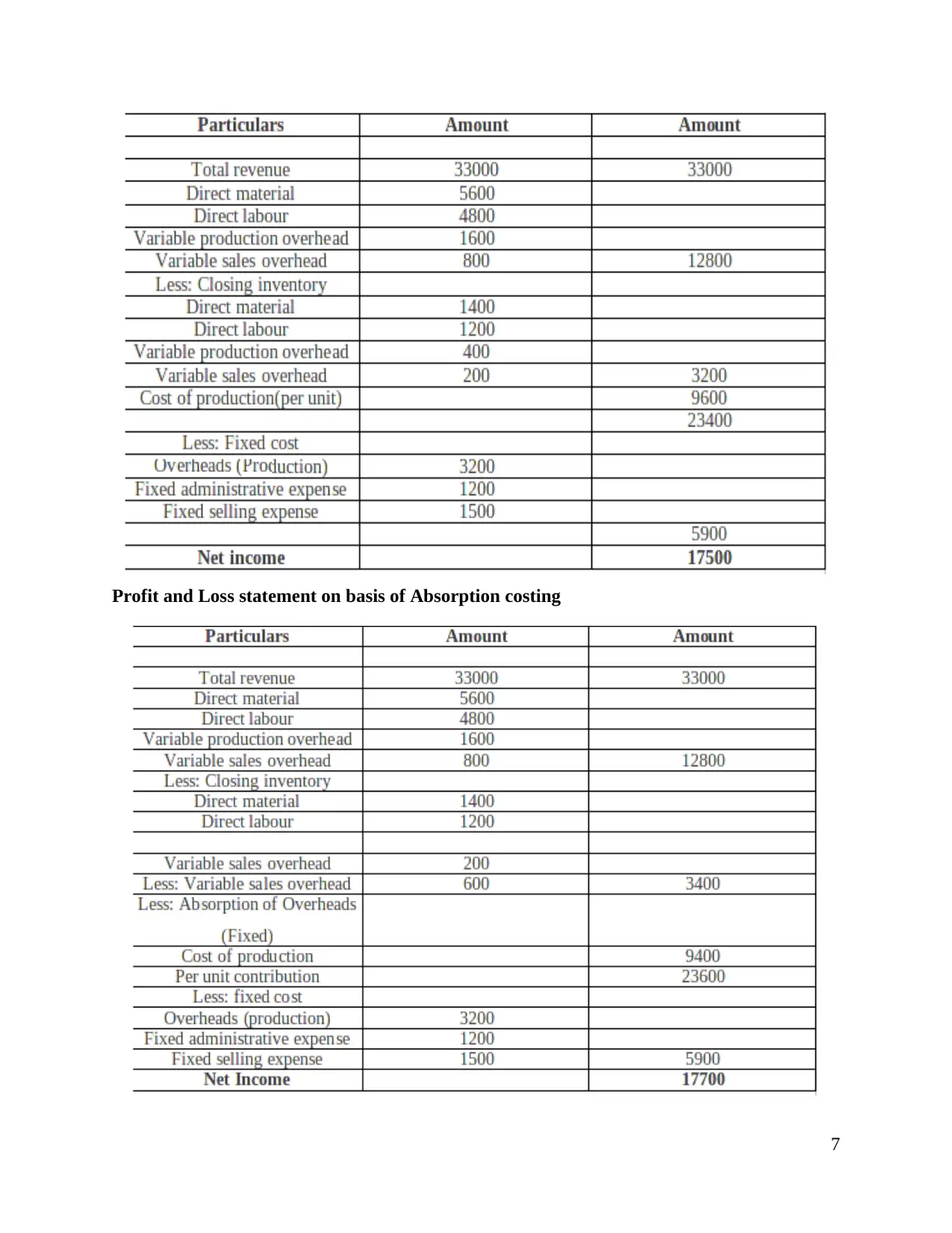

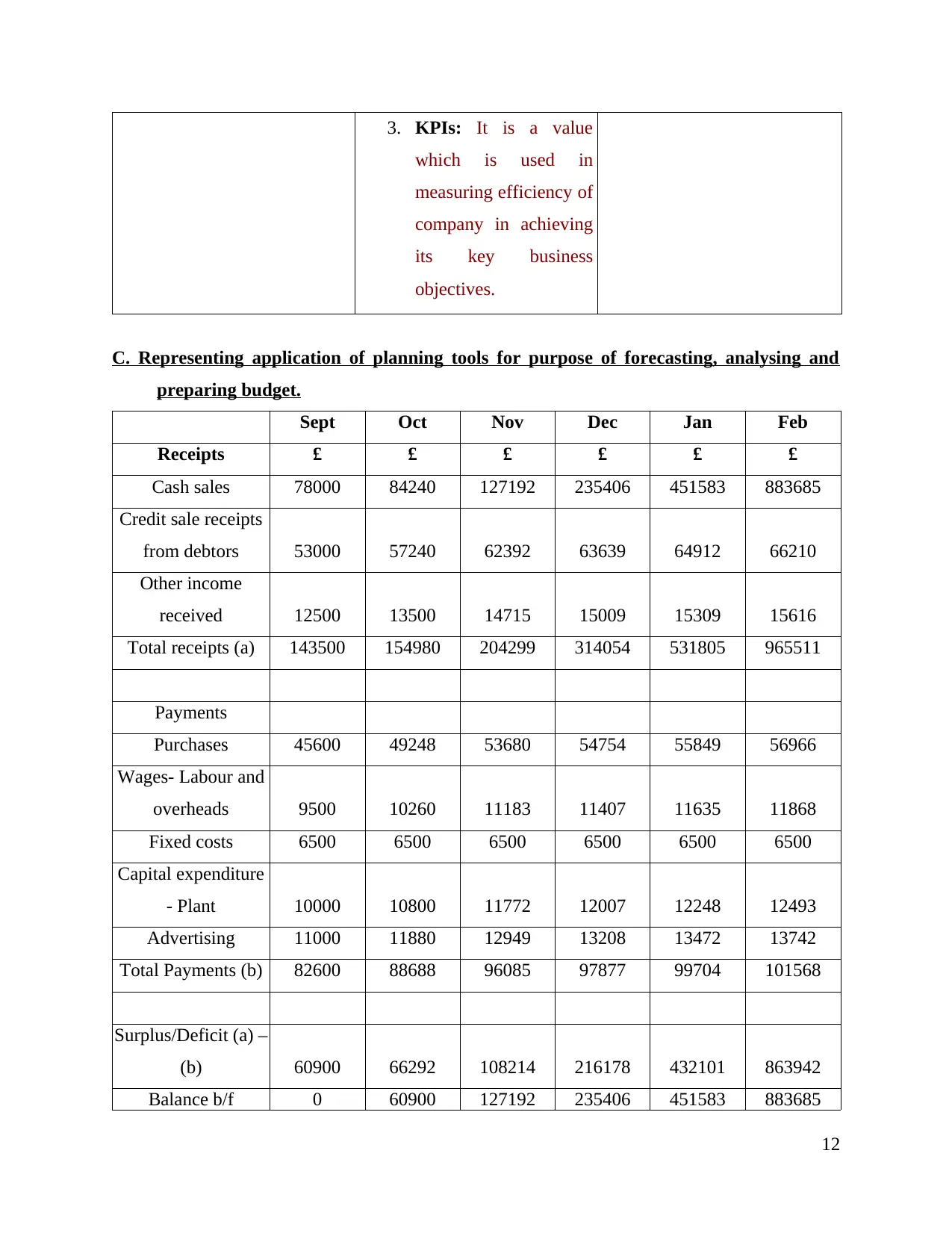

C. Representing application of planning tools for purpose of forecasting, analysing and

preparing budget.

Sept Oct Nov Dec Jan Feb

Receipts £ £ £ £ £ £

Cash sales 78000 84240 127192 235406 451583 883685

Credit sale receipts

from debtors 53000 57240 62392 63639 64912 66210

Other income

received 12500 13500 14715 15009 15309 15616

Total receipts (a) 143500 154980 204299 314054 531805 965511

Payments

Purchases 45600 49248 53680 54754 55849 56966

Wages- Labour and

overheads 9500 10260 11183 11407 11635 11868

Fixed costs 6500 6500 6500 6500 6500 6500

Capital expenditure

- Plant 10000 10800 11772 12007 12248 12493

Advertising 11000 11880 12949 13208 13472 13742

Total Payments (b) 82600 88688 96085 97877 99704 101568

Surplus/Deficit (a) –

(b) 60900 66292 108214 216178 432101 863942

Balance b/f 0 60900 127192 235406 451583 883685

12

which is used in

measuring efficiency of

company in achieving

its key business

objectives.

C. Representing application of planning tools for purpose of forecasting, analysing and

preparing budget.

Sept Oct Nov Dec Jan Feb

Receipts £ £ £ £ £ £

Cash sales 78000 84240 127192 235406 451583 883685

Credit sale receipts

from debtors 53000 57240 62392 63639 64912 66210

Other income

received 12500 13500 14715 15009 15309 15616

Total receipts (a) 143500 154980 204299 314054 531805 965511

Payments

Purchases 45600 49248 53680 54754 55849 56966

Wages- Labour and

overheads 9500 10260 11183 11407 11635 11868

Fixed costs 6500 6500 6500 6500 6500 6500

Capital expenditure

- Plant 10000 10800 11772 12007 12248 12493

Advertising 11000 11880 12949 13208 13472 13742

Total Payments (b) 82600 88688 96085 97877 99704 101568

Surplus/Deficit (a) –

(b) 60900 66292 108214 216178 432101 863942

Balance b/f 0 60900 127192 235406 451583 883685

12

Balance c/f 60900 127192 235406 451583 883685 1747627

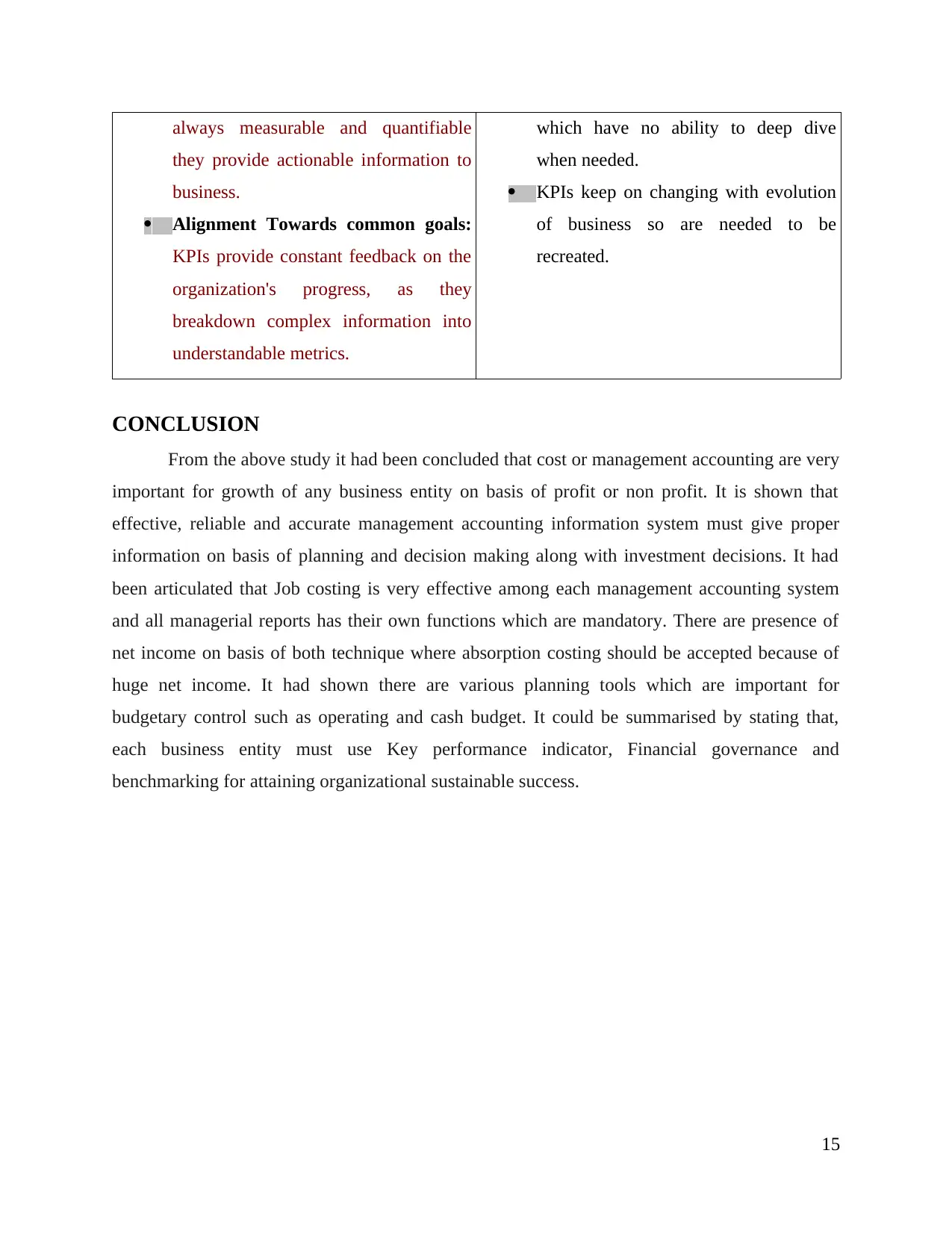

D. Analysation of management accounting techniques for sustainable success

By using different management accounting techniques, Vectair Holdings will be able to

respond effectively to financial problems and issues in adapting changes according the sales and

expenditure. As it is not certain that a specific amount of financial problem could arise by the

end of this month, so to defend that situation in future and prevent facing losses in terms of

finances, the company can use these techniques to keep track on financial activities every month

or quarterly basis. Adapting according to the changes and implementing these accounting

techniques can help and lead business towards sustainable success.

It has been mentioned that Vectair Holdings make use of Bench Marking, Financial

Governance and Key Performance Indicators which would benefit in long run and will assist in

facing each financial problem as well as encourage potential investors to invest which is a good

sign for companies’ growth and sustainable success. It is clearly indicated that bench marking

helped company is measuring products and services against set standards of other competitors in

maintaining a unique quality and standard against other competitors and will encourage growth

in terms of sales and profit. By using financial governance, this company is assuring good

management, collection and control over financial information which will prevent company from

any future financial problem. Finally, by KPIs, Vectair Holdings is able to measure effectiveness

in achieving organizational goals through value

Above mentioned each aspect clearly signifies that this company effectively chose the

management accounting techniques to respond to financial problems so that it will lead to

sustainable success in longer run (Hiebl and et.al., 2015).

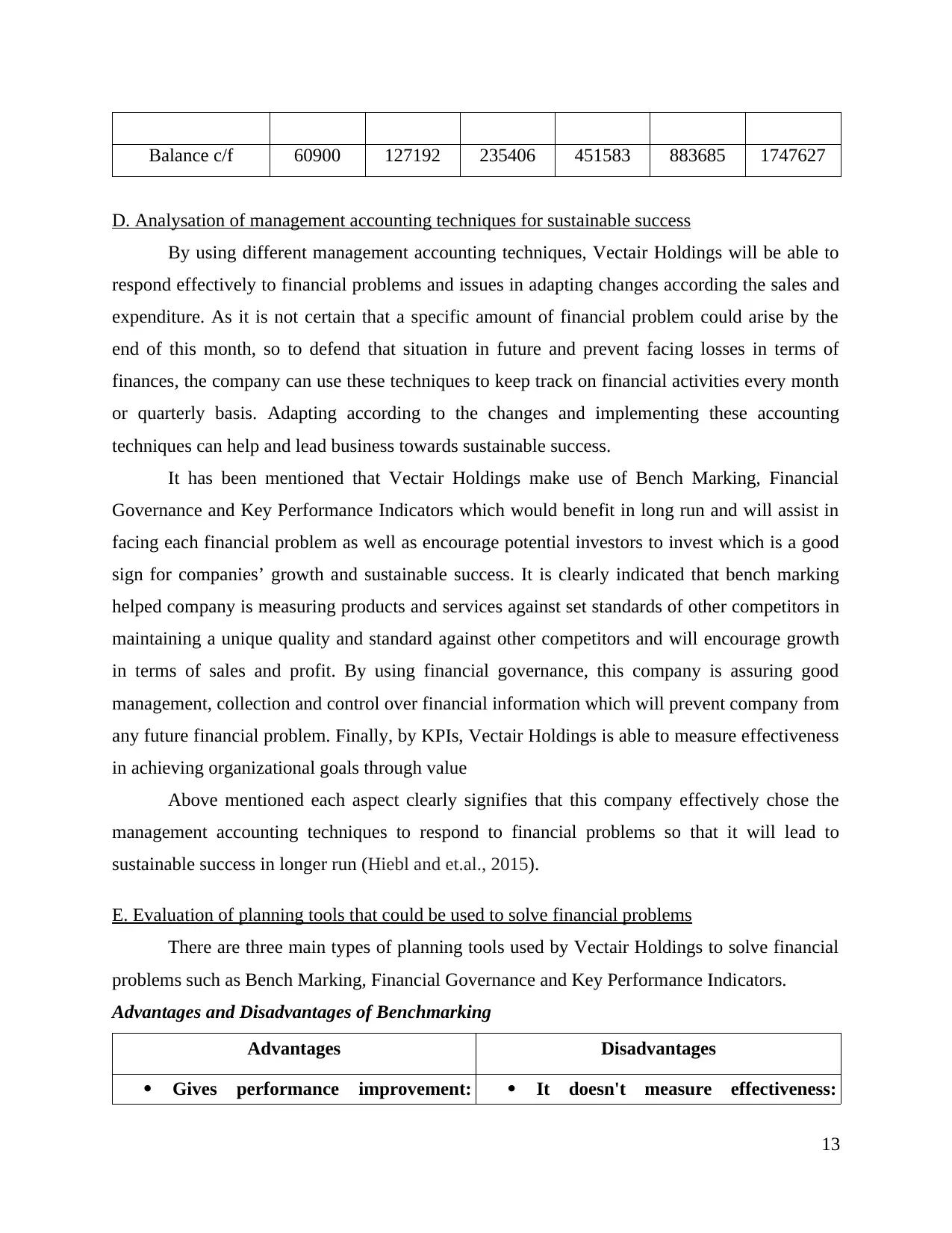

E. Evaluation of planning tools that could be used to solve financial problems

There are three main types of planning tools used by Vectair Holdings to solve financial

problems such as Bench Marking, Financial Governance and Key Performance Indicators.

Advantages and Disadvantages of Benchmarking

Advantages Disadvantages

Gives performance improvement: It doesn't measure effectiveness:

13

D. Analysation of management accounting techniques for sustainable success

By using different management accounting techniques, Vectair Holdings will be able to

respond effectively to financial problems and issues in adapting changes according the sales and

expenditure. As it is not certain that a specific amount of financial problem could arise by the

end of this month, so to defend that situation in future and prevent facing losses in terms of

finances, the company can use these techniques to keep track on financial activities every month

or quarterly basis. Adapting according to the changes and implementing these accounting

techniques can help and lead business towards sustainable success.

It has been mentioned that Vectair Holdings make use of Bench Marking, Financial

Governance and Key Performance Indicators which would benefit in long run and will assist in

facing each financial problem as well as encourage potential investors to invest which is a good

sign for companies’ growth and sustainable success. It is clearly indicated that bench marking

helped company is measuring products and services against set standards of other competitors in

maintaining a unique quality and standard against other competitors and will encourage growth

in terms of sales and profit. By using financial governance, this company is assuring good

management, collection and control over financial information which will prevent company from

any future financial problem. Finally, by KPIs, Vectair Holdings is able to measure effectiveness

in achieving organizational goals through value

Above mentioned each aspect clearly signifies that this company effectively chose the

management accounting techniques to respond to financial problems so that it will lead to

sustainable success in longer run (Hiebl and et.al., 2015).

E. Evaluation of planning tools that could be used to solve financial problems

There are three main types of planning tools used by Vectair Holdings to solve financial

problems such as Bench Marking, Financial Governance and Key Performance Indicators.

Advantages and Disadvantages of Benchmarking

Advantages Disadvantages

Gives performance improvement: It doesn't measure effectiveness:

13

Benchmarking allows an organization

to locate areas which are inefficient and

also enables to match their performance

with that of other businesses in the

same industry.

Inspires Creativity: It helps a business

to provide measurable goals, as time

progresses and standards evolve

around.

Places the focus on change: It enables

and encourages any firm to set a

standard and then allow it to follow a

minimum standard of excellence.

Effectiveness of following standards is

not measured.

Treated as a solo activity: It is not the

only thing that a business need to do to

adapt changes in financial environment

of business.

It can foster mediocrity: The

perspective behind benchmarking is an

ultimate issue. If there is a certain level

of high-handedness which shows that a

business is already the best in this

industry, then this will influence

collected data.

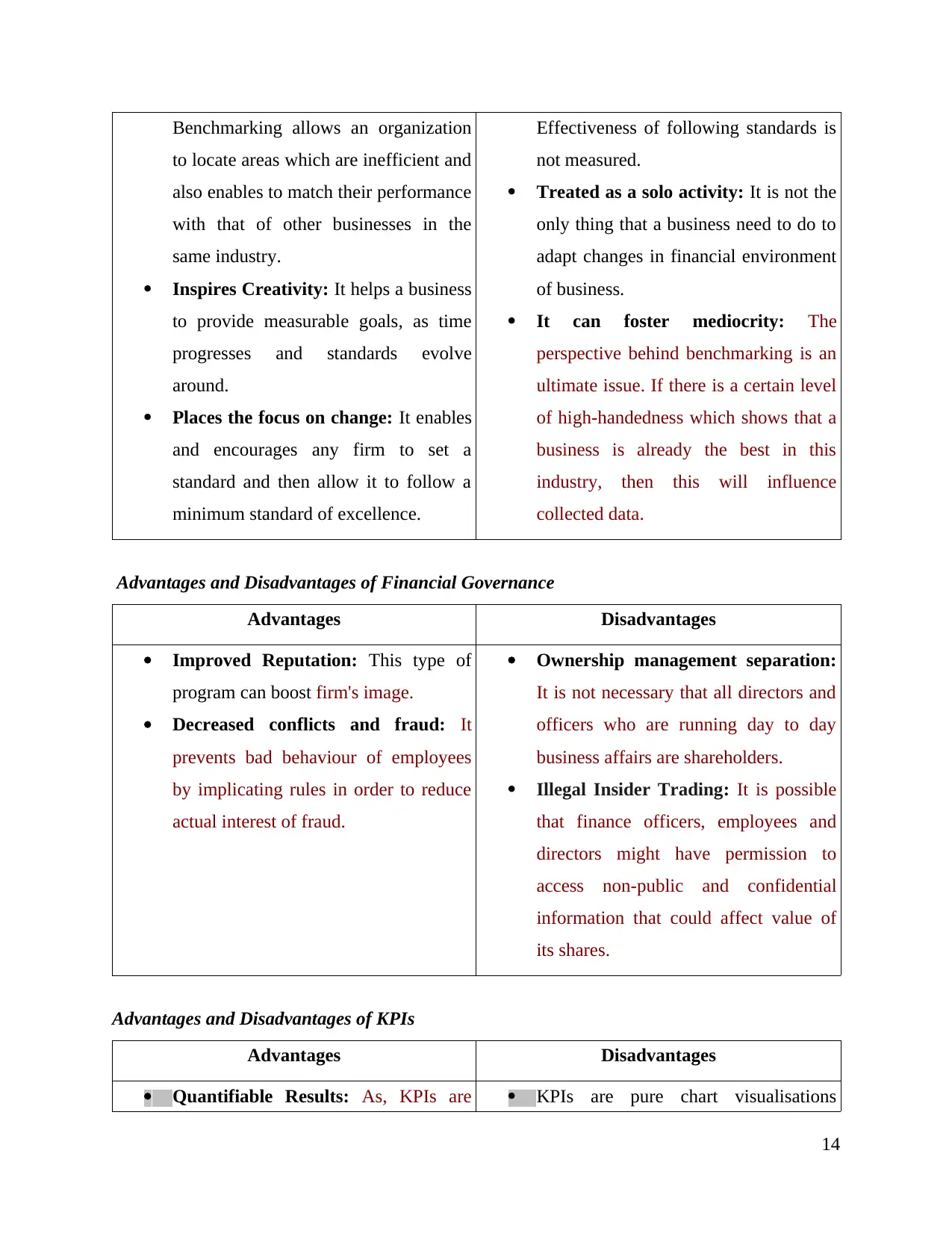

Advantages and Disadvantages of Financial Governance

Advantages Disadvantages

Improved Reputation: This type of

program can boost firm's image.

Decreased conflicts and fraud: It

prevents bad behaviour of employees

by implicating rules in order to reduce

actual interest of fraud.

Ownership management separation:

It is not necessary that all directors and

officers who are running day to day

business affairs are shareholders.

Illegal Insider Trading: It is possible

that finance officers, employees and

directors might have permission to

access non-public and confidential

information that could affect value of

its shares.

Advantages and Disadvantages of KPIs

Advantages Disadvantages

Quantifiable Results: As, KPIs are KPIs are pure chart visualisations

14

to locate areas which are inefficient and

also enables to match their performance

with that of other businesses in the

same industry.

Inspires Creativity: It helps a business

to provide measurable goals, as time

progresses and standards evolve

around.

Places the focus on change: It enables

and encourages any firm to set a

standard and then allow it to follow a

minimum standard of excellence.

Effectiveness of following standards is

not measured.

Treated as a solo activity: It is not the

only thing that a business need to do to

adapt changes in financial environment

of business.

It can foster mediocrity: The

perspective behind benchmarking is an

ultimate issue. If there is a certain level

of high-handedness which shows that a

business is already the best in this

industry, then this will influence

collected data.

Advantages and Disadvantages of Financial Governance

Advantages Disadvantages

Improved Reputation: This type of

program can boost firm's image.

Decreased conflicts and fraud: It

prevents bad behaviour of employees

by implicating rules in order to reduce

actual interest of fraud.

Ownership management separation:

It is not necessary that all directors and

officers who are running day to day

business affairs are shareholders.

Illegal Insider Trading: It is possible

that finance officers, employees and

directors might have permission to

access non-public and confidential

information that could affect value of

its shares.

Advantages and Disadvantages of KPIs

Advantages Disadvantages

Quantifiable Results: As, KPIs are KPIs are pure chart visualisations

14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

always measurable and quantifiable

they provide actionable information to

business.

Alignment Towards common goals:

KPIs provide constant feedback on the

organization's progress, as they

breakdown complex information into

understandable metrics.

which have no ability to deep dive

when needed.

KPIs keep on changing with evolution

of business so are needed to be

recreated.

CONCLUSION

From the above study it had been concluded that cost or management accounting are very

important for growth of any business entity on basis of profit or non profit. It is shown that

effective, reliable and accurate management accounting information system must give proper

information on basis of planning and decision making along with investment decisions. It had

been articulated that Job costing is very effective among each management accounting system

and all managerial reports has their own functions which are mandatory. There are presence of

net income on basis of both technique where absorption costing should be accepted because of

huge net income. It had shown there are various planning tools which are important for

budgetary control such as operating and cash budget. It could be summarised by stating that,

each business entity must use Key performance indicator, Financial governance and

benchmarking for attaining organizational sustainable success.

15

they provide actionable information to

business.

Alignment Towards common goals:

KPIs provide constant feedback on the

organization's progress, as they

breakdown complex information into

understandable metrics.

which have no ability to deep dive

when needed.

KPIs keep on changing with evolution

of business so are needed to be

recreated.

CONCLUSION

From the above study it had been concluded that cost or management accounting are very

important for growth of any business entity on basis of profit or non profit. It is shown that

effective, reliable and accurate management accounting information system must give proper

information on basis of planning and decision making along with investment decisions. It had

been articulated that Job costing is very effective among each management accounting system

and all managerial reports has their own functions which are mandatory. There are presence of

net income on basis of both technique where absorption costing should be accepted because of

huge net income. It had shown there are various planning tools which are important for

budgetary control such as operating and cash budget. It could be summarised by stating that,

each business entity must use Key performance indicator, Financial governance and

benchmarking for attaining organizational sustainable success.

15

REFERENCES

Books and Journals

Bromwich, M. and Scapens, R. W., 2016. Management accounting research: 25 years

on. Management Accounting Research. 31. pp.1-9.

Coad, A., Jack, L. and Kholeif, A. O. R., 2015. Structuration theory: reflections on its further

potential for management accounting research. Qualitative Research in Accounting &

Management. 12(2). pp.153-171.

Cooper, D. J., Ezzamel, M. and Qu, S. Q., 2017. Popularizing a management accounting idea:

The case of the balanced scorecard. Contemporary Accounting Research. 34(2). pp.991-

1025.

Fullerton, R. R., Kennedy, F. A. and Widener, S. K., 2014. Lean manufacturing and firm

performance: The incremental contribution of lean management accounting

practices. Journal of Operations Management. 32(7-8). pp.414-428.

Hall, M., 2016. Realising the richness of psychology theory in contingency-based management

accounting research. Management Accounting Research. 31. pp.63-74.

Hiebl, M. R. and et.al., 2015. Family Influence and Management Accounting

Usage. Schmalenbach Business Review. 67(3). pp.368-404.

Lavia López, O. and Hiebl, M. R., 2014. Management accounting in small and medium-sized

enterprises: current knowledge and avenues for further research. Journal of Management

Accounting Research. 27(1). pp.81-119.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research. 31. pp.45-62.

Senftlechner, D. and Hiebl, M .R., 2015. Management accounting and management control in

family businesses: Past accomplishments and future opportunities. Journal of Accounting

& Organizational Change. 11(4). pp.573-606.

Suomala, P., Lyly-Yrjänäinen, J. and Lukka, K., 2014. Battlefield around interventions: A

reflective analysis of conducting interventionist research in management

accounting. Management Accounting Research. 25(4). pp.304-314.

Tappura, S., and et.al., 2015. A management accounting perspective on safety. Safety science. 71.

pp.151-159.

16

Books and Journals

Bromwich, M. and Scapens, R. W., 2016. Management accounting research: 25 years

on. Management Accounting Research. 31. pp.1-9.

Coad, A., Jack, L. and Kholeif, A. O. R., 2015. Structuration theory: reflections on its further

potential for management accounting research. Qualitative Research in Accounting &

Management. 12(2). pp.153-171.

Cooper, D. J., Ezzamel, M. and Qu, S. Q., 2017. Popularizing a management accounting idea:

The case of the balanced scorecard. Contemporary Accounting Research. 34(2). pp.991-

1025.

Fullerton, R. R., Kennedy, F. A. and Widener, S. K., 2014. Lean manufacturing and firm

performance: The incremental contribution of lean management accounting

practices. Journal of Operations Management. 32(7-8). pp.414-428.

Hall, M., 2016. Realising the richness of psychology theory in contingency-based management

accounting research. Management Accounting Research. 31. pp.63-74.

Hiebl, M. R. and et.al., 2015. Family Influence and Management Accounting

Usage. Schmalenbach Business Review. 67(3). pp.368-404.

Lavia López, O. and Hiebl, M. R., 2014. Management accounting in small and medium-sized

enterprises: current knowledge and avenues for further research. Journal of Management

Accounting Research. 27(1). pp.81-119.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–

2014. Management accounting research. 31. pp.45-62.

Senftlechner, D. and Hiebl, M .R., 2015. Management accounting and management control in

family businesses: Past accomplishments and future opportunities. Journal of Accounting

& Organizational Change. 11(4). pp.573-606.

Suomala, P., Lyly-Yrjänäinen, J. and Lukka, K., 2014. Battlefield around interventions: A

reflective analysis of conducting interventionist research in management

accounting. Management Accounting Research. 25(4). pp.304-314.

Tappura, S., and et.al., 2015. A management accounting perspective on safety. Safety science. 71.

pp.151-159.

16

Wagenhofer, A., 2016. Exploiting regulatory changes for research in management

accounting. Management Accounting Research. 31. pp.112-117.

ONLINE

Cost Accounting system. 2018. [Online]. Available through:

<https://www.accountingtools.com/articles/2017/5/7/actual-cost>.

Job costing. 2018. [Online]. Available through: <https://strategiccfo.com/job-costing/>.

17

accounting. Management Accounting Research. 31. pp.112-117.

ONLINE

Cost Accounting system. 2018. [Online]. Available through:

<https://www.accountingtools.com/articles/2017/5/7/actual-cost>.

Job costing. 2018. [Online]. Available through: <https://strategiccfo.com/job-costing/>.

17

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.